1. Introduction

The Environmental Social and Governance (ESG) market is expected to have increased its assets under management (AuM) to USD 33.9 tn by 2026, from USD 18.4 tn in 2021 (

Ross 2023).

PricewaterhouseCoopers (

2022) assumes ESG investing will be a potential opportunity in the coming years. European investors develop increased demand for ESG products despite headwinds due to rising interest rates, constant high inflation, and recession fears (

Morningstar Manager Research 2023). To advance the effort toward ESG investing in the sustainable financial sector, it is essential to understand the effects of ESG leaders on portfolio performance.

Our study contributes to the relatively limited research on sustainable investing, and addresses whether investing in European ESG leaders could yield positive risk-adjusted returns. Beyond measuring Jensen’s alpha against the market benchmark and the factor loadings given by the Capital Asset Pricing Model (

Treynor 1961,

1962), the

Fama and French (

1993) three-factor model (FF3) and the

Fama and French (

2015) five-factor model (FF5), we analyze the performance and the validity of adding two more factors (volatility and dispersion of returns) to the FF5 model. In this way, we might address two more issues: if ESG leaders’ portfolios are biased toward volatility and dispersion of returns and if ESG leaders’ portfolios lean toward herding.

As proxies for ESG leaders, firstly, we selected a sample consisting of European ESG leaders’ indices (Stoxx Europe ESG Environmental Leaders, Stoxx Europe ESG Social Leaders, Stoxx Europe ESG Governance Leaders, Stoxx Europe ESG Leaders select 30), and as a benchmark, we selected the Stoxx Europe 600 Index. Secondly, for the robustness check, we selected a sample consisting of Global ESG leaders’ indices (Stoxx Global ESG Environmental Leaders, Stoxx Global ESG Social Leaders, Stoxx Global ESG Governance Leaders, Stoxx Global ESG Leaders), and as a benchmark, we selected the Stoxx Global 1800 index. Data were obtained from the

Qontigo (

2023) database, which uses ESG scores in environmental, social, and governance pillars from the

Morningstar/Sustainalytics (

2023) provider “

https://www.sustainalytics.com/esg-data (accessed on 7 July 2023)”. The limited availability of data on EGS index daily prices forced us to use the period from 1 June 2012 to 14 July 2022 from the above provider.

de Oliveira et al. (

2020) argued that ESG indices are a valuable investors’ tool that can be used to reduce the fear of increased uncertainty.

Our second motivation is to identify the validity of adding two more factors (volatility and dispersion of returns) to the FF5 factor model. Volatility behavior is a dominant factor when selecting portfolio construction and performance assets. Like the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), a volatility index may capture short-term mood sentiments and is an effective proxy instrument in behavioral finance. The VIX index displays the volatility expectations over the next 30 calendar days (

Marquit and Curry 2023) and is considered a real-time monitoring index. As

Siriopoulos and Fassas (

2009) explain, the CBOE Volatility Index has been broadly accepted due to its advanced interpretative power in antithesis to historical volatility. Investors, fund managers, and traders use the VIX as a barometer to determine the market’s fear or level of risk when constructing their portfolios (

Economou et al. 2018). The current study uses the VIX index based on the CBOE VIX methodology (

Whaley 2000) to capture any ESG leaders’ investors’ bias in relation to volatility. Furthermore, the present study examines whether European and Global ESG leaders’ portfolios tilt towards the dispersion of returns by employing the cross-sectional absolute deviation of returns (CSAD), introduced by

Chang et al. (

2000), which is the most accepted method of return dispersion used in behavioral finance literature. In this way, we fill the gap in the literature and investigate any bias in the dispersion of returns on ESG leaders’ investments.

An interesting avenue of research arising from the above discussion will be to examine if there is any herding behavior in ESG leaders’ portfolios, motivating us to extend the behavioral finance literature. Herding behavior refers to imitating and following others’ investment decisions instead of following one’s beliefs and information. In the investment process, emotional biases can arise due to herding affecting investment decisions in selecting, buying, holding, or selling assets. Understanding and analyzing herding behavior is vital to the portfolio strategies of investors and fund managers. The cross-sectional absolute deviation of returns (CSAD) is the most common measure used to examine herding behavior, introduced by

Chang et al. (

2000). There is a small volume of existing studies investigating herding behavior using ESG data.

Rubbaniy et al. (

2021),

Blondel (

2022) and

Gavrilakis and Floros (

2023a) found evidence of herding behavior using ESG data, while

Ciciretti et al. (

2021) found anti-herding behavior.

The present study reports negative alphas on European ESG leaders’ portfolios by using the CAPM, FF3, and FF5 regression models. The negative abnormal returns of ESG leaders’ portfolios are homogeneous across the three ESG disclosures (environmental, social, and governance). Moreover, the evidence suggests that European ESG investing tilts towards large caps, and values stocks with robust operating profitability against aggressive strategies. We examine Global ESG leaders’ index-based portfolios in a robustness check, reporting the same outcomes but with insignificant importance in some loading factors like profitability and investment strategy. Furthermore, we document for the first time that ESG leader’s portfolios are biased toward volatility and herding behavior. These results shed light on risk–return tradeoffs and behavioral biases on the part of investors and finance professionals responding proactively and reducing uncertainty in the portfolio optimization process.

The current study contributes to the literature by providing valuable updates for investors and fund managers exposed to ESG leaders’ assets. We show investors and professionals cannot achieve high-risk-adjusted returns when holding ESG leaders’ stocks in the short run. This outcome is helpful during portfolio construction and diversification processes. The evidence that European ESG investing tilts towards large caps, and values stocks with robust operating profitability against aggressive strategies encourages their use in corporate financial decisions. In addition, understanding and exploring how the volatility and dispersion of returns interact with ESG investing is essential for constructing optimal portfolios. Finally, our work contributes by reporting for the first time that ESG leaders’ portfolios are biased toward volatility and herding behavior, which is helpful for investors, fund managers, and analysts seeking to reduce risk-taking and hedge their portfolios.

The rest of this study is organized as follows: In

Section 2, we review the literature and analyze alphas, volatility, and herding. In

Section 3, the methodology is presented, while our results are reported in

Section 4. Finally,

Section 5 concludes the study.

4. Results and Discussion

This section presents the results of European ESG leaders’ portfolios and the outcomes of robustness tests of Global ESG leaders’ index-based portfolios.

Table 1 and

Table 2 describe the indices of selected European and Global ESG leaders.

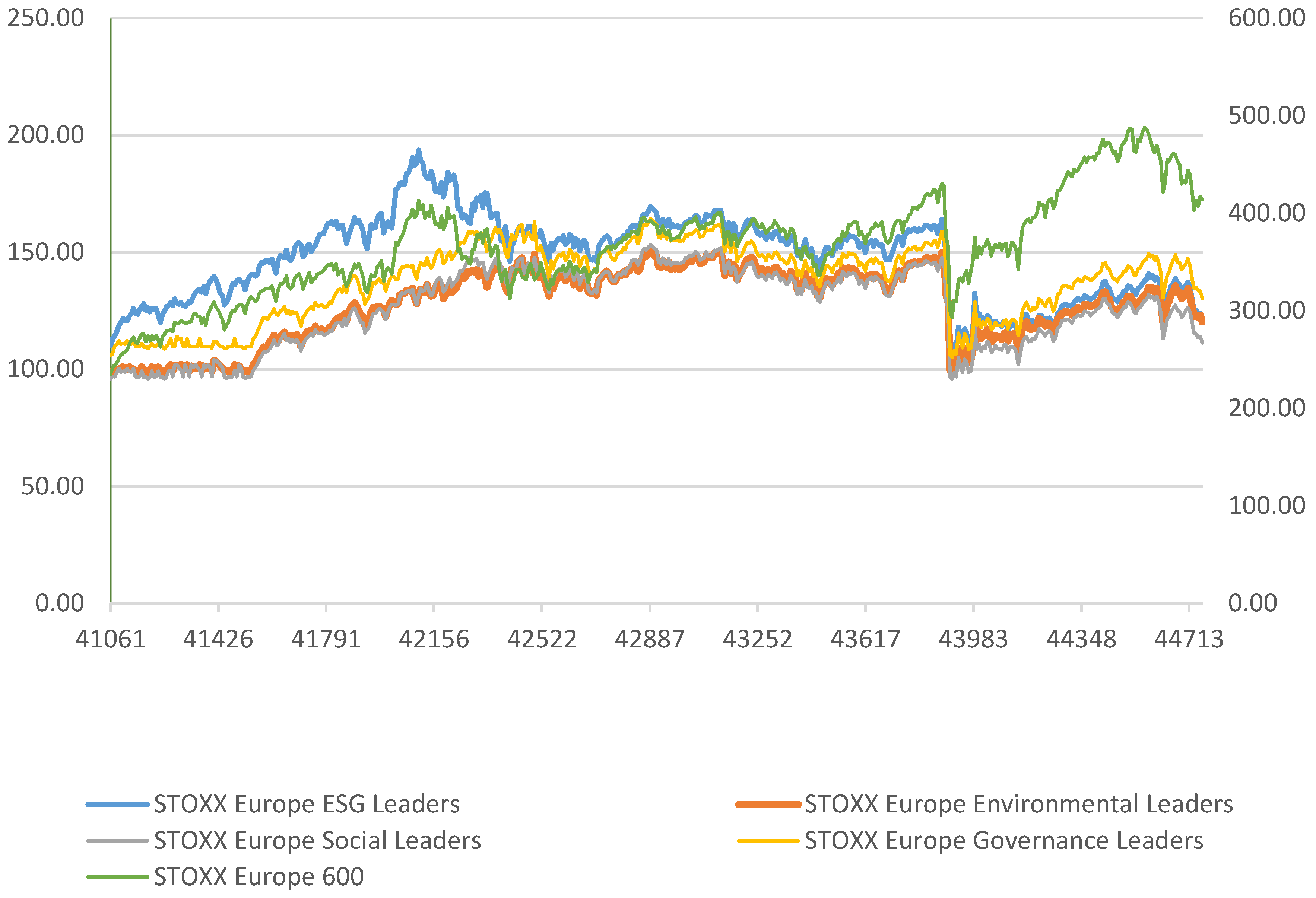

Figure 1 illustrates that the cumulative return of the benchmark index (STOXX Europe 600) significantly exceeded those of the European ESG leaders’ pillars, ending in a full-sample cumulative return of 76.01% from 1 June 2012 to 15 July 2022. The performance of the STOXX Europe ESG leaders’ portfolio (9.92%) is the most notable. The environmental pillar reported a 22.22% return, the social pillar displayed a 16.07% return, and the governance pillar resulted in a cumulative return of 23.20%.

Figure 2 depicts the market returns of the STOXX Global 1800 index and the Global ESG pillar leaders’ indices. The cumulative return of the global benchmark index was 170.3% from 1 June 2012 to 15 July 2022. The cumulative return of STOXX Global ESG leaders was 105.42%, close to the social pillar, with 101.5% return, and the governance pillar, with 98.35% return. The environmental pillar showed a 119.41% cumulative return. The above findings show considerably higher returns on Global ESG leaders’ investments than European ESG leaders’ investments.

Table 3 and

Table 4 show the correlation matrices of selected European and Global ESG pillars, along with the volatility and dispersion of returns factor. All indices are highly positively correlated, while the series is less positively correlated with the volatility index and slightly negatively correlated with the dispersion of returns index, implying that when the dispersion of returns grows, the ESG leaders’ performances decline, which strongly adheres to the risk–return theory.

Table 5 and

Table 6 depict the descriptive statistics of European and Global ESG leaders’ portfolios. The results illustrate, on average, a significant dispersion across all ESG leaders’ indices. The annual mean standard deviation (volatility) suggests that ESG leaders’ investing indicates low risk and negative asymmetry. The summary statistics show the daily returns’ negative asymmetry (negative skewness values). The distributions of ESG indices are leptokurtic, as the kurtosis values are above 12, indicating the presence of fat tails in the series. Kurtosis is only valid when used in connection with standard deviation. ESG indices have high kurtosis, which is unsuitable for investment strategies as the returns are close to the mean, but the overall volatility of the ESG indices is low, which should be considered. The distributions are non-normal for all series as the Jarque–Bera statistics show significant

p-values, indicating the departure from normality and the arrival of volatility clustering. In some cases, we apply logarithms into our series to overcome non-normality. The Augmented Dickey–Fuller (ADF) test results have significant

p-values. As a result, we reject the H0 hypothesis (the series have a unit root problem) and accept the stationarity of the series under study. This finding aligns with that of

Gavrilakis and Floros (

2023b), who concluded that the ESG/thematic market does not have a random walk (non-normal) distribution and that predicting a long-term relationship between the series’ elements is feasible. In the same study, the authors employed several Copula models to reproduce asymmetries in the asymptotic tail dependence of stationary ESG/thematic investment. Copulas have been used extensively in quantitative finance to capture tail risk and, lately, in applications for portfolio optimization (

Patton 2012;

Dewick and Liu 2022;

Nagler et al. 2022). As suggested by many studies on ESG investing that support the null hypothesis of stationarity (

Jain et al. 2020;

Górka and Kuziak 2021;

Ouchen 2022;

Erol et al. 2023), we now proceed by applying an econometric analysis to the reference series.

Table 7 illustrates the OLS regression results (with HAC standard errors) of European ESG Leaders’ index-based portfolios. The validity of the OLS model was tested based on multicollinearity tests detecting values below ten. Therefore, there is no evidence of a multicollinearity problem. The results of all factor models suggest that all the ESG leaders’ portfolios underperformed (with negative risk-adjusted abnormal returns) against the market. We confirm the findings of

Mollet and Ziegler’s (

2014) study, which identified insignificant abnormal returns on three different portfolios (“MSCI sustainability leaders”, “Sustainability leaders”, and “Other MSCI firms”) for Europe and the US from 1998 to 2009. Irrespective of our sample, the ESG portfolios present medium betas (

β), indicating a medium level of systematic risk. The ESG portfolios depict a negative loading on

, implying a tilt toward large-cap firms. The factor loadings for the determinant

are broadly significantly positive in all series, which indicates a bias towards value stocks. The ESG portfolios report a favorable loading on

indicating a tilt toward robust operating profitability. The statistically significant and positive

exposure suggests that the ESG portfolios include firms with conservative investment strategies, usually associated with low future returns. The factor loadings are homogeneous across the environmental, social, and governance components. The ESG premium remains statistically significant after adjusting for the CAPM, FF3, FF5, and augmented FF7 models. This finding supports the results in the literature that FF3 and FF5 effectively explain ESG leaders’ performance concerning market returns (

Zaremba and Czapkiewicz 2017;

Guo et al. 2017). Furthermore, the results confirm that our augmented FF7 model significantly explains all the factor loadings.

Table 7 also reports that the fear or volatility index

is significant and positive in all ESG indices, indicating a volatility bias. We verify the findings of the study of

Górka and Kuziak (

2021), who confirmed a higher dependence on the volatility of selected ESG indices from 2007 until 2019. Finally, the

factor is significant and negative in European ESG Leaders’ portfolios, suggesting a dispersion of return bias. To check the robustness of our results, we rerun the FF7 OLS model by adding the VSTOXX index instead of VIX, ending up with the same results (see

Table 8) but with minor differences in the importance of loading factors (

.

We employed the cross-sectional absolute deviation of returns (

Chang et al. 2000) methodology to enhance our results concerning the dispersion of returns bias and capture any herding effect.

Table 9 summarizes our empirical results concerning herding existence in ESG leaders’ portfolios. The benchmark methodology of herding presented by

Chang et al. (

2000) is applied in model I. Parameter

is significant and negative, implying the herding effect. This critical finding aligns with those of

Benz et al. (

2020),

Blondel (

2022) and

Gavrilakis and Floros (

2023a), who confirmed herding behavior in their studies related to ESG investing. ESG leaders’ investors are involved in herd behavior during flat markets, which may result in market inefficiency and less diversified portfolios. Finally, our outcomes do not indicate herding behavior for up- or down-market days, as coefficients

and

> 0. This is contrary to the findings of

Rubbaniy et al. (

2021), who captured herding behavior during bull and bear market periods. This anti-herding behavior probably indicates that highly ESG-scoring assets conduce to market efficiency by lowering the probability of forming a financial bubble.

Figure 3 presents the effects of herding on STOXX Europe ESG leaders’ portfolios. There is a negative correlation between the dispersion of returns and the performance of ESG leaders’ indices, which means that a 1-unit change in ESG leaders’ returns leads to a −0.79-unit change in the dispersion of returns (see

Figure 3 and

Table 9). We agree with

Verousis and Voukelatos (

2018), who found a negative relation between the dispersion of returns and investment performance.

To check the robustness of our empirical results for European ESG leaders, we ran the same tests but with Global ESG leaders’ portfolio data.

Table 10 reports the OLS (with HAC standard errors) robustness regression results for Global ESG leaders’ index-based portfolios. The validity of the OLS model was tested based on multicollinearity tests detecting values below ten. Therefore, there is no evidence of a multicollinearity problem. The findings of all the factor models used suggest that the Global ESG leaders’ portfolios underperformed in the market from 1 June 2012 to 15 July 2022. This argument confirms the findings of

Hartzmark and Sussman (

2019), who found causal evidence that investors value sustainability, but no evidence of positive effects on performance. In addition, we partly confirm the findings of

Auer and Schuhmacher (

2016), who argued that high- or low-rated ESG stock selection does not provide investors with superior returns, while the returns for Asia-Pacific and the US are similar to ESG performance, but for European markets, they are lower. Moreover, all the ESG portfolios show medium betas (

β), indicating a medium level of systematic risk. The Global ESG portfolios presented a positive loading on

, but this was not significant, except for in the social portfolio, implying a tilt towards small firms. The factor loadings for the determinant

are significantly positive in all series, which indicates a bias towards value stocks. The

and

exposure are not statistically significant in all factor models. In summary, the factor loadings are similar across the environmental, social, and governance components. According to our results, the volatility index

is significant and positive in all portfolios, indicating a volatility bias. This finding agrees with those of

Nishant et al. (

2022), who argued that global companies with better ESG scores are more resilient in high-volatility environments. Furthermore, the

indicator is significant and negative in all portfolios, suggesting a dispersion of returns bias.

Once more, we employed the cross-sectional absolute deviation of returns to attest to the dispersion of returns bias and capture any herding effects (

Chang et al. 2000). Model I in

Table 11 shows evidence of herding, since coefficient

is statistically significant and negative, while our empirical results do not indicate herding behavior toward the ESG leaders’ returns on up- or down-market days, as coefficients

and

> 0. Overall, our findings align with those of

Rubbaniy et al. (

2021) and

Fu and Wu (

2021), who confirmed herding behavior in their studies related to Global ESG investing. We do not confirm the findings of

Ciciretti et al. (

2021), who captured no herding behavior in 10,456 global ESG funds.

Figure 4 presents the effects of herding on the STOXX Global ESG leaders’ portfolio. There is a negative correlation between the dispersion of returns and the performance of ESG leader’s indices, which means that a 1-unit change in ESG leaders’ returns leads to a −0.13-unit change in the dispersion of returns (see

Figure 4 and

Table 11). We contradict the conclusions of

Caoa et al. (

2019), who found a positive relation between fund performance and return dispersion.

5. Conclusions

ESG investing is prevalent in today’s global markets, driven by rising demand for investments that promote sustainability. Investors, fund managers, and regulators require more disclosure to evaluate the extent to which ESG leaders impact portfolio performance. We here investigated the risk-adjusted performance of ESG leaders’ portfolios in European and Global ESG leaders’ markets from 2012 to mid-2022. The ESG leaders’ portfolios did not produce significant alphas, verifying the findings of studies on negative excess returns. The regression models CAPM, FF3, and FF5 were used to test the loading factors’ validity and interpret the returns’ cross-section. We noticed sufficient evidence that the European ESG leaders tilt towards large caps, and value stocks, robust operating profitability, and low-risk investment strategies. In contrast, we reported no significant evidence in relation to Global ESG leaders regarding size, operation profitability, and investment strategy. Our results provide an effective means to capture ESG leaders’ abnormal returns by quantifying the attribution of the ESG pillars’ loading factors. Furthermore, we examined the effects and the validity of adding two secondary behavioral determinants (volatility and dispersion of returns) to the FF5 model, resulting in a novel finding of volatility tilting and a dispersion of returns bias on European and Global ESG leaders’ portfolios. This finding has practical implications for investors and fund managers exposed to ESG leaders’ assets in managing ESG funds and constructing sustainable portfolios. Finally, the indication of herding behavior in ESG leaders’ investing eliminates the diversification benefits, leading to a risk exposure that would be difficult to hedge.

The current study contributes to the literature by providing valuable updates on factor loadings of different regression models on ESG leaders’ portfolios. Furthermore, using well-known regression equation methodologies, it analyzes how those portfolios are affected by volatility, the cross-sectional dispersion of returns, and herding behavior, providing helpful insights that will help investors and policymakers to better understand pricing anomalies and behavioral finance. A limitation to be acknowledged is that the current study did not use herding estimation for sub-periods, time-varying betas of herding measures, or cross-market herding. Future research could examine how ESG investing can be applied for portfolio optimization. An interesting avenue would be to analyze and compare ESG leaders and laggards.