Investigating the Nexus between Corporate Governance and Firm Performance in India: Evidence from COVID-19

Abstract

:1. Introduction

Motivation of the Study

2. Literature Review and Hypothesis Development

2.1. Corporate Governance and Firm Performance before COVID-19

2.2. Corporate Governance and Firm Performance during COVID-19

3. Research Methodology

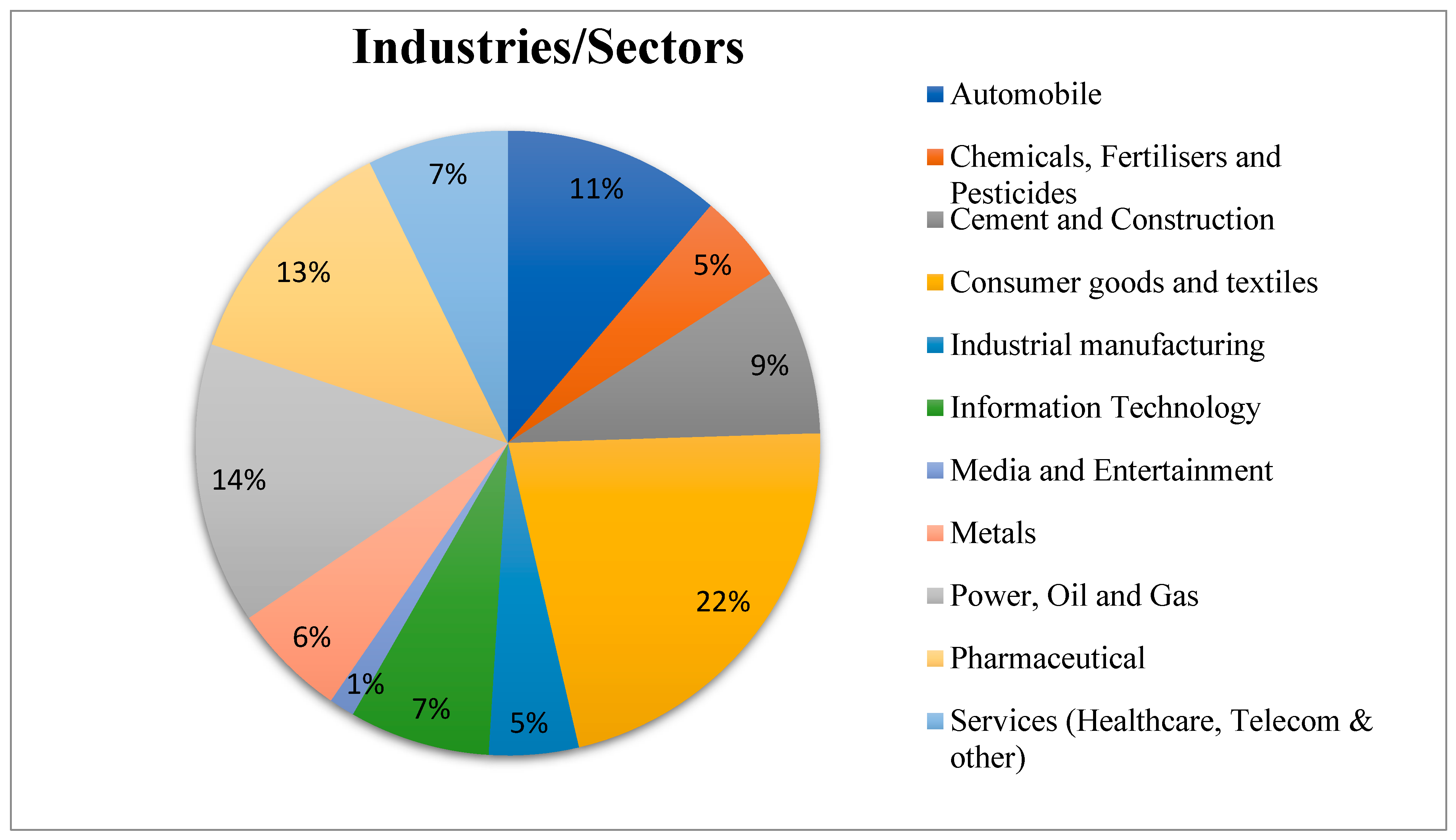

3.1. Sample Size and Period of Study

3.2. Data Collection and Variable Measurement

3.3. Research Tools and Techniques

3.4. Model Specification

4. Results and Findings

4.1. Descriptive Statistics

4.2. Correlation and VIF

4.3. T-Test Analysis

4.4. Regression Results of the Full Sample

4.5. Alternative Analysis: Regression Results of Year-Wise Subsample

4.6. One-Way ANOVA Results

5. Discussion

6. Implications of the Study

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | https://www.worldometers.info/coronavirus/country/india/ (accessed on 9 March 2022). |

| 2 | https://www1.nseindia.com/products/content/equities/indices/nifty_200.htm (accessed on 9 March 2022). |

References

- Abdul Rahman, Rashidah, and Fairuzana Hakeem Mohamed Ali. 2006. Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal 21: 783–804. [Google Scholar] [CrossRef]

- Abdulazeez, Daniya Adeiza, Leonard Ndibe, and Adeyeye M. Mercy. 2016. Corporate governance and financial performance of listed deposit money banks in Nigeria. Journal of Accounting and Marketing 5: 1–6. [Google Scholar]

- Ahmed Haji, Abdifatah. 2014. The relationship between corporate governance attributes and firm performance before and after the revised code: Some Malaysian evidence. International Journal of Commerce and Management 24: 134–51. [Google Scholar] [CrossRef]

- Aifuwa, Hope Osayantin, Musa Saidu, and Success Ayoola Aifuwa. 2020. Coronavirus pandemic outbreak and firms’ performance in Nigeria. Management and Human Resources Research Journal 9: 15–25. [Google Scholar]

- Akbar, Ahsan. 2015. Corporate Governance and Firm Performance: Evidence from Textile Sector of Pakistan. Journal of Asian Business Strategy 4: 200–7. [Google Scholar]

- Anas, Mohd, Mohd Tariq Jamal, Md Moneef Ahmad, Shujaat Naeem Azmi, and Md Firoz Alam. 2022. The Moderating Role of Board Gender Diversity in Association of Board Characteristics and Firm Value. Corporate Governance and Sustainability Review 6: 29–41. [Google Scholar] [CrossRef]

- Atayah, Osama F., Mohamed Mahjoub Dhiaf, Khakan Najaf, and Guilherme F. Frederico. 2021. Impact of COVID-19 on financial performance of logistics firms: Evidence from G-20 countries. Journal of Global Operations and Strategic Sourcing 15: 172–96. [Google Scholar] [CrossRef]

- Azizah, Amiril, and Ratna Wulaningrum. 2022. Corporate Governance and Firm Performance During COVID-19. International Journal of Multidisciplinary Research and Publications (IJMRAP) 5: 84–86. [Google Scholar]

- Bae, Kee-Hong, Sadok El Ghoul, Zhaoran (Jason) Gong, and Omrane Guedhami. 2021. Does CSR matter in times of crisis? Evidence from the COVID-19 pandemic. Journal of Corporate Finance 67: 101876. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Stephen J. Terry. 2020a. COVID-19-Induced Economic Uncertainty. National Bureau of Economic Research No. w26983. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle J. Kost, Marco C. Sammon, and Tasaneeya Viratyosin. 2020b. The Unprecedented Stock Market Impact of COVID-19. National Bureau of Economic Research No. w26945. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Baldwin, Richard, and Beatrice Weder Di Mauro, eds. 2020. Economics in the Time of COVID-19. London: CEPR Press. [Google Scholar]

- Bansal, Nidhi, and Anil K. Sharma. 2016. Audit committee, corporate governance and firm performance: Empirical evidence from India. International Journal of Economics and Finance 8: 103. [Google Scholar] [CrossRef] [Green Version]

- Bartik, Alexander W., Marianne Bertrand, Zoe Cullen, Edward L. Glaeser, Michael Luca, and Christopher Stanton. 2020. The impact of COVID-19 on small business outcomes and expectations. Proceedings of the National Academy of Sciences of the United States of America 117: 17656–66. [Google Scholar] [CrossRef]

- Baysinger, Barry D., and Henry N. Butler. 1985. Corporate governance and the board of directors: Performance effects of changes in board composition. Journal of Law, Economics, & Organization 1: 101–24. [Google Scholar]

- Biao, Xie, Wallace N. Davidson, and Peter J. Dadalt. 2003. Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance 9: 295–316. [Google Scholar]

- Bose, Sudipta, Syed Shams, Muhammad Jahangir Ali, and Dessalegn Mihret. 2021. COVID-19 impact, sustainability performance and firm value: International evidence. Accounting and Finance 62: 597–643. [Google Scholar] [CrossRef]

- Boshnak, Helmi A., Mohammad Alsharif, and Majed Alharthi. 2023. Corporate governance mechanisms and firm performance in Saudi Arabia before and during the COVID-19 outbreak. Cogent Business & Management 10: 2195990. [Google Scholar]

- Daily, Catherine M., Dan R. Dalton, and Albert A. Canella Jr. 2003. Corporate Governance: Decades of Dialogue and Data. Academy of Management Review 28: 371–82. [Google Scholar] [CrossRef]

- Dalton, Dan R., Catherine M. Daily, Jonathan L. Johnson, and Alan E. Ellstrand. 1999. Number of directors and financial performance: A meta-analysis. Academy of Management Journal 42: 674–86. [Google Scholar] [CrossRef]

- Danoshana, Sooriyakumar, and Thuraisingam Ravivathani. 2019. The impact of the corporate governance on firm performance: A study on financial institutions in Sri Lanka. SAARJ Journal on Banking & Insurance Research 8: 62–67. [Google Scholar]

- Datta, Nibedita. 2018. Impact of corporate governance on financial performance: A study on DSE listed Insurance companies in Bangladesh. Global Journal of Management and Business Research: Accounting and Auditing 18: 32–39. [Google Scholar]

- Denis, David J., Diane K. Denis, and Atulya Sarin. 1997. Ownership Structure and Top Executive Turnover. Journal of Financial Economics 45: 193–221. [Google Scholar] [CrossRef]

- Eisenberg, Theodore, Stefan Sundgren, and Martin T. Wells. 1998. Larger board size and decreasing firm value in small firms. Journal of Financial Economics 48: 35–54. [Google Scholar] [CrossRef]

- Eroğlu, Hasan. 2020. Effects of COVID-19 outbreak on the environment and renewable energy sector. Environment, Development, and Sustainability 23: 4782–790. [Google Scholar] [CrossRef]

- Farwis, Mahrool, Mansoor Mohamed Siyam, Nazar M. C. Amcanazar, and M. A. C. Fathima Aroosiya. 2021. The nexus between corporate governance and firm performance during COVID-19 pandemic in Sri Lanka. Journal of Economics, Finance and Accounting Studies 1: 81–88. [Google Scholar] [CrossRef]

- Field, Laura, Michelle Lowry, and Anahit Mkrtchyan. 2013. Are busy boards detrimental? Journal of Financial Economics 109: 63–82. [Google Scholar] [CrossRef]

- Foss, Nicolai J. 2020. The impact of the COVID-19 pandemic on firm’s organisational designs. Journal of Management Studies 58: 270. [Google Scholar] [CrossRef]

- Fu, Mengyao, and Huayu Shen. 2020. COVID-19 and corporate performance in the energy industry. Energy Research Letters 1: 12967. [Google Scholar] [CrossRef]

- Goel, Puneeta. 2018. Implications of corporate governance on financial performance: An analytical review of governance and social reporting reforms in India. Asian Journal of Sustainability and Social Responsibility 3: 1–21. [Google Scholar] [CrossRef]

- Golubeva, Olga. 2021. Firms’ performance during the COVID-19 outbreak: International evidence from 13 countries. Corporate Governance (Bingley) 21: 1011–27. [Google Scholar] [CrossRef]

- Gulzar, Ishfaq, S. M. Imamul Haque, and Tasneem Khan. 2020. Corporate Governance and Firm Performance in Indian Textile Companies: Evidence from NSE 500. Indian Journal of Corporate Governance 13: 210–26. [Google Scholar] [CrossRef]

- Guru, Biplab Kumar, and Amarendra Das. 2021. COVID-19 and uncertainty spillovers in Indian stock market. MethodsX 8: 101199. [Google Scholar] [CrossRef]

- Jamal, Mohd Tariq, Wafa Rashid Alalyani, Prabha Thoudam, Imran Anwar, and Ermal Bino. 2021. Telecommuting during COVID-19 19: A moderated-mediation approach linking job resources to job satisfaction. Sustainability 13: 11449. [Google Scholar] [CrossRef]

- Johnson, Simon, Peter Boone, Alasdair Breach, and Eric Friedman. 2000. Corporate governance in the Asian financial crisis. Journal of Financial Economics 58: 141–86. [Google Scholar]

- Kajola, Sunday. 2008. Corporate governance and firm performance: The case of Nigerian listed firms. European Journal of Economics, Finance and Administrative Sciences 14: 16–28. [Google Scholar]

- Key Highlights of Economic Survey 2019–20. 2020. Press Information Bureau. Available online: https://pib.gov.in/Pressreleaseshare.aspx?PRID=1601273 (accessed on 1 January 2021).

- Khatib, Saleh F. A., and Abdulnaser Ibrahim Nour. 2021. The Impact of Corporate Governance on Firm Performance during the COVID-19 Pandemic: Evidence from Malaysia. Journal of Asian Finance, Economics and Business 8: 943–52. [Google Scholar] [CrossRef]

- Kraus, Sascha, Thomas Clauss, Matthias Breier, Johanna Gast, Alessandro Zardini, and Victor Tiberius. 2020. The economics of COVID-19: Initial empirical evidence on how family firms in five European countries cope with the corona crisis. International Journal of Entrepreneurial Behavior & Research 26: 1067–92. [Google Scholar]

- Kyereboah-Coleman, Anthony. 2008. Corporate governance and firm performance in Africa: A dynamic panel data analysis. Studies in Economics and Econometrics 32: 1–24. [Google Scholar] [CrossRef]

- Larcker, David F., Bradford Lynch, Brian Tayan, and Daniel J. Taylor. 2020. The Spread of COVID-19 Disclosure. Rock Center for Corporate Governance at Stanford University Closer Look Series: Topics, Issues and Controversies in Corporate Governance, CGRP-84. Available online: https://www.gsb.stanford.edu/faculty-research/publications/spread-covid-19-disclosure (accessed on 1 January 2021).

- Leung, Sidney, Grant Richardson, and Bikki Jaggi. 2014. Corporate board and board committee independence, firm performance, and family ownership concentration: An analysis based on Hong Kong firms. Journal of Contemporary Accounting & Economics 10: 16–31. [Google Scholar]

- Levy, David L. 2020. COVID-19 and global governance. Journal of Management Studies 58: 562. [Google Scholar] [CrossRef]

- Limbasiya, Nailesh, and Hitesh Shukla. 2019. Effect of Board Diversity, Promoter’s Presence and multiple Directorships on Firm Performance. Indian Journal of Corporate Governance 12: 169–86. [Google Scholar] [CrossRef]

- Liu, HaiYue, Aqsa Manzoor, CangYu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef] [Green Version]

- López Iturriaga, Felix J., and Ignacio Morrós Rodríguez. 2014. Boards of directors and firm performance: The effect of multiple directorships. Spanish Journal of Finance and Accounting/Revista Espanola de Financiacion y Contabilidad 43: 177–92. [Google Scholar] [CrossRef]

- Malik, Muhammad Shaukat, and Durayya Debaj Makhdoom. 2016. Does corporate governance beget firm performance in fortune global 500 companies? Corporate Governance 16: 747–64. [Google Scholar] [CrossRef]

- Manna, Apu, Tarak Nath Sahu, and Krishna Dayal Pandey. 2020. Board size, multiple directorship and performance of Indian listed firms. International Journal of Economics and Business Research 19: 111–29. [Google Scholar] [CrossRef]

- Mather, Paul. 2020. Leadership and governance in a crisis: Some reflections on COVID-19. Journal of Accounting & Organizational Change 16: 579–85. [Google Scholar]

- Menon, Krishnagopal, and Joanne Deahl Williams. 1994. The use of audit committees for monitoring. Journal of Accounting and Public Policy 13: 121–39. [Google Scholar] [CrossRef]

- Mirza, Nawazish, Birjees Rahat, Bushra Naqvi, and Syed Kumail Abbas Rizvi. 2020. Impact of COVID-19 on corporate solvency and possible policy responses in the EU. Quarterly Review of Economics and Finance 72: 232–39. [Google Scholar] [CrossRef]

- Mohan, Aswathy, and S. Chandramohan. 2018. Impact of corporate governance on firm performance: Empirical evidence from India. International Journal of Research in Humanities, Arts and Literature 6: 2345–4564. [Google Scholar]

- Mohd-Saleh, Norman, Takiah Iskandar, and Mohd Mohid Rahmat. 2007. Audit committee characteristics and earnings management: Evidence from Malaysia. Asian Review of Accounting 15: 147–63. [Google Scholar] [CrossRef]

- Obrenovic, Bojan, Jianguo Du, Danijela Godinic, Diana Tsoy, Muhammad Aamir Shafique Khan, and Ilimdorjon Jakhongirov. 2020. Sustaining enterprise operations and productivity during the COVID-19 pandemic: Enterprise Effectiveness and Sustainability Model. Sustainability 12: 5981. [Google Scholar] [CrossRef]

- Organisation for Economic Co-Operation and Development (OECD). 2020. Corporate Sector Vulnerabilities during the COVID-19 Outbreak: Assessment and Policy Responses. Paris: OECD. [Google Scholar]

- Pibri, Hairul. 2021. The Influence of Corporate Governance on Firm Value and Bank Performance in The Pandemic Crisis in Indonesia. International Journal of Scientific and Research Publications (IJSRP) 11: 211–17. [Google Scholar] [CrossRef]

- Qin, Xiuhong, Guoliang Huang, Huayu Shen, and Mengyao Fu. 2020. COVID-19 pandemic and firm-level cash holding—Moderating effect of goodwill and goodwill impairment. Emerging Markets Finance and Trade 56: 2243–58. [Google Scholar] [CrossRef]

- Rodriguez-Fernandez, Mercedes, Sonia Fernandez-Alonso, and Jose Armando Rodriguez. 2014. Board characteristics and firm performance in Spain. Corporate Governance 14: 485–503. [Google Scholar] [CrossRef]

- Sarkar, Jayati, Subrata Sarkar, and Kaustav Sen. 2012. A Corporate Governance Index for Large Listed Companies in India. Pace University Accounting Research Paper 8: 1–42. [Google Scholar] [CrossRef] [Green Version]

- Shan, Yuan George, and Ron P. McIver. 2011. Corporate governance mechanisms and financial performance in China: Panel data evidence on listed non-financial companies. Asia Pacific Business Review 17: 301–24. [Google Scholar] [CrossRef]

- Sharma, Amalesh, Anirban Adhikary, and Sourav Bikash Borah. 2020. COVID-19′s impact on supply chain decisions: Strategic insights from NASDAQ 100 firms using Twitter data. Journal of Business Research 117: 443–49. [Google Scholar] [CrossRef] [PubMed]

- Singh, Shveta, and Deepika Bansal. 2021. Linkage Between Ownership Structure and Firm’s Financial Performance: An Empirical Analysis of Indian Software Companies. SCMS Journal of Indian Management 2: 55–56. [Google Scholar]

- Slater, Adam. 2020. Soaring corporate debt is a risk to global growth. Economic Outlook 44: 19–23. [Google Scholar] [CrossRef]

- Smith, Nina, Valdermar Smith, and Mette Verner. 2006. Do Women in Top Management Affect Firm Performance? A Panel Study of 2500 Danish Firms. International Journal of Productivity and Performance Management 55: 569–93. [Google Scholar] [CrossRef] [Green Version]

- Vafeas, Nikos. 1999. Board meeting frequency and firm performance. Journal of Financial Economics 53: 113–42. [Google Scholar] [CrossRef]

- Vishwakarma, Rachana, and Alok Kumar. 2015. Does corporate governance increases firm performance of IT industry? An empirical analysis. Journal of Management Research 7: 82–90. [Google Scholar]

- Vo, Duc, and Thuy Phan. 2013. Corporate governance and firm performance: Empirical evidence from Vietnam. Journal of Economic Development 7: 62–78. [Google Scholar]

- Vo, Thi Thuy Anh, and Phan Nha Khanh Bui. 2017. Impact of board gender diversity on firm value: International Evidence. Journal of Economics and Development 19: 65–76. [Google Scholar]

- World Bank. 2020. COVID-19 to Plunge Global Economy into Worst Recession Since World War II. Available online: https://www.worldbank.org/en/news/press-release/2020/06/08/COVID-19-to-plunge-global-economy-into-worst-recession-since-world-war-ii (accessed on 1 January 2021).

- World Economic Forum (WEF). 2020. Mad March: How the Stock Market Is Being Hit by COVID-19. Available online: https://www.weforum.org/agenda/2020/03/stock-marketvolatility-coronavirus/ (accessed on 1 January 2021).

- Yermack, David. 1996. Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40: 185–211. [Google Scholar] [CrossRef]

| S. No. | Variable Name | Definition and Measurement | Symbol |

|---|---|---|---|

| Panel A: Independent Variables | |||

| 1 | Board Size | Number of directors on the board | BS |

| 2 | Board Independence | Percentage of independent directors | BI |

| 3 | Women Directorship | Percentage of female directors | WD |

| 4 | Board Meetings | Number of meetings held by the board during the year | BM |

| 5 | Board Attendance | Average attendance of all the directors in the board meetings | BA |

| 6 | Audit Committee Size | Number of directors on audit committee | ACS |

| 7 | Audit Committee Meetings | Number of meetings held by audit committee during the year | ACM |

| 8 | Board Busyness | Percentage of directors holding directorship in other companies | BB |

| Panel B: Dependent Variables | |||

| 1 | Return on Assets | Percentage of profit after tax over total assets | ROA |

| 2 | Q Ratio | (Market value of equity + Book value of preference share + book value of non-tradable debt)/Book value total assets | Tobin’s Q |

| Panel C: Control Variables | |||

| 1 | Firm Size | Natural log value of total assets | FS |

| 2 | Firm Age | Number of years since the firm was incorporated | FA |

| 3 | Firm Leverage | Debt to equity ratio | LEV |

| 4 | Growth | Natural log of revenue from operation | G |

| 5 | R&D expenditure | Natural log of average expenditure by the company on research and development activities +1 | R&D |

| Variable | Observation | Mean | Std. Dev. | Minimum | Maximum |

|---|---|---|---|---|---|

| Board Size | 302 | 10.26 | 2.49 | 4 | 20 |

| Board Independence | 302 | 48.84 | 12.10 | 18.18 | 85.71 |

| Women Directorship | 302 | 16.66 | 8.63 | 0 | 50 |

| Board Meetings | 302 | 6.66 | 2.49 | 4 | 19 |

| Board Attendance | 302 | 92.46 | 6.74 | 64 | 100 |

| Audit Committee Size | 302 | 4.18 | 1.09 | 3 | 9 |

| Audit Committee Meetings | 302 | 5.82 | 2.20 | 1 | 19 |

| Board Busyness | 302 | 78.70 | 21.79 | 10 | 100 |

| ROA | 302 | 9.61 | 11.80 | −31.95 | 144.26 |

| Tobin’s Q | 302 | 3.78 | 4.37 | 0.039 | 32.81 |

| Firm Size | 302 | 11.92 | 1.28 | 8.99 | 16.08 |

| Firm Age | 302 | 44.79 | 25.97 | 5 | 158 |

| Leverage | 302 | 0.55 | 2.28 | −0.1 | 35.34 |

| Growth | 302 | 11.39 | 1.39 | 7.30 | 15.55 |

| R&D | 302 | 4.87 | 3.50 | 0 | 11.71 |

| Variable | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BS | 1.000 | ||||||||||||

| BI | −0.004 | 1.000 | |||||||||||

| WD | 0.121 | −0.105 | 1.000 | ||||||||||

| BM | 0.016 | 0.335 | 0.124 | 1.000 | |||||||||

| BA | 0.147 | 0.029 | −0.041 | 0.155 | 1.000 | ||||||||

| ACS | −0.266 | −0.181 | 0.088 | 0.014 | −0.032 | 1.000 | |||||||

| ACM | −0.043 | −0.111 | 0.045 | −0.472 | −0.073 | −0.054 | 1.000 | ||||||

| BB | −0.018 | −0.142 | −0.036 | 0.072 | 0.04 | 0.093 | −0.031 | 1.000 | |||||

| FS | −0.074 | 0.061 | −0.034 | −0.039 | 0.007 | 0.079 | −0.176 | −0.038 | 1.000 | ||||

| FA | −0.087 | −0.060 | 0.016 | 0.004 | 0.063 | 0.001 | −0.048 | 0.089 | −0.013 | 1.000 | |||

| G | −0.084 | 0.008 | 0.003 | −0.163 | −0.156 | 0.037 | 0.082 | −0.033 | −0.653 | −0.035 | 1.000 | ||

| LEV | 0.015 | −0.095 | 0.006 | −0.168 | −0.002 | 0.039 | 0.012 | 0.040 | −0.107 | 0.052 | 0.044 | 1.000 | |

| R&D | −0.102 | −0.167 | 0.049 | 0.018 | −0.093 | 0.088 | 0.031 | 0.068 | −0.006 | −0.163 | −0.253 | 0.108 | 1.000 |

| VIF | 1.22 | 1.33 | 1.11 | 1.92 | 1.10 | 1.51 | 1.18 | 1.06 | 2.47 | 1.10 | 2.60 | 1.09 | 1.31 |

| TV | 0.82 | 0.75 | 0.90 | 0.52 | 0.91 | 0.66 | 0.85 | 0.94 | 0.41 | 0.91 | 0.38 | 0.92 | 0.76 |

| Variables | Pre-COVID-19 Phase | COVID-19 Phase | Mean Difference (μd) | T | ||||

|---|---|---|---|---|---|---|---|---|

| Obs. | Mean (μ1) | Std. Dev. | Obs. | Mean (μ2) | Std. Dev | |||

| BS | 151 | 10.75 | 2.99 | 151 | 10.22 | 2.58 | −0.529 | −3.920 * |

| BI | 151 | 55.40 | 1.62 | 151 | 50.90 | 1.57 | −4.44 | −4.052 * |

| WD | 151 | 16.90 | 0.86 | 151 | 17.00 | 0.87 | 0.100 | 0.271 ** |

| BM | 151 | 6.56 | 2.94 | 151 | 6.60 | 2.42 | 0.033 | 0.164 |

| BA | 151 | 88.62 | 8.09 | 151 | 89.88 | 6.72 | 1.268 | 1.999 ** |

| ACS | 151 | 4.45 | 1.19 | 151 | 4.23 | 1.03 | −0.222 | −2.990 ** |

| ACM | 151 | 5.64 | 2.15 | 151 | 5.81 | 2.28 | 0.170 | 1.352 |

| BB | 151 | 79.61 | 23.05 | 151 | 80.73 | 22.77 | 1.112 | 0.913 |

| ROA | 151 | 10.34 | 8.33 | 151 | 10.22 | 14.20 | −0.110 | −0.116 |

| Tobin’s Q | 151 | 3.55 | 3.45 | 151 | 2.96 | 3.61 | −0.590 | −3.543 * |

| FS | 151 | 5.109 | 0.57 | 151 | 5.144 | 0.56 | 0.035 | 3.803 * |

| FA | 151 | 43.08 | 25.90 | 151 | 44.07 | 25.91 | 0.986 | 107.126 * |

| G | 151 | 4.97 | 0.61 | 151 | 4.93 | 1.55 | −0.010 | −0.861 |

| LEV | 151 | 0.37 | 0.58 | 151 | 0.50 | 1.23 | 0.126 | 1.659 *** |

| R&D | 151 | 2.234 | 1.52 | 151 | 2.315 | 1.55 | 0.081 | 1.225 |

| Independent Variables | ROA | Tobin’s Q | ||

|---|---|---|---|---|

| −1 | −2 | −1 | −2 | |

| BS | −0.090(0.805) | −0.079 (0.807) | 0.153 (0.188) | 0.154 (0.189) |

| BI | 0.790 (0.996) | 0.788 (0.999) | −0.036 (0.233) | −0.036 (0.234) |

| WD | −1.507 (1.233) | −1.513 (1.236) | −0.518 (0.289) *** | −0.518 (0.290) *** |

| BM | 0.018 (0.270) | 0.014 (0.271) | −0.681 (0.063) | −0.068 (0.063) |

| BA | 0.069 (0.082) | 0.071 (0.083) | −0.001 (0.019) | −0.001 (0.019) |

| ACS | 0.593 (0.786) | 0.593 (0.788) | −0.002 (0.184) | −0.002 (0.184) |

| ACM | 0.416 (0.436) | 0.438 (0.438) | 0.002 (0.102) | 0.002 (0.102) |

| BB | 0.088 (0.047) *** | 0.088 (0.048) ** | 0.027 (0.011) ** | 0.027 (0.011) ** |

| FS | −75.55 (5.53) * | −75.68 (5.55) * | −8.715 (1.298) * | −8.721 (1.303) * |

| FA | 3.254 (0.731) * | −0.053 (5.575) | −0.183 (0.171) | −0.361 (1.303) |

| G | 8.328 (4.141) ** | 8.270 (4.151) ** | 1.982 (0.970) ** | 1.979 (0.974) ** |

| LEV | −2.628 (0.703) * | −2.641 (0.705) * | −0.096 (0.164) | −0.096 (0.165) |

| R&D | −0.113 (0.780) | −0.110 (0.782) | −0.119 (0.182) | −0.119 (0.183) |

| Constant | 196.167 (42.327) * | 339.614 (243.33) | 44.148 (9.919) * | 51.843 (57.096) |

| Year dummy | No | Yes | No | Yes |

| 2021 | --- | 3.308 (5.526) | --- | 0.177 (1.296) |

| F statistics | 16.21 | 15.01 | 5.14 | 5.11 |

| R2 | 0.262 | 0.159 | 0.47 | 0.36 |

| Observation | 302 | 302 | 302 | 302 |

| Hausman test for model selection | ||||

| χ2 | 17.60 | 21.45 | 85.86 | 61.25 |

| p-value | 0.0041 | 0.0012 | 0.0000 | 0.0000 |

| Model selection | Fixed Effect | Fixed Effect | Fixed Effect | Fixed Effect |

| Independent Variables | ROA | Tobin’s Q | ||

|---|---|---|---|---|

| 2020 | 2021 | 2020 | 2021 | |

| BS | 0.200 (0.309) | 1.514 (0.608) ** | 0.084 (0.141) | −0.019 (0.165) |

| BI | −0.344 (0.562) | −1.514 (1.002) *** | 0.056 (0.256) | 0.229 (0.272) |

| WD | 1.144 (0.625) *** | −0.718 (1.164) | 0.070 (0.285) | −0.092 (0.316) |

| BM | 0.181 (0.233) | −0.511 (0.581) | −0.127 (0.106) | −0.078 (0.158) |

| BA | 0.043 (0.066) | 0.018 (0.152) | 0.016 (0.030) | 0.005 (0.041) |

| ACS | 0.392 (0.469) | 0.073 (1.048) | −0.074 (0.214) | 0.058 (0.285) |

| ACM | 0.845 (0.333) ** | 1.400 (0.596) ** | 0.370 (0.152) ** | 0.157 (0.162) |

| BB | −0.048 (0.023) ** | 0.044 (0.045) | −0.003 (0.010) | −0.0002 (0.122) |

| FS | −9.606 (1.582) * | −19.97 (2.857) * | −4.595 (0.721) * | −4.812 (0.777) * |

| FA | 0.002 (0.021) | −0.230 (0.039) | 0.018 (0.009) *** | 0.015 (0.010) |

| G | 4.018 (1.429) * | 11.153 (2.553) * | 1.390 (0.651) ** | 2.806 (0.695) * |

| LEV | −5.088 (0.926) | −2.608 (0.839) * | −0.503 (0.422) | −0.152 (0.228) |

| R&D | 0.488 (0.395) | 0.391 (0.692) | 0.106 (0.181) | −0.232 (0.188) |

| Constant | 30.246 (8.802) | 47.028 (17.258) | 15.871 (4.015) | 11.822 (4.697) ** |

| F statistics | 8.82 | 6.44 | 5.87 | 4.47 |

| Adjusted R2 | 0.402 | 0.319 | 0.295 | 0.230 |

| Observation | 151 | 151 | 151 | 151 |

| Variables | Source | SS | Df | MS | F | p-Value |

|---|---|---|---|---|---|---|

| ROA | Between groups | 2839.00 | 12 | 236.58 | 3.89 | 0.0000 |

| Within groups | 8383.73 | 138 | 60.75 | |||

| Total | 11,222.73 | 150 | 74.82 | |||

| Tobin’s Q | Between groups | 738.95 | 12 | 61.58 | 2.98 | 0.0010 |

| Within groups | 2847.02 | 138 | 20.63 | |||

| Total | 3585.97 | 150 | 23.91 |

| Industry | ROA | Tobin’s Q | ||||

|---|---|---|---|---|---|---|

| Mean | Std. Dev | Rank | Mean | Std. Dev | Rank | |

| Automobile | 7.306 | 6.366 | 08 | 2.733 | 1.402 | 08 |

| Chemicals, Fertilisers, and Pesticides | 8.153 | 4.285 | 07 | 4.924 | 3.693 | 04 |

| Cement and Construction | 3.645 | 4.552 | 10 | 2.261 | 1.192 | 09 |

| Consumer Goods and Textiles | 10.343 | 11.057 | 06 | 7.963 | 6.081 | 01 |

| Industrial Manufacturing | 5.209 | 6.374 | 09 | 2.078 | 1.571 | 11 |

| Information Technology | 17.207 | 6.968 | 02 | 6.662 | 2.927 | 02 |

| Media and Entertainment | 17.955 | 11.334 | 01 | 2.056 | 0.462 | 12 |

| Metals | 11.377 | 9.842 | 04 | 2.290 | 3.368 | 10 |

| Oil and Gas | 10.549 | 6.068 | 05 | 5.044 | 8.935 | 03 |

| Pharmaceutical | 11.594 | 5.394 | 03 | 3.992 | 2.072 | 05 |

| Power | 2.663 | 1.892 | 11 | 2.994 | 4.540 | 07 |

| Services (Healthcare and Other) | 2.144 | 8.962 | 12 | 3.438 | 3.415 | 06 |

| Telecom | −3.199 | 10.999 | 13 | 0.874 | 0.681 | 13 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Anas, M.; Gulzar, I.; Tabash, M.I.; Ahmad, G.; Yazdani, W.; Alam, M.F. Investigating the Nexus between Corporate Governance and Firm Performance in India: Evidence from COVID-19. J. Risk Financial Manag. 2023, 16, 307. https://doi.org/10.3390/jrfm16070307

Anas M, Gulzar I, Tabash MI, Ahmad G, Yazdani W, Alam MF. Investigating the Nexus between Corporate Governance and Firm Performance in India: Evidence from COVID-19. Journal of Risk and Financial Management. 2023; 16(7):307. https://doi.org/10.3390/jrfm16070307

Chicago/Turabian StyleAnas, Mohd, Ishfaq Gulzar, Mosab I. Tabash, Gayas Ahmad, Wasi Yazdani, and Md. Firoz Alam. 2023. "Investigating the Nexus between Corporate Governance and Firm Performance in India: Evidence from COVID-19" Journal of Risk and Financial Management 16, no. 7: 307. https://doi.org/10.3390/jrfm16070307