Application of a Robust Maximum Diversified Portfolio to a Small Economy’s Stock Market: An Application to Fiji’s South Pacific Stock Exchange

Abstract

1. Introduction

“... there are many issues besetting Fiji’s capital market. These include small retail investor base, limited financial products, illiquid stock market, high transaction costs, lack of awareness of the capital market and inconsistent application of policy by regulatory agencies”.

2. Literature Review

3. Materials and Methods

3.1. RMD Portfolio

3.2. Benchmark Portfolios

3.2.1. Equally Weighted (Naïve)

3.2.2. Minimum Variance

3.2.3. Mean Variance (Market)

3.2.4. Semi-Variance

3.2.5. Max Target Ratio

3.2.6. Maximum Skewness

3.2.7. Most Diversified Portfolio (MDP)

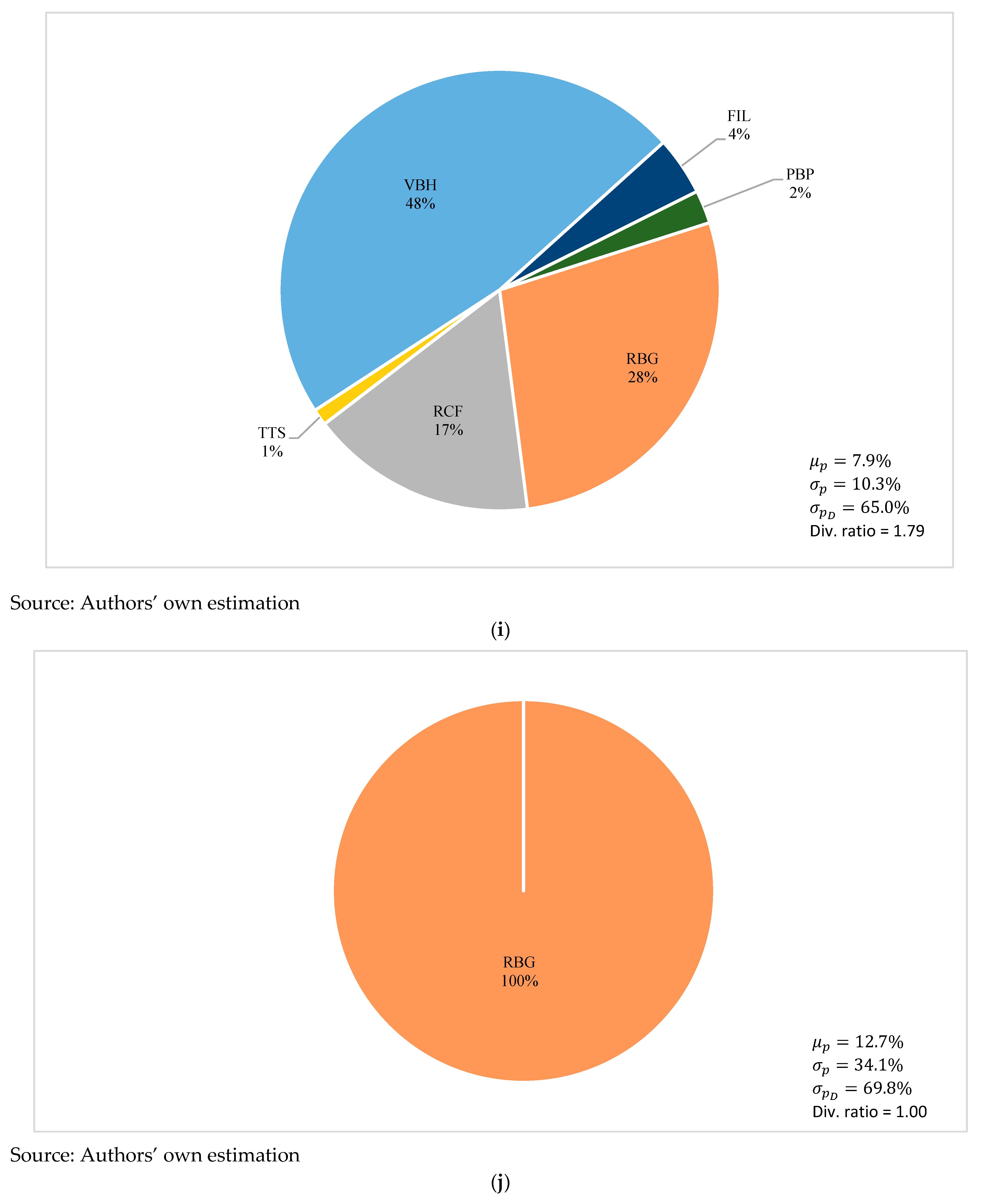

4. Results

4.1. Descriptive Statistics and Asset Betas

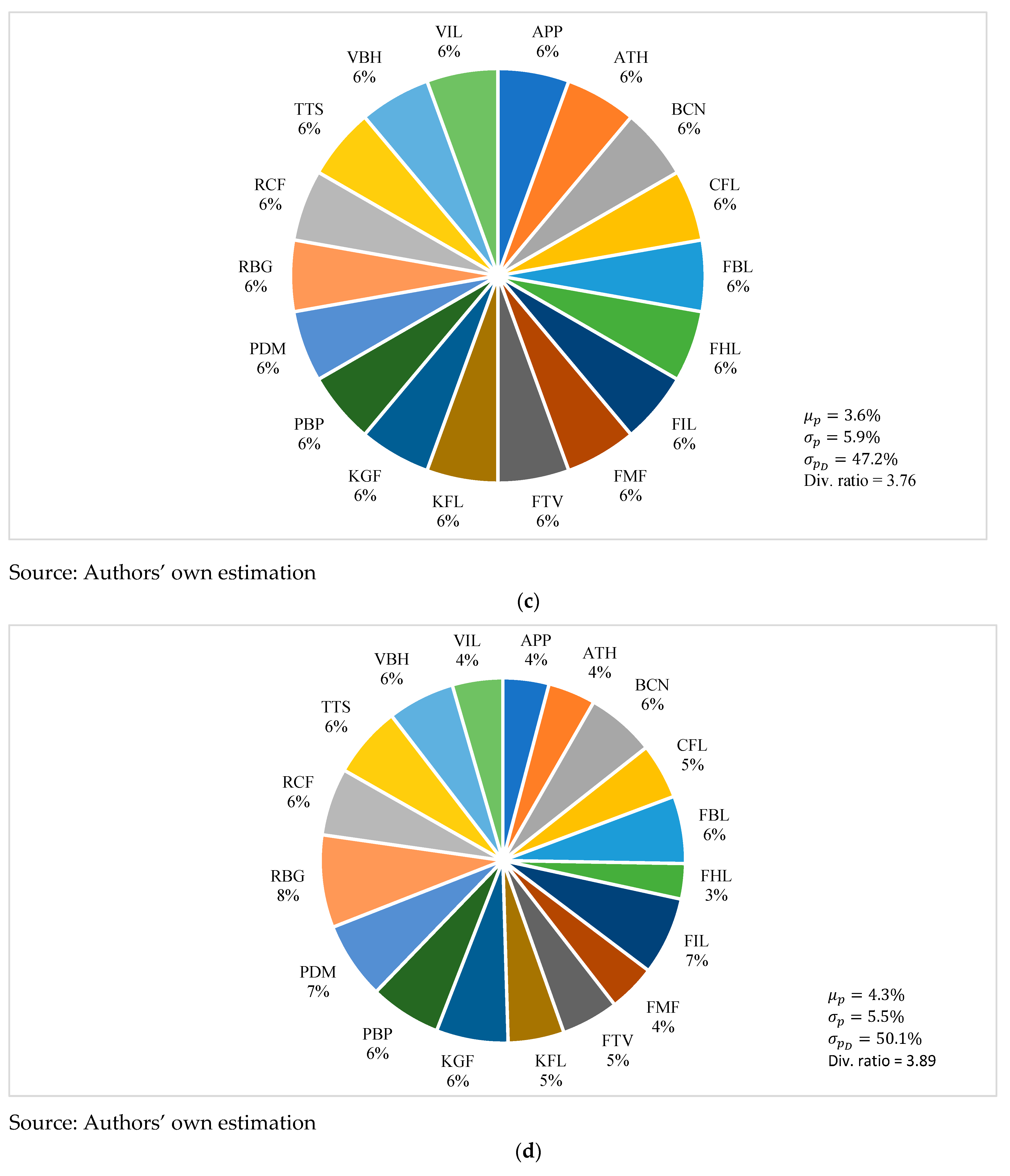

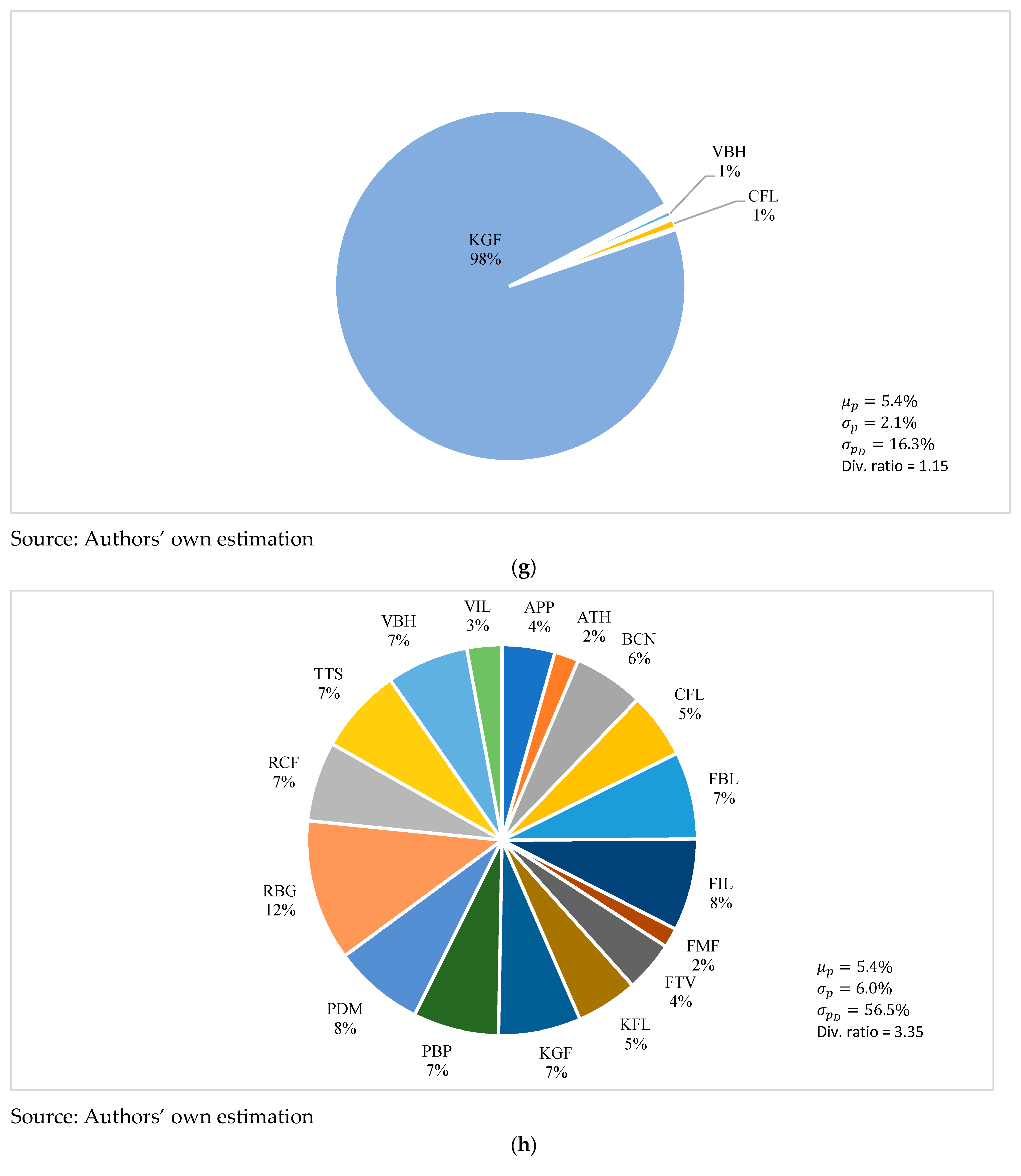

4.2. Portfolios below the RF Rate and below 4%

4.3. Portfolios between 4 and 5% and below RF Rate (5.44%)

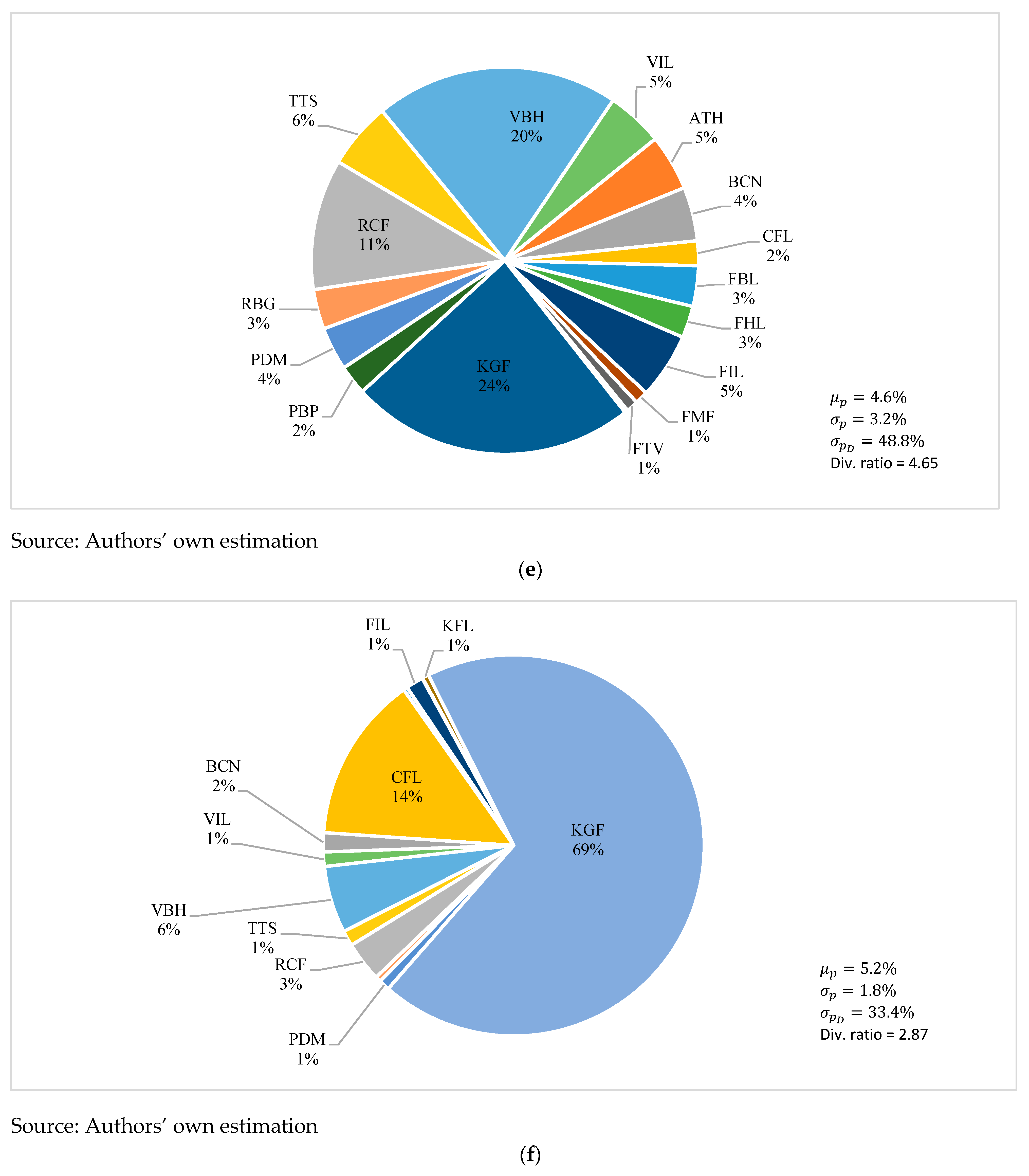

4.4. Portfolios above 5% and below the Risk-Free Rate

4.5. Portfolios above the Risk-Free Rate (5.44%)

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | |

| 2 | The no-short-selling assumption is highly relevant to Fiji’s stock market. |

| 3 | https://www.rbf.gov.fj/bond-pricelist-and-yield-curve-2018-2019/#1608590112383-909852ff-3554 (accessed on 29 August 2024). |

| 4 | The choice of the target ratio is based on the interest earned on superannuation fund in 2019. https://www.parliament.gov.fj/wp-content/uploads/2019/11/Fiji-National-Provident-Fund-2019-Annual-Report.pdf (accessed on 29 August 2024). |

| 5 | Please note that SUN Insurance Company Ltd. (SUN) was listed on 15 August 2024, hence not included in the sample. |

| 6 | |

| 7 | https://knoema.com/data/fiji+savings-rate#:~:text=Savings%20rate%20of%20Fiji%20fell,per%20annum%20in%20May%202024 (accessed on 29 August 2024). |

| 8 | https://www.rbf.gov.fj/category/bond-price-list-new/ (accessed on 29 August 2024). |

References

- Ahmed, Awais, Rizwan Ali, Abdullsh Ejaz, and Ishfaq Ahmad. 2018. Sectoral integration and investment diversification opportunities: Evidence from Colombo Stock Exchange. Entrepreneurship and Sustainability Issues 5: 514–27. [Google Scholar] [CrossRef] [PubMed]

- Al Janabi, Mazin A. M. 2021. Multivariate portfolio optimization under illiquid market prospects: A review of theoretical algorithms and practical techniques for liquidity risk management. Journal of Modelling in Management 16: 288–309. [Google Scholar] [CrossRef]

- Andreev, Nikolay. 2019. Robust Portfolio Optimization in an Illiquid Market in Discrete-Time. Mathematics 7: 1147. [Google Scholar] [CrossRef]

- Bai, Lihui, and Paul Newsom. 2011. Teaching Utility Theory with an Application in Modern Portfolio Optimization. Decision Sciences Journal of Innovative Education 9: 107–12. [Google Scholar] [CrossRef]

- Baumann, Philipp, and Norbert Trautmann. 2013. Portfolio-optimization models for small investors. Mathematical Methods of Operations Research 77: 345–56. [Google Scholar] [CrossRef][Green Version]

- Bielstein, Patrick, Jean-Paul Jaegers, and Paul Wesson. 2023. A Novel way to Diversify Portfolio Weights. Wilmott Magazine, October 11, Issue 128, November 2023 Issue. Available online: https://wilmott.com/wilmott-magazine-november-2023-issue/ (accessed on 29 August 2024).

- Boasson, Vigdis, Emil Boasson, and Zhao Zhou. 2011. Portfolio optimization in a mean-semivariance framework. Investment Management and Financial Innovations 8: 58–68. [Google Scholar]

- Booth, G. Geoffrey, and John Paul Broussard. 2016. The Sortino ratio and extreme value theory: An application to asset allocation. In Extreme Events in Finance: A Handbook of Extreme Value Theory and Its Applications. Wiley: pp. 443–64. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1002/9781118650318.ch17 (accessed on 29 August 2024).

- Choueifaty, Yves, and Yves Coignard. 2008. Toward Maximum Diversification. The Journal of Portfolio Management 35: 40–51. [Google Scholar] [CrossRef]

- Clarke, Roger, Harindra De Silva, and Steven Thorley. 2006. Minimum-Variance Portfolios in the U.S. Equity Market. The Journal of Portfolio Management 33: 10–24. [Google Scholar] [CrossRef]

- Clarke, Roger, Harindra De Silva, and Steven Thorley. 2011. Minimum-variance portfolio composition. The Journal of Portfolio Management 37: 31. [Google Scholar] [CrossRef]

- Dash, Ashutosh, and Giridhari Mohanta. 2024. Fostering financial inclusion for attaining sustainable goals: What contributes more to the inclusive financial behaviour of rural households in India? Journal of Cleaner Production 449: 141731. [Google Scholar] [CrossRef]

- De Athayde, Gustavo M., and Renato G. Flôres, Jr. 2004. Finding a maximum skewness portfolio—A general solution to three-moments portfolio choice. Journal of Economic Dynamics and Control 28: 1335–52. [Google Scholar] [CrossRef]

- DeMiguel, Victor, Lorenzo Garlappi, and Raman Uppal. 2009. Optimal Versus Naive Diversification: How Inefficient is the 1-N Portfolio Strategy? The Review of Financial Studies 22: 1915–53. [Google Scholar] [CrossRef]

- Elton, Edwin J., and Martin J. Gruber. 1997. Modern portfolio theory, 1950 to date. Journal of Banking & Finance 21: 1743–59. [Google Scholar]

- García, Fernando, Francisco Guijarro, Javier Oliver, and Rima Tamošiūnienė. 2018. Hybrid fuzzy neural network to predict price direction in the german DAX-30 index. Technological and Economic Development of Economy 24: 2161–78. [Google Scholar] [CrossRef]

- Ghanbari, Hossein, Mojtaba Safari, Rouzbeh Ghousi, Emran Mohammadi, and Nawapon Nakharutai. 2023. Bibliometric analysis of risk measures for portfolio optimization. Accounting 9: 95–108. [Google Scholar] [CrossRef]

- Haugen, Robert A., and Nardin L. Baker. 1991. The efficient market inefficiency of capitalization–weighted stock portfolios. The Journal of Portfolio Management 17: 35–40. [Google Scholar] [CrossRef]

- Hilkevics, Sergejs, and Valentina Semakina. 2019. The classification and comparison of business ratios analysis methods. Insights into Regional Development 1: 48–57. [Google Scholar] [CrossRef]

- Kalayci, Can B., Okkes Ertenlice, and Mehmet Anil Akbay. 2019. A comprehensive review of deterministic models and applications for mean-variance portfolio optimization. Expert Systems with Applications 125: 345–68. [Google Scholar] [CrossRef]

- Kandpal, Vinay. 2020. Reaching sustainable development goals: Bringing financial inclusion to reality in India. Journal of Public Affairs 20: e2277. [Google Scholar] [CrossRef]

- Kara, Alper, Haoyong Zhou, and Yifan Zhou. 2021. Achieving the United Nations’ sustainable development goals through financial inclusion: A systematic literature review of access to finance across the globe. International Review of Financial Analysis 77: 101833. [Google Scholar] [CrossRef]

- Koumou, Gilles Boevi. 2020. Diversification and portfolio theory: A review. Financial Markets and Portfolio Management 34: 267–312. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh, and Peter Josef Stauvermann. 2022. Portfolios under Different Methods and Scenarios: A Case of Fiji’s South Pacific Stock Exchange. Journal of Risk and Financial Management 15: 549. [Google Scholar] [CrossRef]

- Kumar, Ronald Ravinesh, Peter Josef Stauvermann, and Aristeidis Samitas. 2022. An Application of Portfolio Mean-Variance and Semi-Variance Optimization Techniques: A Case of Fiji. Journal of Risk and Financial Management 15: 190. [Google Scholar] [CrossRef]

- Maillard, Sébastien, Thierry Roncalli, and Jérôme Teïletche. 2010. The Properties of Equally Weighted Risk Contribution Portfolios. The Journal of Portfolio Management 36: 60–70. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 1952a. Portfolio selection. The Journal of Finance 7: 77–91. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 1952b. The Utility of Wealth. Journal of Political Economy 60: 43–50. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 1991. Foundations of portfolio theory. The Journal of Finance 46: 469–77. [Google Scholar] [CrossRef]

- Markowitz, Harry Max. 2010. Portfolio theory: As I still see it. Annual Review of Financial Economics 2: 1–23. [Google Scholar] [CrossRef]

- Merton, Robert Cox. 1972. An analytic derivation of the efficient portfolio frontier. Journal of Financial and Quantitative Analysis 7: 1851–72. [Google Scholar] [CrossRef]

- Milhomem, Danilo Alcantara, and Maria José Pereira Dantas. 2020. Analysis of new approaches used in portfolio optimization: A systematic literature review. Production 30: e20190144. [Google Scholar] [CrossRef]

- Narkunienė, Judita, and Aurelija Ulbinaitė. 2018. Comparative analysis of company performance evaluation methods. Entrepreneurship and Sustainability Issues 6: 125–38. [Google Scholar] [CrossRef] [PubMed]

- Ozili, Peterson K. 2022. Financial inclusion and sustainable development: An empirical association. Journal of Money and Business 2: 186–98. [Google Scholar] [CrossRef]

- Reserve Bank of Fiji (RBF). 2017. Fiji Financial Sector Development Plan 2016–2025; Suva: The Reserve Bank of Fiji. Available online: https://www.rbf.gov.fj/wp-content/uploads/2020/03/Fiji-Financial-Sector-Development-Plan-2016-2025.pdf (accessed on 3 June 2024).

- Righi, Marcelo Brutti, and Denis Borenstein. 2018. A simulation comparison of risk measures for portfolio optimization. Finance Research Letters 24: 105–12. [Google Scholar] [CrossRef]

- Saliya, Candauda Arachchige. 2022. Stock market development and nexus of market liquidity: The case of Fiji. International Journal of Finance & Economics 27: 4364–82. [Google Scholar]

- Salo, Ahti, Michalis Doumpos, Juuso Liesiö, and Constantin Zopounidis. 2024. Fifty years of portfolio optimization. European Journal of Operational Research 318: 1–18. [Google Scholar] [CrossRef]

- Sharpe, William Forsyth. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Sharpe, William Forsyth. 1994. The Sharpe ratio. The Journal of Portfolio Management 21: 49–58. [Google Scholar] [CrossRef]

- Sharpe, William Forsyth. 1996. Mutual Fund Performance. Journal of Business 39: 119–38. [Google Scholar] [CrossRef]

- Singh, Monika. 2019. Evolution of the Stock Market, Stocks, and Markets. The Fiji Times. July 16. Available online: https://www.pressreader.com/fiji/the-fiji-times/20190716/281852940146739 (accessed on 11 July 2024).

- South Pacific Stock Exchange (SPX). 2024a. SPX Market Reports. Available online: https://marketreports.spx.com.fj/Company.aspx?code= (accessed on 3 June 2024).

- South Pacific Stock Exchange (SPX). 2024b. Annual Report 2023. Available online: https://www.spx.com.fj/getattachment/Explore-SPX/Annual-Reports/SPX-AR-2023.pdf?lang=en-US (accessed on 11 June 2024).

- Surtee, Taariq, and Imhotep Paul Alagidede. 2023. A novel approach to using modern portfolio theory. Borsa Istanbul Review 23: 527–40. [Google Scholar] [CrossRef]

- Taljaard, Byran H., and Eben Maré. 2021. Why has the equal weight portfolio underperformed and what can we do about it? Quantitative Finance 21: 1855–68. [Google Scholar] [CrossRef]

- Todoni, Marcela-Daniela. 2015. A post-modern portfolio management approach on CEE markets. Procedia Economics and Finance 32: 1362–76. [Google Scholar] [CrossRef]

- Voica, Marian Cătălin. 2017. Financial inclusion as a tool for sustainable development. Revista Română de Economie 44: 121–29. Available online: https://revecon.ro/articles/2017-1/2017-1-10.pdf (accessed on 3 June 2024).

- Whiteside, Barry. 2016. Recent Developments in the Fijian Stock Market. South Pacific Stock Exchange Listing Forum, Suva, September 22. Central Bankers’ Speeches. Available online: https://www.bis.org/review/r160926j.htm (accessed on 11 July 2024).

| Symbol | Name | Date Listed | Sample End Date | Number of Trading Days | Sector | Date Listed Market Closing Price | Market Closing Price on 31 May-2024 | Financial Year End | Annualized Return | Market Capitalization in Millions of FJD (% of Market Cap.) |

|---|---|---|---|---|---|---|---|---|---|---|

| APP | Atlantic & Pacific Packaging Company Ltd. | 17-Aug-98 | 31-May-24 | 6502.98 | Manufacturing and wholesale (Packaging) | $0.70 | $3.09 | 30-Jun | 5.75% | 24.7 (0.72) |

| ATH | Amalgamated Telecom Holdings Ltd. | 18-Apr-02 | 31-May-24 | 5577.83 | Telecommunications and media (telecommunications and mobile services) | $1.14 | $2.00 | 30-Jun | 2.54% | 1029.0 (30.01) |

| BCN | BSP Convertible Notes Ltd. | 11-May-10 | 31-May-24 | 3544.57 | Banking (Financial services) | $5.25 | $31.00 | 31-Dec | 12.63% | 95.0 (2.77) |

| CFL | Communications (Fiji) Ltd. | 20-Dec-01 | 31-May-24 | 5659.99 | Telecommunications (Radio broadcasting) | $1.15 | $6.17 | 31-Dec | 7.48% | 23.4 (0.68) |

| FBL | Free Bird Institute Ltd. | 2-Feb-17 | 31-May-24 | 1846.85 | Education | $2.00 | $3.65 | 31-Dec | 8.21% | 8.7 (0.25) |

| FHL | Fijian Holdings Ltd. | 20-Jan-97 | 31-May-24 | 6899.28 | Investment (investment chain) | $0.18 | $0.95 | 30-Jun | 6.08% | 304.6 (8.89) |

| FIL | FijiCare Insurance Ltd. | 7-Dec-00 | 31-May-24 | 5920.96 | Insurance | $0.60 | $17.99 | 31-Dec | 14.48% | 159.2 (4.64) |

| FMF | FMF Foods Ltd. | 27-Jul-79 | 31-May-24 | 11308.93 | Manufacturing and wholesale (flour and related products) | $0.06 | $1.78 | 30-Jun | 7.56% | 264.0 (7.70) |

| FTV | Fiji Television Ltd. | 24-Apr-97 | 31-May-24 | 6834.38 | Telecommunications (Television broadcasting) | $1.02 | $2.00 | 30-Jun | 2.48% | 20.6 (0.60) |

| KFL | Kontiki Finance Ltd. | 4-Jul-18 | 31-May-24 | 1489.91 | Investment (Financial services) | $1.14 | $1.13 | 30-Jun | −0.15% | 101.1 (2.95) |

| KGF | Kinetic Growth Fund Ltd. | 16-Dec-04 | 31-May-24 | 4906.06 | Investment (investment chain) | $1.05 | $1.20 | 31-Dec | 0.69% | 4.6 (0.13) |

| PBP | Pleass Global Ltd. | 4-Feb-09 | 31-May-24 | 3862.85 | Manufacturing and wholesale (Bottled water) | $0.94 | $7.95 | 31-Dec | 13.93% | 56.8 (1.66) |

| PDM | Port Denarau Marina | 14-Aug-19 | 31-May-24 | 1209.60 | Tourism (Tourism and hospitality) | $1.40 | $2.30 | 31-Jul | 10.34% | 89.2 (2.60) |

| PGI | Pacific Green Industries | 5-Jun-01 | 31-May-24 | 5796.69 | Manufacturing and wholesale (Furniture) | $1.90 | $1.08 | 31-Dec | −2.46% | 8.2 (0.24) |

| RBG | RB Patel Group Ltd. | 17-Jul-01 | 31-May-24 | 5767.69 | Retail (Supermarket chain) | $0.21 | $3.09 | 30-Jun | 11.75% | 463.5 (13.52) |

| RCF | The Rice Company of Fiji Ltd. | 20-Jan-97 | 31-May-24 | 6899.28 | Manufacturing and wholesale (Rice) | $0.50 | $9.80 | 30-Jun | 10.87% | 58.8 (1.72) |

| TTS | Toyota Tsusho (South Sea) Ltd. | 7-Jun-79 | 31-May-24 | 11343.45 | Automotive (automotive trading) | $1.95 | $20.00 | 31-Mar | 5.17% | 280.6 (8.19) |

| VBH | V B Holdings Ltd. | 1-Nov-01 | 31-May-24 | 5693.82 | Automotive (property and fleet management) | $1.28 | $6.00 | 31-Dec | 6.84% | 12.8 (0.37) |

| VIL | Vision Investments Ltd. | 29-Feb-16 | 31-May-24 | 2080.90 | Investment (investment chain) | $1.70 | $4.09 | 31-Mar | 10.63% | 423.4 (12.35) |

| Statistics | APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | KGF | PBP | PDM | RBG | RCF | TTS | VBH | VIL | DMCWPI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean Return | 0.013 | −0.006 | 0.006 | 0.002 | 0.008 | −0.003 | 0.038 | 0.002 | −0.009 | 0.004 | 0.001 | 0.022 | 0.011 | −0.008 | 0.004 | 0.010 | −0.003 | 0.001 | −0.001 |

| Standard Error | 0.007 | 0.008 | 0.006 | 0.002 | 0.009 | 0.017 | 0.008 | 0.015 | 0.012 | 0.008 | 0.001 | 0.010 | 0.008 | 0.013 | 0.006 | 0.008 | 0.004 | 0.010 | 0.004 |

| Sample Variance | 0.003 | 0.003 | 0.002 | 0.000 | 0.004 | 0.018 | 0.003 | 0.014 | 0.009 | 0.004 | 0.000 | 0.006 | 0.004 | 0.010 | 0.002 | 0.003 | 0.001 | 0.006 | 0.001 |

| Kurtosis | 15.004 | 2.511 | 4.218 | 26.266 | 12.000 | 1.942 | 2.142 | 35.988 | 14.730 | 2.524 | 41.424 | 17.674 | 4.544 | 39.718 | 30.123 | 10.773 | 6.453 | 10.173 | 3.140 |

| Skewness | 2.792 | −0.030 | 0.708 | 4.005 | 1.427 | 0.730 | 1.333 | 4.791 | 1.561 | 0.897 | 6.234 | 3.702 | 1.905 | −5.520 | 4.680 | 2.632 | −0.365 | 1.584 | 0.324 |

| Range | 0.387 | 0.363 | 0.294 | 0.130 | 0.547 | 0.740 | 0.308 | 1.122 | 0.810 | 0.350 | 0.045 | 0.565 | 0.323 | 0.892 | 0.384 | 0.390 | 0.194 | 0.563 | 0.195 |

| Minimum | −0.088 | −0.178 | −0.136 | −0.034 | −0.243 | −0.322 | −0.069 | −0.340 | −0.325 | −0.168 | 0.000 | −0.121 | −0.089 | −0.679 | −0.095 | −0.104 | −0.111 | −0.245 | −0.096 |

| Maximum | 0.299 | 0.185 | 0.158 | 0.095 | 0.304 | 0.418 | 0.239 | 0.782 | 0.485 | 0.182 | 0.045 | 0.443 | 0.234 | 0.213 | 0.289 | 0.286 | 0.083 | 0.318 | 0.099 |

| N (Months) | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 | 58 |

| Symbol | Beta | p-Value | Expected Return E(ri) | Standard Deviation | Market (CAPM)—Adj. Return, | Number of Trades (Jul 2019–May 2024) | Consideration—FJD [Volume Traded] |

|---|---|---|---|---|---|---|---|

| APP | 0.021 | 0.928 | 0.152 | 0.183 | 0.053 | 93 | $201,269 [99,619] |

| ATH | 1.258 *** | <0.001 | −0.076 | 0.205 | −0.022 | 817 | $4,198,696 [2,079,256] |

| BCN | 0.379 ** | 0.053 | 0.074 | 0.156 | 0.031 | 307 | $3,381,869 [123,836] |

| CFL | 0.118 * | 0.072 | 0.022 | 0.052 | 0.047 | 88 | $482,651 [75,774] |

| FBL | −0.043 | 0.881 | 0.095 | 0.228 | 0.057 | 93 | $803,486 [266,528] |

| FHL | 1.983 *** | <0.001 | −0.031 | 0.459 | −0.063 | 7016 | $8,286,653 [8,244,432] |

| FIL | −0.012 | 0.963 | 0.452 | 0.202 | 0.055 | 439 | $4,346,235 [598,217] |

| FMF | 1.591 *** | 0.001 | 0.024 | 0.407 | −0.041 | 166 | $4,019,393 [2,178,942] |

| FTV | 0.715 * | 0.084 | −0.110 | 0.329 | 0.010 | 119 | $1,485,997 [363,014] |

| KFL | 0.387 | 0.160 | 0.044 | 0.218 | 0.030 | 820 | $10,015,865 [10,190,076] |

| KGF | 0.007 | 0.808 | 0.015 | 0.022 | 0.054 | 23 | $90,111.80 [78,481] |

| PBP | −0.073 | 0.827 | 0.262 | 0.262 | 0.059 | 103 | $440,551 [139,544] |

| PDM | −0.032 | 0.903 | 0.136 | 0.205 | 0.056 | 1273 | $36,812,195 [23,808,791] |

| RBG | −1.131 *** | 0.007 | −0.095 | 0.341 | 0.127 | 862 | $9,167,304 [2,723,851] |

| RCF | −0.068 | 0.731 | 0.052 | 0.154 | 0.059 | 257 | $761,443 [76,842] |

| TTS | 0.036 | 0.888 | 0.124 | 0.199 | 0.052 | 85 | $8,616,426 [605,629] |

| VBH | −0.101 | 0.412 | −0.036 | 0.097 | 0.061 | 41 | $280,397 [42,590] |

| VIL | 0.996 *** | 0.002 | 0.012 | 0.267 | −0.006 | 295 | $30,855,896 [7,530,672] |

| APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | KGF | PBP | PDM | RBG | RCF | TTS | VBH | VIL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | 1.000 | |||||||||||||||||

| ATH | 0.005 | 1.000 | ||||||||||||||||

| BCN | 0.028 | 0.000 | 1.000 | |||||||||||||||

| CFL | 0.398 | 0.064 | 0.001 | 1.000 | ||||||||||||||

| FBL | 0.133 | 0.034 | 0.003 | 0.013 | 1.000 | |||||||||||||

| FHL | 0.001 | 0.002 | 0.011 | 0.048 | 0.072 | 1.000 | ||||||||||||

| FIL | 0.006 | 0.006 | 0.003 | 0.002 | 0.003 | 0.001 | 1.000 | |||||||||||

| FMF | 0.013 | 0.009 | 0.003 | 0.001 | 0.072 | 0.033 | 0.019 | 1.000 | ||||||||||

| FTV | 0.010 | 0.016 | 0.005 | 0.025 | 0.004 | 0.000 | 0.028 | 0.000 | 1.000 | |||||||||

| KFL | 0.000 | 0.001 | 0.060 | 0.001 | 0.000 | 0.034 | 0.022 | 0.011 | 0.040 | 1.000 | ||||||||

| KGF | 0.001 | 0.003 | 0.001 | 0.009 | 0.000 | 0.000 | 0.000 | 0.000 | 0.002 | 0.001 | 1.000 | |||||||

| PBP | 0.029 | 0.001 | 0.001 | 0.000 | 0.003 | 0.001 | 0.001 | 0.005 | 0.001 | 0.000 | 0.165 | 1.000 | ||||||

| PDM | 0.000 | 0.016 | 0.003 | 0.004 | 0.000 | 0.000 | 0.015 | 0.000 | 0.006 | 0.016 | 0.004 | 0.003 | 1.000 | |||||

| RBG | 0.000 | 0.054 | 0.032 | 0.005 | 0.009 | 0.005 | 0.003 | 0.000 | 0.039 | 0.000 | 0.000 | 0.000 | 0.020 | 1.000 | ||||

| RCF | 0.004 | 0.010 | 0.000 | 0.001 | 0.002 | 0.000 | 0.004 | 0.000 | 0.007 | 0.002 | 0.001 | 0.001 | 0.000 | 0.006 | 1.000 | |||

| TTS | 0.001 | 0.002 | 0.001 | 0.000 | 0.003 | 0.001 | 0.000 | 0.002 | 0.002 | 0.054 | 0.001 | 0.000 | 0.021 | 0.002 | 0.005 | 1.000 | ||

| VBH | 0.006 | 0.000 | 0.001 | 0.002 | 0.000 | 0.046 | 0.006 | 0.000 | 0.008 | 0.015 | 0.000 | 0.000 | 0.001 | 0.003 | 0.219 | 0.009 | 1.000 | |

| VIL | 0.001 | 0.012 | 0.003 | 0.000 | 0.007 | 0.000 | 0.003 | 0.000 | 0.015 | 0.099 | 0.000 | 0.000 | 0.006 | 0.001 | 0.023 | 0.105 | 0.001 | 1.000 |

| APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | KGF | PBP | PDM | RBG | RCF | TTS | VBH | VIL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | 0.000 | |||||||||||||||||

| ATH | 0.995 | 0.000 | ||||||||||||||||

| BCN | 0.972 | 1.000 | 0.000 | |||||||||||||||

| CFL | 0.602 | 0.936 | 0.999 | 0.000 | ||||||||||||||

| FBL | 0.867 | 0.966 | 0.997 | 0.987 | 0.000 | |||||||||||||

| FHL | 0.999 | 0.998 | 0.989 | 0.952 | 0.928 | 0.000 | ||||||||||||

| FIL | 0.994 | 0.994 | 0.997 | 0.998 | 0.997 | 0.999 | 0.000 | |||||||||||

| FMF | 0.987 | 0.991 | 0.997 | 0.999 | 0.928 | 0.967 | 0.981 | 0.000 | ||||||||||

| FTV | 0.990 | 0.984 | 0.995 | 0.975 | 0.996 | 1.000 | 0.972 | 1.000 | 0.000 | |||||||||

| KFL | 1.000 | 0.999 | 0.940 | 0.999 | 1.000 | 0.966 | 0.978 | 0.989 | 0.960 | 0.000 | ||||||||

| KGF | 0.999 | 0.997 | 0.999 | 0.991 | 1.000 | 1.000 | 1.000 | 1.000 | 0.998 | 0.999 | 0.000 | |||||||

| PBP | 0.971 | 0.999 | 0.999 | 1.000 | 0.997 | 0.999 | 0.999 | 0.995 | 0.999 | 1.000 | 0.835 | 0.000 | ||||||

| PDM | 1.000 | 0.984 | 0.997 | 0.996 | 1.000 | 1.000 | 0.985 | 1.000 | 0.994 | 0.984 | 0.996 | 0.997 | 0.000 | |||||

| RBG | 1.000 | 0.946 | 0.968 | 0.995 | 0.991 | 0.995 | 0.997 | 1.000 | 0.961 | 1.000 | 1.000 | 1.000 | 0.980 | 0.000 | ||||

| RCF | 0.996 | 0.990 | 1.000 | 0.999 | 0.998 | 1.000 | 0.996 | 1.000 | 0.993 | 0.998 | 0.999 | 0.999 | 1.000 | 0.994 | 0.000 | |||

| TTS | 0.999 | 0.998 | 0.999 | 1.000 | 0.997 | 0.999 | 1.000 | 0.998 | 0.998 | 0.946 | 0.999 | 1.000 | 0.979 | 0.998 | 0.995 | 0.000 | ||

| VBH | 0.994 | 1.000 | 0.999 | 0.998 | 1.000 | 0.954 | 0.994 | 1.000 | 0.992 | 0.985 | 1.000 | 1.000 | 0.999 | 0.997 | 0.781 | 0.991 | 0.000 | |

| VIL | 0.999 | 0.988 | 0.997 | 1.000 | 0.993 | 1.000 | 0.997 | 1.000 | 0.985 | 0.901 | 1.000 | 1.000 | 0.994 | 0.999 | 0.977 | 0.895 | 0.999 | 0.000 |

| APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | KGF | PBP | PDM | RBG | RCF | TTS | VBH | VIL | MCWPI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | 1.000 | ||||||||||||||||||

| ATH | 0.070 | 1.000 | |||||||||||||||||

| BCN | 0.167 | 0.021 | 1.000 | ||||||||||||||||

| CFL | 0.631 | 0.253 | −0.035 | 1.000 | |||||||||||||||

| FBL | 0.365 | 0.185 | −0.053 | 0.112 | 1.000 | ||||||||||||||

| FHL | −0.033 | −0.042 | 0.106 | 0.218 | −0.269 | 1.000 | |||||||||||||

| FIL | −0.078 | −0.075 | −0.050 | −0.041 | −0.052 | 0.023 | 1.000 | ||||||||||||

| FMF | −0.113 | 0.094 | 0.053 | 0.024 | −0.268 | 0.181 | 0.139 | 1.000 | |||||||||||

| FTV | −0.099 | 0.127 | 0.074 | 0.159 | 0.060 | −0.009 | −0.167 | −0.021 | 1.000 | ||||||||||

| KFL | 0.003 | 0.024 | 0.245 | −0.037 | −0.003 | 0.183 | −0.149 | 0.103 | 0.201 | 1.000 | |||||||||

| KGF | −0.029 | 0.052 | −0.027 | −0.096 | −0.018 | 0.006 | −0.016 | −0.006 | −0.043 | −0.025 | 1.000 | ||||||||

| PBP | 0.170 | −0.034 | −0.025 | 0.006 | 0.055 | −0.031 | −0.025 | −0.070 | −0.032 | 0.008 | 0.406 | 1.000 | |||||||

| PDM | −0.015 | −0.127 | 0.056 | 0.067 | 0.018 | 0.021 | −0.123 | −0.020 | 0.075 | 0.128 | −0.063 | −0.052 | 1.000 | ||||||

| RBG | 0.004 | −0.232 | −0.180 | −0.068 | 0.094 | −0.071 | −0.052 | −0.020 | −0.198 | 0.015 | 0.007 | 0.017 | 0.141 | 1.000 | |||||

| RCF | 0.061 | −0.099 | 0.014 | −0.031 | −0.047 | 0.005 | 0.062 | 0.018 | 0.083 | 0.039 | −0.028 | −0.030 | −0.007 | 0.080 | 1.000 | ||||

| TTS | 0.039 | −0.047 | 0.036 | 0.009 | 0.051 | −0.022 | −0.006 | 0.041 | 0.050 | 0.231 | −0.035 | −0.012 | 0.145 | −0.049 | 0.071 | 1.000 | |||

| VBH | 0.075 | 0.012 | −0.035 | 0.042 | 0.010 | −0.214 | −0.076 | −0.019 | 0.088 | 0.121 | 0.021 | 0.016 | −0.027 | −0.052 | −0.468 | −0.095 | 1.000 | ||

| VIL | 0.034 | 0.110 | 0.057 | 0.018 | 0.081 | 0.018 | −0.057 | −0.011 | 0.123 | −0.315 | 0.005 | −0.008 | −0.075 | −0.038 | −0.151 | −0.325 | −0.024 | 1.000 | |

| MCWPI | 0.012 | 0.648 | 0.256 | 0.238 | −0.020 | 0.455 | −0.006 | 0.411 | 0.229 | 0.187 | 0.033 | −0.029 | −0.016 | −0.350 | −0.046 | 0.019 | −0.110 | 0.394 | 1.000 |

| APP | ATH | BCN | CFL | FBL | FHL | FIL | FMF | FTV | KFL | KGF | PBP | PDM | RBG | RCF | TTS | VBH | VIL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | 0.033 | |||||||||||||||||

| ATH | 0.003 | 0.042 | ||||||||||||||||

| BCN | 0.005 | 0.001 | 0.024 | |||||||||||||||

| CFL | 0.006 | 0.003 | 0.000 | 0.003 | ||||||||||||||

| FBL | 0.015 | 0.009 | −0.002 | 0.001 | 0.052 | |||||||||||||

| FHL | −0.003 | −0.004 | 0.008 | 0.005 | −0.028 | 0.211 | ||||||||||||

| FIL | −0.003 | −0.003 | −0.002 | 0.000 | −0.002 | 0.002 | 0.041 | |||||||||||

| FMF | −0.008 | 0.008 | 0.003 | 0.001 | −0.025 | 0.034 | 0.011 | 0.166 | ||||||||||

| FTV | −0.006 | 0.009 | 0.004 | 0.003 | 0.004 | −0.001 | −0.011 | −0.003 | 0.108 | |||||||||

| KFL | 0.000 | 0.001 | 0.008 | 0.000 | 0.000 | 0.018 | −0.007 | 0.009 | 0.014 | 0.047 | ||||||||

| KGF | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |||||||

| PBP | 0.008 | −0.002 | −0.001 | 0.000 | 0.003 | −0.004 | −0.001 | −0.007 | −0.003 | 0.000 | 0.002 | 0.069 | ||||||

| PDM | −0.001 | −0.005 | 0.002 | 0.001 | 0.001 | 0.002 | −0.005 | −0.002 | 0.005 | 0.006 | 0.000 | −0.003 | 0.042 | |||||

| RBG | 0.000 | −0.016 | −0.010 | −0.001 | 0.007 | −0.011 | −0.004 | −0.003 | −0.022 | 0.001 | 0.000 | 0.002 | 0.010 | 0.116 | ||||

| RCF | 0.002 | −0.003 | 0.000 | 0.000 | −0.002 | 0.000 | 0.002 | 0.001 | 0.004 | 0.001 | 0.000 | −0.001 | 0.000 | 0.004 | 0.024 | |||

| TTS | 0.001 | −0.002 | 0.001 | 0.000 | 0.002 | −0.002 | 0.000 | 0.003 | 0.003 | 0.010 | 0.000 | −0.001 | 0.006 | −0.003 | 0.002 | 0.040 | ||

| VBH | 0.001 | 0.000 | −0.001 | 0.000 | 0.000 | −0.010 | −0.001 | −0.001 | 0.003 | 0.003 | 0.000 | 0.000 | −0.001 | −0.002 | −0.007 | −0.002 | 0.009 | |

| VIL | 0.002 | 0.006 | 0.002 | 0.000 | 0.005 | 0.002 | −0.003 | −0.001 | 0.011 | −0.018 | 0.000 | −0.001 | −0.004 | −0.003 | −0.006 | −0.017 | −0.001 | 0.071 |

| (I) | (II) | (III) | (IV) | (V) | (VI) | (VII) | (VIII) | (IX) | (X) | |

|---|---|---|---|---|---|---|---|---|---|---|

| Statistics | 1/N (Equally Weighted) | Minimum Variance | Max Sharpe (CAPM) | Semi-Variance (min. Downside) | Max Sortino (CAPM) | Max. Vol Skewness (U/D) | Max. RMD | Max. RMD with Positive Sharpe | Max. RMD with Positive Sharpe (≥RF) and Sortino (≥TR) | Most Diversified Portfolio |

| Unadjusted return (annual) | 0.0619 | 0.0239 | −0.0075 | 0.0153 | −0.0950 | 0.0394 | 0.0637 | 0.0798 | 0.0704 | 0.0443 |

| CAPM-adjusted return (annual) () | 0.0359 | 0.0523 | 0.0786 | 0.0539 | 0.1274 | 0.0030 | 0.0341 | 0.0544 | 0.0426 | 0.0464 |

| Standard deviation () | 0.0589 | 0.0175 | 0.1032 | 0.0213 | 0.3406 | 0.2046 | 0.0600 | 0.0604 | 0.0551 | 0.0318 |

| Sharpe ratio (CAPM) | −0.3384 | −0.1011 | 0.2348 | −0.0255 | 0.2144 | −0.2511 | −0.3393 | 0.0010 | 0.7741 | 1.4578 |

| Sortino ratio (CAPM) | −0.8419 | −1.8969 | 0.1224 | −3.3462 | 0.1917 | −0.8499 | −0.8425 | −0.2724 | 0.0675 | 0.2898 |

| Downside volatility () | 47.18% | 33.39% | 65.02% | 16.34% | 69.80% | 28.54% | 46.90% | 56.51% | 50.13% | 48.82% |

| Volatility skewness (Up-variance/Down variance) | 1.2538 | 3.9796 | 0.2896 | 26.201 | 0.1872 | 6.2719 | 1.2823 | 0.5950 | 0.9894 | 1.099 |

| RMD coefficient | 0.9295 | 0.4976 | 0.6295 | 0.0479 | 0.000 | 0.6246 | 0.9303 | 0.9184 | 0.92812 | 0.8558 |

| Diversification Ratio (Div. ratio) | 3.7577 | 2.8710 | 1.7876 | 1.1508 | 1.0000 | 1.5505 | 3.7507 | 3.3480 | 3.8872 | 4.6486 |

| Asset | Weights | |||||||||

| APP | 0.056 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.039 | 0.044 | 0.041 | 0.000 |

| ATH | 0.056 | 0.000 | 0.000 | 0.000 | 0.000 | 0.079 | 0.057 | 0.020 | 0.042 | 0.047 |

| BCN | 0.056 | 0.016 | 0.000 | 0.001 | 0.000 | 0.000 | 0.062 | 0.058 | 0.061 | 0.045 |

| CFL | 0.056 | 0.141 | 0.000 | 0.008 | 0.000 | 0.000 | 0.044 | 0.055 | 0.049 | 0.021 |

| FBL | 0.056 | 0.003 | 0.000 | 0.000 | 0.000 | 0.277 | 0.052 | 0.072 | 0.060 | 0.034 |

| FHL | 0.056 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.056 | 0.000 | 0.031 | 0.027 |

| FIL | 0.056 | 0.015 | 0.043 | 0.001 | 0.000 | 0.000 | 0.063 | 0.076 | 0.069 | 0.055 |

| FMF | 0.056 | 0.000 | 0.000 | 0.000 | 0.000 | 0.512 | 0.061 | 0.016 | 0.042 | 0.011 |

| FTV | 0.056 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.058 | 0.042 | 0.051 | 0.010 |

| KFL | 0.056 | 0.005 | 0.000 | 0.000 | 0.000 | 0.000 | 0.049 | 0.051 | 0.050 | 0.003 |

| KGF | 0.056 | 0.688 | 0.000 | 0.976 | 0.000 | 0.000 | 0.059 | 0.068 | 0.064 | 0.239 |

| PBP | 0.056 | 0.000 | 0.024 | 0.000 | 0.000 | 0.004 | 0.058 | 0.071 | 0.063 | 0.025 |

| PDM | 0.056 | 0.009 | 0.000 | 0.001 | 0.000 | 0.072 | 0.063 | 0.075 | 0.068 | 0.036 |

| RBG | 0.056 | 0.005 | 0.279 | 0.001 | 1.000 | 0.033 | 0.059 | 0.117 | 0.082 | 0.033 |

| RCF | 0.056 | 0.034 | 0.166 | 0.003 | 0.000 | 0.000 | 0.055 | 0.066 | 0.060 | 0.109 |

| TTS | 0.056 | 0.013 | 0.012 | 0.001 | 0.000 | 0.000 | 0.058 | 0.071 | 0.063 | 0.055 |

| VBH | 0.056 | 0.057 | 0.475 | 0.005 | 0.000 | 0.022 | 0.052 | 0.068 | 0.060 | 0.204 |

| VIL | 0.056 | 0.012 | 0.000 | 0.001 | 0.000 | 0.000 | 0.055 | 0.029 | 0.045 | 0.047 |

| Number of stocks in portfolio (%) | 100% | 72% | 33% | 50% | 6% | 39% | 100% | 94% | 100% | 94% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, R.R.; Ghanbari, H.; Stauvermann, P.J. Application of a Robust Maximum Diversified Portfolio to a Small Economy’s Stock Market: An Application to Fiji’s South Pacific Stock Exchange. J. Risk Financial Manag. 2024, 17, 388. https://doi.org/10.3390/jrfm17090388

Kumar RR, Ghanbari H, Stauvermann PJ. Application of a Robust Maximum Diversified Portfolio to a Small Economy’s Stock Market: An Application to Fiji’s South Pacific Stock Exchange. Journal of Risk and Financial Management. 2024; 17(9):388. https://doi.org/10.3390/jrfm17090388

Chicago/Turabian StyleKumar, Ronald Ravinesh, Hossein Ghanbari, and Peter Josef Stauvermann. 2024. "Application of a Robust Maximum Diversified Portfolio to a Small Economy’s Stock Market: An Application to Fiji’s South Pacific Stock Exchange" Journal of Risk and Financial Management 17, no. 9: 388. https://doi.org/10.3390/jrfm17090388

APA StyleKumar, R. R., Ghanbari, H., & Stauvermann, P. J. (2024). Application of a Robust Maximum Diversified Portfolio to a Small Economy’s Stock Market: An Application to Fiji’s South Pacific Stock Exchange. Journal of Risk and Financial Management, 17(9), 388. https://doi.org/10.3390/jrfm17090388