Energy Pricing and Management for the Integrated Energy Service Provider: A Stochastic Stackelberg Game Approach

Abstract

:1. Introduction

- (1)

- A two-stage stochastic complementarity framework from the perspective of the IESP is developed to study the interactive operation between the IESP and user agent, which comprises energy price setting, DR strategy and energy management.

- (2)

- The proposed hierarchical model for energy pricing and management is transformed into a MILP problem through complementary transformation, the linearization method and strong duality principle in optimization theory.

- (3)

- Through the simulation of the integrated energy system (IES) in an industrial park, the impact of user agent DR and IESP’s electricity/gas/heat energy storage on energy pricing and management is analyzed.

2. Problem Description

- (1)

- Set energy prices: In the first stage of the upper-level issue, the IESP determines the retail electricity price, gas price and heat price to be released to the user agent the next day.

- (2)

- DR strategy: In the first stage of the lower-level problem, the user agent determines the DR strategy to optimize energy consumption pattern based on the retail energy prices issued by the IESP.

- (3)

- Energy management: In the second stage, the IESP optimizes IES operation and determines the electricity and gas purchase contracts in the energy wholesale market based on the energy consumption pattern of the user agent.

3. Problem Formulation

3.1. IESP’s Problem

3.2. User Agent’s Problem

4. Solving Method

4.1. Linearization of Complementary Constraints

4.2. Linearization of Bilinear Terms

4.3. Equivalent MILP

5. Case Study

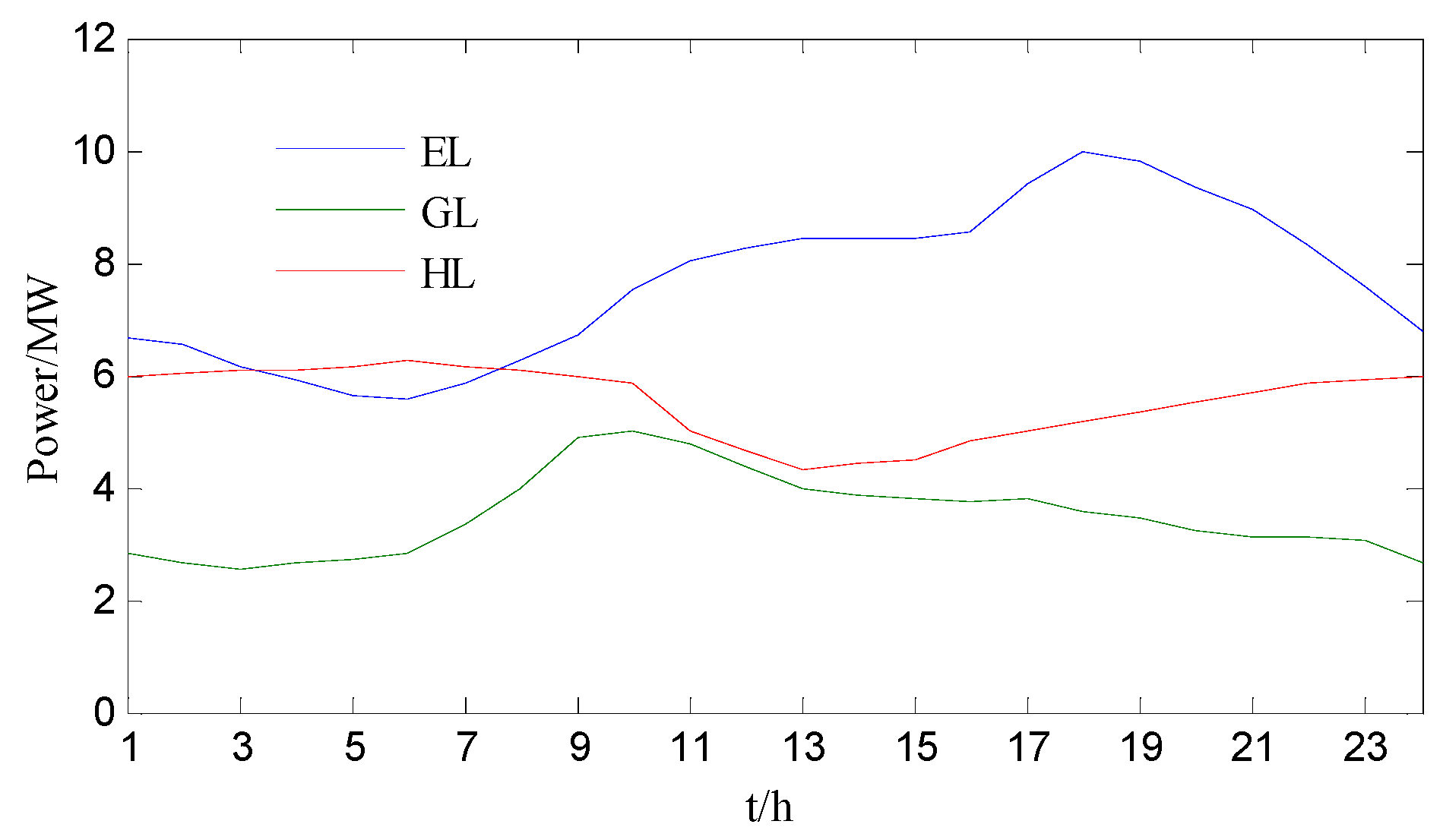

5.1. System Description

5.2. Impact of DR on Energy Pricing and Management

5.3. Sensitivity Analysis of Energy Storage Capacity

6. Conclusions

- (1)

- The participation of user agents in DR through flexible loads can effectively increase the profits of the IESP, reduce the energy cost of user agents and significantly promote the wind power utilization.

- (2)

- The IESP’s formulation of retail electricity prices is significantly affected by the DR strategy. The participation of flexible load in the DR can reduce retail electricity price fluctuations without affecting retail gas prices and heat prices.

- (3)

- The change in the ES capacity of the IESP has a significant impact on the profits of the IESP, and at the same time, it is more conducive to wind power utilization. GS and HS devices have little effect on the profits of the IESP, and the effect can be ignored.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, G.; Zhang, R.; Jiang, T.; Chen, H.; Bai, L.; Li, X. Security-constrained bi-level economic dispatch model for integrated natural gas and electricity systems considering wind power and power-to-gas process. Appl. Energy 2017, 194, 696–704. [Google Scholar] [CrossRef]

- Li, G.; Zhang, R.; Jiang, T.; Chen, H.; Bai, L.; Cui, H.; Li, X. Optimal dispatch strategy for integrated energy systems with CCHP and wind power. Appl. Energy 2017, 192, 408–419. [Google Scholar] [CrossRef]

- Lv, C.; Yu, H.; Li, P.; Wang, C.; Xu, X.; Li, S.; Wu, J. Model predictive control based robust scheduling of community integrated energy system with operational flexibility. Appl. Energy 2019, 243, 250–265. [Google Scholar] [CrossRef]

- Defeuilley, C. Retail competition in electricity markets. Energy Policy 2009, 37, 377–386. [Google Scholar] [CrossRef]

- Burger, S.; Chaves-Ávila, J.P.; Batlle, C.; Pérez-Arriaga, I.J. A review of the value of aggregators in electricity systems. Renew. Sustain. Energy Rev. 2017, 77, 395–405. [Google Scholar] [CrossRef]

- Zhou, Y.; Yu, W.; Zhu, S.; Yang, B.; He, J. Distributionally robust chance-constrained energy management of an integrated retailer in the multi-energy market. Appl. Energy 2021, 286, 116516. [Google Scholar] [CrossRef]

- Abada, I.; Massol, O. Security of supply and retail competition in the European gas market.: Some model-based insights. Energy Policy 2011, 39, 4077–4088. [Google Scholar] [CrossRef]

- Wei, W.; Liu, F.; Mei, S. Energy pricing and dispatch for smart grid retailers under demand response and market price uncertainty. IEEE Trans. Smart Grid 2014, 6, 1364–1374. [Google Scholar] [CrossRef]

- Nojavan, S.; Zare, K.; Mohammadi-Ivatloo, B. Optimal stochastic energy management of retailer based on selling price determination under smart grid environment in the presence of demand response program. Appl. Energy 2017, 187, 449–464. [Google Scholar] [CrossRef]

- Yang, J.; Zhao, J.; Luo, F.; Wen, F.; Dong, Z.Y. Decision-making for electricity retailers: A brief survey. IEEE Trans. Smart Grid 2017, 9, 4140–4153. [Google Scholar] [CrossRef]

- Sheikhahmadi, P.; Bahramara, S.; Moshtagh, J.; Damavandi, M.Y. A risk-based approach for modeling the strategic behavior of a distribution company in wholesale energy market. Appl. Energy 2018, 214, 24–38. [Google Scholar] [CrossRef]

- Van Hoesel, S. An overview of Stackelberg pricing in networks. Eur. J. Oper. Res. 2008, 189, 1393–1402. [Google Scholar] [CrossRef] [Green Version]

- De Miguel, V.; Xu, H. A stochastic multiple-leader Stackelberg model: Analysis, computation, and application. Oper. Res. 2009, 57, 1220–1235. [Google Scholar] [CrossRef] [Green Version]

- Yu, M.; Hong, S.H. A real-time demand-response algorithm for smart grids: A stackelberg game approach. IEEE Trans. Smart Grid 2015, 7, 879–888. [Google Scholar] [CrossRef]

- El Rahi, G.; Etesami, S.R.; Saad, W.; Mandayam, N.B.; Poor, H.V. Managing price uncertainty in prosumer-centric energy trading: A prospect-theoretic Stackelberg game approach. IEEE Trans. Smart Grid 2017, 10, 702–713. [Google Scholar] [CrossRef] [Green Version]

- Liu, N.; Yu, X.; Wang, C.; Wang, J. Energy sharing management for microgrids with PV prosumers: A Stackelberg game approach. IEEE Trans. Ind. Inf. 2017, 13, 1088–1098. [Google Scholar] [CrossRef]

- Khazeni, S.; Sheikhi, A.; Rayati, M.; Soleymani, S.; Ranjbar, A.M. Retail market equilibrium in multicarrier energy systems: A game theoretical approach. IEEE Syst. J. 2018, 13, 738–747. [Google Scholar] [CrossRef]

- Wang, J.; Li, D.; Lv, X.; Meng, X.; Zhang, J.; Ma, T.; Xiao, H. Two-Stage Energy Management Strategies of Sustainable Wind-PV-Hydrogen-Storage Microgrid Based on Receding Horizon Optimization. Energies 2022, 15, 2861. [Google Scholar] [CrossRef]

- Eltamaly, A.M.; Alotaibi, M.A. Novel fuzzy-swarm optimization for sizing of hybrid energy systems applying smart grid concepts. IEEE Access 2021, 9, 93629–93650. [Google Scholar] [CrossRef]

- Mossa, M.A.; Gam, O.; Bianchi, N. Dynamic Performance Enhancement of a Renewable Energy System for Grid Connection and Stand-alone Operation with Battery Storage. Energies 2022, 15, 1002. [Google Scholar] [CrossRef]

- Dolatabadi, A.; Jadidbonab, M.; Mohammadi-ivatloo, B. Short-term scheduling strategy for wind-based energy hub: A hybrid stochastic/IGDT approach. IEEE Trans. Sustain. Energy 2018, 10, 438–448. [Google Scholar] [CrossRef]

- Chen, J.J.; Qi, B.X.; Rong, Z.K.; Peng, K.; Zhao, Y.L.; Zhang, X.H. Multi-energy coordinated microgrid scheduling with integrated demand response for flexibility improvement. Energy 2021, 217, 119387. [Google Scholar] [CrossRef]

- Qi, H.; Yue, H.; Zhang, J.; Lo, K.L. Optimisation of a smart energy hub with integration of combined heat and power, demand side response and energy storage. Energy 2021, 234, 121268. [Google Scholar] [CrossRef]

- Alotaibi, M.A.; Eltamaly, A.M. A smart strategy for sizing of hybrid renewable energy system to supply remote loads in Saudi Arabia. Energies 2021, 14, 7069. [Google Scholar] [CrossRef]

- Zhou, Y.; Hu, W.; Min, Y.; Dai, Y. Integrated power and heat dispatch considering available reserve of combined heat and power units. IEEE Trans. Sustain. Energy 2018, 10, 1300–1310. [Google Scholar] [CrossRef]

- Kumamoto, T.; Aki, H.; Ishida, M. Provision of grid flexibility by distributed energy resources in residential dwellings using time-of-use pricing. Sustain. Energy Grids Netw. 2020, 23, 100385. [Google Scholar] [CrossRef]

- Aghaei, J.; Agelidis, V.G.; Charwand, M.; Raeisi, F.; Ahmadi, A.; Nezhad, A.E.; Heidari, A. Optimal robust unit commitment of CHP plants in electricity markets using information gap decision theory. IEEE Trans. Smart Grid 2016, 8, 2296–2304. [Google Scholar] [CrossRef]

- Gu, H.; Li, Y.; Yu, J.; Wu, C.; Song, T.; Xu, J. Bi-level optimal low-carbon economic dispatch for an industrial park with consideration of multi-energy price incentives. Appl. Energy 2020, 262, 114276. [Google Scholar] [CrossRef]

- Boyd, S.; Boyd, S.P.; Vandenberghe, L. Convex Optimization; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar]

- Taylor, J.A. Convex Optimization of Power Systems; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Fortuny-Amat, J.; McCarl, B. A representation and economic interpretation of a two-level programming problem. J. Oper. Res. Soc. 1981, 32, 783–792. [Google Scholar] [CrossRef]

- Javadi, M.; Marzband, M.; Domínguez-García; Mirhosseini Moghaddam, M. Non-cooperative game theory based energy management systems for energy district in the retail market considering DER uncertainties. IET Gener. Transm. Distrib. 2016, 10, 2999–3009. [Google Scholar]

- IBM ILOG. CPLEX[OL]. 2017. Available online: https://www.gams.com/latest/docs/S_CPLEX.html (accessed on 15 July 2017).

- Chattopadhyay, D. Application of general algebraic modeling system to power system optimization. IEEE Trans. Power Syst. 1999, 14, 15–22. [Google Scholar] [CrossRef]

- GAMS Development Corp. GAMS[OL]. 2017. Available online: http://www.gams.com/ (accessed on 15 July 2017).

| CHPP | 12 | 6 | 1.2 | 0.6 | 0.35 | 0.35 |

| GB | 16 | 8 | 2.4 | 1.2 | - | 0.75 |

| ES | 1.8 | 0.4 | 0.6 | 0.8 | 1 | 0.9 | 0.9 |

| GS | 2.7 | 0.6 | 0.9 | 1.5 | 2.1 | 0.95 | 0.95 |

| HS | 2.25 | 0.5 | 0.75 | 1.25 | 1.5 | 0.85 | 0.85 |

| DR | No DR | 10% DR | 20% DR | 30% DR | 40% DR |

|---|---|---|---|---|---|

| IESP’s expected profits (USD) | 6634.43 | 6806.78 | 6930.53 | 7039.01 | 7077.55 |

| User agent’ cost (USD) | 17,616.5 | 17,365.9 | 17,163.4 | 17,051.2 | 16,979.6 |

| Daily wind power curtailment (MWh) | 10.41 | 6.76 | 3.92 | 2.25 | 1.69 |

| Energy Storage Capacity Variation | IESP’s Expected Profits (USD) | Wind Power Curtailment (MW) | ||||

|---|---|---|---|---|---|---|

| ES | GS | HS | ES | GS | HS | |

| −50% | 6279.05 | 6790.09 | - | 7.74 | 6.76 | - |

| −25% | 6770.34 | 6799.62 | 6789.86 | 7.18 | 6.76 | 6.6 |

| 0 | 6806.79 | 6806.78 | 6806.78 | 6.76 | 6.76 | 6.76 |

| +25% | 6841.27 | 6810.35 | 6812.23 | 6.31 | 6.76 | 6.83 |

| +50% | 6874.73 | 6812.99 | 6813.41 | 5.86 | 6.76 | 6.83 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, H.; Wang, C.; Sun, W.; Khan, M.Q. Energy Pricing and Management for the Integrated Energy Service Provider: A Stochastic Stackelberg Game Approach. Energies 2022, 15, 7326. https://doi.org/10.3390/en15197326

Wang H, Wang C, Sun W, Khan MQ. Energy Pricing and Management for the Integrated Energy Service Provider: A Stochastic Stackelberg Game Approach. Energies. 2022; 15(19):7326. https://doi.org/10.3390/en15197326

Chicago/Turabian StyleWang, Haibing, Chengmin Wang, Weiqing Sun, and Muhammad Qasim Khan. 2022. "Energy Pricing and Management for the Integrated Energy Service Provider: A Stochastic Stackelberg Game Approach" Energies 15, no. 19: 7326. https://doi.org/10.3390/en15197326