Criteria Selection of Housing Loan Based on Dominance-Based Rough Set Theory: An Indian Case

Abstract

1. Introduction

- (i)

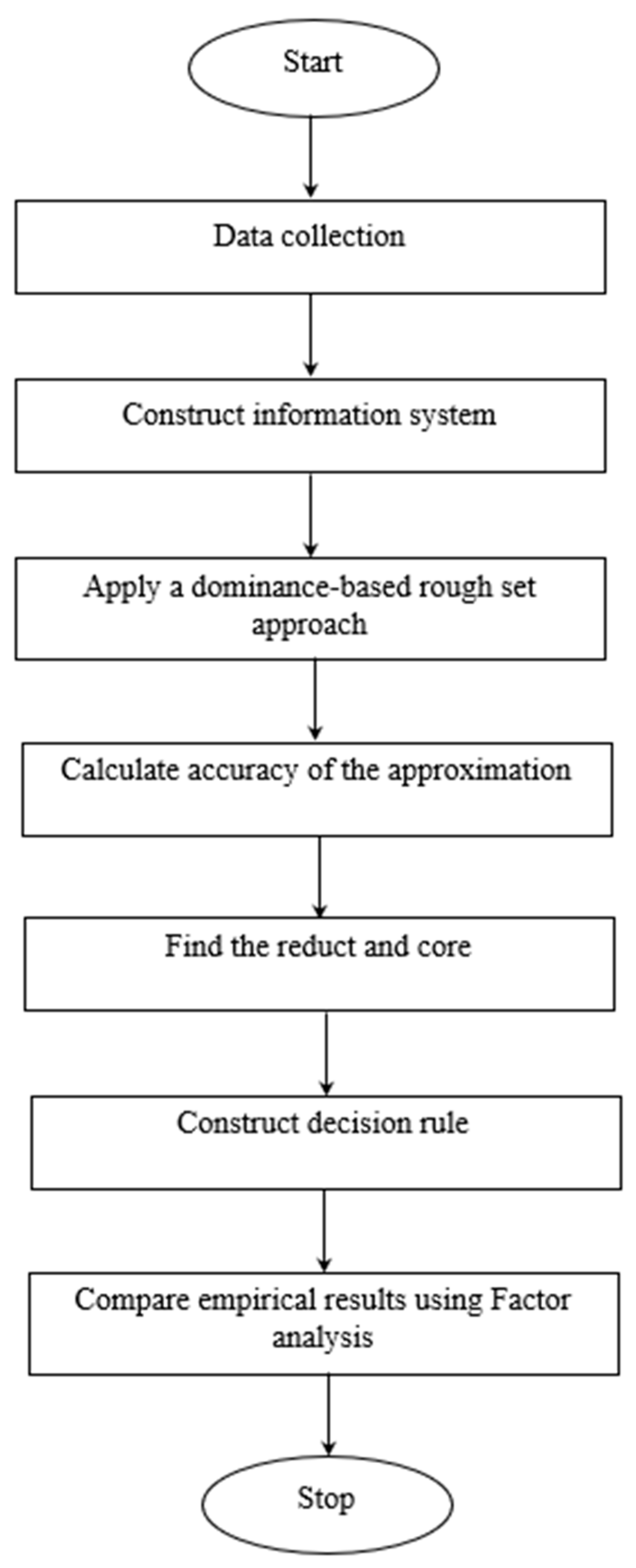

- The dominance-based rough set approach is applied on housing loan data to guide and aid the financial institution for loan sanction. This model focuses on decision making, which is further controlled by various “if … then” decision rules. The bank management defines these decision rules, which consider other relevant and important factors regarding housing loans.

- (ii)

- Factor analysis is used to consider the dataset and a comparative study is performed to analyze the performance of the factors.

2. Previous Works

3. Dominance Rough Set Approach

3.1. Information System

- ▪

- Box office—;

- ▪

- Audis—;

- ▪

- Service—;

- ▪

- Overall experience—.

3.2. RST with Dominance Relation

- ▪

- Concerning , “excellent” is preferable than “good” and “good” is preferable than “average”;

- ▪

- Concerning , “high” is preferable than “medium” and “medium” is preferable than “low”;

- ▪

- Concerning , “excellent” is preferable than “good” and “good” is preferable than “medium”;

- ▪

- Concerning , “excellent” is preferable than “good” and “good” is preferable than “average”.

3.3. Rough Approximated Set through the Dominance Relation

- ▪

- , i.e., overall evaluation of (at most) average cinema hall;

- ▪

- , i.e., overall evaluation of at most good cinema hall;

- ▪

- , i.e., overall evaluation of at least good cinema hall;

- ▪

- , i.e., overall evaluation of (at least) excellent cinema hall.

3.4. Accuracy of Approximation and Quality of Classification

3.5. Decision Rules

- —Principles for making decisions that take the following form:If and and … , then ;

- —Principles for making decisions that take the following form:If and and … , then ;

- —Principles for making decisions that take the following form:If and and … , andand … , then ,where ,() ,and .

3.6. Exploratory Data Analysis Approaches

4. Case Study

4.1. Problem Discussion and Information Collection

4.2. D-RSA Analysis

4.3. Rule Generation

- a customer’s gross monthly income is , the CIBIL Score is or , the CR rating is rated as or , the decision will be .

- the existing credit facility is , the CIBIL Score is , and the CR rating is or , the decision for loan approval will be .

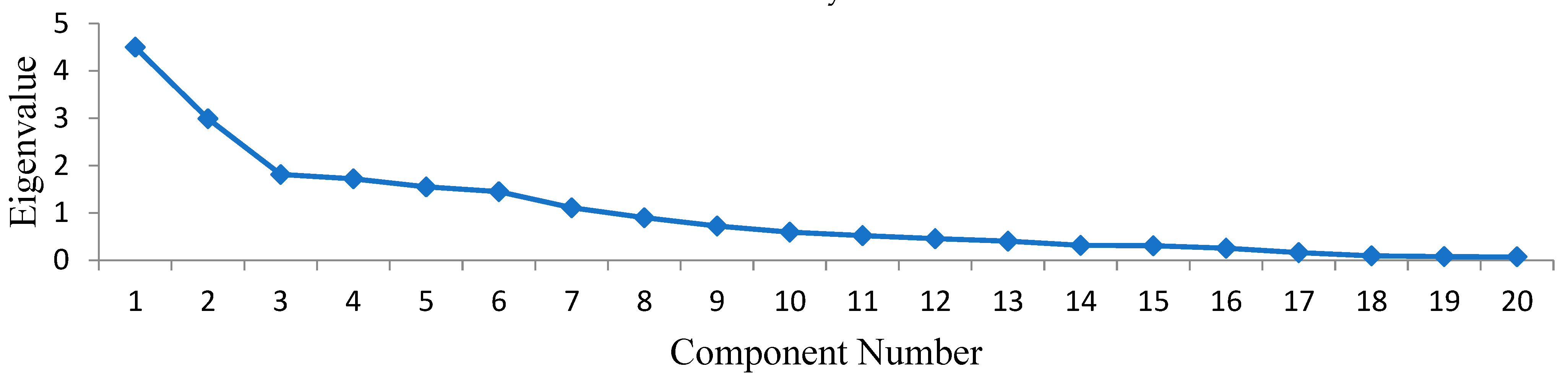

4.4. Variable Extraction

5. Results and Discussion

6. Conclusions and Future Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abdou, Hussein A., Marc D. Dongmo Tsafack, Collins G. Ntim, and Rose D. Baker. 2016. Predicting creditworthiness in retail banking with limited scoring data. Knowledge-Based System 103: 89–103. [Google Scholar] [CrossRef]

- Augeri, Maria Grazia, Paola Cozzo, and Salvatore Greco. 2015. Dominance-based rough set approach: An application case study for Setting speed limits for vehicles in speed controlled zones. Knowledge Based Systems 89: 288–300. [Google Scholar] [CrossRef]

- Baziki, Selva Bahar, Yavuz Kılıç, and Muhammed Hasan Yılmaz. 2022. Consumer loan rate dispersion and the role of competition: Evidence from Turkish banking industry. Central Bank Review 22: 27–47. [Google Scholar] [CrossRef]

- Błaszczyński, Jerzy, Salvatore Greco, and Roman Słowiński. 2007. Multi-criteria classification-a new scheme for application of dominance based decision rules. European Journal of Operational Research 181: 1030–44. [Google Scholar] [CrossRef]

- Blaszczynski, Jerzy, Salvatore Greco, Benedetto Matarazzo, Roman Slowinski, and Marcin Szel¡g. 2009. Poznan University of Technology, Poland, Laboratory of Intelligent Decision Support System. JMAF Software. Available online: https://fcds.cs.put.poznan.pl/IDSS/software/downloads.htm (accessed on 4 January 2023).

- Chakhar, Salem, Alessio Ishizaka, Ashraf Labib, and Inès Saad. 2016. Dominance-based rough set approach for group decisions. European Journal of Operational Research 251: 206–24. [Google Scholar] [CrossRef]

- Chakhar, Salem, and Inès Saad. 2012. Dominance based rough set approach for groups in multicriteria classification problem. Decision Support Systems 54: 372–80. [Google Scholar] [CrossRef]

- Chen, Li-Fei, and Chih-Tsung Tsai. 2016. Data mining framework based on rough set theory to improve location selecting decisions: A case study of a restaurant chain. Tourism Management 53: 197–206. [Google Scholar] [CrossRef]

- Chen, You-Shyang. 2012. Classifying credit ratings for Asian banks using integrating feature selection and the CPDA-based rough set approach. Knowledge-Based Systems 26: 259–70. [Google Scholar] [CrossRef]

- Couto, and Ayrton Benedi Gaia do Gaiado. 2015. Using a dominance based rough set approach for analyzing business indicators, information technology and quantitative management. Procedia Computer Science 55: 350–59. [Google Scholar] [CrossRef]

- Dubois, Didier, and Henri Prade. 1990. Rough fuzzy sets and fuzzy rough set. International Journal of General System 17: 191–200. [Google Scholar] [CrossRef]

- Greco, Salvatore, Benedetto Matarazzo, and Roman Slowinski. 1998. A new rough set approach to multicriteria classification and multiattribute classification. In Rough Sets and Current Trends in Computing. Edited by Lech Polkowski and Andrzej Skowron. Berlin/Heidelberg: Springer, pp. 60–67. Available online: https://link.springer.com/chapter/10.1007/3-540-69115-4_9 (accessed on 4 January 2023).

- Greco, Salvatore, Benedetto Matarazzo, and Roman Slowinski. 2000. Extension of the rough set approach to multicriteria decision support. INFOR 38: 161–95. [Google Scholar] [CrossRef]

- Greco, Salvatore, Benedetto Matarazzo, and Roman Slowinski. 2001. Rough sets theory for multi-criteria decision analysis. European Journal of Operational Research 129: 1–47. [Google Scholar] [CrossRef]

- Greco, Salvatore, Benedetto Matarazzo, and Roman Slowinski. 2002. Rough sets methodology for sorting problems in presence of multiple attributes and criteria. European Journal of Operational Research 138: 247–59. [Google Scholar] [CrossRef]

- Herawan, Tutut, Mustafa Mat Deris, and Jemal H. Abawajy. 2010. A rough set approach for selecting clustering attribute. Knowledge-Based Systems 23: 220–31. [Google Scholar] [CrossRef]

- Hirano, Shoji, and Shusaku Tsumoto. 2005. Rough representation of a region of interest in medical images. International Journal of Approximate Reasoning 40: 23–34. [Google Scholar] [CrossRef]

- Huang, Chun-Che, Tzu-Liang (Bill) Tseng, and Kun-Cheng Chen. 2016. Novel approach to tourism analysis with multiple outcome capability using rough set theory. International Journal of Computational Intelligence Systems 9: 1118–32. [Google Scholar] [CrossRef]

- Krusińska, Ewa, Roman Slowinski, and Jerzy Stefanowski. 1992. Discriminant versus rough set approach to vague data analysis. Applied Stochastic Model and Data Analysis 8: 43–56. [Google Scholar] [CrossRef]

- Li, Shaoyong, Tianrui Li, Zhixue Zhang, Hongmei Chen, and Junbo Zhang. 2015. Parallel computing of approximations in dominance-based rough set approach. Knowledge Based Systems 87: 102–11. [Google Scholar] [CrossRef]

- Lingras, Pawan. 1996. Rough Neural Networks. Paper presented at International Conference on Information Processing and Management of Uncertainty, Granada, Spain, July 1–5; pp. 1445–50. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.49.9280&rep=rep1&type=pdf (accessed on 4 January 2023).

- Liou, James J. H. 2011. Variable consistency dominance-based rough set approach to formulate airline service strategies. Applied Soft Computing 11: 4011–20. [Google Scholar] [CrossRef]

- Liou, James J. H., and Gwo-Hshiung Tzeng. 2010. A Dominance-based Rough Set Approach to customer behaviour in the airline market. Information Sciences 180: 2230–38. [Google Scholar] [CrossRef]

- McCollum, Meagan, and Stanimira Milcheva. 2023. How ‘bad’is renter protection for institutional investment in multifamily housing? Journal of Housing Economics 59: 101912. [Google Scholar] [CrossRef]

- Moody’s Investor’s Service. 2022. Available online: https://www.moodysanalytics.com/solutions-overview/credit-risk/credit-risk-modeling (accessed on 4 January 2023).

- Pawlak, Zdzisław. 1982. Rough sets. International Journal of Computer and Information Science 11: 341–56. [Google Scholar] [CrossRef]

- Polkowski, Lech, and Andrzej Skowron. 1994. Rough mereology. In Methodologies for Intelligent System. Lecture Notes in Artificial Intelligence. Berlin/Heidelberg: Springer, vol. 869, pp. 85–94. Available online: https://link.springer.com/chapter/10.1007/3-540-58495-1_9 (accessed on 4 January 2023).

- Puri, Jolly, and Shiv Prasad Yadav. 2013. A concept of fuzzy input mix-efficiency in fuzzy DEA and its application in banking sector. Expert Systems with Applications 40: 1437–50. [Google Scholar] [CrossRef]

- Puri, Jolly, and Shiv Prasad Yadav. 2014. A fuzzy DEA model with undesirable fuzzy outputs and its application to the banking sector in India. Expert Systems with Applications 41: 6419–32. [Google Scholar] [CrossRef]

- Sawicki, Piotr, and Jacek Żak. 2014. The application of dominance based rough set theory to evaluation of transportation systems. Procedia-Social and Behavioral Sciences 111: 1238–48. [Google Scholar] [CrossRef]

- Shafiee, Morteza, and N. Shams-e-Alam. 2011. Supply Chain Performance Evaluation with Rough Data Envelopment Analysis. Paper presented at 2010 International Conference on Business and Economics Research, Kuala Lumpur, Malaysia, November 26–28, vol. 1, pp. 57–61. [Google Scholar]

- Sharma, Haresh Kumar, Saibal Majumder, Arindam Biswas, Olegas Prentkovskis, Samarjit Kar, and Paulius Skačkauskas. 2022. A Study on Decision-Making of the Indian Railways Reservation System during COVID-19. Journal of Advanced Transportation 2022: 7685375. [Google Scholar] [CrossRef]

- Sreekumar, Sabita Mahapatra, and S. S. Mahapatra. 2015. Service quality of Indian bank: A Fuzzy Inference System Approach. Asian Academy of Management Journal 20: 59–80. [Google Scholar]

- Tsumoto, Shusaku. 2007. Medical differential diagnosis from the viewpoint of rough sets. Information Sciences 2007: 28–34. [Google Scholar]

- Xiao, Shu, and EM-K. Lai. 2005. A Rough programming approach to power-aware VLIW instruction scheduling for digital signal processors. Paper presented at IEEE International Conference on Acoustics, Speech, and Signal Processing, (ICASSP ’05), Philadelphia, PA, USA, March 23; p. v-141. [Google Scholar] [CrossRef]

- Zhai, Lian-Yin, Li-Pheng Khoo, and Zhao-Wei Zhong. 2009. A rough set based decision support approach to improving Consumer affective satisfaction in product design. International Journal of Industrial Ergonomics 39: 295–302. [Google Scholar] [CrossRef]

| Audience | ||||

|---|---|---|---|---|

| Z1 Z2 Z3 Z4 Z5 Z6 Z7 | Excellent Good Excellent Good Excellent Average Excellent | Medium High Medium High Low High High | Medium Excellent Good Excellent Medium Good Good | Good Average Good Excellent Good Average Excellent |

| Audience | P-Dominating Set | P-Dominated Set |

|---|---|---|

| Z1 Z2 Z3 Z4 Z5 Z6 Z7 |

| Lower Approximations | Upper Approximations |

|---|---|

} } } |

|

| At Most Average | At Most Good | At Least Good | At Least Excellent | |

|---|---|---|---|---|

| Accuracy of approximation | 0.333 | 0.667 | 0.667 | 0.333 |

| Quality of classification | 0.714 | |||

| Mortgage Attributes | Interpretation | Literature, Another Source |

|---|---|---|

| (M1) Loan request for | Function for which mortgage is required | RBI guidelines |

| (M2) Loan required area | The place where borrower build a house (city/village) | RBI guidelines |

| (M3) Age | The age of the borrower at the time of lending | Financial institution |

| (M4) Occupation | Borrower’s job at the time of mortgage application | Financial institution |

| (M5) Education | Borrower’s highest academic instruction | Financial institution |

| (M6) Own house | Present living condition of the borrower (living with relative or rent) | RBI guidelines |

| (M7) Net worth level | Total wealth position of the borrower | RBI guidelines |

| (M8) Gross Monthly | Total earnings of the borrower in a month | Financial institution |

| Income (in thousands) | ||

| (M9) Permissible deductions (%) | Total deductions of borrowers in a month | Domain expert |

| (M10) Margin required (%) | Margin to be carried by using the borrower (margin based on basic project cost) | Domain expert |

| (M11) Repayment period | The initial period of the mortgage nationalized banks | Financial institution |

| (in year) | ||

| (M12) Loan required according project | Quantum of mortgage loan | RBI guidelines |

| (in Lakh) | ||

| (M13) Existing credit facility | Existing credit facility is a secured mortgage that takes precedence over unsecured earlier loans furnished through a lender other sources | Financial institution |

| (M14) Guarantor mean | Wealth position of the guarantor for borrower support | RBI guidelines |

| (M15) Title of Property | No objection certificate from the builder or developer (clearances from the builder) | RBI guidelines |

| (M16) Corporation permission | Required clearances from the government sovereignty | RBI guidelines |

| for construction | ||

| (M17) Security | Immovable property of borrowers as a security | RBI guidelines |

| (M18) CIBIL score | CIBIL Score is a credit history of the borrower | Credit information bureau India |

| (M19) Credit risk rating | A credit score rating is estimation of the credit risk (CR) of a potential mortgagor foreseeing their capability to pay mortgage returns | Moody’s investor’s service |

| Decision | ||

| (D) Ranking for loan approval | Evaluation of the borrower detail for mortgage | Financial institution |

| Attributes | Domain Value | Value Set | Preference |

|---|---|---|---|

| Condition attribute (M1) Loan request for (M2) Loan required area (M3) Age (M4) Occupation (M5) Education (M6) Own house (M7) Net worth level (M8) Gross Monthly income (in thousand) (M9) Permissible deductions (%) (M10) Margin required (%) (M11) Repayment period (in year) (M12) Loan required according to project (in Lakh) (M13) Existing credit facility (M14) Guarantor mean (M15) Title of Property (M16) Corporation permission for construction (M17) Security (M18) CIBIL Score (M19) CR rating Decision (D) Ranking for loan approval | Construction of house; purchase of old house; purchase of flat Rural; urban Above 60; 50–60; 40–50; 30–40; Below 30 Others, businessman; private sector staff; government employee 10 + 2 and below; graduation; masters and above No; yes Low; medium; high Below 30; 30–50; above 50 65; 60 15; 20 10 and below; 20; 30 and above Below 20; 20–75; above 75 No; yes Low; medium; high Unclear; clear No; yes Plot and construction portion; flat; old house; flat and shop Medium; high; excellent Very high; high; moderate; low; very low Will not sanction; may be sanction; will certainly sanction | {1, 2, 3} {1, 2} {5, 4, 3, 2, 1} {1, 2, 3, 4} {1, 2, 3} {1, 2} {1, 2, 3} {1, 2, 3} {1, 2} {1, 2} {1, 2, 3} {1, 2, 3} {1, 2} {1, 2, 3} {1, 2} {1, 2} {1, 2, 3, 4} {2, 3, 4} {1, 2, 3, 4, 5} {1, 2, 3} | None Gain Gain Gain None Gain Gain Gain Gain Gain None Cost Gain Gain Gain Gain None Gain Gain Gain |

| At Most 1 | At Most 2 | At Least 2 | At Least 3 | |

|---|---|---|---|---|

| Lower approximation | 7 | 28 | 45 | 23 |

| Upper approximation | 11 | 33 | 49 | 28 |

| Boundary | 4 | 5 | 4 | 5 |

| Accuracy | 0.636 | 0.848 | 0.918 | 0.821 |

| Rule No. | Rule Interpretation | Cover Strength |

|---|---|---|

| S1 | 12 | |

| S2 | 10 | |

| S3 | 7 | |

| S4 | 5 | |

| S5 | 8 | |

| S6 | 27 | |

| S7 | 30 | |

| S8 | 36 | |

| S9 | 36 | |

| S10 | 3 | |

| S11 | 2 | |

| S12 | 3 | |

| S13 | 9 | |

| S14 | 6 | |

| S15 | 3 | |

| S16 | 7 | |

| S17 | 5 | |

| S18 | . | 5 |

| Attributes | Factors | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Factor1 | Factor2 | Factor3 | Factor4 | Factor5 | Factor6 | Factor7 | Factor8 | Communality | |

| M1 | 0.041 | 0.02 | −0.292 | 0.1 | 0.66 | 0.08 | −0.096 | 0.533 | 0.832 |

| M2 | 0.462 | 0.016 | −0.732 | 0.239 | 0.157 | −0.071 | −0.107 | −0.042 | 0.85 |

| M3 | 0.326 | 0.515 | 0.284 | −0.129 | −0.503 | 0.05 | 0.36 | 0.179 | 0.886 |

| M4 | −0.069 | −0.053 | −0.823 | 0.023 | 0.11 | 0.33 | 0.02 | −0.056 | 0.81 |

| M5 | 0.175 | −0.299 | −0.778 | −0.04 | 0.056 | −0.196 | 0.212 | 0.019 | 0.814 |

| M6 | −0.052 | 0.006 | 0.031 | −0.91 | 0.064 | 0.057 | −0.028 | 0.094 | 0.849 |

| M7 | 0.377 | −0.622 | −0.19 | −0.467 | 0.139 | −0.124 | −0.026 | 0.17 | 0.848 |

| M8 | 0.767 | −0.22 | −0.12 | −0.076 | −0.091 | 0.029 | −0.086 | 0.137 | 0.692 |

| M9 | −0.272 | −0.122 | −0.191 | 0.04 | 0.027 | 0.014 | 0.843 | 0.041 | 0.84 |

| M10 | 0.703 | 0.01 | −0.145 | −0.223 | 0.17 | 0.027 | 0.016 | −0.055 | 0.599 |

| M11 | −0.322 | −0.068 | −0.288 | 0.505 | 0.297 | 0.015 | −0.509 | 0.071 | 0.798 |

| M12 | 0.773 | −0.343 | 0.001 | 0.034 | 0.206 | −0.009 | −0.123 | −0.119 | 0.788 |

| M13 | 0.333 | 0.212 | 0.094 | −0.714 | −0.087 | −0.096 | 0.042 | −0.233 | 0.748 |

| M14 | 0.19 | −0.789 | −0.076 | 0.28 | −0.068 | 0.19 | 0.084 | 0.081 | 0.797 |

| M15 | −0.061 | 0.359 | −0.085 | 0.044 | −0.605 | 0.336 | −0.369 | 0.053 | 0.76 |

| M16 | −0.039 | −0.133 | 0.112 | 0.012 | −0.009 | −0.098 | 0.052 | 0.868 | 0.798 |

| M17 | 0.299 | 0.014 | −0.142 | −0.052 | 0.824 | 0.282 | −0.062 | −0.055 | 0.878 |

| M18 | −0.337 | −0.057 | 0.066 | 0.042 | 0.108 | 0.727 | 0.116 | −0.357 | 0.805 |

| M19 | 0.231 | −0.729 | −0.132 | 0.022 | 0.153 | 0.38 | 0.153 | 0.118 | 0.807 |

| D | 0.25 | −0.28 | −0.103 | −0.015 | 0.046 | 0.813 | −0.098 | 0.087 | 0.832 |

| Variance | 2.8311 | 2.3566 | 2.264 | 2.0421 | 2.0163 | 1.7631 | 1.3879 | 1.3709 | 16.032 |

| Var % | 14.2 | 11.8 | 11.3 | 10.2 | 10.1 | 8.8 | 6.9 | 6.9 | 80.2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Singh, A.; Singh, A.; Sharma, H.K.; Majumder, S. Criteria Selection of Housing Loan Based on Dominance-Based Rough Set Theory: An Indian Case. J. Risk Financial Manag. 2023, 16, 309. https://doi.org/10.3390/jrfm16070309

Singh A, Singh A, Sharma HK, Majumder S. Criteria Selection of Housing Loan Based on Dominance-Based Rough Set Theory: An Indian Case. Journal of Risk and Financial Management. 2023; 16(7):309. https://doi.org/10.3390/jrfm16070309

Chicago/Turabian StyleSingh, Anupama, Aarti Singh, Haresh Kumar Sharma, and Saibal Majumder. 2023. "Criteria Selection of Housing Loan Based on Dominance-Based Rough Set Theory: An Indian Case" Journal of Risk and Financial Management 16, no. 7: 309. https://doi.org/10.3390/jrfm16070309

APA StyleSingh, A., Singh, A., Sharma, H. K., & Majumder, S. (2023). Criteria Selection of Housing Loan Based on Dominance-Based Rough Set Theory: An Indian Case. Journal of Risk and Financial Management, 16(7), 309. https://doi.org/10.3390/jrfm16070309