A News Sentiment Index to Inform International Financial Reporting Standard 9 Impairments

Abstract

1. Introduction

2. Literature Review

3. Data Sources

3.1. News Data

3.2. Economic Data

- Stock market: JSE All-Share Index (ALSI); JSE Financial 15 Index (FINI).

- Economic activity: real GDP (GDP); purchasing managers’ index (PMI).

- Credit extension: private sector credit extension (PCE).

- Compensation: employee compensation (ECOMP); personal disposable income (PDI).

- Interest rates: long-term bond yield (BOND).

- Inflation: consumer price index (CPI); producer price index (PPI).

- Exchange rate: Rand per US dollar (USDZAR).

4. Methodology

4.1. Economic Systemic Index

4.2. News Sentiment Index

4.3. Nonstationary Regression

5. Analysis

5.1. Linking News Sentiment to Credit Risk

5.2. Causal Impact of Central Bank Communications

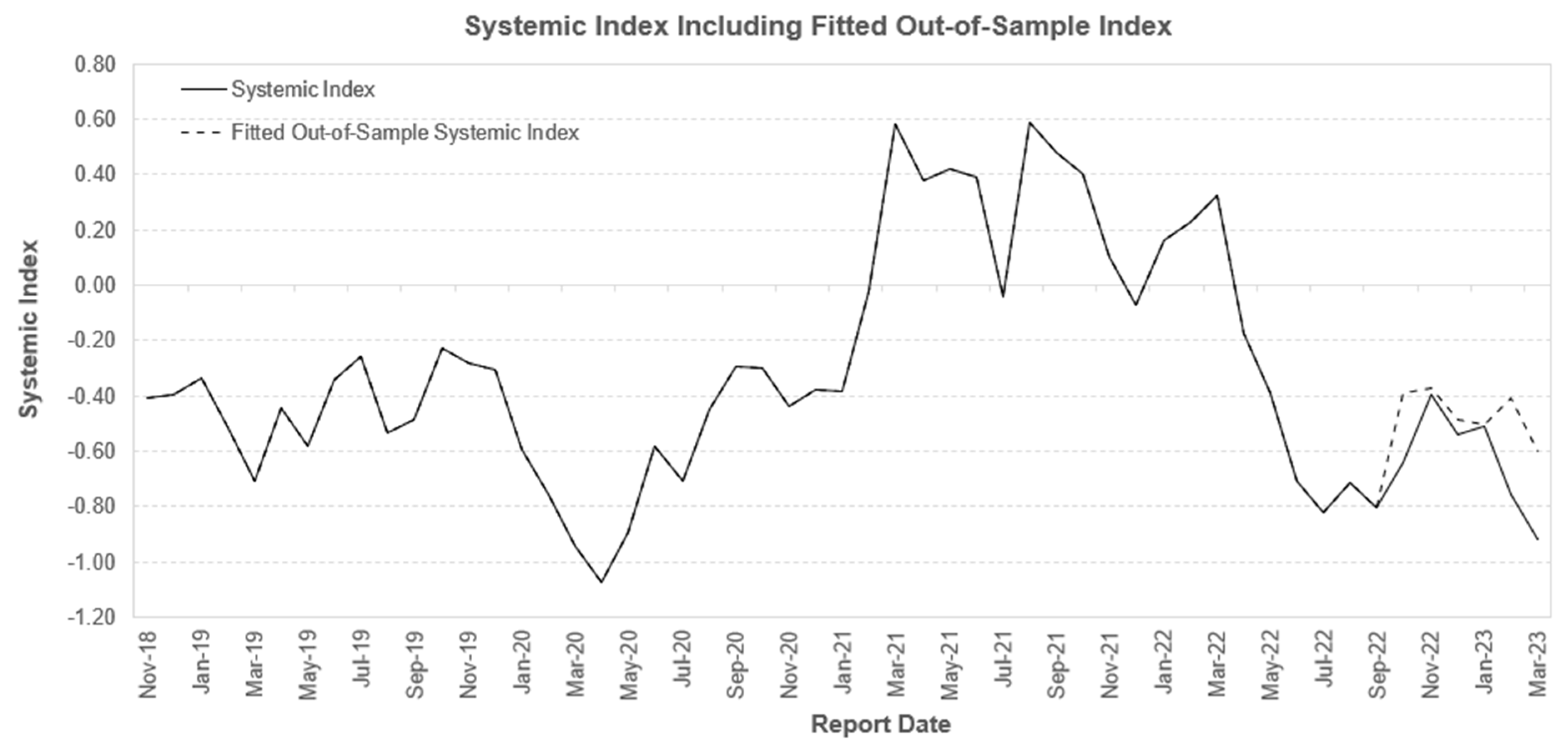

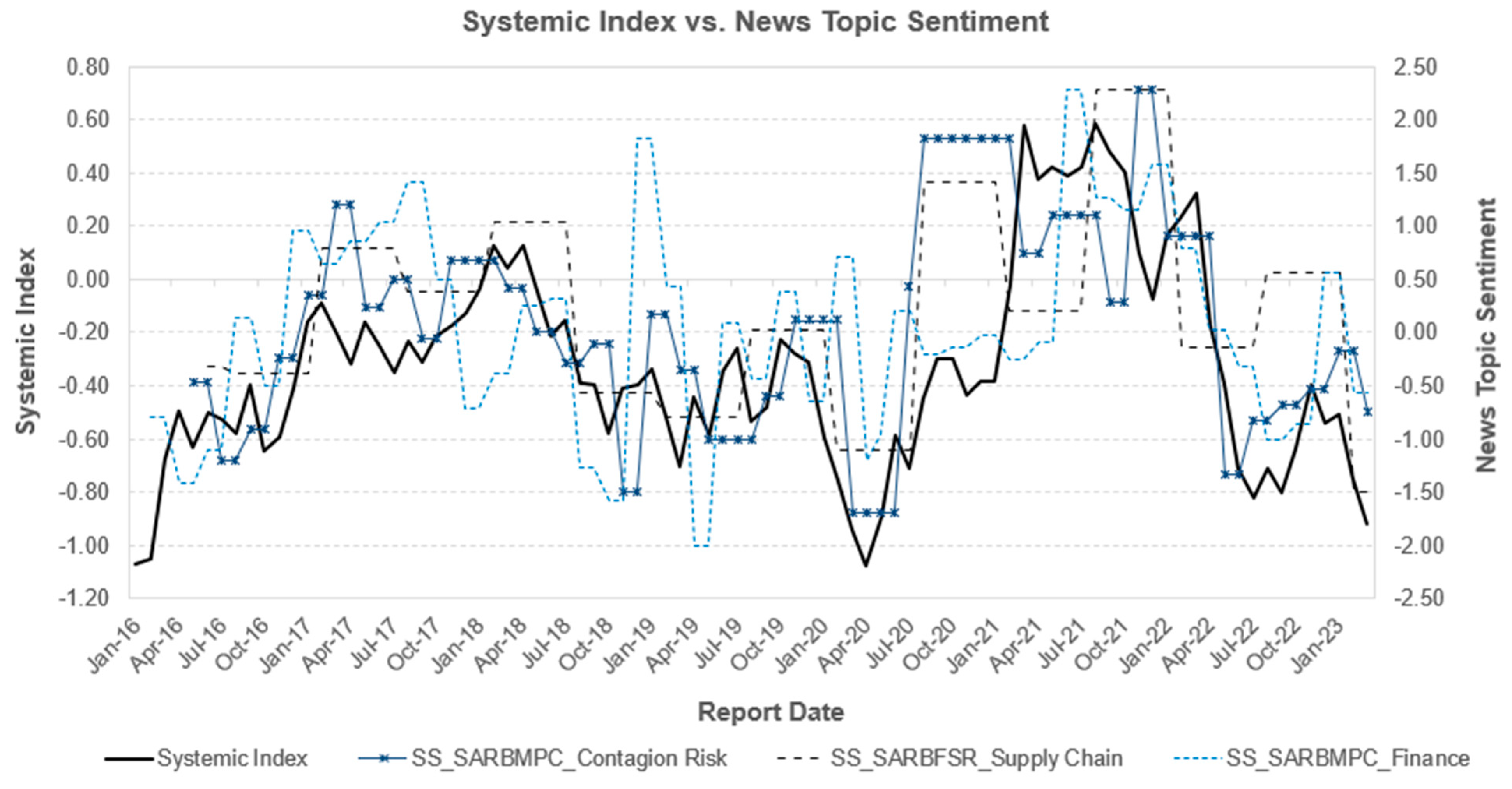

5.3. A Systemic Index and the Relationship with News

5.4. News vs. Other Business Cycle and Survey-Based Indicators

5.5. Aspect-Based Sentiment Analysis

5.6. Summary of the Results

6. Discussion

7. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Afrouzi, Hassan, Spencer Y. Kwon, Augustin Landier, Y. Ma, and David Thesmar. 2020. Overreaction in Expectations: Evidence and Theory. HEC Paris Research Paper No FIN-2021-1444. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3709548 (accessed on 27 May 2024).

- Agyei, Samuel, Zaghum Umar, Ahmed Bossman, and Tamara Teplova. 2023. Dynamic connectedness between global commodity sectors, news sentiment, and sub-Saharan African equities. Emerging Markets Review 56: 101049. [Google Scholar] [CrossRef]

- Albertazzi, Ugo, Fulvia Fringuellotti, and Steven Ongena. 2024. Fixed rate versus adjustable rate mortgages: Evidence from euro area banks. European Economic Review 161: 104643. [Google Scholar] [CrossRef]

- Araci, Dogu Tan. 2019. FinBERT: Financial Sentiment Analysis with Pre-trained Language Models. Master dissertation, Faculty of Science, University of Amsterdam, Amsterdam, The Netherlands, June. Available online: https://arxiv.org/pdf/1908.10063.pdf (accessed on 15 December 2023).

- Ardia, David, Keven Bluteau, and Kris Boudt. 2019. Questioning the news about economic growth: Sparse forecasting using thousands of news-based sentiment values. International Journal of Forecasting 35: 1370–86. [Google Scholar] [CrossRef]

- Ashwin, Julian, Eleni Kalamara, and Lorena Saiz. 2024. Nowcasting Euro area GDP with news sentiment: A tale of two crises. Journal of Applied Econometrics, 1–19. [Google Scholar] [CrossRef]

- Bae, Jihun, Chung Yu Hung, and Laurence van Lent. 2023. Mobilizing Text as Data. European Accounting Review 32: 1085–106. [Google Scholar] [CrossRef]

- Bank of England. 2023. Model Risk Management Principles for Banks. Supervisory Statement SS1/23, Prudential Regulation Authority. Available online: https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/supervisory-statement/2023/ss123.pdf (accessed on 30 April 2024).

- Barbaglia, Luca, Sergio Consoli, and Sebastiano Manzan. 2022. Forecasting with Economic News. Journal of Business & Economic Statistics 41: 708–19. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. 2020. Supplemental Note to External Audits of Banks—Audit of Expected Credit Loss. Guidelines. Basel: Bank for International Settlements, December, Available online: https://www.bis.org/bcbs/publ/d513.pdf (accessed on 1 May 2024).

- Blümke, Oliver. 2022. Multiperiod default probability forecasting. Journal of Forecasting 41: 677–96. [Google Scholar] [CrossRef]

- Boyle, Erik S. 2024. How do auditors’ use of industry norms differentially impact management evaluations of audit quality under principles-based and rules-based accounting standards? Journal of International Accounting, Auditing and Taxation 54: 100598. [Google Scholar] [CrossRef]

- Buckman, Shelby R., Adam Hale Shapiro, Moritz Sudhof, and Daniel J. Wilson. 2020. News Sentiment in the Time of COVID-19. FRBSF Economic Letter, 2020-08. Research from Federal Reserve Bank of San Francisco. Available online: https://www.frbsf.org/wp-content/uploads/el2020-08.pdf (accessed on 1 May 2024).

- Buckmann, Marcus, Andy Haldane, and Anne-Caroline Huser. 2021. Comparing Minds and Machines: Implications for FINANCIAL STABility. London: Bank of England, Staff Working Paper No. 937. Available online: https://www.bankofengland.co.uk/working-paper/2021/comparing-minds-and-machines-implications-for-financial-stability (accessed on 1 May 2024).

- Bullock, Michele. 2023. How well placed are households for interest rate increases. Economic Analysis and Policy 77: 222–30. [Google Scholar] [CrossRef]

- Campbell, Sean D., and Steven A. Sharpe. 2009. Anchoring Bias in Consensus Forecasts and Its Effect on Market Prices. Journal of Financial and Quantitative Analysis 44: 369–90. [Google Scholar] [CrossRef]

- Cao, Longbing. 2021. AI in Finance: Challenges, Techniques and Opportunities. ACM Computing Surveys 55: 1–38. [Google Scholar] [CrossRef]

- Cao, Sean Shun, Wei Jiang, Lijun Lei, and Qing Zhou. 2024. Applied AI for finance and accounting: Alternative data and opportunities. Pacific-Basin Finance Journal 84: 102307. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, Michele Costola, Jean-Charles Garibal, and Bertrand Maillet. 2022. Systemic risk and severe economic downturns: A targeted and sparse analysis. Journal of Banking & Finance 134: 106339. [Google Scholar] [CrossRef]

- Carvalho, Paulo V., José D. Curto, and Rodrigo Primor. 2022. Macroeconomic determinants of credit risk: Evidence from the Eurozone. International Journal of Finance & Economics 27: 2054–72. [Google Scholar] [CrossRef]

- Chatterjee, Somnath, and Marea Sing. 2021. Measuring Systemic Risk in South African Banks. South African Reserve Bank Working Paper Series WP/21/04. Available online: https://www.resbank.co.za/content/dam/sarb/publications/working-papers/2021/WP%202104.pdf (accessed on 1 May 2024).

- Chen, Chung-Chi, Hen-Hsen Huang, and Hsin-Hsi Chen. 2021. From Opinion Mining to Financial Argument Mining, 1st ed. Singapore: Springer Briefs in Computer Science. [Google Scholar] [CrossRef]

- Correa, Ricardo, Keshav Garud, Juan M. Londono, and Nathan Mislang. 2021. Sentiment in Central Banks’ Financial Stability Reports. Review of Finance 25: 85–120. [Google Scholar] [CrossRef]

- Cosma, Simona, Giuseppe Rimo, and Giuseppe Torluccio. 2023. Knowledge mapping of model risk in banking. International Review of Financial Analysis 89: 102800. [Google Scholar] [CrossRef]

- Dai, Peng-Fei, Xiong Xiong, and Wei-Xing Zhou. 2021. A global economic policy uncertainty index from principal component analysis. Finance Research Letters 40: 101686. [Google Scholar] [CrossRef]

- Devlin, Jacob, Ming-Wei Chang, Kenton Lee, and Kristina Toutanova. 2019. BERT: Pre-training of Deep Bidirectional Transformers for Language Understanding. Paper presented at the 2019 Conference of the North American Chapter of the Association for Computational Linguistics: Human Language Technologies, Minneapolis, MN, USA, June; Association for Computational Linguistics, Volume 1 (Long and Short Papers). pp. 4171–86. [Google Scholar]

- Du Rand, Gideon, Ruan Erasmus, Hylton Hollander, Monique Reid, and van Dawie Lill. 2021. The evolution of central bank communication as experienced by the South Africa Reserve Bank. Economic History of Developing Regions 36: 282–312. [Google Scholar] [CrossRef]

- Du, Ning, Alessandra Allini, and Marco Maffei. 2022. How do bank managers forecast the future in the shadow of the past? An examination of expected credit losses under IFRS 9. Accounting and Business Research 53: 699–722. [Google Scholar] [CrossRef]

- Engle, Robert F., and C. W. J. Granger. 1987. Co-integration and error correction: Representation, estimation, and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Engler, Alex. 2020. Can AI Model Economic Choices? The Brookings Institution. Artificial Intelligence and Emerging Technology Series. Available online: https://www.brookings.edu/research/can-ai-model-economic-choices/ (accessed on 1 May 2024).

- European Central Bank (ECB). 2011. Systemic Risk Methodologies. Financial Stability Review. June. Available online: https://www.ecb.europa.eu/pub/pdf/fsr/art/ecb.fsrart201106_03.en.pdf (accessed on 1 May 2024).

- European Systemic Risk Board. 2019. Macroprudential Approaches to Non-Performing Loans. European System of Financial Supervision. Available online: https://www.esrb.europa.eu/pub/pdf/reports/esrb.report190128_macropudentialapproachestonon-performingloans.en.pdf (accessed on 1 May 2024).

- Fallanca, Maria Grazia, Antonio Fabio Forgione, and Edoardo Otranto. 2020. Forecasting the macro determinants of bank credit quality: A non-linear perspective. Journal of Risk Finance 21: 423–43. [Google Scholar] [CrossRef]

- Fenniak, Mathieu, Matthew Stamy, Martin Thoma, Matthew Peveler, and pypdf contributors. 2024. The pypdf Library. Available online: https://pypdf.readthedocs.io/en/latest/meta/faq.html (accessed on 1 May 2023).

- Gardner, Ben, Chiara Scotti, and Clara Vega. 2021. Words Speak as Loudly as Actions: Central Bank Communication and the Response of Equity Prices to Macroeconomic Announcements; Finance and Economics Discussion Series 2021-074; Washington, DC: Board of Governors of the Federal Reserve System. [CrossRef]

- Ghirelli, Corinna, Javier J. Pérez, and Alberto Urtasun. 2019. A New Economic Policy Uncertainty Index for Spain. Economics Letters 182: 64–67. [Google Scholar] [CrossRef]

- Giacomini, Raffaella, and Barbara Rossi. 2015. Forecasting in Nonstationary Environments: What Works and What Doesn’t in Reduced-Form and Structural Models. Annual Review of Economics 7: 207–29. [Google Scholar] [CrossRef]

- Glimcher, Paul W., Colin F. Camerer, Ernst Fehr, and Russell A. Poldrack. 2009. Chapter 1—Introduction: A Brief History of Neuroeconomics. In Neuroeconomics: Decision Making and the Brain. Edited by Paul W. Glimcher, Colin F. Camerer, Ernst Fehr and Russell A. Poldrack. London: Elsevier, pp. 1–12. [Google Scholar]

- Gubareva, M. 2020. IFRS 9 Compliant Economic Adjustment of Expected Credit Loss Modeling. Journal of Credit Risk 16: 29–66. Available online: https://ssrn.com/abstract=3769164 (accessed on 1 May 2024). [CrossRef]

- Gumata, Nombulelo, and Eliphas Ndou. 2021. How Does a Tight Monetary Policy Shock Affect the Household Sector Intermediation? Evidence from Households’ Flow-of-Funds Data. In Achieving Price, Financial and Macro-Economic Stability in South Africa. Cham: Palgrave Macmillan. [Google Scholar] [CrossRef]

- Gupta, Shelley, Archana Singh, and Vivek Kumar. 2023. Emoji, Text, and Sentiment Polarity Detection Using Natural Language Processing. Information 14: 222. [Google Scholar] [CrossRef]

- Gwatidzo, Tendai, and Witness Simbanegavi. 2024. Financial Inclusion and Banking Sector Competition in South Africa. Working Paper Series, WP/24/08; Pretoria: South Africa Reserve Bank, April 16, Available online: https://www.resbank.co.za/content/dam/sarb/publications/working-papers/2024/financial-inclusion-and-banking-sector-competition-in-south-africa.pdf (accessed on 1 June 2024).

- Hanley, Kathleen Weiss, and Gerard Hoberg. 2019. Dynamic Interpretation of Emerging Risks in the Financial Sector. The Review of Financial Studies 32: 4543–603. [Google Scholar] [CrossRef]

- Hartwig, Benny, Christoph Meinerding, and Yves S. Schüler. 2021. Identifying indicators of systemic risk. Journal of International Economics 132: 103512. [Google Scholar] [CrossRef]

- Hassani, Hossein, Christina Beneki, Stephan Unger, Maedeh Taj Mazinani, and Mohammad Reza Yeganegi. 2020. Text Mining in Big Data Analytics. Big Data and Cognitive Computing 4: 1. [Google Scholar] [CrossRef]

- Huang, Allen H., Hui Wang, and Yi Yang. 2023. FinBERT: A large language model for extracting information from financial text. Contemporary Accounting Research 40: 806–41. [Google Scholar] [CrossRef]

- Hyndman, Rob J., and George Athanasopoulos. 2021. Forecasting: Principles and Practice, 3rd ed. Melbourne: OTexts. Available online: https://otexts.com/fpp3/ (accessed on 1 May 2024).

- International Accounting Standards Board. 2014. IFRS 9: Financial Instruments. Available online: https://www.ifrs.org/content/dam/ifrs/publications/pdf-standards/english/2022/issued/part-a/ifrs-9-financial-instruments.pdf?bypass=on (accessed on 30 April 2024).

- International Auditing and Assurance Standards Board. 2018. ISA 540 (Revised) and Conforming and Consequential Amendments to Other International Standards Arising from ISA 540 (Revised). Available online: https://www.ifac.org/_flysystem/azure-private/publications/files/ISA-540-Revised-and-Conforming-Amendments_0.pdf (accessed on 1 May 2024).

- Kohlhas, Alexandre N., and Ansgar Walther. 2021. Asymmetric Attention. American Economic Review 111: 2879–925. [Google Scholar] [CrossRef]

- Kou, Gang, Xiangrui Chao, Yi Peng, Fawaz E. Alsaadi, and Enrique Herrera-Viedma. 2019. Machine learning methods for systemic risk analysis in financial sectors. Technological and Economic Development of Economy 25: 716–42. [Google Scholar] [CrossRef]

- Kryvtsov, Oleksiy, and Luba Petersen. 2021. Central Bank Communication That Works: Lessons from Lab Experiments. Journal of Monetary Economics 117: 760–80. [Google Scholar] [CrossRef]

- Kulbhaskar, Anamika Kumar, and Sowmya Subramaniam. 2023. Breaking news headlines: Impact on trading activity in the cryptocurrency market. Economic Modelling 126: 106397. [Google Scholar] [CrossRef]

- Lee, Younghwan, and Beomseok Seo. 2023. Extracting Economic Sentiment from News Articles: The Case of Korea, IFC Bulletins chapters. In Data Science in Central Banking: Applications and Tools. Basel: Bank for International Settlements, vol. 59, Available online: https://www.bis.org/ifc/publ/ifcb59_37.pdf (accessed on 1 May 2024).

- Li, Hui-Min, Xue-Chun Wang, Xiao-Fan Zhao, and Ye Qi. 2021. Understanding systemic risk induced by climate change. Advances in Climate Change Research 12: 384–94. [Google Scholar] [CrossRef]

- Loewenstein, George, Scott Rick, and Jonathan D. Cohen. 2008. Neuroeconomics. Annual Review of Psychology 59: 647–72. [Google Scholar] [CrossRef] [PubMed]

- Macaulay, Alistair, and Wenting Song. 2023. Narrative-Driven Fluctuations in Sentiment: Evidence Linking Traditional and Social Media. Staff Working Paper 2023-23. Ottawa: Bank of Canada. [Google Scholar] [CrossRef]

- Mahlendorf, Matthias D., Melissa A. Martin, and David Smith. 2023. Innovative Data—Use-cases in Management Accounting Research and Practice. European Accounting Review 32: 547–76. [Google Scholar] [CrossRef]

- Martinelli, Fabio, Francesco Mercaldo, Domenico Raucci, and Antonella Santone. 2020. Predicting Probability of Default under IFRS 9 through Data Mining Techniques. In Web, Artificial Intelligence and Network Applications. Edited by Leonard Barolli, Flora Amato, Francesco Moscato, Tomoya Enokido and Makoto Takizawa. WAINA 2020. Advances in Intelligent Systems and Computing. Cham: Springer, vol. 1150. [Google Scholar] [CrossRef]

- Mäkelä, Maria, Samuli Björninen, Laura Karttunen, Matias Nurminen, Juha Raipola, and Tytti Rantanen. 2021. Dangers of Narrative: A Critical Approach to Narratives of Personal Experience in Contemporary Story Economy. Narrative 29: 139–59. [Google Scholar] [CrossRef]

- McCaul, Elizabeth, and Stefan Walter. 2023. Overlays and In-Model Adjustments: Identifying Best Practices for Capturing Novel Risks. The Supervision Blog. Frankfurt am Main: European Central Bank. Available online: https://www.bankingsupervision.europa.eu/press/blog/2023/html/ssm.blog230526~29af0452d6.en.html (accessed on 1 May 2024).

- Montagna, Maria, Gabriele Torri, and Giovanni Covi. 2021. On the Origin of Systemic Risk. Staff Working Paper No. 906. London: Bank of England. Available online: https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2021/on-the-origin-of-systemic-risk.pdf (accessed on 1 May 2024).

- Nguyen, Kim, and Gianni La Cava. 2020. Start Spreading the News: News Sentiment and Economic Activity in Australia; Research Discussion Paper—RDP 2020-08. Sydney: Reserve Bank of Australia. Available online: https://www.rba.gov.au/publications/rdp/2020/2020-08/full.html (accessed on 1 May 2024).

- Nyati, Malibongwe Cyprian, Paul-Francois Muzindutsi, and Christian Kakese Tipoy. 2023. Macroprudential and Monetary Policy Interactions and Coordination in South Africa: Evidence from Business and Financial Cycle Synchronisation. Economies 11: 272. [Google Scholar] [CrossRef]

- Nyman, Rickard, Sujit Kapadia, and David Tuckett. 2021. News and narratives in financial systems: Exploiting big data for systemic risk assessment. Journal of Economic Dynamics and Control 27: 104119. [Google Scholar] [CrossRef]

- Oshikawa, Ray, Jing Qian, and William Yang Wang. 2018. A Survey on Natural Language Processing for Fake News Detection. Paper presented at the 12th Language Resources and Evaluation Conference (LREC 2020), Marseille, France, May 11–16; pp. 6086–93. [Google Scholar] [CrossRef]

- Pan, Wenrong, Tao Xie, Zhuwang Wang, and Lisha Ma. 2022. Digital economy: An innovation driver for total factor productivity. Journal of Business Research 139: 303–311. [Google Scholar] [CrossRef]

- Peytcheva, Marietta, Arnold M. Wright, and Barbara Majoor. 2014. The Impact of Principles-Based versus Rules-Based Accounting Standards on Auditors’ Motivations and Evidence Demands. Behavioral Research in Accounting 26: 51–72. [Google Scholar] [CrossRef]

- PWC. 2024. South Africa—Major Banks Analysis. March. Available online: https://www.pwc.co.za/en/publications/major-banks-analysis.html (accessed on 15 June 2024).

- Python Software Foundation. 2024. Python Language Reference, Version 3.9.7. Available online: http://www.python.org (accessed on 1 May 2024).

- Raghavendra, Sujay. 2021. Introduction to Selenium. In Python Testing with Selenium. Berkeley: Apress. [Google Scholar] [CrossRef]

- Ranta, Mikko, and Mika Ylinen. 2023. Employee benefits and company performance: Evidence from a high-dimensional machine learning model. Management Accounting Research, 100876. [Google Scholar] [CrossRef]

- Raza, Shahid, Sun Baiqing, Pwint Kay-Khine, and Muhammad Ali Kemal. 2023. Uncovering the Effect of News Signals on Daily Stock Market Performance: An Econometric Analysis. International Journal of Financial Studies 11: 99. [Google Scholar] [CrossRef]

- Richardson, Leonard. 2007. Beautiful Soup Documentation. April. Available online: https://beautiful-soup-4.readthedocs.io/en/latest/ (accessed on 1 May 2023).

- Rooplall, Videshree, and Siphokazi Nkosi. 2021. The South African Reserve Bank’s Systemic Risk Assessment and Macroprudential Policy Frameworks for Financial Stability. Pretoria: Financial Stability Department. South African Reserve Bank, June, Available online: https://www.resbank.co.za/en/home/what-we-do/financial-stability (accessed on 1 May 2024).

- Rossi, Barbara. 2021. Forecasting in the Presence of Instabilities: How We Know Whether Models Predict Well and How to Improve Them. Journal of Economic Literature 59: 1135–90. [Google Scholar] [CrossRef]

- Rönnqvist, Samuel, and Peter Sarlin. 2017. Bank distress in the news: Describing events through deep learning. Neurocomputing 264: 57–70. [Google Scholar] [CrossRef]

- Schutte, Willem Daniel, Tanja Verster, Derek Doody, Helgard Raubenheimer, Peet J. Coetzee, and David McMillan. 2020. A proposed benchmark model using a modularised approach to calculate IFRS 9 expected credit loss. Cogent Economics & Finance 8: 1735681. [Google Scholar] [CrossRef]

- Segawa, Arnold. 2021. Sentimental Outlook for the Monetary Policies of South African Reserve Bank. International Journal of Finance & Banking Studies 10: 37–56. [Google Scholar] [CrossRef]

- Seki, Kazuhiro, Yusuke Ikuta, and Yoichi Matsubayashi. 2022. News-based business sentiment and its properties as an economic index. Information Processing & Management 59: 102795. [Google Scholar] [CrossRef]

- Shapiro, Adam Hale, Moritz Sudhof, and Daniel J. Wilson. 2022. Measuring news sentiment. Journal of Econometrics 228: 221–43. [Google Scholar] [CrossRef]

- Shiller, Robert J. 2020. Narrative Economics: How Stories Go Viral and Drive Major Economic Events. Princeton: Princeton University Press. [Google Scholar]

- Stander, Yolanda S. 2023. The Governance and Disclosure of IFRS 9 Economic Scenarios. Journal of Risk and Financial Management 16: 47. [Google Scholar] [CrossRef]

- Tadphale, Anushkla, Haripriya Saraswat, Omkar Sonawane, and P. R. Deshmukh. 2023. Impact of News Sentiment on Foreign Exchange Rate Prediction. Paper presented at the 2023 3rd International Conference on Intelligent Technologies (CONIT), Hubli, India, June 23–25; pp. 1–8. [Google Scholar] [CrossRef]

- Tank, Ann K., and Anne M. Farrell. 2022. Is Neuroaccounting Taking a Place on the Stage? A Review of the Influence of Neuroscience on Accounting Research. European Accounting Review 31: 173–207. [Google Scholar] [CrossRef]

- Vicari, Mattia, and Mauro Gaspari. 2021. Analysis of news sentiments using natural language processing and deep learning. AI & Society 36: 931–37. [Google Scholar] [CrossRef]

- Vinson, Jeremy M., Byron J. Pike, Lawrence Chui, and Mingjun Zhou. 2024. The Influence of Audit Evidence Framing on Auditors’ Judgment. Behavioral Research in Accounting 36: 105–20. [Google Scholar] [CrossRef]

- William, P., Anurag Shrivastava, Premanand S. Chauhan, Mudasir Raja, Sudhir B. Ojha, and Keshav Kumar. 2023. Natural Language Processing Implementation for Sentiment Analysis on Tweets. In Mobile Radio Communications and 5G Networks. Edited by Nikhil Marriwala, C.C. Tripathi, Shruti Jain and Dinesh Kumar. Lecture Notes in Networks and Systems. Singapore: Springer, vol. 588. [Google Scholar] [CrossRef]

- Xing, Kai, and Xiaoguang Yang. 2020. Predicting default rates by capturing critical transitions in the macroeconomic system. Finance Research Letters 32: 101107. [Google Scholar] [CrossRef]

- Yang, Bill Huajian. 2017. Forward ordinal probability models for point-in-time probability of default term structure: Methodologies and implementations for IFRS 9 expected credit loss estimation and CCAR stress testing. Journal of Risk Model Validation 11: 1–18. [Google Scholar] [CrossRef]

- Zaremba, Adam, and Ender Demir. 2023. ChatGPT: Unlocking the Future of NLP in Finance (January 13, 2023). Modern Finance 1: 93–98. [Google Scholar] [CrossRef]

- Zhang, Chanyuan, Soohyun Cho, and Miklos Vasarhelyi. 2022. Explainable Artificial Intelligence (XAI) in auditing. International Journal of Accounting Information Systems 46: 100572. [Google Scholar] [CrossRef]

| Source | Description | Frequency | Date Range | Online Source |

|---|---|---|---|---|

| BIS | Code = SS_BISER; Annual Economic Report | Annual | 2005 to 2023 | https://www.bis.org/ |

| BIS | Code = SS_BISSP; Central banker’s speeches—South Africa | No set frequency | 2012 to 2023 | https://www.bis.org/ |

| Financial Mail | Code = SS_FM; Financial views and news (South Africa) | Mid-Month | 2013 to 2023 | Newsbank |

| Financial Times | Code = SS_FT; Financial views and news (South Africa), headlines | No set frequency | 2010 to 2023 | https://www.ft.com/south-africa (accessed on 16 April 2024) |

| SARB | Code = SS_SARBFSR; Financial Stability Review | Quarterly | 2004 to 2023 | https://www.resbank.co.za/ |

| SARB | Code = SS_SARBMPC; Monetary Policy Committee Statement | No set frequency | 2013 to 2023 | https://www.resbank.co.za/ |

| SARB | Code = SS_SARBQB; Quarterly Bulletin | Quarterly | 2008 to 2023 | https://www.resbank.co.za/ |

| WEF | Code = SS_WEF; Global Risks Report | Annual | 2006 to 2023 | https://www.weforum.org/ |

| Category | Code | Description | Source | Data Frequency |

|---|---|---|---|---|

| Stock Market | ALSI | JSE All-Share Index. Closing price. Year-on-year. | EquityRT | Daily |

| Stock Market | FINI | JSE Financial 15 Index. Closing price. Year-on-year. | EquityRT | Daily |

| Economic Activity | GDP | Gross domestic product at market prices. Constant 2010 prices. Seasonally adjusted. Code: KBP6006D. Year-on-year. | SARB | Quarterly |

| Economic Activity | PMI | Absa Purchasing Managers’ Index. Survey-based. | BER | Monthly |

| Credit Extension | PCE | All monetary institutions: total credit extended to the private sector. KBP1347M. Year-on-year. | SARB | Monthly |

| Compensation | ECOMP | Compensation of employees at current prices: Total. Code: KBP6240L. Year-on-year. | SARB | Quarterly |

| Compensation | PDI | Disposable income of households. Current prices. Seasonally adjusted. Code: KBP6246L. Year-on-year. | SARB | Quarterly |

| Interest Rates | BOND | Yield on loan stock traded on the stock exchange for government bonds 10 years and over. Code: KBP2003M. Annual moves. | SARB | Monthly |

| Inflation | CPI | Consumer price index. Headline CPI Year-on-year rates; Code: P0141. | Stats SA | Monthly |

| Inflation | PPI | Producer price index. Final manufactured goods. December 2016 = 100. Code: P0142.1. Year-on-year. | Stats SA | Monthly |

| Exchange Rate | USDZAR | Rand per US Dollar. Year-on-year. | EquityRT | Daily |

| Confidence Index | BCI | Composite business confidence index. Survey-based. | BER | Quarterly |

| Confidence Index | CCI | Consumer confidence index. Survey-based. | BER | Quarterly |

| Confidence Index | SARBLEAD | SARB business confidence indicator–leading. Year-on-year. | SARB | Monthly |

| Confidence Index | SARBCOIN | SARB business confidence indicator–coincident. Year-on-year. | SARB | Monthly |

| Confidence Index | SARBLAG | SARB business confidence indicator–lagging. Year-on-year. | SARB | Monthly |

| Asset Class: Corporate | ||||||||

| SA Bank | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| A | 1.01 | 1.94 | 1.87 | 2.69 | 1.9 | 2.8 | 1.86 | 1.19 |

| B | 0.96 | 0.89 | 0.84 | 0.75 | 0.79 | 0.93 | ||

| C | 0.85 | 0.93 | 0.8 | 0.89 | 0.86 | 0.76 | 0.92 | 0.94 |

| D | 1.52 | 1.09 | 1.18 | 2.22 | 2.33 | 1.74 | 1.99 | 1.9 |

| Average PD | 1.13 | 1.32 | 1.20 | 1.67 | 1.48 | 1.51 | 1.39 | 1.24 |

| LN Change in PD | 15.8 | −9.3 | 33.0 | −12.1 | 2.0 | −8.4 | −11.4 | |

| Asset Class: Mortgages | ||||||||

| SA Bank | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| A | 3.53 | 3.28 | 3.07 | 3.26 | 3.19 | 3.33 | 3.46 | 3.88 |

| B | 3.28 | 3.33 | 3.44 | 3.06 | 3.03 | 2.79 | ||

| C | 3.38 | 3.26 | 3.02 | 2.53 | 2.63 | 2.58 | 2.79 | 3.11 |

| D | 4.97 | 5.34 | 5.36 | 6.33 | 7.42 | 7.67 | 6.98 | 7.29 |

| Average PD | 3.96 | 3.96 | 3.68 | 3.86 | 4.17 | 4.16 | 4.07 | 4.27 |

| LN Change in PD | 0.0 | −7.3 | 4.8 | 7.7 | −0.2 | −2.3 | 4.9 | |

| Asset Class: Revolving Retail | ||||||||

| SA Bank | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| A | 7.28 | 7.18 | 7.23 | 7.57 | 7.34 | 7.43 | 7.65 | 8.36 |

| B | 4.21 | 4.38 | 4.32 | 4 | 4.13 | 3.58 | ||

| C | 4.78 | 4.76 | 4.9 | 5 | 5.0 | 4.92 | 5.33 | 5.33 |

| D | 5.94 | 6.05 | 5.59 | 8.35 | 9.33 | 9.58 | 8.86 | 9.1 |

| Average PD | 6.00 | 6.00 | 5.48 | 6.33 | 6.50 | 6.48 | 6.49 | 6.59 |

| LN Change in PD | −0.1 | −9.0 | 14.3 | 2.7 | −0.2 | 0.2 | 1.5 | |

| Asset Class: SME Retail | ||||||||

| SA Bank | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| A | 3.83 | 3.89 | 3.66 | 4.56 | 3.68 | 3.71 | 3.84 | 3.94 |

| B | 3.48 | 3.22 | 3.75 | 3.58 | 2.96 | 3.48 | ||

| C | 2.93 | 2.95 | 3.03 | 2.73 | 3.17 | 3.1 | 2.84 | 1.28 |

| D | 6.25 | 7.41 | 7.16 | 8.2 | 13.64 | 11.72 | 9.08 | 8.18 |

| Average PD | 4.34 | 4.75 | 4.33 | 4.68 | 6.06 | 5.53 | 4.68 | 4.22 |

| LN Change in PD | 9.1 | −9.2 | 7.7 | 25.9 | −9.2 | −16.6 | −10.3 | |

| Eigenvector Squared | ALSI | FINI | PDI | ECOMP | PCE | PPI | CPI | BOND | USD ZAR | GDP | PMI | Eigenvalues | % Variance Explained |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 9% | 32% | 7% | 3% | 1% | 16% | 7% | 3% | 6% | 8% | 10% | 2.54 | 40% | |

| 8% | 1% | 9% | 1% | 9% | 17% | 16% | 16% | 16% | 3% | 4% | 1.87 | 29% | |

| 0% | 1% | 3% | 5% | 1% | 3% | 0% | 13% | 7% | 5% | 61% | 0.97 | 15% | |

| 19% | 19% | 0% | 1% | 0% | 0% | 21% | 12% | 18% | 3% | 7% | 0.29 | 5% | |

| 14% | 1% | 0% | 33% | 0% | 14% | 2% | 0% | 8% | 17% | 11% | 0.20 | 3% | |

| 16% | 0% | 6% | 27% | 0% | 0% | 9% | 6% | 15% | 19% | 1% | 0.16 | 3% | |

| 12% | 4% | 5% | 13% | 0% | 11% | 1% | 35% | 17% | 0% | 0% | 0.16 | 2% | |

| 10% | 11% | 45% | 4% | 0% | 6% | 0% | 11% | 11% | 1% | 2% | 0.10 | 2% | |

| 1% | 1% | 0% | 0% | 86% | 2% | 0% | 2% | 1% | 2% | 4% | 0.08 | 1% | |

| 9% | 29% | 10% | 1% | 1% | 15% | 5% | 1% | 1% | 27% | 0% | 0.05 | 1% | |

| 3% | 0% | 14% | 12% | 0% | 16% | 38% | 0% | 1% | 15% | 0% | 0.01 | 0% |

| Eigenvectors | SS_FM | SS_FT | SS_SARBFSR | SS_SARBMPC | Eigenvalues | % Variance Explained |

|---|---|---|---|---|---|---|

| −0.03 | 0.44 | 0.65 | 0.62 | 1.64 | 44% | |

| −0.91 | −0.34 | 0.22 | −0.04 | 0.98 | 26% | |

| 0.35 | −0.83 | 0.24 | 0.36 | 0.72 | 19% | |

| −0.20 | 0.02 | −0.69 | 0.70 | 0.41 | 11% |

| Symbol | Description | Lag (Months) | Regression Coefficient | ADF Test Statistic | ADF p-Value |

|---|---|---|---|---|---|

| 0 | −1.3 | 18.0% | |||

| 3 | 0.21 * | −1.5 | 11.5% | ||

| BCI | 0 | 0.15 ** | −1.1 | 24.0% | |

| SARBLEAD | 0 | 0.10 * | −1.4 | 15.8% | |

| intercept | −0.25 * | ||||

| Residuals | −3.5 | <0.01% |

| Symbol | Description | Lag (Months) | Regression Coefficient | ADF Test Statistic | ADF p-Value |

|---|---|---|---|---|---|

| 0 | −1.3 | 18.0% | |||

| 3 | 0.16 * | −1.5 | 11.5% | ||

| SS_BISER | 0 | 0.12 * | −1.9 | 5.9% | |

| BCI | 0 | 0.07 *** | −1.1 | 24.0% | |

| SARBLEAD | 0 | 0.17 * | −1.4 | 15.8% | |

| intercept | −0.34 * | ||||

| Residuals | −4.35 | <0.01% |

| Topic | Keyword |

|---|---|

| economic growth | gdp, pmi, economic growth, recession, gross domestic product |

| currency | currency, currencies, usd, zar, rand, forex, foreign exchange, fx, exchange rate, crypto |

| supply chain | supply chain, freight, logistics, import, export, deglobal, logistics |

| inflation | inflation, stagflation, disinflation, consumer price index, cpi, producer price index, ppi |

| AI | chatgpt, chatbot, artificial intelligence, ai, robot, machine learning, automat, algo, cyber |

| electricity | load-shed, loadshed, solar, renewable, electricity, eskom, coal, karpowership, energy, power, diesel |

| sovereign | government, ramaphosa, zuma, president, sovereign downgrade, elections, strike, war, sanction, russia, state capture, fiscal, credit rating, risk premium, protest action, unrest, labour cost |

| climate | climate, weather, natural disaster, water, storm, drought, flood, global warming, esg, green economy, cop |

| consumption | retail, wage, consumption, job, employ, disposable income, compensation, salary, consumer, income, demand, stagflation |

| property | real estate, property, house price, housing, mall, tenant, vacancy rate, construction |

| tourism | aviation, tourism, hotel, tourist, airplane, flight, leisure, travel, hospitality |

| interest rate | cost of borrowing, interest rate, repo rate, monetary policy, borrowing cost, bond, reserve bank, policy rate, lending rate, cost of borrowing |

| stock market | corporate, jse, alsi, equity, stocks, stock price, company, earnings, shares, shareholder |

| finance | bank, fintech, crypto, fatf, greylist, grey list, insurance, hedge fund, asset manager, financial institution |

| commodity | manufacture, pmi, commodity, mining, gold, diamond, oil, petrol |

| pandemic | corona, virus, pandemic, covid, lockdown, vaccination, vaccinate |

| healthcare | nhi, health insurance, disease, illness, hospital, healthcare, nurse, doctor |

| contagion risk | global recession, contagion, usa, china, trade war, russia, ukraine, war |

| agriculture | agriculture, agricultural, farm, food |

| News Source: | SS_SARBFSR | SS_SARBMPC | SS_FM | |||

|---|---|---|---|---|---|---|

| Topic | Lag (Months) | Rank Correlation | Lag (Months) | Rank Correlation | Lag (Months) | Rank Correlation |

| Economic Growth | 0 | 45% | 2 | 33% | 0 | 12% |

| Currency | 2 | −40% | 12 | −10% | 10 | −41% |

| Supply Chain | 5 | 59% | 2 | 29% | 0 | 6% |

| Inflation | 12 | −13% | 12 | −9% | 4 | −38% |

| AI | 8 | 28% | 0 | −19% | 10 | 29% |

| Electricity | 0 | 3% | 1 | 17% | 1 | 16% |

| Sovereign | 2 | 43% | 12 | 17% | 10 | 12% |

| Climate | 0 | 28% | 3 | 25% | 6 | 37% |

| Consumption | 0 | 41% | 0 | 31% | 0 | 13% |

| Property | 12 | −7% | 9 | 15% | 1 | 0% |

| Tourism | 0 | 20% | 0 | 26% | 9 | 26% |

| Interest Rate | 12 | −24% | 12 | −6% | 0 | 7% |

| Stock Market | 0 | 16% | 12 | 40% | 0 | 25% |

| Finance | 3 | 20% | 1 | 51% | 6 | 24% |

| Commodity | 0 | 42% | 9 | 41% | 0 | 11% |

| Pandemic | 0 | 1% | 7 | 25% | 0 | 9% |

| Healthcare | 0 | 3% | 11 | 0% | 12 | 7% |

| Contagion Risk | 0 | 40% | 4 | 67% | 0 | −5% |

| Agriculture | 0 | 20% | 3 | 49% | 4 | 12% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stander, Y.S. A News Sentiment Index to Inform International Financial Reporting Standard 9 Impairments. J. Risk Financial Manag. 2024, 17, 282. https://doi.org/10.3390/jrfm17070282

Stander YS. A News Sentiment Index to Inform International Financial Reporting Standard 9 Impairments. Journal of Risk and Financial Management. 2024; 17(7):282. https://doi.org/10.3390/jrfm17070282

Chicago/Turabian StyleStander, Yolanda S. 2024. "A News Sentiment Index to Inform International Financial Reporting Standard 9 Impairments" Journal of Risk and Financial Management 17, no. 7: 282. https://doi.org/10.3390/jrfm17070282

APA StyleStander, Y. S. (2024). A News Sentiment Index to Inform International Financial Reporting Standard 9 Impairments. Journal of Risk and Financial Management, 17(7), 282. https://doi.org/10.3390/jrfm17070282