Abstract

Organisations attempt to contribute their share towards fighting the climate crisis by trying to reduce their emission of greenhouse gases effectively towards net zero. An instrument to guide their reduction efforts is internal carbon pricing. Next to choosing the right pricing tool, defining the exact value of an internal carbon price, especially against the background of potential regulatory external carbon prices, and assessing its impact on business units’ energy systems poses a challenge for organisations. The academic literature has so far not examined the impact differences of an internal carbon price across different countries, which this paper addresses by using an optimisation model. First, it analyses the energy system cost increase of a real-world facility based on an internal carbon price compared to a potential regulatory carbon price within a country. Second, we evaluate the energy system cost increase based on an internal carbon price across different countries. The results show that with regard to internal carbon prices the additional total system cost compared to potential external carbon prices stays within 9%, 15%, and 59% for Germany, Japan, and the United Kingdom, respectively. The increase in the energy system cost in each country varies between 3% and 93%. For all countries, the cost differences can be reduced by allowing the installation of renewables. The integration of renewables via energy storage and power-to-heat technologies depends on the renewable potentials and the availability of carbon capture and storage. If organisations do not account for these differences, it might raise the disapproval of internal carbon prices within the organisation.

1. Introduction

In accordance with the Paris Climate Agreement, the international community widely acknowledged the urgent need to fight the climate crisis [1,2,3,4]. Currently the most common measure is to reduce carbon dioxide (CO2) and other greenhouse gas (GHG) emissions. The Intergovernmental Panel on Climate Change (IPCC) defines greenhouse gases as “those gaseous constituents of the atmosphere, both natural and anthropogenic, that absorb and emit radiation at specific wavelengths within the spectrum of terrestrial radiation emitted by the Earth’s surface, the atmosphere itself and by clouds. This property causes the greenhouse effect.” [5] In addition to CO2, water moisture (H2O), nitrous oxide (N2O), methane (CH4), ozone (O3), and halocarbons are defined as greenhouse gases [5]. To compare how different greenhouse gases affect the warming of the atmosphere, CO2 equivalents are used, making GHG reduction efforts easier to compare [6].

An instrument used to guide the transformation to low-carbon or decarbonised processes is carbon pricing. The idea is to put a price on CO2 and other GHG emissions, which make emission-intense actions more expensive [7,8]. Besides regulatory bodies defining and implementing some sort of carbon price, the private sector can voluntarily implement a price within its organisation. This is called internal carbon pricing [7]. In the context of carbon pricing, the media claims that the private sector is “moving faster than governments” [9] and the number of companies which use some form of internal carbon price (ICP) has been increasing in recent years [10,11,12].

Institutional pressure and economic reasoning are two motives for the private sector to implement internal carbon prices. The institutional pressure stems from government policy and the expectations of stakeholders, especially investors and customers [13,14,15]. For these stakeholders, the mitigation efforts of organisations regarding climate change gains importance [13,14,16]. Actively managing the reduction of an organisation’s emissions underlines forward-looking behaviour to these stakeholders [7,17]. With internal carbon pricing, investments can be evaluated and might be redirected towards less emission-intensive options. Furthermore, it reduces the threat for an organisation’s assets to be negatively affected from stricter policies and future mandatory carbon prices [7,17,18].

Chang bases the economic reasoning on the multiphase model and the Porter hypothesis [19]. The multiphase model states that organisations may reduce the adaption costs to a new environment (e.g., a decarbonised world) by restructuring, phasing out old technologies, and updating processes and products over longer periods [19]. Therefore, the introduction of an internal carbon price and the associated refinements of investments can reduce the costs of decarbonisation. The Porter hypothesis suggests that organisations are imperfect in reducing cost [19]. In this context, emissions can be seen as inefficiencies in processes and products. By using internal carbon prices, business units have an additional motivation to improve processes and products while reducing emissions [19,20].

The ability to implement some sort of internal carbon pricing is greater in larger companies as they often have more financial and human resources available for the development, implementation, and maintenance of such environmental initiatives [13]. Emission-intensive companies usually prefer methods without money transactions (e.g., proxy prices) [18]. These organisations focus on decarbonisation through sustainable investments. Service-orientated sectors with lower emissions use more fee-like methods (e.g., an internal carbon fee) [18]. Overall, the industry sector accounts for at least 30% of the global GHG emissions and therefore plays a crucial role in fighting the climate crisis through the reduction of these emissions [21].

There are different methods to implement ICP, which vary in their design and complexity. References [7,17,18] give overviews on the different ICP methods. Among the most frequently used ICP methods are proxy prices (also known as shadow prices) [7,10,22]. An organisation which chooses to use this method defines a price for CO2 and other relevant GHG emissions and considers this cost factor during investment decision making or operation planning. It is an assumption about a cost factor just like future exchange rates or commodity prices [18,23].

Defining the height of a proxy price poses a significant challenge, also referred to as the “right price trap” [7,24,25]. One solution is to align the CO2 price with the social costs of carbon [26]. The social costs of carbon take the ecological and economic damage of current and future generations into account [26,27]. A publication in this context is the Dynamic Integrated Climate–Economy (DICE) model, firstly published by Nordhaus [28]. It was much discussed as, in its first version, the model found a significantly higher global warming to be the socioeconomic optimum than the Paris Climate Agreement stated. Hänsel et al. updated the DICE model with new social costs of carbon, which are in line with the aims of the Paris Agreement [29]. These carbon prices are used as an internal carbon price for the scope of this paper.

For private organisations, using an ICP comes with the risk of defining a price which is significantly higher than potential regulatory carbon prices, especially as when comparing the social cost of carbon with (planned) regulatory external carbon prices, e.g., a carbon tax or an emission trading system, the social costs of carbon are often significantly higher [26,29,30,31]. An organisation which applies a higher ICP based on the social costs of carbon might be at risk of losing its competitiveness in its market environment [18,24].

In the context of energy systems, the (cost) factors which influence investment decisions and operation planning are highly intertwined and the decision usually comprises long-term time horizons [32,33]. Therefore, the impact ICP has depends not only on its level but also on the decision environment in which an organisation uses the price. Especially for multinational organisations, defining one proxy price might have very diverse impacts for the organisation’s business units across different countries. Furthermore, the potential technologies for energy systems is ever-increasing [32,34], e.g., currently with the potential use of carbon capture and storage (CCS), solid oxide fuel cells (SOFC), and electrolysers. This increases the number of potential energy system configurations and therefore adds additional complexity to energy system investments and operation planning.

So far, there is no academic literature on the impact an ICP based on the updated DICE model has on a facility’s energy system across different countries and the expected additional costs compared to country-specific regulatory external carbon prices. However, assessing these differences is important, both for multinational organisations and for the academic world.

For organisations, knowing about the impact differences a proxy price has across different countries might be important to evaluate the organisation’s internal approval of such a measure. If proxy prices affect certain business units disproportionally, it might raise the disapproval of these business units which can put the success at risk. Furthermore, assessing the potential cost differences between an internal and external price allows organisations to obtain an estimate of the additional costs they might have to cope with when using a certain ICP or not implementing any ICP at all.

For the academic world, analysing the impact a proxy price has across different countries gives valuable insight into how reasonable the implementation of just one proxy price might be or if a more differentiated price scheme should be put in place within the organisation. Currently, region-specific carbon prices are mentioned in practical examples from the real world [22,35], but are missing in academic guidance, such as [22,23,35]. Therefore, the academic literature around proxy prices needs to be broadened to fully cover the field of impact differences and how to take them into account during the ICP design process. Comparing the cost between an internal and external carbon price provides an insight into how high the additional costs caused by an ICP might be. This adds knowledge to the previously described right price trap by giving an estimate of the potential additional costs.

Our paper addresses this issue by evaluating the energy system of a real-world facility in different country-specific environments between 2020 and 2040, taking DICE-based proxy prices into account. The ICP-based impact on the energy system cost is compared across the different locations to analyse the effects on certain busines units. The optimised energy system costs are then compared to the total system cost, considering the country-specific external carbon price. This allows the cost differences between not implementing a price at all and using the ICP to be assessed.

The countries which were exemplarily analysed for the scope of this paper were Japan (JP), the United Kingdom (UK), and Germany (GER). The selection of these countries was based on their similarities in gross domestic product as well as the diversity in their costs for technologies, fuels, and energy carriers, referred to as the techno-economic environment for the scope of this paper. The availability of country-specific values for the techno-economic environment was an additional decision criterium. Using GER, JP, and the UK for this work allowed us to build on the input parameter values on a variety of sources from the scientific literature. These build a base for the optimisation that helps generate robust and meaningful results.

The remainder of this paper is structured as follows. Section 2 describes the optimisation model which is used to generate the results of this work. Furthermore, all relevant input parameters of the optimisation model are presented. In Section 3, the results of the optimisation for each country are described and summarised. Section 4 discusses the results as well as key findings and describes limitations to this work. The paper closes with a conclusion and the identification of promising areas for future research.

2. Materials and Methods

2.1. Overview

This paper’s analysis builds on a real-world industry facility and its associated electricity, heat, and cooling demands. The facility is in Japan but due to privacy regulations, the facility’s name or exact location cannot be published. To analyse the influence of the country-specific techno-economic environments, it is assumed that the same facility also exists in GER and the UK at locations with similar distances from the coastline. An optimisation model is used to calculate the cost minimal energy system configuration and operation for the three locations, based on the predefined techno-economic environment.

2.2. Optimisation Model

The utilised optimisation model is the mixed-integer linear programming (MILP) tool, DISTRICT, Fraunhofer ISE, Freiburg im Breisgau, Germany [36,37,38]. DISTRICT facilitates the analysis of energy systems from city districts down to the building level. It optimises the investment decisions and operation of the installed technologies simultaneously for given time intervals (e.g., specific years) and time steps (e.g., hours of these years). DISTRICT is implemented in the General Algebraic Modeling System (GAMS). The objective of DISTRICT is to reduce the total discounted cost, summed over all relevant time intervals.

For the scope of this paper, the time horizon is limited to the years 2024, 2030, and 2040, as an optimisation for all years between 2020 and 2040 would exceed reasonable computational efforts. For each of these years, DISTRICT optimised the operation planning in 1 h time intervals. All relevant input data and parameters were defined based on real-world data (demand profiles and preinstalled technologies) or on a literature review as well as expert opinion (e.g., investment costs and efficiencies).

2.3. Data and Assumptions

Figure 1 and Figure 2 show the facility’s location in JP and the assumed locations of the facility for GER and the UK (symbol: circle). The characteristics of the facility’s locations are similar across all three countries (i.e., location close to a big city and similarly close to the coastline). The renewables’ generation profiles of each location are based on data from renewables.ninja [39,40,41]. For both photovoltaic (PV) and wind generation profiles, the MERRA-2 (global) dataset (year of data: 2019) was used. For the PV generation profiles, a tilt of 35° and south-facing (azimuth: 180°) was assumed. For realistic wind energy generation profiles, renewables.ninja allows its users to define specific wind turbine types. For the onshore wind generation profile, a Vestas V136 4000 turbine, Vestas Wind Systems A/S, Aarhus, Denmark (hub height: 114 m) was assumed. For the offshore wind generation profile, a Vestas V164 9500 turbine, Vestas Wind Systems A/S, Aarhus, Denmark (hub height: 110 m) was chosen. The assumed locations of potential offshore wind turbines are displayed in Figure 1 and Figure 2 (symbol: triangle).

Figure 1.

Assumed locations in Germany and the United Kingdom [42].

Figure 2.

Facility and assumed offshore location in Japan [42].

The relevant techno-economic parameters were aligned with country-specific values wherever possible (Table 1). To keep the optimisation results comparable, characteristic technological parameters are constant across all considered countries (see Table 1, “General technological parameters”). The preinstalled technologies were based on the capacities installed in the real-world facility in 2020 (Table 2).

Table 1.

Technology parameters.

Table 2.

Preinstalled technologies.

The facility’s demand for electricity, heat, and cooling was assumed to be the same for all three years and all locations. The same applied to all fuel costs except for hydrogen. This assumption was based on current country-specific energy system models and was applied to all countries for the scope of this paper, to ensure the comparability of the results [47]. For hydrogen, a decrease of the market price was assumed, which was based on a literature review on potential future hydrogen prices [47,66]. Table 3 gives an overview of the assumed fuel costs and associated emission factors.

Table 3.

Fuel and electricity prices.

As previously mentioned in the introduction, two types of CO2 prices are used for the scope of this paper. The assumed ICP was in line with the costs of carbon used by Hänsel et al. (2020) in the context of the updated DICE model (see Table 4).

Table 4.

Economic costs of carbon [29].

For the country-specific cost comparison based on ICP and a potential regulatory external price, a country-specific external price was assumed (Table 5). The prices were, wherever possible, aligned with scientific findings or public guidance. However, there is no price estimate of external carbon prices until 2040 for any of the considered countries. Therefore, the price increase till 2040 was based upon the percentage price increase from 2025 to 2040 (52.9%) for the European Union in the World Energy Model (Stated Policies Scenario) of the International Energy Agency [79]. To ensure the comparability of the results and to keep the focus on ICP, other policy-related country-specific factors, such as feed-in tariffs, were left aside for the scope of this paper.

Table 5.

Assumed external CO2-prices.

Two types of cost definitions were used to examine the cost differences of an energy system which was optimised using the ICP and the actual cost of this system based on the external carbon price. The energy system cost included the discounted annuity, operation, and fuel costs, which were identical to the optimised total cost in DISTRICT excluding the carbon cost. The total system cost included the energy system cost plus the carbon cost, based on the country-specific external CO2 prices.

The scenarios, which were analysed for the scope of this paper, are defined and explained in Table 6. The “no price” scenario served as the reference scenario. Each of the following scenarios increased the complexity for the optimisation model and enabled the analysis of interdependencies between technologies and proxy prices. For all scenarios where only the onsite renewable energy potential was available, the capacities for wind and PV were limited to 0 kW and 1558 kW, respectively. The onsite PV capacity was derived from the available roof and ground areas of the real-world facility.

Table 6.

Scenario overview.

3. Results

In the following section, the optimisation results are presented country-by-country. At the end of each country-specific section, a short paragraph summarises the main findings. The section focuses on the results for the year 2040. However, for each scenario a detailed result overview is given in the Appendix A. It should be noted that, in the following, “generated energy” refers to the specific type of energy each technology supplies, e.g., the generated energy of the compression cooling technology describes the supplied cooling energy not the used electricity. Feed-ins into the electricity grid are allowed but no monetary compensation is paid for that. All scenarios were solved by the Gurobi solver with a relative solution gap of 0.01.

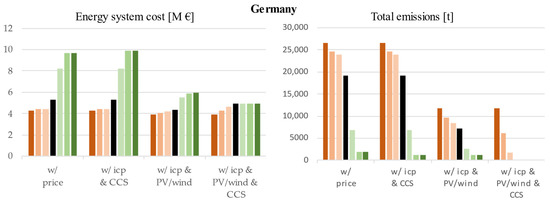

3.1. Germany

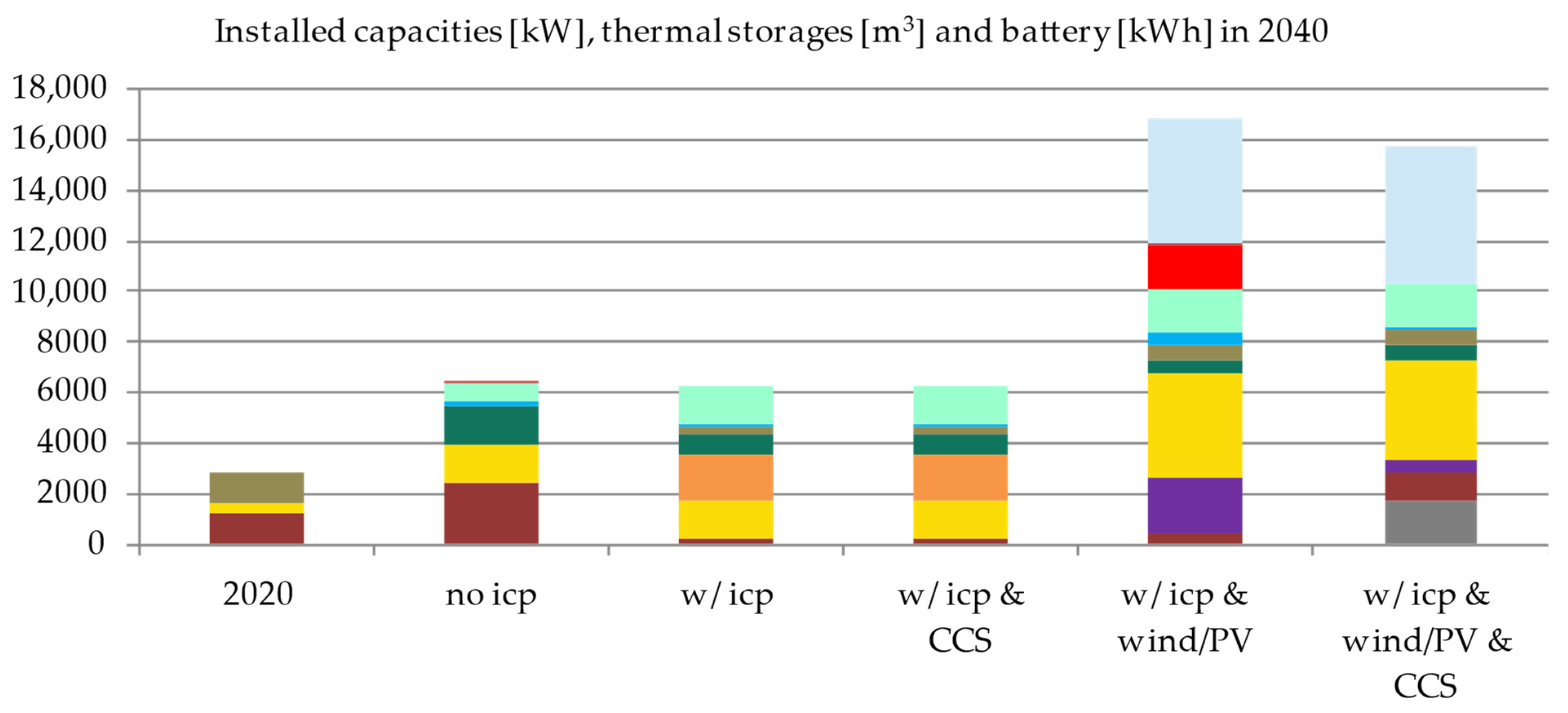

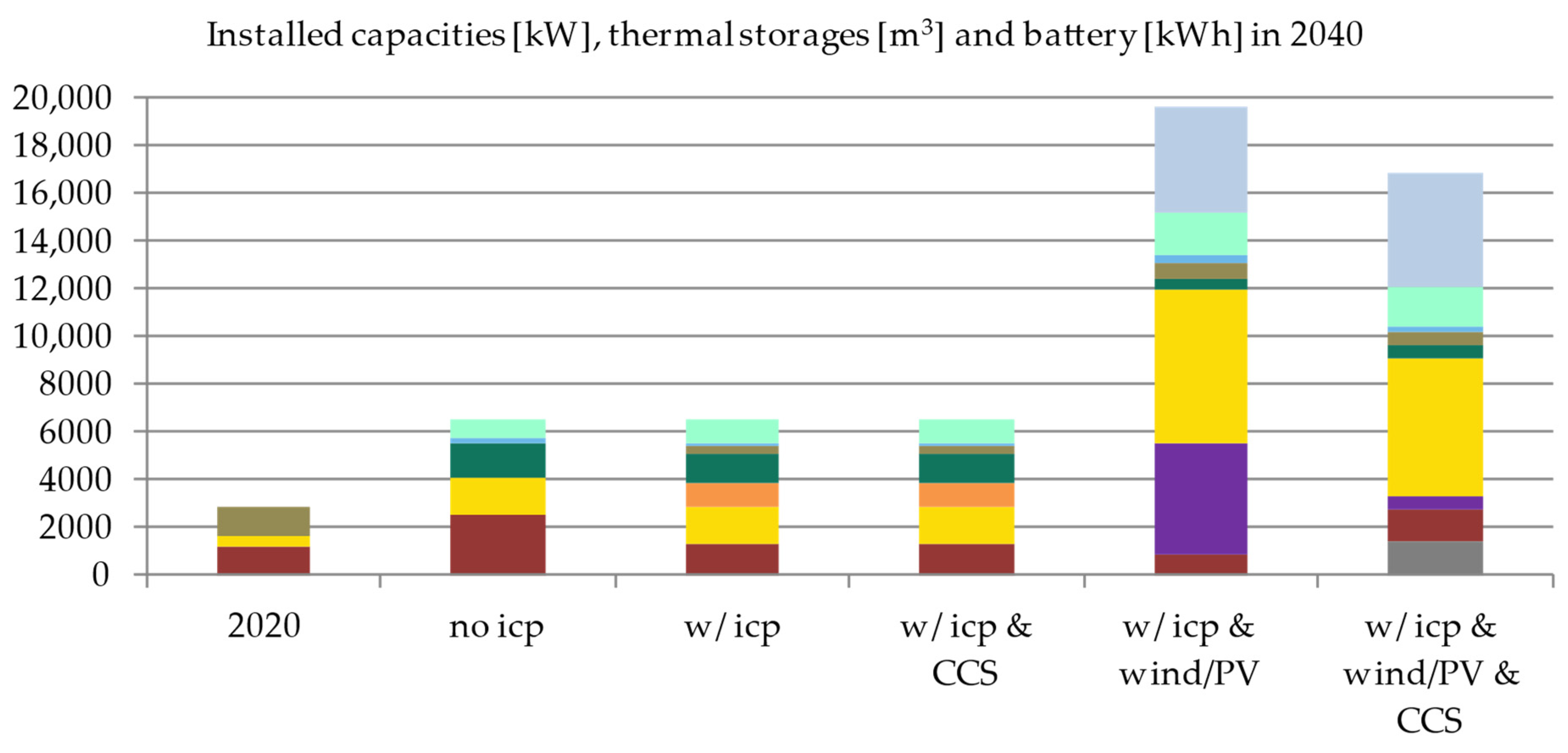

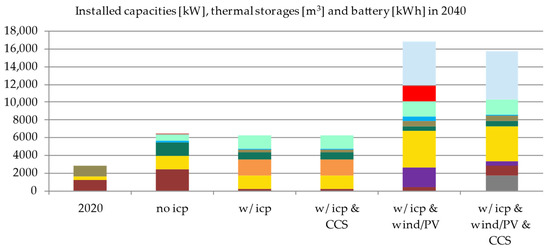

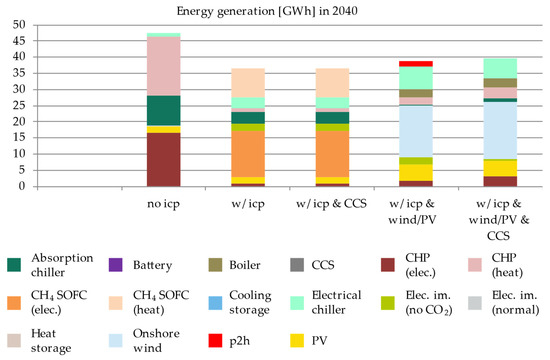

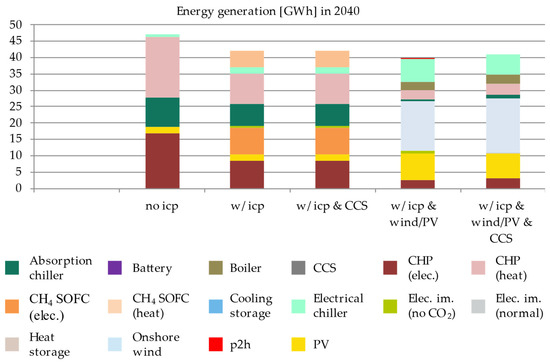

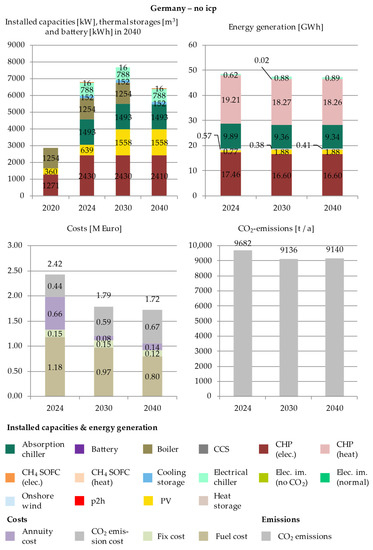

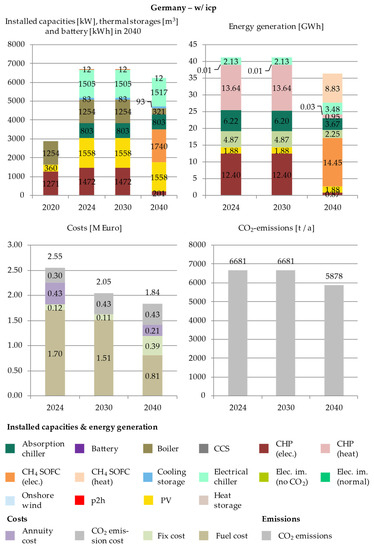

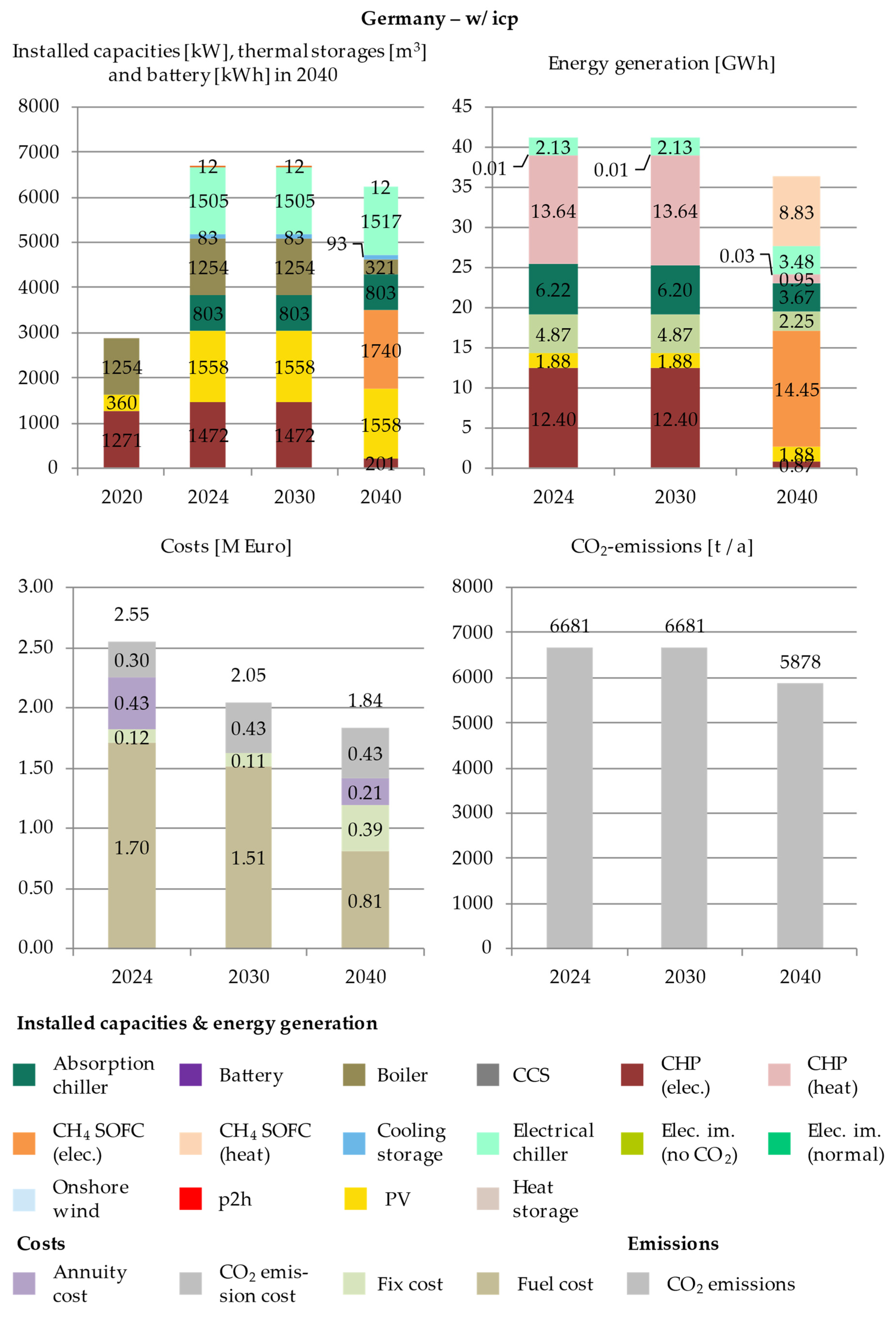

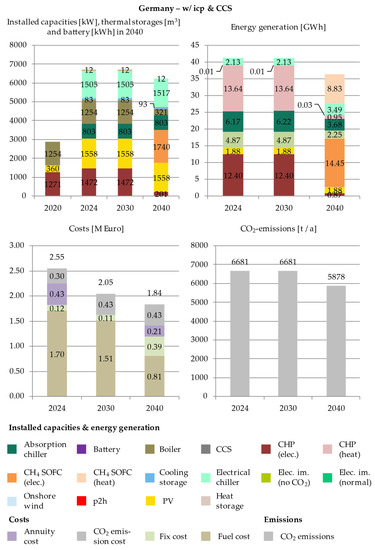

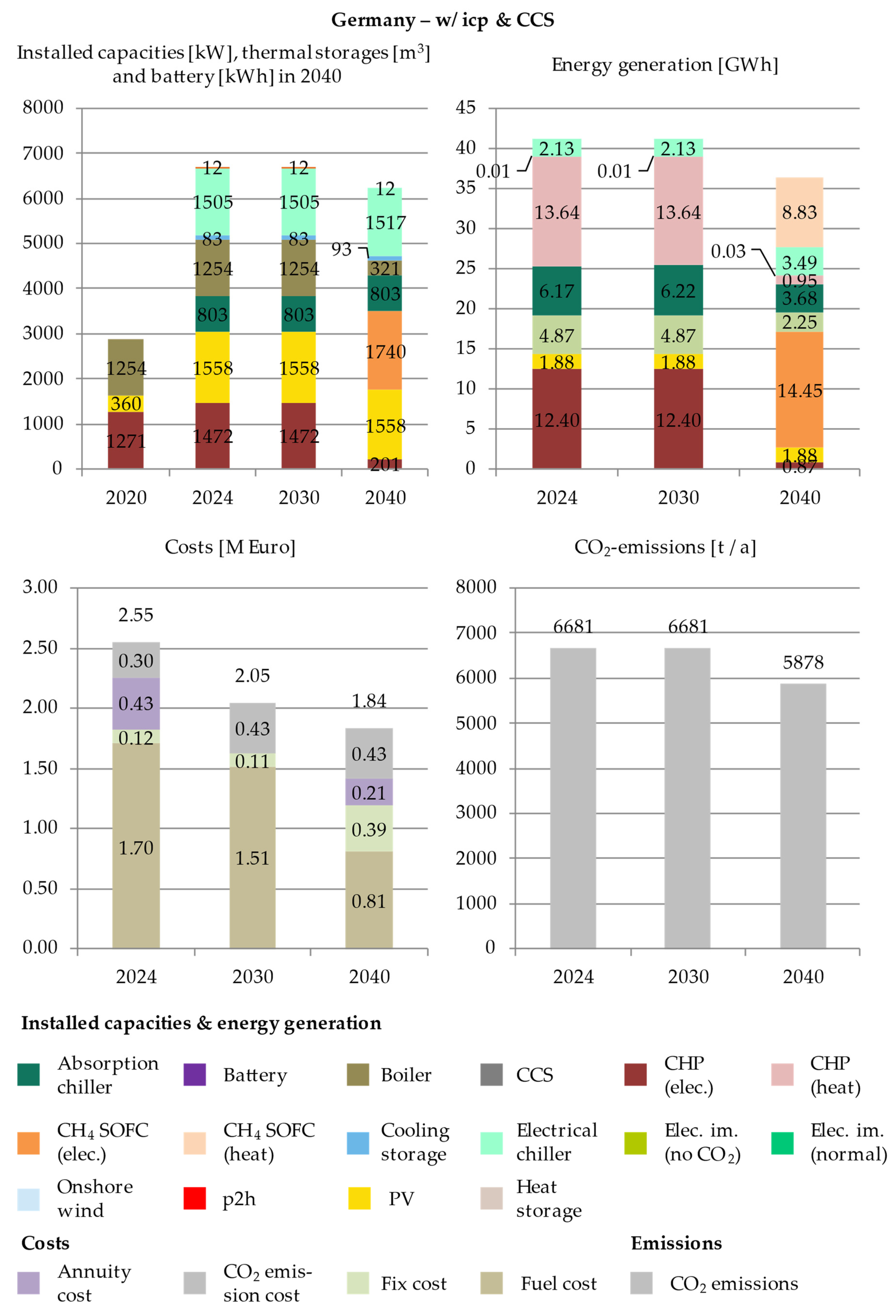

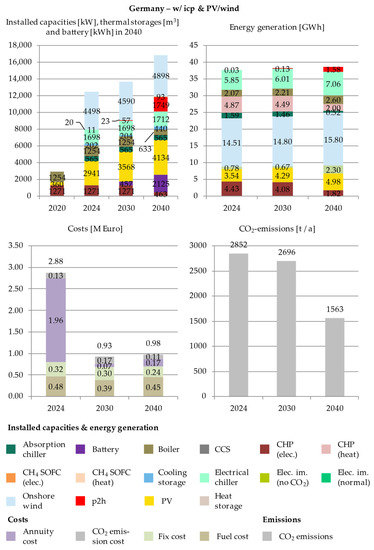

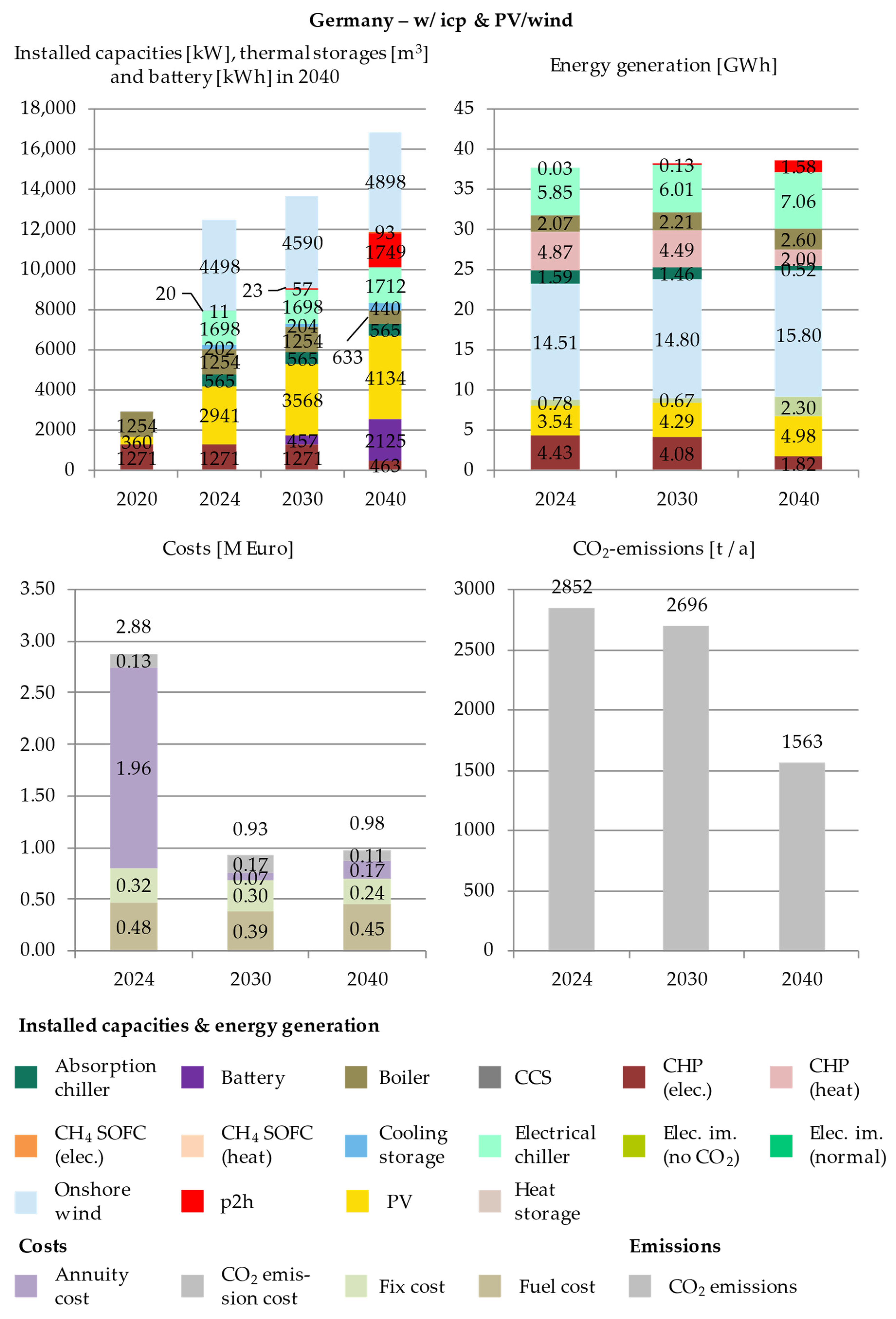

The bar chart in Figure 3 shows the installed capacities in 2040 for the different scenarios. The preinstalled technologies, as presented in Table 1, are displayed in the “2020” bar.

Figure 3.

Installed capacities for the German scenarios in 2040.

For the cost optimal solution of the German “no ICP” scenario, the combined heat-and-power capacity is doubled (2410 kW) and absorption chiller (1493 kW) as well as electrical chiller (788 kW) are installed. Additionally, the onsite PV capacity is fully exploited (1558 kW). Next to these large investments, the model installs a cooling and a heat storage (152 m3 and 16 m3, respectively).

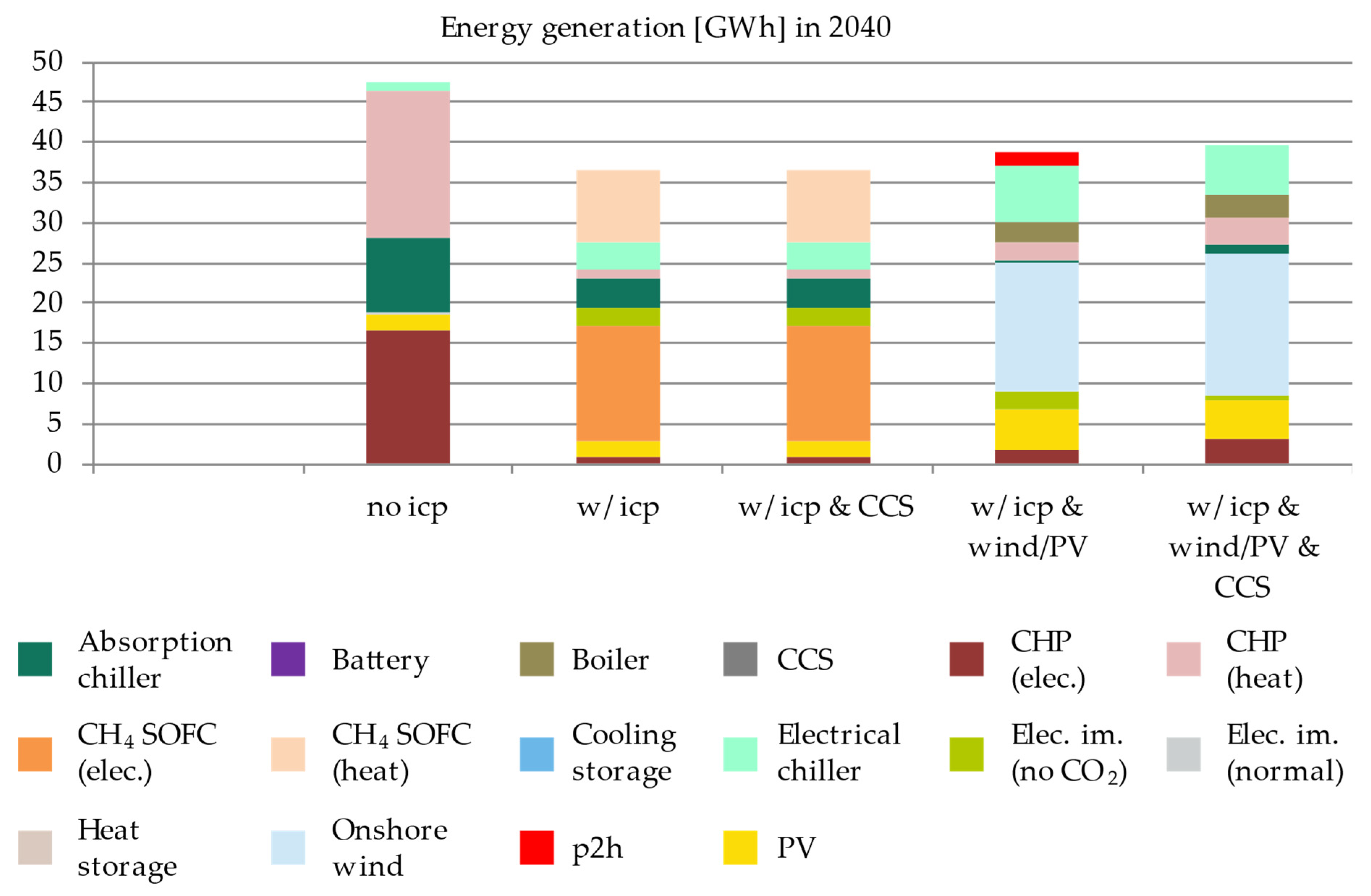

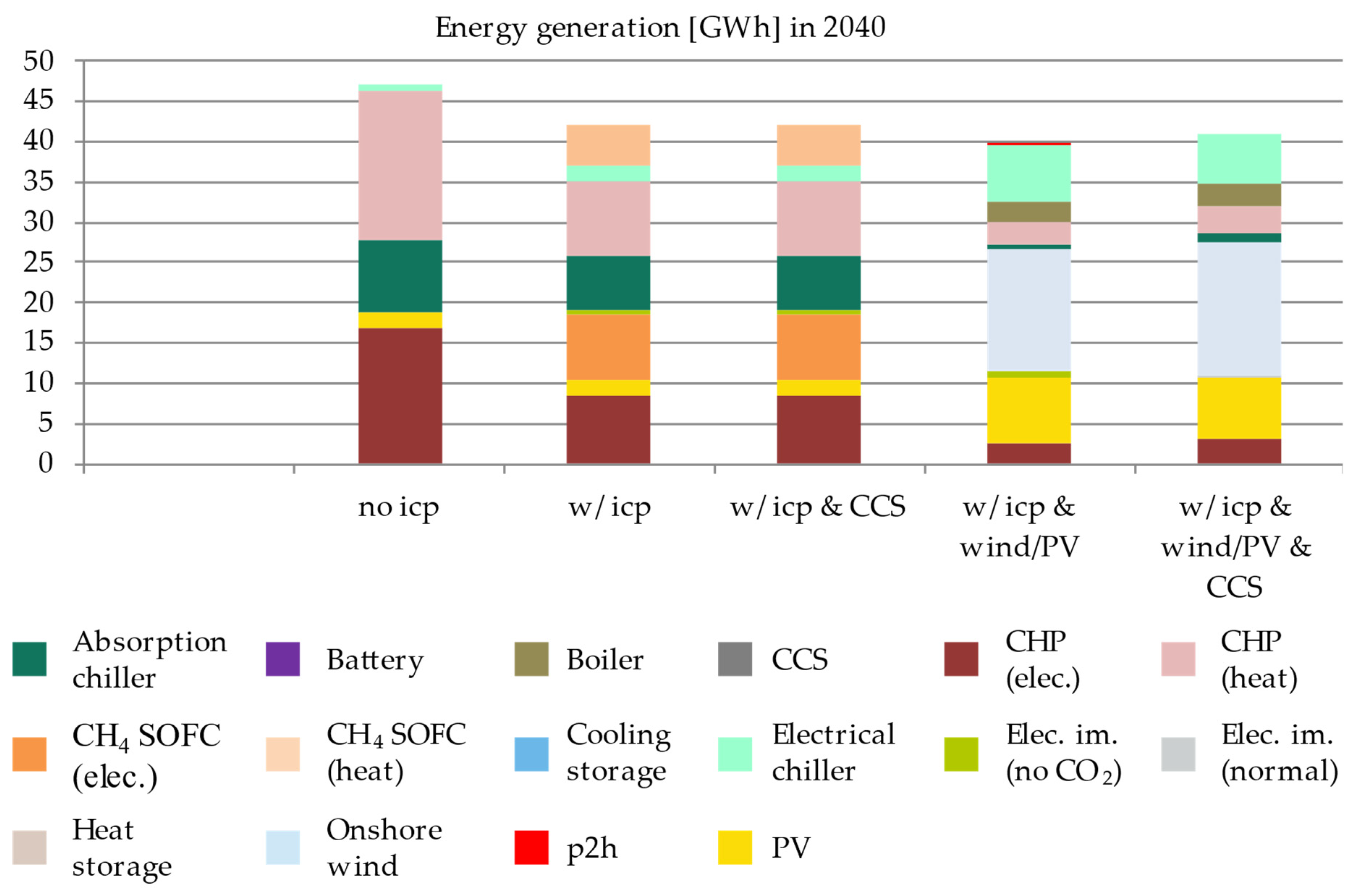

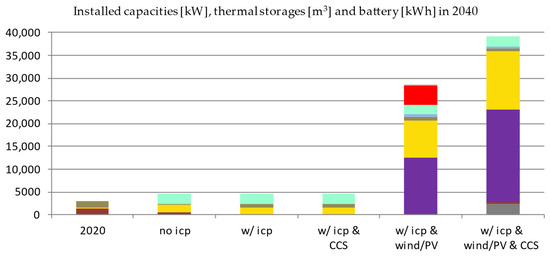

The first bar in Figure 4 shows the energy generation for the “no ICP” scenario. The CHP covers most of the electricity and heat demand. The remaining heat demand is met by the gas boiler. Since electricity is more expensive than heat, the CHP runs power-driven. To maximize the electricity generation of the CHP, an additional heat demand is created by installing the absorption chiller. This allows the CHP-based generation of more heat than the facility requires. The absorption chiller uses the excess heat of the CHP to meet most of the facility’s cooling demand. The electrical chiller and the cooling storage compensate for differences between the cooling demand and the absorption chiller’s generation. Withdrawals from the public electricity grid are relatively low (0.41 GWh) since they must only cover the remaining electricity demand which the CHP and PV do not meet. For the imported electricity, the model chooses the “normal” option, which comes with emissions according to the technology mix for electricity generation in Germany (see Table 6).

Figure 4.

Energy generation for the German scenarios in 2040.

The discounted investment and operation costs for the three considered years (2024, 2030, and 2040) (hereinafter: energy system cost) sums to 4.24 M € and the CO2 emissions amount to 27,957 t (see also Figure A1). With the assumed German external carbon price, the total discounted cost (energy system cost plus discounted carbon cost) sums to 5.92 M € (hereinafter: total system cost). An overview is given in Table 7.

Table 7.

Cost and emission overview for the German scenarios.

Incorporating the ICP (Table 2) into the German scenario environment induces changes in the energy system. Besides the boiler (321 kW), the electrical chiller (1517 kW), and an absorption chiller installation, a CH4-fuel cell (1740 kW) is installed in 2040 (see bar 3 in Figure 3).

Additionally, the onsite PV potential is exploited to the onsite potential from 2024 onwards (see also Figure A2). The installation of a 93 m3 cooling and a 12 m3 heat storage complement the technology installation.

Comparing the energy generation of the “w/ICP” to the “no ICP” scenario underlines the effect of the ICP on the increased use of more efficient technologies. The CH4 fuel cell is installed and replaces the CHP to a large extent. The fuel cell has a higher overall efficiency, compared to the CHP, and generates heat and electricity more evenly. The combined use of the fuel cell, the gas boiler and the CHP enable the model to generate heat more aligned to its demand while still meeting most of the facility’s electricity demand. The higher flexibility in the heat generation also facilitates a higher flexibility in the absorption chiller operation. This, in turn, reduces the need to store chilled water and thus avoids the associated efficiency losses of the cooling storage. Therefore, the overall energy generation is reduced significantly when comparing the “w/ICP” to the “no ICP” scenario. Additionally, the ICP initialises a switch of the electricity import from “normal” to the CO2-neutral alternative. The energy system cost increases to 5.28 M €, while the emissions reduce to 19,240 t (see also Figure A2). Incorporating the external carbon price increases the total system cost to 6.44 M €.

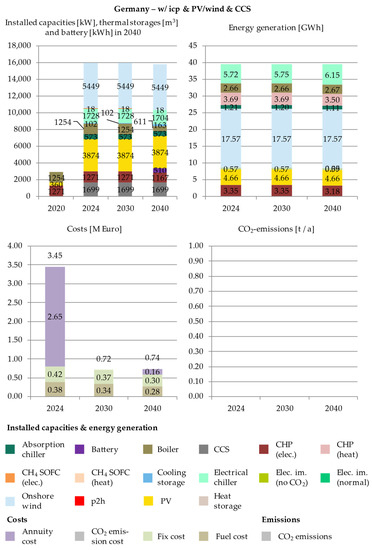

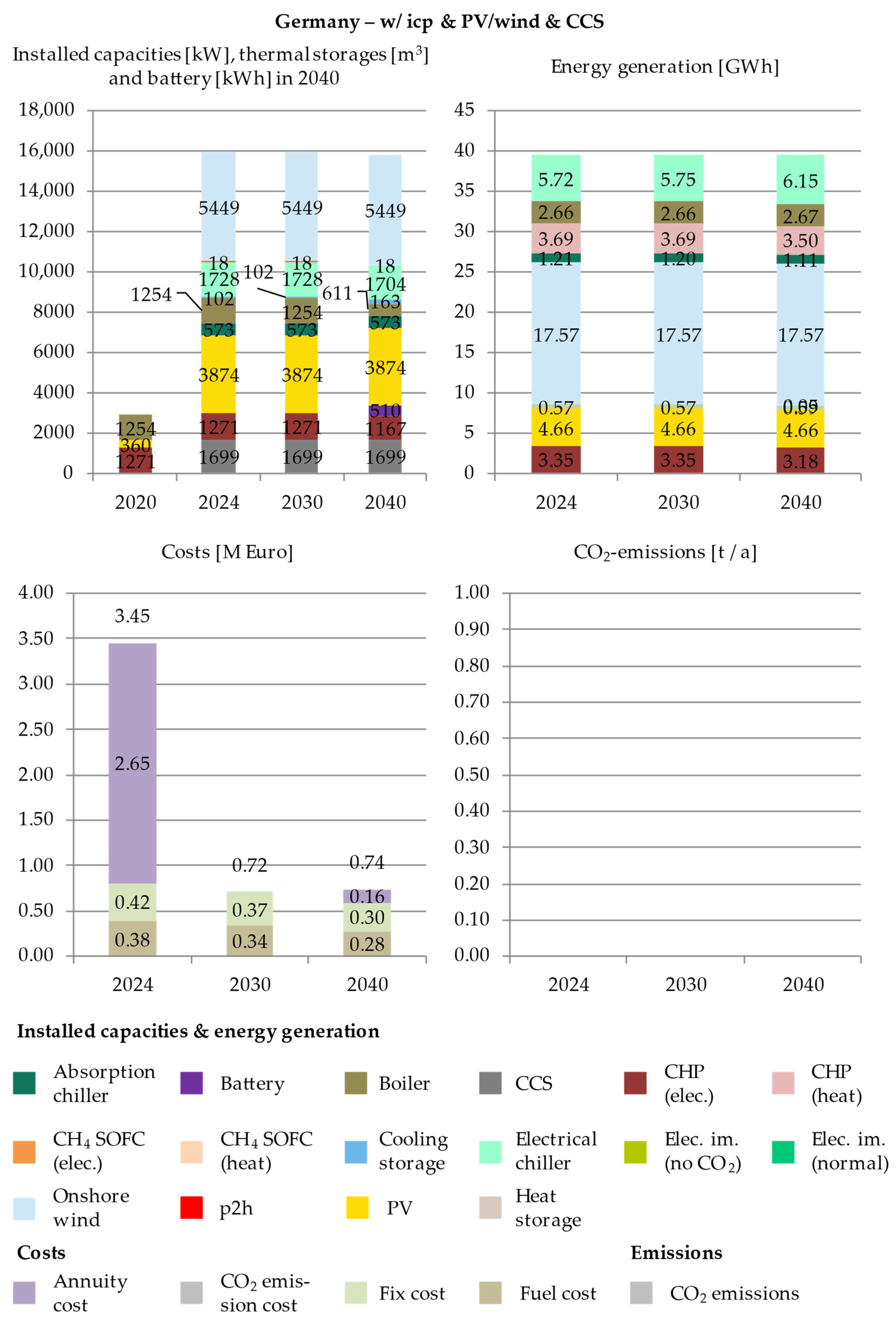

Comparing the “w/ICP” to the “w/ICP and CCS” scenario shows that the CCS technology does not yield any advantages within the German scenario setting. Therefore, the cost optimal solution is the same for both scenarios (see also Figure A2 and Figure A3).

Bar 5 in Figure 3 shows the installed capacities for the “w/ICP and PV/wind” scenario. The PV and onshore wind capacities are increased significantly (4134 kW and 4898 kW, respectively). This expansion is combined with the installation of a battery (2125 kWh), heat (93 m3) and cooling storages (440 m3), and an absorption chiller (565 kW) as well as power-to-heat (p2h) (1749 kW). The CH4 fuel cell is not installed anymore.

The battery stores and the p2h can directly use excess renewable electricity generation. Both serve to integrate renewable energy generation into the local energy system. The p2h technology generates heat, which in turn reduces the use of the CHP and the gas boiler. The electricity demand, which is not met by the installed technologies, namely CHP, PV, and wind, is covered by withdrawing CO2-neutral electricity from the public grid (2.30 GWh in 2040). The energy system cost sums to 4.37 M € and the emissions to 7111 t (see also Figure A4). Incorporating the external carbon price brings the total system cost to 4.79 M €.

Bar 6 of Figure 3 shows the installed capacities for the “w/ICP and PV/wind and CCS” scenario. The CCS technology is installed (1699 kW) while the p2h and the battery storage capacities are, compared to the “w/ICP and PV/wind” scenario, not expanded at all (p2h) or not as much (battery storage).

With the CCS technology and the unlimited renewable energy potential, the energy generation changes (see bar 5 in Figure 4). The use of CHP and boiler increases compared to the “w/ICP and PV/wind” scenario. It is cheaper to use the CHP and boiler, fueled by gas, and compensate the associated emissions with CCS than to focus on integrating renewable energies via energy storage and sector integration technologies. Therefore, the energy storage and sector integration technologies do not play the same role as in the previous scenario and are used considerably less. The energy system cost is 4.91 M €. Since the model is optimised using the ICP and has the highest degree of freedom towards reducing the emissions, they are the lowest of all the German scenarios, reaching complete decarbonisation and hence zero emissions (see also Figure A5). Therefore, there are no additional carbon emission costs.

Country-Specific Summary

For the German energy system environment, the cost optimal solution consists of combined heat and power generation (CHP and fuel cell). When the ICP is incorporated into the energy system optimisation, the model increases the system efficiency and reduces emissions by installing the CH4 fuel cell and importing CO2-neutral electricity. With unlimited renewable energy potential, the optimal energy system builds on high renewable energy installations as well as energy storage (battery/heat/cooling) and p2h technologies. Comparing the “w/ICP and CCS” to the “w/ICP and PV/wind and CCS” scenario underlines the importance of cheap electricity for an economical use of the CCS technology. Only with the possibility for high renewable energy installations, the CCS technology is installed. With the option to install CCS, less energy storage and sector integration technologies are installed and CHP as well as boiler usage increases (comparing “w/ICP and PV/wind” to “w/ICP and PV/wind and CCS”). As the assumed location is relatively close to the shore, the generation profiles of onshore and offshore wind do not differ that much, and the model prefers the cheaper onshore wind technology to the offshore option.

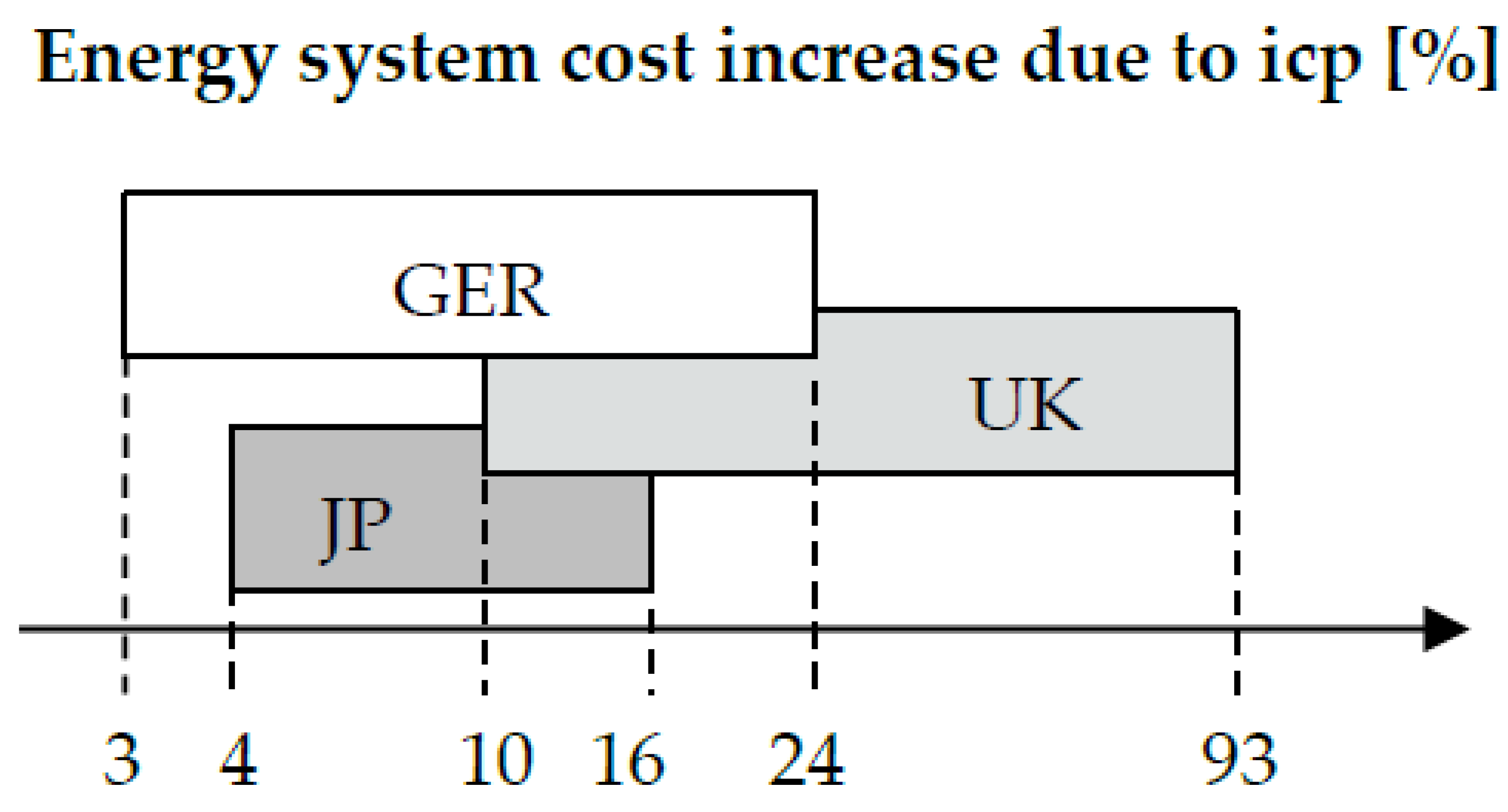

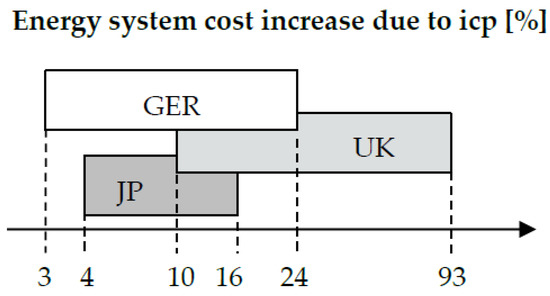

Comparing the total system cost of the “no ICP” to the most expensive scenario (“w/ICP” and “w/ICP and CCS”) shows that the total cost is only up to 9% higher. It indicates that, for an organisation in this scenario environment, it is not necessarily a great danger to evaluate energy systems with high ICPs, even though the external carbon prices are less than half of the internal ones.

Analysing only the energy system cost increase (without accounting for external carbon prices) across the scenarios shows a price increase between 3.1% (comparing the “no ICP” to the “w/ICP and PV/wind” scenario) and 24.5% (comparing the “no ICP” to the “w/ICP and CCS” scenario). This comparison is later used to compare the impact of ICP across different countries. Overall, the results show that for both the energy and the total system cost, an increase in renewable energy capacities leads to a cost reduction.

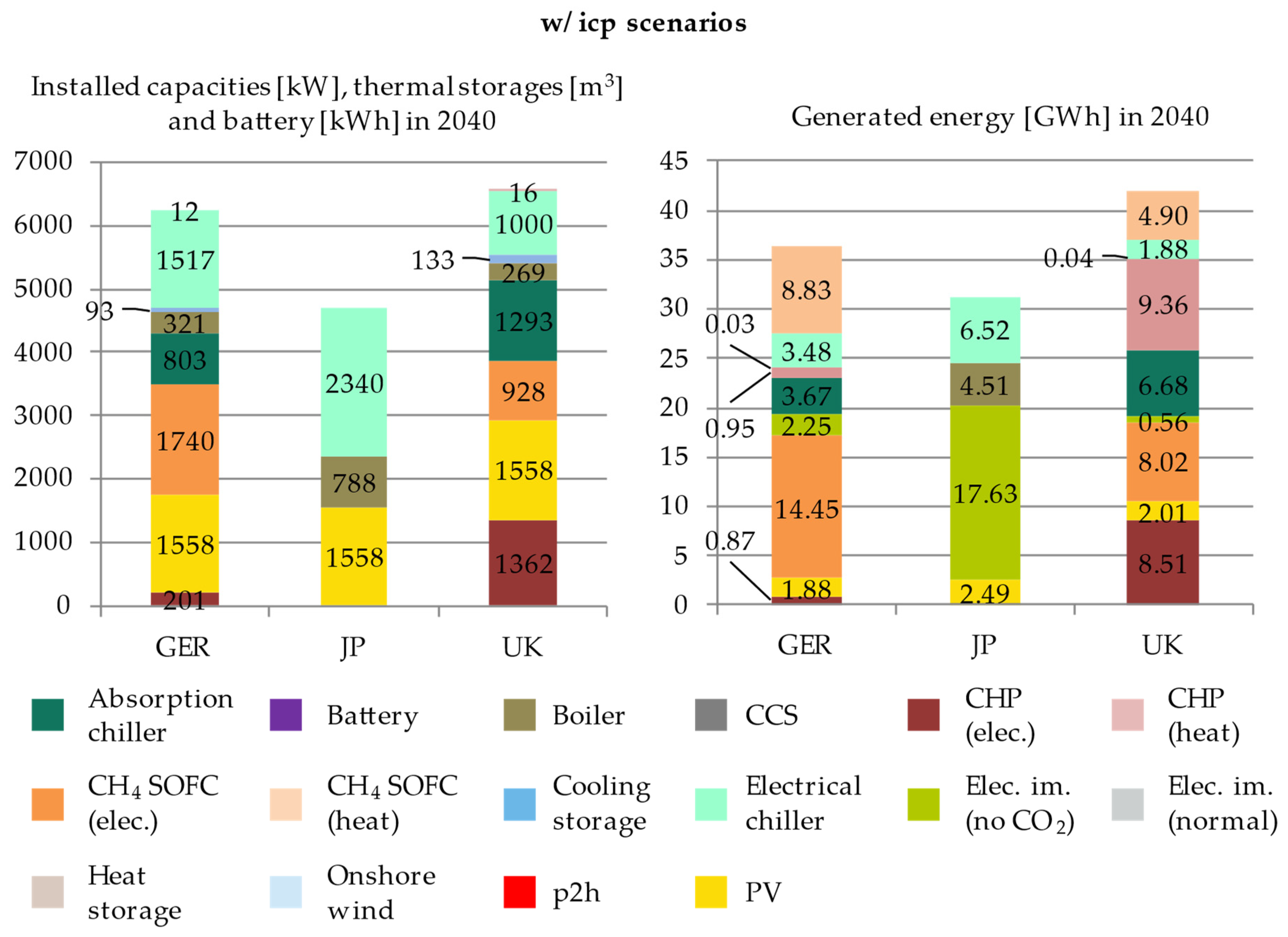

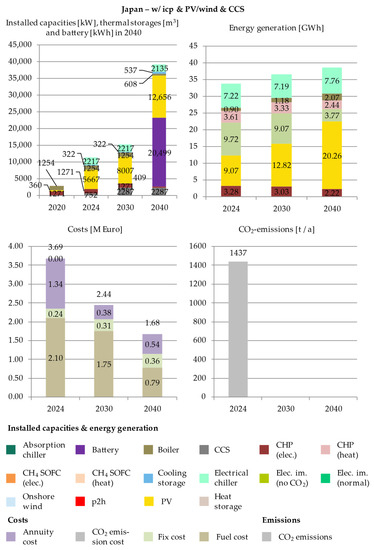

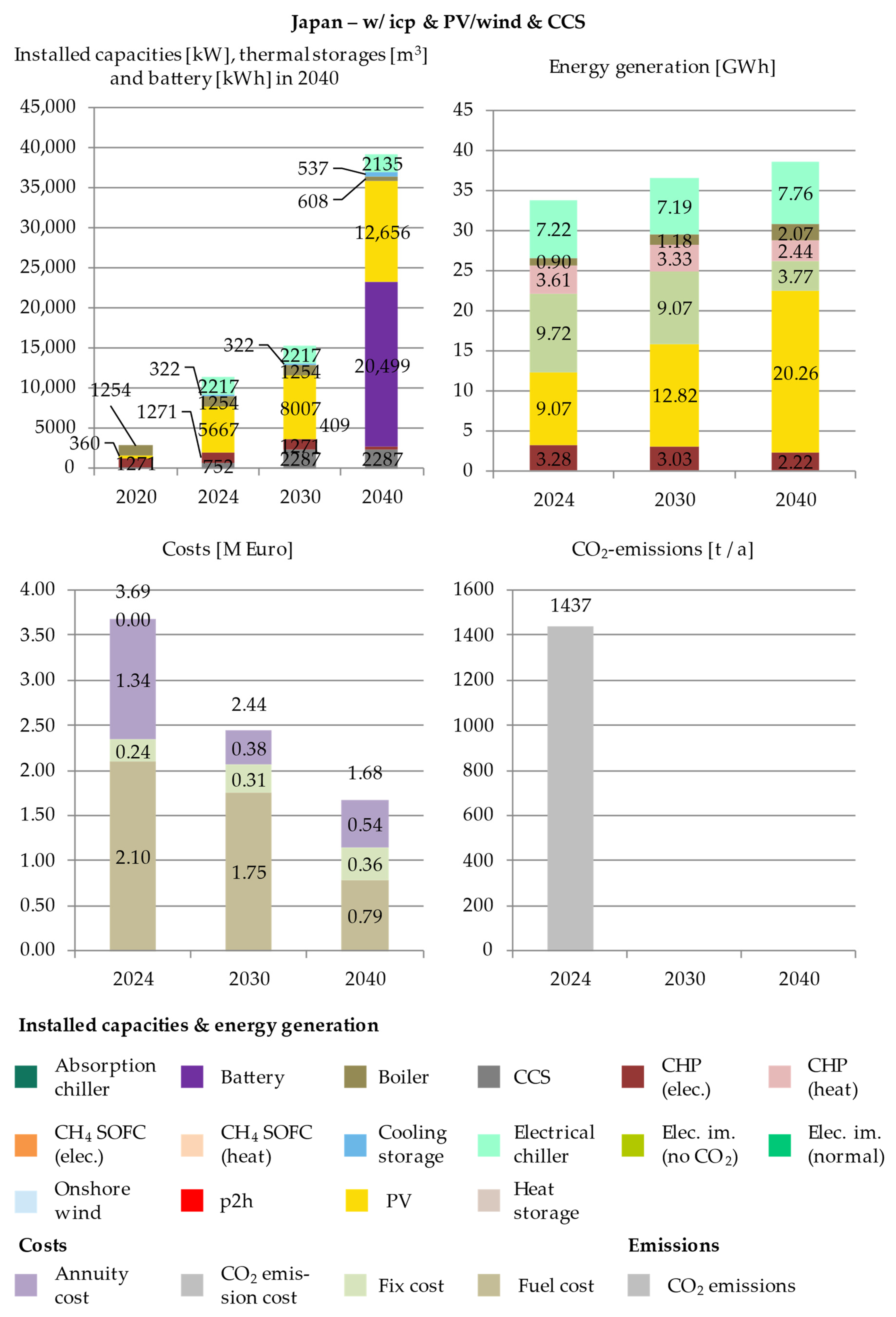

3.2. Japan

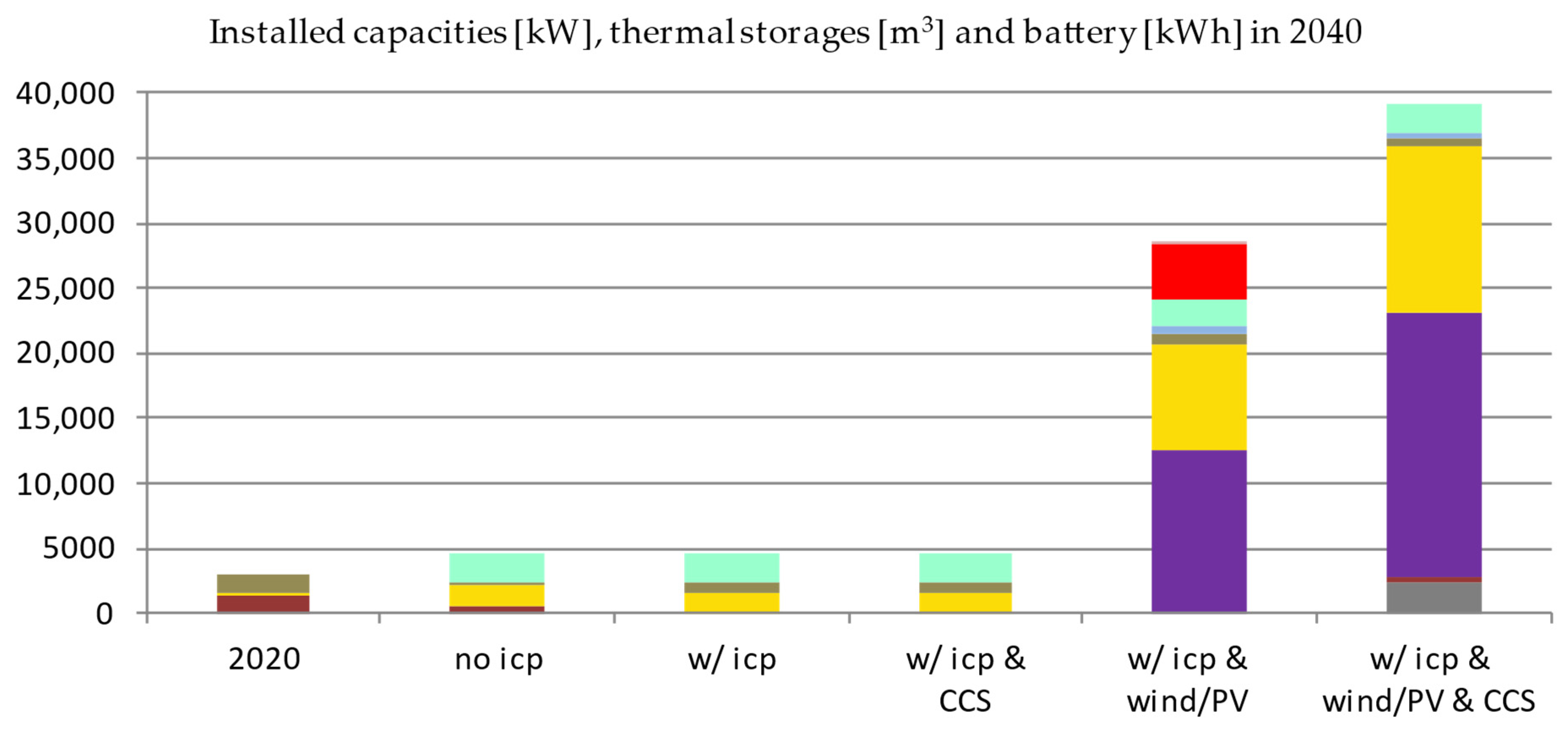

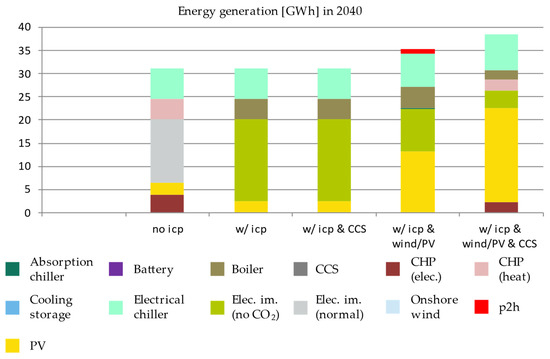

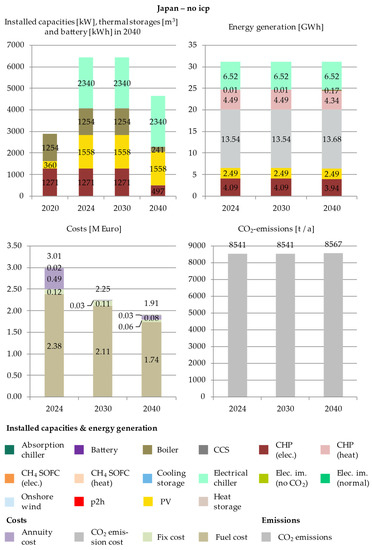

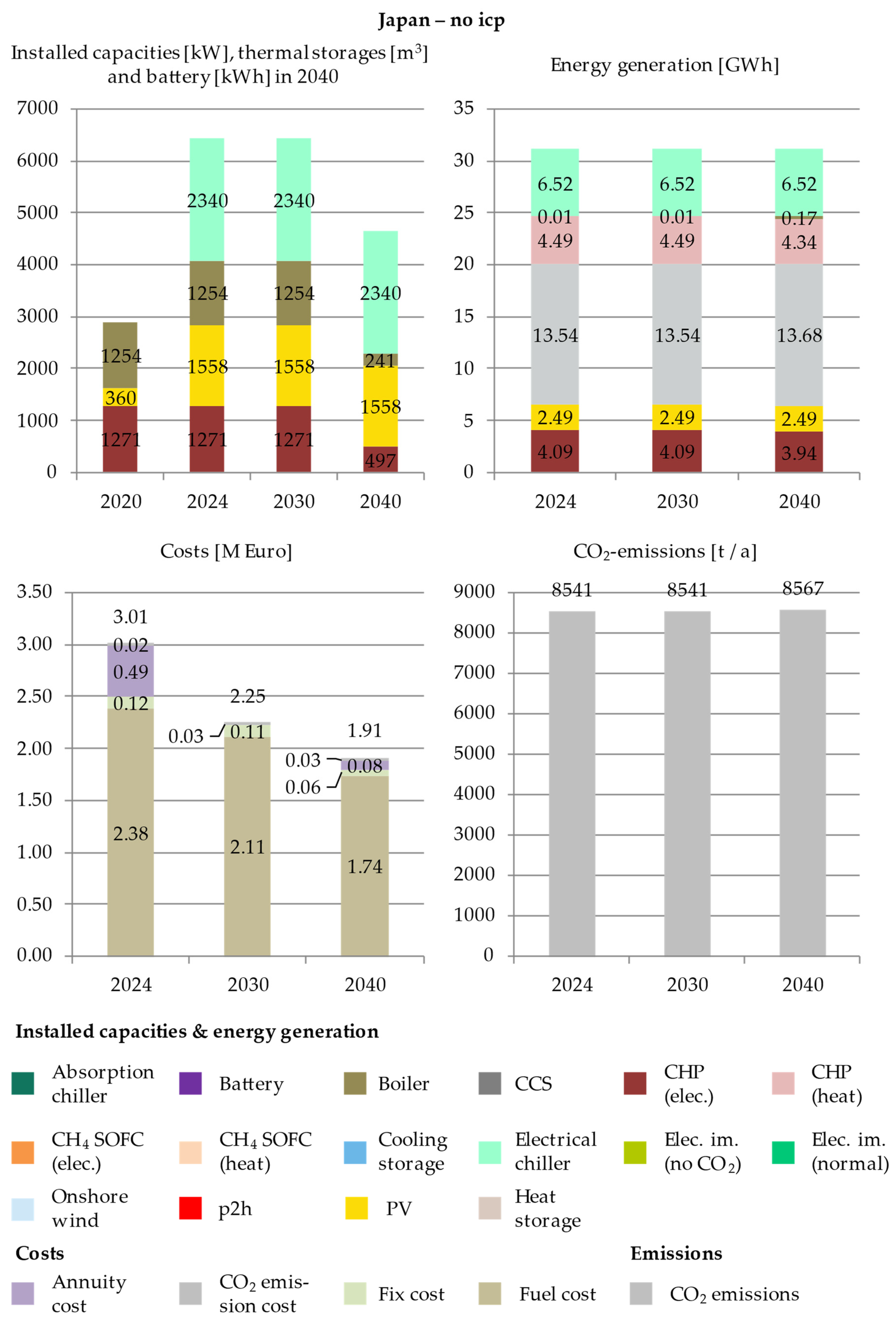

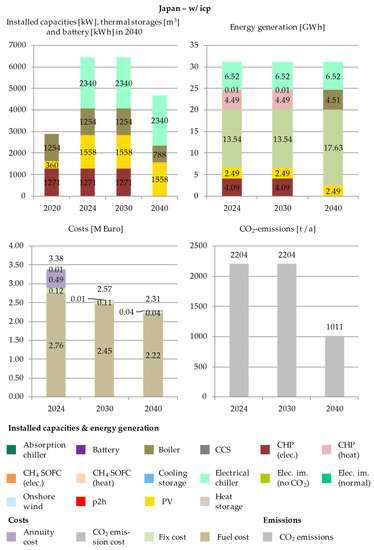

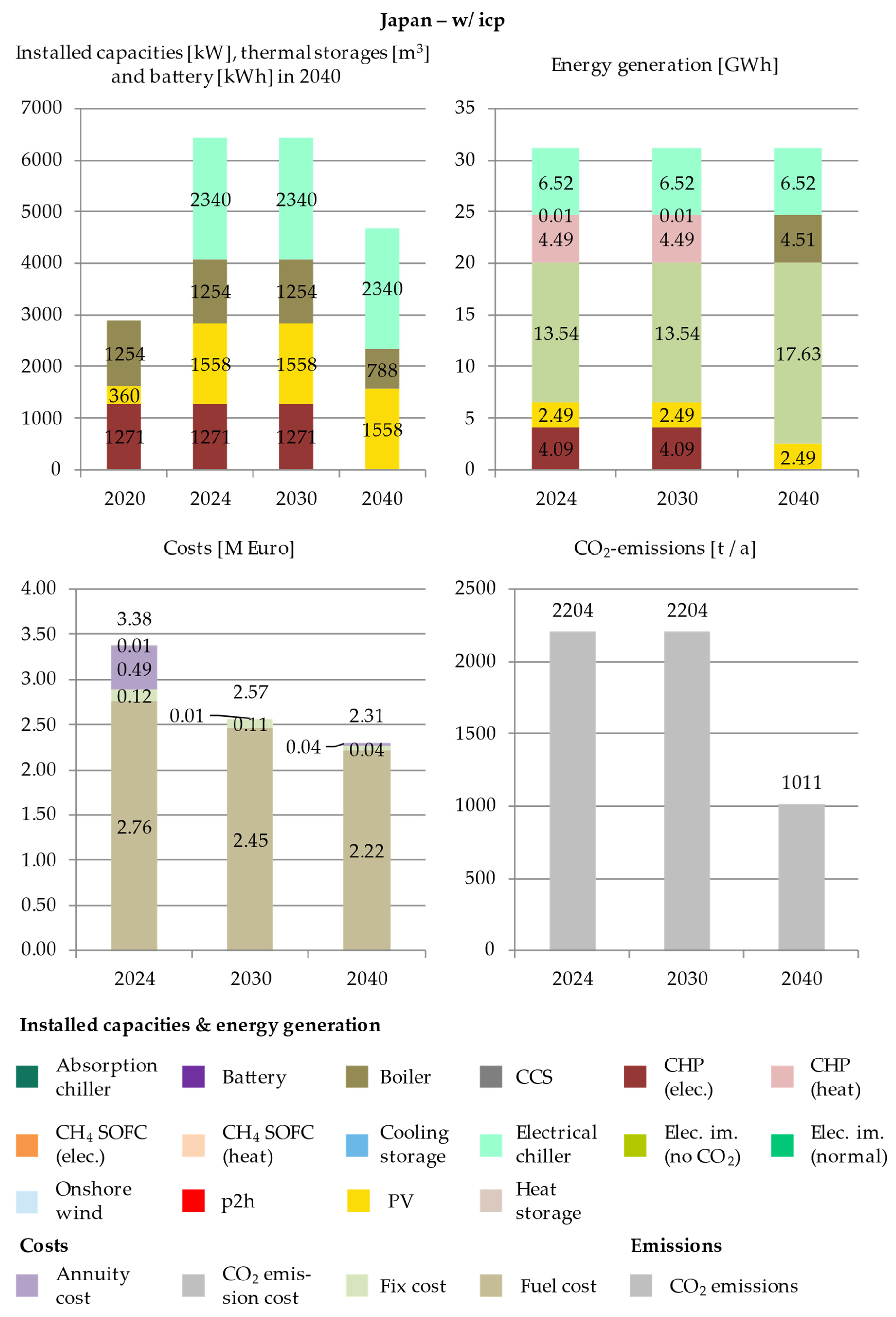

The second bar in Figure 5 shows the installed capacities for the Japanese “no ICP” scenario. In contrast to the German “no ICP” scenario, the model increases the boiler (241 kW) and electrical chiller (2340 kW) capacities but not the CHP’s capacity. Additionally, no thermal or cooling storages are installed (see also Figure A6).

Figure 5.

Installed capacities for the Japanese scenarios in 2040.

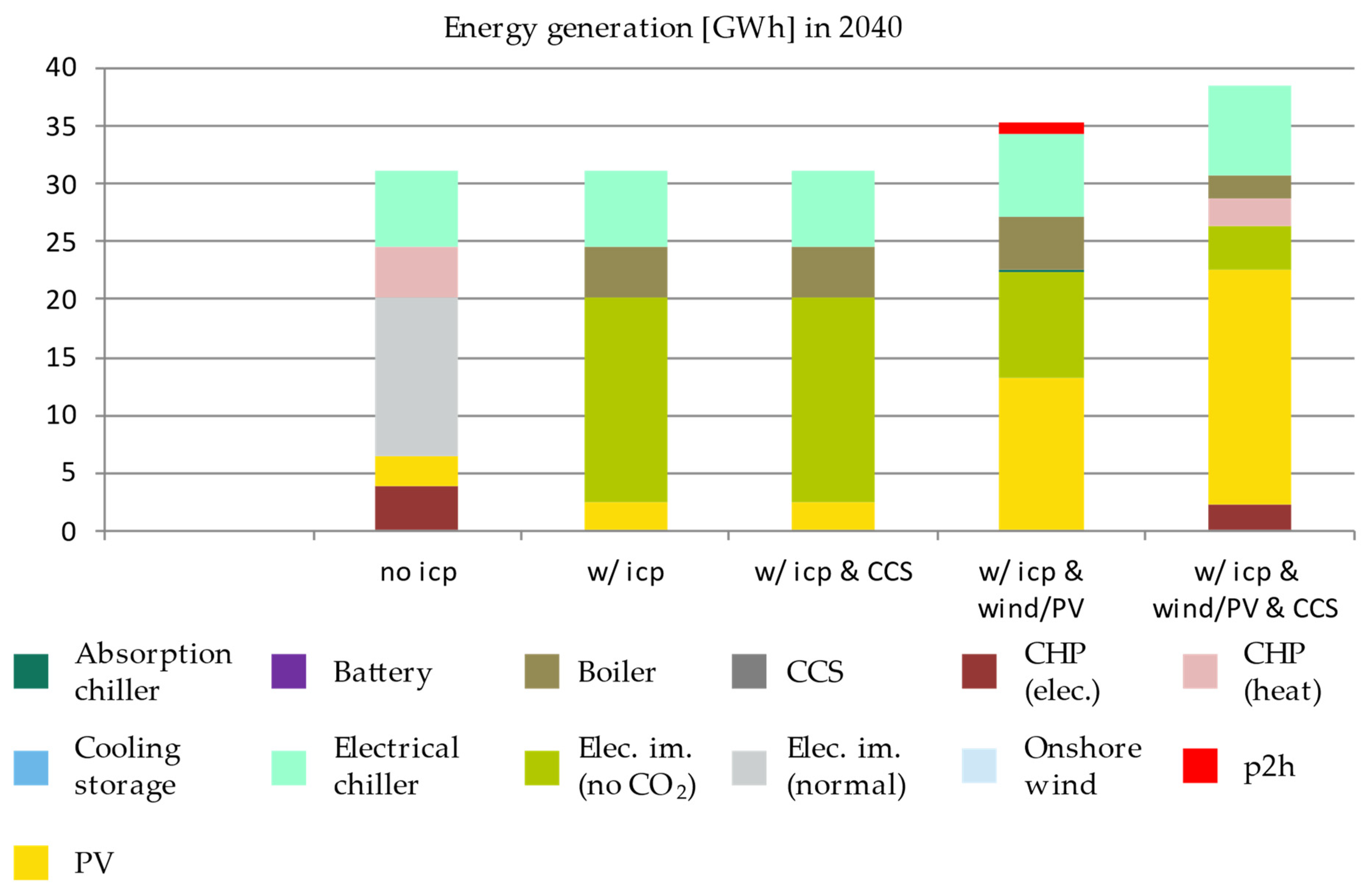

The first bar in Figure 6 shows the energy generation for the “no ICP” scenario. The CHP covers parts of the facility’s electricity and heat demand. Since no significant additional CHP capacity is installed, the share of CHP-generated energy is less than for the German “no ICP” scenario. The boiler compensates the lower CHP-based heat generation and the electrical chiller covers the cooling demand. Meeting the heat demand predominantly with the boiler allows a demand-aligned generation, which in turn reduces the need to store heat. Additionally, the cooling demand is met by the electrical chiller and not by the absorption chiller. Therefore, the overall energy generation is reduced (comparing the German and Japanese “no ICP” scenarios). With the lower CHP generation, more of the necessary electricity is imported from the public grid as “normal” electricity (13.68 GWh). The energy system cost sums up to 7.09 M € and 25,648 t of CO2 are emitted (see also Figure A6). Incorporating the assumed Japanese external carbon price increases the total system cost to 7.18 M € (see Table 8).

Figure 6.

Energy generation for the Japanese scenarios in 2040.

Table 8.

Cost and emission overview for the Japanese scenarios.

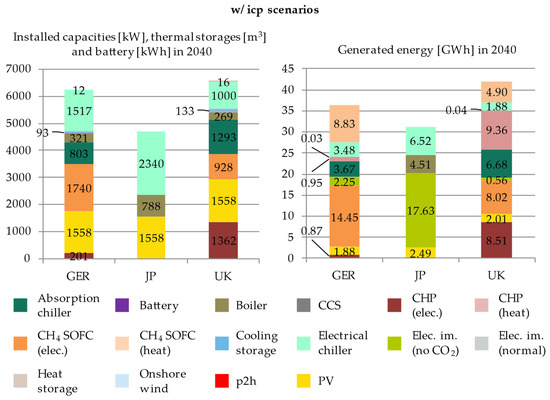

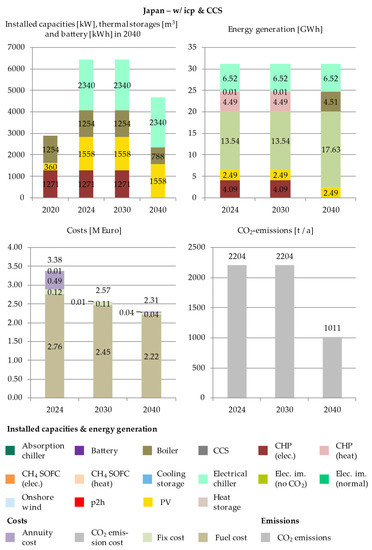

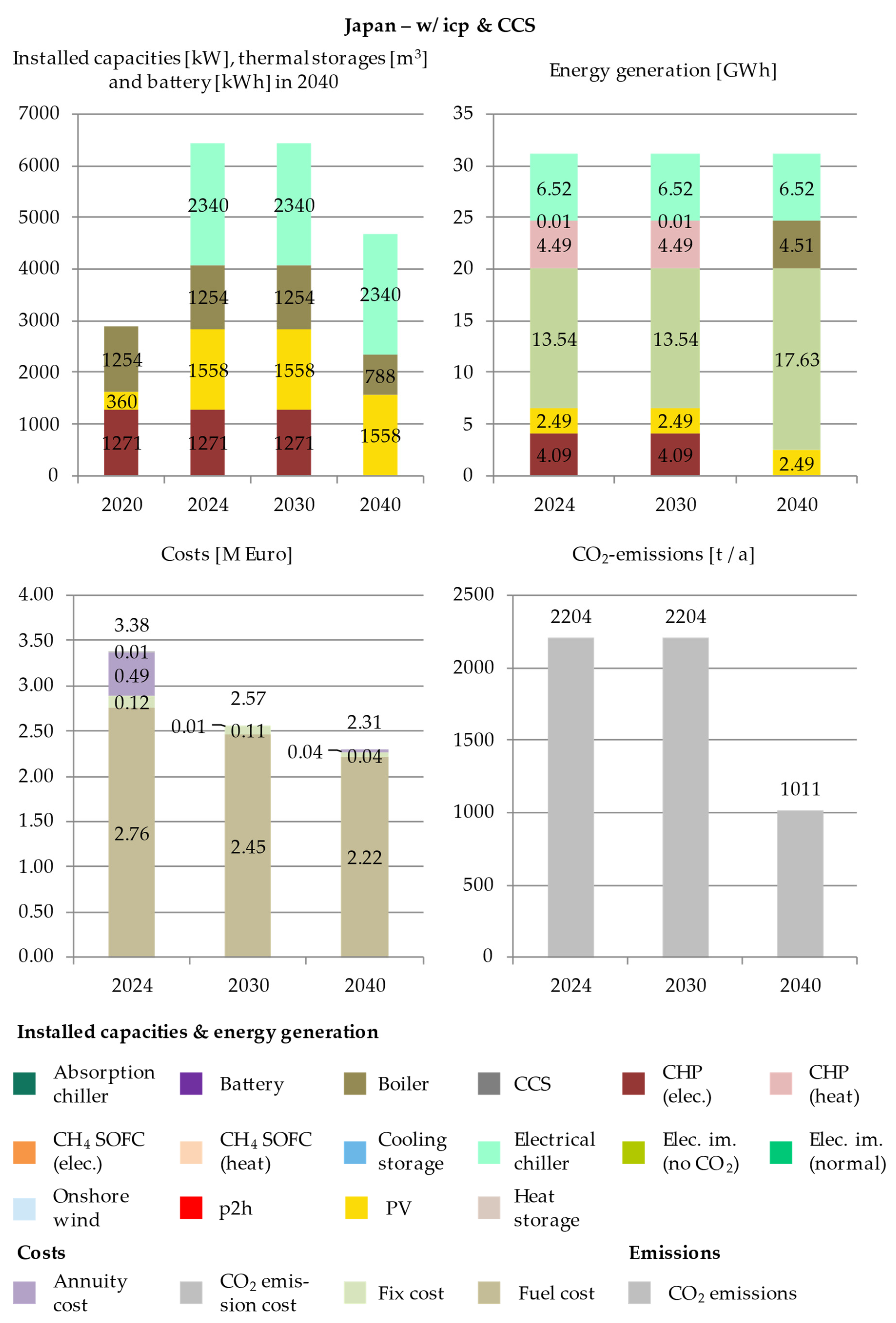

In the Japanese environment the introduction of the ICP leads to changes in the energy system configuration. Unlike in the “no ICP” scenario, the model does not renew the CHP installation after the initial plant has exceeded its lifetime. Therefore, no CHP capacity is installed in 2040. The installed capacities of the electrical chiller (2340 kW) and boiler (788 kW) do not change (see bar 3 in Figure 5).

As bar 2 in Figure 6 shows, the ICP leads to a switch from “normal” electricity imports to the CO2-neutral alternative. As in the “no ICP” scenario, the imported electricity covers a significant share of the electricity demand. Comparing the “no ICP” and the “w/ICP” scenario shows that the CHP is replaced by grid electricity and heat generated with the gas boiler. As the heat and cooling generation of the gas boiler and the electrical chiller can be fully aligned with the respective demands, there is no need for thermal storage capacities. The energy system cost amounts to 8.23 M € and the emissions sum to 5419 t (see also Figure A7). With the external carbon price, the total system cost sums to 8.25 M €.

The results for the Japanese “w/ICP and CCS” scenario do not change compared to the “w/ICP” scenario (bars 3 and 4 in Figure 5, and bars 2 and 3 in Figure 6). The main reason for the similarity of the results is that the use of CCS is not economically feasible, as is the case in the German scenarios. Again, the absence of additional renewable energy capacities leads to a lack of a cheap electricity source. Therefore, it is cheaper to pay the carbon price for the emissions than to install CCS capacities and use CO2-neutral electricity to operate the CCS (see also Figure A8).

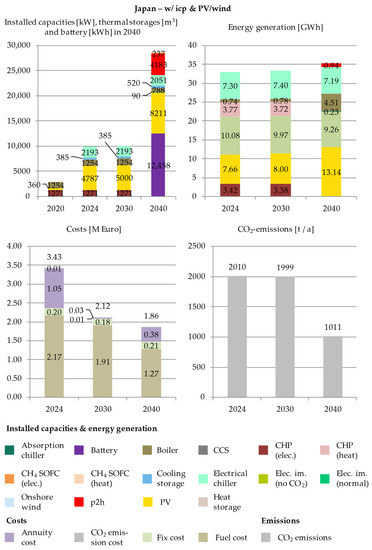

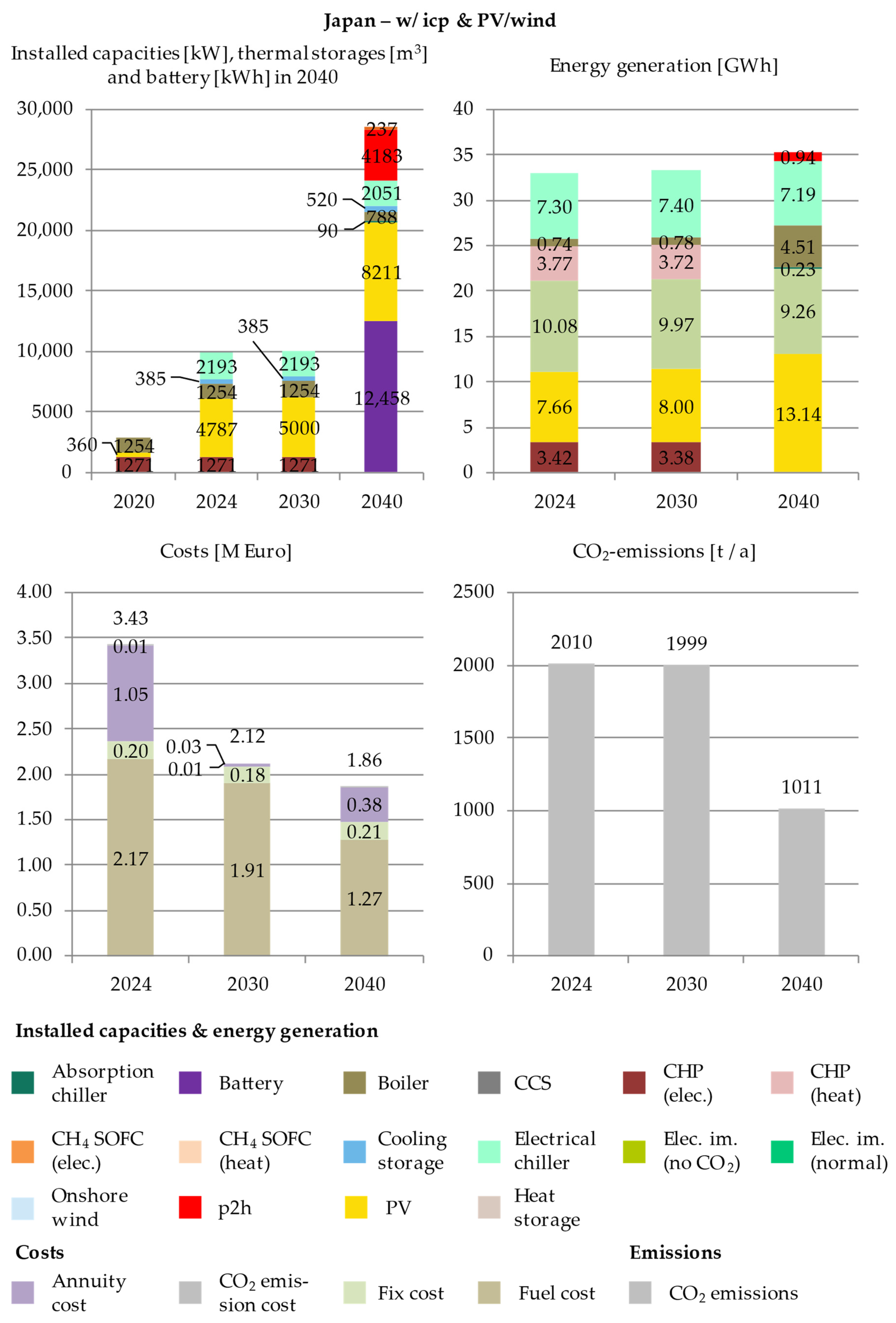

Bar 5 in Figure 5 shows the installed capacities for the Japanese “w/ICP and PV/wind” scenario. Renewables, battery, and p2h technologies are installed. In contrast to the corresponding German scenario, when no wind capacity is installed and compared to the Japanese “w/ICP” scenario, the size of the thermal and cooling storage increases (237 m3 and 520 m3, respectively).

Bar 4 in Figure 6 shows the energy generation for the Japanese “w/ICP and PV/wind” scenario. The PV capacity increases the share of renewable energy. This is supported by the battery and the p2h. The total generated energy increases as the electricity for the p2h and the electricity which is stored in the batteries are generated by the installed PV capacities. The energy system cost of the “w/ICP and PV/wind” scenario sums to 7.40 M € and the emissions amount to 5020 t (see also Figure A9). With the external carbon price, the total system cost sums to 7.41 M €.

Bar 6 in Figure 5 shows the installed capacities for the scenario where CCS is available (“w/ICP and PV/wind and CCS”). Compared to the “w/ICP and PV/wind” scenario, the installation of PV increases and is accompanied by an installation of CCS (2287 kW). The p2h capacities decrease while the battery installation increases considerably. The increase in battery capacity is necessary to facilitate the high share of PV electricity use, as seen in Figure 6. Like the German scenarios, the energy generation for the “w/ICP and PV/wind” and “w/ICP and PV/wind and CCS” scenarios differ in two main aspects (bars 4 and 5 in Figure 6). First, the CHP is used in the “w/ICP and PV/wind and CCS” scenario as its emissions can be compensated by using CCS. Second, the energy generation is slightly higher, which is due to the electricity demand of the CCS technology. The energy system cost amounts to 7.806 M € and the emissions sum up to 1437 t (see also Figure A10). With the external carbon price, the total system cost sums up to 7.809 M €.

Country-Specific Summary

The optimised energy system for Japan is characterised by cheap grid electricity. This leads to higher electricity imports and lower use of the CHP technology compared to the German scenarios. Lower CHP use leads to higher boiler use, which generates the heat to meet the heat demand. This interrelation does not change when an ICP is implemented, only the imported electricity switches from “normal” to the CO2-neutral alternative. With unlimited renewable energy capacities and no CCS technology, the cost optimal solution consists, like the German scenario, of high PV capacities accompanied by battery storage and p2h. In opposition to the German scenario, the model does not install wind capacities, due to the high solar radiation in Japan and associated high PV generation. With CCS, the optimal energy system configuration is, again like the German scenario, less focused on sector integration technologies and more on electricity generation to meet the demand of the CCS, which compensates parts of the system’s emissions.

Even though the ICP is between 47 and 80 times higher than the assumed external carbon price, the total system cost of the most expensive scenario (“w/ICP (and CCS)”) is only 15% more than the cost of the “no ICP” scenario.

When only the energy system cost is compared, the cost increase is between 4% (comparing “no ICP” with “w/ICP and PV/wind”) and 16% (comparing “no ICP” with “w/ICP (and CCS)”). The energy system cost increase is in a similar range as the potential German increases, but less extreme (16% compared with 24%). An organisation that introduces the assumed ICP across their business units might therefore increase the costs for the German business unit more than for the Japanese unit.

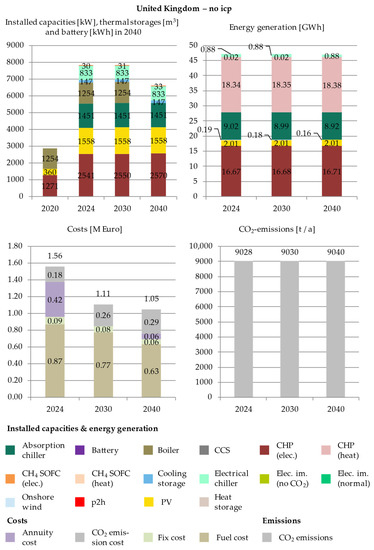

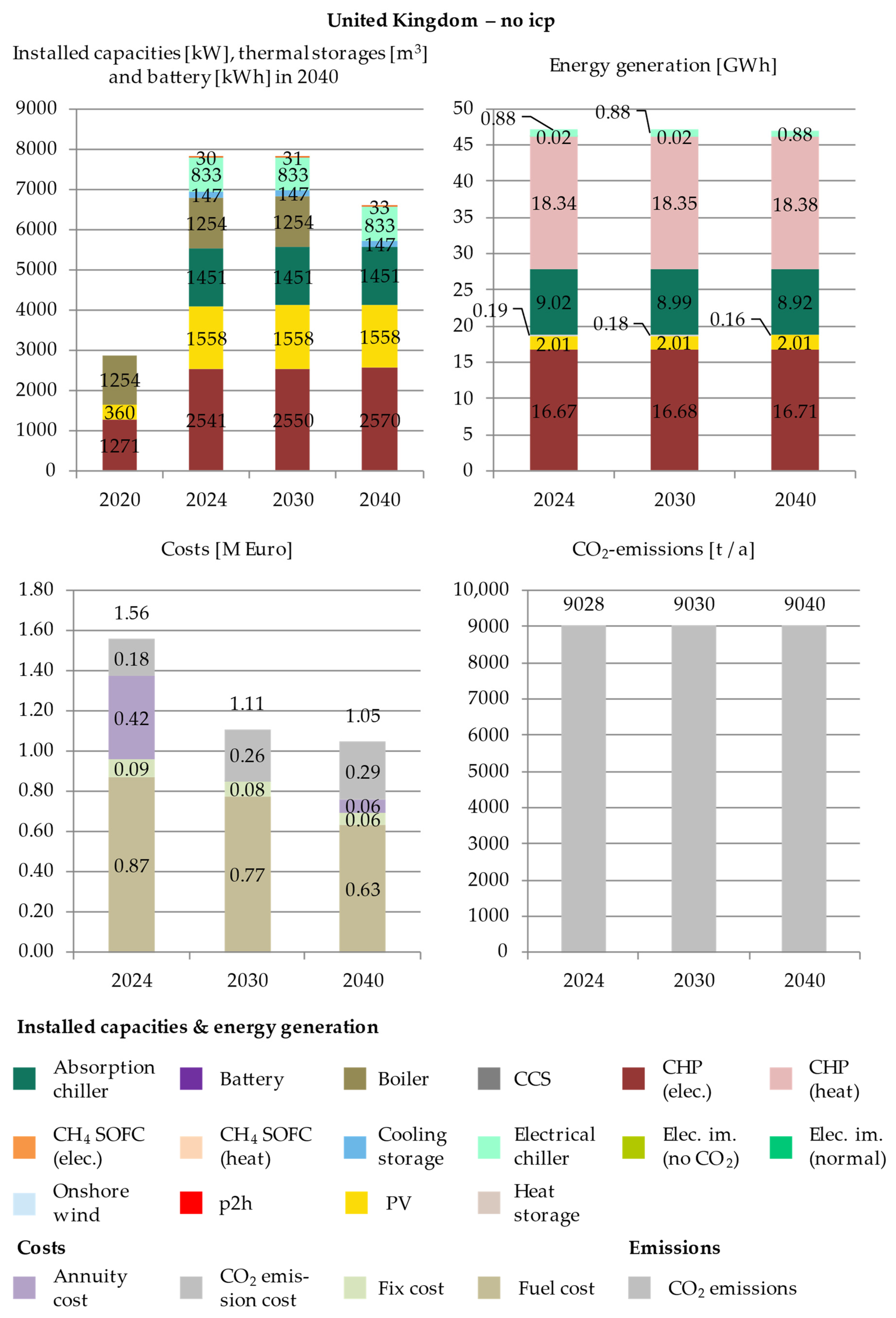

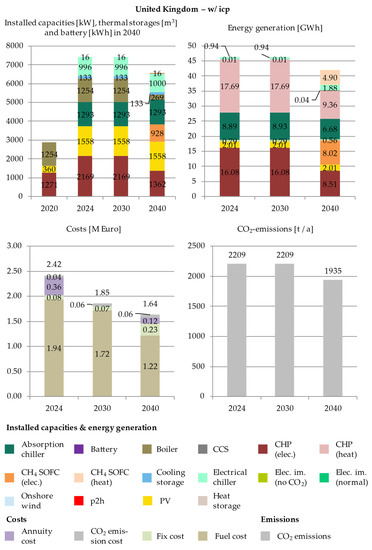

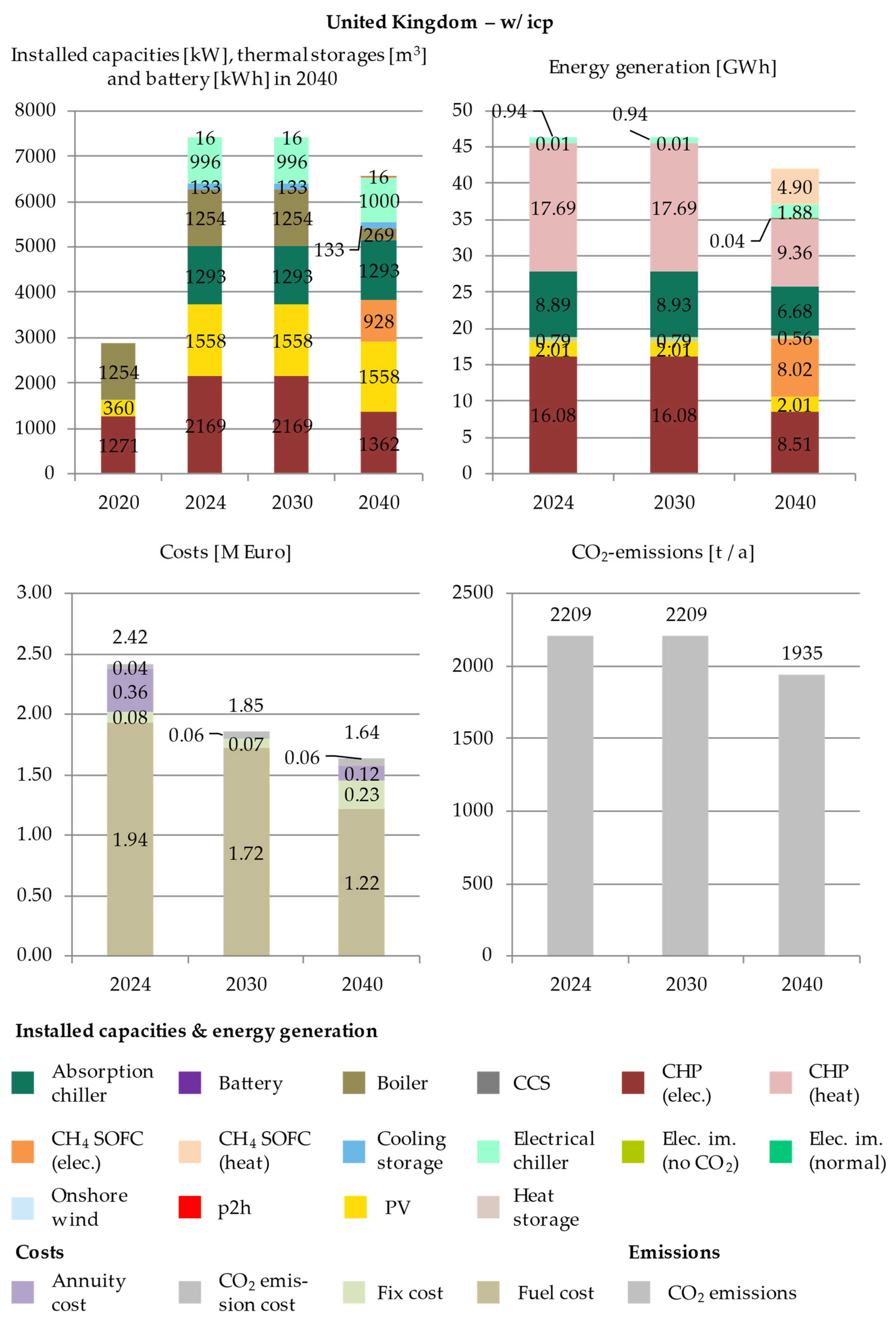

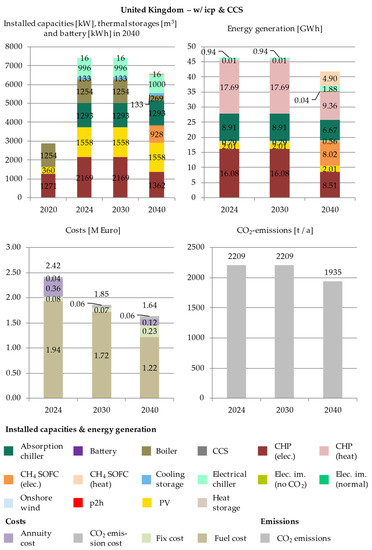

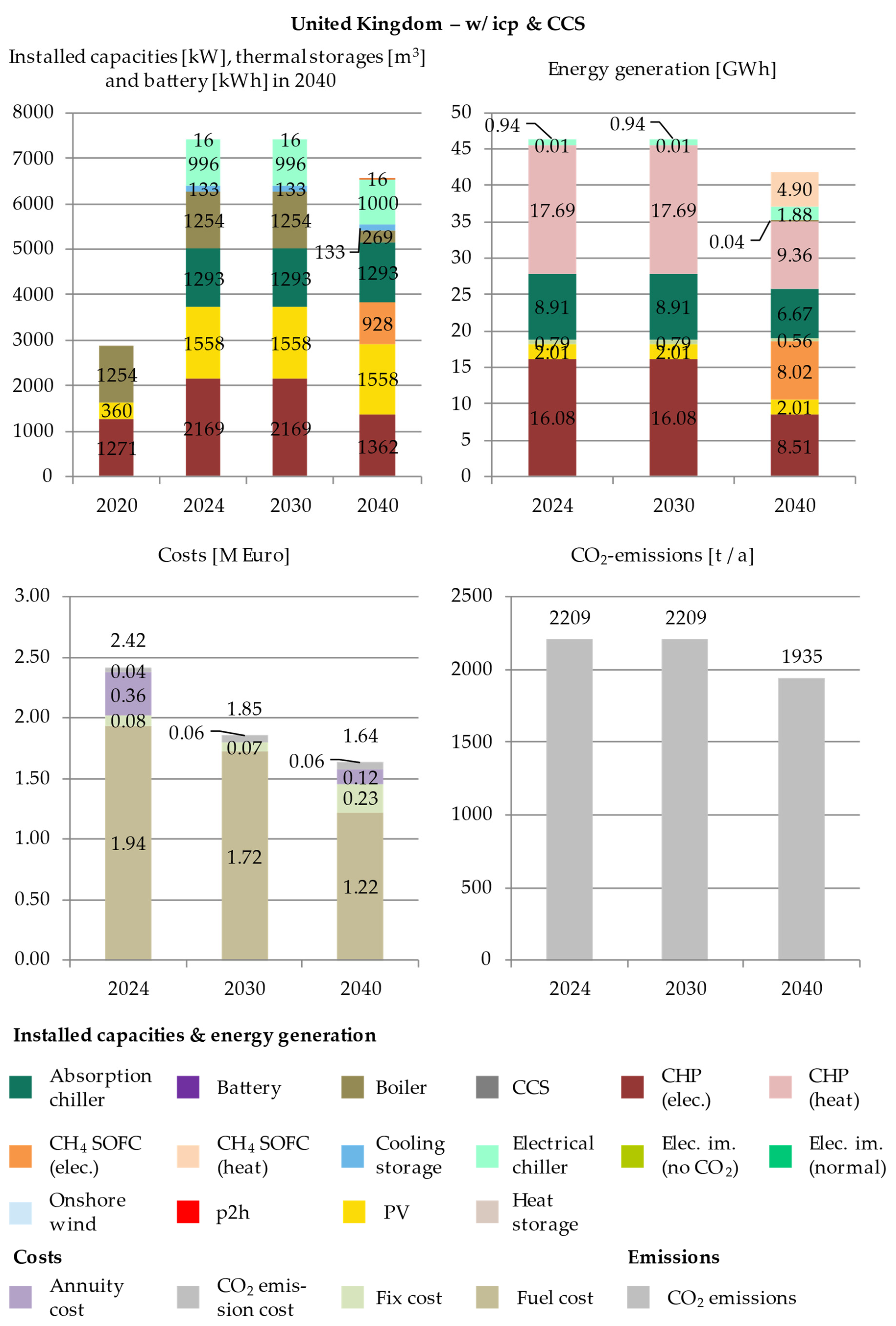

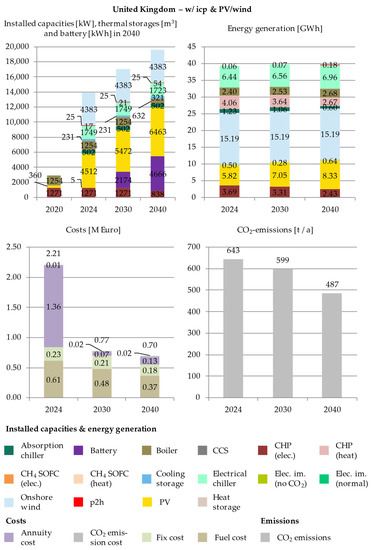

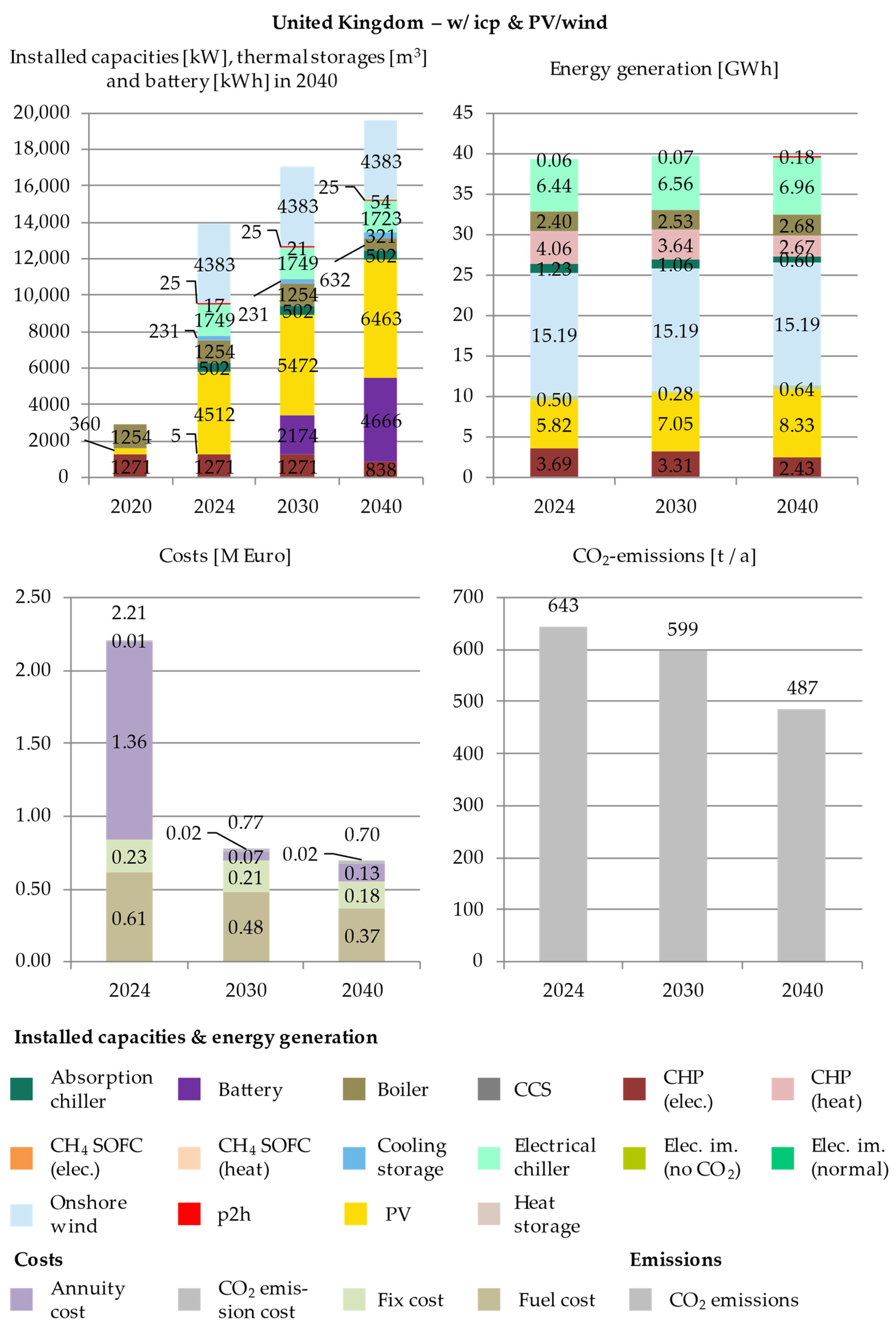

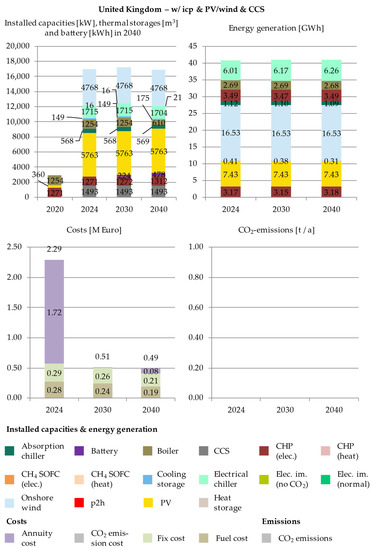

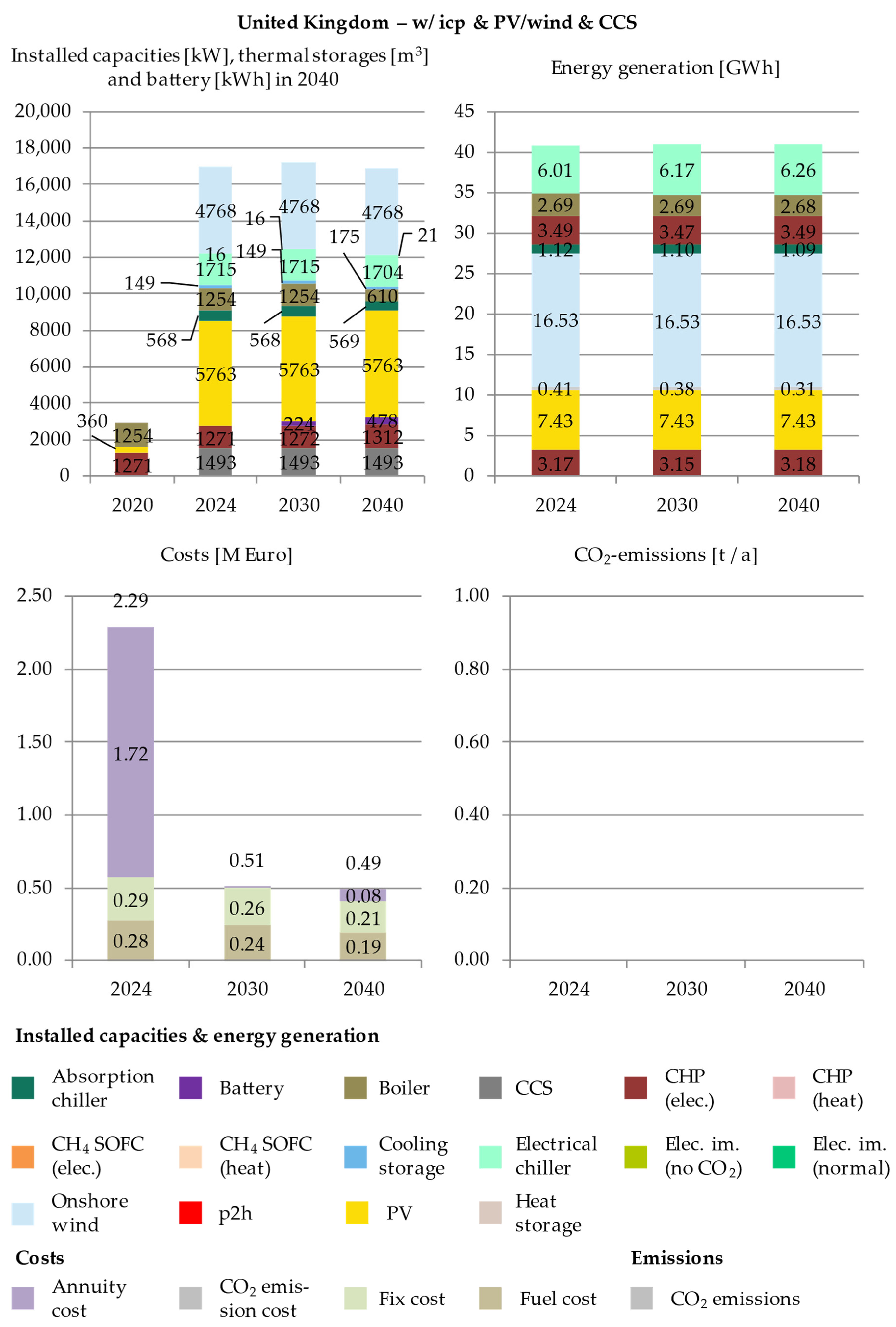

3.3. United Kingdom

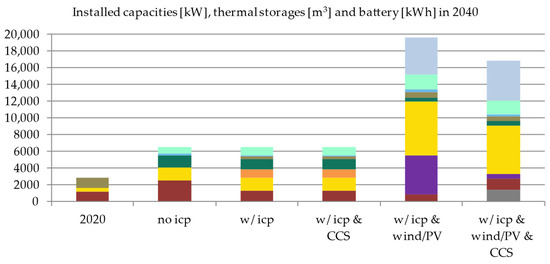

For the British “no ICP” scenario, the installed technologies as well as the generated energy mix are very similar to the German “no ICP” scenario (see bar 2 in Figure 7 and Figure A11). Again, the CHP provides most of the necessary electricity as well as heat and the absorption chiller uses excess heat to meet the cooling demand (see Figure 8). The energy system cost sums up to 2.98 M €, which is less than the energy system cost of the German “no ICP” scenario (4.24 M €). The lower cost is mainly due to the lower gas price in the UK, which reduces the overall fuel cost. The CO2 emissions sum up to 27,098 t, which is less than for the German “no ICP” scenario, due to the lower emission factor of the British grid electricity (see Table 6). Taking the assumed British external carbon price into account brings the total system cost to 3.71 M € (see Table 9).

Figure 7.

Installed capacities for the British scenarios in 2040.

Figure 8.

Energy generation for the British scenarios in 2040.

Table 9.

Cost and emission overview for the British scenarios.

Optimising the British energy system with an ICP changes the installed technology mix, see bar 3 in Figure 7. As already seen in the German scenarios, the model installs the CH4 fuel cell technology (928 kW). For the energy generation, the ICP not only causes a fuel switch from “normal” to CO2-neutral electricity but also from gas to biogas due to the small price difference between them. This is contrary to the German and Japanese scenarios. The switch to biogas leads to a reduction of emissions and therefore to a reduction in emission cost. The energy system cost for the “w/ICP” scenario sums to 5.74 M €, while the emissions reduce to 6353 t (see also Figure A12). Including external carbon prices raises the total system cost to 5.91 M €.

Bar 4 in Figure 7 shows the installed capacities for the “w/ICP and CCS” scenario. As already seen in the other countries’ scenarios, the CCS technology does not yield any advantages within this scenario setting. Therefore, the cost optimal solution is the same as for the “w/ICP” scenario (see also Figure A13).

For the “w/ICP and PV/wind” scenario, the technology mix changes significantly (bar 5 in Figure 7). Up to 6463 kW of PV and 4383 kW of onshore wind capacities are installed. Additionally, p2h capacity (54 kW), cooling (321 m3) and heat storage (25 m3), as well as battery storages (4666 kW) are installed.

Bar 4 in Figure 8 shows the generated energy for the “w/ICP and PV/wind” scenario. With the installed PV and wind capacities, the share of renewable energy generation increases significantly. In combination with the p2h, they replace the CHP to a large extent. The small amounts of imported electricity (0.64 GWh) are CO2-neutral. The energy system cost sums up to 3.63 M € and 1729 t of CO2 are emitted (see also Figure A14). Taking the assumed external carbon price into account increases the total system cost to 3.68 M €.

Bar 6 in Figure 7 shows the installed technologies for the “w/ICP and PV/wind and CCS” scenario. Compared to the “w/ICP and PV/wind” scenario, more PV (5763 kW) and onshore wind (4768 kW) are installed. CCS is installed from 2024 onward (1493 kW in 2040). As already seen previously, the p2h and battery capacities decrease in this scenario setting.

Bar 6 in Figure 8 shows the energy generation for the “w/ICP and PV/wind and CCS” scenario. The high renewable energy generation is used to operate the CCS. In contrast to all other British scenarios where the ICP is incorporated, the model switches the fuel from biogas back to gas and from CO2-neutral electricity to the “normal” option. It is cheaper to compensate the associated emissions with CCS than to avoid them with the low-emission biogas and the CO2-neutral electricity. The CCS compensates the emissions to net zero (see also Figure A15). The energy system cost sums up to 3.28 M €, which does not change once the external carbon price is considered, as the CO2 emissions are net zero.

Country-Specific Summary

The British scenarios are characterised by the cheap gas price. Therefore, the implementation of an ICP does not force a strong switch to more efficient technologies (e.g., a fuel cell), as seen in the German scenarios (“w/ICP” and “w/ICP and CCS”). This is supported by the cheap biogas price, which again reduces the need to switch to more expensive but also more efficient technologies such as the CHP, which is run with the less emission-intensive biogas. The fuel switch to biogas is the main reason for the emission reduction when comparing the British “no ICP” to the “w/ICP” scenario.

The interrelation between the CCS and CHP as well as the availability of unlimited renewable energy capacities is consistent within the German and the Japanese scenario worlds. With the availability of unlimited renewables and CCS, the model reduces the use of energy storage and sector integration technologies and increases the use of CHP. For the British scenarios, the unlimited renewable energy potential combined with CCS additionally initialises a switch back from biogas to gas and from CO2-neutral electricity to the “normal” option.

Comparing the total system cost of the “no ICP” scenario shows that the cost is between 12% (“w/ICP and PV/wind and CCS”) lower and 59% (“w/ICP (and CCS)”) higher. When only the energy system cost is compared, the cost increase is between 10%, comparing “no price” with “w/ICP and PV/wind and CCS”, and 93% for “w/ICP (and CCS)” compared with the “no price” scenario.

4. Discussion

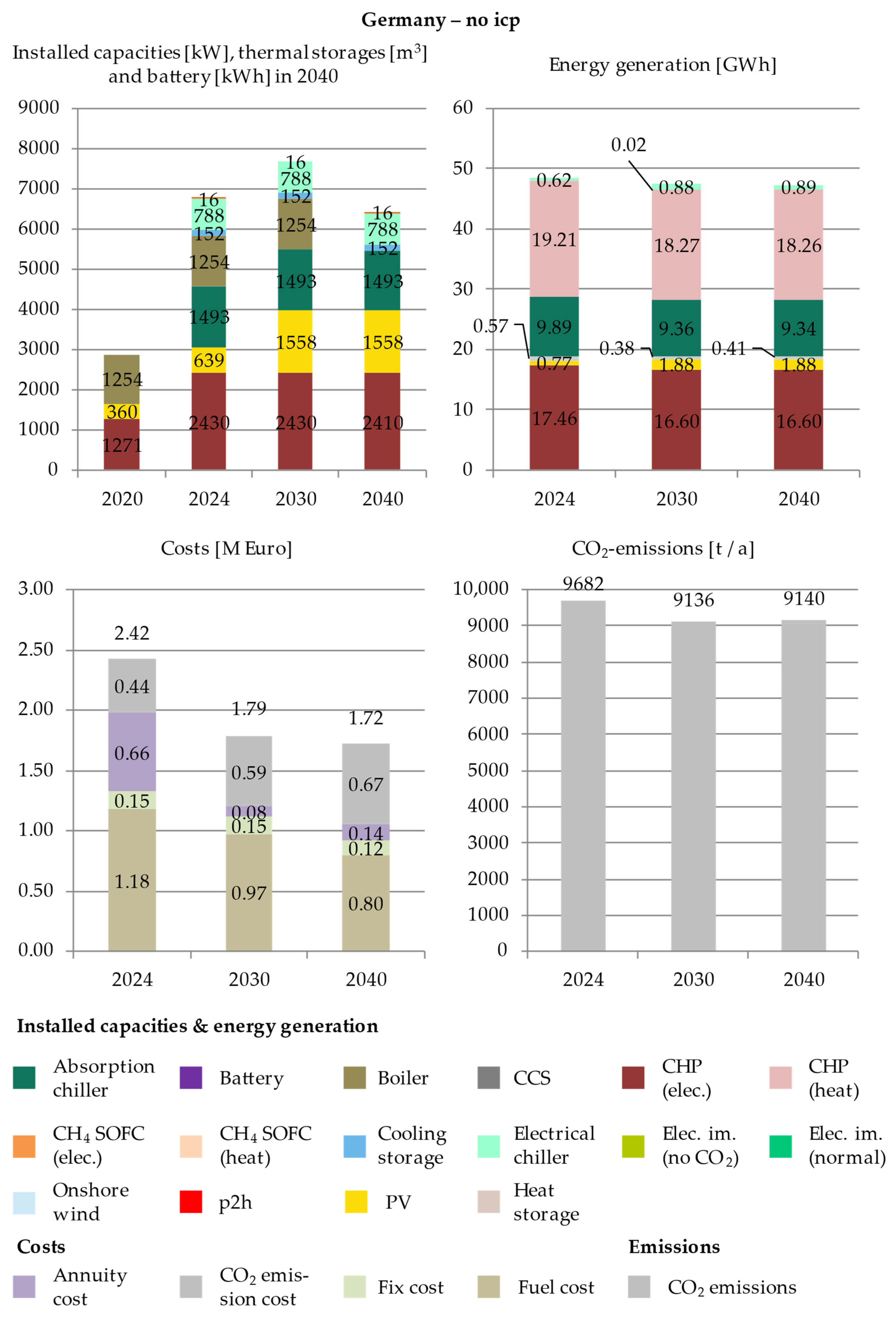

4.1. Significant Impact Differences in the Energy System Cost for the Countries Due to the ICP

Table 10 gives an overview of the energy and total system cost as well as the emissions of all analysed scenarios. Comparing the energy system cost for the different scenarios shows significant differences in the impact of the ICP on the energy system cost across the countries (Figure 9). This indicates that an organisation which chooses to implement an ICP across all its business units influences the energy system cost of its business units very differently. At the same time, the emission reductions vary significantly (Table 10). This is independent of potential country-specific external carbon prices. The diverse impacts of an ICP on the costs and emissions indicates that there are business unit-specific emission abatement cost curves in each examined country. Further research could analyse if the emission abatement cost curves vary for different business units within a country.

Table 10.

Cost and emission overview.

Figure 9.

Percentage price increase in energy system cost due to ICP.

A multinational organisation that plans to implement some sort of ICP across all its business units should consider that the same ICP might have varying cost impacts on different business units. It might otherwise raise disapproval of ICP within the organisation. Academic literature has not yet covered this aspect fully. Accounting for the impact differences when designing ICP schemes is one option for how to mitigate this problem.

4.2. Total System Cost Increase Due to ICP Is Not Proportional to the Price Difference between Internal and External Carbon Prices

To analyse the impact of ICP on the total system cost, the energy system is optimised with the ICP and then the total system cost is calculated based on the assumed external carbon prices.

For the German and British case studies, the total system cost is higher in the “w/ICP” and “w/ICP and CCS” scenarios. With the unlimited renewables potentials in the “w/ICP and PV/wind” as well as the “w/ICP and PV/wind and CCS” scenarios, the total system cost actually decreases below the total system cost of the “no price” scenario. The Japanese scenario results are different, as all “w/ICP” scenarios have a higher cost than the “no price” scenario.

The German and British scenarios show that, even though the ICP is at least twice as high as the external carbon price, the total system cost of the “w/ICP and PV/wind” scenarios are lower than the cost of the “no price” scenario. Comparing both country results indicates that with increasing external carbon prices, the additional total system cost decreases, based on a system optimised with ICP. This is a valuable insight for organisations that are trying to design an ICP and are having problems with defining a price level. Organisations may not necessarily have to bear additional costs due to their ICP being considerably higher than the external carbon price. Only with very high price differences, the additional cost, due to the system optimisation with ICP, might be higher for all the scenarios, as the Japanese results underline. This does change once the organisation knows the future external carbon price. Knowing the exact future carbon price and optimising the energy systems by taking this price into account would obviously yield the lowest cost.

Even though the total system cost increases with ICP, compared to the scenario where no ICP is used at all, the cost difference is not proportional to the difference between the ICP and the actual external carbon price. This indicates that organisations do not necessarily increase their cost proportionally, even though a high internal carbon price is used.

4.3. Installation of Energy Storage and Sector Integration Technologies Depends on the Availability of Renewables and CCS

With unlimited renewable energy capacities, PV and wind are installed and combined with energy storing and integration technologies for all three countries. Allowing the model to install CCS in the unlimited renewable energy capacities scenarios changes the optimal solution significantly. The energy system configuration steers away from energy storage and integration technologies.

Especially the British scenarios demonstrate this change in the energy system configuration. The British “w/ICP and PV/wind” results show a fuel switch from gas to biogas and the installation of energy storage and sector integration technologies. In the “w/ICP and PV/wind and CCS” scenario, CCS is installed, a switch back to gas is executed and less energy storage and sector integration technologies are installed. Similar results are seen for the German and Japanese scenario environments. The energy system configuration builds more on CHP and boiler usage, while associated emissions are compensated by CCS. The renewables supply the cheap electricity for an economically feasible operation of the CCS. Overall, the results show that the renewables lay the foundation for both energy system designs.

4.4. Building the Energy System on a Future Use of CCS Might Lead to a Path Dependency

Designing the energy system configuration around the assumption that in the future CCS is widely accessible and can be combined with renewables can lead to a path dependency. The results show that by planning the energy system investments and operation under this assumption, the investments focus on CCS and not on energy storage and sector integration technologies. If in the future CCS is not available as expected, switching to a more renewable-based, sector-integrated energy system might be difficult and above all expensive. This path dependency is especially prevalent, as investments in energy systems usually comprise long-term time horizons. Therefore, organisations should evaluate their assumptions carefully to avoid unexpected costs in the next decades.

4.5. CCS Is Not Effective without the Availability of Cheap Electricity

Allowing the installation of CCS without increasing the available renewable energy capacities has no significant impact in all the scenarios (“w/ICP” and “w/ICP and CCS”). Only with the unlimited renewables potential, CCS becomes a feasible option in all three scenario environments. Thus, it should not be considered a reasonable technology on a company scale, where renewable and land resources are generally limited.

4.6. Cheapest Main Energy Source Shapes Energy System

Comparing the results for Germany and the United Kingdom with Japan underlines the influence of the cheapest main energy source (Figure 10). With cheap gas prices in the UK and GER, the combined generation of electricity and heat with CHP and fuel cells is predominant. The slightly higher gas and biogas prices in GER force the model to focus more on fuel cells. In JP, the cheap electricity price leads to importing CO2-neutral electricity and generating heat with the more efficient gas boiler. Therefore, CHP and fuel cells are not as important as for the German or British scenarios.

Figure 10.

Country comparison for “w/ICP” scenarios.

4.7. Sensitivity Analysis

As the results highly depend on the level of the assumed internal carbon prices, a sensitivity analysis was conducted. For this analysis the one-at-a-time (OAT) method for sensitivity analysis was used [82,83,84]. In the framework of this method, one specific input value is altered around its nominal or initial level [82,83].

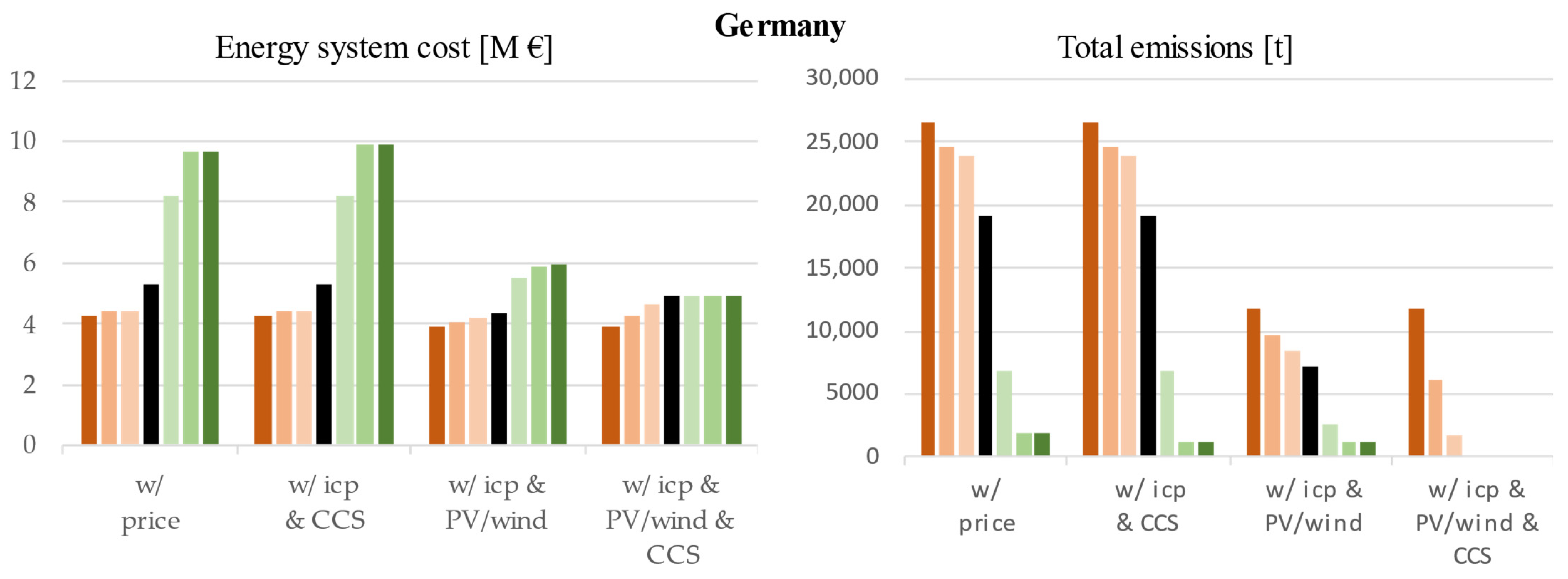

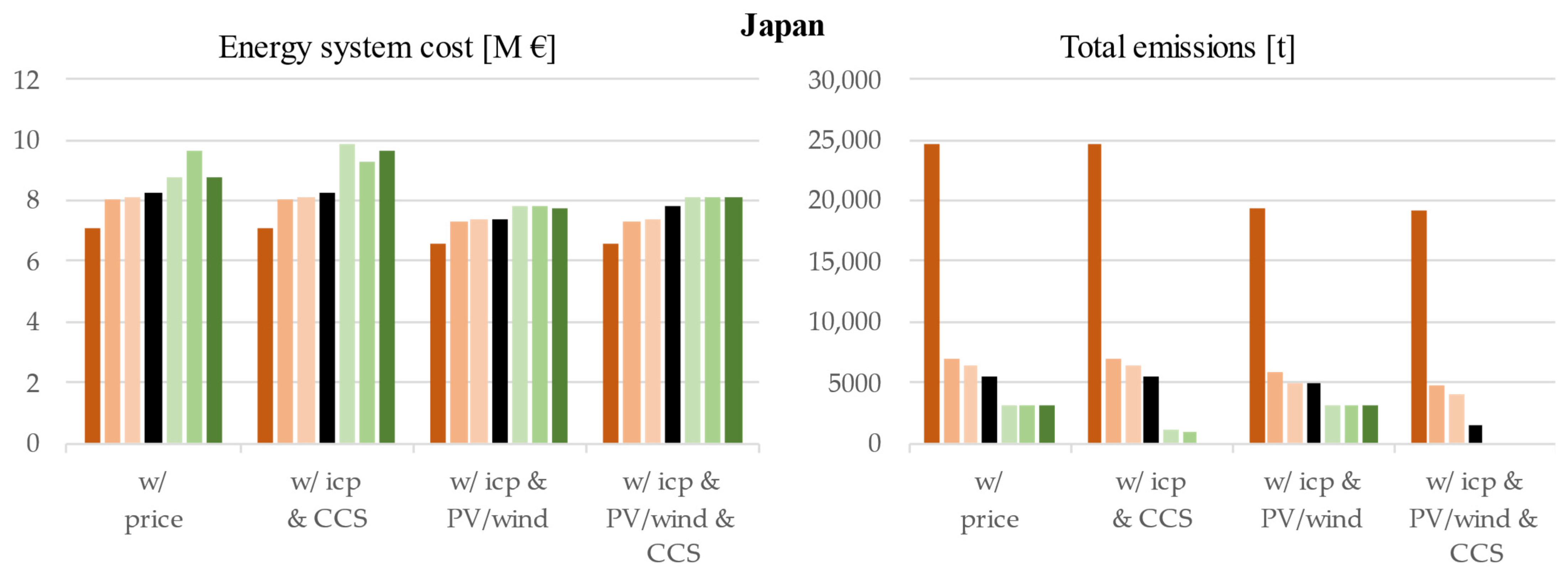

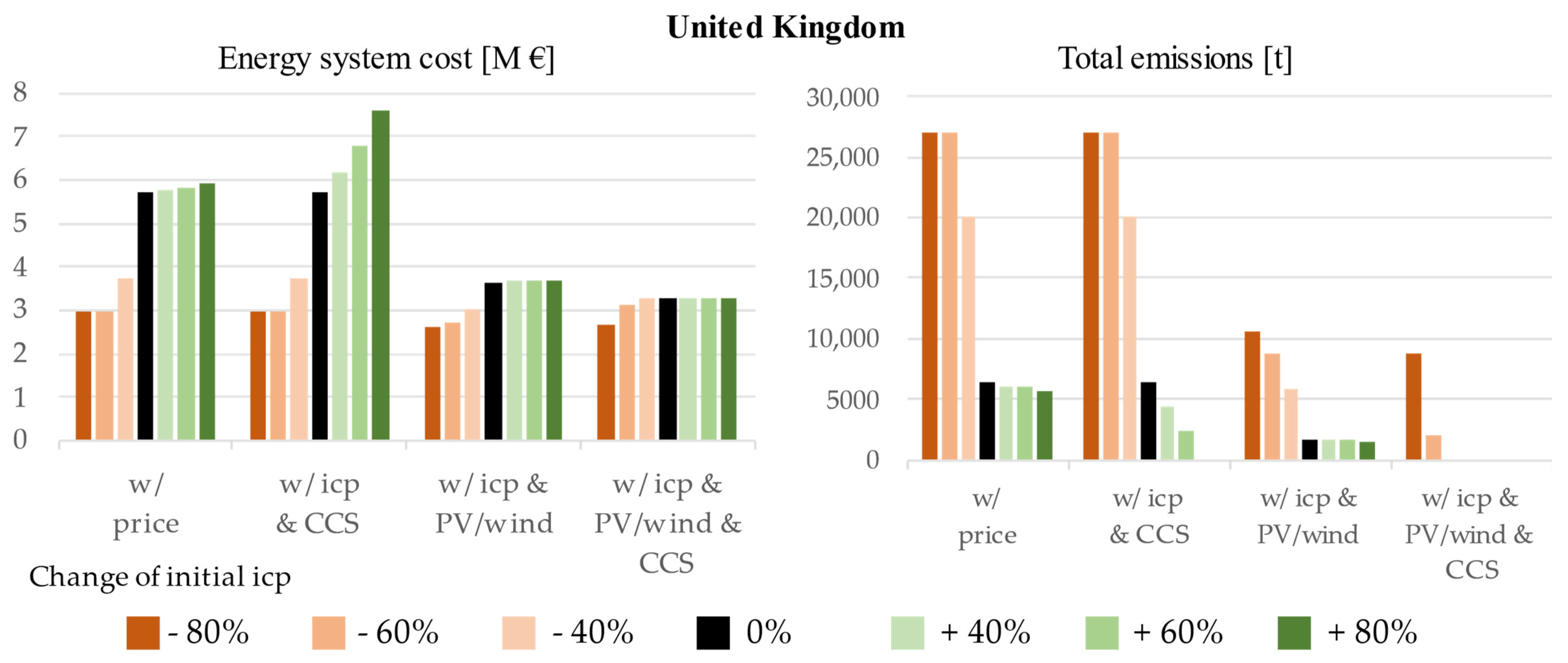

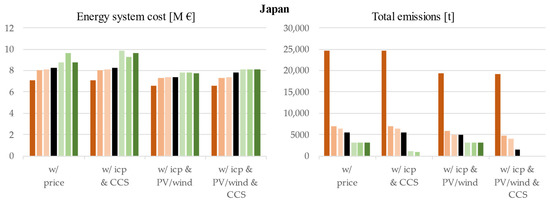

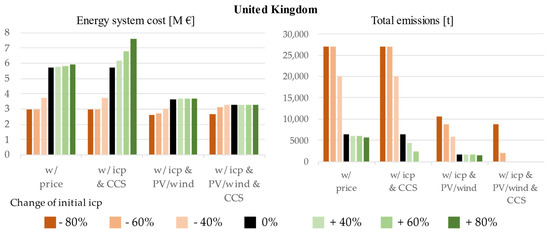

The aim of this analysis was to investigate how the optimisation results change once the value of the ICP is changed. Since the ICP directly affects the energy system cost and the emissions of the whole system, the sensitivity analysis focuses on these two aspects of the optimisation. The sensitivity analysis results are shown in Figure 11, Figure 12 and Figure 13 for Germany, Japan, and the United Kingdom, respectively (see also Appendix B).

Figure 11.

Sensitivity analysis results for the German scenarios.

Figure 12.

Sensitivity analysis results for the Japanese scenarios.

Figure 13.

Sensitivity analysis results for the British scenarios.

All country-specific sensitivity analyses indicate that with a reduction of the ICP, the results approach the findings of the “no price” reference scenario. This interrelation is to be expected and underlines the correct implementation of the sensitivity analysis. A second expected finding of the sensitivity analysis is that the results do not change for scenarios where a full decarbonisation is achieved. Since there are no more CO2 emissions, the ICP does not create a price signal for the optimisation model and the results stay the same even when the ICP level is altered significantly (see “w/ICP and PV/wind and CCS” scenario in Figure 11, Figure 12 and Figure 13 and Appendix B).

The results for the “w/ICP and PV/wind” scenarios show that even with significantly increased ICPs there is no decarbonisation. In the model context, this is mainly due to a lack of options for emission-free heat generation. The model can reduce the emissions by switching from gas to biogas, but the biogas usage still causes emissions (see Table 6). The hydrogen option is not chosen because the hydrogen storage costs are too high (see Table 5) and it was assumed that there is no potential for a cheap hydrogen cavern storage on the facility’s premises. Heat pumps are currently not an applicable option either, which will be discussed in the limitations section.

The “PV/wind” scenarios underline the effectiveness of renewable energies in reducing CO2 emissions cost efficiently. The cost advantage of the “PV/wind” scenarios persists even with a reduction of the internal carbon price level (see Figure 11, Figure 12 and Figure 13 and Appendix B). This underlines the already mentioned recommendation for organisations that an investment in renewable energy sources is a robust measure to prepare its energy supply for the future, independent of the availability of the CCS technology.

The Japanese and British “w/ICP and CCS” results (Figure 12 and Figure 13) show that with very high internal carbon prices (+80%) and low electricity and gas prices, respectively, there might be an economic feasible use of CCS in combination with grid electricity imports or electricity generation via CH4 fuel cells. Organisations that lack sufficient availability of renewable energy sources might evaluate this option once very high CO2 prices are in place or electricity import cost reduces.

4.8. Limitations

Four general remarks should be considered for the results presented in this paper. First, as previously mentioned in the introduction, the (cost) factors which influence energy systems are highly intertwined. Therefore, the results are sensitive to the assumed values of the relevant model factors. Changing the value of just one of these factors can alter the results considerably. Therefore, the results should always be seen in the context of the assumed values.

Second, the optimisation comprises a long-term time horizon. Correctly predicting the exact future value of any factor is probably impossible. Therefore, the results can be used to derive general statements about energy systems with internal carbon prices in different countries, but they cannot serve as exact predictions of future costs developments.

Third, the case studies are based on demand data of a real-world facility in Japan. The facility has electricity, heat, and cooling demand throughout the entire year. This simultaneity of all three energy demands makes the usage of combined electricity, heating, and cooling generation technologies (CHP, fuel cell, and absorption chiller) very effective. If the facility did not have all three demands throughout the whole year, the focus of the cost-optimal technology mix might change from combined generation technologies to other generation technologies.

Additionally, the heat demand of the real-world facility is required to be met by steam. Therefore, heat pumps are not installed as the temperature spread would be too high for most of the market-ready heat pumps.

5. Conclusions

Organisations around the globe try to reduce their greenhouse gas emissions effectively. One instrument used to manage these efforts is internal carbon pricing. Defining the exact value for an internal carbon price and assessing the impact for business units in different countries is seen as challenging for organisations.

This paper analyses the impact of ICP, aligned with the findings of the updated DICE model, on identical business units in Germany, Japan, and the United Kingdom. The results show that the implementation of one ICP within a multinational organisation has very different impacts on the business units in different countries. The differences can not only be found for the costs and emissions but also for the energy system configuration and operation. Additionally, the results show that price differences between an ICP and an external carbon price do not have a proportional impact on the total system cost. Using an ICP which is considerably higher than the external carbon price might therefore not necessarily lead to additional costs, as the German and British scenario results show.

The availability of renewable energy plays an important role in how an energy system configuration changes and how CCS is used when an ICP is introduced. If CCS is not available to the system, but enough renewable energy capacities are, the system consists of high renewable energy technologies, sector integration technologies, as well as energy storage technologies. If renewables and CCS are available, the energy system configuration and operation consist of less energy storage and energy integration technologies and uses CHP and boilers instead. The renewables provide the electricity for the CCS, which compensates the emissions caused by the usage of the heating technologies. Since renewables play an important role in reducing the costs of the energy system, independent of the CCS availability, a robust approach for organisations or business units to support the cost-efficient transition of their energy system is ensuring the availability of enough renewable energy capacities and successively exploiting them.

Overall, an organisation should carefully assess the impact an ICP has on its business units across different countries and consider the differences already during the ICP design process. This study can give a first impression on potential differences in cost increases and emission reductions when looking at different country-specific environments. To allow organisations to prepare themselves for higher external carbon prices and plan their decarbonisation pathways, further research is necessary to develop methods that allow the organisation a thorough assessment of their ICP design and consider impacts on a multinational scale. Other directions of future research might go towards developing methods to fairly mitigate the impact differences to support organisations in implementing internal carbon prices and thereby preparing themselves for a carbon-neutral future.

Author Contributions

Conceptualization, O.G.G., N.S.H. and J.T.; methodology, O.G.G.; software, O.G.G.; validation, O.G.G., N.S.H. and J.T.; formal analysis, O.G.G. and N.S.H.; investigation, O.G.G.; resources, O.G.G.; data curation, O.G.G.; writing—original draft preparation, O.G.G.; writing—review and editing, O.G.G., N.S.H. and J.T.; visualization, O.G.G.; supervision, N.S.H. and J.T.; project administration, O.G.G.; funding acquisition, O.G.G., N.S.H. and J.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data were not publicly available due to privacy restrictions.

Acknowledgments

This work was supported by Research & Development Group Hitachi Ltd., Hatoyama, Japan and by EnBW Energie Baden-Württemberg AG, Karlsruhe, Germany. However, the results and statements do not represent the opinion or beliefs of either Research & Development Group Hitachi Ltd. or of EnBW Energie Baden-Württemberg AG, Karlsruhe, Germany.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Detailed results for the German “no ICP” scenario.

Figure A1.

Detailed results for the German “no ICP” scenario.

Figure A2.

Detailed results for the German “w/ICP” scenario.

Figure A2.

Detailed results for the German “w/ICP” scenario.

Figure A3.

Detailed results for the German “w/ICP and CCS” scenario.

Figure A3.

Detailed results for the German “w/ICP and CCS” scenario.

Figure A4.

Detailed results for the German “w/ICP and PV/wind” scenario.

Figure A4.

Detailed results for the German “w/ICP and PV/wind” scenario.

Figure A5.

Detailed results for the German “w/ICP and PV/wind and CCS” scenario.

Figure A5.

Detailed results for the German “w/ICP and PV/wind and CCS” scenario.

Figure A6.

Detailed results for the Japanese “no ICP” scenario.

Figure A6.

Detailed results for the Japanese “no ICP” scenario.

Figure A7.

Detailed results for the Japanese “w/ICP” scenario.

Figure A7.

Detailed results for the Japanese “w/ICP” scenario.

Figure A8.

Detailed results for the Japanese “w/ICP and CCS” scenario.

Figure A8.

Detailed results for the Japanese “w/ICP and CCS” scenario.

Figure A9.

Detailed results for the Japanese “w/ICP and PV/wind” scenario.

Figure A9.

Detailed results for the Japanese “w/ICP and PV/wind” scenario.

Figure A10.

Detailed results for the Japanese “w/ICP and PV/wind and CCS” scenario.

Figure A10.

Detailed results for the Japanese “w/ICP and PV/wind and CCS” scenario.

Figure A11.

Detailed results for the British “no ICP” scenario.

Figure A11.

Detailed results for the British “no ICP” scenario.

Figure A12.

Detailed results for the British “w/ICP” scenario.

Figure A12.

Detailed results for the British “w/ICP” scenario.

Figure A13.

Detailed results for the British “w/ICP and CCS” scenario.

Figure A13.

Detailed results for the British “w/ICP and CCS” scenario.

Figure A14.

Detailed results for the British “w/ICP and PV/wind” scenario.

Figure A14.

Detailed results for the British “w/ICP and PV/wind” scenario.

Figure A15.

Detailed results for the British “w/ICP and PV/wind and CCS” scenario.

Figure A15.

Detailed results for the British “w/ICP and PV/wind and CCS” scenario.

Appendix B

Table A1.

Sensitivity analysis results for the German scenarios.

Table A1.

Sensitivity analysis results for the German scenarios.

| Germany | ||||||||

|---|---|---|---|---|---|---|---|---|

| Change of Initial ICP [%] | Energy System Cost [M €] | Total CO2 Emissions [t] | ||||||

| w/Price | w/ICP and CCS | w/ICP and PV/Wind | w/ICP and PV/Wind and CCS | w/Price | w/ICP and CCS | w/ICP and PV/Wind | w/ICP and PV/Wind and CCS | |

| −40 | 4.45 | 4.45 | 4.17 | 4.68 | 23,883 | 23,883 | 8430 | 1766 |

| −60 | 4.39 | 4.39 | 4.05 | 4.24 | 24,567 | 24,567 | 9723 | 6150 |

| −80 | 4.26 | 4.26 | 3.92 | 3.92 | 26,616 | 26,616 | 11,855 | 11,774 |

| 40 | 8.19 | 8.19 | 5.49 | 4.91 | 6871 | 6871 | 2606 | 0 |

| 60 | 9.67 | 9.90 | 5.91 | 4.91 | 1919 | 1124 | 1142 | 0 |

| 80 | 9.67 | 9.90 | 5.93 | 4.91 | 1919 | 1124 | 1138 | 0 |

Table A2.

Sensitivity analysis results for the Japanese scenarios.

Table A2.

Sensitivity analysis results for the Japanese scenarios.

| Japan | ||||||||

|---|---|---|---|---|---|---|---|---|

| Change of Initial ICP [%] | Energy System Cost [M €] | Total CO2 Emissions [t] | ||||||

| w/Price | w/ICP and CCS | w/ICP and PV/Wind | w/ICP and PV/Wind and CCS | w/Price | w/ICP and CCS | w/ICP and PV/Wind | w/ICP and PV/Wind and CCS | |

| −40 | 8.11 | 8.11 | 7.40 | 7.38 | 6415 | 6415 | 5033 | 4022 |

| −60 | 8.05 | 8.05 | 7.31 | 7.32 | 6982 | 6982 | 5850 | 4779 |

| −80 | 7.10 | 7.10 | 6.59 | 6.59 | 24,690 | 24,690 | 19,319 | 19,203 |

| 40 | 8.77 | 9.00 | 7.84 | 8.12 | 3034 | 2023 | 3034 | 0 |

| 60 | 8.77 | 9.30 | 7.84 | 8.12 | 3034 | 1011 | 3034 | 0 |

| 80 | 8.77 | 9.64 | 7.84 | 8.12 | 3034 | 0 | 3034 | 0 |

Table A3.

Sensitivity analysis results for the British scenarios.

Table A3.

Sensitivity analysis results for the British scenarios.

| United Kingdom | ||||||||

|---|---|---|---|---|---|---|---|---|

| Change of Initial ICP [%] | Energy System Cost [M €] | Total CO2 Emissions [t] | ||||||

| w/Price | w/ICP and CCS | w/ICP and PV/Wind | w/ICP and PV/Wind and CCS | w/Price | w/ICP and CCS | w/ICP and PV/Wind | w/ICP and PV/Wind and CCS | |

| −40 | 3.76 | 3.76 | 3.04 | 3.28 | 20,067 | 20,067 | 5833 | 0 |

| −60 | 2.99 | 2.99 | 2.74 | 3.11 | 26,977 | 26,977 | 8721 | 1952 |

| −80 | 2.99 | 2.99 | 2.64 | 2.69 | 27,057 | 27,057 | 10,540 | 8849 |

| 40 | 5.80 | 6.17 | 3.66 | 3.28 | 6078 | 4321 | 1607 | 0 |

| 60 | 5.83 | 6.78 | 3.67 | 3.28 | 5977 | 2328 | 1578 | 0 |

| 80 | 5.92 | 7.59 | 3.68 | 3.28 | 5696 | 0 | 1552 | 0 |

References

- Rogelj, J.; Huppmann, D.; Krey, V.; Riahi, K.; Clarke, L.; Gidden, M.; Nicholls, Z.; Meinshausen, M. A new scenario logic for the Paris Agreement long-term temperature goal. Nature 2019, 573, 357–363. [Google Scholar] [CrossRef]

- UN. Paris Agreement; UN: New York, NY, USA, 2016. [Google Scholar]

- UNFCCC. Adoption of the Paris Agreement: Proposal by the President; Draft decision -/CP.21; UNFCCC: New York, NY, USA, 2015. [Google Scholar]

- Schleussner, C.-F.; Rogelj, J.; Schaeffer, M.; Lissner, T.; Licker, R.; Fischer, E.M.; Knutti, R.; Levermann, A.; Frieler, K.; Hare, W. Science and policy characteristics of the Paris Agreement temperature goal. Nat. Clim. Chang. 2016, 6, 827–835. [Google Scholar] [CrossRef] [Green Version]

- IPCC. Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty: Annex I: Glossary; IPCC: Genf, Switzerland, 2018. [Google Scholar]

- Myhre, G.; Shindell, D.; Bréon, F.-M.; Collins, W.; Fuglestvedt, J.; Huang, J.; Koch, D.; Lamarque, J.-F.; Lee, D.; Mendoza, B.; et al. The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change: Anthropogenic and Natural Radiative Forcing; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2013. [Google Scholar]

- Ahluwalia, M.B. The Business of Pricing Carbon: How Companies are Pricing Carbon to Mitigate Risks and Prepare for a Low-Carbon Future; Center for Climate and Energy Solutions: Arlington, VA, USA, 2017. [Google Scholar]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon Pricing in Practice: A Review of the Evidence; Climate Policy Lab: Medford, MA, USA, 2017. [Google Scholar]

- The Economist. Companies Are Moving Faster than Many Governments on Carbon Pricing. Available online: https://www.economist.com/business/2018/01/11/companies-are-moving-faster-than-many-governments-on-carbon-pricing?frsc=dg%7Ce (accessed on 12 November 2020).

- Bartlett, N.; Cushing, H.; Law, S. Embedding a Carbon Price into Business Strategy; Carbon Disclosure Project (CDP) North America: New York, NY, USA, 2016. [Google Scholar]

- Bartlett, N.; Coleman, T.; Schmidt, S. Putting a Price on Carbon: The State of Internal Carbon Pricing by Corporates Globally; Carbon Disclosure Project (CDP) North America: New York, NY, USA, 2016. [Google Scholar]

- Fawson, C.; Cottle, C.; Hubbard, H.; Marshall, M. Carbon Pricing in the US Private Sector; EconPapers: Logan, UT, USA, 2019. [Google Scholar]

- Damert, M.; Paul, A.; Baumgartner, R.J. Exploring the determinants and long-term performance outcomes of corporate carbon strategies. J. Clean. Prod. 2017, 160, 123–138. [Google Scholar] [CrossRef]

- Damert, M.; Baumgartner, R.J. Intra-Sectoral Differences in Climate Change Strategies: Evidence from the Global Automotive Industry. Bus. Strategy Environ. 2018, 27, 265–281. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. Rev. 1983, 48, 147. [Google Scholar] [CrossRef] [Green Version]

- Böttcher, C.F.; Müller, M. Drivers, Practices and Outcomes of Low-carbon Operations: Approaches of German Automotive Suppliers to Cutting Carbon Emissions. Bus. Strat. Environ. 2015, 24, 477–498. [Google Scholar] [CrossRef]

- Gillingham, K.; Carattini, S.; Esty, D. Lessons from first campus carbon-pricing scheme. Nature 2017, 551, 27–29. [Google Scholar] [CrossRef]

- Ducret, P.; Leguet, B.; Senard, J.-D.; Fischer, S.; Canfin, P.; Grandjean, A.; Kerr, T.; Alberola, E.; Afriat, M.; Dahan, L.; et al. Internal Carbon Pricing. A Growing Corporate Practice; Institute for Climate Economics: Paris, France, 2016. [Google Scholar]

- Chang, V. Private firm incentives to adopt internal carbon pricing. J. Public Int. Aff. 2017, 1, 56–77. [Google Scholar]

- Dechezleprêtre, A.; Sato, M. The Impacts of Environmental Regulations on Competitiveness. Rev. Environ. Econ. Policy 2017, 11, 183–206. [Google Scholar] [CrossRef] [Green Version]

- Fischedick, M.; Roy, J.; Abdel-Aziz, A.; Acquaye, A.; Allwood, J.M.; Ceron, J.-P.; Geng, Y.; Kheshgi, H.; Lanza, A.; Perczyk, D.; et al. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change: Industry; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014. [Google Scholar]

- Bartlett, N.; Cushing, H.; Law, S. Putting a Price on Carbon: Integrating Climate Risk into Business Planning; Carbon Disclosure Project (CDP) North America: New York, NY, USA, 2017. [Google Scholar]

- Gajjar, C.; Adhia, V. Reducing Risk, Addressing Climate Change Through Internal Carbon Pricing: A Primer for Indian Business; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Metzger, E.; Park, J.; Gallagher, D. Executive Guide to Carbon Pricing Leadership; UN Global Compact: New York, NY, USA, 2015. [Google Scholar]

- Barron, A.R.; Parker, B.J.; Sayre, S.S.; Weber, S.S.; Weisbord, D.J. Carbon pricing approaches for climate decisions in U.S. higher education: Proxy carbon prices for deep decarbonization. Elem Sci. Anth 2020, 8, 42. [Google Scholar] [CrossRef]

- Barron, A.R.; Parker, B.J. Selecting an Internal Carbon Price for Academic Institutions; Smith College: Northampton, MA, USA, 2018. [Google Scholar]

- Kotchen, M. Which Social Cost of Carbon? A Theoretical Perspective; The University of Chicago Press: Chicago, IL, USA, 2016. [Google Scholar]

- Nordhaus, W.D. An optimal transition path for controlling greenhouse gases. Science 1992, 258, 1315–1319. [Google Scholar] [CrossRef]

- Hänsel, M.C.; Drupp, M.A.; Johansson, D.J.A.; Nesje, F.; Azar, C.; Freeman, M.C.; Groom, B.; Sterner, T. Climate economics support for the UN climate targets. Nat. Clim. Chang. 2020, 10, 781–789. [Google Scholar] [CrossRef]

- World Bank. State and Trends of Carbon Pricing 2018: Washington DC, May 2018; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Bento, N.; Gianfrate, G. Determinants of internal carbon pricing. Energy Policy 2020, 143, 111499. [Google Scholar] [CrossRef]

- Limpens, G.; Moret, S.; Jeanmart, H.; Maréchal, F. EnergyScope TD: A novel open-source model for regional energy systems. Appl. Energy 2019, 255, 113729. [Google Scholar] [CrossRef]

- Mojica, J.L.; Petersen, D.; Hansen, B.; Powell, K.M.; Hedengren, J.D. Optimal combined long-term facility design and short-term operational strategy for CHP capacity investments. Energy 2017, 118, 97–115. [Google Scholar] [CrossRef] [Green Version]

- Kotzur, L.; Nolting, L.; Hoffmann, M.; Groß, T.; Smolenko, A.; Priesmann, J.; Büsing, H.; Beer, R.; Kullmann, F.; Singh, B.; et al. A Modeler’s Guide to Handle Complexity in Energy System Optimization. 2020. Available online: http://arxiv.org/pdf/2009.07216v2 (accessed on 4 July 2021).

- Ecofys; The Generation Foundation; CDP. How-to Guide to Corporate Internal Carbon Pricing—Four Dimensions to Best Practice Approaches: Consultation Draft; CDP: London, UK, 2017. [Google Scholar]

- Saad Hussein, N. A method for evaluating building retrofit effects on a decentral energy system by a sector coupling operation and expansion model. Energy Syst. 2018, 9, 605–645. [Google Scholar] [CrossRef]

- Saad Hussein, N.; Thomsen, J. System Development & Market Integration Heat & Power: »DISTRICT«. Available online: https://www.ise.fraunhofer.de/en/business-areas/power-electronics-grids-and-smart-systems/energy-system-analysis/energy-system-models-at-fraunhofer-ise/district.html (accessed on 2 June 2021).

- Thomsen, J. Enhancing operation of decentralized energy systems by a regional economic optimization model DISTRICT. Energy Syst. 2018, 9, 669–707. [Google Scholar] [CrossRef]

- Staffell, I.; Pfenninger, S. Using bias-corrected reanalysis to simulate current and future wind power output. Energy 2016, 114, 1224–1239. [Google Scholar] [CrossRef] [Green Version]

- Pfenninger, S.; Staffell, I. Long-term patterns of European PV output using 30 years of validated hourly reanalysis and satellite data. Energy 2016, 114, 1251–1265. [Google Scholar] [CrossRef] [Green Version]

- Pfenninger, S.; Staffell, I. Renewables-Ninja. Available online: https://www.renewables.ninja/ (accessed on 22 March 2021).

- OpenStreetMap-Mitwirkende. OpenStreetMap. Available online: www.openstreetmap.org/copyright (accessed on 5 July 2021).

- Schöpfer, M. Absorption Chillers: Their Feasibility in District Heating Networks and Comparison to Alternative Technologies; Technical University of Lisbon: Lisbon, Portugal, 2015. [Google Scholar]

- Shirazi, A.; Taylor, R.A.; Morrison, G.L.; White, S.D. A comprehensive, multi-objective optimization of solar-powered absorption chiller systems for air-conditioning applications. Energy Convers. Manag. 2017, 132, 281–306. [Google Scholar] [CrossRef]

- Fasihi, M.; Efimova, O.; Breyer, C. Techno-economic assessment of CO2 direct air capture plants. J. Clean. Prod. 2019, 224, 957–980. [Google Scholar] [CrossRef]

- Huang, Z.; Yu, H.; Chu, X.; Peng, Z. Energetic and exergetic analysis of integrated energy system based on parametric method. Energy Convers. Manag. 2017, 150, 588–598. [Google Scholar] [CrossRef]

- Sterchele, P.; Brandes, J.; Heilig, J.; Wrede, D.; Kost, C.; Schlegl, T.; Bett, A.; Henning, H.-M. Wege zu Einem Klimaneutralen Energiesystem: Die Deutsche Energiewende im Kontext Gesellschaftlicher Verhaltensweisen Anhang zur Studie; FRAUNHOFER-INSTITUT FÜR SOLARE ENERGIESYSTEME ISE: Freiburg im Breisgau, Germany, 2020. [Google Scholar]

- Wang, H.; Zhang, H.; Gu, C.; Li, F. Optimal design and operation of CHPs and energy hub with multi objectives for a local energy system. Energy Procedia 2017, 142, 1615–1621. [Google Scholar] [CrossRef]

- Zhang, Y.; Hua, Q.S.; Sun, L.; Liu, Q. Life Cycle Optimization of Renewable Energy Systems Configuration with Hybrid Battery/Hydrogen Storage: A Comparative Study. J. Energy Storage 2020, 30, 101470. [Google Scholar] [CrossRef]

- Zhang, Y.; Campana, P.E.; Lundblad, A.; Yan, J. Comparative study of hydrogen storage and battery storage in grid connected photovoltaic system: Storage sizing and rule-based operation. Appl. Energy 2017, 201, 397–411. [Google Scholar] [CrossRef]

- Arpagaus, C.; Bless, F.; Uhlmann, M.; Schiffmann, J.; Bertsch, S.S. High temperature heat pumps: Market overview, state of the art, research status, refrigerants, and application potentials. Energy 2018, 152, 985–1010. [Google Scholar] [CrossRef] [Green Version]

- Spitler, J.D.; Southard, L.E.; Liu, X. Ground-source and air-source heat pump system performance at the ASHRAE headquarters building. In Proceedings of the 12th IEA Heat Pump Conference, Rotterdam, The Netherlands, 15–18 May 2017. [Google Scholar]

- Chaudry, M.; Abeysekera, M.; Hosseini, S.H.R.; Jenkins, N.; Wu, J. Uncertainties in decarbonising heat in the UK. Energy Policy 2015, 87, 623–640. [Google Scholar] [CrossRef] [Green Version]

- Razipour, R.; Moghaddas-Tafreshi, S.-M.; Farhadi, P. Optimal management of electric vehicles in an intelligent parking lot in the presence of hydrogen storage system. J. Energy Storage 2019, 22, 144–152. [Google Scholar] [CrossRef]

- Kawakami, Y.; Komiyama, R.; Fujii, Y. (Eds.) Management of Surplus Electricity to Decarbonize Energy Systems in Japan; Conference on Energy, Economy, and Environment: Kyomachi-bori, Nishi-ku, Osaka, Japan, 2019. [Google Scholar]

- Mariaud, A.; Acha, S.; Ekins-Daukes, N.; Shah, N.; Markides, C.N. Integrated optimisation of photovoltaic and battery storage systems for UK commercial buildings. Appl. Energy 2017, 199, 466–478. [Google Scholar] [CrossRef]

- Groscurth, H.-M.; Bode, S. Discussion Paper Nr. 9 “Power-to-Heat” oder “Power-to-Gas”; Arrhenius Institut für Energie und Klimapolitik: Hamburg, Germany, 2013. [Google Scholar]

- Kimura, K. Solar Power Generation Costs in Japan: Current Status and Future Outlook; Renewable Energy Institute: Minato-City, Tokyo, Japan, 2019. [Google Scholar]

- Felseghi, R.-A.; Carcadea, E.; Raboaca, M.S.; Trufin, C.N.; Filote, C. Hydrogen Fuel Cell Technology for the Sustainable Future of Stationary Applications. Energies 2019, 12, 4593. [Google Scholar] [CrossRef] [Green Version]

- Owaku, T.; Akisawa, A.; Yamamoto, H. Optimal Power Generation Mix including Distributed Generation considering Heat Demand of the Residential and Commercial Sectors. In Proceedings of the ECOS 2020—The 33rd International Conference on Efficiency, Cost Optimization, Simulation and Environment Impact of Energy Systems, Osaka, Japan, 29 June–3 July 2020. [Google Scholar]

- BEIS. Evidence Gathering: Thermal Energy Storage (TES) Technologies; BEIS: London, UK, 2016.

- IRENA. Wind Power: Technology Brief. In IEA-ETSAP and IRENA© Technology Brief E07; IRENA: Abu Dhabi, United Arab Emirates, 2016. [Google Scholar]

- Obane, H. Forecasting photovoltaic and wind energy capital costs in Japan: A Bayesian approach. Energy Procedia 2019, 158, 3576–3582. [Google Scholar] [CrossRef]

- Sherry, P. (Ed.) An Analysis of the Potential Outcome of a Further "Pot 1" CfD Auction in GB; London, UK, 2017. [Google Scholar]

- Moore, A.; Price, J.; Zeyringer, M. The role of floating offshore wind in a renewable focused electricity system for Great Britain in 2050. Energy Strategy Rev. 2018, 22, 270–278. [Google Scholar] [CrossRef]

- Committee on Climate Change. Hydrogen in a Low-Carbon Economy; The Climate Change Committee: London, UK, 2018. [Google Scholar]

- Völler, K.; Reinholz, T. Branchenbarometer Biomethan 2019: Dena-ANALYSE; German Energy Agency: Berlin, Germany, 2019. [Google Scholar]

- Lambert, M. Biogas: A Significant Contribution to Decarbonising Gas Markets; The Oxford Institute for Energy Studies: Oxford, UK, 2017. [Google Scholar]

- Bdew. Strompreis für die Industrie. Available online: https://www.bdew.de/service/daten-und-grafiken/strompreis-fuer-die-industrie/ (accessed on 4 July 2021).

- Icha, P.; Kuhs, G. Entwicklung der Spezifischen Kohlendioxid- Emissionen des Deutschen Strommix in den Jahren 1990–2019; Umweltbundesamt: Dessau-Roßlau, Germany, 2020.

- Hauser, E.; Heib, S.; Hildebrand, J.; Rau, I.; Weber, A.; Welling, J. Marktanalyse Ökostrom II: Marktanalyse Ökostrom und HKN, Weiterentwicklung des Herkunftsnachweissystems und der Stromkennzeichnung Abschlussbericht; Umweltbundesamt: Dessau-Roßlau, Germany, 2019.

- Juhrich, K. CO2 Emission Factors for Fossil Fuels; Umweltbundesamt: Dessau-Roßlau, Germany, 2016.

- Dou, Y.; Togawa, T.; Dong, L.; Fujii, M.; Ohnishi, S.; Tanikawa, H.; Fujita, T. Innovative planning and evaluation system for district heating using waste heat considering spatial configuration: A case in Fukushima, Japan. Resour. Conserv. Recycl. 2018, 128, 406–416. [Google Scholar] [CrossRef]

- TEPCO. CO2 Emissions, CO2 Emissions Intensity and Electricity Sales. Available online: https://www.tepco.co.jp/en/corpinfo/illustrated/environment/emissions-co2-e.html (accessed on 16 April 2021).

- BEIS. Prices of Fuels Purchased by Non-Domestic Consumers in the UK; BEIS: London, UK, 2020.

- BEIS. UK Government GHG Conversion Factors for Company Reporting; BEIS: London, UK, 2020.

- MacDonald, S.; Eyre, N. An international review of markets for voluntary green electricity tariffs. Renew. Sustain. Energy Rev. 2018, 91, 180–192. [Google Scholar] [CrossRef]

- Hydrogen London (Ed.) London: A Capital for Hydrogen and Fuel Cell Technologies; Mayor of London: London, UK, 2016. [Google Scholar]

- IEA. World Energy Model: Documentation—2020 Version; IEA: Paris, France, 2021. [Google Scholar]

- UBA. Nationales Emissionshandelssystem: Hintergrundpapier; UBA: Berlin, Germany, 2020. [Google Scholar]

- Arimura, T.H.; Matsumoto, S. Carbon Pricing in Japan; Springer: Singapore, 2021; ISBN 978-981-15-6963-0. [Google Scholar]

- Burhenne, S. Monte Carlo Based Uncertainty and Sensitivity Analysis for Building Performance Simulation; Shaker Verlag: Düren, Germany, 2013. [Google Scholar]

- Hamby, D.M. A review of techniques for parameter sensitivity analysis of environmental models. Environ. Monit. Assess. 1994, 32, 135–154. [Google Scholar] [CrossRef] [PubMed]

- Hamby, D.M. A comparison of sensitivity analysis techniques. Health Phys. 1995, 68, 195–204. [Google Scholar] [CrossRef] [Green Version]