Volatility Persistence and Spillover Effects of Indian Market in the Global Economy: A Pre- and Post-Pandemic Analysis Using VAR-BEKK-GARCH Model

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Models

3.1.1. Vector Autoregressive Model (VAR)

- Yi,t is the return of the ith stock index at time t.

- ci is the intercept for the ith equation.

- ϕij,1 ϕij,2 are the coefficients for the first and second lags of the jth index return in the ith equation. The coefficients (ϕij,1 ϕij,2) on the lagged values of other indices capture the interdependencies between the indices. For example, ϕIndia,Brazil,1 and ϕIndia,Brazil,2 measure the impact of the first and second lags of Brazil’s returns on India’s returns.

- ϵi,t is the error term for the ith equation.

3.1.2. BEKK-GARCH Model

- The conditional mean equation for each variable i:

- Conditional variance equation for each variable i:

- yt,i is the ith variable at time t.

- μi is the mean of the ith variable.

- ϕij and θik are the autoregressive and moving average coefficients respectively.

- εt−k is the residual at time t − k.

- Ht is the conditional covariance matrix at time t.

- C0 is a constant matrix.

- Ai and Bi are coefficient matrices.

- εt is the vector of standardised residual at time t.

- p and q are the lag orders for the autoregressive and moving average parts, respectively.

- is a constant term related to the multivariate normal distribution and the dimension n of the time series data.

- Ht is the conditional covariance matrix at time t.

- εt is the vector of residuals at time t.

- θ represents the parameters of the model to be estimated.

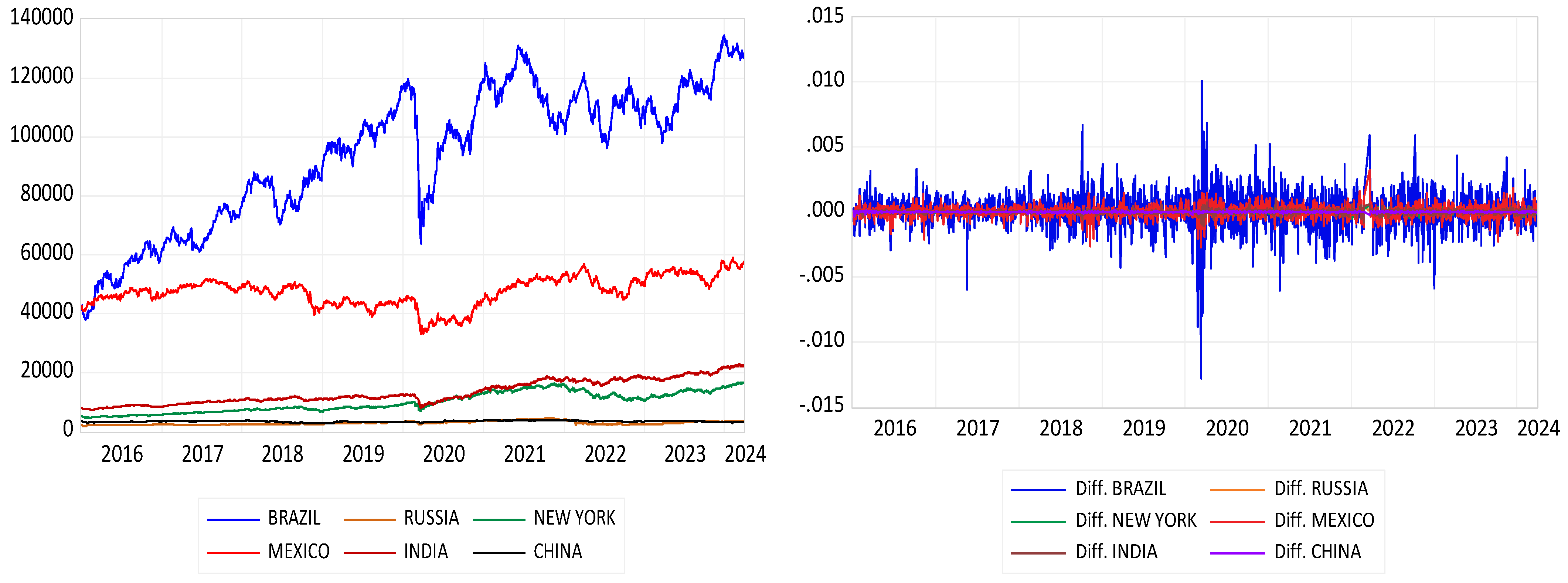

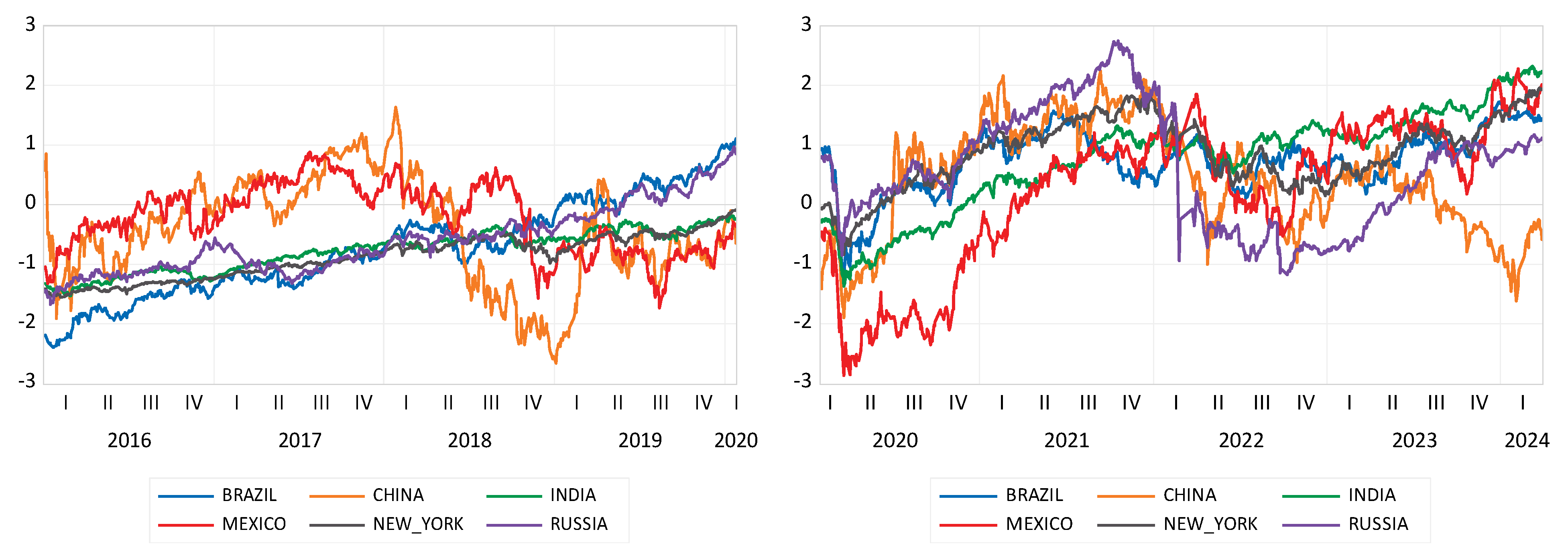

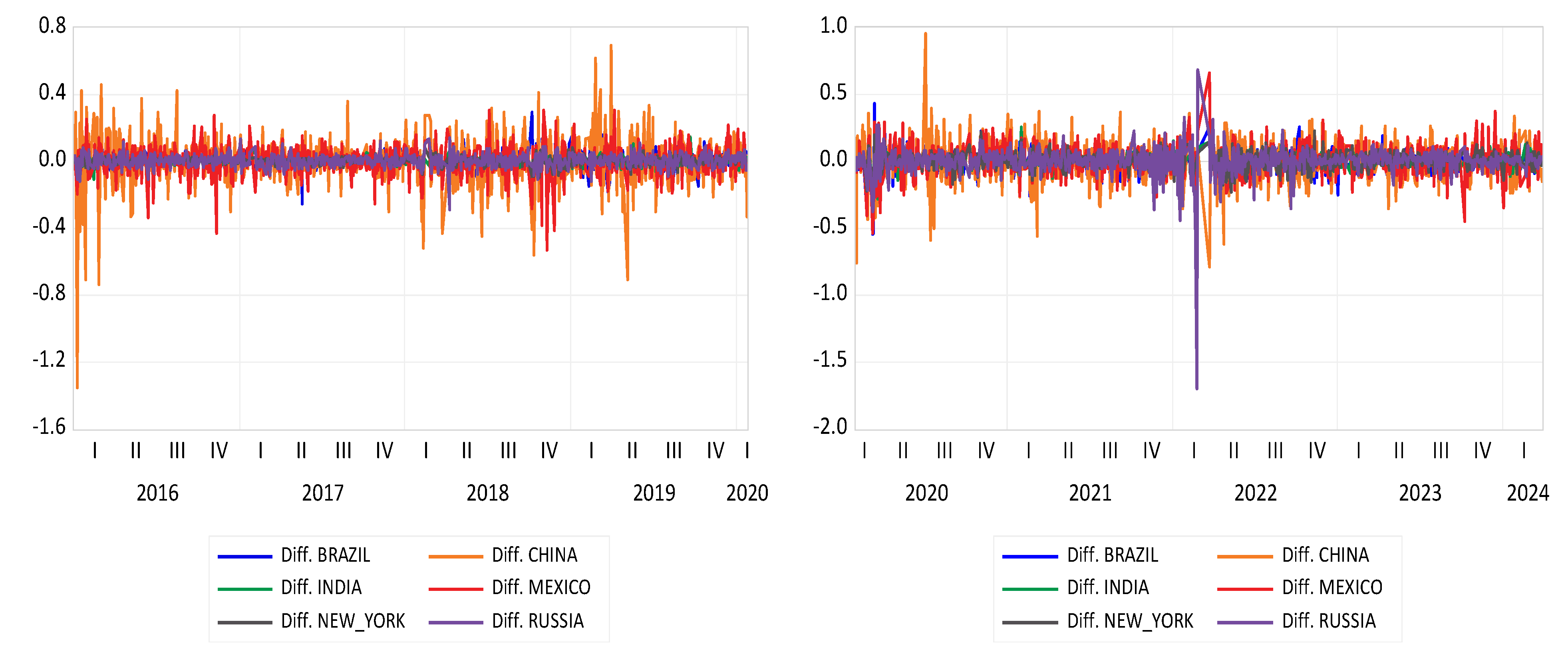

3.2. Data

4. Findings

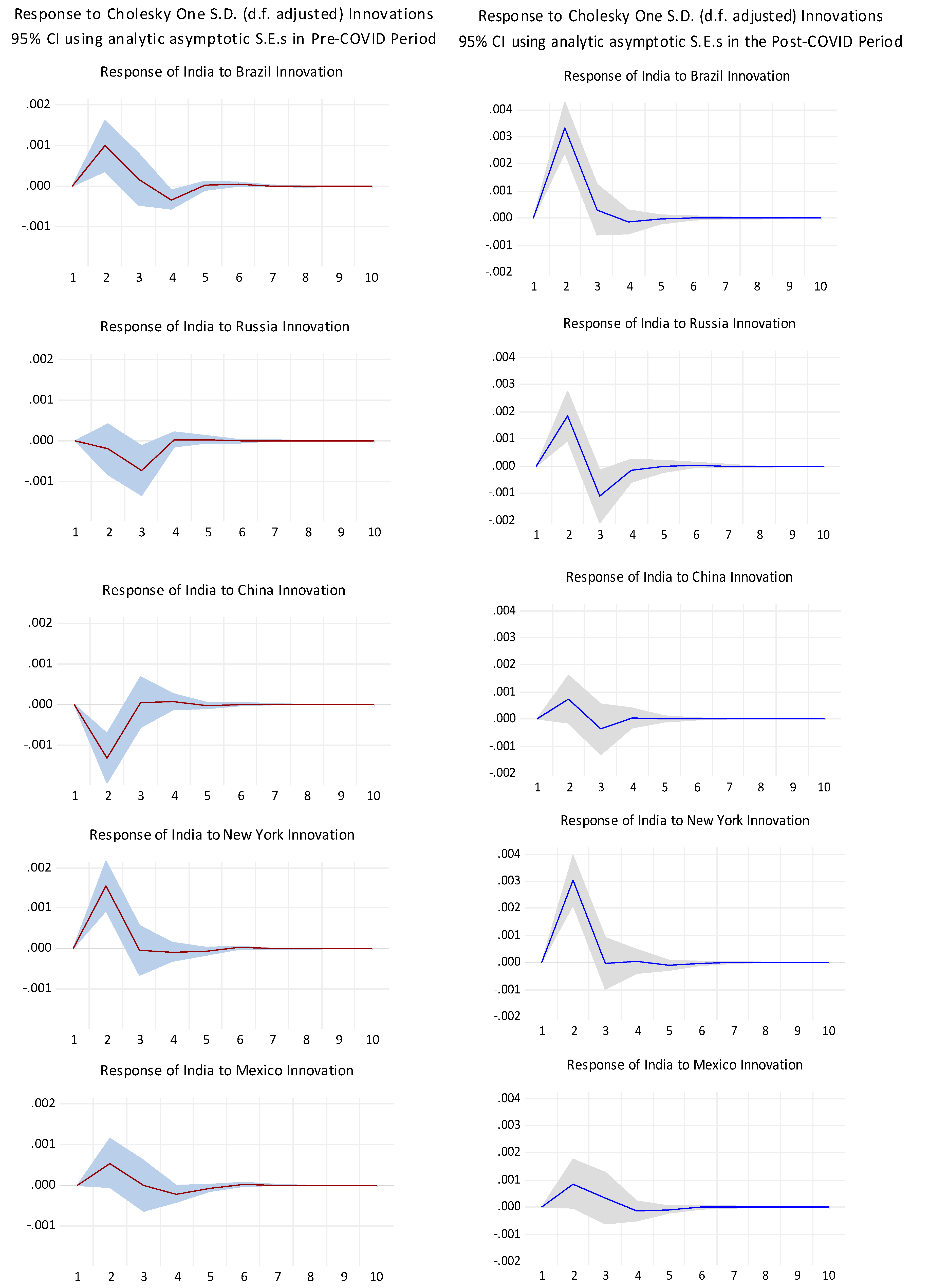

4.1. Spillover Effect of the Stock Market Indices of China and India with Other Markets

4.2. Volatility Spillovers between India and Other Stock Markets

5. Implications

6. Conclusions

7. Limitations and Scope

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agrawal, Gaurav, Aniruddh Kumar Srivastav, and Ankita Srivastava. 2010. A study of exchange rates movement and stock market volatility. International Journal of Business and Management 5: 62. [Google Scholar] [CrossRef]

- Albulescu, Claudiu. 2020. Coronavirus and financial volatility: 40 days of fasting and fear. arXiv arXiv:2003.04005. [Google Scholar] [CrossRef]

- Arfaoui, Nadia, and Imran Yousaf. 2022. Impact of COVID-19 on volatility spillovers across international markets: Evidence from VAR asymmetric BEKK GARCH model. Annals of Financial Economics 17: 2250004. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, Jamel Jouini, and Duc Khuong Nguyen. 2012. On the impacts of oil price fluctuations on European equity markets: Volatility spillover and hedging effectiveness. Energy Economics 34: 611–17. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2020. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance 54: 101249. [Google Scholar] [CrossRef] [PubMed]

- Bae, Kee Hong, and Xin Zhang. 2015. The cost of stock market integration in emerging markets. Asia-Pacific Journal of Financial Studies 44: 1–23. [Google Scholar] [CrossRef]

- Bai, Lan, Yu Wei, Guiwu Wei, Xiafei Li, and Songyun Zhang. 2021. Infectious disease pandemic and permanent volatility of international stock markets: A long-term perspective. Finance Research Letters 40: 101709. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Balli, Faruk, Hassan Rafdan Hajhoj, Syed Abul Basher, and Hassan Belkacem Ghassan. 2015. An analysis of returns and volatility spillovers and their determinants in emerging Asian and Middle Eastern countries. International Review of Economics & Finance 39: 311–25. [Google Scholar]

- Barro, Robert J., José F. Ursúa, and Joanna Weng. 2020. The Coronavirus and the Great Influenza Pandemic: Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Bauwens, Luc, Sébastien Laurent, and Jeroen V. K. Rombouts. 2006. Multivariate GARCH models: A survey. Journal of Applied Econometrics 21: 79–109. [Google Scholar] [CrossRef]

- Bollerslev, Tim, and Jeffrey M. Wooldridge. 1992. Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econometric Reviews 11: 143–72. [Google Scholar] [CrossRef]

- Bonga-Bonga, Lumengo, and Maphelane Palesa Phume. 2022. Return and volatility spillovers between South African and Nigerian equity markets. African Journal of Economic and Management Studies 13: 205–18. [Google Scholar] [CrossRef]

- Chen, Mei-Ping, Chien-Chiang Lee, Yu-Hui Lin, and Wen-Yi Chen. 2018. Did the SARS epidemic weaken the integration of Asian stock markets? Evidence from smooth time-varying cointegration analysis. Economic Research-Ekonomska Istraživanja 31: 908–26. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang, SooCheong Shawn Jang, and Woo Gon Kim. 2007. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management 26: 200–12. [Google Scholar] [CrossRef] [PubMed]

- Colther, Cristian, and Ailin Arriagada-Millaman. 2021. Forecast of Chile’s Tourism Demand Based on Linear and Non-Linear Seasonal Models. PASOS: Revista de Turismo y Patrimonio Cultural 19: 323–36. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Fernandes, Nuno. 2020. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. IESE Business School Working Paper No. WP-1240-E. Available online: https://ssrn.com/abstract=3557504 (accessed on 28 January 2024).

- Gao, Xue, Yixin Ren, and Muhammad Umar. 2021. To what extent does COVID-19 drive stock market volatility? A comparison between the US and China. Economic Research-Ekonomska Istraživanja 35: 1686–706. [Google Scholar] [CrossRef]

- Ghorbel, Ahmed, Mohamed Fakhfekh, Ahmed Jeribi, and Amine Lahiani. 2022. Extreme dependence and risk spillover across G7 and China stock markets before and during the COVID-19 period. The Journal of Risk Finance 23: 206–44. [Google Scholar] [CrossRef]

- Goh, Carey, and Rob Law. 2002. Modeling and forecasting tourism demand for arrivals with stochastic nonstationary seasonality and intervention. Tourism Management 23: 499–510. [Google Scholar] [CrossRef]

- Gormsen, Niels Joachim, and Ralph S. J. Koijen. 2020. Coronavirus: Impact on stock prices and growth expectations. The Review of Asset Pricing Studies 10: 574–97. [Google Scholar] [CrossRef]

- Harjoto, Maretno Agus, Fabrizio Rossi, and John K Paglia. 2021. COVID-19: Stock market reactions to the shock and the stimulus. Applied Economics Letters 28: 795–801. [Google Scholar] [CrossRef]

- He, Pinglin, Yulong Sun, Ying Zhang, and Tao Li. 2020a. COVID–19’s impact on stock prices across different sectors—An event study based on the Chinese stock market. Emerging Markets Finance and Trade 56: 2198–212. [Google Scholar] [CrossRef]

- He, Qing, Junyi Liu, Sizhu Wang, and Jishuang Yu. 2020b. The impact of COVID-19 on stock markets. Economic and Political Studies 8: 275–88. [Google Scholar] [CrossRef]

- Huong, Le Thi Minh. 2021. The contagion between stock markets: Evidence from Vietnam and Asian emerging stocks in the context of COVID-19 Pandemic. Macroeconomics and Finance in Emerging Market Economies 17: 78–94. [Google Scholar] [CrossRef]

- Iyke, Bernard Njindan. 2020. Economic policy uncertainty in times of COVID-19 pandemic. Asian Economics Letters 1: 17665. [Google Scholar]

- Jebran, Khalil, and Amjad Iqbal. 2016. Dynamics of volatility spillover between stock market and foreign exchange market: Evidence from Asian Countries. Financial Innovation 2: 3. [Google Scholar] [CrossRef]

- Jebran, Khalil, Shihua Chen, Irfan Ullah, and Sultan Sikandar Mirza. 2017. Does volatility spillover among stock markets varies from normal to turbulent periods? Evidence from emerging markets of Asia. The Journal of Finance and Data Science 3: 20–30. [Google Scholar] [CrossRef]

- Karolyi, G. Andrew. 1995. A multivariate GARCH model of international transmissions of stock returns and volatility: The case of the United States and Canada. Journal of Business & Economic Statistics 13: 11–25. [Google Scholar]

- Kearney, Colm. 2012. Emerging markets research: Trends, issues and future directions. Emerging Markets Review 13: 159–83. [Google Scholar] [CrossRef]

- Li, Rong, Sufang Li, Di Yuan, Hong Chen, and Shilei Xiang. 2023. Spillover effect of economic policy uncertainty on the stock market in the post-epidemic era. The North American Journal of Economics and Finance 64: 101846. [Google Scholar] [CrossRef]

- Liu, Haiying, Muhammad Mansoor Saleem, Mamdouh Abdulaziz Saleh Al-Faryan, Irfan Khan, and Muhammad Wasif Zafar. 2022. Impact of governance and globalization on natural resources volatility: The role of financial development in the Middle East North Africa countries. Resources Policy 78: 102881. [Google Scholar] [CrossRef]

- Longstaff, Francis. 2010. The subprime credit crisis and contagion in financial markets. Journal of Financial Economics 97: 436–50. Available online: https://EconPapers.repec.org/RePEc:eee:jfinec:v:97:y:2010:i:3:p:436-450 (accessed on 24 January 2024). [CrossRef]

- Ma, Chang, John H Rogers, and Sili Zhou. 2020. Global economic and financial effects of 21st century pandemics and epidemics. Covid Economics 5: 56–78. [Google Scholar] [CrossRef]

- Malik, Kunjana, Sakshi Sharma, and Manmeet Kaur. 2022. Measuring contagion during COVID-19 through volatility spillovers of BRIC countries using diagonal BEKK approach. Journal of Economic Studies 49: 227–42. [Google Scholar] [CrossRef]

- McKibbin, Warwick J., and Roshen Fernando. 2020. Global Macroeconomic Scenarios of the COVID-19 Pandemic. CAMA Working Paper 62/2020. Canberra: Centre for Applied Macroeconomic Analysis, The Australian National University. [Google Scholar] [CrossRef]

- Mishra, Aswini Kumar, Saksham Agrawal, and Jash Ashish Patwa. 2022. Return and volatility spillover between India and leading Asian and global equity markets: An empirical analysis. Journal of Economics, Finance and Administrative Science 27: 294–312. [Google Scholar] [CrossRef]

- Mukherjee, Kedarnath, and Ram Kumar Mishra. 2010. Stock market integration and volatility spillover: India and its major Asian counterparts. Research in International Business and Finance 24: 235–51. [Google Scholar] [CrossRef]

- Ngo Thai, Hung. 2019. Dynamics of volatility spillover between stock and foreign exchange market: Empirical evidence from Central and Eastern European Countries. Economy and Finance 6: 244–65. [Google Scholar] [CrossRef]

- Onali, Enrico. 2020. COVID-19 and stock market volatility. Unpublished working paper Available at SSRN 3571453. [Google Scholar] [CrossRef]

- Ozili, Peterson. 2020. COVID-19 in Africa: Socio-economic impact, policy response and opportunities. International Journal of Sociology and Social Policy 42: 177–200. [Google Scholar] [CrossRef]

- Phan, Dinh Hoang Bach, and Paresh Kumar Narayan. 2020. Country Responses and the Reaction of the Stock Market to COVID-19—A Preliminary Exposition. Emerging Markets Finance and Trade 56: 2138–50. [Google Scholar] [CrossRef]

- Rakshit, Bijoy, and Yadawananda Neog. 2021. Effects of the COVID-19 pandemic on stock market returns and volatilities: Evidence from selected emerging economies. Studies in Economics and Finance 39: 549–71. [Google Scholar] [CrossRef]

- Sahoo, Satyaban, and Sanjay Kumar. 2024. Volatility spillover among the sectors of emerging and developed markets: A hedging perspective. Cogent Economics & Finance 12: 2316048. [Google Scholar] [CrossRef]

- Shi, Kai. 2021. Spillovers of stock markets among the BRICS: New evidence in time and frequency domains before the outbreak of COVID-19 pandemic. Journal of Risk and Financial Management 14: 112. [Google Scholar] [CrossRef]

- Sims, Christopher A. 1980. Macroeconomics and reality. Econometrica: Journal of the Econometric Society 48: 1–48. [Google Scholar] [CrossRef]

- Srivastava, Aman, Shikha Bhatia, and Prashant Gupta. 2015. Financial Crisis and Stock Market Integration: An Analysis of Select Economies. Global Business Review 16: 1127–42. [Google Scholar] [CrossRef]

- Thangamuthu, Mohanasundaram, Suneel Maheshwari, and Deepak Raghava Naik. 2022. Volatility Spillover Effects during Pre-and-Post COVID-19 Outbreak on Indian Market from the USA, China, Japan, Germany, and Australia. Journal of Risk and Financial Management 15: 378. [Google Scholar] [CrossRef]

- Tse, Yiuman, Brian C. McTier, and John K. Wald. 2011. Do Stock Markets Catch the Flu? We Examine the Impact of Influenza on the U.S. Stock Market. A Higher Incidence of Flu Is Associated with Decreased Trading, Decreased Volatility, and Higher Bid- Ask SP (Working Papers 0004). San Antonio: College of Business, University of Texas at San Antonio. Available online: https://ideas.repec.org/p/tsa/wpaper/0024fin.html (accessed on 25 January 2024).

- Vo, Xuan Vinh, and Craig Ellis. 2018. International financial integration: Stock return linkages and volatility transmission between Vietnam and advanced countries. Emerging Markets Review 36: 19–27. [Google Scholar] [CrossRef]

- WHO. 2020. Statement on the Second Meeting of the INTERNATIONAL Health Regulations (2005) Emergency Committee Regarding the Outbreak of Novel Coronavirus (2019-nCoV). [Press Release]. Available online: https://www.who.int/news/item/30-01-2020-statement-on-the-second-meeting-of-the-international-health-regulations-(2005)-emergency-committee-regarding-the-outbreak-of-novel-coronavirus-(2019-ncov) (accessed on 25 January 2024).

- Yadav, Nikhil, Anurag Bhadur Singh, and Priyanka Tandon. 2023. Volatility Spillover Effects between Indian Stock Market and Global Stock Markets: A DCC-GARCH Model. FIIB Business Review. [Google Scholar] [CrossRef]

- Yan, Chao. 2020. COVID-19 Outbreak and Stock Prices: Evidence from China. Unpublished Working Paper. Available online: https://ssrn.com/abstract=3574374 (accessed on 28 January 2024).

- Yong Fu, Tian, Mark J. Holmes, and Daniel F. S. Choi. 2011. Volatility transmission and asymmetric linkages between the stock and foreign exchange markets. Studies in Economics and Finance 28: 36–50. [Google Scholar] [CrossRef]

- Yousef, Ibrahim. 2020. Spillover of COVID-19: Impact on stock market volatility. International Journal of Psychosocial Rehabilitation 24: 18069–81. [Google Scholar]

- Yuan, Ying, and Xinyu Du. 2023. Dynamic spillovers across global stock markets during the COVID-19 pandemic: Evidence from jumps and higher moments. Physica A: Statistical Mechanics and its Applications 628: 129166. [Google Scholar] [CrossRef]

- Yusuf, Andi Ulfaisyah, Syarifuddin Rasyid, and Yohanis Rura. 2020. The effect of intellectual capital and supply chain management on the financial performance by using cost leadership strategy as moderating variable. International Journal of Innovative Science and Research Technology 5: 290–300. Available online: https://ijisrt.com/assets/upload/files/IJISRT20FEB045.pdf (accessed on 24 January 2024).

- Zhou, Xiangyi, Weijin Zhang, and Jie Zhang. 2012. Volatility spillovers between the Chinese and world equity markets. Pacific-Basin Finance Journal 20: 247–70. [Google Scholar] [CrossRef]

| Robustness Check | Metric | BEKK-GARCH | DCC-GARCH | E-GARCH | CCC-GARCH |

|---|---|---|---|---|---|

| Goodness-of-Fit | AIC | 1234.56 | 1250.45 | 1275.89 | 1300.12 |

| BIC | 1260.78 | 1285.67 | 1310.11 | 1335.34 | |

| Log-Likelihood | −600.28 | −609.22 | −625.44 | −640.06 | |

| Out-of-Sample Forecasting | Mean Squared Error (MSE) | 0.0033 | 0.0035 | 0.0039 | 0.0040 |

| Mean Absolute Error (MAE) | 0.045 | 0.048 | 0.056 | 0.053 | |

| Residual Diagnostics | Ljung–Box p-Value | 0.20 | 0.15 | 0.12 | 0.14 |

| ARCH LM Test p-Value | 0.25 | 0.20 | 0.15 | 0.10 | |

| Parameter Sensitivity | Sensitivity to Lag Length Changes | Stable | Stable | Unstable | Unstable |

| Sub-Sample Analysis | Consistency (Pre/Post-Pandemic) | Consistent | Consistent | Not Consistent | Not Consistent |

| Model Residuals Analysis | Residual Normality (p-value) | 0.30 | 0.25 | 0.23 | 0.18 |

| Brazil | China | India | Mexico | New York | Russia | |

|---|---|---|---|---|---|---|

| Pre-COVID | ||||||

| Mean | 0.00402 | −0.00152 | 0.00132 | 0.00082 | 0.00160 | 0.00283 |

| Median | 0.00409 | 0.00469 | 0.00185 | 0.00305 | 0.00270 | 0.00222 |

| Maximum | 0.28848 | 0.68883 | 0.14155 | 0.30254 | 0.08050 | 0.13734 |

| Minimum | −0.25429 | −1.35527 | −0.14478 | −0.53211 | −0.09622 | −0.28954 |

| Std. Dev. | 0.04624 | 0.14342 | 0.02226 | 0.08641 | 0.02089 | 0.03650 |

| Skewness | −0.08388 | −1.32179 | −0.13853 | −0.69588 | −0.75967 | −0.50686 |

| Kurtosis | 6.41785 | 15.91586 | 8.28335 | 6.94625 | 6.52625 | 8.45669 |

| Jarque–Bera | 402.0383 * | 5967.4053 * | 961.0082 * | 601.1722 * | 506.1705 * | 1057.5727 * |

| ADF Test | −22.08157 * | −29.69122 * | −27.18027 * | −18.39225 * | −11.34908 * | −11.94952 * |

| PP Test | −28.77163 * | −29.70658 * | −27.16169 * | −26.15793 * | −30.41699 * | −27.78823 * |

| ARCH Test | 2.167976 *** | 4.076280 ** | 8.150754 * | 11.60958 * | 15.50512 * | 18.14551 * |

| Observations | 825 | 825 | 825 | 825 | 825 | 825 |

| Post-COVID | ||||||

| Mean | 0.00041 | 0.00008 | 0.00292 | 0.00282 | 0.00242 | 0.00032 |

| Median | 0.00225 | 0.00177 | 0.00620 | 0.00011 | 0.00460 | 0.00760 |

| Maximum | 0.43194 | 0.95150 | 0.25189 | 0.65656 | 0.22247 | 0.68334 |

| Minimum | −0.54880 | −0.78987 | −0.28220 | −0.54346 | −0.22815 | −1.70126 |

| Std. Dev. | 0.07643 | 0.14189 | 0.04545 | 0.11150 | 0.05759 | 0.10046 |

| Skewness | −0.91177 | −0.27210 | −0.64538 | −0.02491 | −0.30722 | −5.92586 |

| Kurtosis | 11.55495 | 8.07459 | 8.27124 | 5.47732 | 4.40657 | 103.68962 |

| Jarque–Bera | 2697.0627 * | 918.1772 * | 1038.1822 * | 216.4208 * | 83.0481 * | 362329.9187 * |

| ADF Test | −8.530499 * | −16.23360 * | −28.89254 * | −20.99750 * | −8.034373 * | −5.810476 * |

| PP Test | −29.02778 * | −28.17194 * | −28.89924 * | −27.28747 * | −29.86235 * | −27.47736 * |

| ARCH Test | 509.8519 * | 3.279436 *** | 24.17754 * | 29.24001 * | 22.41474 * | 49.71690 * |

| Observations | 846 | 846 | 846 | 846 | 846 | 846 |

| Brazil | China | India | Mexico | New York | Russia | |

|---|---|---|---|---|---|---|

| Pre-COVID | ||||||

| Brazil | 1.00000 | |||||

| China | −0.18126 | 1.00000 | ||||

| India | 0.91459 | −0.14602 | 1.00000 | |||

| Mexico | −0.38056 | 0.53970 | −0.15693 | 1.00000 | ||

| New York | 0.92699 | −0.15632 | 0.96930 | −0.20131 | 1.00000 | |

| Russia | 0.94694 | −0.27104 | 0.83627 | −0.49587 | 0.88118 | 1.00000 |

| Post-COVID | ||||||

| Brazil | 1.00000 | |||||

| China | 0.23102 | 1.00000 | ||||

| India | 0.69046 | 0.01178 | 1.00000 | |||

| Mexico | 0.69445 | 0.13506 | 0.92196 | 1.00000 | ||

| New York | 0.74610 | 0.48141 | 0.69758 | 0.71351 | 1.00000 | |

| Russia | 0.40886 | 0.56700 | 0.08264 | 0.16402 | 0.68003 | 1.00000 |

| Brazil | Russia | New York | China | Mexico | |

|---|---|---|---|---|---|

| Pre-COVID | |||||

| India(−1) | 0.05516 | −0.06119 | −0.02877 | 0.03462 | −0.01836 |

| 0.06243 | 0.04150 | 0.04428 | 0.05079 | 0.03975 | |

| [0.88356] | [−1.47446] | [−0.64961] | [0.68163] | [−0.46194] | |

| India(−2) | 0.10507 *** | 0.01244 | 0.07454 *** | 0.04357 | −0.02299 |

| 0.06127 | 0.04073 | 0.04346 | 0.04985 | 0.03901 | |

| [1.71483] | [0.30546] | [1.71509] | [0.87401] | [−0.58941] | |

| C | 0.00134 | 0.00064 | 0.00092 | −0.00032 | 0.00023 |

| 0.00052 | 0.00035 | 0.00037 | 0.00043 | 0.00033 | |

| [2.54586] | [1.82898] | [2.48186] | [−0.75754] | [0.69070] | |

| Post-COVID | |||||

| India(−1) | −0.04110 | −0.17808 * | −0.14437 * | −0.10701 * | −0.07313 ** |

| 0.05636 | 0.06532 | 0.05362 | 0.03359 | 0.03734 | |

| [−0.72925] | [−2.72614] | [−2.69266] | [−3.18549] | [−1.95848] | |

| India(−2) | −0.04613 | −0.05035 | 0.00045 | 0.01696 | −0.06234 *** |

| 0.05438 | 0.06302 | 0.05173 | 0.03241 | 0.03603 | |

| [−0.84842] | [−0.79896] | [0.00879] | [0.52329] | [−1.73038] | |

| C | 0.00034 | 0.00030 | 0.00089 | 0.00005 | 0.00041 |

| 0.00063 | 0.00073 | 0.00060 | 0.00037 | 0.00042 | |

| [0.54477] | [0.41313] | [1.49095] | [0.14507] | [0.98513] |

| 1 | India | India | India | India | India | India | India | India | India | India |

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Brazil | Brazil | China | China | Mexico | Mexico | New York | New York | Russia | Russia |

| Pre-COVID | Post-COVID | Pre-COVID | Post-COVID | Pre-COVID | Post-COVID | Pre-COVID | Post-COVID | Pre-COVID | Post-COVID | |

| Variable | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) | Coeff.(sig) |

| Conditional Mean | ||||||||||

| µ1 | 0.00089 * | 0.00118 * | 0.00075 * | 0.00111 * | 0.00077 * | 0.00110 * | 0.00119 * | 0.00117 * | 0.00074 ** | 0.00107 * |

| µ2 | 0.00119 ** | 0.00061 | 0.00025 | 0.00010 | 0.00016 | 0.00068 *** | 0.00125 * | 0.00134 ** | 0.00090 * | 0.00110 * |

| Conditional Variance | ||||||||||

| C (1,1) | 0.00119 *** | 0.00329 * | 0.00215 * | 0.00117 * | 0.00199 *** | 0.00106 *** | 0.00365 * | 0.00172 * | 0.00233 * | 0.00196 * |

| C (2,1) | −0.00387 * | −0.00091 | −0.00041 | −0.00095 | 0.00203 *** | −0.00092 | −0.00033 | 0.00122 | −0.00211 ** | 0.00005 |

| C (2,2) | 0.00000 | 0.00000 | 0.00120 * | 0.00062 | 0.00000 | 0.00212 | 0.00193 * | 0.00297 * | 0.00354 * | 0.00189 * |

| A (1,1) | 0.26872 * | 0.07657 | 0.22419 * | 0.30832 * | 0.10973 ** | 0.20929 * | 0.21341 * | 0.30826 * | 0.28905 * | 0.33737 * |

| A (1,2) | 0.14035 ** | 0.40015 * | −0.09928 ** | 0.08145 * | 0.26707 * | 0.22883 * | 0.16865 * | −0.03183 | −0.22016 * | −0.13130 * |

| A (2,1) | −0.09039 * | 0.18190 * | −0.07699 * | 0.02832 | −0.19244 * | 0.17471 * | −0.24218 * | 0.05408 ** | −0.00753 | 0.02222 |

| A (2,2) | 0.23292 * | 0.14720 * | 0.26924 * | 0.08554 *** | 0.12607 * | −0.00724 | 0.26763 * | 0.29147 * | 0.32065 * | 0.37704 * |

| B (1,1) | 0.92352 * | 0.77085 * | 0.93233 * | 0.94285 * | 0.69522 * | 0.92764 * | 0.83239 * | 0.93845 * | 0.92059 * | 0.92623 * |

| B (1,2) | −0.11451 * | −0.46199 * | 0.01167 | −0.02959 * | −0.49539 * | −0.06584 * | 0.00259 | 0.00337 | 0.16591 * | 0.02570 ** |

| B (2,1) | 0.08283 * | 0.23620 * | 0.04008 * | 0.02305 * | 0.46340 * | 0.05079 ** | 0.09238 * | −0.01473 | 0.01211 | 0.00003 |

| B (2,2) | 0.93649 * | 0.97078 * | 0.95744 * | 0.99067 * | 0.94402 * | 0.97394 * | 0.92196 * | 0.93620 * | 0.80236 * | 0.92979 * |

| Diagnostic Test Q-statistics for autocorrelation of ordinary residuals [Q (12)] and standardised Cholesky of covariance [Qc (12)] up to 12 Lag | ||||||||||

| Q (10) | 8.8437 (0.5469) | 3.1783 (0.9769) | 13.7755 (0.1834) | 5.0633 (0.8869) | 8.0904 (0.6200) | 4.4455 (0.925) | 6.0762 (0.8088) | 4.0154 (0.9467) | 9.5946 (0.4767) | 3.5911 (0.9639) |

| Qc (10) | 1.8581 (0.9973) | 9.936 (0.4461) | 3.1252 (0.9783) | 10.4144 (0.4049) | 3.7624 (0.9574) | 8.7508 (0.5559) | 5.4866 (0.8563) | 8.9593 (0.536) | 3.6317 (0.9624) | 12.6134 (0.2461) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maharana, N.; Panigrahi, A.K.; Chaudhury, S.K. Volatility Persistence and Spillover Effects of Indian Market in the Global Economy: A Pre- and Post-Pandemic Analysis Using VAR-BEKK-GARCH Model. J. Risk Financial Manag. 2024, 17, 294. https://doi.org/10.3390/jrfm17070294

Maharana N, Panigrahi AK, Chaudhury SK. Volatility Persistence and Spillover Effects of Indian Market in the Global Economy: A Pre- and Post-Pandemic Analysis Using VAR-BEKK-GARCH Model. Journal of Risk and Financial Management. 2024; 17(7):294. https://doi.org/10.3390/jrfm17070294

Chicago/Turabian StyleMaharana, Narayana, Ashok Kumar Panigrahi, and Suman Kalyan Chaudhury. 2024. "Volatility Persistence and Spillover Effects of Indian Market in the Global Economy: A Pre- and Post-Pandemic Analysis Using VAR-BEKK-GARCH Model" Journal of Risk and Financial Management 17, no. 7: 294. https://doi.org/10.3390/jrfm17070294