Abstract

The typical small investor makes on average about 5% a year in investment gains, just half of what the market does. Moreover, most investment funds also underperform compared to the broader market. In two previous papers, we explored how a specific and simple approach to algorithmic trading can help both types of investors achieve strong results. For concreteness, we focused attention on investing in a single variable, in our case, a major US-based index such as SPX and IXIC, individually. For illustrative purposes, we also considered some highly traded tech stock examples. In this paper, we extend our work to study the US sector funds, and for the first time in our series, we also consider trading multiple variables at a time to see how that may differ from our single-variable investment strategy. To simplify matters, we consider an initial equal weighted portfolio of several sector funds, selected randomly without any analysis, and assume that each is traded independently. To simplify further, we do no rebalancing in our study, though that is an essential part of money management according to modern portfolio theory. We nevertheless obtain interesting and informative results. We can typically improve on the performance of most sector funds compared to buy-and-hold (hereafter referred to as BnH). Moreover, as an example of portfolio growth, a portfolio of five equal weighted sector funds in BnH achieves 6.5× growth over 20 years (ending in March 2023), whereas our approach achieves 12.4× growth—nearly 2× better, at roughly half the maximum drawdown. That is a strong win for both professional and home investors.

1. Introduction

The financial market is populated by lions and lambs, or rather pros and novice small investors: professional institutional investors and traders, plus professional investment advisors, whose time frames are typically short (e.g., a year or less, down to microseconds), and retail small investors, whose time frames are typically long, stretching to decades. Professional traders understand market volatility and generally use algorithmic trading to deal with it. By contrast, the small investor has limited knowledge of the market, finds volatility frightening, and has few tools at their disposal to make sound investment decisions. It is known that the typical small investor only achieves half the market performance, about 5% annual return, but actively managed funds also underperform compared to the market. What can help?

A loud and vociferous chorus of investment advisors has long cautioned the small investor to spend “time in the market”, rather than trying to “time the market.” Given the dismal performance of the small investor, they certainly need some help. However, with some 10K investment options (stocks, funds, etc.), what to invest in, and when, are as important as staying in the market for a period of time. In previous papers Topiwala and Dai (2022), Topiwala (2023), we presented substantial background on market history, typical investor as well as managed fund performance, and algorithmic trading methods suitable for our market timing needs. We showed strong evidence that, despite overwhelming negative opinion regarding even the possibility of successful timing, simple timing methods can be developed that can be effective in both outperforming the market as well as in reducing drawdowns. Please refer to our cited papers, available online, for extensive background and approach development.

Briefly, we developed a trading algorithm suite which we call FastHedge, consisting of some 20 core algorithms, utilized with a variety of parameters such as various moving average time periods (up to 4), leverage level, borrowing rates and slippage, as well as a variety of discrete binary switches such as decision smoothing, leverage scaling, drawdown thresholds, and algorithm adaptivity. When all variations are combined, we estimate that there are roughly 1000 total distinct parametric algorithms to be selected in the suite. However, importantly, in testing, we hold virtually all the parameters constant, and for all testing periods simultaneously (whether for 100, 250, 1000, or 5000 trading days, or roughly 5 months, 1 year, 4 years, or 20 years), and vary only the core trading decision algorithms. These core algorithms are all based on simple moving averages, as we review. Again, we refer the reader to our previous papers Topiwala and Dai (2022), Topiwala (2023). We remark that our algorithms are very elementary, and do not rely on advanced topics such as stochastic calculus, Black–Sholes formulas, and the like. Moreover, the buy and sell decisions occur only once a day (at the end of the day), and on average less than 20 times/year. That is, our method is suitable for use by both the typical small and professional investors alike. These elementary yet powerful algorithms are designed to run in seconds on a laptop and instantly in server-class machines.

In this paper, we expand our scope to study the US sector funds within the S&P 500 (SPX). Note that these eleven sector funds reflect different parts of the economy, and since they are smaller aggregations than the SPX index itself, they are likely to be more volatile individually. Furthermore, between them, they may be somewhat less correlated than major indices (e.g., the SPX and IXIC have a fairly high 0.75 correlation coefficient). While there are many vendors of such sector funds, for concreteness, we will use a single family, the so-called SPDR sector funds: XLB (Materials), XLC (Communications), XLE (Energy), XLF (Financials), XLI (Industrials), XLK (Technology), XLP (Consumer Staples), XLRE (Real Estate), XLU (Utilities), XLV (Healthcare), and XLY (Consumer Discretionary). Of these funds, XLRE only dates back to October 2015, while XLC only dates to June 2018. Neither of these have enough history to be useful in our analysis, and will not be considered further. The rest date back to December 1998, with over 20 years of history, which is sufficient for our analysis (we will study the 20-year period).

While we do present some results for each of these funds, for convenience, we will further focus our attention on a subset of just five funds for portfolio analysis. For the first time in our series, we also consider the impact of trading more than one variable at a time. However, just like a typical small investor, we will select our portfolio fairly randomly, without any analysis related to asset allocation. We remark at the outset that we do not have anything special to add to the body of work called modern portfolio theory (MPT) (Elton et al. 2014; Markowitz 1952) at this time (we may address extensions of MPT in our context in future papers). However, for completeness, we provide some results in multi-variable trading, as it is relevant to all investors. While investors may do well to hold a single major index fund related to the SPX or IXIC, as we will see, it would be inadvisable to hold just a single sector fund. We do so, however, in a way that is orthogonal to MPT. In essence, we start with equal-weighted investment in each of several sector funds, and let them evolve independently, without recourse to regular rebalancing, normally a central feature of active portfolio management.

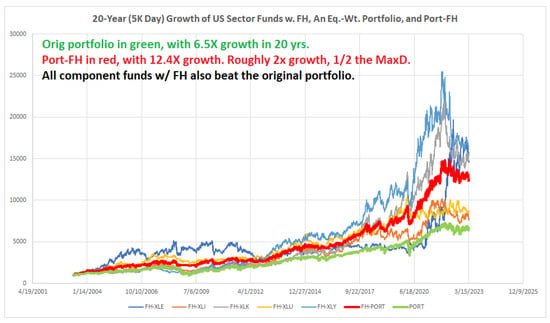

MPT suggests to that asset allocation should be performed along a so-called Efficient Frontier of available investment options, which offer efficiencies in risk/reward profiles as sought by the investor, and based on their joint correlations. As these conditions evolve with time, staying on the Efficient Frontier would naturally involve rebalancing. In our case, even without rebalancing, due to the diversity of our sector funds, we expect them to be partially independent of each other, so we can reasonably expect some improved stability with trading multiple funds instead of one. This is evidenced in our experiments. The unaided equal-weight portfolio of five funds (XLE, XLI, XLK, XLU, and XLY), held for 20 years, achieves a nice 6.5× growth (650%), in constant dollars. However, under FastHedge trading, that same portfolio achieves 12.4× growth, nearly double, under an effortless automatic trade signaling system, a valuable surplus that any investor would like. We could do even better with regular rebalancing in the style of MPT, a topic for another day. Note that we ignore tax consequences, which is a reasonable assumption if trading in a retirement account for example.

The rest of this paper is organized as follows. As this is a follow-on paper, we will assume some familiarity with our previous development, but for reader convenience, Section 2 repeats the included material to provide some of the pertinent background, market history, our simulation framework, investment performance metrics (including key new ones!), and some key prior results. Section 3 presents our new market timing results for the US sector funds, individually. Section 4 presents some simplified results in trading multiple sector funds simultaneously (but independently). Our results are presented in easily interpretable graphical form, showing strong performance curves versus the buy-and-hold method, as well as the drawdowns over time. Finally, Section 5 provides a summary of all our new results in convenient tabular form, and uses our innovative performance metrics to compare investments. We also offer brief conclusions to our line of inquiry. We show strong value-added for our methods over buy-and-hold, with consistent annual gains and constrained drawdowns. We also find that our newly developed measures outperform standard measures such as the Sharpe Ratio in rating investments according to risk-adjusted gains. In fact, from here on, we exclusively rely on our PARC measure Topiwala (2023). Thus, our contributions to the literature include both our innovative trading methods as well as our state-of-the-art performance metrics.

Just at the time of this paper, the US financial sector saw major disruptions due to the failure of the Silicon Valley Bank and its aftermath. This in fact reverberated across the entire economy, and all over the globe. Thus, by chance, we obtained another Black Swan event that we had not expected, and another test of our methods. The question is: can we survive it? One caveat is that our method was really developed for trading the major indices, SPX and IXIC (especially the latter). We make no effort to tailor the method (even so much as adjusting any hyperparameters) for these sectors, but apply exactly the same methods to these sectors. In that sense, our results here are not really indicative of the potential of our methods on sector funds, as they are on the major indices. Recall that, in trading IXIC, we can obtain a dramatic 20% annual return over 40 years, whilst keeping maximum drawdowns to under 40%, a remarkable feat that is actually competitive with the performance of some of the best-known investors, including Warren Buffett. However, the volatility of sector funds means that we cannot expect that kind of result with sector funds alone. Nevertheless, we can achieve up to 14.5% on some funds, and approximately 13.4% in a portfolio. Furthermore, as it turns out, we do remarkably well with the XLF (financials) fund, despite the 2008 financial crisis, and the recent financial scare. This is very good, although we can do better with just the IXIC index alone. To do better with sector funds and portfolios, we would need to incorporate deeper portfolio analysis, a topic for another time.

2. Investment and Market Timing Essentials

In this section, we rapidly review the core tools we need for our analysis, as well as some necessary contextual information. Please see our previous papers for more details and background.

2.1. Investment Basics

There is only one rule in investment: buy low and sell high. However, there are a number of ways to try to achieve this, and two distinct styles have emerged.

Fundamental analysis aims to understand companies from an operational and cash flow point of view, computes a present value of future cash flows to arrive at a fair (intrinsic) price, and makes buy or sell decisions based on the difference between the computed and actual price.

In contrast, technical analysis generally studies the price history of its shares and the market to derive signals for when to buy or sell a stock ChartSchool (2022).

Both of these methods are successfully used in the market. We will work within the second approach. We also note that there is a third method we can compare these with, in which an investor can simply buy and hold a security (buy-and-hold, hereafter referred to as BnH).

2.2. Market Timing Background

Market timing is an approach to trading based on determining when to buy or sell a stock; this can be done algorithmically, or by other methods. In a sense, all approaches to trading can be viewed as timing.

We remark that much of the published literature has been strongly skeptical of market timing as even a possibility (Damodaram n.d.; Graham and Harvey 1994; Henriksson and Merton 1981; Merton 1981; Sharpe 1975). However, there have been some countering voices Chen and Liang (2007).

Contrary to this, in two previous papers Topiwala and Dai (2022), Topiwala (2023), we developed a simple and effective timing method, based on so-called moving averages, which is suitable for both professionals and small investors aiming to grow wealth over long periods of time (decades). We achieved powerful results in trading both US-based market indices, as well as well-known tech stocks.

2.3. Market History

It is important to understand the conditions in which market timing systems such as those we propose can be successful.

- Markets have long-term trends, which are generally up.

- They have periods of downturns as well, which can be protracted.

- They also have some rapid plunges (e.g., Black Monday).

- They may even have some self-similarity properties at different scales (a point we mention, but do not explore).

We mainly utilize item (1), while (2) is just a special case, (3) is a feature that we have to deal with, and (4) is a sidelight we ignore, but which may be amenable to multiscale analysis Topiwala (1998).

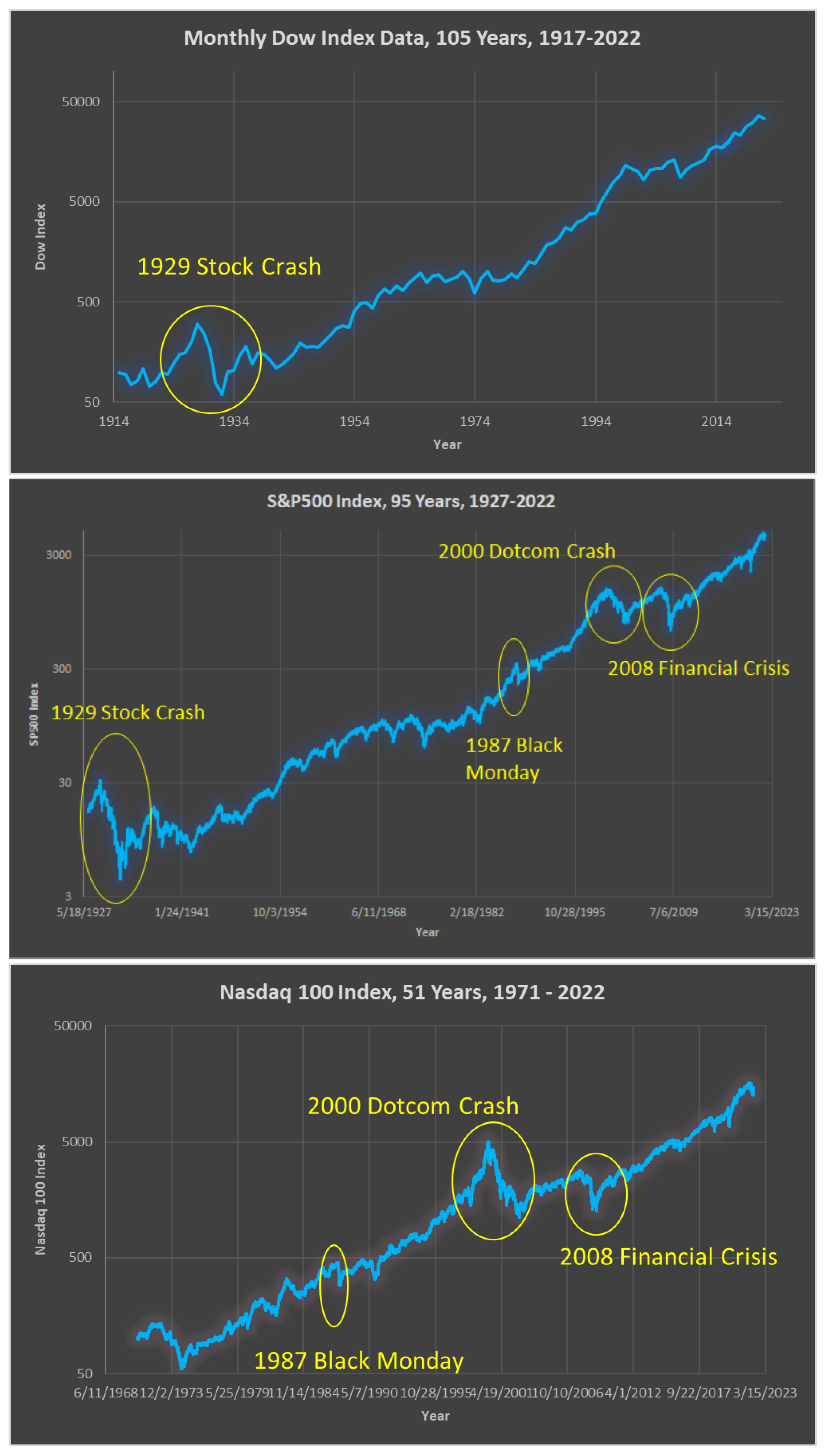

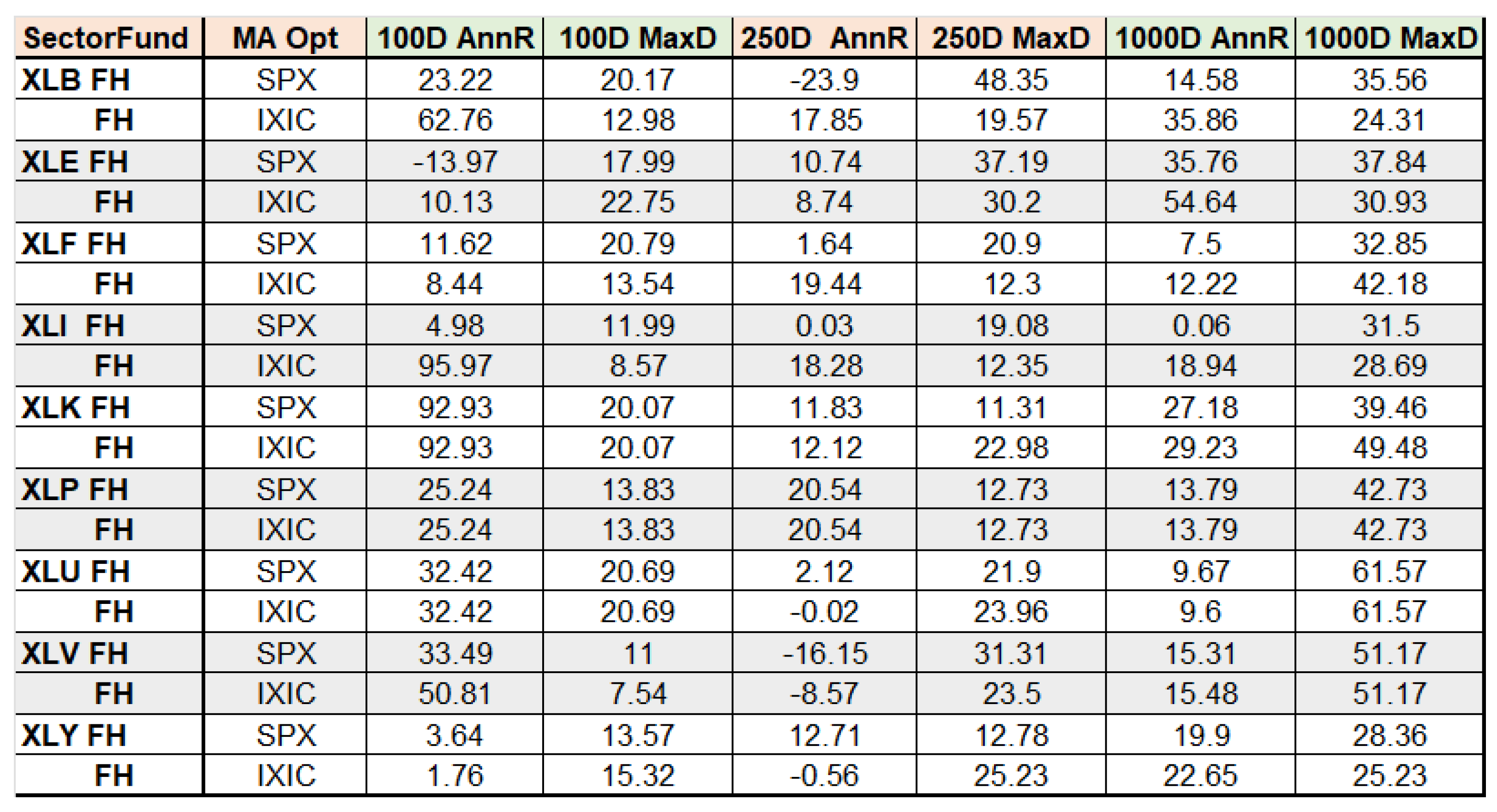

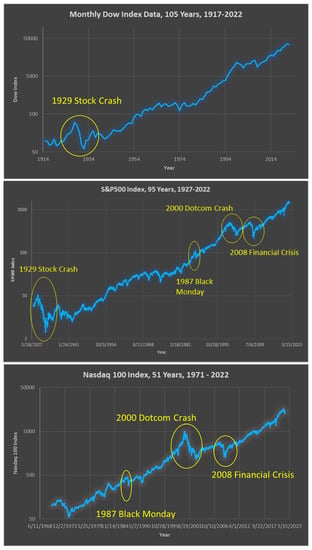

We see in Figure 1 that the three main US-based market indices, DOW, SPX, and IXIC, have had a remarkable history of growth (the first two for about 100 years, the last about 50 years). The growth of the economy and of stock prices are of course the fundamental force behind all investment.

Figure 1.

A remarkable century of markets and growth, even through the Depression and World Wars: (top) 105 years of the DOW; (middle) 95 years of the S&P500; (bottom) 51 years of the Nasdaq index; data from (macrotrends 2022).

2.4. Simulation Setup

To make progress, we formulate a concrete simulation setup and goal for our investment studies.

Simulation setup: Start with $1K, allow leverage, model interest rate as 3%, and track the performance of a timing algorithm vs. an underlying variable (buy-and-hold) for a period of time (e.g., decades, for example, 20–40 years).

Goal of market timing: To meet or exceed an investment’s buy-and-hold performance, while limiting its maximum drawdowns (e.g., to <50%, or even <40%) over the investment time period.

2.5. Market Performance Metrics

The first and most obvious indicator of performance is simply to graph the growth of an investment over time, as well as to compare several of them. However, if two investments, say A and B, have similar growth but one is more volatile than the other, an investor would naturally prefer the less volatile one. The Sharpe ratio, developed by the 1990 Nobel Prize-winning economist William F. Sharp (Sharpe 1994), is the excess return of an investment (over a risk-free one), divided by the volatility of the investment, measured as the standard deviation of the excess return, when measured in increments of time (for example, daily returns). In practice, the Sharpe ratio is computed using the expected value of the excess daily return of the asset, divided by the standard deviation of the daily return. Furthermore, it is common practice to treat the risk-free rate as zero.

One known problem with using the standard deviation to capture volatility in the Sharpe ratio is that it penalizes the upside as much as the downside variability, which is contrary to investment objectives (a defect fixed by the so-called Sortino ratio). For completeness, we also mention another useful measure, the Treynor ratio (Treynor and Mazuy 1966), whose numerator is the same as for the Sharpe ratio, but the denominator is the beta of the portfolio (defined as the ratio of a covariance to a variance ). A number of papers and blogs discuss the use of both the Sharpe and Treynor ratios (plus scaled versions), for example, to measure the hedge fund performance (van Dyck et al. 2014). For now, we stay focused on the well-known Sharpe ratio as a comparator.

Note that an initial investment of dollars, with an annual rate of return r over a period of M years would give:

In addition to gains over time, an investment also has drawdowns (relative losses) from time to time, and we are especially sensitive to the maximum percentage drawdown, MaxD, over an investment period. Thus, two important measures for an investment are the annual return (AnnR), and the maximum drawdown (MaxD). Using this, we introduce the ARM Ratio = ARMR = AnnR/MaxD. It has elsewhere been called the RoMaD (Chen 2020).

In addition, we define Co-MaxD as (1 − MaxD), and define a second, more powerful measure: the Product of Annualized Return and Co-MaxD, PARC = AnnR * (1 − MaxD). We have shown in previous papers that our measures ARMR and PARC are superior to capturing the value of investments better than Sharpe, with PARC being the best.

Investment objective: In our view, the objective of sound long-term investment is to simultaneously maximize the annualized return (AR) and minimize the maximum drawdown (MaxD) over the period of investment; that is, to maximize the ARM ratio (ARMR), or better, to maximize the PARC measure.

2.6. Rule-Based Trading Using Moving Averages

One simple market timing approach is in fact well known in the industry and involves the use of the so-called weighted moving average, WMA(N), the weighted average price of a stock or index over the past N trading days. Starting from a given day, labeled Day 0, count backwards up to N − 1 days and average the price on those days, with weights

As a special case, set

More precisely, the exponential moving average (EMA) is an infinite sum going back, where . We will mainly use the SMA for our elementary analysis. Now, a very simple and well-known indicator based on the SMA is as follows. Let S and L be two positive integers, S < L, and consider SMA(S) and SMA(L). For example, one can set S = 50 and L = 200 and consider the 50-day and 200-day simple moving averages. Our indicator is the difference.

While this is a prototype trading algorithm based on moving averages, this specific algorithm only has a modest performance in actual trading. However, based on this core concept, we developed a much more elaborate system, building a suite of over 20 trading algorithms, each using a decision logic based on conditional statements with inequalities utilizing up to four moving average periods, which we call FastHedge, to achieve stable and beneficial results, which we use in our simulations going forward. While the specifics of our algorithms are withheld, each is directly an elaboration of Algorithm 1 above. Moreover, in our results below, we provide a graphic of the trade decisions actually made based on our algorithms. Each of these algorithms can be further refined based on a variety of discrete parameters (such as the specific moving average periods, etc.), to give a total suite of over 1000 individual trading algorithms. The savvy reader can look through the historical record of each traded variable to confirm the reported performance based on our trades.

| Algorithm 1: Prototype trading algorithm |

| 1. Ind = SMA(50) − SMA(200). |

| 2. If Ind > 0 be in, |

| 3. else be out. |

3. Timing the US Sector Funds

Now that we have the basics under our belt, we can look at how these ideas fare in actual trading, here and now. Previously, we studied trading indices such as SPX and IXIC (with funds such as SPY and QQQ), as well as some well-known stocks such as AAPL, MSFT, and AMZN. This time, we are studying the 11 US sector funds of the S&P 500. For specificity, we will trade the funds of the SPDR family: XLB to XLY. It turns out that two of the funds, XLC (Communications) and XLRE (Real Estate), have too short histories (XLC only dates back to 2018, and XLRE only dates back to 2015) to be meaningfully studied in our framework, where our objective is to create wealth over a lifetime of investment, e.g., over decades. The remaining funds do have over 20 years of history, allowing us to study them for a 20-year period (the actual 20-year period ending on, e.g., 17 March 2023, had 5036 days, but we just used 5000 trading days as a stand-in; the difference is immaterial for our long-range study).

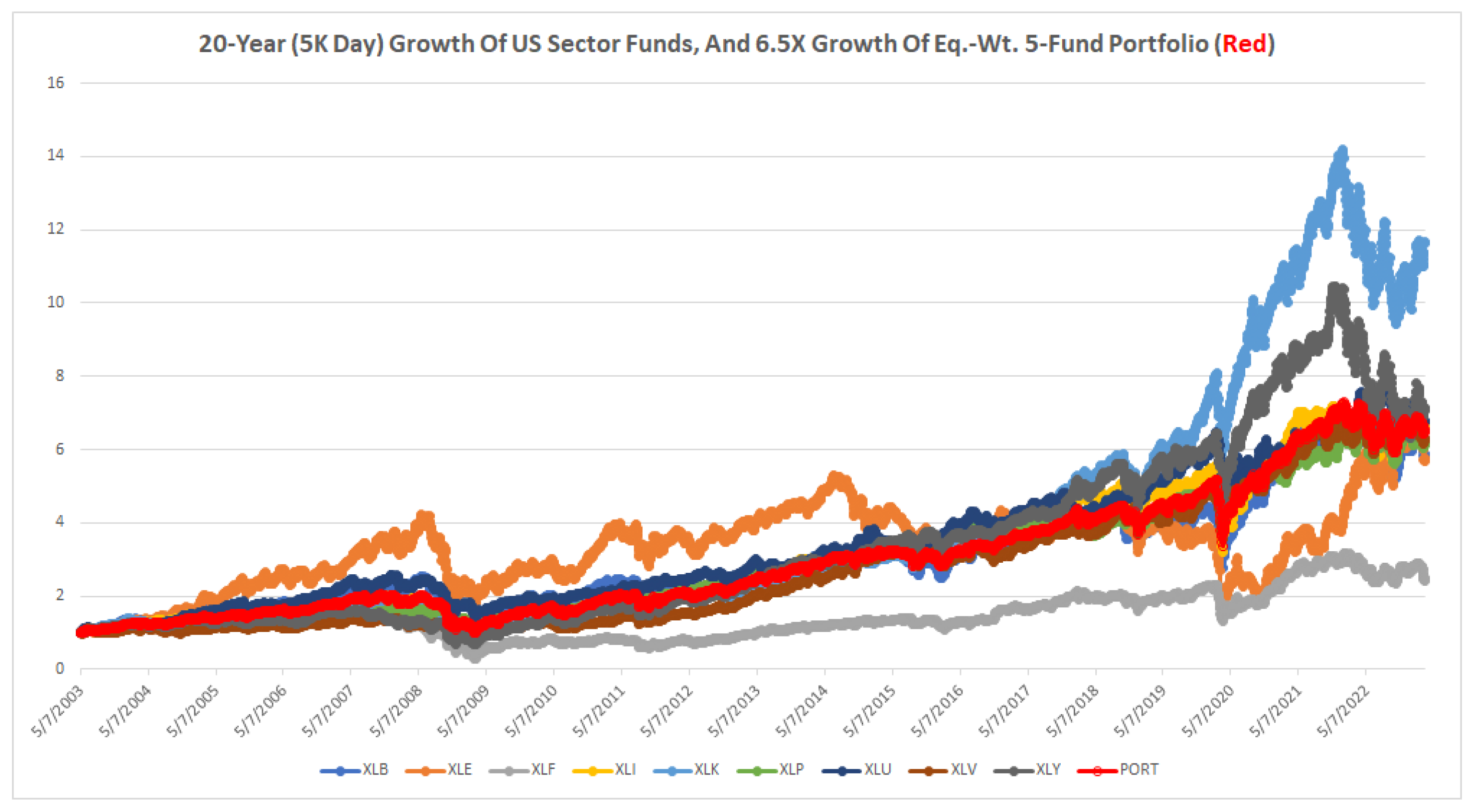

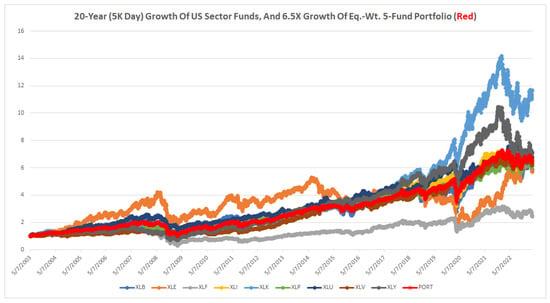

Figure 2 shows the growth of the remaining nine US sector funds, XLB – XLY. This also shows the performance of an equal weighted portfolio of five of the funds: XLE, XLI, XLK, XLU, and XLY. Note that the laggard fund in the figure, XLF, is not included in the portfolio. As it happens, that is the fund that our method FastHedge performs the best on, and gives the largest gain. However, since that overperformance is an outlier, as a handicap, we leave it out of the portfolio. The portfolio does manage to give a reasonable 6.5× gain as a multiple of the initial investment, which is a nice return. The question is then whether our FastHedge method will provide any further benefit: we will answer that in the next two sections.

Figure 2.

Performance of 9 SPDR US sector funds XLB–XLY over the last 20 years, along with the performance of an equal-weight portfolio of 5 sector funds: XLE, XLI, XLK, XLU, XLY, shown in red. Note that XLF is a laggard, but excluded from our portfolio. In 20 years (5K trading days), that portfolio, based on just holding these sector funds throughout, grew by a factor of 6.5× (or 650%), a nice return. Can FastHedge do better?

Figure 2 establishes a baseline for our FastHedge approach to trading these sector funds. First, note that while we have a very flexible trading framework consisting of 20 (actually 22) core trading algorithms based on inequalities involving up to 4 moving average periods, endowed with a variety of adjustable parameters (constituting a total system of about 1000 algorithms), it was not our mission to find the optimum performance of our system on these sector funds. Rather, this was merely intended as a proof of concept that a system primarily designed for trading index funds can also be used—without too much tweaking—to reasonably trade other instruments, such as these sector funds. In effect, we will be applying the same framework, including the set of parameter values that we used for trading SPX and IXIC, and test whether they work well on the sector funds. In particular, we reuse the set of moving average time periods, as well as combinations of how much to leverage in the long and short directions for these indices. We also test whether to use fixed or adaptive trading models. Furthermore, that is essentially all the degrees of freedom that we test. There are various parameters that are continuously adjustable constants, but we do not adjust them! We just reuse good existing values from trading indices. As we will see, these provided quite decent results already. Naturally, we would expect that, by doing a systematic regression study of all adjustable parameters, we may be able to do substantially better. However, that is unnecessary to prove our point, and not undertaken.

We make two further important remarks. In trading a major index, such as SPX or IXIC, one is already well diversified, so it is reasonable to just trade that index. In trading a sector fund, one is no longer broadly diversified. So, even if one were to trade a single variable at a time, as sector funds may be cyclical, one may at minimum want to switch funds from time to time. Furthermore, it would be even better if one wanted to hold a portfolio of several funds and regularly rebalance them. These are both valuable ideas, which have a long and rich history, and are now part of the so-called modern portfolio theory (MPT) (Elton et al. 2014; Markowitz 1952). As we have no new insights to add to that theory at the present time, we work in a somewhat orthogonal direction. We will study a portfolio of, e.g., five sector funds (and to be specific, we will choose XLE, XLI, XLK, XLU, and XLY), equally weighted at the start, and then trade each individually without any rebalancing. That is, we will simply combine the fortunes of five different funds to see whether the aggregate has a smoother, steadier performance. In the next two sections, we first trade each fund individually, and then as a portfolio.

3.1. Performance of Trading Individual Sector Funds

As may be expected, and seen in Figure 2, the individual sector funds do exhibit a fair bit of volatility and variability, then our standard index funds for SPX and IXIC, for which our method was principally designed. Due to these differences, one would normally expect to modify the approach somewhat significantly to achieve anything like optimum performance. While that may be true, it is not our purpose in fact to achieve optimum performance, only to showcase that our framework can be applied “as is” to this new problem of trading sector funds. Nor will much energy even be exerted in optimizing the parameters that we have. Rather, we simply use the set of parameters we use for SPX and IXIC separately (these relate to the set of moving average periods, and the relative leverage in the long and short directions—these items are somewhat specific to these indices, and differ between them.

Note that we normally invest 2× the money in the long direction, and we never actually leverage in the short direction, but may use a fractional multiplier value, somewhere in the [−1, 1] range. For example, if the multiplier is −0.5, what that means is that rather than fully shorting (−1×), we only short with half of our money, and hold the rest in cash, etc. In any case, we established these values that we use for the index funds—and we will blindly reuse them here, without any further research and testing! A priori, this may not work at all, and it is certain to be suboptimal (the behavior of the sector funds is quite different from the indices, which also differ between them). However, suboptimality is fine as long as we do achieve some useful gains to make our point.

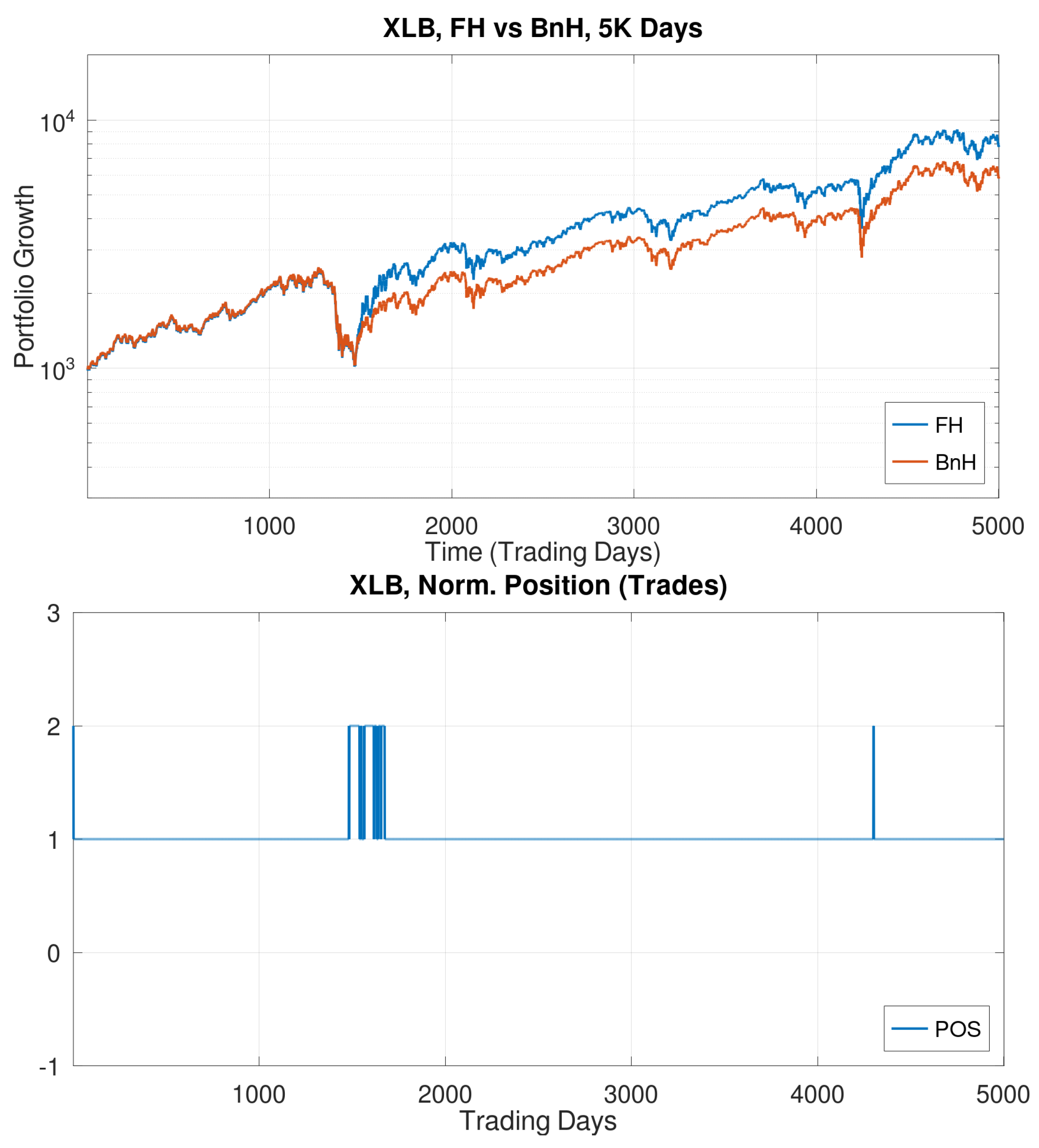

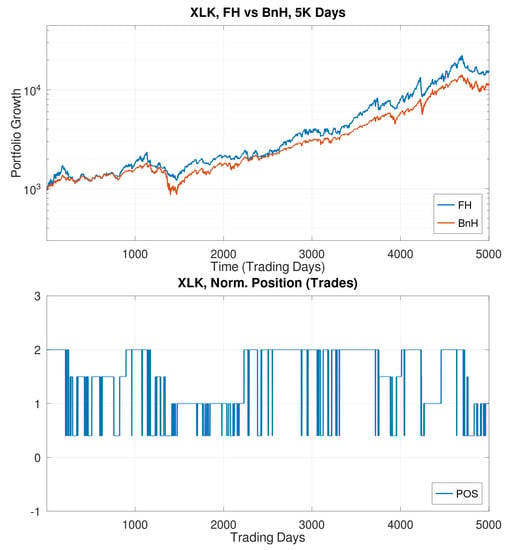

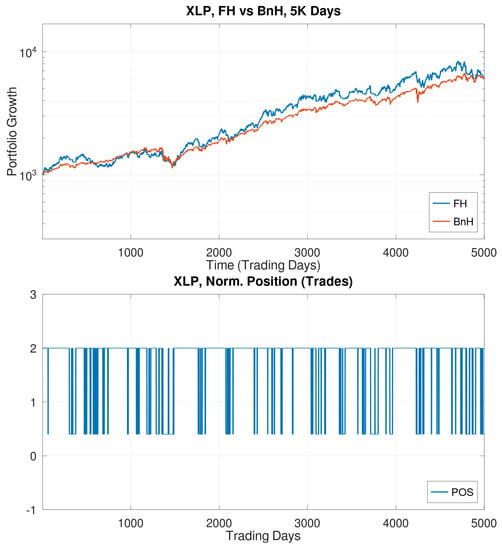

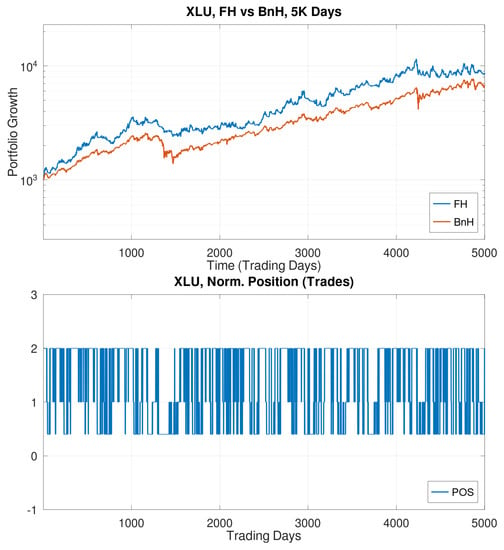

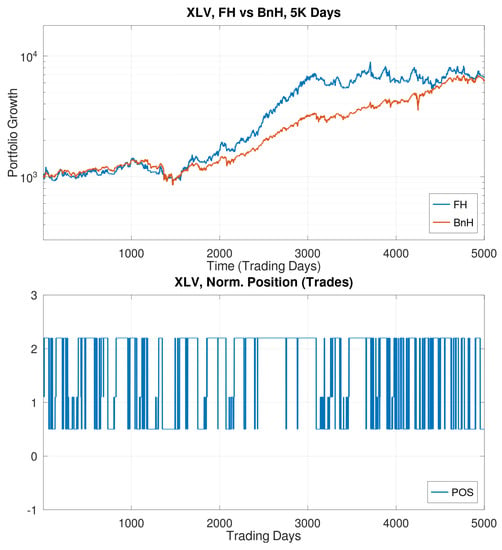

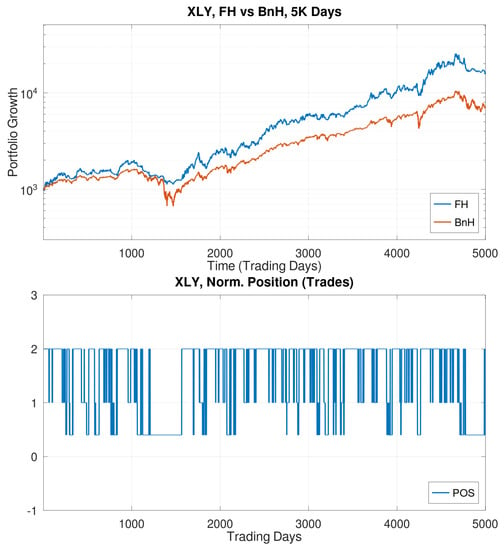

We now present the performance results for each of the nine tested sector funds, in Figure 3, Figure 4, Figure 5, Figure 6, Figure 7, Figure 8, Figure 9, Figure 10 and Figure 11. We only make the following general remarks. First, we can obtain a gain on each of the funds. We also obtain the largest gain on the least performing fund, XLF (but we exclude it from the portfolio). Furthermore, we note that we make only modest gains on several of the funds, most notably XLV. In fact, later evidence will show that XLV is a very reliable fund, with good growth and modest maximum drawdown on its own—our detailed analysis later indicates that it is a good general fund for any investor to invest in. Besides that fund, we note the expected strong performance of XLK, the technology fund, as well as a couple of others such as XLY (consumer discretionary).

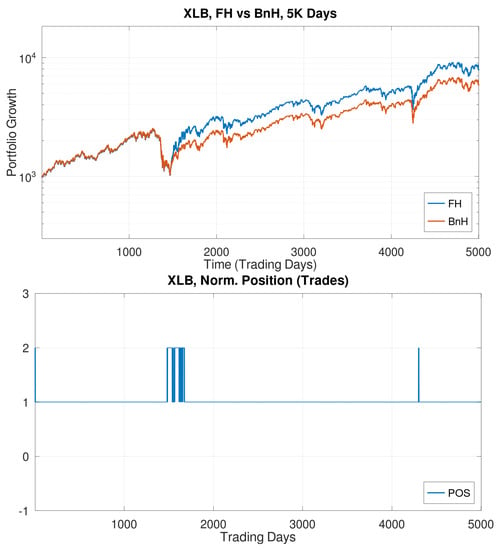

Figure 3.

Performance of the SPDR US sector fund XLB under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

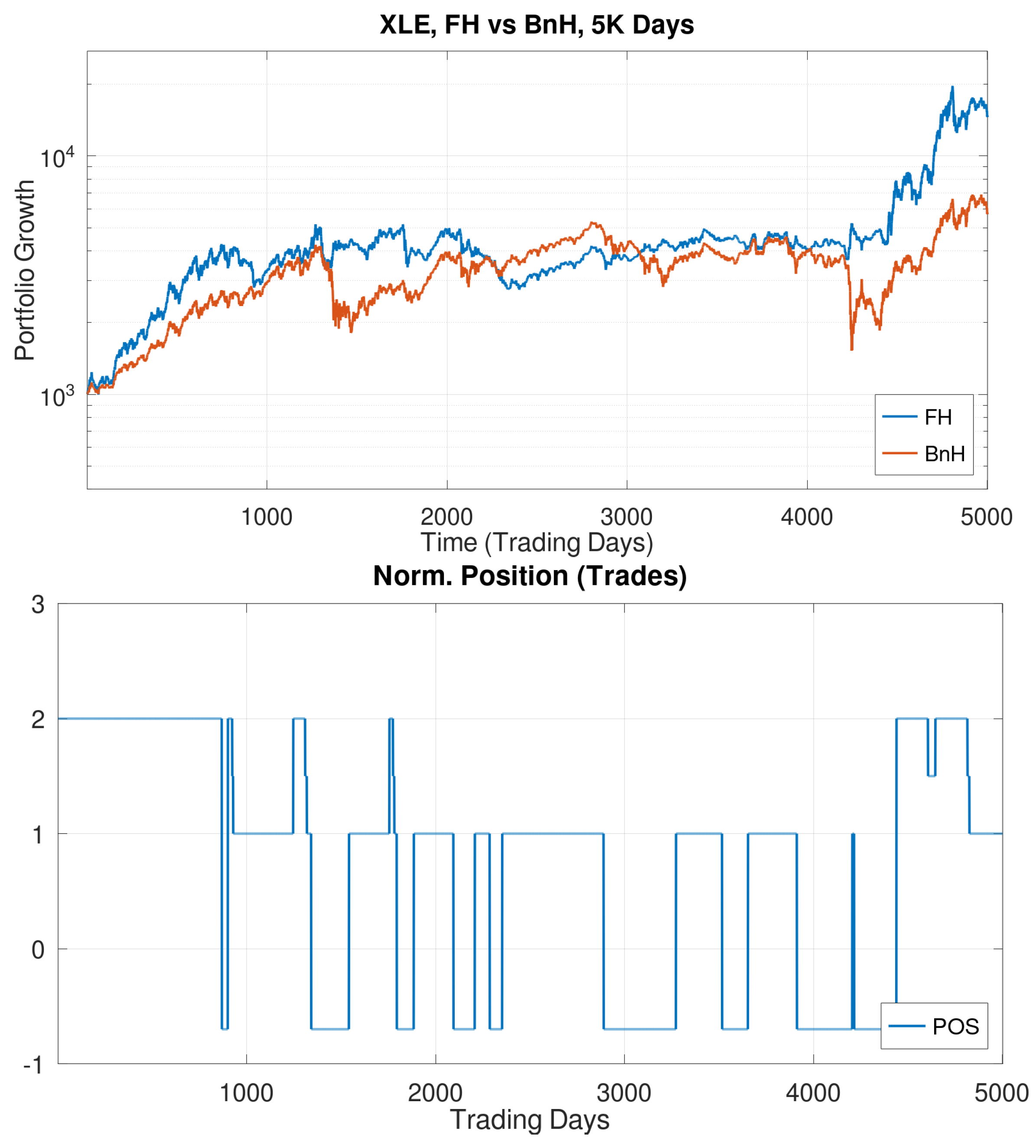

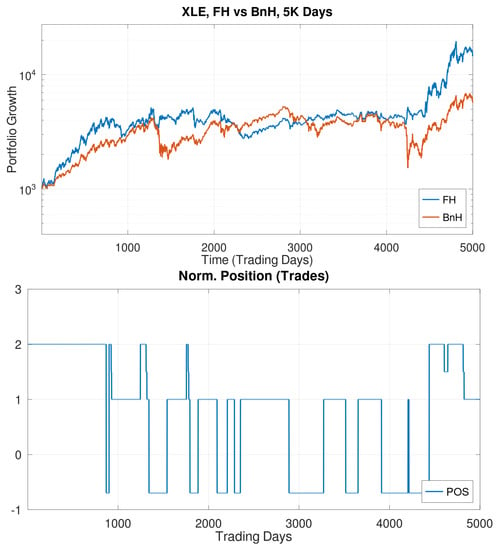

Figure 4.

Performance of SPDR US sector fund XLE under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

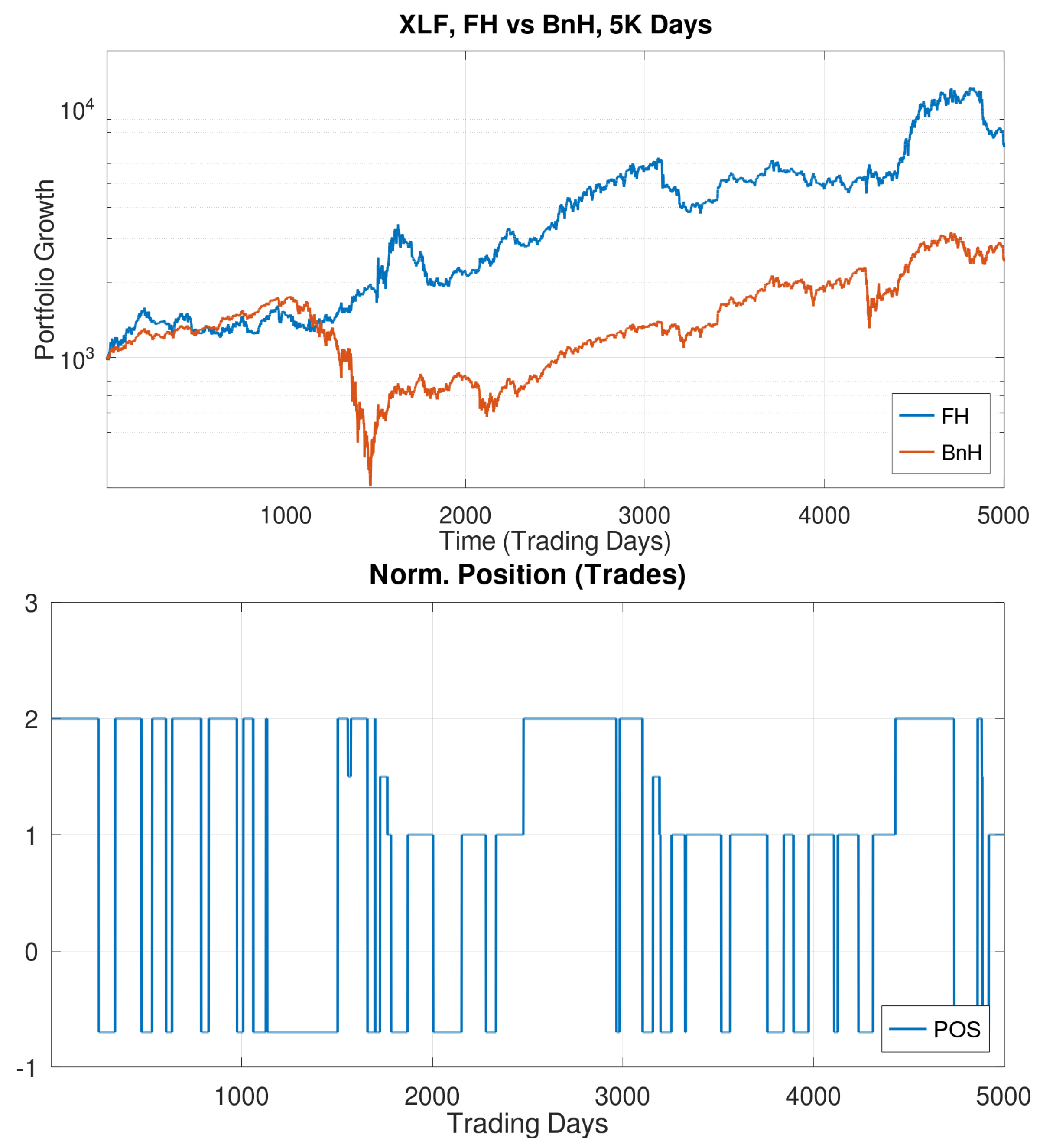

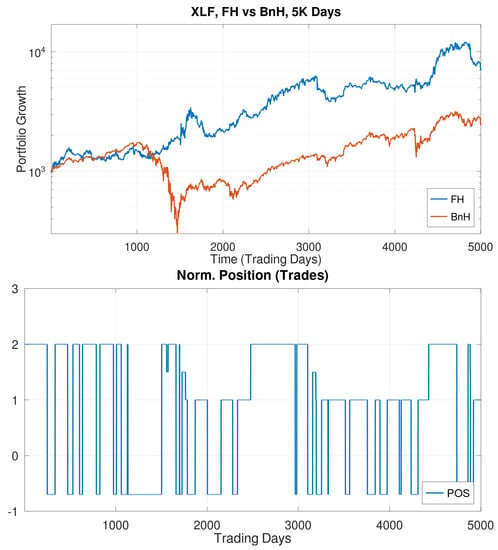

Figure 5.

Performance of SPDR US sector fund XLF under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided. Note the spectacular performance gain of our FH method over the fund itself. That sector fund suffered a devastating blow in 2008 during the financial crisis; however, we did not even notice it! We effectively managed that Black Swan. However, as a handicap, we excluded it from our portfolio study.

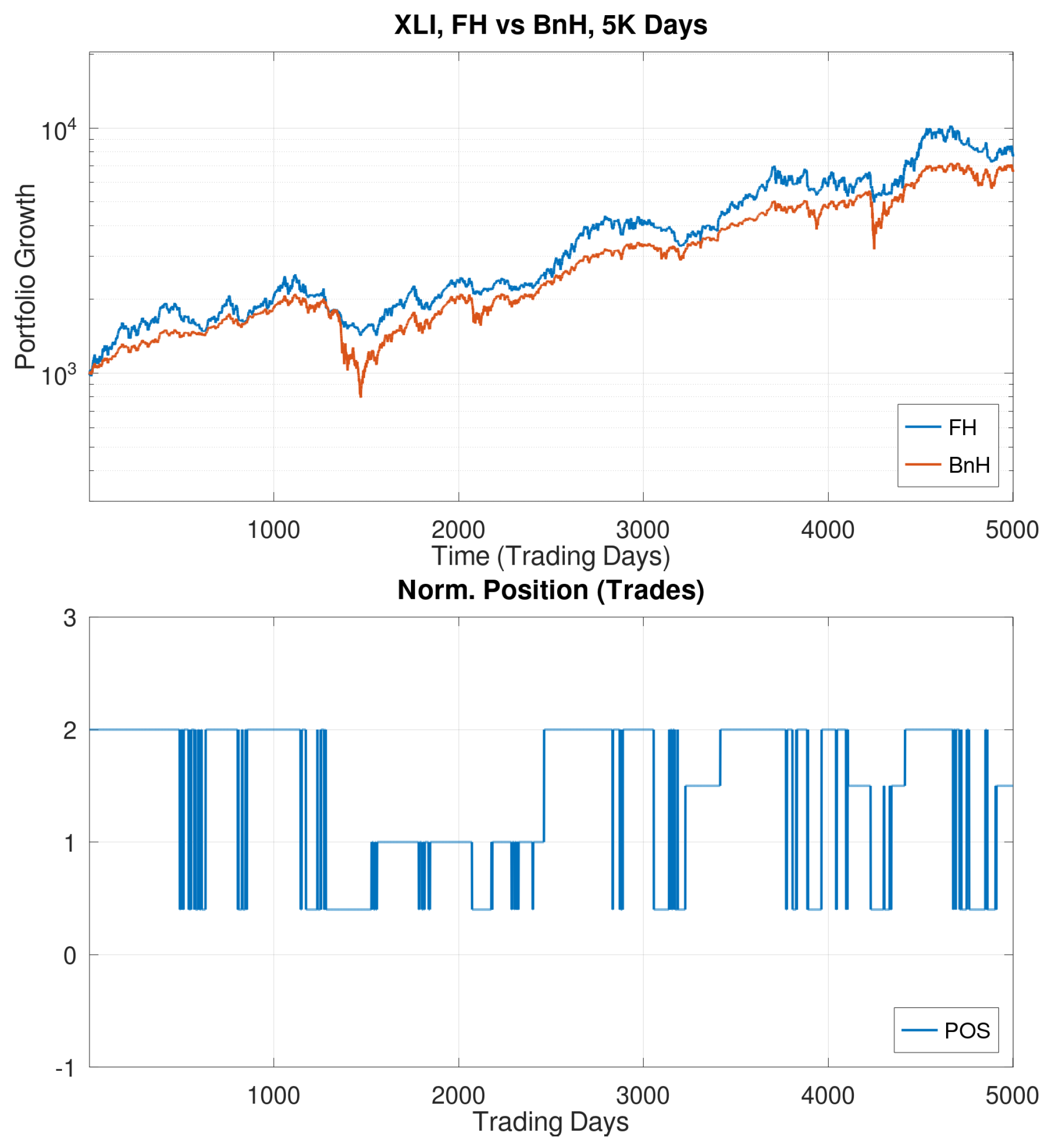

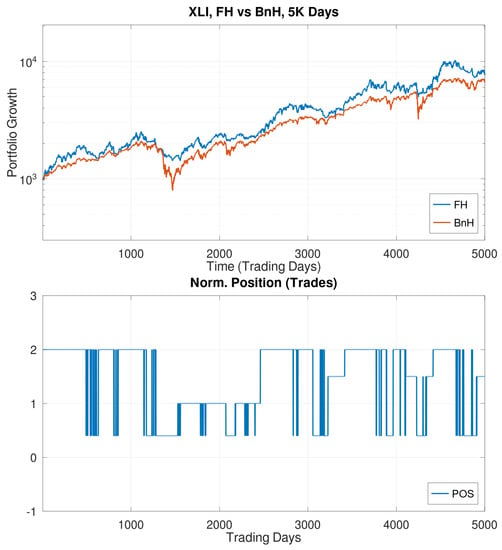

Figure 6.

Performance of the SPDR US sector fund XLI under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

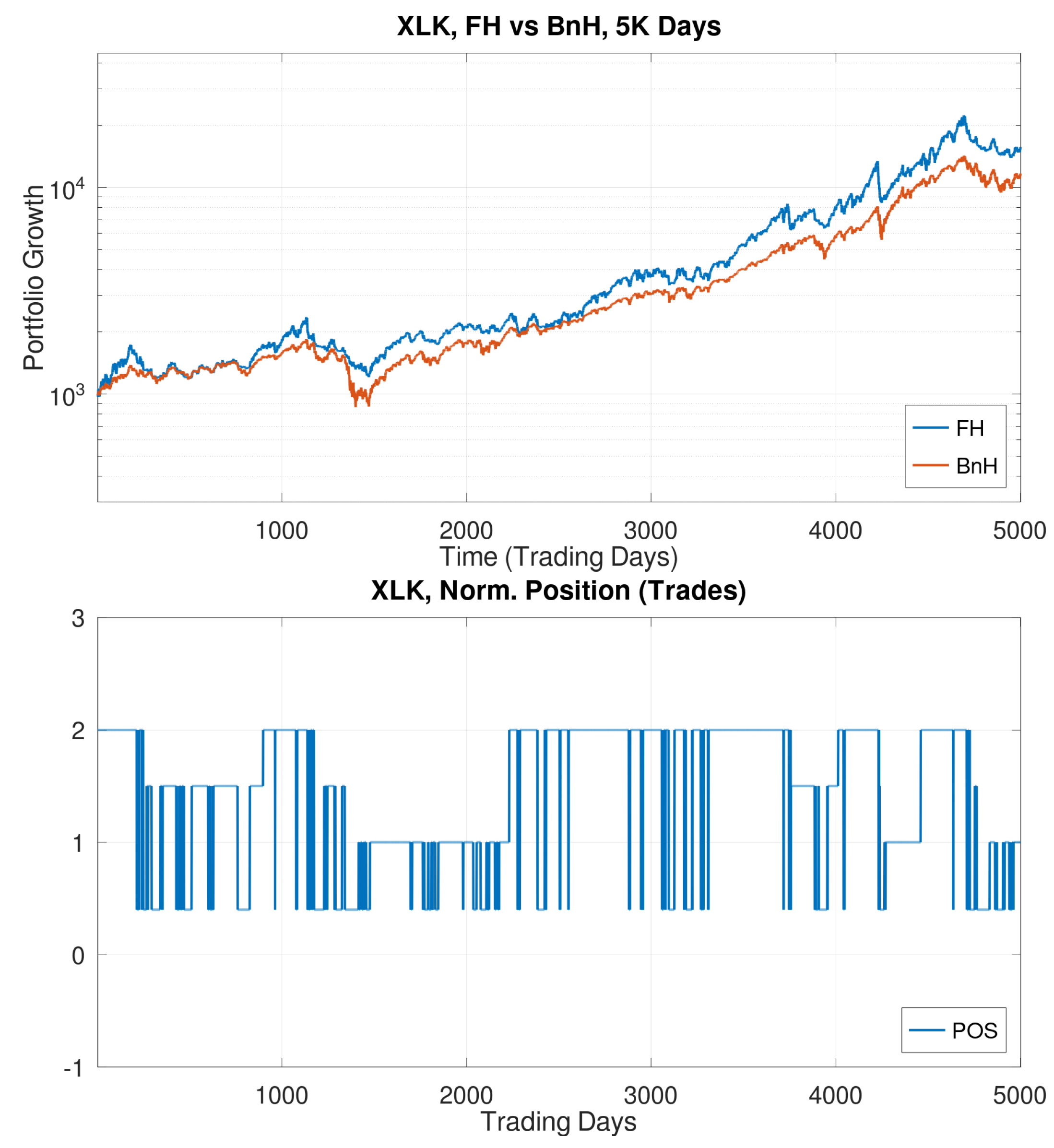

Figure 7.

Performance of the SPDR US sector fund XLB under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

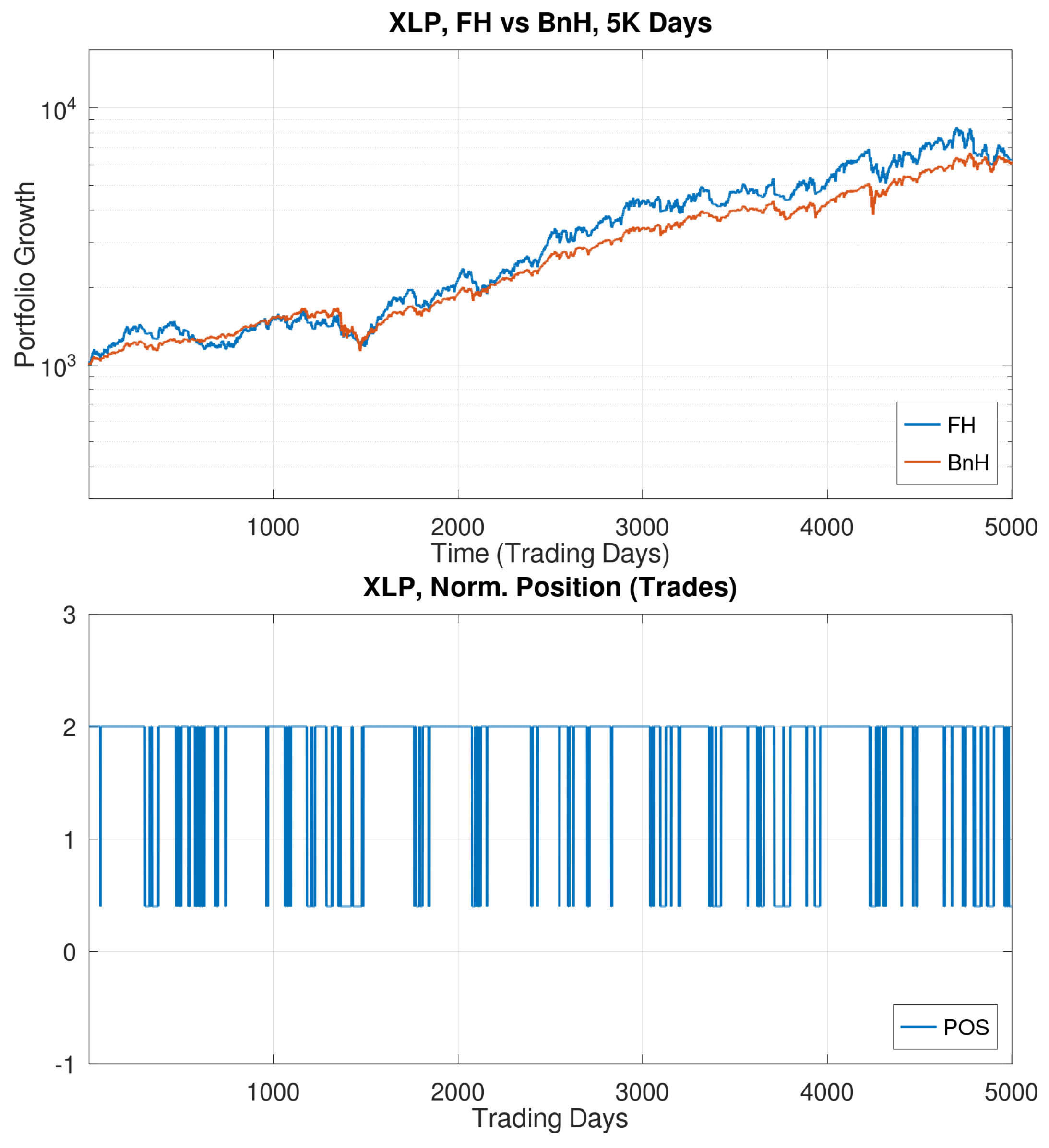

Figure 8.

Performance of the SPDR US sector fund XLP under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

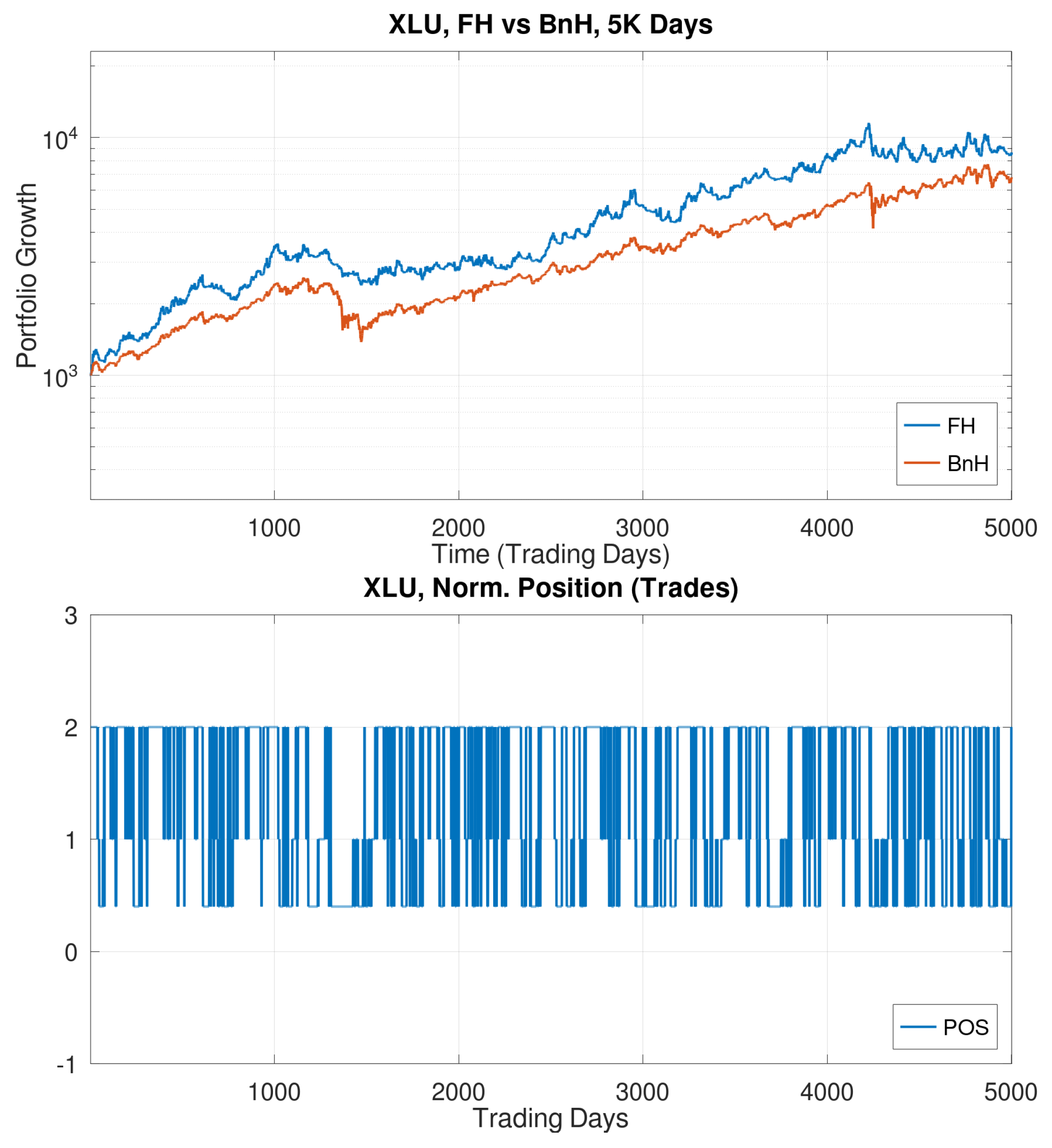

Figure 9.

Performance of the SPDR US sector fund XLU under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

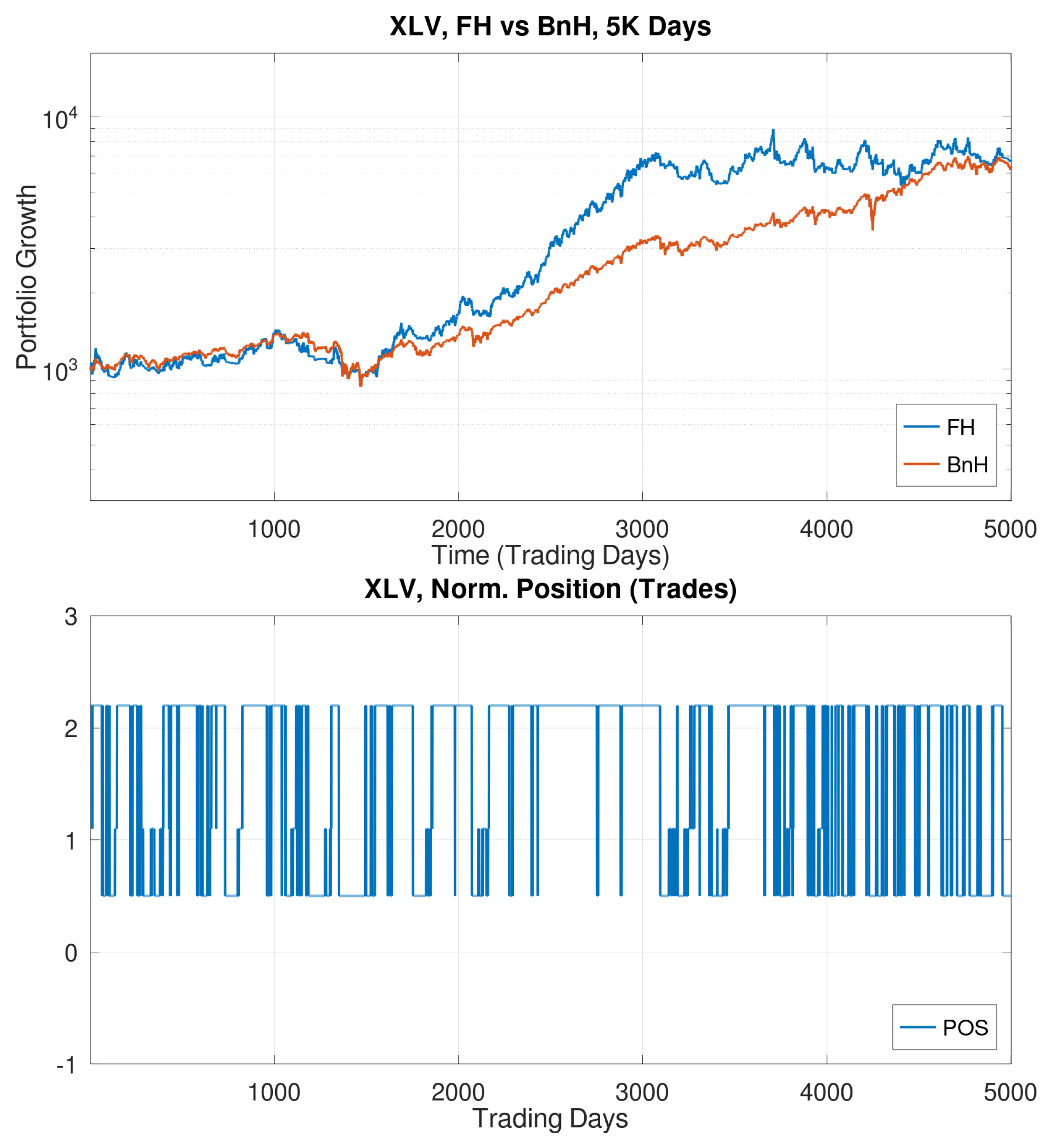

Figure 10.

Performance of the SPDR US sector fund XLV under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

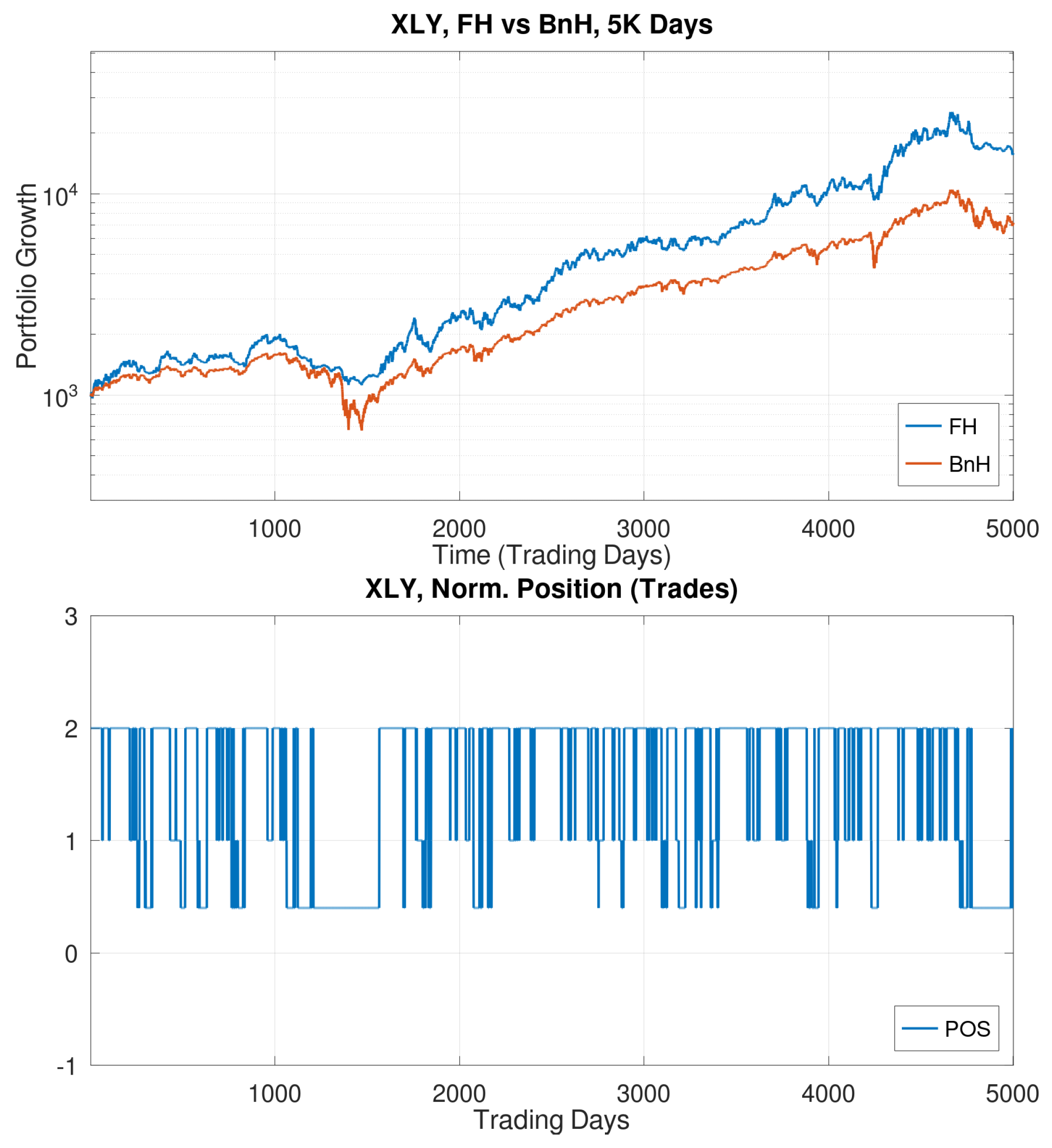

Figure 11.

Performance of the SPDR US sector fund XLY under FastHedge trading. A graphical timeline of the position taken on every day, and the trades made, is also provided.

3.2. Performance of a Portfolio of Five Sector Funds

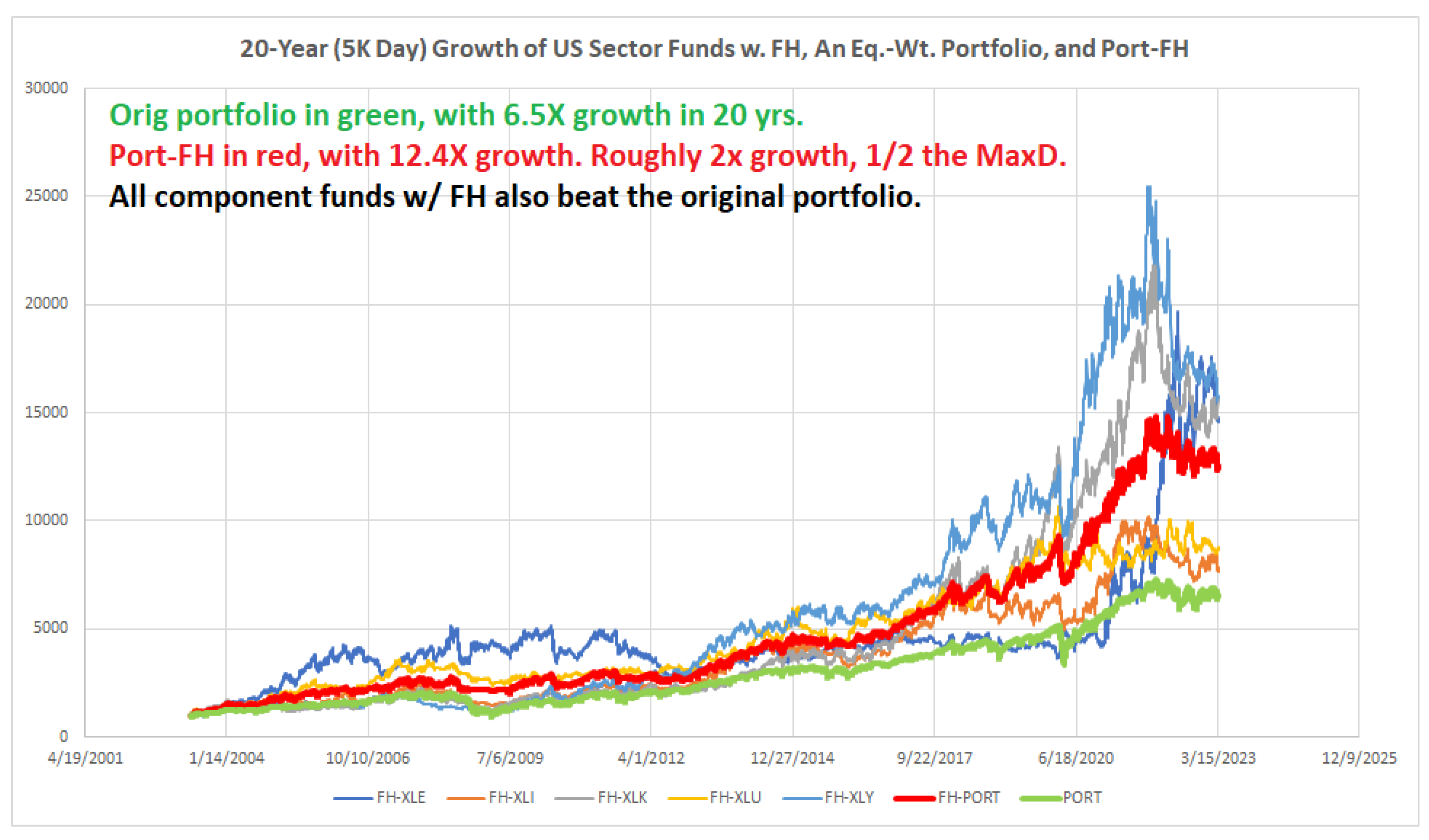

In the last section, we saw that FastHedge can provide a strong boost to some funds, but not much to others. We now assume that we have an equal weighted portfolio of five US sector funds, specifically XLE, XLI, XLK, XLU, and XLY (these were chosen fairly randomly, with no particular agenda, just for illustration purposes). Our premise is that we simply invest an equal amount in each of these funds, trade them individually without any rebalancing, and see how we end up after our 20-year period (actually 5000 trading days, but the difference is negligible). As we expect, individual sector funds may be volatile, but combining them should provide some level of diversification, and thus some moderation in volatility. While by averaging we may not achieve the best performance available among the individual sector funds this way, we may succeed in reducing our drawdowns, a goal of primary importance to small investors (along with the total performance). The performance of that portfolio under buy-and-hold is given in Figure 2, while the performance of that portfolio under FastHedge trading is given in Figure 12 (the unaided portfolio is also presented for direct comparison). Instead of a mere 6.5× gain, we now have a 12.4× gain, nearly double. Furthermore, we would have performed even better if we had not excluded the laggard XLF, on which we in fact have our best gains. Moreover, this is without any rebalancing at all in the 20-year (5K trading day) period. However, smart rebalancing in the style of MPT would have certainly provided further gains, a topic for another time.

Figure 12.

Performance of an equal-weight portfolio of five sector funds: XLE, XLI, XLK, XLU, and XLY. Over a 20-year period (5K trading days), pictured in red; the portfolio gained by a factor of 12.4× (or a 1240% gain). This is nearly double the performance of the same portfolio in buy-and-hold, as per Figure 2, where the multiplier is 6.5×. Moreover, it is achieved with half the MaxD, a massive gain overall. With XLF in the mix, we’d have done even better due to our massive gains on it.

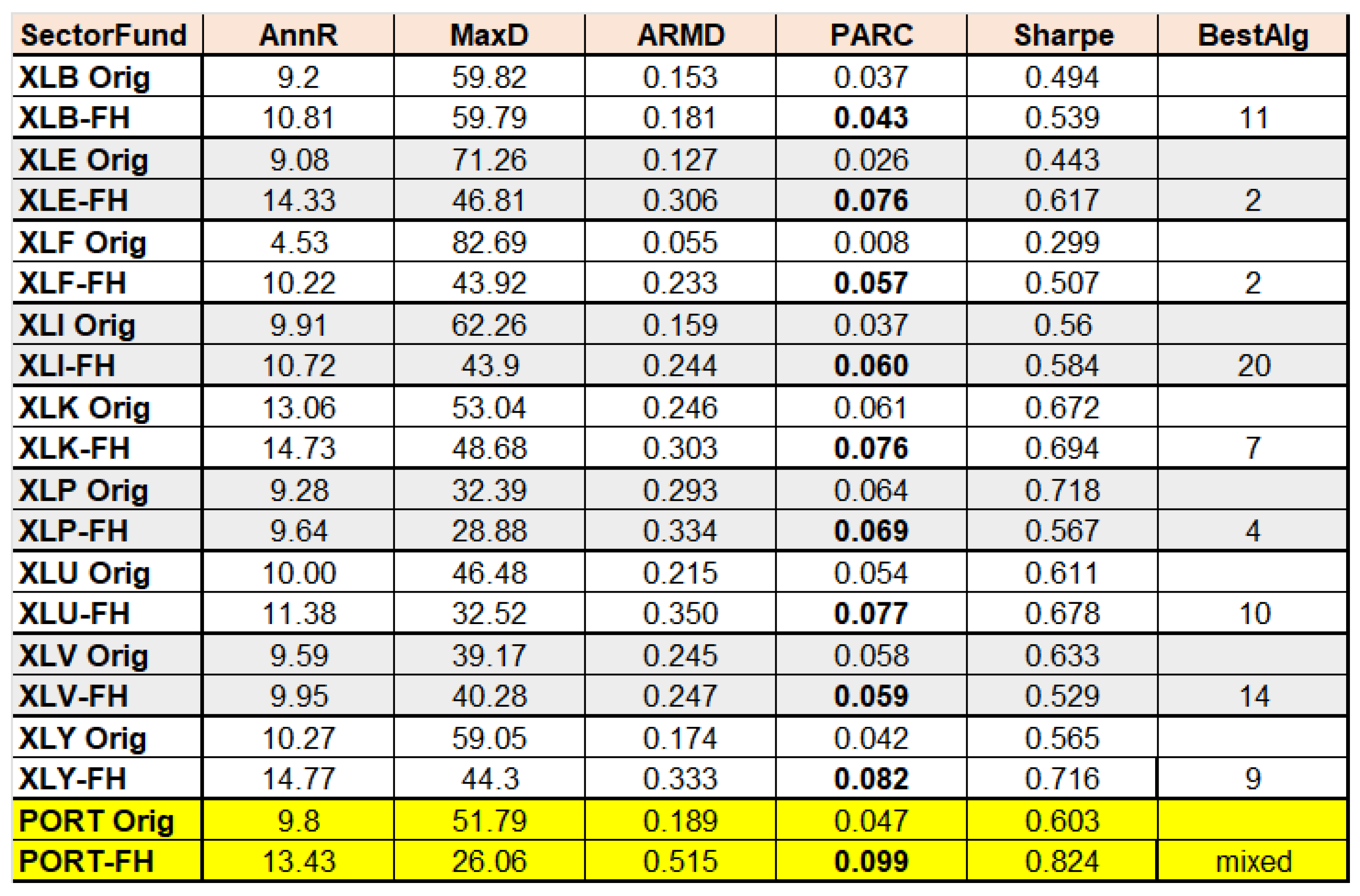

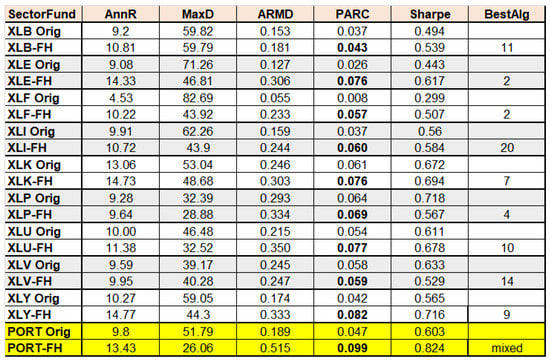

4. Performance in Tabular Form with Quantitative Metrics

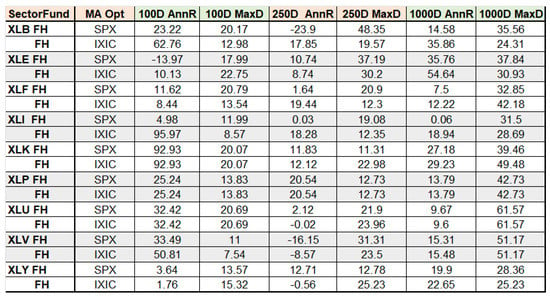

We now present our key findings in a convenient tabular form. We separate our results into shorter-term time windows of up to 4 years (1000 days), and a longer-term window of 20 years (5000 days); see Figure 13 and Figure 14. Note that, for shorter time periods, the performance can vary wildly, from negative to rapid positive growth, even for the 4-year mark. However, very high levels of growth cannot be sustained by any fund for much longer periods, and we do not see it in the important 20-year data. Nevertheless, we do see that we can improve the performance of each of the funds, according to our performance metrics, especially PARC. Furthermore, we especially note how dramatically we improve the performance of the portfolio, nearly doubling the gain while roughly halving the losses as measured by the MaxD. Indeed, our PARC measures more than doubles under FastHedge.

Figure 13.

Performance of US sector funds under FastHedge trading, for time periods of 100, 250, and 1000 trading days (roughly 4 months, 1 year, and 4 years). Note that, for shorter time periods, one can achieve very high rates of return, even up to 1000 days. We will see that such returns are not sustainable for much longer periods.

Figure 14.

Performance of US sector funds for a period of 5000 trading days (roughly 20 years) which ended on the 17 March 2023, along with an array performance metrics, including AnnR, MaxD, ARMR, PARC, and Sharpe. These results are graphically presented in Figure 12. The Sharpe Ratio is well established, but we find that our measures, esp. PARC, are more discerning. Note that we are able to improve the PARC measure for each sector fund, although only marginally for XLV. Our comparison of the original 5-fund portfolio, and the FastHedge version, is truly remarkable. By a simple and direct application of our method, applied individually to component funds without any sophisticated rebalancing, we can still manage to roughly double the performance, and halve the MaxD, greatly improving all performance measures, especially PARC. Obtaining 13.4% AnnR at 26.1% MaxD, even through the financial crisis of 2008 and the 2022 meltdown is an extremely remarkable success. We again note that had we not excluded XLF (a laggard on which FH had great success) from the portfolio, our performance surplus would have been even greater. We also note that no elements of modern portfolio theory were applied.

We now comment on the performance measures themselves. As we observed in our two previous papers, the Sharpe ratio is a decent but ultimately less reliable performance measure, and we can point out its shortcomings or outright failures. First, on XLB, where we have a useful gain of 1.6% in AnnR at a similar MaxD, both our ARMR and PARC measures improve more notably than the Sharpe does. On XLE, we make a dramatic performance improvement both in AnnR and MaxD, which is well rewarded in our two measures, but not as strongly in Sharpe. For XLF, we actually hit a home run, obtaining more than 2X in AnnR and cutting MaxD nearly in half. Again, both ARMR and PARC record very strong gains, while Sharpe is more muted. This contrast is even more severe in XLI, where the Sharp ratio hardly budges from 0.56 to 0.584, whereas the PARC moves sharply upward. Similar results were observed for XLK.

Finally, some more serious failures for Sharpe were observed. Take XLP, where we both improve AnnR and reduce MaxD, modestly. Thus, both ARMR and PARC record modest gains, while Sharpe actually penalizes XLP-FH, which is outrageous in our view. Similarly, we achieve quite modest gains for XLV, and our measures record a very modest gain, while Sharpe again goes the other way, penalizing XLV-FH. For XLU and XLY, Sharpe does record gains, but again fails to record sufficient gains. Finally, for a portfolio, we achieve dramatic gains with nearly double the performance and nearly half the MaxD, which is well rewarded in both our measures, especially PARC, which both more than double. By contrast, Sharpe only goes from 0.6 to 0.82, which is hardly significant. In short, the Sharpe ratio is inadequate to confirm the level of gains, and can even work in the wrong direction. We have yet to find a situation wherein our measures, especially PARC, fail us in this way.

5. Conclusions

In this paper (as in the previous ones), we employed an elementary form of algorithmic trading, namely rule-based market timing using moving averages, to achieve strong results in US-based stock and fund investment over long periods. We were certainly aware of the risk of over-tuning to the past market behavior in our algorithm development. This called over-fitting or data-mining bias, and is a risk that is common to all algorithmic trading. With that view, our goal was to build in as few tunable parameters as possible. Furthermore, in our testing approach, we generally fixed the elements of the method, including all parameters, for each test. Of course, the proof of any trading system is to fix a trading method, and test it on new data. Our approach aims to approximate that as much as possible. As in previous papers, wherein we tested US-based market indices, as well as some well-known tech stocks, we find here that our approach can also perform well on US market sector funds. We also find, graphically in Figure 12, and in tabular form in Figure 14, that by combining several of the funds but trading them individually, we can achieve both strong performance and very constrained drawdowns (of approximately 13.4% annual return, and only 26.1% maximum drawdown), which is highly desirable, and far better than that achieved by either the typical investor or even the typical managed fund. Furthermore, this is despite the 2008 Financial Crisis, the 2020 pandemic, and the 2022 market meltdown. Moreover, trading is limited to only once per day maximum, and on average, only approximately 20 times a year, which is entirely manageable for both individual investors and professionals.

We note again that we have by choice thus far made no use of modern portfolio theory. However, to obtain optimal results with multi-variable trading, that is clearly the next step, and a task for future research. Furthermore, we hope to test our ideas and framework on trading stocks and indices beyond US financial markets, to see whether they are still valid. These are just two of the many directions of possible future work.

Of course, any trading algorithm can be improved, or be defeated by a well-contrived time series designed to test its failure modes. All trading algorithms have decision boundaries, and markets that straddle those boundaries will dissipate performance. Real markets are likely to test any and every decision boundary over time. The challenge is to construct decision algorithms that are both simple and generic, so its failure modes constitute a vanishing subspace of the space of possible trajectories of real markets. Moreover, investing in multiple variables and trading them individually can help mitigate the effects of markets testing any one decision boundary.

Our methods are suitable for advising trading decisions by both individuals and professionals, and are fairly easy to execute by hand and instantly in software, showing resilient performance in the face of the many Black Swan events to date. While past performance is no guarantee of future returns and any algorithm can be improved, since the algorithms themselves are generic, as long as markets continue to have long-term trends, and mostly upwards, these methods should remain applicable.

Thus, our work supports the thesis that effective market timing is not only possible but relatively easy, and requiring only a reasonable number of trades per year. We therefore push back on the long-standing wisdom that market timing is impossible.

The past 100 years have seen continued (though not consistent) growth, on a trajectory that seems remarkable. Will it continue? No one knows. The human enterprise has been challenged many times across history, by wars, famines, and disease. The future is untold. However, as long as there is growth generally, our methods can help both professionals and individual investors navigate financial markets to achieve strong results as well as constrain drawdowns.

Funding

This paper received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data sources for figures other than our results are cited in the paper. Our own results and figures rely on index and stock data widely available from many sources, for example, historical data from finance.yahoo.com (accessed last on 16 March 2023).

Conflicts of Interest

The author declares no conflict of interest.

References

- ChartSchool. 2022. StockCharts.com. Available online: https://school.stockcharts.com/doku.php?id=chart_school&campaign=web&gclid=Cj0KCQiAnsqdBhCGARIsAAyjYjR76pMXP_-XEzBWsrFjtJHzq57aLHxojITGC5m0XxW3x0Xg3EkwdYYaAk4jEALw_wcB (accessed on 30 December 2022).

- Chen, James. 2020. Return over Maximum Drawdown (RoMaD). Available online: https://www.investopedia.com/terms/r/return-over-maximum-drawdown-romad.asp (accessed on 30 April 2022).

- Chen, Yong, and Bing Liang. 2007. Do Market Timing Hedge Funds Time the Market? Journal of Financial and Quantitative Analysis 42: 827–56. [Google Scholar] [CrossRef]

- Damodaram, Aswath. n.d. Dreaming the Impossible Dream? Market Timing. NYU Stern School of Business Document. Available online: https://pages.stern.nyu.edu/~adamodar/pdfiles/invphiloh/mkttiming.pdf (accessed on 30 April 2022).

- Elton, Edwin J., Martin J. Gruber, Stephen J. Brown, and William N. Goetzmann. 2014. Modern Portfolio Theory and Investment Analysis. New York: John Wiley and Sons. Available online: https://dl.rasabourse.com/Books/Finance%20and%20Financial%20Markets/%5BEdwin_J._Elton%2C_Martin_J._Gruber%2C_Stephen_J._Brow_Modern%20Portfolio%20Theory%20and%20Investment%28rasabourse.com%29.pdf (accessed on 1 January 2023).

- Graham, John, and Campbell Harvey. 1994. Market timing ability and volatility implied in investment newsletters’ asset allocation recommendations. Journal of Financial Economics 42: 397–421. [Google Scholar] [CrossRef]

- Henriksson, Roy, and Robert Merton. 1981. On Market Timing and Investment Performance. II: Statistical Procedures for Evaluating Forecasting Skills. Working Paper. Cambridge: Sloane School of Management, MIT. [Google Scholar]

- macrotrends. 2022. Macrotrends—The Premier Research Platform for Long Term Investors. Available online: https://www.macrotrends.net (accessed on 30 April 2022).

- Markowitz, Harry. 1952. Portfolio Selection. Journal of Finance 7: 77–91. Available online: https://www.jstor.org/stable/2975974 (accessed on 1 January 2023).

- Merton, Robert. 1981. On Market Timing and Investment Performance. I. An Equilibrium Theory of Value for Market Forecasts. Journal of Business 54: 363–406. [Google Scholar] [CrossRef]

- Sharpe, William. 1975. Likely Gains from Market Timing. Financial Analysts Journal 31: 60–69. [Google Scholar] [CrossRef]

- Sharpe, William. 1994. The Sharpe ratio. The Journal of Portfolio Management 21: 49–58. [Google Scholar] [CrossRef]

- Topiwala, Pankaj. 1998. Wavelet Image and Video Compression. Cham: Springer. Available online: https://www.amazon.com/s?k=wavelet+image+and+video+compression&crid=349R6JQD7OVUE&sprefix=wavelet+image+and+video+compression%2Caps%2C116&ref=nb_sb_noss (accessed on 30 December 2022).

- Topiwala, Pankaj. 2023. Surviving Black Swans II: Timing the 2020–2022 Roller Coaster. Journal of Risk and Financial Management 16: 106. Available online: https://www.mdpi.com/1911-8074/16/2/106 (accessed on 1 January 2023). [CrossRef]

- Topiwala, Pankaj, and Wei Dai. 2022. Surviving Black Swans: The Challenge of Market Timing Systems. Journal of Risk and Financial Management 5: 280. Available online: https://www.mdpi.com/1911-8074/15/7/280 (accessed on 30 December 2022). [CrossRef]

- Treynor, Jack, and Kay Mazuy. 1966. Can Mutual Funds Outguess the Market? Harvard Business Review 44: 131–36. [Google Scholar]

- van Dyck, Francois, Gary Van Vuuren, and Andre Heymans. 2014. Hedge Fund Performance Using Scaled Sharpe and Treynor Measures. International Journal of Economics and Business Research 13: 1261–300. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).