Perceived Risk and External Finance Usage in Small- and Medium-Sized Enterprises: Unveiling the Moderating Influence of Business Age

Abstract

1. Introduction

2. Theoretical Framework and Hypotheses

3. Methods

3.1. Data

3.2. Sample

4. Results

4.1. Measurement Model

4.2. Structural Model

4.3. Results of Hypotheses Testing

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Correction Statement

References

- Agarwal, Devyani. 2022. New Approaches to SME and Entrepreneurship Financing. Ph.D. dissertation, School of Petroleum Management, Raysan, India. [Google Scholar]

- Alakaleek, Wejdan, and Sarah Yvonne Cooper. 2018. The female entrepreneur’s financial networks: Accessing finance for the emergence of technology-based firms in Jordan. Venture Capital 20: 137–57. [Google Scholar] [CrossRef]

- Alharbi, Raed Khamis, Sofri Yahya, and Veland Ramadani. 2022. Financial literacy, access to finance, SMEs performance and Islamic religiosity: Evidence from Saudi Arabia. International Journal of Entrepreneurship and Small Business 46: 259–85. [Google Scholar] [CrossRef]

- Alhawel, Hisham Mohammed, Mohammad Nurunnabi, and Nourah Alyousef. 2020. The Impact of COVID-19 on SME in Saudi Arabia: A Large-Scale Survey. White Paper. Riyadh: Prince Sultan University, Saudi Economic Association. [Google Scholar]

- Amoah, John, Jaroslav Belas, Raymond Dziwornu, and Khurram Ajaz Khan. 2022. Enhancing SME contribution to economic development: A perspective from an emerging economy. Journal of International Studies 15: 63–76. [Google Scholar] [CrossRef]

- Andrieș, Alin Marius, Nicu Marcu, Florin Oprea, and Mihaela Tofan. 2018. Financial infrastructure and access to finance for European SMEs. Sustainability 10: 3400. [Google Scholar] [CrossRef]

- Arora, Sangeeta, and Simarpreet Kaur. 2018. Perceived risk dimensions and its impact on intention to use e-banking services: A conceptual study. Journal of Commerce and Accounting Research 7: 18–27. [Google Scholar]

- Aswicahyono, Haryo, Hal Hill, and Dionisius Narjoko. 2013. Indonesian industrialization: A latecomer adjusting to crises. In Pathways to Industrialization in the Twenty-First Century: New Challenges and Emerging Paradigms. Oxford: Oxford University Press, pp. 193–222. [Google Scholar]

- Ayyagari, Meghana, Pedro Juarros, Maria Soledad Martinez Peria, and Sandeep Singh. 2021. Access to finance and job growth: Firm-level evidence across developing countries. Review of Finance 25: 1473–96. [Google Scholar] [CrossRef]

- Batrancea, Larissa M., Mehmet Ali Balcı, Leontina Chermezan, Ömer Akgüller, Ema Speranta Masca, and Lucian Gaban. 2022. Sources of SMEs financing and their impact on economic growth across the European Union: Insights from a panel data study spanning sixteen years. Sustainability 14: 15318. [Google Scholar] [CrossRef]

- Belás, Jaroslav, Přemysl Bartoš, Aleksandr Ključnikov, and Jiří Doležal. 2015. Risk perception differences between micro-, small and medium enterprises. Journal of International Studies 8: 20–30. [Google Scholar]

- Beqaj, Besim, and Granit Baca. 2022. Consumer evaluations of e-services: A perceived risk perception in financial institutions. Ekonomski Vjesnik 35: 113–23. [Google Scholar]

- Brown, Jeffrey Robert, Arie Kapteyn, Erzo Luttmer, Olivia Mitchell, and Anya Samek. 2021. Behavioral impediments to valuing annuities: Complexity and choice bracketing. The Review of Economics and Statistics 103: 533–46. [Google Scholar] [CrossRef]

- Buser, Thomas, Muriel Niederle, and Hessel Oosterbeek. 2024. Can competitiveness predict education and labor market outcomes? Evidence from incentivized choice and survey measures. Review of Economics and Statistics, National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Butler, Alexander W., Jess Cornaggia, Gustavo Grullon, and James P. Weston. 2009. Corporate Financing Decisions and Managerial Market Timing. Working Paper. Houston: Rice University. [Google Scholar]

- Chandra, Ashna, Justin Paul, and Meena Chavan. 2020. Internationalization barriers of SMEs from developing countries: A review and research agenda. International Journal of Entrepreneurial Behavior & Research 26: 1281–310. [Google Scholar]

- Chen, ChauShen. 2013. Perceived risk, usage frequency of mobile banking services. Managing Service Quality: An International Journal 23: 410–36. [Google Scholar] [CrossRef]

- Chin, Wynne, Barbara Marcolin, and Peter Newsted. 2003. A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic-mail emotion/adoption study. Information Systems Research 14: 189–217. [Google Scholar] [CrossRef]

- Chiu, Chao-Min, Eric T. G. Wang, Yu-Hui Fang, and Hsin-Yi Huang. 2014. Understanding customers’ repeat purchase intentions in B2C e-commerce: The roles of utilitarian value, hedonic value, and perceived risk. Information Systems Journal 24: 85–114. [Google Scholar] [CrossRef]

- Cowling, Marc, Weixi Liu, and Ning Zhang. 2018. Did firm age, experience, and access to finance count? SME performance after the global financial crisis. Journal of Evolutionary Economics 28: 77–100. [Google Scholar] [CrossRef]

- Cubeddu, Luis, Swarnali Ahmed Hannan, and Pau Rabanal. 2023. External financing risks: How important is the composition of the international investment position? Journal of International Money and Finance 131: 102772. [Google Scholar] [CrossRef]

- Diacon, Stephen, and Christine Ennew. 2001. Consumer perceptions of financial risk. The Geneva Papers on Risk and Insurance—Issues and Practice 26: 389–409. [Google Scholar] [CrossRef]

- Dijkstra, Theo K., and Jörg Henseler. 2015. Consistent partial least squares path modeling. MIS Quarterly 39: 297–316. [Google Scholar] [CrossRef]

- Dowling, Michael, Colm O’gorman, Petya Puncheva, and Dieter Vanwalleghem. 2019. Trust and SME attitudes toward equity financing across Europe. Journal of World Business 54: 101003. [Google Scholar] [CrossRef]

- Dressler, Efrat, and Yevgeny Mugerman. 2023. Doing the right thing? The voting power effect and institutional shareholder voting. Journal of Business Ethics 183: 1089–112. [Google Scholar] [CrossRef]

- Drum, David J., Chris Brownson, Adryon Burton Denmark, and Shanna E. Smith. 2009. New data on the nature of suicidal crises in college students: Shifting the paradigm. Professional Psychology: Research and Practice 40: 213. [Google Scholar] [CrossRef]

- Dvorský, Ján, Ludmila Kozubíková, and Barbora Bacová. 2020. The perception of business risks by SMEs in the Czech Republic. Central European Business Review 9: 25–44. [Google Scholar] [CrossRef]

- Endris, Ebrahim, and Andualem Kassegn. 2022. The role of micro, small and medium enterprises (MSMEs) to the sustainable development of sub-Saharan Africa and its challenges: A systematic review of evidence from Ethiopia. Journal of Innovation and Entrepreneurship 11: 20. [Google Scholar] [CrossRef] [PubMed]

- Esho, Ebes, and Grietjie Verhoef. 2022. SME funding-gap and financing: A comprehensive literature review. International Journal of Globalisation and Small Business 13: 164–91. [Google Scholar] [CrossRef]

- Farsi, Jahangir Yadollahi, Maryam Azizi, Reza Mohammadkazemi, and Babak Ziya. 2019. Identifying factors of fitness between business model and entrepreneurial opportunity for effective opportunity exploitation. Revista Gestão & Tecnologia 19: 71–86. [Google Scholar]

- Featherman, Mauricio S., and Paul A. Pavlou. 2003. Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human-Computer Studies 59: 451–74. [Google Scholar] [CrossRef]

- Fink, Jason, Gustavo Grullon, Kristin Fink, and James Weston. 2004. Firm age and fluctuations in idiosyncratic risk. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Finnegan, Marie, and Supriya Kapoor. 2023. ECB unconventional monetary policy and SME access to finance. Small Business Economics 61: 1253–88. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. Journal of Marketing Research 18: 382–88. [Google Scholar] [CrossRef]

- Frankfurt am Main. 2021. European Central Bank (Annual Report 2020). Available online: https://www.ecb.europa.eu/pub/pdf/annrep/ar2020~4960fb81ae.en.pdf (accessed on 1 November 2023).

- General Authority for Small and Medium Enterprises (Monsha’at). 2017. Definition of Establishments. Available online: https://www.stats.gov.sa/en/statistical-knowledge/160 (accessed on 1 November 2023).

- Ghosh, Saibal. 2022. Financing obstacles for SMEs: The role of politics. Journal of Global Entrepreneurship Research 12: 329–40. [Google Scholar] [CrossRef]

- Grima, Simon, Bahattin Hamarat, Ercan Özen, Alessandra Girlando, and Rebecca Dalli-Gonzi. 2021. The relationship between risk perception and risk definition and risk-addressing behaviour during the early COVID-19 stages. Journal of Risk and Financial Management 14: 272. [Google Scholar] [CrossRef]

- Grimmelikhuijsen, Stephan. 2023. Explaining why the computer says no: Algorithmic transparency affects the perceived trustworthiness of automated decision-making. Public Administration Review 83: 241–62. [Google Scholar] [CrossRef]

- Gu, Ja-Chul, Sang-Chul Lee, and Yung-Ho Suh. 2009. Determinants of behavioral intention to mobile banking. Expert Systems with Applications 36: 11605–16. [Google Scholar] [CrossRef]

- Hair, Joe Franklin, Jr., Christian M. Ringle, and Marko Sarstedt. 2011. PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice 19: 139–52. [Google Scholar] [CrossRef]

- Hair, Joe Franklin, Jr., G. Tomas Hult, Christian M. Ringle, and Marko Sarstedt. 2016. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Amsterdam: Sage. [Google Scholar]

- Hair, Joe Franklin, Jr., Marko Sarstedt, Lucas Hopkins, and Volker Georg Kuppelwieser. 2014. Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review 26: 106–21. [Google Scholar] [CrossRef]

- Hastuti, Theresia Dwi, Ridwan Sanjaya, and Freddy Koeswoyo. 2021. The investment opportunity, information technology and financial performance of SMEs. Paper presented at the 2021 International Conference on Computer & Information Sciences (ICCOINS), Kuching, Malaysia, July 13–15; pp. 247–51. [Google Scholar]

- Hu, Ding, Xianming Fang, and Yuting Meng DiGiovanni. 2023. Technological progress, financial constraints, and digital financial inclusion. Small Business Economics 61: 1693–721. [Google Scholar] [CrossRef]

- Hurwitz, Abigail, Olivia S. Mitchell, and Orly Sade. 2022. Testing methods to enhance longevity awareness. Journal of Economic Behavior & Organization 204: 466–75. [Google Scholar]

- Hyytinen, Ari, and Mika Pajarinen. 2008. Opacity of young businesses: Evidence from rating disagreements. Journal of Banking & Finance 32: 1234–41. [Google Scholar]

- Jamali, Behrooz, Reza MohammadKazemi, Jahangir Y. Farsi, and Ali Mobini Dehkordi. 2018. The study on the theories’ gap of technological entrepreneurship opportunities emergence. International Business Research 11: 79–88. [Google Scholar] [CrossRef]

- Jones-Evans, Dylan. 2015. Access to finance for SMEs at a regional level: The case of Finance Wales. Venture Capital 17: 27–41. [Google Scholar] [CrossRef]

- Jude, Forbeneh Agha, Chi Collins Penn, and Ntieche Adamou. 2021. Financing of small and medium-sized enterprises: A supply-side approach based on the lending decisions of commercial banks. European Journal of Economics and Business Studies 4: 123–35. [Google Scholar] [CrossRef]

- Klapper, Leora, and Christine Richmond. 2011. Patterns of business creation, survival, and growth: Evidence from Africa. Labour Economics 18: S32–S44. [Google Scholar] [CrossRef][Green Version]

- Kokot-Stępień, Patrycja. 2022. The importance of external financing in the management of innovative processes in the SME sector. Ekonomia i Prawo. Economics and Law 21: 145–63. [Google Scholar] [CrossRef]

- Laaouina, Soukaina, Sara El Aoufi, and Mimoun Benal. 2024. How does age moderate the determinants of crowdfunding adoption by SMEs? Evidences from Morocco. Journal of Risk and Financial Management 17: 18. [Google Scholar] [CrossRef]

- Le, Truc H., and Charles Arcodia. 2018. Risk perceptions on cruise ships among young people: Concepts, approaches, and directions. International Journal of Hospitality Management 69: 102–12. [Google Scholar] [CrossRef]

- Li, Jing, Hao Feng, Mao Li, ManJie Li, and Yuyuan Chen. 2022. Relationship between enterprise financing structure and business performance assisted by blockchain for the Internet of Things financing mode. Computational Intelligence and Neuroscience 2022: 2076830. [Google Scholar] [CrossRef]

- Ljajić, Samir. 2021. Features and possibilities of small and medium enterprises development in modern economies. Univerzitetska Misao-Časopis Za Nauku, Kulturu i Umjetnost, Novi Pazar 20: 190–200. [Google Scholar] [CrossRef]

- Loehlin, John Clinton, and Alex Alexander Beaujean. 2016. Latent Variable Models: An Introduction to Factor, Path, and Structural Equation Analysis. Abingdon: Taylor & Francis. [Google Scholar]

- Lucia, Cusmano. 2015. New Approaches to SME and Entrepreneurship Financing: Broadening the Range of Instruments. Istanbul: OECD. [Google Scholar]

- Ludlow, Peter. 2018. The European Commission. In The New European Community. Hoboken: Routledge, pp. 85–132. [Google Scholar]

- Lyu, Tu, Yulin Guo, and Hao Chen. 2023. Understanding people’s intention to use facial recognition services: The roles of network externality and privacy cynicism. Information Technology & People. [Google Scholar] [CrossRef]

- MacGregor, Donald G., Paul Slovic, Michael Berry, and Harold Evensky. 1999. Perception of financial risk: A survey study of advisors and planners. Journal of Financial Planning 12: 68. [Google Scholar]

- Mallinguh, Edmund, Christopher Wasike, and Zeman Zoltan. 2020. The business sector, firm age, and performance: The mediating role of foreign ownership and financial leverage. International Journal of Financial Studies 8: 79. [Google Scholar] [CrossRef]

- Mateev, Miroslav, Panikkos Poutziouris, and Konstantin Ivanov. 2013. On the determinants of SME capital structure in Central and Eastern Europe: A dynamic panel analysis. Research in International Business and Finance 27: 28–51. [Google Scholar] [CrossRef]

- Memon, Aftab Hameed, and Ismail Abdul Rahman. 2014. SEM-PLS analysis of inhibiting factors of cost performance for large construction projects in Malaysia: Perspective of clients and consultants. The Scientific World Journal 2014: 165158. [Google Scholar] [CrossRef] [PubMed]

- Mitchell, Vincent-Wayne, and Mike Greatorex. 1993. Risk perception and reduction in the purchase of consumer services. Service Industries Journal 13: 179–200. [Google Scholar] [CrossRef]

- Mohamed Zabri, Shafie, Kamilah Ahmad, and Siti Azirah Adonia. 2021. The influence of managerial characteristics on external financing preferences in smaller enterprises: The case of Malaysian micro-sized enterprises. Cogent Business & Management 8: 1912524. [Google Scholar]

- Morrison, Emily, Henriette Lundgren, and SeoYoon Sung. 2023. Learning to surf: Catching the waves of dynamic emotions in experiential teaching. In Honing Self-Awareness of Faculty and Future Business Leaders: Emotions Connected with Teaching and Learning. Edited by Emily A. Morrison, Henriette Lundgren and SeoYoon Sung. Bradford: Emerald Publishing Limited, pp. 159–77. [Google Scholar]

- Morsy, Hanan. 2020. Access to finance–Mind the gender gap. The Quarterly Review of Economics and Finance 78: 12–21. [Google Scholar]

- Nafisi, Firoozeh, and Reza Mohammad Kazemi. 2023. Providing an open innovation model for high-tech startups in the unit of industries related to information technology. International Journal of Nonlinear Analysis and Applications 15: 159–72. [Google Scholar]

- Nguyen, Duc Khuong, and Dinh-Tri Vo. 2020. Enterprise risk management and solvency: The case of the listed EU insurers. Journal of Business Research 113: 360–69. [Google Scholar] [CrossRef]

- Nizaeva, Mirgul, and Ali Coşkun. 2018. Determinants of the financing obstacles faced by SMEs: An empirical study of emerging economies. Journal of Economic and Social Studies 7: 81. [Google Scholar] [CrossRef]

- Nkansah-Sakyi, Ewuraba Adua. 2023. Financing of small and medium manufacturing entities (SMMEs) in the sub-region (Africa): A contribution to economic growth. Central European Management Journal 31: 294–303. [Google Scholar]

- Nkundabanyanga, Stephen Korutaro, Elizabeth Mugumya, Irene Nalukenge, Moses Muhwezi, and Grace Muganga Najjemba. 2020. Firm characteristics, innovation, financial resilience, and survival of financial institutions. Journal of Accounting in Emerging Economies 10: 48–73. [Google Scholar] [CrossRef]

- Nordin, Norhafiza, and Zaemah Zainuddin. 2023. A review of a fintech financing platform: Potential and challenges of Islamic crowdfunding to entrepreneurs. International Journal of Islamic Business 8: 79–90. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1967. Psychometric Theory. New York: McGraw-Hill. [Google Scholar]

- Okello-Obura, C., and James Matovu. 2011. SMEs and business information provision strategies: Analytical perspective. Library Philosophy and Practice 1: 13. [Google Scholar]

- Osano, Hezron Mogaka, and Hilario Languitone. 2016. Factors influencing access to finance by SMEs in Mozambique: Case of SMEs in Maputo central business district. Journal of Innovation and Entrepreneurship 5: 1–16. [Google Scholar] [CrossRef]

- Peredy, Zoltán, Xie Yaouki, and Balázs Laki. 2022. Challenges of the innovative Chinese small and medium-sized enterprises (SMEs) in the last decade. Acta Periodica (Edutus) 24: 19–35. [Google Scholar] [CrossRef]

- Peter, J. Paul, and Michael J. Ryan. 1976. An investigation of perceived risk at the brand level. Journal of Marketing Research 13: 184–88. [Google Scholar] [CrossRef]

- Pires, Guilherme, John Stanton, and Andrew Eckford. 2004. Influences on the perceived risk of purchasing online. Journal of Consumer Behaviour: An International Research Review 4: 118–31. [Google Scholar] [CrossRef]

- Rahid, Abu Obida. 2023. SME financing of commercial banks in Bangladesh: Policy directions based on SME loan borrowers’ view. International Journal of Small and Medium Enterprises 6: 1–8. [Google Scholar] [CrossRef]

- Rahman, Md Mizanur, Mosab I. Tabash, Aidin Salamzadeh, Selajdin Abduli, and Md Saidur Rahaman. 2022. Sampling techniques (probability) for quantitative social science researchers: A conceptual guidelines with examples. Seeu Review 17: 42–51. [Google Scholar] [CrossRef]

- Ramachandran, Nithya, and Hmaa Yahmadi. 2019. Challenges faced by SMEs in Oman. Shanlax International Journal of Arts, Science and Humanities 7: 15–25. [Google Scholar] [CrossRef]

- Ramalho, Rita, Nan Jiang, Olena Koltko, Édgar Chávez, Klaus Adolfo Koch-Saldarriaga, and Maria Antonia Quesada Gamez. 2018. Improving Access to Finance for SMEs: Opportunities through Credit Reporting, Secured Lending, and Insolvency Practices. Washington, DC: The World Bank. [Google Scholar]

- Ringle, Christian M., Sven Wende, and S. Will. 2005. SmartPLS 2.0 (M3) Beta. Hamburg: University of Hamburg. Available online: www.smartpls.de (accessed on 22 October 2023).

- Robson, Colin, and Kieran McCartan. 2015. Real World Research. Hoboken: John Wiley & Sons, pp. 243–56. ISBN 978-1-118-74523-6. [Google Scholar]

- Roselius, Ted. 1971. Consumer rankings of risk reduction methods. Journal of Marketing 35: 56–61. [Google Scholar] [CrossRef]

- Ross, Ted. 1975. Perceived risk and consumer behavior: A critical review. ACR North American Advances 2: 1–19. [Google Scholar]

- Rydehell, Hanna, Anders Isaksson, and Hans Löfsten. 2019. Business networks and localization effects for new Swedish technology-based firms’ innovation performance. The Journal of Technology Transfer 44: 1547–76. [Google Scholar] [CrossRef]

- Sanayei, Ali, and Ebrahim Bahmani. 2012. Integrating TAM and TPB with perceived risk to measure customers’ acceptance of Internet banking. International Journal of Information Science and Management (IJISM), 25–37. [Google Scholar]

- Schiffman, Leon G., and Leslie Lazar Kanuk. 1994. Consumer decision-making. In Consumer Behaviour. Englewood Cliffs: Prentice Hall. [Google Scholar]

- Serrasqueiro, Zélia, Paulo Maçãs Nunes, and Jacinto Vidigal da Silva. 2016. The influence of age and size on family-owned firms’ financing decisions: Empirical evidence using panel data. Long Range Planning 49: 723–45. [Google Scholar] [CrossRef]

- Shahzad, Akmal, Muhammad Khan, Taseer Salahuddin, and Sarah Qaim. 2020. Impact of perceived business risk on organization performance: An integrated risk management framework based on internal controls. International Journal of Management (IJM) 11: 3129–41. [Google Scholar] [CrossRef]

- Simba, Amon, Mahdi Tajeddin, Léo-Paul Dana, and Domingo E. Ribeiro Soriano. 2024. Deconstructing involuntary financial exclusion: A focus on African SMEs. Small Business Economics 62: 285–305. [Google Scholar] [CrossRef]

- Sindhu, K. P., and Rajitha Kumar. 2014. Influence of risk perception of investors on investment decisions: An empirical analysis. Journal of Finance and Bank Management 2: 15–25. [Google Scholar]

- Steinerowska-Streb, Izabella, and Artur Steiner. 2014. An analysis of external finance availability on SMEs’ decision making: A case study of the emerging market of Poland. Thunderbird International Business Review 56: 373–86. [Google Scholar] [CrossRef]

- Stone, Robert, and Kjell Grønhaug. 1993. Perceived risk: Further considerations for the marketing discipline. European Journal of Marketing 27: 39–50. [Google Scholar] [CrossRef]

- The World Bank. 2023. Small and Medium Enterprises (SMEs) Finance. Washington, DC: World Bank. [Google Scholar]

- U.S. Small Business Administration (SBA). 2019. The U.S. Small Business Administration’s Agency Financial Report (AFR) for FY 2019. Available online: https://www.sba.gov/sites/default/files/2019-12/SBA_FY_2019_AFR-508.pdf (accessed on 20 September 2023).

- Usman, Garba, and Mahmood Zahid. 2011. Factors influencing performance of microfinance firms in Pakistan: Focus on market orientation. International Journal of Academic Research 3. [Google Scholar]

- Waked, Bronwyn. 2016. Access to Finance by Saudi SMEs: Constraints and the Impact on Their Performance. Ph.D. dissertation, Victoria University, Melbourne, Australia. [Google Scholar]

- Wang, Yao. 2016. What are the biggest obstacles to growth of SMEs in developing countries?—An empirical evidence from an enterprise survey. Borsa Istanbul Review 16: 167–76. [Google Scholar] [CrossRef]

- Wasiuzzaman, Shaista, Nabila Nurdin, Aznur Hajar Abdullah, and Gowrie Vinayan. 2020. Creditworthiness and access to finance of SMEs in Malaysia: Do linkages with large firms matter? Journal of Small Business and Enterprise Development 27: 197–217. [Google Scholar] [CrossRef]

- Wignaraja, Ganeshan, and Yothin Jinjarak. 2015. Why Do SMEs Not Borrow More from Banks? Evidence from the People’s Republic of China and Southeast Asia. ADBI, Working Paper, No. 509. Tokyo: Asian Development Bank Institute (ADBI). [Google Scholar]

- Woldie, Atsede, and Uruemuesiri Ubrurhe. 2018. Small and medium enterprises’ challenges of accessing microfinance in Nigeria. In Financial Entrepreneurship for Economic Growth in Emerging Nations. Warsaw: IGI Global, pp. 229–53. [Google Scholar]

- Yao, Lianying, and Xiaoli Yang. 2022. Can digital finance boost SME innovation by easing financing constraints? Evidence from Chinese GEM-listed companies. PLoS ONE 17: e0264647. [Google Scholar] [CrossRef]

- Yeung, Ruth M. W., and Joe Morris. 2006. An empirical study of the impact of consumer perceived risk on purchase likelihood: A modelling approach. International Journal of Consumer Studies 30: 294–305. [Google Scholar] [CrossRef]

- Zeebaree, Mohammed R. Yaseen, and Rusinah Bt Siron. 2017. The impact of entrepreneurial orientation on competitive advantage moderated by financing support in SMEs. International Review of Management and Marketing 7: 43–52. [Google Scholar]

- Zhanbirov, Z. G., O. V. Deryugin, A. B. Toktamyssova, D. A. Agabekova, and M. M. Arkhirei. 2023. Research on the impact of cognitive biases of workers on the subjective assessment of occupational risk. Naukovyi Visnyk Scientific Bulletin of the National Mining University 1: 136–41. [Google Scholar] [CrossRef]

- Zhang, Xiaoxue, and Xiaofeng Yu. 2020. The impact of perceived risk on consumers’ cross-platform buying behavior. Frontiers in Psychology 11: 592246. [Google Scholar] [CrossRef]

| Characteristic | Frequency | Percentage |

|---|---|---|

| Estimated number of employees | ||

| 6–49 | 305 | 43% |

| 50–249 | 406 | 57% |

| Total | 711 | 100% |

| Estimated annual revenue | ||

| 3–40 M SR | 339 | 48% |

| 40–200 M SR | 372 | 52% |

| Total | 711 | 100% |

| Years in business | ||

| Less than 5 years | 277 | 39% |

| 5–10 | 206 | 28% |

| 11–15 | 111 | 16% |

| 16–20 | 82 | 12% |

| More than 20 | 35 | 4% |

| Total | 711 | 100% |

| Item | Cronbach’s Alpha | Composite Reliability (rho_a) | Composite Reliability (rho_c) | Average Variance Extracted (AVE) |

|---|---|---|---|---|

| CovR | 0.874 | 0.884 | 0.906 | 0.620 |

| EFU | 0.711 | 0.848 | 0.839 | 0.643 |

| FinR | 0.805 | 0.823 | 0.868 | 0.574 |

| PR | 0.920 | 0.925 | 0.929 | 0.550 |

| PerformR | 0.773 | 0.784 | 0.869 | 0.688 |

| Psy | 0.714 | 0.771 | 0.789 | 0.562 |

| SocR | 0.833 | 0.837 | 0.881 | 0.556 |

| TimeR | 0.950 | 0.950 | 0.975 | 0.952 |

| Item | CovR | EFU | FinR | PR | PerformR | Psy | SocR | TimeR |

|---|---|---|---|---|---|---|---|---|

| CovR | 0.828 | |||||||

| EFU | 0.089 | 0.934 | ||||||

| FinR | 0.397 | −0.086 | 0.822 | |||||

| PR | 0.811 | 0.086 | 0.727 | 0.592 | ||||

| PerformR | 0.556 | 0.132 | 0.491 | 0.768 | 0.830 | |||

| Psy | 0.361 | −0.025 | 0.645 | 0.628 | 0.385 | 0.859 | ||

| SocR | 0.518 | −0.045 | 0.432 | 0.722 | 0.437 | 0.315 | 0.799 | |

| TimeR | 0.465 | 0.198 | 0.318 | 0.653 | 0.549 | 0.337 | 0.307 | 0.976 |

| Item | CovR | EFU | FinR | PerformR | Psy | SocR | TimeR |

|---|---|---|---|---|---|---|---|

| CovR1 | 0.789 | ||||||

| CovR2 | 0.859 | ||||||

| CovR3 | 0.793 | ||||||

| CovR4 | 0.865 | ||||||

| CovR5 | 0.786 | ||||||

| EFU1 | 0.864 | ||||||

| EFU3 | 0.916 | ||||||

| FinR1 | 0.812 | ||||||

| FinR3 | 0.852 | ||||||

| FinR4 | 0.756 | ||||||

| FinR5 | 0.801 | ||||||

| PerformR1 | 0.771 | ||||||

| PerformR2 | 0.846 | ||||||

| PerformR3 | 0.869 | ||||||

| Psy1 | 0.835 | ||||||

| Psy3 | 0.83 | ||||||

| SocR1 | 0.684 | ||||||

| SocR2 | 0.723 | ||||||

| SocR3 | 0.829 | ||||||

| SocR4 | 0.860 | ||||||

| SocR6 | 0.793 | ||||||

| TimeR1 | 0.975 | ||||||

| TimeR2 | 0.976 |

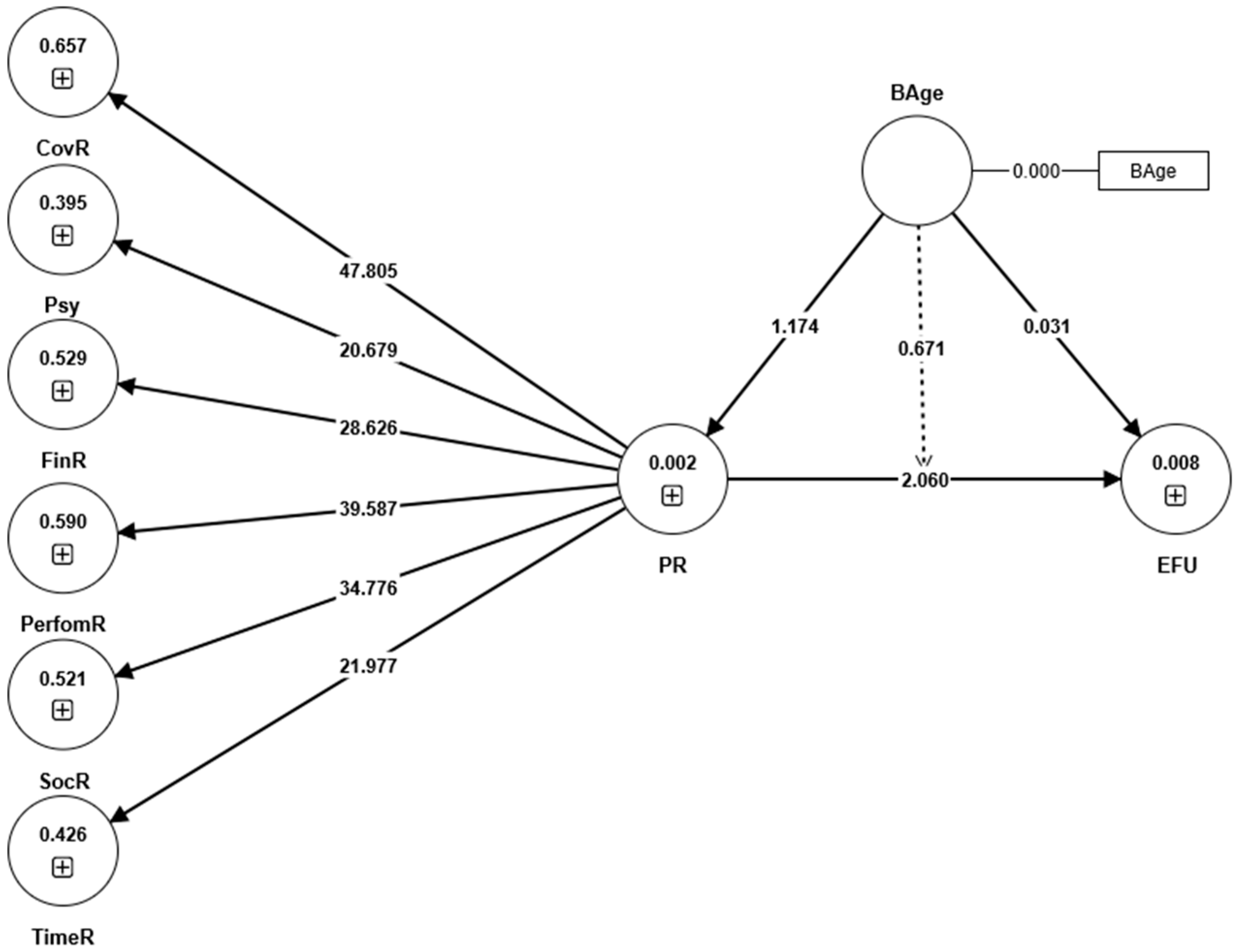

| Path | Original Sample (O) | Sample Mean (M) | STDEV | t-Statistics | Confidence Interval | Decision | |

|---|---|---|---|---|---|---|---|

| LL (2.5%) | UL (97.5%) | ||||||

| H1: PR -> EFU | −0.087 | 0.089 | 0.042 | 2.060 ** | −0.015 | 0.163 | Supported |

| H2: BAge -> EFU | −0.001 | 0.001 | 0.039 | 0.031 * | −0.076 | 0.076 | Not supported |

| H3: BAge -> PR | 0.039 | 0.039 | 0.033 | 1.174 * | −0.028 | 0.103 | Not supported |

| H4: BAge × PR -> EFU | 0.032 | 0.029 | 0.047 | 0.671 ** | −0.066 | 0.118 | Supported |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adam, N.A. Perceived Risk and External Finance Usage in Small- and Medium-Sized Enterprises: Unveiling the Moderating Influence of Business Age. J. Risk Financial Manag. 2024, 17, 150. https://doi.org/10.3390/jrfm17040150

Adam NA. Perceived Risk and External Finance Usage in Small- and Medium-Sized Enterprises: Unveiling the Moderating Influence of Business Age. Journal of Risk and Financial Management. 2024; 17(4):150. https://doi.org/10.3390/jrfm17040150

Chicago/Turabian StyleAdam, Nawal Abdalla. 2024. "Perceived Risk and External Finance Usage in Small- and Medium-Sized Enterprises: Unveiling the Moderating Influence of Business Age" Journal of Risk and Financial Management 17, no. 4: 150. https://doi.org/10.3390/jrfm17040150

APA StyleAdam, N. A. (2024). Perceived Risk and External Finance Usage in Small- and Medium-Sized Enterprises: Unveiling the Moderating Influence of Business Age. Journal of Risk and Financial Management, 17(4), 150. https://doi.org/10.3390/jrfm17040150