Abstract

This paper aims to leverage Bayesian nonlinear expectations to construct Bayesian lower and upper estimates for prices of Ether options, that is, options written on Ethereum, with conditional heteroscedasticity and model uncertainty. Specifically, a discrete-time generalized conditional autoregressive heteroscedastic (GARCH) model is used to incorporate conditional heteroscedasticity in the logarithmic returns of Ethereum, and Bayesian nonlinear expectations are adopted to introduce model uncertainty, or ambiguity, about the conditional mean and volatility of the logarithmic returns of Ethereum. Extended Girsanov’s principle is employed to change probability measures for introducing a family of alternative GARCH models and their risk-neutral counterparts. The Bayesian credible intervals for “uncertain” drift and volatility parameters obtained from conjugate priors and residuals obtained from the estimated GARCH model are used to construct Bayesian superlinear and sublinear expectations giving the Bayesian lower and upper estimates for the price of an Ether option, respectively. Empirical and simulation studies are provided using real data on Ethereum in AUD. Comparisons with a model incorporating conditional heteroscedasticity only and a model capturing ambiguity only are presented.

1. Introduction

Cryptocurrency options are important instruments for managing risks of trading cryptocurrencies, speculating and leveraging future performances of cryptocurrencies. Bitcoin options, whose underlying assets could be Bitcoin or Bitcoin futures, appear to be the most popular among different cryptocurrency options. Indeed, Bitcoin options are less than ten years old. The first Bitcoin options were launched by Deribit (crypto options and futures exchange for Bitcoin and Ethereum) in 2016, while the first regulated Bitcoin option exchange is LedgerX, which started offering products in 2017. In the aftermath of the enlightening year of 2019 for the cryptocurrency derivatives market, other players started to roll out Bitcoin options. Some of them include Bakkt, CME, Bit.com, OKEx, Binance and Huobi futures. See Yang (2021) for related discussions and more detail about the history of the cryptocurrency derivatives market.

The highly volatile cryptocurrency market poses significant challenges to the valuation of cryptocurrency options. Some researchers have taken up the challenges and proposed quantitative models for pricing cryptocurrency options. Specifically, the uses of stochastic volatility and GARCH-type models for pricing Bitcoin options have received considerable attention in the literature (see, for example, (Chen and Yang 2024; Hou et al. 2020; Jalan et al. 2021; Siu and Elliott 2021; Venter and Maré 2021)). Jump-diffusion models for pricing Bitcoin options have also been considered (see, for example, (Cao and Celik 2021; Hilliard and Ngo 2022)). The uses of machine learning techniques and neural networks for pricing Bitcoin options or cryptocurrency options were considered in (Alexander et al. 2023; Li et al. 2019; Pagnottoni 2019). Alexander et al. (2023) considered the valuation of crypto quanto and inverse options. Lucic (2024) discussed the pricing and hedging of cryptocurrency inverse options. Siu (2024) considered an application of finite-mixture models to pricing Bitcoin options.

While Bitcoin is the largest cryptocurrency in terms of market capitalization, Ethereum (ETH) is the second largest cryptocurrency. The history of the blockchain technology backing Ethereum can be traced back to its creation by Vitalik Buterin in 2013, which was then launched in 2015 (see Copeland (2023)). Ether options, which are also called ETH options, are option contracts written on Ethereum. OKEx and CME launched Ether options in 2020 and 2022, respectively (see Godbole (2020) and Chan (2022)). CME also offered options written on Ether futures. According to McGleenon (2024), the trading volume of Ether options has surged to around USD 20 billion in January 2024. However, there is a relatively small amount of studies on the pricing of Ether options compared with those on the valuation of Bitcoin options. Some works on the pricing of Ether options include, for example, Shegokar (2022) for jump-diffusion stochastic volatility models and Brini and Lenz (2024) for a machine learning regression approach.

Modelling the return dynamics of cryptocurrencies is a challenging task. This is particularly the case in light of the impact of the pandemic. It is imperative to take into account model uncertainty, or ambiguity, about the return dynamics of cryptocurrencies (see, for example, Siu (2023a)). Early works on option pricing with model uncertainty focus on incorporating volatility uncertainty. Specifically, Boyle and Ananthanarayanan (1977) introduced a Bayesian approach to incorporate volatility uncertainty into option pricing. Avellaneda et al. (1995) and Lyons (1995) introduced volatility uncertainty for pricing and hedging options through “uncertain” volatility, where volatility is assumed to take on values in a bounded interval. These works seem to have provided a practical ground for the developments of nonlinear G-expectations, including the work by Peng (1997), which gives a mathematically sound approach to describe volatility uncertainty. Some other works on option pricing with model uncertainty, or volatility uncertainty in particular, include, for example, (Agarwal et al. 2021; Beissner and Riedel 2019; Boyle et al. 2008; Buraschi and Jiltsov 2006; Chau et al. 2022; Cohen and Tegnér 2019; Cont 2006; Elliott et al. 2022; Fouque and Ren 2014; Jaroszkowski and Jensen 2022; Siu 2023a; Wilmott and Oztukel 1998). It does not seem that the impacts of model uncertainty on pricing cryptocurrency options have been well explored or well understood up to now.

This paper aims to leverage Bayesian nonlinear expectations introduced in the work of Siu (2023a) to construct Bayesian lower and upper estimates for the price of an Ether option, that is, an option on Ethereum, in the presence of conditional heteroscedasticity and model uncertainty. Specifically, a discrete-time generalized conditional autoregressive heteroscedastic (GARCH) model introduced by Bollerslev (1986) and Taylor (1986) is adopted to describe conditional heteroscedasticity in the logarithmic returns of Ethereum. To incorporate model uncertainty or ambiguity about the conditional mean and volatility of the logarithmic returns, a pair of Bayesian nonlinear expectations, that is, a Bayesian superlinear expectation and a Bayesian sublinear expectation, are used to construct the Bayesian lower and upper estimates for the price of the Ether option. Firstly, using an extended Girsanov’s principle in discrete time, which is also called a discrete-time Girsanov’s transform (see (Elliott and Madan 1998; Elliott and Siu 2017; Elliott et al. 1995; Siu 2023a)), a family of alternative models capturing model uncertainty about the conditional mean and volatility is introduced via perturbing the conditional mean and volatility of the GARCH model. Then, applying a “risk-neutral” extended Girsanov’s principle to the family of alternative models results in a family of “risk-neutralized” alternative GARCH models. Lastly, using Bayesian credible intervals obtained from conjugate priors and residuals obtained from the estimated GARCH model, Bayesian conditional superlinear and sublinear expectations are constructed, which give the Bayesian lower and upper estimates for the price of the Ether option, respectively. Empirical and simulation studies are provided using real data on Ethereum in AUD (ETH-AUD). The impacts of model uncertainty, conditional heteroscedasticity and their interactions on the Ether option prices are explored by comparing different models.

Boyle and Ananthanarayanan (1977) seem to have been among the first to propose a Bayesian approach to incorporate model uncertainty, particularly volatility uncertainty, into option valuation. Other papers on the use of Bayesian statistics in option pricing include, for example, (Bauwens and Lubrano 2002; Darsinos and Satchell 2007; Foster and Whiteman 1999; Gzyl et al. 2022; Ho et al. 2011; Jang and Lee 2019; Karolyi 1993; Martin et al. 2005; Mozumder et al. 2021; Qin and Almeida 2020; Romboutsa and Stentoft 2014; Wang et al. 2016). Bayesian option pricing under GARCH-type models or stochastic volatility models were considered in (Bauwens and Lubrano 2002; Martin et al. 2005; Mozumder et al. 2021; Romboutsa and Stentoft 2014; Wang et al. 2016). However, it seems that those papers did not use Bayesian nonlinear expectations to describe the impacts of model uncertainty, or ambiguity, about the conditional mean and volatility on estimates for option prices. Furthermore, those papers did not consider the pricing of options on cryptocurrencies such as Ethereum. Siu (2001) considered the use of Bayesian statistics to construct Bayesian credible intervals for coherent risk measures of derivative securities under discrete-time binomial tree models. (Siu et al. 2001, 2004b) proposed the use of Bayesian statistics to construct Bayesian coherent risk measures and Bayesian Value at Risk, respectively, for derivative securities. However, these papers considered risk measures for derivative securities instead of option pricing. They did not consider cryptocurrencies.

The current paper may be thought of as a companion paper of the work of Siu (2023a). In Siu (2023a), the Bayesian nonlinear expectations were applied to provide lower and upper forecasts for Bitcoin returns and to construct lower and upper estimates for tail-based risk metrics, namely Value at Risk and Expected Shortfall, for a Bitcoin position. However, Siu (2023a) did not discuss the use of Bayesian nonlinear expectations for option valuation in general, or pricing Ether options in particular. Now, in the current paper, I endeavour to use the Bayesian nonlinear expectations for constructing Bayesian lower and upper estimates for the price of an Ether option. The current paper also aims to provide novel insights into advancing the understanding for the impacts of model uncertainty, conditional heteroscedasticity and their interactions on Ether option prices through the lens of the Bayesian nonlinear expectations. To this end, the Bayesian lower and upper estimates are interpreted as the “confidence” limits of Bayesian interval estimates for the price of an Ether option along the line of Boyle and Ananthanarayanan (1977). From the perspective of two-price conic finance (Cherny and Madan 2009; Elliott et al. 2022; Madan 2015, 2016; Madan and Cherny 2010), one may explore the possibility of studying a Bayesian version of lower and upper prices of an Ether option using the Bayesian lower and upper estimates. One may also explore the possibility of developing a Bayesian version of nonlinear valuation operators, for example, (Coque et al. 2002; Peng 2004a 2004b, 2004c, 2005). These will be briefly discussed as potential topics for further research in Section 8.

The rest of the paper is organized in the following manner. Section 2 presents a GARCH model without incorporating model uncertainty, namely a reference model, for the dynamics of the logarithmic returns from Ethereum. Then, the pricing of an Ether option under the GARCH model is discussed by reviewing some existing results on GARCH option pricing using an extended Girsanov’s principle. In Section 3, the family of alternative GARCH models and its risk-neutralization were introduced using the extended Girsanov’s principle, and lower and upper estimates for the price of the Ether option are constructed using nonlinear expectations. In Section 4, the Bayesian lower and upper estimates for the price of the Ether option are constructed using the Bayesian conditional superlinear and sublinear expectations, respectively. The numerical and simulation procedures are presented in Section 5. The empirical and simulation results are discussed in Section 6. Model comparisons are also presented in Section 6. The chaotic and random aspects of price fluctuations are briefly commented in Section 7. Concluding remarks are provided, and some limitations of the proposed approach are discussed in Section 8. Some potential topics for further research are briefly discussed in Section 8.

2. The GARCH Model without Model Uncertainty

A simple discrete-time market consisting of two underlying securities, namely a risk-free (zero-coupon) bond and a risky asset, that is, Ethereum, is considered. The logarithmic return process of Ethereum is modelled by a discrete-time GARCH model. Specifically, we start with a reference model under a real-world reference probability measure for the logarithmic return process of Ethereum in AUD (ETH-AUD). To simplify the discussion and notation, a GARCH(1,1) model for the logarithmic return process is considered. This simple set up can be generalized to a higher-order GARCH model. A discrete-time Girsanov’s transform in, for example, Elliott et al. (1995) and Elliott and Madan (1998), is used to specify a risk-neutral probability measure for valuing an Ether option under the reference GARCH(1,1) model. A discrete-time Girsanov’s transform was employed to specify an equivalent martingale measure for option pricing under discrete-time GARCH-type models (see, for example, Badescu et al. (2008) and Badescu et al. (2011)). Here, we state some relevant results and include the proofs for some of them using the results found in the work of Elliott et al. (1995). This section may serve as a recap on some existing results on GARCH option pricing in the literature. They are included here for the sake of completeness.

Let denote the (finite) time parameter set of our discrete-time model, where . A complete probability space is considered on which random processes are defined, where is a reference (real-world) probability measure on the measurable space . is interpreted as the real-world probability measure underlying the reference model, which is also called an approximating model. A sequence of independent and identically distributed (i.i.d.) standard normal random variables under , namely , is considered. In general, one may consider a sequence of i.i.d. non-normal random variables. However, for illustration, a sequence of i.i.d. normal random variables is considered here. Write for a time series process on , which represents the logarithmic return process of Ethereum in AUD. That is, for each , denotes the logarithmic return of Ethereum in AUD over the tth period. Assume that the reference model for the logarithmic return process under is governed by the GARCH(1,1) model:

Here, is the mean return; is the conditional variance when given the price information up to and including time t; , and are the parameters in the conditional variance process; and is a given constant.

In the sequel, a risk-neutral probability measure is specified using a discrete-time Girsanov’s transform. Let denote the probability density function (pdf) of a normal distribution with mean and variance . Write for . That is, is the pdf of a standard normal distribution with zero mean and unit variance (i.e., ). Let denote the -augmentation of the natural filtration generated by the logarithmic return process . That is, for each , the -field represents the information set generated by the observations about the logarithmic return process up to and including time t.

For each , define the notation by

Then, an -adapted process, denoted by , is defined by putting

Furthermore, another -adapted process, , is defined as follows:

By definition, is a positive-valued process. It is also an -martingale. Consequently, a probability measure , which is equivalent to on , is defined by setting

Then, the following lemma provides the conditional distribution of when given under the probability measure .

Lemma 1.

Under the probability measure , the conditional distribution of , given that is a normal distribution with mean and variance . That is, .

Proof.

The proof follows some results or arguments in the work of Elliott et al. (1995) (Chapter 3 therein). Using a version of the Bayes’ rule, the martingale property of , Equation (4), the law of iterated expectations, and the fact that is -measurable,

Here, is the conditional expectation given under ; is the conditional expectation given under . Recall that under the real-world reference probability measure . This, together with Equation (1), imply that . Then, by Equations (3) and (6),

Recall that is the pdf of a normal distribution with mean and variance . Consequently, by Equation (7), . Note from Equation (2) that . Hence, the result follows. □

By the fundamental theorem of asset pricing, the absence of arbitrage opportunities in a financial market is “essentially” equivalent to the existence of an equivalent martingale measure under which the discounted price process of an asset relative to a numeraire asset is a martingale (see, for example, Delbaen and Schachermayer (1994); Hansen and Richard (1987); Harrison and Kreps (1979); Harrison and Pliska (1981, 1983)). Let denote the price process of a risk-free (zero-coupon) bond with the constant continuously compounded interest rate . Then, for each ,

The bond is the numeraire asset used for discounting.

Let denote the price process of Ethereum in AUD, where is the adjusted close price of Ethereum in AUD in the tth period (i.e., the tth trading day). Let denote the initial price at the beginning of the first period. Then, , for each . The following theorem shows that the discounted price process of Ethereum in AUD by the bond is an -martingale.

Theorem 1.

is an -martingale.

Proof.

It suffices to prove that

The result is then followed by induction.

From Theorem 1, is an equivalent martingale measure, which is a risk-neutral probability measure selected by the discrete-time Giransov’s transform.

Let denote a sequence of i.i.d. standard normal random variables under the probability measure . Then, from Lemma 1, under ,

Write, for each ,

Then, by comparing the real-world and risk-neutral dynamics for in Equation (1) and Equation (13), respectively,

Using Equation (15) and the conditional variance process in Equation (1),

Putting together Equations (13) and (16), under the risk-neutral probability measure , the logarithmic return process has the following GARCH dynamics:

Note that the market described by the discrete-time GARCH model is incomplete. Consequently, there are many equivalent martingale measures under the discrete-time GARCH model. The risk-neutral probability measure selected by the discrete-time Girsanov’s transform is one of them.

There are other approaches to specify an equivalent martingale measure under a discrete-time GARCH model and their variants. Duan (1995) introduced the locally risk-neutral valuation relationship for option pricing under a discrete-time GARCH model. Siu et al. (2004a) adopted the conditional Esscher transform to select an equivalent martingale measure under discrete-time GARCH models. Elliott et al. (2006) and Siu et al. (2006) discussed the use of the conditional Esscher transform or its variants for pricing European-style options under a discrete-time Markov-switching GARCH model and a discrete-time SETAR-ARCH model, respectively. The self-exciting threshold autoregressive (SETAR) model pioneered by (Tong 1977, 1983, 1990) is one of the major classes of parametric nonlinear time series models. Siu and Elliott (2021) studied the valuation of Bitcoin options under a discrete-time SETAR-GARCH model using the conditional Esscher transform and the variance-dependent pricing kernel.

3. Model Uncertainty via Nonlinear Expectations

In this section, model uncertainty about the conditional mean and volatility of the logarithmic returns of Ethereum is introduced using an extended Girsanov’s principle under the GARCH model in Section 2. Nonlinear expectations are then used to construct lower and upper estimates for the price of an Ether option in light of the model uncertainty. To this end, the following three steps are considered:

- (I)

- Using an extended Girsanov’s principle, as in (Elliott 2017; Elliott and Siu 2017; Siu 2023a), a family of alternative GARCH models is introduced by perturbing the conditional mean and volatility of the reference GARCH model in Equation (1).

- (II)

- As in Section 2, a “risk-neutral” extended Girsanov’s principle is adopted to transform the family of alternative GARCH models into a family of “risk-neutralized” alternative GARCH models.

- (III)

- A pair of conditional nonlinear expectations, namely a conditional superlinear expectation and a conditional sublinear expectation, is constructed based on the family of “risk-neutralized” GARCH alternative models. The conditional superlinear and sublinear expectations then give the lower and upper estimates for the price of an Ether option, respectively.

3.1. A Family of Alternative Models

Step (I) is now considered. Cryptocurrency markets are highly volatile and uncertain. Modelling price fluctuations of cryptocurrencies could be a formidable task. Consequently, model uncertainty is an important and relevant issue as far as the modelling of price fluctuations of cryptocurrencies is concerned. In practice, the mean (or drift) and the volatility of the logarithmic returns are two quantities which interest market practitioners. In the context of a discrete-time GARCH model, the two quantities of interest are the conditional mean and volatility. Accurate modelling or estimation of the conditional mean and volatility of the logarithmic returns of cryptocurrencies could be difficult in practice. Consequently, from a practical perspective, a relevant issue could be how might the model uncertainty, or ambiguity, of the conditional mean and volatility be incorporated.

When faced with model uncertainty, or ambiguity, about the conditional mean and volatility, market practitioners may form interval estimates for misspecifications in the conditional mean and volatility. These interval estimates give the ranges of the “uncertain” parameters, describing the misspecifications in the conditional mean and volatility. Specifically, as in Siu (2023a), a two-dimensional vector of “uncertain” parameters, denoted by , describing the misspecifications in the conditional mean and volatility under the GARCH model in Equation (1), is defined as follows:

Indeed, and describe perturbations in the conditional mean and volatility of the logarithmic return process under the reference GARCH model in Equation (1). is the “uncertain” parameter describing the misspecification in the conditional mean (or drift), and is the “uncertain” parameter describing the misspecification in the conditional volatility. Specifically, if and , there will be no perturbations/misspecification in the conditional mean and volatility of the logarithmic return process . denotes the transpose of a vector, or a matrix, .

For practical purposes, the interval estimates for misspecifications in the conditional mean and volatility should be finite intervals. Consequently, it may not be unreasonable to assume that the perturbations in the conditional mean and volatility do not take infinite values. This assumption may also be in line with the specifications of the g-expectation for the drift uncertainty in Peng (1997) and the G-expectation for the volatility uncertainty in Peng (2006, 2019). Specifically, the vector of the “uncertain” parameters in Equation (18) takes on values in the following rectangular region in :

for and such that and . Specifically, and are, respectively, the lower and upper limits of the interval estimate for the “uncertain” parameter , while and are, respectively, the lower and upper limits of the interval estimate for the “uncertain” parameter .

To capture volatility uncertainty in continuous time, Avellaneda et al. (1995) and Lyons (1995) introduced an “uncertain” volatility parameter and supposed that the “uncertain” volatility parameter lies in an interval whose lower and upper limits could be specified based on the extreme values of the implied volatilities of liquid securities or the high–low peaks of historical volatilities. To incorporate both drift and volatility uncertainties in continuous time, Wilmott and Oztukel (1998) and Wilmott (2007) introduced both the “uncertain” drift and volatility parameters and supposed that they lie in the respective intervals whose lower and upper limits are pre-specified. They called the intervals for the “uncertain” parameters “certainty bands”. Agarwal et al. (2021) incorporated the model uncertainty about the market price of risk in a continuous-time model with multiple risk factors and adopted an ellipsoid-shaped set instead of a rectangular set to specify a statistical confidence region for the “uncertain” market price of risk. The ambiguity specified by an ellipsoid-shaped set is called an elliptical ambiguity, while the ambiguity specified by a rectangular set is called a rectangular ambiguity. The elliptical ambiguity was also considered in Cohen and Tegnér (2019). Siu (2023b) applied some asymptotic results of the maximum likelihood estimates for transition probabilities for the Markov chain to specify the lower and upper limits for the perturbations/misspecifications in the transition rates of the chain.

The aforementioned works considered the incorporation of model uncertainty in continuous time, whereas the incorporation of model uncertainty in discrete time is considered here. Indeed, as noted in Elliott and Siu (2017) and Siu (2023a), besides some advantages from an econometric perspective, in a discrete-time modelling framework, volatility uncertainty can be incorporated via the use of an extended Girsanov’s principle for changing probability measures. Unlike the continuous-time situation where singular probability measures are involved (e.g., Peng (1997) and Fouque and Ren (2014)), the use of an extended Girsanov’s principle involves absolutely continuous changes in probability measures, and it provides a streamlined approach to incorporate volatility uncertainty. Furthermore, in (Agarwal et al. 2021; Avellaneda et al. 1995; Lyons 1995; Wilmott 2007; Wilmott and Oztukel 1998), “uncertain” parameters were introduced to directly describe the ambiguity of the model parameters, such as the drift, volatility, and market price of risk, whereas, as in Siu (2023a), the “uncertain” parameters are introduced here to describe the perturbations/misspecifications in the conditional mean and volatility. Lastly, in some of the existing literature, confidence limits are specified by market information, such as the extreme values of implied volatilities, pre-specified or specified by classical statistical approaches. However, the confidence limits are to be specified here using Bayesian credible intervals along the lines of Boyle and Ananthanarayanan (1977) and Siu (2023a). This will be discussed in more detail in Section 4.

For each , let denote an -adapted process on defined by putting

where under the reference probability measure as defined in the last section (Section 2).

For each , the -adapted process is defined as follows:

By definition, for each , is a positive-valued process. It is also an -martingale. Consequently, it can be used as a density process for changing probability measures in discrete time. Then, for each , a probability measure equivalent to on is defined by putting

By a discrete-time Girsanov’s theorem (see, for example, Elliott et al. (1995) and Elliott and Madan (1998)), for each , is defined by putting:

which is a sequence of i.i.d. standard normal random variables under the newly defined probability measure in Equation (22).

The family indexed by , where , defines a family of sequences of Gaussian “uncertain” noises. From Equations (17) and (23), for each , under , the logarithmic return process is governed by

When varies in , a family of alternative GARCH models having the form in Equation (24) is defined under a family of probability measures . Borrowing some terminologies from relativity in physics, each of the alternative GARCH models may be considered a reference frame to describe the dynamics of the logarithmic returns. The reference GARCH model in Equation (1) may also be thought of as a reference frame as it is included in the family of alternative GARCH models. In other words, the dynamics of the logarithmic returns are described by a family of reference frames. They may be thought of as “equivalent” reference frames in the sense that they are described by a family of equivalent probability measures.

3.2. Risk-Neutralization

In this subsection, Step (II) is considered. For each and each , let

Then, an -adapted process is defined by putting

where and are given by Equations (2) and (25), respectively.

From Equation (26), for each , an -adapted process is defined by putting

Note that for each , is a positive-valued -martingale. Consequently, for each , a new probability measure , which is equivalent to on , is defined by setting

Using arguments similar to the proof of Lemma 1, it can be shown that for each , under the probability measure , the conditional distribution of with given is a normal distribution with mean and variance . Similarly to Equation (13), for each , under ,

where under .

For each and each , let

Comparing the dynamics for in Equation (24) and those in Equation (29) gives

Substituting Equation (31) into the conditional variance process in Equation (24) gives

Putting together Equations (29) and (32), for each , under , the logarithmic return process has the following dynamics:

Using arguments similar to the proof of Theorem 1 and Equation (33), it can be shown that for each , the discounted price process of ETH-AUD, i.e., , is an -martingale. Consequently, for each , is a “risk-neutral” probability measure. It defines a “risk-neutralized” alternative GARCH model in Equation (33), which incorporates the impact of model uncertainty about the conditional mean and volatility via the vector of the “uncertain” parameters . Then, the family of “risk-neutral” probability measures defines a family of “risk-neutralized” alternative GARCH models, each having the form in Equation (33).

3.3. Lower and Upper Estimates for Ether Option Prices

Step (III) is considered in this subsection. A European-style Ether option with maturity at time T and payoff described by a random variable X on is considered. Assume that the random variable X is -measurable and integrable under the probability measure . That is, .

For each , let denote the conditional expectation given under a “risk-neutral” probability measure . Then, an -adapted process is defined by putting

From Equation (34), for each , is an -martingale. For a given , if is taken as a price process of the Ether option, and then the discounted price process of the Ether option is an -martingale, where the numeraire asset for the discounting is chosen to be the bond.

The conditional superlinear and sublinear expectations for the discounted payoff of the Ether option with respect to the family of “risk-neutral” probability measures are now defined. Specifically, for each , given , the conditional superlinear expectation for with respect to , denoted by , is defined as follows:

where the essential infimum is taken over .

Similarly, for each , given , the conditional sublinear expectation for with respect to , denoted by , is defined as follows:

where the essential supremum is taken over .

Note that the conditional sublinear expectation in Equation (36) satisfies the following five properties:

- (i)

- Measurability: For any integrable random variable (i.e., X is an integrable, -measurable random variable),

- (ii)

- Monotonicity: For any two integrable random variables , satisfying for all ,

- (iii)

- Translation Invariance: For any two integrable random variables and ,

- (iv)

- Positive Homogeneity: For any two integrable random variables and such that , for all ,

- (v)

- Sub-additivity: For any two integrable random variables ,

The conditional superlinear expectation in Equation (35) satisfies Properties (i)–(iv) above. However, instead of satisfying the sub-additivity property in Equation (41), the conditional superlinear expectation in Equation (35) satisfies the following super-additivity property:

- (v*)

- Super-additivity: For any two integrable random variables ,

For each , let be the space of integrable random variables defined on . Since , and is a complete lattice, both and exist, and they are -measurable random variables (see Dunford and Schwartz (1958), p. 302 therein, and Elliott (1982), p. 225 and Lemma 16.A.2 therein).

Using the conditional superlinear expectation in Equation (35), the lower estimate for the price of the Ether option at time t, denoted by , with respect to the family of “risk-neutral” probability measures is defined by

Similarly, using the conditional sublinear expectation in Equation (36), the upper estimate for the price of the Ether option at time t, denoted by , with respect to the family of “risk-neutral” probability measures is defined by

4. Bayesian Lower and Upper Estimates

In this section, the Bayesian lower and upper estimates for the price of an Ether option under the GARCH model are constructed using Bayesian nonlinear expectations in Siu (2023a). The basic idea is to adopt the “confidence” limits of Bayesian credible intervals to specify the lower and upper limits for each of the “uncertain” parameters and describing the perturbations/misspecifications in the conditional mean and volatility, respectively. Specifically, the “confidence” limits of the Bayesian credible intervals are used to specify the lower and upper limits of the rectangular region in Equation (19).

Bayesian statistics provides a data analytical approach, which is supplemented by expert opinion or subjective judgement, to specify the conditional nonlinear expectations in Equations (35) and (36). The two sources of information are combined “rationally” using the Bayes’ theorem. Indeed, Bayesian statistics contributes to many developments of machine learning, artificial intelligence and data science. Its relevance to model uncertainty, or ambiguity, was featured in the smooth ambiguity approach to model uncertainty proposed by Klibanoff et al. (2005). Its connection with decision theory was highlighted in the classic monograph by Bernardo and Smith (2000). See also Siu (2023a) for some related discussions. Bayesian statistics and computation can also be used to handle missing data, which may be particularly relevant as far as big data are concerned. See, for example, (Kong et al. 1994; Ramoni and Sebastiani 2001; Rubin 1976; Tanner and Wong 1987). The constructions and notation below follow those in Siu (2023a), Section 4 therein, which were based on results in Bernardo and Smith (2000).

From Equation (23),

Recall that for each , under , . Consequently, by Equation (45), under . The above statements still hold if the two-dimensional vector of the “uncertain” parameters . In Bayesian statistics, the vector of the “uncertain” parameters is regarded as a random vector. When evaluating the Bayesian credible intervals for the random vector , it is assumed that the state space of the random vector is . Following Bernardo and Smith (2000), Siu (2023a) and some relevant references therein, instead of considering , the precision is considered, where . In other words, the random vector , with the same state space , is considered. Since is an “uncertain” parameter, may also be interpreted as an “uncertain” parameter.

A Normal–Gamma conjugate prior distribution is assigned for the random vector . That is,

where and are the prior mean and precision of the normal prior distribution for , respectively. Note that and . The prior distribution of is a Gamma distribution with the shape parameter and the rate parameter . Note also that and . In practice, those prior parameters, which are also called hyper-parameters, can be chosen based on expert opinion or subjective judgement. See Siu (2023a), Section 4, for discussions about the intuitions behind and interpretations for those prior parameters.

Suppose that the reference model under the reference (real-world) probability measure (e.g., the GARCH model in Equation (1)) is estimated, given . That is, the GARCH model is estimated using observations about the logarithmic returns . The estimation for the GARCH model based on the conditional maximum likelihood estimation method is performed using the R package “rugarch” Galanos and Kley (2023). Let , which is a set of indices of the observations. Then, from Equation (1), the standardized residuals from the model fitting are computed as follows:

where is the estimate for the mean parameter , and is the estimate for the conditional variance such that

Note that , and are the conditional maximum likelihood estimates for the GARCH parameters , and , respectively.

Recall that under , . It may not be unreasonable to assume that under , . Let . Write and for two probability levels such that . Let denote the upper-tail critical value of a t-distribution with the degree of freedom corresponding to the probability level . Then, using results in Bernardo and Smith (2000), p. 440 (see also Siu (2023a), Section 4), the Bayesian credible interval for the “uncertain” parameter given is such that

where

Using some terminologies in machine learning, the sample mean may be related to the training error, while the unknown mean may be related to the test error that is to be learned or estimated from the training error (see, for example, Zhang (2023), page 9 therein).

Furthermore, the Bayesian credible interval for the “uncertain” parameter given is such that

where is the upper-tail critical value of a Gamma distribution with the shape parameter and the rate parameter corresponding to the probability level .

Take

Then, the following rectangular region is defined:

Note that may be called a Bayesian (posterior) rectangular region. It may be thought of as a Bayesian (posterior) estimate for the rectangular region in Equation (19). To simplify the notation, we write for .

Let denote the set of non-negative integers truncated at the terminal time . That is, . Define the product space by

We consider an -adapted stochastic process, denoted by , such that for each and each , .

Define, for each , . Note that for each , is an -measurable random variable such that for each , . Similarly, for each , is an -measurable random variable such that for each , .

For each process , each and each , let

Then, for each , each and each , we define

where and are given by Equation (2) and Equation (55), respectively. Furthermore, we take

For each , let denote the “tail” filtration generated by the logarithmic returns such that for each ,

where for any two -algebras and on ; is a collection of -null subsets in the -field .

By the definitions in Equations (56)–(58), for each , the “tail” process is an -adapted stochastic process.

For each and each , using Equation (56), the -adapted process is defined such that for each ,

Then, by the definitions in Equations (56), (57) and (59), for each , is an -martingale.

Consequently, for each and each , a new probability measure , which is equivalent to on , is defined by setting

For each , a family of Bayesian (posterior) “risk-neutral” probability measures, given , which is indexed by the space of processes , is defined by

The family defines a family of probability measures underlying a family of Bayesian (posterior) “risk-neutral” alternative GARCH models given . Note that for each , only the coordinate, i.e., , of the process is involved in defining the probability measure corresponding to within the family .

For each , a Bayesian (posterior) superlinear expectation for the discounted payoff of the Ether option given with respect to in Equation (61), denoted by , is defined as follows:

where is the conditional expectation given under the probability measure . The essential infimum in Equation (62) is taken over all the probability measures in the family . Note that the Bayesian (posterior) superlinear expectation in Equation (62) satisfies the five properties (Properties (i)–(iv) in Equations (37)–(40) and Property (v*) in Equation (42)).

Similarly, for each , a Bayesian (posterior) sublinear expectation for the discounted payoff of the Ether option given with respect to in Equation (61), denoted by , is defined as follows:

The Bayesian (posterior) sublinear expectation in Equation (63) satisfies the five properties (Properties (i)–(v) in Equations (37)–(41)).

Using the Bayesian (posterior) superlinear expectation in Equation (62), the Bayesian (posterior) lower estimate for the price of the Ether option at time n with respect to , denoted by , is defined by

Similarly, using the Bayesian (posterior) sublinear expectation in Equation (63), the Bayesian (posterior) upper estimate for the price of the Ether option at time n with respect to , denoted by , is defined by

The Bayesian (posterior) lower and upper estimates for the price of the Ether option are interpreted as the Bayesian (posterior) lower and upper confidence limits on the option price, respectively, in the line with the interpretations adopted in Boyle and Ananthanarayanan (1977).

5. Numerical/Simulation Procedure

In this section, the numerical/simulation procedure for computing the Bayesian lower and upper estimates for the price of the Ether option is described. Given (i.e., the standardized residuals ), the Bayesian (posterior) rectangular region can be computed using Equations (49)–(53). Then, the Bayesian lower and upper estimates for the price of the Ether option in Equations (64) and (65) are computed using the procedures described in Section 4. However, it does not seem that closed-form expressions for the Bayesian lower and upper estimates in Equations (64) and (65) are available. Consequently, they are computed by the numerical/simulation procedures to be described in the sequel.

To compute the Bayesian lower and upper estimates, a numerical/simulation procedure based on the Monte Carlo simulation is adopted. A European call Ether option with strike price K and maturity at time T is considered. In this case, the terminal payoff of the Ether option at time T is

where is the price of Ethereum in AUD at the maturity T.

To approximate the Bayesian (posterior) superlinear expectation , it is conjectured that the infirmum of over is attained at the extremal point . Similarly, to approximate the Bayesian (posterior) sublinear expectation , it is conjectured that the supremum of over is attained at the extremal point .

It is possible that the supremum and infimum may be attained at some interior points of the rectangular region . However, the approximations to the Bayesian (posterior) superlinear and sublinear expectations based on the extremal points look simpler than using grid search. The latter could be computationally intensive when the number of grid points is large and it is used coupled with the Monte Carlo simulation method. Furthermore, the approximation results based on extremal, or boundary, points to be presented look reasonable at an intuitive level.

To sum up, when approximating the Bayesian (posterior) superlinear expectation , the following extremal, or boundary, point is adopted:

Similarly, when approximating , the following extremal, or boundary, point is used:

Consequently, the Bayesian (posterior) superlinear and sublinear expectations may be, respectively, approximated as follows:

and

The Monte Carlo method is used to estimate the conditional expectations and in Equations (69) and (70), respectively. The use of the Monte Carlo method for option pricing was pioneered by Boyle (1977). See also Boyle et al. (1997) for an excellent account. Here, the Monte Carlo method with control variates is used to estimate and . To illustrate this, the estimation of based on the Monte Carlo method with control variates is presented here. The estimation of follows similarly. For more detail about the Monte Carlo method with control variates and other variance reduction techniques, such as antithetic variates, please refer to Boyle (1977) and Boyle et al. (1997).

Under the probability measure , the estimated dynamics for the “risk-neutralized” alternative GARCH in Equation (33) are given by

whereby, from Equation (30),

Recall that , , and are the estimates for the unknown parameters in the GARCH model with drift in Equation (1) under the reference probability measure . Under the probability measure , .

Suppose now that a set of simulated values for the terminal payoff X in Equation (66), that is, , is generated by simulating from the estimated dynamics in Equation (71). Then, the Monte Carlo estimate for the conditional expectation is given by

Using Equations (65), (70) and (73), without control variates, the Monte Carlo estimate for the Bayesian (posterior) upper price is given by

Let denote the known price of the European call Ether option at time n, which is taken as the Black–Scholes–Merton call price at time n. Write for the Monte Carlo estimate for the known price . Then, with control variates, the Monte Carlo estimate, denoted by , for the Bayesian (posterior) upper estimate for the price of the Ether option is given by

where

The standard error of the Monte Carlo estimate in Equation (75) is given by

In line with Boyle and Ananthanarayanan (1977), a Bayesian model for estimating the unknown volatility parameter in the Black–Scholes–Merton (BSM) model is adopted to compute Bayesian confidence limits and a Bayesian point estimate for the price of an Ether option in the current paper. For convenience, this model is called the Bayesian BSM model here. The Bayesian BSM model corresponds to a model with volatility uncertainty (but without conditional heteroscedasticity), and it is briefly discussed in the rest of this section for the sake of completeness. In Section 6, the Bayesian confidence limits obtained from the Bayesian BSM model will be compared with those obtained from the proposed model, which incorporates both model uncertainty and conditional heteroscedasticity.

In the Bayesian BSM model, the logarithmic returns of Ethereum are directly used to compute the Bayesian credible interval for the unknown volatility parameter. Let (i.e., the observations about the logarithmic returns of Ethereum up to and including time n). Define

As in Equation (50), define and as follows:

Similarly to Equations (51) and (52), the Bayesian credible interval for the unknown annualized volatility of the logarithmic returns of Ethereum, i.e., , given , is such that

where the scaling factor is applied to annualize the lower and upper limits of the Bayesian credible interval for under the assumption that there are 252 trading days per annum.

Let denote the annualized risk-free interest rate. Then, given the volatility , the Black–Scholes–Merton model gives the following closed-form solution to the price of the European call Ether option with strike price K and time-to-maturity :

where

Note that s is the current price of Ethereum in AUD; is measured in year(s).

The Bayesian point estimate for given , denoted by , is taken as follows:

Then, the (closed-form) Bayesian lower and upper estimates for the price of the European call Ether option given are, respectively, given by

and

Furthermore, the (closed-form) Bayesian point estimate for the price of the European call Ether option given is given by

6. Empirical and Simulation Results

Real data on the daily adjusted close prices of Ethereum in AUD (ETH-AUD) are considered. The period of the data is from 1 January 2018 to 21 May 2024 (a total of 2333 observations) covering some periods of the COVID-19 pandemic. The data were downloaded from Ethereum AUD (ETH-AUD) price history and historical data—Yahoo Finance (https://au.finance.yahoo.com/quote/ETH-AUD/, (accessed on 15 September 2024)). Data on the daily logarithmic returns from ETH-AUD (a total of 2332 observations) are used to estimate the reference model, i.e., the GARCH(1,1) model with drift, in Equation (1). The estimation of the GARCH(1,1) model was performed using the R package “rugarch” Galanos and Kley (2023). The Monte Carlo estimates and their standard errors for the Bayesian lower and upper estimates for prices of Ether options with different strike prices and maturities are computed. The strike prices are 80%, 90%, 100%, 110% and 120% of the current adjusted close price of ETH-AUD. Consequently, in-the-money (ITM), at-the-money (ATM) and out-of-the-money (OTM) Ether options are considered. The maturities are three months, six months, nine months and one year. It is supposed that there are 252 trading days per year. Besides the Bayesian lower and upper estimates, the prices of Ether options without incorporating model uncertainty, which are called the standard prices, are also considered. Specifically, Monte Carlo estimates and their standard errors for the standard prices with different strike prices and maturities are computed. The standard prices refer to the prices of the Ether options from a model incorporating conditional heteroscedasticity only, that is, the reference model in Equation (1). The Bayesian lower and upper estimates, as well as the Bayesian point estimates, for the prices of the Ether options are computed from the model incorporating volatility uncertainty only in line with Boyle and Ananthanarayanan (1977), as described in Section 5. All the statistical analyses, simulations and computations were performed using R.

Table 1 presents some summary statistics of the daily logarithmic returns data.

Table 1.

Summary statistics of daily log returns from ETH-AUD.

From Table 1, the daily logarithmic returns from ETH-AUD have a negatively skewed and heavy-tailed distribution. Furthermore, the range of the returns is large. Similar findings were discussed in Siu (2023a) for Bitcoin returns data covering some periods of the COVID-19 pandemic.

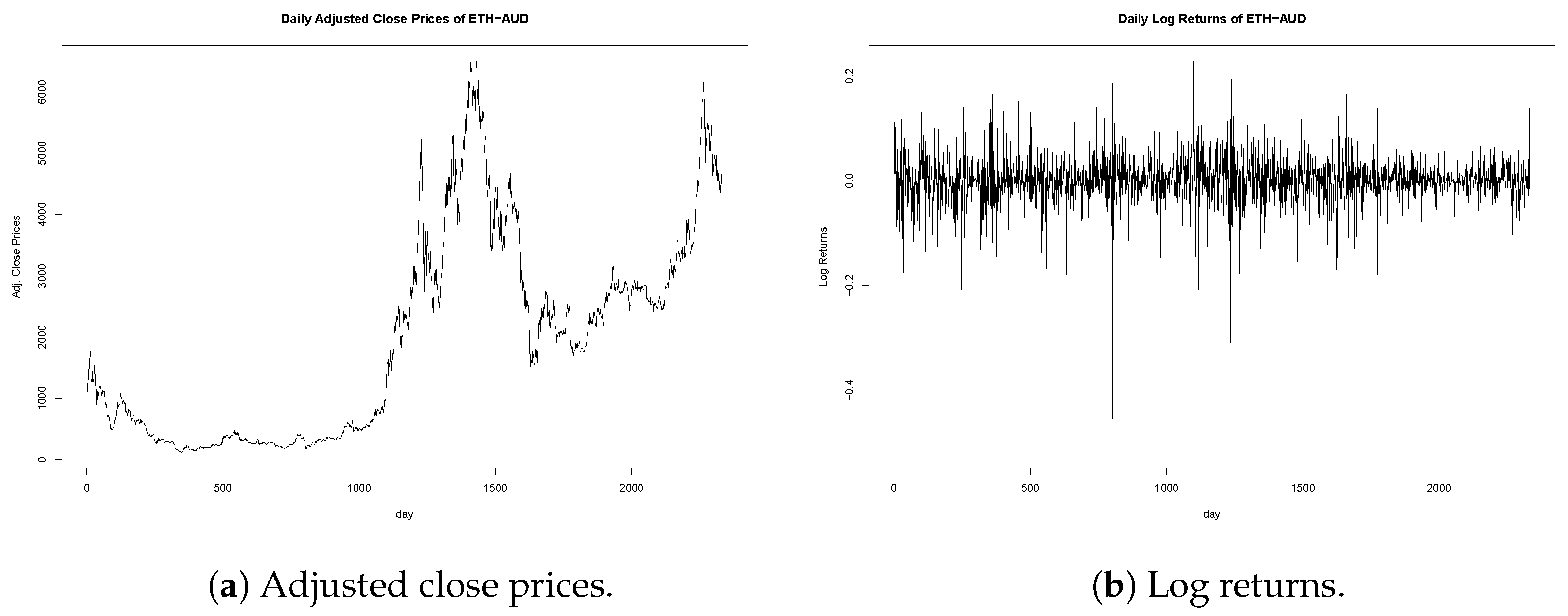

Figure 1 depicts the time series plots for the daily adjusted close prices (a) and logarithmic returns (b) from ETH-AUD. [subfigure]justification=centering

Figure 1.

Time series plots for adjusted close prices and log returns.

From Figure 1a, there was an upward trend in the adjusted close prices of ETH-AUD starting around the 1000th day and ending at around the 1500th day. This corresponds to the first half year of 2020 during which the impact of the COVID-19 pandemic started emerging. Furthermore, from Figure 1b, the daily logarithmic returns from ETH-AUD exhibit volatility clustering, that is, periods of high (low) volatility followed by periods of high (low) volatility. Similar observations were made in Siu (2023a) for Bitcoin returns data covering some periods of the COVID-19 pandemic.

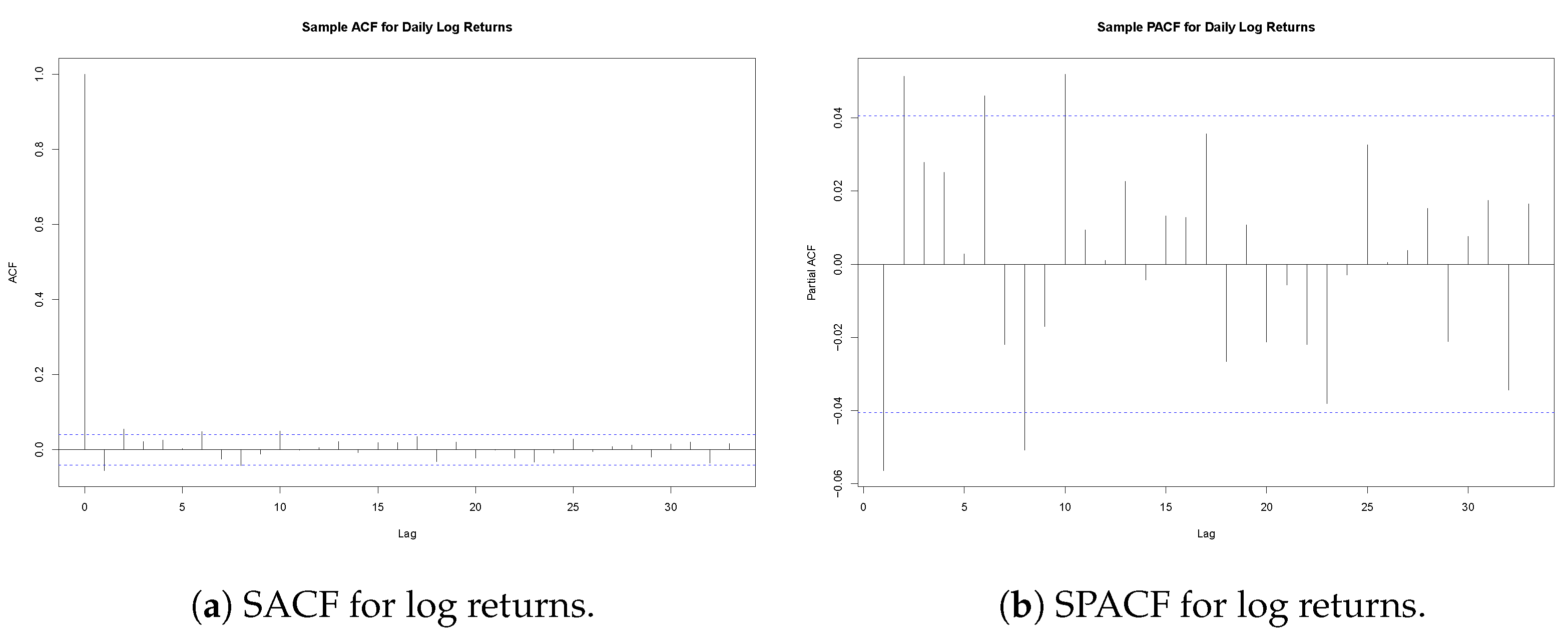

Figure 2 depicts the sample ACF plot (a) and the sample PACF plot (b) for the daily logarithmic returns from ETH-AUD.

Figure 2.

SACF and SPACF plots for log returns.

From Figure 2, the daily logarithmic returns from ETH-AUD appear to be stationary. To provide further evidence for the stationarity, three types of the augmented Dickey–Fuller (ADF) test were performed using the R package “aTSA” Qiu (2024). They are “Type 1: no drift no trend”, “Type 2: with drift no trend”, and “Type 3: with drift and trend”. The alternative hypothesis of the test is “stationary”. The p values of the three types of the ADF test are all less than , indicating the stationarity of the logarithmic returns data.

Table 2 provides the estimation results for the GARCH(1,1) model with drift. Note that the standard errors reported are robust standard errors.

Table 2.

The estimation results of the GARCH(1,1) model with drift.

From the estimation results in Table 2, the standard error of the estimate for the drift parameter is large compared with the estimate for . This indicates that estimating the drift parameter could be noisy, which has been documented in Merton (1980) for market returns data. Furthermore, the (G)ARCH coefficients and are significant at the 5% significance level. This provides evidence for the presence of conditional heteroscedasticity. To provide further evidence, a weighted Ljung–Box test on the standardized squared residuals and a weighted ARCH LM test were performed. Table 3 presents the results of the weighted Ljung–Box test on standardized squared residuals and the weighted ARCH LM test. The results of the two tests support the presence of conditional heteroscedasticity or ARCH effect in the daily logarithmic returns from ETH-AUD.

Table 3.

Weighted Ljung–Box test on standardized squared residuals and ARCH LM test.

Table 4 provides the lower and upper limits of the 90% Bayesian credible intervals for the “uncertain” parameters and , which were computed using the Normal–Gamma conjugate prior and the standardized residuals from the estimated reference model. As an illustration, the assumed values for the prior parameters are , , and . These assumed values for the prior parameters were considered in Siu (2023a) for Bitcoin returns data.

Table 4.

90% Bayesian credible intervals for and .

From Table 4, the Bayesian credible interval for covers the point zero. This indicates that the Bayesian credible interval includes the situation where there are no perturbations/misspecifications in the conditional mean. Likewise, the Bayesian credible interval for covers the point one. This indicates that the Bayesian credible interval includes the situation where there are no perturbations/misspecifications in the conditional volatility. The Bayesian credible interval for appears to be relatively wide compared with that for . This indicates that model uncertainty about the conditional mean could be more significant than model uncertainty about the conditional volatility for the daily logarithmic returns from ETH-AUD. This appears to be in line with the finding in Merton (1980) that the drift estimate could be more noisy than the volatility estimate for market returns data. The lower and upper limits of the Bayesian credible intervals for and in Table 4 are used to compute the Monte Carlo estimates and their standard errors for the Bayesian lower and upper estimates for the prices of Ether options following the procedures described in Section 5.

Table 5, Table 6 and Table 7 give the Monte Carlo estimates for the Bayesian lower and upper estimates for the prices of the Ether options as well as their standard prices with different strike prices K and maturities T. The respective standard errors are presented in parentheses below the Monte Carlo estimates. Each Monte Carlo estimate is computed by 10,000 simulation runs. The risk-free interest rate r is taken as 5% per annum. The current adjusted close price of ETH-AUD .

Table 5.

Monte Carlo estimates for lower limits.

Table 6.

Monte Carlo estimates for standard prices.

Table 7.

Monte Carlo estimates for upper limits.

From Table 5, Table 6 and Table 7, the Bayesian lower and upper estimates as well as the standard prices increase as the maturity T increases. Furthermore, they decrease as the strike price K increases. These results are intuitively reasonable. Specifically, the results can be explained by the time value of the call option and the payoff of the call option as a decreasing function of the strike price. Furthermore, the Bayesian lower estimates are lower than the respective Bayesian upper estimates, and the standard prices lie between the respective Bayesian lower and upper estimates. This may lend support to the conjecture that the supremum and infimum of over may be attained at the extremal, or boundary, points of the rectangular region . The standard errors are relatively small compared with the respective Monte Carlo estimates. This indicates that the Monte Carlo estimates for the Bayesian lower and upper prices as well as the standard prices are quite precise.

Table 8 presents the differences in the Monte Carlo estimates for the Bayesian upper and lower estimates for the prices of the Ether options with different strikes K and maturities T.

Table 8.

Differences in the Monte Carlo estimates for upper and lower limits.

From Table 8, for a fixed strike price K, the differences in the Monte Carlo estimates for the Bayesian upper and lower estimates for the prices of the Ether options increase as the maturity T increases. This indicates that as the maturity T of an Ether option becomes longer, the effect of model uncertainty about the conditional mean and volatility on the option prices could be more significant.

Table 9 gives the Bayesian upper, point and lower estimates for the prices of the Ether options with different strikes K and maturities T under the Bayesian BSM model. Note that the prior parameters used here are the same as those values assumed before. The 90% Bayesian credible interval for the annualized volatility parameter is given by . The Bayesian point estimate for is given by .

Table 9.

Upper (U), point (P) and lower (L) estimates under the Bayesian BSM model.

From Table 9, the Bayesian lower, point and upper estimates for the prices of the Ether options increase as the maturity T increases. They decrease as the moneyness increases. Again, these results are intuitively reasonable. The Bayesian lower, point and upper estimates for the prices of the Ether options are in correct order. That is, the Bayesian lower estimates are below the respective Bayesian upper estimates, and the Bayesian point estimates lie between the respective Bayesian lower and upper estimates. This is explained by the fact that the Black–Scholes–Merton formula for the call price is an increasing function of the annualized volatility parameter , and the numerical results that the Bayesian point estimate for lies within the Bayesian credible interval for .

Table 10 presents the differences in the upper and lower estimates for the prices of the Ether options with different strikes K and maturities T under the Bayesian BSM model.

Table 10.

Differences in the upper and lower estimates under the Bayesian BSM model.

From Table 10, for a fixed strike price, the differences in the upper and lower estimates for the prices of the Ether options increase as the maturity T increases. This result is consistent with that from Table 8. This reflects that as the maturity T of an Ether option becomes longer, the impact of volatility uncertainty on the option prices could be more pronounced. Comparing Table 8 and Table 10, the differences in the upper and lower estimates for the prices of the Ether options under the proposed model with both model uncertainty and conditional heteroscedasticity are substantially higher than those under the Bayesian BSM model. This indicates that the combined effect of model uncertainty about the conditional mean and conditional heteroscedasticity on the option prices are more significant than the impact of volatility uncertainty.

7. Price Fluctuations: Chaotic or Random?

Are price fluctuations chaotic or random? This question has captured considerable attention from academic researchers and market practitioners. If price fluctuations are chaotic, they may be considered a deterministic (nonlinear) dynamical system. If price fluctuations are random, they are totally unpredictable and may be described by the random walk theory. The latter is related to a (weak) form of market efficiency, although rejecting random walk theory does not imply market efficiency when trading costs are taken into account (see (Taylor 1986, 2005)). Henri Poincaré realized more than a century ago that a deterministic (nonlinear) dynamical system, which is sensitive to its initial state, can generate behaviour which is reminiscent of random behaviour. In a seminal article by May (1976), a logistic map was used to illustrate chaotic dynamics in the study of animal population dynamics. Although it may not be possible to define the notion of chaos precisely, the sensitivity to the initial state is an important property of a chaotic dynamical system. See (Tong 1990, 1995, 2002) for related discussions and more detail. See also the monographs by (Gleick 1987; Palmer 2023) for an excellent account to the chaos theory and its applications to diverse fields.

Motivated by the market crash in October 1987, an early study on deterministic chaotic and nonlinear dynamical systems in financial markets was conducted in a seminal article by Hsieh (1991). Through performing a statistical test, namely the BDS test Broock et al. (1996), on weekly stock returns from the Center for Research in Securities Prices (CRSP) at the University of Chicago, the empirical results in Hsieh (1991) revealed that logarithmic stock returns are not independent and identically distributed (i.i.d.) and that conditional heteroscedasticity is the cause of the rejection of the i.i.d. logarithmic stock returns. Hsieh (1991) also pointed out that to model nonlinear behaviour in the logarithmic stock returns, instead of focusing on the conditional mean returns including chaotic dynamics, attention should be given to modelling conditional heteroscedasticity, i.e., time-varying conditional volatility. (Hsieh 1993, 1995) further explored implications of nonlinear dynamical systems for financial risk management and financial markets, respectively. Using data on four currency futures markets (the British Pound, Deutsche Mark, Japanese Yen and Swiss Franc), Hsieh (1993) found empirically that while conditional mean returns may not be predictable, the conditional variances are predictable. Using data on stock index futures prices for the S&P, Nikkei, DAX, FTSE and CAC, the empirical findings in Hsieh (1995) indicated that conditional variance models such as the ARCH-type models can account for a great deal of non-random behaviour in asset returns. For excellent accounts on chaos and nonlinear dynamical systems in financial markets and the economy, one may refer to the monographs by (Broock et al. 1991; Farmer 2024; Peters 1996). Additionally, Schefczyk (2012) may provide some discussions from a philosophical perspective.

Deterministic nonlinear dynamical systems and chaos may not provide realistic descriptions for real-world dynamics. To address some limitations of deterministic nonlinear dynamical systems and chaos, stochastic dynamical systems and noisy chaos were introduced by researchers in the 1990s. See, for example, (Bartlett 1990; Berliner 1992; Casdagli 1992; Cheng and Tong 1992, 1994; Fan et al. 1993; Tong 1990, 1992, 1995; Yao and Tong 1994a, 1994b; Chan and Tong 1994). Specifically, stochastic dynamical systems and noisy chaos are described by stochastic difference equations or nonlinear autoregressive models which generalize deterministic difference equations by introducing stochastic noise. Two important approaches have been introduced to quantify the sensitivity of stochastic dynamical systems with respect to their initial conditions. They are the conditional distribution approach and the conditional mean approach. The conditional distribution approach was considered in (Yao and Tong 1994a, 1994b). The key idea of this approach is to describe the sensitivity of the conditional distribution with respect to the initial state through the divergence of the conditional distribution relating to the Kullback–Leibler information. The conditional mean approach describes the sensitivity of the conditional mean with respect to the initial state. It aims to generalize the notion of the Lyapunov exponent in a stochastic environment. See (Chan and Tong 2001; Tong 1995, 2002; Yao and Tong 1994a) for more detailed discussions on the two approaches. Indeed, the sensitivity of stochastic dynamical systems with respect to their initial states has an important implication for nonlinear prediction. Specifically, how well you can predict depends on where you are now (Chan and Tong 2001; Fan and Yao 2003; Tong 1995; Yao and Tong 1994a). This highlights the importance of state-dependency for nonlinear prediction. Stochastic (nonlinear) dynamical systems have been explored for modelling, estimating and predicting volatility in (Elliott et al. 2012; Tong 2007). Yao and Tong (1998) introduced a bootstrap test for deterministic chaos and stochastic randomness. As a potential topic for further research, it might be interesting to explore the possibility of using this bootstrap test to examine whether price fluctuations in financial markets, or particularly in crypto markets, are chaotic or random. Indeed, Garnier and Solna (2019) and Pietrych (2021) studied the nonlinearity, chaos and multifractality in the cryptocurrency markets as well as their implications for the market efficiency of cryptocurrencies.

8. Conclusions

Using Bayesian nonlinear expectations introduced in Siu (2023a), Bayesian lower and upper estimates for the price of an Ether option are constructed with the objective of incorporating the impacts of model uncertainty and conditional heteroscedasticity. Specifically, model uncertainty about the conditional mean and volatility of the return dynamics of Ethereum modelled by a reference GARCH model is incorporated by introducing the “uncertain” parameters describing the perturbations/misspecifications in the conditional mean and volatility. Then, a family of alternative GARCH models are introduced via changing probability measures using an extended Girsanov’s principle. The risk-neutralization of the family of alternative GARCH models is also performed via the extended Girsanov’s principle. The Bayesian nonlinear expectations are constructed using closed-form Bayesian credible intervals with conjugate priors and the residuals from the estimated reference GARCH model. The numerical/simulation procedures for the computation of the Bayesian lower and upper estimates for the prices of Ether options are introduced based on the Monte Carlo simulation method with control variates. Empirical results from real data on the daily logarithmic returns from Ethereum in AUD are presented. Monte Carlo estimates and their standard errors for the Bayesian lower and upper estimates for the prices of the Ether options as well as their standard prices are provided. The Monte Carlo estimates are precise and consistent with intuition. It is also found that the impact of model uncertainty about the conditional mean and volatility on the Ether option prices is more significant as the maturity increases. Comparisons between the Bayesian lower and upper estimates for the prices of the Ether options under the Bayesian BSM model, which incorporates volatility uncertainty only, are provided. It is found that the combined effect of model uncertainty about the conditional mean and conditional heteroscedasticity on the option prices is more pronounced than the impact of volatility uncertainty. Some discussions about the chaotic and random aspects of price fluctuations in financial markets in general, or crypto markets in particular, are provided. The chaotic and random aspects of price fluctuations may have implications for market efficiency in cryptocurrencies (see, for example, Garnier and Solna (2019) and Pietrych (2021)). The latter is relevant to crypto option pricing as discussed in Siu and Elliott (2021). It is hoped that those discussions might provide insights and inspiration, which may be helpful for future endeavours to explore the chaotic and random aspects of price fluctuations, as well as their implications for financial markets in general, or crypto markets in particular.

Some limitations of the proposed model are briefly discussed here. Firstly, the conjugate priors for the “uncertain” parameters describing the perturbations/misspecifications in the conditional mean and volatility are adopted here. Although the conjugate priors lead to closed-form Bayesian credible intervals, it is possible that the “uncertain” parameters may be better modelled by other distributions. Indeed, one may explore the possibility of using a Bayesian nonparametric approach to construct Bayesian credible intervals for the “uncertain” parameters as noted in Siu (2023a), Online Appendix F. Secondly, to simplify the discussion, it is assumed here that the random shocks of the GARCH model are normally distributed. It is possible that the random shocks of the GARCH model follow non-normal distributions. A similar remark was made in Boyle and Ananthanarayanan (1977) for the Bayesian BSM model. Thirdly, for illustration, the GARCH model is adopted here as a reference model. It is possible that some variants of the GARCH model, such as the GJR-GARCH model and the SETAR-GARCH model, may be better candidates for a reference model. Here, it is assumed that the risk-free interest rate is a constant. However, in practice, it may be realistic to consider the situation of a stochastic interest rate. It is conjectured here that the infimum and supremum of a conditional expectation are attained at the extremal points of a rectangular region when approximating the Bayesian (posterior) superlinear and sublinear expectations. Although the numerical results presented here may lend support to this conjecture, it is possible that the the infimum and supremum may be attained at some interior points of the rectangular region. Although the chaotic and random aspects of price fluctuations are briefly touched on in Section 7, empirical studies on the chaotic and random aspects of price fluctuations in Ether and other cryptocurrencies are not provided in the current paper. The papers by Garnier and Solna (2019) and Pietrych (2021) may provide an excellent account on this topic.

As noted in Godbole (2023), bid and ask prices prevail in Bitcoin and Ether option markets. However, it seems that the literature on modelling the bid and ask prices in cryptocurrency option markets may be rather limited. In a recent paper by Madan et al. (2019), they calibrated the Bitcoin price dynamics under several Markov models using vanilla Bitcoin options and studied the implied liquidity of Bitcoin call options using conic finance theory. How might the prevalence of bid and ask prices in Bitcoin and Ether options be explained? This may be a potential topic for further research. From the perspective of a two-price economy (Cherny and Madan 2009; Madan 2015, 2016; Madan and Cherny 2010), a recent paper by Elliott et al. (2022) considered a two-price system based on a lower price process and an upper price process attributed to model uncertainty, or uncertainty in probability, for financial valuation. Suppose the Bayesian lower and upper estimates for the price of an Ether option are interpreted as a Bayesian version of the lower and upper prices of the Ether option. Then, one may consider a Bayesian two-price system for the Ether option, in which the prevalence of bid and ask prices of the Ether option is explained by the model uncertainty about the conditional mean and volatility of the logarithmic returns of Ethereum. In this case, some further questions may arise. For example, besides model uncertainty, can the prevalence of bid and ask prices of the Ether option be explained by other economic factors? If yes, what other economic factors might be included? Another potential topic for further research may be to explore the possibility of developing a Bayesian version of nonlinear valuation operators in (Coque et al. 2002; Peng 2004a, 2004b, 2004c, 2005). For example, can a Bayesian version of nonlinear valuation operators be developed in continuous time?

Funding

The author wishes to acknowledge the Discovery Grant from the Australian Research Council (ARC) (project number: DP190102674).

Data Availability Statement

The data supporting reported results can be found from Yahoo Finance (https://au.finance.yahoo.com/quote/ETH-AUD/ (accessed on 15 September 2024)).

Acknowledgments

The author sincerely thanks the three reviewers for helpful and insightful comments. The author would like to thank the comment from a referee which inspired the discussions in Section 7.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Agarwal, Ankush, Christian Oliver Ewald, and Yihan Zou. 2021. An RBSDE Based Monte Carlo Method for Solving Optimal Stopping Problems under Parameter Uncertainty. Available online: https://ssrn.com/abstract=3549891 (accessed on 21 June 2021).

- Alexander, Carol, Ding Chen, and Arben Imeraj. 2023. Crypto quanto and inverse options. Mathematical Finance 33: 1005–43. [Google Scholar] [CrossRef]

- Avellaneda, Marco, Arnon Levy, and Antonio Paras. 1995. Pricing and hedging derivative securities in markets with uncertain volatilities. Applied Mathematical Finance 2: 73–88. [Google Scholar] [CrossRef]

- Badescu, Alexandru M., and Reg J. Kulperger. 2008. GARCH option pricing: A semiparametric approach. Insurance: Mathematics and Economics 43: 69–84. [Google Scholar] [CrossRef]

- Badescu, Alexandru M., Robert J. Elliott, Reg J. Kulperger, Jarkko Miettinen, and Tak Kuen Siu. 2011. A comparison of pricing kernels for GARCH option pricing with generalized hyperbolic distributions. International Journal of Theoretical and Applied Finance 14: 669–708. [Google Scholar] [CrossRef]

- Bartlett, Maurice S. 1990. Chance or chaos (with discussion). Journal of Royal Statistical Society A 153: 321–47. [Google Scholar] [CrossRef]

- Bauwens, Luc, and Michel Lubrano. 2002. Bayesian option pricing using asymmetric GARCH models. Journal of Empirical Finance 9: 321–42. [Google Scholar] [CrossRef]

- Beissner, Patrick Beissner, and Frank Riedel. 2019. Equilibria under Knightian price uncertainty. Econometrica 87: 37–64. [Google Scholar] [CrossRef]

- Berliner, L. Mark. 1992. Statistics, probability and chaos. Statistical Science 7: 69–122. [Google Scholar] [CrossRef]

- Bernardo, José M., and Adrian F. M. Smith. 2000. Bayesian Theory. New York: John Wiley & Sons, Inc. [Google Scholar]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Boyle, Phelim P. 1977. Options: A Monte Carlo approach. Journal of Financial Economics 4: 323–38. [Google Scholar] [CrossRef]

- Boyle, Phelim P., and A. L. Ananthanarayanan. 1977. The impact of variance estimation in option valuation models. Journal of Financial Economics 5: 375–87. [Google Scholar] [CrossRef]

- Boyle, Phelim P., Mark Broadie, and Paul Glasserman. 1997. Monte Carlo methods for security pricing. Journal of Economic Dynamics and Control 21: 1267–321. [Google Scholar] [CrossRef]

- Boyle, Phelim P., Shui Feng, Weidong Tian, and Tan Wang. 2008. Robust stochastic discount factors. Review of Financial Studies 21: 1077–122. [Google Scholar] [CrossRef]

- Brini, Alessio, and Jimmie Lenz. 2024. Pricing cryptocurrency options with machine learning regression for handling market volatility. Economic Modelling 136: 106752. [Google Scholar] [CrossRef]

- Broock, William A., David A. Hsieh, and Blake LeBaron. 1991. Nonlinear Dynamics, Chaos and Instability: Statistical Theory and Economic Evidence. Cambridge: MIT Press. [Google Scholar]

- Broock, William A., José A. Scheinkman, W. Davis Dechert, and Blake Lebaron. 1996. A test for independence based on the correlation dimension. Econometric Reviews 15: 197–235. [Google Scholar] [CrossRef]

- Buraschi, Andrea, and Alexei Jiltsov. 2006. Model uncertainty and option markets with heterogeneous beliefs. Journal of Finance 61: 2841–97. [Google Scholar] [CrossRef]

- Cao, Melanie, and Batur Celik. 2021. Valuation of bitcoin options. The Journal of Futures Markets 41: 1007–26. [Google Scholar] [CrossRef]

- Casdagli, Martin. 1992. Chaos and deterministic versus stochastic nonlinear modelling. Journal of Royal Statistical Society Series B 54: 303–28. [Google Scholar] [CrossRef]

- Chan, Jeremy. 2022. CME to Launch Ether Options Contract. Financial News. Dow Jones & Company, Inc. September. Available online: https://www.fnlondon.com/articles/cme-ether-bitcoin-options-futures-crypto-merge-derivatives-contract-20220913 (accessed on 15 September 2024).

- Chan, Kung-Sik, and Howell Tong. 1994. A note on noisy chaos. Journal of Royal Statistical Society Series B 56: 301–11. [Google Scholar] [CrossRef]

- Chan, Kung-Sik, and Howell Tong. 2001. Chaos: A Statistical Approach. New York: Springer. [Google Scholar]

- Chau, Huy N., Masaaki Fukasawa, and Miklós Rásonyi. 2022. Super-replication with transaction costs under model uncertainty for continuous processes. Mathematical Finance 32: 1066–85. [Google Scholar] [CrossRef]

- Chen, Kuo Shing, and J. Jimmy Yang. 2024. Price dynamics and volatility jumps in bitcoin options. Financial Innovation 10: 132. [Google Scholar] [CrossRef]

- Cheng, Bing, and Howell Tong. 1992. Consistent nonparametric order determination and chaos (with discussion). Journal of Royal Statistical Society Series B 54: 427–449, 451–474. [Google Scholar] [CrossRef]

- Cheng, Bing, and Howell Tong. 1994. Orthogonal projection, embedding dimension and sample size in chaotic time series from a statistical perspective. Philosophical Transactions of the Royal Society (London) A 348: 325–41. [Google Scholar]

- Cherny, Alexander, and Dilip B. Madan. 2009. New measures for performance evaluation. The Review of Financial Studies 22: 2571–606. [Google Scholar] [CrossRef]

- Cohen, Samuel N., and Martin Tegnér. 2019. European option pricing with stochastic volatility models under parameter uncertainty. In Frontiers in Stochastic Analysis–BSDEs, SPDEs and Their Applications. Edited by Samuel N. Cohen, Istvan Gyongy, Goncalo dos Reis, David Siska and Lukasz Szpruch. BSDE-SPDE 2017. Springer Proceedings in Mathematics & Statistics. Cham: Springer, vol. 289. [Google Scholar] [CrossRef]

- Cont, Rama. 2006. Model uncertainty and its impact on the pricing of derivative instruments. Mathematical Finance 16: 519–47. [Google Scholar] [CrossRef]

- Copeland, Tim. 2023. A Brief History of Ethereum. The Block. September. Available online: https://www.theblock.co/learn/245716/a-brief-history-of-ethereum (accessed on 15 September 2024).

- Coque, François, Ying Hu, Jean Mémin, and Shige Peng. 2002. Filtration-consistent nonlinear expectations and related g-expectations. Probability Theory and Related Fields 123: 1–27. [Google Scholar] [CrossRef]