On the Exchange Rate Dynamics of the Norwegian Krone

Abstract

:1. Introduction

2. Literature Review

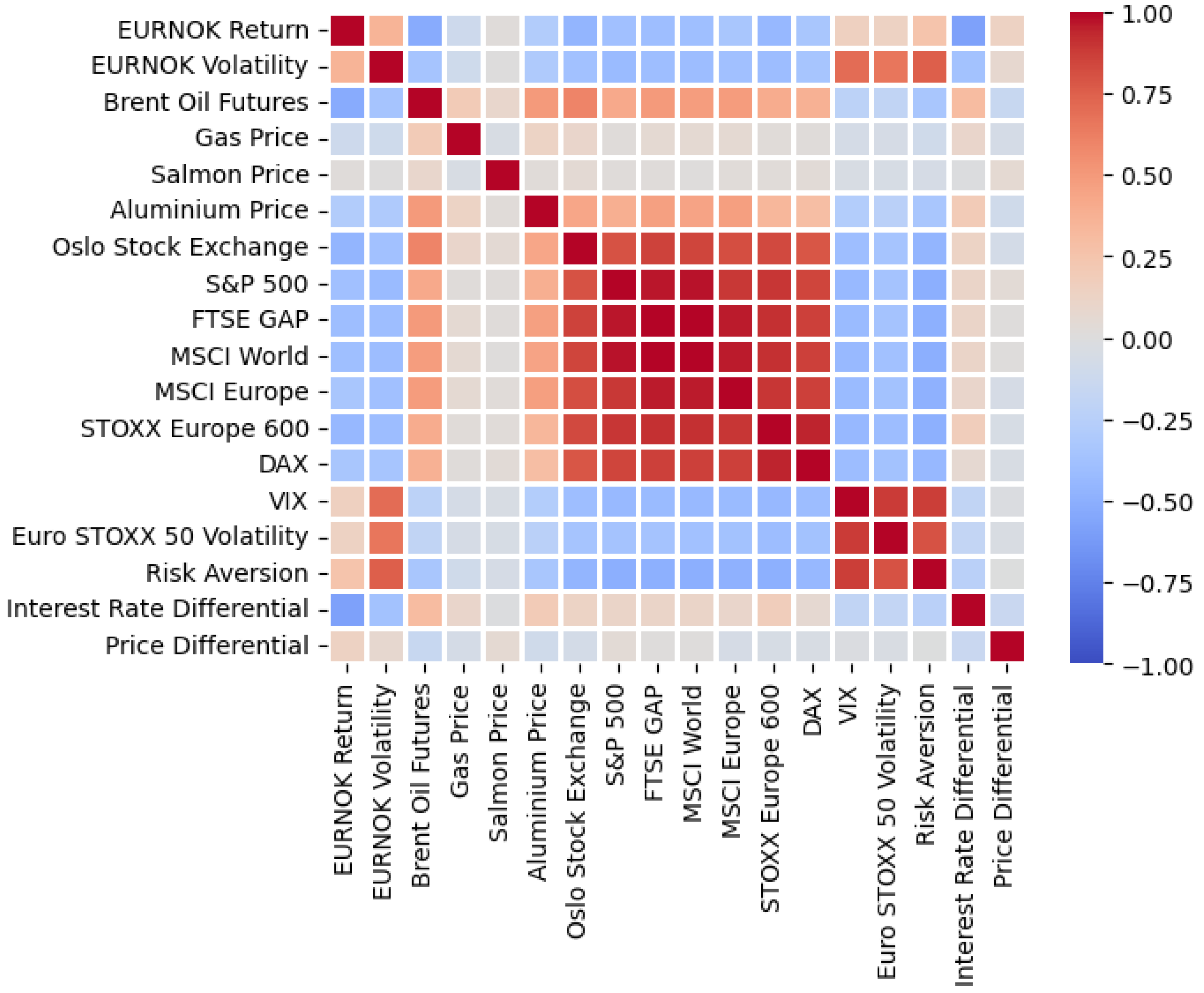

3. Data and Variables

3.1. Data Overview

3.2. The Dependent Variable

3.3. Explanatory Variables

3.3.1. Commodities

3.3.2. Financial Assets

3.3.3. Financial Uncertainty

3.3.4. Macroeconomic Fundamentals

4. Methodology

4.1. Univariate Regression

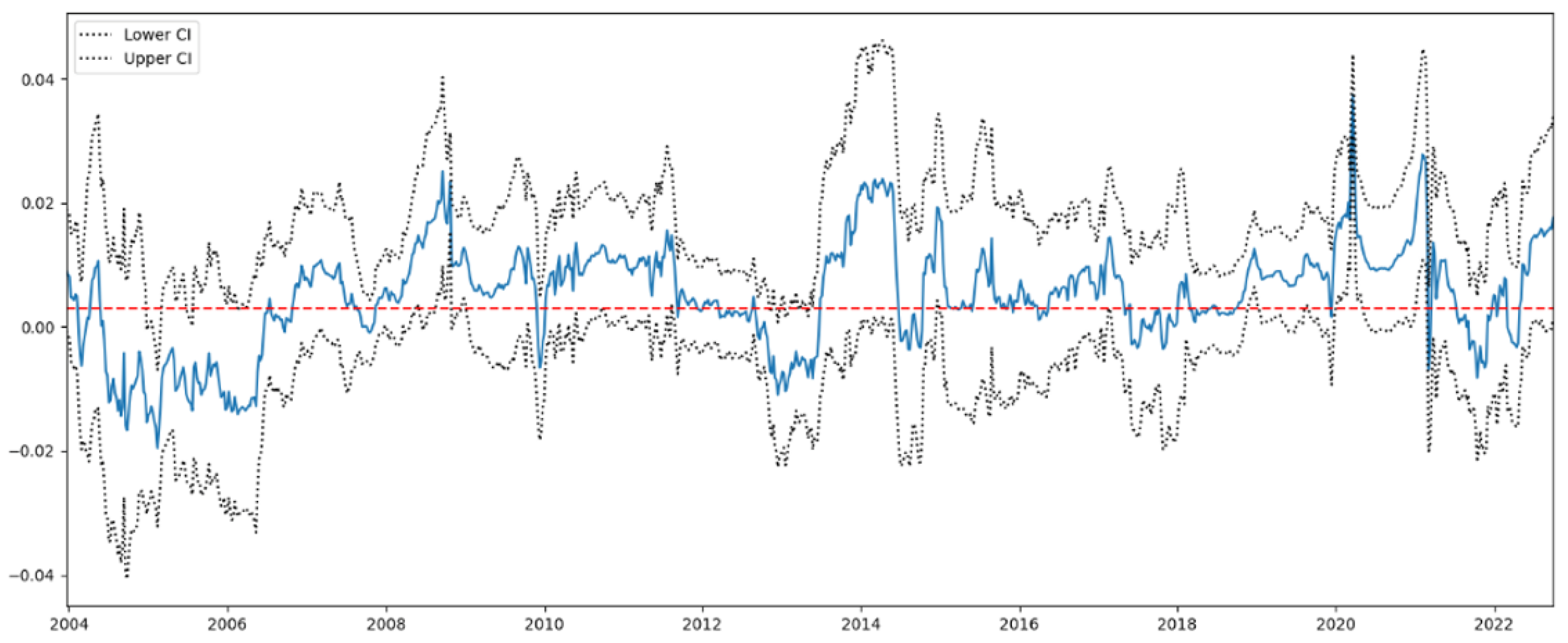

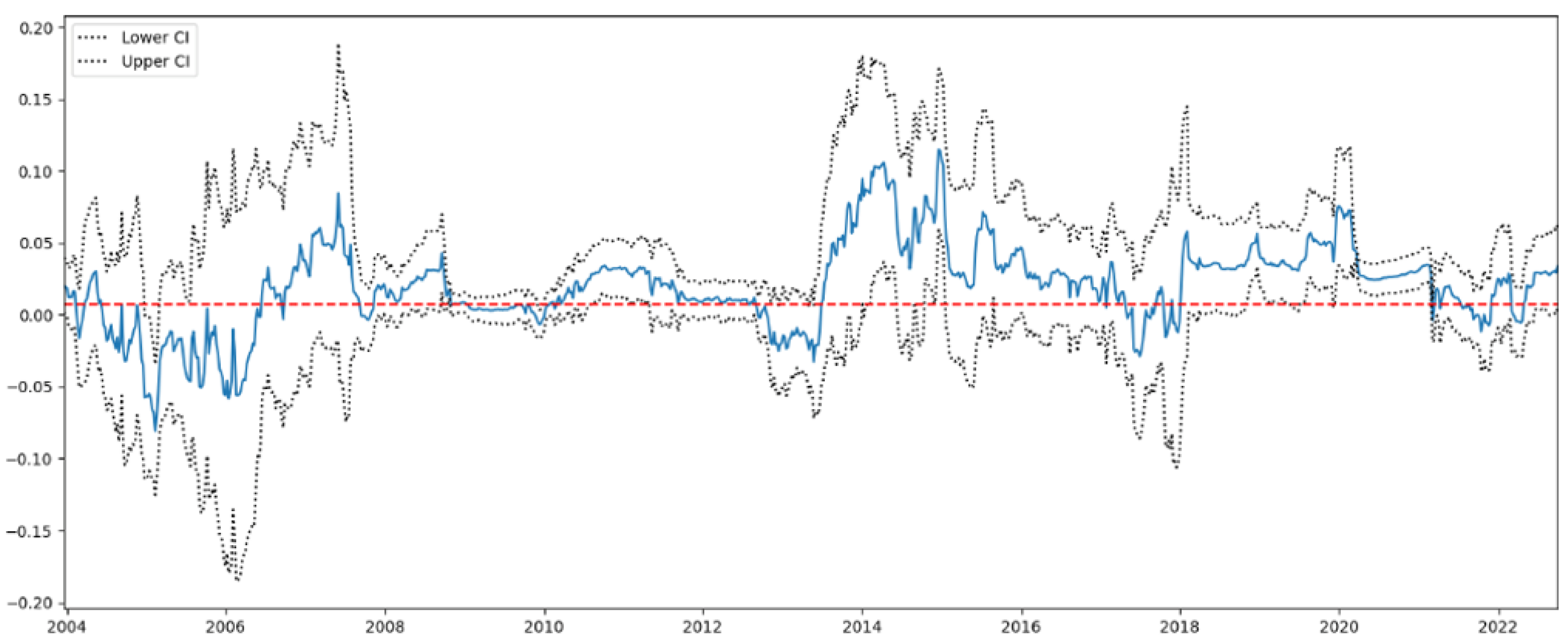

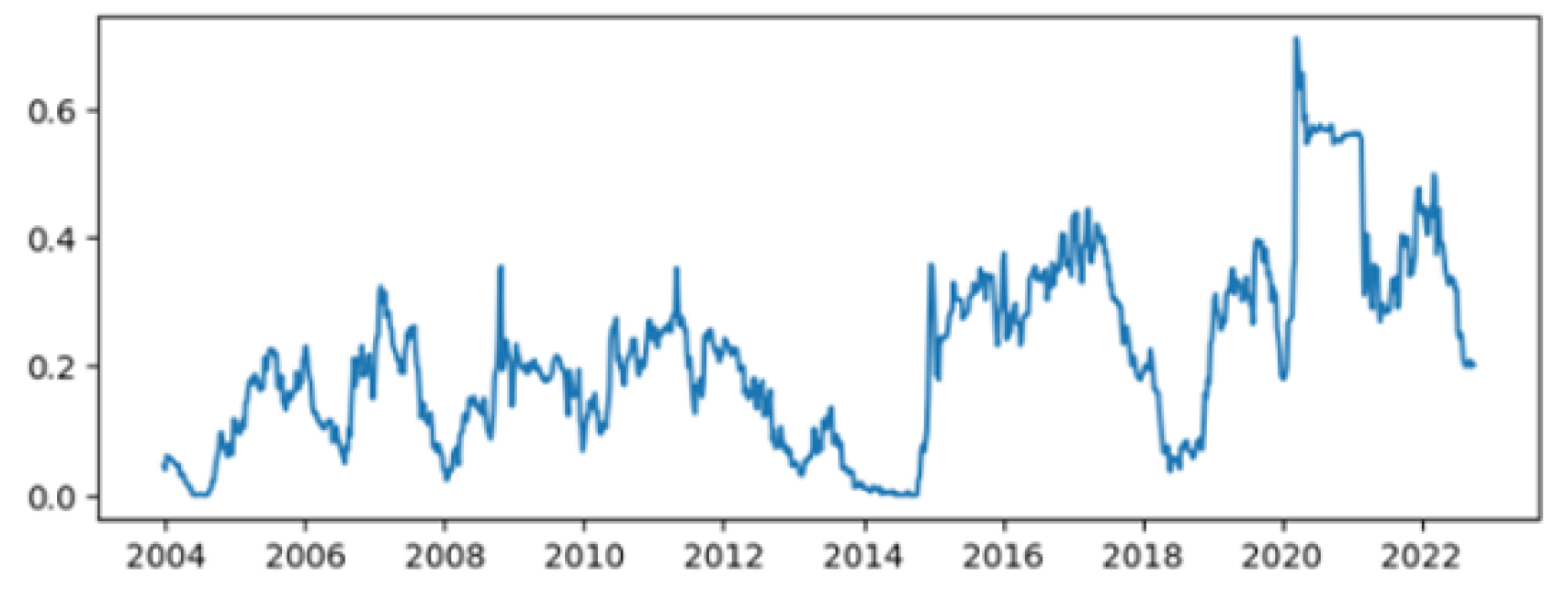

4.1.1. Time-Varying Relationship

4.1.2. Predictability

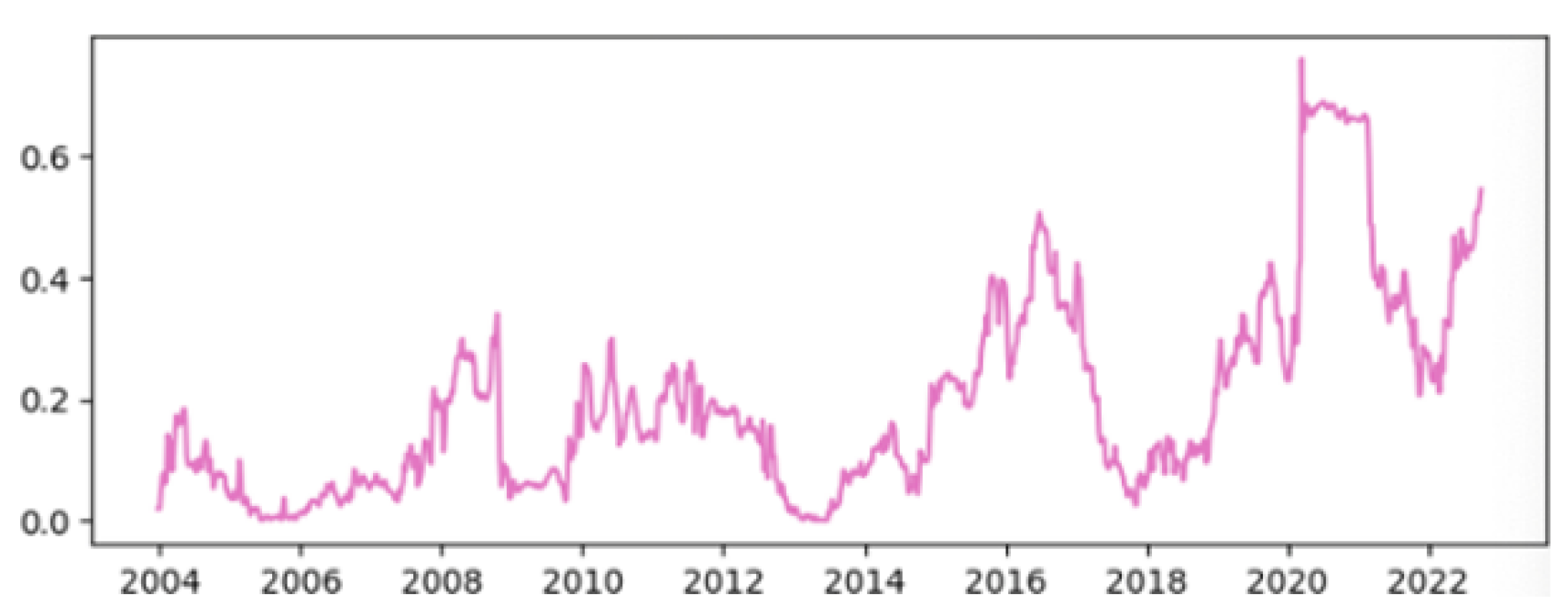

4.2. Dynamic Conditional Correlation

5. Results and Discussion

5.1. Time-Varying Relationship

5.2. Predictability

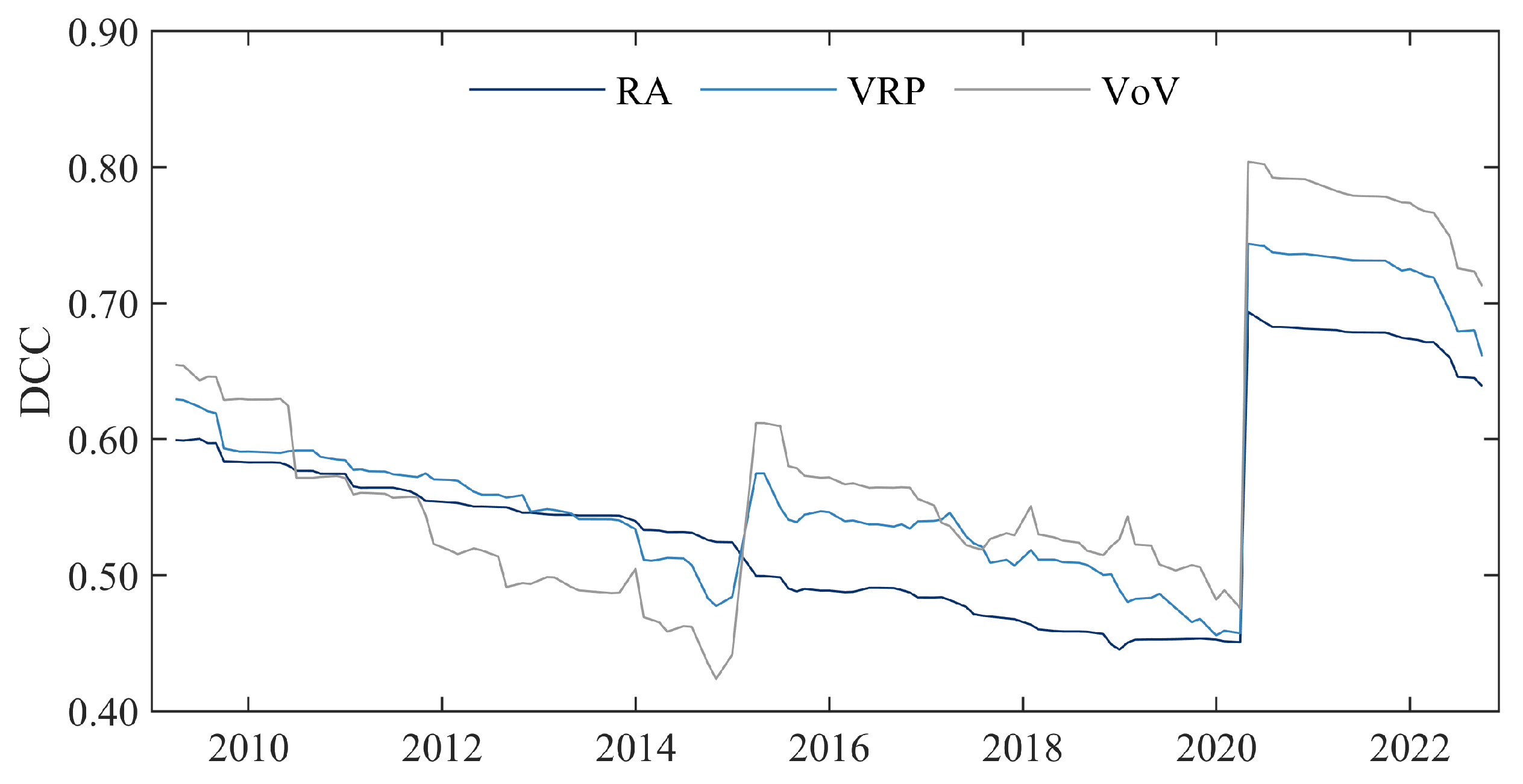

5.3. Dynamic Conditional Correlations (DCCs)

5.4. Risk Aversion Robustness Analysis

5.5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | I44 is a nominal effective krone exchange rate calculated on the basis of NOK exchange rates against the currencies of Norway’s 25 main trading partners (Norges Bank 2023). |

| 2 | Using more than 140 years of data, they analyzed the predictive power of a broad set of business cycle variables for risk and return in commodity spot markets. They found statistically significant predictors for both commodity returns and commodity volatilities using univariate rolling OLS regression models. |

| 3 | See Section 2.3 of Rapach and Wohar (2006). |

| 4 | Available from the corresponding author upon request. |

| 5 | As is common in the literature, we estimated from high-frequency data sampled at a 5-minute frequency (Andersen et al. 2001; Liu et al. 2015). To filter the tick-level data, we started by applying the cleaning procedure suggested by Barndorff-Nielsen et al. (2009), which is summarized as follows: First, we deleted entries with (i) zero quotes, (ii) a negative bid–ask spread, (iii) a bid–ask spread greater than 50 times the median spread on that day, and (iv) a mid-quote that deviates by more than 10 mean absolute deviations from the centered mean (excluding the observation under consideration) of 25 observations before and 25 observations after. Second, we computed mid-quotes as the average of the bid and ask quotes and resampled the data using a 5 min frequency. The data are publicly available at DukasCopy (accessed 10 January 2023). |

| 6 | Note that, due to the availability of data, the sample underlying Figure 8 covers June 2009 to September 2022, i.e., slightly shorter than the full sample period from January 2003 to September 2022 applied elsewhere in the paper. |

References

- Akram, Q. Farooq. 2006. PPP in the medium run: The case of norway. Journal of Macroeconomics 28: 700–19. [Google Scholar] [CrossRef]

- Akram, Q. Farooq. 2020. Oil price drivers, geopolitical uncertainty and oil exporters’ currencies. Energy Economics 89: 104801. [Google Scholar] [CrossRef]

- Aloosh, Arash, and Geert Bekaert. 2022. Currency factors. Management Science 68: 4042–64. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, Francis X. Diebold, and Paul Labys. 2001. The distribution of realized exchange rate volatility. Journal of the American Statistical Association 96: 42–55. [Google Scholar] [CrossRef]

- Baltussen, Guido, Sjoerd Van Bekkum, and Bart Van Der Grient. 2018. Unknown unknowns: Uncertainty about risk and stock returns. Journal of Financial and Quantitative Analysis 53: 1615–51. [Google Scholar] [CrossRef] [Green Version]

- Barndorff-Nielsen, Ole E., P. Reinhard Hansen, Asger Lunde, and Neil Shephard. 2009. Realized kernels in practice: Trades and quotes. The Econometrics Journal 12: C1–C32. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Marie Hoerova. 2014. The vix, the variance premium and stock market volatility. Journal of Econometrics 183: 181–92. [Google Scholar] [CrossRef] [Green Version]

- Bekaert, Geert, Eric C. Engstrom, and Nancy R. Xu. 2022. The time variation in risk appetite and uncertainty. Management Science 68: 3975–4004. [Google Scholar] [CrossRef]

- Benedictow, Andreas, and Roger Hammersland. 2022. Why Has the Norwegian Krone Exchange Rate Been Persistently Weak? A Fully Simultaneous VAR Approach. Technical Report, Statistics Norway, Discussion Papers. Available online: https://www.ssb.no/en/nasjonalregnskap-og-konjunkturer/konjunkturer/artikler/why-has-the-norwegian-krone-exchange-rate-been-persistently-weak-a-fully-simultaneous-var-approach/_/attachment/inline/f1c08d6c-7a4b-4e14-93ec-f410095f9411:c9e0e487e483c7bd265aae1205aaab247a410634/DP981_web.pdf (accessed on 1 February 2023).

- Bernhardsen, Tom, and Oistein Roisland. 2000. Factors that influence the krone exchange rate. Economic Bulletin 71: 143. [Google Scholar]

- Bollerslev, Tim, George Tauchen, and Hao Zhou. 2009. Expected stock returns and variance risk premia. The Review of Financial Studies 22: 4463–92. [Google Scholar] [CrossRef]

- Campbell, John Y., and Samuel B. Thompson. 2008. Predicting excess stock returns out of sample: Can anything beat the historical average? Review of Financial Studies 21: 1509–31. [Google Scholar] [CrossRef] [Green Version]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Flatner, Alexander, Preben Holthe Tornes, and Magne Østnor. 2010. En oversikt over Norges Banks Analyser av Kronekursen. Norges Bank Staff Memo, 7/2010. Available online: https://norges-bank.brage.unit.no/norges-bank-xmlui/bitstream/handle/11250/2507760/staff_memo_0710.pdf?sequence=1&isAllowed=y (accessed on 1 February 2023).

- Furuseth, Thomas. 2022. Hvorfor er den norske krona så svak? DnB Analyst Report. Available online: https://www.dnb.no/dnbnyheter/no/bors-og-marked/hvorfor-er-den-norske-krona-saa-svak-mkts (accessed on 1 February 2023).

- Hollstein, Fabian, Duc Binh Benno Nguyen, and Marcel Prokopczuk. 2019. Asset prices and “the devil (s) you know”. Journal of Banking & Finance 105: 20–35. [Google Scholar]

- Hollstein, Fabian, Marcel Prokopczuk, Björn Tharann, and Chardin Wese Simen. 2021. Predictability in commodity markets: Evidence from more than a century. Journal of Commodity Markets 24: 100–71. [Google Scholar] [CrossRef]

- Jeon, Byounghyun, Sung Won Seo, and Jun Sik Kim. 2020. Uncertainty and the volatility forecasting power of option-implied volatility. Journal of Futures Markets 40: 1109–26. [Google Scholar] [CrossRef]

- Jiang, Zhengyang, and Robert J. Richmond. 2023. Origins of international factor structures. Journal of Financial Economics 147: 1–26. [Google Scholar] [CrossRef]

- Klovland, Jan Tore, Lars Myrstuen, and Didrik Sylte. 2021. Den svake norske kronen—Fakta eller fiksjon? Samfunnsøkonomen 2: 9–20. [Google Scholar]

- Liu, Lily Y., Andrew J. Patton, and Kevin Sheppard. 2015. Does anything beat 5-minute rv? A comparison of realized measures across multiple asset classes. Journal of Econometrics 187: 293–311. [Google Scholar] [CrossRef] [Green Version]

- Lustig, Hanno, and Robert J. Richmond. 2020. Gravity in the exchange rate factor structure. The Review of Financial Studies 33: 3492–540. [Google Scholar] [CrossRef]

- Lustig, Hanno, Nikolai Roussanov, and Adrien Verdelhan. 2011. Common risk factors in currency markets. The Review of Financial Studies 24: 3731–77. [Google Scholar] [CrossRef]

- Lustig, Hanno, Nikolai Roussanov, and Adrien Verdelhan. 2014. Countercyclical currency risk premia. Journal of Financial Economics 111: 527–53. [Google Scholar] [CrossRef] [Green Version]

- Martinsen, Kjetil. 2017. Norges Bank’s BEER Models for the Norwegian Effective Exchange Rate. Norges Bank Staff Memo, No. 7/2017. Available online: https://www.econstor.eu/handle/10419/210341 (accessed on 1 February 2023).

- Maurer, Thomas A., Thuy-Duong Tô, and Ngoc-Khanh Tran. 2019. Pricing risks across currency denominations. Management Science 65: 5308–36. [Google Scholar] [CrossRef]

- McCracken, Michael W. 2007. Asymptotics for out of sample tests of granger causality. Journal of Econometrics 140: 719–52. [Google Scholar] [CrossRef]

- Meese, Richard A., and Kenneth Rogoff. 1983. Empirical exchange rate models of the seventies. Journal of International Economics 14: 3–24. [Google Scholar] [CrossRef]

- Naug, Bjørn E. 2003. Factors behind movements in the krone exchange rate—An empirical analysis. Norges Banks Skriftserie 32: 115–35. [Google Scholar]

- Norges Bank. 2023. TWI, Trade Weighted Exchange Rate. Available online: https://www.norges-bank.no/en/topics/Statistics/twi/ (accessed on 1 February 2023).

- Rapach, David E., and Mark E. Wohar. 2006. In-sample vs. out-of-sample tests of stock return predictability in the context of data mining. Journal of Empirical Finance 13: 231–47. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 1996. The purchashing power parity puzzle. Journal of Economic Literature 34: 647–68. [Google Scholar]

- Sarno, Lucio. 2005. Towards a solution to the puzzles in exchange rate economics: Where do we stand? The Canadian Journal of Economics 38: 673–708. [Google Scholar] [CrossRef]

- Taylor, Mark P. 2003. Purchasing power parity. Review of International Economics 11: 436–52. [Google Scholar] [CrossRef]

- Verdelhan, Adrien. 2018. The share of systematic variation in bilateral exchange rates. The Journal of Finance 73: 375–418. [Google Scholar] [CrossRef]

| Reference | Period | Method | Main Explanatory Variables |

|---|---|---|---|

| Naug (2003) | 2000–2003 Monthly | ECM | Interest rate differential. Oil price. S&P 500. A global hazard indicator. |

| Bernhardsen and Roisland (2000) | 1993–2000 Monthly | ECM | Price differential. Interest rate differential. Oil price. Financial turbulence. |

| Klovland et al. (2021) | 2001–2020 Monthly | VECM | Price differential. Interest rate differential. Oil price. CVIX. S&P 500. |

| Benedictow and Hammersland (2022) | 2001–2020 Quarterly | VECM | Price differential. Interest rate differential. Oil price. Oil/gas share of exports. Energy-specific equity index. VIX. Net capital flow. |

| Flatner et al. (2010) | 1983–2008 Monthly and weekly | BEER | Price differential. Interest rate differential. Oil price. Financial turbulence. |

| Martinsen (2017) | 1999–2016 Quarterly and weekly | BEER | Price differential. Interest rate differential. Oil price. Norwegian basic balance. Norwegian specific volatility. |

| Akram (2006) | 1970–2003 Quarterly | VAR | Price differential. |

| Mean | SD | Skew | Kurt | AR(1) | Unit | Freq. | |

|---|---|---|---|---|---|---|---|

| EURNOK returns | 0.001 | 0.019 | 1.282 | 5.584 | 0.190 | Log d | Daily |

| Brent Futures | 0.005 | 0.093 | −1.288 | 4.079 | 0.350 | Log d | Daily |

| Natural Gas price | 0.002 | 0.145 | 0.037 | 4.046 | −0.119 | Log d | Daily |

| Salmon price | 0.004 | 0.077 | −0.065 | −0.012 | 0.223 | Log d | Weekly |

| Aluminum price | 0.002 | 0.051 | −0.613 | 1.430 | 0.323 | Log d | Daily |

| Oslo Stock Exchange | 0.010 | 0.051 | −2.203 | 10.510 | 0.294 | Log d | Daily |

| S&P 500 | 0.006 | 0.038 | −2.176 | 10.372 | 0.204 | Log d | Daily |

| FTSE GAP | 0.005 | 0.042 | −2.172 | 11.071 | 0.277 | Log d | Daily |

| MSCI World | 0.005 | 0.040 | −2.191 | 10.840 | 0.257 | Log d | Daily |

| MSCI Europe | 0.002 | 0.047 | −1.745 | 7.809 | 0.313 | Log d | Daily |

| STOXX Euro 600 | 0.003 | 0.041 | −2.010 | 9.475 | 0.179 | Log d | Daily |

| DAX | 0.006 | 0.049 | −1.680 | 7.408 | 0.199 | Log d | Daily |

| VIX | 2.891 | 0.356 | 0.907 | 0.925 | 0.870 | Log | Daily |

| Euro Stoxx 50 Vol | 3.280 | 0.354 | 0.546 | 0.162 | 0.880 | Log | Daily |

| Risk aversion | 1.102 | 0.230 | 3.598 | 16.611 | 0.809 | Log | Daily |

| Interest rate diff. | −0.008 | 0.159 | −1.790 | 8.178 | 0.362 | Diff | Daily |

| Price level diff. | 0.049 | 0.528 | −1.391 | 10.281 | −0.188 | Diff | Monthly |

| Monthly | Weekly | |||||

|---|---|---|---|---|---|---|

| Mean | Min | Max | Mean | Min | Max | |

| Brent Oil Futures | 0.278 | <0.001 | 0.741 | 0.215 | <0.001 | 0.807 |

| Gas price | 0.025 | <0.001 | 0.127 | 0.039 | <0.001 | 0.288 |

| Salmon price | 0.085 | <0.001 | 0.405 | 0.033 | <0.001 | 0.332 |

| Aluminum price | 0.094 | <0.001 | 0.288 | 0.085 | <0.001 | 0.436 |

| Oslo Stock Exchange | 0.259 | <0.001 | 0.894 | 0.200 | <0.001 | 0.828 |

| S&P 500 | 0.169 | <0.001 | 0.878 | 0.175 | <0.001 | 0.820 |

| FTSE GAP | 0.191 | <0.001 | 0.899 | 0.206 | <0.001 | 0.866 |

| MSCI World | 0.181 | <0.001 | 0.894 | 0.195 | <0.001 | 0.849 |

| MSCI Europe | 0.174 | <0.001 | 0.895 | 0.175 | <0.001 | 0.833 |

| Stoxx Europe 600 | 0.199 | <0.001 | 0.884 | 0.201 | <0.001 | 0.797 |

| DAX | 0.153 | <0.001 | 0.858 | 0.163 | <0.001 | 0.772 |

| VIX | 0.068 | <0.001 | 0.433 | 0.064 | <0.001 | 0.796 |

| Euro Stoxx 50 Volatility | 0.072 | <0.001 | 0.590 | 0.056 | <0.001 | 0.825 |

| Risk aversion | 0.109 | <0.001 | 0.716 | 0.084 | <0.001 | 0.906 |

| Interest rate differential | 0.332 | <0.001 | 0.719 | 0.161 | <0.001 | 0.719 |

| Price differential | 0.060 | <0.001 | 0.291 | - | - | - |

| Before 2015 | After 2015 | Before 2015 | After 2015 | Chow-Value | |

| Brent Oil Futures | −0.081 | −0.125 | 0.138 | 0.325 | 0.002 |

| Oslo Stock Exchange | −0.083 | −0.335 | 0.107 | 0.322 | 0.000 |

| FTSE GAP | −0.113 | −0.369 | 0.115 | 0.328 | 0.000 |

| Risk aversion | 0.004 | 0.019 | 0.050 | 0.098 | 0.000 |

| Monthly | Weekly | |||

|---|---|---|---|---|

| Brent Oil Futures | 0.093 ** | −0.090 | 0.061 *** | −0.048 |

| Gas price | 0.008 * | −0.071 | 0.024 | −0.029 |

| Salmon price | 0.042 ** | −0.032 | 0.023 | −0.017 |

| Aluminum price | 0.085 ** | −0.031 | 0.028 | −0.034 |

| Oslo Stock Exchange | 0.062 ** | −0.003 | 0.121 *** | 0.060 *** |

| S&P 500 | 0.051 | −0.016 | 0.083 *** | −0.021 |

| FTSE GAP | 0.047 | −0.021 | 0.091 *** | −0.027 |

| MSCI World | 0.046 | −0.021 | 0.091 *** | −0.020 |

| MSCI Europe | 0.037 | −0.034 | 0.095 *** | −0.010 |

| Stoxx Europe 600 | 0.030 | −0.021 | 0.110 *** | 0.028 *** |

| DAX | 0.024 | −0.026 | 0.096 *** | −0.004 |

| VIX | 0.086 | −0.030 | 0.083 | −0.096 |

| Euro Stoxx 50 Volatility | 0.076 | −0.018 | 0.079 | −0.084 |

| Risk aversion | 0.111 | −0.368 | 0.109 * | −0.209 |

| Interest rate differential | 0.084 * | −0.205 | 0.072 *** | −0.072 |

| Price differential | 0.068 ** | −0.044 | - | - |

| Combination All | 0.084 | −0.010 | 0.118 | 0.014 |

| Combination Selected | - | - | 0.126 | 0.055 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Risstad, M.; Thodesen, A.; Thune, K.A.; Westgaard, S. On the Exchange Rate Dynamics of the Norwegian Krone. J. Risk Financial Manag. 2023, 16, 308. https://doi.org/10.3390/jrfm16070308

Risstad M, Thodesen A, Thune KA, Westgaard S. On the Exchange Rate Dynamics of the Norwegian Krone. Journal of Risk and Financial Management. 2023; 16(7):308. https://doi.org/10.3390/jrfm16070308

Chicago/Turabian StyleRisstad, Morten, Airin Thodesen, Kristian August Thune, and Sjur Westgaard. 2023. "On the Exchange Rate Dynamics of the Norwegian Krone" Journal of Risk and Financial Management 16, no. 7: 308. https://doi.org/10.3390/jrfm16070308

APA StyleRisstad, M., Thodesen, A., Thune, K. A., & Westgaard, S. (2023). On the Exchange Rate Dynamics of the Norwegian Krone. Journal of Risk and Financial Management, 16(7), 308. https://doi.org/10.3390/jrfm16070308