International Diversification Versus Domestic Diversification: Mean-Variance Portfolio Optimization and Stochastic Dominance Approaches

Abstract

:1. Introduction

2. Literature Review

2.1. Portfolio Optimization

2.2. Stochastic Dominance

2.3. International Versus Domestic Diversification Benefits

3. Data, Methodology and Hypotheses

3.1. Data

| 1 | Apple (AAPL) | 16 | Citigroup (C) |

| 2 | Exxon Mobil (XOM) | 17 | Merck (MRK) |

| 3 | Microsoft (MSFT) | 18 | Verizon Communications (VZ) |

| 4 | Johnson & Johnson (JNJ) | 19 | Cisco Systems (CSCO) |

| 5 | General Electric (GE) | 20 | PepsiCo (PEP) |

| 6 | Wal-Mart (WMT) | 21 | Schlumberger (SLB) |

| 7 | Chevron (CVX) | 22 | Disney (DIS) |

| 8 | Wells Fargo (WFC) | 23 | JPMorgan Chase (JPM) |

| 9 | Procter & Gamble (PG) | 24 | Intel (INTC) |

| 10 | IBM (IBM) | 25 | Home Depot (HD) |

| 11 | Pfizer (PFE) | 26 | United Technologies (UTX) |

| 12 | AT&T (T) | 27 | McDonald’s (MCD) |

| 13 | Coca-Cola (KO) | 28 | Boeing (BA) |

| 14 | Bank of America (BAC) | 29 | ConocoPhillips (COP) |

| 15 | Oracle (ORCL) | 30 | Amgen (AMGN) |

3.2. Portfolio Optimization

. More precisely, assuming that there are n assets, we denote Ri to be the expected return of asset i and σij to be the covariance of returns between asset i and asset j for i,j = 1,…, n. Given the required level of risk,

. More precisely, assuming that there are n assets, we denote Ri to be the expected return of asset i and σij to be the covariance of returns between asset i and asset j for i,j = 1,…, n. Given the required level of risk,  , for the portfolio, the classical PO model without short selling can be formulated as follows:

, for the portfolio, the classical PO model without short selling can be formulated as follows:

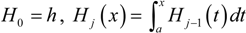

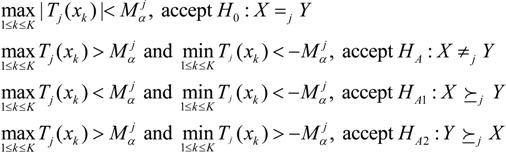

3.3. Stochastic Dominance Test

in which Fj and Gj are defined in (1), and (x)+ = {x,0}.

in which Fj and Gj are defined in (1), and (x)+ = {x,0}.- H0 : Fj (xi) = Gj (xi), for all xi, i = 1,2,...,k;

- HA : Fj (xi) ≠ Gj (xi) for some xi;

- HA1 : Fj (xi) ≤ Gj (xi) for all xi, Fj (xi) < Gj (xi) for some xi;

- HA2 : Fj (xi) ≥ Gj (xi) for all xi, Fj (xi) > Gj (xi) for some xi.

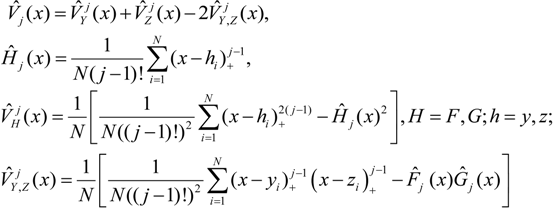

is the bootstrapped critical value of the j-order DD statistic. In this paper, we follow their recommendation to use simulated critical values in our analysis. We also follow their recommendation to use the maximum values of the test statistics to draw conclusions. However, since computing each grid point for the entire sample would entail a lot of computer time, we specify K equal-interval grid points {xk,k = 1,2,…,K} to cover the common support of random samples {Xi} and {Yi}, with K = 100 as recommended by Fong, Wong, and Lean [56], Gasbarro, Wong, and Zumwalt [22], and others. Simulation shows that the performance of the modified DD statistics is not sensitive to the number of grid points if the number of grid points is reasonably large, such as K = 100.

is the bootstrapped critical value of the j-order DD statistic. In this paper, we follow their recommendation to use simulated critical values in our analysis. We also follow their recommendation to use the maximum values of the test statistics to draw conclusions. However, since computing each grid point for the entire sample would entail a lot of computer time, we specify K equal-interval grid points {xk,k = 1,2,…,K} to cover the common support of random samples {Xi} and {Yi}, with K = 100 as recommended by Fong, Wong, and Lean [56], Gasbarro, Wong, and Zumwalt [22], and others. Simulation shows that the performance of the modified DD statistics is not sensitive to the number of grid points if the number of grid points is reasonably large, such as K = 100. states that the IND dominates the DOD portfolio, G ≽j F, at order j.

states that the IND dominates the DOD portfolio, G ≽j F, at order j.4. Empirical Results

4.1. Portfolio Optimization

| Mean (µ) | Std Dev (σ) | CV (σ/µ) | Skewness | Kurtosis | |

|---|---|---|---|---|---|

| DOD1 | 0.00048 | 0.00973 | 20.26 | 0.19096 | 9.21767 |

| DOD2 | 0.00055 | 0.00997 | 18.01 | 0.15212 | 8.61416 |

| DOD3 | 0.00063 | 0.01059 | 16.88 | 0.10630 | 7.39123 |

| DOD4 | 0.00070 | 0.01159 | 16.53 | 0.07693 | 6.09004 |

| DOD5 | 0.00077 | 0.01295 | 16.72 | 0.06230 | 5.29170 |

| DOD6 | 0.00085 | 0.01459 | 17.19 | 0.03572 | 4.87478 |

| DOD7 | 0.00092 | 0.01645 | 17.84 | 0.02482 | 4.73178 |

| DOD8 | 0.00010 | 0.01851 | 18.58 | 0.03847 | 4.94001 |

| DOD9 | 0.00107 | 0.02093 | 19.57 | 0.03114 | 5.46898 |

| DOD10 | 0.00114 | 0.02371 | 20.73 | 0.02005 | 5.95474 |

| Mean (µ) | Std Dev (σ) | CV (σ/µ) | Skewness | Kurtosis | |

|---|---|---|---|---|---|

| IND1 | 0.00032 | 0.00684 | 21.53 | −0.21007 | 5.04703 |

| IND2 | 0.00038 | 0.00712 | 18.92 | −0.18726 | 4.45829 |

| IND3 | 0.00044 | 0.00799 | 18.36 | −0.15911 | 3.76602 |

| IND4 | 0.00050 | 0.00973 | 19.34 | −0.12344 | 3.49837 |

| IND5 | 0.00051 | 0.00997 | 19.54 | −0.11918 | 3.54673 |

| IND6 | 0.00052 | 0.01059 | 20.04 | −0.10654 | 3.72651 |

| IND7 | 0.00055 | 0.01159 | 20.93 | −0.05806 | 3.88917 |

| IND8 | 0.00059 | 0.01294 | 22.00 | −0.04853 | 4.43614 |

| IND9 | 0.00063 | 0.01459 | 23.30 | −0.00687 | 4.79284 |

| IND10 | 0.00066 | 0.01645 | 24.74 | 0.01599 | 5.32968 |

| IND11 | 0.00071 | 0.01851 | 2609.17 | 0.07545 | 5.83010 |

| IND12 | 0.00076 | 0.02093 | 27.69 | 0.10862 | 6.26873 |

| IND13 | 0.00081 | 0.02371 | 29.39 | 0.13647 | 6.54289 |

4.2. Stochastic Dominance

| Portfolios | IND1 | IND2 | IND3 | IND4 | IND5 | IND6 | IND7 | IND8 | IND9 | IND10 | IND11 | IND12 | IND13 | SSD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DOD1 | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 8 | |||

| DOD2 | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 8 | |||

| DOD3 | ND | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 7 | |||

| DOD4 | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | 6 | |||||

| DOD5 | ND | SSD | SSD | SSD | SSD | SSD | 5 | |||||||

| DOD6 | ND | SSD | SSD | SSD | SSD | 4 | ||||||||

| DOD7 | ND | SSD | SSD | SSD | 3 | |||||||||

| DOD8 | ND | SSD | SSD | 2 | ||||||||||

| DOD9 | ND | SSD | 1 | |||||||||||

| DOD10 | ND | 0 | ||||||||||||

| SSD | 0 | 0 | 0 | 0 | 0 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Portfolios | DOD1 | DOD2 | DOD3 | DOD4 | DOD5 | DOD6 | DOD7 | DOD8 | DOD9 | DOD10 | SSD | TSD | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IND1 | SSD | SSD | SSD | SSD | SSD | SSD | TSD | SSD | TSD | TSD | 7 | 3 | 10 |

| IND2 | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 10 | 0 | 10 |

| IND3 | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 10 | 0 | 10 |

| IND4 | ND | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 7 | 0 | 7 |

| IND5 | ND | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | SSD | 7 | 0 | 7 |

| IND6 | ND | ND | SSD | SSD | SSD | SSD | SSD | SSD | 6 | 0 | 6 | ||

| IND7 | ND | SSD | SSD | SSD | SSD | SSD | SSD | 6 | 0 | 6 | |||

| IND8 | ND | SSD | SSD | SSD | SSD | SSD | 5 | 0 | 5 | ||||

| IND9 | ND | SSD | SSD | SSD | SSD | 4 | 0 | 4 | |||||

| IND10 | ND | SSD | SSD | SSD | 3 | 0 | 3 | ||||||

| IND11 | ND | SSD | SSD | 2 | 0 | 2 | |||||||

| IND12 | ND | SSD | 1 | 0 | 1 | ||||||||

| IND13 | ND | 0 | 0 | 0 | |||||||||

| SSD | 3 | 3 | 3 | 5 | 7 | 8 | 8 | 10 | 10 | 11 | |||

| TSD | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | |||

| Total | 3 | 3 | 3 | 5 | 7 | 8 | 9 | 10 | 11 | 12 | |||

| FSD | ||

| T1 > 0 | T1 < 0 | |

| Total (%) | 18.3 | 20.8 |

| Positive Domain (%) | 18.3 | 0 |

| Negative Domain (%) | 0 | 20.8 |

| Max (|Tj|) | 8.31 | 9.92 |

| SSD | ||

| T2 > 0 | T2 < 0 | |

| Total (%) | 39.9 | 0 |

| Positive Domain (%) | 39.9 | 0 |

| Negative Domain (%) | 0 | 0 |

| Max (|Tj|) | 8.53 | 0.63 |

| TSD | ||

| T3 > 0 | T3 < 0 | |

| Total (%) | 27.9 | 0 |

| Positive Domain (%) | 27.9 | 0 |

| Negative Domain (%) | 0 | 0 |

| Max (|Tj|) | 6.97 | NA |

| FSD | ||

| T1 > 0 | T1 < 0 | |

| Total (%) | 0 | 0 |

| Positive Domain (%) | 0 | 0 |

| Negative Domain (%) | 0 | 0 |

| Max (|Tj|) | 2.80 | 2.99 |

| SSD | ||

| T2 > 0 | T2 < 0 | |

| Total (%) | 0 | 0 |

| Positive Domain (%) | 0 | 0 |

| Negative Domain (%) | 0 | 0 |

| Max (|Tj|) | 1.88 | 2.12 |

| TSD | ||

| T3 > 0 | T3 < 0 | |

| Total (%) | 0 | 0 |

| Positive Domain (%) | 0 | 0 |

| Negative Domain (%) | 0 | 0 |

| Max (|Tj|) | 1.75 | 1.21 |

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- H. Markowitz. “Portfolio selection.” J. Financ. 7 (1952): 77–91. [Google Scholar]

- R.O. Michaud. “The Markowitz optimization enigma: Is “optimized” optimal? ” Financ. Anal. J. 45 (1989): 31–42. [Google Scholar] [CrossRef]

- Z.D. Bai, H.X. Liu, and W.K. Wong. “Enhancement of the applicability of Markowitz’s portfolio optimization by utilizing random matrix theory.” Math. Financ. 19 (2009): 639–667. [Google Scholar] [CrossRef]

- Z.D. Bai, H.X. Liu, and W.K. Wong. “On the Markowitz mean-variance analysis of self-financing portfolios.” Risk Decis. Anal. 1 (2009): 35–42. [Google Scholar]

- Z.D. Bai, H. Li, H.X. Liu, and W.K. Wong. “Test statistics for prospect and Markowitz stochastic dominances with applications.” Econom. J. 14 (2011): 278–303. [Google Scholar] [CrossRef]

- P.L. Leung, H.Y. Ng, and W.K. Wong. “An improved estimation to make Markowitz’s portfolio optimization theory practically useful and users friendly.” Eur. J. Oper. Res. 222 (2012): 85–95. [Google Scholar] [CrossRef]

- R.B. Porter, and J.E. Gaumnitz. “Stochastic dominance vs. mean-variance portfolio analysis: An empirical evaluation.” Am. Econ. Rev. 62 (1972): 438–446. [Google Scholar]

- J. Glen, and P. Jorion. “Currency hedging for international portfolios.” J. Financ. 48 (1993): 1865–1886. [Google Scholar] [CrossRef]

- S. Ross. “Some stronger measures of risk aversion in the small and the large with applications.” Econometrica 49 (1981): 621–638. [Google Scholar] [CrossRef]

- W.K. Wong. “Stochastic dominance and mean-variance measures of profit and loss for business planning and investment.” Eur. J. Oper. Res. 182 (2007): 829–843. [Google Scholar] [CrossRef]

- P.L. Leung, and W.K. Wong. “On testing the equality of the multiple Sharpe ratios, with application on the evaluation of iShares.” J. Risk 10 (2008): 1–16. [Google Scholar]

- C. Ma, and W.K. Wong. “Stochastic dominance and risk measure: A decision-theoretic foundation for VaR and C-VaR.” Eur. J. Oper. Res. 207 (2010): 927–935. [Google Scholar] [CrossRef]

- Z.D. Bai, K.F. Phoon, K.Y. Wang, and W.K. Wong. “The performance of commodity trading advisors: A mean-variance-ratio test approach.” N. Am. J. Econ. Financ. 25 (2013): 188–201. [Google Scholar] [CrossRef]

- Z.D. Bai, Y.C. Hui, W.K. Wong, and R. Zitikis. “Evaluating prospect performance: Making a case for a non-asymptotic UMPU test.” J. Financ. Econ. 10 (2012): 703–732. [Google Scholar]

- J. Hadar, and S. Russel. “Rules for ordering uncertain prospects.” Am. Econ. Rev. 59 (1969): 25–34. [Google Scholar]

- H. Levy. “Stochastic dominance and expected utility: Survey and analysis.” Manag. Sci. 38 (1992): 555–593. [Google Scholar] [CrossRef]

- C.K. Li, and W.K. Wong. “Extension of stochastic dominance theory to random variables RAIRO.” Rech. Opér. 33 (1999): 509–524. [Google Scholar]

- C. Hodges, and J. Yoder. “Time diversification and security preferences: A stochastic dominance analysis.” Rev. Quant. Financ. Account. 7 (1996): 289–298. [Google Scholar] [CrossRef]

- O.T. Meyer, X.M. Li, and C.L. Rose. “Comparing mean variance tests with stochastic dominance tests when assessing international portfolio diversification benefits.” Financ. Serv. Rev. 14 (2005): 149–168. [Google Scholar]

- W.K. Wong, H.E. Thompson, S. Wei, and Y.F. Chow. “Do winners perform better than losers? A stochastic dominance approach.” Adv. Quant. Anal. Financ. Account. 4 (2006): 219–254. [Google Scholar] [CrossRef]

- H.H. Lean, R. Smyth, and W.K. Wong. “Revisiting calendar anomalies in Asian stock markets using a stochastic dominance approach.” J. Multinatl. Financ. Manag. 17 (2007): 125–141. [Google Scholar] [CrossRef]

- D. Gasbarro, W.K. Wong, and J.K. Zumwalt. “Stochastic dominance analysis of iShares.” Eur. J. Financ. 13 (2007): 89–101. [Google Scholar] [CrossRef]

- W.M. Fong, W.K. Wong, and H.H. Lean. “Stochastic dominance and the rationality of the momentum effect across markets.” J. Financ. Mark. 8 (2005): 89–109. [Google Scholar]

- W.K. Wong, K.F. Phoon, and H.H. Lean. “Stochastic dominance analysis of Asian hedge funds.” Pac. Basin Financ. J. 16 (2008): 204–223. [Google Scholar] [CrossRef]

- A. Abhyankar, K. Ho, and H. Zhao. “International value versus growth: Evidence from stochastic dominance analysis.” Int. J. Financ. Econ. 14 (2009): 222–232. [Google Scholar] [CrossRef]

- F. Abid, M. Mroua, and W.K. Wong. “Impact of option strategies in financial portfolios performance: Mean-variance and stochastic dominance approaches.” Financ. India 23 (2009): 503–526. [Google Scholar]

- H.H. Lean, M. McAleer, and W.K. Wong. “Market efficiency of oil spot and futures: A mean-variance and stochastic dominance approach.” Energy Econ. 32 (2010): 979–986. [Google Scholar] [CrossRef]

- C.Y. Chan, C. De Peretti, Z. Qiao, and W.K. Wong. “Empirical test of the efficiency of UK covered warrants market: Stochastic dominance and likelihood ratio test approach.” J. Empir. Financ. 19 (2012): 162–174. [Google Scholar] [CrossRef]

- Z. Qiao, E. Clark, and W.K. Wong. “Investors’ preference towards risk: Evidence from the Taiwan stock and stock index futures markets.” Account. Financ. 54 (2012): 251–274. [Google Scholar] [CrossRef]

- B. Solnik. “Why not diversify internationally rather than domestically? ” Financ. Anal. J. 68 (1995): 89–94. [Google Scholar] [CrossRef]

- C.S. Eun, and B.G. Resnick. “International diversification of investment portfolios: U.S. and Japanese perspectives.” Manag. Sci. 40 (1994): 140–161. [Google Scholar] [CrossRef]

- K. Li, A. Sarkar, and Z. Wang. “Diversification benefits of emerging markets subject to portfolio constraints.” J. Empir. Financ. 10 (2003): 57–80. [Google Scholar] [CrossRef]

- T.O. Meyer, and L.C. Rose. “The persistence of international diversification benefits before and during the Asian crisis.” Glob. Financ. J. 14 (2003): 217–242. [Google Scholar] [CrossRef]

- F. Carrieri, V. Errunza, and S. Sarkissian. “Industry risk and market integration.” Manag. Sci. 50 (2004): 207–221. [Google Scholar] [CrossRef]

- J. Driessen, and L. Laeven. “International portfolio diversification benefits: Cross-country evidence from a local perspective.” J. Bank. Financ. 31 (2007): 1693–1712. [Google Scholar] [CrossRef]

- W.-J.P. Chiou. “Benefits of international diversification with investment constraints: An over-time perspective.” J. Multinatl. Financ. Manag. 19 (2009): 93–110. [Google Scholar] [CrossRef]

- C. Eun, S. Lai, F. Roon, and Z. Zhang. “International diversification with factor funds.” Manag. Sci. 56 (2010): 1500–1518. [Google Scholar] [CrossRef]

- K. French, and J. Poterba. “Investor diversification and international equity markets.” Am. Econ. Rev. 81 (1991): 222–226. [Google Scholar]

- L. Tesar, and I. Werner. “Home bias and high turnover.” J. Int. Money Financ. 14 (1995): 467–492. [Google Scholar] [CrossRef]

- K. Lewis. “Trying to explain home bias in equities and consumption.” J. Econ. Lit. 37 (1999): 571–608. [Google Scholar] [CrossRef]

- M. Kilka, and M. Weber. “Home bias in international stock return expectations.” J. Behav. Financ. 1 (2000): 176–192. [Google Scholar]

- A. Oehler, M. Rummer, and S. Wendt. “Portfolio Selection of German Investors: On the Causes of Home-Biased Investment Decisions.” J. Behav. Financ. 9 (2008): 149–162. [Google Scholar] [CrossRef]

- A. Antoniou, O. Olusi, and K. Paudyal. “Equity home-bias: A suboptimal choice for UK investors? ” Eur. Financ. Manag. 16 (2010): 449–479. [Google Scholar] [CrossRef]

- Z. Qiao, T.C. Chiang, and W.K. Wong. “Long-run equilibrium, short-term adjustment, and spillover effects across Chinese segmented stock markets.” J. Int. Financ. Mark. Inst. Money 18 (2008): 425–437. [Google Scholar] [CrossRef]

- G. Hanoch, and H. Levy. “The efficiency analysis of choices involving risk.” Rev. Econ. Stud. 36 (1969): 335–346. [Google Scholar] [CrossRef]

- W.K. Wong, and R.H. Chan. “Markowitz and prospect stochastic dominances.” Ann. Financ. 4 (2008): 105–129. [Google Scholar] [CrossRef]

- S. Sriboonchita, W.K. Wong, S. Dhompongsa, and H.T. Nguyen. Stochastic Dominance and Applications to Finance, Risk and Economics. Boca Raton, FL, USA: Chapman and Hall/CRC, 2009. [Google Scholar]

- W.K. Wong, and C.K. Li. “A note on convex stochastic dominance theory.” Econ. Lett. 62 (1999): 293–300. [Google Scholar] [CrossRef]

- W.K. Wong, and C. Ma. “Preferences over location-scale family.” Econ. Theory 37 (2008): 119–146. [Google Scholar] [CrossRef]

- R. Jarrow. “The relationship between arbitrage and first order stochastic dominance.” J. Financ. 41 (1986): 915–921. [Google Scholar] [CrossRef]

- G. Barrett, and S. Donald. “Consistent tests for stochastic dominance.” Econometrica 71 (2003): 71–104. [Google Scholar]

- O. Linton, E. Maasoumi, and Y.-J. Whang. “Consistent testing for stochastic dominance under general sampling schemes.” Rev. Econ. Stud. 72 (2005): 735–765. [Google Scholar] [CrossRef]

- R. Davidson, and J.Y. Duclos. “Statistical inference for the measurement of the incidence of taxes and transfers.” Econometrica 52 (2000): 761–776. [Google Scholar]

- H.H. Lean, W.K. Wong, and X. Zhang. “Size and power of stochastic dominance tests.” Math. Comput. Simul. 79 (2008): 30–48. [Google Scholar] [CrossRef]

- H. Li, Z.D. Bai, M. McAleer, and W.K. Wong. “Stochastic dominance statistics for risk averters and risk seekers: An analysis of stock preferences for USA and China.” Quant. Financ. conditionally accepted. , 2014. [Google Scholar]

- W.M. Fong, H.H. Lean, and W.K. Wong. “Stochastic dominance and behavior towards risk: The market for internet stocks.” J. Econ. Behav. Organ. 68 (2008): 194–208. [Google Scholar] [CrossRef]

- U. Broll, M. Egozcue, W.K. Wong, and R. Zitikis. “Prospect theory, indifference curves, and hedging risks.” Appl. Math. Res. Express 2 (2010): 142–153. [Google Scholar]

- D. Gasbarro, W.K. Wong, and J.K. Zumwalt. “Stochastic dominance and behavior towards risk: The market for iShares.” Ann. Financ. Econ. 7 (2012): 1250005. [Google Scholar] [CrossRef]

- K. Lam, T.S. Liu, and W.K. Wong. “A pseudo-Bayesian model in financial decision making with implications to market volatility, under- and overreaction.” Eur. J. Oper. Res. 203 (2010): 166–175. [Google Scholar] [CrossRef]

- K. Lam, T.S. Liu, and W.K. Wong. “A new pseudo-Bayesian model with implications to financial anomalies and investors’ behaviors.” J. Behav. Financ. 13 (2012): 93–107. [Google Scholar] [CrossRef]

- F.J. Fabozzi, C.Y. Fung, K. Lam, and W.K. Wong. “Market overreaction and underreaction: Tests of the directional and magnitude effects.” Appl. Financ. Econ. 23 (2013): 1469–1482. [Google Scholar] [CrossRef]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Abid, F.; Leung, P.L.; Mroua, M.; Wong, W.K. International Diversification Versus Domestic Diversification: Mean-Variance Portfolio Optimization and Stochastic Dominance Approaches. J. Risk Financial Manag. 2014, 7, 45-66. https://doi.org/10.3390/jrfm7020045

Abid F, Leung PL, Mroua M, Wong WK. International Diversification Versus Domestic Diversification: Mean-Variance Portfolio Optimization and Stochastic Dominance Approaches. Journal of Risk and Financial Management. 2014; 7(2):45-66. https://doi.org/10.3390/jrfm7020045

Chicago/Turabian StyleAbid, Fathi, Pui Lam Leung, Mourad Mroua, and Wing Keung Wong. 2014. "International Diversification Versus Domestic Diversification: Mean-Variance Portfolio Optimization and Stochastic Dominance Approaches" Journal of Risk and Financial Management 7, no. 2: 45-66. https://doi.org/10.3390/jrfm7020045

APA StyleAbid, F., Leung, P. L., Mroua, M., & Wong, W. K. (2014). International Diversification Versus Domestic Diversification: Mean-Variance Portfolio Optimization and Stochastic Dominance Approaches. Journal of Risk and Financial Management, 7(2), 45-66. https://doi.org/10.3390/jrfm7020045