Nexus Between Fintech Innovations and Liquidity Risk in GCC Banks: The Moderating Role of Bank Size

Abstract

1. Introduction

2. Literature Review

2.1. Financial Technology Innovations (FIs)

2.2. FIs and the Banking Industry

2.3. FIs and Liquidity Risk

2.4. The Moderating Role of Bank Size

3. Materials and Methods

3.1. Independent Variable: Fintech Innovations (FIs)

3.2. Dependent Variable: Liquidity Management

3.3. Control Variables

- Return on assets: net profit after tax on total assets;

- Bank size: the natural logarithm of total assets;

- Capital adequacy ratio: Tier1 + Tier2 risk-weighted assets;

- Bank age: the number of years from banks’ establishment to the year of study;

- Inflation rate: Consumer Price Index, which reflects the change in the prices of a fixed basket of goods and services consumed by individuals.

investment + government spending + (exports − imports).

3.4. Study Model

4. Results

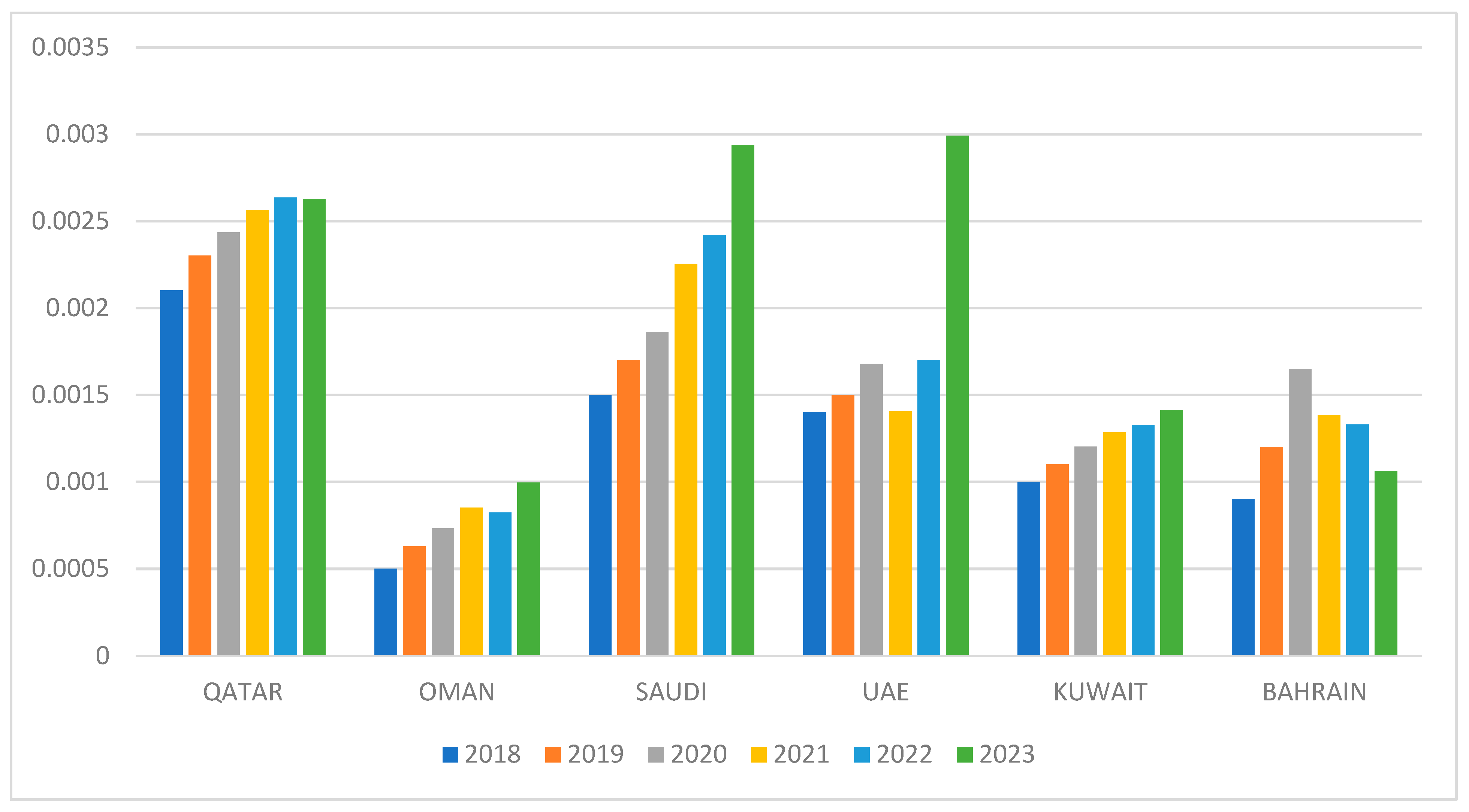

4.1. National Indicators

4.2. Descriptive Analysis

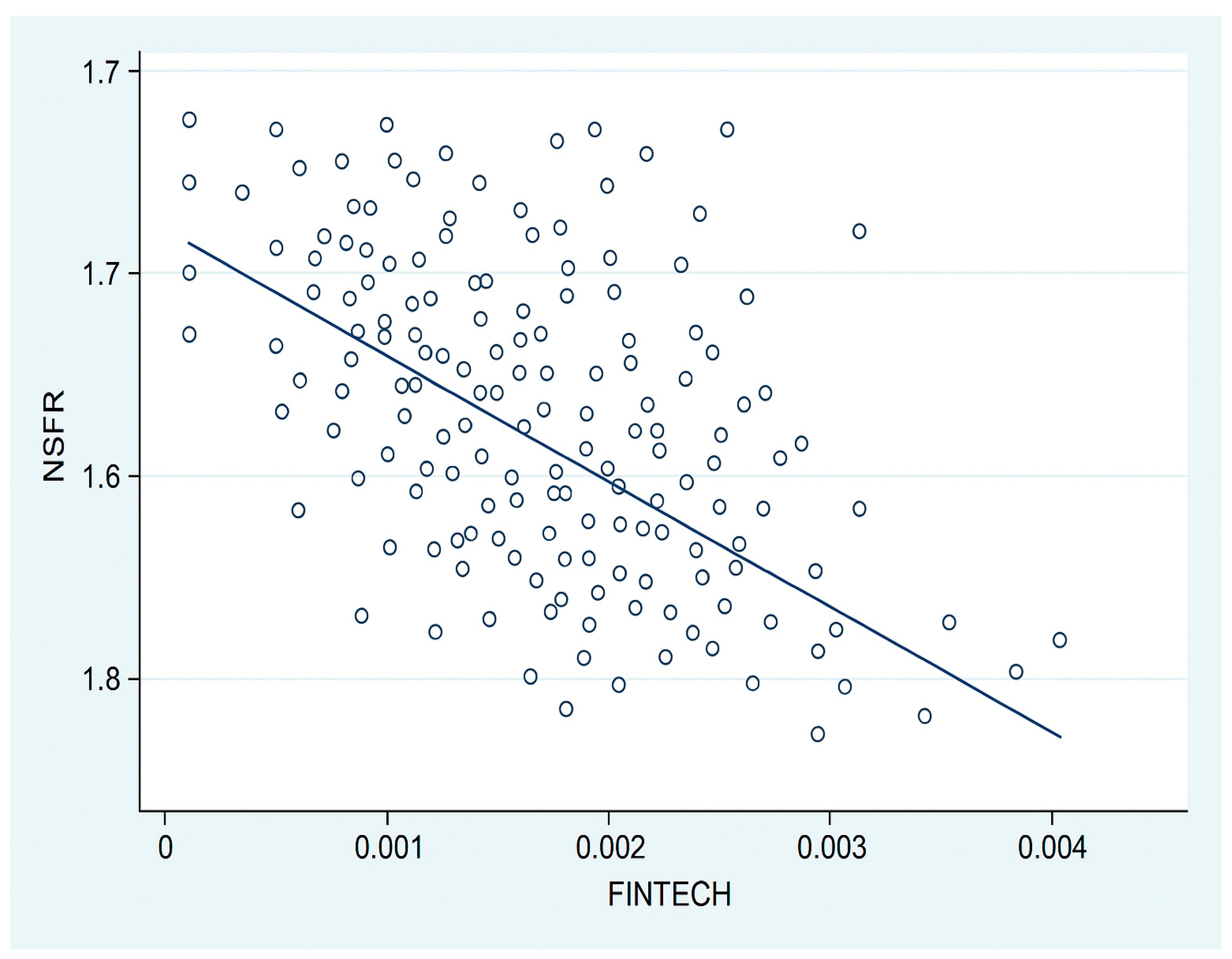

4.3. Correlation Analysis

4.4. Regression Results

4.5. Heterogeneity Analysis

4.6. Robustness Testing

4.6.1. Alternative Proxy for Bank Liquidity

4.6.2. Addressing Endogeneity: Two-Step Gaussian Mixture Model (GMM)

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AI | Artificial intelligence |

| FEM | Finite element method |

| FDI | Foreign direct investment |

| FI | Fintech innovation |

| Fintech | Financial technology |

| GCC | Gulf Cooperation Council |

| GDP | Gross domestic product |

| HQLA | High-quality liquid assets |

| LCR | Liquidity coverage ratio |

| MENA | Middle East and North Africa |

| NSFR | Net stable funding ratio |

| OIC | Organization of Islamic Cooperation |

| ROI | Return on investment |

| SD | Standard deviation |

| VIF | Variance inflation factor |

Appendix A

| Activity/Asset | Classification | ASF/RSF Contribution |

|---|---|---|

| Capital instruments | Long-term stable funding | 100% ASF (Tier 1 and Tier 2 capital components) |

| Retail deposits (stable) | Core deposits | 95% ASF (with insurance) |

| Retail deposits (less stable) | Other retail deposits | 90% ASF (without deposit insurance or less established) |

| Wholesale funding (long-term) | Committed stable funding | 50–100% ASF (depending on contractual maturity) |

| Wholesale funding (short-term) | Volatile funding | 0–50% ASF (depending on relationship and maturity) |

| Loans to non-financial corporates | Illiquid assets | 85% RSF (loans maturing > 1 year) |

| Residential mortgages | Illiquid assets | 65% RSF (non-securitized mortgages maturing > 1 year) |

| Short-term loans (corporates) | Relatively liquid assets | 10% RSF (short-term loans < 1 year) |

| High-quality liquid assets (HQLAs) | Liquid buffer | 0–5% RSF (depending on HQLA level 1, 2A, or 2B) |

| Other marketable securities | Relatively liquid assets | 50–85% RSF (depending on credit rating and market characteristics) |

| Cash and central bank reserves | Mostly liquid assets | 0% RSF |

| Derivatives exposures | Contingent liabilities | 100% RSF (depending on replacement cost and collateralization) |

| Off-balance sheet commitments | Contingent liabilities | 5–10% RSF (depending on commitment type and nature) |

References

- Aastvedt, T. M., Behmiri, N. B., & Lu, L. (2021). Does green innovation damage financial performance of oil and gas companies? Resources Policy, 73, 102235. [Google Scholar] [CrossRef]

- Abisola, A. (2022). The nexus between bank size and financial performance: Does internal control adequacy matter? Journal of Accounting and Taxation, 14(1), 13–20. [Google Scholar] [CrossRef]

- Acharya, V. V., & Mora, N. (2015). A crisis of banks as liquidity providers. Journal of Finance, 70(1), 1–43. [Google Scholar] [CrossRef]

- Ahsan, T., Al-Gamrh, B., Qureshi, M. A., & Gull, A. A. (2024). Does eco-innovation foster or hinder environmental performance? Recent evidence from Europe. International Journal of Green Energy, 21(2), 205–215. [Google Scholar] [CrossRef]

- Al-Dmour, A., Al-Dmour, R. H., Al-Dmour, H. H., & Ahmadamin, E. B. (2021). The effect of big data analytic capabilities upon bank performance via FinTech innovation: UAE evidence. International Journal of Information Systems in the Service Sector, 13(4), 62–87. [Google Scholar] [CrossRef]

- Alkhazaleh, A. M. K. (2021). Challenges and opportunities for Fintech startups: Situation in the Arab World. Academy of Accounting and Financial Studies Journal, 25(3), 1–14. [Google Scholar]

- Allen, F., Gu, X., & Jagtiani, J. (2021). A survey of fintech research and policy discussion. Review of Corporate Finance, 1, 259–339. [Google Scholar] [CrossRef]

- Al-Maamary, H. M., Kazem, H. A., & Chaichan, M. T. (2017). The impact of oil price fluctuations on common renewable energies in GCC countries. Renewable and Sustainable Energy Reviews, 75, 989–1007. [Google Scholar] [CrossRef]

- Al-Shouha, L., Khasawneh, O., El-qawaqneh, S., Al-Naimi, A. A., Saram, M., & Ismail, W. N. S. W. (2024). The impact of financial technology on bank performance in Arabian countries. Banks and Bank Systems, 19(2), 234–244. [Google Scholar] [CrossRef]

- Anagnostopoulos, I. (2018). Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business, 100(2), 7–25. [Google Scholar] [CrossRef]

- Anshari, M., Almunawar, M. N., Lim, S. A., & Al-Mudimigh, A. (2019). Customer relationship management and big data enabled: Personalization & customization of services. Applied Computing and Informatics, 15(2), 94–101. [Google Scholar] [CrossRef]

- Arner, D. W., Barberis, J., & Buckley, R. P. (2015). The evolution of fintech: A new post-crisis paradigm (Research Paper No. 2015/047). University of Hong Kong Faculty of Law. [Google Scholar] [CrossRef]

- Arner, D. W., Barberis, J., & Buckley, R. P. (2017). FinTech and RegTech in a nutshell, and the future in a sandbox. CFA Institute Research Foundation. [Google Scholar]

- Banna, H., Hassan, M. K., & Rashid, M. (2021). Fintech-based financial inclusion and bank risk-taking: Evidence from OIC countries. Journal of International Financial Markets, Institutions and Money, 75, 101447. [Google Scholar] [CrossRef]

- Barman, R. D., Hanfy, F. B., Rajendran, R., Masood, G., Dias, B., & Maroor, J. P. (2022). A critical review of determinants of financial innovation in global perspective. Materials Today: Proceedings, 51(2), 88–94. [Google Scholar] [CrossRef]

- Barney, J. B. (2000). Firm resources and sustained competitive advantage. In J. A. C. Baum, & F. Dobbin (Eds.), Economics meets sociology in strategic management (Vol. 17, pp. 203–227). Advances in Strategic Management. Emerald Group Publishing Limited. [Google Scholar]

- Belanche, D., Casaló, L. V., & Flavián, C. (2019). Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Industrial Management & Data Systems, 119(7), 1411–1430. [Google Scholar] [CrossRef]

- Berger, A. N., & Bouwman, C. H. (2009). Bank liquidity creation. Review of Financial Studies, 22(9), 3779–3837. [Google Scholar] [CrossRef]

- Boot, A., Hoffmann, P., Laeven, L., & Ratnovski, L. (2021). Fintech: What’s old, what’s new? Journal of Financial Stability, 53(3), 100836. [Google Scholar] [CrossRef]

- Broby, D. (2021). Financial technology and the future of banking. Financial Innovation, 7(1), 47. [Google Scholar] [CrossRef]

- Brunnermeier, M. K., & Oehmke, M. (2013). Bubbles, financial crises, and systemic risk. Handbook of the Economics of Finance, 2, 1221–1288. [Google Scholar] [CrossRef]

- Buchak, G., Matvos, G., Piskorski, T., & Seru, A. (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. Journal of Financial Economics, 130(3), 453–483. [Google Scholar] [CrossRef]

- Cheng, M., & Qu, Y. (2020). Does bank FinTech reduce credit risk? Evidence from China. Pacific-Basin Finance Journal, 63(3), 101398. [Google Scholar] [CrossRef]

- Corbet, S., Cumming, D. J., Hou, Y. G., Hu, Y., & Oxley, L. (2022). Have crisis-induced banking supports influenced European bank performance, resilience and price discovery? Journal of International Financial Markets, Institutions and Money, 78, 101566. [Google Scholar] [CrossRef]

- Corbet, S., Hou, Y., Hu, Y., & Oxley, L. (2020). The influence of the COVID-19 pandemic on asset-price discovery: Testing the case of Chinese informational asymmetry. International Review of Financial Analysis, 72(7), 101560. [Google Scholar] [CrossRef]

- Cornett, M. M., McNutt, J. J., Strahan, P. E., & Tehranian, H. (2011). Liquidity risk management and credit supply in the financial crisis. Journal of Financial Economics, 101(2), 297–312. [Google Scholar] [CrossRef]

- Cumming, D. J., & Schwienbacher, A. (2021). Fintech venture capital. In K. T. Liaw (Ed.), The Routledge handbook of FinTech (pp. 11–37). Routledge. [Google Scholar] [CrossRef]

- Deng, L., Lv, Y., Liu, Y., & Zhao, Y. (2021). Impact of fintech on bank risk-taking: Evidence from China. Risks, 9(5), 99. [Google Scholar] [CrossRef]

- Diamond, D. W., & Rajan, R. G. (2001). Liquidity risk, liquidity creation, and financial fragility: A theory of banking. Journal of Political Economy, 109(2), 287–327. [Google Scholar] [CrossRef]

- Ding, N., Gu, L., & Peng, Y. (2022). Fintech, financial constraints and innovation: Evidence from China. Journal of Corporate Finance, 73, 102194. [Google Scholar] [CrossRef]

- Dwivedi, P., Alabdooli, J. I., & Dwivedi, R. (2021). Role of FinTech adoption for competitiveness and performance of the bank: A study of banking industry in UAE. International Journal of Global Business and Competitiveness, 16(2), 130–138. [Google Scholar] [CrossRef]

- Ediagbonya, V., & Tioluwani, C. (2023). The role of fintech in driving financial inclusion in developing and emerging markets: Issues, challenges and prospects. Technological Sustainability, 2(1), 100–119. [Google Scholar] [CrossRef]

- Fang, Y., Wang, Q., Wang, F., & Zhao, Y. (2023). Bank fintech, liquidity creation, and risk-taking: Evidence from China. Economic Modelling, 127, 106445. [Google Scholar] [CrossRef]

- Field, A. (2013). Discovering statistics using IBM SPSS statistics. SAGE Publications. [Google Scholar]

- Frederiks, E. R., Stenner, K., & Hobman, E. V. (2015). Household energy use: Applying behavioural economics to understand consumer decision-making and behaviour. Renewable and Sustainable Energy Reviews, 41, 1385–1394. [Google Scholar] [CrossRef]

- Frost, J. (2020). The economic forces driving fintech adoption across countries. Bank for International Settlements. [Google Scholar]

- Fuster, A., Plosser, M., Schnabl, P., & Vickery, J. (2019). The role of technology in mortgage lending. Review of Financial Studies, 32(5), 1854–1899. [Google Scholar] [CrossRef]

- Gabor, D., & Brooks, S. (2020). The digital revolution in financial inclusion: International development in the fintech era. In K. Bayliss, B. Fine, & M. Robertson (Eds.), Material cultures of financialisation (pp. 69–82). Routledge. [Google Scholar]

- Ghosh, S., Pareek, R., & Sahu, T. N. (2023). U-shaped relationship between environmental performance and financial performance of non-financial companies: An empirical assessment. Corporate Social Responsibility and Environmental Management, 30(4), 1805–1815. [Google Scholar] [CrossRef]

- Gomber, P., Koch, J. A., & Siering, M. (2017). Digital finance and FinTech: Current research and future research directions. Journal of Business Economics, 87, 537–580. [Google Scholar] [CrossRef]

- Goralski, M. A., & Tan, T. K. (2020). Artificial intelligence and sustainable development. International Journal of Management Education, 18(1), 100330. [Google Scholar] [CrossRef]

- Greene, W. H. (2018). Econometric analysis (8th ed.). Pearson. [Google Scholar]

- Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate data analysis. Pearson. [Google Scholar]

- Halimi, F. F., Gabarre, S., Rahi, S., Al-Gasawneh, J. A., & Ngah, A. H. (2022). Modelling Muslims’ revisit intention of non-halal certified restaurants in Malaysia. Journal of Islamic Marketing, 13(11), 2437–2461. [Google Scholar] [CrossRef]

- Hamadien, A. M. (2022). Understanding factors facilitating the diffusion of financial technology (FinTech): A case study of the Gulf Cooperation Council [Doctoral dissertation, University of Bradford]. Bradscholars. Available online: http://hdl.handle.net/10454/19901 (accessed on 31 March 2025).

- Jameaba, M. S. (2020). Digitization revolution, FinTech disruption, and financial stability: Using the case of Indonesian banking ecosystem to highlight wide-ranging digitization opportunities and major challenges. Available online: https://ssrn.com/abstract=3529924 (accessed on 25 December 2024).

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. [Google Scholar] [CrossRef]

- Jović, Ž., & Nikolić, I. (2022). The darker side of fintech: The emergence of new risks. Zagreb International Review of Economics & Business, 25(S1), 46–63. [Google Scholar] [CrossRef]

- Khan, H. H., Khan, S., & Ghafoor, A. (2023). Fintech adoption, the regulatory environment and bank stability: An empirical investigation from GCC economies. Borsa Istanbul Review, 23(6), 1263–1281. [Google Scholar] [CrossRef]

- Kharrat, H., Trichilli, Y., & Abbes, B. (2024). Relationship between FinTech index and bank’s performance: A comparative study between Islamic and conventional banks in the MENA region. Journal of Islamic Accounting and Business Research, 15(1), 172–195. [Google Scholar] [CrossRef]

- Kharroubi, S. G. (2015). Why does financial sector growth crowd out real economic growth? Bank for International Settlements. Available online: https://www.bis.org/publ/work490.pdf (accessed on 31 March 2025).

- Kline, R. B. (2023). Principles and practice of structural equation modeling. Guilford Publications. [Google Scholar]

- Kyriazis, N., Papadamou, S., & Corbet, S. (2020). A systematic review of the bubble dynamics of cryptocurrency prices. Research in International Business and Finance, 54, 101254. [Google Scholar] [CrossRef]

- Kyriazis, N., Papadamou, S., Tzeremes, P., & Corbet, S. (2023). Can cryptocurrencies provide a viable hedging mechanism for benchmark index investors? Research in International Business and Finance, 64, 101832. [Google Scholar] [CrossRef]

- Lescrauwaet, L., Wagner, H., Yoon, C., & Shukla, S. (2022). Adaptive legal frameworks and economic dynamics in emerging technologies: Navigating the intersection for responsible innovation. Law and Economics, 16(3), 202–220. [Google Scholar] [CrossRef]

- Li, C., He, S., Tian, Y., Sun, S., & Ning, L. (2022). Does the bank’s FinTech innovation reduce its risk-taking? Evidence from China’s banking industry. Journal of Innovation & Knowledge, 7(3), 100219. [Google Scholar] [CrossRef]

- Lv, P., & Xiong, H. (2022). Can FinTech improve corporate investment efficiency? Evidence from China. Research in International Business and Finance, 60, 101571. [Google Scholar] [CrossRef]

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81, 102103. [Google Scholar] [CrossRef]

- Musleh Alsartawi, A. (2024). The diffusion of financial technology-enabled innovation in GCC-listed banks and its relationship with profitability and market value. Journal of Financial Reporting and Accounting. Advanced online publication. [Google Scholar] [CrossRef]

- Notheisen, B., Cholewa, J. B., & Shanmugam, A. P. (2017). Trading real-world assets on blockchain: An application of trust-free transaction systems in the market for lemons. Business & Information Systems Engineering, 59, 425–440. [Google Scholar] [CrossRef]

- Odinet, C. K. (2020). Predatory fintech and the politics of banking. Iowa Law Review, 106, 1739–1800. [Google Scholar]

- Philippon, T. (2016). The fintech opportunity (Working Paper No. w22476). National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Qiu, H., Huang, Y. P., & Ji, Y. (2018). How does FinTech development affect traditional banking in China? The perspective of online wealth management products. Journal of Financial Research, 11, 17–29. [Google Scholar]

- Roodman, D. (2009). A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 135–158. [Google Scholar] [CrossRef]

- Saif-Alyousfi, A. Y. H. (2025). The impact of COVID-19 on foreign direct investment in Arab economies. Journal of Islamic Accounting and Business Research. Advanced online publication. [Google Scholar] [CrossRef]

- Semwayo, J. (2024). Information-technology-aided customer relationship management strategies for improving financial institutions’ business performance [Doctoral dissertation, Walden University]. Walden Dissertations and Doctoral Studies. Available online: https://scholarworks.waldenu.edu/dissertations/16510 (accessed on 31 March 2025).

- Stulz, R. M. (2019). Fintech, bigtech, and the future of banks. Journal of Applied Corporate Finance, 31(4), 86–97. [Google Scholar] [CrossRef]

- Tang, M., Hu, Y., Corbet, S., Hou, Y. G., & Oxley, L. (2024). Fintech, bank diversification and liquidity: Evidence from China. Research in International Business and Finance, 67(A), 102082. [Google Scholar] [CrossRef]

- Thompson, B. S. (2017). Can financial technology innovate benefit distribution in payments for ecosystem services and REDD+? Ecological Economics, 139, 150–157. [Google Scholar] [CrossRef]

- Van Loo, R. (2018, March 23). Making innovation more competitive: The case of fintech. UCLA Law Review. Available online: https://www.uclalawreview.org/making-innovation-competitive-case-fintech/ (accessed on 31 March 2025).

- Varian, H. R. (2014). Intermediate microeconomics: A modern approach (9th ed.). W. W. Norton & Company. [Google Scholar]

- Vazquez, F., & Federico, P. (2015). Bank funding structures and risk: Evidence from the global financial crisis. Journal of Banking & Finance, 61, 1–14. [Google Scholar]

- Wang, R., Liu, J., & Luo, H. (2021). Fintech development and bank risk taking in China. European Journal of Finance, 27(4–5), 397–418. [Google Scholar] [CrossRef]

- Wang, Y., Sui, X., & Zhang, Q. (2021). Can fintech improve the efficiency of commercial banks?—An analysis based on big data. Research in International Business and Finance, 55, 101338. [Google Scholar] [CrossRef]

- Wang, Y., & Wen, H. (2024). Digital finance, digital transformation, and the development of off-balance sheet activities by commercial banks. Systems, 12(8), 301. [Google Scholar] [CrossRef]

- Wu, Z., Pathan, S., & Zheng, C. (2024). FinTech adoption in banks and their liquidity creation. British Accounting Review, 101322, Advanced online publication. [Google Scholar] [CrossRef]

- Yang, L., & Wang, S. (2022). Do fintech applications promote regional innovation efficiency? Empirical evidence from China. Socio-Economic Planning Sciences, 83, 101258. [Google Scholar] [CrossRef]

- Zhao, J., Li, X., Yu, C. H., Chen, S., & Lee, C. C. (2022). Riding the FinTech innovation wave: FinTech, patents and bank performance. Journal of International Money and Finance, 122, 102552. [Google Scholar] [CrossRef]

| Variables | Obs | Mean | SD | Min | Max | Skew | Kurt |

|---|---|---|---|---|---|---|---|

| FINTCH | 156 | 0.001 | 0.001 | 0 | 0.004 | 0.746 | 2.797 |

| NSFR | 156 | 1.201 | 0.178 | 0.858 | 1.7 | 0.877 | 3.419 |

| LEVE | 156 | 0.106 | 0.038 | 0.013 | 0.173 | −0.708 | 3.661 |

| LCR | 156 | 2.112 | 0.811 | 0.957 | 4.535 | 0.903 | 3.273 |

| CAD | 156 | 0.188 | 0.034 | 0.137 | 0.281 | 1.171 | 4.37 |

| ROE | 156 | 0.083 | 0.063 | −0.139 | 0.177 | −1.237 | 5.524 |

| SIZ | 156 | 10.124 | 0.687 | 8.036 | 11.507 | −0.711 | 4.739 |

| AGE | 156 | 46.065 | 11.689 | 14 | 68 | −0.902 | 3.748 |

| INAF | 156 | 0.019 | 0.019 | −0.025 | 0.05 | −0.794 | 2.777 |

| GDP | 156 | 0.012 | 0.04 | −0.053 | 0.075 | −0.27 | 1.806 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (8) | (9) | (10) | (11) | VIF |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) NSFR | 1.000 | ||||||||||

| (2) FINTCH | −0.062 | 1.000 | 1.45 | ||||||||

| (3) LCR | 0.354 | −0.154 | 1.000 | 1.40 | |||||||

| (4) LEVE | 0.051 | −0.059 | 0.155 | 1.000 | |||||||

| (5) SIZ | 0.174 | 0.444 | −0.126 | −0.152 | 1.000 | 1.48 | |||||

| (6) ROE | 0.146 | −0.086 | 0.147 | 0.073 | −0.208 | 1.000 | 1.48 | ||||

| (8) CAD | 0.547 | 0.038 | 0.478 | 0.357 | −0.017 | 0.224 | 1.000 | 1.61 | |||

| (9) INF | −0.192 | 0.027 | 0.008 | 0.066 | −0.140 | 0.222 | −0.034 | 1.000 | 1.32 | ||

| (10) AGE | −0.006 | −0.191 | 0.184 | 0.032 | −0.344 | 0.065 | 0.080 | 0.079 | 1.000 | 0.85 | |

| (11) GDP | −0.038 | 0.079 | −0.112 | −0.053 | 0.110 | 0.015 | 0.027 | 0.322 | −0.024 | 1.000 | 1.38 |

| Variables | Coef. | t-Value | Sig |

|---|---|---|---|

| FINTECH | −0.14 | 2.0 | ** |

| SIZ | −0.007 | 2.10 | ** |

| INAF | 0.87 | 0.26 | |

| GDP | −0.002 | 1.91 | * |

| LCR | −0.251 | 1.59 | |

| ROE | 0.053 | 1.60 | |

| CAAD | 0.087 | 2.30 | * |

| AGE | 0.01 | 1.9 | * |

| FINTECH*SIZ | 0.076 | 2.34 | ** |

| ADV-COUNT | 0.064 | 2.44 | ** |

| CON | 0.97 | 0.52 | |

| Mean dependent var | 1.201 | SD dependent var | 0.178 |

| R-squared | 0.45 | Number of obs | 156 |

| F-test | 1.95 | Prob > F | 0.00 |

| Breusch–Pagan test | 279.20 * | Hausman test | 72.8 * |

| Variables | Coef. | t-Value | Sig |

|---|---|---|---|

| FINTECH | −0.116 | 1.92 | * |

| SIZ | −0.007 | 2.10 | ** |

| INAF | 0.87 | 0.26 | |

| GDP | −0.002 | 1.91 | * |

| LCR | −0.251 | 1.59 | |

| ROE | 0.053 | 1.60 | |

| CAAD | 0.087 | 2.30 | * |

| AGE | 0.01 | 1.9 | * |

| ADV-COUNT | 0.060 | 2.34 | * |

| FINTECH*ADV-COUNT | 0.092 | 2.60 | ** |

| CON | 0.97 | 0.52 | |

| Mean dependent var | 1.201 | SD dependent var | 0.178 |

| R-squared | 0.45 | Number of obs | 156 |

| F-test | 2.05 | Prob > F | 0.00 |

| Breusch–Pagan Test | 279.20 | Hausman test | 72.8 |

| Variables | Coef. | t-Value | Sig |

|---|---|---|---|

| FINTECH | −0.27 | 2.2 | * |

| SIZ | −0.002 | 1.97 | * |

| INAF | −0.025 | −0.38 | |

| GDP | 0.070 | 2.22 | * |

| LCR | 0.47 | 1.79 | * |

| ROE | −0.267 | −1.22 | |

| CAAD | −0.002 | −1.70 | * |

| AGE | −0.02 | −1.7 | * |

| FINTECH*SIZ | −0.050 | 1.74 | * |

| ADV-COUNT | 0.1 | 2.01 | ** |

| CON | 0.37 | 0.62 | |

| Mean dependent var | 0.106 | SD dependent var | 0.038 |

| R-squared | 0.40 | Number of obs | 156 |

| F-test | 1.76 | Prob > F | 0.00 |

| Breusch–Pagan test | 179.20 * | Hausman test | 58 * |

| Variables | Coef. | t-Value | Sig |

|---|---|---|---|

| NSFRt-1 | 0.67 | 2.08 | ** |

| FINTCH | −1.51 | 2.04 | ** |

| SIZ | −0.02 | −1.50 | * |

| INAF | 0.46 | 0.22 | * |

| AGE | 0.003 | 1.78 | * |

| GDP | −0.201 | −1.21 | |

| LCR | −0.02 | −0.64 | * |

| CAD | 0.54 | 0.52 | ** |

| ROE | 0.110 | 1.21 | |

| FINTECH*SIZ | 0.084 | 1.99 | ** |

| ADV-COUNT | 0.12 | 1.95 | ** |

| Constant | 0.011 | 0.61 | |

| Hansen | 0.98 | No. groups | 26 |

| AR(1) | 2.05 | No. instruments | 15 |

| AR(2) | 0.88 | ||

| No. of obs | 130 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alshouha, L.; Khasawneh, O.; Alshannag, F.; Al Tanbour, K. Nexus Between Fintech Innovations and Liquidity Risk in GCC Banks: The Moderating Role of Bank Size. J. Risk Financial Manag. 2025, 18, 226. https://doi.org/10.3390/jrfm18050226

Alshouha L, Khasawneh O, Alshannag F, Al Tanbour K. Nexus Between Fintech Innovations and Liquidity Risk in GCC Banks: The Moderating Role of Bank Size. Journal of Risk and Financial Management. 2025; 18(5):226. https://doi.org/10.3390/jrfm18050226

Chicago/Turabian StyleAlshouha, Laith, Ohoud Khasawneh, Fadi Alshannag, and Khalid Al Tanbour. 2025. "Nexus Between Fintech Innovations and Liquidity Risk in GCC Banks: The Moderating Role of Bank Size" Journal of Risk and Financial Management 18, no. 5: 226. https://doi.org/10.3390/jrfm18050226

APA StyleAlshouha, L., Khasawneh, O., Alshannag, F., & Al Tanbour, K. (2025). Nexus Between Fintech Innovations and Liquidity Risk in GCC Banks: The Moderating Role of Bank Size. Journal of Risk and Financial Management, 18(5), 226. https://doi.org/10.3390/jrfm18050226