The Impact of Human Resource Management on Financial Performance: A Systematic Review in Cooperative Enterprises

Abstract

1. Introduction

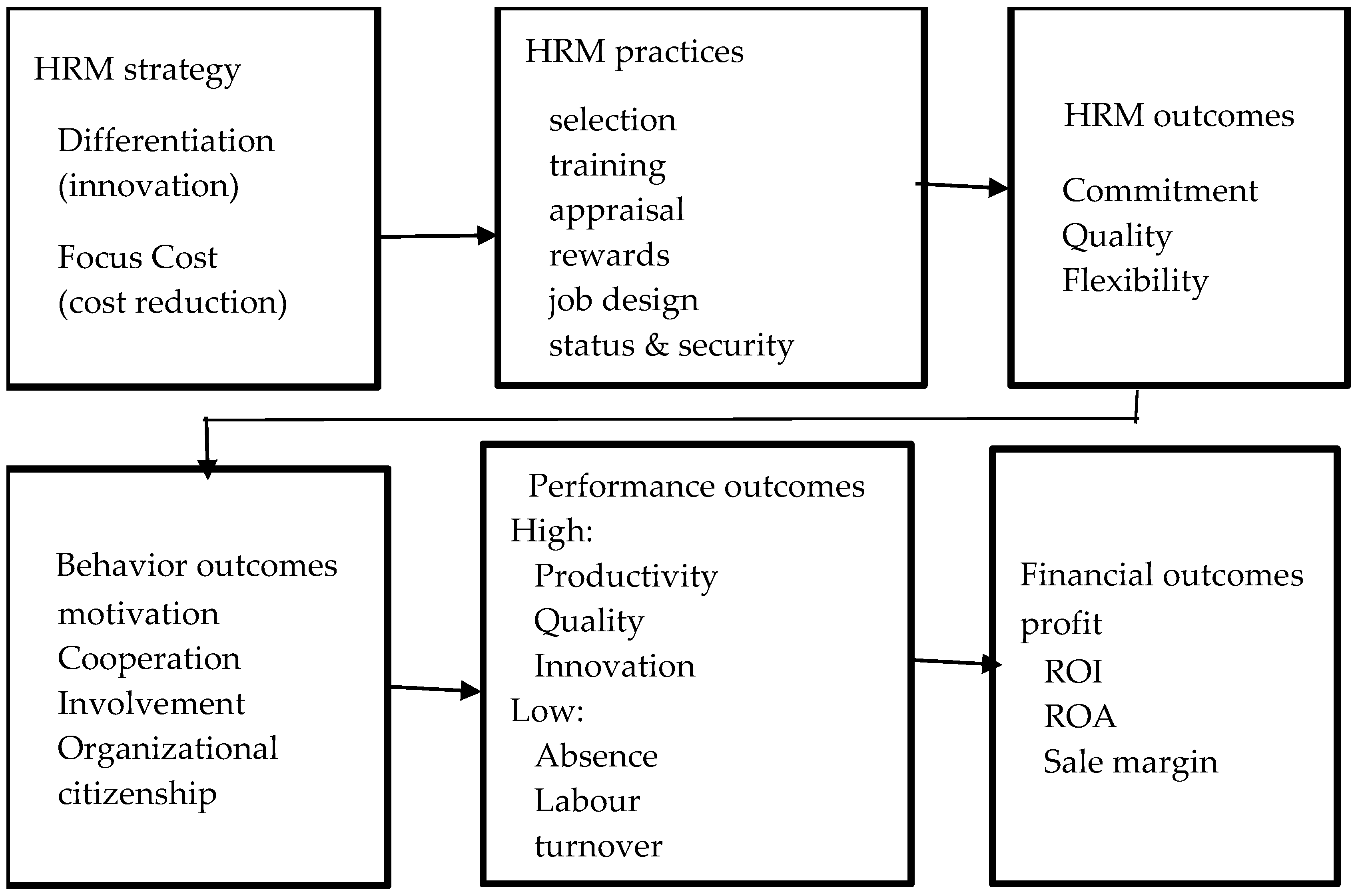

Theoretical Background

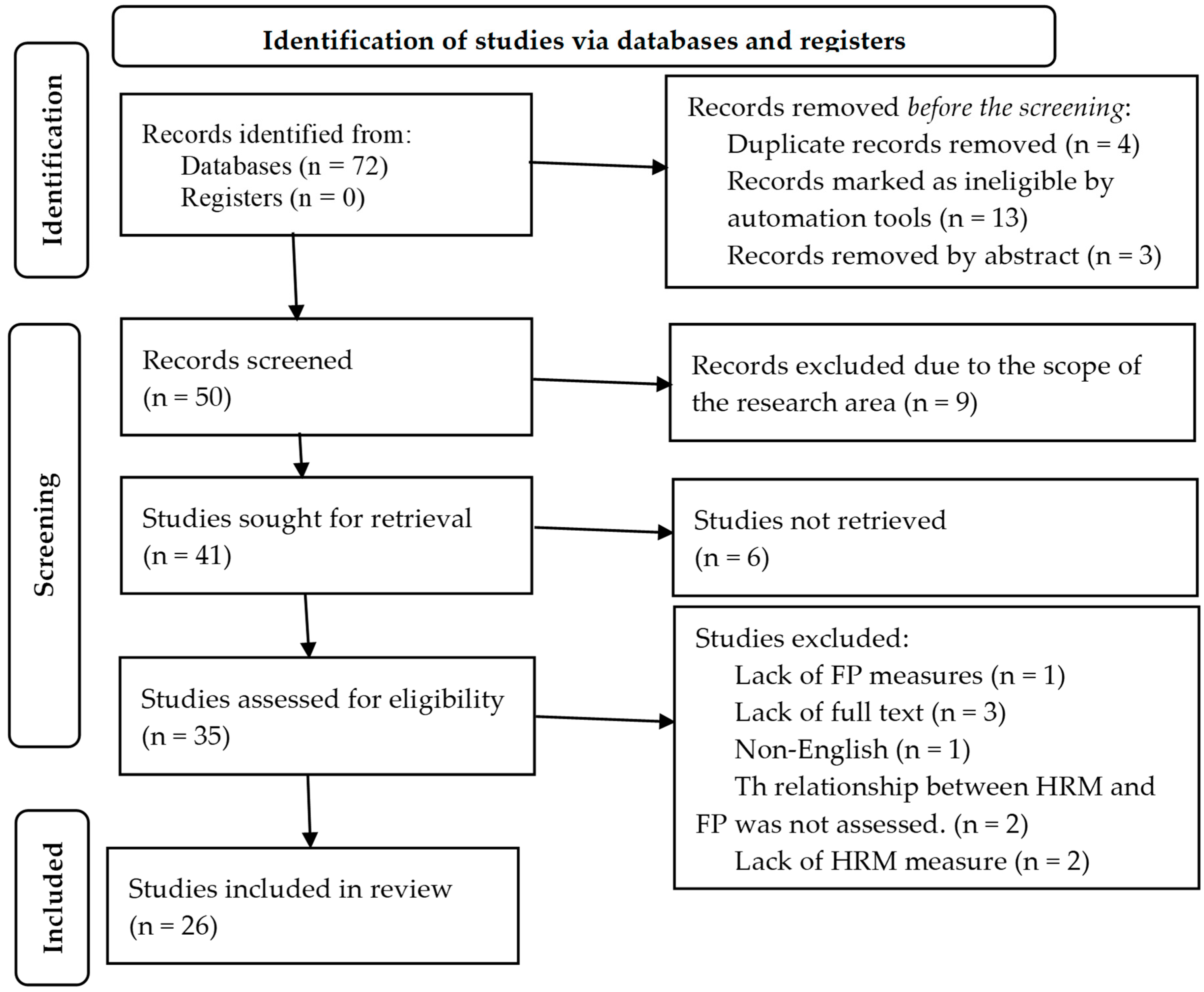

2. Methods

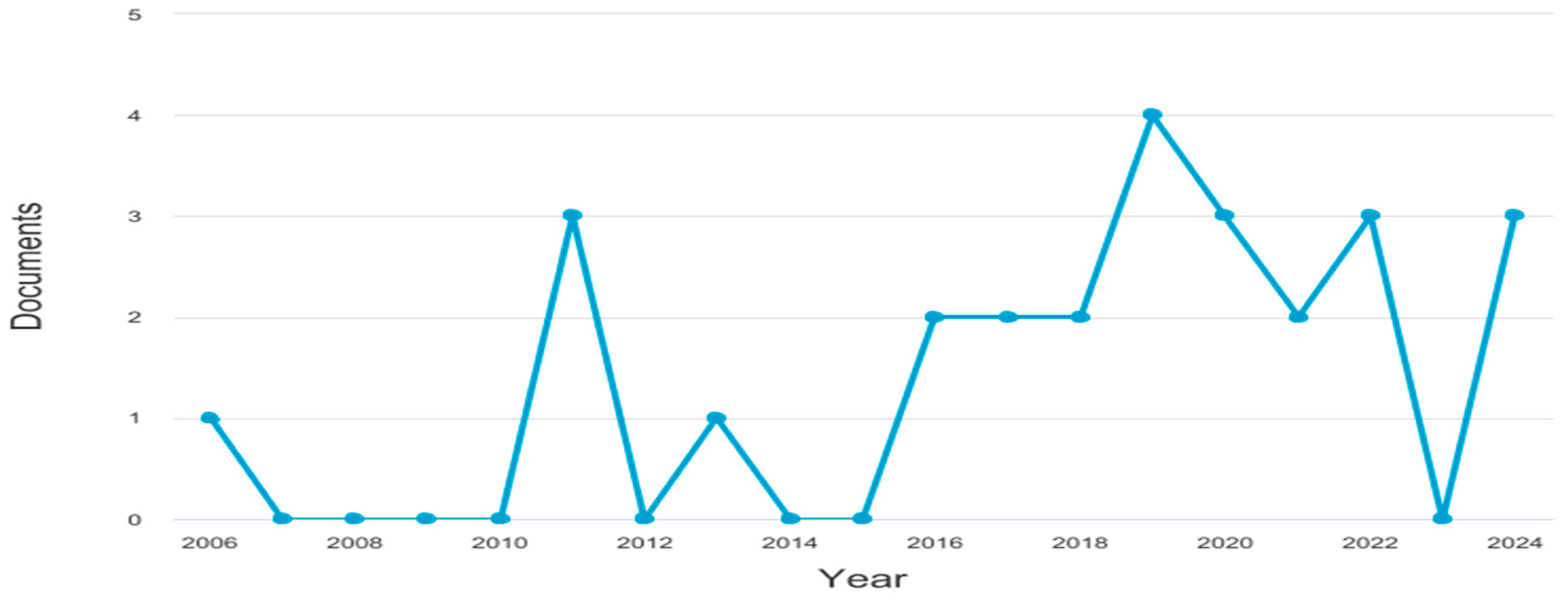

3. Result

4. Discussion

5. Impact on Financial Performance

6. Conclusions

7. Limitations and Future Directions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Ahmed, Ammar, Faiz Muhammad Khuwaja, Noor Ahmed Brohi, I. Othman, and L. Bin. 2018. Organizational factors and organizational performance: A resource-based view and social exchange theory viewpoint. International Journal of Academic Research in Business and Social Sciences 8: 579–99. [Google Scholar] [CrossRef] [PubMed]

- Alkhowaiter, Wassan Abdullah. 2020. Digital payment and banking adoption research in Gulf countries: A systematic literature review. International Journal of Information Management 53: 102102. [Google Scholar] [CrossRef]

- Anca-Ioana, Munteanu. 2013. New Approaches to the Concepts of Human Resources, Human Resource Management, and Strategic Human Resource Management. Annals of the University of Oradea, Economic Science Series 22: 1520–25. [Google Scholar]

- Anwar, Govand, and Nabaz Nawzad Abdullah. 2021. The impact of Human resource management practice on Organizational performance. International Journal of Engineering, Business and Management 5: 35–47. [Google Scholar] [CrossRef]

- April Chang, Wan-Jing, and Tung Chun Huang. 2005. Relationship between strategic human resource management and firm performance: A contingency perspective. International Journal of Manpower 26: 434–49. [Google Scholar] [CrossRef]

- Aryal, Narayan Prasad, and Gobind Kumar Singh. 2023. Human Resource Planning on Organization Performance in Cooperatives Sector. Journal of Development Review 8: 114–24. [Google Scholar] [CrossRef]

- Bakator, Mihalj, Nikola Petrović, Slađana Borić, and Nataša Đalić. 2019. Impact of Human Resource Management on Business Performance: A Review of Literature Original Scientific Paper. Journal Of Engineering Management and Competitiveness (JEMC) 9: 3–13. Available online: http://www.tfzr.uns.ac.rs/jemc (accessed on 25 March 2019). [CrossRef]

- Bakker, Arnold, Evangelia Demerouti, and Wilmar Schaufeli. 2009. Work engagement and financial returns: A diary study on the role of job and personal resources. Journal of Occupational and Organizational Psychology 82: 183–200. [Google Scholar]

- Byarugaba, Jolly Kabagabe, Samuel Mafabi, MTutuzeli Dywili, Bagorogoza Janatti Kyogabiirwe, and Willie Chinyamurindi. 2022. Mediation of Psychological Capital on Human Resource Management Practices and Firm Financial Performance. International Journal of Business & Society 23: 1066–85. [Google Scholar]

- Chinyamurindi, Willie, Janatti Bagorogoza Kyogabiirwe, Jolly Byarugaba Kabagabe, Samuel Mafabi, and MTutuzeli Dywili. 2021. Antecedents of small business financial performance: The role of human resource management practices and strategy. Employee Relations: The International Journal 43: 1214–31. [Google Scholar] [CrossRef]

- Gerhart, Barry, and Jie Feng. 2021. The resource-based view of the firm, human resources, and human capital: Progress and prospects. Journal of Management 47: 1796–819. [Google Scholar] [CrossRef]

- Guest, David. 1997. Human resource management and performance: A review and research agenda. International journal of human Resource Management 8: 263–76. [Google Scholar] [CrossRef]

- Ghosh, Chandralekha, and Rimita Hom Chaudhury. 2019. Gender gap in case of financial inclusion: An empirical analysis in Indian context. Economics Bulletin 39: 2615–30. [Google Scholar]

- Hameed, Zahid, Ikram Ullah Khan, Tahir Islam, Zaryab Sheikh, and Rana Muhammad Naeem. 2020. Do green HRM practices influence employees’ environmental performance? International Journal of Manpower 41: 1061–79. [Google Scholar] [CrossRef]

- Hijazi, Haitham Ali, Hassan Al-Wahshat, Adnan Taha, Firas Rashed Wahsheh, Salim Naif Alkaraky, Bashar Younis Alkhawaldeh, and Ahmad Y. A. Bani Ahmad. 2024. Exploring the link between human resource management practices and financial performance: The moderating effect of organizational culture. Supply Chain Management 12: 1885–902. [Google Scholar] [CrossRef]

- Khan, Falak, Muhammad Ayub Siddiqui, and Salma Imtiaz. 2022. Role of financial literacy in achieving financial inclusion: A review, synthesis and research agenda. Cogent Business & Management 9: 2034236. [Google Scholar]

- Khan, Umair, Yongan Zhang, and Madiha Salik. 2020. The financial performance of Korean manufacturing SMEs: Influence of human resources management. The Journal of Asian Finance, Economics and Business 7: 599–611. [Google Scholar] [CrossRef]

- Kumar, Rajiv, and Jasmindeep Kaur. 2015. Impact of Human Resource Management Practices on the Financial Performance of Haryana State Cooperative Apex Bank. 1 January 2015. Journal of Commerce & Business Studies. 2. Available online: https://ssrn.com/abstract=2995394 (accessed on 25 September 2024).

- Lambooij, Mattijs, Karin Sanders, Ferry Koster, and Marieke Zwiers. 2006. Human resource practices and organizational performance: Can the HRM-performance linkage be explained by the cooperative behaviors of employees? Management Review 17: 223–40. [Google Scholar]

- Martinia, Ida Ayu Oka, Ni Wayan Lasmib, NK Jayac, and Ni Ketut Elly Sutrisni. 2017. Improving Cooperative Performance through Human Resource Development Efforts. International Journal of Social Sciences and Humanities (IJSSH) 1: 49. [Google Scholar] [CrossRef]

- Meier, Olivier, Philippe Naccache, and Guillaume Schier. 2021. Exploring the curvature of the relationship between HRM–CSR and corporate financial performance. Journal of Business Ethics 170: 857–73. [Google Scholar] [CrossRef]

- Ming-Chu, Yu. 2017. How Can Human Resource Management Practices Lead to Increased Corporate Social Performance? Institutional Theory Perspective. Management Challenges in a Network Economy. pp. 17–19. Available online: https://toknowpress.net/ISBN/978-961-6914-21-5/papers/ML17-132.pdf (accessed on 25 September 2024).

- Mohammad, Tamara, Tamer K. Darwish, Satwinder Singh, and Osama Khassawneh. 2021. Human resource management and organisational performance: The mediating role of social exchange. European Management Review 18: 125–36. [Google Scholar] [CrossRef]

- Morrison, Wayne. 2011. China and the global financial crisis: Implications for the United States. Journal of Current Issues in Finance, Business and Economics 4: 151. [Google Scholar]

- Mulolli, Enis, and Diana Boskovska. 2020. The Role of Human Resource Management Practices on Financial Performance in Firms. International Journal of Multidisciplinary and Current Research 8. [Google Scholar]

- Mutua, Mbithi. 2019. Linking Human Capital Resourcing Practices and Performance of Financial Cooperatives in Kenya: Does Presence of Formal Human Resource Department Matter? Management and Labour Studies 44: 148–67. [Google Scholar] [CrossRef]

- Mutua, Shedrack Mbithi, Kabare Karanja, and G. S. Namusonge. 2012. Role of human resource management practices on performance of financial cooperatives based in Nairobi County, Kenya. International Journal of Humanities and Social Science 2: 289–97. [Google Scholar]

- Nguyena, Thi Minh Phuong, Duc Tai Doc Van Toi Dinhb, Thi Hoang Mai, and Thi Hanh Duyen Nguyene Trand. 2020. The impact of human resource management on the financial performance of listed firms in Vietnam. International Journal of Innovation, Creativity and Change 12: 26–37. [Google Scholar]

- Papaioannou, Alkistis, Panagiotis Dimitropoulos, Konstantinos Koronios, and Konstantinos Marinakos. 2024. Perceived financial performance in sport services firms: The role of HRM practices and innovation. In Evidence-Based HRM: A Global Forum for Empirical Scholarship. Bingley: Emerald Publishing Limited, vol. 12, pp. 1–22. [Google Scholar]

- Priyadharshini, S. K., T. J. Kamalanabhan, and R. Madhumathi. 2015. Human resource management and firm performance. International Journal of Business Innovation and Research 9: 229–51. [Google Scholar] [CrossRef]

- Purnomo, Agung, Nur Afia, Yogi Tri Prasetyo, Elsa Rosyidah, Satria Fadil Persada, and Fairuz Iqbal Maulana. 2022. Business Model on M-Business: A Systematic Review. Procedia Computer Science 215: 955–62. [Google Scholar] [CrossRef]

- Ramos-Torres, Sonia. 2017. The Impact of Human Resources Management Practices. 8 December 2017. Available online: https://ssrn.com/abstract=3084946 or http://dx.doi.org/10.2139/ssrn.3084946 (accessed on 25 September 2024).

- Rompho, Nopadol. 2017. HC and financial performance with two HRM strategies. International Journal of Productivity and Performance Management 66: 459–78. [Google Scholar] [CrossRef]

- Sacchetti, Silvia, Ermanno Celeste Tortia, and J. Francisco. 2016. Human resource management practices and organizational performance. The mediator role of immaterial satisfaction in Italian Social Cooperatives. pp. 1–22. Available online: https://ideas.repec.org/p/zar/wpaper/dt2016-02.html (accessed on 25 September 2024).

- Saridakis, George, Yanqing Lai, and Cary L. Cooper. 2017. Exploring the relationship between HRM and firm performance: A meta-analysis of longitudinal studies. Human Resource Management Review 27: 87–96. [Google Scholar] [CrossRef]

- Shakir, Khairunnisak Ahmad, Azahari Ramli, Buba Musa Pulka, and Faizatul Hasliyanti Ghazali. 2020. The Link Between Human Capital and Cooperatives Performance. Journal of Entrepreneurship Education 23: 1–11. [Google Scholar]

- Singh, Nongmaithem Robindro, and Biniam Kassa. 2016. The Impact of Human Resource Management Practice on Organizational Performance—A Study on Debre Brehan University. International Journal of Recent Advances in Organizational Behaviour & Decision Sciences 1: 643–62. [Google Scholar]

- Sojka, Ladislav. 2015. Investigation of the relationship between human resource management practices and firm’s finance performance. European Scientific Journal 11: 87–105. [Google Scholar]

- Voo, Ivana Chandra, Khairiah Soehod, and Sang LongSang Long. 2018. HRM Practices and Firm Performance: The Mediation of HR Roles. Bandung: IEOM Society International. [Google Scholar]

- Wohlin, Claes. 2014. Guidelines for snowballing in systematic literature studies and a replication in software engineering. Paper presented at the 18th International Conference on Evaluation and Assessment in Software Engineering, London, UK, May 13–14; pp. 1–10. [Google Scholar]

- Wright, Patrick M., Timothy M. Gardner, Lisa M. Moynihan, and Mathew R. Allen. 2004. The Relationship between HR Practices and Firm Performance: Examining Causal Order. Available online: http://digitalcommons.ilr.cornell.edu/cahrswp/13 (accessed on 9 May 2005).

| Study design | The study employs a systematic literature review to condense the body of existing research. |

| Review protocol | To reduce the possibility of “biased post hoc decisions in review methods” (Purnomo et al. 2022), the search criteria and related keywords have already been determined by reviewers. |

| Eligibility criteria and publication type included | Only articles published in peer-reviewed journals were deemed eligible. Peer-reviewed publications from the electronic databases Google Scholar, Scopus, and Web of Science were located. |

| Publication time frame | 2006–2024 |

| Language | English |

| Search strategy | Selected the codes to search in the source database: “HRM” AND “Financial Performance” OR “Cooperative”. Categories: finance, business; management; cooperative studies. Full-text articles were identified for the subsequent eligibility and inclusion decision. |

| Author | Methodology | Main Finding |

|---|---|---|

| Hijazi et al. (2024) | The quantitative approach of questionnaire from 353 employees of Jordanian Banking. | Employee training, incentives, and decentralization contribute positively toward financial performance. Organizational culture increases the effects of HRM practices on financial results. |

| Byarugaba et al. (2022) | Cross-sectional survey design of 401 owners–managers of the small business operating in South Africa. | Human resource management practices, psychological capital, and financial performance are positively correlated to one another. |

| Nguyena et al. (2020) | Audited annual reports and questionnaires from firms listed on HOSE. | Training and developing personnel skills; developing recruitment activities to ensure the most suitable input resources for firms. |

| Chinyamurindi et al. (2021) | A questionnaire was filled in by 401 small businesses. | The results confirm that a direct relationship exists between HRM strategy and financial performance. |

| Khan et al. (2020) | From 99 companies a total of 2126 employees participated. | HRM has a direct impact on financial performance and the impact of individual human resource management systems and policies. |

| Meier et al. (2021) | A total of 591 companies were included; 1405 firm–year observations from 36 industries were made based on VIGEO classification. | Significant quadratic relationship between HRM–CSP and CFP. Inverted U-shaped relationship. |

| Papaioannou et al. (2024) | Empirical data from 172 managers of Greek sports services firms. | HRM practices significantly impact innovation activities, which have a significant and positive effect on perceived financial performance. |

| Mulolli and Boskovska (2020) | Descriptive and comparative method, questionnaire, and econometric model. | If a firm’s managers use the appropriate HRM practices, the enterprise can be in competition with competitors or even pass them in a positive aspect. |

| Bakator et al. (2019) | A systematic review was conducted. | A positive relationship between HRM practices and overall business performance was found. In addition, HRM has a positive influence on employee well-being, productivity, and organizational climate. |

| Ghosh and Chaudhury (2019) | Qualitative studies were conducted. | Concluded that firms operating in democracies, such as India, demonstrated higher financial performance metrics compared to those in more authoritarian systems. It highlighted that better governance practices promote transparency and accountability. |

| Saridakis et al. (2017) | A meta-analysis of longitudinal studies was conducted. | A set of integrated, mutually reinforcing high-performance best practices has a stronger impact on firm performance than HRM practices have individually. |

| Mutua (2019) | A total of 340 cooperatives in Kenya were included. Qualitative and quantitative research was conducted. | A significant relationship exists between human capital resourcing practices and the performance of cooperatives. |

| Kumar and Kaur (2015) | Collected qualitative data from employees. | HRM in cooperative banks in India emphasizes the positive impact of developing human resources on organizational performance. |

| Shakir et al. (2020) | Analyzed 135 questionnaires using a linear regression model. | A positive and significant relationship between the human capital of cooperative board members and cooperatives’ performance. |

| Priyadharshini et al. (2015) | A content analysis of annual reports and a regression analysis was conducted. | HRM practices significantly impact firm financial performance, and market capitalization positively influences human resource management practices. |

| Ramos-Torres (2017) | Sampling of nearly one thousand firms. | High-performance work practices have a significant impact on output and financial management, reducing turnover and increasing productivity. |

| Sojka (2015) | Experimental research on a sample of 102 organizations. | Causality between HR practices and economic performance was not proven; a positive correlation was found when management practices were at average or higher levels, with remuneration being a factor. |

| Mutua et al. (2012) | A comprehensive analysis was conducted. | Develops a conceptual framework that links human resource management practices and firms’ performance. |

| Morrison (2011) | Qualitative interviews and case studies were conducted. | Showed that democratic HRM practices promote a culture of openness that fosters innovation and creativity in teams, resulting in better financial outcomes. |

| Bakker et al. (2009) | Used a quantitative approach using surveys by employed structural equation modeling. | Opined that participatory governance increases employee engagement, which can lead to enhanced firm performance. |

| Lambooij et al. (2006) | Multilevel regression analysis was used to test hypotheses and Kendall’s tau-b for a macro-level analysis. | The more HRM practices are aligned within themselves, the better employees know what is expected of them, and the more they behave cooperatively towards their co-workers and their supervisors. A negative relationship was observed between cooperation with co-workers and turnover, a positive relationship with sick leave was observed. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chali, B.D.; Lakatos, V. The Impact of Human Resource Management on Financial Performance: A Systematic Review in Cooperative Enterprises. J. Risk Financial Manag. 2024, 17, 439. https://doi.org/10.3390/jrfm17100439

Chali BD, Lakatos V. The Impact of Human Resource Management on Financial Performance: A Systematic Review in Cooperative Enterprises. Journal of Risk and Financial Management. 2024; 17(10):439. https://doi.org/10.3390/jrfm17100439

Chicago/Turabian StyleChali, Birhanu Daba, and Vilmos Lakatos. 2024. "The Impact of Human Resource Management on Financial Performance: A Systematic Review in Cooperative Enterprises" Journal of Risk and Financial Management 17, no. 10: 439. https://doi.org/10.3390/jrfm17100439

APA StyleChali, B. D., & Lakatos, V. (2024). The Impact of Human Resource Management on Financial Performance: A Systematic Review in Cooperative Enterprises. Journal of Risk and Financial Management, 17(10), 439. https://doi.org/10.3390/jrfm17100439