Abstract

The study of the rates of innovative development of various sectors of the modern economy makes it possible to determine the existence of a scientific and practical problem, eliciting the need for urgent identification of the reasons for non-innovative development of Oil and Gas Companies and development of the directions for innovation development. Based on a number of methods, including methods of graphical analysis, time series forecasting, construction of linear trends, correlation analysis and scenario forecasting, the authors stated the fact of the serious depth of the problem of innovative insufficiency in the oil sector in comparison with other sectors and they built six scenarios for the development of these companies. The applied methods made it possible to not only come to the conclusion that with the current level of investment in R&D in the oil and gas sector, Oil Companies may find themselves in difficult conditions, especially if breakthrough technologies show themselves in the non-hydrocarbon energy of the future, but also made it possible to determine the most important directions for the development of Oil Companies, including the formation and development of the oil and gas industry 4.0, marketing strategic management of the activities of these companies.

1. Introduction

The modern energy sector is experiencing a number of serious problems. On the one hand, there is a number of common problems, experienced by most companies, related, for example, to internal management peculiarities [1,2,3,4]; networking strategy [5]; concentration and diversification issues [6] and so forth. On the other hand, the energy sector and specifically Oil Companies are affected by specific external factors, such as changes in OPEC (The Organization of the Petroleum Exporting Countries) policy, the “shale revolution,” green course [7,8]. The pandemic and lockdowns in their course had a profound financial impact, influenced the decrease in demand for the products of the Energy Industry and thus reduced the investment potential necessary for the development of companies of this industry [9].

The consequences of the pandemic and lockdowns are not only not yet overcome but have also not yet been determined, since the pandemic is not over yet, the crisis phenomena are growing, their duration and timeline are unknown. But these are common problems, they apply to practically all sectors and spheres of the Modern Economy. However, companies in the Energy Sector are influenced not only by common but also specific problems due to the fact that production in this Industry, as a rule, has a continuous nature; the suspension of a number of technological processes can lead to the complete interruption of production. In addition, a significant part of the sub-sectors of the Energy sector does not have the technical and technological capabilities of warehousing and storage of products in principle. Sometimes this is technically impossible (as in the Electric Power Industry) and in the oil and gas industry, for example, these possibilities (storage and warehousing) are extremely limited. Speaking about the problems that relate to the energy sector and, in particular, oil and gas companies, it is worth recalling the collapse in oil prices, as well as the procedural and positional difficulties in making OPEC decisions in the spring of 2020 [10,11].

At the same time, there is still a number of fundamental problems related to the energy sector. Thus, it is the Energy Companies that are primarily charged with the burden of environmental responsibility before society. But this accusation is not entirely fair, because they are only providing energy resources for other industries of the economy. If the Economy had a demand for environmentally friendly energy resources, the Energy Companies would change the structure of their supply and begin to provide energy resources that meet such demand. But for the sake of fairness, it must be said that most energy companies do not show the necessary activity to produce environmentally friendly energy resources, they are the least innovatively active and negligibly little is invested in R&D, compared to companies in other industries. And all this despite the fact that it is they who have significant investment opportunities for the implementation of innovative processes. Of course, this applies, first of all, to Oil Companies (hereinafter, under Oil Companies we mean companies engaged in the production, transportation and processing of oil and gas (Upstream, Midstream, Downstream) as a Business model, mainly it is large companies that are often called supermajors, including state-owned). It should be noted here that the existence of the problem of insufficient investment in R&D by Oil Companies, on the one hand, cannot remain unnoticed for those researchers who analyze data on the structure and growth rates of all sectors of the modern world economy, as well as for those who have researched the regional profile by conducting a comparative analysis between the scale of companies’ activities, their Profitability, Innovation and Investment in R&D. But this problem, fraught with a threat to the Oil Business, is clearly ignored by the Oil Companies management. They prefer not only not to increase the rate of innovation and investment in R&D but even reduce their volumes both in relative and absolute indicators. The reasons for this—as a rule consider the fact that these companies are too profitable and have stable positions—have significant market power, in order to think about the importance of increasing the pace of their innovative and technological development. Innovative development, corresponding to the pace of technological development typical for other sectors of the economy, does not represent to Oil Companies the relevance and importance that it represents for heads of companies from other sectors of the Economy. In general, one gets the impression that this problem of development by Oil Companies (it should be emphasized that it is precisely the Oil Companies and not the oil and gas or energy sectors as such, operating according to these familiar extensive schemes corresponding to the industrial era) are not considered as posing a threat; it is veiled. This situation apparently suits the management of the Oil Companies. But this is a very serious problem, the manifestation of which, taking into account the development of energy technologies, can create conditions for the impossibility of the functioning of modern Oil Companies even in the foreseeable future, regardless of the time of depletion of hydrocarbon energy sources.

If the management of Oil Companies were to compare their capabilities and threats to their business based not on an intra-industry analysis but taking into account the pace of innovation in other areas of the economy, where success is achieved through systematic, effective innovation, then this threat would be understood by management and they would begin to revise strategies for their development. Therefore, we can say that the reason for the inattention and low rates of innovative development of Oil Companies is that the threat of the emergence and impact on them of the fifth force of competition M. Porter [12,13,14] is not taken seriously by them. The importance of changes in the development strategy in accordance with the changes taking place in the modern economy is not adequately considered by them, they have not drawn conclusions that the general drop in demand from production consumers realizing strategies to increasing energy efficiency also contribute to the reduction in oil prices. As a consequence, the competitiveness of hydrocarbon-oriented Oil Companies is under threat.

It must be said that it is not only these factors and factors of global oil prices that determine the problems of increasing the vulnerability of the oil industry. Compared to high-tech industries (ICT, Pharmaceuticals and Automobiles), Oil companies are characterized by low operational flexibility and insufficient marketing activity. But, given the persisting internal resource potential, high barriers to entry into the industry and the strong dependence of the world economy on oil and gas, their position cannot yet be called critical. However, the changes in the global market require Oil Companies to rethink their corporate strategies. For example, due to a man-made accident in the Gulf of Mexico, the US government took a tough stance against Oil Companies [15,16]. It banned upstream in this region for an extended period and blamed the oil company (BP) for this technological accident. Despite the fact that as a result of the elimination of the consequences of this catastrophe, a number of innovations have arisen; nevertheless, the presence of a more developed scientific and technical base in the field of ecology, as well as more attention to R&D in the field of environmental safety could, if not prevent the catastrophe, then reduce the scale of consequences for the environment and, accordingly, for the economic position of the oil company—the perpetrator of the technogenic accident in the Gulf of Mexico.

Thus, the problem of the non-innovative development of modern Oil Companies can also be viewed as a problem of the short-sightedness of their development strategies.

Strategies of modern companies must be innovation-oriented. This is where one should look for reasons and not condone Oil Companies in their choice to follow a formal approach to innovative development.

These premises define the aim of this manuscript. It consists of the determination of the causes and identifies the expected consequences of low innovation activity of Oil Companies, their relatively low investment in R&D and design of possible scenarios for the development of Oil Companies and innovative development of Energy generally. The main research tasks of this article are, first, the task to identify the reasons for the low innovative activity of Oil Companies and, based on a comparative analysis, to determine the depth of the problem; secondly, the task to form a scientific and methodological basis for solving the problem under study, to choose a set of methods necessary to solve the problem; third, the task to review the current situation and the determination of the nature of innovative development of Oil Companies; fourth, the task of making estimates (forecast) of the development prospects of Oil Companies; fifth, the task of working out scenarios for the development of Oil Companies; sixth, the task of proposing the most important directions for the development of Oil Companies.

The hypothesis of this study is that if Oil Companies maintain their existing low investment in R&D and low innovation activity, in a few years they will find themselves in a difficult situation, which will mark a collapse for those of them that will not revise their development strategies, having seriously increased attention to the issues of innovative and technological development, taking into account the fact that the return on investment in R&D takes a rather long period. The expanded basic hypothesis has a general character and implies the formulation in the study of a number of intermediate hypotheses that correlate with the research tasks indicated above and the general hypothesis itself is supported by the results of the research given this article. This study is based on a comparative cross-sectoral analysis, with the construction of development trends and possible scenarios for the development of Oil Companies. As conclusions, a change the strategic guidelines of these companies was proposed, to transform them into more innovatively active ones; the authors highlight the areas of innovative development and emphasize the importance of diversifying their activities to create energy products that meet the requirements of environmental friendliness and innovation, also involving the widespread introduction of digital technologies and development innovative marketing culture.

Section 1—“Introduction”—of the manuscript provides its actuality, purposes, tasks and the significance of studying the current state of the research field. Section 2—“Materials and Methods”—of the manuscript provides the sources of used data, the basic approaches used in the article and the methods that make up the methodological basis for studying the problems studied in the article. Section 3—“Results”—contains the substantive part of the results of the research, the problem and the results of its solution, providing ways of solving the problems of development of Oil Companies, are described. In addition to analyzing the current state, it provides forecasts and scenarios for the development of Oil Companies and the oil and gas industry as a whole. In Section 4—“Discussion”—the authors discuss the results, the correctness of the working hypotheses and highlight future research directions. Section 5—“Conclusions”—presents the conclusions of the article.

This structure of article is determined by the need to achieve confirmation of the basic hypothesis of the study and its accompanying hypotheses (including those related to determining the degree of probability of the implementation of positive scenarios for the development of Oil Companies and their qualitative transformation) and it also allows the removal of the gaps in the work of other authors. In particular, these research gaps are associated, first of all, with theoretical gaps that dominate in a number of publications on this topic and reflect an absence of interdisciplinary approaches to studying the problem of the development of this industry. Thus, research on the development issues of Oil and Gas Companies is carried out within the framework of separate research areas—either current technological problems of the industry or issues of financial and economic development or within the framework of management science or in other rather narrow areas. As a result, the general situation and development opportunities of companies of this industry are ignored. In turn, the proposed approach in this article, which is the result of the conceptual integration of the research results of various authors, starting with the ideas presented in the works of the classics of economic science and taking into account the contribution of specialized research in this industry (see below, Section 2, Section 3.1 and Section 3.2), conceptualizes the formation of a special intersectoral approach that allows study of the current and future problems of the development of the industry. It forms the basis for the development of a new institutional approach, which allows the formation of a system of ideas about the importance of developing a non-autonomous approach to the analysis of the industry, based on an understanding of the consistency of relationships that create opportunities and threats to development for individual companies in a globalizing world, increasing the impact of intersectoral competition on the development of industry enterprises in the context of growing uncertainty and acceleration of the pace of scientific and technological progress and uneven distribution of its results. With regard to the object of research, a significant theoretical gap also reflects the need to develop special marketing approaches that form strategies for the long-term development of companies at the corporate level and the development of Industry 4.0. in the field of Oil and Gas companies.

In addition, there are serious empirical problems in the research of Oil and Gas companies, which are caused by the dominance of studying and comparing only intra-industry development trends, which is closely interconnected and influenced by the development of the methodology for studying the activities of Oil and Gas companies and allows us to identify a number of serious methodological gaps in the study of the activities of companies in the industry (see below, Section 3.1 and Section 3.2). They are predetermined by the existing methodological disadvantage of the domination of intra-industry analysis, which does not allow realistic evaluation of the likelihood of the realization of a negative development scenario for existing oil and gas companies, narrowing the horizon of their research, which does not allow assessment of the depth and scale of the problem of innovation insufficiency of the development of the industry and strengthens a non-systemic representation of the existence of Oil Companies and problems in the development of this industry, taking a nihilistic short-sighted traditionalist position. The gap in the dominance of the prevalent methodology, is based, as a rule, on the study of Oil Companies as objects isolated from the economic system, detached from the processes occurring in it, ineffectively abstracted from the development of the entire system, seems impermissible today, either from the point of view of the development of science, methodology and practices and is destructive in the modern world.

This methodological problem is solved in the article by decomposing the groups of companies under study and applying a comparative intersectoral analysis of the innovative activities of modern companies in the modern competitive world, based on the use of various forecasting methods and selection from among those that objectively reflect the depth of the problem, which is also applicable when analyzing other industries and areas of activity. These are general, conceptual gaps in the research. The Results Section (below) describes the private research gaps in Oil Companies and the oil and gas industry.

2. Materials and Methods

As materials in this article, we used data from open sources: data from international economic organizations, authoritative consulting and rating agencies, statistical information, as well as data published in scientific publications (books, articles).

At the same time, the basic approaches used in the article are based in a broad sense on the classical political economy, neoclassical economic school presented in the works of A. Marshall [17], P. Samuelson, P. Nordhaus [18], G. Mensh [19], F.A. Hayek [20], in the works of scientists who investigated the patterns of innovation and technological development N. D. Kondratiev [21], J. Schumpeter [22,23,24], R. Nelson and S. Winter [25], A. Toffler [26], D. Bell [27], J. Galbraith [28,29], B. Santo [30], M. Porter [12,13,14] and on the works of Russian scientists: A. Anchishkin [31], S. Glazyev [32,33], Yu. Yakovets [34] and others.

In a narrower sense, of interest are the results of empirical studies of the oil industry and Oil Companies of famous scientists, such as R. Oligny, A. Izquierdo, M. Economides [35], M. Kamien, N. Schwartz [36], H. G. Grabowski, N. Baxter [37,38], E. Mansfield et al. [39], W.S. Commanor, F.M.Sherer [40], A. Phillips [41], J. Shmookler [42], contributed to the understanding of the reasons explaining why Oil Companies are in a state of low innovation activity A. Mastepanov [43], M. Poleshchuk [44], M. Cherkasov [45,46] and others.

An important role is played by the methodological aspects from the works of M. Blaug [47], as well as the methods for developing forecasts and scenario forecasting—the works of K. Abt, R. Foster, R. Ri [48].

The main methods that make up the methodological basis for studying the problems studied in this article are a set of general scientific methods (analysis and synthesis, the method of scientific abstraction, generalization, analogies), methods of economic analysis, classification, ranking and structuring of data, rating analysis, statistical analysis, comparative analysis, as well as graphical analysis, analysis and forecasting of time series, method of constructing linear trends (extrapolation of trends), ETS forecasting (Exponential Triple Smoothing Forecasting), correlation analysis, scenario planning and forecasting.

Based on this methodology and on the mentioned theoretical and practical platforms, at the article have formulated the problem of the innovative insufficiency of the oil sector in comparison with other sectors, assesses the prospects for the development of Oil Companies, provided that while maintaining modern technological trends (the absence of breakthrough technologies in the field of production, processing oil and gas) and with the current level of their investments in R&D in the oil and gas sector, Oil Companies may find themselves in difficult conditions, especially in a situation where the disruptive energetic technologies will be commercializing by non-hydrocarbon energy companies.

3. Results

3.1. Review of the Current Situation—Determination of the Nature of Innovative Development of Oil Companies

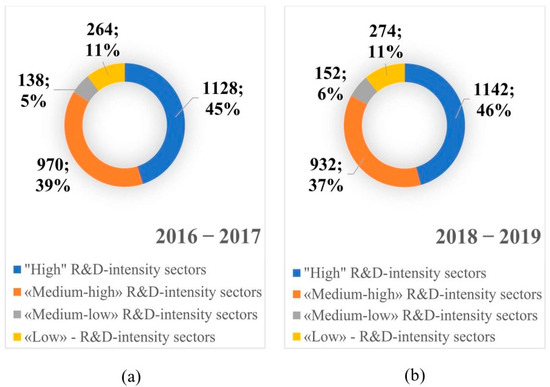

The ICT sphere has demonstrated the highest rates of innovative development not the first decade. Of course, ICT is not as capital intensive as the oil and gas sector and has a much faster return on investment. However, in recent years, some Oil Companies have also started to appear in the global innovation ratings [49,50,51,52]. But their number is extremely small. There is no encouraging data from the WIPO (World Intellectual Property Organization) 2020—The Global Innovation Index 2020. In 2018–2019, the entire oil and gas sector accounted for less than 1% of all R&D spending in the modern economy [52]. It is not surprising that none of the Oil Companies ranked among the leaders in R&D investments in the GII 2020 rating. Moreover, the data even indicate a decrease in the level of innovative activity of oil and gas companies in 2018–2020, even without taking into account the impact of the pandemic (the impact of the pandemic on energy development is presented in detail in [53]). The data of the rating EU R&D Scoreboard: The 2017 EU Industrial R&D Investment Scoreboard [54,55] also testifies to the incomparably low innovative activity of Oil Companies, compared with companies from other industries. The intensity of Oil and Gas Companies innovation activity in comparison with companies from other industries is shown in the diagram (Figure 1).

Figure 1.

(a) R&D intensity by industry sector in 2016-2017; (b) R&D intensity by industry sector in 2018–2019. Source: drawn up by [54,55].

It is necessary to clarify the diagram in which the gradation of the analytical review of the European Commission is preserved. In it, the first group (high) of companies with a high intensity of R&D (>5%) included companies specializing in aerospace technologies, computer equipment, protection and security, the production of office equipment, leisure goods, medical equipment, pharmaceuticals, semiconductors, software, telecommunications equipment, as well as providing medical and Internet services.

The second group (“medium-high”)—medium-high intensity of R&D (2–5%) included companies specializing in the production of auto components, automobiles, trucks, chemicals, packaging, electrical equipment, electronic equipment, household goods, industrial equipment, manufacture of automobile tires and financial and travel services.

The third group “medium-low”—groups companies with a medium-low level of R&D intensity (1–2%). It included only one segment of companies related to the oil sector, namely, oil equipment manufacturers. The same group includes companies specializing in alternative energy, beverage production, food, retail, media, tobacco production and distribution services.

Finally, the fourth group (“low”) is characterized by a low degree of R&D intensity (up to 1%). It includes mining companies, companies specializing in the production of aluminum, precious metals, gas, steel, water supplies, timber processing, water suppliers, real estate, as well as the provision of services in the field of insurance, mobile telecommunications and transport [54,55].

The above data once again prove that Oil Companies are seriously lagging behind in terms of R&D intensity relative to companies from other sectors of the economy. It should be added that alternative energy also occupies a low position.

In general, the oil and gas sector accounted for 1.12% of all R&D expenditures in the world in 2018 (€9.3 billion out of €823.4 billion), while the Net Sales of Oil Companies amounted to €2812.5 billion (13.8% of the global volume of all industries). Their R&D intensity is 0.3% (the penultimate sector in the world), provided that in terms of profitability Oil Companies rank second in the world (14%), yielding first place to the banking sector (26.6%).

A detailed review of the positions of Oil Companies in 2019 shows that PetroChina, which received 81st place in the overall rating, ranks first among Oil Companies with an intensity of 0.6%. As noted in the 2019 EU Industrial R&D Investment Scoreboard: «In contrast, companies in the biotechnology & pharmaceuticals, software and technology hardware sectors have R&D intensities well into double figures and R&D is a key success factor for them» [55], p. 59.

To demonstrate the extent of the problem, let us compare the indicators of revenue (total income), R&D expenditures and R&D intensity of the three absolute leaders studied by PWC in 2016–2018. and leaders among Oil Companies in the same ratings (Table 1).

Table 1.

Comparison of revenue, R&D Expenditures and R&D Intensity of innovations leaders of the world and the leaders of the Oil Companies, 2016–2018.

Table 1 shows that investments in R&D by Oil Companies and investments in R&D by leading companies are not comparable. The highest position (84th place) in 2018 is occupied by PetroChina (84th in 2017), followed by Exxon Mobil—152nd (129th in 2017), [56,57].

It should be noted that PetroChina’s high positions in comparison with other Oil Companies could be explained only due to a large number of patents and not to commercialized innovations, which is confirmed by other sources, for example, data from the World Intellectual Property Organization (2020 and earlier) [52].

Regarding the patent activity of Oil Companies, note that the main areas of patent activity in the oil industry are Upstream (64% of patents), Downstream is account for 32% of patents, oil refining—1%, Midstream have 3% [50]. The number of patents by Oil Companies grew fivefold over the period 2000–2014. But the reason for this growth is only “shale revolution.” After a slight decline in 2015, growth resumed the following year. So, Upstream accounts for 18,358 patents (in 2015—18,086), production of fuels and other oil products—9861 (against 9224 in 2015), Midstream has—1321 (+52%). On the contrary, in the Downstream sector there was a significant decrease—by 15%, despite the fact that its share in the structure of patenting in the industry is only 1% [51].

Meanwhile, the patenting indicator, although it reflects the presence of innovative ideas in companies, cannot fully reflect the fact of the presence of innovative activity, this indicator does not renew significantly worn-out production assets of a significant number of Oil Companies. Against the background of a decrease in the efficiency of the main activity due to the consequences of the financial and economic crisis and a decrease in the profitability of Oil Companies due to the pandemic, these indicators indicate not only low rates of innovative development but also characterize the presence of serious threats due to the growing likelihood of technogenic accidents. In general, the low innovative activity of Oil Companies cannot be explained only by those rather comfortable conditions in which modern Oil Companies exist, the rather high profitability of which, in general, does not stimulate them to invest enough funds in R&D (relative to other companies). This situation characterizes the presence of a scientific problem, the solution to which can also solve a number of practical problems.

3.2. Estimates of the Development Prospects of Oil Companies (Forecast)

Based on the hypothesis defined in this article we need to get an idea of the significance of this trend and the extent of its impact (the trend that if the current pace of R&D and investment in R&D of Oil Companies is maintained, they (and the oil and gas industry as a whole) will experience serious problems of their development in the future).

Unfortunately, the analytical data and forecasts below evidence just that.

To evaluate the development prospects of Oil Companies, it is necessary to identify future trends in terms of R&D intensity, R&D investment volumes and revenue from their activities based on forecasting time series in comparison with other industries (comparative analysis).

The forecasting methodology used by building linear trends has advantages and disadvantages. But for the tasks solved in this article, that methodology is applicable and its use is reasonable. This is due to the fact that it is necessary to first determine how the oil market will develop and what will be the main economic indicators of companies’ development while maintaining the current level of R&D costs in comparison with other industries, when all other things are equal (macroeconomic stability and the absence of breakthrough commercialized technologies in energy sphere in general (in hydrocarbon and non-hydrocarbon energy)). Thus, the task is to identify a trend that will make it possible to assess what will happen to Oil Companies if they do not take appropriate measures to increase investment in innovation and in-crease the intensity and efficiency of their innovation activities (including based on the fact that Oil Companies also there are opportunities for the development of non-hydrocarbon technologies). Based on these data, a scenario forecast will be built.

To build forecast data, information was taken from open sources PWC (PricewaterhouseCoopers) for 2011–2017 [56] and the comparative approach allowed for cross-sectoral comparisons. The period 2011–2017 was chosen due to the fact that the dynamics during this period demonstrates the situation quite well, during this period there are no sharp declines and rises. This allows us to come to the most objective conclusions.

Forecasting objects. To forecasting was created the nonrandom (nonprobability) quota sample. The sample included companies grouped by industry: Software & Service & Semiconductors companies, Pharmaceuticals & Biotechnology companies, Technology Hardware & Equipment, Automobiles & Components Companies, Oil & Gas companies (using PWC terms). The sample consists of 40 companies and it is representative sample. The forecasting time-frame is 8 years—2018–2025. Forecasting methods—building linear and exponential trend.

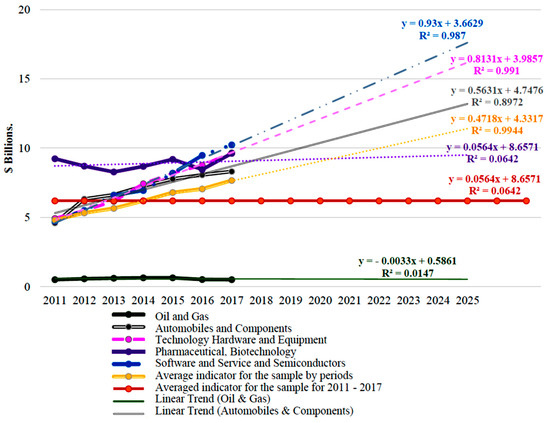

The first forecasted parameter is the volume of investment in R&D in absolute terms. The trend is built on the average data for each quota (a group of companies belonging to a particular industry, the leader of cluster). When forecasting this indicator, the following are additionally introduced indicators: the average indicator for the sample by periods (2011–2017). it reflects the general trend of changes in investments in R&D for the entire sample and the averaged indicator for the sample for 2011–2017. Obtained linear trend in forecasting investments in R&D in absolute terms is shown in Figure 2.

Figure 2.

Forecast (linear trend) of investments in R&D of Oil Companies in comparison with companies in other industries until 2025, in billions of dollars. Source: calc. by author by data [56].

As can be seen from Figure 2, according to the forecast, the largest growth in investment in R&D since 2018, as in 2011–2017, belongs to Technology Hardware & Equipment Companies, similar positions belong to Pharmaceuticals & Biotechnology Companies. Investments in the Automobiles & Components and Software & Service & Semiconductors industries will grow above the average indicators of sample. Only Oil Companies, whose investments in R&D are in the range of $0.5–0.7 billion, will seriously lagging behind other companies from this sample. (It should be noted that in the calculations of the authors, both linear and exponential trends were built for all parameters but only linear trends could be recognized as reliable trend).

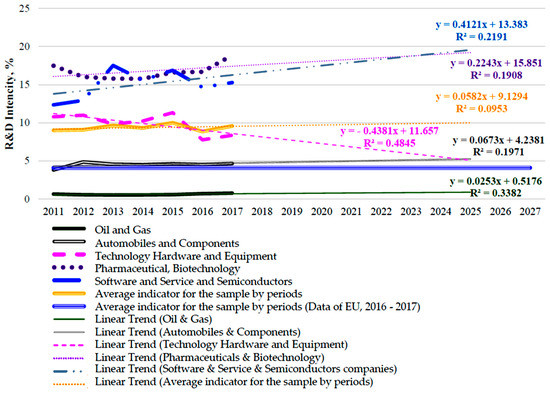

However, in general, the linear trend of the growth of investments in R&D in absolute terms is largely demonstrative. More significant conclusions can be drawn based on the analysis of relative indicators—the Intensity of R&D (Figure 3).

Figure 3.

Forecast (building a linear trend) R&D intensity of Oil Companies in comparison with companies in other industries until 2025, %. Source: calc. by author by data [56].

Figure 3, in contrast to Figure 2, shows two linear trends in the average R&D Intensity indicators for the sample by periods. The first one was calculated by us on the basis of data for the entire period and the second one was calculated by the European Commission for 2016–2017. The indicator the European Commission calculated is based on an results of analysis of the R&D Intensity of 2500 R&D companies and its size is 4.1% [54], p. 36.

As can be seen from Figure 3, in this trend, the leadership was recorded by companies belonging to the Pharmaceuticals & Biotechnology and Software & Service & Semiconductors sectors. The rest of the groups of companies will maintain their positions within the average fluctuations in the trend. But this does not apply to Oil Companies, which will only be able to slightly intensify R&D and will remain lagging behind.

These trends (Figure 2 and Figure 3), being linear, do not allow predicting possible changes in the socio-economic, scientific and technical development of the Economy, since they are implemented only with other things being equal. However, since the forecast horizon is of a medium-term nature and expert assessments indicate an almost unchanged nature of investments in R&D of Oil Companies, this forecast can be considered reliable as supported by additional data [54].

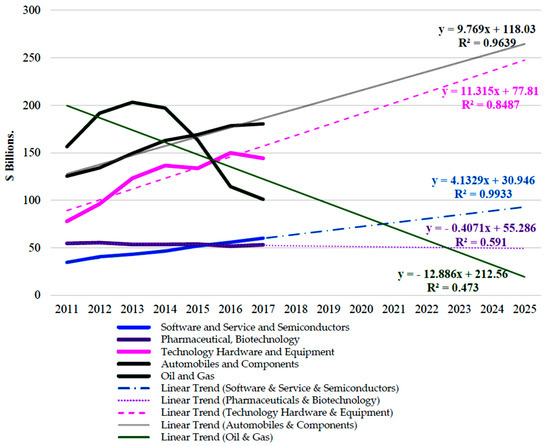

Under these conditions (according to the same estimates) Oil Companies will reduce or maintain the same level of investment in R&D. In this case, they should think about how effective such a policy is, because these companies need to intensify their innovation activity (even not within the framework of the industry’s traditional lines of business). However, for investment in R&D, Oil Companies need funds, therefore, in order to identify the growth trends of the revenue (income) of the companies included in this sample, a linear trend in income was built within the same forecasting time-frame (Figure 4).

Figure 4.

Forecast (Linear Trend) of revenue (income) of the Oil Companies in comparison with companies of other industries until 2025, in billions of dollars. Source: calc. by author by data [56].

The Linear Trend reflecting the forecast of changes in the company’s revenues determines, firstly, that high positions are no longer held by Software & Service & Semiconductors companies and Pharmaceuticals & Biotechnology but by Oil & Gas and Automobiles & Components sectors, while maintaining the middle positions in Technology Hardware & Equipment. Second, revenues in all quotas will grow during the forecasting time-frame, while revenues in the Oil and Gas sector will seriously decline. So, according to the European Commission, Oil Companies form the majority of those companies whose sales volume decreased in 2016–2017. These are: Eni −18%, Total −11%, Royal Dutch Shell −12%, BP −18%; net sales decreased at Petroleos de Venezuela (−24%), Statoil (−23%), Petrochina (−6%), Chevron (−15%) and Exxon Mobil (−16%). It must be said that during this period Apple also experienced an 8% decrease in this indicator [56].

To clarify this fact, we note, first, that, as can be seen from Figure 2, in absolute terms, the investments of Oil Companies in R&D are also not large. Secondly, we note that the correlation coefficient we calculated indicates that there is a close and direct relationship for all groups of companies between the indicators of investment in R&D and the dynamics of income for the period under study. But this does not apply to Oil Companies, for which this relationship, due to low investment in R&D, is direct but not tight (close). And thirdly, perhaps the most important, perhaps, one should not explain the decline in the profitability of Oil Companies (moreover, diversified in a number of areas) only by the dynamics of oil prices and the tax burden. Indeed, at this stage of the analysis, it can be concluded that it is short-sighted of the explaining of the decline of company income only by market volatility. Perhaps it should be assumed (including based on the above data) that the problems of development of Oil Companies are contained in the insufficient investment in R&D that has been observed in the industry for several decades, as well as in their organizational management.

Uncertainty in this issue is removed when studying the results of empirical studies of the diffusion of innovations in the industry and investment in R&D by a number of well-known scientists. Thus, J. Schmookler back in the 60s of the twentieth century established that there is a direct relationship between the increase in industry investment and the invention of means of production in the oil refining industry [42]. Moreover, the same proportions are also characteristic of the construction sector; this fact fully explains why construction and Oil Companies belong to the 3rd and 4th groups in the study of the European Commission (Figure 1) and confirms the relevance of the forecast results (Figure 2, Figure 3 and Figure 4). In addition, it also suggests that Oil Companies in the 21st century remain committed to the strategies that have brought them in successful in the 20th century.

E. Mansfield et al. came to conclusions that do not contradict J. Shmooklers position [39].Having studied 9 Oil Companies (along with 10 chemical companies and 11 steel companies), they found that the distinguishing quality of the oil industry is, firstly, a direct proportional relationship between the budget of these companies for R&D and the orderly distribution of their programs by the criterion of the quality and efficiency of their investments in R&D, and, secondly, by an inverse proportional relationship to the volume of their sales (while, for example, in the chemical industry, there is a direct proportional relationship between the increase in R&D costs and the results of their inventive activity).

The stimulus for the innovative development of Oil Companies was identified by H.G. Grabowski [37,38], who made an interesting conclusion (based on the study of oil refining, chemical and pharmaceutical companies). It consists in the fact that one of the most important factors (“determinants”) of the intensity of R&D by companies is the “index of firm productivity before the start of research,” measured by the ratio of the number of patents per scientist and engineer working in a given firm. He found, therefore, that companies in this industry are characterized by a long-term effect of R&D, characterized by the fact that the more patents accrued to scientists and engineers in the past, the higher the research intensity of these companies in relation to their competitors (all other things being equal) [37]. It should be noted that the evidence that the growth in the number of scientists and engineers in the company leads to the growth of patents was led by J. Schmookler [42] and W.S. Comanor with Sherer, F.M. found a positive effect and correlation between the volume of sales of new products within two years after their invention, the number of employees in R&D and the number of patents. This correlation effect has been found to be positive for a constant firm size [40]. M.I. Kamien and N.L. Schwartz adhere to a similar position [36].

So what conditions are needed for the industry to innovate? To answer, firstly, one must recall the warnings of J. Galbraith more than half a century ago, who believed that “the era of cheap innovations is a thing of the past and an era of diminishing returns has come to replace it” [28,29] and secondly, one should pay attention to the thoughts of A. Phillips, who argued that the special state of the industry can stimulate the development of innovations in it: “there is such a level of competition that occupies an intermediate position between perfect competition and monopoly and that it stimulates innovation as much as possible ” [41]. Consequently, the expectation of an increase in innovative activity in the oil industry should be associated with changes in the macro environment and in the structure of the oil market.

There are opinions according to which a large monopoly firm is more inclined to innovative activity, since it has more opportunities for diversification [36]. For example, H. Grabowski and N. D. Baxter came to the conclusion that the more oligopolistic the industry is, the higher the R&D competition in it [38]. If we apply this conclusion to the situation on the oil market, which is characterized by an oligopolistic nature, then this sector of the economy is characterized by a high degree of competition in the field of R&D. However, the low degree of innovative activity of Oil Companies today suggests that this is not entirely true. There is that industry also no intense competition in the questions about innovation and their commercialization. But competition is happens going on in certain segments of production, such as such as vertical drilling technologies (shale gas upstream technologies), development and promotion of innovative fuels and oils and offshore production technologies.

In general, there are different points of view on the problem of the relationship between the intensity of R&D in the industry and the companies size. According to one of them, current profits are predetermined by future innovations and the most probable sources of technological progress are created by large companies, since they are in the best position in terms of profitability (“high current profits, which are a source of liquidity, are an essential condition for the application of significant efforts in the field of R&D”) [36].

The above points of view of scientists and the conclusions made by the above authors are not typical for studies of the features and directions of development of companies in the oil and gas industry. Unlike the cited researchers, most analysts ignore the problem of the futility of maintaining the current extremely low rates and volumes of R&D and their technological lagging behind the general development trends of the modern economy, not to mention lagging behind the advanced industries. The main purpose of illustrating views of these scientists was the need to emphasize that the situation with the non-innovative nature of the development of Oil Companies has deep roots and requires a conceptual revision of the innovative and investment strategies for the development of Oil Companies. Therefore, the points of view are given not of opponents but of like-minded persons. That is why we did not dispute with these authors, although we see a number of disadvantages in their works. Such disadvantages and controversial points include the lack of study of the types of innovations being introduced and their impact on the quality of innovative development, the feedback between inventions and the development of an oil company is not studied [36,39,42], the focus on the study of patent activity and inattention to the organization of the process of commercialization of innovations [36,37,42], lack of attention to environmental factors, the use of digital technologies, organizational innovation and more.

Nevertheless, an important general conclusion can be made that there is still a direct relationship between the income of companies and their investments in R&D. But this relationship is differentiated depending on the characteristics and structure of the industry and, when certain proportions in the industry are reached, incentives for innovation are formed in it. (As M. Porter noted, “innovation is both a response to incentives created by the general structure of the industry and a powerful influence on this structure)” [58], p. 284).

The solution to the problem of low rates of innovative development of Oil Companies should be based on the concept of M. Porter including his industry life cycle concept. Since the oil industry is at a stage of maturity, which is predetermined by the objective reasons for its resource orientation, the following statement by M. Porter is true in relation to it: “as the industry moves to the stage of maturity, the product design changes more slowly and mass production techniques appear. Product innovation is giving way to organizational innovation … the latter becomes the main form of technological activity in the industry, since the goal at this stage is to reduce the cost of producing a product … Finally, in the later stages of industry maturity, the rate of innovation slows down and innovation gradually fizzles out: investments in technology in the industry reach the point, followed by a decline in profitability from further improvements” [58], p. 283.

However, the maturity of the industry at the moment is not a “verdict.” Oil companies today have the opportunity to take a number of actions that will allow them in the future to apply the strategy of “rejuvenation,” in conditions “when, due to major technological changes, the industry can be thrown back into a state of instability” [58], p. 283. We are talking about R&D and the commercialization of their results in the field of non-hydrocarbon energy and diversification (which is not yet active enough but a number of companies are already developing, see below).

The “state of instability,” which is the result of technological evolution in interaction (according to M. Porter) with the life cycle, gives rise to five forces: first, “change in scale” due to the fact that as companies and the industry as a whole grow, they have more room for innovation. Secondly, “learning,” which means that in the course of the life cycle of companies and the industry, they accumulate skills to improve this process. Third, “uncertainty reduction and borrowing” characterizes the process of “pushing for product standardization.” Fourth, “the spread of technology,” and fifth, “a fall in profits from technological innovations in various types of activities,” when the limit of possibilities for further improvement of this technology comes [58], p. 284.

Therefore, Oil Companies should pay attention to the idea proposed by M. Porter about the need to form industry scenarios as a competitive strategy in conditions of uncertainty. The industry scenario is a “consistent and consistent system of views on the industry and its future structure” [58], p. 603. Uncertainty, in this case, can come from any of the five forces of competition and from the point of view of the oil market, the most “dangerous” for Oil Companies is the massive distribution of substitute goods (other types of energy). To protect business from them, M. Porter proposed a system of protection against substitute goods, which also includes an “attack on the industry” where substitute goods are produced [58], (pp. 428–430). Another “recipe” by M. Porter is to use market relationships, concerning the unification of marketing, logistics efforts, production of products, as well as—joint efforts in the field of R&D [58], (pp. 470–474), as it was implemented by corporations in the market electronics.

3.3. The Scenarios of Development of Oil Companies

Scenario planning is a promising method for the variable description of the position of an object in the future, taking into account the influence of various factors on the change in the object. Scenario planning and forecasting are often used to forecast the development of the oil and gas and energy sectors. The most famous in the energy sector are the scenarios of the International Energy Agency, OPEC scenarios and scenarios for individual countries and regions are being developed. Scenario forecasts are also made by Oil Companies such as BP, ExxonMobil, Shell. All these materials were studied before the development of the following scenarios for the development of the oil industry.

The peculiarity of the above scenarios is that they consider the problems caused by the development of the industry—these are intra-industry comparisons. Without questioning the significance of such forecasts and expressing respect for the authority of these studies, we note that, in general, intra-industry comparisons do not create conditions for the transition of Oil & Gas Industry companies to innovative development. Meanwhile, it is precisely the cross-sectoral comparisons that make it possible to assess the complexity of the position of Oil Companies, their future as such and their business models.

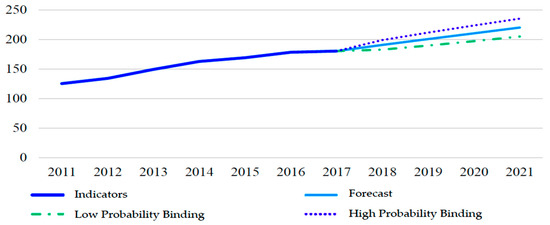

The starting point for making a decision on the formation of the scenarios outlined in this article was also the results obtained using the MS Excel toolkit (ETS forecast). The initial data was the information from PWC [56,59,60,61] and so forth on the incomes of companies used to build linear trends in the development of the industry but with a forecasting time-frame until 2032 (15 years) for Oil Companies (Figure 5).

Figure 5.

Forecast of revenues of Oil Companies 2018-2032, billions of dollars. Source: calc. by author by data [56].

As Figure 5 shows, if the current situation persists, the revenues of Oil Companies will take negative values by 2025 and by 2032 their losses will amount to more than $ 90 billion per year (all other things being equal). To establish whether the downward trend in Oil Companies’ revenues is typical/atypical, a similar forecast was made for automobile component sectors. The choice of the automotive industry as a base for comparison was determined, firstly, by the relative similarity of the income values in both industries (see Figure 4), and, secondly, by the similarity both in the models of industry competition (oligopolistic) and factors influencing production and consumption in these industries. The forecast result is shown in Figure 6.

Figure 6.

Forecast of revenues for the automotive industry 2018–2032, billions of dollars. Source: calc. by author by data [56].

From the forecasts (Figure 5 and Figure 6), compiled by applying the ETS-forecast, it can be seen that with respect to the automotive industry (and other sectors of the economy), the situation with a decrease in income, which is characteristic of Oil Companies, is atypical. Of course, the decline in income of Oil Companies was also associated with a decrease in oil prices and the Excel forecast is based on the constancy of other factors. However, this is fair, since there are no guarantees that the price of oil will rise and this will create conditions for stabilization and growth of incomes of Oil Companies (in 2019 and 2020 there was a decline in prices for oil and oil products). Therefore, the probability of this forecast being realized is nonzero. This further reinforces the fact that Oil Companies must seek other sources of innovative growth. In particular, by diversifying and stepping up its innovative activities. An alternative forecast of the dynamics of income of Oil Companies for the same period can be presented using the method of analogies, assuming that the income of Oil Companies will increase if they are more active in innovation and bring the level of their investments in R&D to the level of other companies.

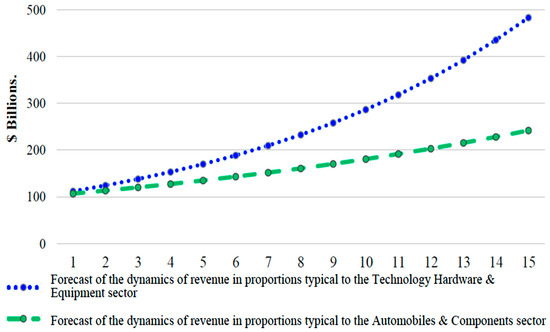

For forecasting, based on the correlation analysis, the degree of dependence of the income growth rates of the companies included in the sample on the level of their investments in R&D was established and the growth rate was revealed. In accordance with this, two forecasts were formed. In the first, a proportional relationship between these indicators is used for Oil Companies, by analogy with automobile concerns (Automobiles & Components) and in the second, a proportional relationship between these indicators is used to predict the revenue of Oil Companies, by analogy with the industries producing Technology Hardware & Equipment companies. The forecast is shown in Figure 7.

Figure 7.

Forecast of the dynamics of revenue of Oil and Gas sector in proportions typical for the growth of the Automobiles & Components and Technology Hardware & Equipment sectors 2018–2032, billion dollars. Source: calc. by author by data [56].

As can be seen, increasing investments of Oil Companies in R&D can lead to the implementation of optimistic development scenarios. Based on the forecasting results, it is possible to build preliminary generalized scenarios for the development of the oil industry. They are shown in Table 2—scenarios for the development of Oil Companies (oil industry).

Table 2.

The Scenarios of Development of the Oil Companies (Oil and Gas Industry).

Here, it is necessary to add that the used forecasting methods are not multifactorial. They are not intended to reflect the entire set of factors in full, which serves as the key idea of the study—to study how events will develop, taking into account an important proviso for economists—“all other things being equal” (according to P. Samuelson [18], A. Marshall [17]). The indicated drawbacks of the method for constructing linear trends are compensated for by constructing a scenario forecast of the industry development and strategic initiatives of companies from other sectors of the Economy (below).

In addition to this remark, others should be added. First, the scenario is built based on traditional concepts of formation of the scenarios and can be identified as a contrasting type of scenario. This type of scenario allows the exploration of the conditions in which decisions will be made, assessing existing concepts and other factors, as well as to make more correct decisions. The create of this scenario aims to complete and concretize the forecasting process and determine the parameters of the transformation of the Oil Companies’ market as a result of the implementation of one of the scenarios and the scale of the consequences for Oil Companies in their current state, as well as an assessment of the likelihood of acquisitions of Oil Companies by the non-Oil Companies.

Secondly, the scenario method presupposes a written description of problems and proposals for their solution, as a result of which a comprehensive summary of the problem is achieved. Third, the scenario shown in Table 2 was formed in accordance, as follows from the above study, with the principles, the most important of which was the principle of proportionality of the volumes of investments in R&D of Oil Companies in R&D, combined with the dynamics of their profitability/profitability with similar parameters of non-Oil Companies. Fourthly, this scenario makes it possible to understand that Oil Companies, provided that they maintain their current innovation, technological and investment development strategies may find themselves under the influence of a serious threat due to the growing risks of exposure to them from the fifth force of competition (according to M. Porter).

The proposed scenarios, in contrast to the development scenarios of the IEA (International Energy Agency) and another’s scenarios are characterized by the fact that they are primarily assess the future of existing Oil Companies who continue to implement their low-innovation development strategies (or rather, regression strategies). The scenarios take into account the models of the future oil and gas business, their actual place in the structure of the world economy in situations of decreasing/maintaining the rates/growth of their R&D relative to other industries (including those that may arise in future, as a result of a technological shift). Indeed, the analysis of dynamics, comparison and forecasting of the rate of investment in R&D, the rate of commercialization, the efficiency of R&D and the profitability of Oil Companies and other companies indicated that the enterprises of this industry are faced with the need to increase their innovative activity. In this case and in the post-carbon era, companies related to oil today tomorrow will exist and develop, either diversifying their activities or increasing the pace of innovation or becoming at the forefront of innovative development. Otherwise, Oil Companies may not only become unprofitable but also be object of mergers and acquisitions by corporations from other sectors of the economy, which may have the competence of high rates of innovation activity and rapid rates of commercialization of innovations. There is also a high probability of a technological breakthrough in the field of energy production.

3.4. Important Directions for Development

When starting to consider the issue of important areas of development, it should be noted that, of course, one cannot say that companies are not doing any work—it is simply not enough. If we look at individual companies, it can be noted that, for example, traditionally leading places in the ratings in terms of absolute volume of funds among companies belonging to the oil and gas sector belonged to Exxon Mobil and Total, annually investing 700–800 million USD. But on the whole, as the ratings show, in comparison with other sectors, Oil Companies can hardly be called innovatively active. To the above indicators and facts, we add the fact that the average annual indicator of investments in R&D in the industry is 0.7%, however, specific values for countries vary significantly. For American and European companies, such expenses are generally equal to $1 per 1 ton of oil equivalent, while in China and Brazil they are 2.5–3.2 times higher. For Russian companies, the share of R&D in the same relative indicators is less than $0.2 per ton. Undoubtedly, such a spread in data is explained by the size of companies and the specific starting conditions for innovative development, determined by the history of investment in R&D. Western companies have been paying attention to this area for many years, while Chinese and Brazilian companies have turned to it relatively recently. For a long time, Russian companies have been operating production facilities created back in the Soviet period. A protracted innovation pause against the backdrop of low investment in R&D turns out to be a serious problem for them.

At the same time, given the major changes in the context of these article, it is not enough for oil and gas companies to simply increase R&D spending and increase innovation activity. They need to choose directions of development and develop appropriate strategies.

The number of non-oil energy companies is growing and their efficiency is improving. The oil business in oil importing countries, for example China, is focused on the development of innovations in the downstream.

It must be said that the overall low level of R&D expenditures in this industry can be explained by the fact that its subjects remain super-profitable. This industry is at the top in terms of wages and is viewed by many governments as the main source of tax revenue [35].

The development of innovative processes is also seriously hampered by the internal structure of Oil Companies, which is vertically integrated, in which the development of new technologies is limited to the activities of special units. Not all companied disclose this information. Nevertheless, for example, in British Petroleum and in Statoil, innovation processes are managed by a line manager, for whom this function is secondary [62].

The analysis shows that investments in R&D can be transformed into successfully implemented innovations that produce an economic effect only if there are special market strategies. The key perspectives directions for Oil Companies will be: drilling technologies, remote control of drilling, improving hydraulic fracturing technologies, ensuring environmental safety, new methods of studying the geology of wells at great depths.

At the end of the last century, the global average oil recovery rate did not exceed 15–20%. Since the beginning of this century, it has grown to 35% and in some countries, it has reached 50%. In modern oil production, the oil recovery coefficient ranges from 9–75% [63] but this coefficient differs in different countries: the highest is at one of the fields in Norway (66%), in Russia—up to 35%, in North America—35–37%, in Latin America and Southeast Asia—24–27% and in Iran 16–17% [64,65]. Meanwhile, an increase in oil recovery in all regions of the world by at least 1% would cover the needs of the world economy for 2–3 years ahead (according to Ernst & Young, by about 88 billion barrels [66]).

One of the most important directions in the development of the oil and gas industry is to increase the efficiency of operating the existing fields. The most challenging tasks are production optimization and maximum reduction of downtime costs. It can be solved through the introduction of automation systems that reduce labor costs for well maintenance, reservoir-to-surface modeling, pump control and the development and implementation of integrated technologies for Smart Field. It will be possible to maximize oil production from the reservoir through real-time control, flexible changes in the production schedule, adaptation to changing environmental conditions and reduction of energy and hydraulic costs. In this case, the life cycle of the field will be lengthened and environmental risks will decrease.

As the analysis of plans and projects of Oil Companies has shown, projects on the use of solar energy and wind energy are being implemented by Royal Dutch Shell, Chevron, Petrobras, Total, BP; projects related to geothermal energy are being developed by Royal Dutch Shell, Chevron, PetroChina; Chevron, Petrobras, PetroChina are interested in the implementation of projects for the production of biodiesel; BP is interested in the development of projects for obtaining biofuels and energy from inedible plant materials and R&D in the field of hydrogen energy belongs to ExxonMobil, Chevron, Total.

Due to the industry specifics, the development and implementation of innovations in the oil and gas industry initially implies a high level of R&D costs. In the near future, the demand for them may reach such volumes that will not be available even to supermajors. Realizing this, these companies are already looking for government support today.

4. Discussion

Despite the fact that the purpose of this article has been achieved and its hypothesis has been confirmed, the issues studied in this article can be further developed and become objects for scientific and practical discussions. All problems determine the prospects for the further development of the authors’ ideas, both in terms of the further development of theory and in relation to the development of practical possibilities for applying the conclusions obtained in this article.

The object for further scientific research and for scientific and scientific-practical discussions becomes and another moment. It consists in the point that the scenario forecasting methodology can be developed in further research, which will study the problems associated with taking into account new trends, including those caused by the crisis caused by Covid-19 and the subsequent economic recovery. There are also important directions for the development of this approach through the use of quantitative methods for assessing the development of scenarios and it is the to expand of the research horizon.

Another discussion point, which requires further research, is the conclusion made by the authors and that the problem of insufficient investment in R&D in Oil Companies is a consequence but the reason consists of the existing and prevailing business model in the industry. Their disadvantages were identified in the article. They can lead to the collapse of the existing (modern) Oil Companies due to the impact on them of the fifth force of competition.

5. Conclusions

The hypothesis proposed in this study is confirmed. However, the confirmation does not cause optimism in connection with the results of forecasting. Indeed, most Oil Companies show low innovative activity, continuing to develop along an extensive trajectory. The transition to an intensive model is possible only through an active innovation policy, an increase in R&D costs and the effectiveness of the implementation of the results obtained, as in other industries.

Practical conclusions should be drawn from our analysis, which is that Oil Companies need not only come to understand that they are in a “pre-calaptic” state but also that it is necessary to develop new directions of their development that will allow them to achieve the best possible development scenario. As the main directions for the development of Oil Companies and this industry it should be noted that as the main directions of the industry development, several consolidated directions should be distinguished. The first of them consists of the implementation of innovative activities in the field of traditional processes associated with the production of hydrocarbons and the production of petroleum products, where R&D should be aimed at increasing the efficiency of production processes, increasing reservoir recovery. The second direction is to improve the environmental friendliness of the production processes of traditional hydrocarbon products. The third direction is associated with diversification, with the development of new sources of energy production. An important direction is also the improvement of the organizational structure of the management of R&D processes, the innovation policy of Oil Companies (fourth). As the fifth direction, one should also highlight the direction associated with the use of digital technologies in the production process—the use of big data technologies, Distributed ledger systems, AI, VR, and nanotechnology [67].

A source of accelerating the rate of innovative development can be the possibility of forming intersectoral scientific and technical alliances, developing scientific and technical cooperation with other companies through the creation of joint ventures and the organization of specialized portals.

The above aspects, on the one hand, define a wide field of discussion and on the other, they determine the further direction of research. In addition to the need to develop the above areas, to continue the process of monitoring R&D in the energy sector, we believe that it is important, firstly, to raise the issue of forming a concept for the development of the oil and gas business in the 4.0 format, as a symbol of a qualitative business transformation. So far, this sounds like a slogan [52] and therefore there is an urgent need for a transition to action—exploring opportunities, forming a methodology and forming special strategies, tactics and instruments.

Secondly, the development of an effective system of innovative marketing, which involves monitoring changing demand and opportunities for innovative development not only through portfolio but also through direct investment. The tactical component of new business models is to increase investment in R & D and more actively implement their results in production. The strategic component involves the development of innovative marketing principles and the transformation of Oil Companies into diversified energy producers.

Author Contributions

Conceptualization, Y.S.M. and E.V.; methodology, Y.S.M.; validation, Y.S.M., L.S. and Y.P.; formal analysis, Y.S.M.; investigation, Y.S.M.; resources, L.S.; data curation, E.V.; writing—original draft preparation, Y.S.M.; writing—review and editing, E.V.; visualization, E.V.; project administration, Y.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ardalan, F.; Almasi, N.A.; Atasheneh, M. Effects of contractor and employer’s obligations in buy back contracts: Case study of oil exporting country. Entrep. Sustain. Issues 2017, 5, 345–356. [Google Scholar] [CrossRef]

- Plenkina, V.; Osinovskaya, I. Improving the system of labor incentives and stimulation in oil companies. Entrep. Sustain. Issues 2018, 6, 912–926. [Google Scholar] [CrossRef]

- Plenkina, V.; Andronova, I.; Deberdieva, E.; Lenkova, O.; Osinovskaya, I. Specifics of strategic managerial decisions-making in Russian oil companies. Entrep. Sustain. Issues 2018, 5, 858–874. [Google Scholar] [CrossRef]

- Plėta, T.; Tvaronavičienė, M.; Della-Casa, S.; Agafonov, K. Cyber-attacks to critical energy infrastructure and management issues: Overview of selected cases. Insights Reg. Dev. 2020, 2, 703–715. [Google Scholar] [CrossRef]

- Sansyzbayev, A. Influence of social partnership to the development of enterprise: On the example of oil industry. Entrep. Sustain. Issues 2019, 7, 1613–1627. [Google Scholar] [CrossRef]

- Alkhathlan, K.A.; Alkhateeb, T.T.Y.; Mahmood, H.; Bindabel, W.A. Concentration of oil sector or diversification in Saudi economy: Consequences on growth sustainability. Entrep. Sustain. Issues 2020, 7, 3369–3384. [Google Scholar] [CrossRef]

- Masood, O.; Tvaronavičienė, M.; Javaria, K. Impact of oil prices on stock return: Evidence from G7 countries. Insights Reg. Dev. 2019, 1, 129–137. [Google Scholar] [CrossRef]

- Al-Mazrouei, M.A.; Khalid, K.; Davidson, R. Development and validation of a safety climate scale for United Arab Emirates oil and gas industries. Entrep. Sustain. Issues 2020, 7, 2863–2882. [Google Scholar] [CrossRef]

- Humbatova, S.I.; Tanriverdiev, S.M.O.; Mammadov, I.N.; Hajiyev, N.G.-O. Impact of investment on GDP and non-oil GDP in Azerbaijan. Entrep. Sustain. Issues 2020, 7, 2645–2663. [Google Scholar] [CrossRef]

- Hughes, J.E.; Lange, I. Who (else) benefits from electricity deregulation? Coal prices, natural gas, and price discrimination. Econ. Inq. 2020, 58, 1053–1075. [Google Scholar] [CrossRef]

- World Production Gas, Natural Gas Liquids, Coal and Lignite, Electricity, Primary Energy. Oil & Energy Trends: Annual Sta-tistical Review. Stat. Tables 2019, 40, 1. [Google Scholar]

- Porter, M.E. Competitive Advantage, Creating and Sustaining Competitive Performance, 1st ed.; The Free Press: New York, NY, USA, 1985. [Google Scholar]

- Harvey, M.; Porter, M.E. Competition in Global Industries. J. Mark. 1988, 52, 150. [Google Scholar] [CrossRef]

- Porter, M.E. Towards a dynamic theory of strategy. Strat. Manag. J. 1991, 12, 95–117. [Google Scholar] [CrossRef]

- Obama, B. Oval Office Address to the Nation on BP Oil Spill Disaster. Available online: https://www.americanrhetoric.com/speeches/barackobama/barackobamabpoilspillovaloffice.htm (accessed on 20 November 2020).

- Helman, C. Which Companies Pay the Most in Taxes? Available online: https://www.forbes.com/sites/christopherhelman/2012/04/16/which-megacorps-pay-megataxes/#31fd69d85586 (accessed on 30 September 2020).

- Marshall, A. Principles of Economics, 8th ed.; Amherst Prometheus Books: New York, NY, USA, 1997; 356p. [Google Scholar]

- Samuelson, P.A.; Nordhaus, W.D. Economics: An Introductory Analysis, 19th ed.; McGraw–Hill: New York, NY, USA, 2009. [Google Scholar]

- Rapp, F.; Mensch, G. Das technologische Patt: Innovationen uberwinden die Depression. Technol. Cult. 1977, 18, 287. [Google Scholar] [CrossRef]

- Hayek, F.A. Competition as a Discovery Procedure/F. A. Hayek, trans in English S. Marcellus. Q. J. Austrian Econ. 2002, 5, 9–23. [Google Scholar]

- Kondratiev, N.D. Bol’shie Cikly Ehkonomicheskoj Kon”Yunktury Problemy Ehkonomicheskoj Dinamiki [Big Cycles of an Economic Conjuncture. Problems of Economic Dynamics]; EHkonomika: Moscow, Russia, 1989; pp. 172–226. (In Russian) [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle; translated from the German by Redvers Opie; Oxford University Press: Oxford, UK, 1961. [Google Scholar]

- Schumpeter, J.A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle, Translated from the German by Redvers Opie; Transaction Publishers: New Brunswick, NJ, USA, 2008. [Google Scholar]

- Nussbaum, F.L.; Schumpeter, J.A.; Schumpeter, E.B. History of Economic Analysis. Am. Hist. Rev. 1954, 60, 62. [Google Scholar] [CrossRef]

- Nelson, R.R.; Winter, S.G. An Evolutionary Theory of Economic Change; Harvard University Press: Cambridge, MA, USA, 1982. [Google Scholar]

- Bornstein, M.; Toffler, A. Future Shock. Technol. Cult. 1971, 12, 532. [Google Scholar] [CrossRef][Green Version]

- Bell, D. The Coming of Post-Industrial Society: A Venture of Social Forecasting; Basic Books: New York, NY, USA, 1973. [Google Scholar]

- Galbraith, J.K. American Capitalism. Am. Capital. 2017, 8. [Google Scholar] [CrossRef]

- Galbraith, J.K. Economics as a System of Belief. Am. Econ. Rev. 1970, 60, 469–478. [Google Scholar]

- Santo, B. Innovaciya kak Sredstvo Ehkonomicheskogo Razvitiya [Innovation as a Means of Economic Development]; Progress: Moscow, Russia, 1990; p. 296. (In Russian) [Google Scholar]

- Anchishkin, A.I. Nauka—Tekhnika—Ehkonomika [Science—Technology—Economics], 2nd ed.; EHkonomika: Moscow, Russia, 1989; p. 386. (In Russian) [Google Scholar]

- Glaziev, S.Y. Teoriya Dolgosrochnogo Tekhniko-Ehkonomicheskogo Razvitiya [Theory of Long-Term Technical and Economic Devel-Opment.]; VlaDar: Moscow, Russia, 1993; p. 310. [Google Scholar]

- Glaziev, S.Y. EHkonomicheskaya Teoriya Tekhnicheskogo Razvitiya [Economic Theory of Technical Development]; Nauka: Moscow, Russia, 1990; p. 230. [Google Scholar]

- Yakovec, Y.V. Innovacionnyj proryv: Social’nye i nauchnye aspekty [Innovative breakthrough: Social and scientific aspects]. Filos. Hozyajstva Econ. Philos. 2008, 6, 281–286. (In Russian) [Google Scholar]

- Oligney, R.; Izquierdo, A.; Economides, M. The Color of Oil: The History, the Money and the Politics of the World’s Biggest Business; Round Oak Publishing: Katy, TX, USA, 2000; p. 220. [Google Scholar]

- Kamien, M.I.; Schwartz, N.L. Market structure and innovation: A survey. J. Econ. Lit. 1975, 13, 1–37. [Google Scholar]

- Grabowski, H.G. The Determinants of Industrial Research and Development: A Study of the Chemical, Drug, and Petroleum Industries. J. Politi Econ. 1968, 76, 292–306. [Google Scholar] [CrossRef]

- Grabowski, H.G.; Baxter, N.D. Rivalry in Industrial Research and Development: An Empirical Study. J. Ind. Econ. 1973, 21, 209. [Google Scholar] [CrossRef]

- Mansfield, E.; Rapoport, J.; Schnee, J.; Wagner, S.; Hamburger, M. Research and Development: Characteristics, Organization, and Outcome. In Research and Innovation in the Modern Corporation; Springer Nature: New York, NY, USA, 1971; pp. 18–46. [Google Scholar]

- Commanor, W.S.; Sherer, F.M. Patent Statistics as a Mesure of Technical Change. J. Political Econ. 1969, 77, 392–398. [Google Scholar] [CrossRef]

- Phillips, A. Market Structure, Innovation and Investment. In Patents and Progress: The Sources and Impact of Advancing Technology; Alderson, W., Terpstra, V., Shapiro., J., Eds.; Irwin: Homewood, IL, USA, 1965; p. 251. [Google Scholar]

- Shmookler, J. Invention and Economic Growth; Harvard University Press: Cambridge, MA, USA, 1966; p. 332. [Google Scholar]

- Mastepanov, A. Perelom energeticheskoi filosofii [Fracture of energy philosophy]. Neft’ Ross. Oil Russ. 2014, 11, 17–24. (In Russian) [Google Scholar]

- Poleshchuk, M.S. Analiz prioritetnykh napravlenii innovatsionnoi deyatel’nosti rossiiskikh i inostrannykh neftegazovykh kompanii [Analysis of priority directions of innovative activity of Russian and foreign oil and gas companies]. Probl. Ekon. Upr. Neftegazov. Kompleks. Probl. Econ. Manag. Oil Gas Complex 2015, 2, 31–37. (In Russian) [Google Scholar]

- Cherkasov, M. Kurs na povyshenie effektivnosti [Course on increasing efficiency]. Neft’ Ross. Oil Russ. 2015, 5, 38–39. (In Russian) [Google Scholar]

- Cherkasov, M. Intellektual’nye Tekhnologii Dlya Sovremennogo Mestorozhdeniya: «Umnoe Mestorozhdenie» [Intellectual Technologies for a Modern Deposit: “Smart Deposit”]. Delovoi Portal «Upravlenie Proizvodstvom» [Business Portal “Production Management”]. Available online: http://www.up-pro.ru/print/library/information_systems/production/umnoe-mestorojdenie.html (accessed on 5 September 2020). (In Russian).

- Blaug, M. The Methodology of Economics, or How Economists Explain; Cambridge University Press: Cambridge, UK, 1992. [Google Scholar]

- Abt, K.C.H.; Foster, R.N.; Ri, R.G. Metodika Sostavleniya Scenariev [A Scenario Generating Methodology]. Rukovodstvo Po Nauchno-Tekhnicheskomu Prognozirovaniy. [Scientific and Technical Forecasting Guide]; To Russian, Progress: Moscow, Russia, 1977; Volume 349, pp. 132–163. (In Russian) [Google Scholar]

- Thomas Reuters. State of Innovation 2015. The Future Is Open; Thomson Reuters: Toronto, ON, Canada, 2015; Available online: https://www.thomsonreuters.com/en/press-releases/2015/october/thomson-reuters-reports-third-quarter-2015-results.html (accessed on 15 May 2020).

- Thomson Reuters. Disruptive, Game-Changing Innovation; Thomson Reuters: Toronto, ON, Canada, 2016; Available online: https://www.thomsonreuters.com/en/press-releases/2016/november/thomson-reuters-reports-third-quarter-2016-results.html (accessed on 15 May 2020).

- Clarivate Analytics. The State of Innovation Report. 2017. The Relentless Desire to Advance. Available online: https://clarivate.com/wp-content/uploads/2017/10/The_State_of_Innovation_Report_2017.pdf (accessed on 16 May 2020).

- The Global Innovation Index 2020: Who Will Finance Innovation? Cornell University, INSEAD, and the World Intellectual Property Organization. 2020. Available online: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2020.pdf (accessed on 15 October 2020).

- Matkovskaya, Y. The influence of the pandemic to the energy development of the economy: Innovation should solve problems. Druk. Vestnik 2020, 104–110. [Google Scholar] [CrossRef]

- Hernández, G.H.; Grassano, N.; Tübke, A.; Potters, L.; Amoroso, S.; Dosso, M.; Gkotsis, P.; Vezzani, A. EU R&D Scoreboard: The 2017 EU Industrial R&D Investment Scoreboard. Available online: http://iri.jrc.ec.europa.eu/survey17.html (accessed on 15 October 2020).

- Hernández, G.H.; Grassano, N.; Tübke, A.; Grassano, N.; Tübke, A.; Amoroso, S.; Csefalvay, Z.; Gkotsis, P. The 2019 EU Industrial R&D Investment Scoreboard. EU Science Hub. Available online: https://ec.europa.eu/jrc (accessed on 15 October 2020).