The Greater Sustainability of Stablecoins Relative to Other Cryptocurrencies

Abstract

:1. Introduction

1.1. Cryptocurrencies

- Decentralization: Cryptocurrencies are stored in a database that is distributed across numerous network nodes in different locations worldwide. This ensures the integrity of the stored data and prevents any single actor from altering a record of the database.

- High security level: The currencies are very secure. Every transaction made through the blockchain network is secured through the mining process, and all miners must approve them based on an algorithm.

- Protection from inflation: Most cryptocurrencies determine the maximum number of coins that can be produced at the time of the currency’s launch. Therefore, as demand for them increases, their value rises, which can help stabilize the market and in the long run prevent inflation that would devalue the currency.

- Lack of regulation and oversight: This feature naturally attracts individuals who wish to conceal their actions, evade taxes, or commit various types of financial crime.

- Lack of protection in case of fraud: The loss or theft of digital currencies leads to a complete loss of value because they are not insured, and there is no entity responsible for replacing them or compensating the customer.

- Environmental impact: Mining cryptocurrencies requires enormous computing power, which results in the release of large amounts of greenhouse gasses and air pollutants into the atmosphere and uses large quantities of water.

1.2. Stablecoins

- Fiat or Asset-Backed Stablecoins (Srivisad & Wattanakoon, 2024): These are cryptocurrencies supported by reserves of fiat currency, such as the US dollar, or a commodity such as gold. These stablecoins are typically governed in a centralized manner, with reserves managed by a custodian or organization. Furthermore, for every stablecoin issued, an equivalent amount of fiat currency or the equivalent value in commodities is held in reserve by a central authority in order to ensure stability. Examples include Tether (USDT), USD Coin (USDC), and TrueUSD (TUSD).

- Crypto-Backed Stablecoins (Feng et al., 2024): These are decentralized stablecoins that use other cryptocurrencies as collateral rather than fiat currency. These stablecoins are typically governed by smart contracts and community protocols, ensuring decentralized management. The cryptocurrencies used as collateral help support the stablecoin’s value. Examples include DAI, which is backed by a basket of cryptocurrencies, and USD.

- Algorithmic Stablecoins (Clements, 2021): These are stablecoins that are not backed by any collateral. Instead, they use sophisticated algorithms and smart contracts, driven by external price feeds, to manage the supply of the stablecoin, increasing or decreasing it to stabilize its value. These mechanisms automate the process of minting and withdrawing coins from circulation in order to maintain price stability (Kahya et al., 2021). Governance is typically decentralized, with automatic adjustments managed by algorithms. Examples include Terra (LUNA) and Ampleforth (AMPL).

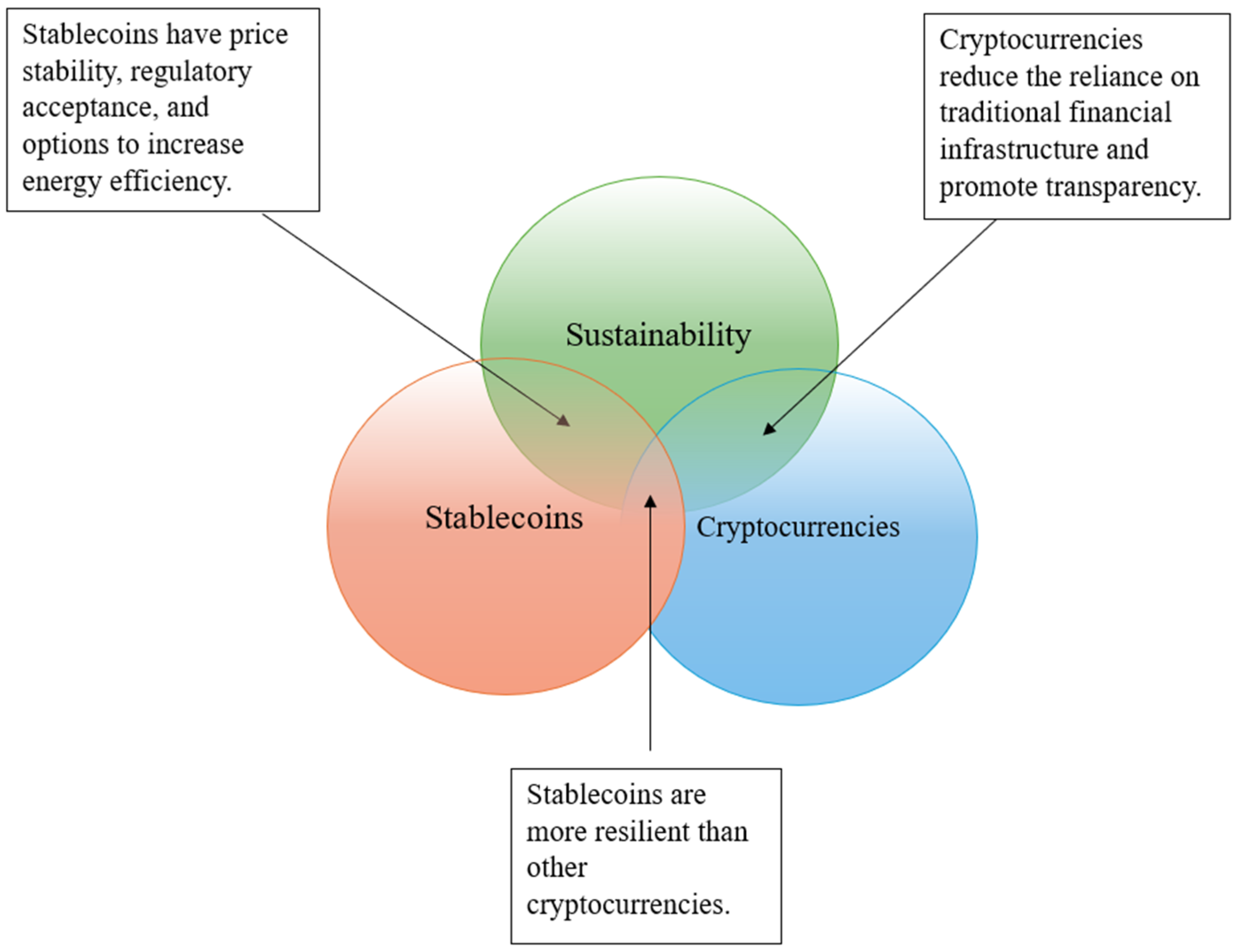

1.3. The Main Differences Between Cryptocurrencies and Stablecoins

1.4. The Sustainability of Cryptocurrencies

2. Methods

- Technical indicators:

- The foundation year, which measures the maturity and stability of a cryptocurrency.

- The confirmation latency, which is the time required for transactions to be confirmed.

- The transactions per second, which assesses the scalability of a cryptocurrency network.

- The network size, which reflects the number of nodes in a cryptocurrency network.

- The development activity, which measures ongoing development efforts for a cryptocurrency.

- Economic indicators:

- 6.

- The market capitalization, reflecting the total value of a cryptocurrency.

- 7.

- The volatility, which is a measure of price fluctuations.

- 8.

- The transaction volume, which is the level of activity on a cryptocurrency network.

- 9.

- Transaction costs, which are the fees associated with transactions.

- Social indicators:

- 10.

- The activity on social networks, which measures the level of public interest and support for a cryptocurrency.

- Ecological/environmental indicators:

- 11.

- The total network energy consumption.

- 12.

- The energy consumption per transaction.

3. Results

3.1. Sustainability Assessment of Cryptocurrencies Versus Stablecoins

3.1.1. General Value Contribution to Sustainable Development

3.1.2. Environmental Sustainability

Efficient Use of Ecological Resources

3.1.3. Social Sustainability

- Participative culture: This category relates to the ethics of the ecosystem in its treatment of the different stakeholders in the cryptocurrency network.

- Adaptable coordinated governance: Despite the decentralized character of cryptocurrencies, coordinated innovation management, clear structures and processes, and transparent management will increase their sustainability.

- Knowledge transfer: A cryptocurrency that is supported by knowledge transfer through concise documentation is clearly advantageous.

- Protection of stakeholders: This involves safety instructions, stakeholder privacy, and data protection while at the same time reducing the risk to all users. The key social aspects of the cryptocurrency market center on safety and transparency, with the goal of preventing discrimination among stakeholders and mitigating harm to the population. This may be direct harm, as in the case of crime, or indirect harm, as in the case of fraud. Additionally, users seek stability in the decentralized market. Stablecoins—being less volatile and more controlled and hence more stable—offer a secure and regulated alternative to traditional cryptocurrencies, making them a more ethical and sustainable solution.

3.1.4. Economic Sustainability

- Long-term financial stability: Ensuring sustainable funding in the cryptocurrency market by means of a stable market position and low volatility protects stakeholders and promotes the use of cryptocurrencies as a means of payment.

- Technical maturity: A more mature technological system offers a higher level of security and contributes to sustainability.

- Technical performance: A powerful and scalable network capable of processing high transaction volumes in a short time with low fees enhances sustainability.

- Legal compliance: Adherence to laws and ethical principles, alongside collaboration with legislators, ensures the long-term viability of cryptocurrencies.

- Trustworthiness of developers and administrators: Developers and administrators must be reliable, refrain from illegal activities, and support the continued existence of the cryptocurrency.

- Network security: A high degree of decentralization and robust protective mechanisms prevent network attacks and improve sustainability.

- Established infrastructure: A comprehensive infrastructure ensures the easy and secure use of cryptocurrencies. Stablecoins, being less volatile and more usable in current markets, offer greater long-term financial stability and support economic growth. They are therefore more economically sustainable. However, stablecoins have not always achieved their promised stability. Instances of losing their pegs to reference assets (depegging) and the failures of algorithmic stablecoins highlight their limitations (Yujin et al., 2024). Stablecoins and cryptocurrencies are often subject to overlapping regulations. However, due to their pegged nature and closer ties to traditional finance, stablecoins face additional regulatory scrutiny that does not necessarily apply to other cryptocurrencies. Stablecoins often fall under specific regulatory frameworks aimed at addressing issues such as fraud, money laundering, and financial system stability. For instance, the Financial Innovation and Technology for the 21st Century Act in the U.S. (2023) established a regulatory framework in which the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) oversee asset-backed tokens, while the Federal Reserve regulates bank-issued stablecoins. Similarly, under the UK Financial Services and Markets Act (2023), stablecoins are classified as “systemic payment instruments” and are subject to oversight by the Financial Conduct Authority (FCA)—the primary financial regulatory body in the United Kingdom. This classification ensures stricter supervision regarding issuance, reserve management, consumer protection, and financial stability risks.

3.2. A More Sustainable Solution

4. Conclusions and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ackoff, R. L. (1989). From data to wisdom. Journal of Applied Systems Analysis, 16(1), 3–9. [Google Scholar]

- Al-Afeef, M. A., Al-Smadi, R. W., & Al-Smadi, A. W. (2024). The role of stable coins in mitigating volatility in cryptocurrency markets. International Journal of Applied Economics, Finance and Accounting, 19(1), 176–185. [Google Scholar] [CrossRef]

- Ante, L., Fiedler, I., & Strehle, E. (2021). The impact of transparent money flows: Effects of stablecoin transfers on the returns and trading volume of Bitcoin. Technological Forecasting and Social Change, 170, 120851. [Google Scholar] [CrossRef]

- Arner, D. W., Auer, R., & Frost, J. (2020). Stablecoins: Risks, potential and regulation. Bank for International Settlements. [Google Scholar]

- Asadov, A., Yildirim, R., & Masih, M. (2023). Toward greater stability in stablecoins: Empirical evidence from an analysis of precious metals. Borsa Istanbul Review, 23(5), 1152–1172. [Google Scholar] [CrossRef]

- Bajra, U. Q., Rogova, E., & Avdiaj, S. (2024). Cryptocurrency blockchain and its carbon footprint: Anticipating future challenges. Technology in Society, 77, 102571. [Google Scholar] [CrossRef]

- Brundtland, G. H. (1985). World commission on environment and development. Environmental Policy and Law, 14(1), 26–30. [Google Scholar]

- Bunjaku, F., Gjorgieva-Trajkovska, O., & Miteva-Kacarski, E. (2017). Cryptocurrencies–advantages and disadvantages. Journal of Economics, 2(1), 31–39. [Google Scholar]

- Chohan, U. W. (2022). Cryptocurrencies: A brief thematic review. Available online: https://ssrn.com/abstract=3024330 (accessed on 20 July 2024).

- Clark, C. E., & Greenley, H. L. (2019). Bitcoin, blockchain, and the energy sector. Congressional Research Service. [Google Scholar]

- Clements, R. (2021). Built to fail: The inherent fragility of algorithmic stablecoins. Available online: https://ssrn.com/abstract=3952045 (accessed on 20 July 2024).

- Colantonio, A. (2009). Social sustainability: A review and critique of traditional versus emerging themes and assessment methods. In M. Horner, A. Price, J. Bebbington, & R. Emmanuel (Eds.), SUE-Mot conference 2009: Second international conference on whole life urban sustainability and its assessment: Conference proceedings (pp. 865–885). Loughborough University. [Google Scholar]

- Davidson, S., De Filippi, P., & Potts, J. (2018). Blockchain and the economic institutions of capitalism. Journal of Institutional Economics, 14(4), 639–658. [Google Scholar] [CrossRef]

- Davies, G. (2010). History of money. University of Wales Press. [Google Scholar]

- de Vries, A. (2018). Bitcoin’s growing energy problem. Joule, 2(5), 801–805. [Google Scholar] [CrossRef]

- Dhali, M., Hassan, S., & Mehar, S. M. (2023). Cryptocurrency in the Darknet: Sustainability of the current national legislation. International Journal of Law and Management, 65(3), 261–282. [Google Scholar] [CrossRef]

- Doane, D., & MacGillivray, A. (2001). Economic sustainability: The business of staying in business. New Economics Foundation. [Google Scholar]

- Duong, T., Chepurnoy, A., Fan, L., & Zhou, H. S. (2018, June 4). Twinscoin: A cryptocurrency via proof-of-work and proof-of-stake. Proceedings of the 2nd ACM Workshop on Blockchains, Cryptocurrencies, and Contracts (pp. 1–13), Incheon, Republic of Korea. [Google Scholar]

- Egiyi, M. A., & Ofoegbu, G. N. (2020). Cryptocurrency and climate change: An overview. International Journal of Mechanical Engineering and Technology (IJMET), 11(3), 15–22. [Google Scholar]

- El Hajj, M., & Farran, I. (2024). The cryptocurrencies in emerging markets: Enhancing financial inclusion and economic empowerment. Journal of Risk and Financial Management, 17(10), 467. [Google Scholar] [CrossRef]

- Elkington, J., & Rowlands, I. H. (1999). Cannibals with forks: The triple bottom line of 21st century business. Alternatives Journal, 25(4), 42. [Google Scholar] [CrossRef]

- Feng, Z., Mohanty, H., & Krishnamachari, B. (2024). Modeling and analysis of crypto-backed over-collateralized stable derivatives in DeFi. Frontiers in Blockchain, 7, 1392812. [Google Scholar] [CrossRef]

- Ferreira, A. (2021). The curious case of stablecoins-balancing risks and rewards? Journal of International Economic Law, 24(4), 755–778. [Google Scholar] [CrossRef]

- Financial Innovation and Technology for the 21st Century Act in the U.S. (2023). Available online: https://www.congress.gov/bill/118th-congress/house-bill/4763 (accessed on 20 July 2024).

- Gervais, A., Karame, G. O., Wüst, K., Glynatsis, V., Ritzdorf, H., & Capkun, S. (2016, October 24–28). On the security and performance of proof of work blockchains. Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security (pp. 3–16), Vienna, Austria. [Google Scholar]

- Golosova, J., & Romanovs, A. (2018, November 8–10). The advantages and disadvantages of the blockchain technology. 2018 IEEE 6th Workshop on Advances in Information, Electronic and Electrical Engineering (AIEEE) (pp. 1–6), Vilnius, Lithuania. [Google Scholar]

- Goodkind, A. L., Jones, B. A., & Berrens, R. P. (2020). Cryptodamages: Monetary value estimates of the air pollution and human health impacts of cryptocurrency mining. Energy Research & Social Science, 59, 101281. [Google Scholar]

- Gulli, A. (2020). (Un)sustainability of bitcoin mining. Rutgers Computer & Tech. [Google Scholar]

- Hahn, T., Figge, F., Pinkse, J., & Preuss, L. (2010). Trade-offs in corporate sustainability: You can’t have your cake and eat it. Business Strategy and the Environment, 19(4), 217–229. [Google Scholar] [CrossRef]

- Hoang, L. T., & Baur, D. G. (2024). How stable are stablecoins? The European Journal of Finance, 30(16), 1984–2000. [Google Scholar] [CrossRef]

- Howson, P., & de Vries, A. (2022). Preying on the poor? Opportunities and challenges for tackling the social and environmental threats of cryptocurrencies for vulnerable and low-income communities. Energy Research & Social Science, 84, 102394. [Google Scholar]

- Jagtiani, J., Papaioannou, M., Tsetsekos, G., Dolson, E., & Milo, D. (2021). Cryptocurrencies: Regulatory perspectives and implications for investors. In The palgrave handbook of technological finance (pp. 161–186). Palgrave Macmillan. [Google Scholar]

- Kahya, A., Krishnamachari, B., & Yun, S. (2021). Reducing the Volatility of Cryptocurrencies—A Survey of Stablecoins. arXiv, arXiv:2103.01340. [Google Scholar]

- Koemtzopoulos, D., Zournatzidou, G., & Sariannidis, N. (2025). Can cryptocurrencies be green? The role of stablecoins toward a carbon footprint and sustainable ecosystem. Sustainability, 17, 483. [Google Scholar] [CrossRef]

- Kołodziejczyk, H., & Jarno, K. (2020). Stablecoin—The stable cryptocurrency. Studia BAS, 3(63), 155–170. [Google Scholar] [CrossRef]

- Krause, M. J., & Tolaymat, T. (2018). Quantification of energy and carbon costs for mining cryptocurrencies. Nature Sustainability, 1(11), 711–718. [Google Scholar] [CrossRef]

- Kyriazis, N. A. (2021). A survey on volatility fluctuations in the decentralized cryptocurrency financial assets. Journal of Risk and Financial Management, 14(7), 293. [Google Scholar] [CrossRef]

- Limba, T., Stankevičius, A., & Andrulevičius, A. (2019). Towards sustainable cryptocurrency: Risk mitigations from a perspective of national security. Journal of Security and Sustainability Issues, 9(2), 375–389. [Google Scholar] [CrossRef]

- MacDonald, C., & Zhao, L. (2022). Stablecoins and their risks to financial stability (Staff Discussion Paper 2022-20). Bank of Canada.

- Makarov, I., & Schoar, A. (2022). Cryptocurrencies and decentralized finance (DeFi). Brookings Papers on Economic Activity, 2022(1), 141–215. [Google Scholar] [CrossRef]

- McCook, H. (2018). The cost & sustainability of Bitcoin. A Monthly Bitcoin Journal, 1–34. [Google Scholar]

- McKinnon, A., Browne, M., Piecyk, M., & Whiteing, A. E. (2010). Green logistics: Improving the environmental sustainability of logistics. Chartered Institute of Logistics and Transport in the UK. [Google Scholar]

- Mita, M., Ito, K., Ohsawa, S., & Tanaka, H. (2020). What is stablecoin?: A survey on its mechanism and potential as decentralized payment systems. International Journal of Service and Knowledge Management, 4(2), 71–86. [Google Scholar]

- Mitawa, A., & Bhambu, P. (2023). Safeguarding financial transaction with cryptocurrency. In International conference on data science and applications (pp. 361–368). Springer Nature Singapore. [Google Scholar]

- Morrison-Saunders, A., & Pope, J. (2013). Conceptualising and managing trade-offs in sustainability assessment. Environmental Impact Assessment Review, 38, 54–63. [Google Scholar] [CrossRef]

- Mullan, P. C. (2016). E-gold. In A history of digital currency in the United States: New technology in an unregulated market. Springer Nature. [Google Scholar]

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 20 July 2024).

- Näf, M., Keller, T., & Seiler, R. (2021, January 5). Proposal of a methodology for the sustainability assessment of cryptocurrencies. Proceedings of the 54th Hawaii International Conference on System Sciences (pp. 5617–5626), Kauai, HI, USA. [Google Scholar]

- Sahoo, P. K. (2017). Bitcoin as digital money: Its growth and future sustainability. Theoretical & Applied Economics, 24(4), 53–64. [Google Scholar]

- Saleh, F. (2021). Blockchain without waste: Proof-of-stake. The Review of Financial Studies, 34(3), 1156–1190. [Google Scholar] [CrossRef]

- Sanz-Bas, D. (2020). Hayek and the cryptocurrency revolution. Iberian Journal of the History of Economic Thought, 7, 15–28. [Google Scholar] [CrossRef]

- Sanz-Bas, D. (2022). Las profecías de Hayek sobre las criptomonedas. In Digitalización de empresas y economía: Tendencias actuales (pp. 28–39). Dykinson eBook. [Google Scholar]

- Sanz-Bas, D., Del Rosal, C., Náñez Alonso, S. L., & Echarte Fernández, M. Á. (2021). Cryptocurrencies and fraudulent transactions: Risks, practices, and legislation for their prevention in Europe and Spain. Laws, 10(3), 57. [Google Scholar] [CrossRef]

- Sheikh, H., Azmathullah, R. M., & Rizwan, F. (2018). Proof-of-work vs proof-of-stake: A comparative analysis and an approach to blockchain consensus mechanism. International Journal for Research in Applied Science & Engineering Technology, 6(12), 786–791. [Google Scholar]

- Shin, D., & Rice, J. (2022). Cryptocurrency: A panacea for economic growth and sustainability? A critical review of crypto innovation. Telematics and Informatics, 71(1), 101830. [Google Scholar] [CrossRef]

- Siddik, M. A. B., Amaya, M., & Marston, L. T. (2023). The water and carbon footprint of cryptocurrencies and conventional currencies. Journal of Cleaner Production, 411, 137268. [Google Scholar] [CrossRef]

- Srivisad, N., & Wattanakoon, P. (2024). Assessing price stability in fiat-backed stablecoins: Implications for financial regulation and market dynamics. Available online: https://ssrn.com/abstract=4977810 (accessed on 24 July 2024).

- Stoll, C., Klaaßen, L., & Gallersdörfer, U. (2019). The carbon footprint of bitcoin. Joule, 3(7), 1647–1661. [Google Scholar] [CrossRef]

- Swan, M. (2015). Blockchain: Blueprint for a new economy. O’Reilly Media, Inc. [Google Scholar]

- Truby, J., Brown, R. D., Dahdal, A., & Ibrahim, I. (2022). Blockchain, climate damage, and death: Policy interventions to reduce the carbon emissions, mortality, and net-zero implications of non-fungible tokens and Bitcoin. Energy Research & Social Science, 88, 102499. [Google Scholar]

- UK Financial Services and Markets Act. (2023). Available online: https://www.legislation.gov.uk/ukpga/2021/22/contents (accessed on 24 July 2024).

- Vargo, S. L., & Lusch, R. F. (2004). Evolving to a New Dominant Logic for Marketing. Journal of Marketing, 68, 1–17. [Google Scholar] [CrossRef]

- Vranken, H. (2017). Sustainability of bitcoin and blockchains. Current Opinion in Environmental Sustainability, 28, 1–9. [Google Scholar] [CrossRef]

- Wolfson, A. (2016). Sustainable service. Business Expert Press. [Google Scholar]

- Wolfson, A., Mark, S., Martin, P. M., & Tavor, D. (2015). Sustainability and Service. In Sustainability through service (pp. 31–48). Springer. [Google Scholar]

- Yermack, D. (2017). Corporate governance and blockchains. Review of Finance, 21(1), 7–31. [Google Scholar] [CrossRef]

- Yujin, K., Kornrapat, P., Kaihua, Q., Ariah, K. M., Philipp, J., Christine, P., Arthur, G., & Dawn, S. (2024, May 27–31). What drives the (in)stability of a stablecoin? 2024 IEEE International Conference on Blockchain and Cryptocurrency (ICBC) (pp. 316–324), Dublin, Ireland. [Google Scholar]

- Zhong, Y. (2022). Review on digital currency (pp. 585–590). Atlantis Press. [Google Scholar]

- Zohar, A. (2015). Bitcoin: Under the hood. Communications of the ACM, 58(9), 104–113. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wolfson, A.; Khaladjan, G.; Lurie, Y.; Mark, S. The Greater Sustainability of Stablecoins Relative to Other Cryptocurrencies. J. Risk Financial Manag. 2025, 18, 161. https://doi.org/10.3390/jrfm18030161

Wolfson A, Khaladjan G, Lurie Y, Mark S. The Greater Sustainability of Stablecoins Relative to Other Cryptocurrencies. Journal of Risk and Financial Management. 2025; 18(3):161. https://doi.org/10.3390/jrfm18030161

Chicago/Turabian StyleWolfson, Adi, Gerard Khaladjan, Yotam Lurie, and Shlomo Mark. 2025. "The Greater Sustainability of Stablecoins Relative to Other Cryptocurrencies" Journal of Risk and Financial Management 18, no. 3: 161. https://doi.org/10.3390/jrfm18030161

APA StyleWolfson, A., Khaladjan, G., Lurie, Y., & Mark, S. (2025). The Greater Sustainability of Stablecoins Relative to Other Cryptocurrencies. Journal of Risk and Financial Management, 18(3), 161. https://doi.org/10.3390/jrfm18030161