1. Introduction

In the last 20 years, Italian biomethane production was initially on a constant rise until most recently when it hit a stable plateau. Today’s annual biomethane production in Italy is 2.5 Bn Nm

3 from over 1600 anaerobic digestion plants that utilize waste and by-products from the agrofood chain [

1].

Currently, most Italian biogas plants produce electricity even though recent political incentives are promoting biomethane from biogas by “upgrading” it [

2,

3].

In Europe and Italy, the number of biomethane plants has grown exponentially in the last years. At the end of 2019, we reached a total 725 biomethane plants across Europe, with an increase of almost 100% compared with 2014 (

Figure 1 and

Figure 2). Biomethane production in 2019 increased by 15% relative to the previous year, reaching a total of 26 TWh or 2.5 Bm

3 [

4].

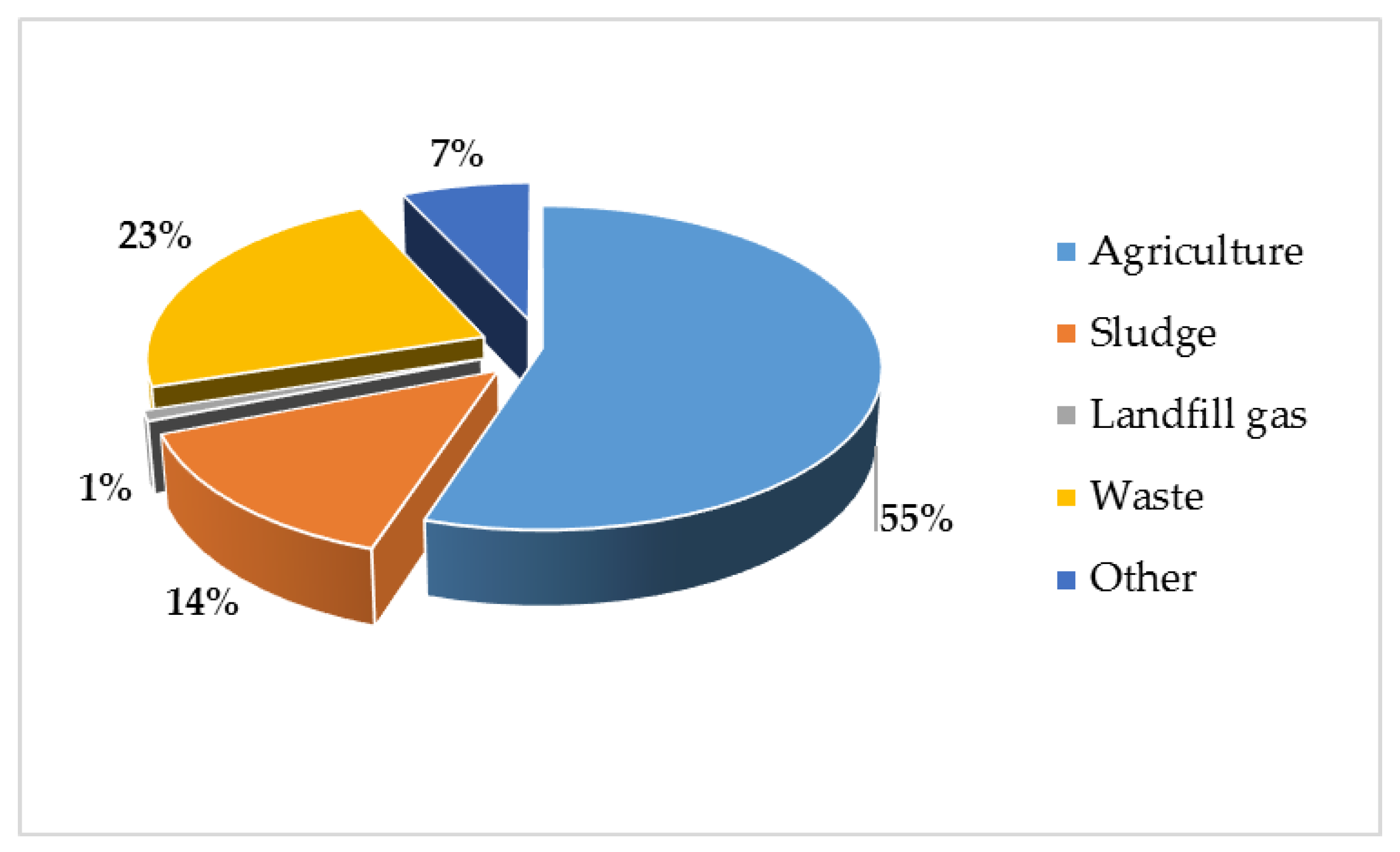

As regards biogas plants in Europe, biomethane plants use mainly resources from the agricultural sector (275 plants), followed by waste (115) and sewage sludge (73) (

Figure 3). In detail, the use of by-products and waste from crops and livestock is prevalent, followed by dedicated energy crops [

5].

In Italy, the release for consumption of biofuels (biodiesel, biogasoline, biomethane) in 2019 amounted to about 1.5 million tons, with an energy content of 1.32 Mtoe (+5.4% compared with that in 2018) [

6]. In 2020, biomethane production amounted to 133 million cubic meters with 18 biomethane plants and 35,000 tons of biomethane released for consumption. Most of the plants generate biomethane for the transport sector (13 plants out of 18), and the most used technology for upgrading is membrane separation [

4].

Biogas production is a significant opportunity for Italian agriculture not only to provide new revenue and jobs but also to guarantee greater sustainability in agricultural production [

7]. However, sustainable biogas in Italy requires new investment in equipment and technology within agricultural companies as well as in alternative management due to any potential environmental impact from introducing biogas [

8,

9,

10]. In 2016, Dale et al. [

11] proposed a new model of sustainable biogas production called

Biogasdoneright® in order to reduce the impact of biogas production on the environment. In particular, the model proposes cultivating nonenergy crops only in rotation after food/feed crops and the use of huge quantities of “integration biomass,” which means waste and by-products from agroindustrial activities, like livestock manure, hay, and agroindustrial waste, which are often still considered environmental problems and treated as waste.

Even new EU policies are promoting “integration biomass” to produce advanced biofuels like biomethane according to the principles of circular economy. In particular, EU Directive 2015/1513 of the European Parliament and Council of 9 September 2015 [

12], amending Directive 98/70/EC relating to the quality of petrol and diesel fuels and amending Directive 2009/28/EC on the promotion of the use of energy from renewable sources, also known as ILUC (indirect land use change), protects some agricultural lands.

Therefore, European Renewable Energy Directive 2018/2001 (RED II) [

13] prioritizes low indirect land use change risk bioenergy production, supporting biofuels from by-products, residues, and lignocellulosic biomasses, so called “advanced” biofuels with low ILUC impact [

14].

ILUC can occur when agricultural lands, previously destined to produce food and feed for human or animal markets, are diverted to biofuel production. This implies land use change (by changing such areas into agricultural land) and may cause the release of greenhouse gas emissions (CO

2 stored in trees and soil), which negate the emission savings from the use of biofuels instead of fossil fuels [

15].

Moreover, as defined by D’Adamo et al. [

16], the use of residual biomasses to produce biofuels is decisive to contribute to the so called “sustainability contention of biofuel” as it would not have an impact on the consumption of land and water for the food supply. Furthermore, the energy production from biomass can reinforce the economic competitivity of agricultural companies [

17,

18,

19].

The

Biogasdoneright® approach has developed well in Italy [

20], but Southern Italy is well behind in anaerobic digestion, leaving the great potential of this area unfulfilled and to some in the industry unknown [

21,

22,

23]. This great biogas potential is above all due to the agricultural and climatic characteristics of these regions like the typical Mediterranean climate, marginal land ideal for growing species of interest for biomethane production (e.g.,

Opuntia spp.), and agrofood production suitable for agroindustrial processing from which large quantities of “integration biomass” (e.g., citrus pulp, olive mill waste) can be obtained. These examples fall well within the remit of attachment IX of EU Directive 2015/1513 to produce advanced biofuels.

According to this EU directive, the Southern Italian regions could cultivate

Sulla or

Sorghum to produce “advanced” biofuels when they are in rotation after cereals (e.g., durum wheat) destined for the traditional food or feed markets [

24,

25].

Moreover, advanced biofuel production could stimulate new financial investment, which would further create new jobs [

26,

27], contributing to the reinforcement of agriculture’s role as a source of economic development in rural areas [

28,

29]. Furthermore, digestate selling can improve the economic balance of the farms by replacing costs for fertilizers with sales revenues [

30]. This opportunity is very important in any area of the country but is even more so in the socioeconomic context of the South, where agriculture and agroindustry are at risk of becoming economically marginal with the consequent danger of closure and job losses.

The objective of this paper is to focus on a regulatory framework that is not always simple and linear and that probably puts off new investments and the creation of new opportunities. The complexity and lack of knowledge of the regulations on biofuel production and of anaerobic digested biomethane from waste and by-products create difficulties of interpretation and application. Consequently, the aim of this paper is to analyze the regulations for producing biomethane, underline the critical issues and opportunities, and evaluate whether an electrical plant built in the last 10 years in Italy can really be converted to a biomethane plant, thereby lengthening its lifespan.

2. The Regulations for Incentivizing Biomethane Production

The Italian National Energy Strategy (NES), approved in 2017, focussed attention on the opportunities offered by developing biomethane with particular reference to transportation sector emissions. In 2014, an interministerial decree (10 October 2014) had already specified that biomethane from residues, by-products, and second harvest crops were included among advanced biofuels whose incentivization became an EU priority from the 2015 EU Directive 1513.

This Italian approach to define the role of state-level incentives, the tendency to use biomethane for automotive, and the focus on residual biomasses and waste as feedstock for biomethane production is in line with the framework conditions described by Schimid et al. [

31] in other European and non-European countries.

Really, the regulations on incentivizing biomethane production were reported in a national guidance already in 2011 with Legislative Decree No. 28 (3 March 2011) [

32], whose dispositions were activated by a decree (5 December 2013) that defined the means of incentivization both by cogenerative plant and by transportation fueled by low-emission natural gas. In particular, the decree (5 December) provided for the use of already-existing equipment as regards the first two cases and detailed a new incentive specifically for emissions by the natural gas network. Economically, the major incentives were already reserved for the use of biomethane for transport vehicles, a sector in which Italy may have had greater difficulty in adhering to EU objectives.

In our opinion, as reported by Piechota and Igliński [

33], in Italy as well as in other European countries, the main strategy for refineries is to produce biomethane for the transport sector to obtain large quantities of advanced biofuels and to satisfy the request of the European members.

For plant viability, it had been necessary to wait for a series of guideline regulations: this phase needed a couple of years, but despite all the efforts by the institutions concerned, between 2015–2017 it had only been possible to set up one biomethane plant, and even that derived from the organic fraction of municipal solid waste (OFMSW).

The causes of this delay in setting up biomethane plants are probably the complexity of the system, which, especially for agricultural companies, required a brand-new entrepreneurial effort, but above all, because of the difficult “bankability” of the investments—evaluating the difficulty to valorize in a free market the Certificates of Release to Consumption of Biofuels (CIC) received by manager plants from the GSE (Gestore dei Servizi Elettrici) in accord with the biofuel quotas.

To relaunch investment for this new challenge, the second half of 2016 saw the revision of regulations to make the investment periods more ample up to and beyond 2020 and to resolve the critical issues that had previously “complicated” the setting up of a biomethane plant in the agriculture sector.

The regulation revision was completed with the publication of an interministerial decree, dated 2 March 2018, in the Gazzetta Ufficiale (Official Gazette), No. 65 (19 March 2018), on promoting the use of biomethane and other advanced biofuels for transportation [

34].

This Decree of 2 March 2018 aimed to promote biomethane and all the other “advanced” biofuels highlighted:

lengthening the access period for investments to beyond 2020, emphasizing the objectives behind the consumption of advanced biofuels with a forecasted growth over time that would overtake EU forecasts;

supplying greater guarantees of investment dividends by withdrawing the GSE’s CICs at an agreed price;

creating a specific obligation for advanced biofuels different from that for biomethane in order to offer prospective development and a market for these innovative products;

improving the prospects of converting a biogas plant for electrical energy to a biomethane plant;

improving the prospects of using biomethane in the form of liquefied natural gas (LNG), which could further increase the market share of gas in the transportation sector.

The decree applied to a new biomethane plant that started operating after 20 March 2018, when the law came into force. To be considered new, the plant must have brand-new sections for biogas production, conveying, purification, refining, and upgrading.

As regards the cumulability of incentives for a plant powered by agricultural or agroindustrial biomass, entitlement comes from the digesters and the upgrading sections for purifying and refining the biogas to obtain biomethane.

Furthermore, the decree applied to an already-existing plant that produced biogas and that from 20 March 2018 was partially or totally converted to biomethane production. In any case, any new plant and the converted ones should start operations by 31 December 2022. The annual production limit of biomethane is 1.1 Bn Sm3.

To guarantee transparency and monitor this limit, the GSE should publish on its site an advisory that 90% of the said limit has been reached, after which only a plant that has become operational in the subsequent 12 months may benefit from the mechanisms of the decree.

The decree (2 March 2018) defines new levels of the obligation for consumption taking into account the novelties introduced by the ILUC directive. The advanced biofuel target should be achieved by advanced biomethane together with the other advanced biofuels.

The obligation also persists after 2022, the updating mechanism also including the percentage split between advanced biomethane at 75% and 25% for the other advanced biofuels. The update should take into account the effective availability and advantageousness of the various advanced biofuels.

To be considered advanced and therefore qualify for the objectives described previously, the biomethane must be obtained from the materials listed in Part A of Attachment 3 of the decree (10 October 2014) and its subsequent modifications.

In order to supply operators with punctual updates on certain definitions cited in Attachment 3 (above), the decree lists a series of crops in rotation before or after the main crop can be used to produce advanced biofuels.

2.1. The Biomethane Incentive Mechanisms for Transportation

Since 2006, Italy has made biofuels available to reduce the consumption of petrol and diesel. Therefore, the GSE provides Certificates of Release to Consumption of Biofuels to those who is obliged to use biofuels, thereby showing that they (the GSE) have met their obligations. The CICs are saleable and are one of the main forms of incentivization for using renewable fuels.

In line with this procedure, even biomethane producers who contribute to the natural gas network for transportation and sell directly to a transportation gas distributor at an agreed market price can take part in the BCC mechanism.

In other words, any biomethane producer can ask the GSE for CICs for the quantities sold (within the natural gas network for transportation) and then sell the CICs to those who are obliged to pay the agreed market price.

In derogation to the mainstream, the decree specifies a monthly timetable for the release of the CICs and can recognize “double counting” or the release of one CIC for every 5 Gcal instead of every 10 Gcal when biomethane is produced from waste or by-products. For “double counting” to be recognized, the construction authorization and operation of the plant should explicitly indicate the use of such materials. The plant can codigest other materials provided that they do not exceed 30% by weight; “double counting” in this case is based on only 70% of the biomethane released for consumption.

This type of incentive covers all forms of biomethane not classified as “advanced” but will become so in the future once the 10-year incentivization period elapses and CICs are withdrawn.

The “traditional” mechanism described above until recently had been applied to both fossil fuels and renewable ones, so in most cases, CICs could have been used as an alternative to buying them.

By contrast, biomethane producers have no quota of fossil fuels for consumption, so they must sell their CICs at a fixed or minimal price. This uncertainty in the past caused difficulties in obtaining credit so much so that investments for the building of new biomethane plants were blocked, especially in agriculture.

To obviate this critical issue and relaunch investments in advanced biomethane production, the new decree instituted a direct withdrawal mechanism for CICs by the GSE, which includes being issued advanced biomethane. On request of the producer, this mechanism provides that the GSE withdraws advanced biomethane for transportation and distributes it through the network, whose affiliates must sell to third parties attributing directly the CIC value to the producer, including any “double counting,” fixed by the decree at 375 € for every CIC. Since advanced biomethane always respects “double counting,” “advanced” CICs are issued at one for every 5 Gcal of biomethane.

Apart from CICs, the GSE’s advanced biomethane is valued on average at −5% on the month of market registration of the natural gas network (MPGAS), which is run on its own site, Gestore dei Mercati Energetici (GME).

To cover the costs of these incentives, the charges earned by the CICs are invoiced by the GSE to those entitled to them in proportion to the required quota assigning them the corresponding CICs. Taking part in this mechanism is by choice to those entitled but has the advantage of guaranteeing exoneration from the “advanced” obligation for the percentage quota of biomethane irrespective of the quantities of biomethane actually withdrawn from the GSE.

Advanced biomethane and its CICs are withdrawn from the GSE chronologically according to the initial date of the plant operation, which can be deduced from the plant table issued by the GSE and up to the maximum quantity withdrawable or the obliged quota of advanced biomethane (75% of the overall obligation for the “advanced” fuels).

This mechanism is applicable to the production of a plant that begins operating before 31 December 2022 for a maximum period of 10 years from the eligibility date of the incentive. As reported above, after 10 years, the biomethane producer can operate in the “traditional” market by only issuing CICs at a value negotiable on the market.

The decree provides for choosing between total and partial withdrawal of the biomethane produced, whereas the BCC countervalue always corresponds to the entirety of the production. If the consumption quota occurs via an alternative network to that with an obligation to connect to third parties, the producer can only benefit from CICs being issued and their withdrawal at the value fixed by the GSE.

The CIC and biomethane value is established monthly by the GSE with an initial delay of 3 months from the issuance of the biomethane.

To conclude the advanced biomethane issues, it should be underlined that even this decree stipulates that if the advanced biomethane producer is an agricultural business, taking out CICs is cumulable with other public incentives aimed at constructing a plant for up to 40% of the investment.

2.2. Distribution and Liquefaction Plants for Advanced Biomethane

Local investments are very important for cofinancing the development of an infrastructure for biomethane in rural areas and not only for that [

35].

To obtain increased methane consumption and therefore biomethane in the transportation sector, simply producing more is not sufficient unless it is accompanied by greater application by consumers, who in turn are discouraged from buying methane vehicles due to lack of methane distributors [

36,

37,

38]. Much more widespread liquefaction plants are absolutely necessary for promoting the use of biomethane for heavy transportation and local networks for public transport [

39,

40].

In other words, a vicious circle is created: the number of vehicles does not increase unless the distribution plants are more widespread, which are not built if the vehicles in circulation are not powered by biomethane. To make this circle “virtuous,” the decree has put in place an increased number of CICs recognized by those producers who build new natural gas distribution plants and new liquefaction plants for biomethane. The increase in CICs is 20% with respect to the following maximums:

- (a)

for new compressed natural gas (CNG) distribution plants and/or liquefied natural gas (LNG), the value of the increase in CICs cannot be greater than 70% of the investment cost and in any case not greater than 600,000 €;

- (b)

for new biomethane liquefaction plants producing liquefied natural gas (LNG), the bonus value in CICs cannot be more than 70% of the investment cost and not over 1.2 M €.

The choice to produce CNG or LNG is determined for the plants and the subsidies to realize that stations are fundamental for improving their markets and reducing the initial costs [

41].

Such plants must be “pertinent” for advanced biomethane production, so they must be built by one or more biomethane producers and may also be located away from the biomethane production plant. Furthermore, only those plant builders that contribute more than 51% to the investment will be considered.

Should both plant types be built, they can benefit from both increases provided that they abide by each maximum.

Moreover, a distribution plant is considered new when the operations of unloading, storage, and supply to the customer have been newly built, even if it is built alongside an existing alternative fuel distribution plant. The increase is measured according to the quantity of biomethane or LNG produced and supplied to the consumer by the new distribution plant and is proportional to the financial share of each producer.

2.3. Opportunities for Converting Biogas Plant to Biomethane

For existing plants producing biogas for electricity, the decree provides for a total or partial conversion to biomethane and 100% access to incentives due to new plants by the GSE at 375 € per CIC.

For a converted plant, all new plant bonuses are applied provided that the conversion authorizations and those for operating the converted plant specify the type and weight of the materials used, and these coincide with those receiving bonuses for a new plant.

Should existing plants already benefit from incentives for energy produced and want to continue to benefit, the decree requires the following:

the residual period of a right to electricity incentives must not be less than 3 years or less than 2 years for biogas plants in operation prior to 31 December 2017;

biogas for electricity production provided that it is less than 70% of the average annual production incentivized prior to conversion.

The period of entitlement to CICs for the production of biomethane in a converted plant is the same as that for new plants—10 years from conversion. Subsequently, production can continue, and CICs can be obtained without the GSE retracting them.

Whatever a converted plant gets at the end of its right to incentives for producing electricity from renewable sources, any due CICs are recognized at 70% of those for a new plant.

2.4. The New Italian Mandatory Quota of Release for Consumption of Biofuels Intended for Transport

Last year, 2020, some innovations were introduced to relevant regulations and policies for biomethane. First, the Italian Ministry of Economic Development published the new Integrated National Plan for Energy and Climate 2030. The plan establishes the national targets for 2030 for energy efficiency, renewable sources, and reduction of CO2 emissions, as well as targets for energy security, single energy market and competitiveness, sustainable development, and mobility.

The plan in particular is structured on five lines of invention, which will then be developed in an integrated way—decarbonization, energy efficiency, energy security, development of the internal energy market, and research, innovation, and competitiveness—outlining for each of them the measures that will be implemented to ensure their achievement.

In detail, the Integrated National Plan for Energy and Climate for 2030 provides for measures concerning the transport sector, particularly sustainable mobility. The new share of renewable energy in transport fuel consumption is 22% by 2030, as set by the RED II directive’s targets.

Besides, the plan includes specific standards in order to promote electric mobility and the use of alternative fuels over traditional fossil fuels, particularly advanced biofuels like biomethane. According to the plan, the contribution of biomethane as a share of final consumption of energy in the transport sector shall be at least 75% of the total target (0.8 Mtoe) at 1.1 billion cubic meters by 2030.

As part of the promotion of the use of biofuels in transport and in order to achieve the goals of the plan, the government has decided to revise the legislation concerning the share of obligation to introduce a minimum share of biofuels and other specific renewable fuels for consumption. The Ministerial Decree of 30 December 2020, published in the Official Gazette, No. 3, of 5 January 2021, has introduced and updated the national system with new conditions and criteria for fulfilling the obligation, including advanced ones.

The new decree updates a previous minimum share provided for by the Decree of the Minister of Economic Development of 10 October 2014, increasing the mandatory quota of biofuels to be released for consumption by 2021 by 1%, thus raising the amount to 10%.

The share for advanced biofuels is also increased as listed below:

2.0% in 2021 (previously 1.5%);

2.5% in 2022 (previously 1.85%);

3.0% in 2023 (previously 1.85%).

Besides, it provides for advanced biofuels except biomethane an obligation in the amount of 0.5% by 2021 and 0.6% by 2022. This requirement will add a share according to standard procedure in Article 7 of the Ministerial Decree of 2 March 2018 (see

Table 1).

The guidelines published by the GSE specify that this new obligation can be fulfilled by purchasing the advanced biofuel produced by any production plant, even outside those included in the incentive ranking drawn up by the operator, considering compliance with sustainability requirements referred to in the Ministerial Decree of 14 November 2019 (national certification system for the sustainability of bioliquids and biofuels).

The method for calculating the traditional obligation is also revised, and it is no longer related to the quantities of advanced biofuels incentivized by the GSE. By now, the mandatory release for consumption of biofuels intended for transport will be in the amount of the difference between the overall obligation share and that of the three advanced ones.

In order to strongly encourage investments in this sector, the Ministerial Decree of 30 December 2020 meets the need to further increase the consumption of advanced biofuels, including biomethane, supporting an increase in demand from fuel distributors (parties subject to the obligation of release to consumption of biofuels and other specific renewable fuels).

The reshaping of the release for consumption of biofuels stands for an even more challenging goal for the development of the biomethane sector, particularly for agricultural biomethane.

This can ensure further virtuous production cycles, highlighting, among other things, the potential, largely still unexpressed, of renewable gas in Italy, together with appropriate investment planning and a congruous system of rules.

3. Discussions

In the preceding paragraph, we looked into the Decree of 2 March 2018, summarizing the new opportunities of the modified regulations for biomethane production.

Here, we look more closely into applying the decree and the types of incentivization in agriculture with some examples based on certain fuel types typical of a standard biomethane plant of 500 Sm3 or 1 MWel.

We considered three models that use different fuels from a mix of agricultural/animal biomasses to highlight the incentive levels available compared with an agricultural company’s annual costs for agricultural raw materials.

The three models refer to the production of advanced biomethane either at 100% or at up to 70%, since there is an entitlement to CICs from the GSE as specified by the regulations: one CIC for every 5 Gcal of biomethane produced rather than one CIC for every 10 Gcal. The CIC value is considered equal to that recognized by the GSE at 375 €.

Furthermore, the biomethane produced and released to the network via third-party connection, in addition to the CIC being recognized, can be sold to the GSE for 5% off the average monthly price on the cash market of natural gas (MPGAS) run by the GME.

In this case, the value considered for the income analysis is 16.94 €/MWh, which corresponds to the value registered by MPGAS in January 2021 (17.83 €/MWh) reduced by 5%.

Data from the literature supporting the models in

Table 2,

Table 3 and

Table 4 are based on average national data and processed by software developed in conjunction with Centro Ricerche Produzioni Animali (CRPA S.p.A.) of Reggio Emilia to highlight the benefits of converting an existing biogas plant given the costs of investment and biomass.

3.1. Example 1

Calculation based on 100% biomass of second harvest, which is covered by Attachment 3 of the Decree of 2 March 2018 for the production of advanced biomethane. The main assumptions of the model are as follows:

Plant operation: 8500 h/year.

Fuel: 100% triticale silage.

Hypothesized fuel cost: 40 €/ton.

Annual quantity of fuel to produce 500 Sm

3 biomethane/h plant: 18,000 tons. Data obtained from the “Biomass Project—Promotion of the development of biomass plants for energy transformation on farms” edited by ENAMA [

42].

CIC value: 375 €.

Table 2 shows the results of this model.

In this example, the biomethane plant is fueled by about 18,000 tons of raw material costing 700,000 € per year.

This type of plant produces about 2 M Sm3 of biomethane, entitling it to about 3000 CICs worth over 1 M €. In this case, 100% within the hypothesis of advanced biomethane production, the GSE issues one CIC every 5 Gcal (double counting method).

Furthermore, the annual revenue from the sale of biomethane to the GSE is about 350,000 €.

3.2. Example 2

Calculation based on a diet for the anaerobic digestion plant with 30% maize silage and 70% animal waste and by-products, which are covered by Attachment 3 of the decree (2 March 2018). The results of this case study are showed in

Table 3. The main assumptions of this model are as follows:

Plant operation: 8500 h/year.

Fuels: 70% cow sewage and olive oil pomace + 30% maize silage.

Hypothesized cost of maize silage: 50 €/ton. Source:

www.clal.it, accessed on 16 December 2020 [

43].

Hypothesized cost of cow sewage: 2 €/ton. Average cost estimate for sewage management, storage, and transport within the agricultural company.

Hypothesized cost of olive oil pomace: 45 €/ton. Source:

www.frantoionline.it, accessed on 8 January 2021 [

44].

Annual quantity of maize silage to fuel 500 Sm

3 biomethane/h plant: 7300 tons. Source: BTS Biogas [

45].

Annual quantity of cow sewage to fuel 500 Sm

3 biomethane/h plant: 20,075 tons. Source: BTS Biogas [

45].

Annual quantity of olive oil pomace to fuel 500 Sm

3 biomethane/h plant: 3650 tons. Source: BTS Biogas [

45].

CIC value: 375 €.

In Example 2, the 500 Sm3 biomethane/h biomethane plant should be fueled by about 30,000 tons of mixed raw materials at a cost of about 600,000 € per year.

This type of plant produces about 1.5 M Sm3 of biomethane, entitling it to more than 1600 CICs.

This type of plant is covered by Article 5, Paragraph 6, of the decree (2 March 2018), and is a codigestion plant fueled by by-products with other biological material (max. 30% by weight) for which double counting is allocated to only 70% of the biomethane production for total annual incentives of about 600,000 €.

Furthermore, the annual revenue from biomethane sales on the cash market for natural gas (MPGAS) run by the GME is about 300,000 €.

3.3. Example 3

Calculation based on a plant fueled by 30% second harvest crop and 70% animal waste and by-products. All the biomass used for the diet mix is covered by Attachment 3 of the decree for the production of advanced biomethane. The results of this example are showed in

Table 4. The main assumptions for this third case are as follows:

Plant operation: 8500 h/year.

Fuels: 70% cow sewage and olive oil pomace + 30% triticale silage (second harvest crop).

Hypothetical cost of triticale silage: 40 €/ton. Data obtained from “Biomass Project—Promotion of the development of biomass plants for energy transformation on farms”, edited by ENAMA [

42].

Hypothetical cost of cow sewage: 2 €/ton. Average cost estimate for sewage management, storage, and transport within the agricultural company.

Hypothetical cost of olive oil pomace: 45 €/ton. Source:

www.frantoionline.it, accessed on 8 January 2021 [

44].

Annual quantity of triticale silage to fuel 500 Sm

3 biomethane/h plant: 7300 tons. Source: BTS Biogas [

45].

Annual quantity of cow sewage to fuel 500 Sm

3 biomethane/h: 20,075 tons. Source: BTS Biogas [

45].

Annual quantity of olive oil pomace to fuel 500 Sm

3 biomethane/h plant: 3650 tons. Source: BTS Biogas [

45].

CIC value: 375 €.

In Example 3, the digesters for the production of 500 Sm3 biomethane/h should be fueled by about 30,000 tons of raw materials at a cost of 500,000 € per year.

This type of plant produces about 1.3 M Sm3 of biomethane, entitling it to about 2000 CICs. This case is 100% within the hypothesis of advanced biomethane production since all the raw materials are listed in Attachment 3, and so the GSE issues one BCC for every 5 Gcal for a total annual incentive of about 800,000 €.

Furthermore, the annual revenue for biomethane sales on the cash market of natural gas (MPGAS) run by the GME is about 250,000 €.

4. Conclusions

The aim of the three models has been to evaluate the economic benefits of using three different mixes of agricultural/animal raw materials in a biogas plant to produce biomethane.

The various hypotheses evaluated a discrete range with a variety of raw materials or waste to determine their benefits given that the most appropriate mix depended on the peculiar characteristics of the agricultural companies and market conditions.

The three models are incentivized differently according to raw material fuel type and their annual supply costs. Assumptions were made for market values and raw material costs, which are extremely variable factors directly influencing how much or how little the economic benefits are based on the choices made.

Analyzing the average biomass costs, the revenues from incentives, and those from the sales of the biomethane produced and made available to the network, Example 1 proved to be the most economically convenient in which the plant is entirely fueled by an agricultural product of second harvest (triticale silage). In this first case, the revenue generated from incentives and biomethane sales makes it better than the other two models with, on average, an income of 1 M €. Obviously, this conclusion is strongly influenced by raw material costs, which our hypothesis fixed at 40 € per ton.

In any case, it is evident that biomethane is a further opportunity for development with a high level of efficiency for all biogas producers, especially for many biogas plants whose incentivization period is about to finish. Anaerobic digestion and the subsequent production of biomethane could give rise to numerous economic and environmental benefits like (a) reducing agricultural and agroindustrial greenhouse gas (GHG) emissions, (b) maintaining agricultural biodiversity, (c) increasing the revenue of agricultural companies, and (d) improving the food safety of agrofood production.

The main strategy to convert all plants is to admit the usage of residual biomasses. Integration biomass does not have any direct or indirect impact on land use change but allows agricultural companies to improve sustainability, for example, by reducing greenhouse gases and maintaining biodiversity. Therefore, the use of integration biomass should be encouraged by whoever makes the laws.

All the biogas plants built in the last 10 years can benefit from a very interesting development—they can be converted, lengthening their lifespans and continuing to generate positive effects on economic, environmental, and social sustainability. This is a concrete opportunity to produce advanced biofuels and to fulfil the obligation to release for consumption.