Unveiling the Influencing Factors of Cryptocurrency Return Volatility

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Framework of Cryptocurrencies

2.2. The Cryptocurrencies Market Overview

2.3. The Volatility of Returns Factors for Cryptocurrencies

2.4. Research Hypotheses

3. Data and Methodology

3.1. Sample and Data

3.2. Model and Variables

- rt = return for period t

- β0 = constant

- β1 = parameter

- rt−1 = return for previous period t − 1

- εt = error term

- = conditional variance

- θ = GARCH model parameter

- TQTY = Weekly trading volume/traded quantity of coins

- INFO = Information demand: weekly number of keyword searches in Google Trends

- ACWI = Weekly MSCWI ASCWI/weekly world stock market index returns

- USD/EUR = Exchange rate/weekly USD to EUR exchange rate

- -

- Keyword for Bitcoin (BTC)—“Bitcoin”

- -

- Keyword for Ether/Ether (ETH)—“Ether”

- -

- Keyword for XRP Ripple (XRP)—“XRP”

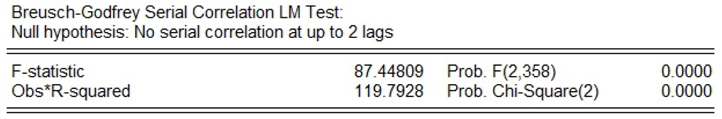

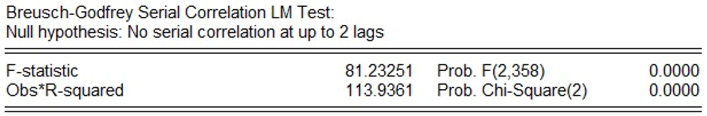

4. Results

Descriptive Statistics

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Correlations BTC | ||||||

| BTC CCY Return | BTC Trading Volume CCC Qty | BTC Info Demand | EUR-USD Close | MSCI ACWI Stock Return | ||

| BTC CCY Return | Pearson Correlation | 1 | 0.052 | 0.124 * | 0.098 | 0.212 * |

| Sig. (2-tailed) | 0.318 | 0.018 | 0.062 | 0.000 | ||

| BTC Trading Volume CCC Qty | Pearson Correlation | 0.052 | 1 | 0.005 | −0.086 | 0.057 |

| Sig. (2-tailed) | 0.138 | 0.923 | 0.101 | 0.274 | ||

| BTC Info Demand | Pearson Correlation | 0.124 * | 0.005 | 1 | 0.110 * | −0.003 |

| Sig. (2-tailed) | 0.018 | 0.923 | 0.035 | 0.947 | ||

| EUR-USD Close | Pearson Correlation | 0.098 | −0.086 | 0.0110* | 1 | 0.042 |

| Sig. (2-tailed) | 0.062 | 0.101 | 0.035 | 0.425 | ||

| MSCI ACWI Stock Return | Pearson Correlation | 0.212 ** | 0.057 | −0.003 | 0.042 | 1 |

| Sig. (2-tailed) | 0.000 | 0.274 | 0.947 | 0.425 | ||

| * Correlations is significant at the 0.05 level (2-tailed) | ||||||

| ** Correlations is significant at the 0.01 level (2-tailed) | ||||||

| Correlations ETH | ||||||

| ETH CCY Return | ETH Trading Volume CCC Qty | ETH Info Demand | EUR-USD Close | MSCI ACWI Stock Return | ||

| ETH CCY Return | Pearson Correlation | 1 | 0.08 | 0.00054 | 0.021 | 0.230 ** |

| Sig. (2-tailed) | 0.125 | 0.992 | 0.688 | 0.000 | ||

| ETH Trading Volume CCC Qty | Pearson Correlation | 0.08 | 1 | −0.180** | −0.088 | 0.063 |

| Sig. (2-tailed) | 0.125 | 0.001 | 0.095 | 0.227 | ||

| ETH Info Demand | Pearson Correlation | 0.00054 | −0.180 ** | 1 | 0.09912 | 0.0144 |

| Sig. (2-tailed) | 0.992 | 0.001 | 0.059 | 0.794 | ||

| EUR-USD Close | Pearson Correlation | 0.021 | −0.088 | 0.09912 | 1 | 0.042 |

| Sig. (2-tailed) | 0.688 | 0.095 | 0.059 | 0.425 | ||

| MSCI ACWI Stock Return | Pearson Correlation | 0.230 ** | 0.063 | 0.014 | 0.042 | 1 |

| Sig. (2-tailed) | 0.000 | 0.227 | 0.794 | 0.425 | ||

| * Correlations is significant at the 0.05 level (2-tailed) | ||||||

| ** Correlations is significant at the 0.01 level (2-tailed) | ||||||

| Correlations XRP | ||||||

| XRP CCY Return | XRP Trading Volume CCC Qty | XRP Info Demand | EUR-USD Close | MSCI ACWI Stock Return | ||

| XRP CCY Return | Pearson Correlation | 1 | 0.035 | 0.04492 | −0.039 | 0.143 ** |

| Sig. (2-tailed) | 0.507 | 0.392 | 0.46 | 0.006 | ||

| XRP Trading Volume CCC Qty | Pearson Correlation | 0.035 | 1 | 0.081 | 0.193 ** | 0.028 |

| Sig. (2-tailed) | 0.507 | 0.121 | 0 | 0.597 | ||

| XRP Info Demand | Pearson Correlation | 0.04492 | 0.0801 | 1 | −0.188 ** | −0.037 |

| Sig. (2-tailed) | 0.392 | 0.121 | 0 | 0.485 | ||

| EUR-USD Close | Pearson Correlation | −0.039 | 0.193 ** | −0.188 ** | 1 | 0.042 |

| Sig. (2-tailed) | 0.460 | 0.000 | 0.000 | 0.425 | ||

| MSCI ACWI Stock Return | Pearson Correlation | 0.143 ** | 0.028 | −0.037 | 0.042 | 1 |

| Sig. (2-tailed) | 0.006 | 0.597 | 0.485 | 0.425 | ||

| * Correlations is significant at the 0.05 level (2-tailed) | ||||||

| ** Correlations is significant at the 0.01 level (2-tailed) | ||||||

| Variable | Dicker Fuller |

| Diff_LN of BTC CCY Return | <0.0001 |

| Diff_LN of BTC Trading Volume CCC Qty | <0.0001 |

| Diff_LN of BTC Info Demand | <0.0001 |

| Diff_LN of ETH CCY Return | <0.0001 |

| Diff_LN of ETH Trading Volume CCC Qty | <0.0001 |

| Diff_LN of ETH Info Demand | <0.0001 |

| Diff_LN of XRP CCY Return | <0.0001 |

| Diff_LN of XRP Trading Volume CCC Qty | <0.0001 |

| Diff_LN of XRP Info Demand | <0.0001 |

| Diff_LN of MSCI ACWI Stock Return | <0.0001 |

| Diff_LN of EUR-USD Close | <0.0001 |

References

- Almansour, Bashar Yaser, Yaser Ammar Almansour, and Mohammad In’airat. 2020. The Impact of Exchange Rates on Bitcoin Returns: Further Evidence From a Time Series Framework. International Journal of Scientific & Technology Research 9: 4577–81. [Google Scholar]

- Arouxet, M. Belen, Aurelio F. Bariviera, Veronica E. Pastor, and Victoria Vampa. 2022. COVID-19 impact on cryptocurrencies: Evidence from a wavelet-based Hurst exponent. Physica A: Statistical Mechanics and Its Applications 596: 127170. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Elie Bouri, Rangan Gupta, and David Roubaud. 2017. Can volume predict Bitcoin returns and volatility? A quantiles-based approach. Economic Modelling 64: 74–81. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Angela Ng. 2005. Market Integration and Contagion. The Journal of Business 78: 39–69. [Google Scholar] [CrossRef]

- Bouri, Elie, Georges Azzi, and Anne Haubo Dyhrberg. 2017. On the Return-Volatility Relationship in the Bitcoin Market around the Price Crash of 2013. Economics e-Journal 11: 1–16. [Google Scholar] [CrossRef]

- Cermak, Vavrinec. 2017. Can Bitcoin Become a Viable Alternative to Fiat Currencies? An Empirical Analysis of Bitcoin’s Volatility Based on a GARCH Model. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2961405#:~:text=The%20volatility%20of%20Bitcoin%20has,functioning%20alternative%20to%20fiat%20currencies (accessed on 1 December 2023).

- Cheah, J. Eng-Tuck, and John Fry. 2015. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Economics Letters 130: 32–36. [Google Scholar] [CrossRef]

- Chowdhury, Abdur. 2016. Is Bitcoin the “Paris Hilton” of the Currency World? Or Are the Early Investors onto Something That Will Make Them Rich? The Journal of Investing 25: 64–72. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and D’ Artis Kancs. 2016. The Economics of BitCoin Price Formation. Applied Economics 48: 1799–815. [Google Scholar] [CrossRef]

- Ciaian, Pavel, Miroslava Rajcaniova, and D’ Artis Kancs. 2017. Virtual Relationships: Short- and Long-run Evidence from BitCoin and Altcoin Markets. Journal of International Financial Markets Institutions and Money 52: 173–95. [Google Scholar] [CrossRef]

- Coinbase. 2022. What Is “Proof of Work” or “Proof of Stake”? Coinbase. Available online: https://www.coinbase.com/learn/crypto-basics/what-is-proof-of-work-or-proof-of-stake (accessed on 1 December 2023).

- CoinMarketCap. 2022. Historical Snapshot—25 December 2022. Available online: https://coinmarketcap.com/historical/20221225/ (accessed on 1 December 2023).

- CoinMarketCap. 2023a. Bitcoin. Available online: https://coinmarketcap.com/currencies/bitcoin/ (accessed on 1 December 2023).

- CoinMarketCap. 2023b. Cryptocurrency Historical Data Snapshot. Available online: https://coinmarketcap.com/historical (accessed on 1 December 2023).

- CoinMarketCap. 2023c. Global Cryptocurrency Charts. Available online: https://coinmarketcap.com/charts/ (accessed on 1 December 2023).

- Corbet, Shaen, Brian Lucey, and Larisa Yarovaya. 2018. Datestamping the Bitcoin and Ether Bubbles. Finance Research Letters 26: 81–88. [Google Scholar] [CrossRef]

- Corbet, Shaen, Yang Greg Hou, Yang Hu, Charles Larkin, and Les Oxley. 2020. Any port in a storm: Cryptocurrency safe-havens during the COVID-19 pandemic. Economics Letters 194: 109377. [Google Scholar] [CrossRef] [PubMed]

- Corva, Frank. 2022. Bitcoin Is a Store of Values. NASDAQ. Available online: https://www.nasdaq.com/articles/bitcoin-is-a-store-of-values (accessed on 1 December 2023).

- DeJesus, Taylor. 2022. Are We In a Crypto Bubble? NASDAQ. Available online: https://www.nasdaq.com/articles/are-we-in-a-crypto-bubble (accessed on 1 December 2023).

- Demir, Ender, Giray Gozgor, Chi Keung Marco Lau, and Samuel A. Vigne. 2018. Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Finance Research Letters 26: 145–49. [Google Scholar] [CrossRef]

- Drozdz, Stanislaw, Jaroslaw Kwapien, Pawel Oswiecimka, Tomas Stanisz, and Marcin Watorek. 2020. Complexity in Economic and Social Systems: Cryptocurrency Market at around COVID-19. Entropy 22: 1043. [Google Scholar] [CrossRef] [PubMed]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef]

- El Alaoui, Marwane, Elie Bouri, and David Roubaud. 2019. Bitcoin price-volume: A multifractal cross-correlation approach. Finance Research Letters 103: 374–81. [Google Scholar] [CrossRef]

- Engle, Robert. 2001. GARCH 101: The Use of ARCH/GARCH Models in Applied Econometrics. Journal of Economic Perspectives 15: 157–68. [Google Scholar] [CrossRef]

- Feng, Wenjun, Yiming Wang, and Zhengjun Zhang. 2018. Can cryptocurrencies be a safe haven: A tail risk perspective analysis. Applied Economics 50: 4745–62. [Google Scholar] [CrossRef]

- Forbes Advisor. 2023. Why Crypto Market Is Down in May 2023. Forbes. Available online: https://www.forbes.com/advisor/in/investing/cryptocurrency/why-crypto-market-is-down/#:~:text=Reasons%20Behind%20Crypto%20Collapse%20In%202022&text=The%20prime%20reason%20for%20the,liquidity%20from%20the%20crypto%20market (accessed on 1 December 2023).

- Francq, Christian, and Jean-Michel Zakoian. 2019. GARCH Models: Structure, Statistical Inference and Financial Applications, 2nd ed. Hoboken: John Wiley & Sons. [Google Scholar] [CrossRef]

- Frankenfield, Jake. 2022a. Cryptocurrency Explained with Pros and Cons for Investment. Investopedia. Available online: https://www.investopedia.com/terms/c/cryptocurrency.asp (accessed on 1 December 2023).

- Frankenfield, Jake. 2022b. What Does Proof-of-Stake (PoS) Mean in Crypto? Investopedia. Available online: https://www.investopedia.com/terms/p/proof-stake-pos.asp#:~:text=What%20Is%20Proof%2Dof%2DStake%20vs.,new%20blocks%20to%20the%20blockchain (accessed on 1 December 2023).

- Frankenfield, Jake. 2023c. What Are Crypto Tokens, and How Do They Work? Investopedia. Available online: https://www.investopedia.com/terms/c/crypto-token.asp#:~:text=Is%20Bitcoin%20a%20Token%20or,make%20purchases%2C%20or%20store%20value (accessed on 1 December 2023).

- Garner, Jonathan. 2022. When Will Bitcoin Become a Unit of Account? Medium. Available online: https://medium.com/the-capital/when-will-bitcoin-become-a-unit-of-account-2fe9f79dbb7a#:~:text=A%20unit%20of%20account%20is,would%20be%20priced%20in%20Bitcoin (accessed on 1 December 2023).

- Gervais, Arthur, Ghassan Karame, Vedran Capkun, and Srdjan Capkun. 2014. Is Bitcoin a Decentralized Currency? IEEE Security and Privacy Magazine. Available online: https://ieeexplore.ieee.org/document/6824541 (accessed on 1 December 2023).

- Gillis, Alexander S. 2021. How Is Bitcoin Used? TechTarget. Available online: https://www.techtarget.com/whatis/definition/Bitcoin (accessed on 1 December 2023).

- Goodell, John W., and Stephane Goutte. 2021. Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Finance Research Letters 38: 101625. [Google Scholar] [CrossRef]

- Google Trends. 2023. Available online: https://trends.google.com/trends/ (accessed on 1 December 2023).

- Hansen, Peter Reinhard, and Asger Lunde. 2005. A Forecast Comparison of Volatility Models: Does Anything Beat a Garch(1,1)? Journal of Applied Econometrics 20: 873–89. [Google Scholar] [CrossRef]

- Hong, Euny. 2022. How Does Bitcoin Mining Work? Investopedia. Available online: https://www.investopedia.com/tech/how-does-bitcoin-mining-work/ (accessed on 1 December 2023).

- Investing. 2023. MSCI All-Country World Equity Index Historical Data. Investing. Available online: https://www.investing.com/indices/msci-world-stock-historical-data (accessed on 1 December 2023).

- Kaniel, Ron, Arzu Ozoguz, and Laura Starks. 2001. The High Volume Return Premium: Cross Country Evidence. Journal of Financial Economics 103: 255–79. [Google Scholar] [CrossRef]

- Kaplanov, Nikolei M. 2012. Nerdy Money: Bitcoin, the Private Digital Currency, and the Case Against its Regulation. Loyola Consumer Law Review 25. Available online: https://lawecommons.luc.edu/cgi/viewcontent.cgi?article=1920&context=lclr (accessed on 1 December 2023).

- Kaskersky. 2022. Cryptography Definition. Available online: https://www.kaspersky.com/resource-center/definitions/what-is-cryptography (accessed on 1 December 2023).

- Kerner, Sean M. 2023. Crypto Winter Explained: Everything You Need to Know. TechTarget. Available online: https://www.techtarget.com/whatis/feature/Crypto-winter-explained-Everything-you-need-to-know#:~:text=As%20of%20Dec.,year%2Dover%2Dyear%20decline (accessed on 1 December 2023).

- Kristoufek, Ladislav. 2013. BitCoin Meets Google Trends and Wikipedia: Quantifying the Relationship between Phenomena of the Internet Era. Scientific Reports 3: 3415. [Google Scholar] [CrossRef] [PubMed]

- Maitra, Debasish, Mobeen U. Rehman, Saumya Ranjan Dash, and Sang Hoon Kang. 2022. Do cryptocurrencies provide better hedging? Evidence from major equity markets during COVID-19 pandemic. The North American Journal of Economics and Finance 62: 101776. [Google Scholar] [CrossRef]

- Mitchell, Cory. 2022. MSCI All Country World Index (ACWI): Definition and Countries. Edited by Michael J. Boyle and Kirsten Rohrs Schmitt. Investopedia. Available online: https://www.investopedia.com/terms/m/msci-acwi.asp (accessed on 1 December 2023).

- MSCI. 2023. MSCI ACWI Index. Available online: https://www.msci.com/our-solutions/indexes/acwi (accessed on 1 December 2023).

- Naimy, Viviane, and Marianne R. Hayek. 2018. Modelling and predicting the Bitcoin volatility using GARCH models. International Journal of Mathematical Modelling and Numerical Optimisation 8: 197. [Google Scholar] [CrossRef]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 1 December 2023).

- Pilbeam, Keith, and Kjell Noralf Langeland. 2014. Forecasting exchange rate volatility: GARCH models versus implied volatility forecasts. International Economics and Economic Policy 12: 127–42. [Google Scholar] [CrossRef]

- Putzhammer, Moritz. 2022. How to Allocate and Diversify Your Crypto Portfolio to Limit Risks. Trailty. Available online: https://www.trality.com/blog/diversify-your-crypto-portfolio (accessed on 1 December 2023).

- Reiff, Nathan. 2022. How to Pay with Cryptocurrency. Investopedia. Available online: https://www.investopedia.com/ask/answers/100314/what-are-advantages-paying-bitcoin.asp#:~:text=Fewer%20Fees%3A%20Many%20financial%20services,parties%20involved%20in%20a%20transaction (accessed on 1 December 2023).

- Republic of the Marshall Islands. 2018. Declaration and Issuance of Soveregn Currency Act 2018. 125ND2 P.L. 2018-53. Majuro: Republic of the Marshall Islands. Available online: https://sov.foundation/ (accessed on 1 December 2023).

- Sajeev, Kavya Clanganthuruthil, and Mohd Afjal. 2022. Contagion effect of cryptocurrency on the securities market: A study of Bitcoin volatility using diagonal BEKK and DCC GARCH models. SN Business & Economics 2: 1–21. [Google Scholar] [CrossRef]

- Sharma, Rakesh. 2022. Is There a Cryptocurrency Price Correlation to the Stock Market? Investopedia. Available online: https://www.investopedia.com/news/are-bitcoin-price-and-equity-markets-returns-correlated/#:~:text=Key%20Takeaways,tend%20to%20trend%20the%20same (accessed on 1 December 2023).

- Statista. 2022. Overall Cryptocurrency 24 Hour Trade Volume 2020–2022. Available online: https://www.statista.com/statistics/1272903/cryptocurrency-trade-volume/ (accessed on 1 December 2023).

- Susilo, Didik, Sugeng Wahyudi, and Robiyanto Robiyanto. 2020. Cryptocurrencies: Hedging Opportunities From Domestic Perspectives in Southeast Asia Emerging Markets. Sage Open 10: 2158244020971609. [Google Scholar] [CrossRef]

- The Economist. 2015. The Great Chain of Being Sure about Things. Available online: https://www.economist.com/briefing/2015/10/31/the-great-chain-of-being-sure-about-things (accessed on 1 December 2023).

- Tse, Wai Man. 2021. Crypto-Asset Pricing Models and Their Efficiency-Dependent Trading Strategies. SSRN Electronic Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3898534 (accessed on 1 December 2023).

- Urquhart, Andrew. 2018. What causes the attention of Bitcoin? Economics Letters 166: 40–44. [Google Scholar] [CrossRef]

- Usbek & Rica. 2020. How Will Cryptocurrencies Impact National Currencies?—A USD 120 Billion Question. Available online: https://usbeketrica.com/en/article/how-will-cryptocurrencies-impact-national-currencies-a-120-billion-question (accessed on 1 December 2023).

- Wall Street Journal. 2023. EUR to USD. Available online: https://www.wsj.com/market-data/quotes/fx/EURUSD/historical-prices (accessed on 1 December 2023).

- World Health Organization. 2020. WHO Director-General’s Opening Remarks at the Media Briefing on COVID-19—11 March 2020. Available online: https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19---11-march-2020 (accessed on 1 December 2023).

- Yermack, David. 2015. Is Bitcoin a Real Currency? An Economic Appraisal. In Handbook of Digital Currency. Cambridge: Academic Press. [Google Scholar] [CrossRef]

| Currency (Trading Code) | Market Cap (in USD Billions) | Price on 25 December 2022 | Circulating Supply |

|---|---|---|---|

| Bitcoin (BTC) | USD 324.09 | USD 16,841.99 | 19,243,168 BTC |

| Ether/Ethereum (ETH) | USD 149.17 | USD 1218.96 | 122,373,866 ETH |

| Tether (USDT) | USD 66.24 | USD 0.9999 | 66,247,647,090 USDT |

| USD Coin (USDC) | USD 44.35 | USD 1.0001 | 44,345,240,440 USDC |

| Binance Coin (BNB) | USD 38.89 | USD 243,14 | 159,965,769 BNB |

| XRP/Ripple (XRP) | USD 17.44 | USD 0.3464 | 50,343,500,506 XRP |

| Binance USD (BUSD) | USD 17.39 | USD 1.0003 | 17,388,891,975 BUSD |

| Dogecoin (DOGE) | USD 10.08 | USD 0.07595 | 132,670,764,300 DOGE |

| Cardano (ADA) | USD 8.95 | USD 0.2593 | 34,503,744,627 ADA |

| Polygon (MATIC) | USD 6.94 | USD 0.7951 | 8,734,317,475 MATIC |

| Variable | N Statistic | Min | Max | Mean | St. Dev. |

|---|---|---|---|---|---|

| BTC CCY Return | 365 | 0.1532 | 0.1562 | 0.0015 | 0.0389 |

| BTC Trad. Vol. | 365 | 83,528 | 13,328,655 | 1,389,562 | 1,418,026 |

| BTC Inf. Demand | 365 | 4 | 100 | 38.2400 | 20.339 |

| ETH CCY Return | 365 | 0.2552 | 0.3347 | 0.0037 | 0.056 |

| ETH Trad. Vol. | 365 | 217,365 | 209,193,867 | 18,558,848 | 24,790,920 |

| ETH Inf. Demand | 365 | 2 | 100 | 34.08 | 20.856 |

| XRP CCY Return | 365 | 0.1475 | 0.6008 | 0.0073 | 0.0684 |

| XRP Trad. Vol. | 365 | 24,294,676 | 51,308,361,534 | 4,309,759,544 | 5,765,491,690 |

| XRP Inf. Demand | 365 | 1 | 100 | 33.58 | 24.605 |

| MSCI ACWI Index | 365 | 0.0476 | 0.0527 | 0.0001 | 0.0094 |

| EUR–USD Close | 365 | 0.9689 | 1.2458 | 1.1309 | 0.0561 |

| Variable | Coeff. | Std. Error | z-Statistic | Prob |

|---|---|---|---|---|

| Diff_Ln_InfoDemand | 0.233828 | 0.384563 | 0.609036 | 0.5432 |

| Diff_Ln_Trading Vol. | 1.741995 | 0.200644 | 8.682016 | 0.0000 |

| Diff_Ln_Eur-USD | 4.778128 | 7.838159 | 0.609598 | 0.5421 |

| Diff_Ln_MSCI-ACWI | 0.069719 | 0.048631 | 1.433638 | 0.1517 |

| Variance Equation | ||||

| C | 1.695585 | 0.239675 | 7.074521 | 0.0000 |

| RESID(-1)^2 | 0.276874 | 0.086478 | 3.201664 | 0.0014 |

| GARCH(-1) | 0.069649 | 0.103444 | 0.673298 | 0.5008 |

| Model Information | ||||

| R-Squared | 0.110254 | Mean Dependent Var | −0.004006 | |

| Adjusted R-Squared | 0.102860 | S.D. Dependent Var | 1.740754 | |

| S.E. of Regression | 1.648798 | Akaike Info Criterion | 3.753477 | |

| Sum of Squared Resid. | 981.3910 | Schwarz Criterion | 3.828270 | |

| Log Likelihood | −678.0096 | Hannan–Quinn Crit. | 3.783201 | |

| Durbin–Watson Stat. | 3.022854 | |||

| Variable | Coeff. | Std. Error | z-Statistic | Prob |

|---|---|---|---|---|

| Diff_Ln_InfoDemand | 0.547060 | 0.313684 | 1.743984 | 0.0812 |

| Diff_Ln_Trading Vol. | 1.238336 | 0.178083 | 6.953707 | 0.0000 |

| Diff_Ln_Eur-USD | 1.643485 | 7.930122 | 0.207246 | 0.8358 |

| Diff_Ln_MSCI-ACWI | 0.036809 | 0.042276 | 0.870689 | 0.3839 |

| Variance Equation | ||||

| C | 1.823165 | 0.279923 | 6.513089 | 0.0000 |

| RESID(-1)^2 | 0.228080 | 0.082184 | 2.775226 | 0.0055 |

| GARCH (-1) | 0.139083 | 0.099900 | 1.392216 | 0.1639 |

| Model Information | ||||

| R-Squared | 0.126009 | Mean Dependent Var | −0.006010 | |

| Adjusted R-Squared | 0.118746 | S.D. Dependent Var | 1.824365 | |

| S.E. of Regression | 1.712625 | Akaike Info Criterion | 3.873793 | |

| Sum of Squared Resid. | 1058.843 | Schwarz Criterion | 3.948585 | |

| Log Likelihood | −699.9672 | Hannan–Quinn Crit. | 3.903516 | |

| Durbin–Watson Stat. | 2.906306 | |||

| Variable | Coeff. | Std. Error | z-Statistic | Prob |

|---|---|---|---|---|

| Diff_Ln_InfoDemand | −0.077299 | 0.245145 | −0.315321 | 0.7525 |

| Diff_Ln_Trading Vol. | 0.933109 | 0.120121 | 7.768086 | 0.0000 |

| Diff_Ln_Eur-USD | −9.846853 | 7.045207 | −1.397667 | 0.1622 |

| Diff_Ln_MSCI-ACWI | −0.001481 | 0.047430 | −0.031235 | 0.9751 |

| Variance Equation | ||||

| C | 1.490260 | 0.210390 | 7.083314 | 0.0000 |

| RESID(-1)^2 | 0.352556 | 0.086333 | 4.083663 | 0.0000 |

| GARCH(-1) | 0.075063 | 0.087293 | 0.859898 | 0.3898 |

| Model Information | ||||

| R-Squared | 0.106824 | Mean Dependent Var | −0.000125 | |

| Adjusted R-Squared | 0.099401 | S.D. Dependent Var | 1.709963 | |

| S.E. of Regression | 1.622753 | Akaike Info Criterion | 3.721613 | |

| Sum of Squared Resid. | 950.6306 | Schwarz Criterion | 3.796405 | |

| Log Likelihood | −672.1943 | Hannan–Quinn Crit. | 3.751336 | |

| Durbin–Watson Stat. | 2.965242 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kufo, A.; Gjeci, A.; Pilkati, A. Unveiling the Influencing Factors of Cryptocurrency Return Volatility. J. Risk Financial Manag. 2024, 17, 12. https://doi.org/10.3390/jrfm17010012

Kufo A, Gjeci A, Pilkati A. Unveiling the Influencing Factors of Cryptocurrency Return Volatility. Journal of Risk and Financial Management. 2024; 17(1):12. https://doi.org/10.3390/jrfm17010012

Chicago/Turabian StyleKufo, Andromahi, Ardit Gjeci, and Artemisa Pilkati. 2024. "Unveiling the Influencing Factors of Cryptocurrency Return Volatility" Journal of Risk and Financial Management 17, no. 1: 12. https://doi.org/10.3390/jrfm17010012

APA StyleKufo, A., Gjeci, A., & Pilkati, A. (2024). Unveiling the Influencing Factors of Cryptocurrency Return Volatility. Journal of Risk and Financial Management, 17(1), 12. https://doi.org/10.3390/jrfm17010012