1. Introduction

Energy system decarbonization requires massive and rapid investments in both renewable energy (RE) and flexibility technologies [

1]. Essential emission reduction measures include utilization of biomass, wind and solar energy, electrifying heat generation and transport, and replacing fossil fuels with renewable hydrogen in selected applications [

1]. Flexibility—the ability to react to changes in demand and supply—accommodates effective variable RE integration, and arises from various processes, e.g., energy storage, demand-side management and sector-coupling technologies [

2]. Ideally, needs from the private sector based on market conditions without public supports should drive these investments.

Studies on optimal investments at a national level which consider a variety of potentials, e.g., [

3,

4,

5], found that both RE and complementing flexibility investments are necessary for cost-effective and sustainable decarbonization efforts. Studies at an end-user level are sparse and often focus of selected technologies or applications. For example: [

6] studied optimal sizes battery in households with PV. An optimal planning of a microgrid campus with PV and battery was evaluated in [

7]. In [

8], a self-sufficient energy supply concept based on local bio-waste and flexible combined heat-and-power plants was analysed. Ref. [

9] studied the flexibility potential for reserve energy provision and electricity cost reduction in a pulp-and-paper industry. Similarly, potentials in steel production and chemical plants are studied in [

10,

11], respectively. Ref. [

12] found that the potential to reduce primary energy and CO

2 emissions of a plastic processing industry is best used when consumption, generation, distribution and storage are intelligently linked. This suggests that synergies between these potentials also exist in various end-users, and that end-users should investigate them together.

Policymakers introduce energy and climate policies to steer end-users’ investment strategies towards common welfare [

13,

14]; for example, introducing CO

2 prices for transport and heating fuels encourage electrification and the utilization of renewable fuels [

15]. Commercial end-users should plan their long-term investment strategies carefully to stay competitive under prospective policies, i.e., to invest in new technologies at the right time, while adapting their production and energy supply towards carbon neutrality [

16]. As policies are constantly changing, so do the optimal strategies and the synergetic effects of RE and flexibility. Furthermore, these synergies are likely different for each end-user group, as operating characteristics of end-users influence their investment strategies [

17]. Thus, regular evaluations of investment strategies for each end-user group are crucial, both for policymakers and investors.

In this work, an energy supply concept for a medium-sized aggregate industry, a gravel plant, is proposed and evaluated. The plant is characterized by high demand for electricity and transport fuel, high RE potentials from its large vicinity and operational flexibility from semi-automated production and material storage. Aggregate industries supply construction materials, which are essential elements not only for the urbanization of developing economies but also for the global growth of climate-resilient infrastructure [

18,

19]. This work will answer two questions: (1) How do different investment strategies affect total costs and scope 1 and 2 CO

2 emissions of the plant in 2030? Scope 1 includes emissions directly from sources owned by the company. Scope 2 considers emissions related to purchased electricity [

20]. (2) What are the advantages and disadvantages of the least-cost strategy for medium-sized industries? A techno-economic optimization model for distributed energy systems is used to analyse the plant and to answer the first question; the second question is answered by performing the SWOT analysis on the optimal investment strategy from the modelling results.

The contributions of this work are: The joint consideration of various investment options—namely PV, wind turbines, battery storage, demand-side management, fuel cell electric trucks and hydrogen production from electricity surplus—under a novel business model reveals their interaction. The combination of model-based and qualitative analyses provides deeper insights for operators and decision-makers. Its contribution to the knowledge on investment strategies towards sustainable productions for medium-sized industries enables more inclusive energy system transition and decarbonization.

The paper is structured as follows:

Section 2 introduces the expected regulatory framework in the future.

Section 3 presents the methodology. The case study is described in

Section 4. Results are presented in

Section 5, and are discussed in

Section 6. Lastly,

Section 7 concludes the paper.

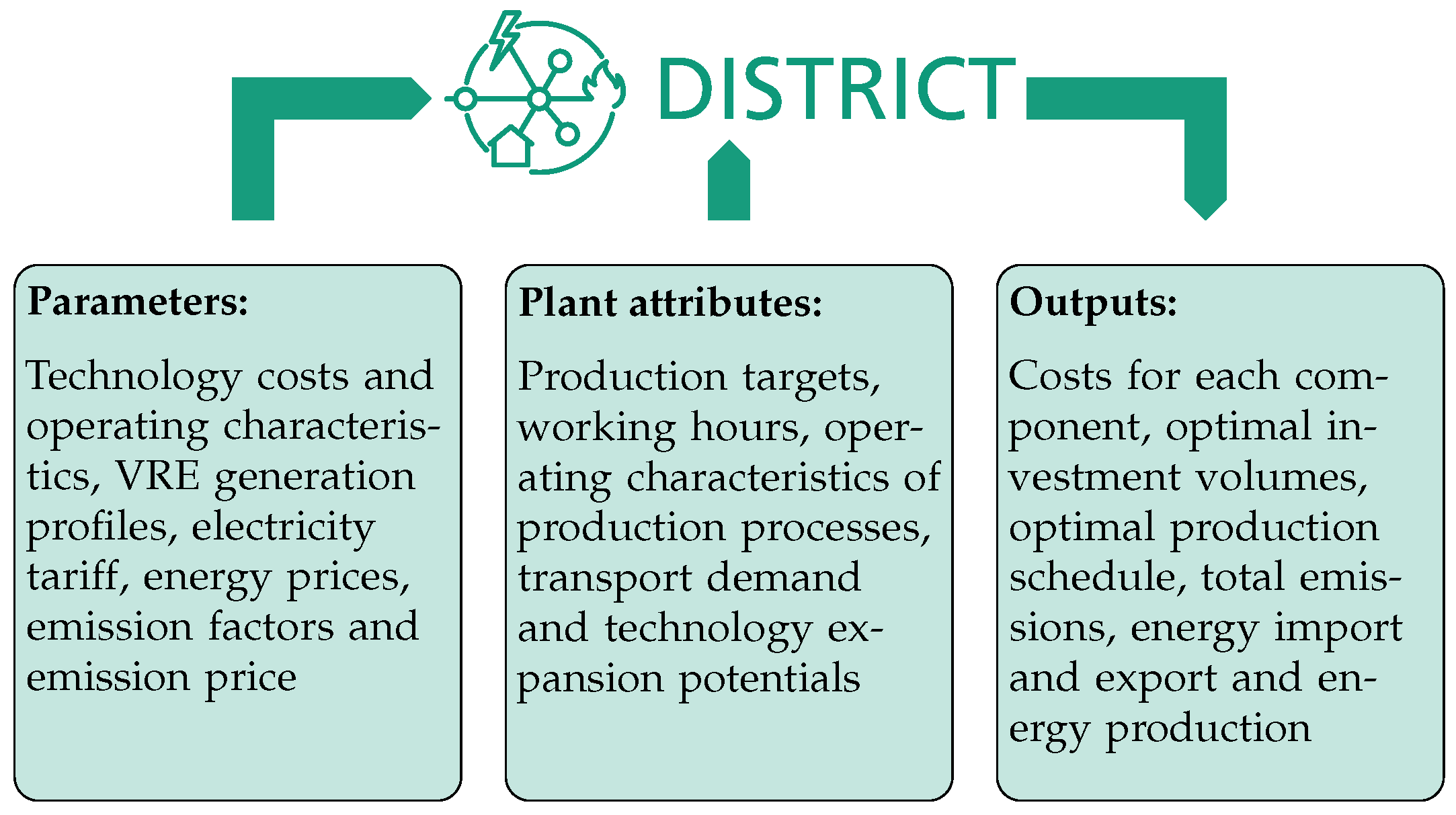

4. Case Study

The case study is a gravel plant, an energy intensive medium-sized industry, in Germany. Its operation and technical measures are described in

Section 4.1. An energy concept is explained in

Section 4.2. In

Section 4.3 and

Section 4.4, scenarios and related parameters are presented.

4.1. Description of the Plant

The plant produces gravel with different sizes, that is delivered to customers via diesel trucks.

Figure 3 shows the internal processes of the plant. The production begins with backhoes extracting raw material from an on-site artificial lake. A conveyor system transports material through out the production line. In the pre-sieving, raw material is cleaned, sorted and stored by sizes. Large gravel is broken down by stone crushers before the final sieving, where it is again cleaned and sorted. Finally, processed gravel are stored before delivery. Water pumps supply high-pressured water jet for cleaning. Auxiliary processes include product transport and energy demand for office buildings.

In status quo: No distributed energy resource is installed. The plant is automatically controlled by a production management system according to planned output while keeping the peak power under a limit. Operation planning does neither consider energy prices nor local generation. It operates 1 to 2 shifts on weekdays, which is unlike the round-the-clock operation of large industries. In the reference year 2019, the plant demands 3.7 GWh p.a. electricity for the production and 2.2 GWh diesel for the transport fleet. On the transport demand, the fleet travels on average 2700 km per day, 248 days a year. Transformers connecting the plant to the medium voltage grid have a cumulative capacity of 1700 kW, and set a limit on the power feed-in and withdrawal. Next to the plant is a 47 ha. gravel lake (German: Baggersee).

Together with the plant operators, three technical measures are identified.

Installation of energy technologies 8.3 MWp floating PV and 2 MWh battery storage are deemed feasible. PV can produce electricity on-site, and battery can increase the self-consumption. Due to low heating demand, a combined heat-and-power plant is excluded.

Investment in a production-energy management system (PEMS) Due to embedded storage and long lead time between order and delivery, the production is flexible, i.e., it can be shifted within the same day or between adjacent days. A modern PEMS is required to utilize this potential, e.g., to react to time-varying prices.

Adoption of a low-emission transport fleet Hydrogen fuel cell electric trucks (FCEV) can replace diesel trucks for product transport. FCEV can deliver high payload over a long distance. Note that refueling stations should be available across the region in the future. Battery electric vehicles are not suitable because of limited travel distance and high tare weight.

This case study belongs to an aggregate industry sector. The sector produces varieties of products including sand, gravel and crushed rock, which are used as raw materials for construction. In Europe, the sector has over 15,000 SMEs, operates in 26,000 sites and employs over 200,000 people [

53]. Overall, the sector demands electricity for mechanical processes and fuels largely for product transport, e.g., 67% primary energy consumption of a construction waste recycling plant are for the production operation, and 32% are for transportation [

54]. This is similar to the energy demand of the case study.

4.2. Energy Concept

The case study has high electricity and transport fuel demand and high PV and flexibility potentials. The plant can reduce its energy import and CO

2 emissions, and benefit from flexibility incentives. It is assumed that hydrogen production and storage capacities, distributed across Europe [

45], can be rented by industrial end-users.

Figure 4 presents the proposed energy concept. The concept focuses on four actors: the end-user, local hydrogen producer, local community and national energy system. Their interactions are:

Distributed energy resources supply internal processes with on-site electricity generation. Flexibility increases self-consumption, and allows responses to time-varying electricity prices. The production-energy management system monitors and controls all processes.

Electricity is imported for on-site utilization or for hydrogen production. The import is subject to procurement costs, grid fees and taxes-and-levies.

On-site electricity generation is fed-in, and simultaneously withdrawn for hydrogen production. Grid fees are applied.

Hydrogen is produced with the electricity from (2) and (3), and stored at the production facility waiting to be tanked or (optional) transported to the end-user via a hydrogen grid. End-users may use the facility up to the rented capacities, and must pay levelized operation and investment costs. Note that idle capacities can still be used by the facility or other end-users.

(optional) End-users and local communities can trade surplus energy with each other.

It is assumed that end-users do not plan for electricity sale, as the goal is to be self-sufficient. Except for reacting to time-varying prices, end-users do not directly interact with grid operators or energy providers.

4.3. Scenarios

A scenario is a framework, i.e., parameters and possible decisions, under which total costs will be minimized. Scenario names are written in typewritter font. Five scenarios are defined based on the proposed concept, and form the principle scenario set. Each scenario is built on the previous.

Business as usualBAU The plant has no energy technologies, and is inflexible. That is, the production follows the historical plan regardless of electricity prices. The transport fleet consists of diesel trucks.

Technology expansionTECH The company can invest in PV and battery.

Flexible productionFLEX A production-energy management system is installed; thus, the production is flexible.

Decarbonized transportTRAN Diesel trucks are replaced by fuel cell electric trucks, which are filled by purchased hydrogen.

Local synegiesSYN Hydrogen can be produced from surplus generation.

Three supplementary scenario sets are investigated to understand the effects of the peak power charge, type of renewable energy and decision year. In GFS, a grid fee structure has a fixed annual access charge accounts for 50%, a time-varying volumetric charge 25% and a peak power charge of 25%. Benefits of wind energy potential instead of solar energy are studied in WEP. In Y25, parameters for 2025 are assumed. Lastly, a sensitivity analysis is performed on the cost-optimal scenario to understand the effects of parameter uncertainties.

4.4. Parameters

Sources and assumptions for parameters used for the calculations are presented as follows and also in tables in

Appendix B.

4.4.1. Electricity Prices and Emission Factors

In 2019, an average procurement rate based on EPEX prices [

55] and historical consumption amounts to 4.30 ct€/kWh. Grid fees interpolated from data in [

56] are 5.65 ct€/kWh. Taxes-and-levies comprise of EEG-Levy 6.41 ct€/kWh and other taxes 2.55 ct€/kWh [

57]. Thus, the effective price for the case study totals to 18.90 ct€/kWh.

The price projection for future years assumes that total price and other taxes remain the same. After 2022, EEG-Levy is assumed to linearly reduce to zero in 20 years. In the past five years, grid fees increase by 0.072 ct€/kWh p.a. This is assumed to continue. The procurement price is the adjusting component so that the total prices equal to 18.90 ct€/kWh.

Table A1 shows the projected electricity prices. [

58] projected electricity prices with the same trend. On the grid fee structure, a fixed access charge contributes to 75% of grid fees, and the rest is a volumetric charge. The latter and electricity procurement are time-varying following the EPEX price profile.

A German emission factor profile for 2019 is processed from generation profiles [

59] and emission factors [

60] specific to power plant types. An average factor is 401 g/kWh [

60]. German emission factor is assumed to reduce by 12.0 g/kWh p.a. This rate is derived from data in [

42]. The projected average factor in 2030 is 269 g/kWh; the corresponding profile is processed by offsetting the profile for 2019.

Figure 5 plots the volumetric price and emission profiles in 2030. Winter prices are higher than summer due to the higher demand. PV generation lowers both price and emission factor at midday; this is especially notable in summer.

4.4.2. Energy Technologies

Investment costs for PV park and wind turbines (WT) in 2030 are 718, 550 and 1366 €/kWp [

61]. Costs for floating PV is approximately 18% higher than PV park due to the floating platform [

62]. Correspondingly, floating PV price is assumed to be 660 €/kWp. On-site PV and WT generation profiles are extracted from [

63] based on methods in [

64,

65]. The full load hours of PV generation are 1250 h p.a., and 1800 h for WT. Battery prices strongly vary by system sizes. A 150 kWh lithium-battery system costs around 1000 €/kWh [

66] in 2019. For the projection, the cost reduction from [

67] is applied, which results in the price 550 €/kWh in 2030.

Table A2 provides more detail.

4.4.3. Fuel Import and Emission Price

In 2030, diesel price without emission costs is assumed to be 10.89 ct/kWh [

68,

69]. Diesel specific emission factor is 266 g/kWh [

70]. Price of renewable hydrogen produced in Germany is 20 ct/kWh [

71].

Table A3 shows hydrogen price components. Its emission factor is neglected.

Future emission prices are uncertain. [

15] estimate German emission price in 2030 in the range of 80–96 €/ton; whereas, [

42] expects a price of 140 €/ton. In this work, emissions are priced at 100 €/ton.

4.4.4. Hydrogen Production

According to [

71], renewable hydrogen production in 2030 has an average efficiency of 71%, and a price of 20 ct€/kWh. Related costs are electricity costs, investment and operation costs of equipment, and transport and distribution costs. To produce hydrogen from own electricity, end-users pay the related costs minus the electricity costs to the local hydrogen producer. These costs amount to 7.5 ct€/kWh, and represent levelized costs of production, storage and distribution services. Grid fees of 1.0 ct€/kWh also apply for electricity fed-in for the hydrogen production.

In this work, the rented capacities are predetermined based on historical transport demand. The sizing criteria is the 90

th percentile of daily travel is 4074 km, which corresponds to 8.5 MWh-H

2 demand based on the efficiency of fuel cell electric trucks in [

58]. At minimum, a 355 kW-H

2 electrolyser running non-stop is needed to supply this demand. It is assumed that the plant rents 3 × 355 kW production and 2 × 8.5 MWh storage capacities.

For the transport fleet,

Table A4 provides parameters on different trucks according to [

58].

5. Results

5.1. Overview on Costs, Emissions and Energy Technology

Costs by component for each principle scenario are shown in

Figure 6.

Table 1 presents PV capacities, generation utilization, energy imports and total emissions.

In summary, BAU has the highest costs and emissions. All measures reduce energy imports and emissions. PV and flexible production reduce costs. The switch to hydrogen fuel cell trucks (FCEV) increase costs unless hydrogen can be produced from own electricity. SYN has the lowest costs and emissions, 14.0% and 69.6% lower than BAU, respectively. Battery is not invested. In the following, results by scenario are described.

In BAU, the plant imports all of its energy demand, 3.64 GWh electricity and 1.58 GWh diesel p.a. This is associated with procurement costs of 687 k€ and emissions of 1.01 ktons for electricity; and 173 k€ and 0.42 ktons for diesel. Emission costs are 143 k€.

In

TECH, 2.58 MW

p PV is installed, which can generate 3.23 GWh electricity p.a. However, only 51.0% of the generation are consumed by the plant; 47.5% are exported, and 1.5% are curtailed due to the transformer limit. On-site generation significantly reduces electricity import and emissions. In comparison to

BAU in

Figure 6, reduced electricity and emission costs outweigh the additional energy technology costs.

In FLEX, flexible production has two benefits: First, PV potentials are better utilized, i.e., higher optimal capacity and higher self-consumption rate. Second, electricity costs are lower as consumption during periods with high prices is avoided.

In TRAN, the switch to FCEV increases the transport fleet costs and fuel procurement costs, but results in lower emissions. However, the reduced emission costs do not compensate for the increase; thus, total costs are higher in comparison to FLEX. Due to higher vehicle-to-wheel efficiency of FCEV, fuel import also decreases.

In SYN, the option to produce own hydrogen increases PV value. This results in the highest PV installation (3.63 MWp) and self-consumption rate (80.3%), higher than the maximum on-site utilization (71.4%) (As the plant operates five days a week, of PV generation can theoretically be used.) The hydrogen import and fuel costs significantly reduce. The latter outweighs the higher energy technology costs and additional hydrogen production costs.

5.2. Utilization of Production Flexibility

From FLEX onward, production is intelligently scheduled; thus, electricity demand is flexible. As the electrical operation in TRAN is identical to FLEX, it is excluded from the analysis.

Figure 7 plots average electricity demand, PV generation and electricity prices. In

BAU, demand is high in the morning, and is lower in the afternoon. This is the historical inflexible production, in which the plant simply operates until storage is full or production quota is met. In

FLEX, the intelligently-planned demand is shifted to midday to increase the self-consumption and to procure electricity during periods with low prices. Furthermore, the demand during early morning and evening, i.e., when prices are high, is reduced. The demand in

SYN and

FLEX are similar, which suggests hydrogen production and flexible production are disjointed. Note that demand cannot be shifted to night time or weekends, which leads to the weekend surplus.

Figure 8 plots average electricity import, PV generation and electricity prices. In

BAU without on-site generation, electricity import represents demand and transformer losses. Comparing

SYN to

TECH, two benefits of production flexibility can be observed. First, on-site electricity import is lower due to higher PV utilization. Second, import during periods with high prices is notably reduced. This also results in lower average import peak power. Electricity import for hydrogen production is not subject to the working hours, and can freely react to electricity prices. Thus, it is high during night time and weekends.

Figure 9 plots daily demand shift and change together with the planned demand. The planned demand is not uniform throughout the year. There is hardly any demand during January and February, and lower demand during summer break. Furthermore, the demand during weekends is near zero. As the planned demand limits the maximum shiftable demand, the realized demand shift and change also inherit the aforementioned pattern. In other words, production flexibility potentials depend on season and day. The total demand shift volume is 330 MWh p.a. or 9.4% of the planned demand, and demand change amounts to 193 MWh p.a. or 5.5%.

5.3. Hydrogen Production

For companies committed to FCEV, the option to produce hydrogen from surplus generation is highly profitable, e.g., total costs reduce by 8.7% between TRAN and SYN. In fact, this benefits even provide financial incentives to invest in FCEV, as evidenced by the 1.6% cost reduction between FLEX and SYN.

Hydrogen produced from own electricity generation and electricity import supplies 75.5% and 8.4% of hydrogen demand (1.39 GWh p.a.), respectively. The rest, 16.1%, is imported. Despite the additional electricity demand, electricity import slightly decreases. This is because the additional PV generation is used not only for the hydrogen production but also for on-site consumption.

Figure 10 plots daily hydrogen demand, supply and average electricity prices. Hydrogen demand, an indicator for transport demand, is low during winter, as construction activities and with it the product demand are low. On the supply side: the hydrogen production from electricity import is sporadic, and occurs during days with low electricity prices. Hydrogen import is needed during late autumn and early winter, because PV generation is limited, and own production from electricity import is more expensive. Owing to the hydrogen storage, hydrogen can be produced from surplus PV generation during weekends, generation which would otherwise be exported or curtailed. The plant utilizes electrolysers for 1096 full load hours or a 12.5%. On average, hydrogen storage is filled to 5.52 MWh or 32.4%. Note that actual utilization is higher, as idle capacities can be used by others.

5.4. Supplementary Scenarios

Grid Fee Structure with Peak Power Charge (GFS)

The peak power charge incentivizes the flexibility utilization for peak power reduction. Consequently, peak power in FLEX is 1154 kW lower than 1633 kW in the principle results. This also reduces the peak power costs by 17.1 k€ p.a. and total costs by 12.5 k€ p.a. Reduced grid fees imply lower grid operators’ revenues, which may prevent full recovery of grid investment. The optimal PV capacity slightly increases so too does the self-consumption, because on-site generation can reduce peak residual load. The strategic reduction of peak feed-in leads to a higher curtailment rate and a lower self-consumption rate in SYN. Overall, investment and costs in GFS are similar to the principle results. The differences mainly lie on the operation, which can be adapted by a modern production-energy management system.

Location with Only Wind Energy Potentials (WEP)

Only in SYN, a 2.3 MW wind turbine (WT) is installed. Battery is not installed. Without on-site generation, TECH and BAU are identical, and production flexibility in FLEX is used only in response to time-varying electricity prices and emission factors. The latter leads to the cost reduction of 23 k€ p.a. (1.6%), and 68 tons p.a. (4.8%) emission reduction. Without the benefits of on-site generation, TRAN has the highest costs due to the increase from the FCEV switch. In SYN, WT generation mitigates the cost increase, as it reduces energy imports and emissions; however, SYN is not the least cost scenario, but rather FLEX.

Figure 11 plots normalized PV-, WT generation and demand, i.e., profiles are scaled to a 1 MWh annual energy so that they are comparable. WT generation is high in winter, spring and often at night, see

Figure 11a; whereas, PV generation is more seasonally and diurnally aligns with the demand, see

Figure 11b. Analysing these profiles shows that the utilization rate of WT generation is about 31.5%, and 47.2% for PV. This suggests that wind energy may not be an appropriate energy source for medium-sized end-users.

Early Endeavour in Year 2025 (Y25)

The total costs in BAU, TECH and FLEX are slightly lower than the principle results despite of the higher diesel consumption and total emissions. This is due to lower CO2 emission and diesel prices. As hydrogen technologies are relatively immature, i.e., high vehicle costs and fuel consumption of FCEV and high hydrogen import and production costs, the switch to FCEV is very costly. The cost increase in TRAN and SYN compared to FLEX are 17.8% and 6.3%, compared to 7.8% and -1.6% in 2030. While the option to produce own hydrogen mitigates the cost increase to 6.3%, companies are unlikely to accept this. Thus, FCEV switch in 2025 is unlikely without public support schemes.

5.5. Sensitivity Analysis

Sensitivity of the least cost scenario

SYN to parameter changes is analysed. Five parameters—CO

2 emission price (

CEP), electricity price level (

EPL), hydrogen price including costs of production and storage (

HYP), PV price and operation costs (

PVP) and PV yield (

PVY)—are varied in the range of ±20%. The analysis focuses on four variables: total costs, PV installed capacity, emissions and energy import.

Figure 12 presents the sensitivity analysis results.

Throughout this section, effects are considered insignificant when changes are within ±1%, slight ±4%, moderate ±8% and strong for changes greater than ±8%. Changes in CEP have insignificant effects on all four variables. This is because the plant is insusceptible to CEP due to its low emissions. As the electricity procurement makes up 31.4% of the total costs, they are moderately affected by changes in EPL; However, technical variables are only slightly affected. If EPL is higher, the plant reduces its electricity import by increasing its PV installed capacity, which also reduces the CO2 emissions. The changes in HYP slightly increase the total costs; however, they insignificantly affect the technical variables. That is, the self-sufficiency from own hydrogen production protects the plant from fuel price fluctuation.

Regarding PVP and PVY, both parameters slightly affect the total costs and CO2 emissions; however, they strongly influence the optimal PV capacity. A higher PV price reduces the capacity, and increase the energy import. A higher PV yield leads to lower installed capacity and energy import. Note that variable changes are not necessarily symmetrical. For example, the decrease in PVP has greater effects on the optimal capacity and energy import than the increase.

Some parameter changes can cancel the 1.6% cost reduction between SYN and FLEX, and result in FLEX being the least cost scenario. For example, 20% increase in HYP increases the total costs of SYN by 2.1% but does not affect the costs of FLEX.

6. Discussion

Potential implications of the proposed energy concept to end-users and the energy transition are discussed in

Section 6.1 and

Section 6.2, respectively.

6.1. Advantages and Disadvantages to End-Users

The model-based analysis suggests that end-users should invest in PV, production flexibility and fuel cell electric trucks (FCEV) if hydrogen can be produced from own electricity generation. This strategy, i.e., the proposed energy concept, results in a least-cost least-emission energy system. The following presents the SWOT analysis of the concept.

Strengths

By supplying electricity demand from on-site renewable generation instead of import, end-users utilize its low-cost generation, and avoid paying grid fees, taxes-and-levies and other administrative charges. Lower energy import also means less susceptibility to energy or emission price fluctuation. Benefits of a production-energy management system, apart from increasing self-consumption and shifting demand to periods with low prices, also include reducing price risks, increasing efficiency and preemptively detecting potential problems. Lastly, the adoption of low-emission technologies can improve the company’s image as technologically advanced and sustainable, which can improve its reputation to the local community, customers and investors.

Opportunities

As public concerns over climate change grow, sustainability will be important for long term competitiveness. The company, already in the low-emission stage, can appeal its products to environmentally-conscious customers, or further offset its remaining emissions to be emission-neutral. Sales of unused generation can bring in additional revenues. The already-invested PV generation and PEMS also reduce the barriers for the utilization of power-to-heat technologies and participation in demand response programs.

Weaknesses

Initially, training for employees to operate new technologies involves additional costs and time. Installing PV in publicly-accessible area may involve permit acquisition and potential vandalism. Frequent operation changes can lead to higher maintenance costs due to extra wear-and-tear. To use own hydrogen, trucks may only be allowed to tank at designated stations, which could limit the day-to-day operation. As energy technologies, FCEV and production processes have high capital costs, simultaneous investments can lead to low financial liquidity of the firm.

Threats

The operation of FCEV may be difficult if filling stations and/or production facilities are not widely-available, e.g., due to slow transition towards the hydrogen economy. Furthermore, the regulations related to hydrogen production and storage business models are unclear; the feasibility of own hydrogen production can be reduced if taxes-and-levies are applied. Lastly, as the system relies largely on PV generation, it is susceptible to risks from fluctuating yield.

Although the model-based analysis indicates the profitability of the proposed energy concept, the SWOT analysis reveals new weaknesses and threats. The company should be aware of these disadvantages and try to mitigate them. For example, to avoid the threat from fluctuating PV yield, the company can deliberately oversize their PV systems or set up energy procurement contracts with favorable terms for uncertain consumption.

6.2. Implication to Energy Transition

The path towards climate-neutral energy systems has four phases: the development of renewable energy generation technologies, the integration of variable renewable energy (VRE), e.g., via direct electricity use or energy storage, the utilization of synthetic fuels and the final displacement of fossil fuels [

25]. The three measures considered in this work, see

Section 4.1, correspond to the first three phases.

The decarbonization of energy systems requires massive volumes of VRE investment, which must predominantly come from the private sector [

72]. VRE investment has been growing in past decades given public supports and falling costs. As VRE values on saturated markets and subsidies are decreasing [

22,

27], the future investment is arguably to focus on self-consumption. Our results show that end-user flexibility leads not only to the higher self-consumption rate but also installed capacities. This suggests that financial or regulatory supports for flexibility investment and utilization can indirectly foster private investments in VRE.

In this work, flexible production is deployed to increase PV utilization, react to time-varying prices and reduce peak power. While flexibility potential can also provide reserve energy or interruptible load services [

73], technical requirements can restrict the participation of small- and medium-sized end-users. For example in Germany, the minimum bid size of manual frequency restoration reserve, i.e., tertiary reserve, is one MW with a four-hours stand-by period [

74]. Although pooling is allowed, it may not be an effective mean. Alternatively, regional markets can open up marketing opportunities for these potentials. In the project WindNODE, a market concept aimed to coordinate flexibility potentials to mitigate grid congestion is proposed and tested. In this concept, a minimum bid is 100 kW in size and 15 minutes in duration [

75]. Potential revenues and benefits to energy systems from future markets should be investigated further.

Despite its higher efficiency and lower emissions, the switch to fuel cell electric trucks (FCEV) increases the costs due to high vehicle and fuel prices; this is observed in both 2025 and also 2030 albeit to a lesser extent. The use of synthetic fuels in transport would likely need a higher emission price, subsidies for vehicle investments or fuel procurement. Furthermore, the feasibility of FCEV in the long term can be improved by extensive supports in fuel cell research, which would reduce price and increase efficiency.

The switch to FCEV could be economical when hydrogen can be produced from own electricity generation. This is mainly because the company has significant electricity surplus which would otherwise be curtailed or exported at marginal prices. Despite having to pay for grid fees and production and storage costs, own hydrogen production is cheaper than hydrogen import to the point that this combination is more economic than the use of diesel trucks. Arguably, end-users not blessed with on-site VRE potentials could benefit from these benefits as well by directly purchasing surplus electricity from external sources, e.g., local communities as shown in

Figure 4 or own off-site VRE investments. Both cases are similar from the perspective of the national climate goal, namely, VRE and FCEV are invested by private sectors and renewable hydrogen is produced inland. This shows that novel business models can promote investments in sustainable technologies by linking generation and demand from different sectors and various agents in the systems.

In this work, a time-resolved optimization model is used to plan the investments and operation of a company. Noteworthy cautions of this application are: Various data—e.g., operation profiles of the company or techno-economics parameters of an energy system or technologies—are required in detail; however, information may not be easily accessible or available in all cases. As the investigation scope involves flexibility and its response to time-varying electricity prices, these efforts are deemed necessary. The optimization assumes a perfect foresight on parameters. This certainly does not reflect the reality where politics and markets constantly change. The sensitivity analysis partially addresses the robustness of results to parameter changes. In the future, more extensive models, such as stochastic programs, can also account the decisive uncertainties.

7. Conclusions

An energy concept for an industrial end-user with renewable energy and flexibility potentials—PV plant, battery storage, flexible production, FCEV and hydrogen production—is analysed. Different investment strategies are investigated. PV is a highly profitable investment as it reduces electricity import and emission costs. Flexible production reduces costs by shifting the production to periods with low electricity prices and increasing the utilization of PV generation. The switch from diesel to hydrogen for product transport is not economical due to higher fuel and vehicle costs, unless hydrogen can be produced from own surplus electricity generation. The synergistic benefits of both potentials lead to the least-cost least-emission system.

End-users are advised to consider both potentials in the planning process to ensure that a strategy is optimal in the long term. The cost optimal investment strategy entails new risks and opportunities from the changing energy politics and the adoption of new technologies. For example, heavy reliance on PV generation implies susceptibility to uncertain PV yield. Carbon-neutral industrial end-users can appeal its products to environmentally-conscious customers.

The pathway towards sustainable energy systems requires not only supports for the R&D or the adoption of new technologies but also new incentives—e.g, time-varying electricity prices for flexibility or CO2 prices for decarbonization—and enabling business models. Case in point, the switch to FCEV is promoted by the higher fossil fuel prices and by own hydrogen production via a regional hydrogen facility. Early regulatory adjustments, e.g., tax exemptions for own hydrogen production, can accelerate the adoption in easily-achievable cases. Next generation energy policies should couple supports for flexibility and renewable energy expansion to transition towards integrated energy systems with coordination of multiple applications, sectors and infrastructures.

On the limitations of this work: as policies are constantly changing, the absolute results are subject to uncertainties of the future development. Each end-user group has unique potentials and requirements. It stands to reason that synergies between both potentials exist in all users; nevertheless, studies similar to this for other end-users are advised to gauge the effects and to gain insights into optimal investment behaviours. Energy efficiency measures should also be considered.