Are Regulatory Short Sale Data a Profitable Predictor of UK Stock Returns?

Abstract

:1. Introduction

2. Data and Methods

2.1. Net Short Position Disclosures

2.2. Sample and Data

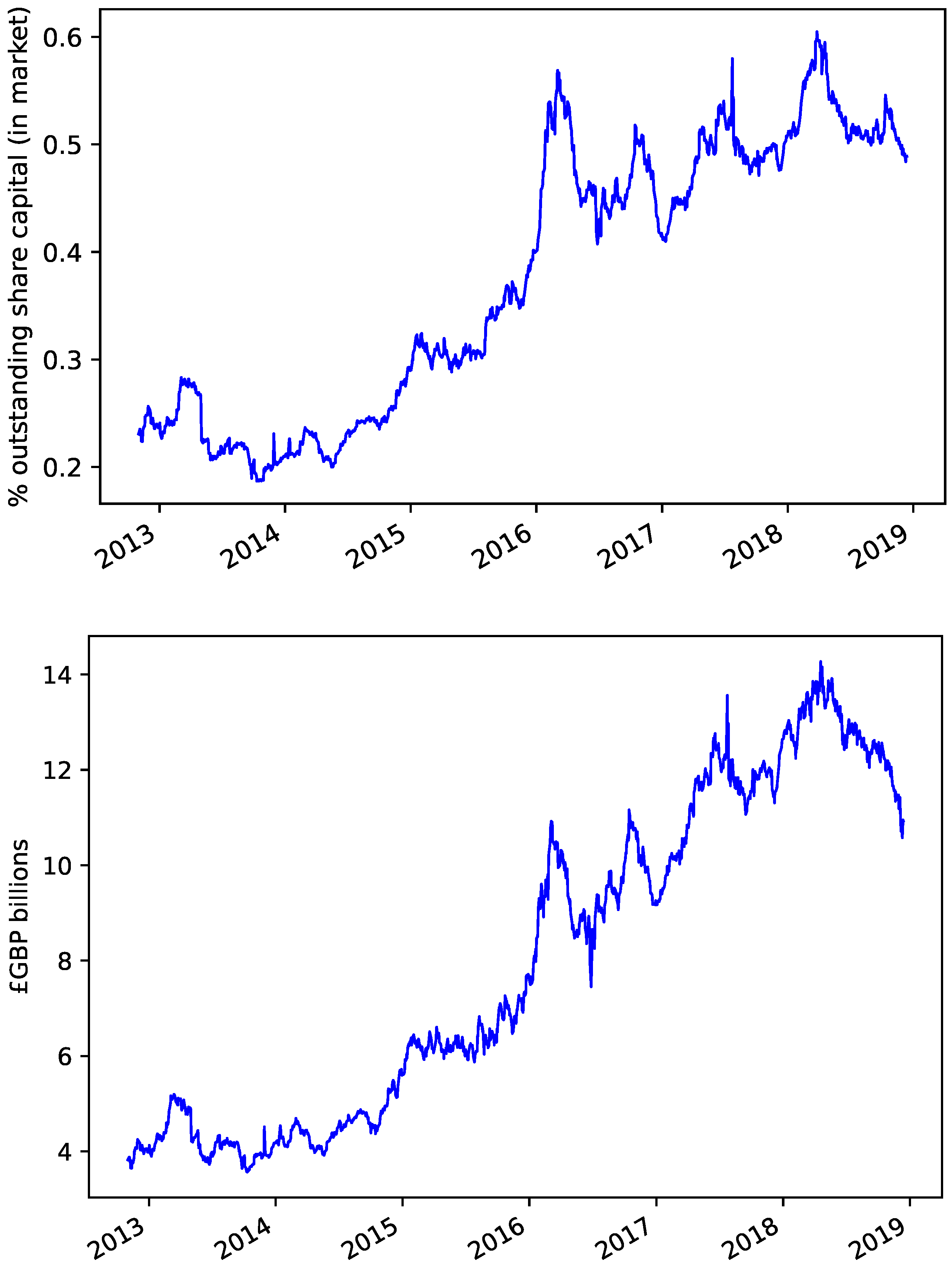

2.3. Net Short Position Disclosures across the Sample

2.4. Portfolio Evaluation

3. Results and Discussion

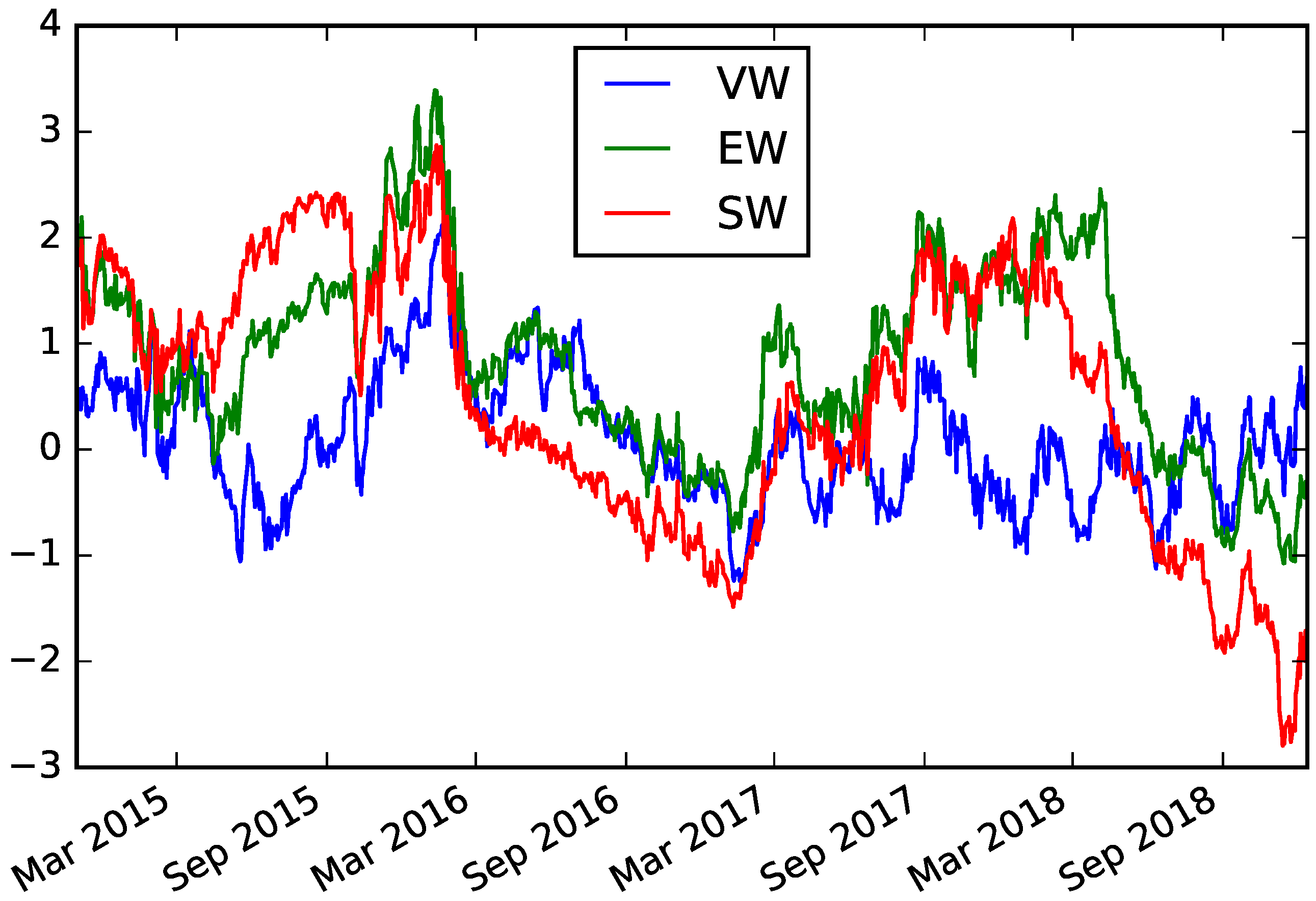

3.1. The Failure of Long-Short Portfolios

3.1.1. Portfolios Using the Most Recent Declared Net Short Positions

3.1.2. Portfolios Using Multiple Days’ Declarations

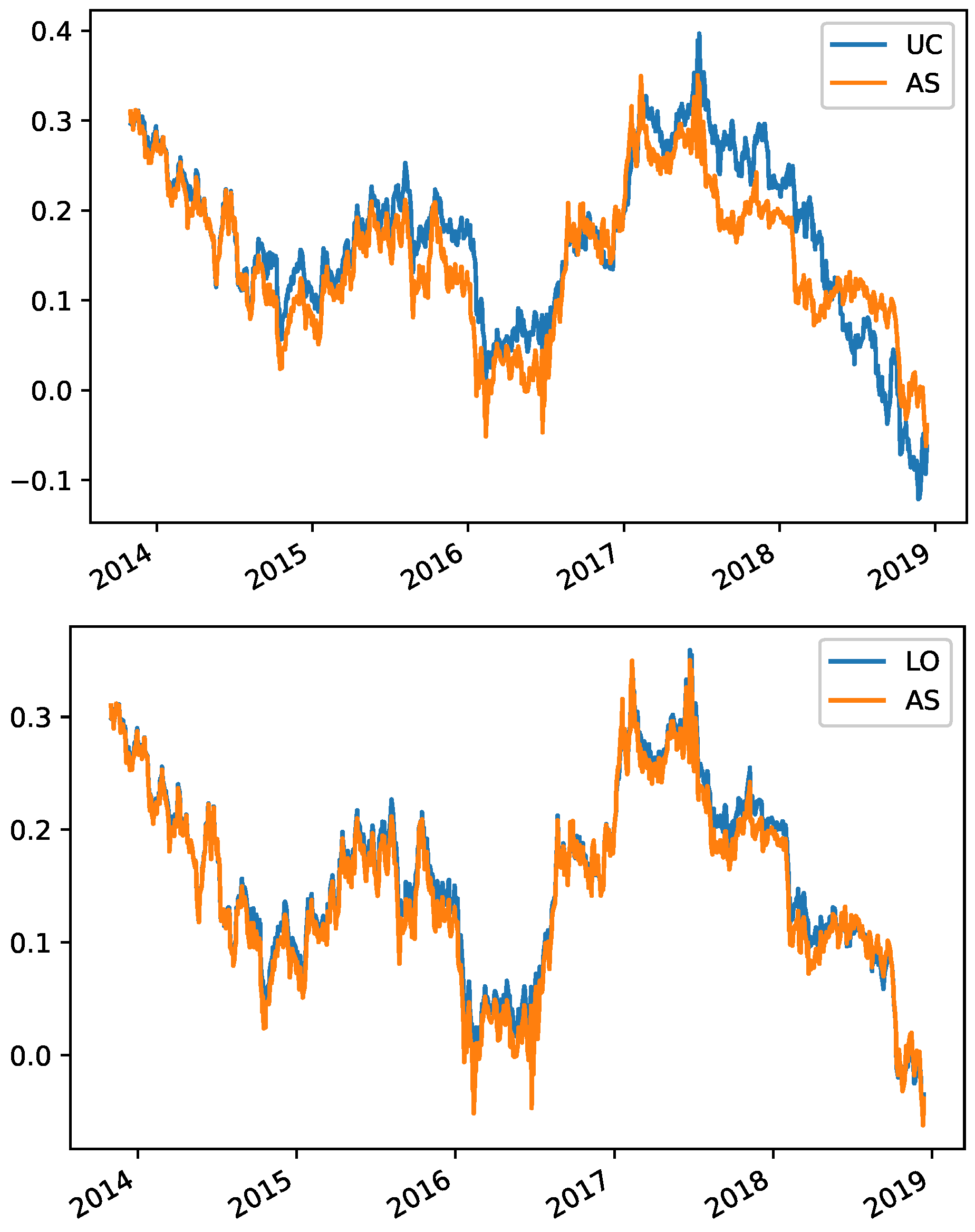

3.2. Fully Invested Portfolios

3.2.1. Portfolios Using the Most Recent Day’s Declarations

3.2.2. Portfolios Using Multiple Days’ Declarations

4. Robustness

4.1. Closing Prices

4.2. Portfolio Formation

4.2.1. Using Sub-Samples of Stocks

4.2.2. Short Position Measure

4.2.3. High/Low Total Net Short Position Threshold

4.2.4. Forming Portfolios Based on Changes in Declared Net Short Positions

4.2.5. Forming Portfolios Based on Scaled Surprises in Declared Net Short Positions

4.3. Sensitivity of Multiple Signals and Regression-Based Portfolios to Set of Horizons

4.3.1. Long-Short Portfolios

4.3.2. Fully Invested Portfolios

4.4. Day-t Strategies

5. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Std Err | Std Err | Std Err | Std Err | Std Err | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Value-weighted | ||||||||||

| Long | 0.291 | 0.048 | 0.079 | 0.052 | 0.020 | 0.055 | 0.077 | 0.038 | −0.224 | 0.103 |

| Short | 0.343 | 0.061 | 0.269 | 0.055 | 0.070 | 0.060 | −0.084 | 0.051 | −0.092 | 0.136 |

| L-S | −0.053 | 0.029 | −0.190 | 0.025 | −0.050 | 0.067 | 0.160 | 0.045 | −0.131 | 0.088 |

| Equal-weighted | ||||||||||

| Long | 0.257 | 0.032 | 0.153 | 0.043 | −0.021 | 0.044 | 0.075 | 0.026 | −0.220 | 0.098 |

| Short | 0.332 | 0.054 | 0.221 | 0.049 | 0.015 | 0.049 | −0.051 | 0.045 | −0.198 | 0.131 |

| L-S | −0.075 | 0.027 | −0.069 | 0.023 | −0.036 | 0.023 | 0.125 | 0.029 | −0.021 | 0.051 |

| Net short position-weighted | ||||||||||

| Long | 0.257 | 0.032 | 0.153 | 0.043 | −0.021 | 0.044 | 0.075 | 0.026 | −0.220 | 0.098 |

| Short | 0.339 | 0.057 | 0.229 | 0.049 | 0.057 | 0.053 | −0.082 | 0.054 | −0.159 | 0.130 |

| L-S | −0.082 | 0.029 | −0.077 | 0.027 | −0.078 | 0.028 | 0.157 | 0.041 | −0.061 | 0.054 |

| Multiple signals approach | ||||||||||

| Long | 0.227 | 0.028 | 0.134 | 0.038 | −0.025 | 0.039 | 0.067 | 0.024 | −0.202 | 0.088 |

| Short | 0.327 | 0.048 | 0.219 | 0.046 | 0.023 | 0.048 | −0.014 | 0.040 | −0.201 | 0.119 |

| L-S | −0.100 | 0.025 | −0.085 | 0.019 | −0.048 | 0.020 | 0.081 | 0.026 | −0.001 | 0.043 |

| Regression-based approach: Value weights | ||||||||||

| Long | 0.287 | 0.049 | 0.086 | 0.053 | 0.001 | 0.054 | 0.064 | 0.042 | −0.286 | 0.106 |

| Short | 0.304 | 0.039 | 0.223 | 0.048 | −0.001 | 0.039 | −0.029 | 0.053 | −0.168 | 0.099 |

| L-S | −0.018 | 0.027 | −0.137 | 0.033 | 0.003 | 0.045 | 0.093 | 0.049 | −0.117 | 0.053 |

| Regression-based approach: Equal weights | ||||||||||

| Long | 0.262 | 0.036 | 0.163 | 0.043 | −0.030 | 0.045 | 0.044 | 0.030 | −0.249 | 0.114 |

| Short | 0.314 | 0.043 | 0.207 | 0.051 | −0.006 | 0.041 | 0.023 | 0.041 | −0.234 | 0.106 |

| L-S | −0.052 | 0.012 | −0.044 | 0.016 | −0.024 | 0.020 | 0.021 | 0.021 | −0.015 | 0.034 |

| Regression-based approach: Expected return weights | ||||||||||

| Long | 0.355 | 0.043 | 0.274 | 0.057 | 0.050 | 0.048 | 0.062 | 0.054 | −0.227 | 0.119 |

| Short | 0.324 | 0.064 | 0.225 | 0.073 | 0.014 | 0.063 | 0.014 | 0.066 | −0.261 | 0.110 |

| L-S | 0.031 | 0.031 | 0.048 | 0.028 | 0.036 | 0.035 | 0.048 | 0.036 | 0.033 | 0.066 |

| Std Err | Std Err | Std Err | Std Err | Std Err | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Single day’s declarations: Equal-weighted | ||||||||||

| UC | 0.204 | 0.029 | 0.066 | 0.053 | −0.047 | 0.058 | 0.143 | 0.029 | −0.201 | 0.096 |

| LO | 0.256 | 0.032 | 0.152 | 0.043 | −0.022 | 0.043 | 0.075 | 0.026 | −0.223 | 0.098 |

| AS | 0.277 | 0.036 | 0.175 | 0.043 | −0.012 | 0.044 | 0.051 | 0.029 | −0.224 | 0.105 |

| Single day’s declarations: Value-weighted | ||||||||||

| UC | 0.265 | 0.049 | 0.025 | 0.058 | 0.000 | 0.061 | 0.122 | 0.045 | −0.223 | 0.100 |

| LO | 0.290 | 0.048 | 0.079 | 0.052 | 0.019 | 0.055 | 0.077 | 0.038 | −0.227 | 0.103 |

| AS | 0.304 | 0.048 | 0.105 | 0.051 | 0.027 | 0.052 | 0.056 | 0.037 | −0.229 | 0.106 |

| Multiple days’ declarations: Equal-weighted | ||||||||||

| UC | 0.158 | 0.055 | −0.010 | 0.062 | 0.004 | 0.113 | 0.140 | 0.038 | −0.014 | 0.168 |

| LO | 0.224 | 0.027 | 0.131 | 0.037 | −0.025 | 0.038 | 0.066 | 0.024 | −0.196 | 0.086 |

| AS | 0.277 | 0.036 | 0.175 | 0.043 | −0.012 | 0.044 | 0.051 | 0.029 | −0.224 | 0.105 |

| Multiple days’ declarations: Value-weighted | ||||||||||

| UC | 0.256 | 0.048 | 0.010 | 0.060 | −0.006 | 0.065 | 0.128 | 0.050 | −0.214 | 0.098 |

| LO | 0.288 | 0.047 | 0.078 | 0.052 | 0.016 | 0.056 | 0.072 | 0.039 | −0.226 | 0.103 |

| AS | 0.304 | 0.048 | 0.105 | 0.051 | 0.027 | 0.052 | 0.056 | 0.037 | −0.229 | 0.106 |

Appendix B

| Mean | p-Value | Sharpe | p-Value | p-Value | p-Value | ||||

|---|---|---|---|---|---|---|---|---|---|

| Value-weighted | |||||||||

| Long | 0.075 | 0.062 | 0.797 | 0.073 | 0.021 | 0.069 | 0.037 | 0.082 | 0.017 |

| Short | 0.022 | 0.785 | 0.111 | 0.834 | 0.025 | 0.716 | 0.042 | 0.511 | 0.048 |

| L-S | 0.053 | 0.288 | 0.563 | 0.414 | 0.049 | 0.287 | 0.027 | 0.518 | 0.034 |

| Equal-weighted | |||||||||

| Long | 0.119 | 0.007 | 1.170 | 0.118 | 0.001 | 0.114 | 0.002 | 0.127 | 0.001 |

| Short | 0.065 | 0.321 | 0.479 | 0.402 | 0.067 | 0.248 | 0.079 | 0.168 | 0.089 |

| L-S | 0.054 | 0.166 | 0.668 | 0.197 | 0.051 | 0.183 | 0.035 | 0.340 | 0.038 |

| Net short position-weighted | |||||||||

| Long | 0.119 | 0.007 | 1.170 | 0.118 | 0.001 | 0.114 | 0.002 | 0.127 | 0.001 |

| Short | 0.097 | 0.140 | 0.730 | 0.211 | 0.100 | 0.084 | 0.112 | 0.052 | 0.120 |

| L-S | 0.022 | 0.640 | 0.213 | 0.637 | 0.018 | 0.681 | 0.002 | 0.966 | 0.006 |

| Mean | p-Value | Sharpe | p-Value | p-Value | p-Value | ||||

|---|---|---|---|---|---|---|---|---|---|

| Value-weighted | |||||||||

| Long | 0.075 | 0.062 | 0.797 | 0.073 | 0.021 | 0.069 | 0.037 | 0.082 | 0.017 |

| Short | 0.064 | 0.263 | 0.492 | 0.344 | 0.066 | 0.155 | 0.072 | 0.119 | 0.078 |

| L-S | 0.010 | 0.690 | 0.228 | 0.814 | 0.008 | 0.754 | −0.003 | 0.899 | 0.004 |

| Equal-weighted | |||||||||

| Long | 0.119 | 0.007 | 1.170 | 0.118 | 0.001 | 0.114 | 0.002 | 0.127 | 0.001 |

| Short | 0.077 | 0.125 | 0.733 | 0.242 | 0.078 | 0.047 | 0.082 | 0.041 | 0.094 |

| L-S | 0.043 | 0.006 | 1.694 | 0.093 | 0.041 | 0.010 | 0.032 | 0.035 | 0.033 |

| Net short position-weighted | |||||||||

| Long | 0.119 | 0.007 | 1.170 | 0.118 | 0.001 | 0.114 | 0.002 | 0.127 | 0.001 |

| Short | 0.089 | 0.119 | 0.778 | 0.214 | 0.091 | 0.055 | 0.100 | 0.036 | 0.110 |

| L-S | 0.030 | 0.373 | 0.427 | 0.421 | 0.027 | 0.399 | 0.013 | 0.667 | 0.017 |

| 1 | These data were initially only available for a trial period ending in August 2007. Such disclosures have subsequently become mandatory again, but the exchanges are permitted to charge for the data. The fees are high. |

| 2 | In addition, there are private notifications, which the regulator keeps confidential. These must be made once the position crosses a threshold of 0.2% of share capital outstanding, and at each 0.1% increment/decrement in the position. |

| 3 | This does not perfectly overlap with the components of the FTSE350 at each point in time over the sample. Nor does it perfectly overlap with the constituents of the Asness et al. (2019) market factor. As a result, a value-weighted portfolio of all stocks in my sample has a non-zero (positive) alpha even in a market model. |

| 4 | Despite the regulation entering into force on 1 November, there are some disclosures for 31 October. |

| 5 | There are three on 31 October 2012 and 111 on 1 November 2012. None of the 1 November declarations are updates to the 31 October ones. |

| 6 | Note that the largest position in monetary terms and the largest position in terms of outstanding share capital are two different positions. The 8.03% position is a position in Melrose Industries PLC held by Guevoura Fund Ltd and was declared on 19 August 2016. The GBP 1.4 billion position is a position in British American Tobacco PLC held by Millennium International Management LP and was declared on 24 July 2017. The position amounted to 1.43% of the outstanding share capital. |

| 7 | The estimated Sharpe ratio for strategy i is given as , where is the mean daily return to strategy i in excess of the risk-free rate and the sample standard deviation. Lo (2002) then shows that the q-day Sharpe ratio is given by

|

| 8 | The enhanced threshold is due to multiple testing concerns; a large amount of research on possible investment signals is focused on a small number of underlying datasets. The mean returns and alphas for portfolios based on new potential signals must therefore exceed a higher t-statistic threshold to be deemed profitable. |

| 9 | When rebalanced once every q days, the long and short sides of the equal-weighted long-short portfolio have weights

|

| 10 | I cannot use in place of in (2) due to collinearity issues. |

| 11 | I thank Jacopo Capra of Cantab Capital for our discussions of this assumption. Since the earlier long-short portfolios do not generally make a significant profit without transaction costs, they will obviously not make one with transaction costs. So transaction costs are unimportant in Section 3.1. |

| 12 | A total of 50 bps each way is a common assumed level of transaction costs in the literature. However, my conversations with practitioners suggest this is somewhat higher than the level investors typically face. I leave results using 50 bps each-way transaction costs untabulated throughout in the interest of space. |

| 13 | I am grateful to an anonymous referee for this suggestion. In all three cases, the screen for positions entered on day t is based on data available to the investor at . I compute volatility as for volatility scaling. Trading volume and institutional ownership data are from Refinitiv Eikon. |

| 14 | I am grateful to an anonymous referee for this suggestion. |

| 15 | The smoothing inherent in computing generated too great a degree of collinearity for the regression-based approach to forming portfolios to be viable. |

References

- Andrikopoulos, Panagiotis, James Clunie, and Antonios Siganos. 2012. UK short selling activity and firm performance. Journal of Business Finance and Accounting 39: 1403–17. [Google Scholar] [CrossRef]

- Asness, Clifford S., Andrea Frazzini, and Lasse Heje Pedersen. 2019. Quality minus junk. Review of Accounting Studies 24: 34–112. [Google Scholar] [CrossRef]

- Au, Andrea S., John A. Doukas, and Zhan Onayev. 2009. Daily short interest, idiosyncratic risk, and stock returns. Journal of Financial Markets 12: 290–316. [Google Scholar] [CrossRef]

- Boehmer, Ekkehart, Charles M. Jones, and Xiaoyan Zhang. 2008. Which shorts are informed? Journal of Finance 63: 491–527. [Google Scholar] [CrossRef]

- Boehmer, Ekkehart, Zsuzsa R. Huszar, and Bradford D. Jordan. 2010. The good news in short interest. Journal of Financial Economics 96: 80–97. [Google Scholar] [CrossRef]

- Boehmer, Ekkehart, Zsuzsa R. Huszár, Yanchu Wang, Xiaoyan Zhang, and Xinran Zhang. 2022. Can shorts predict returns? A global perspective. Review of Financial Studies 35: 2428–63. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On persistence in mutual fund performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef]

- Daske, Holger, Scott A. Richardson, and Irem Tuna. 2005. Do Short Sale Transactions Precede Bad News Events? SSRN. Available online: https://ssrn.com/abstract=722242 (accessed on 26 April 2018).

- Della Corte, Pasquale, Robert Kosowski, and Nikolaos Rapanos. 2022. Best Short. SSRN. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3436433 (accessed on 2 August 2023).

- Diamond, Douglas W., and Robert E. Verrecchia. 1987. Constraints on short-selling and asset price adjustment to private information. Journal of Financial Economics 18: 277–311. [Google Scholar] [CrossRef]

- Diether, Karl B., Kuan-Hui Lee, and Ingrid M. Werner. 2009. Short-sale strategies and return predictability. Review of Financial Studies 22: 575–607. [Google Scholar] [CrossRef]

- Elaut, Gert, and Péter Erdos. 2019. Trends’ signal strength and the performance of CTAs. Financial Analysts Journal 74: 64–83. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Geraci, Marco Valerio, Jean-Yves Gnabo, and David Veredas. 2023. Common short selling and excess comovement: Evidence from a sample of LSE stocks. Journal of Financial Markets. in press. [Google Scholar] [CrossRef]

- Han, Yufeng, Guofu Zhou, and Yingzi Zhu. 2016. A trend factor: Any economic gains from using information over investment horizons? Journal of Financial Economics 122: 352–75. [Google Scholar] [CrossRef]

- Hanauer, Matthias X., Pavel Lesnevski, and Esad Smajlbegovic. 2023. Surprise in short interest. Journal of Financial Markets 65: 100841. [Google Scholar] [CrossRef]

- Harvey, Campbell R., Yan Liu, and Heqing Zhu. 2016. … and the cross-section of expected returns. Review of Financial Studies 29: 5–68. [Google Scholar] [CrossRef]

- Hong, Harrison, and Jeremy C. Stein. 2003. Differences of opinion, short-sales constraints, and market crashes. Review of Financial Studies 16: 487–525. [Google Scholar] [CrossRef]

- Huo, Xiaolin, Xin Liu, and Vesa Pursiainen. 2023. Geographic Proximity in Short Selling. SSRN. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3854459 (accessed on 2 August 2023).

- Jank, Stephan, and Esad Smajlbegovic. 2017. Dissecting Short-Sale Performance: Evidence from Large Position Disclosures. SSRN. Available online: https://ssrn.com/abstract=2631266 (accessed on 23 July 2019).

- Jank, Stephan, Christoph Roling, and Esad Smajlbegovic. 2021. Flying under the radar: The effects of short-sale disclosure rules on investor behavior and stock prices. Journal of Financial Economics 139: 209–33. [Google Scholar] [CrossRef]

- Jones, Charles M., Adam V. Reed, and William Waller. 2016. Revealing shorts an examination of large short position disclosures. Review of Financial Studies 29: 3278–3320. [Google Scholar] [CrossRef]

- Lo, Andrew W. 2002. The statistics of Sharpe ratios. Financial Analysts Journal 48: 36–52. [Google Scholar] [CrossRef]

- Miller, Edward M. 1977. Risk, uncertainty, and divergence of opinion. Journal of Finance 32: 1151–68. [Google Scholar] [CrossRef]

- Mohamad, Azhar, Aziz Jaafar, Lynn Hodgkinson, and Jo Wells. 2013. Short selling and stock returns: Evidence from the UK. British Accounting Review 45: 125–37. [Google Scholar] [CrossRef]

- Urbanke, Kai. 2019. Momentum in Short Selling: The Two Faces of Short Sellers. SSRN. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3550672 (accessed on 2 August 2023).

- Wang, Shu-Feng, Kuan-Hui Lee, and Min-Cheol Woo. 2017. Do individual short-sellers make money? evidence from Korea. Journal of Banking and Finance 79: 159–72. [Google Scholar] [CrossRef]

| No. of Disclosures | Position Size | Duration | |||

|---|---|---|---|---|---|

| Per Day | Per Stock | % Outstanding Share Capital | GBP | Mean Days per Stock | |

| Mean | 18.9 | 29.7 | 0.94% | £30.5 mn | 49.2 |

| Median | 16.0 | 19.0 | 0.71% | £19.3 mn | 35.8 |

| Standard deviation | 13.1 | 30.4 | 0.68% | £44.5 mn | 49.5 |

| Maximum | 68.0 | 149 | 8.03% | £1443 mn | 529 |

| Minimum | 0.00 | 0.00 | 0.00% | £0.07 mn | 1.00 |

| Mean | p-Value | Sharpe | p-Value | p-Value | p-Value | ||||

|---|---|---|---|---|---|---|---|---|---|

| Value-weighted | |||||||||

| Long | 0.075 | 0.062 | 0.797 | 0.073 | 0.021 | 0.069 | 0.037 | 0.082 | 0.017 |

| Short | 0.053 | 0.401 | 0.377 | 0.055 | 0.275 | 0.065 | 0.193 | 0.070 | 0.184 |

| L-S | 0.022 | 0.491 | 0.415 | 0.018 | 0.519 | 0.004 | 0.873 | 0.012 | 0.658 |

| Equal-weighted | |||||||||

| Long | 0.119 | 0.007 | 1.170 | 0.118 | 0.001 | 0.114 | 0.002 | 0.127 | 0.001 |

| Short | 0.075 | 0.161 | 0.679 | 0.077 | 0.076 | 0.084 | 0.053 | 0.096 | 0.035 |

| L-S | 0.044 | 0.042 | 1.127 | 0.041 | 0.046 | 0.029 | 0.133 | 0.031 | 0.121 |

| Net short position-weighted | |||||||||

| Long | 0.119 | 0.007 | 1.170 | 0.118 | 0.001 | 0.114 | 0.002 | 0.127 | 0.001 |

| Short | 0.092 | 0.121 | 0.777 | 0.094 | 0.059 | 0.104 | 0.036 | 0.113 | 0.029 |

| L-S | 0.027 | 0.449 | 0.360 | 0.024 | 0.479 | 0.010 | 0.772 | 0.013 | 0.692 |

| Monthly Rebalancing | |||||||||

| Mean | -Value | Sharpe | -Value | -Value | -Value | ||||

| Value-weighted | |||||||||

| Long | 0.051 | 0.140 | 0.647 | 0.048 | 0.078 | 0.039 | 0.178 | 0.050 | 0.093 |

| Short | 0.103 | 0.085 | 0.777 | 0.105 | 0.036 | 0.115 | 0.019 | 0.122 | 0.022 |

| L-S | −0.053 | 0.166 | −0.722 | −0.057 | 0.093 | −0.076 | 0.016 | −0.072 | 0.034 |

| Equal-weighted | |||||||||

| Long | 0.106 | 0.004 | 1.251 | 0.104 | 0.000 | 0.098 | 0.002 | 0.110 | 0.001 |

| Short | 0.028 | 0.607 | 0.209 | 0.029 | 0.518 | 0.040 | 0.359 | 0.049 | 0.298 |

| L-S | 0.078 | 0.030 | 1.009 | 0.075 | 0.026 | 0.058 | 0.062 | 0.061 | 0.062 |

| Net short position-weighted | |||||||||

| Long | 0.106 | 0.004 | 1.251 | 0.104 | 0.000 | 0.098 | 0.002 | 0.110 | 0.001 |

| Short | 0.030 | 0.641 | 0.199 | 0.032 | 0.564 | 0.046 | 0.391 | 0.052 | 0.359 |

| L-S | 0.076 | 0.154 | 0.674 | 0.072 | 0.142 | 0.053 | 0.260 | 0.058 | 0.215 |

| Annual Rebalancing | |||||||||

| Mean | -Value | Sharpe | -Value | -Value | -Value | ||||

| Value-weighted | |||||||||

| Long | 0.047 | 0.187 | 0.580 | 0.045 | 0.114 | 0.042 | 0.160 | 0.054 | 0.084 |

| Short | 0.113 | 0.040 | 0.977 | 0.114 | 0.013 | 0.118 | 0.010 | 0.127 | 0.009 |

| L-S | −0.066 | 0.029 | −1.245 | −0.068 | 0.014 | −0.076 | 0.005 | −0.072 | 0.009 |

| Equal-weighted | |||||||||

| Long | 0.104 | 0.006 | 1.225 | 0.102 | 0.001 | 0.098 | 0.002 | 0.111 | 0.001 |

| Short | 0.045 | 0.396 | 0.382 | 0.046 | 0.287 | 0.052 | 0.231 | 0.062 | 0.171 |

| L-S | 0.059 | 0.032 | 1.087 | 0.057 | 0.020 | 0.047 | 0.044 | 0.048 | 0.039 |

| Net short position-weighted | |||||||||

| Long | 0.104 | 0.006 | 1.225 | 0.102 | 0.001 | 0.098 | 0.002 | 0.111 | 0.001 |

| Short | 0.044 | 0.455 | 0.337 | 0.046 | 0.367 | 0.054 | 0.280 | 0.064 | 0.217 |

| L-S | 0.060 | 0.143 | 0.697 | 0.057 | 0.131 | 0.044 | 0.229 | 0.046 | 0.201 |

| Mean | p-Value | Sharpe | p-Value | p-Value | p-Value | ||||

|---|---|---|---|---|---|---|---|---|---|

| Multiple signals approach | |||||||||

| Long | 0.107 | 0.008 | 1.133 | 0.105 | 0.001 | 0.101 | 0.002 | 0.113 | 0.001 |

| Short | 0.077 | 0.151 | 0.692 | 0.078 | 0.068 | 0.084 | 0.052 | 0.096 | 0.033 |

| L-S | 0.030 | 0.169 | 0.832 | 0.027 | 0.183 | 0.017 | 0.382 | 0.017 | 0.382 |

| Regression-based approach: Value weights | |||||||||

| Long | 0.099 | 0.025 | 0.957 | 0.099 | 0.007 | 0.098 | 0.009 | 0.110 | 0.004 |

| Short | 0.057 | 0.285 | 0.516 | 0.058 | 0.161 | 0.057 | 0.162 | 0.065 | 0.129 |

| L-S | 0.042 | 0.172 | 0.966 | 0.041 | 0.192 | 0.041 | 0.196 | 0.045 | 0.148 |

| Regression-based approach: Equal weights | |||||||||

| Long | 0.122 | 0.008 | 1.110 | 0.122 | 0.001 | 0.121 | 0.001 | 0.135 | 0.001 |

| Short | 0.067 | 0.179 | 0.660 | 0.067 | 0.084 | 0.065 | 0.103 | 0.078 | 0.058 |

| L-S | 0.056 | 0.017 | 1.118 | 0.055 | 0.015 | 0.056 | 0.010 | 0.057 | 0.011 |

| Regression-based approach: Expected return weights | |||||||||

| Long | 0.165 | 0.052 | 0.760 | 0.166 | 0.027 | 0.165 | 0.039 | 0.171 | 0.037 |

| Short | 0.066 | 0.342 | 0.451 | 0.065 | 0.264 | 0.067 | 0.260 | 0.076 | 0.187 |

| L-S | 0.099 | 0.262 | 0.500 | 0.101 | 0.255 | 0.098 | 0.276 | 0.095 | 0.297 |

| Mean | p-Value | Sharpe | p-Value | p-Value | p-Value | ||||

|---|---|---|---|---|---|---|---|---|---|

| Multiple signals approach | |||||||||

| Long | 0.113 | 0.002 | 1.376 | 0.111 | 0.000 | 0.106 | 0.000 | 0.117 | 0.000 |

| Short | 0.068 | 0.148 | 0.691 | 0.068 | 0.067 | 0.071 | 0.059 | 0.084 | 0.030 |

| L-S | 0.045 | 0.003 | 1.946 | 0.043 | 0.003 | 0.035 | 0.012 | 0.033 | 0.017 |

| Regression-based approach: Value weights | |||||||||

| Long | 0.081 | 0.037 | 0.899 | 0.080 | 0.011 | 0.077 | 0.019 | 0.089 | 0.008 |

| Short | 0.059 | 0.259 | 0.564 | 0.058 | 0.155 | 0.053 | 0.192 | 0.062 | 0.139 |

| L-S | 0.022 | 0.524 | 0.398 | 0.022 | 0.546 | 0.024 | 0.505 | 0.027 | 0.455 |

| Regression-based approach: Equal weights | |||||||||

| Long | 0.108 | 0.006 | 1.184 | 0.107 | 0.000 | 0.106 | 0.001 | 0.119 | 0.000 |

| Short | 0.062 | 0.157 | 0.687 | 0.062 | 0.070 | 0.057 | 0.109 | 0.069 | 0.052 |

| L-S | 0.046 | 0.005 | 1.617 | 0.045 | 0.004 | 0.049 | 0.002 | 0.050 | 0.001 |

| Regression-based approach: Expected return weights | |||||||||

| Long | 0.142 | 0.072 | 0.707 | 0.142 | 0.036 | 0.140 | 0.055 | 0.147 | 0.046 |

| Short | 0.047 | 0.470 | 0.317 | 0.045 | 0.395 | 0.046 | 0.405 | 0.057 | 0.269 |

| L-S | 0.095 | 0.202 | 0.608 | 0.097 | 0.195 | 0.094 | 0.223 | 0.090 | 0.248 |

| No Volatility Scaling | |||||||||

| Mean | -Value | Sharpe | -Value | -Value | -Value | ||||

| Multiple signals approach | |||||||||

| Long | 0.112 | 0.011 | 1.200 | 0.115 | 0.001 | 0.112 | 0.001 | 0.122 | 0.001 |

| Short | 0.029 | 0.670 | 0.186 | 0.040 | 0.466 | 0.050 | 0.364 | 0.055 | 0.329 |

| L-S | 0.083 | 0.041 | 0.998 | 0.075 | 0.046 | 0.063 | 0.088 | 0.067 | 0.071 |

| With Volatility Scaling | |||||||||

| Mean | -Value | Sharpe | -Value | -Value | -Value | ||||

| Multiple signals approach | |||||||||

| Long | 0.117 | 0.004 | 1.364 | 0.120 | 0.000 | 0.116 | 0.001 | 0.126 | 0.000 |

| Short | 0.029 | 0.607 | 0.224 | 0.038 | 0.398 | 0.044 | 0.324 | 0.052 | 0.259 |

| L-S | 0.088 | 0.002 | 1.400 | 0.082 | 0.003 | 0.072 | 0.010 | 0.074 | 0.009 |

| Fully Invested Portfolios | |||||||||||

| Mean | -Value | Sharpe | -Value | -Value | -Value | Turn | MDD | ||||

| Equal-weighted | |||||||||||

| UC | 0.129 | 0.006 | 1.085 | 0.126 | 0.001 | 0.114 | 0.006 | 0.126 | 0.003 | 0.070 | 0.160 |

| LO | 0.117 | 0.009 | 1.151 | 0.116 | 0.001 | 0.112 | 0.002 | 0.125 | 0.001 | 0.009 | 0.127 |

| AS | 0.108 | 0.019 | 1.059 | - | - | - | - | - | - | 0.000 | 0.139 |

| Value-weighted | |||||||||||

| UC | 0.054 | 0.129 | 0.665 | 0.051 | 0.072 | 0.042 | 0.159 | 0.055 | 0.072 | 0.032 | 0.139 |

| LO | 0.072 | 0.075 | 0.760 | 0.070 | 0.027 | 0.065 | 0.048 | 0.079 | 0.022 | 0.013 | 0.155 |

| AS | 0.079 | 0.068 | 0.783 | - | - | - | - | - | - | 0.009 | 0.167 |

| Differences between Portfolios | |||||||||||

| Mean | -Value | Sharpe | -Value | -Value | -Value | ||||||

| Equal-weighted | |||||||||||

| UC-AS | 0.022 | 0.358 | 0.525 | 0.019 | 0.461 | 0.009 | 0.713 | 0.008 | 0.749 | ||

| LO-AS | 0.010 | 0.038 | 1.266 | 0.009 | 0.062 | 0.007 | 0.160 | 0.007 | 0.157 | ||

| UC-LO | 0.012 | 0.536 | 0.349 | 0.010 | 0.644 | 0.003 | 0.903 | 0.001 | 0.953 | ||

| Value-weighted | |||||||||||

| UC-AS | −0.025 | 0.159 | −0.749 | −0.027 | 0.104 | −0.034 | 0.049 | −0.034 | 0.045 | ||

| LO-AS | −0.008 | 0.191 | −0.744 | −0.008 | 0.126 | −0.011 | 0.057 | −0.011 | 0.052 | ||

| UC-LO | −0.018 | 0.147 | −0.744 | −0.019 | 0.097 | −0.024 | 0.047 | −0.024 | 0.043 | ||

| Expected Shortfalls (Daily Returns) | |||||||||||

| Equal-weighted | |||||||||||

| UC | 0.029 | 0.016 | 0.012 | ||||||||

| LO | 0.028 | 0.016 | 0.012 | ||||||||

| AS | 0.030 | 0.017 | 0.013 | ||||||||

| Value-weighted | |||||||||||

| UC | 0.031 | 0.018 | 0.014 | ||||||||

| LO | 0.030 | 0.018 | 0.014 | ||||||||

| AS | 0.032 | 0.019 | 0.014 | ||||||||

| Fully Invested Portfolios | |||||||||||

| Mean | -Val | Sharpe | -Val | -Val | -Val | Turn | MDD | ||||

| Equal-weighted | |||||||||||

| UC | 0.123 | 0.004 | 1.276 | 0.118 | 0.003 | 0.104 | 0.010 | 0.105 | 0.014 | 0.102 | 0.256 |

| LO | 0.107 | 0.008 | 1.135 | 0.105 | 0.001 | 0.101 | 0.002 | 0.112 | 0.001 | 0.005 | 0.119 |

| AS | 0.108 | 0.019 | 1.059 | - | - | - | - | - | - | 0.000 | 0.139 |

| Value-weighted | |||||||||||

| UC | 0.052 | 0.125 | 0.696 | 0.049 | 0.083 | 0.039 | 0.191 | 0.051 | 0.087 | 0.031 | 0.136 |

| LO | 0.073 | 0.069 | 0.771 | 0.071 | 0.026 | 0.066 | 0.046 | 0.079 | 0.022 | 0.011 | 0.155 |

| AS | 0.079 | 0.068 | 0.783 | - | - | - | - | - | - | 0.009 | 0.167 |

| Differences between Portfolios | |||||||||||

| Mean | -Val | Sharpe | -Val | -Val | -Val | ||||||

| Equal-weighted | |||||||||||

| UC-AS | 0.016 | 0.688 | 1.035 | 0.011 | 0.788 | −0.001 | 0.987 | −0.013 | 0.732 | ||

| LO-AS | −0.001 | 0.895 | −0.085 | −0.002 | 0.772 | −0.004 | 0.555 | −0.005 | 0.449 | ||

| UC-LO | 0.017 | 0.618 | 1.874 | 0.013 | 0.710 | 0.004 | 0.915 | −0.007 | 0.815 | ||

| Value-weighted | |||||||||||

| UC-AS | −0.027 | 0.185 | −0.689 | −0.030 | 0.115 | −0.037 | 0.064 | −0.038 | 0.053 | ||

| LO-AS | −0.006 | 0.296 | −0.618 | −0.007 | 0.206 | −0.009 | 0.110 | −0.010 | 0.084 | ||

| UC-LO | −0.021 | 0.159 | −0.690 | −0.022 | 0.097 | −0.028 | 0.058 | −0.028 | 0.050 | ||

| Expected Shortfalls (Daily Returns) | |||||||||||

| Equal-weighted | |||||||||||

| UC | 0.026 | 0.014 | 0.011 | ||||||||

| LO | 0.038 | 0.021 | 0.015 | ||||||||

| AS | 0.030 | 0.017 | 0.013 | ||||||||

| Value-weighted | |||||||||||

| UC | 0.031 | 0.018 | 0.014 | ||||||||

| LO | 0.030 | 0.018 | 0.015 | ||||||||

| AS | 0.032 | 0.019 | 0.014 | ||||||||

| Fully Invested Portfolios | |||||||||||

| Mean | -Val | Sharpe | -Val | -Val | -Val | Turn | MDD | ||||

| Equal-weighted | |||||||||||

| UC | 0.129 | 0.000 | 1.613 | 0.125 | 0.000 | 0.117 | 0.000 | 0.124 | 0.000 | 0.066 | 0.090 |

| LO | 0.109 | 0.003 | 1.321 | 0.107 | 0.000 | 0.103 | 0.001 | 0.113 | 0.000 | 0.019 | 0.104 |

| AS | 0.097 | 0.013 | 1.111 | - | - | - | - | - | - | 0.015 | 0.118 |

| Value-weighted | |||||||||||

| UC | 0.065 | 0.061 | 0.819 | 0.062 | 0.030 | 0.053 | 0.070 | 0.063 | 0.035 | 0.034 | 0.126 |

| LO | 0.072 | 0.052 | 0.846 | 0.069 | 0.019 | 0.064 | 0.038 | 0.075 | 0.017 | 0.016 | 0.142 |

| AS | 0.076 | 0.084 | 0.738 | - | - | - | - | - | - | 0.009 | 0.169 |

| Differences between Portfolios | |||||||||||

| Mean | -Val | Sharpe | -Val | -Val | -Val | ||||||

| Equal-weighted | |||||||||||

| UC-AS | 0.032 | 0.029 | 1.350 | 0.030 | 0.050 | 0.024 | 0.118 | 0.019 | 0.190 | ||

| LO-AS | 0.012 | 0.005 | 1.566 | 0.012 | 0.005 | 0.010 | 0.015 | 0.009 | 0.032 | ||

| UC-LO | 0.020 | 0.065 | 1.196 | 0.018 | 0.111 | 0.014 | 0.229 | 0.010 | 0.338 | ||

| Value-weighted | |||||||||||

| UC-AS | −0.010 | 0.528 | −0.365 | −0.013 | 0.384 | −0.019 | 0.212 | −0.022 | 0.138 | ||

| LO-AS | −0.004 | 0.686 | −0.202 | −0.005 | 0.523 | −0.008 | 0.361 | −0.010 | 0.261 | ||

| UC-LO | −0.006 | 0.402 | −0.600 | −0.007 | 0.322 | −0.011 | 0.137 | −0.012 | 0.088 | ||

| Mean | p-Val | Sharpe | p-Val | p-Val | p-Val | ||||

|---|---|---|---|---|---|---|---|---|---|

| Value-weighted portfolio based on most recent day’s declaration | |||||||||

| Long | 0.082 | 0.040 | 0.882 | 0.068 | 0.049 | 0.056 | 0.131 | 0.082 | 0.027 |

| Short | 0.012 | 0.855 | 0.059 | 0.014 | 0.743 | 0.036 | 0.417 | 0.047 | 0.271 |

| L-S | 0.070 | 0.048 | 1.110 | 0.054 | 0.152 | 0.020 | 0.579 | 0.035 | 0.361 |

| Value-weighted regression-based portfolio | |||||||||

| Long | 0.124 | 0.008 | 1.176 | 0.112 | 0.001 | 0.110 | 0.003 | 0.133 | 0.000 |

| Short | 0.041 | 0.454 | 0.359 | 0.037 | 0.364 | 0.041 | 0.328 | 0.055 | 0.187 |

| L-S | 0.083 | 0.009 | 1.729 | 0.076 | 0.004 | 0.069 | 0.005 | 0.078 | 0.002 |

| Mean | p-Val | Sharpe | p-Val | p-Val | p-Val | ||||

|---|---|---|---|---|---|---|---|---|---|

| Non-volatility-scaled | |||||||||

| Long | 0.082 | 0.040 | 0.880 | 0.068 | 0.049 | 0.056 | 0.132 | 0.082 | 0.027 |

| Short | −0.001 | 0.986 | −0.034 | 0.003 | 0.955 | 0.034 | 0.535 | 0.041 | 0.449 |

| L-S | 0.084 | 0.119 | 0.896 | 0.065 | 0.226 | 0.022 | 0.656 | 0.042 | 0.432 |

| Volatility-scaled | |||||||||

| Long | 0.081 | 0.038 | 0.905 | 0.065 | 0.069 | 0.050 | 0.183 | 0.072 | 0.053 |

| Short | −0.006 | 0.932 | −0.071 | −0.007 | 0.888 | 0.013 | 0.796 | 0.022 | 0.651 |

| L-S | 0.087 | 0.017 | 1.291 | 0.072 | 0.102 | 0.037 | 0.375 | 0.050 | 0.250 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ashby, M. Are Regulatory Short Sale Data a Profitable Predictor of UK Stock Returns? J. Risk Financial Manag. 2024, 17, 320. https://doi.org/10.3390/jrfm17080320

Ashby M. Are Regulatory Short Sale Data a Profitable Predictor of UK Stock Returns? Journal of Risk and Financial Management. 2024; 17(8):320. https://doi.org/10.3390/jrfm17080320

Chicago/Turabian StyleAshby, Michael. 2024. "Are Regulatory Short Sale Data a Profitable Predictor of UK Stock Returns?" Journal of Risk and Financial Management 17, no. 8: 320. https://doi.org/10.3390/jrfm17080320