Development of Shale Gas Prediction Models for Long-Term Production and Economics Based on Early Production Data in Barnett Reservoir

Abstract

1. Introduction

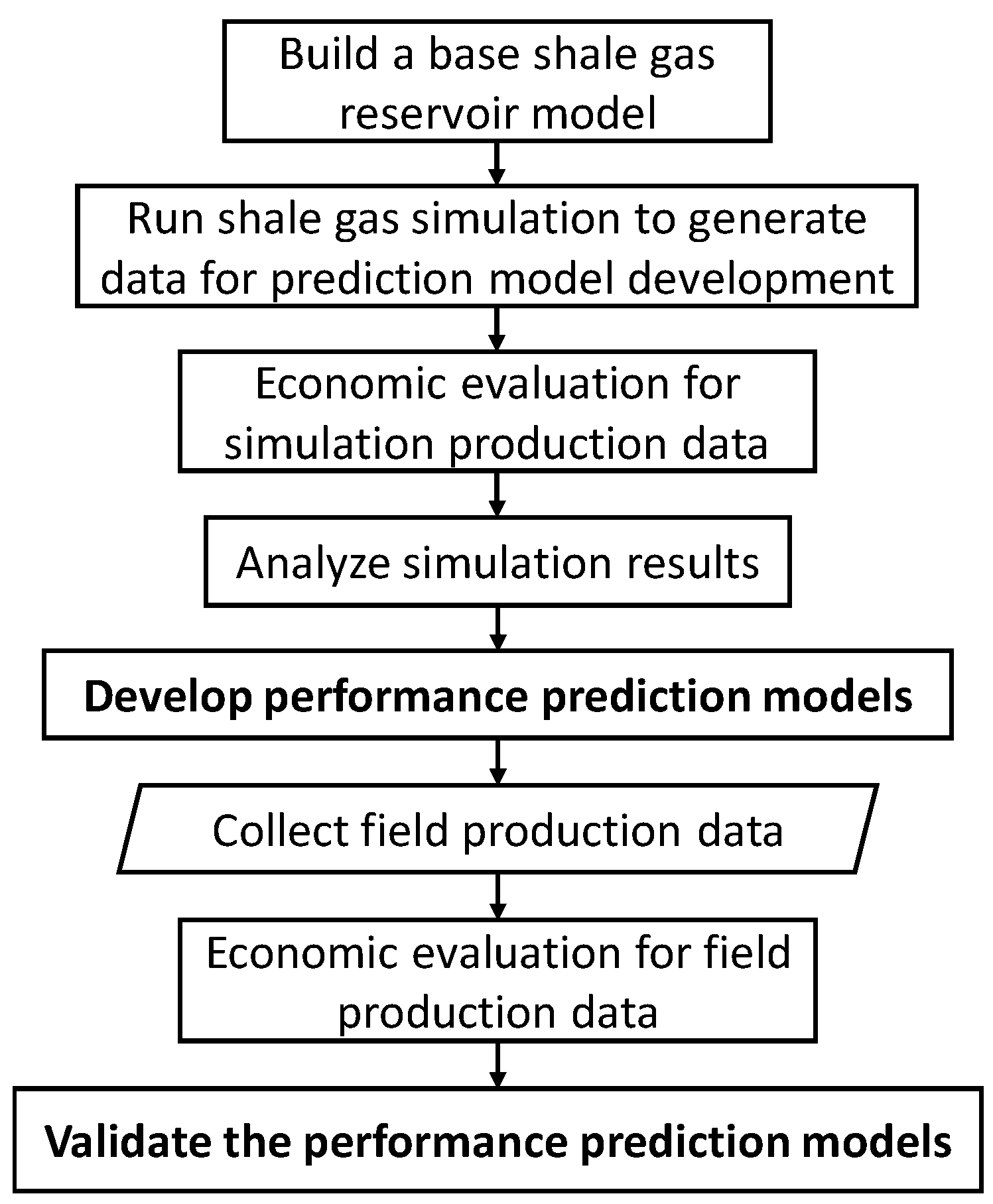

2. Methodology

3. Development of the Performance Prediction Models

3.1. Barnett Shale

3.2. Numerical Simulation Model

3.3. Input Parameters for Reservoir Simulation

3.4. Economic Evaluation Model

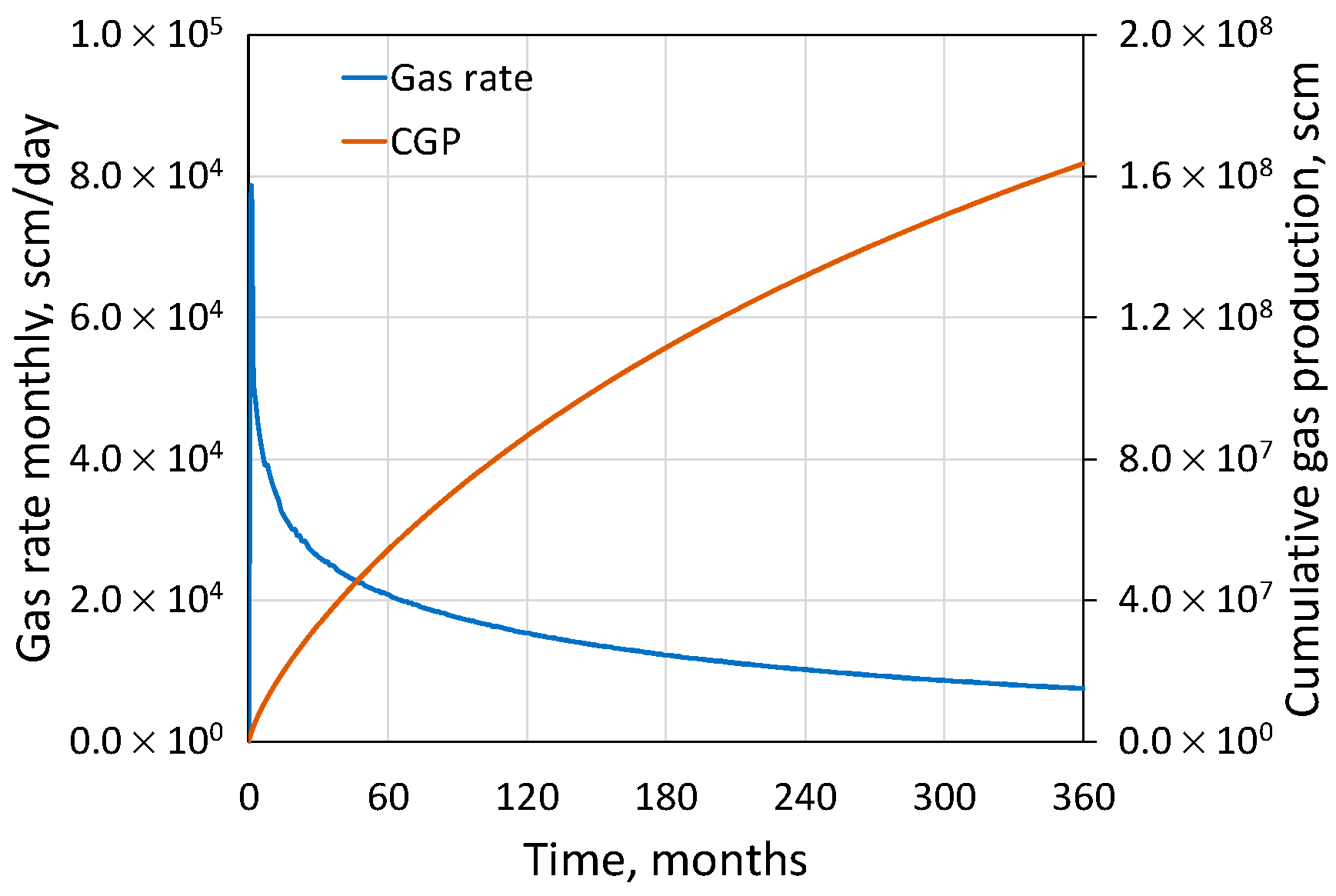

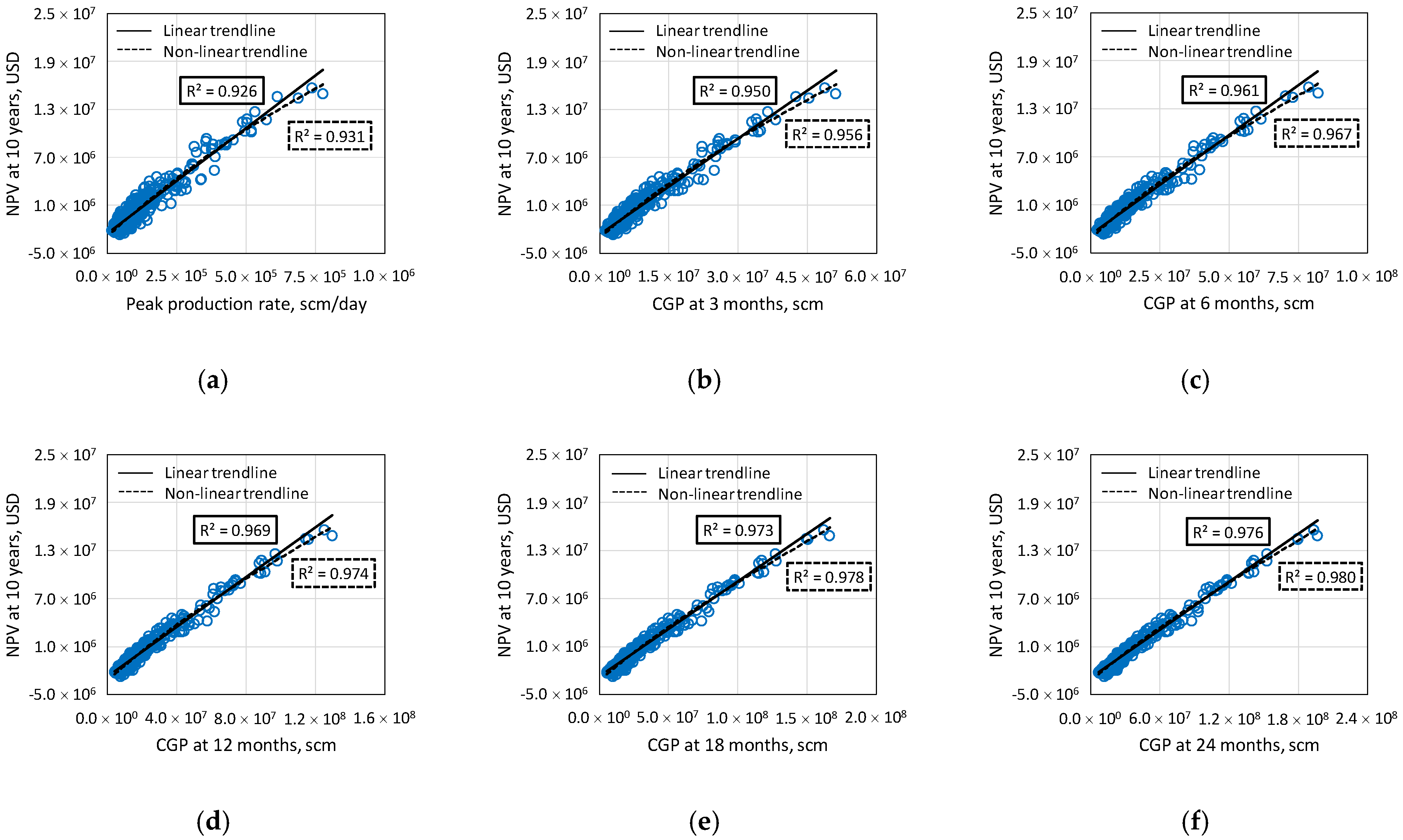

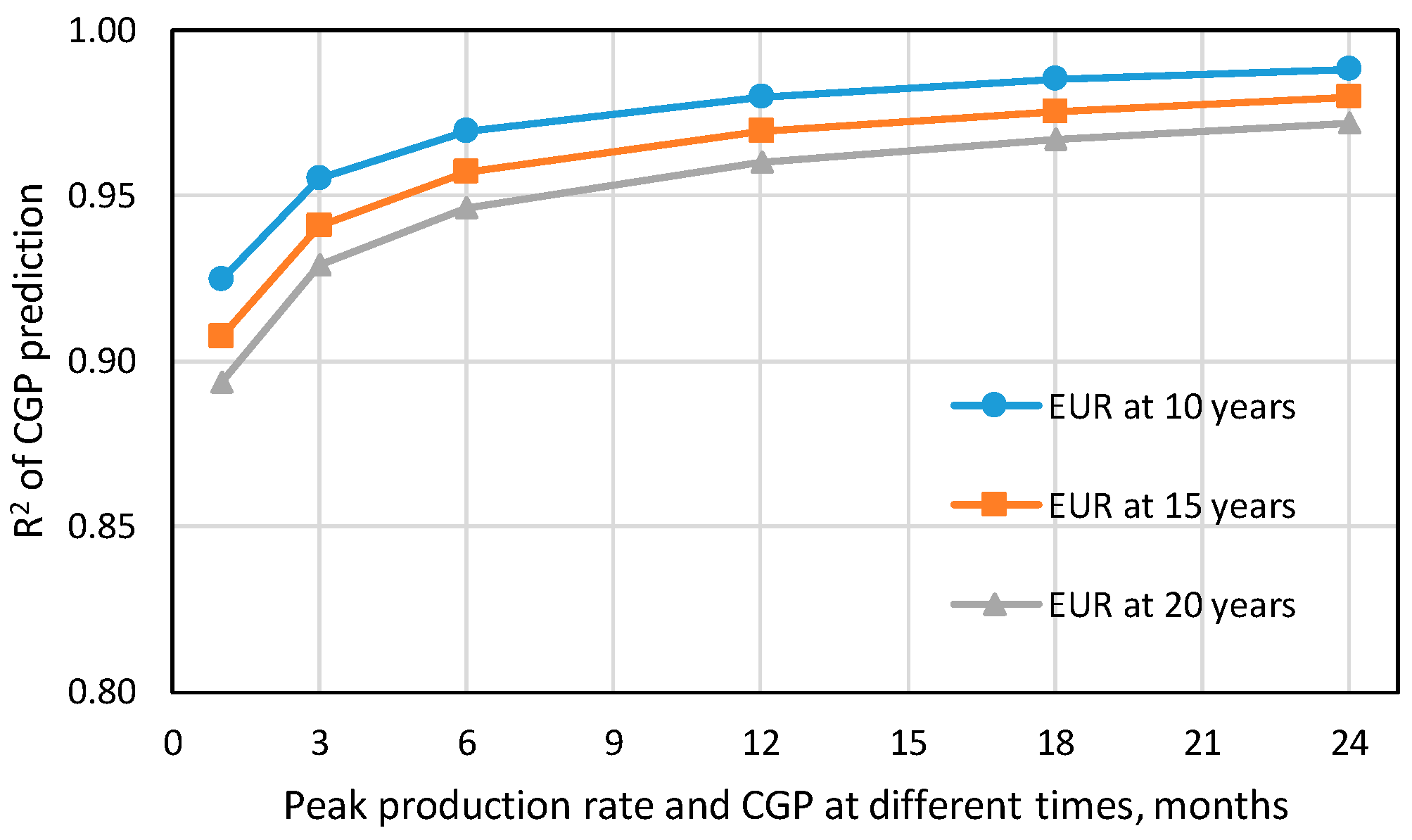

3.5. Development of the Prediction Models

3.6. Validation of the Prediction Models

4. Discussion

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Nomenclature

| EUR | Estimated ultimate recovery |

| NPV | Net present value |

| CGP | Cumulative gas production |

| OPEX | Operating expense, USD/Mscm |

| CAPEX | Capital expense, USD |

| DCA | Decline curve analysis |

| SSE | Sum of squared errors |

| MAPE | Mean absolute percentage error |

| PR | Peak production rate, scm/day |

| CGP3m | Cumulative gas production at 3 months, scm |

| CGP6m | Cumulative gas production at 6 months, scm |

| CGP12m | Cumulative gas production at 12 months, scm |

| CGP18m | Cumulative gas production at 18 months, scm |

| CGP24m | Cumulative gas production at 24 months, scm |

References

- Geng, L.; Li, G.; Wang, M.; Li, Y.; Tian, S.; Pang, W.; Lyu, Z. A fractal production prediction model for shale gas reservoirs. J. Nat. Gas Sci. Eng. 2018, 55, 354–367. [Google Scholar] [CrossRef]

- Wang, S.; Chen, Z.; Chen, S. Applicability of deep neural networks on production forecasting in Bakken shale reservoirs. J. Pet. Sci. Eng. 2019, 179, 112–125. [Google Scholar] [CrossRef]

- Xu, B.; Haghighi, M.; Cooke, D.A.; Li, X. Production Data Analysis in Eagle Ford Shale Gas Reservoir. In Proceedings of the SPE/EAGE European Unconventional Resources Conference and Exhibition, Vienna, Austria, 20–22 March 2012; pp. 20–22. [Google Scholar]

- Ikewun, P.O.; Ahmadi, M. Production Optimization and Forecasting of Shale Gas Wells Using Simulation Models and Decline Curve Analysis. In Proceedings of the SPE Western Regional Meeting, Bakersfield, CA, USA, 21–23 March 2012; pp. 1–27. [Google Scholar]

- Ilk, D.; Currie, S.M.; Blasingame, T.A. Production Analysis and Well Performance Forecasting of Tight Gas and Shale Gas Wells. In Proceedings of the SPE Eastern Regional Meeting, Morgantown, WV, USA, 13–15 October 2010. [Google Scholar]

- Sun, H.; Chawathe, A.; Zhou, D.; MacIvor, K.; Hoteit, H. Integrated Haynesville Production Analysis. In Proceedings of the the 3rd Unconventional Resources Technology Conference, San Antonio, TX, USA, 20–22 July 2015; American Association of Petroleum Geologists: Tulsa, OK, USA, 2015; pp. 20–22. [Google Scholar]

- Stewart, G. Integrated Analysis of Shale Gas Well Production Data. In Proceedings of the SPE Asia Pacific Oil & Gas Conference and Exhibition, Adelaide, Australia, 14–16 October 2014; pp. 14–16. [Google Scholar]

- Mishra, S. A New Approach to Reserves Estimation in Shale Gas Reservoirs Using Multiple Decline Curve Analysis Models. In Proceedings of the SPE Eastern Regional Meeting, Lexington, KY, USA, 3–5 October 2012; pp. 106–119. [Google Scholar]

- Zhang, H.; Cocco, M.; Rietz, D.; Cagle, A.; Lee, J. An Empirical Extended Exponential Decline Curve for Shale Reservoirs. In Proceedings of the SPE Annual Technical Conference and Exhibition, Houston, TX, USA, 28–30 September 2015; pp. 4118–4140. [Google Scholar]

- Bashir, M.O. Decline Curve Analysis on the Woodford Shale and Other Major Shale Plays. In Proceedings of the SPE Western Regional Meeting, Anchorage, AK, USA, 23–26 May 2016. [Google Scholar]

- Doughty, C.; Moridis, G.J. The Use of the Bimodal Production Decline Curve for the Analysis of Hydraulically Fractured Shale/Tight Gas Reservoirs. In Proceedings of the 6th Unconventional Resources Technology Conference, Houston, TX, USA, 23–25 July 2018; American Association of Petroleum Geologists: Tulsa, OK, USA, 2018; pp. 1–20. [Google Scholar]

- Odi, U.; Bacho, S.; Daal, J. Decline Curve Analysis in Unconventional Reservoirs Using a Variable Power Law Model: A Barnett Shale Example. In Proceedings of the 7th Unconventional Resources Technology Conference, Denver, CO, USA, 22–24 July 2019; American Association of Petroleum Geologists: Tulsa, OK, USA, 2019. [Google Scholar]

- Gupta, I.; Rai, C.; Devegowda, D.; Sondergeld, C. Haynesville Shale: Predicting Long-Term Production and Residual Analysis To Identify Well Interference and Fracture Hits. SPE Reserv. Eval. Eng. 2019. [Google Scholar] [CrossRef]

- Baihly, J.; Malpani, R.; Altman, R.M.; Lindsay, G.; Clayton, R. Shale Gas Production Decline Trend Comparison Over Time and Basins-Revisited. In Proceedings of the 3rd Unconventional Resources Technology Conference, San Antonio, TX, USA, 20–22 July 2015; American Association of Petroleum Geologists: Tulsa, OK, USA, 2015. [Google Scholar]

- Kenomore, M.; Hassan, M.; Malakooti, R.; Dhakal, H.; Shah, A. Shale gas production decline trend over time in the Barnett Shale. J. Pet. Sci. Eng. 2018, 165, 691–710. [Google Scholar] [CrossRef]

- Montgomery, S.L.; Jarvie, D.M.; Bowker, K.A.; Pollastro, R.M. Mississippian Barnett Shale, Fort Worth basin, north-central Texas: Gas-shale play with multi–trillion cubic foot potential. Am. Assoc. Pet. Geol. Bull. 2005, 89, 155–175. [Google Scholar] [CrossRef]

- Jeff, H.; Dave, P. The Barnett Shale. Visitor’s Guide to the Hottest Gas Play in the US; Pickering Energy Partners: Houston, TX, USA, 2005. [Google Scholar]

- Martineau, D.F. History of the Newark East field and the Barnett Shale as a gas reservoir. Am. Assoc. Pet. Geol. Bull. 2007, 91, 399–403. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration. Review of Emerging Resources: U.S. Shale Gas and Shale Oil Plays; Government Printing Office: Washington, DC, USA, 2011.

- Browning, J.; Tinker, S.W.; Ikonnikova, S.; Gülen, G.; Potter, E.; Fu, Q.; Horvath, S. Barnett Shale Model–1: Study develops decline analysis, geologic parameters for reserves, production forecast. Oil Gas J. 2013, 111, 63–71. [Google Scholar]

- Browning, J.; Ikonnikova, S.; Gülen, G.; Tinker, S. Barnett Shale Production Outlook. SPE Econ. Manag. 2013, 5, 89–104. [Google Scholar] [CrossRef]

- Ahmed, U.; Meehan, D.N. Unconventional Oil and Gas Resources; CRC Press: Boca Raton, FL, USA, 2016; ISBN 9781498759410. [Google Scholar]

- Dong, Z.; Holditch, S.; McVay, D.; Ayers, W.B.; Lee, W.J.; Morales, E. Probabilistic Assessment of World Recoverable Shale-Gas Resources. SPE Econ. Manag. 2015, 7, 72–82. [Google Scholar] [CrossRef]

- Zhang, H.; Wang, J.; Zhang, H. Investigation of the Main Factors During Shale-gas Production Using Grey Relational Analysis. Open Pet. Eng. J. 2016, 9, 207–215. [Google Scholar] [CrossRef]

- Nguyen-Le, V.; Shin, H. Development of reservoir economic indicator for Barnett Shale gas potential evaluation based on the reservoir and hydraulic fracturing parameters. J. Nat. Gas Sci. Eng. 2019, 66, 159–167. [Google Scholar] [CrossRef]

- CMG. GEM User Manual; Computer Modeling Group: Calgary, Italy, 2018. [Google Scholar]

- Langmuir, I. The Adsorption of Gases on Plane Surfaces of Glass, Mica and Platinum. J. Am. Chem. Soc. 1918, 40, 1361–1403. [Google Scholar] [CrossRef]

- Chen, Z.; Lavoie, D.; Malo, M.; Jiang, C.; Sanei, H.; Ardakani, O.H. A dual-porosity model for evaluating petroleum resource potential in unconventional tight-shale plays with application to Utica Shale, Quebec (Canada). Mar. Pet. Geol. 2017, 80, 333–348. [Google Scholar] [CrossRef]

- Zhang, T.; Ellis, G.S.; Ruppel, S.C.; Milliken, K.; Yang, R. Effect of organic-matter type and thermal maturity on methane adsorption in shale-gas systems. Org. Geochem. 2012, 47, 120–131. [Google Scholar] [CrossRef]

- Yu, W.; Sepehrnoori, K.; Patzek, T.W. Modeling Gas Adsorption in Marcellus Shale With Langmuir and BET Isotherms. SPE J. 2016, 21, 589–600. [Google Scholar] [CrossRef]

- Belyadi, H.; Fathi, E.; Belyadi, F. Hydraulic Fracturing in Unconventional Reservoirs; Elsevier: Amsterdam, The Netherlands, 2017; ISBN 9780128498712. [Google Scholar]

- CMG. CMOST User Manual; Computer Modeling Group: Calgary, Italy, 2018. [Google Scholar]

- Schweitzer, R.; Bilgesu, H.I. The Role of Economics on Well and Fracture Design Completions of Marcellus Shale Wells. In Proceedings of the SPE Eastern Regional Meeting, Charleston, WV, USA, 23–25 September 2009. [Google Scholar]

- Yu, W.; Sepehrnoori, K. An Efficient Reservoir-Simulation Approach To Design and Optimize Unconventional Gas Production. J. Can. Pet. Technol. 2014, 53, 109–121. [Google Scholar] [CrossRef]

- Vilela, M.; Marin, P.; Rodrigo, M.; Medina, A.; Limeres, A.; Mata Petit, F. Building the Field Development Plan for a New Gas Field Located in Algeria, Reggane Trend. In Proceedings of the Asia Pacific Oil and Gas Conference and Exhibition, Jakarta, Indonesia, 30 October–1 November 2007. [Google Scholar]

- Bhattacharya, S.; Nikolaou, M. Using Data From Existing Wells To Plan New Wells in Unconventional Gas Field Development. In Proceedings of the Canadian Unconventional Resources Conference, Calgary, AB, Canada, 15–17 November 2011. [Google Scholar]

- Goedeke, S.; Hossain, M.M. Simulation of Shale Gas Field Development: An Example from Western Australia. In Proceedings of the SPE Middle East Unconventional Gas Conference and Exhibition, Abu Dhabi, UAE, 23–25 January 2012. [Google Scholar]

- Jackson, G.T.; Sahai, V.; Lalehrokh, F.; Rai, R. Impact of Staggered Fracture Placement on Field Development Planning of Unconventional Reservoirs: A Critical Evaluation of Overlapping SRVs. In Proceedings of the SPE Western Regional & AAPG Pacific Section Meeting 2013 Joint Technical Conference, Monterey, CA, USA, 19–25 April 2013. [Google Scholar]

- Brouwer, B.; Scheffers, B.C.; Harings, M.; Godderij, R.; Brolsma, M.-J.; Bouw, S. A Conceptual Shale Gas Field Development Plan for the Lower Jurassic Posidonia Shale in The Netherlands. In Proceedings of the SPE/EAGE European Unconventional Resources Conference and Exhibition, Vienna, Austria, 25–27 February 2014. [Google Scholar]

- Montgomery, D.C.; Runger, G.C. Applied Statistics and Probability for Engineers, 7th ed.; Wiley: Hoboken, NJ, USA, 2018; ISBN 978-1-119-40036-3. [Google Scholar]

- Walpole, R.E.; Myers, R.H.; Myers, S.L.; Keying, Y. Probability and Statistics for Engineers and Scientists, 9th ed.; Pearson Education Inc.: London, UK, 2012; ISBN 978-0-321-62911-1. [Google Scholar]

- Drillinginfo Shale Gas Field Production Data in Barnett, USA. Available online: http://drillinginfo.com/ (accessed on 23 April 2019).

| Parameter | Unit | Lower Limit | Upper Limit |

| Thickness | m | 60.96 | 121.92 |

| Reservoir pressure | kpa | 20,684 | 34,474 |

| Matrix porosity | fraction | 0.03 | 0.08 |

| Matrix permeability | md | 0.0001 | 0.001 |

| Initial gas saturation | fraction | 0.55 | 0.75 |

| Langmuir volume | scm/ton | 2.55 | 4.25 |

| Langmuir pressure | kpa | 6,895 | 10,342 |

| Fracture half-length | m | 60.96 | 152.40 |

| Fracture spacing | m | 60.96 | 152.40 |

| Fracture conductivity | md.m | 0.15 | 13.72 |

| Lateral Horizontal Well Length, M | Cost, USD | Fracture Half-Length Per Stage, M | Cost, USD | Parameter | Value |

|---|---|---|---|---|---|

| 305 | 2,000,000 | 76 | 100,000 | Interest rate, % | 10 |

| 610 | 2,100,000 | 152 | 125,000 | Royalty tax, % | 12.5 |

| 915 | 2,200,000 | 229 | 150,000 | Gas price, USD/Mscm | 106 |

| 1220 | 2,300,000 | 305 | 175,000 | OPEX, USD/Mscm | 26.5 |

| Model Based on | Term of Model | Predicted Objectives | |||||

|---|---|---|---|---|---|---|---|

| EUR 10 yrs | EUR 15 yrs | EUR 20 yrs | NPV 10 yrs | NPV 15 yrs | NPV 20 yrs | ||

| PR | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.327 | 0.175 | 0.128 | 0.120 | 0.088 | 0.079 | ||

| 0.737 | 0.925 | 1.000 | 0.742 | 0.701 | 0.693 | ||

| CGP3m | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.004 | 0.001 | 0.001 | 0.003 | 0.001 | 0.001 | ||

| 0.348 | 0.231 | 0.203 | 0.182 | 0.149 | 0.142 | ||

| CGP6m | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.069 | 0.041 | 0.038 | 0.060 | 0.041 | 0.038 | ||

| CGP12m | 0.004 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.008 | 0.005 | 0.006 | 0.026 | 0.014 | 0.013 | ||

| CGP18m | 0.018 | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.002 | 0.002 | 0.003 | 0.026 | 0.013 | 0.011 | ||

| CGP24m | 0.030 | 0.003 | 0.000 | 0.000 | 0.000 | 0.000 | |

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| 0.001 | 0.001 | 0.002 | 0.038 | 0.018 | 0.015 | ||

| Time | EUR Prediction Models | NPV Prediction Models | ||||||

|---|---|---|---|---|---|---|---|---|

| a0 | a1 | a2 | a3 | b0 | b1 | b2 | b3 | |

| 10 years | 4.11 × 106 | 4.61 × 100 | −1.67 × 10−8 | 4.88 × 10−17 | −3.23 × 106 | 1.98 × 10−1 | −6.50 × 10−10 | 2.04 × 10−18 |

| 15 years | 7.48 × 106 | 5.70 × 100 | −2.47 × 10−8 | 7.37 × 10−17 | −3.17 × 106 | 2.20 × 10−1 | −8.12 × 10−10 | 2.55 × 10−18 |

| 20 years | 1.11 × 107 | 6.50 × 100 | −3.08 × 10−8 | 9.13 × 10−17 | −3.12 × 106 | 2.30 × 10−1 | −8.88 × 10−10 | 2.77 × 10−18 |

| Parameter | Value |

|---|---|

| Number of datasets, wells | 164 |

| Well producing time, years | ≥10 |

| Minimum peak production rate, Mscm/day | 38.71 |

| Average peak production rate, Mscm/day | 97.18 |

| Maximum peak production rate, Mscm/day | 340.27 |

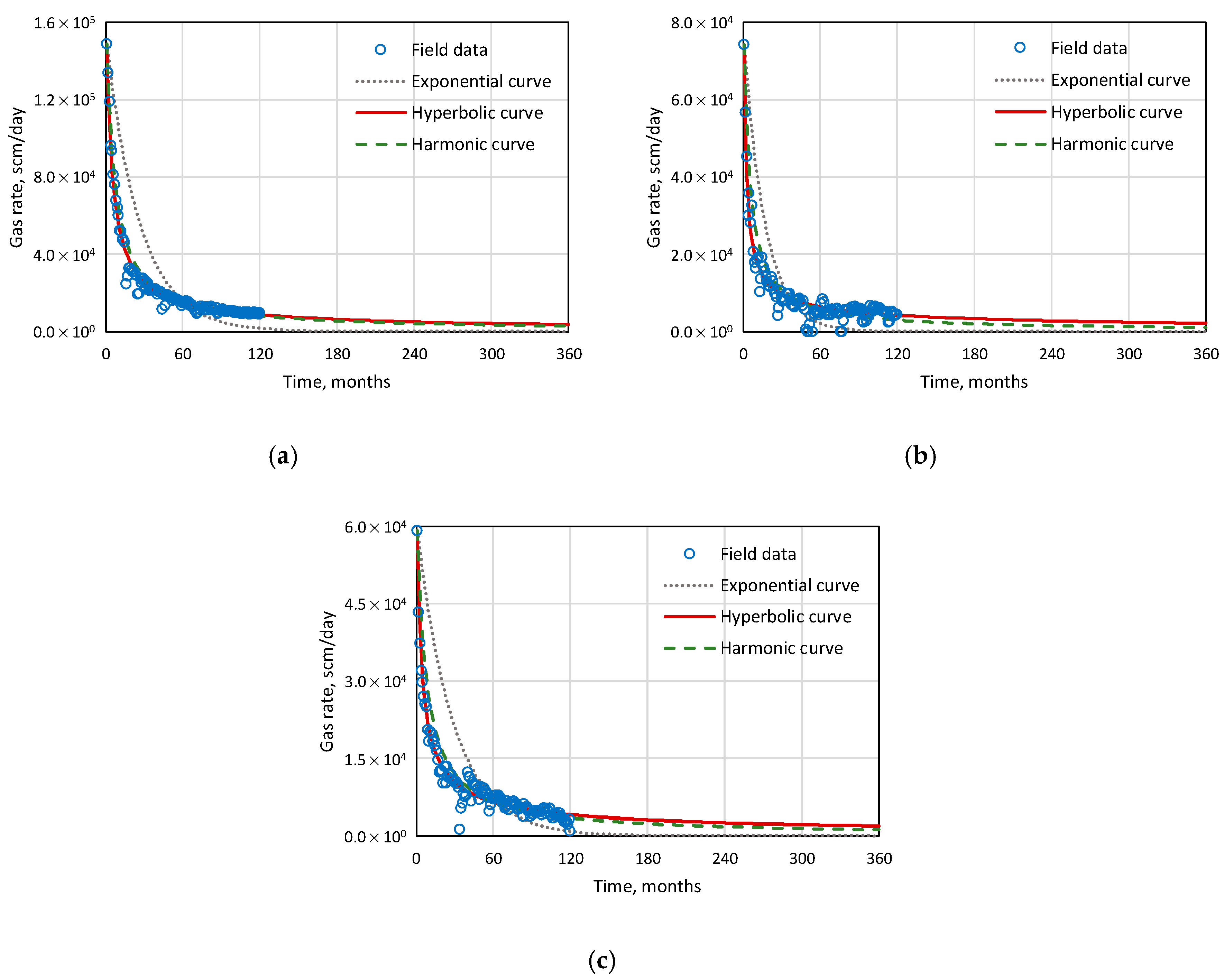

| Parameter | Exponential Curve | Hyperbolic Curve | Harmonic Curve |

|---|---|---|---|

| Minimum MAPE, % | 11.9 | 3.6 | 4.1 |

| Average MAPE, % | 44.2 | 10.3 | 13.6 |

| Maximum MAPE, % | 85.8 | 32.5 | 54.4 |

| Time | Modified EUR Prediction Models | Modified NPV Prediction Models | ||||||

|---|---|---|---|---|---|---|---|---|

| a0 | a1 | a2 | a3 | b0 | b1 | b2 | b3 | |

| 10 years | −1.87 × 107 | 4.61 × 100 | −1.67 × 10−8 | 4.88 × 10−17 | −3.90 × 106 | 1.98 × 10−1 | −6.50 × 10−10 | 2.04 × 10−18 |

| 15 years | −2.62 × 107 | 5.70 × 100 | −2.47 × 10−8 | 7.37 × 10−17 | −4.03 × 106 | 2.20 × 10−1 | −8.12 × 10−10 | 2.55 × 10−18 |

| 20 years | −3.15 × 107 | 6.50 × 100 | −3.08 × 10−8 | 9.13 × 10−17 | −4.08 × 106 | 2.30 × 10−1 | −8.88 × 10−10 | 2.77 × 10−18 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen-Le, V.; Shin, H.; Little, E. Development of Shale Gas Prediction Models for Long-Term Production and Economics Based on Early Production Data in Barnett Reservoir. Energies 2020, 13, 424. https://doi.org/10.3390/en13020424

Nguyen-Le V, Shin H, Little E. Development of Shale Gas Prediction Models for Long-Term Production and Economics Based on Early Production Data in Barnett Reservoir. Energies. 2020; 13(2):424. https://doi.org/10.3390/en13020424

Chicago/Turabian StyleNguyen-Le, Viet, Hyundon Shin, and Edward Little. 2020. "Development of Shale Gas Prediction Models for Long-Term Production and Economics Based on Early Production Data in Barnett Reservoir" Energies 13, no. 2: 424. https://doi.org/10.3390/en13020424

APA StyleNguyen-Le, V., Shin, H., & Little, E. (2020). Development of Shale Gas Prediction Models for Long-Term Production and Economics Based on Early Production Data in Barnett Reservoir. Energies, 13(2), 424. https://doi.org/10.3390/en13020424