Environmental, Social and Governance Awareness and Organisational Risk Perception Amongst Accountants

Abstract

:1. Introduction

2. Significance of the Study

3. Problem Statement

4. Research Gaps

5. Research Objectives and Questions

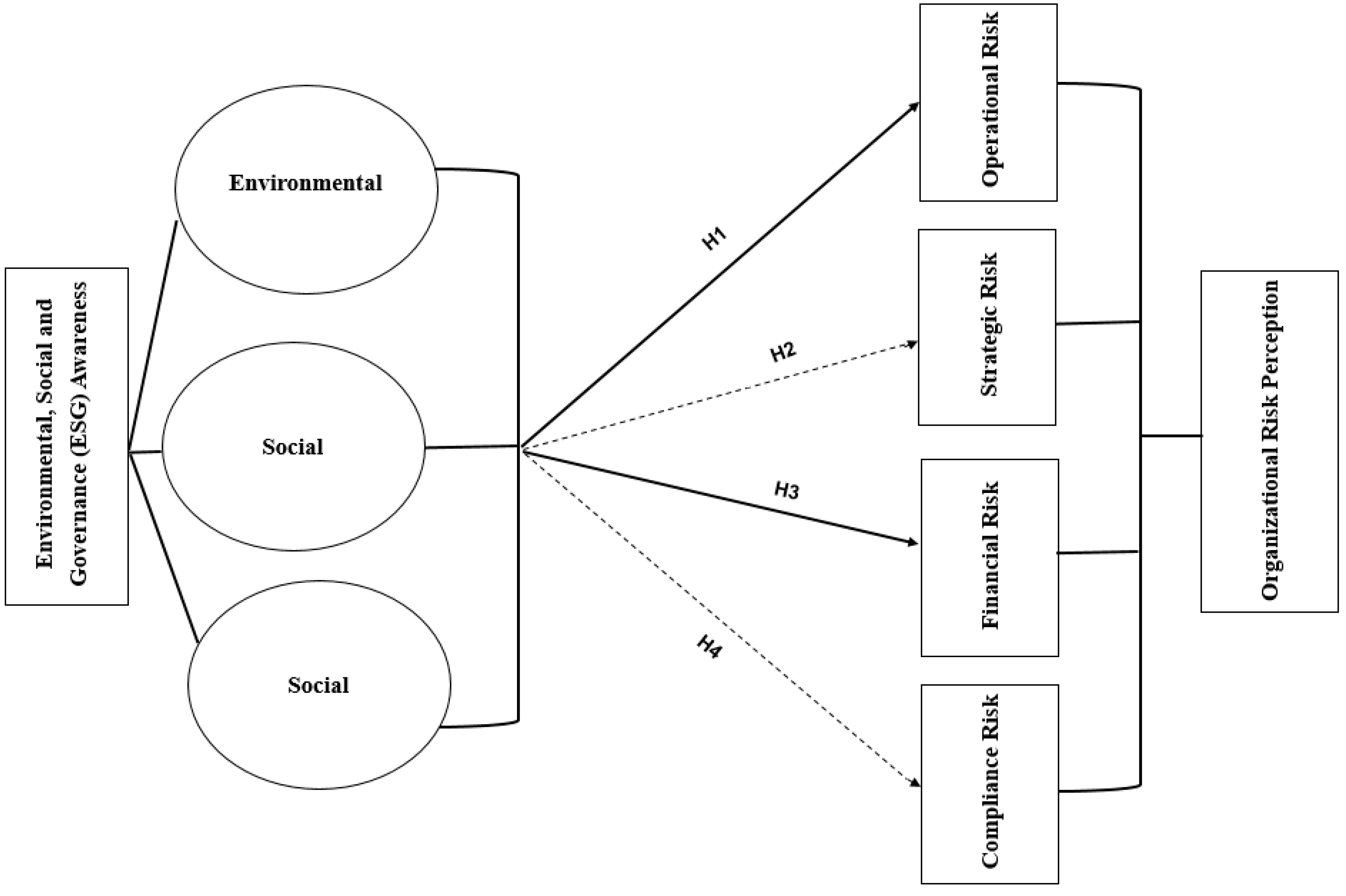

- Measure the correlation between ESG awareness and the perception of operational risk amongst accountants;

- Evaluate the impact of ESG awareness on the perception of strategic risk;

- Determine the extent to which ESG awareness influences financial risk perception;

- Enhance the empirical understanding of ESG consciousness and its influence on compliance risk perceptions.

Research Questions

- What are the relationships between the ESG awareness of accountants and their perceptions of certain organisational risks?

- How does the ESG awareness of accountants predict their perceptions of specific risks within an organisation?

6. Theoretical Framework

7. Literature Review

7.1. ESG Awareness and Organisational Risk Perception

7.2. Definition and Importance of ESG Awareness

7.3. Impact of ESG Awareness on Risk Perception

7.4. Challenges in Integrating ESG into Risk Perception

8. Domains of Organisational Risk Perception

8.1. Operational Risk Perception

8.2. Strategic Risk Perception

8.3. Financial Risk Perception

8.4. Compliance Risk Perception

9. Theoretical Frameworks for ESG Awareness and Risk Perception

9.1. Stakeholder Theory and Agency Theory

9.2. Risk Management Theory

9.3. Ethical Decision-Making Theory and Institutional Theory

9.4. Variability in the Impact of ESG Awareness on Risk Perception

10. Hypotheses

11. Methodology

11.1. Research Design

11.2. Instruments

11.3. Sustainability Consciousness Questionnaire (SCQ)

- Knowledge domain (9 items): This domain assesses the comprehension of sustainability concepts, such as awareness of environmental sustainability.

- Attitude domain (9 items): This domain evaluates the essential principles and attitudes that individuals hold about sustainability, such as whether they have any belief in ensuring future generations’ quality of life.

- Behaviour domain (9 items): This domain measures how sustainability is applied professionally, including actions that support sustainable business practices.

11.4. CSR Scale

11.5. Organisational Risk Perception Scale (ORPS)

12. Samples and Sampling Technique

12.1. Stratified Random Sampling

12.2. Snowball Sampling

13. Questionnaire Design and Administration

14. Data Collection

15. Data Analysis

16. Results

16.1. Factor Analysis

16.1.1. SCQ with CSR–Governance Scale

16.1.2. ORPS

16.2. Internal Consistency

16.3. Descriptive Results

16.3.1. Participant Demographics

16.3.2. Statistical Analysis of Demographic Influences

- Gender: No significant differences were found in the risk perceptions or sustainability consciousness of male and female respondents. Gender does not have a significant influence on sustainability consciousness or risk perception.

- Age: Older people are more responsible, more aware of the environment and more concerned about operational risk than other respondents are. Older participants (44 years and older) demonstrated higher levels of environmental consciousness and operational risk perception, mainly because of their greater experience with and exposure to ESG issues, than did the participants in other age groups.

- Education: Higher-level education likely increases risk perception and ESG awareness. High educational attainment, particularly at the doctoral level, is associated with increased ESG awareness and risk perception. Enhanced knowledge of ESG-related issues is facilitated by high education levels.

- Work experience and salary: A positive correlation was found between work experience and ESG awareness and risk perception and between salary level and ESG awareness and risk perception. Professional experience and high income levels contribute to improved ESG awareness and ESG-related risk perception.

- Religious belief, industry and position: High levels of sustainability consciousness and risk perception were manifested by respondents who identified themselves as being religiously affiliated, those employed in the public sector or government positions and those who held senior job titles (e.g., chief finance officers and internal auditors). Thus, people’s personal values, industry setting and job roles contribute to their ESG awareness and the associated risks.

16.4. Correlation Analysis

16.4.1. Correlations Between ESG Awareness and Operational Risk Perception

16.4.2. Correlations Between ESG Awareness and Strategic Risk Perception

16.4.3. Correlations Between ESG Awareness and Financial Risk Perception

16.4.4. Correlations Between ESG Awareness and Compliance Risk Perception

16.5. Hierarchical Regression Analysis

16.5.1. Operational Risk Domain

16.5.2. Strategic Risk Domain

16.5.3. Financial Risk Domain

16.5.4. Compliance Risk Domain

17. Discussion

17.1. ESG Awareness and Operational Risk Perception

17.2. ESG Awareness and Strategic Risk Perception

17.3. ESG Awareness and Financial Risk Perception

17.4. ESG Awareness and Compliance Risk Perception

17.5. Theoretical Implications

17.6. Practical Implications

17.7. Conclusions

17.8. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Alkaraan, Fadi, Khaldoon Albitar, Khaled Hussainey, and V. G. Venkatesh. 2022. Corporate transformation toward Industry 4.0 and financial performance: The influence of environmental, social, and governance (ESG). Technological Forecasting & Social Change 175: 121423. [Google Scholar] [CrossRef]

- Alsaifi, Khaled, Marwa Elnahass, and Aly Salama. 2020. Market responses to firms’ voluntary carbon disclosure: Empirical evidence from the United Kingdom. Journal of Cleaner Production 262: 121377. [Google Scholar] [CrossRef]

- Apergis, Nicholas, Thomas Poufinas, and Alexandros Antonopoulos. 2022. ESG scores and cost of debt. Energy Economics 112: 106186. [Google Scholar] [CrossRef]

- Armstrong, Anona. 2020. Ethics and ESG. Australasian Accounting, Business and Finance Journal 14: 6–17. [Google Scholar] [CrossRef]

- Asante-Appiah, Bright, and Tamara A. Lambert. 2023. The role of the external auditor in managing environmental, social, and governance (ESG) reputation risk. Review of Accounting Studies 28: 2589–641. [Google Scholar] [CrossRef]

- Atan, Ruhaya, Fatin Adilah Razali, Jamaliah Said, and Saunah Zainun. 2016. Environmental, social and governance (ESG) disclosure and its effect on firm’s performance: A comparative study. International Journal of Economics and Management 10: 355–75. [Google Scholar]

- Atif, Muhammad, and Searat Ali. 2021. Environmental, social and governance disclosure and default risk. Business Strategy and the Environment 30: 3937–59. [Google Scholar] [CrossRef]

- Bacci, Silvia, Bruno Bertaccini, Ester Macrì, and Anna Pettini. 2024. Measuring sustainability consciousness in Italy. Quality & Quantity 58: 4751–78. [Google Scholar] [CrossRef]

- Bandura, Albert, and Daniel Cervone. 1986. Differential engagement of self-reactive influences in cognitive motivation. Organizational Behavior and Human Decision Processes 38: 92–113. [Google Scholar] [CrossRef]

- BBC News. 2017. Wells Fargo Reveals More Fake Accounts. BBC News. August 31. Available online: https://www.bbc.com/news/business-41113665 (accessed on 8 July 2024).

- BBC News. 2022. Wirecard Trial of Executives Opens in German Fraud Scandal. BBC News. December 8. Available online: https://www.bbc.com/news/world-europe-63893933 (accessed on 8 July 2024).

- Bearpark, Noémi També. 2022. Deconstructing Money Laundering Risk: De-Risking, the Risk-Based Approach and Risk Communication, 1st ed. Cham: Springer International Publishing AG. [Google Scholar] [CrossRef]

- Berglund, Teresa, Niklas Gericke, Jelle Boeve-de Pauw, Daniel Olsson, and Tzu-Chau Chang. 2020. A cross-cultural comparative study of sustainability consciousness between students in Taiwan and Sweden. Environment, Development and Sustainability 22: 6287–313. [Google Scholar] [CrossRef]

- Bhandari, Krishna Raj, Mikko Ranta, and Jari Salo. 2022. The resource-based view, stakeholder capitalism, ESG, and sustainable competitive advantage: The firm’s embeddedness into ecology, society, and governance. Business Strategy and the Environment 31: 1525–37. [Google Scholar] [CrossRef]

- Caiazza, Stefano, Giuseppe Galloppo, and Viktoriia Paimanova. 2021. The role of sustainability performance after merger and acquisition deals in short and long-term. Journal of Cleaner Production 314: 127982. [Google Scholar] [CrossRef]

- Carattini, Stefano, Edgar Hertwich, Givi Melkadze, and Jeffrey G. Shrader. 2022. Mandatory disclosure is key to address climate risks. Science 378: 352–54. [Google Scholar] [CrossRef]

- Chairani, Chairani, and Sylvia Veronica Siregar. 2021. The effect of enterprise risk management on financial performance and firm value: The role of environmental, social and governance performance. Meditari Accountancy Research 29: 647–70. [Google Scholar] [CrossRef]

- Chen, Hsiao-Min, Tsai-Chi Kuo, and Ju-Long Chen. 2022. Impacts on the ESG and financial performances of companies in the manufacturing industry based on the climate change related risks. Journal of Cleaner Production 380: 134951. [Google Scholar] [CrossRef]

- Chen, Simin, Yu Song, and Peng Gao. 2023. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. Journal of Environmental Management 345: 118829. [Google Scholar] [CrossRef]

- Comoli, Maurizio, Patrizia Tettamanzi, and Michael Murgolo. 2023. Accounting for ‘ESG’under disruptions: A systematic literature network analysis. Sustainability 15: 6633. [Google Scholar] [CrossRef]

- Damodaran, Aswath. 2007. Strategic Risk Taking: A Framework for Risk Management. Philadelphia: Wharton School Publishing. [Google Scholar]

- David, Lemuel Kenneth, Jianling Wang, Vanessa Angel, and Meiling Luo. 2024. Environmental commitments and Innovation in China’s corporate landscape: An analysis of ESG governance strategies. Journal of Environmental Management 349: 119529. [Google Scholar] [CrossRef]

- Dechow, Patricia M. 2023. Understanding the sustainability reporting landscape and research opportunities in accounting. The Accounting Review 98: 481–93. [Google Scholar] [CrossRef]

- DiMaggio, Paul J., and Walter W. Powell. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef]

- Ding, Xiangan, Andrea Appolloni, and Mohsin Shahzad. 2022. Environmental administrative penalty, corporate environmental disclosures and the cost of debt. Journal of Cleaner Production 332: 129919. [Google Scholar] [CrossRef]

- Eccles, Robert G., Ioannis Ioannou, and George Serafeim. 2014. The impact of corporate sustainability on organizational processes and performance. Management Science 60: 2835–57. [Google Scholar] [CrossRef]

- El Khoury, Rim, Nohade Nasrallah, and Bahaaeddin Alareeni. 2023. ESG and financial performance of banks in the MENAT region: Concavity–convexity patterns. Journal of Sustainable Finance & Investment 13: 406–30. [Google Scholar]

- Faccia, Alessio, Francesco Manni, and Fabian Capitanio. 2021. Mandatory ESG reporting and XBRL taxonomies combination: ESG ratings and income statement, a sustainable value-added disclosure. Sustainability 13: 8876. [Google Scholar] [CrossRef]

- Freeman, R. Edward. 2010. Strategic Management: A Stakeholder Approach. Cambridge: Cambridge University Press. [Google Scholar]

- Freeman, R. Edward, Jeffrey S. Harrison, and Stelios Zyglidopoulos. 2018. Stakeholder Theory: Concepts and Strategies. Cambridge: Cambridge University Press. [Google Scholar]

- Friede, Gunnar, Timo Busch, and Alexander Bassen. 2015. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment 5: 210–33. [Google Scholar]

- Galletta, Simona, John W. Goodell, Sebastiano Mazzù, and Andrea Paltrinieri. 2023. Bank reputation and operational risk: The impact of ESG. Finance Research Letters 51: 103494. [Google Scholar] [CrossRef]

- Gericke, Niklas, Jelle Boeve-de Pauw, Teresa Berglund, and Daniel Olsson. 2019. The Sustainability Consciousness Questionnaire: The theoretical development and empirical validation of an evaluation instrument for stakeholders working with sustainable development. Sustainable Development 27: 35–49. [Google Scholar] [CrossRef]

- Gupta, Amit Kumar, and Narain Gupta. 2021. Environment practices mediating the environmental compliance and firm performance: An institutional theory perspective from emerging economies. Global Journal of Flexible Systems Management 22: 157–78. [Google Scholar] [CrossRef]

- Hassanein, Ahmed, Ahmed Bani-Mustafa, and Khalil Nimer. 2024. A country’s culture and reporting of sustainability practices in energy industries: Does a corporate sustainability committee matter? Humanities and Social Sciences Communications 11: 1140. [Google Scholar] [CrossRef]

- He, Xu, Qinlei Jing, and Hao Chen. 2023. The impact of environmental tax laws on heavy-polluting enterprise ESG performance: A stakeholder behavior perspective. Journal of Environmental Management 344: 118578. [Google Scholar] [CrossRef]

- Hoang, Thinh. 2018. The Role of the Integrated Reporting in Raising Awareness of Environmental, Social and Corporate Governance (ESG) Performance. In Stakeholders, Governance and Responsibility. Bingley: Emerald Publishing Limited, vol. 14, pp. 47–69. [Google Scholar] [CrossRef]

- Hubbard, Douglas W. 2020. The Failure of Risk Management: Why It’s Broken and How to Fix It, 2nd ed. Hoboken: Wiley. [Google Scholar] [CrossRef]

- Ishak, Nurul Diana Intan Zafirah, and Arnifa Asmawi. 2022. Integrating ESG Framework in Corporate Strategic Planning: A Proposed Case Study of a Technology Hub Developer. Journal of Logistics, Informatics and Service Science 9: 53–63. [Google Scholar]

- Jackson, Gregory, Julia Bartosch, Emma Avetisyan, Daniel Kinderman, and Jette Steen Knudsen. 2020. Mandatory Non-financial Disclosure and Its Influence on CSR: An International Comparison. Journal of Business Ethics 162: 323–42. [Google Scholar] [CrossRef]

- Jejeniwa, Temitayo Oluwaseun, Noluthando Zamanjomane Mhlongo, and Titilola Olaide Jejeniwa. 2024. The role of ethical practices in accounting: A review of corporate governance and compliance trends. Finance & Accounting Research Journal 6: 707–20. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jones, Thomas M. 1991. Ethical decision making by individuals in organizations: An issue-contingent model. Academy of Management Review 16: 366–95. [Google Scholar] [CrossRef]

- Kandpal, Vinay, Anshuman Jaswal, Ernesto DR Santibanez Gonzalez, and Naveen Agarwal. 2024. Sustainable Energy Transition: Circular Economy and Sustainable Financing for Environmental, Social and Governance (ESG) Practices. Cham: Springer Nature. [Google Scholar] [CrossRef]

- Kaplan, Robert S., and Anette Mikes. 2012. Managing risks: A new framework. Harvard Business Review 90: 48–60. [Google Scholar]

- Karwowski, Mariusz, and Monika Raulinajtys-Grzybek. 2021. The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corporate Social Responsibility and Environmental Management 28: 1270–84. [Google Scholar] [CrossRef]

- Kazancoglu, Ipek, Muhittin Sagnak, Sachin Kumar Mangla, and Yigit Kazancoglu. 2021. Circular economy and the policy: A framework for improving the corporate environmental management in supply chains. Business Strategy and the Environment 30: 590–608. [Google Scholar] [CrossRef]

- Khan, Tariqullah. 2024. Circular-ESG Model for Regenerative Transition. Sustainability 16: 7549. [Google Scholar] [CrossRef]

- Kim, Sol, Geul Lee, and Hyoung-Goo Kang. 2021. Risk management and corporate social responsibility. Strategic Management Journal 42: 202–30. [Google Scholar] [CrossRef]

- Landi, Giovanni Catello, Francesca Iandolo, Antonio Renzi, and Andrea Rey. 2022. Embedding sustainability in risk management: The impact of environmental, social, and governance ratings on corporate financial risk. Corporate Social Responsibility and Environmental Management 29: 1096–107. [Google Scholar] [CrossRef]

- Lee, Jooh, Kyungyeon Koh, and Eunsup Daniel Shim. 2024. Managerial incentives for ESG in the financial services industry: Direct and indirect association between ESG and executive compensation. Managerial Finance 50: 10–27. [Google Scholar] [CrossRef]

- Lee, Lee Siew, and Mansor Isa. 2020. Environmental, Social and Governance (ESG) Practices and Performance in Shariah Firms: Agency or Stakeholder Theory? Asian Academy of Management Journal of Accounting and Finance 16: 1–34. [Google Scholar] [CrossRef]

- Lennard, Jacob B., and Robin W. Roberts. 2023. The accounting profession, corporate social responsibility, and ethics. In Research Handbook on Accounting and Ethics. Cheltenham: Edward Elgar Publishing, pp. 35–49. [Google Scholar]

- Leung, Tiffany Cheng-Han, and You Shi Xiang. 2022. The general overview of environmental, social, and governance (ESG) guidelines in Hong Kong: Past, present, and future. In Comparative CSR and Sustainability. London: Routledge, pp. 345–63. [Google Scholar]

- Liang, Lin, and Yan Li. 2023. The double-edged sword effect of organizational resilience on ESG performance. Corporate Social Responsibility and Environmental Management 30: 2852–72. [Google Scholar] [CrossRef]

- Liang, Yi, Min Jae Lee, and Jin Sup Jung. 2022. Dynamic capabilities and an ESG strategy for sustainable management performance. Frontiers in Psychology 13: 887776. [Google Scholar] [CrossRef]

- Lisi, Irene Eleonora. 2018. Determinants and performance effects of social performance measurement systems. Journal of Business Ethics 152: 225–51. [Google Scholar] [CrossRef]

- Liu, Min, Tongji Guo, Weiying Ping, and Liangqing Luo. 2023. Sustainability and stability: Will ESG investment reduce the return and volatility spillover effects across the Chinese financial market? Energy Economics 121: 106674. [Google Scholar] [CrossRef]

- MacNeil, Iain, and Irene-Marié Esser. 2022. From a financial to an entity model of ESG. European Business Organization Law Review 23: 9–45. [Google Scholar] [CrossRef]

- Moffitt, Jacquelyn Sue, Jeanne-Claire Alyse Patin, and Luke Watson. 2024. Corporate environmental, social, and governance (ESG) performance and the internal control environment. Accounting Horizons 38: 103–24. [Google Scholar] [CrossRef]

- Mooneeapen, Oren, Subhash Abhayawansa, and Naushad Mamode Khan. 2022. The influence of the country governance environment on corporate environmental, social and governance (ESG) performance. Sustainability Accounting, Management and Policy Journal 13: 953–85. [Google Scholar] [CrossRef]

- Ni, Jiahao. 2024. Research On Compliance Risk Identification and Prevention Mechanism of Enterprises in The ESG Field. Highlights in Science, Engineering and Technology 85: 1294–99. [Google Scholar] [CrossRef]

- Nilipour, Tabatabaei A., Tracy-Anne De Silva, and Xuedong Li. 2020. The Readability of Sustainability Reporting in New Zealand over time. Australasian Accounting, Business & Finance Journal 14: 86–107. [Google Scholar] [CrossRef]

- Nocco, Brian W., and René M. Stulz. 2006. Enterprise risk management: Theory and practice. Journal of Applied Corporate Finance 18: 8–20. [Google Scholar] [CrossRef]

- Nugroho, Deinera P. D., Yi Hsu, Christian Hartauer, and Andreas Hartauer. 2024. Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability 16: 614. [Google Scholar] [CrossRef]

- Oh, Hyun Jung, Byoungkwan Lee, Hye Hyun Ma, Dayeoun Jang, and Sejin Park. 2024. A preliminary study for developing perceived ESG scale to measure public perception toward organizations’ ESG performance. Public Relations Review 50: 102398. [Google Scholar] [CrossRef]

- Park, So Ra, and Jae Young Jang. 2021. The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies 9: 48. [Google Scholar] [CrossRef]

- Pollman, Elizabeth. 2019. Corporate Social Responsibility, ESG, and Compliance. Forthcoming, Cambridge Handbook of Compliance. Edited by D. Daniel Sokol and Benjamin van Rooij. Loyola Law School, Los Angeles Legal Studies Research Paper, (2019-35). Cambridge: Cambridge University Press. [Google Scholar]

- Pong, Hok-Ko, and Chun-Cheong Fong. 2023. The Associations of Spirituality, Adversity Quotient and Ethical Decision Making of Accounting Managers in the Contexts of Financial Management and Corporate Social Responsibility. Sustainability 15: 14287. [Google Scholar] [CrossRef]

- Pong, Hok-Ko, and Chun-Cheong Fong. 2024. The Impact of Personal Satisfaction on the Environmental, Social, and Governance Practices of Chinese Accounting Managers. Sustainability 16: 5839. [Google Scholar] [CrossRef]

- Raghavan, Kamala. 2022. ESG reporting impact on accounting, finance. Journal of Global Awareness 3: 9. [Google Scholar] [CrossRef]

- Ramos, Jessica, Ella Adler, and Erietta Exarchopoulou. 2024. How to maintain a strong compliance function in a remote/hybrid working environment, using ESG as both the objective and the driver. Journal of Financial Compliance 8: 43–53. [Google Scholar]

- Redondo Alamillos, Rocío, and Frédéric De Mariz. 2022. How can European regulation on ESG impact business globally? Journal of Risk and Financial Management 15: 291. [Google Scholar] [CrossRef]

- Saari, Ulla A., Svenja Damberg, Lena Frömbling, and Christian M. Ringle. 2021. Sustainable consumption behavior of Europeans: The influence of environmental knowledge and risk perception on environmental concern and behavioral intention. Ecological Economics 189: 107155. [Google Scholar] [CrossRef]

- Sadaf, Rabeea, Judit Oláh, József Popp, and Domicián Máté. 2018. An investigation of the influence of the worldwide governance and competitiveness on accounting fraud cases: A cross-country perspective. Sustainability 10: 588. [Google Scholar] [CrossRef]

- Sassen, Remmer, Anne-Kathrin Hinze, and Inga Hardeck. 2016. Impact of ESG factors on firm risk in Europe. Journal of Business Economics 86: 867–904. [Google Scholar] [CrossRef]

- Scherer, Andreas Georg, and Christian Voegtlin. 2020. Corporate governance for responsible innovation: Approaches to corporate governance and their implications for sustainable development. Academy of Management Perspectives 34: 182–208. [Google Scholar] [CrossRef]

- Schwartz, Mark S. 2016. Ethical Decision-Making Theory: An Integrated Approach. Journal of Business Ethics 139: 755–76. [Google Scholar] [CrossRef]

- Shakil, Mohammad Hassan. 2021. Environmental, social and governance performance and financial risk: Moderating role of ESG controversies and board gender diversity. Resources Policy 72: 102144. [Google Scholar] [CrossRef]

- Sheedy, Elizabeth, Le Zhang, and Kenny Chi Ho Tam. 2019. Incentives and culture in risk compliance. Journal of Banking & Finance 107: 105611. [Google Scholar]

- Singhania, Monica, and Neha Saini. 2023. Institutional framework of ESG disclosures: Comparative analysis of developed and developing countries. Journal of Sustainable Finance & Investment 13: 516–59. [Google Scholar]

- Solaimani, Sam. 2024. From Compliance to Capability: On the Role of Data and Technology in Environment, Social, and Governance. Sustainability 16: 6061. [Google Scholar] [CrossRef]

- South, David, Kaitlyn Zolton, and Andy Trump. 2021. Expanded climate risk disclosure requirements by the security and exchange commission. Climate and Energy 38: 1–12. [Google Scholar] [CrossRef]

- Sulkowski, Adam, and Ruth Jebe. 2022. Evolving ESG reporting governance, regime theory, and proactive law: Predictions and strategies. American Business Law Journal 59: 449–503. [Google Scholar] [CrossRef]

- The Guardian. 2010. BP Oil Spill: Timeline of Events. The Guardian. April 20. Available online: https://www.theguardian.com/environment/2010/jun/29/bp-oil-spill-timeline-deepwater-horizon (accessed on 8 July 2024).

- The Guardian. 2018. Brazil Dam Disaster: Firm Knew of Potential Impact Months in Advance. The Guardian. March 1. Available online: https://www.theguardian.com/world/2018/feb/28/brazil-dam-collapse-samarco-fundao-mining (accessed on 8 July 2024).

- The Guardian. 2019. Facebook to Pay $5bn Fine as Regulator Settles Cambridge Analytica Complaint. The Guardian. July 24. Available online: https://www.theguardian.com/technology/2019/jul/24/facebook-to-pay-5bn-fine-as-regulator-files-cambridge-analytica-complaint (accessed on 8 July 2024).

- The Guardian. 2021a. Boohoo Accused of Failing to Improve Working Conditions in Its Supply Chain. The Guardian. June 18. Available online: https://www.theguardian.com/business/2021/jun/18/boohoo-accused-of-failing-to-improve-working-conditions-in-its-supply-chain (accessed on 8 July 2024).

- The Guardian. 2021b. What Did Greensill Capital Actually Do? The Guardian. April 15. Available online: https://www.theguardian.com/commentisfree/2021/apr/15/what-did-greensill-capital-actually-do (accessed on 8 July 2024).

- The New York Times. 2019. Boeing 737 Max: What’s Happened After the 2 Deadly Crashes. The New York Times. October 28. Available online: https://www.nytimes.com/interactive/2019/business/boeing-737-crashes.html (accessed on 8 July 2024).

- Trevino, Linda K., and Stuart A. Youngblood. 1990. Bad Apples in Bad Barrels: A Causal Analysis of Ethical Decision-Making Behavior. Journal of Applied Psychology 75: 378–85. [Google Scholar] [CrossRef]

- Treviño, Linda K., Gary R. Weaver, and Scott J. Reynolds. 2006. Behavioral ethics in organizations: A review. Journal of Management 32: 951–90. [Google Scholar] [CrossRef]

- Tsang, Albert, Tracie Frost, and Huijuan Cao. 2023. Environmental, Social, and Governance (ESG) disclosure: A literature review. The British Accounting Review 55: 101149. [Google Scholar] [CrossRef]

- Turker, Duygu. 2009. Measuring Corporate Social Responsibility: A Scale Development Study. Journal of Business Ethics 85: 411–27. [Google Scholar] [CrossRef]

- Yu, Ellen Pei-Yi, Christine Qian Guo, and Bac Van Luu. 2018. Environmental, social and governance transparency and firm value. Business Strategy and the Environment 27: 987–1004. [Google Scholar] [CrossRef]

- Yu, Wenjun, Yu Gu, and Jun Dai. 2023. Industry 4.0-enabled environment, social, and governance reporting: A case from a Chinese energy company. Journal of Emerging Technologies in Accounting 20: 245–58. [Google Scholar] [CrossRef]

- Zaporowska, Zuzanna, and Marek Szczepański. 2024. The Application of Environmental, Social and Governance Standards in Operational Risk Management in SSC in Poland. Sustainability 16: 2413. [Google Scholar] [CrossRef]

- Zhao, Donghui. 2022. ESG risk management and compliance practices in China. Law and Economy 1: 27–32. [Google Scholar] [CrossRef]

- Ziolo, Magdalena, Beata Zofia Filipiak, Iwona Bąk, and Katarzyna Cheba. 2019. How to design more sustainable financial systems: The roles of environmental, social, and governance factors in the decision-making process. Sustainability 11: 5604. [Google Scholar] [CrossRef]

- Zioło, Magdalena, Iwona Bąk, and Anna Spoz. 2023. Incorporating ESG risk in companies’ business models: State of research and energy sector case studies. Energies 16: 1809. [Google Scholar] [CrossRef]

- Zumente, Ilze, and Jūlija Bistrova. 2021. ESG importance for long-term shareholder value creation: Literature vs. practice. Journal of Open Innovation 7: 127. [Google Scholar] [CrossRef]

| Scale | Factors | CFI | TLI | SRMR | RMSEA |

|---|---|---|---|---|---|

| SCQ with CSR | Environmental, Social, Economic, Governance | 0.96 | 0.95 | 0.04 | 0.06 |

| ORPS | Operational, Strategic, Financial, Compliance | 0.93 | 0.92 | 0.06 | 0.07 |

| Scale | Subscale/Dimension | Cronbach’s α |

|---|---|---|

| SCQ | Environmental (9 items) | 0.73 |

| SCQ | Social (9 items) | 0.73 |

| SCQ | Economic (9 items) | 0.74 |

| SCQ | Overall (27 items) | 0.83 |

| CSR | Governance (4 items) | 0.93 |

| ORPS | Operational | 0.82 |

| ORPS | Strategic | 0.82 |

| ORPS | Financial | 0.83 |

| ORPS | Compliance | 0.95 |

| ORPS | Overall | 0.91 |

| N (%) | Environmental | Social | Economics | CSR Awareness in Governance | |

|---|---|---|---|---|---|

| Mean (S.D.) | Mean (S.D.) | Mean (S.D.) | Mean (S.D.) | ||

| All | 462 (100%) | 3.04 (0.45) | 3.08 (0.39) | 2.65 (0.44) | 4.58 (0.54) |

| Gender | |||||

| (1) Male | 223 (48.3%) | 3.07 (0.47) | 3.11 (0.41) | 2.65 (0.47) | 4.61 (0.55) |

| (2) Female | 239 (51.7%) | 3.01 (0.44) t = 1.43 | 3.05 (0.38) t = 1.72 | 2.64 (0.42) t = 0.01 | 4.55 (0.53) t = 1.10 |

| Age | |||||

| (1) Under 26 Years Old | 98 (21.2%) | 2.81 (0.37) | 2.99 (0.36) | 2.59 (0.41) | 4.23 (0.51) |

| (2) 26–30 | 118 (25.5%) | 2.95 (0.40) | 3.02 (0.36) | 2.58 (0.40) | 4.43 (0.57) |

| (3) 31–36 | 129 (27.9%) | 3.16 (0.45) | 3.11 (0.42) | 2.68 (0.46) | 4.78 (0.44) |

| (4) 37–43 | 75 (16.2%) | 3.15 (0.45) | 3.15 (0.40) | 2.67 (0.42) | 4.75 (0.48) |

| (5) 44 or Above | 42 (9.1%) | 3.30 (0.47) F = 15.99 ** (3), (4) and (5) > (1) and (2) | 3.21 (0.41) F = 3.72 * (5) > (1) | 2.83 (0.56) F = 3.20 * (5) > (1) and (2) | 4.93 (0.22) F = 28.36 ** (3), (4) and (5) > (1) and (2); (2) > (1) |

| Work Experience | |||||

| (1) Less Than 4 Years | 98 (21.2%) | 2.81 (0.37) | 2.99 (0.36) | 2.59 (0.41) | 4.23 (0.51) |

| (2) 4–9 Years | 160 (34.6%) | 3.02 (0.43) | 3.05 (0.37) | 2.61 (0.43) | 4.52 (0.55) |

| (3) 10–16 Years | 122 (26.4%) | 3.11 (0.46) | 3.07 (0.43) | 2.63 (0.46) | 4.70 (0.52) |

| (4) 17–24 Years | 64 (13.9%) | 3.29 (0.44) | 3.25 (0.38) | 2.81 (0.46) | 4.95 (0.19) |

| (5) 25 Years or Above | 18 (3.9%) | 3.17 (0.43) F = 14.04 ** (5) > (1); (4) > (1) and (2); (3) > (1) (2) > (1) | 3.15 (0.49) F = 4.73 * (4) > (1), (2) and (3) | 2.76 (0.51) F = 3.13 * (4) > (1) and (2) | 4.92 (0.21) F = 26.43 ** (5) > (1) and (2); (4) > (1), (2) and (3); (3) > (1) and (2) (2) > (1) |

| Education Level | |||||

| (1) Diploma/Associate | 122 (26.4%) | 2.85 (0.37) | 2.98 (0.35) | 2.53 (0.40) | 4.31 (0.60) |

| (2) Bachelor | 178 (38.5%) | 3.11 (0.46) | 3.12 (0.40) | 2.66 (0.46) | 4.62 (0.54) |

| (3) Master/Postgraduate | 157 (34%) | 3.11 (0.46) | 3.10 (0.41) | 2.72 (0.43) | 4.74 (0.41) |

| (4) Doctoral | 5 (1.1%) | 3.24 (0.72) F = 11.17 ** (3) > (1); (2) > (1) | 3.22 (0.48) F = 3.31 * (1) > (2) | 2.93 (0.50) F = 4.92 * (3) > (1) | 5.0 (0.01) F = 17.11 ** (4) > (1); (3) > (1); (2) > (1) |

| Religious Beliefs | |||||

| (1) No | 287 (62.1%) | 2.98 (0.43) | 3.04 (0.39) | 2.59 (0.40) | 4.51 (0.57) |

| (2) Yes | 175 (37.9%) | 3.15 (0.46) t = −4.11 ** (1) < (2) | 3.14 (0.38) t = −2.84 * (1) < (2) | 2.74 (0.49) t = −3.56 ** (1) < (2) | 4.70 (0.46) t = −3.88 ** (1) < (2) |

| Monthly Salaries | |||||

| (1) Below HK$20,000 | 37 (8%) | 2.79 (0.43) | 2.95 (0.40) | 2.63 (0.37) | 4.14 (0.61) |

| (2) HK$20,000–HK$39,999 | 72 (15.6%) | 2.80 (0.34) | 3.02 (0.33) | 2.56 (0.43) | 4.19 (0.55) |

| (3) HK$40,000–HK$59,999 | 104 (22.5%) | 2.97 (0.40) | 3.01 (0.37) | 2.58 (0.39) | 4.48 (0.54) |

| (4) HK$60,000–HK$79,999 | 159 (34.4%) | 3.19 (0.45) | 3.13 (0.41) | 2.67 (0.46) | 4.82 (0.35) |

| (5) HK$80,000–HK$99,999 | 69 (14.9%) | 3.18 (0.45) | 3.17 (0.43) | 2.77 (0.48) | 4.74 (0.51) |

| (6) HK$100,000 and Above | 21 (4.5%) | 3.19 (0.44) F = 13.79 ** (6) > (1) and (2); (5) > (1), (2) and (3); (4) > (1), (2) and (3) | 3.11 (0.34) F = 3.02 | 2.75 (0.52) F = 2.47 | 4.92 (0.21) F = 28.88 ** (6) > (1), (2) and (3); (5) > (1), (2) and (3); (4) > (1), (2) and (3); (3) > (1) and (2) |

| Industries | |||||

| (1) Financial Services | 117 (25.3%) | 3.05 (0.46) | 3.04 (0.40) | 2.66 (0.43) | 4.58 (0.52) |

| (2) Accounting and Auditing Firms | 100 (21.6%) | 3.18 (0.49) | 3.12 (0.42) | 2.72 (0.44) | 4.71 (0.49) |

| (3) Real Estate and Construction | 58 (12.6%) | 2.86 (0.33) | 3.08 (0.36) | 2.56 (0.47) | 4.47 (0.61) |

| (4) Manufacturing and Industrial | 52 (11.3%) | 3.03 (0.45) | 3.11 (0.37) | 2.66 (0.46) | 4.57 (0.57) |

| (5) Retail and Consumer Goods | 70 (15.2%) | 2.86 (0.31) | 2.97 (0.41) | 2.60 (0.45) | 4.36 (0.55) |

| (6) Government and Public Sector | 40 (8.7%) | 3.38 (0.41) | 3.22 (0.36) | 2.74 (0.46) | 4.96 (0.13) |

| (7) Others | 25 (5.4%) | 2.88 (0.43) F = 10.30 ** (7) < (6) and (2); (6) > (1), (3), (4), (5) and (7); (5) < (2); (3) < (2) | 3.09 (0.38) F = 2.09 | 2.52 (0.35) F = 1.60 | 4.35 (0.57) F = 7.94 ** (7) < (2) and (6); (6) > (1), (3), (4), (5); (5) < (2) |

| Positions | |||||

| (1) Junior Accountant/Entry-Level Accountant | 49 (10.6%) | 2.79 (0.40) | 2.93 (0.39) | 2.59 (0.40) | 4.14 (0.61) |

| (2) Senior Accountant | 56 (12.1%) | 2.78 (0.33) | 3.05 (0.31) | 2.58 (0.43) | 4.17 (0.52) |

| (3) Accounting Manager/Finance Manager | 117 (25.3%) | 2.96 (0.43) | 3.00 (0.39) | 2.53 (0.40) | 4.45 (0.5) |

| (4) Internal Auditor/Compliance Officer | 86 (18.6%) | 3.25 (0.37) | 3.19 (0.38) | 2.79 (0.48) | 4.92 (0.25) |

| (5) Controller/Financial Controller | 75 (16.2%) | 2.97 (0.33) | 3.07 (0.38) | 2.68 (0.47) | 4.65 (0.55) |

| (6) Chief Financial Officer (CFO)/Partner | 68 (14.7%) | 3.36 (0.51) | 3.22 (0.44) | 2.77 (0.42) | 4.91 (0.27) |

| (7) Others | 11 (2.4%) | 3.44 (0.38) F = 21.25 ** (7) > (1), (2), (3) and (5); (6) > (1), (2), (3) and (5); (4) > (1), (2), (3), (5) | 3.01 (0.40) F = 4.73 ** (6) > (1) and (3); (4) > (1) and (3) | 2.40 (0.25) F = 4.96 ** (6) > (3); (4) > (3) | 4.91 (0.3) F = 31.59 ** (7) > (1), (2) and (3); (6) > (1), (2), (3) and (5); (5) > (1), (2) and (3); (4)> (1), (2), (3), (5) and (6); (3) > (1) and (2) |

| N (%) | ORPS Operational Risk | ORPS Strategic Risk | ORPS Financial Risk | ORPS Compliance Risk | |

|---|---|---|---|---|---|

| Mean (S.D.) | Mean (S.D.) | Mean (S.D.) | Mean (S.D.) | ||

| All | 462 (100%) | 4.15 (0.54) | 4.04 (0.59) | 3.56 (0.69) | 3.11 (1.07) |

| Gender | |||||

| (1) Male | 223 (48.3%) | 4.19 (0.56) | 4.06 (0.62) | 3.61 (0.69) | 3.12 (1.10) |

| (2) Female | 239 (51.7%) | 4.11 (0.52) | 4.01 (0.56) | 3.51 (0.68) | 3.09 (1.04) |

| t = 1.56 | t = 0.80 | t = 1.61 | t = 0.29 | ||

| Age | |||||

| (1) Under 26 Years Old | 98 (21.2%) | 3.87 (0.56) | 3.75 (0.61) | 3.30 (0.60) | 3.00 (0.93) |

| (2) 26–30 | 118 (25.5%) | 4.01 (0.52) | 3.91 (0.53) | 3.43 (0.66) | 2.95 (1.12) |

| (3) 31–36 | 129 (27.9%) | 4.27 (0.47) | 4.18 (0.52) | 3.68 (0.70) | 3.17 (1.14) |

| (4) 37–43 | 75 (16.2%) | 4.28 (0.48) | 4.15 (0.59) | 3.69 (0.65) | 3.26 (1.01) |

| (5) 44 or Above | 42 (9.1%) | 4.53 (0.47) | 4.42 (0.48) | 3.91 (0.70) | 3.36 (1.09) |

| F = 18.87 ** (5) > (1), (2) and (3); (4) > (1) and (2); (3) > (1) and (2) | F = 16.10 ** (5) > (1) and (2); (4) > (1) and (2); (3) > (1) and (2) | F = 9.91 ** (5) > (1) and (2); (4) > (1); (3) > (1) and (2) | F = 2.03 | ||

| Work Experience | |||||

| (1) Less Than 4 Years | 98 (21.2%) | 3.87 (0.56) | 3.75 (0.61) | 3.30 (0.60) | 3.00 (0.93) |

| (2) 4–9 Years | 160 (34.6%) | 4.11 (0.53) | 4.01 (0.56) | 3.53 (0.68) | 3.11 (1.13) |

| (3) 10–16 Years | 122 (26.4%) | 4.17 (0.47) | 4.05 (0.56) | 3.57 (0.67) | 3.02 (1.10) |

| (4) 17–24 Years | 64 (13.9%) | 4.53 (0.42) | 4.42 (0.49) | 3.90 (0.73) | 3.38 (1.06) |

| (5) 25 Years or Above | 18 (3.9%) | 4.43 (0.42) | 4.37 (0.38) | 3.92 (0.50) | 3.31 (1.06) |

| F = 18.13 ** (5) > (1); (4) > (1), (2), (3); (3) > (1); (2) > (1) | F = 15.80 ** (5) > (1); (4) > (1), (2), (3); (3) > (1); (2) > (1) | F = 9.61 ** (5) > (1); (4) > (1), (2), (3); (3) > (1) | F = 1.62 | ||

| Education Level | |||||

| (1) Diploma/Associate | 122 (26.4%) | 3.91 (0.49) | 3.79 (0.58) | 3.41 (0.58) | 2.79 (0.98) |

| (2) Bachelor | 178 (38.5%) | 4.23 (0.55) | 4.09 (0.61) | 3.60 (0.73) | 3.16 (1.09) |

| (3) Master/Postgraduate | 157 (34%) | 4.22 (0.51) | 4.15 (0.51) | 3.61 (0.70) | 3.27 (1.06) |

| (4) Doctoral | 5 (1.1%) | 4.52 (0.54) | 4.72 (0.41) | 4.00 (0.68) | 4.04 (1.17) |

| F = 12.06 ** (3) > (1); (2) > (1) | F = 12.92 ** (4) > (1); (3) > (1); (2) > (1) | F = 3.17 * (1) < (2) and (3) | F = 6.36 ** (3) > (1); (2) > (1) | ||

| Religious Beliefs | |||||

| (1) No | 287 (62.1%) | 4.06 (0.52) | 3.95 (0.56) | 3.51 (0.62) | 3.03 (1.04) |

| (2) Yes | 175 (37.9%) | 4.28 (0.55) | 4.17 (0.61) | 3.63 (0.78) | 3.23 (1.10) |

| t = −4.38 ** (2) > (1) | t = −3.90 ** (2) > (1) | t = −1.76 | t = −1.98 * (2) > (1) | ||

| Monthly Salaries | |||||

| (1) Below HK$20,000 | 37 (8%) | 3.83 (0.66) | 3.68 (0.72) | 3.34 (0.58) | 3.03 (0.91) |

| (2) HK$20,000-HK$39,999 | 72 (15.6%) | 3.86 (0.50) | 3.76 (0.52) | 3.19 (0.63) | 2.85 (1.00) |

| (3) HK$40,000-HK$59,999 | 104 (22.5%) | 4.06 (0.49) | 3.94 (0.54) | 3.48 (0.65) | 2.96 (1.12) |

| (4) HK$60,000-HK$79,999 | 159 (34.4%) | 4.28 (0.48) | 4.20 (0.52) | 3.72 (0.68) | 3.25 (1.06) |

| (5) HK$80,000-HK$99,999 | 69 (14.9%) | 4.38 (0.50) | 4.21 (0.61) | 3.74 (0.71) | 3.27 (1.13) |

| (6) HK$100,000 and Above | 21 (4.5%) | 4.33 (0.50) F = 13.71 ** (6) > (1) and (2); (5) > (1), (2), (3); (4) > (1), (2), (3) | 4.25 (0.53) F = 12.02 ** (6) > (1) and (2); (5) > (1), (2) and (3); (4) > (1), (2), (3) | 3.77 (0.59) F = 8.78 ** (6) > (2); (5) > (2); (4) > (1) and (2) | 3.28 (1.01) F = 2.270 * (5) > (2); (4) > (2) and (3) |

| Industries | |||||

| (1) Financial Services | 117 (25.3%) | 4.16 (0.53) | 4.05 (0.62) | 3.58 (0.69) | 3.00 (1.09) |

| (2) Accounting and Auditing Firms | 100 (21.6%) | 4.26 (0.54) | 4.13 (0.58) | 3.61 (0.69) | 3.14 (1.15) |

| (3) Real Estate and Construction | 58 (12.6%) | 4.05 (0.48) | 4.00 (0.53) | 3.48 (0.66) | 3.23 (1.01) |

| (4) Manufacturing and Industrial | 52 (11.3%) | 4.18 (0.54) | 4.08 (0.60) | 3.52 (0.67) | 3.18 (1.11) |

| (5) Retail and Consumer Goods | 70 (15.2%) | 3.97 (0.52) | 3.81 (0.59) | 3.43 (0.66) | 3.13 (0.97) |

| (6) Government and Public Sector | 40 (8.7%) | 4.44 (0.41) | 4.30 (0.46) | 3.95 (0.70) | 3.18 (1.08) |

| (7) Others | 25 (5.4%) | 3.77 (0.58) | 3.78 (0.52) | 3.23 (0.54) | 2.88 (0.99) |

| F = 6.77 ** (7) < (1), (2), (4) and (6); (6) > (3) and (5); (5) < (2) | F = 4.40 ** (7) < (6); (6) > (5); (5) < (2) | F = 3.82 * (6) > (3), (5) and (7) | F = 0.62 | ||

| Positions | |||||

| (1) Junior Accountant/Entry-Level Accountant | 49 (10.6%) | 3.82 (0.61) | 3.67 (0.67) | 3.34 (0.56) | 3.04 (0.91) |

| (2) Senior Accountant | 56 (12.1%) | 3.85 (0.51) | 3.76 (0.52) | 3.13 (0.62) | 2.77 (1.02) |

| (3) Accounting Manager/Finance Manager | 117 (25.3%) | 4.05 (0.49) | 3.90 (0.51) | 3.48 (0.66) | 2.98 (1.08) |

| (4) Internal Auditor/Compliance Officer | 86 (18.6%) | 4.49 (0.43) | 4.38 (0.46) | 3.75 (0.74) | 3.40 (1.06) |

| (5) Controller/Financial Controller | 75 (16.2%) | 4.09 (0.46) | 4.01 (0.56) | 3.58 (0.62) | 3.05 (1.07) |

| (6) Chief Financial Officer (CFO)/Partner | 68 (14.7%) | 4.44 (0.45) | 4.37 (0.54) | 3.90 (0.63) | 3.35 (1.12) |

| (7) Others | 11 (2.4%) | 3.98 (0.43) F = 19.49 ** (6) > (1), (2), (3) and (5); (4) > (1), (2), (3), (5) and (7) | 3.95 (0.42) F = 17.91 ** (6) > (1), (2), (3) and (5); (5) > (1); (4) > (1), (2), (3) and (5) | 3.67 (0.65) F = 9.77 ** (6) > (1), (2) and (3); (5) > (2); (4) > (1) and (2); (3) > (2) | 3.16 (1.03) F = 3.01 * (4) > (2) |

| Correlations | |||||

|---|---|---|---|---|---|

| ORPS Operational Risk | ORPS Strategic Risk | ORPS Financial Risk | ORPS Compliance Risk | ||

| SCQ Environmental | Pearson Correlation | 0.58 ** | 0.49 ** | 0.36 ** | 0.23 ** |

| Sig. (2-tailed) | 0.00 | 0.00 | 0.00 | 0.00 | |

| Sum of Squares and Cross-Products | 64.76 | 60.37 | 50.83 | 51.78 | |

| Covariance | 0.14 | 0.13 | 0.11 | 0.11 | |

| N | 462 | 462 | 462 | 462 | |

| SCQ Social | Pearson Correlation | 0.29 ** | 0.29 ** | 0.26 ** | 0.17 ** |

| Sig. (2-tailed) | 0.00 | 0.00 | 0.00 | 0.00 | |

| Sum of Squares and Cross-Products | 28.16 | 31.48 | 32.25 | 32.40 | |

| Covariance | 0.06 | 0.07 | 0.07 | 0.07 | |

| N | 462 | 462 | 462 | 462 | |

| SCQ Economic | Pearson Correlation | 0.30 ** | 0.25 ** | 0.13 ** | 0.17 ** |

| Sig. (2-tailed) | 0.00 | 0.00 | 0.00 | 0.00 | |

| Sum of Squares and Cross-Products | 33.06 | 29.48 | 18.69 | 37.83 | |

| Covariance | 0.07 | 0.06 | 0.04 | 0.08 | |

| N | 462 | 462 | 462 | 462 | |

| CSR Governance | Pearson Correlation | 0.64 ** | 0.62 ** | 0.40 ** | 0.24 ** |

| Sig. (2-tailed) | 0.00 | 0.00 | 0.00 | 0.00 | |

| Sum of Squares and Cross-Products | 86.46 | 90.57 | 68.57 | 64.33 | |

| Covariance | 0.19 | 0.20 | 0.15 | 0.14 | |

| N | 462 | 462 | 462 | 462 | |

| Variable | β | t | F | R | R2 | ΔR2 | Adjusted R2 | |

|---|---|---|---|---|---|---|---|---|

| Organisational Risk Perception (Operational Risk) | ||||||||

| Step 1 | 15.32 ** | 0.44 | 0.19 | 0.19 | 0.180 | |||

| Demographics | ||||||||

| Age | 0.25 | 1.59 | ||||||

| Work Experience | 0.05 | 0.47 | ||||||

| Educational Level | 0.16 | 3.68 ** | ||||||

| Religion Monthly Salaries Industries Positions | 0.15 −0.02 −0.08 0.06 | 3.61 ** −0.16 −1.80 0.77 | ||||||

| Step 2 | 35.70 ** | 0.62 | 0.39 | 0.20 | 0.38 | |||

| Demographics | ||||||||

| Age | 0.14 | 1.06 | ||||||

| Work Experience | 0.07 | 0.71 | ||||||

| Educational Level | 0.09 | 2.23 * | ||||||

| Religion Monthly Salaries Industries Positions | 0.08 0.04 −0.06 −0.10 | 2.25 * 0.35 −1.73 −1.56 | ||||||

| SCQ Environmental | 0.49 | 12.02 ** | ||||||

| Step 3 | 32.28 ** | 0.63 | 0.39 | 0.01 | 0.38 | |||

| Demographics | ||||||||

| Age | 0.14 | 1.04 | ||||||

| Work Experience | 0.06 | 0.65 | ||||||

| Educational Level | 0.08 | 2.19 * | ||||||

| Religion Monthly Salaries Industries Positions | 0.08 0.05 −0.07 −0.10 | 2.12 * 0.41 −1.82 −1.58 | ||||||

| SCQ Environmental | 0.47 | 10.94 ** | ||||||

| SCQ Social | 0.07 | 1.85 | ||||||

| Step 4 | 29.83 ** | 0.63 | 0.40 | 0.01 | 0.39 | |||

| Demographics | ||||||||

| Age | 0.14 | 1.01 | ||||||

| Work Experience | 0.06 | 0.66 | ||||||

| Educational Level | 0.07 | 1.94 | ||||||

| Religion Monthly Salaries Industries Positions | 0.07 0.05 −0.06 −0.09 | 1.91 0.39 −1.70 −1.48 | ||||||

| SCQ Environmental | 0.46 | 10.53 ** | ||||||

| SCQ Social | 0.04 | 1.05 | ||||||

| SCQ Economic | 0.09 | 2.27 * | ||||||

| Step 5 | 38.44 ** | 0.70 | 0.48 | 0.09 | 0.47 | |||

| Demographics | ||||||||

| Age | 0.28 | 2.19 * | ||||||

| Work Experience | −0.02 | −0.26 | ||||||

| Educational Level | 0.02 | 0.50 | ||||||

| Religion Monthly Salaries Industries Positions | 0.05 −0.08 −0.06 −0.14 | 1.53 −0.72 −1.82 −2.37 * | ||||||

| SCQ Environmental | 0.23 | 4.76 ** | ||||||

| SCQ Social | 0.03 | 0.82 | ||||||

| SCQ Economic | 0.07 | 1.84 | ||||||

| CSR Governance | 0.44 | 8.68 ** |

| Variable | β | t | F | R | R2 | ΔR2 | Adjusted R2 | |

|---|---|---|---|---|---|---|---|---|

| Organisational Risk Perception (Strategic Risk) | ||||||||

| Step 1 | 14.47 ** | 0.43 | 0.18 | 0.18 | 0.17 | |||

| Demographics | ||||||||

| Age | 0.18 | 1.16 | ||||||

| Work Experience | 0.08 | 0.693 | ||||||

| Educational Level | 0.19 | 4.35 ** | ||||||

| Religion Monthly Salaries Industries Positions | 0.13 −0.09 −0.05 0.15 | 3.12 * −0.65 −1.26 2.13 * | ||||||

| Step 2 | 24.50 ** | 0.55 | 0.30 | 0.12 | 0.29 | |||

| Demographics | ||||||||

| Age | 0.10 | 0.70 | ||||||

| Work Experience | 0.09 | 0.87 | ||||||

| Educational Level | 0.13 | 3.22 * | ||||||

| Religion Monthly Salaries Industries Positions | 0.08 −0.04 −0.04 0.03 | 1.98 * −0.32 −1.12 0.47 | ||||||

| SCQ Environmental | 0.39 | 8.81 ** | ||||||

| Step 3 | 22.89 ** | 0.56 | 0.31 | 0.01 | 0.30 | |||

| Demographics | ||||||||

| Age | 0.10 | 0.66 | ||||||

| Work Experience | 0.08 | 0.78 | ||||||

| Educational Level | 0.13 | 3.17 * | ||||||

| Religion Monthly Salaries Industries Positions | 0.07 −0.03 −0.05 0.03 | 1.81 −0.23 −1.26 0.44 | ||||||

| SCQ Environmental | 0.35 | 7.65 ** | ||||||

| SCQ Social | 0.11 | 2.70 * | ||||||

| Step 4 | 20.69 ** | 0.56 | 0.31 | 0.00 | 0.30 | |||

| Demographics | ||||||||

| Age | 0.09 | 0.65 | ||||||

| Work Experience | 0.08 | 0.79 | ||||||

| Educational Level | 0.12 | 3.06 * | ||||||

| Religion Monthly Salaries Industries Positions | 0.07 −0.03 −0.05 0.03 | 1.71 −0.24 −1.20 0.49 | ||||||

| SCQ Environmental | 0.34 | 7.42 ** | ||||||

| SCQ Social | 0.10 | 2.27 * | ||||||

| SCQ Economic | 0.04 | 0.95 | ||||||

| Step 5 | 29.39 ** | 0.65 | 0.42 | 0.10 | 0.40 | |||

| Demographics | ||||||||

| Age | 0.25 | 1.84 | ||||||

| Work Experience | −0.01 | −0.15 | ||||||

| Educational Level | 0.06 | 1.64 | ||||||

| Religion Monthly Salaries Industries Positions | 0.05 −0.16 −0.05 −0.02 | 1.30 −1.43 −1.29 −0.27 | ||||||

| SCQ Environmental | 0.09 | 1.83 | ||||||

| SCQ Social | 0.09 | 2.13 * | ||||||

| SCQ Economic | 0.02 | 0.40 | ||||||

| CSR Governance | 0.48 | 8.95 ** |

| Variable | β | t | F | R | R2 | ΔR2 | Adjusted R2 | |

|---|---|---|---|---|---|---|---|---|

| Organisational Risk Perception (Financial Risk) | ||||||||

| Step 1 | 7.79 ** | 0.31 | 0.09 | 0.09 | 0.08 | |||

| Demographics | ||||||||

| Age | 0.16 | 0.95 | ||||||

| Work Experience | 0.06 | 0.49 | ||||||

| Educational Level | 0.07 | 1.44 | ||||||

| Monthly Salaries Industries Positions | −0.09 −0.01 0.19 | −0.66 −0.25 2.47 * | ||||||

| Step 2 | 12.15 ** | 0.40 | 0.16 | 0.07 | 0.15 | |||

| Demographics | ||||||||

| Age | 0.09 | 0.54 | ||||||

| Work Experience | 0.07 | 0.64 | ||||||

| Educational Level | 0.02 | 0.51 | ||||||

| Monthly Salaries Industries Positions | −0.05 −0.00 0.10 | −0.39 −0.07 1.30 | ||||||

| SCQ Environmental | 0.28 | 5.90 ** | ||||||

| Step 3 | 11.94 | 0.42 | 0.17 | 0.02 | 0.16 | |||

| Demographics | ||||||||

| Age | 0.08 | 0.48 | ||||||

| Work Experience | 0.06 | 0.55 | ||||||

| Educational Level | 0.02 | 0.43 * | ||||||

| Monthly Salaries Industries Positions | −0.04 −0.01 0.09 | −0.29 * −0.21 1.28 | ||||||

| SCQ Environmental | 0.23 | 4.72 ** | ||||||

| SCQ Social | 0.14 | 2.99 * | ||||||

| Step 4 | 10.63 ** | 0.42 | 0.18 | 0.00 | 0.16 | |||

| Demographics | ||||||||

| Age | 0.08 | 0.49 | ||||||

| Work Experience | 0.06 | 0.55 | ||||||

| Educational Level | 0.02 | 0.49 | ||||||

| Monthly Salaries Industries Positions | −0.04 −0.01 0.09 | −0.28 −0.24 1.25 | ||||||

| SCQ Environmental | 0.24 | 4.75 ** | ||||||

| SCQ Social | 0.15 | 3.02 * | ||||||

| SCQ Economic | −0.03 | −0.57 | ||||||

| Step 5 | 11.46 ** | 0.45 | 0.20 | 0.03 | 0.19 | |||

| Demographics | ||||||||

| Age | 0.15 | 0.99 | ||||||

| Work Experience | 0.01 | 0.12 | ||||||

| Educational Level | −0.01 | −0.23 | ||||||

| Monthly Salaries Industries Positions | −0.11 −0.01 0.07 | −0.80 −0.23 0.91 | ||||||

| SCQ Environmental | 0.11 | 1.82 * | ||||||

| SCQ Social | 0.14 | 2.91 * | ||||||

| SCQ Economic | −0.04 | −0.88 | ||||||

| CSR Governance | 0.25 | 3.97 ** |

| Variable | β | t | F | R | R2 | ΔR2 | Adjusted R2 | |

|---|---|---|---|---|---|---|---|---|

| Organisational Risk Perception (Compliance Risk) | ||||||||

| Step 1 | 5.97 ** | 0.22 | 0.05 | 0.05 | 0.04 | |||

| Demographics | ||||||||

| Educational Level | 0.17 | 3.58 ** | ||||||

| Religion Monthly Salaries Positions | 0.07 0.08 0.02 | 1.61 0.99 0.26 | ||||||

| Step 2 | 7.66 ** | 0.28 | 0.08 | 0.03 | 0.07 | |||

| Demographics | ||||||||

| Educational Level | 0.14 | 2.98 * | ||||||

| Religion Monthly Salaries Positions | 0.05 0.07 −0.04 | 1.03 0.90 −0.49 | ||||||

| SCQ Environmental | 0.19 | 3.71 ** | ||||||

| Step 3 | 6.93 | 0.29 | 0.08 | 0.01 | 0.07 | |||

| Demographics | ||||||||

| Educational Level | 0.14 | 2.99 * | ||||||

| Religion Monthly Salaries Positions | 0.04 0.07 −0.04 | 0.91 0.87 −0.50 | ||||||

| SCQ Environmental | 0.16 | 3.02 * | ||||||

| SCQ Social | 0.09 | 1.76 | ||||||

| Step 4 | 6.25 ** | 0.30 | 0.09 | 0.00 | 0.07 | |||

| Demographics | ||||||||

| Educational Level | 0.13 | 2.76 * | ||||||

| Religion Monthly Salaries Positions | 0.04 0.06 −0.03 | 0.77 0.81 −0.44 | ||||||

| SCQ Environmental | 0.15 | 2.77 * | ||||||

| SCQ Social | 0.06 | 1.22 | ||||||

| SCQ Economic | 0.07 | 1.44 | ||||||

| Step 5 | 5.78 ** | 0.30 | 0.09 | 0.01 | 0.08 | |||

| Demographics | ||||||||

| Educational Level | 0.12 | 2.43 * | ||||||

| Religion Monthly Salaries Positions | 0.03 0.05 −0.05 | 0.69 −0.61 −0.59 | ||||||

| SCQ Environmental | 0.09 | 1.50 | ||||||

| SCQ Social | 0.06 | 1.17 | ||||||

| SCQ Economic | 0.07 | 1.33 | ||||||

| CSR Governance | 0.10 | 1.53 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pong, H.-K.; Fong, C.-C. Environmental, Social and Governance Awareness and Organisational Risk Perception Amongst Accountants. J. Risk Financial Manag. 2024, 17, 480. https://doi.org/10.3390/jrfm17110480

Pong H-K, Fong C-C. Environmental, Social and Governance Awareness and Organisational Risk Perception Amongst Accountants. Journal of Risk and Financial Management. 2024; 17(11):480. https://doi.org/10.3390/jrfm17110480

Chicago/Turabian StylePong, Hok-Ko, and Chun-Cheong Fong. 2024. "Environmental, Social and Governance Awareness and Organisational Risk Perception Amongst Accountants" Journal of Risk and Financial Management 17, no. 11: 480. https://doi.org/10.3390/jrfm17110480

APA StylePong, H.-K., & Fong, C.-C. (2024). Environmental, Social and Governance Awareness and Organisational Risk Perception Amongst Accountants. Journal of Risk and Financial Management, 17(11), 480. https://doi.org/10.3390/jrfm17110480