Abstract

The integration of commodities into stock exchanges marked a pivotal moment in the analysis of price dynamics. Commodities are essential for both daily sustenance and industrial processes and are separated into hard commodities, like metals, and soft commodities, such as agricultural produce. This paper provides a review of the relevant literature concerning the implications of commodity price volatility on commercial and financial landscapes, recognizing its profound impact on global economies. Drawing from Google Scholar and Science Direct, we analyze trends in academic publications until 2022, particularly focusing on the interplay between volatility spillover and ten different commodities, providing insights into the evolution of research paradigms over time. In a nutshell, the literature suggests that relationships between hard commodities are stronger since, in addition to being raw materials, they also serve as investment products. For the same reason, relationships between agricultural products appear to be relatively weaker.

Keywords:

volatility spillover; gold; silver; aluminum; copper; platinum; oil; gas; soybeans; corn; wheat JEL Classification:

G11; G12; G13; G20

1. Introduction

Commodities are the main input in a variety of processes, either as raw materials for manufacturing, food, and survival or as parts of a product, with their importance growing over time, as they are key in economic growth and are expected to greatly support the green transition. These goods are usually divided into two basic categories: hard and soft. Specifically, hard commodities include metals (e.g., gold) and energy (e.g., natural gas), whereas soft goods are agricultural and livestock products such as corn and wheat (UNCTAD 2023).

Commodities and their means of exploitation have long been one of the main themes in the economic literature as to how the latter should be better managed. From the early works of Karl Marx (2016) to the neo-liberal economic approach of Milton Friedman (Milton 2007) in the Chicago School, as well as the recent works of globalization (Lang 2006) and de-globalization (Stiglitz 2017), commodities have constantly been on the economic agenda. At the same time, a country’s dependence on goods, conditional on its natural resources, can potentially define it in terms of economic prowess. In particular, it is a fact that phenomena such as unemployment and low rates of production processes are directly linked to dependence on goods (UNCTAD 2023).

Commodities have seen a recent resurgence in popularity since the beginning of the 21st century, as they have been introduced to exchanges, and their standardization as financial market products is a milestone creating measurable volatility with regard to their price behavior. For this reason, there has been a strong investor interest in commodities and their investment potential (Basak and Pavlova 2016). However, the modern era is also characterized by high levels of volatility, which is evident both in financial markets and the global economy.

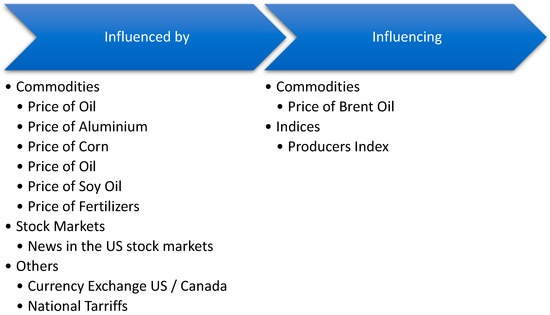

The effects of commodity price volatility become evident in the prices of various goods, stock markets, certain indices, stock markets, exchange rates, and a variety of different variables (Chevallier and Ielpo 2013; Gao et al. 2021; Hegerty 2016; Malik and Hammoudeh 2007; Mensi et al. 2017b; Sumner et al. 2010). Given that, as already discussed, these goods play an important role in the daily life of the global populace, it is understandable that price volatility affects not only the raw materials themselves but has a strong impact on the rest of the supply chain. For this reason, researchers frequently deal with the behavior of prices and the implications these may have. At the same time, for both practical and academic purposes, it is also of great importance to highlight the source of this volatility, given that the effect can be self-inflicted (e.g., higher oil price volatility due to conflict or due to production issues) in some cases, while in others the impact may spill over from other commodities.

In this research paper, our aim is to examine the sources of volatility in commodities and, in particular, any spillovers between commodity types. As such, we have collected all available bibliographies concerning the interdependence of the volatility of major commodities, both between themselves as well as other financial and economic markets. This survey aims to assist both academics and professionals in summarizing the existing knowledge on the relationship between the markets and to explore any potential gaps that exist concerning the matter.

The following section outlines the methodology used to obtain the relevant research papers on the topic, while the next two sections provide the results for both soft (agricultural) and hard (metals and energy) commodities. Overall, the results suggest quite a lot of interplay between commodity prices, something that will be outlined in the coming sections.

2. Methodology

The research was carried out using a specific methodological tool. In particular, methodical research was conducted with the aim of selecting data from reliable sources, as is common practice in the literature (Jan et al. 2023). This tactic presupposes the definition of specific keywords that are relevant to the subject of the research. In addition, it requires the search and selection of the literature through which the necessary data are retrieved (Saunders et al. 2009). The bibliographic review has as its main axis the critical utilization of the already existing scientific knowledge, aiming to cover the bibliographic gaps (Tranfield et al. 2003). At the same time, the methodological tool in question has the possibility of determining cognitive limitations and submitting proposals for further study. The choice of the specific method for the present research was made as the contemporary literature uses different tactics. This results in existing data coming from primary research. Thus, this particular study fills the gap by investigating the existing data.

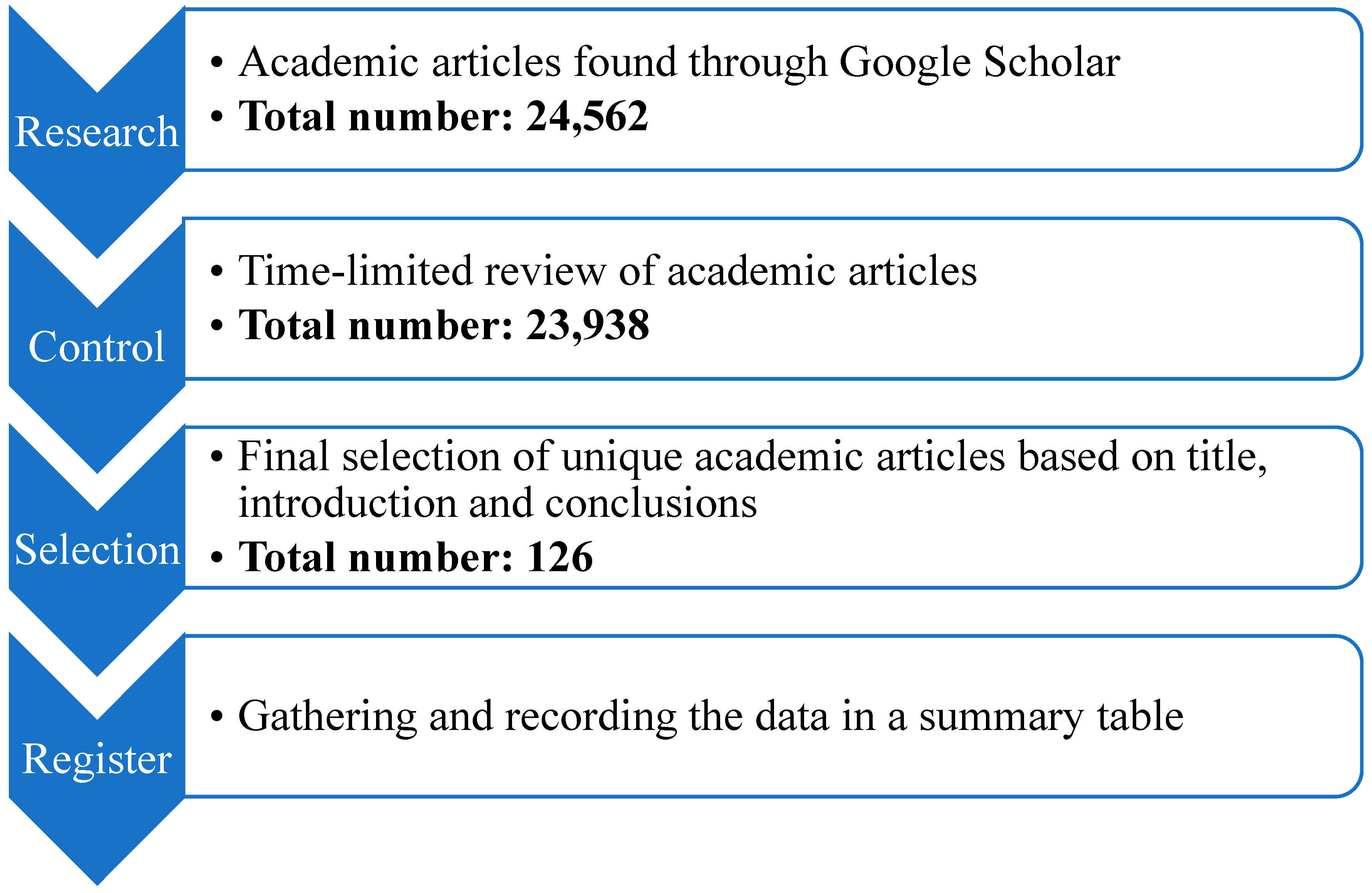

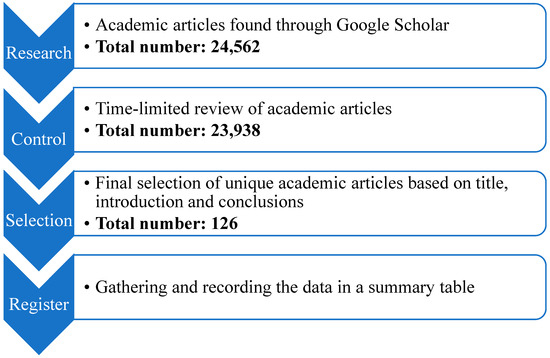

Therefore, the present research uses a literature review as a methodological technique, with the aim of selecting existing data and classifying them according to the content as well as the perspectives for future study. In detail, Figure 1 shows the steps of the method, which include searching the data, checking the relevant publications, selecting the scientific articles and recording them in summary tables. Additionally, Figure 1 graphically displays the number of academic publications per year for the “volatility spillover” and “gold” combination. It is important to note that the main purpose of gathering the data is to record research knowledge on the topic in question clearly and to identify directions for further research.

Figure 1.

Methodology flow chart.

The data collection for the present study was carried out using two electronic tools, Google Scholar and Science Direct. In particular, Google Scholar is one of the most popular search engines for academic publications, and it covers findings of a global scope. In addition, it offers numerous research publications regarding management and finance issues (Amara and Landry 2012) In addition, a variety of academic articles is sourced from Science Direct. In particular, it is considered an online site that provides academic findings that are published by the publishing house Elsevier. For this reason, it is a reliable source of data for the business and finance industry (Charoenthammachoke et al. 2020).

2.1. Search for Academic Articles

The search for the data was carried out using the online tools Google Scholar, while various findings come from publishing houses such as Springer, Elsevier, and Emerald. The search used only published academic articles on the subject. The keywords that were used to search the data are descriptive of the topic and the loads selected to be studied. In particular, these words were “volatility spillover”, “gold”, “silver”, “aluminum”, “copper”, “platinum”, “oil”, “natural gas”, “soybeans”, “corn”, and “wheat”. At this point, it is necessary to note that, during the research, combinations of the keyword “volatility spillover” were used with each of the above commodities. Therefore, the total combinations are ten and indicatively have the following form: “volatility spillover” and “gold.” In particular, the total number of results when searching for the above combinations in Google Scholar is 24,562. Table 1 presents the search results in more detail.

Table 1.

Search results.

2.2. Review of Peer-Reviewed Articles

The results of the initial search include published academic works of various years. Therefore, a selection of articles was then carried out, which were published in the last twenty-five years or so, namely from 1998 to 2024. The number of results is smaller compared to the initial search, as 23,958 appear in Google Scholar. Table 2 shows the results of the relevant publications in detail.

Table 2.

Time-limited search results.

2.3. Selection of Academic Articles

The initial search based on the general keywords indicated a large number of published articles having “volatility” or “spillover” in their topic. To ensure that each article in this study was relevant to the researched domain, the abstract, key words, and introductory section were manually evaluated by the authors. This allowed us to exclude false positives, i.e., articles that include the terms “volatility” and “spillover” in the title, abstract, or keywords but are unrelated to the domain under study.

In this way, the data for each project were checked thoroughly. Afterward, three academic experts were assigned the task of re-evaluating the listed documents. Then, the final selection was based on the presence or absence of the keywords in two main parts of the academic works. Thus, it was deemed necessary to have these words in the title and summary of the publications. This resulted in 119 unique articles being isolated from the Google Scholar and Science Direct search. This resulted in the following number of articles, as can be observed in Table 3.

Table 3.

Final results from Google Scholar and Science Direct.

2.4. Data Records

The gathering and recording of them was carried out using Excel, where summary tables were created according to the commodities. Specifically, the tables in question contain information related to the selected scientific articles. The author, the year of publication, the title of the article, the name of the scientific journal, the econometric method, the frequency of data collection, the period, the place of interest, and the results of each research are recorded in detail. It is important to note that the data in the scientific articles come from 1980 to 2024.

As we can observe from Table 4, the majority of the papers have been published in journals related to energy and resources thematics; however, due to the econometric approaches that volatility spillover is using, research has also appeared in econometric or financial journals.

Table 4.

Number of published papers per journal.

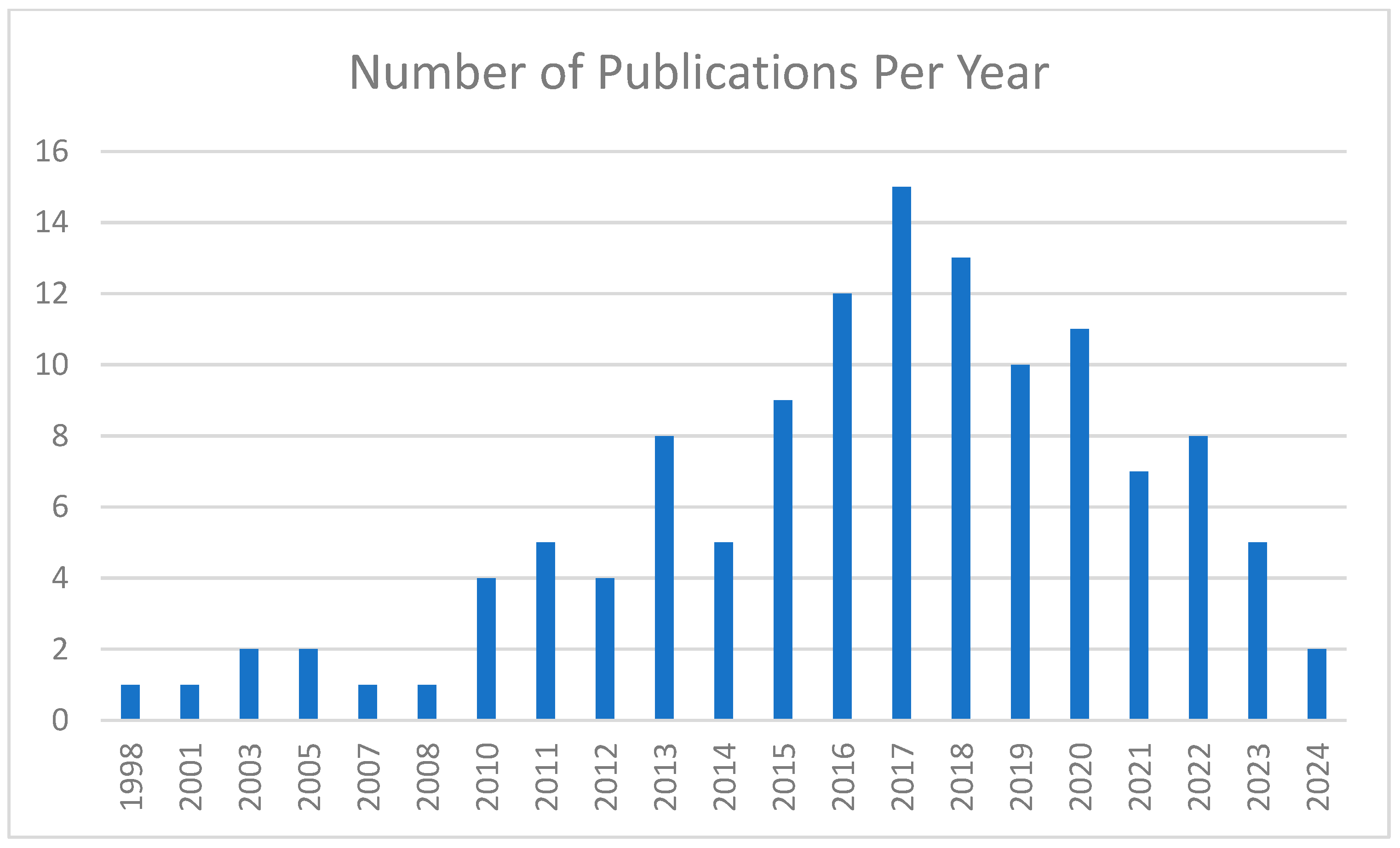

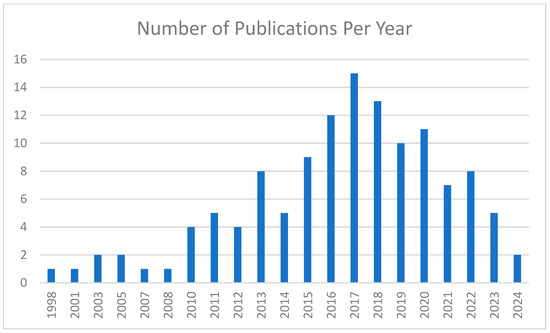

As our research has revealed, the matter of volatility spillover has been highly researched over the years, and we see a clear increase in publications between 1998 and 2024 in Figure 2. Regarding the publishing houses that publish research papers concerning the matter, we have found that the majority of them are under the auspices of the Elsevier publishing house, as can be seen from Table 5.

Figure 2.

Number of academic papers published per year.

Table 5.

Number of papers per publishing house.

Accordingly, we counted the research methodologies that each paper is using in order to establish the volatility spillovers (see Table 6). In particular, we group the methodologies into groups of methodologies that assist in clarifying the nature of the underlying methodology. We underline here that if a study has employed more than one methodology (e.g., GARCH and spillover index), this was counted in both categories.

Table 6.

Research methodologies.

The most popular methodology in the surveyed papers is the GARCH family of models, which includes studies that have employed either the Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) model or one of its variants (e.g., BEKK, GARCH-in-mean, etc.). As the table shows, the GARCH model family, given its, by construction, inherent ability to capture volatility, has been the main workhorse of the literature across all types of commodities.

The second most popular methodology is the Vector Autoregression (VAR) model family, which can employ impulse response functions, variance decompositions or historical decompositions, as well as other estimates (e.g., rolling windows) to reach its conclusions. The third most popular methodology employs the spillover index of Diebold and Yilmaz (Diebold and Yilmaz 2009), which specifies spillovers in a Vector Autoregression setup, in particular, using a variance decomposition. While the spillover index is, naturally, a subset of VAR models, we report it separately as it uses only one of the VAR outputs, while other papers focus on different aspects of the methodology. Other methodologies employed by the literature include Granger-causality studies and copula models, as well as frequency domain setups, along with other, even less popular methodologies such as non-linear types of estimations and Markov chain models.

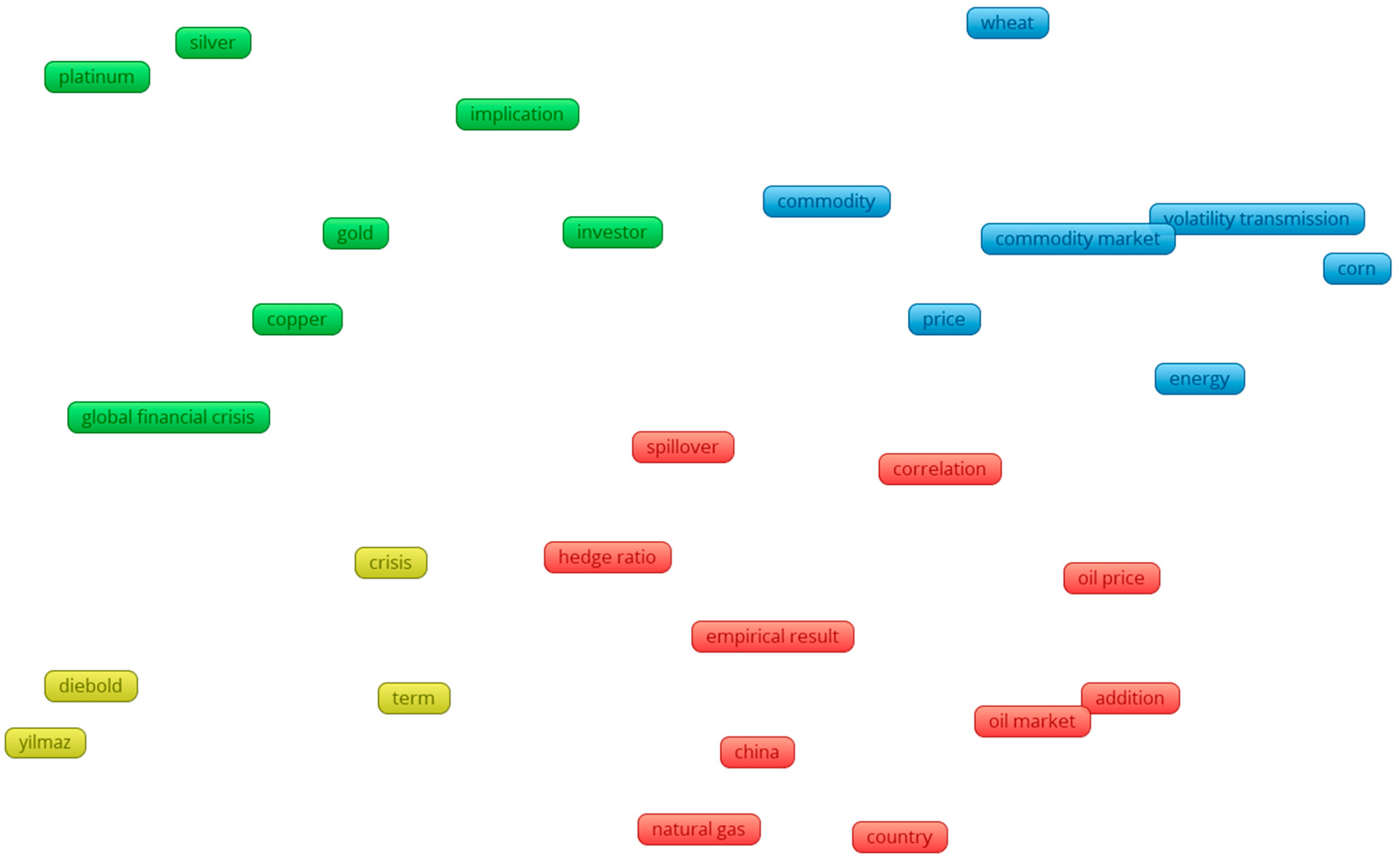

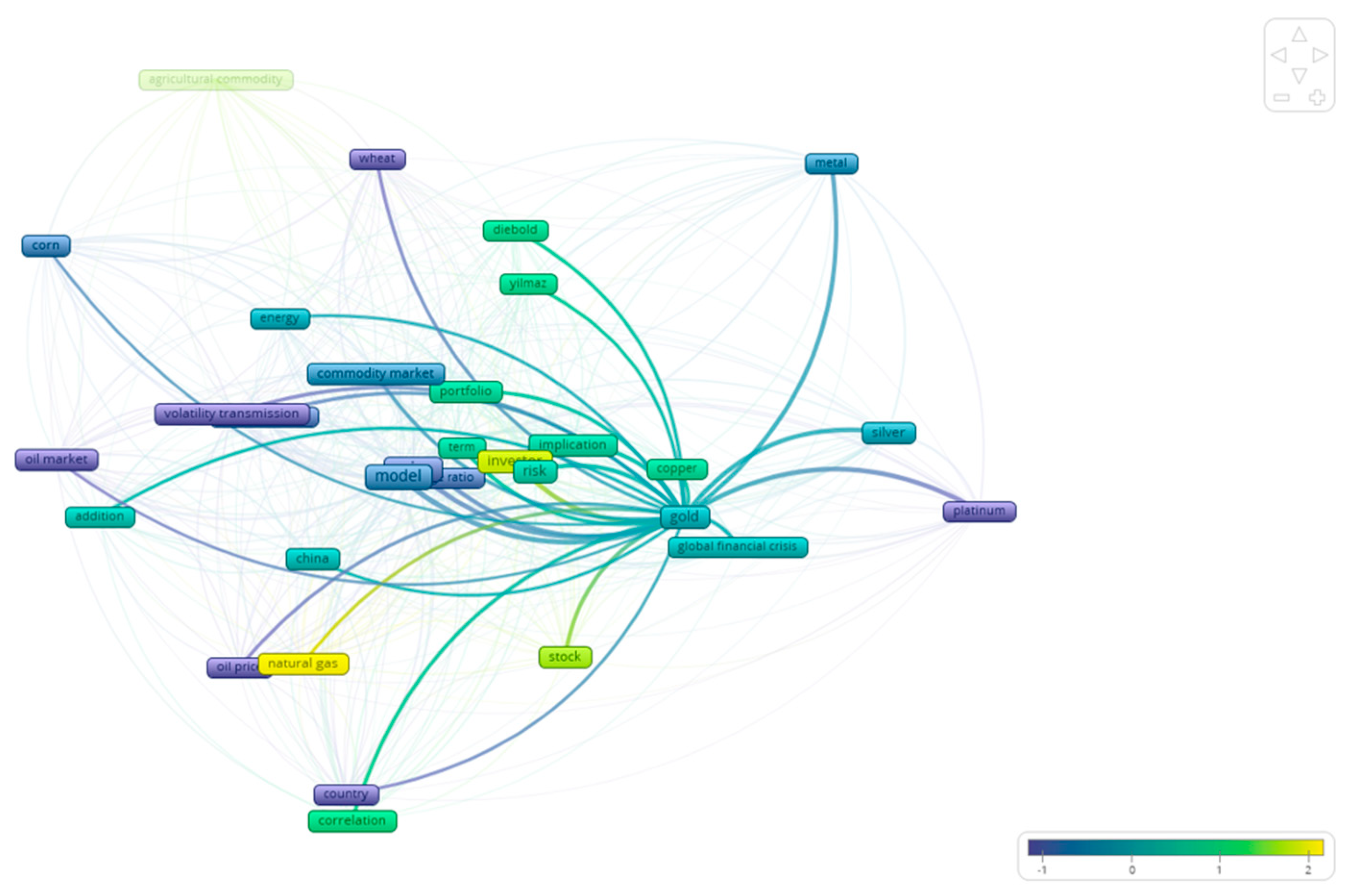

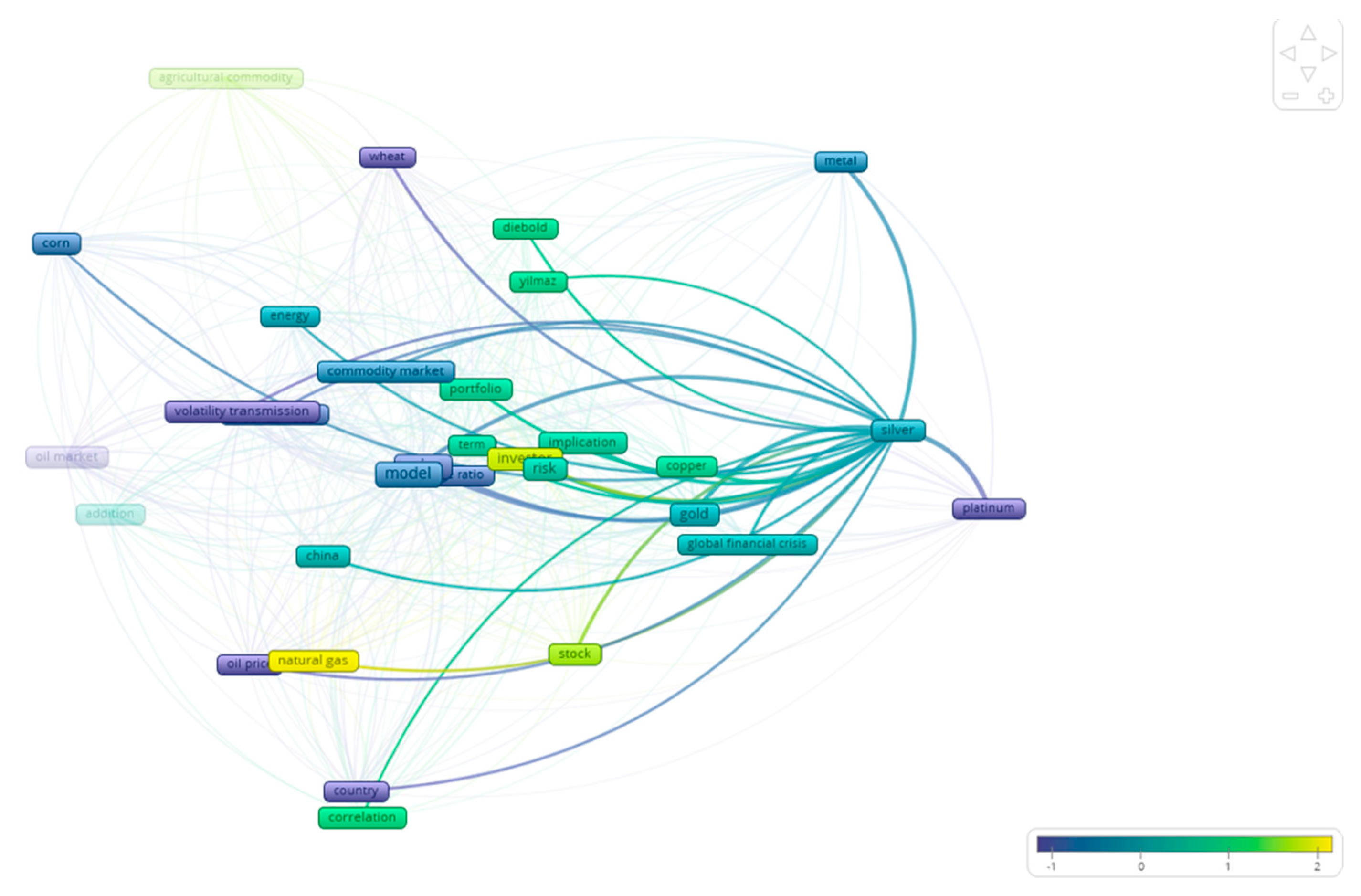

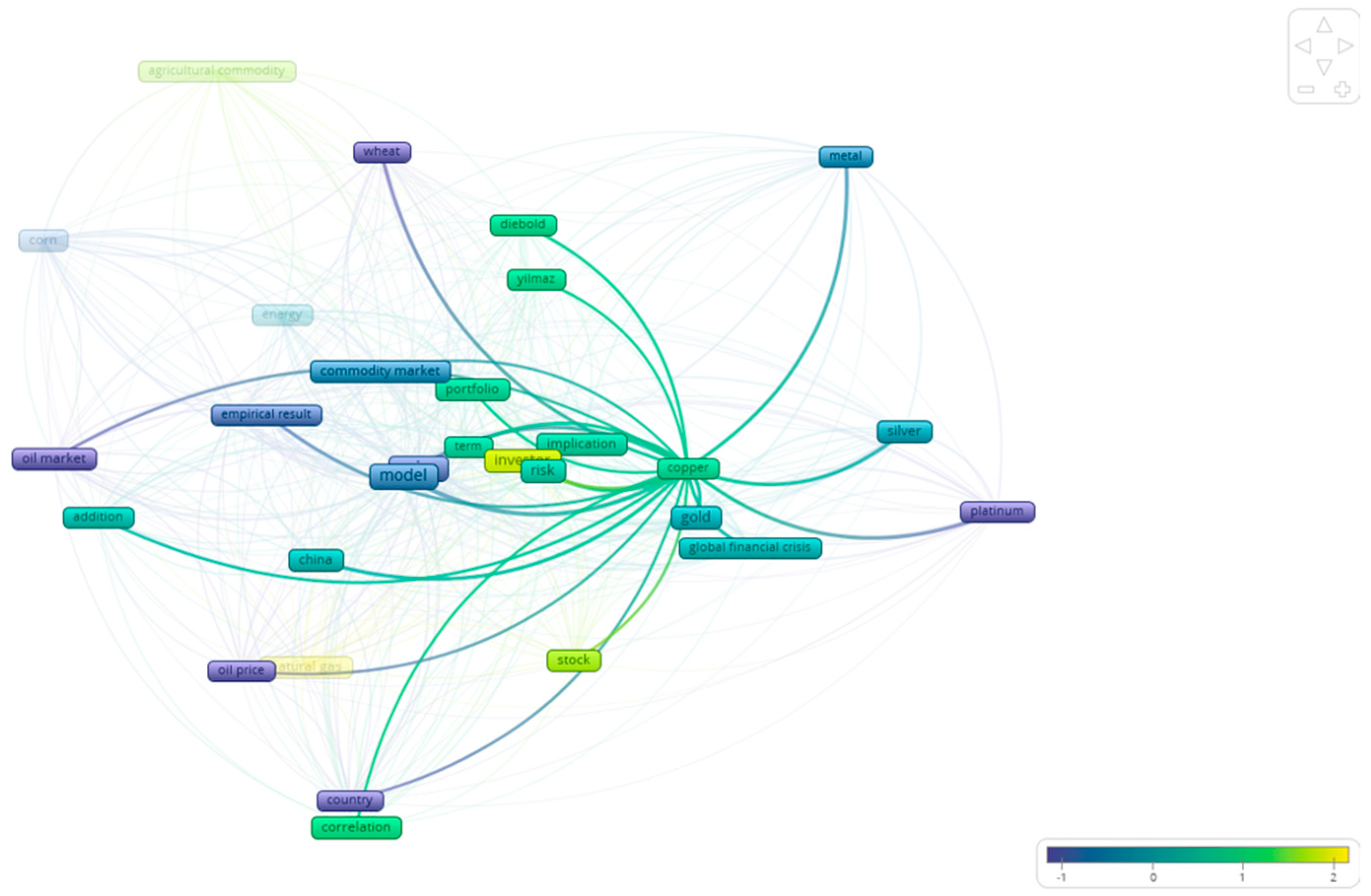

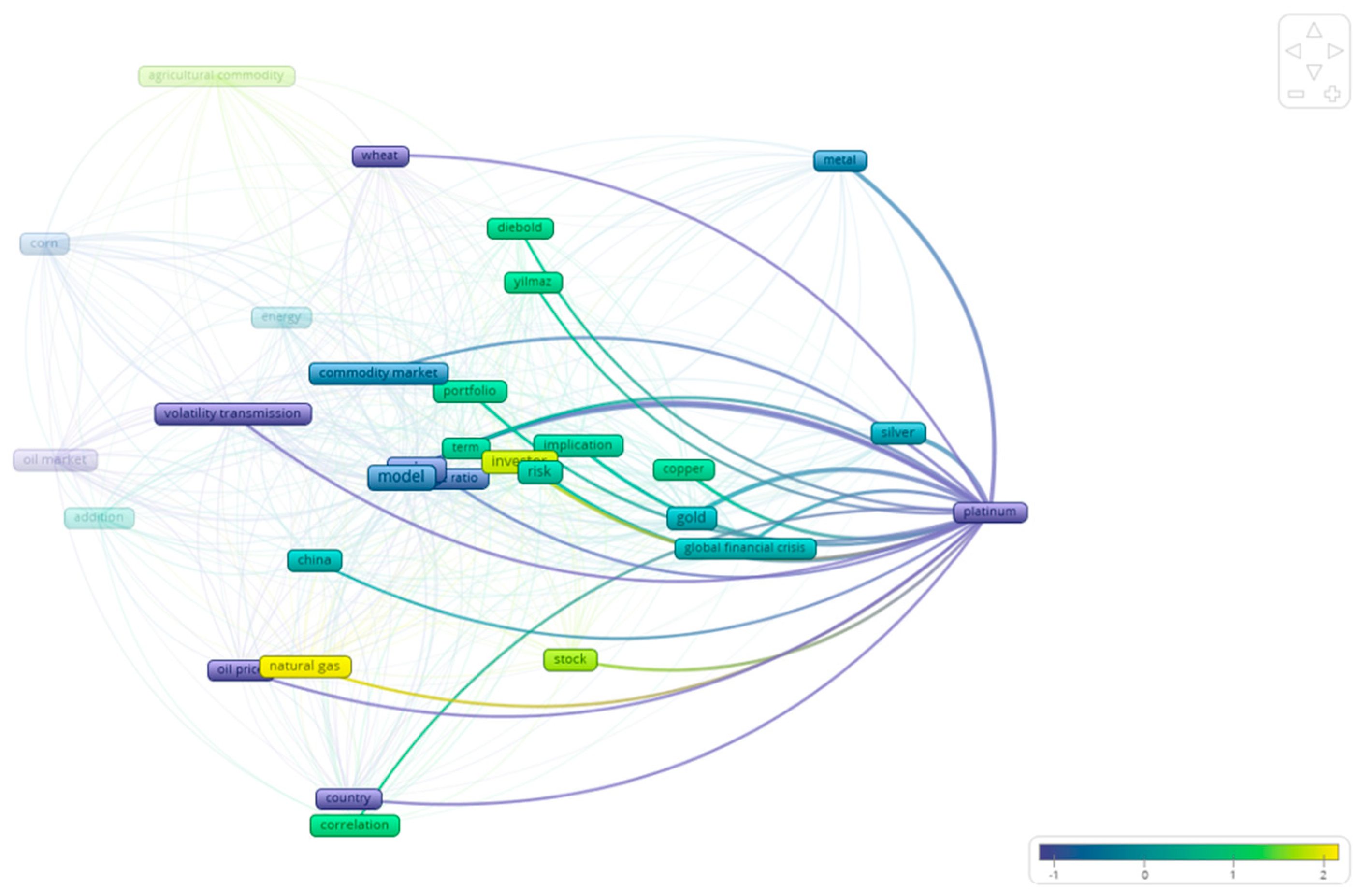

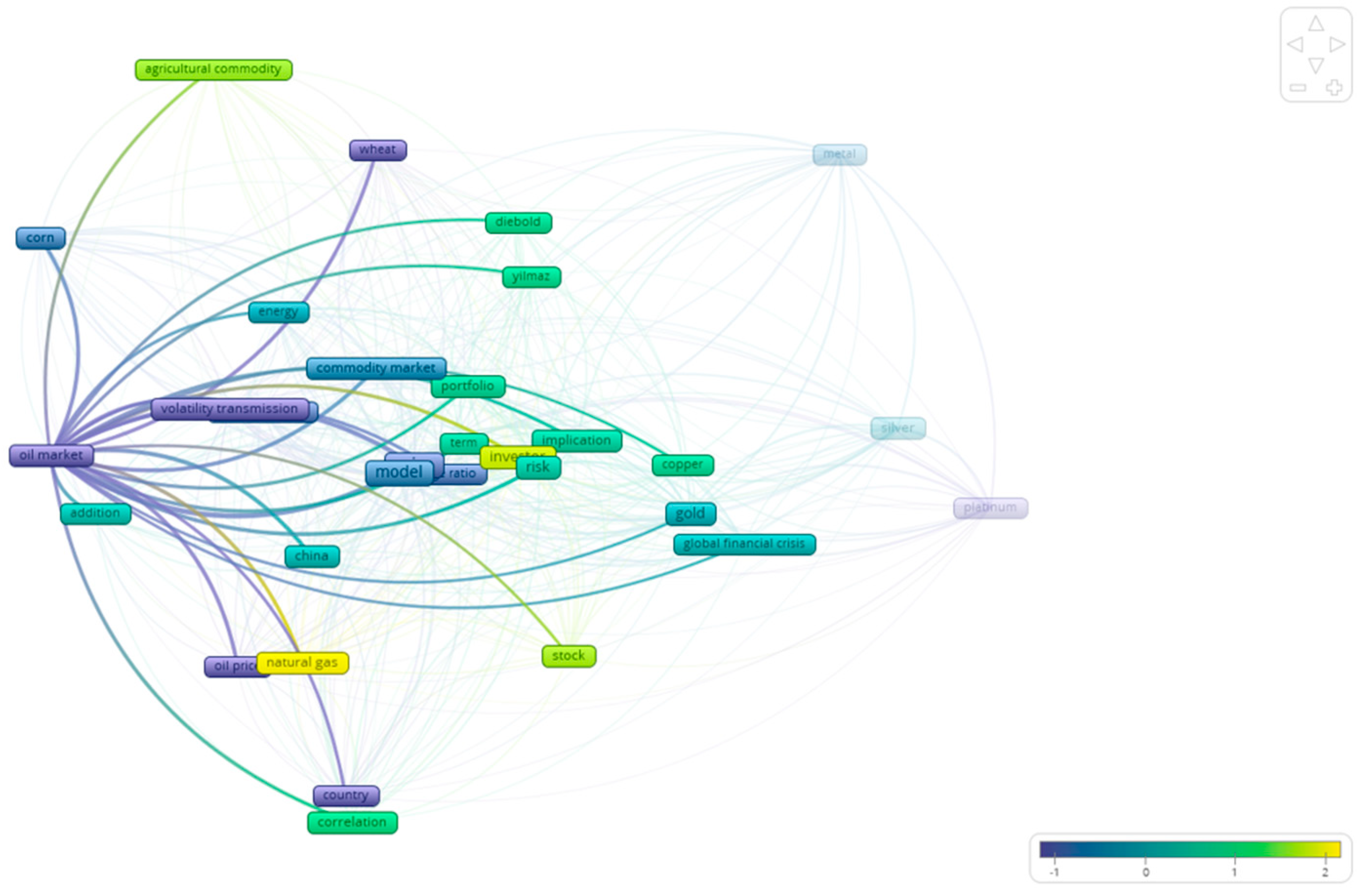

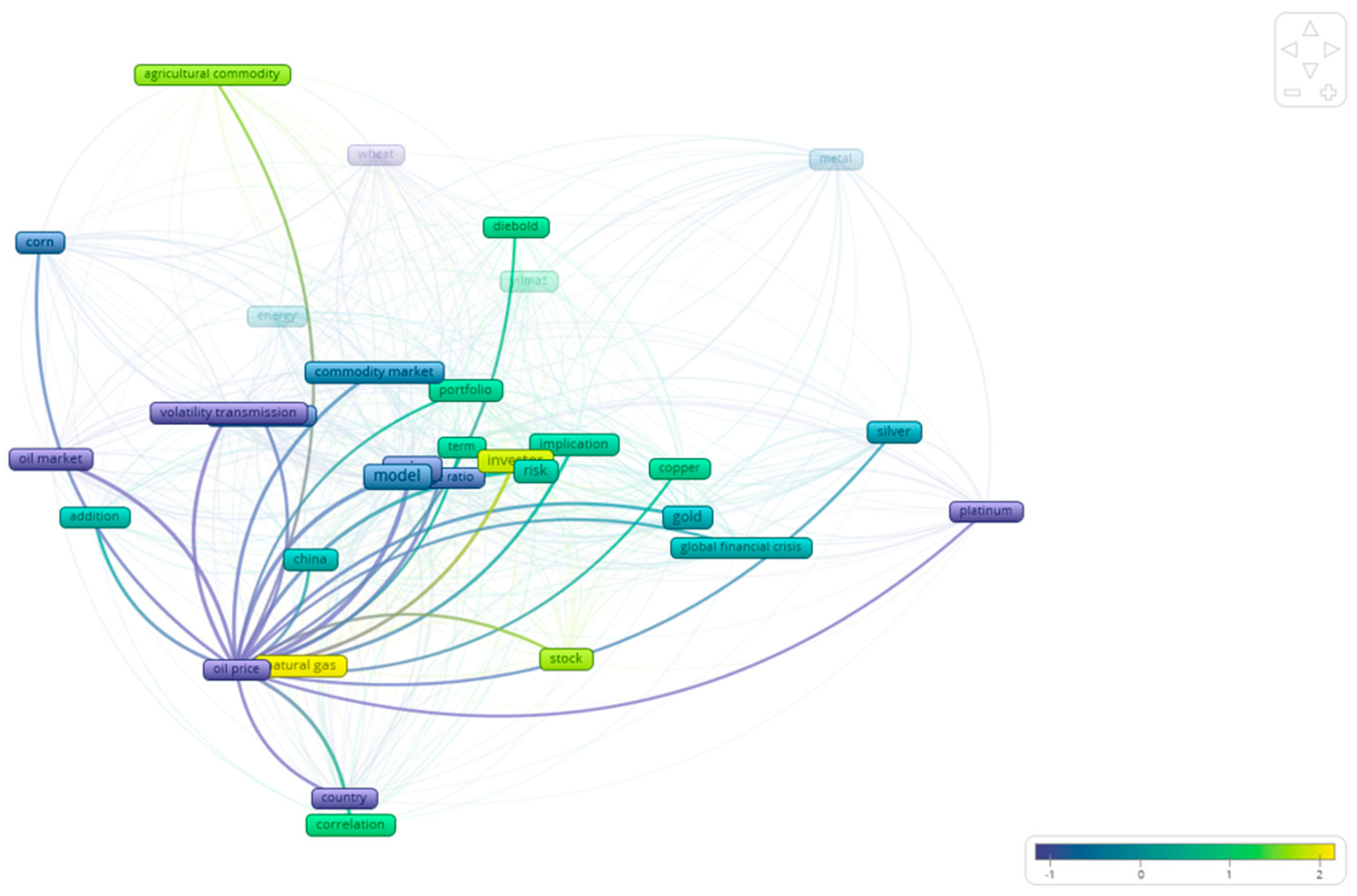

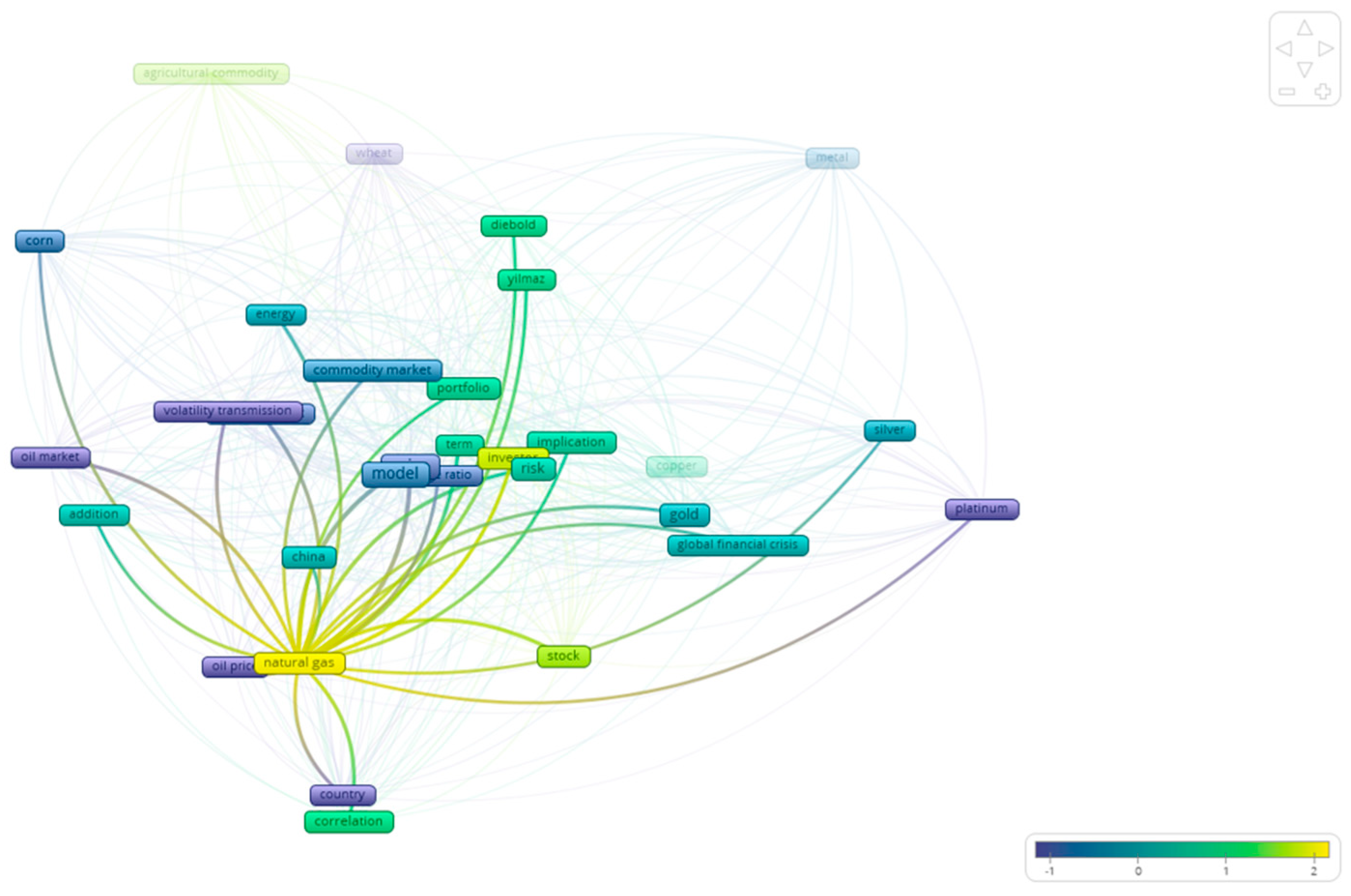

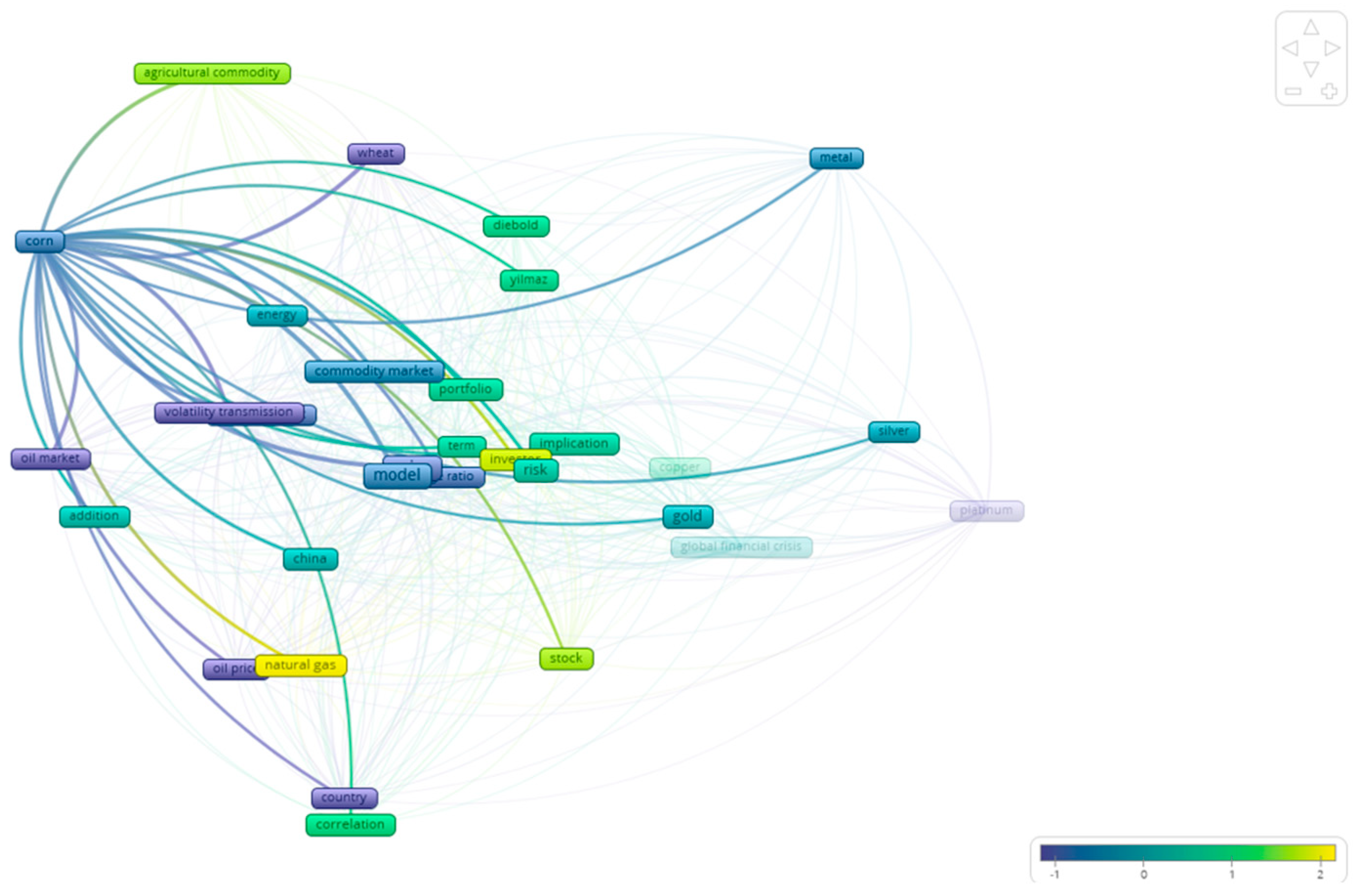

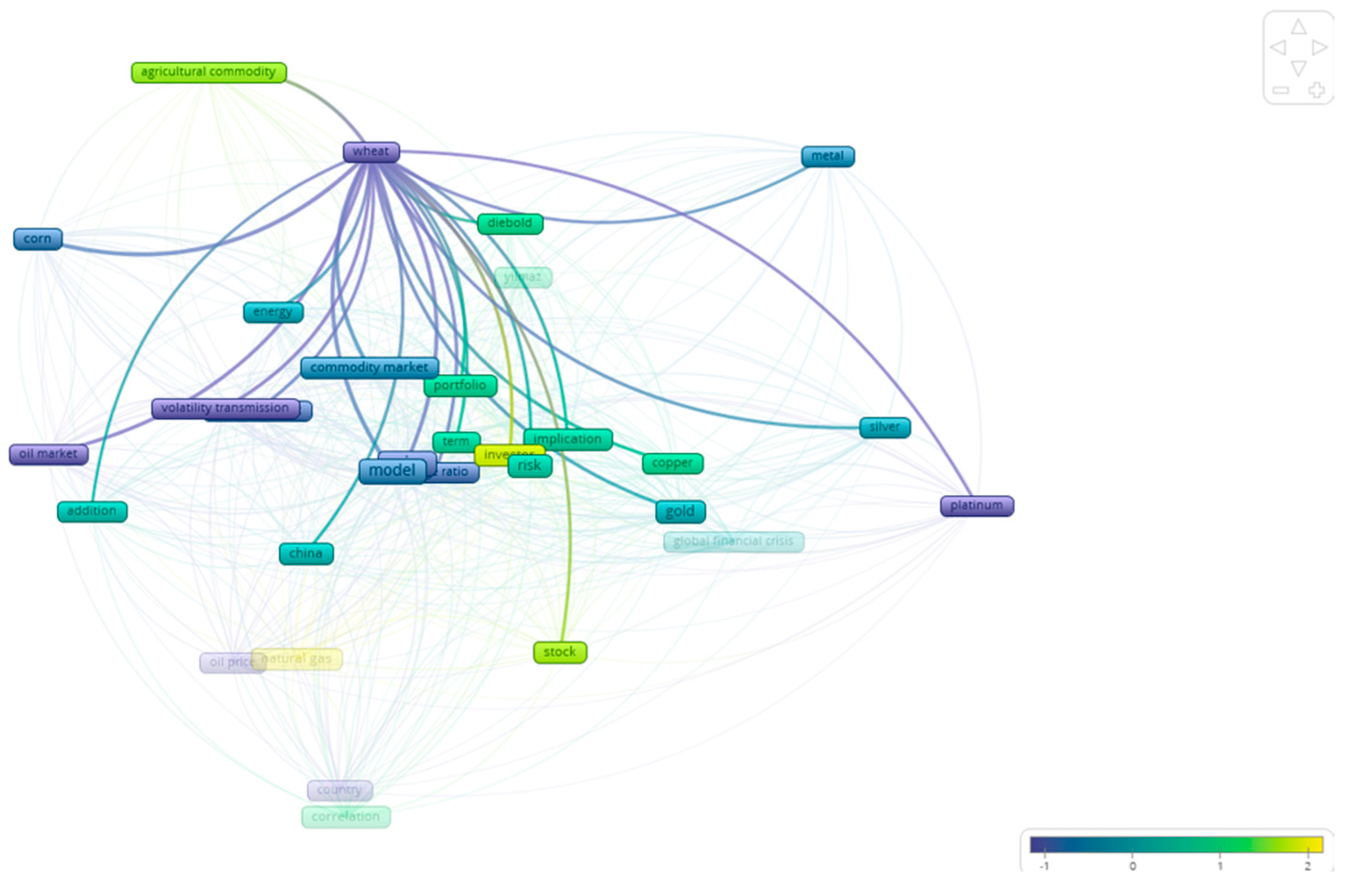

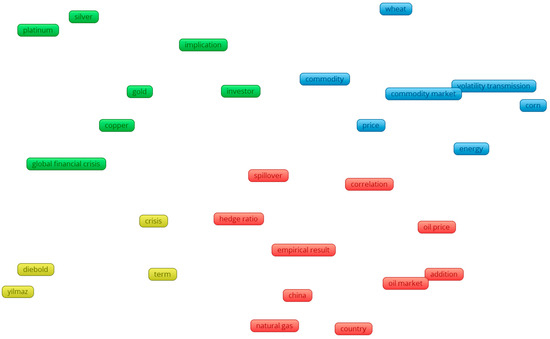

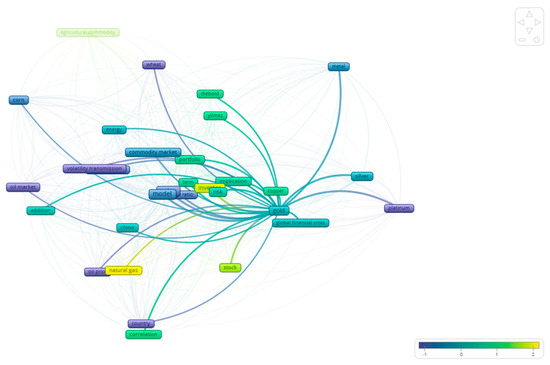

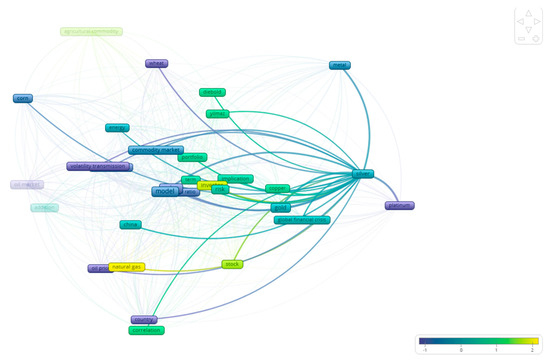

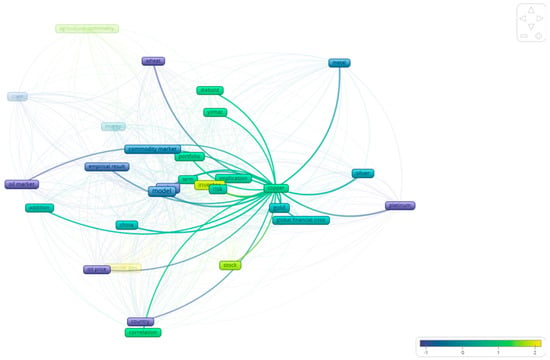

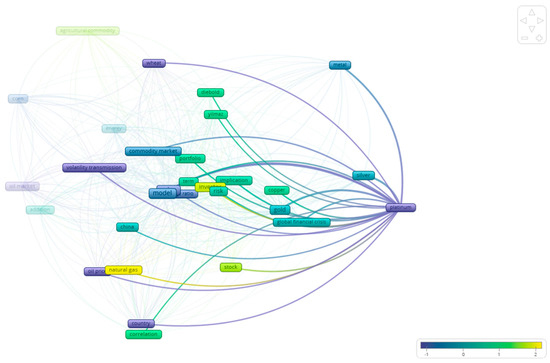

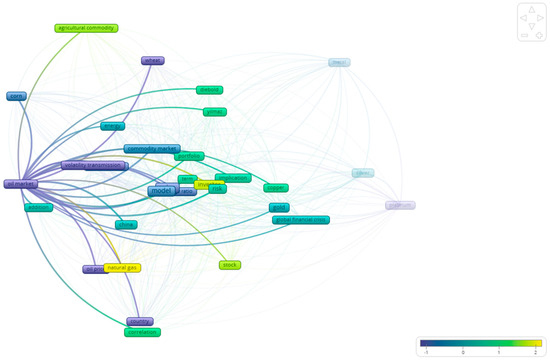

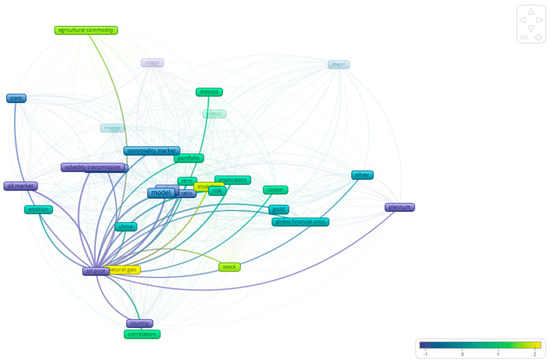

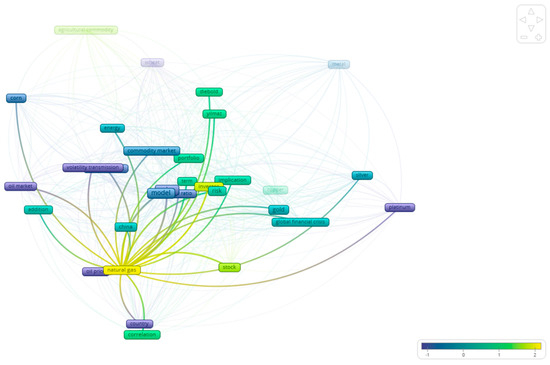

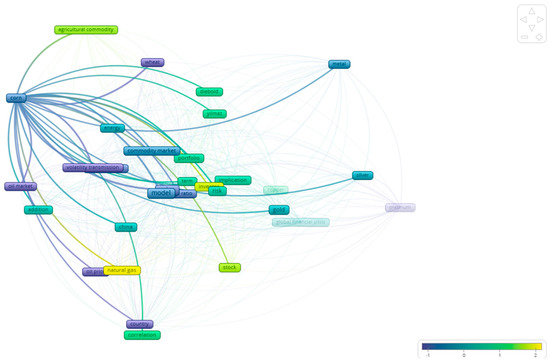

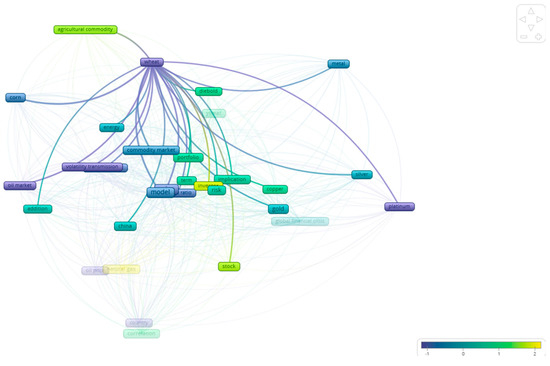

As already discussed, this study elaborates on the literature concerning the relationship between the volatility of different assets. As a first step, we used VOSViewer, 1.6.20 which enabled us to find the examined relationships that exist in the bibliography between the different commodities. As Figure 3 shows, there are four distinct clusters in the studies included in this paper. In particular, the majority of the studies study agricultural commodities in relation to the energy markets (blue color). In a similar manner, the bibliography focuses on the relationship between hard commodities (like gold, platinum, silver etc.), as observed by the green color in the figure. Following this mapping, the remainder of this section examines more closely, at the commodity level, the relationships that appear in the bibliography.

Figure 3.

Density visualization of the relevant bibliography.

3. Results—Hard Commodities

3.1. Gold

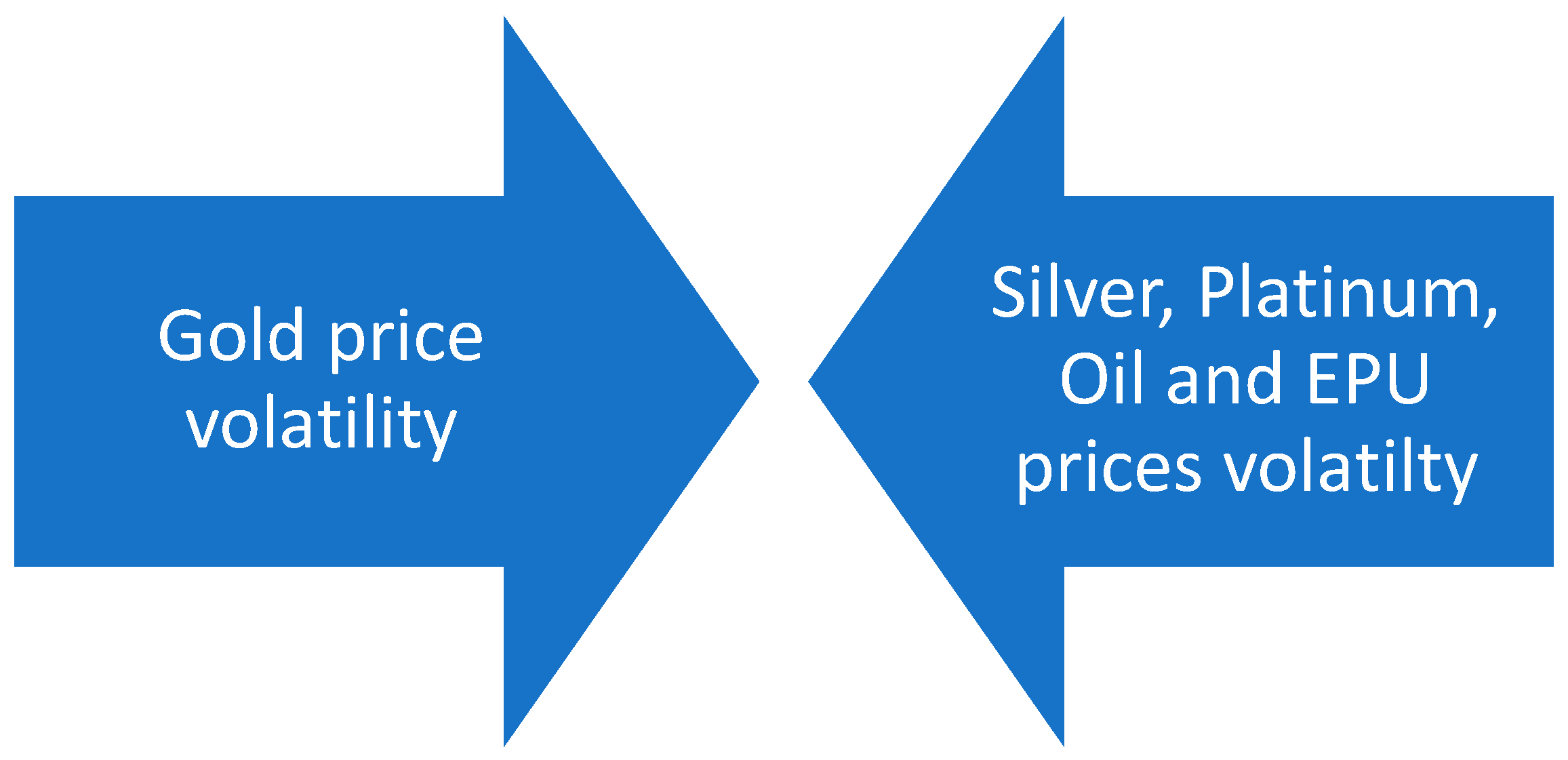

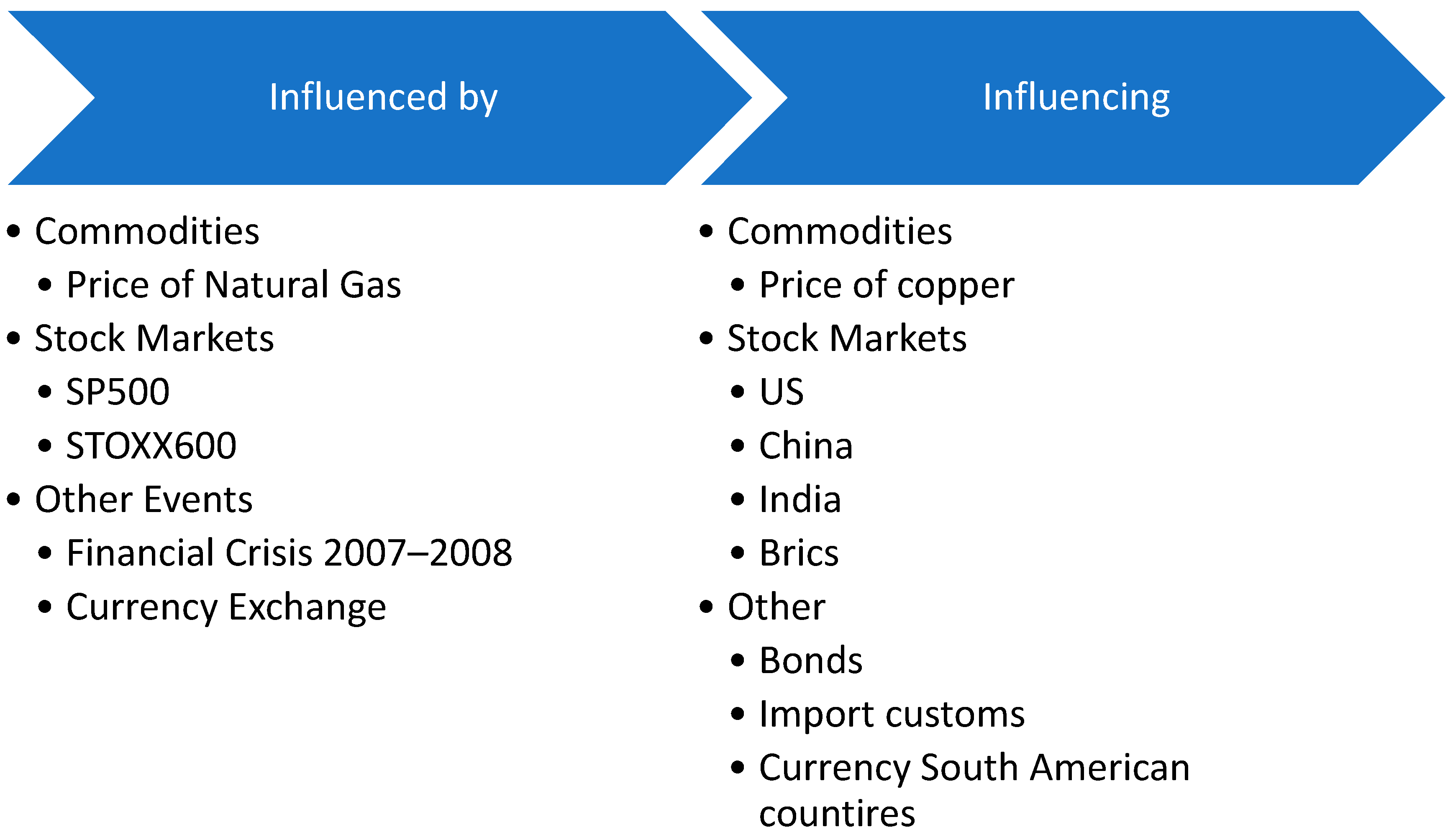

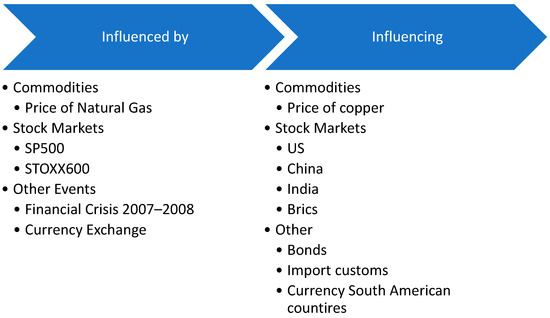

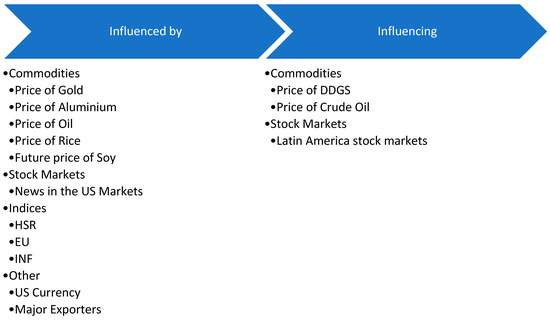

Golds market is affected by a variety of factors. In particular, according to Figure 4, precious metals such as silver and platinum have an obvious two-way effect on their prices in global markets (Mensi et al. 2017b; Reboredo and Ugolini 2015; Uddin et al. 2019). At the same time, energy commodities such as oil and natural gas play an important role in their price change at the international level and in the last 30 years (Arfaoui et al. 2023; Behmiri and Manera 2015; Guhathakurta et al. 2020; Jiang et al. 2022; Reboredo and Ugolini 2016). Additionally, there is a strong influence of various commodity prices on the volatility of the precious metal in India (Roy and Sinha Roy 2017). Therefore, it is necessary to point out that gold prices interact with each other. According to the literature, the New York market exerts a significant influence on gold prices in Asia and, in particular, in Tokyo and Shanghai (Wang et al. 2016).

Figure 4.

Gold price volatility and its main determinants.

Then, the stock market exerts a significant influence on the volatility of the price of the metal in question, as shown in Figure 5. In particular, during the period 2009–2014, the spot and forward price of gold on the Indian Multi Commodity Exchange showed a significant impact on the market for the precious metal, which in turn increased import duties but also the accuracy of domestic available reserves. It is crucial to add that the mobility of the stock market indices shows a significant impact on γολδ’σ price. In particular, the literature reports that volatility is observed in the precious metal market when the S&P 500, STOXX 600, and EPU indices show movements in their prices since the 1980s (Balcilar et al. 2019; Gao et al. 2021; Mensi et al. 2013, 2017b).

Figure 5.

Relationships between the markets that transmit and the ones that receive volatility from the prices of gold.

Modern researchers, examining the period since the 1990s, observed a strong influence of the international financial crisis of 2007 on various commodities, which resulted in the appearance of a changing price for gold (Chevallier and Ielpo 2013). In addition, another major factor in gold price volatility appears to be the exchange rates. It is necessary to note that exchange rate markets interact with each other as well as with the markets of various goods (Hammoudeh et al. 2010; Kumar et al. 2022). Finally, the interest of various scholars has been attracted to the monetary variables and the existence of correlation with the gold market. Thus, the literature shows that there is an effect of monetary variables on the price of the precious metal during the period 1986–2006 (Batten et al. 2010). However, the influence that the volatile price of gold has on different variables is remarkable.

The literature time limits the effect of gold on other commodities from 1985 to the present. In particular, the researchers observe a special correlation between the gold market and other precious metals such as silver, platinum, and copper, while at the same time, it seems to affect future prices (Antonakakis and Kizys 2015; Dutta 2018; Kang et al. 2017; Oliyide et al. 2021; Umar et al. 2021). At this point, it is necessary to point out that precious metal markets show significant interactions regarding their prices (Batten et al. 2015). Additionally, oil prices are greatly affected whenever gold markets are volatile (Ewing and Malik 2013; Maghyereh et al. 2017; Tiwari et al. 2021).

More recently, the war between Ukraine and Russia has pushed gold pressure on other commodities, and a separate example of this pressure is wheat price volatility (Wang et al. 2022). During the research of the BRICS markets, the volatility of the gold price affects the South African exchange rate and inflation (Hegerty 2016). In conclusion, the volatility of gold in the US and Japanese markets appears to interact with each other, with the former market appearing to exert a stronger influence (Xu and Fung 2005).

At this point, it is necessary to point out that the research on the behavior of gold was carried out thoroughly and in both directions. Nevertheless, the relationship between agricultural commodities and gold, as observed in Figure 6 and from the review so far, has been under-researched. Given the political unrest of the current period, we would suggest that future research would look into this area.

Figure 6.

Relationship between gold and other relevant themes.

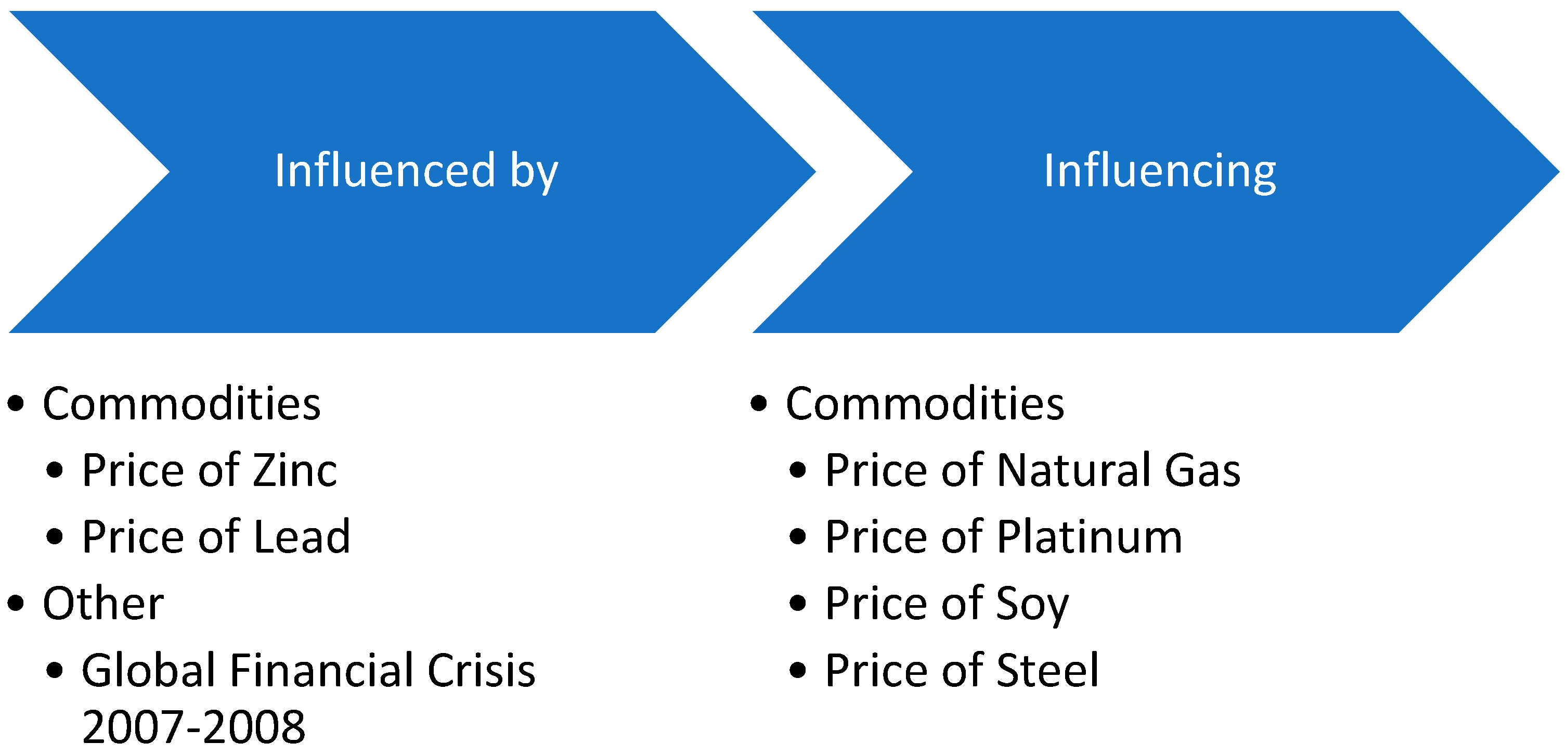

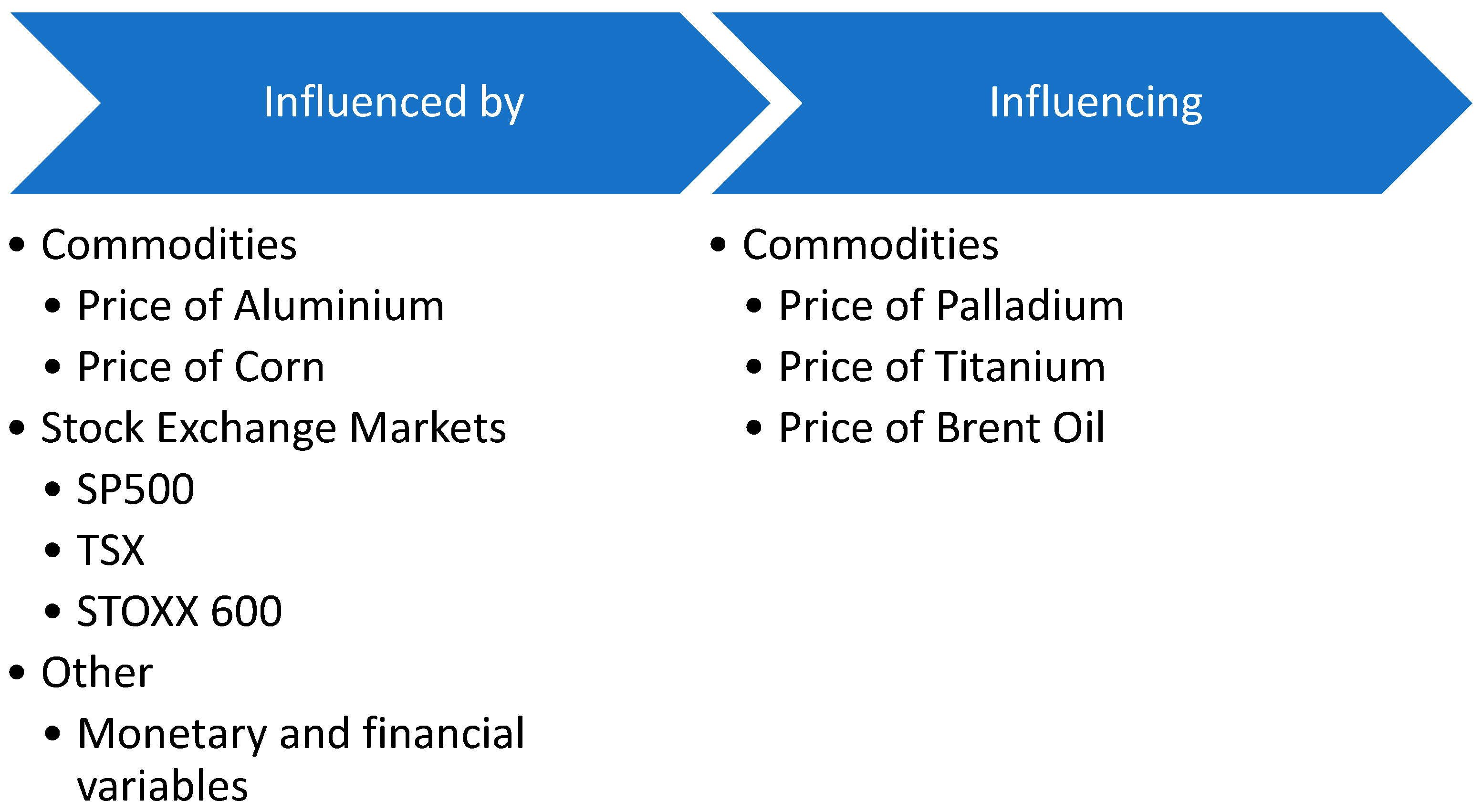

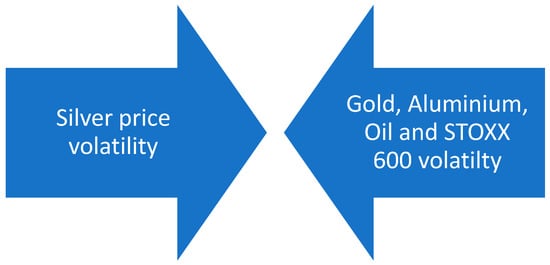

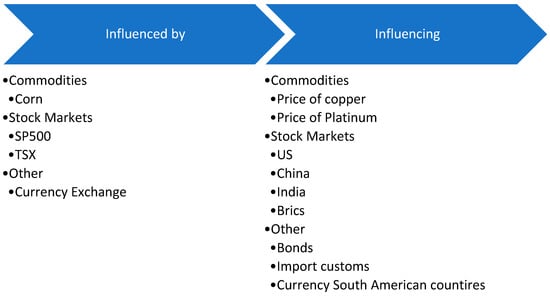

3.2. Silver

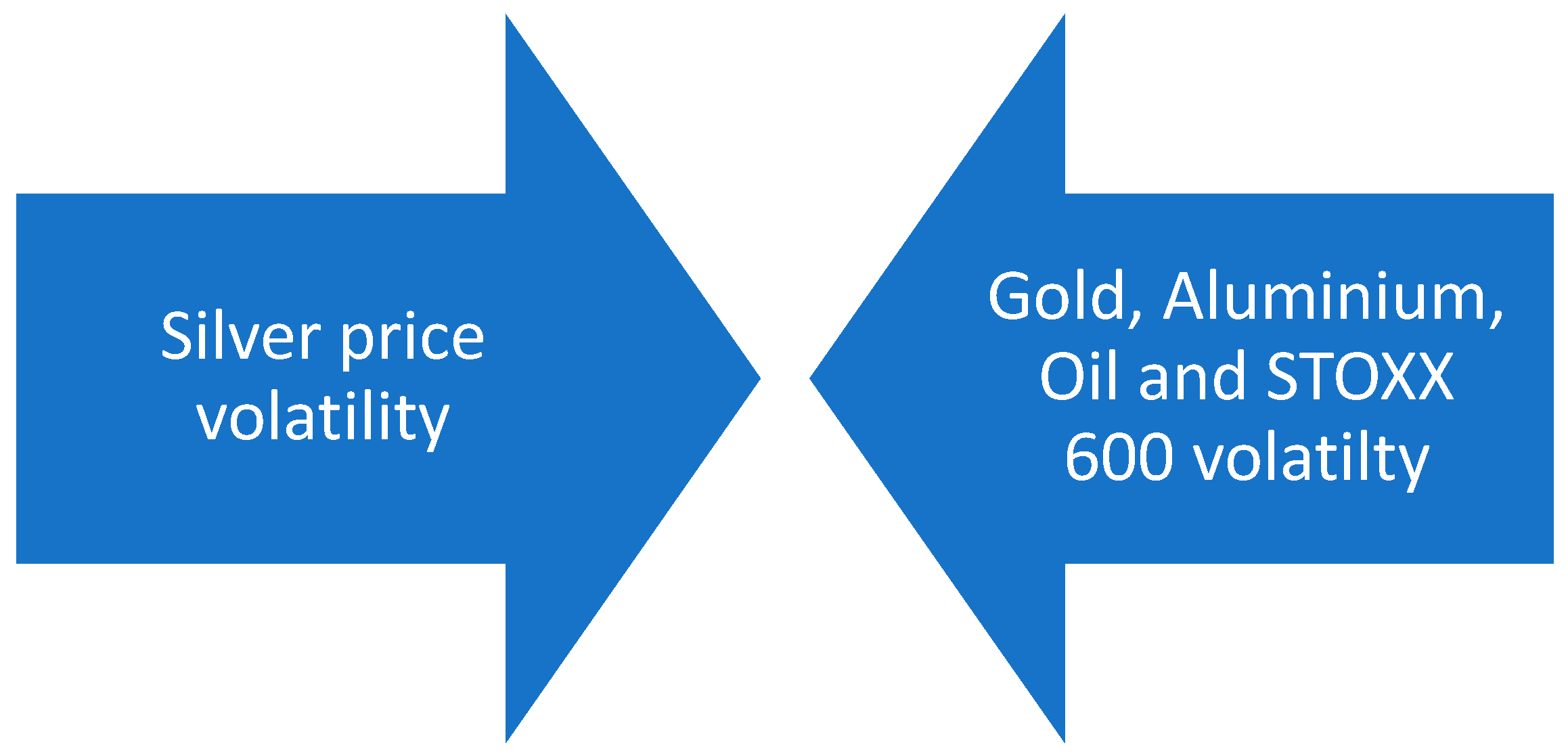

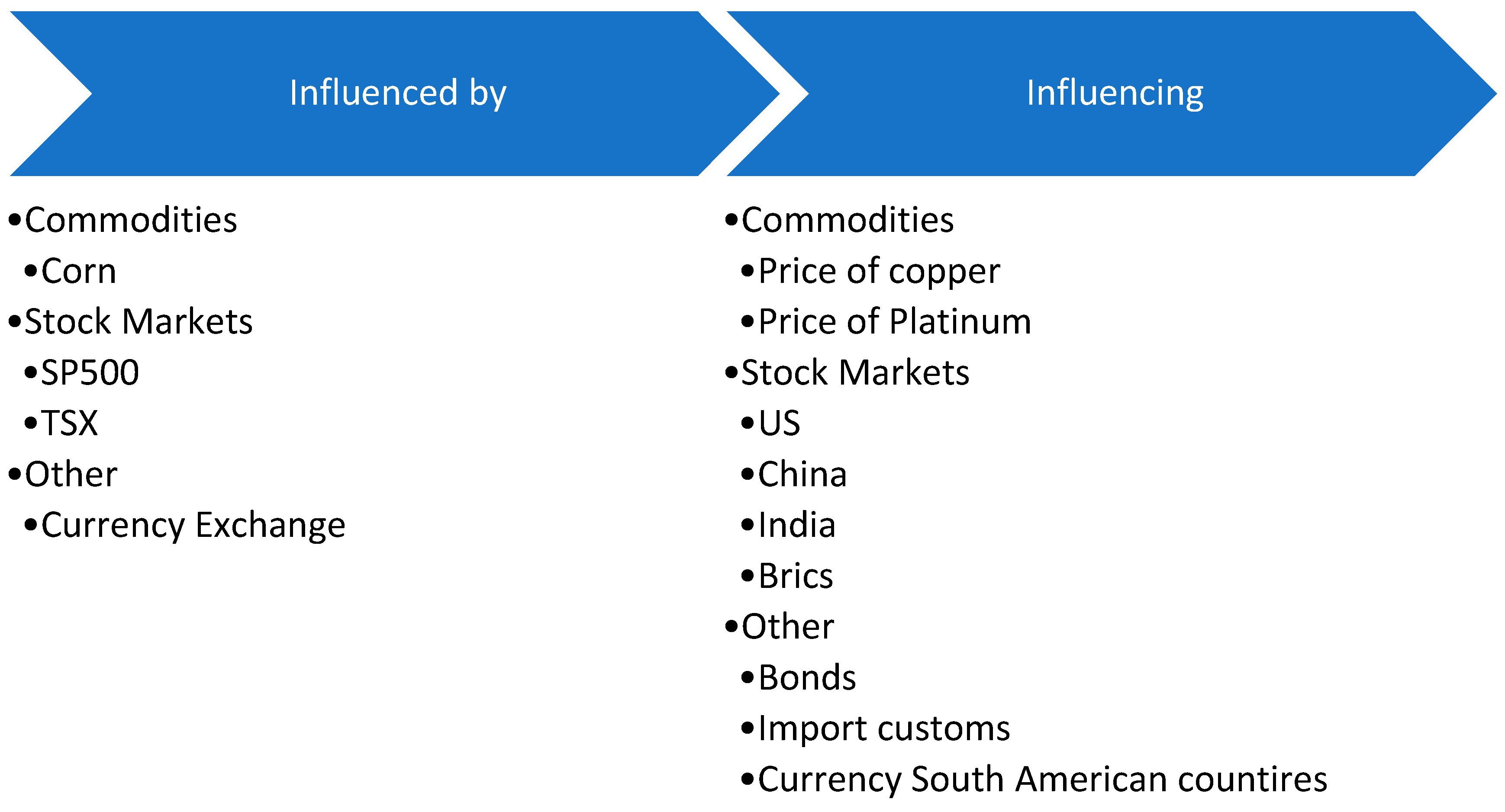

Silver, like any precious metal, exhibits a strong correlation with a variety of commodities, as shown in Figure 7. Of particular importance is the effect of oil on it. The literature reports that sudden changes in the price of oil have a direct effect on the volatility of the price of silver during the period 1993–2015 in international markets (Behmiri and Manera 2015; Reboredo and Ugolini 2016). Additionally, the relationship of all precious metals to silver is important. In particular, the researchers, when examining the period 1986–2015, noted that almost all metals (Batten et al. 2010; Reboredo and Ugolini 2015) influence silver. However, the strongest interaction appears to exist between gold, aluminum, and silver over the last 30 years (Antonakakis and Kizys 2015; Chevallier and Ielpo 2013; Dutta 2018; Uddin et al. 2019; Umar et al. 2021). In addition, silver is correlated with the price of an agricultural product, corn. It is reported in the literature that the volatility of the price of this agricultural product had significant effects on the silver market (Chevallier and Ielpo 2013).

Figure 7.

Silver price volatility and its main determinants.

It is necessary to note that various financial indicators heavily influence its market. In particular, the movement of the S&P 500, STOXX 600, and TSX indices approached the interest of the researchers during the period under review from 2000 to 2016. The results of the research show a strong pressure of these indices on the price of silver (Mensi et al. 2017b). In summary, the market of silver shows a strong connection with the exchange rate. The researchers, examining daily data, concluded that during the decade 1997–2007, the foreign exchange market affected the change in the price of silver (Hammoudeh et al. 2010).

However, it is equally important to analyze the variables that affect the volatility of silver prices. Like any precious metal, silver has a significant impact on hard commodities. In particular, the literature reports that silver affects the price of gold, aluminum, copper, and platinum when examining the period 1982–2019, while this relationship is strongly displayed in the markets of China, Japan, and the USA (Batten et al. 2015; Chevallier and Ielpo 2013; Hu et al. 2020; Oliyide et al. 2021; Reboredo and Ugolini 2015; Xu and Fung 2005). In addition, the mention of its effect during the war in Ukraine is noteworthy. Contemporary research notes that silver, along with gold, copper, and platinum, are the transmitters of volatility in commodities such as wheat (Wang et al. 2022).

A variety of studies then presents the connectivity of silver market volatility with stock markets and financial indices. The effect of silver is felt in various financial institutions inside and outside Europe, such as in Germany, France, South Korea, India, and the USA. Researchers report that during and after the global crisis, precious metal price volatility pressured financial markets (Tiwari et al. 2021; Vardar et al. 2018). Additionally, the STOXX 600 index is a shining example of the effect of silver on financial variables, especially during the period 2000–2016 (Mensi et al. 2017b). Research reports that this precious metal has a significant impact on solar energy businesses, specifically in the period 2011–2017 (Dutta 2019), as can be observed from Figure 8.

Figure 8.

Relationships between the markets that transmit and the ones that receive volatility from the price of silver.

However, scholarly research on silver market activity is relatively limited compared to that of gold. The basic proposition of this bibliographic study is the future engagement of researchers with the behavior of the price of silver in agricultural products and the oil markets (primarily refined products) (see Figure 9).

Figure 9.

Relationship between silver and other relevant themes.

3.3. Aluminum

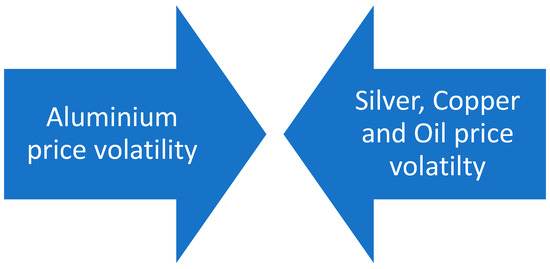

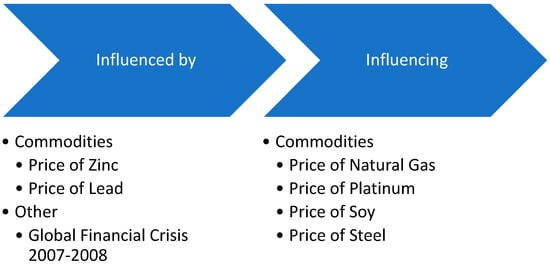

Aluminum, also known as aluminium, shows a weaker interaction with the rest of the commodities, as can be understood from Figure 10. Specifically, according to the literature, this precious metal is under pressure from the volatility of the price of zinc and lead (Gong et al. 2022). At the same time, according to Figure 10, aluminum has a bidirectional effect with silver and copper. In particular, the researchers have presented a correlation of these three metals since 1985 (Chevallier and Ielpo 2013; Oliyide et al. 2021; Umar et al. 2021). However, this relationship is noteworthy in the Chinese market, where the literature states that the specific metals interacted with each other in the period 2009–2017 (Hu et al. 2020).

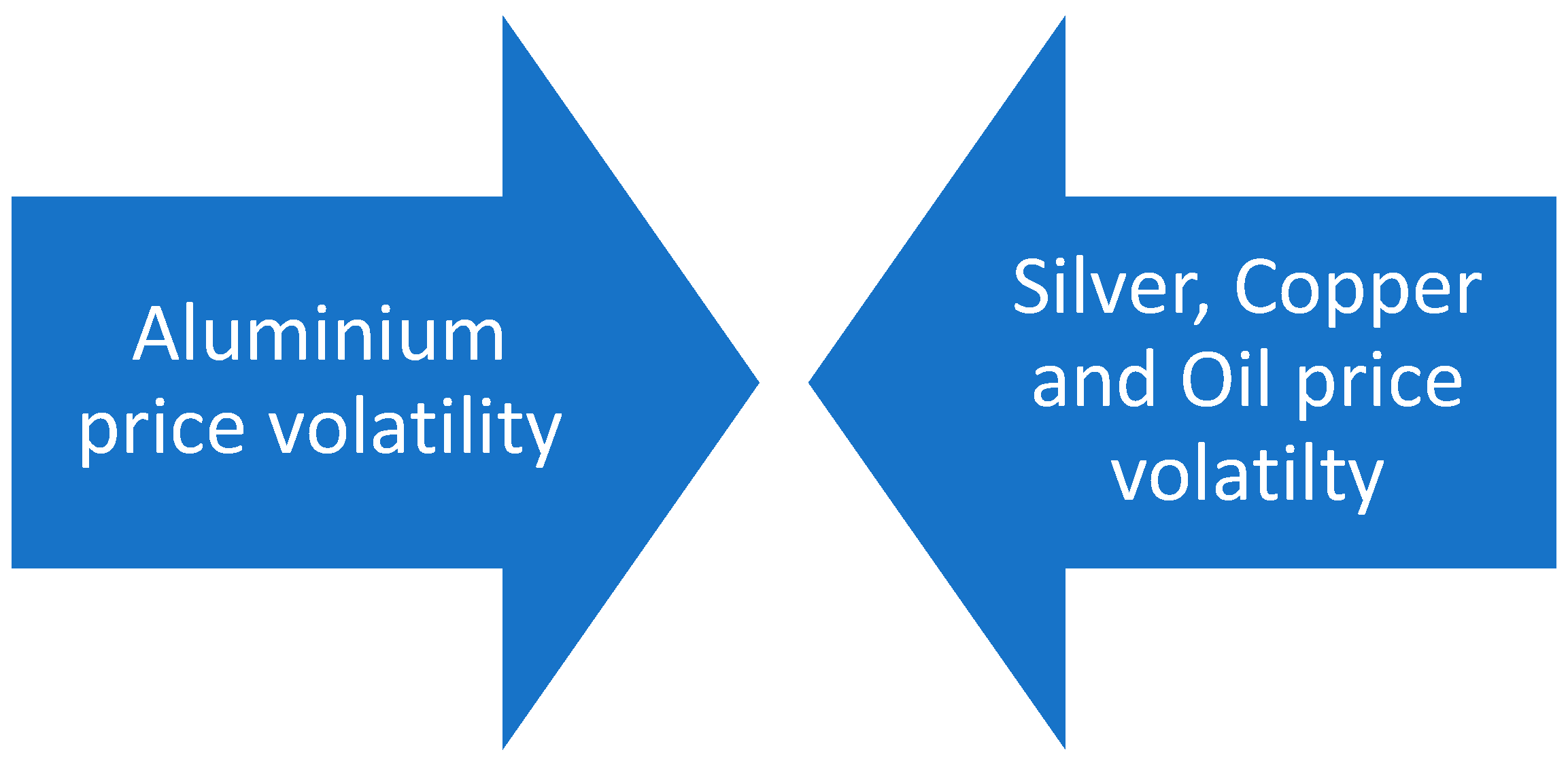

Figure 10.

Aluminum price volatility and its main determinants.

Additionally, there is a significant correlation between the price of aluminum and the volatility of the oil market. This relationship is also bidirectional and appears stronger from 2004 to 2015, according to Figure 10 (Behmiri and Manera 2015; Reboredo and Ugolini 2016; Zhang and Tu 2016). In addition, the literature notes the significant influence of the 2008 international financial crisis on precious metal prices (Kang and Yoon 2016) (Figure 11).

Figure 11.

Relationships between the markets that transmit and the ones that receive volatility from the price of aluminum.

However, it is also worth noting the variables that are affected by the volatility of the aluminum price. The platinum and steel market is highly volatile because of the pressure that they receive from the aluminum price (Chevallier and Ielpo 2013; Hu et al. 2020; Umar et al. 2021). At the same time, the researchers have examined the relationship between aluminum and natural gas. They observed that the volatility of the aluminum market directly affected the price of natural gas, especially in the period 1992–2015 (Chevallier and Ielpo 2013). Of particular interest is the influence of aluminum on agricultural products. The literature reports that this particular metal results in wheat and soybean price volatility. Equally important is the effect of the war between Ukraine and Russia. In the survey of the period, aluminum is presented as a transmitter of volatility, directly affecting the prices of various commodities (Wang et al. 2022)

It is necessary to make suggestions regarding the necessity of future investigation of the aluminum market. This precious metal presents various research gaps as its price behavior has been studied to a limited extent. Thus, a primary proposal for research is the relationship of the aluminum market with the stock markets worldwide. These investigations have, as a direct result, the understanding of the strong connection of various commodities with financial institutions. At the same time, it is important to study the behavior of the price of aluminum, taking as an impact parameter various stock indices such as the S&P 500. In this way, basic literature gaps are covered regarding the causes and consequences of the volatility of the aluminum market.

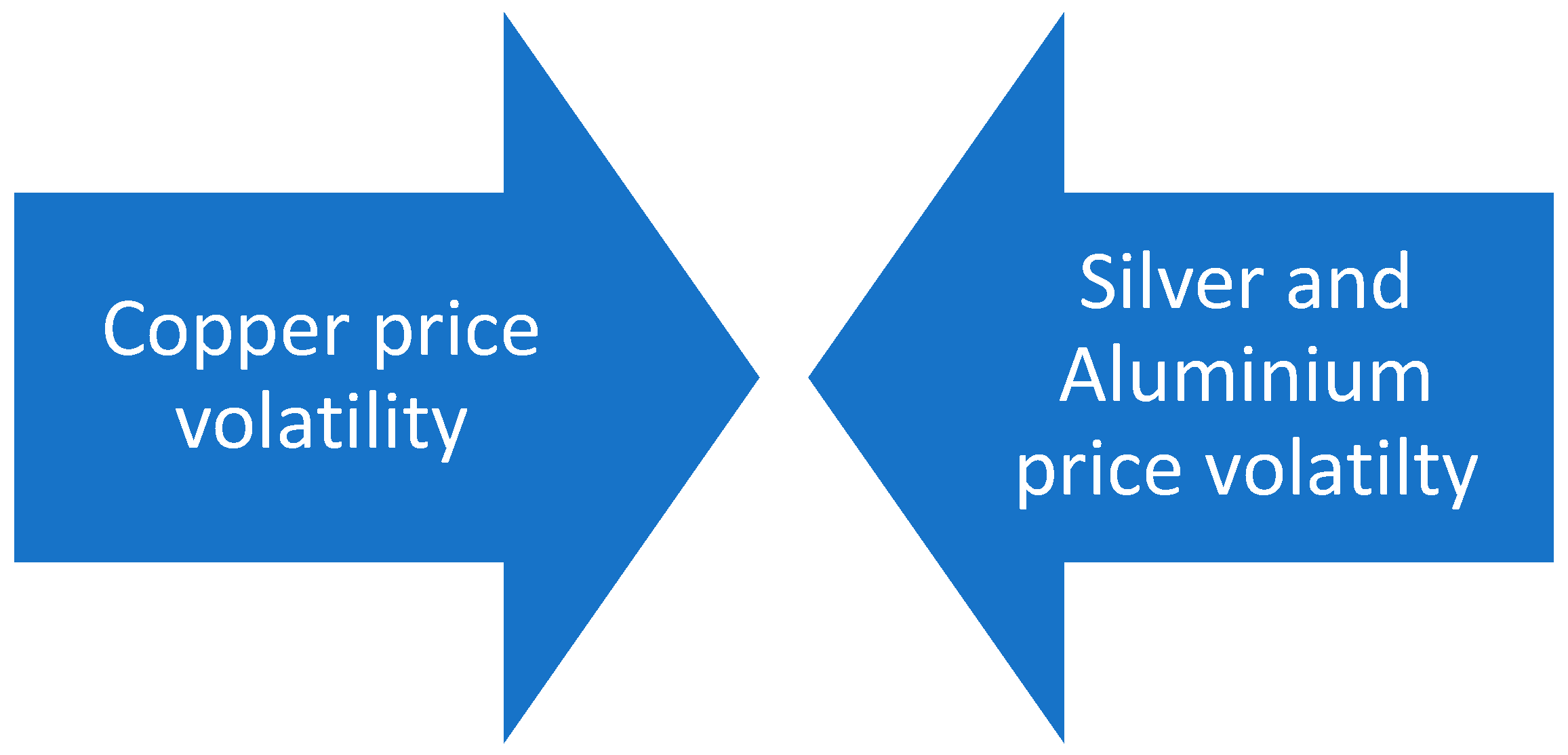

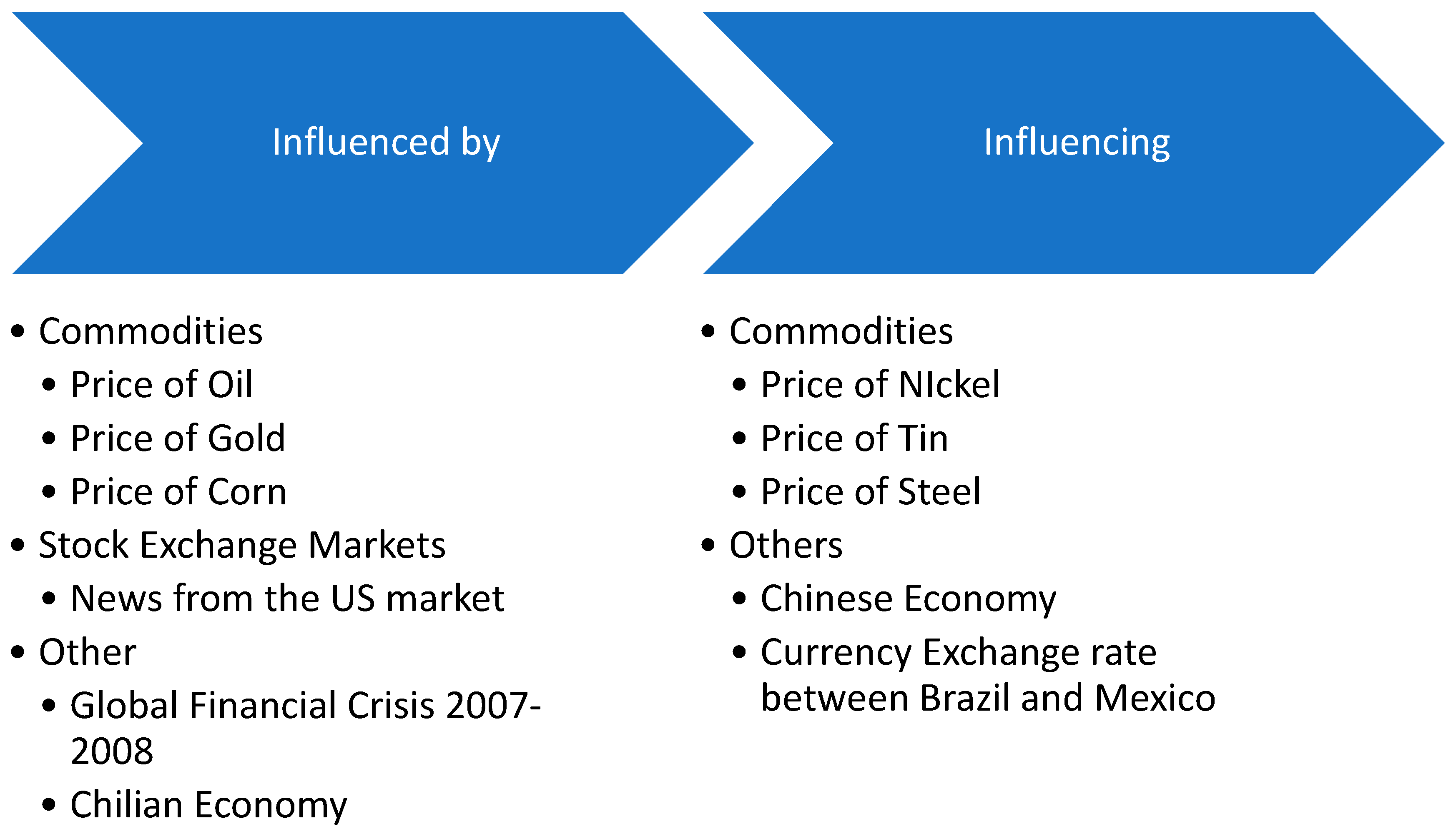

3.4. Copper

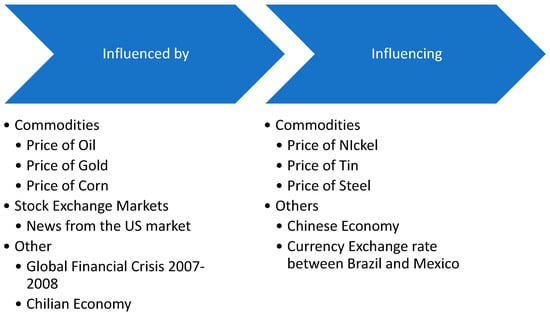

Continuing with the next commodity, copper is worth investigating. The markets of this particular metal worldwide show strong interaction. In particular, the literature notes that during the period 2000–2006, the spot price of copper in the Chinese market interacted with the futures price of the commodity (Liu et al. 2008). At the same time, before the onset of the global crisis in 2007–2008, the volatility of the price of copper on the London Metal Exchange (LME) and the New York-based Commodity Futures Exchange (NYMEX) resulted in the volatility of the copper market. On the Shanghai Metal Exchange (Kang and Yoon 2016; Lee and Park 2020; Yin and Han 2013). However, during the international crisis, while the above effects remain unchanged, it is observed that the Shanghai market (SHFE) affects the LME and NYMEX yield spreads (Lee and Park 2020). After the financial crisis, the SHFE copper price appeared to influence the corresponding market on the London Metal Exchange (Figure 12), while the SHFE copper price appeared to be pressured by NYMEX copper volatility (Yin and Han 2013).

Figure 12.

Copper price volatility and its main determinants.

In addition, the volatility of the futures price of copper on the London Metal Exchange has a direct impact on the appearance of volatile futures prices of the metal at the global level. In particular, the researchers report this phenomenon for the US and China markets during the period 2003–2019. It is worth noting (Shen and Huang 2022) that at this point, the fluctuating copper prices on the LME and NYMEX are affecting the Indian commodity exchange (MCX). Thus, according to the literature, in the decade 2007–2017, the price of copper in MCX showed strong volatility (Manisha 2017).

However, the relationship of copper with other commodities is of particular interest. Various researchers have dealt with the effect of the price of various goods on the market volatility of the metal in question. As shown in Figure 13, oil is one of the commodities that obviously affects the price of copper, especially when investigating the period since the 1990s and the Chinese metal market in particular (Behmiri and Manera 2015; Reboredo and Ugolini 2016; Zhang and Tu 2016). In addition, volatility in the price of copper occurs due to the volatile behavior of the gold market. Specifically, the literature notes that for about 30 years, the unstable price of gold worldwide resulted in the volatility of the copper market (Oliyide et al. 2021). It is necessary to point out that aluminum and silver behave in a bidirectional manner with the specific metal, as shown in Figure 13. In particular, aluminum and copper show a strong interaction (Chevallier and Ielpo 2013; Hu et al. 2020). At the same time, the volatility of the price of corn has an effect on the price of copper, which seems to change during the investigation of the years 1992–2015 (Chevallier and Ielpo 2013).

Figure 13.

Relationships between the markets that transmit and the ones that receive volatility from the price of copper.

Next, it is worth investigating various exogenous variables that directly affect the price of the precious metal. The US stock market news is a key driver of volatility in commodity prices, specifically copper. In particular, researchers observed a strong influence of new US financial institutions on the price of copper, especially in the Chinese metal market (Fung et al. 2003). In addition, the global financial crisis in 2007, which saw a sharp downturn in banking systems, also affected commodity prices. Therefore, the price of copper experienced extreme volatility during that period (Kang and Yoon 2016; Manisha 2017).

On the other hand, equally important are the factors that are affected by the change in the price of copper. The literature reports that nickel and tin are directly affected by the volatility of the copper market by using daily data (Gong et al. 2022). In addition, the researchers note that the price of steel shows strong volatility from 2007 to 2019 due to the corresponding volatility in the copper market in China (Hu et al. 2020). Also, the volatility of international copper prices has significant consequences for the economic actions of the Asian country (Guo 2018). Concluding with the variables that are affected by the volatility of the copper market, it is important to mention that the volatile price of the precious metal in Brazil and Mexico has affected the exchange rate of these countries for about 35 years (Hegerty 2016).

Nevertheless, it is worth noting that the copper market is suitable for further research. Thus, one of the important gaps that arise in this particular literature study is the correlation of the copper market with the volatility of certain indicators (see Figure 14). Considering that modern studies deal with the interaction of metal markets, specifically with copper, the existence of a relationship between the price of copper and stock market indices is considered worthy of investigation. Also, the relationship between copper and agricultural products is under-researched. Thus, future literature can shed light on this aspect.

Figure 14.

Relationship between copper and other relevant themes.

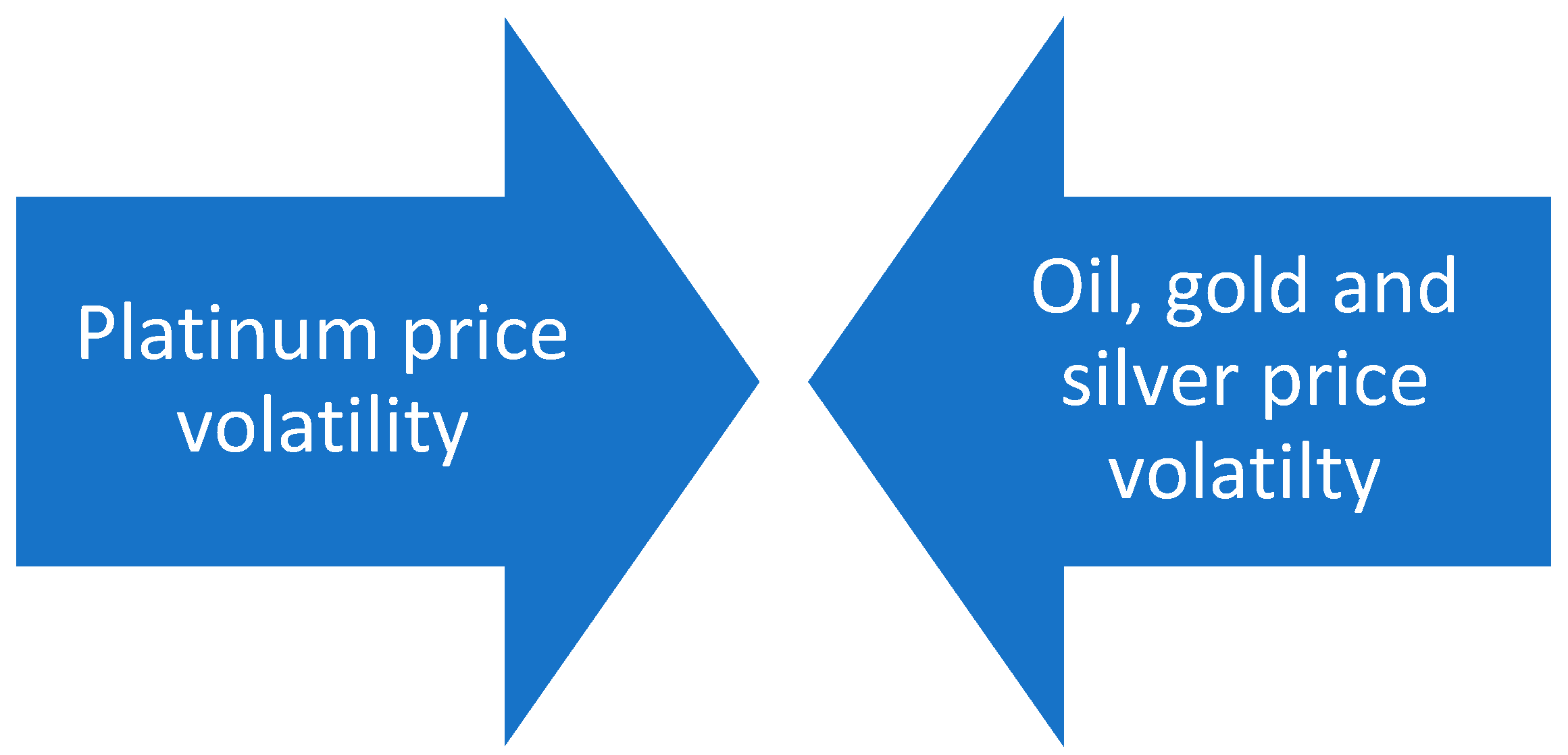

3.5. Platinum

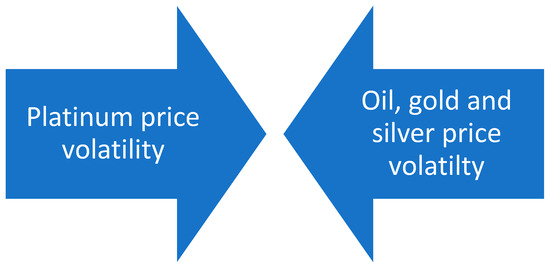

In summary, after analyzing the behavior of the precious metals market, it is worth investigating the price of platinum. Its characteristic is that the platinum market interacts with the price of oil, gold, and silver. Specifically, when analyzing the period since the 1990s, the literature reveals that the platinum and oil markets are affected in both directions, as can be understood from Figure 15 (Behmiri and Manera 2015; Reboredo and Ugolini 2016; Tiwari et al. 2021). Additionally, gold and platinum have a similar relationship. In detail, the volatility of the price of one precious metal results in the volatility of the market of the other.

Figure 15.

Platinum price volatility and its main determinants.

Thus, researchers analyzing this correlation noticed that for about 30 years, these markets showed strong interaction (Antonakakis and Kizys 2015; Mensi et al. 2017b; Reboredo and Ugolini 2015; Uddin et al. 2019). At the same time, it is worth noting that platinum and silver attracted the interest of various scholars because of the relationship they exhibited. In particular, in the last 20 years, the prices of these precious metals have mutually influenced each other (Reboredo and Ugolini 2015; Uddin et al. 2019).

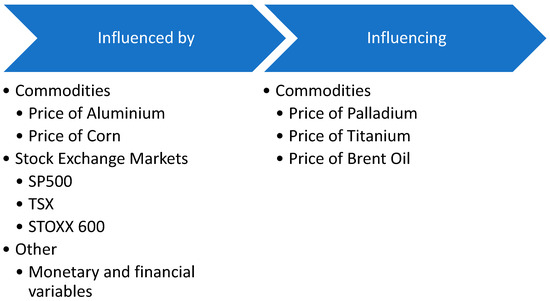

According to Figure 16, the volatility in the platinum price is also caused by the volatility of the aluminum market. More specifically, the literature reports that, when investigating the last 30 years, the fluctuating price of aluminum induces volatility in the platinum market. Another commodity that affects the price of platinum is corn. Its market shows various fluctuations during the period 1992–2015, an element that is reflected, according to the researchers, in the price of platinum (Chevallier and Ielpo 2013). Despite this, the particular valuable is seriously affected by the prices of various financial indicators. In detail, indices such as the S&P 500, the TSX, and the STOXX 600 strongly affect platinum. Concluding with the factors that influence the price of platinum, various monetary and financial variables have the above capacity (Batten et al. 2015).

Figure 16.

Relationships between the markets that transmit and the ones that receive volatility from the price of platinum.

However, particularly important is the influence exerted by the price of platinum on various commodities. In more detail, the price of palladium shows intense volatility during the period during which it receives pressure from the platinum market. Additionally, the literature reports that both titanium and crude oil are affected by platinum price volatility. At this point, it is necessary to underline that these effects appear in the US markets and during the research, which is conducted from 1990 to 2017 (Tiwari et al. 2021).

Additionally, the literature approach regarding the platinum market has aspects that remain under-searched. In particular, research gaps are observed in the relationship between platinum and the energy and agricultural markets (Figure 17).

Figure 17.

Relationship between platinum and other relevant themes.

3.6. Oil

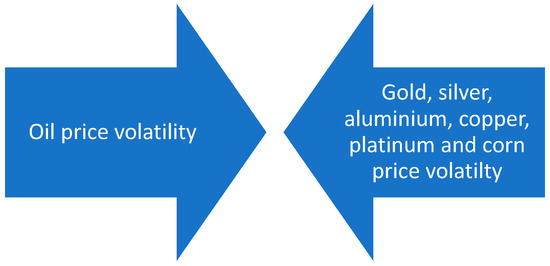

Oil, like gold, is a commodity for which thorough research has been carried out regarding the reaction of their price to various stimuli, as well as the impact of their volatility. However, the interaction of the oil market with the prices of precious metals is of particular interest. In particular, it is observed that oil exhibits a stronger interaction with gold than with the rest of the metals under consideration. This correlation appears when investigating the period since 1990s and includes markets of global scope, with the European Union, the USA, and the Gulf countries being prominent examples (Antonakakis and Kizys 2015; Chevallier and Ielpo 2013; Ewing and Malik 2013; Guhathakurta et al. 2020; Maghyereh et al. 2017; Tiwari et al. 2021). Additionally, as shown in Figure 18, the literature notes that oil market volatility is correlated with silver, aluminum, copper, and platinum prices. The markets in which this interaction is more pronounced are those of China, Japan, the European Union, and the USA over fifteen years, i.e., from 2000 to 2015 (Behmiri and Manera 2015; Ji and Fan 2012; Oliyide et al. 2021; Zhang and Tu 2016). Another commodity that has a bilateral relationship with the oil market is corn. In particular, the researchers point out that for the decade 2007–2017, the two markets simultaneously acted in the same direction. This has, as a clear result, the existence of a correlation between the volatility of the price of these commodities (Du et al. 2011; Guhathakurta et al. 2020; Onour and Sergi 2012; Wu et al. 2011).

Figure 18.

Oil price volatility and its main determinants.

Moreover, the stock returns of Saudi Arabian and Iraqi financial institutions showed a strong interaction during the survey, which was carried out in the period 2009–2018 (Ashfaq et al. 2019). Stock returns in the United Arab Emirates have a similar correlation with oil stock prices in Korea (Ashfaq et al. 2019). The above reactions are justified by the characterization of these countries as exporters and importers of oil. Therefore, commodity prices and stock markets show a direct relationship.

At this point, it is necessary to point out that oil is under strong pressure from the price of West Texas Intermediate (WTI) crude oil. This type of oil is a tool for pricing oil. Therefore, WTI price volatility is a direct result of commodity market volatility (An et al. 2020; Luo and Ji 2018; Mensi et al. 2021). However, this relationship has become bidirectional in the Chinese and US markets due to the onset of the 2007 global financial crisis (Xu et al. 2019).

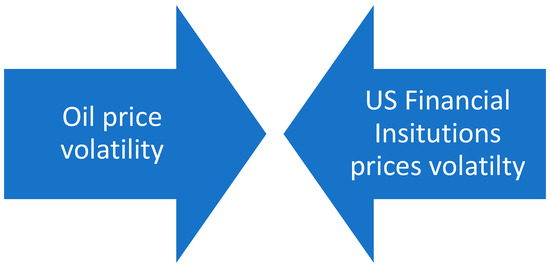

As shown in Figure 19, the oil market interacts with financial institutions in the United States of America. However, the researchers set a specific parameter for the existence of this relationship. When using the data analysis models, specific events are defined, such as a war conflict, and only then the two-way correlation between the price of oil and the US stock markets is shown (Ewing and Malik 2016; Khalfaoui et al. 2019).

Figure 19.

Oil Price volatility and its endogeneity with the US financial markets.

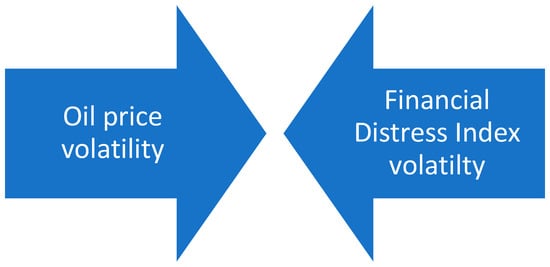

According to Figure 20, the price of oil interacts with the Financial Distress Index. It is noteworthy that researchers delineate their study temporally, taking into account the years before and after the global crisis. Therefore, the results indicate that before the 2007 crisis, the oil market influenced the price of this particular index, whereas, after the event, this relationship reversed direction (Nazlioglu et al. 2015).

Figure 20.

Oil price volatility and its endogeneity with the financial distress index.

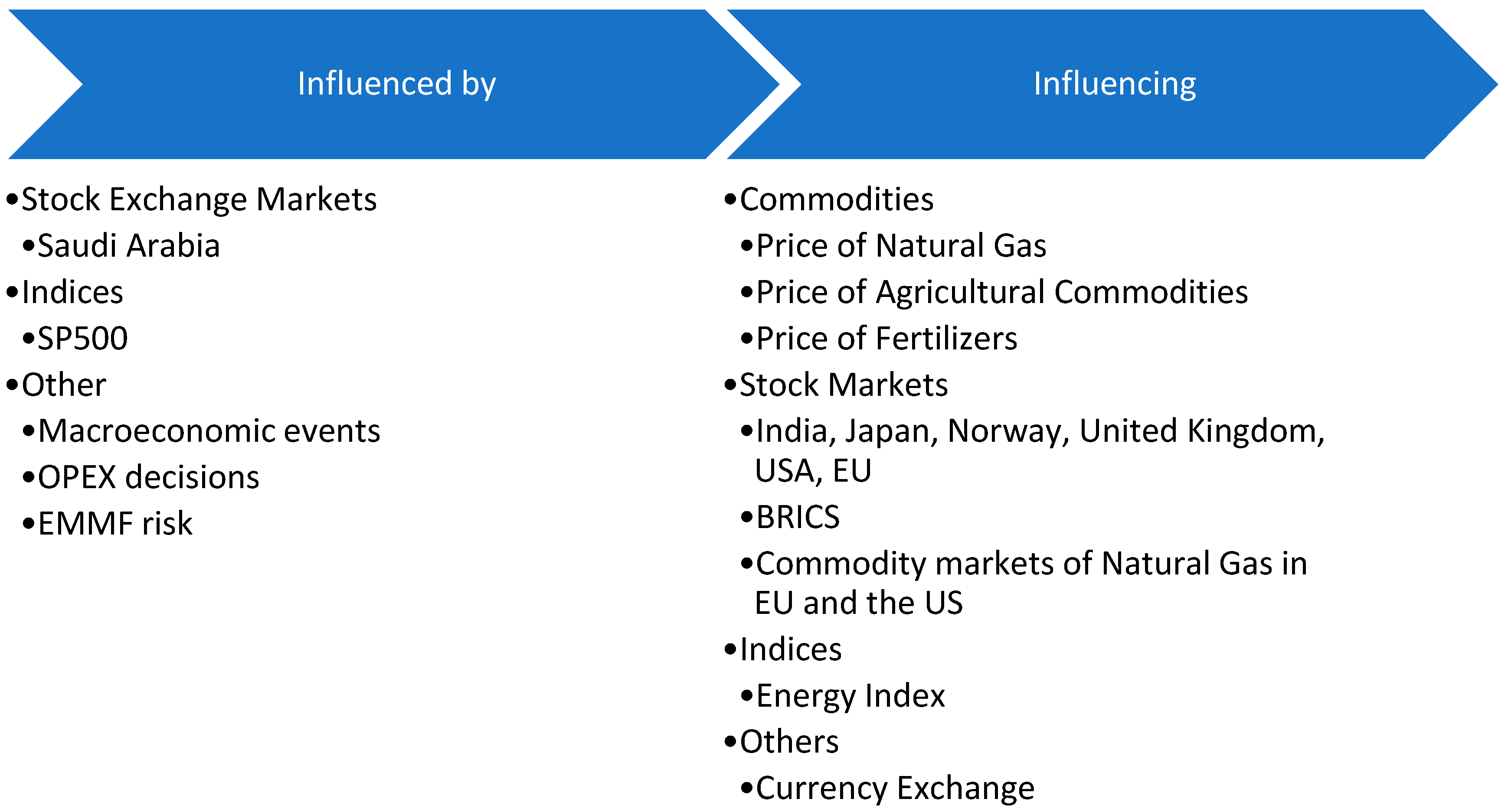

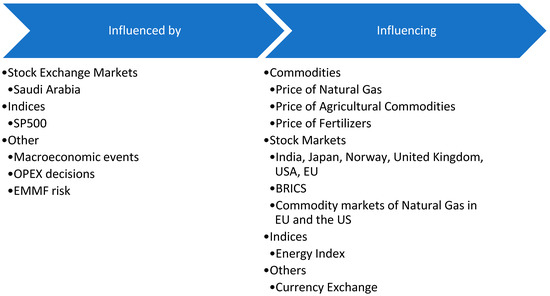

Furthermore, it is necessary to examine the factors that are responsible for the change in the price of oil, as presented in Figure 21. The Saudi Arabian stock market influences oil prices. When investigating the period 1994–2001, the literature notes that the volatility of the global oil market occurs due to the effect of shares in the stock markets of the Arab country (Malik and Hammoudeh 2007). Additionally, scholars cite the effect of S&P 500 stock index volatility on the price of “black gold”. In particular, this index shows a strong influence on the global oil market from 2000 to 2011 (Mensi et al. 2013; Xu et al. 2019).

Figure 21.

Relationships between the markets that transmit and the ones that receive volatility from the price of oil.

It is necessary to note that this particular market is highly sensitive to various political and economic events. Some examples of such situations are the global financial crisis of 2007 and the terrorist attack of September 11 in America. The effects of these actions become evident in both commodity prices and stock markets (Kumar et al. 2022). At the same time, the Organization of Petroleum Exporting Countries has attracted the interest of researchers regarding its ability to influence oil prices. Thus, in a study, which was carried out from 2000 to 2003 with daily data, the conclusions state that the organization’s production decisions significantly affect the oil market (Mensi et al. 2014). In conclusion, the literature links the price volatility of this commodity to the risk of EMMFs in the period before 2008. However, after the global crisis, this effect weakens (Ewing et al. 2018).

On the other hand, there are a variety of variables that make the impact of oil price volatility apparent. Natural gas is one of the commodities that react to the volatile “black gold” market (Dai and Zhu 2022; Karali and Ramirez 2014; Zhong et al. 2019). A notable event is the “Shale Gas Revolution” in the USA, which was a transmitter of instability from oil prices in the European natural gas market. However, researchers note that prior to the above incident, the oil market was influencing natural gas prices in North America (Geng et al. 2016; Lin and Li 2015). In addition, the volatility of the oil market carries its effects on agricultural commodities. Commodities under investigation include wheat, barley, cereals, corn, and soybeans. Various scholars thoroughly investigated the relationship between oil and these products over 35 years (Dahl et al. 2020; Du et al. 2011; Guhathakurta et al. 2020; Mensi et al. 2014; Nazlioglu et al. 2013; Onour and Sergi 2012; Saghaian et al. 2018; Yip et al. 2020).

Regarding stock exchanges, the countries in which these exchanges are located are Japan, Norway, the United Kingdom, the USA, and Europe. In particular, the studies time limit the influence of the oil market on institutions over 30 years, i.e., from 1985 to 2015 (Ågren 2006; Arouri et al. 2012; El Hedi Arouri et al. 2011; Perifanis and Dagoumas 2018; Zhang et al. 2020). In addition, the literature cites that the volatile oil market has serious effects on the stock markets of the BRICS countries (Brazil, Russia, India, China, and South Africa). Findings regarding the Indian financial market indicate that this pressure appeared in 2009 and lasted for 7 years (Bouri et al. 2017; Kumar et al. 2019). At the same time, for the rest of the countries of the BRICS organization, the duration of this influence has a starting year in 2000 and a fifteen-year duration (Pandey and Vipul 2018; Raza et al. 2016).

At the level of stock market indices, the price of oil has a significant effect on the electricity index. In addition, the effect of the oil market on the fertilizer market is particularly important. In particular, food commodities, the price of oil, sudden events in the energy market, and changes in the prices of edible goods have a direct effect on the volatile fertilizer market. Thus, a change is also observed in the prices of wheat and corn (Onour and Sergi 2012). Concluding with the effects of the volatility of the oil market, it is worth noting that this action affects the exchange rate around the world. The literature points out that this effect was researched from 2005 to 2020 and is due to the close connection of exchange rates with various commodities (Nekhili et al. 2021).

However, the research process on oil prices has some gaps. The present bibliographic study proposes, as a future action, the investigation of the behavior of the specific energy commodity with regard to sustainable development. Considering that this concept is related to the environment and economic development, it is worth noting its relationship with oil. Additionally, another suggestion for future research is energy storage and the ways in which the price of oil can be changed with this process (Figure 22 and Figure 23).

Figure 22.

Relationship between the oil market and other relevant themes.

Figure 23.

Relationship between the oil price and other relevant themes.

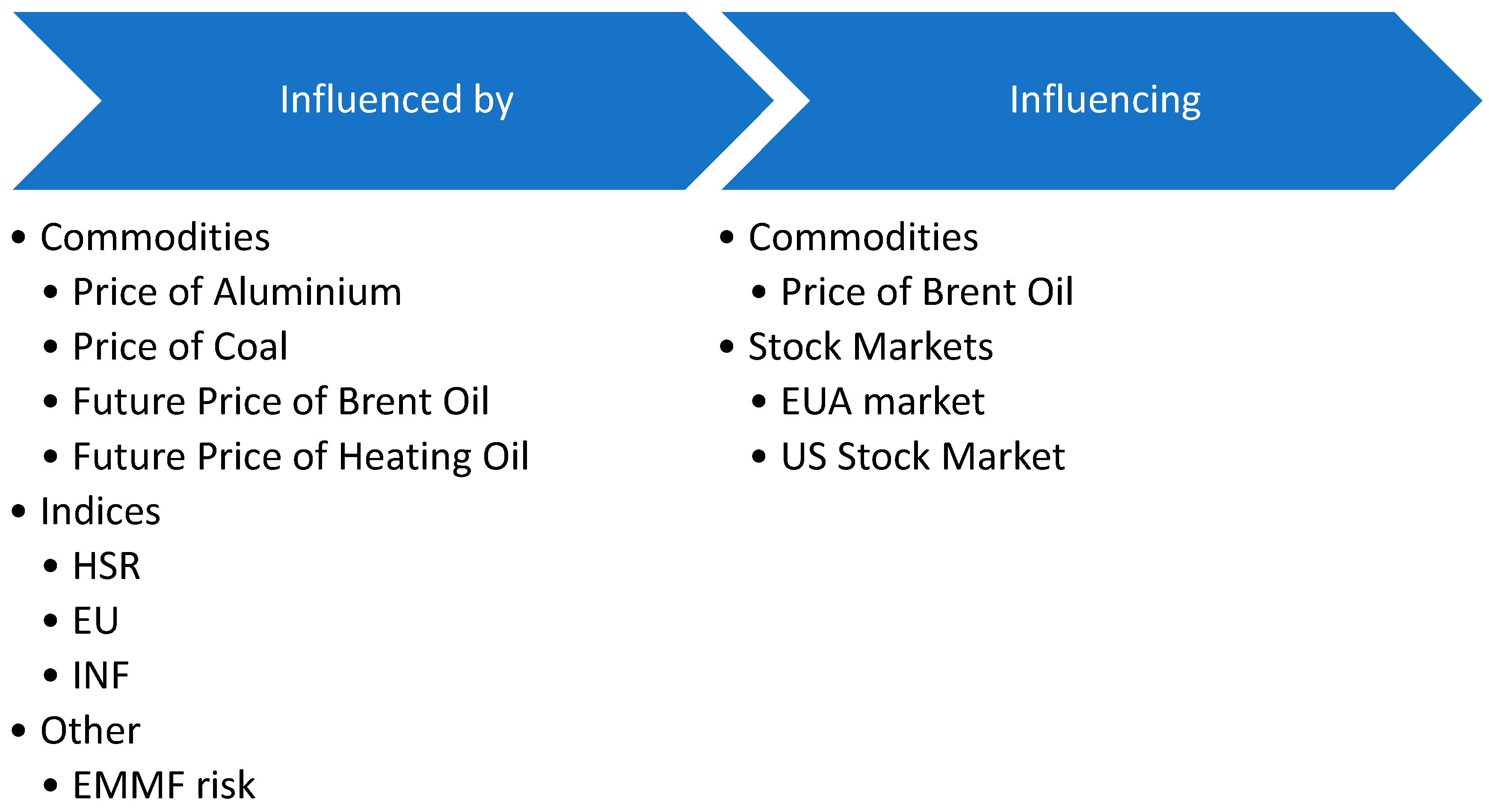

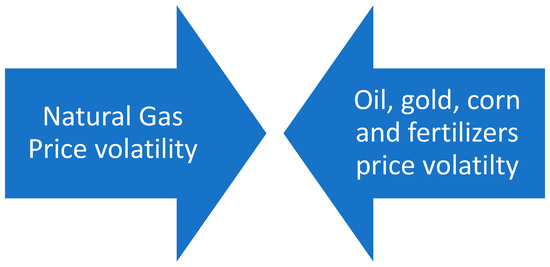

3.7. Natural Gas

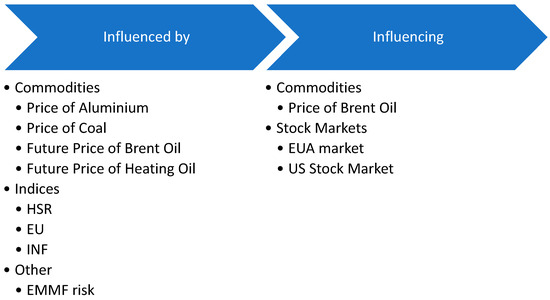

Another important energy commodity that is worth investigating in terms of its price behavior is natural gas. As shown in Figure 24, the price of this commodity is affected by precious metals, namely aluminum and coal. At the same time, coal has had a strong influence on the price of natural gas in the European markets since 2008. At this point, it is necessary to point out that the volatility of the coal price comes from the occurrence of volatility in the coal market (Wu et al. 2020; Zhang and Sun 2016).

Figure 24.

Relationships between the markets that transmit and the ones that receive volatility from the price of natural gas.

It is important to investigate the effect of stock prices on the commodity market. In particular, the literature notes that the future prices of crude oil and heating oil affect the natural gas market during the survey of the years 2005–2019 (Gong et al. 2021; Sehgal et al. 2013). Another important factor in the occurrence of volatility in the price of natural gas is the pressure of the stock market indices. The volatile energy commodity market is a result of the volatility in the price of the CNI HSR, CNI EU, and CNI INF indices, which appeared in 2010 (Dai and Zhu 2022). In conclusion, scholars associate natural gas market volatility with the risk of EMMFs before the onset of the global financial crisis in 2007. However, after 2008, there was a decline in this relationship (Ewing et al. 2018).

Nevertheless, the price of natural gas, in turn, has important consequences on a variety of variables. Specifically, researchers present the effect of volatility in the price of natural gas as a cause for the volatility of the crude oil market during the period 1994–2011 (Karali and Ramirez 2014).

In addition, there is a spillover of natural gas price volatility into the EUA markets (Dhamija et al. 2018; Xu et al. 2019). Next, it is worth noting that the price of the specific energy commodity and the American stock markets show a short-term correlation (Geng et al. 2020).

It is also noteworthy the fact of interaction, which the natural gas market exhibits with oil, gold, and corn, as shown in Figure 25. More specifically, the markets of the two energy commodities show a strong interaction both in terms of spot and forward prices (Dai and Zhu 2022). At the same time, researchers researching the period 1992–2022 observed a strong correlation between the prices of natural gas and gold. It is necessary to note that, during the COVID-19 era, this relationship is characterized as stronger (Arfaoui et al. 2023). The last commodity with which the price of natural gas seems to interact is corn. The direction of the correlation of their markets is characterized as bidirectional (Etienne et al. 2016).

Figure 25.

Natural gas price volatility and its main determinants.

The price of natural gas was also investigated thoroughly in terms of its relationship with the fertilizer market. Additionally, researchers note that these two markets influenced each other over twenty years (Etienne et al. 2016). In addition, natural gas markets around the world exhibit significant interdependence. In particular, the energy commodity’s spot and futures prices, as well as the US and UK ETF markets, were highly correlated from the start of the global crisis of 2007 to 2016 (Chang et al. 2018; Zhang and Liu 2018). It is necessary to note that according to the literature, its markets at the European level are strongly connected (Broadstock et al. 2020).

At this point, it is necessary to underline those studies on the natural gas market that have literature gaps. For this reason, it is appropriate to list some suggestions for future study. In particular, the price of natural gas is worth investigating in relation to the course of energy utilities. Thus, the importance of the energy commodity in relation to the supply of electricity becomes understandable. At the same time, the relationship between the price of natural gas and the energy sector of the S&P 500 index is worthy of investigation (see Figure 26). In this way, the influence of the index on the formation of the natural gas market and the activity of the companies concerned is perceived.

Figure 26.

Relationship between natural gas and other relevant themes.

4. Results—Soft Commodities

4.1. Soybeans

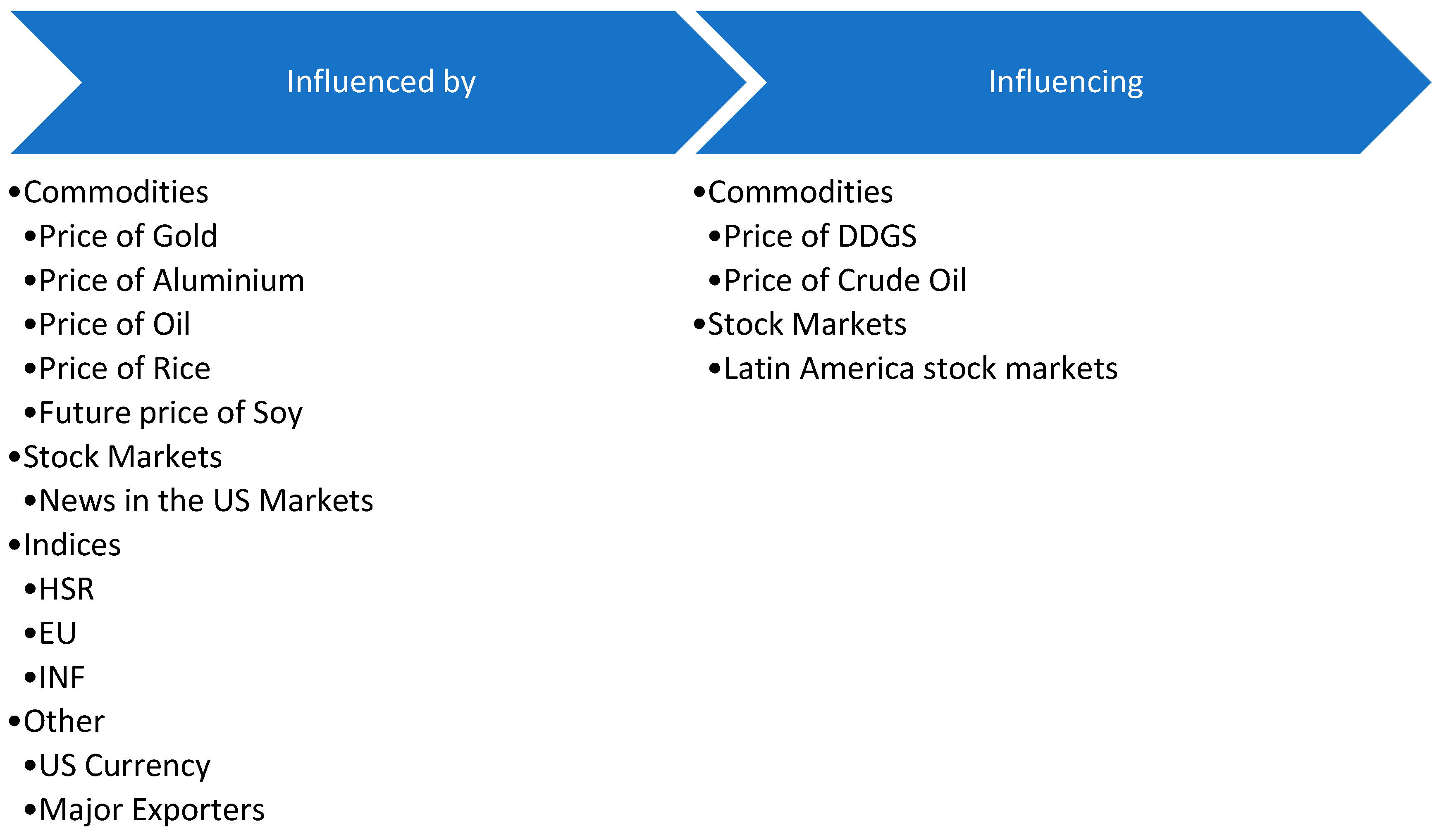

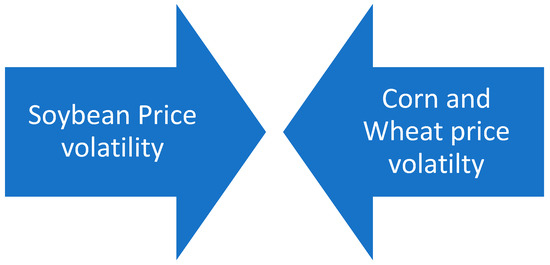

The last category of goods investigated is agricultural products, with soybeans being the main commodity. According to Figure 27, soybeans are strongly correlated with a variety of commodities, stock markets around the world, and various variables. Precious metals that affect the soybean market are gold and aluminum. Scholars, using daily data, observe this effect (Chevallier and Ielpo 2013). Additionally, the literature highlights that soybean price volatility is a result of the pressure exerted by the oil market. In particular, in the last 30 years, the price of soybeans has shown unstable behavior when linked to oil (Guhathakurta et al. 2020; Nazlioglu et al. 2013; Yip et al. 2020). Another commodity that has a significant impact on the soybean market is rice. The literature notes that the price of rice has a strong influence on the soybean market, making it volatile (Chevallier and Ielpo 2013).

Figure 27.

Relationships between the markets that transmit and the ones that receive volatility from the price of soybeans.

Next, the effect that the stock market has on the price of soybeans is notable. The researchers note that the international futures prices of the agricultural commodity in question have a direct effect on the appearance of volatility in the price of imported soybeans in China (Ma and Diao 2017; Sanjuán-López and Dawson 2017; Zhao et al. 2010). At the same time, the news of the American financial institutions is a main cause of volatility in the price of soybeans. In more detail, scholars present the influence of these youth on Chinese agricultural markets (Fung et al. 2003).

It is also notable that the price of soybeans is volatile as a variety of variables pressure it. Specifically, after the global financial crisis of 2007, the exchange rate of the USD and its unstable price had a great impact on the international soybean market. In addition, soybeans in the local Chinese market are showing strong volatility, which comes from the dominant agricultural exporters. The above occurs as these producers can adjust pricing.

However, the soy market, in turn, affects certain commodities and stock exchanges. In particular, the volatility of the soybean market has a severe impact on the price of DDGS wheat, an animal feed commodity (Etienne et al. 2017). In addition, spillover of soybean price volatility is present in the crude oil market. After the end of the global crisis of 2007, agricultural commodities significantly affected the price of this type of oil in global markets (Dahl et al. 2020). Concluding with the consequences of the volatile soybean price, it is worth noting that Latin American financial institutions are significantly affected. Researchers show that negative changes in agricultural commodity prices can exert severe pressure on Latin American stock markets (Candila and Farace 2018).

Of particular interest are the two-way relationships of the soybean market with different commodities. As shown in Figure 28, soybeans interact with two agricultural products, corn and wheat. The literature findings highlight that the correlation of soybean market volatility with corn is mainly found in the US during the period 1992–2015. In the case of soybeans and wheat, scholars report that volatility spillovers between markets existed from 1999 to 2016. Notably, this correlation is strongly found in US agricultural markets (Hamadi et al. 2017).

Figure 28.

Soybean price volatility and its main determinants.

However, the soybean price literature presents some research gaps. For this reason, the present study lists suggestions for future research processes below. First, it is worth investigating the relationship of the soybean price to the S&P GSCI Soybeans Index. In this way, a check is made on the effect of the stock market index on the soybean price and vice versa. Additionally, one more indicator that needs to be researched in terms of its relationship with the soybean market is the producer price index (PPI). This index provides information on various agricultural commodities and varies according to the prices producers receive for their goods. Thus, the connection of this index with the price of soybeans is examined.

4.2. Corn

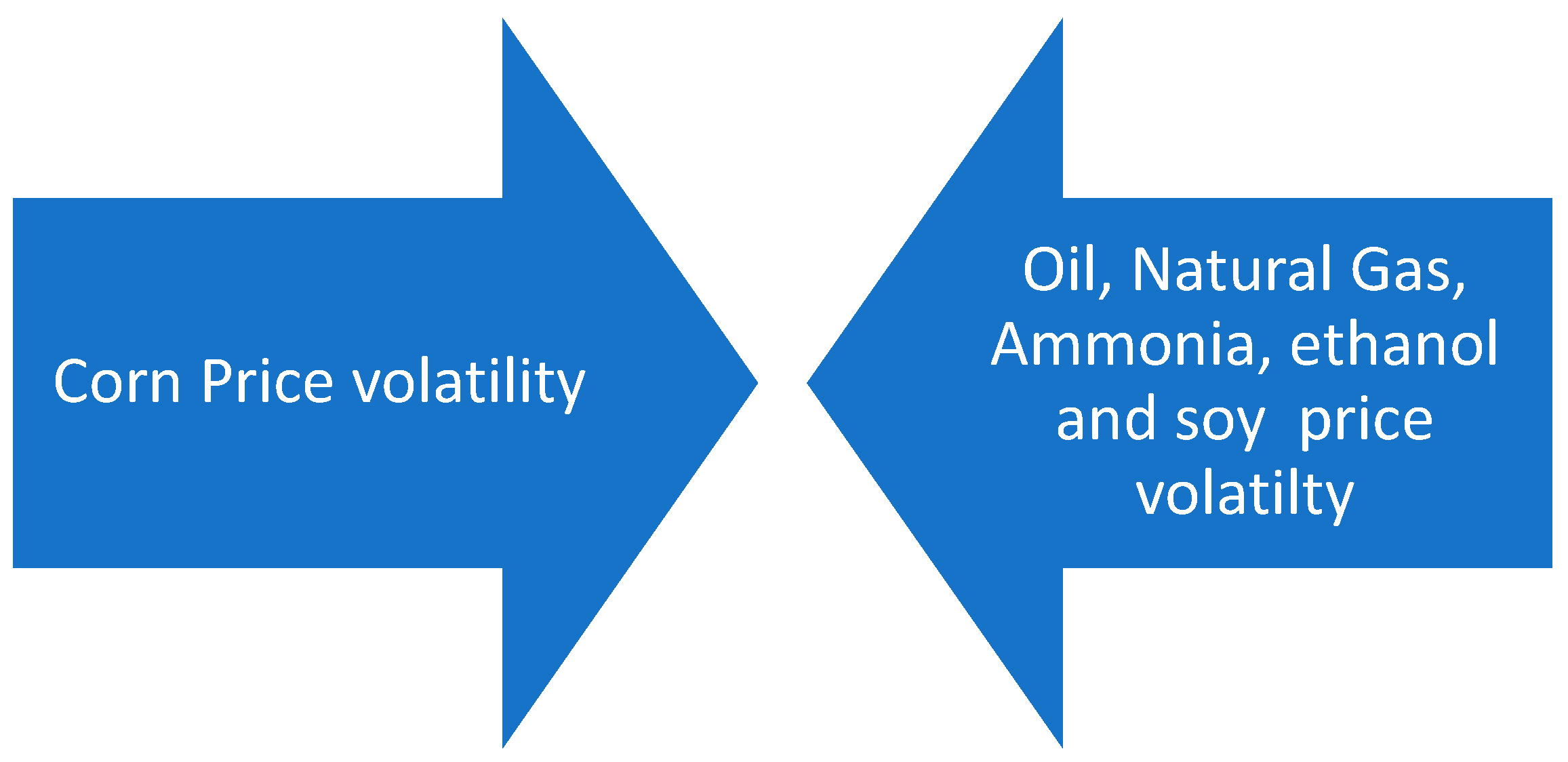

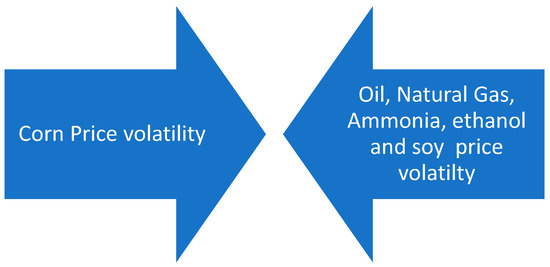

The next agricultural commodity, which is of particular interest in terms of its volatility, is corn. As shown in Figure 29, maize exhibits a strong interaction with a variety of variables. The researchers emphasize that the variable prices of oil and corn are directly linked. For this reason, their findings indicate that the markets of the specific commodities are affected both ways and mainly in the USA (Du et al. 2011; Mensi et al. 2017a; Nazlioglu et al. 2013; Onour and Sergi 2012; Yip et al. 2020). In addition, corn and natural gas show a similar relationship. According to the literature, the prices of these commodities show volatility when considered simultaneously since 1992 (Etienne et al. 2016; Yang et al. 2022). Then, there is a particular correlation between the price of corn and crude oil, especially in the US and China. The results of the studies note that this two-way energy in the Chinese and American markets (Haixia and Shiping 2013; Jiang et al. 2015; Luo and Ji 2018; Saghaian et al. 2018; Trujillo-Barrera et al. 2012; Wu et al. 2011).

Figure 29.

Corn price volatility and its main determinants.

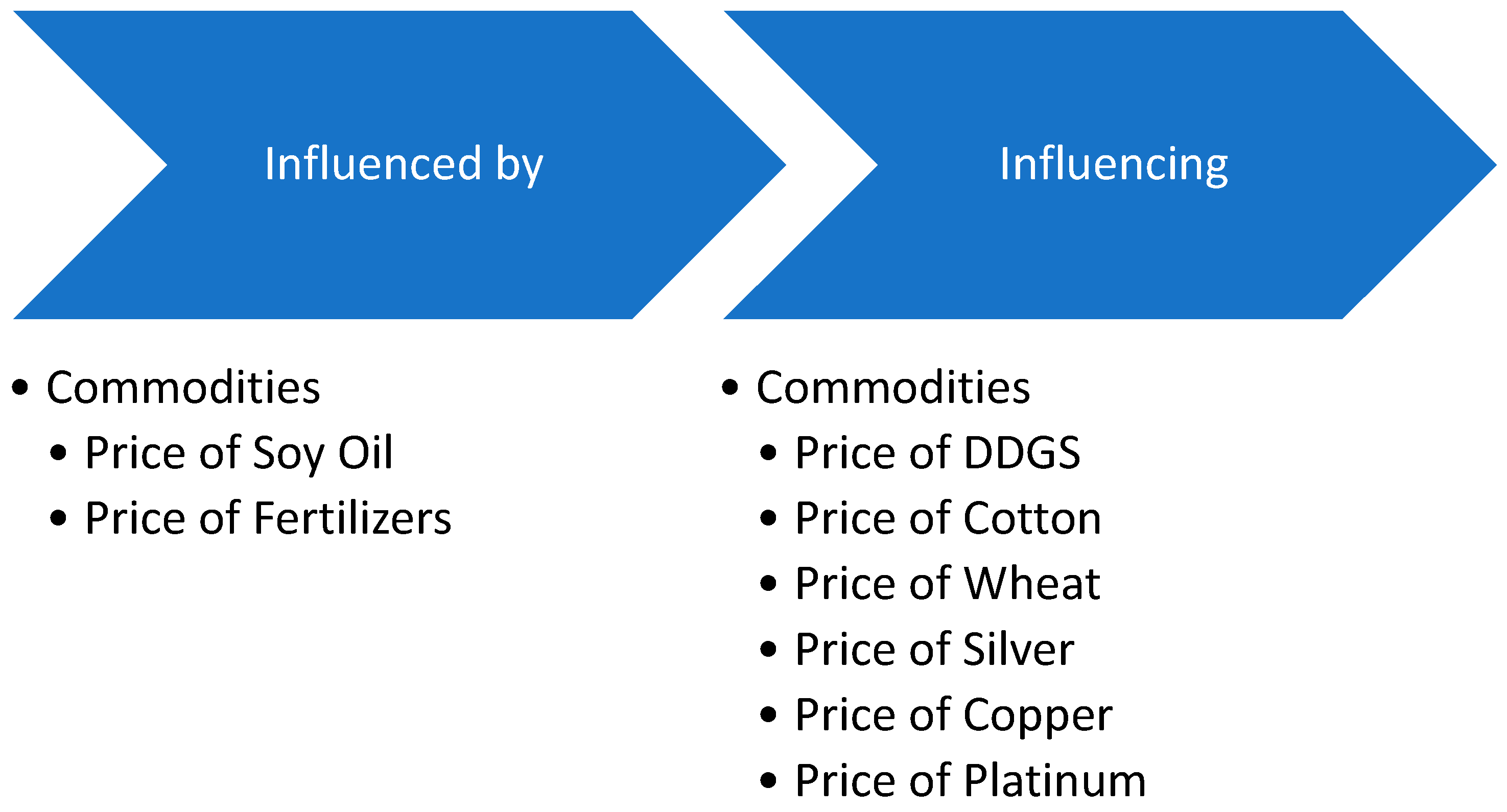

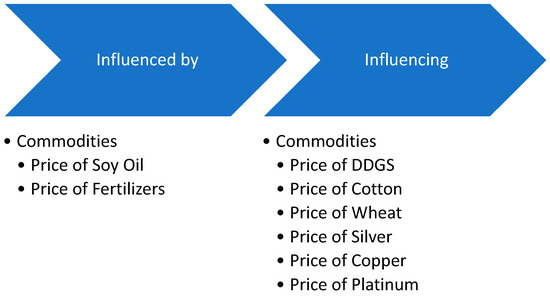

It is worth noting that the ammonia and corn markets show interaction. Scholars showed a two-way effect, resulting in their volatility (Etienne et al. 2016). Additionally, there is a strong interaction between corn and ethanol prices. The volatility of these goods is shown mainly in the markets of China, the USA, and Brazil (Yosthongngam et al. 2022). The last commodity, whose price moves depending on the corn market, is soybeans. The literature reports that the prices of the two agricultural goods show a strong interaction in the American markets. The corn market, as shown in Figure 30, is affected by a few variables. In particular, the literature highlights that the price of corn is volatile as the soybean oil market pressures it in the USA (Hamadi et al. 2017). At the same time, the price of the specific agricultural good shows variability due to the purchase of fertilizers. In more detail, fertilizer prices adjust the corn market for about 20 years internationally (Onour and Sergi 2012).

Figure 30.

Relationships between the markets that transmit and the ones that receive volatility from the price of corn.

On the other hand, the volatile price of corn has the potential to cause a variety of consequences. In particular, one of the products that is under pressure from the volatility of the corn market is cotton. Researchers reported that the price of cotton moved according to the market mobility of the agricultural commodity (Beckmann and Czudaj 2014). Additionally, the fluctuating price of corn has a significant impact on the wheat market.

It is necessary to point out that a variety of precious metals is seeing a spillover of this volatility. In particular, the metals are silver, copper, and platinum. Finally, another commodity heavily impacted by the corn market is DDGS wheat. This product is a component of animal feed and adjusts its price proportionally to that of corn (Etienne et al. 2016). At this point, it is necessary to mention the existence of research gaps on corn market behavior.

Therefore, the present bibliographic study proposes a future action: the investigation of the relationship between the stock markets and the price of agricultural goods, as can be observed in Figure 31. In this way, the ability of stock exchanges to shape the prices of various commodities is understood. Additionally, as a suggestion for future research, it is the engagement of scholars regarding the influence of exports on the corn market. It is necessary to point out that relevant research has been carried out on the effect of China’s dominant export sectors on the price of soybeans.

Figure 31.

Relationship between corn and other relevant themes.

4.3. Wheat

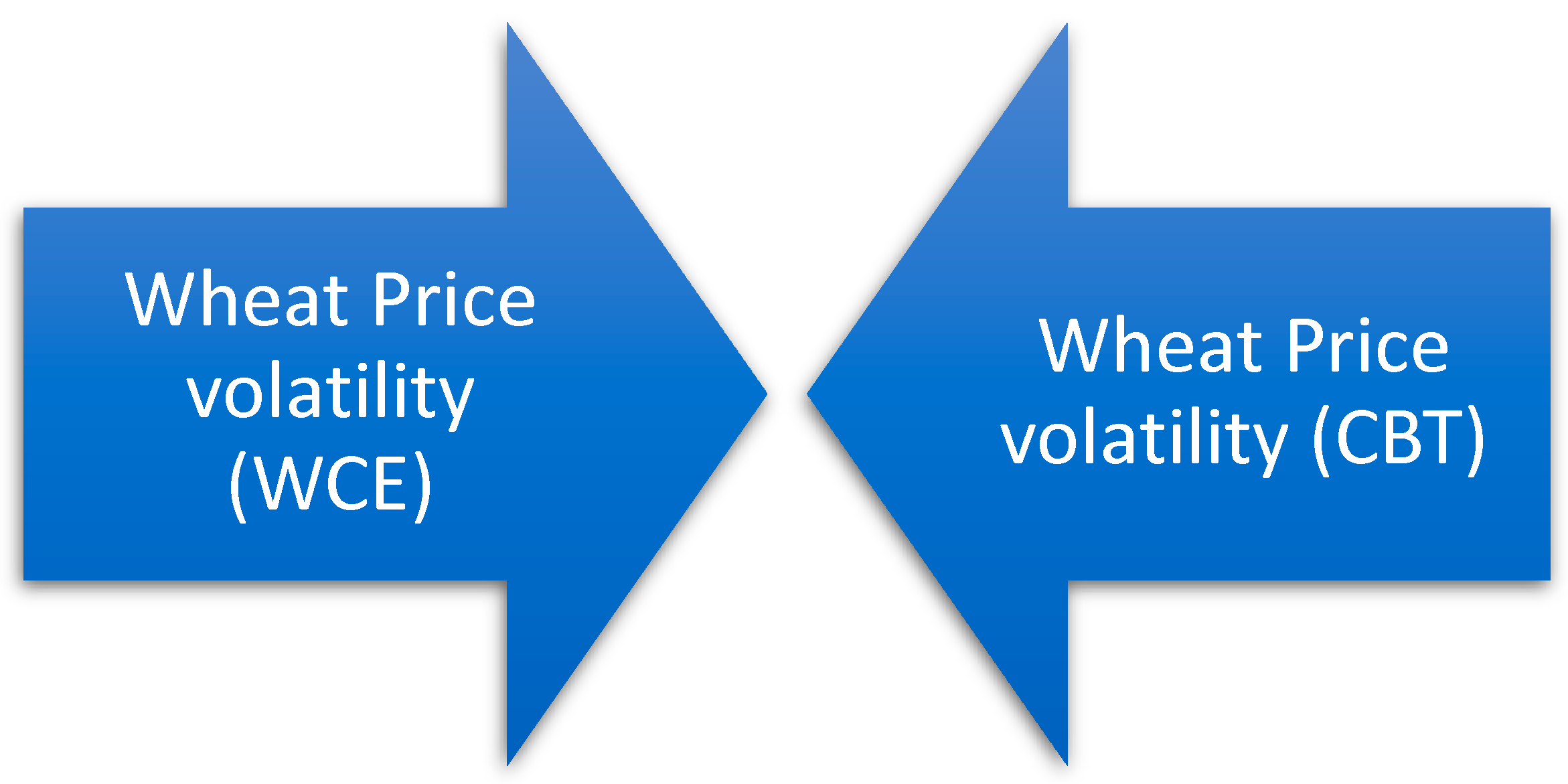

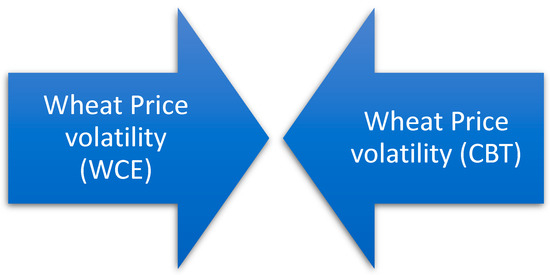

The last under-investigated commodity of the present bibliographic study is wheat. This specific agricultural good is of particular interest as its various markets interact with each other. As Figure 32 shows, wheat prices on the Winnipeg Commodity Exchange (WCE) and Chicago SRW Wheat Futures (CBOT) are affected both ways. The above markets are located in Canada and the USA, respectively (Booth et al. 1998).

Figure 32.

Wheat price markets volatility and their inter-relationship.

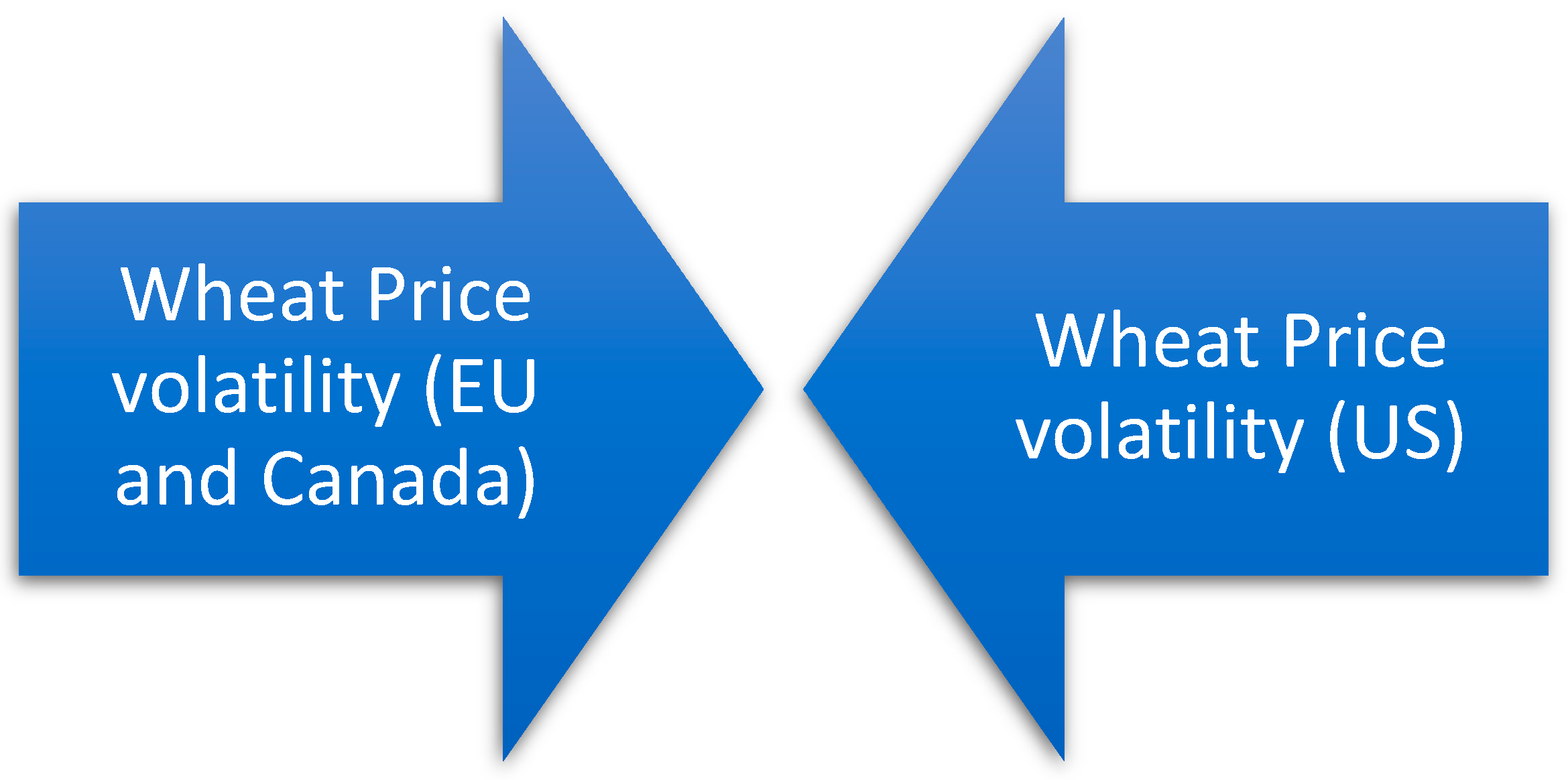

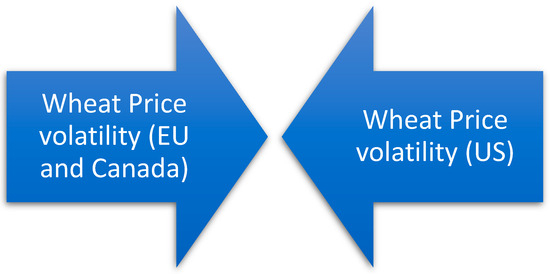

The above correlation of Canadian and US wheat prices is changing. In particular, as can be understood from Figure 33, volatility spillover is now taking place from the European and Canadian markets to the US. At this point, it is important to note that the researchers detected this relationship only two years after the end of the above two-way effect (Yang et al. 2003).

Figure 33.

Wheat price markets volatility and their inter-relationship across the globe.

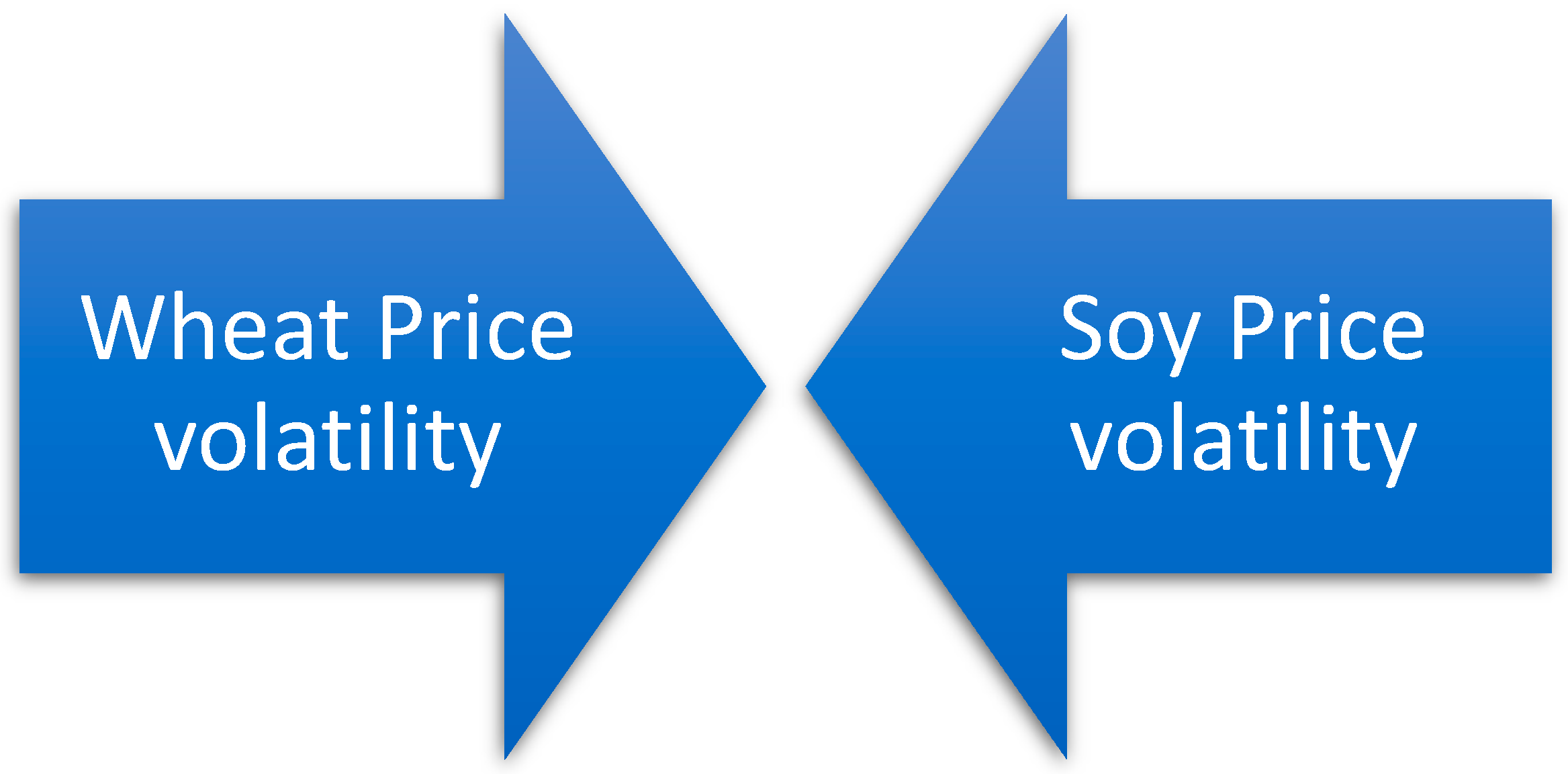

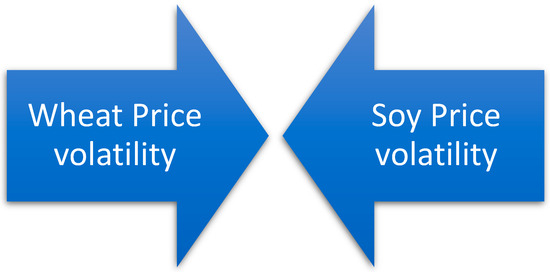

Additionally, Figure 34 illustrates the correlation between the wheat and soybean markets. The two specific agricultural products show a two-way relationship regarding their prices. In more detail, the researchers trace the above effect over time from 1999 to 2016, taking daily data (Hamadi et al. 2017).

Figure 34.

Wheat price volatility and its inter-relationship with the prices of other commodities.

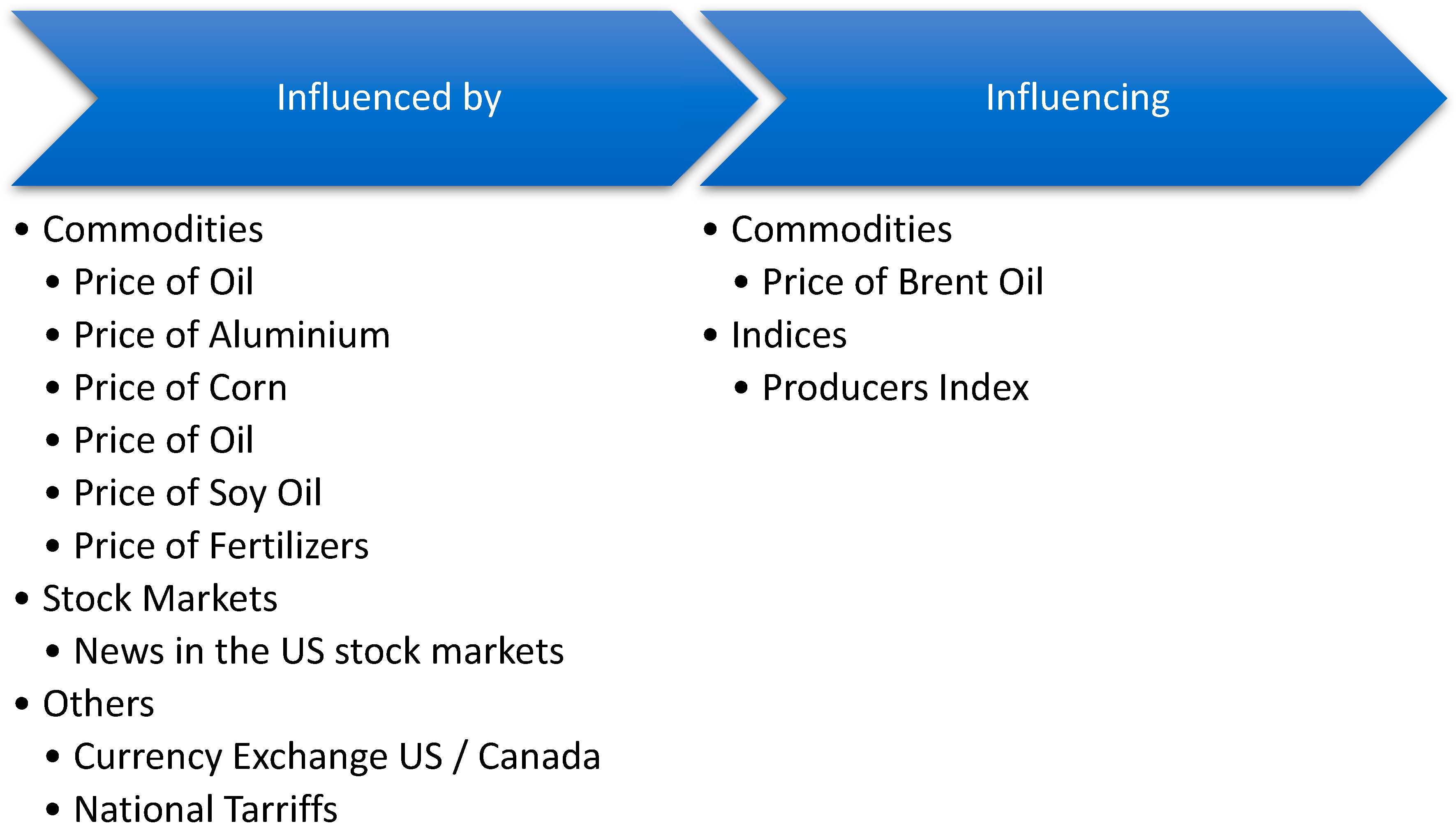

Next, the relationship of wheat with certain precious metals is of particular importance. As shown in Figure 35, the price of gold and aluminum affects the wheat market (Chevallier and Ielpo 2013). In addition, a significant cause of wheat price volatility is the mobility of the corn market. Specifically, various studies identify the effect of corn price on wheat, resulting in its volatility (Beckmann and Czudaj 2014; Lahiani et al. 2013).

Figure 35.

Relationships between the markets that transmit and the ones that receive volatility from the price of wheat.

Another case of volatility spillover is seen from oil to wheat. In more detail, the volatile price of oil has a direct impact on the wheat market (Guhathakurta et al. 2020; Yip et al. 2020). In addition, the effect of soybean oil on the price of wheat is noteworthy. In particular, the volatile price of agricultural commodities due to the volatility of the oil market is strongly presented in the American markets (Hamadi et al. 2017).

Another important factor in changing the price of wheat is the news from the stock markets of America. Specifically, the literature reports that the wheat market in China is strongly pressured by news of financial institutions in the US (Fung et al. 2003). The exchange rate of the Canadian dollar (CAD) plays an important role in the volatility of the price of wheat (Nekhili et al. 2021). In addition, the fertilizer market has had a great influence on the price of the agricultural commodity from 1992 to 2011. In particular, fertilizers are considered essential tools in agricultural activity and, for this reason, possess the ability to shape the pricing policy of wheat as a product (Onour and Sergi 2012). Finally, government decisions regarding export procedures in Ukraine seriously affect wheat prices around the world. Therefore, the established restrictions of the state lead to the instability of the market of the specific good (An et al. 2016).

In conclusion, wheat price volatility affects some variables. However, as shown in Figure 35, the effects become apparent in very few cases. In more detail, the volatility spillover from the wheat market is shown in the price of crude oil. However, the findings indicate that the price of wheat significantly depressed the market for the energy commodity after 2006 (Dahl et al. 2020). Additionally, at the stock market index level, the volatile wheat market can shape the producer price index. Specifically, researchers report that international wheat prices affect the producer price index (Hassouneh et al. 2017).

At this point, the research process on the behavior of the price of wheat presents some gaps. For this reason, the present bibliographic study proposes specific proposals for future research. In particular, it is worth studying the influence that the price of wheat may have on the DDGS product market. Also, as can be observed from Figure 36, the relationships between wheat and some major energy and metal commodities have not been examined yet. While the physical relationship may not be apparent, when one considers the trading pattern per se of hedge funds, conclusions can be derived from such research concerning the markets.

Figure 36.

Relationship between wheat and other relevant themes.

5. Conclusions

The purpose of this study is to provide a survey of the relevant literature concerning the causes and spillovers of volatility in commodity markets in order to provide a comprehensive view of the topic. Since commodities play an important role in the daily life of the global populace, it is understandable that price volatility affects not only the raw materials themselves but has a strong impact on the rest of the supply chain.

In this research paper, our aim is to examine the sources of volatility in commodities and, in particular, examine for any spillovers between commodity types. As such, we have collected all available bibliographies concerning the interdependence of the volatility of major commodities, both between themselves as well as other financial and economic markets. This survey aims to assist both academics and professionals in summarizing the existing knowledge on the relationship between the markets and to explore any potential gaps that exist concerning the matter.

Our results have revealed both the academic and professional spotlight that has been the recent year on the relationship between commodities. In particular, we have seen that the relationships between hard commodities are stronger since, in addition to being raw materials, they also serve as investment products. On the other hand, soft commodities are of primary use in the production process of end goods and are thus not so much impacted by market volatility.

Naturally, as with all reviews, the current one is not free from limitations. Most importantly, given the extensive coverage of the spillover effects in the finance literature, it was extremely difficult to cover the full bibliography since papers have been issued while this research was being written. Thus, future studies can focus on more recent publications concerning the matter, and additionally, they can look into one of the commodities in more depth.

Author Contributions

Conceptualization, K.D.M., A.F. and N.A.M.; methodology, A.F.; software, K.D.M.; validation, K.D.M., A.A. and N.A.M.; formal analysis, A.F.; investigation, A.F.; resources, K.D.M.; data curation, K.D.M. and N.A.M.; writing—original draft preparation, K.D.M., A.F. and A.A.; writing—review and editing, K.D.M. and N.A.M.; visualization, K.D.M. and A.F.; supervision, K.D.M.; project administration, K.D.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

We would like to thank the editor and the four anonymous referees for their careful consideration of an earlier version of the paper and their insightful comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Amara, Nabil, and Réjean Landry. 2012. Counting Citations in the Field of Business and Management: Why Use Google Scholar Rather than the Web of Science. Scientometrics 93: 553–81. [Google Scholar] [CrossRef]

- An, Henry, Feng Qiu, and Yanan Zheng. 2016. How do export controls affect price transmission and volatility spillovers in the Ukrainian wheat and flour markets? Food Policy 62: 142–50. [Google Scholar] [CrossRef]

- An, Sufang, Xiangyun Gao, Haizhong An, Feng An, Qingru Sun, and Siyao Liu. 2020. Windowed volatility spillover effects among crude oil prices. Energy 200: 117521. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, and Renatas Kizys. 2015. Dynamic spillovers between commodity and currency markets. International Review of Financial Analysis 41: 303–19. [Google Scholar] [CrossRef]

- Arfaoui, Nadia, Imran Yousaf, and Francisco Jareño. 2023. Return and volatility connectedness between gold and energy markets: Evidence from the pre- and post-COVID vaccination phases. Economic Analysis and Policy 77: 617–34. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, Jamel Jouini, and Duc Khuong Nguyen. 2012. On the impacts of oil price fluctuations on European equity markets: Volatility spillover and hedging effectiveness. Energy Economics 34: 611–17. [Google Scholar] [CrossRef]

- Ashfaq, Saleha, Yong Tang, and Rashid Maqbool. 2019. Volatility spillover impact of world oil prices on leading Asian energy exporting and importing economies’ stock returns. Energy 188: 116002. [Google Scholar] [CrossRef]

- Ågren, Martin. 2006. Does Oil Price Uncertainty Transmit to Stock Markets? (No. 23), Working Paper. Uppsala: Uppsala University. [Google Scholar]

- Balcilar, Mehmet, Zeynel Abidin Ozdemir, and Huseyin Ozdemir. 2019. Dynamic return and volatility spillovers among S&P 500, crude oil, and gold. International Journal of Finance and Economics 26: 153–70. [Google Scholar] [CrossRef]

- Basak, Suleyman, and Anna Pavlova. 2016. A Model of Financialization of Commodities. Journal of Finance 71: 1511–56. [Google Scholar] [CrossRef]

- Batten, Jonathan A., Cetin Ciner, and Brian M. Lucey. 2010. The macroeconomic determinants of volatility in precious metals markets. Resources Policy 35: 65–71. [Google Scholar] [CrossRef]

- Batten, Jonathan A., Cetin Ciner, and Brian M. Lucey. 2015. Which precious metals spill over on which, when and why? Some evidence. Applied Economics Letters 22: 466–73. [Google Scholar] [CrossRef]

- Beckmann, Joscha, and Robert Czudaj. 2014. Volatility transmission in agricultural futures markets. Economic Modelling 36: 541–46. [Google Scholar] [CrossRef]

- Behmiri, Niaz Bashiri, and Matteo Manera. 2015. The role of outliers and oil price shocks on volatility of metal prices. Resources Policy 46: 139–50. [Google Scholar] [CrossRef]

- Booth, G. Geoffrey, Paul Brockman, and Yiuman Tse. 1998. The relationship between US and Canadian wheat futures. Applied Financial Economics 8: 73–80. [Google Scholar] [CrossRef]

- Bouri, Elie, Anshul Jain, P. C. Biswal, and David Roubaud. 2017. Cointegration and nonlinear causality amongst gold, oil, and the Indian stock market: Evidence from implied volatility indices. Resources Policy 52: 201–6. [Google Scholar] [CrossRef]

- Broadstock, David C., Raymond Li, and Linjin Wang. 2020. Integration reforms in the European natural gas market: A rolling-window spillover analysis. Energy Economics 92: 104939. [Google Scholar] [CrossRef]

- Candila, Vincenzo, and Salvatore Farace. 2018. On the volatility spillover between agricultural commodities and Latin American stock markets. Risks 6: 116. [Google Scholar] [CrossRef]

- Chang, Chia Lin, Michael McAleer, and Yanghuiting Wang. 2018. Testing Co-Volatility spillovers for natural gas spot, futures and ETF spot using dynamic conditional covariances. Energy 151: 984–97. [Google Scholar] [CrossRef]

- Charoenthammachoke, Kananut, Natt Leelawat, Jing Tang, and Akira Kodaka. 2020. Business Continuity Management: A Preliminary Systematic Literature Review Based on Sciencedirect Database. Journal of Disaster Research. [Google Scholar] [CrossRef]

- Chevallier, Julien, and Florian Ielpo. 2013. Volatility spillovers in commodity markets. Applied Economics Letters 20: 1211–27. [Google Scholar] [CrossRef]

- Dahl, Roy Endré, Atle Oglend, and Muhammad Yahya. 2020. Dynamics of volatility spillover in commodity markets: Linking crude oil to agriculture. Journal of Commodity Markets 20: 100111. [Google Scholar] [CrossRef]

- Dai, Zhifeng, and Haoyang Zhu. 2022. Time-varying spillover effects and investment strategies between WTI crude oil, natural gas and Chinese stock markets related to belt and road initiative. Energy Economics 108: 105883. [Google Scholar] [CrossRef]

- Dhamija, Ajay K., Surendra S. Yadav, and Pk Jain. 2018. Volatility spillover of energy markets into EUA markets under EU ETS: A multi-phase study. Environmental Economics and Policy Studies 20: 561–91. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Du, Xiaodong, Cindy L. Yu, and Dermot J. Hayes. 2011. Speculation and volatility spillover in the crude oil and agricultural commodity markets: A Bayesian analysis. Energy Economics 33: 497–503. [Google Scholar] [CrossRef]

- Dutta, Anupam. 2018. A note on the implied volatility spillovers between gold and silver markets. Resources Policy 55: 192–95. [Google Scholar] [CrossRef]

- Dutta, Anupam. 2019. Impact of silver price uncertainty on solar energy firms. Journal of Cleaner Production 225: 1044–51. [Google Scholar] [CrossRef]

- El Hedi Arouri, M., Jamel Jouini, and Duc Khuong Nguyen. 2011. Volatility spillovers between oil prices and stock sector returns: Implications for portfolio management. Journal of International Money and Finance 30: 1387–405. [Google Scholar] [CrossRef]

- Etienne, Xiaoli Liao, Andrés Trujillo-Barrera, and Linwood A. Hoffman. 2017. Volatility spillover and time-varying conditional correlation between DDGS, corn, and soybean meal markets. Agricultural and Resource Economics Review 46: 529–54. [Google Scholar] [CrossRef]

- Etienne, Xiaoli Liao, Andrés Trujillo-Barrera, and Seth Wiggins. 2016. Price and volatility transmissions between natural gas, fertilizer, and corn markets. Agricultural Finance Review 76: 151–71. [Google Scholar] [CrossRef]

- Ewing, Bradley T., Alper Gormus, and Ugur Soytas. 2018. Risk Transmission from Oil and Natural Gas Futures to Emerging Market Mutual Funds. Emerging Markets Finance and Trade 54: 1828–37. [Google Scholar] [CrossRef]

- Ewing, Bradley T., and Farooq Malik. 2013. Volatility transmission between gold and oil futures under structural breaks. International Review of Economics & Finance 25: 113–21. [Google Scholar] [CrossRef]

- Ewing, Bradley T., and Farooq Malik. 2016. Volatility spillovers between oil prices and the stock market under structural breaks. Global Finance Journal 29: 12–23. [Google Scholar] [CrossRef]

- Fung, Hung-gay, Wai K Leung, Xiaoqing Xu Eleanor, and W. Paul Stillman. 2003. Information Flows Between the U.S. and China Commodity Futures Trading, Review of Quantitative Finance and Accounting. Review of Quantitative Finance and Accounting 21: 267–85. [Google Scholar] [CrossRef]

- Gao, Ruzhao, Yancai Zhao, and Bing Zhang. 2021. The spillover effects of economic policy uncertainty on the oil, gold, and stock markets: Evidence from China. International Journal of Finance and Economics 26: 2134–41. [Google Scholar] [CrossRef]

- Geng, Jiang Bo, Qiang Ji, and Ying Fan. 2016. How regional natural gas markets have reacted to oil price shocks before and since the shale gas revolution: A multi-scale perspective. Journal of Natural Gas Science and Engineering 36: 734–46. [Google Scholar] [CrossRef]

- Geng, Jiang Bo, Xiao Yue Xu, and Qiang Ji. 2020. The time-frequency impacts of natural gas prices on US economic activity. Energy 205: 118005. [Google Scholar] [CrossRef]

- Gong, Xu, Jun Xu, Tangyong Liu, and Zicheng Zhou. 2022. Dynamic volatility connectedness between industrial metal markets. North American Journal of Economics and Finance 63: 101814. [Google Scholar] [CrossRef]

- Gong, Xu, Yun Liu, and Xiong Wang. 2021. Dynamic volatility spillovers across oil and natural gas futures markets based on a time-varying spillover method. International Review of Financial Analysis 76: 101790. [Google Scholar] [CrossRef]

- Guhathakurta, Kousik, Saumya Ranjan Dash, and Debasish Maitra. 2020. Period specific volatility spillover based connectedness between oil and other commodity prices and their portfolio implications. Energy Economics 85: 104566. [Google Scholar] [CrossRef]

- Guo, Jin. 2018. Co-movement of international copper prices, China’s economic activity, and stock returns: Structural breaks and volatility dynamics. Global Finance Journal 36: 62–77. [Google Scholar] [CrossRef]

- Haixia, Wu, and Li Shiping. 2013. Volatility spillovers in China’s crude oil, corn and fuel ethanol markets. Energy Policy 62: 878–86. [Google Scholar] [CrossRef]

- Hamadi, Hassan, Charbel Bassil, and Tamara Nehme. 2017. News surprises and volatility spillover among agricultural commodities: The case of corn, wheat, soybean and soybean oil. Research in International Business and Finance 41: 148–57. [Google Scholar] [CrossRef]

- Hammoudeh, Shawkat M., Yuan Yuan, Michael McAleer, and Mark A. Thompson. 2010. Precious metals-exchange rate volatility transmissions and hedging strategies. International Review of Economics and Finance 19: 633–47. [Google Scholar] [CrossRef]

- Hassouneh, Islam, Teresa Serra, Štefan Bojnec, and José M. Gil. 2017. Modelling price transmission and volatility spillover in the Slovenian wheat market. Applied Economics 49: 4116–26. [Google Scholar] [CrossRef]

- Hegerty, Scott W. 2016. Commodity-price volatility and macroeconomic spillovers: Evidence from nine emerging markets. North American Journal of Economics and Finance 35: 23–37. [Google Scholar] [CrossRef]

- Hu, Haiqing, Di Chen, Bo Sui, Lang Zhang, and Yinyin Wang. 2020. Price volatility spillovers between supply chain and innovation of financial pledges in China. Economic Modelling 89: 397–413. [Google Scholar] [CrossRef]

- Jan, Ahmad Ali, Fong Woon Lai, Junaid Siddique, Muhammad Zahid, and Syed Emad Azhar Ali. 2023. A walk of corporate sustainability towards sustainable development: A bibliometric analysis of literature from 2005 to 2021. Environmental Science and Pollution Research 30: 36521–32. [Google Scholar] [CrossRef] [PubMed]

- Ji, Qiang, and Ying Fan. 2012. How does oil price volatility affect non-energy commodity markets? Applied Energy 89: 273–80. [Google Scholar] [CrossRef]

- Jiang, Jingze, Thomas L. Marsh, and Peter R. Tozer. 2015. Policy induced price volatility transmission: Linking the U.S. crude oil, corn and plastics markets. Energy Economics 52: 217–27. [Google Scholar] [CrossRef]

- Jiang, Shangrong, Yuze Li, Quanying Lu, Shouyang Wang, and Yunjie Wei. 2022. Volatility communicator or receiver? Investigating volatility spillover mechanisms among Bitcoin and other financial markets. Research in International Business and Finance 59: 101543. [Google Scholar] [CrossRef]

- Kang, Sang Hoon, and Seong Min Yoon. 2016. Dynamic spillovers between Shanghai and London nonferrous metal futures markets. Finance Research Letters 19: 181–88. [Google Scholar] [CrossRef]

- Kang, Sang Hoon, Ron McIver, and Seong Min Yoon. 2017. Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Economics 62: 19–32. [Google Scholar] [CrossRef]

- Karali, Berna, and Octavio A. Ramirez. 2014. Macro determinants of volatility and volatility spillover in energy markets. Energy Economics 46: 413–21. [Google Scholar] [CrossRef]

- Khalfaoui, Rabeh, Suleman Sarwar, and Aviral Kumar Tiwari. 2019. Analysing volatility spillover between the oil market and the stock market in oil-importing and oil-exporting countries: Implications on portfolio management. Resources Policy 62: 22–32. [Google Scholar] [CrossRef]

- Kumar, Satish, Ashis Kumar Pradhan, Aviral Kumar Tiwari, and Sang Hoon Kang. 2019. Correlations and volatility spillovers between oil, natural gas, and stock prices in India. Resources Policy 62: 282–91. [Google Scholar] [CrossRef]

- Kumar, Suresh, Gurcharan Singh, and Ankit Kumar. 2022. Volatility spillover among prices of crude oil, natural gas, exchange rate, gold, and stock market: Fresh evidence from exponential generalized autoregressive conditional heteroscedastic model analysis. Journal of Public Affairs 22: e2594. [Google Scholar] [CrossRef]

- Lahiani, Amine, Duc Khuong Nguyen, and Thierry Vo. 2013. Understanding return and volatility spillovers among major agricultural commodities. Journal of Applied Business Research 29: 1781–90. [Google Scholar] [CrossRef]

- Lang, Michael. 2006. Globalization and Its History. The Journal of Modern History 78: 899–931. [Google Scholar] [CrossRef]

- Lee, Hyun Bock, and Cheol Ho Park. 2020. Spillover effects in the global copper futures markets: Asymmetric multivariate GARCH approaches. Applied Economics 52: 5909–20. [Google Scholar] [CrossRef]

- Lin, Boqiang, and Jianglong Li. 2015. The spillover effects across natural gas and oil markets: Based on the VEC-MGARCH framework. Applied Energy 155: 229–41. [Google Scholar] [CrossRef]

- Liu, Xiangli, Siwei Cheng, Shouyang Wang, Yongmiao Hong, and Yi Li. 2008. An empirical study on information spillover effects between the Chinese copper futures market and spot market. Physica A: Statistical Mechanics and its Applications 387: 899–914. [Google Scholar] [CrossRef]

- Luo, Jiawen, and Qiang Ji. 2018. High-frequency volatility connectedness between the US crude oil market and China’s agricultural commodity markets. Energy Economics 76: 424–38. [Google Scholar] [CrossRef]

- Ma, Kun, and Gang Diao. 2017. Estudio sobre el efecto derrame entre el mercado internacional de soja y el mercado nacional de soja de China. Ensayos Sobre Politica Economica 35: 260–66. [Google Scholar] [CrossRef]

- Maghyereh, Aktham I., Basel Awartani, and Panagiotis Tziogkidis. 2017. Volatility spillovers and cross-hedging between gold, oil and equities: Evidence from the Gulf Cooperation Council countries. Energy Economics 68: 440–53. [Google Scholar] [CrossRef]

- Malik, Farooq, and Shawkat Hammoudeh. 2007. Shock and volatility transmission in the oil, US and Gulf equity markets. International Review of Economics and Finance 16: 357–68. [Google Scholar] [CrossRef]

- Manisha, Dey. 2017. Study in copper price linkage between intrnational and indian commodity market. International Journal on Recent Trends in Business and Tourism 1: 49–53. [Google Scholar]

- Marx, Karl. 2016. Capital. In Social Theory Re-Wired. London: Routledge, pp. 145–51. [Google Scholar]

- Mensi, Walid, Aviral Tiwari, Elie Bouri, David Roubaud, and Khamis H. Al-Yahyaee. 2017a. The dependence structure across oil, wheat, and corn: A wavelet-based copula approach using implied volatility indexes. Energy Economics 66: 122–39. [Google Scholar] [CrossRef]

- Mensi, Walid, Khamis Hamed Al-Yahyaee, and Sang Hoon Kang. 2017b. Time-varying volatility spillovers between stock and precious metal markets with portfolio implications. Resources Policy 53: 88–102. [Google Scholar] [CrossRef]

- Mensi, Walid, Makram Beljid, Adel Boubaker, and Shunsuke Managi. 2013. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling 32: 15–22. [Google Scholar] [CrossRef]