Abstract

Investment appraisal of agricultural projects (APs) is particularly demanding due to several factors. Namely, APs may have longer time horizons, higher external and internal volatility, and uncertainty caused by less control of production and external conditions (e.g., climatic conditions and market demand). Indeed, these APs may face high and different risks that should be managed properly. Nevertheless, both the literature and practice do not address such complexity and uncertainty conveniently. Thus, this research aimed to develop an integrative and easy-to-use framework to support the investment appraisal of APs, which goes beyond the traditional approach based on simple and deterministic models. This framework is based on an approach that includes several capital budgeting techniques integrating extended multi-index methodology (EMIM), Monte Carlo simulation (MCS), and real options analysis (ROA). This framework allows dealing with different risk and uncertainty scenarios and managerial flexibilities, which allow alternative and additional investment options. A simpler and easier approach can be particularly important for family agribusinesses, which usually do not use sophisticated decision-making tools. An AP in an agrosilvopastoral system (i.e., agriculture, livestock, forestry) was used to present and discuss the proposed methodology considering the relevance of such systems for sustainable agriculture and their higher risk and complexity when compared to traditional approaches. The main contribution of the framework is structuring a set of steps based on several tools to carry out investment appraisal in APs.

1. Introduction

Motivated by the increased need for food production to supply population growth and the potential saturation of arable land, studies are needed to economically evaluate sustainable food supply chains in the agricultural environment (Thesari et al. 2021). Investments in agriculture aim to improve production and economic results (OECD/FAO 2016a). Furthermore, agricultural investment projects (AIPs) can promote economic development, poverty reduction, and food security (OECD/FAO 2016b), contributing to sustainable development goals (SDGs) and the 2030 Agenda (Zanin et al. 2022). This study focuses on agribusiness investment projects inside the gate (i.e., agriculture, livestock, forestry), also called agrosilvopastoral systems. Indeed, AIPs that promote crop-livestock-forestry integration are important because of both economic and environmental sustainability (Kuypers et al. 2021).

The high dependence of agribusiness on external factors makes it particularly suitable for the application of investment evaluation methods that incorporate risk and uncertainty (Deina et al. 2023). External factors are not just climatic, but also changes at the market level, such as consumer preferences, disruptions in global supply chains, legal and health impositions, etc. Currently, the global supply and demand for food are balanced but farmers are worried, especially because of the impact of population growth and the saturation of cultivable areas. Furthermore, facing more demanding competitive conditions, agribusiness profit margins have decreased over the years (Bronson et al. 2019).

In this context, it is necessary to increase productivity, improve product quality, and maintain a balanced sustainability tripod—economic, social, and environmental (Poffenbarger et al. 2017; Crews 2019; Kruger et al. 2022). However, it is necessary to adequately evaluate the costs and revenues of new investments and the use of new technologies in such a way that it is possible to identify the best alternative for the invested capital (Deina et al. 2023; Braun et al. 2018).

When implementing new technologies, it is necessary to evaluate the various risks involved (Souza et al. 2020). In (Komarek et al. 2020) the authors developed a literature review where five main types of risk in agriculture were identified: production risk, market risk, institutional risk, personal risk, and financial risk. (Nadezda et al. 2017) argue about the importance of managing investment risks because they can compromise the project in the future if conditions vary from the most expected scenario. It should be noted that some risks are not controllable (such as climatic factors), while others can be more controlled (such as financial risk). Investment appraisal requires the use of appropriate methods and techniques to deal with these constraints and risks (Kuypers et al. 2021; Spilioti and Anastasiou 2024; Dranka et al. 2020).

The most used methods for the analysis of AIP include the discounted cash flow (DCF) methods, such as the net present value (NPV), internal rate of return (IRR), and discounted Payback (Zanin et al. 2022; Souza et al. 2020; Kruger et al. 2019). The NPV is the method most used, including in agribusinesses (before, inside, and after the gate), as it is easy to apply and understand (Souza et al. 2020; Copeland and Antikarov 2002; De la Torre-Torres et al. 2024; Issa et al. 2024; Buchenberg et al. 2023; Pacassa et al. 2022). However, DCF methods are deterministic, i.e., they do not incorporate uncertainty and risks (Kuypers et al. 2021; Dranka et al. 2020; Copeland and Antikarov 2002).

Thus, DCF methods can be complemented with sensitivity analysis, scenario analysis, decision trees, and Monte Carlo simulation (MCS). The risk of an investment project is related to the variability of costs and revenues, interest rates and opportunity costs, etc., which may result in financial losses (Gitman and Zutter 2017). Risks can be assessed through the use of MCS, which is a statistical approach used in capital budgeting for risk perception through the application of predetermined probabilistic distributions and pseudo-random numbers to estimate the expected results. The components of the cash flow (CF) can be included in a stochastic and computational model, through a process repeated thousands of times. Such an approach generates probabilistic distributions of the probable return and risks of the project (Spilioti and Anastasiou 2024; Issa et al. 2024; Pacassa et al. 2022; Gitman and Zutter 2017).

As there are several forms of investment appraisal, the choice must be judicious (Dranka et al. 2020; Damodaran 2018). In addition, when evaluating a real asset, we should not use more inputs than necessary (Damodaran 2018). How to apply these analyses is already known and can be found in a high number of scientific papers (Kuypers et al. 2021; Spilioti and Anastasiou 2024; De la Torre-Torres et al. 2024; Issa et al. 2024; Buchenberg et al. 2023; Pacassa et al. 2022; Noja et al. 2015; Mota and Moreira 2023; Horobet et al. 2021; Morera et al. 2023; Gorman 2023), being such discussion is outside the scope of this study.

The original contribution of this paper is a framework to guide the analysis of agricultural investment projects, which includes (i) the expected return, (ii) potential risks, (iii) sensitivity analysis, (iv) Monte Carlo simulation (MCS), and (v) real options analysis (ROA).

Thus, this paper is organized as follows. Section 2 presents the structure of the proposed framework. Section 3 and Section 4 present the case study and the application of the framework. Section 5 discusses the results and offers some insights for additional applications. Finally, Section 6 presents the main conclusions of this research.

2. Structure of the Framework

Variability, risks, uncertainty, and managerial flexibilities are characteristics present in most AIPs (Kuypers et al. 2021). Variability can occur in terms of time, volume, costs, and quality of production, as well as in market prices of agricultural commodities. The main risks include, among others, climate changes and unpredictability, the impact of pests, and several types of financial risks. The uncertainties are related to market demand, financial results, and agricultural policies. Finally, managerial flexibilities (MFs) can be found before, during, and after production, e.g., when farmers decide about how much and which products will be produced, when agricultural production is substituted by livestock or forestry, and in the way activities are integrated (e.g., in an agrosilvopastoral system) (Kuypers et al. 2021; Poffenbarger et al. 2017; Komarek et al. 2020).

Investment appraisal approaches in agricultural projects can be divided into four groups: (i) those using a deterministic multi-index methodology (Souza et al. 2020; De la Torre-Torres et al. 2024; Souza and Clemente 2015, 2022), (ii) those based on a deterministic extended multi-index methodology (Kuypers et al. 2021; Lima et al. 2015; Noja et al. 2015), (iii) stochastic models using MCS (Spilioti and Anastasiou 2024; Issa et al. 2024; Buchenberg et al. 2023; Pacassa et al. 2022; Lima et al. 2017), and (iv) those that consider managerial flexibilities through real options analysis (ROA). ROA allows assessing managerial flexibilities related to irreversible investments and operational strategies (Dranka et al. 2020; Copeland and Antikarov 2002), which are the focus of the case study.

The first group includes AIPs that do not have relevant uncertainties and managerial flexibilities, i.e., projects whose results can be easily predicted before execution, since the value of the initial investment, the costs of operation and maintenance, the revenues, and the residual value are well known in the project planning stage. These AIPs can be analyzed using an extended multi-index methodology—EMIM (Kuypers et al. 2021; De la Torre-Torres et al. 2024; Noja et al. 2015; Horobet et al. 2021; Morera et al. 2023; Manna et al. 2022). These deterministic approaches use criteria related to economic return, risks, and sensitivity analysis, which are acceptable in the presence of small variability in the input data (Kuypers et al. 2021; Lima et al. 2015).

In the second group, AIPs consider the variability of some key parameters of the project, generally related to revenues and costs. In these cases, Monte Carlo simulation (MCS) is considered an effective approach (Spilioti and Anastasiou 2024; Issa et al. 2024; Buchenberg et al. 2023; Lima et al. 2017; Gorman 2023). MCS is a computational tool that can be used in uncertain environments through the elaboration of hundreds of thousands of possible scenarios and their respective probability distributions (Graveline et al. 2012; Bertolozzi-Caredio et al. 2022). Among others, the average NPV and the probability of a negative NPV can be calculated, as well as value at risk (VaR), conditional VaR (CVaR), cost at risk (CaR), etc. (Issa et al. 2024; Buchenberg et al. 2023; Lima et al. 2017; Rockafellar and Uryasev 2000; Rockafellar and Uryasev 2002; Jiménez and Afonso 2016).

The third group considers uncertainties and management flexibility (MF) in AIPs. MFs generate options that the decision maker faces in terms of maintaining, expanding, reducing, or abandoning the project. Generally, these projects are more complex, and real options analysis (ROA) can be used to deal with such complexity (Dranka et al. 2020; Copeland and Antikarov 2002). The traditional methods based on the discounted CF do not present relevant errors when uncertainty is low and MF is reduced (Minardi 2004). However, in the presence of significant uncertainties and high MFs, these methods can lead to inadequate decisions (Dranka et al. 2020; Copeland and Antikarov 2002; Nardelli and Macedo 2011; Zilio and Lima 2015; Souza et al. 2019).

The economic return, risk, and sensitivity indicators are included in the EMIM proposed by Lima et al. (2015), which have already been used in a significant number of publications such as Lima et al. (2017) and Dranka et al. (2020). EMIM includes all the indicators of MIM (multi-index methodology) and CM (the classical methodology). Thus, we can state that EMIM is superior to other deterministic approaches because it produces more qualified information using the same input. On the other hand, in a stochastic environment, the choice of MCS or ROA depends on the specificities of the agricultural project under evaluation. MCS can be used to evaluate projects that do not present relevant uncertainties and flexibilities (Souza et al. 2020; Dranka et al. 2020; Lima et al. 2017; Lima and Southier 2024). In addition, MCS is used to estimate the volatility of a project, which is essential for the application of ROA. Appendix A shows the mathematical models of the indicators of the EMIM, MCS, and ROA methodologies.

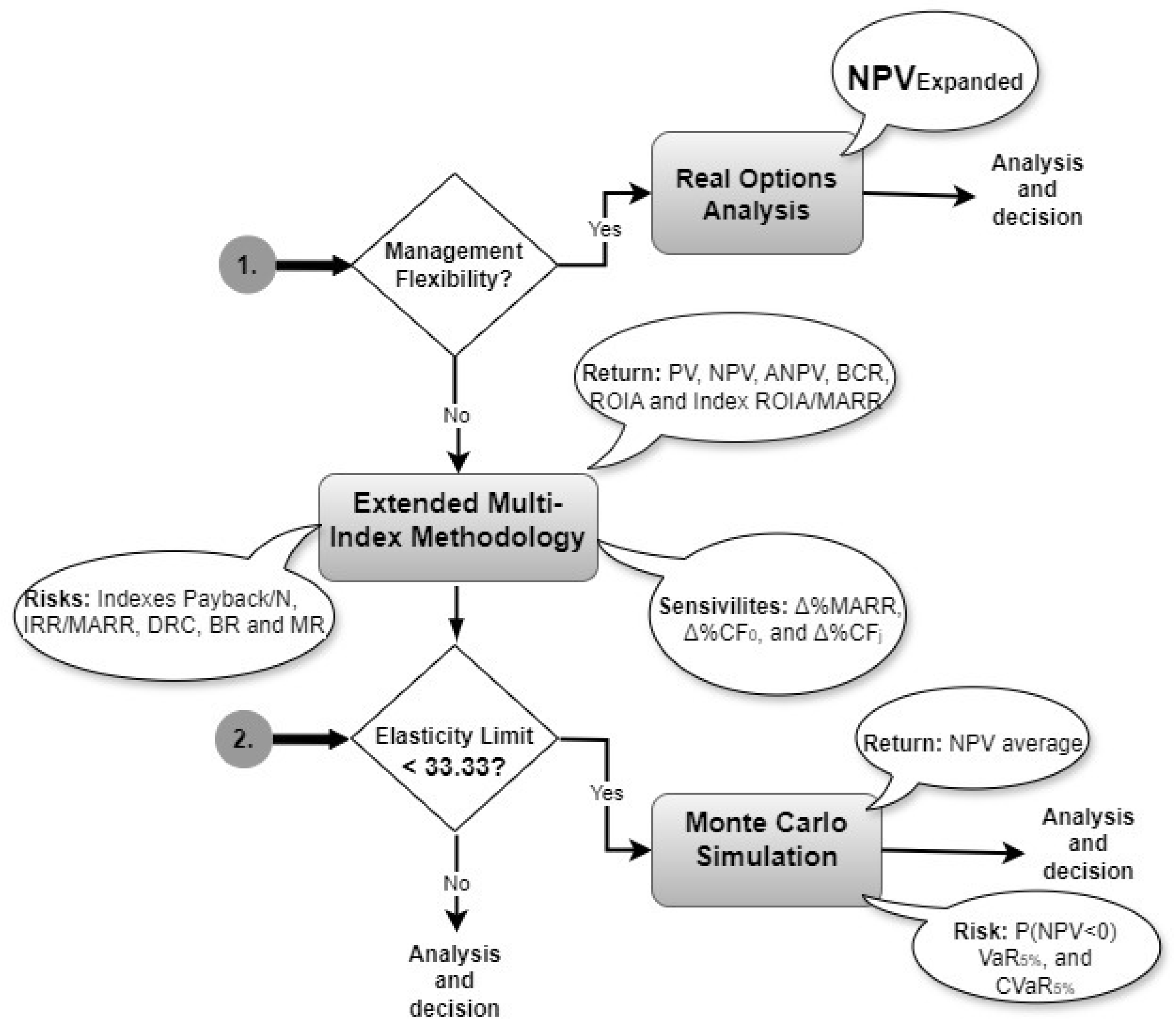

Here, we provide an easy-to-use framework to guide decision makers in the investment appraisal of agricultural projects. Through two simple questions, the framework indicates the most appropriate approach considering the project’s singularities. The first question assesses the presence of managerial flexibility. The second question verifies whether the project is highly sensitive (33.33%). EMIM uses the following scale to classify sensitivity: (i) high: <33.33%, (ii) low > 66.66%, and (iii) medium in all other cases (Dranka et al. 2020; Lima et al. 2015).

Figure 1 presents the 3 main steps of the proposed methodology. The first step is to find potential significant management flexibilities (MFs). If yes, real options analysis (ROA) must be used (Dranka et al. 2020; Copeland and Antikarov 2002). Furthermore, in projects without relevant MF, we must apply a deterministic approach (Lima et al. 2015), and the need for using Monte Carlo simulation (MCS) must be evaluated—e.g., if the elasticity limit is less than or equal to 33.33%, a stochastic analysis, for instance, based on MCS, should be made (Lima et al. 2017).

Figure 1.

Framework for Investment and Risk Assessment of Agricultural Projects. Legend: PV (present value), NPV (net present value), ANPV (annualized net present value), BCR (benefit-cost ratio), ROIA (additional return on investment), index MARR/IRR (minimum attractive rate of return/internal rate of return), index Payback/N (N is the number of periods of the AIP), DRC (degree of revenue commitment), BR (business risk), MR (management risk), P(NPV < 0)—probability that the agricultural investment project (AIP) will produce a negative value, VaR5%—value at risk at level 5%, and CVaR5%—conditional VaR at level 5%.

The main variables for calculating the EMIM are initial investment, operating and maintenance costs, quantity, unit sales price, unit variable cost, and fixed cost, i.e., these are the variables that characterize an investment project. To apply the MCS, it is necessary to identify the random variables and their respective probability distributions, such as manufacturing quantities, unit manufacturing cost, and unit marginal result. Finally, the application of ROA is more complex and was, therefore, the subject of the case study.

The last step is focused on the analysis and the decision, e.g., to invest or not to invest, to postpone or to anticipate the AIP. Finally, if the project is approved, regardless of the investment analysis made, it is essential to monitor and control it, and if there are deviations, corrective actions must be implemented. However, some variables cannot be controlled (e.g., climate, pests, price, and new health restrictions). A real case study is used to present and discuss the proposed methodology.

3. Case Study

Agriculture worldwide involves approximately 570 million people throughout its value chain (FAO 2022). In the European Union (EU), the agribusiness sector employs 44 million people, with approximately 20 million of these jobs being exclusively “agribusiness inside the gate” (EU 2019). In Portugal, for example, agribusiness involves 750,000 people, and more than 90% are family farming, responsible for 55% of the planting area and 50% of the country’s food (DGADR 2021). In Brazil, more than 80% of farmers are family businesses, totaling approximately 4.4 million families. These producers represent 35% of the gross domestic product (GDP) (MDA 2021). The relevance of family agribusiness in Brazil is similar to what happens in other economies, and it is evident from the data published by the Brazilian Institute of Geography and Statistics related to economic and social development (IBGE 2017).

In family agribusiness, farmers are particularly skilled in operational activities and have, in general, reduced financial literacy. The level of digitalization in these companies is also very low, without access to modern software and information technologies, which reduces the amount and availability of financial and non-financial data for both operational and strategic decision making (Deina et al. 2023). Considering the increasing competition and complexity that characterizes agribusiness, managers of smaller farms need cheap and easy-to-use tools to support decision making. Current solutions are expensive and complex to handle (Deina et al. 2023; IBGE 2023).

Agribusiness has also been pushed to be more sustainable and to use land in a much more rational way. The integrated production of crops, livestock, and forest, the so-called ASS (agrosilvopastoral system), has been a trend in Brazil in recent decades.

The use of ASS offers a variety of benefits, mainly the mitigation of risks in the face of variability in production and prices. A mixed portfolio is an efficient risk regulator. Thus, these systems may help risk-averse farmers and regions that face climate problems and consequent variability in production and annual volatility in commodity trading prices (Cordeiro et al. 2018; Figueroa et al. 2022; Bell et al. 2021; Varela and Santana 2009). Indeed, diversifying agricultural production aims to enhance ecological and economic benefits. Gains from diversifying agricultural activities include risk reduction using a portfolio perspective. Thus, given the relevance of investments in ASS for economic development and sustainability, it was decided to apply the framework to this type of agricultural investment project.

A large farm located in the municipality of Campo Erê in the western region of the state of Santa Catarina, Brazil was selected. The data were collected through semi-structured interviews, document analysis, and systematic observation, similarly to (Gil 2010; Yin 2005). The farm’s main activity is the production of grains, particularly soybeans. The choice of a large property to carry out the analysis is justified by the possibility of creating simulations combining the cultivation of eucalyptus on a large scale, the production of grains following two or three harvests per year, and the production of beef cattle for commercial purposes.

The farm has a total area of 640 ha, from which 500 hectares are used for mechanized planting, and the AIP that was studied has a planning horizon of 10 years (2023 to 2032). In this case, the land use was distributed as follows: (i) 160 hectares for beef cattle production (including crop areas for animal feed), (ii) 90 hectares of eucalyptus plantations, and (iii) 250 hectares of grain production. In the area intended for grain production, soybeans and corn are the predominant crops, with two annual harvests, one for each crop. The planting of oats for soil cover in the winter was considered. Some fallow periods for soil recovery between crop rotations were also considered. In crop rotation, the period of sanitary emptiness was not considered.

4. Application of the Framework

To discuss the applicability of the framework proposed in this research, we focus on ROA, which presents greater complexity and less empirical evidence in the literature. Nevertheless, all the framework steps were performed, namely, the application of EMIM (see Appendix A and (Pacassa et al. 2022; Lima et al. 2015, 2017) for additional information). Furthermore, the application of MCS in AIPs can be found in (Dranka et al. 2020; Lima and Southier 2024). An interest rate of 13.75% per year (BACEN 2024) (i.e., minimum attractiveness rate of return (MARR) or risk-free rate) was considered for the computation of the discounted cash flows. This discount rate is based on the “Selic” rate, which is the reference interest rate in Brazil, influencing the rates used in financing and investments.

In the studied AIP, the company faces managerial flexibilities (MFs) related to the land distribution options, and uncertainty related to the production volume, sales prices, production costs, etc., which present significant variation in each harvest.

Following what was proposed in the framework, the AIP characterized by MF and uncertainty must be analyzed through real options analysis (ROA) using the binomial model and the four steps presented in (Copeland and Antikarov 2002). The binomial model makes it possible to compute the economic value of the real options (RO) at each node of the model, identifying investment opportunities that may not be considered using traditional analysis methods (Nardelli and Macedo 2011).

Considering the expected revenues and costs and corresponding discounted cash-flows per year, an NPV of BRL 15,562.27 per hectares was computed. Given the lack of historical references to volatility for this type of investment, it was necessary to use an approximation measure to estimate it (Souza et al. 2019). Thus, the volatility (σ) of the AIP was calculated based on the prices of soy, corn, eucalyptus, and beef cattle. The historical series of annual prices for ten years (2013 to 2022) was obtained from the databases of CEPEA (center for advanced studies on applied economics) and SEAB (department of agriculture and supply). The series was deflated using the IGP-M (general price index–market) index from the Fundação Getúlio Vargas (FGV), for the end of the period under analysis. The standard deviation of the price series was calculated, and a weighted average was used to find the volatility result (σ). The estimated value for “σ” was 17.77% per year.

With the estimated volatility, it was possible to calculate the factors “u” (upward movement) and “d” (downward movement) and their respective probabilities. The results obtained were the following: (i) annual volatility (σ) 17.77% per year, (ii) upward movement (u) 1.19446, (iii) downward movement (d) 0.83719, (iv) risk-neutral probability of an upward movement (p) 84.06%, and (v) risk-neutral probability of a downward move (q) 15.94%.

From a deterministic perspective, the project presents a positive NPV (BRL 15,562.27/ha). However, a deterministic NPV is not enough, as it does not consider the uncertainty, that is, the volatility of the project return and the economic value of the implicit MFs related to this type of investment. In agribusiness, MFs are typically the options to expand, abandon, or postpone the cultivation, harvest, and sale of crops.

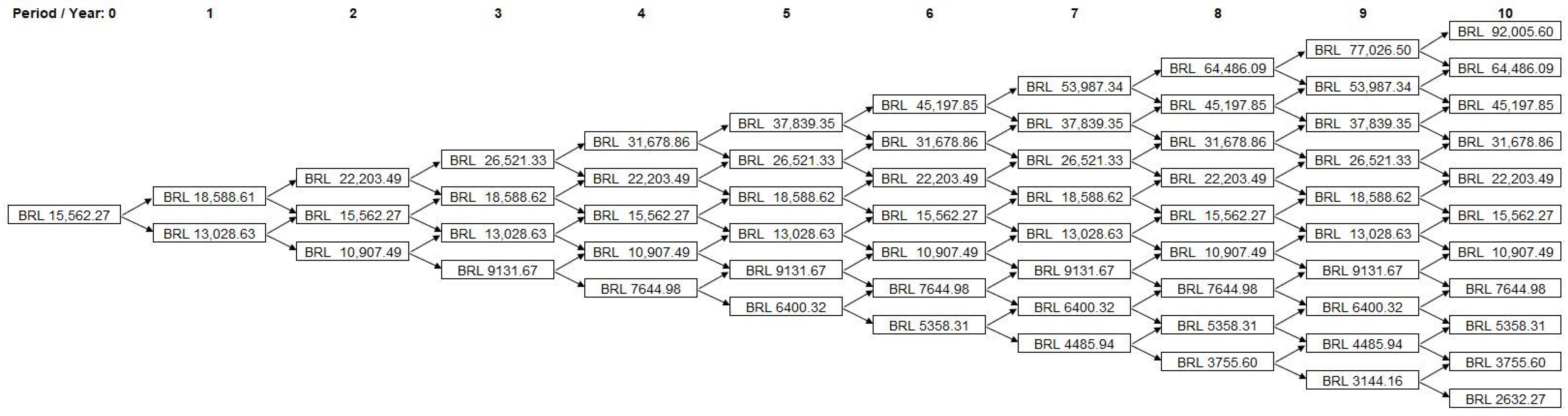

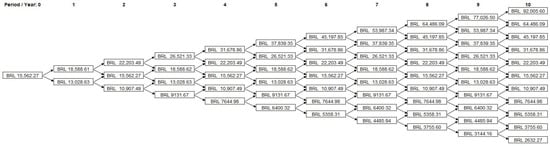

To build the event tree (ET) and its nodes, the NPV was multiplied by the value of the upward movement (u) or downward movement (d) in each period. The real options (RO) binomial tree of the project is shown in Figure 2.

Figure 2.

Binomial Tree of the Real Options of the Project.

On the one hand, with the application of the upward movement (u) in the 1st period, the NPV value is BRL 18,588.62. On the other hand, considering the downward trend (d), the computed NPV is BRL 13,028.63. For the 2nd period, the ascending NPV of the 1st period can be ascending again (BRL 22,203.49) or descending (BRL 15,562.27). The descending NPV of the 1st period also has two forms: ascending (BRL 15,562.27) or descending again (BRL 10,907.49). The calculations were made successively for 10 periods.

The analysis of the binomial tree shows that the NPV of BRL 15,562.27 measured in terms of present value can reach, in the best possible scenario, BRL 92,005.60 in the tenth period or BRL 2632.28 in the worst possible scenario. This information shows the economic feasibility of the project, which, even in the worst possible scenario, presents positive financial results.

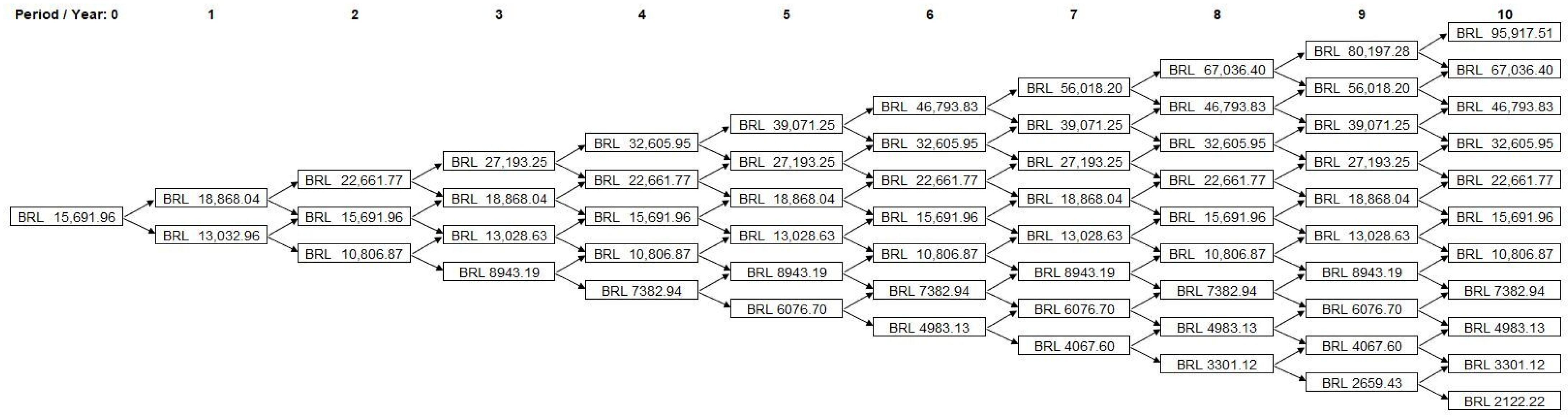

Extending the analysis, a different scenario for the distribution of the land was considered, according to the data collected from the case study. The eucalyptus area was expanded and redistributed as follows: (i) 160 hectares for beef cattle (including crop areas for animal feed), (ii) 150 hectares of eucalyptus, and (iii) 190 hectares for grains. Accordingly, new CFs were computed and a new tree, shown in Figure 3.

Figure 3.

Binomial Tree of Real Options for expansion of eucalyptus plantation area—American Option.

In this new scenario, the NPV reaches BRL 95,917.51 in the best possible scenario, BRL 3911.91 more than in the previous analysis. Therefore, expanding the eucalyptus plantation area is a better option. Table 1 shows a comparative analysis of these different scenarios.

Table 1.

ROA of the Different Scenarios.

The investment appraisal showed the existence of positive financial results in the example studied, even when the NPV was stressed by risk situations. With this result, the implementation of the studied ASS proved to be a good alternative for farmers, mainly because the project reduces business risk by diversifying activities over the years.

For the case studied, a more detailed analysis was requested, considering ASS risks and MFs. In this case and similar projects, the analyst needs to use ROA to obtain a full perspective of all possible results.

The two studied scenarios presented financial viability, with the second one (with more Eucalyptus and smaller grain planting areas) being a more attractive option. We emphasize that after the analysis and decision to invest, those responsible must monitor and follow up on its execution. We recommend monitoring the expected results of the AIP and applying corrections, if necessary, in its implementation.

5. Discussion

Every investment project faces some risks and uncertainty, but projects in agriculture are more prone to situations that cannot be controlled by the farmer, due to the uncertainty inherent in this sector, such as climate variations, variability in the price of commodities due to market conditions and exchange rate variations, global political and logistics issues, and problems with the supply of water for irrigation (Graveline et al. 2012). To mitigate these problems, it is necessary to use more powerful investment appraisal methods.

The literature highlights the use of NPV (net present value), IRR (internal rate of return), and discounted payback methods and traditional techniques such as sensitivity analysis, scenario analysis, and decision trees. However, this approach does not adequately assess the risks, uncertainty, and management flexibilities present in most AIPs (Dranka et al. 2020; Lima et al. 2015). The methodology proposed here also considers the inherent risks and variability related to the project using MCS and ROA.

Thus, this work contributes to mitigating a significant gap in the literature and in practice by presenting a methodology that establishes a set of criteria to be used in the investment appraisal of projects characterized by high variability and risk, as well as a high number of managerial flexibilities and real options for decision makers, as is the case with many agricultural investment projects (AIPs).

Applied individually, traditional methods are useful for investment analysis, but such an approach is not sufficient to deal with the complexity of the agricultural environment. The integration of risk analysis, economic return, sensitivity analysis, and a stochastic approach focused on real options theory makes the investment appraisal framework much more efficient for complex environments.

The proposed framework also can be applied in other complex investment decision-making environments by jointly using consolidated analysis tools and methodologies (expected net present value or expected return on investment, potential risks, sensitivity analysis, Monte Carlo simulation (MCS), and real options analysis (ROA)). The application of the framework is particularly well explained and discussed in the agricultural context due to the usual complexity and uncertainty that characterize such an environment.

The relevance of the proposed framework to guide and support decision making in AIPs was verified. Particularly, the use of tools and methods to carry out a complete investment analysis is an essential contribution to decision-making in such environments characterized by high levels of uncertainty. Thus, the main contribution of the proposed framework is to structure a set of steps based on several tools to carry out investment appraisal in agricultural contexts. Being easy to use and flexible, this framework can be used by managers with more or less experience in capital budgeting techniques and with low or high financial literacy. Nevertheless, the use of the most complex tools, such as MCS and ROA, requires support from consultants or academics with expertise in these domains. The framework proposed here bridges people with those different expertise and literacy, contributing to the diffusion of financial knowledge and good practices.

For the generalization of the use of this framework, its different users must understand their roles and contribution in terms of data collection and analysis. Particularly, farmers must be encouraged to participate actively in the process turning capital budgeting a routinized process in their management activities.

The presented framework goes beyond the methods offered by De la Torre-Torres et al. (2024), Noja et al. (2015), Horobet et al. (2021), Morera et al. (2023), and Manna et al. (2022) by presenting elements of analysis aimed at rural activity simultaneously, such as (i) estimated expected return, (ii) indication of potential risks, (iii) sensitivity analysis, (iv) Monte Carlo simulation (MCS), and (v) real options analysis (ROA). In addition, the study corroborates the indications of research by (4) when describing the adequacy of management tools with the sustainable development goals—ODS (ONU 2021), more specifically with ODS 8: “Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all”, helping to increase the level of employment and stable income, through the strengthening of organizations.

The proposed framework goes beyond the multi-index methodologies already presented in the literature (Dranka et al. 2020; Lima et al. 2017; Lima and Southier 2024), as it includes layers of risk analysis and a stochastic approach through MCS. This perspective is aligned with the current volatile, uncertain, complex, and ambiguous (VUCA) world that many managers face. This context promotes different investment alternatives and changes, requiring managers to use adequate methods such as ROA, as suggested in the framework. Due to these aspects, the framework is, in fact, original and relevant for application in complex investment appraisal projects, as is the case with many AIPs.

6. Conclusions

The research was carried out with the proposal to present a framework for investment and risk assessment of agricultural projects, offering small, medium, and large farmers a solution for investment appraisal. As a general objective, we sought to develop a framework to support the appraisal of AIPs, which contains technical suitability, incorporating each AIP’s specificities and complexities (uncertainties and managerial flexibilities). This study achieved the desired objectives. The methodology and development of the framework construction were also presented. The information generated in the analyses developed using the framework was sufficient to aid decision-making.

The main contributions of this study are (i) presentation and validation of a framework for investment appraisal and the risk of AIP, which contains technical suitability; (ii) presentation of the indicators covered by the framework; and (iii) evaluation of an AIP, using the framework, to confirm its applicability and functionality.

It was verified that agricultural activities are continuously undergoing relevant evolutions, mainly caused by increased technologies in the activities of rural properties. In this way, the necessary investments are more significant, making it essential to use the proposed framework to analyze these investments. The development of tools that assist in the execution of this analysis is a substantial contribution to the rural environment.

The framework results are sufficient to diagnose the current situation and identify investment projects that can bring more returns with reduced risks and improve the farm’s profitability. The specificities of the AIP make it notorious for difficulty in choosing the form of an investment appraisal. Therefore, the framework fulfills this vital task.

The adoption of the framework by farmers can overcome the problems of similar investments being evaluated with different methodologies, as this makes it difficult for evaluators to choose the most appropriate analytical approach.

The proposed framework can be used to evaluate investment projects in different industries and domains, such as energy (Dranka et al. 2020). However, it is important to highlight that here we are focused on the investment appraisal process. Before using the proposed framework, it is necessary to develop a technical, social, and environmental feasibility study. Financial analysis will come later. The purpose of the framework is only to guide the economic-financial assessment of a project previously approved from a technical perspective.

The implementation of the proposed framework in the agricultural context may be subject to several limitations, especially if the inputs databases used are limited and/or incomplete, which can frequently occur.

Agriculture, in general, is strongly seasonal and influenced by internal and external factors (for example, climate and exchange rates). Thus, databases should span several years to incorporate all relevant variability and seasonality. In many cases, it is not possible to use such databases because they are not accessible (to all decision makers) or because they simply do not (yet) exist.

Furthermore, there are challenges with implementing the framework related to difficulties in using technological tools. Particularly, many farmers, especially in small businesses, have reduced technological literacy. However, these difficulties can be overcome with specific training and the support of experts from both the industry and the academia.

One of the limitations of this research work is the need of a more generalized application of the proposed framework. Indeed, studying more AIPs will offer interesting insights on both the design and the application of all tools proposed. The current framework is sufficiently comprehensive to deal with the different types of AIPs but it can be improved and extended to deal with subsets and specific technologies, products and markets.

In future research, the framework proposed in this study can be applied and adapted to other industries and companies. In the case studies analyzed, it is suggested that in future studies, the correlations and influences between variables be evaluated, such as, for example, the correlation between the risk-free rate and volatility in applying ROA. Furthermore, it is suggested that multi-criteria models be developed to support decision-making and analyze decision makers’ opinions in choosing an investment.

Author Contributions

Study conceptualization: L.V., M.G.T. and J.D.d.L.; methodology development: L.V., A.Z., M.L., M.G.T., P.A. and J.D.d.L.; software development and analysis: L.V. and J.D.d.L.; validation: L.V., M.G.T., M.L., A.Z., J.D.d.L. and P.A.; writing—original draft preparation: L.V., A.Z., M.G.T., M.L., P.A. and J.D.d.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created in addition to those presented in the manuscript.

Acknowledgments

Thanks to Federal University of Technology—Parana (UTFPR), Campus Pato Branco, Graduate Program in Production and Systems Engineering and Department of General and Applied Management, Federal University of Paraná (UFPR).

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Appendix A: summary of the main methods/indicators, dimensions (return, risks, and sensitivities), and methodologies (CM, MIM, EMIM, MCS, and ROA) used in investment analysis in real assets.

EMIM (extended multi-index methodology) can be arranged into the return dimension (PV—present value; NPV—net PV; ANPV—annualized NPV; BCR—benefit-cost ratio; ROIA—additional return on investment; and index ROIA/MARR—ROIA/minimum attractive rate of return); risk dimension (IRR—internal rate of return; index MARR/IRR; payback; payback/N—payback/horizon plan; DRC—degree of revenue commitment; BR—business risk; and MR—management risk); and sensitivity analysis dimension (Δ%MARR—percentual variation of the MARR; Δ%CF0—percentual variation of the initial cash flow; and Δ%CFj—percentual variation of the CF per each period j) (Souza et al. 2020; Lima et al. 2015).

The set of indicators of MCS (Monte Carlo simulation) can be arranged in terms of return (average NPV) and risks (P(NPV < 0)—the probability that the project will produce a negative present value; VaR5%—Value at Risk at a significance level of 5%; and CVaR5%—Conditional Value at Risk at a significance level of 5%—CVaR (Issa et al. 2024; Buchenberg et al. 2023; Lima et al. 2017; Rockafellar and Uryasev 2000; Rockafellar and Uryasev 2002).

| Dimension | Indicators | Mathematical Model | |

| E X T E N D E D M U L T I - I N D E X M E T H O D O L O G Y1 | RETURN 2 | Present value (PV) | |

| Net present value (NPV 3) | |||

| Annualized NPV (ANPV) | |||

| Benefit-cost ratio (BCR) | |||

| ROIA 4 | |||

| MIRR 5 or ROI 6 | |||

| Index ROIA/MARR 7 | |||

| RISKS 2 | Payback 3 | ||

| Internal rate of return (IRR 3) | |||

| Index Payback/N | |||

| Index MARR/IRR | |||

| SENSITIVITIES: ELASTICITY LIMITS (EL) | Δ%MARR | ||

| Δ%CF0 | |||

| Δ%CFj | |||

| SENSITIVITIES: LIMIT VALUES (LV) | |||

| (j = 1, 2, …, N) | |||

| MCS | PROBABILITY: P(NPV < 0) 8 | ||

| VaR5% 9 | , where | ||

| CVaR5% 10 | |||

| ROA | Real Option Value (ROV) | NPVExpanded − NPVTraditional | |

| Legend: 1 Extended Multi-index Methodology (EMIM) proposed by (Lima et al. 2015). 2 Dimen-sions of the Multi-index Methodology (MIM) proposed by (Souza and Clemente 2008). 3 Traditional indicators of the Classical Methodology (CM) (Casarotto Filho and Kopittke 2020). 4 Additional Return on Investment (Souza et al. 2020; Souza and Clemente 2008). 5 Modified Internal Rate of Return (Casarotto Filho and Kopittke 2020). 6 Return on Investment (Casarotto Filho and Kopittke 2020). 7 Minimum Attractiveness Rate of Return (Souza et al. 2020; Casarotto Filho and Kopittke 2020). 8 The probability of financial failure is measured by the NPVs resulting from the Monte Carlo Simulation—MCS (Lima et al. 2017; Lima and Southier 2024). 9 Value at Risk (VaR) at level 5% (J.P. Morgan 1996). 10 Value at Risk Conditional (CVaR) at the level 5% (Rockafellar and Uryasev 2000; Rockafellar and Uryasev 2002). CF: Cash Flow; Δ: variation; j: period; and N: planning horizon. Z: Standard Normal Distribution: N (0, 1). : average NPV obtained numerically through MCS; : standard deviation obtained via MCS; X is a random variable such that: . ROA: real options analysis. k: number of iterations. | |||

References

- BACEN. Central Bank of Brazil. 2024. Selic Interest Rate. Available online: https://www.bcb.gov.br/en/monetarypolicy/selicrate (accessed on 4 July 2024).

- Bell, Lindsay. W., Andrew. D. Moore, and Dean Timothy Thomas. 2021. Diversified crop-livestock farms are risk-efficient in the face of price and production variability. Agricultural Systems 189: 103050. [Google Scholar] [CrossRef]

- Bertolozzi-Caredio, Daniele, Barbara Soriano, Isabel Bardaji, and Alberto Garrido. 2022. Analysis of perceived robustness, adaptability and transformability of Spanish extensive livestock farms under alternative challenging scenarios. Agricultural Systems 202: 103487. [Google Scholar]

- Braun, Anja Tatjana, Eduardo Colangelo, and Thilo Steckel. 2018. Farming in the era of Industrie 4.0. Procedia CIRP 72: 979–84. [Google Scholar] [CrossRef]

- Bronson, Kelly, Irena Knezevic, and Chantal Clement. 2019. The Canadian family farm, in literature and in practice. Journal of Rural Studies 66: 104–11. [Google Scholar] [CrossRef]

- Buchenberg, Patrick, Thushara Addanki, David Franzmann, Christoph Winkler, Felix Lippkau, Thomas Hamacher, Philipp Kuhn, Heidi Heinrichs, and Markus Blesl. 2023. Global Potentials and Costs of Synfuels via Fischer–Tropsch Process. Energies 16: 1976. [Google Scholar] [CrossRef]

- Casarotto Filho, Nelson, and Bruno Hartmut Kopittke. 2020. Análise de Investimentos: Manual para Solução de Problemas e Tomadas de Decisão, 12th ed. São Paulo: Atlas. [Google Scholar]

- Copeland, Tom, and Vladimir Antikarov. 2002. Opções Reais: Um Novo Paradigma para Reinventar a Avaliação de Investimentos. Rio de Janeiro: Campus. [Google Scholar]

- Cordeiro, Sidney Araujo, Marcio Lopes da Silva, Silvio Nolasco de Oliveira Neto, and Tiago Moreira Oliveira. 2018. Simulação da Variação do Espaçamento na Viabilidade Econômica de um Sistema Agroflorestal. Floresta e Ambiente Online 25: e00034613. [Google Scholar] [CrossRef]

- Crews, Chistian. 2019. What machine learning can learn from foresight: A human-centered approach. Research-Technology Management 62: 30–33. [Google Scholar] [CrossRef]

- Damodaran, Aswath. 2018. Introdução à Avaliação de Investimentos: Ferramentas e Técnicas para a Determinação do Valor de Qualquer Ativo, 2nd ed. Rio de Janeiro: Qualitymark. [Google Scholar]

- De la Torre-Torres, Oscar V., Francisco Venegas-Martínez, and José Álvarez-García. 2024. The Benefits of Workforce Well-Being on Profitability in Listed Companies: A Comparative Analysis between Europe and Mexico from an ESG Investor Perspective. Journal of Risk and Financial Management 17: 118. [Google Scholar] [CrossRef]

- Deina, Carolina, João Lucas Ferreira dos Santos, Lucas Henrique Biuk, Mauro Lizot, Attilio Converti, Hugo Valadares Siqueira, and Flavio Trojan. 2023. Forecasting Electricity Demand by Neural Networks and Definition of Inputs by Multi-Criteria Analysis. Energies 16: 1712. [Google Scholar] [CrossRef]

- DGADR. Directorate General for Agriculture and Rural Development. 2021. Charter of Portuguese Family Farming. Available online: http://agriculturafamiliar.dgadr.pt/images/docs/Recursos/cartaagriculturafamiliar.pdf (accessed on 26 May 2023).

- Dranka, Gerimi Gilson, Jorge Cunha, Jose Donizetti de Lima, and Paula Ferreira. 2020. Economic evaluation methodologies for renewable energy projects. AIMS Energy 8: 339–63. [Google Scholar] [CrossRef]

- EU. European Union. 2019. Agriculture. Available online: https://europa.eu/european-union/topics/agriculture_en (accessed on 19 June 2023).

- FAO. Food and Agriculture Organization of the United Nations. 2022. Structural Data from Agricultural Censuses. Available online: http://www.fao.org/brasil/programas-e-projetos/programa/en/ (accessed on 26 May 2023).

- Figueroa, Oscar Burbano, Alexandra Sierra Monroy, Adriana David Hinestroza, Cory Whitney, Christian Borgemeister, and Eike Luedeling. 2022. Farm-planning under risk: An application of decision analysis and portfolio theory for the assessment of crop diversification strategies in horticultural systems. Agricultural Systems 199: 103409. [Google Scholar] [CrossRef]

- Gil, Antonio Carlos. 2010. Como Elaborar Projetos de Pesquisa. Sao Paulo: Atlas. [Google Scholar]

- Gitman, Lawrence J., and Chad J. Zutter. 2017. Princípios de Administração Financeira. Rio de Janeiro: Editora Pearson. [Google Scholar]

- Gorman, Timothy. 2023. The Art of Not Being Freshened: The Everyday Politics of Infrastructure in the Mekong Delta. Sustainability 15: 5494. [Google Scholar] [CrossRef]

- Graveline, Nina, Sebastien Loubier, Guy Gleyses, and Jean Daniel Rinaudo. 2012. Impact of farming on water resources: Assessing uncertainty with Monte Carlo simulations in a global change context. Agricultural Systems 108: 29–41. [Google Scholar] [CrossRef]

- Horobet, Alexandra, Stefania Cristina Curea, Alexandra Smedoiu Popoviciu, Cosmin-Alin Botoroga, Lucian Belascu, and Dan Gabriel Dumitrescu. 2021. Solvency Risk and Corporate Performance: A Case Study on European Retailers. Journal of Risk and Financial Management 14: 536. [Google Scholar] [CrossRef]

- IBGE. Brazilian Institute of Geography and Statistics. 2017. Census of Brazilian Agriculture. Available online: https://censos.ibge.gov.br/agro/2017/templates/censo_agro/resultadosagro/index.html (accessed on 26 September 2022).

- IBGE. Brazilian Institute of Geography and Statistics. 2023. Discover Brazil—Territory. Available online: https://educa.ibge.gov.br/jovens/conheca-o-brasil/territorio/20644-clima.html#:~:text=O%20clima%20equatorial%20abrange%20boa,regi%C3%A3o%20mais%20fria%20do%20pa%C3%ADs (accessed on 20 June 2023).

- Issa, Samar, Gulhan Bizel, Sharath Kumar Jagannathan, and Sri Sarat Chaitanya Gollapalli. 2024. A Comprehensive Approach to Bankruptcy Risk Evaluation in the Financial Industry. Journal of Risk and Financial Management 17: 41. [Google Scholar] [CrossRef]

- Jiménez, Victor, and Paulo Afonso. 2016. Risk assessment in costing systems using costing at risk (CaR): An application to the coffee production cost. Paper presented at the 2016 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Bali, Indonesia, December 4–7; Available online: https://ieeexplore.ieee.org/stamp/stamp.jsp?tp=&arnumber=7798091 (accessed on 28 July 2024).

- J.P. Morgan. 1996. Risk Metrics. In Technical Manual, 4th ed. New York: J.P. Morgan. Available online: https://www.msci.com/documents/10199/5915b101-4206-4ba0-aee2-3449d5c7e95a (accessed on 18 October 2022).

- Komarek, Adam M., Alessandro de Pinto, and Vicent H. Smith. 2020. A review of types of risks in agriculture: What we know and what we need to know. Agricultural Systems 178: 102738. [Google Scholar] [CrossRef]

- Kruger, Silvana Dalmutt, Antonio Zanin, Orlando Durán, and Paulo Afonso. 2022. Performance measurement model for sustainability assessment of the swine supply chain. Sustainability 14: 9926. [Google Scholar] [CrossRef]

- Kruger, Silvana Dalmutt, Renata Pesente, Antonio Zanin, and Sergio Murilo Petri. 2019. Comparative analysis of the economic and financial return of milk and poultry activities. Custos e @Gronegócio on Line 15: 22–49. [Google Scholar]

- Kuypers, Stef, Thomas Goorden, and Bruno Delepierre. 2021. Computational Analysis of the Properties of Post-Keynesian Endogenous Money Systems. Journal of Risk and Financial Management 14: 335. [Google Scholar] [CrossRef]

- Lima, Jose Donizetti de, and Luiz Fernando P. Southier. 2024. Practical Guide for User of $AVEPI®. Federal University of Technology—Paraná (UTFPR)—Pato Branco Campus. Academic Department of Mathematics (DAMAT) and Graduate Program in Production and Systems Engineering (PPGEPS). Available online: http://pb.utfpr.edu.br/savepi (accessed on 14 May 2023).

- Lima, Jose Donizetti de, Marcelo Gonçalves Trentin, Gilson Adamczuk Oliveira, Dayse Regina Batistus, and Dalmarino Setti. 2015. A systematic approach for the analysis of the economic feasibility of investment projects. International Journal Engineering Management and Economics 5: 19–34. [Google Scholar]

- Lima, Jose Donizetti de, Marcio Bennmann, Luiz Fernando P. Southier, Dayse Regina Batistus, and Gilson Adamczuk Oliveira. 2017. $AVEPI—Web System to Support the Teaching and Learning Process in Engineering Economics. Brazilian Journal of Operations and Production Management 14: 469–85. [Google Scholar] [CrossRef]

- Manna, Amalesh Kumar, Leopoldo Eduardo Cárdenas-Barrón, Jayanta Kumar Dey, Shyamal Kumar Mondal, Ali Akbar Shaikh, Armando Céspedes-Mota, and Gerardo Treviño-Garza. 2022. A Fuzzy Imperfect Production Inventory Model Based on Fuzzy Differential and Fuzzy Integral Method. Journal of Risk and Financial Management 15: 239. [Google Scholar] [CrossRef]

- MDA. Ministry of Agrarian Development. 2021. Brazil: 70% of the Food That Arrives at the Table of Brazilians Comes from Family Farming. Available online: http://www.mda.gov.br/sitemda/noticias/brasil-70-dos-alimentos-que-v%C3%A3o-%C3%A0-mesa-dos-brasileiros-s%C3%A3o-da-agricultura-familiar (accessed on 20 October 2022).

- Minardi, Andrea Maria A. F. 2004. Teoria de Opções Aplicada a Projetos de Investimento. São Paulo: Editora Atlas. [Google Scholar]

- Morera, Josep M., Emiliano Borri, Gabriel Zsembinszki, David Vérez, Gemma Gasa, Esther Bartolí, and Luisa F. Cabeza. 2023. Energy Assessment of a Tannery to Improve Its Sustainability. Sustainability 15: 5599. [Google Scholar] [CrossRef]

- Mota, Jorge, and António Carrizo Moreira. 2023. Capital Budgeting Practices: A Survey of Two Industries. Journal of Risk and Financial Management 16: 191. [Google Scholar] [CrossRef]

- Nadezda, Jankelova, Masar Dusan, and Moricova Stefania. 2017. Risk factors in the agriculture sector. Agricultural Economics 63: 247–58. [Google Scholar]

- Nardelli, Paula Moreira, and Marcelo Alvaro Macedo. 2011. Análise de um projeto agroindustrial utilizando a Teoria de Opções Reais: A opção de adiamento. Revista de Economia e Sociologia Rural 49: 941–66. [Google Scholar] [CrossRef]

- Noja, Gratiela Georgiana, Eleftherios Thalassinos, Mirela Cristea, and Irina Maria Grecu. 2015. The Interplay between Board Characteristics, Financial Performance, and Risk Management Disclosure in the Financial Services Sector: New Empirical Evidence from Europe. Journal of Risk and Financial Management 14: 79. [Google Scholar] [CrossRef]

- OECD/FAO. 2016a. Agricultural Outlook 2016–2025. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- OECD/FAO. 2016b. Policy Framework for Investment in Agriculture. Paris: OECD Publishing. [Google Scholar]

- ONU—Organização das Nações Unidas. 2021. Objetivos de Desenvolvimento Sustentável. Available online: https://unric.org/pt/objetivos-de-desenvolvimento-sustentavel/ (accessed on 13 January 2023).

- Pacassa, Franciele, Antonio Zanin, Leonir Vilani, and Jose Donizetti de Lima. 2022. Análise de viabilidade econômica da implantação da robotização da ordenha em uma propriedade rural familiar. Custos e @Gronegócio on Line 18: 363–86. [Google Scholar]

- Poffenbarger, Hanna, Georgeanne Artz, Garland Dahlke, William Edwards, Mark Hanna, James Russell, Harris Sellers, and Matt Liebman. 2017. An economic analysis of integrated crop-livestock systems in Iowa, U.S.A. Agricultural System 157: 51–69. [Google Scholar] [CrossRef]

- Rockafellar, Tyrrell, and Stan Uryasev. 2000. Optimization of Conditional Value-at-Risk. The Journal of Risk 2: 21–41. [Google Scholar] [CrossRef]

- Rockafellar, Tyrrell, and Stan Uryasev. 2002. Conditional Value-at-Risk for general loss distributions. Journal of Banking & Finance 26: 1443–71. [Google Scholar]

- Souza, Alceu, and Ademir Clemente. 2008. Decisões Financeiras e Análise de Investimentos: Fundamentos, Técnicas e Aplicações, 6th ed. São Paulo: Atlas. [Google Scholar]

- Souza, Alceu, and Ademir Clemente. 2015. Decisões Financeiras e Análises de Investimentos: Conceitos, Técnicas e Aplicações, 6th ed. São Paulo: Atlas. [Google Scholar]

- Souza, Alceu, and Ademir Clemente. 2022. Metodologia Multi-Índice: Um novo Olhar Sobre a Avaliação de Planos de Negócios, 1st ed. Lisboa: Lisbon International Press, p. 200. [Google Scholar]

- Souza, Alceu, Ariane Maria M. d. Oliveira, Dayla Karolina Fossile, Emmanuel Óguchi Ogu, Luciano Luiz Dalazen, and Claudimar Pereira da Veiga. 2020. Business plan analysis using multi-index methodology: Expectations of return and perceived risks. Sage Open 10: 2158244019900171. [Google Scholar] [CrossRef]

- Souza, Wagne. Dantas J., Juliano Francisco Baldissera, and Geysler Rogis Flor Bertolini. 2019. Análise de opções reais aplicada na diversificação da produção rural no estado do Paraná. Revista de Economia e Sociologia Rural 57: 253–69. [Google Scholar] [CrossRef]

- Spilioti, Nikolitsa, and Athanasios Anastasiou. 2024. European Structural and Investment Funds (ESIFs) and Regional Development across the European Union (EU). Journal of Risk and Financial Management 17: 228. [Google Scholar] [CrossRef]

- Thesari, Shirley Suellen, Mauro Lizot, and Flavio Trojan. 2021. 2023 Municipal Public Budget Planning with Sustainable and Human Development Goals Integrated in a Multi-Criteria Approach. Sustainability 13: 10921. [Google Scholar] [CrossRef]

- Varela, Luiz Benedito, and Antonio Cordeiro Santana. 2009. Aspectos econômicos da produção e do risco nos sistemas agroflorestais e nos sistemas tradicionais de produção agrícola em Tomé-açu, Pará—2001 a 2003. Revista Árvore 33: 151–60. [Google Scholar] [CrossRef]

- Yin, Roberto K. 2005. Estudo de Caso: Planejamento e Métodos. São Paulo: Bookman Press, Brasil. [Google Scholar]

- Zanin, Antonio, Silvana Dalmutt Kruger, Vitor Cardoso da Silveira, and Antonio Sergio Eduardo. 2022. Financial feasibility study and innovation in robotic milking. Research, Society and Development 11: e286111335129. [Google Scholar] [CrossRef]

- Zilio, Leonardo Botelho, and Roberto Arruda de Souza Lima. 2015. Atratividade de Canaviais Paulistas Sob a Ótica da Teoria das Opções Reais. Revista de Economia e Sociologia Rural 53: 377–94. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).