Abstract

Spot Bitcoin Exchange Traded Products (ETPs) are financial instruments enabling Bitcoin to be traded on traditional brokerage platforms, reducing the risks associated with direct Bitcoin exposure while addressing fraud and market manipulation concerns. This study examines the adoption of Spot Bitcoin ETPs, emphasizing the roles of financial and digital literacy, market dynamics, and regulatory frameworks in influencing individual investor behavior. Based on a survey of 428 U.S. respondents, financial literacy and early adopter traits were found to significantly enhance adoption likelihood (β = 0.458, p < 0.001). Government factors, such as compliance guidelines and tax policies, improved investor confidence and adoption rates (β = 0.409, p < 0.001). Market factors, including volatility and sentiment, played a notable yet secondary role (β = 0.34, p < 0.001). Institutional investment mediated the effects of regulatory and market dynamics on individual adoption, legitimizing Spot Bitcoin ETPs and fostering trust (β = 0.298, p < 0.001). The findings emphasize the need for clear regulations, robust disclosure requirements, and investor education to enhance adoption. Policymakers should focus on regulatory transparency to build investor confidence, while financial institutions can advance adoption by promoting financial and digital literacy. This study contributes to understanding how individual, market, and regulatory factors collectively drive the integration of regulated cryptocurrency products into mainstream finance.

1. Introduction

The cryptocurrency sector, including Bitcoin, has faced significant regulatory challenges, such as fraud, market manipulation, insufficient disclosure, and inadequate investor protection (Moffett, 2022). Bitcoin’s decentralized structure facilitates fraudulent activities and price manipulation, while a lack of transparency and standardized oversight exacerbates investment risks. Additionally, the complexity of Bitcoin technologies often leaves investors without a clear understanding of associated risks, emphasizing the need for robust regulatory measures (Magnuson, 2018). These regulatory concerns have limited their adoption, particularly among individual investors who seek secure and compliant investment avenues.

The approval of Spot Bitcoin Exchange-Traded Products (ETPs) by the U.S. Securities and Exchange Commission (SEC) marks a significant shift in regulatory oversight, providing a structured and legally compliant investment vehicle for Bitcoin exposure (Securities and Exchange Commission, 2024). While Bitcoin ETPs offer investors a regulated pathway to participate in the cryptocurrency market, their adoption remains influenced by multiple factors, including regulatory clarity, market sentiment, and individual investor characteristics. Prior research has explored how individual and market factors shape cryptocurrency adoption, but few studies have empirically tested how SEC regulations interact with these factors to influence adoption decisions.

Research Objectives and Scope

This study aims to empirically examine the direct effects of SEC regulations, individual investor characteristics, and market sentiment on the adoption of Spot Bitcoin ETPs. Additionally, it explores the mediating role of institutional investment, assessing whether institutional engagement reinforces regulatory confidence and facilitates broader individual adoption. Unlike prior studies that focus on the impact of regulatory announcements on cryptocurrency prices or institutional investment trends, this research investigates how individual investors perceive and respond to SEC regulatory frameworks, market conditions, and institutional legitimacy in shaping their adoption decisions.

Specifically, this study seeks to answer the following research questions:

- How do SEC regulations (e.g., regulatory clarity, tax policies, compliance) directly influence individual adoption of Spot Bitcoin ETPs?

- How do individual factors (e.g., financial literacy, risk tolerance, innovativeness) contribute to Spot Bitcoin ETP adoption, and how do they compare in strength to SEC regulations?

- How do market factors (e.g., volatility, demand, sentiment) directly impact Spot Bitcoin ETP adoption?

- Does institutional investment mediate the relationship between SEC regulations, market sentiment, and individual adoption?

Using survey data from 428 U.S. participants, this study employs structural equation modeling (SEM) to assess the direct influence of SEC regulations, financial literacy, and market sentiment on Spot Bitcoin ETP adoption. It further examines the mediating role of institutional investment, analyzing whether institutional participation enhances investor confidence and facilitates broader adoption.

This research is grounded in established theories, including the Theory of Planned Behavior (TPB) (Ajzen, 1991) and the Diffusion of Innovation (DOI) theory (Rogers et al., 2014), which provides a theoretical framework for understanding how regulatory clarity, financial knowledge, and market sentiment influence investment behavior. By integrating individual, market, and regulatory dimensions into a unified empirical model, this study contributes to the broader discourse on cryptocurrency adoption and financial regulation.

2. Literature Review

2.1. Foundational Context

Spot Bitcoin vs. regulatory Spot Bitcoin (Spot Bitcoin ETPs)

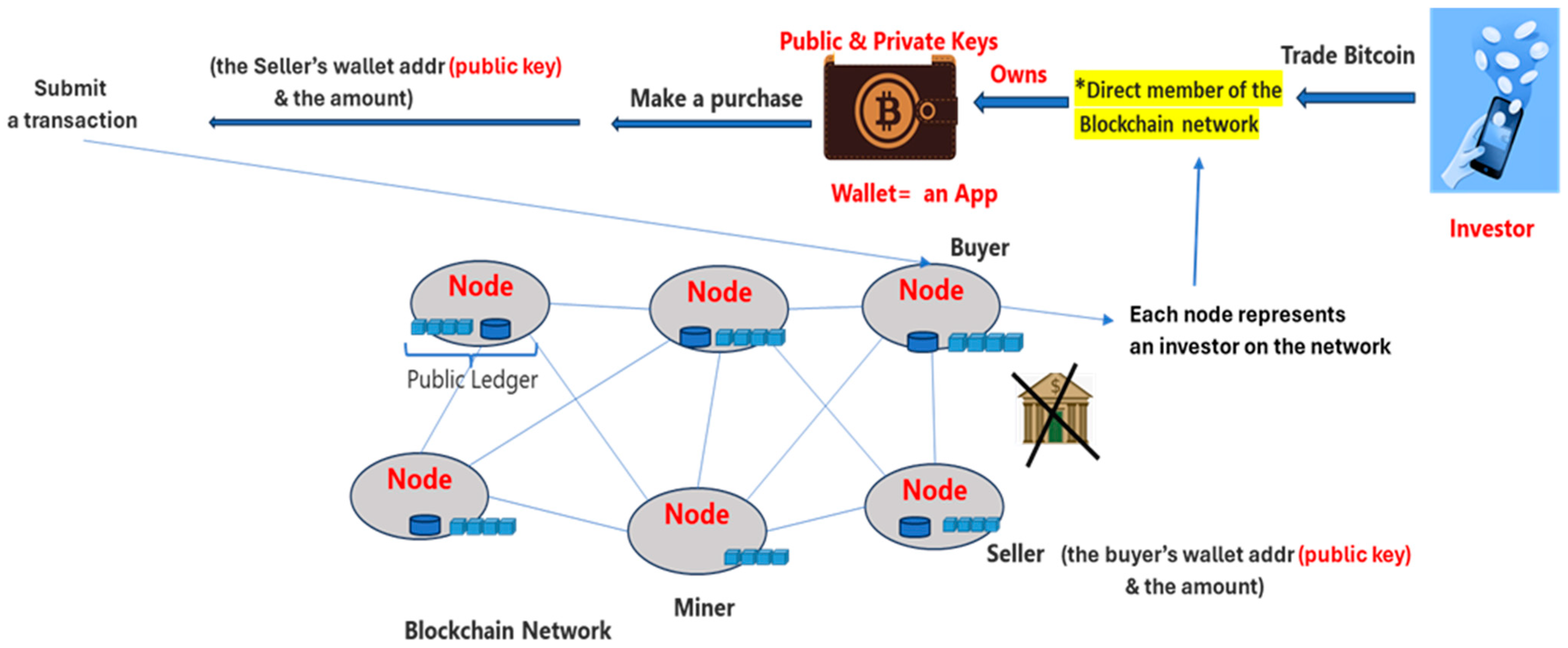

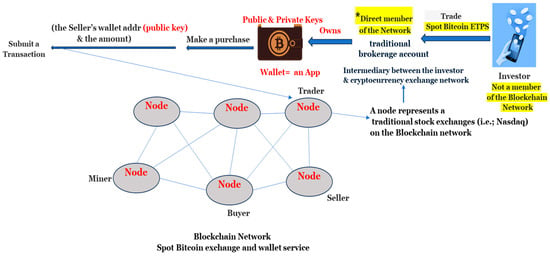

The global financial system is rapidly transforming due to the emergence of digital assets, particularly cryptocurrencies (Anuyahong & Ek-udom, 2023; Härdle et al., 2020). Among these, Bitcoin has become a revolutionary digital currency built on blockchain technology, offering decentralized, peer-to-peer transactions without intermediaries (Nakamoto, 2008; Böhme et al., 2015). According to the Securities and Exchange Commission, Bitcoin is categorized as both a cryptocurrency and a virtual currency. Thus, Bitcoin emerged, offering a revolutionary shift in the financial sector (Singh, 2024; Kayani & Hasan, 2024). Figure 1 illustrates how Spot Bitcoin (Bitcoin or Real bitcoin) is traded on a public blockchain network using a client application.

Figure 1.

Spot Bitcoin trading and wallet service on the blockchain network.

2.2. Spot Bitcoin ETPs

Spot Bitcoin ETPs are financial instruments traded on traditional securities exchanges. These ETPs expose investors to the price movements of Bitcoin without needing them to directly purchase, store, or manage the underlying Bitcoin as a cryptocurrency and without needing to manage the technical aspects of owning Bitcoin, such as using crypto wallets or safeguarding private keys. This setup offers a bridge between the traditional financial and cryptocurrency markets, allowing investors to buy and sell shares of ETP through standard brokerage accounts (Congressional Research Service, 2024; Smales, 2019).

It is important to mention that Spot Bitcoin ETPs are backed solely by Bitcoin held in secure digital wallets. They do not pool other types of assets (like bonds or commodities) or involve futures contracts, which is how Bitcoin Futures ETFs work. The value of Spot Bitcoin ETPs comes from the real-time price (or “spot price”) of Bitcoin rather than derivatives or other asset classes (Low & Marsh, 2019). Given the fact that multiple sources of pricing information for the spot bitcoin market are available 24 h per day on public websites and through subscription services, trading Spot bitcoin ETPs through traditional security exchanges provides investors with a single source of tracking Spot Bitcoin price (Mazur & Polyzos, 2025).

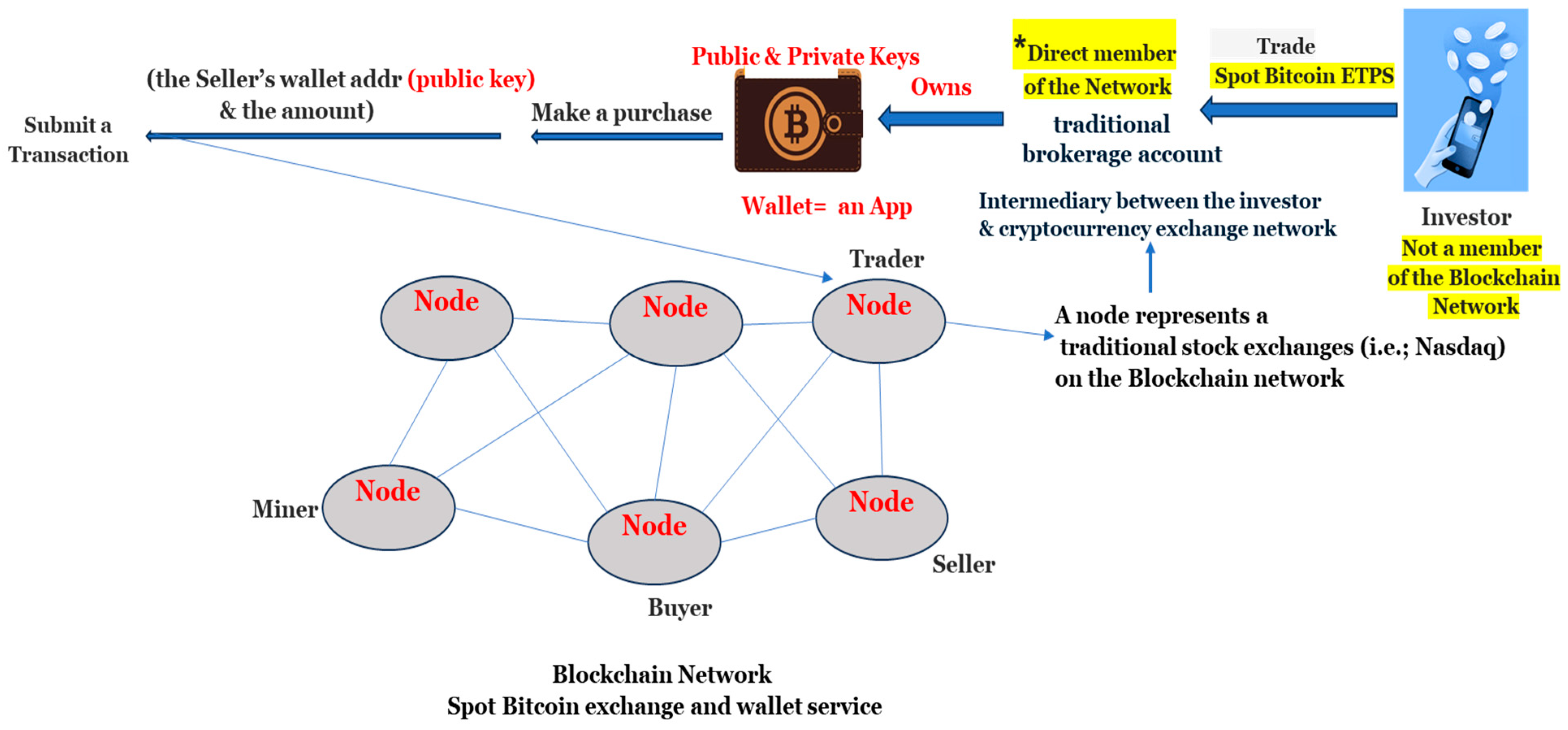

Figure 2 illustrates the trading of Spot Bitcoin ETPs on a traditional securities exchange. An investor is not a direct network member through which the Spot Bitcoin is traded. Traditional exchange is a direct member of the Blockchain network represented by a node. A node is a lightweight, containerized software package called a peer node, which is required to receive a transaction from a client application via which the traditional brokerage firm accesses the network and interacts with other peer nodes to make the trade happen and record.

Figure 2.

A blockchain network providing Spot Bitcoin trading and wallet service.

2.3. Bridging the Context: From ETPs to Related Work

Spot Bitcoin ETPs bridge traditional financial markets and the Bitcoin market, but their adoption depends on factors like government regulation, market dynamics, and individual behavior. Research has explored these influences, focusing on how regulatory frameworks and individual and institutional actions shape the integration of such products into mainstream investment portfolios. The next section reviews key studies addressing these themes.

Several studies have examined the role of government regulation, financial literacy, and market factors in cryptocurrency adoption, particularly regarding Bitcoin ETFs. Chokor and Alfieri (2021) analyzed the impact of regulatory news and events on cryptocurrency market returns, highlighting how regulatory announcements shape investor sentiment and market stability.

Similarly, Krause D. examined how Bitcoin Exchange-Traded Fund (ETF) approvals contributes to the mainstreaming of cryptocurrencies by increasing institutional legitimacy and boosting market confidence and encouraging broader participation (Krause, 2024). While these studies focus on broader regulatory influences, our study specifically investigates how institutional adoption mediates the relationship between SEC regulations, market forces, and individual participation in Spot Bitcoin ETPs. Unlike prior studies that analyze institutional participation in general cryptocurrency investments, our research assesses how institutional investment in Spot Bitcoin ETPs serves as a channel for regulatory legitimacy and individual investor confidence.

Individual characteristics, such as financial and digital literacy, risk tolerance, and innovativeness, play a significant role in cryptocurrency adoption. Kumari et al. examined these factors through the UTAUT2 framework, demonstrating that financial literacy and technology awareness enhance user adoption of blockchain-based financial products (Kumari et al., 2023). Similarly, Sohaib et al. applied the Technology Readiness Index (TRI) and the Technology Acceptance Model (TAM) to show that early adopters’ innovativeness influences their willingness to embrace new financial instruments like Bitcoin (Sohaib et al., 2019). These findings align with the Diffusion of Innovations Theory, which suggests that individuals with higher innovation are more likely to adopt emerging financial technologies (Rogers et al., 2014).

Furthermore, Gazali et al. (2018) and Gerrans et al. (2023) found that individuals with greater risk tolerance exhibit a higher likelihood of investing in cryptocurrencies, reinforcing the Theory of Reasoned Action (TRA), which links risk tolerance with engagement in high-risk financial assets. Hayashi and Routh (2024) further support this by demonstrating that financial literacy correlates positively with cryptocurrency ownership. While these studies highlight individual adoption drivers, they do not account for how institutional adoption influences individual decision-making. Our study fills this gap by exploring how institutional investment in Spot Bitcoin ETPs reduces perceived risk, enhances accessibility, and serves as a regulatory bridge that facilitates individual investor participation.

Market factors, such as volatility, demand, and sentiment, also significantly affect cryptocurrency adoption. Liu et al. found that while volatility deters risk-averse individuals, it attracts risk-tolerant investors who perceive price fluctuations as opportunities for substantial returns (Liu & Tsyvinski, 2021). Similarly, Gupta and Chaudhary (2022) noted that the high-risk, high-return nature of cryptocurrencies appeals to investors willing to accept greater financial risks.

Additionally, Krafft et al. demonstrated that surging market demand, reflected in trading volumes and price spikes, influences adoption rates by increasing asset attractiveness (Krafft et al., 2018). The Information Cascade Theory supports this view, explaining how investment decisions are shaped by observed behavior, particularly in markets driven by media and public perception (Bikhchandani et al., 1992). Empirical studies by Kim et al. and Answer et al. reinforce this by showing that social media plays a critical role in shaping cryptocurrency investment behavior, further demonstrating the impact of market sentiment (Kim & Fan, 2024; Chokor & Alfieri, 2021). While these studies establish a strong link between market factors and individual adoption, they overlook the crucial role of institutional investment in translating market demand and sentiment into structured investment opportunities. Our study extends this discussion by analyzing how institutional participation in Spot Bitcoin ETPs acts as a stabilizing force in volatile cryptocurrency markets, legitimizing investment opportunities for retail investors.

Jackson’s research further underscores the role of regulatory clarity in enabling institutional investment in Bitcoin ETFs, demonstrating that well-defined policies facilitate market integration (Jackson, 2024). Similarly, Cohort et al. found that regulatory announcements directly influence cryptocurrency prices and trading volumes, suggesting that clear and consistent regulations reduce uncertainty and promote institutional participation (Chokor & Alfieri, 2021). The importance of institutional adoption as a mediating force between regulatory clarity and individual adoption is also supported by Auer et al., who show that institutional investors, such as hedge funds and asset managers, provide liquidity, infrastructure, and legitimacy to cryptocurrency markets (Auer et al., 2022). While prior research has highlighted the relationship between regulation and institutional participation, our study bridges this gap by explicitly examining how institutional investment in Spot Bitcoin ETPs translates regulatory clarity into increased trust and adoption among individual investors.

Investor psychology and behavioral influences also contribute to cryptocurrency adoption. Anser et al. (2020) applied the Theory of Planned Behavior (TPB) to examine how social media influences investor attitudes, subjective norms, and perceived behavioral control, ultimately shaping Bitcoin adoption behavior. They also found that perceived risk moderates the relationship between investment intention and actual behavior, illustrating how investor sentiment can be a significant adoption driver. However, their study does not address how institutional investment influences risk perception and mitigates uncertainty. Our research expands on this by demonstrating that institutional adoption of Spot Bitcoin ETPs plays a crucial role in reducing uncertainty for retail investors, thereby enhancing confidence in regulated cryptocurrency investments.

Institutional investment serves as a mediator between macro-level market and regulatory influences and micro-level individual investor behavior. Jackson and Auer et al. emphasize how institutional engagement improves cryptocurrency legitimacy, strengthens market infrastructure, and fosters greater trust in investment vehicles (Jackson, 2024; Auer et al., 2022). Chainalysis (2024) provides empirical evidence that the launch of Spot Bitcoin ETPs in the U.S. has significantly increased institutional inflows, influencing broader market sentiment and retail investor participation. Additionally, MicroStrategy’s inclusion in the Nasdaq-100 index illustrates how corporate and institutional Bitcoin holdings drive individual investment trends, as retail investors often interpret institutional actions as validation of asset’s legitimacy (Reuters, 2024). While existing studies explore the role of institutional investors in the cryptocurrency ecosystem, our study explicitly examines how their participation in regulated Spot Bitcoin ETPs mediates the relationship between government policies, market conditions, and individual adoption.

This study aims to empirically investigate the influence of SEC regulations and regulatory factors on individual and institutional adoption, with institutional adoption serving as a mediating factor. While previous research has examined ETF markets broadly, few studies have specifically explored how SEC regulations shape investor adoption of Spot Bitcoin ETPs. Some studies have focused on regulatory announcements’ impact on cryptocurrency prices or institutional investment trends but have not empirically tested how SEC approval affects retail investors’ decision-making in structured financial markets.

To address this gap, we develop a model grounded in the Theory of Planned Behavior (TPB) and Diffusion of Innovation (DOI) Theory. TPB explains how regulatory clarity and market conditions shape investment behavior, while DOI captures how financial literacy and innovativeness drive early adoption of emerging financial products. Together, these theories offer a structured approach to understanding how external regulatory influences and individual investor traits contribute to Spot Bitcoin ETP adoption.

Despite growing interest in ETFs, empirical research on how SEC regulations influence investor adoption of Spot Bitcoin ETPs remains scarce. Unlike traditional ETFs that provide exposure to equity and fixed-income markets, Spot Bitcoin ETPs offer a regulated investment alternative to direct Bitcoin ownership, attracting investors unfamiliar with self-custody solutions. With recent SEC approval transforming the accessibility of Bitcoin through financial markets, this study examines how regulatory clarity, market sentiment, and institutional investment influence retail participation in this evolving investment instrument.

2.4. Proposed Model and Hypotheses

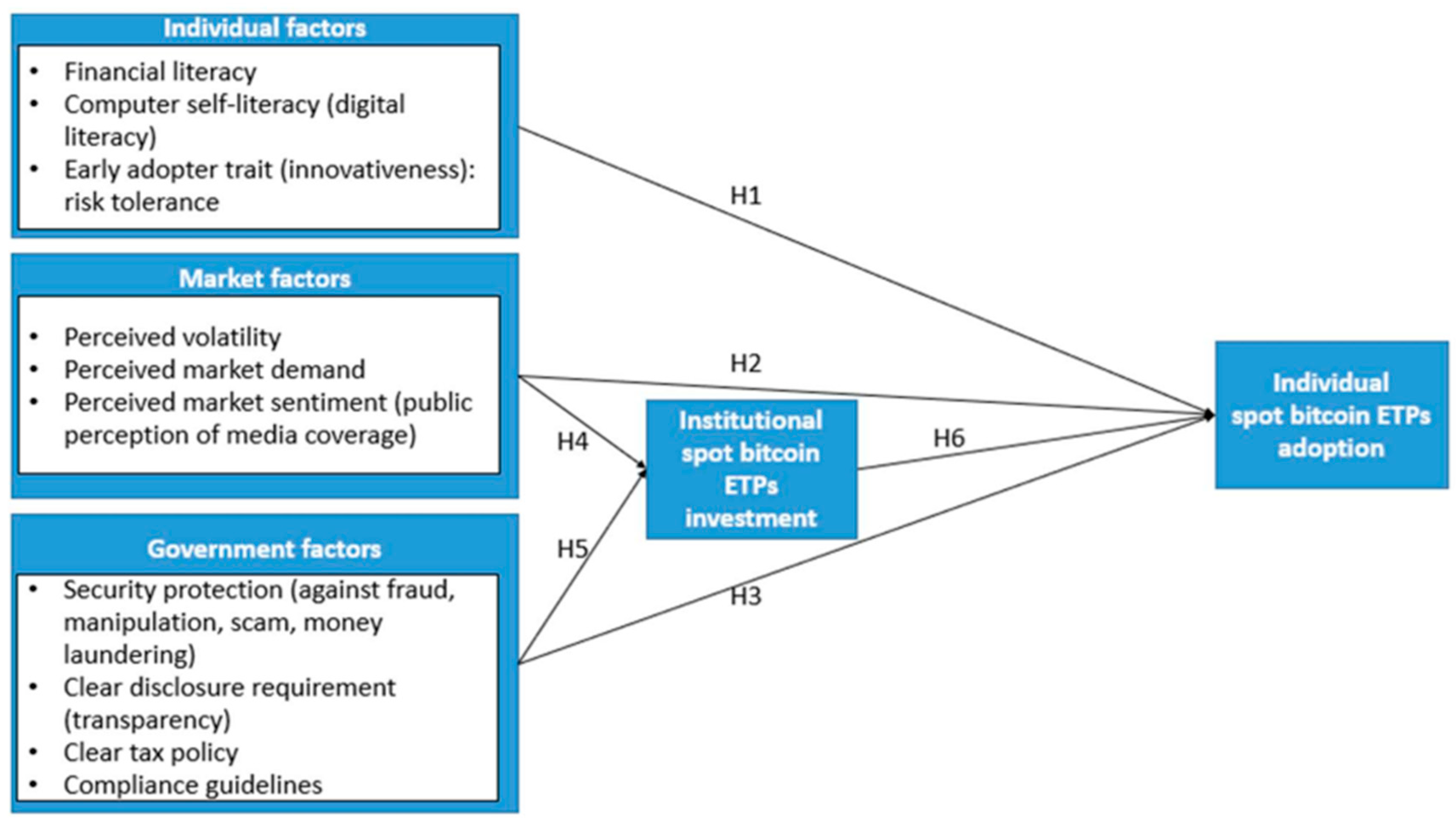

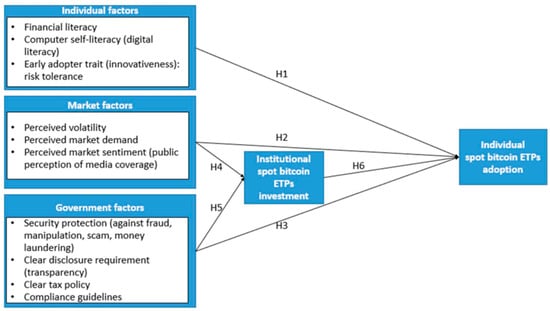

Figure 3 represents our conceptual model focusing on the relationships between individual, market, and government factors and their influence on adopting spot Bitcoin exchange-traded products (ETPs).

Figure 3.

Conceptual Model Illustrating Factors Influencing Spot Bitcoin ETP Adoption.

The conceptual model illustrates how these market and government factors directly affect institutional investment in Bitcoin ETPs, which mediates the impact on individual adoption of spot Bitcoin ETPs. Individual factors encompass financial literacy, digital literacy, and early adopter traits (innovativeness), highlighting the importance of personal knowledge and risk tolerance in driving cryptocurrency investments. Similarly, market factors, such as perceived volatility, demand, and market sentiment, reflect external influences that shape individual confidence in Bitcoin investments. Additionally, government factors, including security protection, clear tax policies, and compliance guidelines, provide a regulatory backdrop that bolsters the legitimacy of Bitcoin ETPs and encourages broader adoption.

Hypotheses Development

The first three hypotheses (H1–H3) address the antecedents of the primary drivers (confidence, perceptions, risk evaluation, trust, and sense of protection against fraud and scam, transparency) of investment decisions. These relationships are grounded in financial literacy research, the Theory of Planned Behavior (TPB) (Ajzen, 1991), Innovation Diffusion Theory (Rogers, 1962), and prospect theory (Kahneman & Tversky, 1979).

Financial and Digital Literacy as Drivers of Spot Bitcoin ETP Adoption

The influence of financial and digital literacy on individuals’ investment decisions and adoption of financial products, particularly complex financial products like cryptocurrency-based ETFs (H1), builds on the theoretical foundation that individuals with higher financial literacy exhibit greater confidence, knowledge, and awareness in investment decisions (Ajzen, 1991). Financial literacy enhances risk assessment abilities, enabling investors to evaluate potential returns versus risks associated with digital currencies. Innovation Diffusion Theory (Rogers, 1962) According to the Diffusion of Innovations theory, there is a strong connection between an individual’s characteristics of innovativeness and the adoption of new technology. The theory explains that individuals who are more innovative are typically early adopters.

Thus, we hypothesize the following point:

H1.

Financial and digital literacy positively influence Spot Bitcoin ETP adoption by enhancing confidence, knowledge, and awareness.

Market Conditions and Investment Decisions

Similarly, market factors, including perceived volatility, demand, and sentiment, play a crucial role in shaping investment behavior. Expected Utility Theory (Von Neumann & Morgenstern, 1947) explains that investors assess financial decisions based on expected returns, adjusting their strategies based on market risks. Information Cascade Theory (Bikhchandani et al., 1992) further explains how market sentiment, particularly public perception of media coverage and institutional involvement, influences investor behavior, often leading to collective adoption trends in speculative markets.

Thus, we hypothesize the following point:

H2.

Market factors (perceived volatility, demand, sentiment) positively influence adoption by shaping investor perceptions and risk tolerance.

Government Regulations and Investor Protection

The influence of government factors such as regulatory clarity, tax policies, and compliance guidelines (H3) is rooted in Regulatory Signaling Theory (Spence, 1973) and Institutional Legitimacy Theory (Suchman, 1995). Regulatory transparency fosters investor confidence by providing a sense of protection against financial fraud and exploitation, which in turn drives investment behavior (Ajzen, 1991). The Theory of Planned Behavior (TPB) (Ajzen, 1991) suggests that regulatory transparency enhances perceived control and security, fostering trust in financial instruments. Institutional Legitimacy Theory (Suchman, 1995) further argues that government-backed regulatory measures increase institutional participation, which indirectly reinforces trust in digital assets and influences individual adoption.

Thus, we hypothesize the following point:

H3.

Government factors (regulatory clarity, tax policies, compliance) positively influence adoption by enhancing trust and perceived security.

Institutional Investment as an Intermediate Outcome for Institutional Adoption

H4 and H5 examine the factors influencing institutional investment in Spot Bitcoin ETPs, making them intermediate outcomes for institutional adoption. However, institutional investment does not serve as an intermediate outcome for individual adoption, as individual investors may adopt Spot Bitcoin ETPs regardless of institutional participation. Instead, institutional investment plays a mediating role (H6), partially explaining how market and government factors influence individual adoption.

Market Conditions and Institutional Investment

Institutional investors, including hedge funds and asset managers, make strategic investment decisions based on market volatility, demand, and sentiment. Behavioral finance theories (Kahneman & Tversky, 1979) suggest that institutional investors assess market risks and opportunities differently from retail investors, placing greater emphasis on liquidity, stability, and regulatory oversight. High market demand and strong sentiment signal greater institutional interest, reinforcing market credibility and increasing participation in regulated cryptocurrency-backed financial products.

Thus, we hypothesize the following point:

H4.

Market factors positively influence institutional investment in Spot Bitcoin ETPs.

Government Regulations and Institutional Investment

Regulatory clarity plays a fundamental role in institutional decision-making. Regulatory Signaling Theory (Spence, 1973) suggests that clear governance structures attract institutional investors by reducing uncertainty and ensuring compliance. Favorable regulations, such as transparent disclosure requirements and investor protections, enhance institutional confidence in cryptocurrency-backed financial products.

Thus, we hypothesize the following point:

H5.

Government factors positively influence institutional investment in Spot Bitcoin ETPs.

Institutional Investment as a Mediator in Individual Adoption

Institutional investment in cryptocurrency-backed financial products enhances market legitimacy, liquidity, and perceived credibility, influencing retail investors’ willingness to adopt Spot Bitcoin ETPs. Institutional Legitimacy Theory (Suchman, 1995) suggests that retail investors are more likely to engage with financial instruments that receive institutional backing, as it signals credibility and long-term stability. The Theory of Institutional Endorsement (DiMaggio & Powell, 1983) further supports this, arguing that institutional participation reduces perceived risks for individual investors, increasing confidence in adoption.

Thus, we hypothesize the following point:

H6.

Institutional investment mediates the relationship between market/government factors and individual adoption of Spot Bitcoin ETPs.

Table 1 summarizes the research studies on factors influencing cryptocurrency adoption.

Table 1.

A summary of the research studies on factors influencing cryptocurrency adoption.

3. Research Methodology

3.1. Data and Sample

The target population was those US citizens. The data were collected through an online survey using Qualtrics and distributed via Prolific.com to a sample of 428 participants. The survey comprised questions related to financial literacy, digital literacy, market sentiment, government regulations, and institutional involvement. Respondents’ demographic characteristics, including gender, age, education, and income, were also captured. The study’s participants were predominantly male (61.2%) and from the 31–45 age group (49.5%). Educationally, the largest group had some college education (32.2%), and income distribution was diverse, with the majority earning between USD 40,000 and USD 60,000 annually.

A summary of demographic data from 428 participants is shown in Table 2.

Table 2.

Descriptive statistics.

3.2. Data Collection and Analysis

The survey used to collect data for this study comprised items designed to measure key constructs, including financial literacy, digital literacy, market sentiment, and perceptions of government regulations. The full list of survey questions is provided in Appendix A for reference.

3.3. Measurement Model

The measurement model’s validity and reliability were assessed using Confirmatory Factor Analysis (CFA) via SmartPLS 4.0. All constructs demonstrated good reliability and validity, as shown in Table 3 below, with standardized factor loadings exceeding 0.7 and composite reliability and Cronbach’s alpha values above 0.7.

Table 3.

Results of convergent validity.

4. Results

The study consists of 428 participants, of which 262 (61.2%) are male and 166 (38.8%) are female. Most participants are between 31 and 45 years old (49.5%). 28.5% of participants are aged 18–30, 18.2% are aged 45–60, and 3.7% are 60 and older. Participants come from various educational backgrounds, with 32.2% having attended college. In total, 25% are undergraduates, 24.8% are graduates, and 18% have completed high school. Income distribution is diverse, with 21.5% of participants earning more than USD 100 thousand annually, 23.6% earning between USD 40 thousand and USD 60 thousand, 19.4% earn USD 60 thousand to USD 80 thousand, 13.8% earn USD 80 thousand to USD 100 thousand, and 9.3% earn less than USD 20 thousand.

4.1. Instrument Assessment

The model contains both first-order and second-order constructs. The individual, market, and government factors are measured as formative second-order constructs. We used the repeated items approach to evaluate the measurement models, as recommended for the second-order formative construct. This approach includes indicators of both the first-order and second-order constructs. The Confirmatory Factor Analysis (CFA) is conducted using a component-based approach to Partial Least Squares (PLS), which is appropriate for formative constructs. SmartPLS 4.0 is used for the CFA to assess the measurement model, focusing on factor loadings, reliability, and validity.

4.2. Convergent Validity

The standardized factor loadings for all constructs exceeded 0.7, which is the acceptable range for factor loadings (Hair et al., 2006). The composite reliability values and Cronbach’s alpha were above the recommended value of 0.7, demonstrating the adequate reliability of the constructs (Chin, 1998). All the average variance extracted (AVE) values exceeded 0.5, which is the cutoff value (Segars, 1997). These measures indicated the acceptability of the measurement model’s convergent validity.

4.3. Discriminant Validity

All diagonal values (the square roots of the AVEs) were higher than 0.7 and also greater than off-diagonal values (correlations) between any pair of constructs (Fornell et al., 1982). Thus, the discriminant validity requirements were satisfied for the research model, as shown in Table 4.

Table 4.

Results of discriminant validity.

Table 5 displays the Heterotrait–Monotrait Ratio of Correlations (HTMT) in assessing the discriminant validity. According to Henseler et al. (2015), if the HTMT value is below 0.90, discriminant validity can be established between two reflective constructs. Based on the results, the HTMT ratio between constructs was met, demonstrating acceptable levels of discriminant validity.

Table 5.

HTMT analysis.

4.4. Formative Construct Validation

We evaluated the validity of the second-order constructs with their respective dimensions using the adequacy coefficient (R2a) (MacKenzie et al., 2011), as shown in Table 6. The R2a values were higher than the threshold of 0.50, suggesting that the majority of variance in the dimensions is shared with the formative construct and, therefore, indicating validity. The weights from lower-order dimensions to higher-order constructs were positive and significant, demonstrating that the indicators of formative constructs load highly on their corresponding constructs in comparison to other constructs (Klein & Rai, 2009). Also, VIF values were examined for first-order and second-order constructs, with all values less than 3.3 (the most conservative threshold), showing that multicollinearity was not a problem in the model (Cenfetelli & Bassellier, 2009).

Table 6.

Formative construct validation.

4.5. Structural Model and Path Analysis

Based on the fit indices provided in Table 7, the structural model shows a good fit to the data. Most of the fit indices fall within acceptable ranges, suggesting that the model adequately represents the relationships among the variables.

Table 7.

Goodness of fit.

Table 8 presents the path analysis results, showing the relationships between individual, market, and government factors and Bitcoin ETP adoption.

Table 8.

Path analysis.

The standardized coefficient for the relationship between individual factors (such as financial literacy, digital literacy, and early adopter traits) and individual spot Bitcoin ETPs adoption is β = 0.458, with a t-value of 9.359 (p < 0.001). This indicates a significant positive effect, suggesting that individuals with greater financial literacy, digital skills, and willingness to take risks are more likely to adopt spot Bitcoin ETPs. The path between market factors (e.g., perceived volatility, market demand, and sentiment) and individual adoption of spot Bitcoin ETPs has a standardized coefficient of β = 0.34, with a t-value of 11.361 (p < 0.001). This demonstrates that market-related influences significantly impact individuals’ decisions to adopt spot Bitcoin ETPs. The standardized coefficient for the effect of government factors (e.g., security perception, transparency, tax policy, and compliance guidelines) on individual adoption is β = 0.409, with a t-value of 12.029 (p < 0.001). This suggests that the clarity and security of government regulations play an important role in individual decisions to adopt spot Bitcoin ETPs. The effect of market factors on institutional spot Bitcoin ETPs investment is positive and significant, with a standardized coefficient of β = 0.48 and a t-value of 12.919 (p < 0.001). This indicates that favorable market perceptions and conditions are key motivators for institutional investors to engage in spot Bitcoin ETPs. The relationship between government factors and institutional investment has a standardized coefficient of β = 0.409 and a t-value of 12.029 (p < 0.001). This suggests that government policies, regulations, and perceived security significantly influence the level of institutional investments in spot Bitcoin ETPs. The final hypothesis explores the mediating role of institutional spot Bitcoin ETPs investment on individual adoption, with a standardized coefficient of β = 0.298 and a t-value of 9.867 (p < 0.001).

The final hypothesis, as presented in Table 9, explores the mediating role of institutional spot Bitcoin ETPs investment on individual adoption, with a standardized coefficient of β = 0.298 and a t-value of 9.867 (p < 0.001).

Table 9.

Mediation analysis results.

This significant positive effect implies that increased institutional investment positively influences individuals’ willingness to adopt spot Bitcoin ETPs. Essentially, individuals perceive spot Bitcoin ETPs as more legitimate or safe when institutions invest in them, thereby encouraging individual adoption.

All the relationships in the model are supported, indicating that individual, market, and government factors significantly influence both individual adoption and institutional investment in spot Bitcoin ETPs. Additionally, institutional investment plays a crucial mediating role, amplifying the effect of market and government factors on individual adoption. These findings highlight the interconnected nature of factors influencing Bitcoin ETP adoption, with institutional investment serving as an essential link between macro-level influences (market and government) and individual decision-making. This suggests that increasing institutional participation could be a key driver for boosting individual adoption of spot Bitcoin ETPs, ultimately enhancing overall market penetration.

The mediation effects are significant in both relationships, as indicated by the 95% confidence intervals not containing zero. This means that institutional spot Bitcoin ETPs investment plays an important mediating role between both market and government factors and individual adoption of spot Bitcoin ETPs.

4.6. The Explanatory Power of the Research Model

The model accounts for 62.7% of the variance in institutional spot Bitcoin ETPs investment (R2 = 0.627). This indicates that the combination of individual, market, and government factors provides substantial explanatory power for institutional investment decisions. The model explains 45.8% of the variance in individual adoption of spot Bitcoin ETPs (R2 = 0.458). This means that the factors included in the model, including the mediating effect of institutional investment, have a moderate ability to explain why individuals choose to adopt spot Bitcoin ETPs. These R2 scores imply that the model has relatively strong explanatory power, especially for institutional investment decisions, and provides a reasonable level of explanatory power for individual adoption behaviors. The combination of individual, market, and government factors, along with the mediating role of institutional investment, helps to predict a significant proportion of the variance in individual adoption of spot Bitcoin ETPs. This suggests that institutional investment decisions are key in influencing individual adoption, strengthening the overall model’s explanatory power.

5. Discussion

5.1. Key Insights

Spot Bitcoin ETPs are one of several ETF products, each introducing unique adoption dynamics, risk perceptions, and legal frameworks that serve distinct investor profiles. Spot Bitcoin ETPs represent a distinct and evolving subset, shaped by their direct exposure to Bitcoin, sensitivity to regulatory environments, and heightened investor caution. Despite increasing interest in cryptocurrency-based ETFs, there remains a noticeable scarcity of empirical research that examines the adoption of Spot Bitcoin ETPs through a focused behavioral and institutional lens.

This study addresses that gap by offering analytical insights into the interplay of individual, market, and regulatory factors in driving adoption. Individual characteristics—particularly financial literacy, digital competence, and openness to innovation—emerge as central determinants in shaping investor decisions. These findings highlight the importance of personal capabilities in understanding and engaging with complex digital financial products.

Equally important are government regulations, which act not only as compliance mechanisms but also as trust-building tools. Clear regulatory guidance, transparent disclosure requirements, and well-defined tax policies help reduce uncertainty and foster a greater sense of investor protection. These factors enhance investor confidence and provide a stable foundation for broader adoption.

Institutional investment also plays a critical role in the adoption process. While it may not be the strongest direct driver, its presence significantly enhances the perceived credibility and legitimacy of Spot Bitcoin ETPs. Institutional engagement acts as a signal to individual investors, reinforcing the notion that these products are stable and trustworthy financial instruments.

Market dynamics such as volatility, demand, and sentiment also contribute meaningfully to investor behavior, especially when shaped by broader institutional movements and public discourse. Although secondary in impact compared to individual and regulatory factors, they remain essential elements in the adoption landscape.

Overall, this study provides a comprehensive view of the interconnected influences that drive the adoption of Spot Bitcoin ETPs. It contributes to a deeper understanding of how these unique financial instruments are positioned within traditional investment frameworks and fills a critical gap in the existing empirical literature on their adoption.

5.2. Theoretical Implications

This research offers valuable theoretical contributions to the literature on cryptocurrency adoption, particularly in the context of regulated financial products like Spot Bitcoin ETPs. By highlighting the role of individual factors such as financial and digital literacy, this study provides a framework for understanding how personal knowledge and technical competencies drive engagement with emerging digital financial instruments. It extends existing adoption models by demonstrating how early adopter traits—such as risk tolerance and comfort with innovation—can accelerate the uptake of new financial products.

Furthermore, the study sheds light on the mediating effect of institutional investment in legitimizing and fostering individual adoption of Spot Bitcoin ETPs. While much of the cryptocurrency literature has focused on individual or governmental factors independently, this paper integrates these perspectives, showing how institutional involvement bridges the gap between regulatory frameworks and individual behavior. The identification of government regulations as a crucial factor that enhances investor confidence and mitigates perceived risks adds depth to the theoretical discourse on the role of regulation in digital asset markets. It underscores the need for a balanced approach that both protects investors and encourages innovation.

In addition to these contributions, this study provides new insights into classical theories of Bitcoin adoption, such as the Technology Acceptance Model (TAM). By aligning the findings with TAM’s constructs of perceived usefulness and perceived ease of use, this research demonstrates how financial and digital literacy significantly enhance perceived ease of use for Spot Bitcoin ETPs. Investors with a higher level of financial literacy are better equipped to understand the benefits and operational mechanics of these products, perceiving them as more useful and accessible. This alignment enriches the TAM framework by incorporating individual-level competencies as key determinants of technology adoption in financial contexts.

Moreover, the study’s focus on early adopter traits, including risk tolerance and comfort with innovation, extends TAM by emphasizing the psychological and behavioral dimensions that influence perceived usefulness. Early adopters are more likely to see Spot Bitcoin ETPs as valuable additions to their investment portfolios, enhancing the utility and ease of adopting these products. Additionally, the integration of institutional investment as a legitimizing factor offers a novel perspective on how external influences shape user perceptions, complementing TAM’s emphasis on individual decision-making.

The study also contributes to the Diffusion of Innovations Theory by identifying the mechanisms through which institutional investment and regulatory clarity accelerate the adoption process. By demonstrating how institutional involvement and government policies act as enablers, this research highlights the role of social systems and external structures in diffusing new financial technologies. These findings provide a richer understanding of how regulated cryptocurrency products fit within broader theoretical frameworks of technology adoption, bridging the gap between individual, institutional, and regulatory influences.

5.3. Practical Implications

From a practical standpoint, the findings of this study offer actionable insights for policymakers, financial institutions, and investors. The research emphasizes the importance of regulatory clarity and transparency in fostering a secure environment for Bitcoin ETP investments. Clear disclosure requirements, robust security measures, and compliance guidelines are vital in reducing fears related to market manipulation, fraud, and the overall safety of cryptocurrency investments. Governments should focus on developing comprehensive policies that protect investors while still allowing room for innovation in financial markets. By addressing these regulatory concerns, policymakers can improve investor confidence and facilitate the broader integration of Spot Bitcoin ETPs into traditional financial markets.

The results indicate a need to prioritize investor education, particularly around financial literacy and digital competencies. Institutions can encourage more widespread adoption by enhancing individual understanding of Bitcoin ETPs and their associated risks and benefits. Moreover, financial institutions can leverage their role as institutional investors to signal legitimacy and reduce the perceived risks of Bitcoin ETPs, thereby boosting confidence among retail investors. Institutions should also explore partnerships with educational platforms to offer tailored courses and resources on cryptocurrency investments. These initiatives could include workshops, webinars, and interactive tools designed to demystify complex concepts surrounding Bitcoin ETPs. Additionally, financial institutions can strengthen investor trust by transparently communicating their own involvement in Spot Bitcoin ETPs and highlighting the security measures and due diligence they undertake.

The study highlights the significance of self-education in both financial and digital literacy. Better informed people are more likely to engage confidently with complex financial products like Bitcoin ETPs. As digital assets continue to evolve, individuals must stay informed about the changing regulatory and market landscapes to make sound investment decisions. Individual investors should actively seek resources to enhance their understanding of financial products and digital technologies. Online courses, industry publications, and financial advisory services can play a crucial role in improving literacy. Staying informed about government compliance guidelines and tax policies related to cryptocurrencies is essential for navigating these investments’ legal and financial implications. By monitoring institutional activity in Spot Bitcoin ETPs, retail investors can use the actions of major financial entities as a trust signal, helping them assess the legitimacy and stability of these products.

Furthermore, investors should develop strategies to assess market sentiment and volatility effectively. Understanding these dynamics can provide valuable insights into the potential risks and rewards of investing in Spot Bitcoin ETPs. Proactively engaging in financial communities and leveraging insights from experienced investors can also enhance their decision-making process.

5.4. Limitations and Future Research

Several limitations of this paper can be identified, which are crucial for understanding the scope and context of the findings. The study’s sample was primarily drawn from individuals familiar with cryptocurrencies, collected through platforms like Prolific.com, which may introduce selection bias as these participants likely possess higher financial literacy or interest in Bitcoin ETPs compared to the general population, limiting the generalizability of the findings. Additionally, the cross-sectional design, with data collected at a single point in time, provides only a snapshot of the factors influencing Bitcoin ETP adoption, making it difficult to analyze changes in adoption behavior over time; a longitudinal approach would better capture evolving market sentiments, regulatory changes, and their effects on investor behavior. Furthermore, the reliance on self-reported survey data introduces the possibility of response bias, where participants might overestimate their financial or digital literacy or misreport their actual adoption behavior, potentially skewing the results. These limitations suggest areas for refinement in future research, such as broadening the sample, incorporating longitudinal data, and expanding the analysis to include additional external factors affecting cryptocurrency adoption.

6. Conclusions

This study highlights the critical roles of financial literacy, regulatory clarity, and institutional participation in driving the adoption of Spot Bitcoin ETPs. Individual-level factors, such as financial and digital literacy, emerge as the most significant drivers, emphasizing the need for investor education to enhance understanding and confidence in these financial instruments. Clear and transparent government regulations play a vital role in mitigating risks and fostering trust among investors. Additionally, institutional investment serves as a crucial intermediary, legitimizing Spot Bitcoin ETPs and encouraging individual adoption by reducing perceived uncertainties. These findings underscore the interconnected nature of individual, regulatory, and market dynamics in shaping the integration of cryptocurrency products into traditional financial markets, offering a pathway for broader adoption and trust in innovative financial products.

Author Contributions

Conceptualization, S.H., M.M. and P.E.; methodology, S.H., M.M. and P.E.; software, M.M. and P.E.; validation, S.H., M.M. and P.E.; formal analysis, M.M. and P.E.; investigation, S.H.; resources, S.H.; data curation, P.E.; writing—original draft preparation, S.H.; writing—review and editing, S.H., M.M. and P.E.; visualization, S.H.; supervision, P.E.; project administration, S.H.; funding acquisition, S.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Ethical review and approval were waived for this study due to the paper meets the criteria 45 CFR 46.101 for exemption and is not subject to further review by the IRB.

Informed Consent Statement

Informed consent for participation was obtained from all subjects involved in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A

Survey Questionnaire

Do you consent to participate in this survey?

○ YES

○ No

What is your gender?

○ Male

○ Female

How old are you?

○ 18–30

○ 31–45

○ 45–60

○ 60 and older

What is your highest level of education?

○ Elementary

○ High school

○ College

○ Undergraduate

○ Graduate

What is your annual income?

○ Less than 20 k

○ 20 k to 40 k

○ 40 k to 60 k

○ 60 k to 80 k

○ 80 k to 100 k

○ More than 100 k

Individual Factors: Influence on Spot Bitcoin ETPs Adoption

Financial literacy: An individual’s ability to understand and effectively apply various financial skills needed to make informed financial decisions, such as personal financial management and investing.

I have a good knowledge of Bitcoin and cryptocurrency investments.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I feel I have a high capacity to manage investments in Spot Bitcoin ETPs.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I have a good understanding of financial products related to Bitcoin.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Digital literacy: an individual’s ability to use digital technologies and networks to access, manage, evaluate, and create information.

I know how to change the privacy settings on cryptocurrency exchange platforms to enhance my account security.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I know how to adjust the privacy settings of social media platforms to protect my information when discussing Bitcoin investments (e.g., Instagram, Snapchat, TikTok).

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I know how to securely store my cryptocurrency-related documents and backup keys in cloud storage services (e.g., Google Drive, iCloud).

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Early adopter trait (innovativeness–risk tolerance): an individual’s tendency to adopt new products, services, or technologies before others, often associated with risk tolerance and a desire to stay current with new developments.

In general, I am among the first in my circle of friends to acquire a new digital currency when it appears.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I keep up with the latest technological developments in my areas of interest, such as digital currencies.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I can usually figure out new digital currencies without help from others.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Market factors: Influence on Individuals

Perceived volatility: Refers to the expectation of rapid and unpredictable changes in market conditions, such as fluctuations in supply, demand, and competitor actions.

The returns on investments in Bitcoin/Spot Bitcoin ETPs are unpredictable.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

The volume of Bitcoin transactions and trading in this industry is unstable.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

It is difficult to monitor price changes for Bitcoin in the cryptocurrency market.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Perceived market demand: An individual’s assessment of consumer needs and the demand for products or services in a market, including price sensitivity and potential opportunities.

I tend to explore Spot Bitcoin ETPs investment products, paying close attention to their price sensitivity.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I seek technical support to address specific challenges in cryptocurrency investments and to enhance our investment strategies.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I assess the market segmentation and price flexibility of Spot Bitcoin ETPs to optimize our investment decisions.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Perceived market sentiment (public perception of media coverage): Involves understanding public attitudes and media coverage of the market, including the influence of expert opinions and social media on investment decisions.

I trust the opinions of experts discussing Bitcoin investments on social media.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

It is most likely I invest in Bitcoin based on recommendations from social media influencers.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

It is important for me that a Spot Bitcoin ETP provider or cryptocurrency exchange platform has good reviews on social media.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Government factors: Influence on the Individual

Security protection (fraud, manipulation, scam, KYC, ransomware, money laundering): Includes measures to safeguard online transactions and data from threats like fraud, manipulation, scams, and money laundering.

The SEC ensures that Spot Bitcoin ETP providers offer robust technical protection for online transactions to prevent fraud and manipulation.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

The SEC’s regulations provide comprehensive legal protection for transactions involving Spot Bitcoin ETPs to safeguard against denial-of-service attacks and fraud.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

The SEC requires Spot Bitcoin ETP providers to implement strong measures to protect the integrity and confidentiality of data transmission.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Clear disclosure requirement (transparency): Refers to the clarity and accessibility of financial information, particularly in cryptocurrency transactions, ensuring stakeholders can easily understand relevant details.

I believe that SEC regulations ensure that Bitcoin transaction processes are transparent and easily understandable.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I feel that SEC guidelines provide in-depth access to financial information related to Bitcoin transactions.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I find that the usability of Bitcoin transactions is clear and straightforward due to the transparency enforced by SEC regulations.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Clear tax policy: Involves the comprehensibility of tax-related information, including disclosures in reports and the implications of tax strategies for investment decisions.

SEC-mandated tax disclosures can significantly influence our perception of a Bitcoin or cryptocurrency trading platform.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

We consider tax compliance and disclosures crucial factors when deciding whether to invest in Bitcoin or through cryptocurrency trading platforms, as per SEC guidelines.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

According to SEC regulations, the annual report is the most important and comprehensive source of tax information for evaluating Bitcoin and cryptocurrency trading platforms.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Compliance guidelines: The standards and laws that organizations must follow in areas such as financial reporting, environmental protection, and data privacy.

Financial Compliance: Refers to adhering to accounting standards, disclosure requirements, and regulations designed to prevent financial crimes such as money laundering and ensure transparency and trustworthiness in financial operations.

I have positive attitudes toward Bitcoin and cryptocurrency trading platforms that comply with SEC financial reporting standards.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I believe that responsible financial disclosures by Bitcoin or cryptocurrency trading platforms, in accordance with SEC guidelines, enhance my trust in them.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

My trust in Bitcoin and cryptocurrency trading platforms is influenced by their adherence to SEC-mandated Corporate Social Responsibility (CSR) practices, including environmental protection and data privacy.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Environmental Compliance: Involves meeting regulatory requirements related to environmental protection and sustainability, including practices aimed at reducing environmental impact and promoting eco-friendly operations.

I seek firms with proactive involvement in recycling, waste reduction, and environmental cleanup.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I avoid firms producing toxic products and contributing to global warming.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I avoid manufacturers of tobacco products.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Institutional Spot Bitcoin ETPs investment:

Institutional Spot Bitcoin Adoption: Refers to the process by which large financial entities, such as banks, investment firms, and hedge funds, begin to incorporate Bitcoin into their investment portfolios and trading activities, treating it as a viable asset class for direct purchase and ownership without using derivatives.

I believe that after the SEC regulated Bitcoin, many institutions are attempting to adopt Spot Bitcoin ETPs.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I believe institutions are adopting Spot Bitcoin based on their confidence in the long-term viability and stability of Spot Bitcoin ETPs.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I think institutional investors are increasingly adopting new strategies and showing a growing interest in expanding their investments in Bitcoin ETPs.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

Individual Spot Bitcoin ETPs adoption: Cryptocurrency Trust and Adoption

I want to use cryptocurrency regularly.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I want to use services that accept cryptocurrency payments.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I want to use Spot Bitcoin for my purchases.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I want to use platforms that support cryptocurrency.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

I want to use cryptocurrency for convenience.

○ Strongly disagree ○ Somewhat disagree ○ Neither agree nor disagree ○ Somewhat agree ○ Strongly agree

References

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes. [Google Scholar]

- Anser, M. K., Zaigham, G. H. K., Imran Rasheed, M., Pitafi, A. H., Iqbal, J., & Luqman, A. (2020). Social media usage and individuals’ intentions toward adopting Bitcoin: The role of the theory of planned behavior and perceived risk. International Journal of Communication Systems, 33(17), e4590. [Google Scholar] [CrossRef]

- Anuyahong, B., & Ek-udom, N. (2023). The impact of cryptocurrency on global trade and commerce. International Journal of Current Science Research and Review, 6(4), 2543–2553. [Google Scholar]

- Auer, R., Farag, M., Lewrick, U., Orazem, L., & Zoss, M. (2022). Banking in the shadow of Bitcoin? The institutional adoption of cryptocurrencies (BIS Working Paper No. 1013). Bank for International Settlements. Available online: https://www.bis.org/publ/work1013.htm (accessed on 11 March 2025).

- Bikhchandani, S., Hirshleifer, D., & Welch, I. (1992). A theory of fads, fashion, customs, and cultural change as informational cascades. Journal of Political Economy, 100(5), 992–1026. [Google Scholar] [CrossRef]

- Bondarenko, N., & Soponar, P. (2024). Bitcoin ETF approval: Catalyst for crypto realization and augmented real-world utility. YNBC Research Institute. Available online: https://www.theconnecter.io/pdf/2024-01-23-_YNBC%20and%20The%20Connecter%20R_D_%20Bitcoin%20ETF%20Approval.pdf (accessed on 11 March 2025).

- Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 29(2), 213–238. [Google Scholar]

- Cenfetelli, R. T., & Bassellier, G. (2009). Interpretation of formative measurement in information systems research. MIS Quarterly, 33(4), 689–707. [Google Scholar]

- Chainalysis. (2024). North America: Institutional momentum and U.S. Bitcoin ETPs propel crypto further into the mainstream. Available online: https://www.chainalysis.com/blog/north-america-crypto-adoption-2024/ (accessed on 11 March 2025).

- Chin, W. W. (1998). The partial least squares approach to structural equation modeling. Modern Methods for Business Research, 295(2), 295–336. [Google Scholar]

- Chokor, A., & Alfieri, E. (2021). Long and short-term impacts of regulation in the cryptocurrency market. The Quarterly Review of Economics and Finance, 81, 157–173. [Google Scholar]

- Congressional Research Service. (2024). SEC approves Bitcoin exchange-traded products (ETPs). Available online: https://crsreports.congress.gov/product/pdf/IF/IF12573 (accessed on 11 March 2025).

- DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147–160. [Google Scholar]

- Fornell, C., Tellis, G. J., & Zinkhan, G. M. (1982, ). Validity assessment: A structural equations approach using partial least squares. American Marketing Association Educators’ Conference, Chicago, IL, USA. [Google Scholar]

- Gazali, H. M., Ismail, C. M. H. B. C., & Amboala, T. (2018, July 23–25). Exploring the intention to invest in cryptocurrency: The case of Bitcoin [Conference presentation]. 2018 International Conference on Information and Communication Technology for the Muslim World (ICT4M), Kuala Lumpur, Malaysia. [Google Scholar]

- Gerrans, P., Abisekaraj, S. B., & Liu, Z. F. (2023). The fear of missing out on cryptocurrency and stock investments: Direct and indirect effects of financial literacy and risk tolerance. Journal of Financial Literacy and Wellbeing, 1(1), 103–137. [Google Scholar]

- Gupta, H., & Chaudhary, R. (2022). An empirical study of volatility in the cryptocurrency market. Journal of Risk and Financial Management, 15(11), 513. [Google Scholar]

- Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis 6th Edition. Pearson Prentice Hall. New Jersey. humans: Critique and reformulation. Journal of Abnormal Psychology, 87, 49–74. [Google Scholar]

- Hayashi, F., & Routh, A. (2024). Financial literacy, risk tolerance, and cryptocurrency ownership in the United States (Working paper No. 24-03). Federal Reserve Bank of Kansas City. [Google Scholar]

- Härdle, W. K., Harvey, C. R., & Reule, R. C. (2020). Understanding cryptocurrencies. Journal of Financial Econometrics, 18(2), 181–208. [Google Scholar]

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. [Google Scholar]

- Jackson, G. (2024). Cryptocurrency adoption in traditional financial markets in the United States. American Journal of Finance, 9(1), 40–50. [Google Scholar] [CrossRef]

- Kai-Ineman, D. A. N. I. E. L., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 363–391. [Google Scholar]

- Kayani, U., & Hasan, F. (2024). Unveiling cryptocurrency impact on financial markets and traditional banking systems: Lessons for sustainable blockchain and interdisciplinary collaborations. Journal of Risk and Financial Management, 17(2), 58. [Google Scholar]

- Kim, K. T., & Fan, L. (2024). Beyond the hashtags: Social media usage and cryptocurrency investment. International Journal of Bank Marketing, 43(3), 569–590. [Google Scholar]

- Klein, R., & Rai, A. (2009). Interfirm strategic information flows in logistics supply chain relationships. MIS Quarterly, 33, 735–762. [Google Scholar]

- Krafft, P. M., Della Penna, N., & Pentland, A. S. (2018, April 21–26). An experimental study of cryptocurrency market dynamics [Conference presentation]. 2018 CHI Conference on Human Factors in Computing Systems, Montreal, QC, Canada. [Google Scholar]

- Krause, D. (2024). The rise of spot cryptocurrency ETFs: Implications for institutional investors (Working paper). SSRN. Available online: https://ssrn.com/abstract=4868157 (accessed on 11 March 2025).

- Kumari, V., Bala, P. K., & Chakraborty, S. (2023). An empirical study of user adoption of cryptocurrency using blockchain technology: Analysing role of success factors like technology awareness and financial literacy. Journal of Theoretical and Applied Electronic Commerce Research, 18(3), 1580–1600. [Google Scholar]

- Liu, Y., & Tsyvinski, A. (2021). Risks and returns of cryptocurrency. The Review of Financial Studies, 34(6), 2689–2727. [Google Scholar]

- Low, R., & Marsh, T. (2019). Cryptocurrency and blockchains: Retail to institutional. The Journal of Investing, 29(1), 18–30. [Google Scholar]

- MacKenzie, S. B., Podsakoff, P. M., & Podsakoff, N. P. (2011). Construct measurement and validation procedures in MIS and behavioral research: Integrating new and existing techniques. MIS Quarterly, 35, 293–334. [Google Scholar]

- Magnuson, W. (2018). Financial regulation in the Bitcoin era. Stanford Journal of Law, Business & Finance, 23, 159. [Google Scholar]

- Mazur, M., & Polyzos, E. (2025). Spot bitcoin ETFs: The effect of fund flows on bitcoin price formation. The Journal of Alternative Investments, 27(3). [Google Scholar] [CrossRef]

- Moffett, T. A. (2022). CFTC & SEC: The wild west of cryptocurrency regulation. University of Richmond Law Review, 57, 713. [Google Scholar]

- Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 11 March 2025).

- Rakowski, D. (2010). Fund flow volatility and performance. Journal of Financial and Quantitative Analysis, 45(1), 223–237. [Google Scholar]

- Reuters. (2024). MicroStrategy’s Nasdaq-100 entry attracts nearly $11 million retail inflows. Available online: https://www.reuters.com/technology/microstrategys-nasdaq-100-entry-attracts-nearly-11-million-retail-inflows-2024-12-17/ (accessed on 11 March 2025).

- Rogers, E. M. (1962). Diffusion of innovations (1st ed.). Macmillan. [Google Scholar]

- Rogers, E. M., Singhal, A., & Quinlan, M. M. (2014). Diffusion of innovations. In D. K. Holtzhausen, & A. Zerfass (Eds.), The Routledge handbook of strategic communication (pp. 432–448). Routledge. [Google Scholar]

- Securities and Exchange Commission. (2024). Order granting accelerated approval of proposed rule changes to list and trade Bitcoin-based commodity-based trust shares and trust units. Securities and Exchange Commission. Available online: https://www.sec.gov/files/rules/sro/nysearca/2024/34-99306.pdf (accessed on 11 March 2025).

- Segars, A. H. (1997). Assessing the unidimensionality of measurement: A paradigm and illustration within the context of information systems research. Omega, 25(1), 107–121. [Google Scholar]

- Singh, D. S. (2024). Decentralized finance (DeFi): Exploring the role of blockchain and cryptocurrency in financial ecosystems. International Research Journal of Modernization in Engineering Technology and Science, 6, 2888–2892. [Google Scholar]

- Smales, L. A. (2019). Bitcoin as a safe haven: Is it even worth considering? Finance Research Letters, 30, 385–393. [Google Scholar]

- Sohaib, O., Hussain, W., Asif, M., Ahmad, M., & Mazzara, M. (2019). A PLS-SEM neural network approach for understanding cryptocurrency adoption. IEEE Access, 8, 13138–13150. [Google Scholar]

- Spence, M. (1973). l the MIT press. The Quarterly Journal of Economics, 87(3), 355–374. [Google Scholar]

- Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3), 571–610. [Google Scholar]

- Von Neumann, J., & Morgenstern, O. (1947). Theory of games and economic behavior (2nd ed.). Princeton University Press. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).