Cost of Industrial Process Shutdowns Due to Voltage Sag and Short Interruption

Abstract

:1. Introduction

1.1. Relevance

1.2. State of Art

1.3. Contributions

2. Theory

2.1. Voltage Sag and Short Interruption

2.2. Overview of Equipment and Process Sensitivity

- point on wave—which corresponds to the phase angle of the instantaneous voltage at the sag initiation.

- phase–angle shift—the difference between the voltage phase angle at the pre sag moment and during the event.

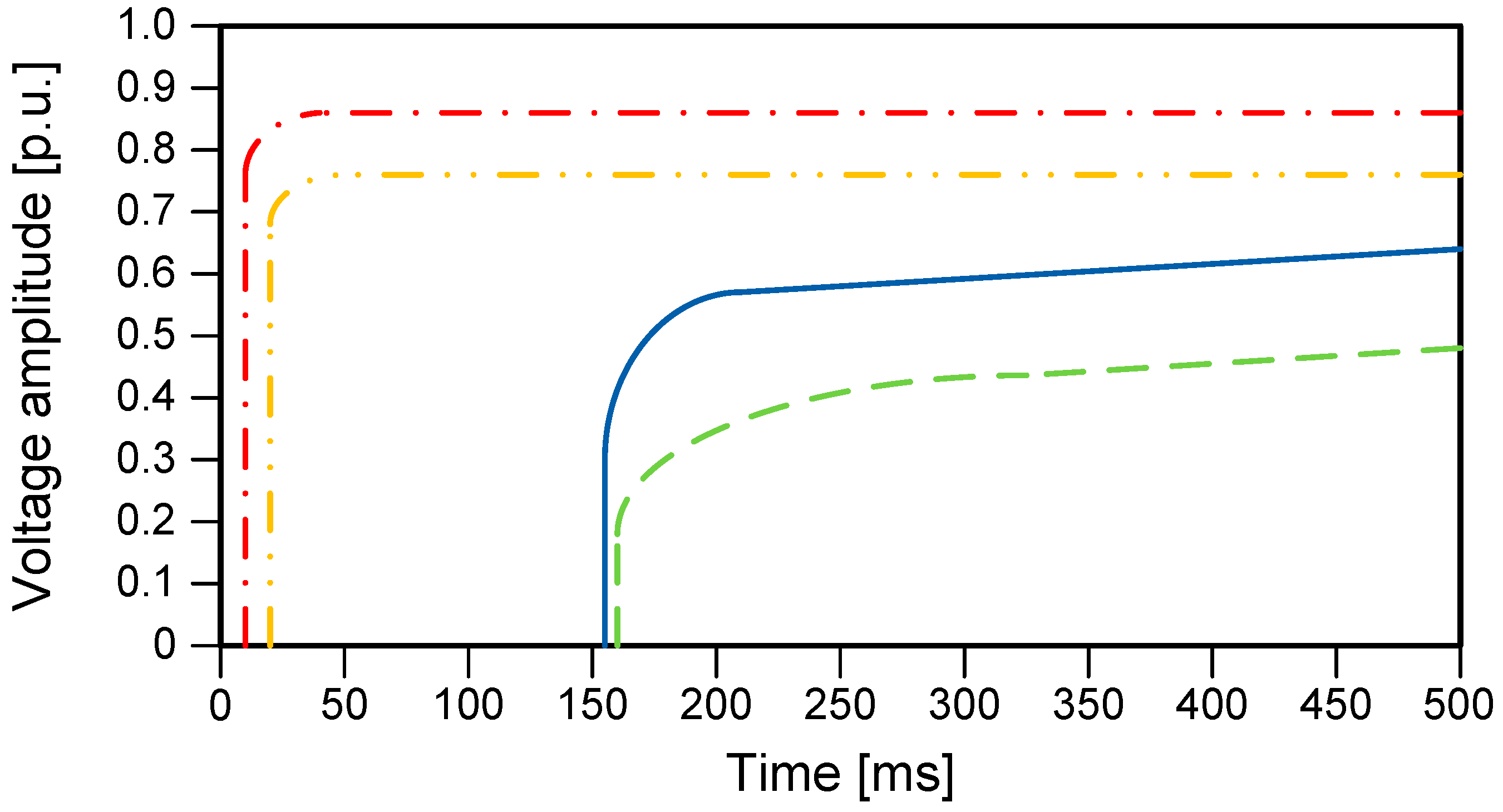

2.2.1. Adjustable Speed Drive—ASD

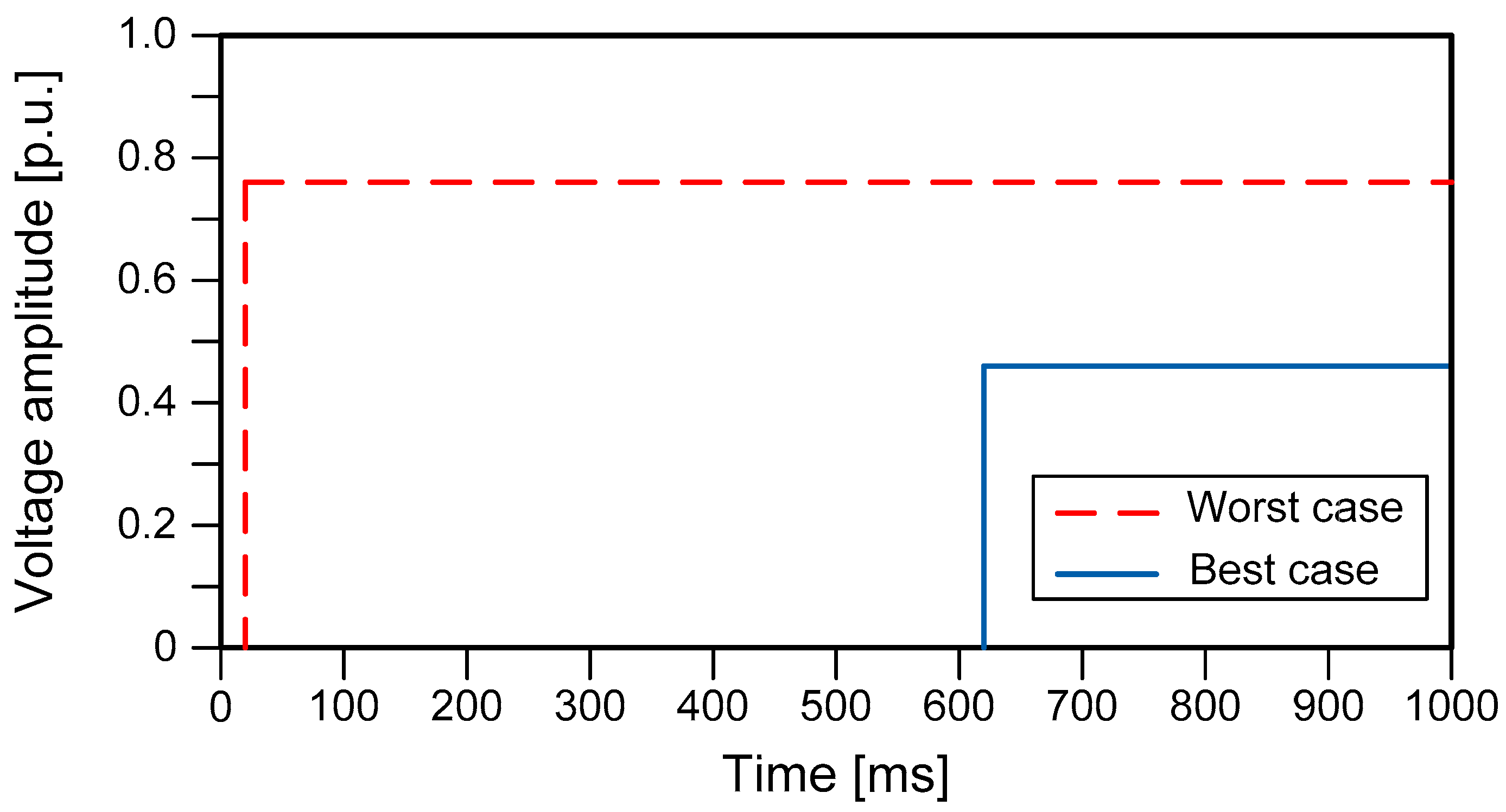

2.2.2. Programmable Logic Controller—PLC

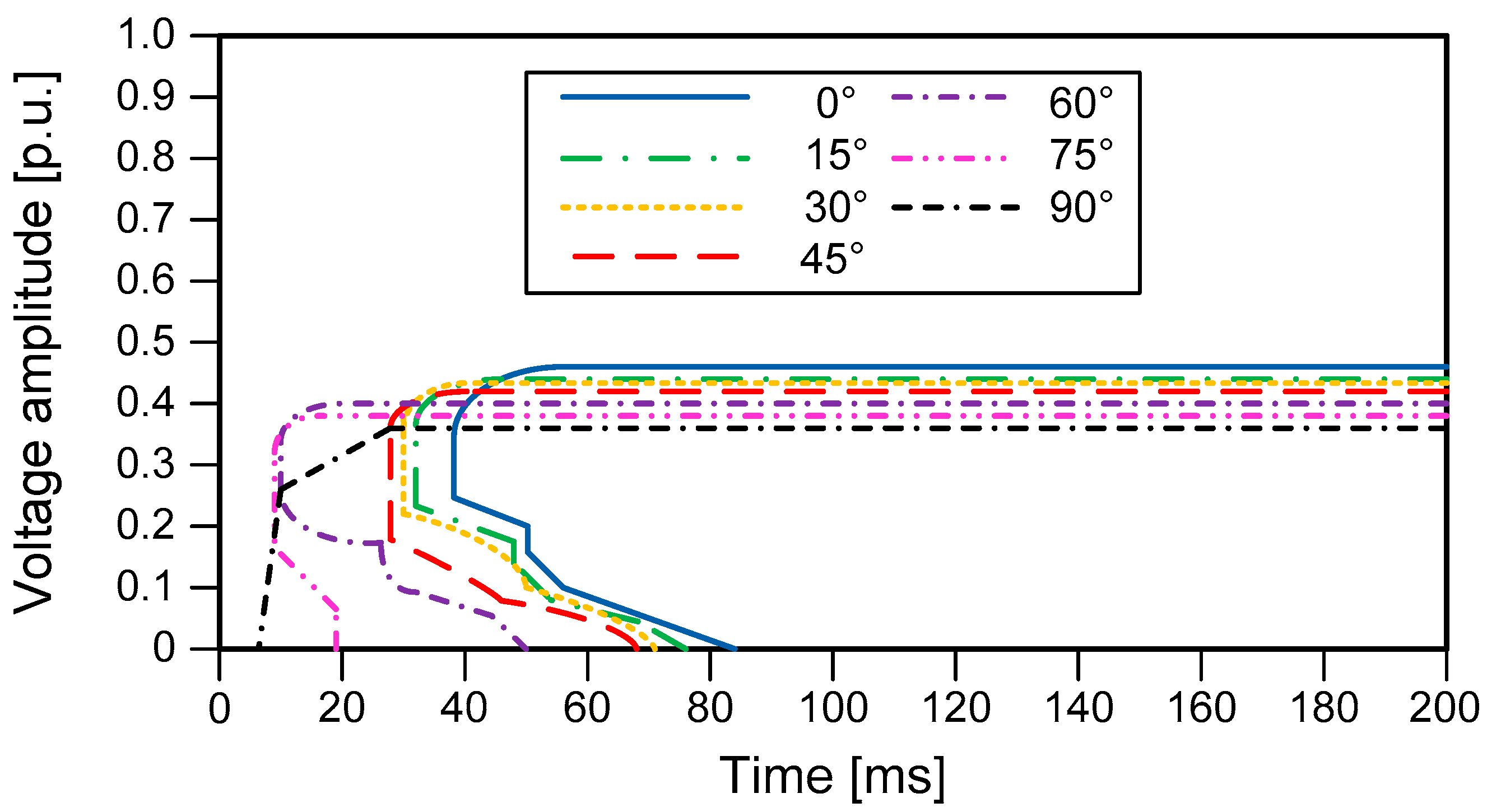

2.2.3. Contactor

3. Methods

- Preparation of the survey form;

- Selection of companies;

- Field survey;

- Analysis of the results.

3.1. Preparation of the Survey Form

- Type of industrial activity, contracted demand, supply voltage, installed loads;

- Industry opening hours, number of employees;

- Critical parts of the process, identification of sensitive equipment, number of process shutdowns, types of losses, and critical period of the day;

- Overtime to recover lost production, lost raw material, investments to mitigate shutdowns.

3.2. Selection of Companies

3.3. Field Survey

- Schedule visits in advance with the assistance of the electric utility;

- Clarify the client about the survey objectives and send the survey form in advance to be evaluated and filled out.

- The researcher was always accompanied by an EDP representative. On the day of the visit, the objectives of the survey were explained again and its importance clarified, both in relation to the academic sphere, as well as the business aspect of customer service;

- When possible, the plants of the companies’ production process were visited, in order to understand the manufacturing process, identifying the critical parts of the process, in order to better understand the causes of the shutdowns due to the occurrence of voltage sags and short interruptions.

3.4. Analysis of the Results

4. Case Study

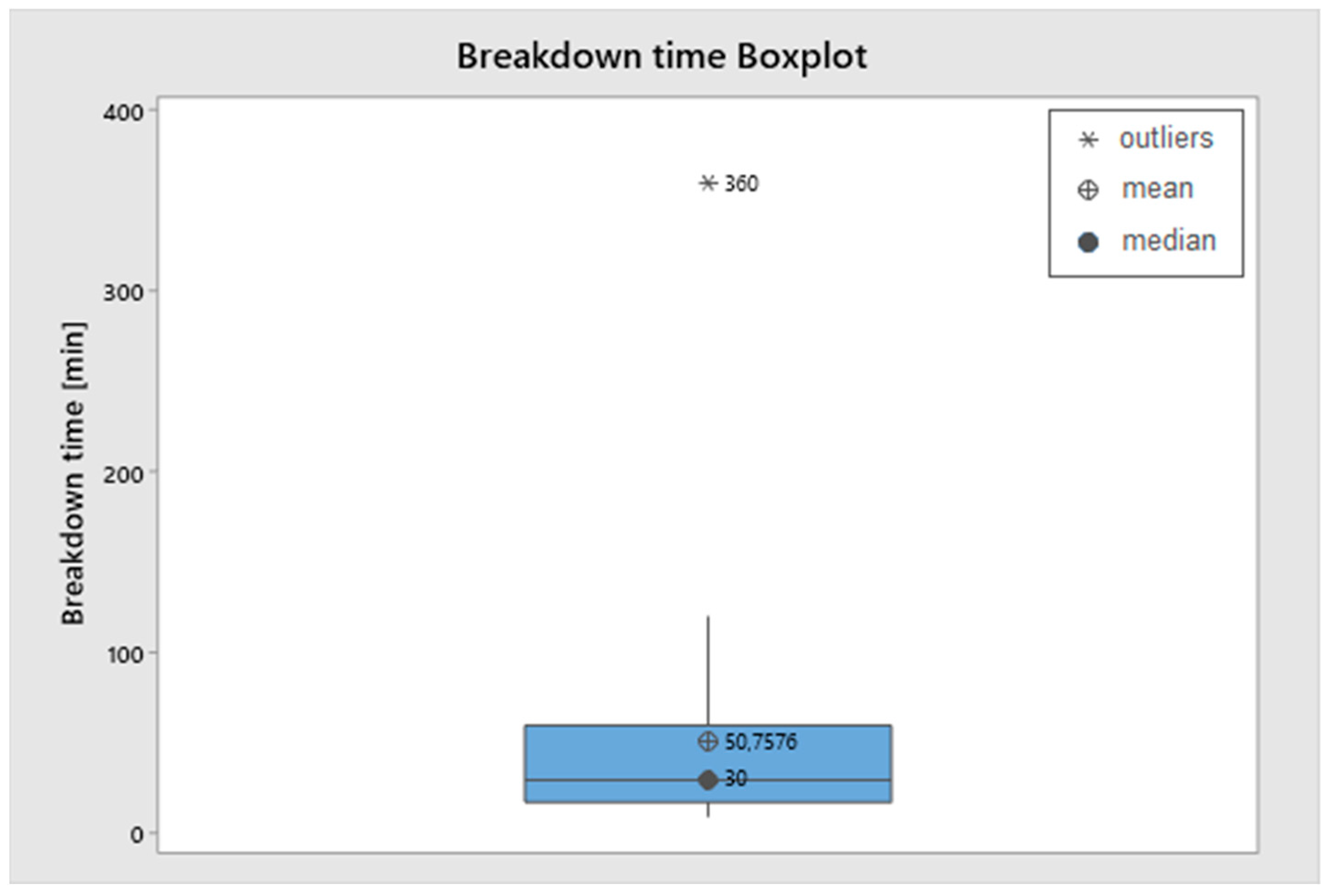

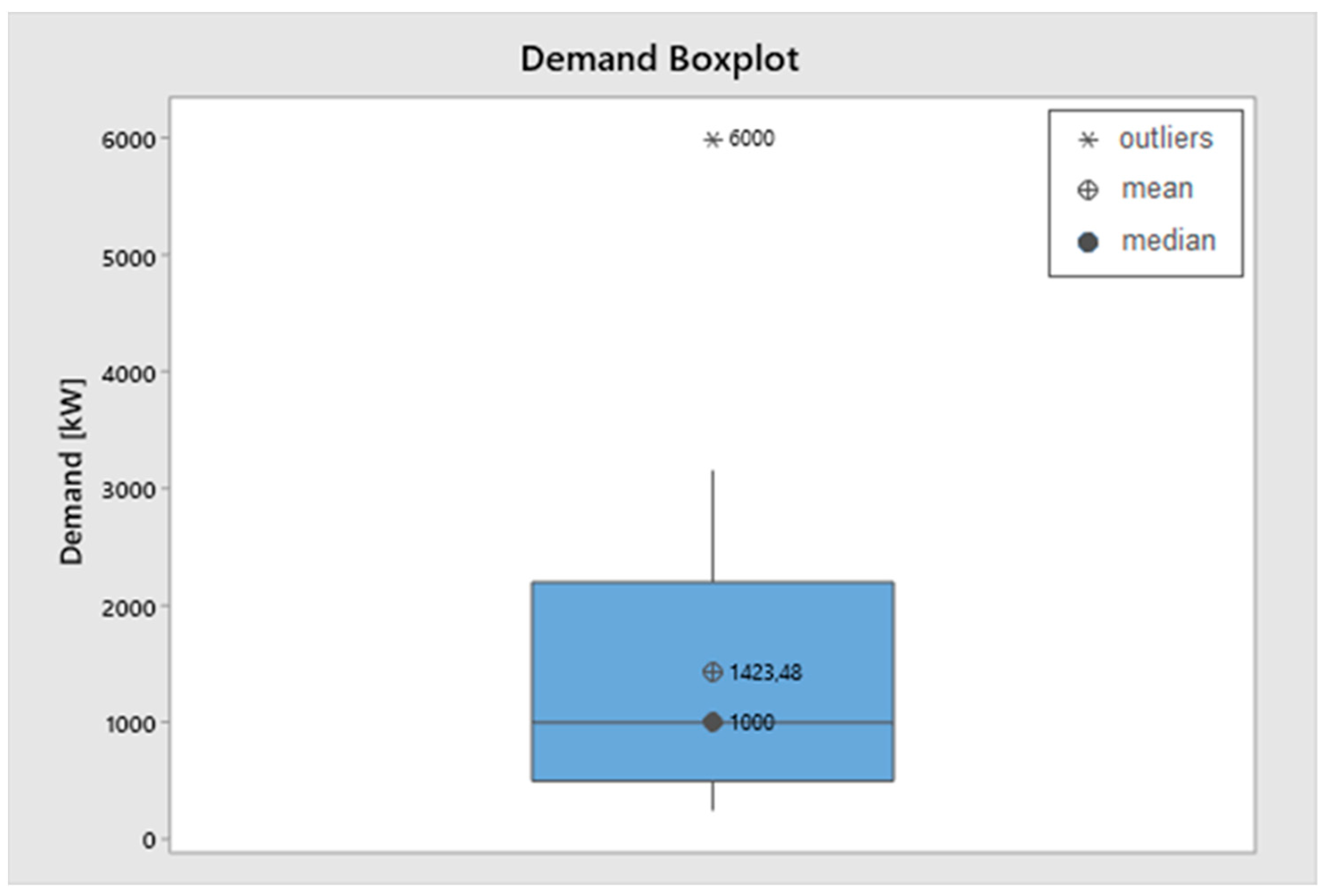

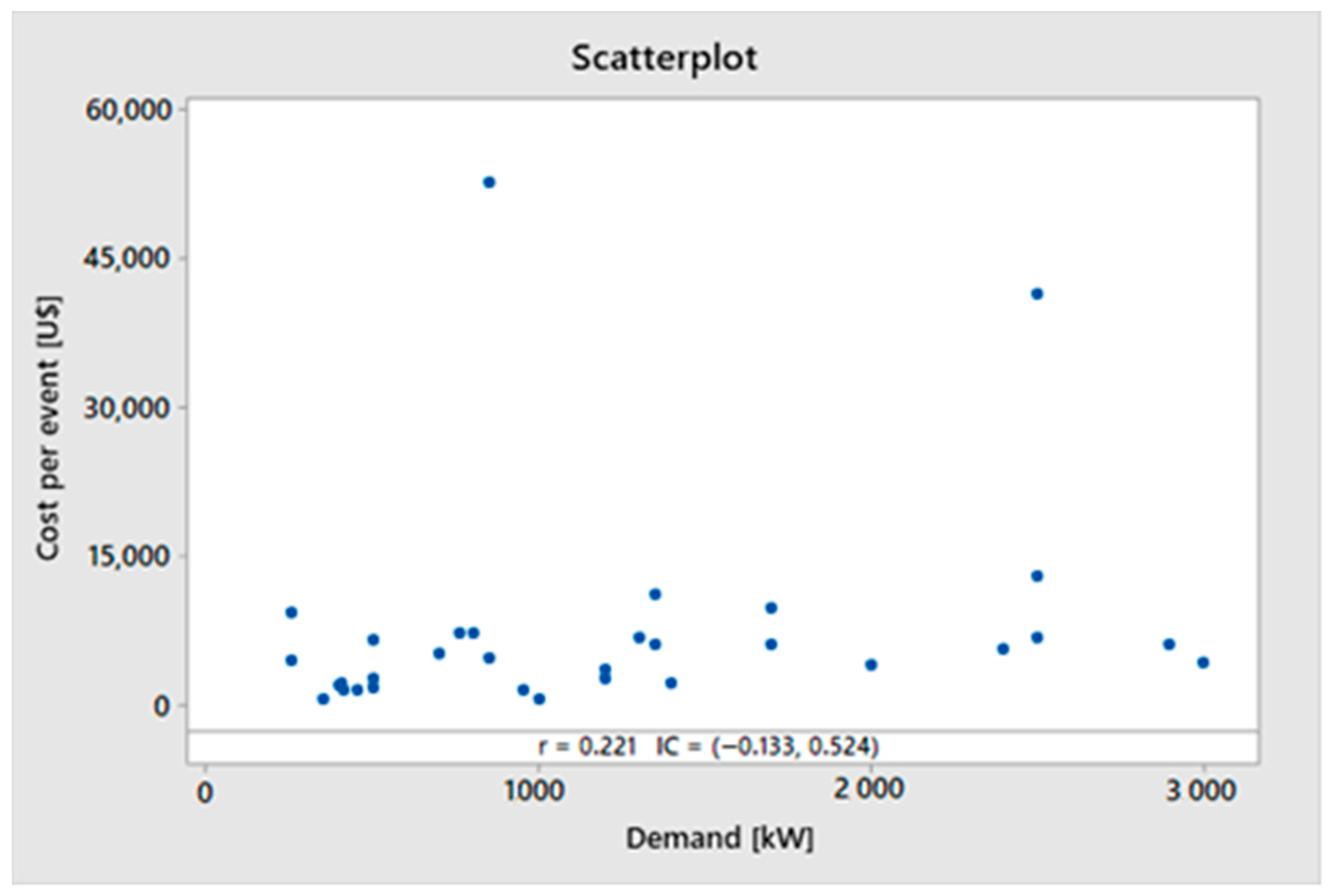

4.1. Results

4.2. General Analysis

4.3. Analyzes by Type of Activity

4.4. Difficulties

- Planning visits, scheduling difficulties, and delay in responding to the interest in participating in the survey;

- Difficulty in logistics and locomotion to visit companies. The distance between the city of São Paulo, where the researcher resides, and the companies chosen in this state was around 150 km. Regarding the state of Espírito Santo, travel is only viable by air, since the distance between São Paulo and Espírito Santo is 1100 km.

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- 1.

- Company name.

- 2.

- Main type of activity.

- 3.

- Average monthly demand, consumption and supply voltage.

- 4.

- Opening hours of the company.

- 5.

- Number of employees of the company.

- 6.

- Types of loads and processes installed.

- 7.

- How many processes shutdowns have occurred due to voltage sags and short interruptions in the last 12 months?

- 8.

- Considering voltage sag and short interruption identify the events that have the greatest impact (instantaneous, momentary, and temporary).

- 9.

- What is the critical period of the day that the occurrence of a voltage sag or short interruption causes more losses?

- 10.

- Which equipment in your company is most sensitive to voltage sag or short interruption?

- 11.

- How long would it take to resume production or operation if there was an unexpected process shutdown?

- 12.

- When there is an unexpected process shutdown due to voltage sag or short interruption, what type of damage or loss does the company have, and to what extent?

- 13.

- Considering a day and a period of high production, what is the estimated cost of restarting production/operation and the loss of production/operation/billing that your company would have in that period if there was an unexpected process shutdown due to voltage sag and short interruption?

- 14.

- Does the company pay overtime to employees in order to recover production or billing losses, even to end interrupted production, due to an unexpected process shutdown due to voltage sag and short interruption? If so, could the expenditure on the payment of such overtime be estimated?

- 15.

- Does your company have raw material, product in process, or finished product that would be discarded due to an unexpected process shutdown? If so, could you estimate the cost related to these losses?

- 16.

- Does the company have expenses for repairs and replacement of damaged equipment due to an unexpected process shutdown? If so, could you estimate the cost related to this?

- 17.

- Would the company have, in addition to the factors mentioned above, any other type of loss if an unexpected process shutdown occurred due to voltage sag and short interruption? If so, which one? Could you estimate the cost related to this other factor?

- 18.

- Does the company have procedures or equipment to monitor voltage sags and short interruptions? If yes, detail the type of monitoring.

- 19.

- What does your company do to mitigate voltage sag and short interruption? And what is the investment for that?

References

- MCGranaghan, M.; Roettger, B. Economic Evaluation of Power Quality. IEEE Power Eng. Rev. 2002, 22, 8–12. [Google Scholar] [CrossRef]

- LaMedica, R.; Esposito, G.; Tironi, E.; Zaninelli, D.; Prudenzi, A. A survey on power quality cost in industrial customers. In Proceedings of the 2001 IEEE Power Engineering Society Winter Meeting. Conference Proceedings (Cat. No.01CH37194), Columbus, OH, USA, 28 January–1 February 2001. [Google Scholar]

- Heine, P.; Pohjanheimo, P.; Lehtonen, M.; Lakervi, E. A method for estimating the frequency and cost of voltage sags. IEEE Trans. Power Syst. 2002, 17, 290–296. [Google Scholar] [CrossRef]

- Quaia, S.; Tosato, F. A method for the computation of the interruption costs caused by supply voltage dips and outages in small industrial plants. In Proceedings of the IEEE Region 8 EUROCON 2003, Computer as a Tool, Ljubljana, Slovenia, 22–24 September 2003; Volume 2, pp. 249–253. [Google Scholar] [CrossRef]

- Gupta, C.P.; Milanovic, J.V. Costs of Voltage Sags: Comprehensive Assessment Procedure. In Proceedings of the IEEE Russia Power Tech, St. Petersburg, Russia, 27–30 June 2005; pp. 1–7. [Google Scholar] [CrossRef]

- Milanovic, J.V.; Gupta, C.P. Probabilistic Assessment of Financial Losses due to Interruptions and Voltage Sags-Part I: The Methodology. IEEE Trans. Power Deliv. 2006, 21, 918–924. [Google Scholar] [CrossRef]

- Milanovic, J.V.; Gupta, C.P. Probabilistic Assessment of Financial Losses due to Interruptions and Voltage Sags—Part II: Practical Implementation. IEEE Trans. Power Deliv. 2006, 21, 925–932. [Google Scholar] [CrossRef]

- Goswami, A.K.; Gupta, C.P.; Singh, G.K. Assessment of Financial Losses due to Voltage Sags in an Indian Distribution System. In Proceedings of the 2008 IEEE Region 10 and the Third international Conference on Industrial and Information Systems, Kharagpur, India, 8–10 December 2008; pp. 1–6. [Google Scholar] [CrossRef]

- Kjølle, G.H.; Samdal, K.; Singh, B.; Kvitastein, O.A. Customer Costs Related to Interruptions and Voltage Problems: Methodology and Results. IEEE Trans. Power Syst. 2008, 23, 1030–1038. [Google Scholar] [CrossRef]

- Carvalho Filho, J.M.; Leborgne, R.C.; Oliveira, T.C.; Oliveira, J.F.; Watanabe, G.T. Voltage Sag Cost Assessment Based on Power Flow Reduction and Non Supplied Energy. In Proceedings of the 2009 IEEE Power & Energy Society General Meeting, Calgary, AB, Canada, 26–30 July 2009. [Google Scholar]

- Cebrian, J.C.; Kagan, N. Hybrid Method to Assess Sensitive Process Interruption Costs Due to Faults in Electric Power Dis-tribution Networks. IEEE Trans. Power Deliv. 2010, 25, 1686–1696. [Google Scholar] [CrossRef]

- Goswami, A.K.; Gupta, C.P.; Singh, G.K. Cost-benefit analysis of voltage sag mitigation methods in cement plants. In Proceedings of the 2014 16th International Conference on Harmonics and Quality of Power (ICHQP), Bucharest, Romania, 25–28 May 2014; pp. 866–870. [Google Scholar]

- Salim, F.; Nor, K.M.; Said, D.M.; Rahman, A.A.A. Voltage sags cost estimation for malaysian industries. In Proceedings of the 2014 IEEE International Conference on Power and Energy (PECon), Kuching, Sarawak, 1–3 December 2014; pp. 41–46. [Google Scholar]

- Chen, W.; Ding, C.; Wang, L.; Zhu, X. Economic analysis of voltage sag loss and treatment based on on-site data. In Proceedings of the 2016 China International Conference on Electricity Distribution (CICED), Xi’an, China, 10–13 August 2016; pp. 1–4. [Google Scholar]

- Behera, C.; Banik, A.; Nandi, J.; Dey, S.; Reddy, G.H.; Goswami, A.K. Assessment of Financial Loss Due to Voltage Sag in an Industrial Distribution System. In Proceedings of the 2019 IEEE 1st International Conference on Energy, Systems and Information Processing (ICESIP), Chennai, India, 4–6 July 2019; pp. 1–6. [Google Scholar]

- Somrak, T.; Tayjasanant, T. Minimized Financial Losses Due to Interruptions and Voltage Sags with Consideration of Investment Cost. In Proceedings of the 2019 IEEE PES GTD Grand International Conference and Exposition Asia (GTD Asia), Bangkok, Thailand, 19–23 March 2019; pp. 29–34. [Google Scholar]

- He, H.-Y.; Zhang, W.-H.; Wang, Y.; Xiao, X.-Y. A Sensitive Industrial Process Model for Financial Losses Assessment Due to Voltage Sag and Short Interruptions. IEEE Trans. Power Deliv. 2020. [Google Scholar] [CrossRef]

- Institute of Electrical and Electronics Engineers IEEE Std 1159-2009: IEEE Recommended Practice for Monitoring Electric Power Quality; IEEE: New York, NY, USA, 2009. [CrossRef]

- Escribano, A.H.; Gómez-Lázaro, E.; Molina-García, A.; Fuentes, J. Influence of voltage dips on industrial equipment: Analysis and assessment. Int. J. Electr. Power Energy Syst. 2012, 41, 87–95. [Google Scholar] [CrossRef]

- Djokic, S.; Stockman, K.; Milanovic, J.; Desmet, J.; Belmans, R. Sensitivity of AC adjustable speed drives to voltage sags and short interruptions. IEEE Trans. Power Deliv. 2005, 20, 494–505. [Google Scholar] [CrossRef]

- Wu, Y.; Li, C.; Xu, Y.; Wei, P. Characterizing the tolerance performance of PLCs to voltage sag based on experimental research. In Proceedings of the 2016 IEEE PES Asia-Pacific Power and Energy Engineering Conference (APPEEC), Xi’an, China, 25–28 October 2016; pp. 496–501. [Google Scholar]

- Djokic, S.; Milanovic, J.; Kirschen, D. Sensitivity of AC Coil Contactors to Voltage Sags, Short Interruptions, and Undervoltage Transients. IEEE Trans. Power Deliv. 2004, 19, 1299–1307. [Google Scholar] [CrossRef]

- Kanokbannakorn, W.; Saengsuwan, T.; Sirisukprasert, S. The modeling of AC magnetic contactor for immunity studies and voltage sag assessment. In Proceedings of the The 8th Electrical Engineering/ Electronics, Computer, Telecommunications and Information Technology (ECTI) Association of Thailand—Conference 2011, Khon Kaen, Thailand, 17–19 May 2011; pp. 621–624. [Google Scholar]

- Shareef, H.; Marzuki, N.; Mohamed, A.; Mohamed, K. Experimental Investigation of ac contactor ride through capability during voltage sag. In Proceedings of the 2010 9th International Conference on Environment and Electrical Engineering, Institute of Electrical and Electronics Engineers (IEEE), Cappadocia, Turkey, 16–19 May 2010; pp. 325–328. [Google Scholar]

- Cigre/Cired/Uie Joint Working Group C4.110 Voltage Dip Immunity of Equipment and Installations; Cigre Technical Brochure 412; CIGRE: Paris, France, 2010.

- Magalhaes, C.H.N. Recursos Operativos no Planejamento de Expansão de Sistemas de Potência. Doctoral Thesis, Universidade de São Paulo–USP, São Paulo, Brazil, 23 March 2009. (In Portuguese). [Google Scholar]

- Pelegrini, M.A.; Almeida, C.F.M.; Kondo, D.V.; Magalhaes, C.H.; Silva, F.T.; Baldan, S.; Filho, F.C.S.; Garcia, V.V. Survey and applications of interruption costs in large customers. In Proceedings of the 2012 IEEE 15th International Conference on Harmonics and Quality of Power, Hong Kong, China, 17–20 June 2012; pp. 860–864. [Google Scholar]

| Category | Transitory | Duration | Voltage Magnitude | |

|---|---|---|---|---|

| Short-time duration | Instantaneous | Voltage sag | 0.5→to 30 cycles | 0.1 to 0.9 pu |

| Momentaneous | Interruption | 0.5→to 30 cycles | <0.1 pu | |

| Voltage sag | 30 cycles to 3 s | 0.1 to 0.9 pu | ||

| Temporary | Interruption | 3 s to 1 min | <0.1 pu | |

| Voltage sag | 3 s to 1 min | 0.1 to 0.9 pu |

| Number | Activity Type | Company Size | Observation |

|---|---|---|---|

| 1 | Plastic | Big (1000 employees) | Plastic film for food area |

| 2 | Automotive | Medium (560 employees) | Locks and door handles |

| 3 | Tires | Big (1000 employees) | Tires for cars |

| 4 | Tires | Big (1000 employees) | Tires for cars |

| 5 | Commercial | Medium (300 employees) | Space lease |

| 6 | Commercial | Small (150 employees) | Space lease |

| 7 | Wallpaper | Medium (300 employees) | Wallpaper |

| 8 | Metallurgical | Small (170 employees) | Aluminum profiles |

| 9 | Toys | Small (190 employees) | Toys |

| 10 | PVC Plastic | Medium (400 employees) | Plastic film for food area |

| 11 | PVC Plastic | Medium (800 employees) | Plastic film for food area |

| 12 | Electroplating | Small (35 employees) | Pieces and parts |

| 13 | Extrusion | Small (49 employees) | Metallurgical |

| 14 | Textile | Small (120 employees) | Wool fiber |

| 15 | Textile | Small (70 employees) | Dyeing clothes |

| 16 | Glass | Small (80 employees) | Glass for boxing, doors of residences |

| 17 | Extrusion | Medium (500 employees) | Use in deep sea waters |

| 18 | Plastic | Medium (300 employees) | Packaging for food area |

| 19 | Foundry | Small (50 employees) | Freight train parts—Vale do Rio Doce |

| 20 | Rock mining | Small (45 employees) | Granules for civil industry |

| 21 | Glass | Small (60 employees) | Glass for boxing, doors of residences |

| 22 | Food | Small (250 employees) | Pulp juices |

| 23 | Furniture | Medium (300 employees) | MDF boards |

| 24 | Furniture | Medium (300 employees) | MDF boards |

| 25 | Animal food | Small (50 employees) | Animal food |

| 26 | Stones and granites | Small (250 employees) | Manufacturing granite and marble sinks |

| 27 | Chips cards | Small (200 employees) | Card for banks and general trade |

| 28 | Plastic | Small (100 employees) | Plastic packaging for food industry |

| 29 | Metallurgical | Medium (300 employees) | Vertical, horizontal movements |

| 30 | Commercial | Big (1000 employees) | Space lease |

| 31 | Fertilizer | Small (100 employees) | Packaging |

| 32 | Automotive | Medium (500 employees) | Bus assembler |

| 33 | Petroleum | Big (1000 employees) | Onshore oil prospecting |

| Number | Activity Type | Sensitive Equipment | Event History | Breakdown Time |

|---|---|---|---|---|

| 1 | Plastic | ASD, PLC | 2 events/month | 120 min |

| 2 | Automotive | ASD, PLC, Robot | 4 events/month | 60 min |

| 3 | Tires | ASD, PLC | 2 events/month | 120 min |

| 4 | Tires | ASD, PLC, Electronic cards | 3 events/month | 60 min |

| 5 | Commercial | Computer, No break | 7 events/month | 15 min |

| 6 | Commercial | Building Manag. System, No break, Computer | 4 events/month | 20 min |

| 7 | Wallpaper | ASD, PLC | 5 events/month | 30 min |

| 8 | Metallurgical | ASD, PLC | 2 events/month | 60 min |

| 9 | Toys | ASD, PLC | 8 events/month | 45 min |

| 10 | PVC Plastic | ASD, PLC, electronic cards | 10 events/month | 30 min |

| 11 | PVC Plastic | ASD, PLC, electronic cards | 10 events/month | 30 min |

| 12 | Electroplating | Contactor | 1 event/month | 10 min |

| 13 | Extrusion | ASD, PLC | 3 events/month | 15 min |

| 14 | Textile | ASD, Contactor | 2 events/month | 30 min |

| 15 | Textile | ASD, PLC, Electronic cards | 6 events/month | 40 min |

| 16 | Glass | ASD, PLC | not available | 10 min |

| 17 | Extrusion | ASD, PLC, RX SCANNER | 30 events/month | 60 min |

| 18 | Plastic | ASD, PRINTER | 25 events/month | 60 min |

| 19 | Foundry | ASD, PLC | 1 event/month | 60 min |

| 20 | Rock mining | ASD, PLC | not available | 20 min |

| 21 | Glass | ASD, PLC | not available | 20 min |

| 22 | Food | ASD, PLC | not available | 360 min |

| 23 | Furniture | ASD, PLC, UV lamp | 8 events/month | 60 min |

| 24 | Furniture | ASD, PLC, UV lamp | 8 events/month | 30 min |

| 25 | Animal food | ASD, PLC | 8 events/month | 30 min |

| 26 | Stones and granites | ASD, PLC | 4 events/month | 30 min |

| 27 | Chips cards | Printers machines | 8 events/month | 120 min |

| 28 | Plastic | ASD, PLC | 4 events/month | 15 min |

| 29 | Metallurgical | ASD, PLC | 4 events/month | 15 min |

| 30 | Commercial | Computers, Servers, Elevators, Escalators | 5 events/month | 10 min |

| 31 | Fertilizer | ASD, PLC, Contactor, Elevator | not available | 10 min |

| 32 | Automotive | Laser, Tube Bender, Welding Robot | 30 events/month | 20 min |

| 33 | Petroleum | ASD, PLC | 18 events/month | 60 min |

| Number | Activity Type | Demand (kW) | Cost/Event (US $) | Cost/kW (US $/kW) | Other Information |

|---|---|---|---|---|---|

| 1 | Plastic | 3000 | 4190.30 | 1.40 | US $3286.50 equipment damage |

| 2 | Automotive | 2500 | 6847.00 | 2.74 | Damage to some equipment |

| 3 | Tires | 2900 | 6003.00 | 2.07 | US $12,005.00/month (scrap reprocessed) |

| 4 | Tires | 1700 | 6000.00 | 3.53 | US $18,000.00/month (scrap reprocessed) + 2096.00 maintenance |

| 5 | Commercial | 1200 | 2717.00 | 2.26 | US $76,070.00/month of penalty (12 h no energy) |

| 6 | Commercial | 1300 | 6851.00 | 5.27 | US $261.00 in damaged equipment and 1 h no monitoring Investment—US $227,718.00 in 8 generators, 2018/Jan. |

| 7 | Wallpaper | 1700 | 9667.00 | 5.69 | US $2370.00 equipment damage |

| 8 | Metallurgical | 1400 | 2071.00 | 1.48 | - |

| 9 | Toys | 1200 | 3657.00 | 3.05 | US $740.00 equipment damage |

| 10 | PVC Plastic | 500 | 1640.00 | 3.28 | US $2368,00 equipment damage |

| 11 | PVC Plastic | 1350 | 6056.00 | 4.50 | US $7130,00 equipment damage |

| 12 | Electroplating | 350 | 556.00 | 1.60 | US $470,00 equipment damage |

| 13 | Extrusion | 500 | 1811.00 | 3.62 | - |

| 14 | Textile | 950 | 1501.00 | 1.67 | - |

| 15 | Textile | 450 | 1509.45 | 3.35 | US $2841,00 equipment damage |

| 16 | Glass | 410 | 1437.00 | 3.51 | Loss of 1 oven due to an 8-h interruption |

| 17 | Cables Extrusion | 850 | 52,800.00 | 62.18 | Loss of umbilical tubes up to 2 km |

| 18 | Plastic | 2400 | 5690.00 | 2.37 | - |

| 19 | Foundry | 850 | 4773.00 | 5.61 | Scraps are reprocessed |

| 20 | Rock mining | 2000 | 4085,00 | 2.04 | Loss of particle size |

| 21 | Glass | 405 | 2161.00 | 5.33 | Scraps are destined for beverage factories |

| 22 | Food | 700 | 5145.00 | 7.35 | 5 no breaks—800 kVA |

| 23 | Furniture | 760 | 7238.00 | 9.52 | Damage of UV Lamps |

| 24 | Furniture | 800 | 7153.00 | 8.94 | Damage of Transformer and track rollers |

| 25 | Animal food | 1000 | 650.00 | 0.65 | Refused feed is recycled in the process |

| 26 | Stones and granites | 3150 | 11,130.00 | 3.53 | Imperfect granite slabs are reprocessed |

| 27 | Chips cards | 500 | 6613.00 | 13.26 | - |

| 28 | Plastic | 400 | 2031,00 | 5.08 | Material is recycled and reprocessed |

| 29 | Metallurgical | 500 | 2715.00 | 5.43 | - |

| 30 | Commercial | 6000 | 9311.00 | 1.55 | Investment in harmonic filter |

| 31 | Fertilizer Chemical | 250 | 4565.00 | 18.26 | Refuse is reprocessed |

| 32 | Automotive | 2500 | 13,049.00 | 5.22 | Investment in no breaks, generator |

| 33 | Petroleum | 2500 | 41,414.00 | 16.57 | - |

| Number | Demand (kW) | Cost/Event (US $) | Cost/kW (US $/kW) |

|---|---|---|---|

| Plastic—Total Companies: 8—24.24% | |||

| 1 | 3000 | 4190.00 | 1.40 |

| 7 | 1700 | 9667.00 | 5.69 |

| 9 | 1200 | 3657.00 | 3.05 |

| 10 | 500 | 1640.00 | 3.28 |

| 11 | 1350 | 6056.00 | 4.50 |

| 18 | 2400 | 5690.00 | 2.37 |

| 27 | 500 | 6613.00 | 13.26 |

| 28 | 400 | 2031.00 | 5.08 |

| Range | 400 to 3000 | 1640.00 to 9667.00 | 1.40 to 13.26 |

| Average | 1381.25 | 4943.00 | 4.83 |

| Automotive—Total Companies: 4—12.12% | |||

| 2 | 2500 | 6847.00 | 2.74 |

| 3 | 2900 | 6003.00 | 2.07 |

| 4 | 1700 | 6000.00 | 3.53 |

| 32 | 2500 | 13,049.00 | 5.22 |

| Range | 1700 to 2900 | 6000.00 to 13,049.00 | 2.07 to 5.22 |

| Average | 2400 | 7974.75 | 3.39 |

| Commercial—Total Companies: 3—9.09% | |||

| 5 | 1200 | 2717.00 | 2.26 |

| 6 | 1300 | 6851.00 | 5.27 |

| 30 | 6000 | 9311.00 | 1.55 |

| Range | 1200 to 6000 | 2717.00 to 9311.00 | 1.55 to 5.27 |

| Average | 2833.33 | 6293.00 | 3.03 |

| Glass—Total Companies: 2—6.06% | |||

| 16 | 410 | 1437.00 | 3.51 |

| 21 | 405 | 2161.00 | 5.33 |

| Range | 405 to 410 | 1437.00 to 2161.00 | 3.51 to 5.33 |

| Average | 408 | 1799.00 | 4.42 |

| Metallurgical—Total Companies: 6—18.18% | |||

| 8 | 1400 | 2071.00 | 1.48 |

| 12 | 350 | 556.00 | 1.60 |

| 13 | 500 | 1811.00 | 3.62 |

| 17 | 850 | 52,800.00 | 62.18 |

| 19 | 850 | 4773.00 | 5.61 |

| 29 | 500 | 2715.00 | 5.08 |

| Range | 350 to 1400 | 556.00 to 52,800.00 | 1.48 to 62.18 |

| Average | 741.67 | 10,787.67 | 13.26 |

| Mining—Total Companies: 1—3.03% | |||

| 20 | 2000 | 4085.00 | 2.04 |

| Food—Total Companies: 2—6.06% | |||

| 22 | 700 | 5145.00 | 7.35 |

| 25 | 1000 | 650.00 | 0.65 |

| Range | 700 to 1000 | 650.00 to 5145.00 | 0.65 to 7.35 |

| Average | 850 | 2897.50 | 4.00 |

| Furniture—Total Companies: 2—6.06% | |||

| 23 | 760 | 7238.00 | 9.52 |

| 24 | 800 | 7153.00 | 8.94 |

| Range | 760 to 800 | 7153.00 to 7238.00 | 8.97 to 9.52 |

| Average | 780 | 7195.50 | 9.23 |

| Stones and Granites—Total Companies: 1—3.03% | |||

| 26 | 3150 | 11,130.00 | 3.53 |

| Chemical—Total Companies: 1—3.03% | |||

| 31 | 250 | 4565.00 | 18.26 |

| Textile—Total Companies: 2—6.06% | |||

| 14 | 950 | 1501.00 | 1.67 |

| 15 | 450 | 1509.45 | 3.35 |

| Range | 450 to 950 | 1501 to 1509.45 | 1.67 to 3.35 |

| Average | 700 | 1505.23 | 2.51 |

| Petroliferous—Total Companies: 1—3.03% | |||

| 33 | 2500 | 41,414.00 | 16.57 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Motoki, É.M.; Filho, J.M.d.C.; da Silveira, P.M.; Pereira, N.B.; de Souza, P.V.G. Cost of Industrial Process Shutdowns Due to Voltage Sag and Short Interruption. Energies 2021, 14, 2874. https://doi.org/10.3390/en14102874

Motoki ÉM, Filho JMdC, da Silveira PM, Pereira NB, de Souza PVG. Cost of Industrial Process Shutdowns Due to Voltage Sag and Short Interruption. Energies. 2021; 14(10):2874. https://doi.org/10.3390/en14102874

Chicago/Turabian StyleMotoki, Édison Massao, José Maria de Carvalho Filho, Paulo Márcio da Silveira, Natanael Barbosa Pereira, and Paulo Vitor Grillo de Souza. 2021. "Cost of Industrial Process Shutdowns Due to Voltage Sag and Short Interruption" Energies 14, no. 10: 2874. https://doi.org/10.3390/en14102874