Integration of Joint Power-Heat Flexibility of Oil Refinery Industries to Uncertain Energy Markets

Abstract

:1. Introduction

1.1. Motivation and Problem Description

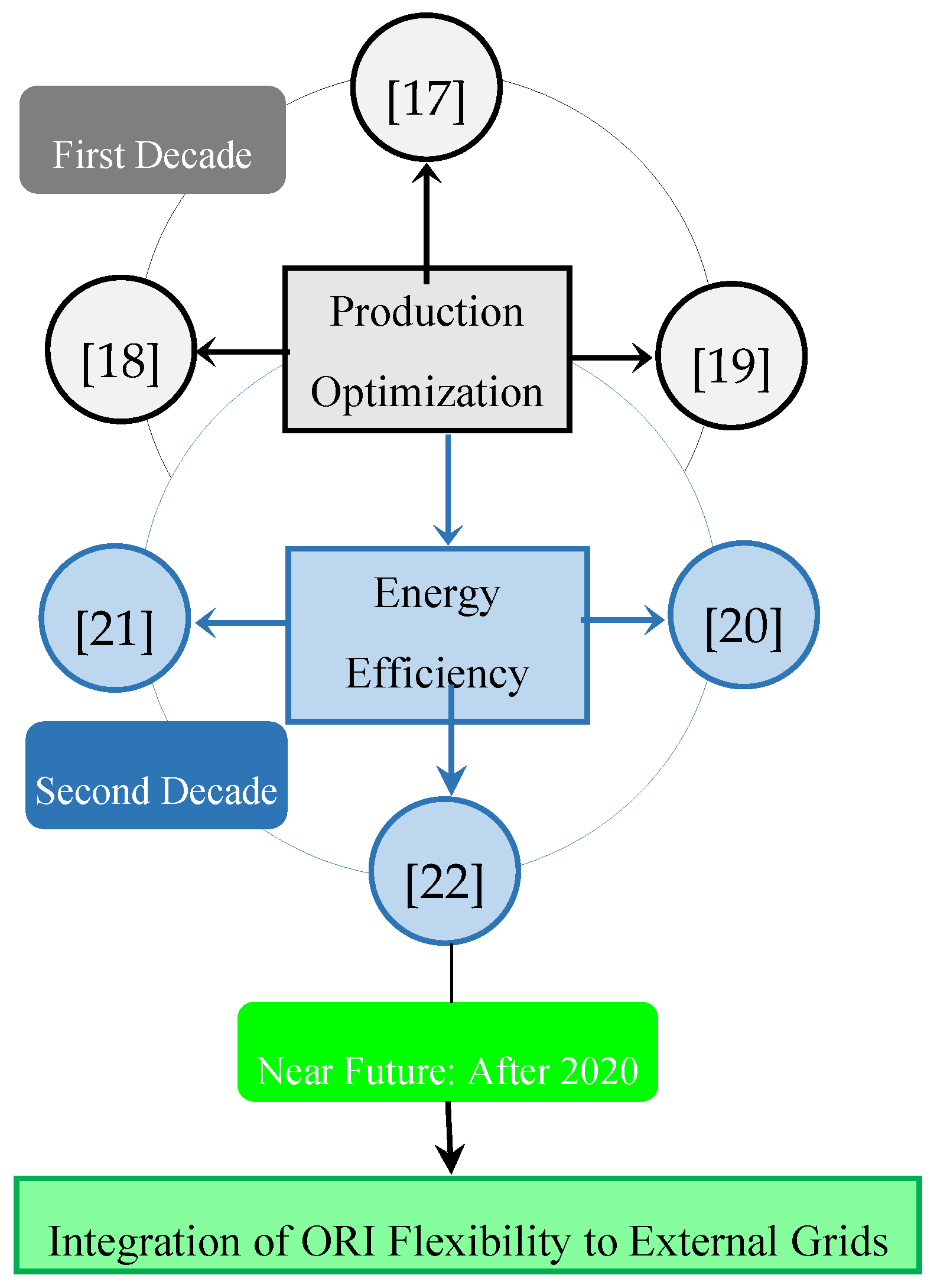

1.2. Literature Review

- (1)

- Optimization of oil and gas productions.

- (2)

- Energy efficiency measures in the ORI equipment.

1.3. Paper Contributions and Organization

- (1)

- Mathematical frameworks of joint heat-power management in the ORI.

- (2)

- Integration of ORI flexibility into uncertain electricity markets.

- (1)

- Proposing a mathematical framework for whole processing units of the ORI.

- (2)

- Integrating joint heat-power flexibility of the ORI into the power system under electricity price uncertainty.

- (3)

- Investigating the role of self-generation facilities and storages on the ORI flexibility potentials.

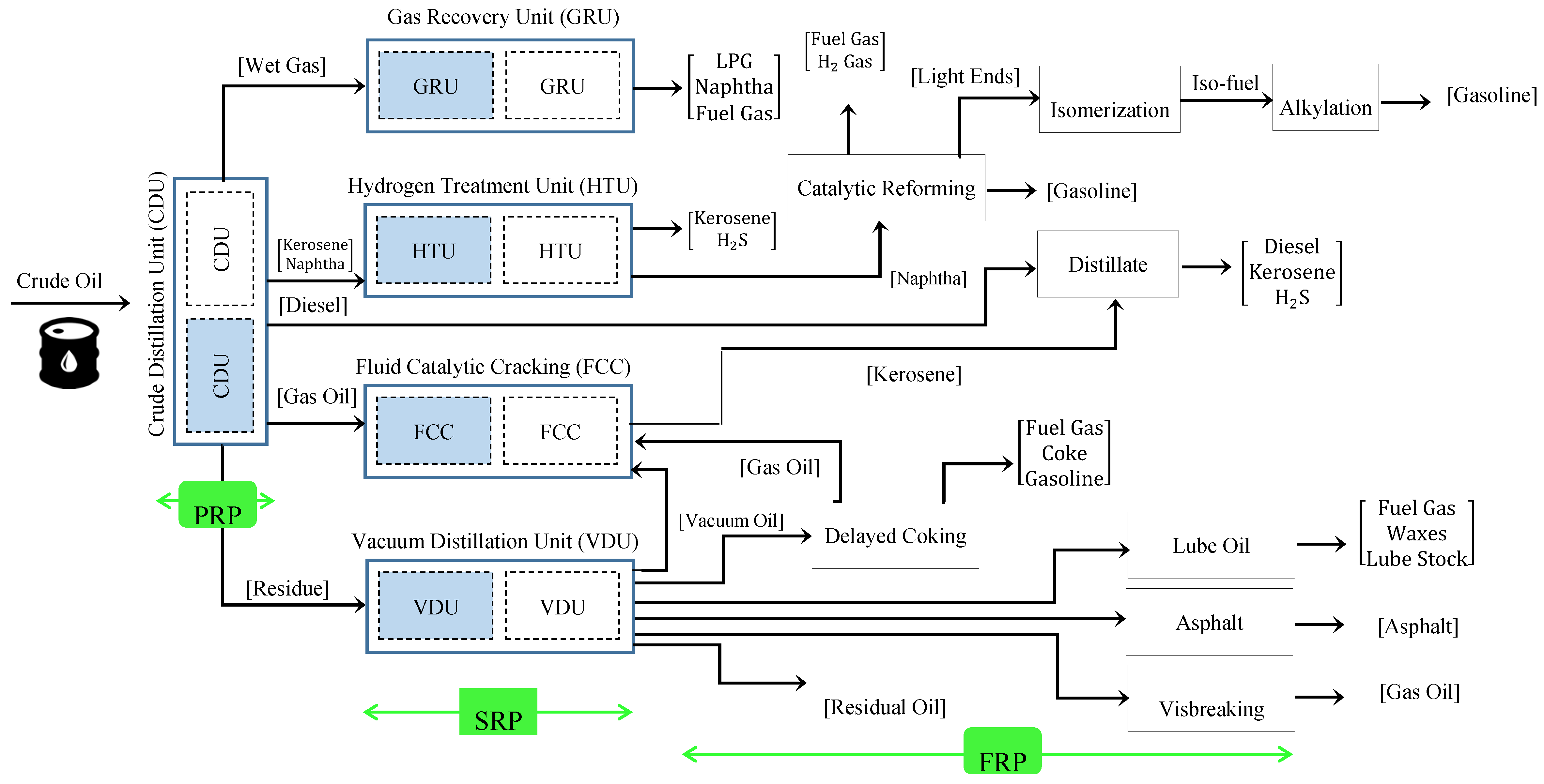

2. Description of Refinery Processes

- (1)

- Section 1: Primary refining processes (PRP), including the crude distillation unit (CDU).

- (2)

- Section 2: Secondary refining processes (SRP), including the gas recovery unit (GRU), hydrogen treatment unit (HTU), fluid catalytic cracking (FCC), and vacuum distillation unit (VDU).

- (3)

- Section 3: Final refining processes (FRP), including catalytic reforming unit (CRU), distillate hydroforming unit (DHU), delayed coking unit (DCU), lube oil processing unit (LPU), asphalt processing unit (APU) and visbreaking.

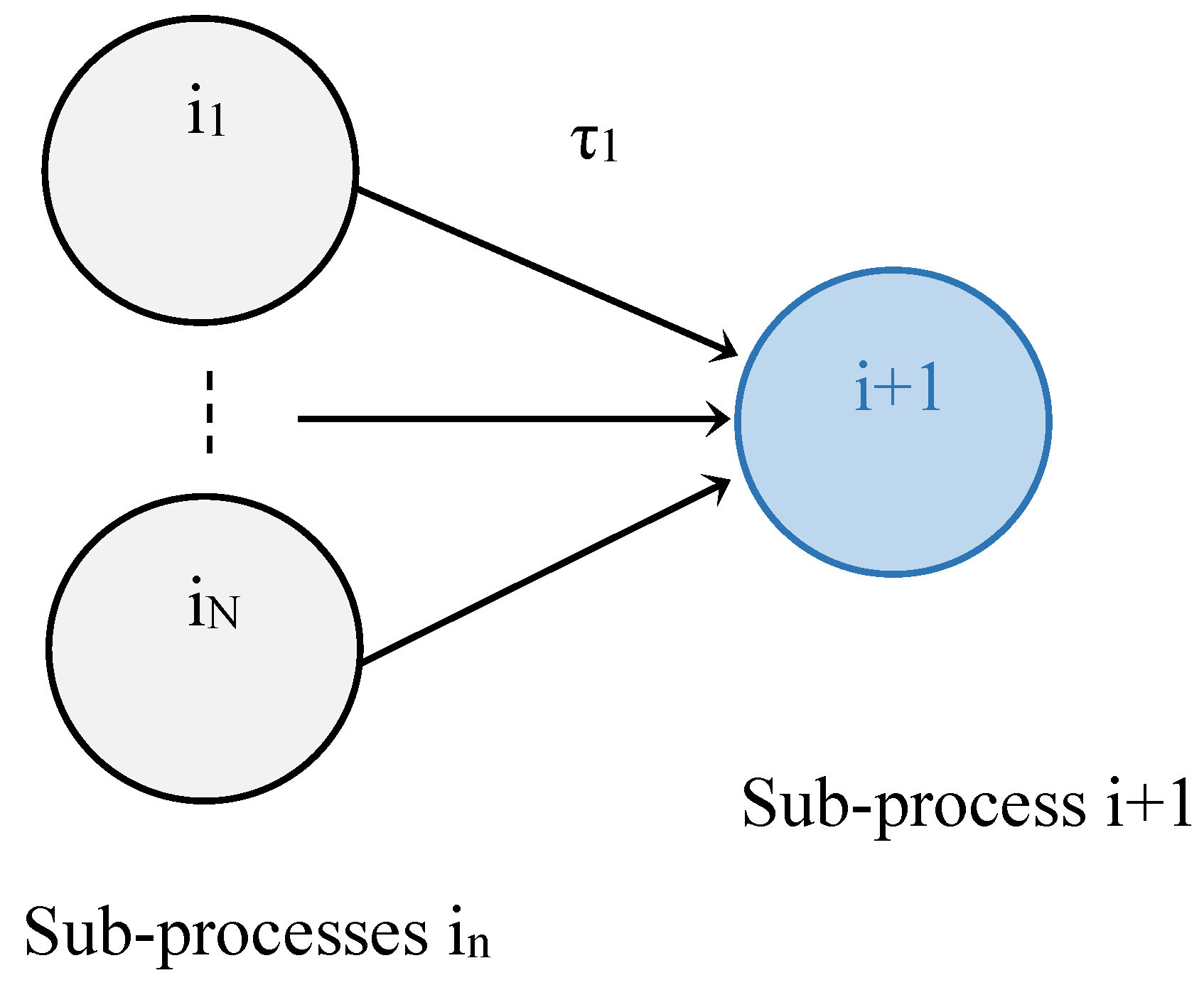

3. Formulation of Oil Refinery Industry

4. Co-Generation Units

5. Industrial Boiler

6. Energy Cost Optimization

7. Time Framework

8. Solution Methodology

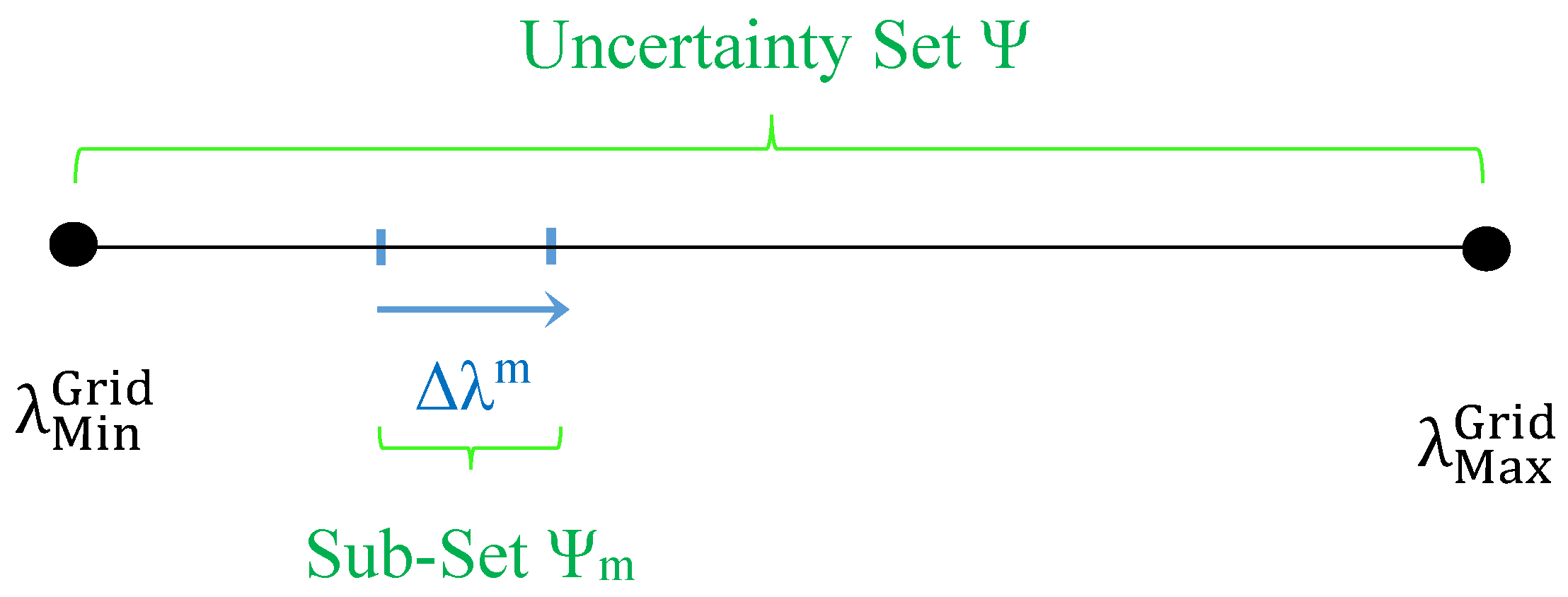

8.1. Electricity Price Uncertainty

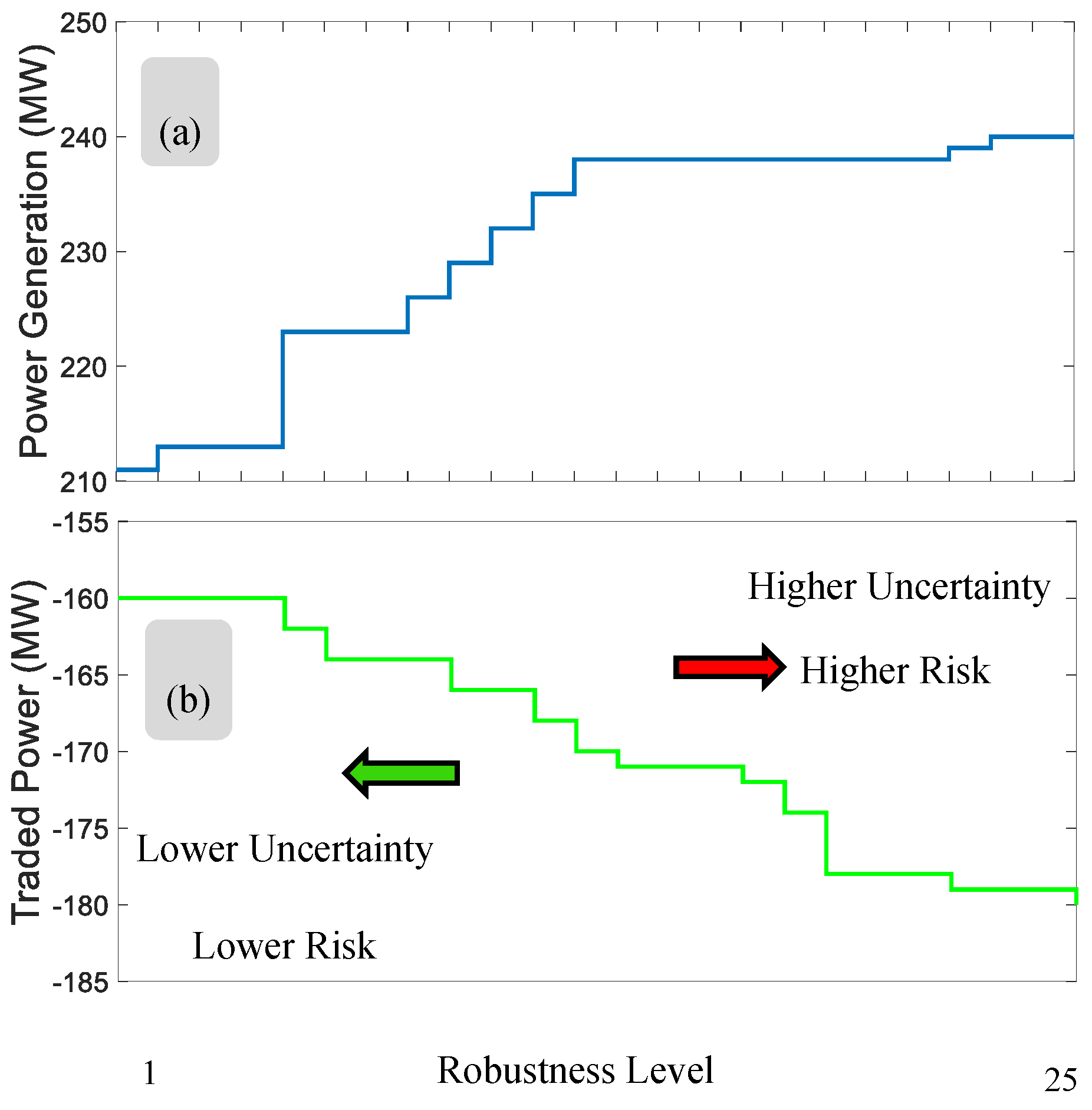

8.2. Robust Optimization Approach

| Algorithm 1: Incorporation of robustness region to R-MIQP | |

| 1 | Investigate lower and upper thresholds of possible electricity price |

| 2 | Construct the envelope bound |

| 3 | For m = 1, 2, …, M: |

| 4 | Add the incremental value |

| 5 | Solve R-MIQP Equation (42) |

| 6 | Determine robust decisions in worst-case realization of . |

| 7 | Increase counter index m→m + 1 |

| 8 | End For |

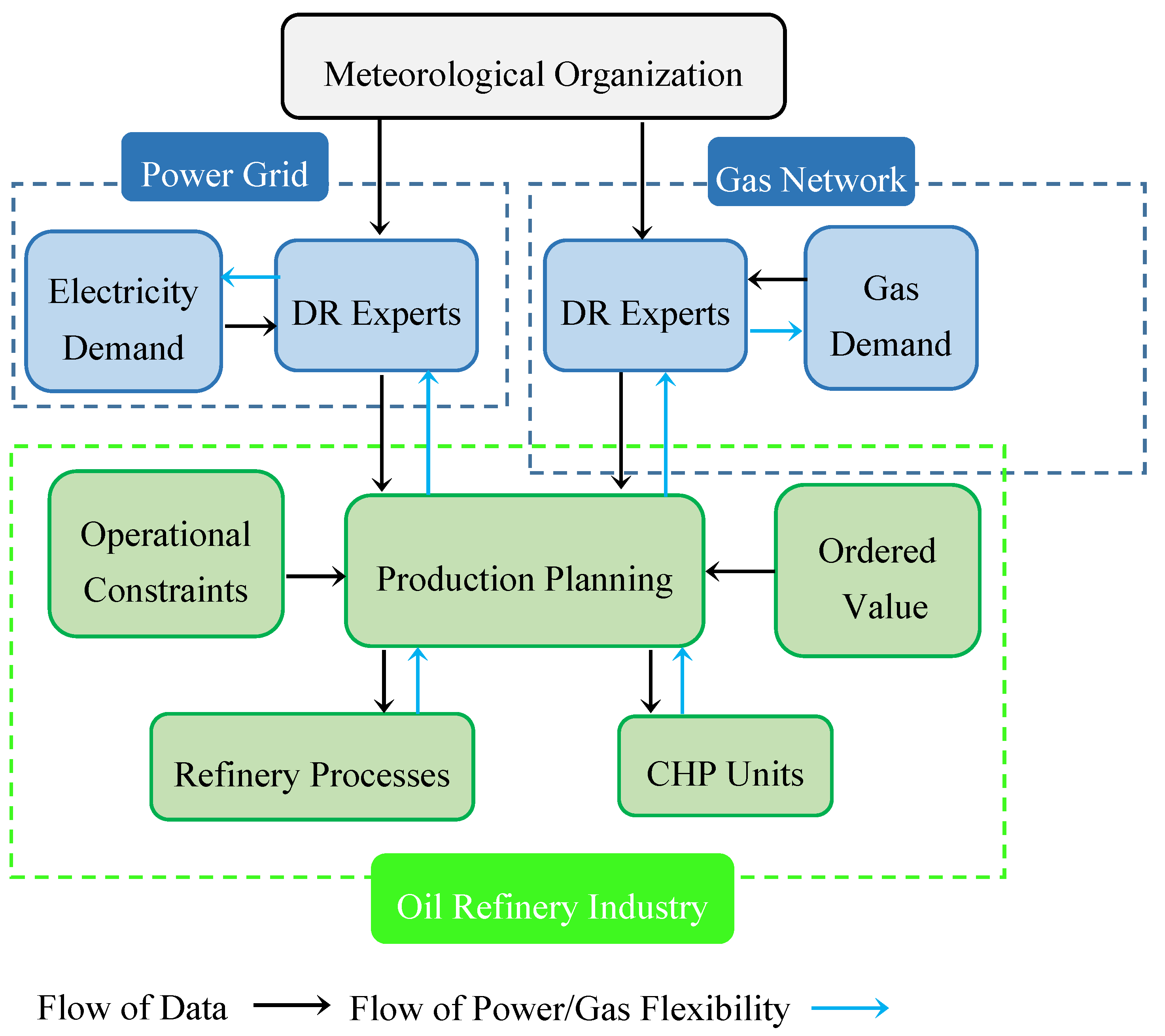

9. Integration of Flexibility to External Networks

10. Numerical Studies

10.1. Input Data

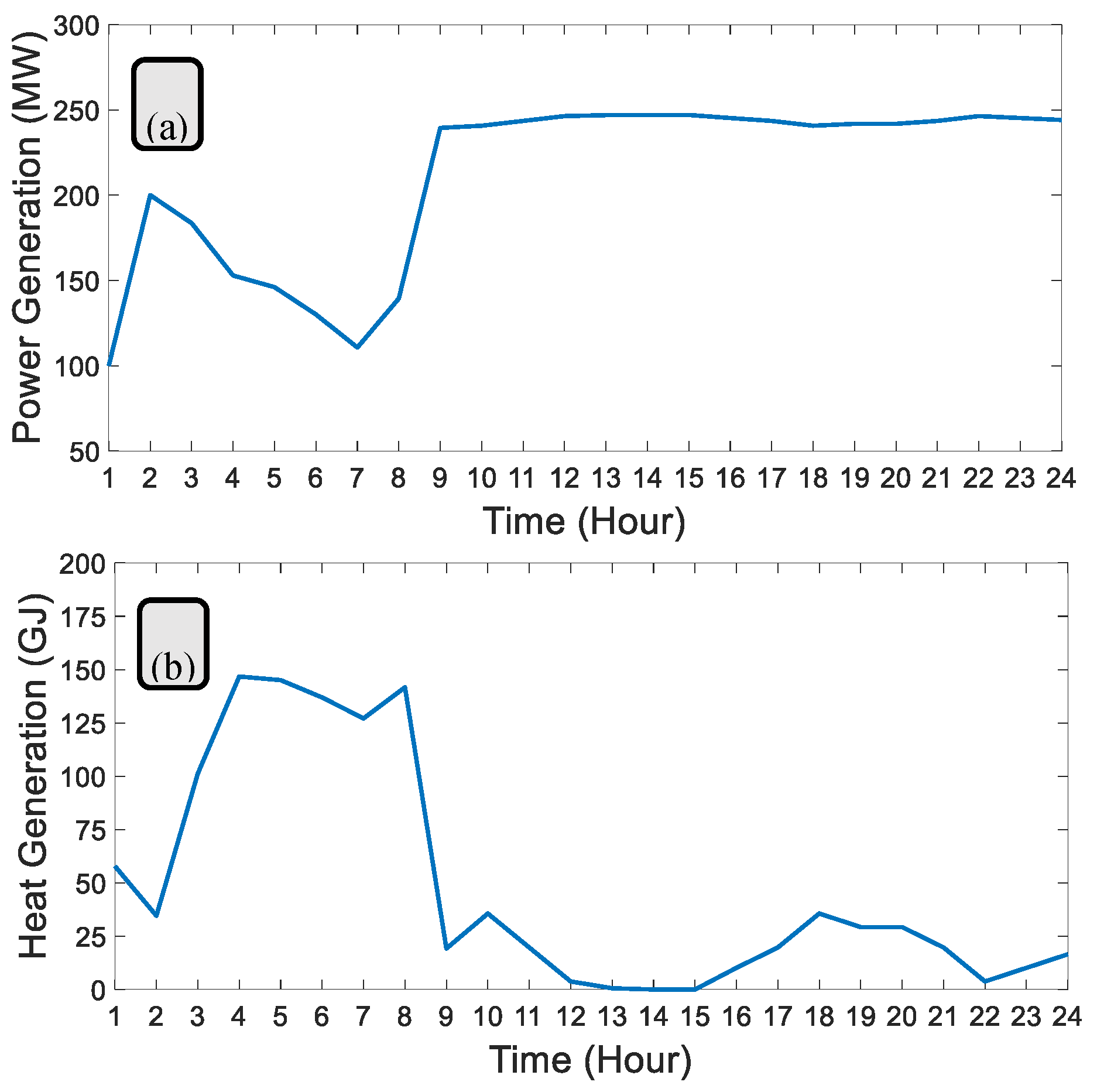

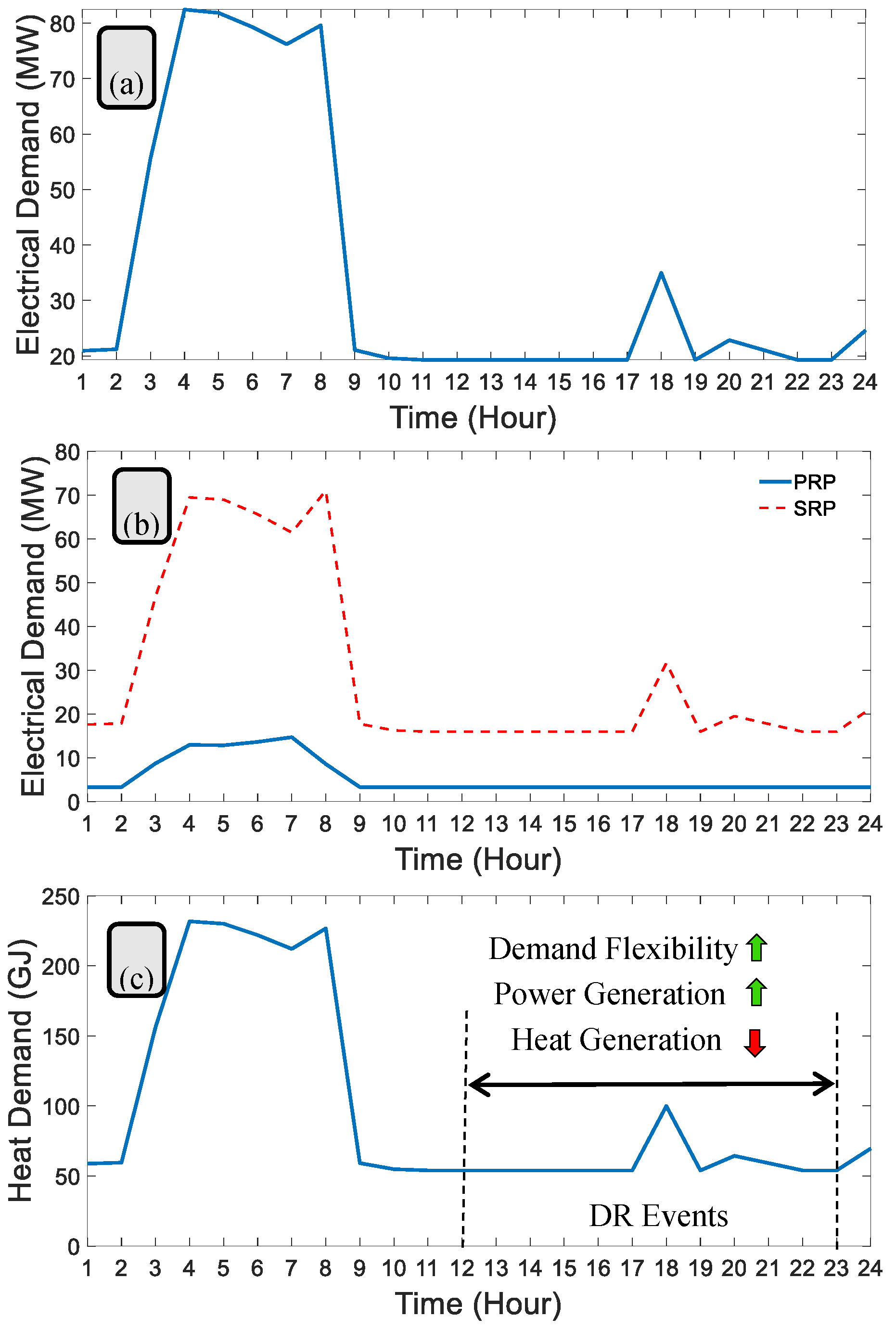

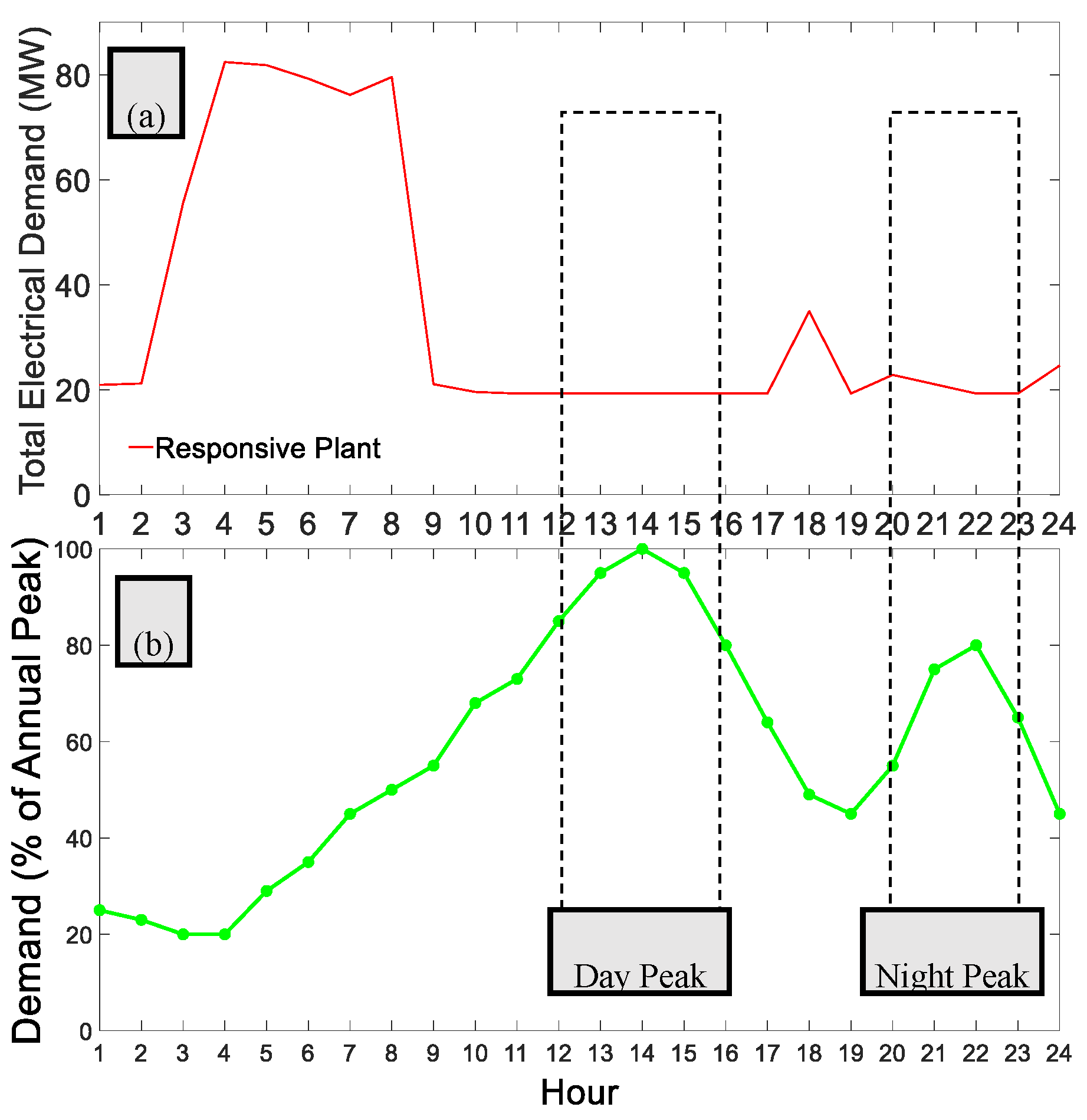

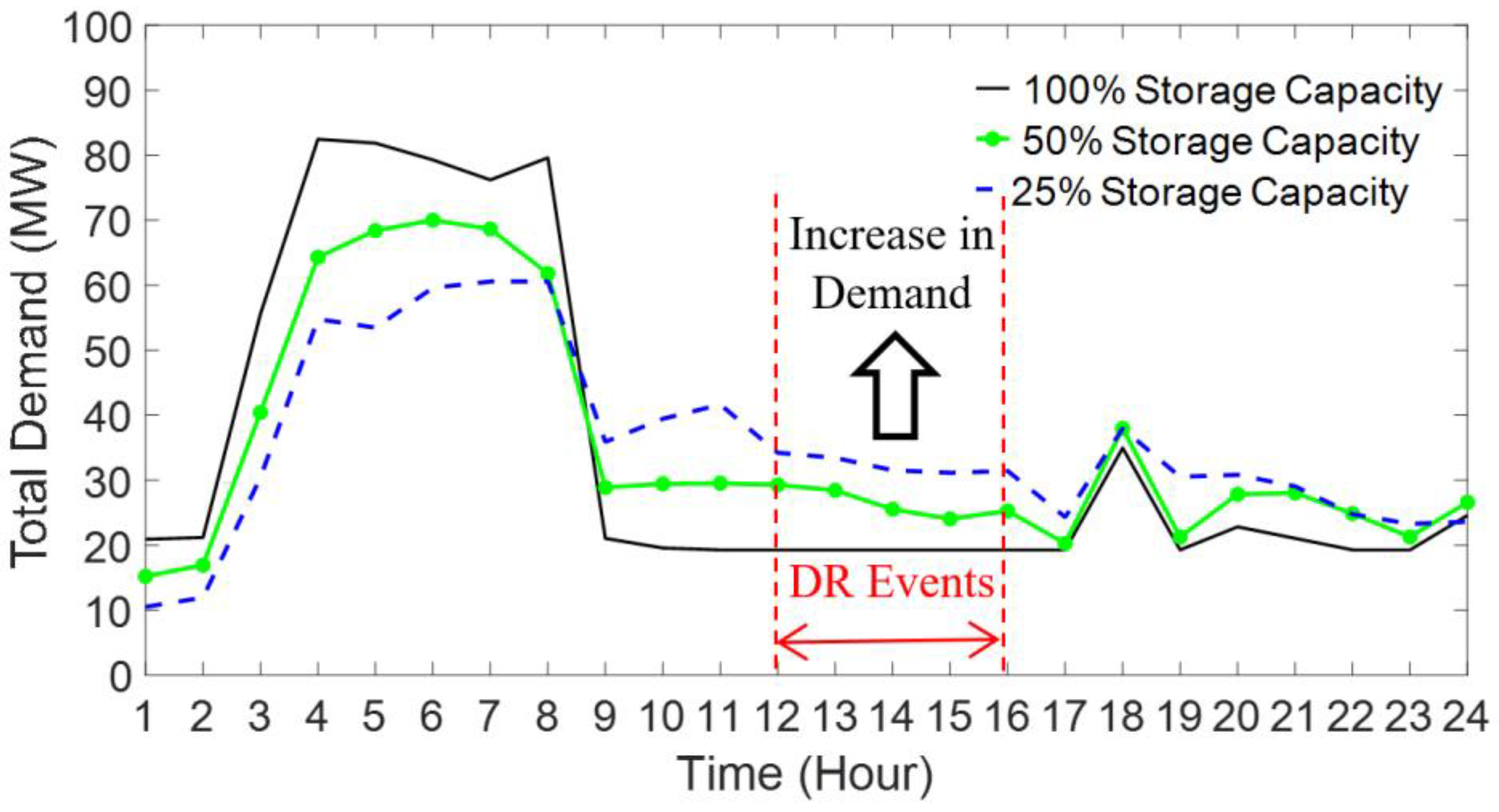

10.2. Results and Discussions

- (1)

- Risk-taker market participants

- (2)

- Risk-averse market participants

- (1)

- Integration of joint heat-power flexibility to electricity markets with price uncertainty.

- (2)

- Cost-effective energy management for oil refinery industries, not only to provide demand-side flexibility to the electricity market, but also to increase the industries’ profit.

11. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| Indices/Sets | |

| i | Index of SRP subprocesses |

| t | Index of time, t = {1, 2, …, N} |

| Θ | Set of SRP units |

| m | Counter index of robustness region, m = {1, …, M} |

| Ψ | Robustness set of market electricity price |

| Variables | |

| ΠCDU | Electricity consumption of CDU (MW) |

| XCDU | Material flow in CDU (kt/h) |

| ΛCDU | Heat consumption of CDU (GJ) |

| ΛSD | Total heat consumption of ORI (GJ) |

| XSRP | Input material flow to SRP (kt/h) |

| SoSCDU | State of storage of CDU (kt) |

| XCDUIn | Input material flow to storage of CDU (kt/h) |

| XCDUOut | Output material flow from storage of CDU (kt/h) |

| ΠSRP | Total electricity consumption of SRP (MW) |

| ΛSRP | Total heat consumption of SRP (GJ) |

| Πi | Electricity consumption for subprocess i of SRP (MW) |

| Xi | Material flow of unit i of SRP (kt/h) |

| SoSi | State of storage for unit i of SRP (kt) |

| ΠEl | Electricity generation of CHP (MW) |

| ΠTh | Thermal generation of CHP (MW) |

| CCHP | Cost function of CHP ($) |

| ΠBo | Thermal generation of industrial boiler (GJ) |

| ΠGrid | Electrical power purchased/sold from/to the power grid (kW) |

| CGrid | Procurement cost from the power grid ($) |

| ΠED | Total electrical demand of ORI (MW) |

| ΠSD | Total steam demand of ORI (kg) |

| GCHP | Gas consumption of CHP (m3/h) |

| CBo | Cost function of boiler ($) |

| ξt, ψt | Dual variables of the robust theory |

| Constants | |

| ηPRP | Ratio between input and output flows of CDU |

| ρi | Ratio between input flows of SRP and unit i |

| αx,βx,γx,υx | Coefficients of cost function of CHP units, x = {El, Th, CHP} |

| αBo,βBo,γBo | Coefficients of cost function of boiler |

| ΠCDUR | Nominal electricity consumption of CDU (MWh/kt) |

| ΛCDUR | Nominal heat consumption of CDU (GJ/kt) |

| ΠiR | Nominal electricity consumption of subprocess i of SRP (MWh/kt) |

| ΛiR | Nominal heat consumption of subprocess i of SRP (GJ/kt) |

| XCDUmin/max | Minimum/maximum material flow of CDU (kt/h) |

| Minimum/maximum electricity consumption of CDU (MW) | |

| Minimum/maximum heat demand of CDU (GJ) | |

| Minimum/maximum storage capacity of CDU (GJ) | |

| Minimum and maximum material flow of subprocess i of SRP (kt/h) | |

| Minimum and maximum electricity consumption for subprocess i of SRP (MW) | |

| Minimuma and maximum heat consumption of subprocess i of SRP (GJ/kt) | |

| Minimum/maximum storage capacity of subprocess I of SRP (GJ) | |

| XOrd | Daily ordered value of final production (kt) |

| ηCHP | Overal efficiency of CHP |

| GHV | Gas heat value (MWh/m3) |

| Ramp-up of the CHP (MW/h) | |

| Ramp-down of the CHP (MW/h) | |

| λGrid | Electricity price of wholesale market ($/kWh) |

| Grid | Expected value of market electricity price ($/kWh) |

| Nominal demand of the ORI (MW) | |

| δ | Robustness level of envelope bound |

| κ | Coefficient of steam thermal demand |

| Acronyms | |

| IEM | Iran energy market |

| ORI | Oil refinery industry |

| SoS | State of storage |

| CHP | Combined heat and power |

| FOR | Feasible operation region |

| DR | Demand response |

| PRP | Primary refining process |

| SRP | Secondary refining processes |

| FRP | Final refining processes |

| IPG | Iran power grid |

References

- Golmohamadi, H.; Keypour, R.; Bak-Jensen, B.; Pillai, J.R.; Khooban, M.H. Robust Self-Scheduling of Operational Processes for Industrial Demand Response Aggregators. IEEE Trans. Ind. Electron. 2020, 67, 1387–1395. [Google Scholar] [CrossRef] [Green Version]

- Golmohamadi, H.; Keypour, R.; Bak-Jensen, B.; Pillai, J.R. A multi-agent based optimization of residential and industrial demand response aggregators. Int. J. Electr. Power Energy Syst. 2019, 107, 472–485. [Google Scholar] [CrossRef]

- James, D.G.; Gary, H.; James; Handwerk, H.; Mark; Kaiser, J. Petroleum Refining Technology and Economics; CRC Press: Boca Raton, FL, USA, 2007. [Google Scholar]

- Branco, D.A.C.; Gomes, G.L.; Szklo, A.S. Challenges and technological opportunities for the oil refining industry: A Brazilian refinery case. Energy Policy 2010, 38, 3098–3105. [Google Scholar] [CrossRef]

- Wu, N.; Chu, C.; Chu, F.; Zhou, M. Schedulability Analysis of Short-Term Scheduling for Crude Oil Operations in Refinery With Oil Residency Time and Charging-Tank-Switch-Overlap Constraints. IEEE Trans. Autom. Sci. Eng. 2011, 8, 190–204. [Google Scholar] [CrossRef]

- Bayat, M.; Aminian, J.; Bazmi, M.; Shahhosseini, S.; Sharifi, K. CFD modeling of fouling in crude oil pre-heaters. Energy Convers. Manag. 2012, 64, 344–350. [Google Scholar] [CrossRef]

- Johansson, D.; Franck, P.-Å.; Berntsson, T. CO2 capture in oil refineries: Assessment of the capture avoidance costs associated with different heat supply options in a future energy market. Energy Convers. Manag. 2013, 66, 127–142. [Google Scholar] [CrossRef]

- Flores, L.I.R.; García, J.A.E. Modernization of National Oil Industry in Mexico: Upgrading With IEC61850. IEEE Access 2014, 2, 571–576. [Google Scholar] [CrossRef]

- Zhou, L.; Liao, Z.; Wang, J.; Jiang, B.; Yang, Y.; Du, W. Energy configuration and operation optimization of refinery fuel gas networks. Appl. Energy 2015, 139, 365–375. [Google Scholar] [CrossRef]

- Yang, Q.; Qian, Y.; Zhou, H.; Yang, S. Conceptual design and techno-economic evaluation of efficient oil shale refinery processes ingratiated with oil and gas products upgradation. Energy Convers. Manag. 2016, 126, 898–908. [Google Scholar] [CrossRef]

- Eldean, M.A.S.; Soliman, A.M. A novel study of using oil refinery plants waste gases for thermal desalination and electric power generation: Energy, exergy & cost evaluations. Appl. Energy 2017, 195, 453–477. [Google Scholar] [CrossRef]

- Khodabakhsh, A.; Arí, I.; Bakír, M.; Ercan, A.O. Multivariate Sensor Data Analysis for Oil Refineries and Multi-mode Identification of System Behavior in Real-time. IEEE Access 2018, 6, 64389–64405. [Google Scholar] [CrossRef]

- Renzi, M.; Rudolf, P.; Štefan, D.; Nigro, A.; Rossi, M. Installation of an axial Pump-as-Turbine (PaT) in a wastewater sewer of an oil refinery: A case study. Appl. Energy 2019, 250, 665–676. [Google Scholar] [CrossRef]

- Ashok, S.; Banerjee, R. Optimal operation of industrial cogeneration for load management. IEEE Trans. Power Syst. 2003, 18, 931–937. [Google Scholar] [CrossRef]

- Gholian, A.; Mohsenian-Rad, H.; Hua, Y.; Qin, J. Optimal industrial load control in smart grid: A case study for oil refineries. In Proceedings of the 2013 IEEE Power Energy Society General Meeting, Vancouver, BC, Canada, 21–25 July 2013; pp. 1–5. [Google Scholar] [CrossRef]

- Alarfaj, O.; Bhattacharya, K. Material Flow Based Power Demand Modeling of an Oil Refinery Process for Optimal Energy Management. IEEE Trans. Power Syst. 2019, 34, 2312–2321. [Google Scholar] [CrossRef]

- Rivero, R.; Garcia, M.; Urquiza, J. Simulation, exergy analysis and application of diabatic distillation to a tertiary amyl methyl ether production unit of a crude oil refinery. Energy 2004, 29, 467–489. [Google Scholar] [CrossRef]

- Kumar, A.; Gautami, G.; Khanam, S. Hydrogen distribution in the refinery using mathematical modeling. Energy 2010, 35, 3763–3772. [Google Scholar] [CrossRef]

- Weijermars, R. Accelerating the three dimensions of E&P clockspeed—A novel strategy for optimizing utility in the Oil & Gas industry. Appl. Energy 2009, 86, 2222–2243. [Google Scholar] [CrossRef]

- Gueddar, T.; Dua, V. Novel model reduction techniques for refinery-wide energy optimisation. Appl. Energy 2012, 89, 117–126. [Google Scholar] [CrossRef]

- Coatalem, M.; Mazauric, V.; le Pape-Gardeux, C.; Maïzi, N. Optimizing industries’ power generation assets on the electricity markets. Appl. Energy 2017, 185, 1744–1756. [Google Scholar] [CrossRef]

- Mete, E.; Turkay, M. Energy Network Optimization in an Oil Refinery. In 13 International Symposium on Process Systems Engineering (PSE 2018); Eden, M.R., Ierapetritou, M.G., Towler, G.E., Eds.; Elsevier: Amsterdam, The Netherlands, 2018; Volume 44, pp. 1897–1902. [Google Scholar]

- The International Council of Clean Transportation. An Introduction to Petroleum Refining and the Production of Ultra Low Sulfur Gasoline and Diesel Fuel; MathPro: Bethesda, MD, USA, 2011. [Google Scholar]

- Golmohamadi, H.; Keypour, R.; Mirzazade, P. Multi-objective co-optimization of power and heat in urban areas considering local air pollution. Eng. Sci. Technol. Int. J. 2020. [Google Scholar] [CrossRef]

- Golmohamadi, H.; Keypour, R. Retail Energy Management in Electricity Markets: Structure, Challenges and Economic Aspects—A Review. Technol. Econ. Smart Grids Sustain. Energy 2017, 2, 20. [Google Scholar] [CrossRef] [Green Version]

- Golmohamadi, H.; Keypour, R. A bi-level robust optimization model to determine retail electricity price in presence of a significant number of invisible solar sites. Sustain. Energy Grids Netw. 2018, 13, 93–111. [Google Scholar] [CrossRef]

- Golmohamadi, H.; Keypour, R. Application of Robust Optimization Approach to Determine Optimal Retail Electricity Price in Presence of Intermittent and Conventional Distributed Generation Considering Demand Response. J. Control. Autom. Electr. Syst. 2017, 28, 664–678. [Google Scholar] [CrossRef]

- Golmohamadi, H.; Keypour, R.; Hassanpour, A.; Davoudi, M. Optimization of green energy portfolio in retail market using stochastic programming. In Proceedings of the 2015 North American Power Symposium (NAPS), Charlotte, NC, USA, 4–6 October 2015; pp. 1–6. [Google Scholar] [CrossRef]

- International Energy Agency, IEA. 2020. Available online: https://www.iea.org/ (accessed on 3 February 2020).

- Iran Grid Management Company (IGMC). 2019. Available online: https://www.igmc.ir/Power-grid-status-report (accessed on 11 January 2019).

- GAMS Software. Available online: https://www.gams.com/ (accessed on 2 April 2019).

- CPLEX Solver. Available online: https://www.ibm.com/dk-en/analytics/cplex-optimizer (accessed on 11 July 2019).

- CONOPT Solver. Available online: http://www.conopt.com/ (accessed on 11 July 2019).

- Zhang, Z.; Ding, S.; Sun, Y. A support vector regression model hybridized with chaotic krill herd algorithm and empirical mode decomposition for regression task. Neurocomputing 2020, 410, 185–201. [Google Scholar] [CrossRef]

- Zhang, Z.; Ding, S.; Jia, W. A hybrid optimization algorithm based on cuckoo search and differential evolution for solving constrained engineering problems. Eng. Appl. Artif. Intell. 2019, 85, 254–268. [Google Scholar] [CrossRef]

- Li, M.-W.; Geng, J.; Hong, W.-C.; Zhang, L.-D. Periodogram estimation based on LSSVR-CCPSO compensation for forecasting ship motion. Nonlinear Dyn. 2019, 97, 2579–2594. [Google Scholar] [CrossRef]

| Sub-Process | Electrical Demand (MWh/kt) | Steam Demand (GJ/kt) | Storage Capacity (kt) | Threshold of Feedstock Flow (kt/h) |

|---|---|---|---|---|

| CDU | 3.68 | 8 | 4 | 1~4 |

| GRU | 7.5 | 12 | 2 | 0.25~1 |

| HTU | 20.5 | 33 | 2 | 0.25~1 |

| FCC | 25 | 25 | 2 | 0.25~1 |

| VDU | 18 | 138 | 2 | 0.25~1 |

| CHP | Cost Function Equation (21) | αEl | βEl | γEl | βTh | γTh | νCHP |

| 2950 | 28.5 | 0.1045 | 4.2 | 0.03 | 0.031 | ||

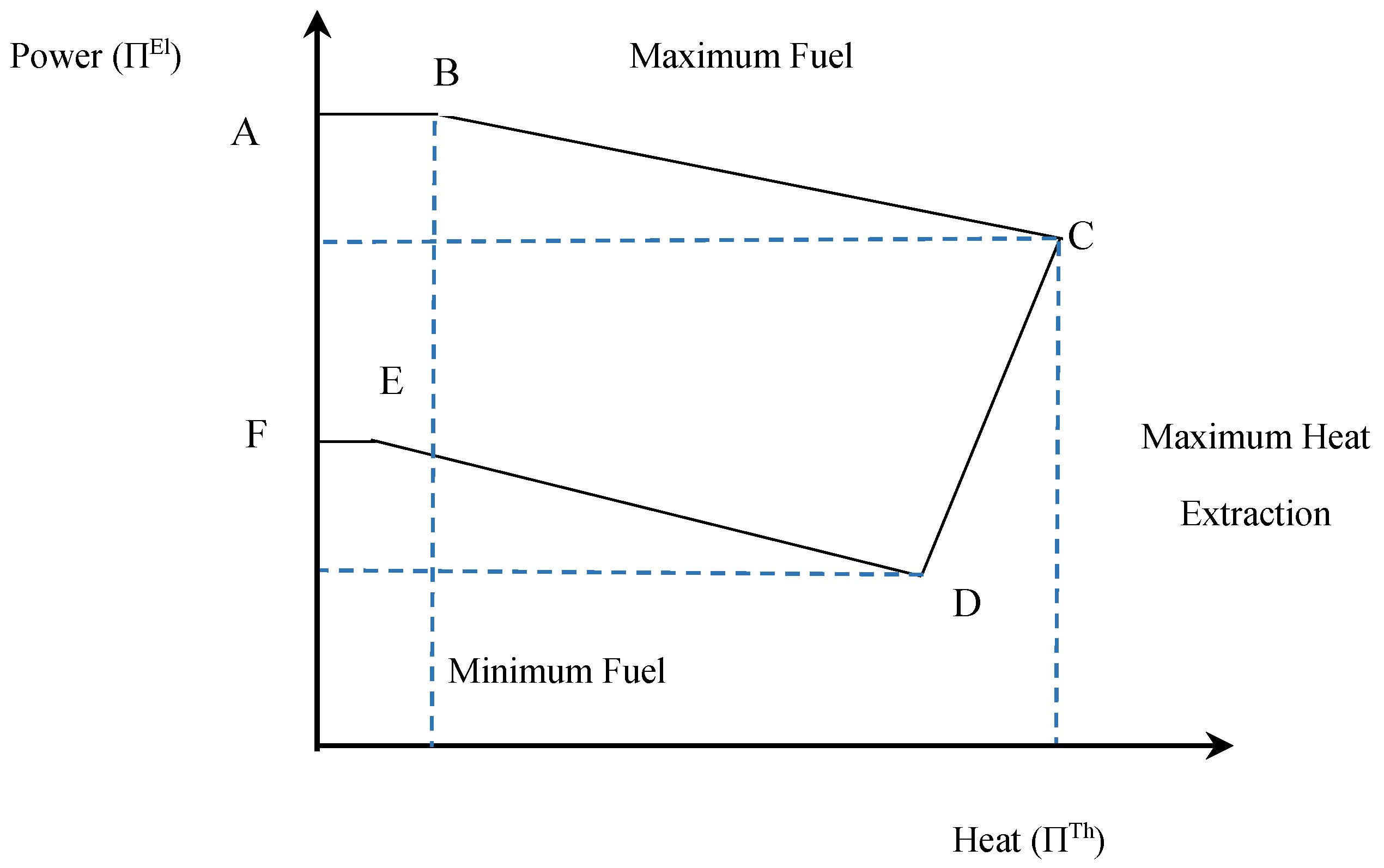

| FOR (ΠEl, ΠTh) Figure 3 | A | B | C | D | E | F | |

| (247,0) | (247,0) | (215,180) | (81,104.8) | (98.8,0) | (98.8,0) | ||

| Boiler | Cost Function Equation (27) | αBo | βBo | γBo | |||

| 0 | 14.7 | 0 | 1 | 85 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Golmohamadi, H.; Asadi, A. Integration of Joint Power-Heat Flexibility of Oil Refinery Industries to Uncertain Energy Markets. Energies 2020, 13, 4874. https://doi.org/10.3390/en13184874

Golmohamadi H, Asadi A. Integration of Joint Power-Heat Flexibility of Oil Refinery Industries to Uncertain Energy Markets. Energies. 2020; 13(18):4874. https://doi.org/10.3390/en13184874

Chicago/Turabian StyleGolmohamadi, Hessam, and Amin Asadi. 2020. "Integration of Joint Power-Heat Flexibility of Oil Refinery Industries to Uncertain Energy Markets" Energies 13, no. 18: 4874. https://doi.org/10.3390/en13184874