The Impact of the COVID-19 Pandemic and Energy Crisis on CSR Policy in Transport Industry in Poland

Abstract

:1. Introduction

2. Literature Overview

2.1. CSR as a Philosophy of Corporate Action

2.2. Impact of Abnormal Situations on CSR-P

3. Materials and Methods

4. Results

4.1. CSR Policy Analysis

4.1.1. Raben’s CSR Policy

4.1.2. Schenker’s CSR Policy

4.1.3. DSV’s CSR Policy

4.2. Financial Data Analysis

4.3. Statistical Analysis

4.3.1. Examine the Significance of Differences in Selected Financial Parameters between the Group of Companies Studied and the Control Group

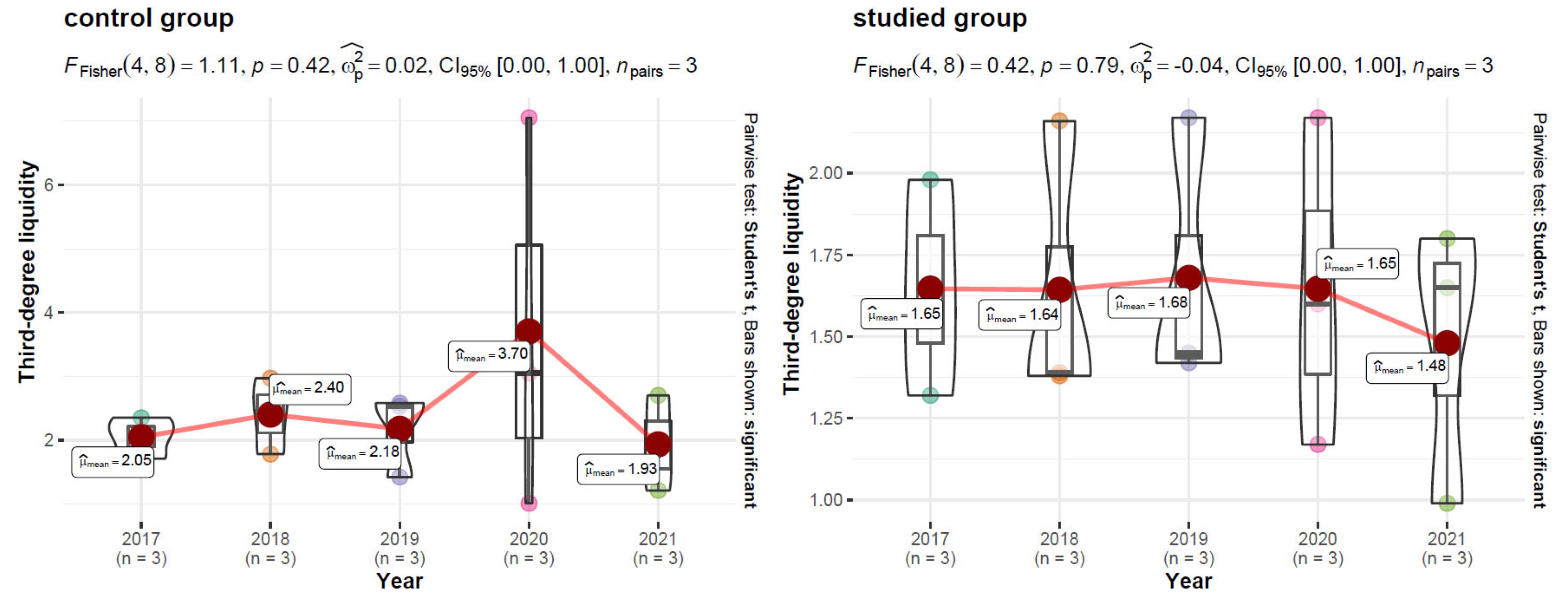

Classical Current Ratio (Third-Degree Liquidity)

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 2.05 (0.32) | 1.50 | 0.207 | 0.98 |

| studied | 1.65 (0.33) | ||||

| 2018 | control | 2.40 (0.60) | 1.76 | 0.120 | 1.12 |

| studied | 1.64 (0.45) | ||||

| 2019 | control | 2.18 (0.66) | 1.10 | 0.340 | 0.68 |

| studied | 1.68 (0.42) | ||||

| 2020 | control | 3.70 (3.07) | 1.14 | 0.370 | 0.55 |

| studied | 1.65 (0.5) | ||||

| 2021 | control | 1.93 (0.75) | 0.91 | 0.430 | 0.55 |

| studied | 1.48 (0.43) |

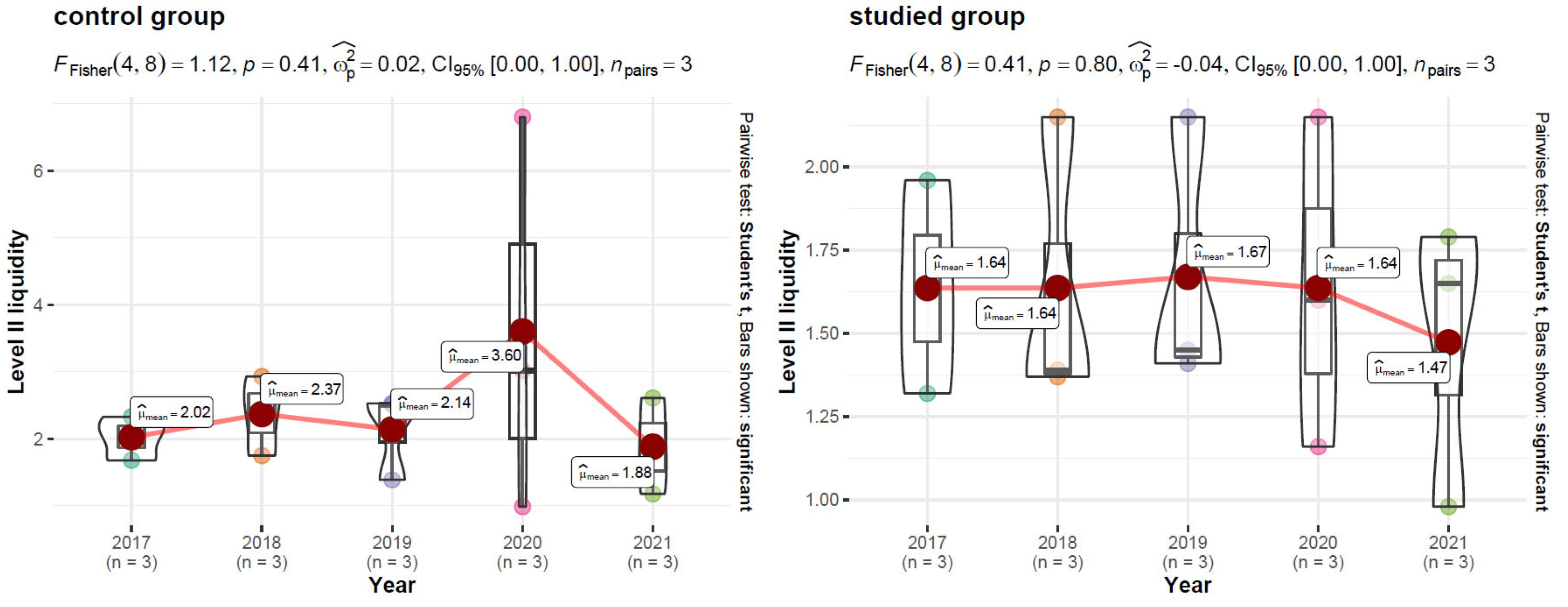

Classical Quick Liquidity Ratio (Second-Degree Liquidity)

Receivables Turnover Rate in Days (Receivables Cycle)

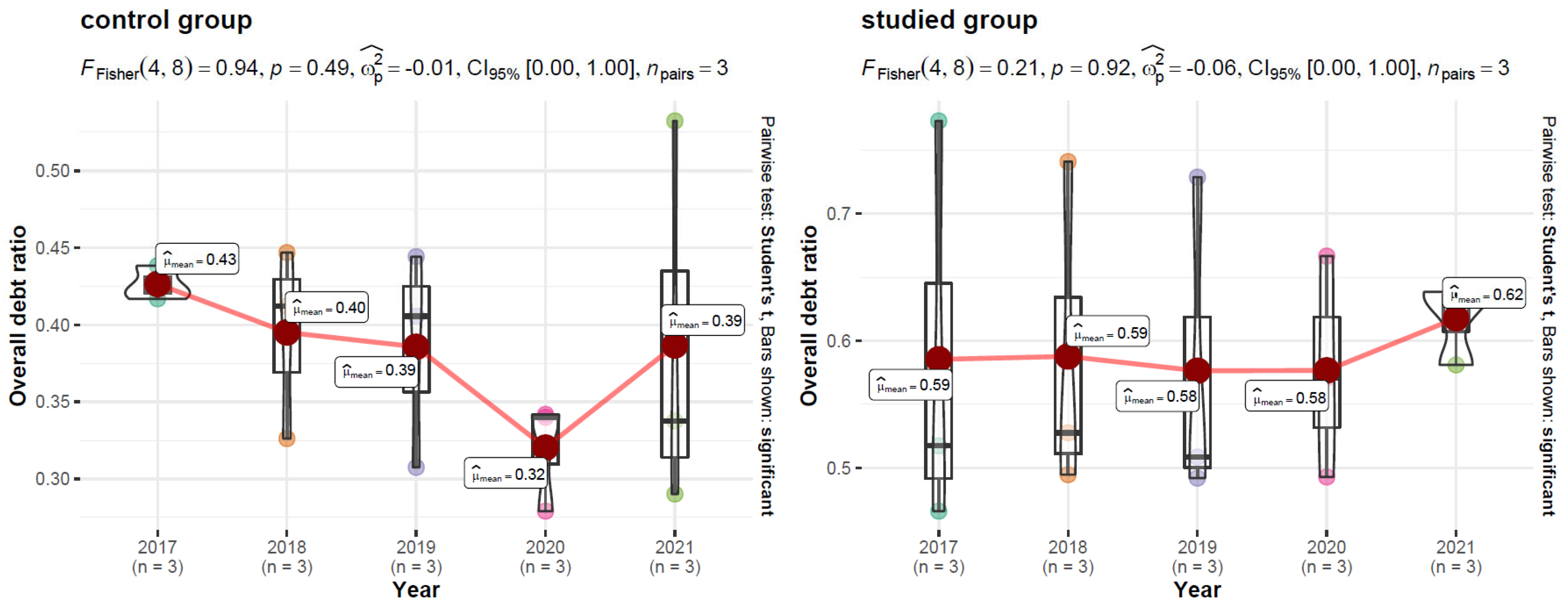

Overall Debt Ratio

Net Return on Sales (ROS)

Return on Assets (ROA)

Return on Equity (ROE)

4.3.2. Examine the Significance of Differences in Selected Financial Parameters within the Group of Companies Studied and the Control Group

Classical Current Ratio (Third-Degree Liquidity)

Classical Quick Liquidity Ratio (Second-Degree Liquidity)

Receivables Turnover Rate in Days (Receivables Cycle)

Overall Debt Ratio

Net Return on Sales (ROS)

Return on Assets (ROA)

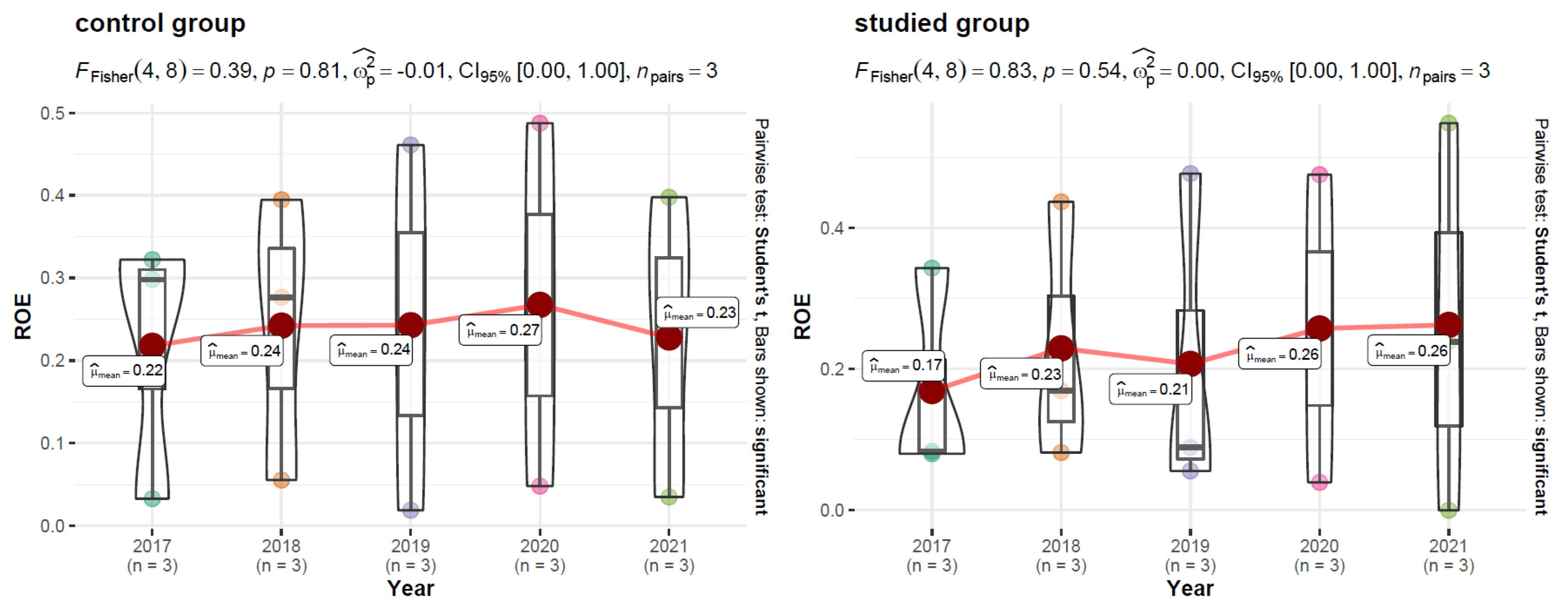

Return on Equity (ROE)

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| List of Abbreviations of the Names of Statistical Measures: | |

| N | sample size; |

| n | group sample |

| M | mean |

| SD | standard deviation |

| nobs | number of observations |

| df | degrees of freedom |

| p | p-value of statistical test |

| measure of Hedges g effect size | |

| CI 95% | confidence interval 95%; |

| tWelch | the t Welch test statistic |

| FFisher | the Fisher’s One-way ANOVA statistic |

| ω2p | omega square (partial) effect size |

| Other Abbreviations: | |

| CSR-P | CSR Policy |

References

- Haski-Leventhal, D.; Roza, L.; Meijs, L.C.P.M. Congruence in corporate social responsibility: Connecting the identity and behavior of employers and employees. J. Bus. Ethics 2017, 143, 35–51. Available online: https://link.springer.com/article/10.1007/s10551-015-2793-z (accessed on 13 September 2022). [CrossRef]

- Szutkowski, D.; Ratajczak, P. The Relation between CSR and Innovation. A Model Approach. J. Entrep. Manag. Innov. 2016, 12, 2. Available online: https://jemi.edu.pl/vol-12-issue-2-2016/the-relation-between-csr-and-innovation-model-approach (accessed on 13 September 2022).

- Jankal, R. The role of innovation in the assessment of the excellence of enterprise subjects. Procedia-Soc. Behav. Sci. 2014, 109, 541–545. [Google Scholar] [CrossRef] [Green Version]

- Jankalova, M. Business Excellence evaluation as the reaction on changes in global business environment. Procedia-Soc. Behav. Sci. 2012, 62, 1056–1060. [Google Scholar] [CrossRef] [Green Version]

- Saxton, G.D.; Waters, R.D. What do stakeholders like on Facebook? Examining public reactions to nonprofit organizations’ informational, promotional, and community-building messages. J. Public Relat. Res. 2014, 26, 280–299. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business is to Increase Its Profits. In Corporate Ethics and Corporate Governance; Springer: Berlin/Heidelberg, Germany, 2007. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Freeman, R.E. The new story of business: Towards a more responsible capitalism. Bus. Soc. Rev. 2017, 122, 449–465. Available online: https://onlinelibrary.wiley.com/doi/10.1111/basr.12123 (accessed on 13 September 2022). [CrossRef]

- Antonia García-Benau, M.; Sierra-Garcia, L.; Zorio, A. Financial crisis impact on sustainability reporting. Manag. Decis. 2013, 51, 1528–1542. [Google Scholar] [CrossRef]

- Sun, W.; Stewart, J.; Pollard, D. Reframing Corporate Social Responsibility. In Reframing Corporate Social Responsibility: Lessons from the Global Financial Crisis (Critical Studies on Corporate Responsibility, Governance and Sustainability), 1st ed.; Sun, W., Stewart, J., Pollard, D., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2010; pp. 3–19. [Google Scholar] [CrossRef]

- Oliveira, J.d.S.; Azevedo, G.M.d.C.; Silva, M.J.P.C. Institutional and economic determinants of corporate social responsibility disclosure by banks: Institutional perspectives. Meditari Account. Res. 2019, 27, 196–227. [Google Scholar] [CrossRef]

- Hackett, C. The rebirth of dependence-offering an alternative understanding of financial crisis. Int. J. Law Manag. 2014, 56, 121–135. [Google Scholar] [CrossRef] [Green Version]

- Bu, M.; Rotchadl, S.; Bu, M. A comparative analysis of corporate social responsibility development in the USA and China. Crit. Perspect. Int. Bus. 2022. [Google Scholar] [CrossRef]

- Bebchuk, L.A.; Tallarita, R. The illusory promise of stakeholder governance. Cornell Law Rev. 2020, 106, 91. Available online: https://heinonline.org/HOL/LandingPage?handle=hein.journals/clqv106&div=5&id=&page= (accessed on 5 September 2022). [CrossRef]

- Guthrie, J.; Mathews, M.R. Corporate social accounting in Australasia. In Research in Corporate Social Performance and Policy; JAI Press: New York, NY, USA, 1985; pp. 251–277. [Google Scholar]

- Matten, D.; Moon, J. Corporate social responsibility. J. Bus. Ethics 2004, 54, 323–337. [Google Scholar] [CrossRef] [Green Version]

- Carroll, A.B. Corporate social responsibility, evolution of a definitional construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Crane, A.; Matten, D. Corporate Social Responsibility as a Field of Scholarship. In Corporate Social Responsibility; Andrew Crane, Dirk Matten; Sage: London, UK, 2007; Volume I–III, Available online: https://ssrn.com/abstract=1865404 (accessed on 11 September 2022).

- Raimo, N.; Vitolla, F.; Nicolò, G.; Polcini, P.T. CSR disclosure as a legitimation strategy: Evidence from the football industry. Meas. Bus. Excel. 2021, 25, 493–508. Available online: https://www.emerald.com/insight/content/doi/10.1108/MBE-11-2020-0149/full/html (accessed on 11 September 2022). [CrossRef]

- Jones, D.A. Does serving the community also serve the company? Using organizational identification and social exchange theories to understand employee responses to a volunteerism program. J. Occup. Organ. Psychol. 2010, 83, 857–878. [Google Scholar] [CrossRef]

- Haski-Leventhal, D. Strategic Corporate Social Responsibility: A Holistic Approach to Responsible and Sustainable Business, 2nd ed.; SAGE Publications: Newbury Park, CA, USA, 2022. [Google Scholar]

- Johnson, M.P.; Schaltegger, S. Two Decades of Sustainability Management Tools for SMEs: How Far Have We Come? J. Small Bus. Manag. 2015, 54, 481–505. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/jsbm.12154 (accessed on 11 September 2022). [CrossRef]

- Boronat-Navarro, M.; Pérez-Aranda, J.A. Consumers’ perceived corporate social responsibility evaluation and support: The moderating role of consumer information. Tour. Econ. 2019, 25, 613–638. Available online: https://journals.sagepub.com/doi/10.1177/1354816618812297 (accessed on 13 September 2022). [CrossRef]

- Variak, L. CSR reporting of companies on a global scale. Procedia-Soc. Behav. Sci. 2016, 39, 176–183. [Google Scholar]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. Available online: https://www.jstor.org/stable/259398?origin=crossref#metadata_info_tab_contents (accessed on 10 November 2022). [CrossRef]

- Greening, D.W.; Turban. D.B. Corporate social performance as a competitive advantage in attracting a quality workforce. Bus. Soc. 2000, 39, 254–280. [Google Scholar] [CrossRef]

- Simionescu, L.N.; Dumitrescu, D. Empirical Study toward Corporate Social Responsibility Practices and Company Financial Performance. Evidence for Companies Listed on the Bucharest Stock Exchange. Sustainability 2018, 10, 3141. [Google Scholar] [CrossRef]

- Lee, Y.-J.; Cho, M. Socially stigmatized company’s CSR efforts during the COVID-19 pandemic: The effects of CSR fit and perceived motives. Public Relat. Rev. 2022, 48, 284–289. [Google Scholar] [CrossRef]

- CSR in the Time of Coronavirus: Social Marketing & Corporate Brand. Available online: https://businessforimpact.georgetown.edu/uncategorized/csr-in-the-time-of-coronavirus-social-marketing-corporate-brands (accessed on 25 April 2022).

- Gutierrez, G. COVID-19 Poses New Challenges for Corporate Social Responsibility Efforts. 6 May 2020. Available online: https://www.kcl.ac.uk/news/covid-19-poses-new-challenges-corporate-social-responsibility-efforts#:~:text=Prioritizing%20the%20vulnerable,an%20even%20more%20urgent%20priority (accessed on 4 November 2022).

- Danisch, C. The Relationship of CSR Performance and Voluntary CSR Disclosure Extent in the German DAX Indices. Sustainability 2021, 13, 4904. [Google Scholar] [CrossRef]

- Wen, S.; Zhao, J. The Commons, the Common Good and Extraterritoriality: Seeking Sustainable Global Justice through Corporate Responsibility. Sustainability 2020, 12, 9475. [Google Scholar] [CrossRef]

- Bapuji, H.; Patel, C.; Ertug, G.; Allen, D.G. Corona crisis and inequality: Why management research needs a societal turn. J. Manag. 2020, 46, 1205–1222. [Google Scholar] [CrossRef]

- Fabig, H.; Boele, R. The Changing Nature of NGO Activity in a Globalising World: Pushing the Corporate Responsibility Agenda. IDS Bull. 2009, 30, 58–67. [Google Scholar] [CrossRef]

- Blowfield, M.; Frynas, J.G. Editorial Setting new agendas: Critical perspectives on Corporate Social Responsibility in the developing world. Int. Aff. 2005, 81, 499–513. [Google Scholar] [CrossRef]

- Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. A Renewed EU Strategy 2011-14 for Corporate Social Responsibility /* COM/2011/0681 Final */. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:52011DC0681&from=EN (accessed on 4 November 2022).

- Holme, R.; Watts, P. Corporate Social Responsibility: Making Good Business Sense; World Business Council for Sustainable Development: Conches-Geneva, Switzerland, 2000; Available online: https://www.worldcat.org/title/corporate-social-responsibility-making-good-business-sense/oclc/53238304 (accessed on 4 November 2022).

- Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 Amending Directive 2013/34/EU as Regards Disclosure of Non-Financial and Diversity Information by Certain Large Undertakings and Groups, Official Journal of the European Union, L330/1. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32014L0095&from=PL (accessed on 4 November 2022).

- Kein, M.; Harford, T. Corporate responsibility: When will voluntary reputation building improve standards? Public Policy J. 2004, 271. Available online: http://www.energytoolbox.org/library/water_utility_corporatization/references/Corporate_Responsibility.pdf (accessed on 4 November 2022).

- How Do Poles Perceive Green Transportation? Available online: https://raportcsr.pl/europejski-dzien-bez-samochodu-jak-polacy-postrzegaja-ekologiczny-transport/ (accessed on 4 November 2022).

- Stawicka, E. Sustainable Business Strategies as an Element Influencing Diffusion on Innovative Solutions in the Field of Renewable Energy Sources. Energies 2021, 14, 5453. [Google Scholar] [CrossRef]

- Svenson, G.; Wood, G.; Callaghan, M. A corporate model of sustainable business practices: An ethical perspective. J. World Bus. 2010, 45, 336–345. [Google Scholar] [CrossRef]

- Steurer, R. The role of governments in corporate social responsibility: Characterizing public policies on CSR in Europe. Policy Sci. 2010, 43, 49–72. Available online: https://www.jstor.org/stable/40586552 (accessed on 4 November 2022). [CrossRef]

- Clarkson, M.B.E. A stakeholder framework for analyzing and evaluating corporate social performance. Acad. Manag. Rev. 1995, 20, 92–117. Available online: https://www.jstor.org/stable/258888#metadata_info_tab_contents (accessed on 4 November 2022). [CrossRef]

- Mitchell, R.K. Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of Who and What Really Counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Cragg, W.; Greenbaum, A. Reasoning about Responsibilities: Mining Company Managers on What Stakeholders are Owed. J. Bus. Ethics 2002, 39, 319–335. Available online: https://ixtheo.de/Record/1785618199 (accessed on 4 November 2022). [CrossRef]

- Frooman, J. Stakeholder Influence Strategies. Acad. Manag. Rev. 1999, 24, 191–205. [Google Scholar] [CrossRef]

- Post, J.E.; Preston, L.E.; Sachs, S. Redefining the Corporation: Stakeholder Management and Organizational Wealth. In Stanford Business Books, 1st ed.; Stanford University Press: Redwood City, CA, USA, 2002. [Google Scholar]

- European Council. Lisbon European Council 23 and 24 March 2000 Presidency Conclusions. Available online: https://www.europarl.europa.eu/summits/lis1_en.htm (accessed on 4 November 2022).

- European Council. Review of the EU Sustainable Development Strategy (EU SDS)—Renewed Strategy 10917/06. Available online: https://data.consilium.europa.eu/doc/document/ST%2010917%202006%20INIT/EN/pdf (accessed on 4 November 2022).

- Dyllick, T.; Hickerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Carroll, A.B. The Four Faces of Corporate Citizenship. Bus. Soc. Rev. 2003, 100, 1–7. Available online: https://onlinelibrary.wiley.com/doi/10.1111/0045-3609.00008 (accessed on 4 November 2022). [CrossRef]

- Matten, D.; Moon, J. “Implicit” and “Explicit” CSR: A Conceptual Framework for a Comparative Understanding of Corporate Social Responsibility. Acad. Manag. Rev. 2008, 33, 51–66. [Google Scholar] [CrossRef] [Green Version]

- Eberhard-Harribey, L. Corporate social responsibility as a new paradigm in the European policy: How CSR comes to legitimize the European regulation process. Corp. Gov. Int. J. Bus. Soc. 2006, 6, 358–368. Available online: https://www.emerald.com/insight/content/doi/10.1108/14720700610689487/full/html (accessed on 4 November 2022).

- Smith, N.C. Changes in Corporate Practices in Response to Public Interest Advocacy and Actions. In Handbook of Marketing and Society; Bloom, P.N., Gundlach, G.T., Eds.; Sage Publications, Inc: Thousand Oaks, CA, USA; London, UK; New Delhi, India, 2001; Available online: https://books.google.pl/books?hl=pl&lr=&id=qlPqBu48IvUC&oi=fnd&pg=PR7&dq=Handbook+of+Marketing+and+Society.+Thousand+Oaks,+2001.&ots=G583Vg6M23&sig=jjPg0sVpj7kLSlFdCWdtvJWztKk&redir_esc=y#v=onepage&q=Handbook%20of%20Marketing%20and%20Society.%20Thousand%20Oaks%2C%202001.&f=false (accessed on 4 November 2022).

- Lantos, G.P. The Boundaries of Strategic Corporate Social Responsibility. J. Consum. Mark. 2001, 18, 595–632. [Google Scholar] [CrossRef]

- Husted, B.W.; Allen, D.B. Strategic corporate social responsibility and value creation among large firms: Lessons from the Spanish experience. Long Range Plan. 2007, 40, 594–610. [Google Scholar] [CrossRef] [Green Version]

- Porter, M.E.; Kramer, M.R. Strategy and Society: The Link Between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 78–92. Available online: https://hbr.org/2006/12/strategy-and-society-the-link-between-competitive-advantage-and-corporate-social-responsibility (accessed on 4 November 2022).

- Chandler, D. Strategic Corporate Social Responsibility: Sustainable Value Creation; SAGE Publications, Inc: Thousand Oaks, CA, USA, 2016; Available online: https://www.worldcat.org/title/strategic-corporate-social-responsibility-sustainable-value-creation/oclc/957324862 (accessed on 4 November 2022).

- Heslin, P.A.; Ochoa, J.D. Understanding and developing strategic corporate social responsibility. Organ. Dyn. 2008, 37, 125–144. [Google Scholar] [CrossRef]

- Flammer, C. Does Corporate Social Responsibility Lead to Superior Financial Performance? A Regression Discontinuity Approach. Manag. Sci. 2015, 61, 2549–2568. [Google Scholar] [CrossRef] [Green Version]

- Flammer, C. Competing for government procurement contracts: The role of corporate social responsibility. Strateg. Manag. J. 2018, 39, 1299–1324. [Google Scholar] [CrossRef]

- Flammer, C. Corporate green bonds. J. Financ. Econ. 2021, 142, 499–516. [Google Scholar] [CrossRef]

- Borghesi, R.; Houston, J.F.; Naranjo, A. Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Financ. 2014, 26, 164–181. [Google Scholar] [CrossRef]

- Ferrell, A.; Hao, L.; Renneboog, L. Socially responsible firms. J. Financ. Econ. 2016, 122, 585–606. [Google Scholar] [CrossRef] [Green Version]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social Capital, Trust, and Firm Performance: The Value of Corporate Social Responsibility during the Financial Crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef] [Green Version]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Resiliency of Environmental and Social Stocks: An Analysis of the Exogenous COVID-19 Market Crash. Rev. Corp. Financ. Stud. 2020, 9, 593–621. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Creating Shared Value. In Harvard Business Review; FSG: Boston, MA, USA, 2011; Available online: https://hbr.org/2011/01/the-big-idea-creating-shared-value (accessed on 4 November 2022).

- Peters, J.; Simaens, A. Integrating sustainability into corporate strategy: A case study of the textile and clothing industry. Sustainability 2020, 12, 6125. Available online: https://www.mdpi.com/2071-1050/12/15/6125 (accessed on 4 November 2022). [CrossRef]

- Aarstad, J.; Jakobsen, S.-E. Norwegian firms’ green and new industry strategies: A dual challenge. Sustainability 2020, 12, 361. Available online: https://www.mdpi.com/2071-1050/12/1/361 (accessed on 4 November 2022). [CrossRef] [Green Version]

- Lloret, A. Modeling corporate sustainability strategy. J. Bus. Res. 2016, 69, 418–425. Available online: https://linkinghub.elsevier.com/retrieve/pii/S0148296315002787 (accessed on 4 November 2022). [CrossRef]

- Coombs, W.T.; Holladay, S.J. The negative communication dynamic: Exploring the impact of stakeholder affect on behavioral intentions. J. Commun. Manag. 2007, 11, 300–312. Available online: https://www.emerald.com/insight/content/doi/10.1108/13632540710843913/full/html (accessed on 14 November 2022). [CrossRef]

- Grappi, S.; Romani, S. Company Post-Crisis Communication Strategies and the Psychological Mechanism Underlying Consumer Reactions. J. Public Relat. Res. 2015, 27, 22–45. [Google Scholar] [CrossRef]

- Arpan, L.M.; Roskos-Ewoldsen, D.R. Stealing thunder: Analysis of the effects of proactive disclosure of crisis information. Public Relat. Rev. 2005, 31, 425–433. [Google Scholar] [CrossRef]

- Kim, J.; Kim, H.J.; Cameron, G.T. Making nice may not matter: The interplay of crisis type, response type and crisis issue on perceived organizational responsibility. Public Relat. Rev. 2009, 35, 86–88. [Google Scholar] [CrossRef]

- Ham, C.D.; Kim, J. The effects of CSR communication in corporate crises: Examining the role of dispositional and situational CSR skepticism in context. Public Relat. Rev. 2020, 46, 101792. [Google Scholar] [CrossRef]

- Janssen, C.; Sen, S.; Bhattacharya, C. Corporate crises in the age of corporate social responsibility. Bus. Horiz. 2015, 58, 183–192. [Google Scholar] [CrossRef]

- Burnett, J.J. A strategic approach to managing crises. Public Relat. Rev. 1998, 24, 475–488. Available online: https://www.scopus.com/record/display.uri?eid=2-s2.0-0032325568&origin=inward (accessed on 14 November 2022). [CrossRef]

- Chesbrough, H. To recover faster from COVID-19, open up: Managerial implications from an open innovation perspective. Ind. Mark. Manag. 2020, 88, 410–413. Available online: https://www.sciencedirect.com/science/article/pii/S001985012030300X?via%3Dihub (accessed on 13 September 2022). [CrossRef]

- Renjen, P. The Heart of Resilient Leadership: Responding to COVID-19. A Guide for Senior Executives. Available online: https://www2.deloitte.com/global/en/insights/economy/covid-19/heart-of-resilient-leadership-responding-to-covid-19.html (accessed on 25 April 2022).

- Sohrabi, C.; Alsafi, Z.; O’Neill, N.; Khan, M.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, R. World Health Organization declares global emergency: A review of the 2019 novel coronavirus (COVID-19). Int. J. Surg. 2020, 76, 71–76. [Google Scholar] [CrossRef] [PubMed]

- Burkert, A.; Loeb, A. Flattening the COVID-19 Curves. Social Distancing Imposes Hardships, But it Can Save Many Millions of Lives. Available online: https://blogs.scientificamerican.com/observations/flattening-the-covid-19-curves/ (accessed on 25 April 2022).

- Guidance on Social Distancing for Everyone in the, UK. Available online: https://www.gov.uk/government/publications/covid-19-guidance-on-social-distancing-and-for-vulnerable-people/guidance-on-social-distancing-for-everyone-in-the-uk-and-protecting-older-people-and-vulnerable-adults (accessed on 25 April 2022).

- Donthu, N.; Gustafsson, A. Effects of COVID-19 on business and research. J. Bus. Res. 2020, 117, 284–289. [Google Scholar] [CrossRef] [PubMed]

- Torreggiani, G.; Rosa De Giacomo, M. CSR representation in the public discourse and corporate environmental disclosure strategies in the context of Brexit. A cross-country study of France, Germany, and the United Kingdom. J. Clean. Prod. 2022, 367, 132783. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. A purpose-action framework for Corporate Social Responsibility in times of shock. J. Clean. Prod. 2021, 312, 127789. [Google Scholar] [CrossRef]

- Zhao, J. Reimagining Corporate Social Responsibility in the Era of COVID-19: Embedding Resilience and Promoting Corporate Social Competence. Sustainability 2021, 13, 6548. [Google Scholar] [CrossRef]

- Raynor, M.E. The Strategy Paradox: Why Committing to Success Leads to Failure (And What to Do About It); Crown Business: New York, NY, USA, 2007. [Google Scholar]

- Fighting the Energy Crisis. Available online: https://poland.representation.ec.europa.eu/news/walka-z-kryzysem-energetycznym-2022-10-07_pl (accessed on 18 October 2022).

- Maźkowiak-Pandera, J.; Gawlikowska-Fyk, A. The End of Energy Imports from Russia? Available online: https://www.forum-energii.eu/pl/blog/stop-import-rosja (accessed on 10 October 2022).

- Pawlowski, D. Energy Crisis 2022—Causes, Price Increases. How to Cope? Available online: https://magazynprzedsiebiorcy.pl/kryzys-energetyczny (accessed on 15 October 2022).

- EU Sanctions Against Russia Explained. Available online: https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/sanctions-against-russia-explained/ (accessed on 18 October 2022).

- CSO, 2021: Import Dependency = Imports/Domestic Consumption. Available online: https://stat.gov.pl/obszary-tematyczne/srodowisko-energia/energia/energia-2021-folder,1,9.html (accessed on 1 September 2022).

- Kleinschmidt, P.; Maćkowiak-Pandera, J. More Than a Trillion Zlotys for the Import of Energy Resources to Poland. Available online: https://www.forum-energii.eu/pl/blog/import-paliw-kopalnych (accessed on 1 September 2022).

- National Fiscal Policy Responses to the Energy Crisis. Available online: https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices (accessed on 1 September 2022).

- More Mining and Imports from Australia, Colombia and the US Will Replace Coal from Russia. Available online: https://cleanerenergy.pl/2022/03/30/wieksze-wydobycie-oraz-import-z-australii-kolumbii-i-usa-zastapia-wegiel-z-rosji/ (accessed on 1 September 2022).

- European Energy Secuity Strategy, Communication from the Commission to the European Parliament and the Council, Com (2014) 330 Final. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014DC0330&from=EN (accessed on 1 September 2022).

- Electricity and Gas Prices Are Hitting Businesses. The Entire Revenue Is Not Even Enough for One Bill. Available online: https://www.money.pl/gospodarka/ceny-pradu-i-gazu-uderzaja-w-firmy-caly-utarg-nie-starczy-nawet-na-jeden-rachunek-6807658764052992a.html (accessed on 1 September 2022).

- What to Know (and Do) About the UK’s Rising Energy Costs. Available online: https://www.entrepreneur.com/en-gb/business-news/what-to-know-and-do-about-the-uks-rising-energy-costs/435331 (accessed on 1 September 2022).

- Croatian Entrepreneurs Urge Government Action as Power Bills Triple. Available online: https://balkangreenenergynews.com/croatian-entrepreneurs-urge-government-action-as-power-bills-triple/ (accessed on 1 September 2022).

- Business Energy Prices to Be Cut by Half Expected Levels. Available online: https://www.bbc.com/news/business-62969427 (accessed on 1 September 2022).

- Electricity Prices Are Striking. Companies Will Raise Rates or Go Bankrupt. Available online: https://www.rp.pl/finanse/art36996211-ceny-pradu-porazaja-firmy-podniosa-stawki-albo-upadna (accessed on 5 September 2022).

- The Lancet. Redefining Vulnerability in the Era of COVID-19. Lancet 2020, 395, 1089. Available online: https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)30757-1/fulltext (accessed on 10 November 2022). [CrossRef]

- de Jong, M.D.T.; van der Meer, M. How Does It Fit? Exploring the Congruence Between Organizations and Their Corporate Social Responsibility (CSR) Activities. J. Bus. Ethics 2017, 143, 71–83. [Google Scholar] [CrossRef] [Green Version]

- Mott MacDonald. Available online: https://www.mottmac.com/views/adapting-corporate-social-responsibility-to-covid-19 (accessed on 25 April 2022).

- Kacprzak, M.; Milewska, A.; Kacprzak, A.; Król, A. Corporate Social Responsibility in the Era of the COVID-19 Pandemic on the Example of Companies from Poland, Belgium, and Ukraine. Eur. Res. Stud. J. 2021, 24, 547–562. [Google Scholar] [CrossRef]

- Sankar, C. 3 Ways Companies Have Shown Corporate Social Responsibility during the Pandemic. Available online: https://www.inc.com/carol-sankar/3-ways-companies-have-shown-corporate-social-responsibility-during-pandemic.html (accessed on 25 April 2022).

- Courier Asks: #Stayathome. Available online: https://youtu.be/gHAXPAPt5YE (accessed on 14 November 2022).

- Adamska-Cieśla, E. New dimension of CSR-pandemic verifies existing strategies. Marketer+ 2020, 6, 18–21. [Google Scholar]

- Edelman Trust Barometer. Available online: https://www.edelman.com/sites/g/files/aatuss191/files/2021-04/2021%20Edelman%20Trust%20Barometer%20Trust%20in%20Financial%20Services%20Global%20Report_website%20version.pdf (accessed on 14 November 2022).

- Responsible Business in Poland. Good Practices, Responsible Business Forum, Report 2017. 2017. Available online: https://odpowiedzialnybiznes.pl/wp-content/uploads/2018/04/Raport2017-1.pdf (accessed on 25 April 2022).

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Routledge: New York, NY, USA, 1998; Available online: https://www.utstat.toronto.edu/~brunner/oldclass/378f16/readings/CohenPower.pdf (accessed on 14 November 2022).

- Field, A. Discovering Statistics Using IBM SPSS Statistics, 4th ed.; Sage Publications Ltd.: Thousand Oaks, CA, USA, 2013; Available online: https://in.sagepub.com/en-in/sas/discovering-statistics-using-ibm-spss-statistics/book238032 (accessed on 14 November 2022).

- R Core Team R: A Language and Environment for Statistical Computing. R Foundation for Statistical Computing, Vienna, Austria. 2021. Available online: https://www.R-project.org (accessed on 14 November 2022).

- Ben-Shachar, M.S.; Lüdecke, D.; Makowski, D. Effectsize: Estimation of Effect Size Indices and Standardized Parameters. J. Open Source Softw. 2020, 5, 2815. Available online: https://joss.theoj.org/papers/10.21105/joss.02815 (accessed on 14 November 2022). [CrossRef]

- Kassambara, A. Rstatix: Pipe-Friendly Framework for Basic Statistical Tests. R Package Version 0.7.0. 2021. Available online: https://CRAN.R-project.org/package=rstatix (accessed on 14 November 2022).

- Lüdecke, D. Sjplot: Data Visualization for Statistics in Social Science. R Package Version 2.8.10. 2021. Available online: https://CRAN.R-project.org/package=sjPlot (accessed on 14 November 2022).

- Makowski, D.; Ben-Shachar, M.; Patil, I.; Lüdecke, D. Automated Results Reporting as a Practical Tool to Improve Reproducibility and Methodological Best Practices Adoption. 2021 CRAN. Available online: https://github.com/easystats/report (accessed on 14 November 2022).

- Patil, I. Visualizations with statistical details: The ‘ggstatsplot’ approach. J. Open Source Softw. 2021, 6, 3167. [Google Scholar] [CrossRef]

- Revelle, W. Psych: Procedures for Psychological, Psychometric, and Personality Research. Northwestern University, Evanston, Illinois, 2021. R Package Version 2.1.6. Available online: https://CRAN.R-project.org/package=psych (accessed on 14 November 2022).

- Wickham, H. Ggplot2: Elegant Graphics for Data Analysis; Springer: New York, NY, USA, 2016; Available online: https://ggplot2.tidyverse.org (accessed on 14 November 2022).

- CSR Report 2019 Raben Group. Available online: https://pl-api.raben-group.com/fileadmin/user_upload/Raport_Zrownowazonego_Rozwoju_2019.pdf (accessed on 6 September 2022).

- CSR Report 2020 Raben Group. Available online: https://pl-api.raben-group.com/fileadmin/user_upload/Raport_Zrownowazonego_Rozwoju_2020.pdf (accessed on 6 September 2022).

- CSR Report 2021 Raben Group. Available online: https://pl-api.raben-group.com/fileadmin/CSR/RABEN_Sustainability_Report_2021_vPL_FINAL.pdf (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2019 the Company Raben. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2020 the Company Raben. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2021 the Company Raben. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- CSR Report 2019–2020 DB Schenker. Available online: https://www.dbschenker.com/resource/blob/738080/7c3130fa8025f3321a02265710d35434/raport-zrównoważonego-rozwoju-2019-2020-data.pdf (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2019 the Company Schenker. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2020 the Company Schenker. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2021 the Company Schenker. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- CSR Report 2019 DVS. Available online: https://docs.dsv.com/group/group-compliance/responsibility-report-2019/?page=2 (accessed on 6 September 2022).

- CSR Report 2020 DVS. Available online: https://docs.dsv.com/group/group-compliance/corporate-responsibility-report-2020/?_ga=2.95128474.762161064.1666636775-1967800165.1666276763&_gl=1*1mh4zbo*_ga*MTk2NzgwMDE2NS4xNjY2Mjc2NzYz*_ga_2DYYPJ3BGM*MTY2NjYzNjc3NC4yLjEuMTY2NjYzNjk1Ny4wLjAuMA (accessed on 6 September 2022).

- CSR Report 2021 DVS. Available online: https://docs.dsv.com/group/group-compliance/corporate-sustainability-report-2021/?_ga=2.95128474.762161064.1666636775-1967800165.1666276763&_gl=1*1mh4zbo*_ga*MTk2NzgwMDE2NS4xNjY2Mjc2NzYz*_ga_2DYYPJ3BGM*MTY2NjYzNjc3NC4yLjEuMTY2NjYzNjk1Ny4wLjAuMA (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2020 the Company DSV. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Report on the Activities of the Board of Directors for the Year of 2021 the Company DSV. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Raben of 2019. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Raben of 2020. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Raben of 2021. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Schenker of 2019. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Schenker of 2020. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Schenker of 2021. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, DSV of 2019. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, DSV of 2020. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, DSV of 2021. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Raben of 2018. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Raben of 2017. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Schenker of 2018. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, Schenker of 2017. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, DSV of 2018. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Financial Statement, DSV of 2017. Available online: https://ekrs.ms.gov.pl/rdf/pd/search_df (accessed on 6 September 2022).

- Benchmarking Transfer Pricing Benchmarking Analysis 2017–2021.

- Skare, M.; Golja, T. The impact of government CSR supporting policies on economic growth. J. Policy Model. 2014, 36, 562–577. Available online: https://reader.elsevier.com/reader/sd/pii/S0161893814000192?token=01CBB43E3381F12CDD65E9EC25F271DED7B0F82A7E4EE45ACB6BE32D6D5C1C9A8313E1D62E4FA51281180347BA3B2188&originRegion=eu-west-1&originCreation=20221120091937 (accessed on 20 November 2022). [CrossRef]

- Navarro Espigares, J.L. Responsabilidad social corporativa y crecimiento económico. Estud. Econ. Apl. 2006, 24, 637–638. Available online: https://www.scopus.com/record/display.uri?eid=2-s2.0-84890169173&origin=inward (accessed on 20 November 2022).

- Magno, F.; Cassia, F. Effects of agritourism businesses’ strategies to cope with the COVID-19 crisis: The key role of corporate social responsibility (CSR) behaviours. J. Clean. Prod. 2021, 325, 129292. Available online: https://reader.elsevier.com/reader/sd/pii/S0959652621034776?token=6768EB979ABD5EFD64576E8C54EC192F289E63BD0D3A221BEF57F3094E10B87B74CD2D98110AF0EFEC4E02F8ADA9D20C&originRegion=eu-west-1&originCreation=20221120092932 (accessed on 20 November 2022). [CrossRef]

- Scott, N.; Laws, E. Tourism Crises and Disasters: Enhancing Understanding of System Effects. J. Travel Tour. Mark. 2006, 19, 149–158. Available online: https://www.tandfonline.com/doi/abs/10.1300/J073v19n02_12 (accessed on 20 November 2022). [CrossRef]

- Scott, N.; Laws, E. Tourism Crises and Marketing Recovery Strategies. J. Travel Tour. Mark. 2008, 23, 1–13. Available online: https://www.tandfonline.com/doi/abs/10.1300/J073v23n02_01 (accessed on 20 November 2022). [CrossRef] [Green Version]

- Alonso-Almeida, M.M.; Bremser, K. Strategic responses of the Spanish hospitality sector to the financial crisis. Int. J. Hosp. Manag. 2013, 32, 141–148. Available online: https://www.sciencedirect.com/science/article/pii/S0278431912000655 (accessed on 20 November 2022). [CrossRef]

- Gossling, S.; Scott, D.; Hall, C.M. Pandemics, tourism and global change: A rapid assessment of COVID-19. J. Sustain. Tour. 2020, 29, 1–20. Available online: https://www.scopus.com/record/display.uri?eid=2-s2.0-85089501412&origin=inward (accessed on 20 November 2022). [CrossRef]

| Founding | Target | Result |

|---|---|---|

| Customer loyalty and satisfaction | NPS ≥ 20 CSI ≥ 80 | NPS = 24 CSI = 82 |

| Fleet fill | 150% | 124% (+2%) |

| Modern fleet | 0% < EURO4 | 14% |

| An interdependent security culture | YES | NO |

| Neutralization of greenhouse gases | 1eFV = 1 tree | 100% |

| Founding | Target |

|---|---|

| Global market leader | Excellence in action |

| First choice supplier | Reliable supplier |

| A leader in responsibility | Cooperation with local communities |

| Digital value generator | Business model based on digitization |

| Productivity leader | Use of technology |

| Preferred employer | Employee development |

| Company | Year | Balance Total | Dynamics [%]. | Total Equity | Dynamics [%]. |

|---|---|---|---|---|---|

| Raben | 2021 | 1068.16 | 0.01 | 447.57 | −17.37 |

| 2020 | 1068.02 | 26.07 | 541.67 | 25.85 | |

| 2019 | 847.15 | 9.53 | 430.41 | 10.12 | |

| Schenker | 2021 | 795.15 | 0.79 | 287.44 | −15.15 |

| 2020 | 788.89 | 26.43 | 338.76 | 10.46 | |

| 2019 | 623.98 | 9.92 | 306.67 | 14.36 | |

| DSV | 2021 | 281.48 | 19.54 | 103.09 | 31.31 |

| 2020 | 235.46 | 49.97 | 78.51 | 84.3 | |

| 2019 | 157.01 | 1.13 | 42.60 | 5.88 |

| Company | Year | Net Profit | Dynamics [%]. | Revenues | Dynamics [%]. |

|---|---|---|---|---|---|

| Raben | 2021 | 245.30 | −4.70 | 2339.56 | 19.59 |

| 2020 | 257.40 | 25.47 | 1956.24 | 2.46 | |

| 2019 | 205.14 | 20.21 | 1909.23 | 7.50 | |

| Schenker | 2021 | 19.29 | −39.88 | 2294.74 | 29.14 |

| 2020 | 32.09 | −16.67 | 1776.99 | 1.38 | |

| 2019 | 38.52 | 564.15 | 1752.78 | 6.02 | |

| DSV | 2021 | 24.58 | 21.92 | 849.66 | 29.67 |

| 2020 | 20.16 | 751.75 | 655.25 | 14.04 | |

| 2019 | 2.36 | −65.18 | 574.58 | 8.62 |

| Company | Ratio | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|

| The entire industry | Classical current ratio (third-degree liquidity) | 1.52 | 1.51 | 1.48 | 1.58 | 1.68 |

| Classical quick liquidity ratio (second-degree liquidity) | 1.39 | 1.38 | 1.35 | 1.45 | 1.55 | |

| Receivables turnover rate in days (receivables cycle) | 64 | 66 | 64 | 65 | 61 | |

| Overall debt ratio | 65.92% | 65.5% | 67.16% | 67.52% | - | |

| Net Return on Sales (ROS) | 3.76% | 3.77% | 3.9% | 1.96% | 4.3% | |

| Return on assets (ROA) | 2.76% | 2.82% | 2.92% | 1.28% | - | |

| Return on assets (ROA) | 7.99% | 8.16% | 8.88% | 3.95% | - | |

| Raben | Classical current ratio (third-degree liquidity) | 1.98 | 2.16 | 2.17 | 2.17 | 1.80 |

| Classical quick liquidity ratio (second-degree liquidity) | 1.96 | 2.15 | 2.15 | 2.15 | 1.79 | |

| Receivables turnover rate in days (receivables cycle) | 51 | 51 | 47 | 48 | 50 | |

| Overall debt ratio | 51.73% | 49.46% | 49.19% | 49.28% | 58.10% | |

| Net Return on Sales (ROS) | 6.97% | 9.61% | 10.75% | 13.16% | 10.49% | |

| Return on assets (ROA) | 16.54% | 22.07% | 24.22% | 24.1% | 22.97% | |

| Return on assets (ROA) | 34.26% | 43.66% | 47.66% | 47.52% | 54.81% | |

| Schenker | Classical current ratio (third-degree liquidity) | 1.64 | 1.38 | 1.42 | 1.17 | 0.99 |

| Classical quick liquidity ratio (second-degree liquidity) | 1.63 | 1.37 | 1.41 | 1.16 | 0.98 | |

| Receivables turnover rate in days (receivables cycle) | 54 | 557 | 56 | 59 | 56 | |

| Overall debt ratio | 46.59% | 52.76% | 50.85% | 57.06% | 63.85% | |

| Net Return on Sales (ROS) | 3.76 | 3.77 | 3.9 | 1.96 | 4.3 | |

| Return on assets (ROA) | 2.76 | 2.82 | 2.92 | 1.28 | - | |

| Return on assets (ROA) | 7.99 | 8.16 | 8.88 | 3.95 | - | |

| DSV | Classical current ratio (third-degree liquidity) | 1.32 | 1.39 | 1.45 | 1.60 | 1.65 |

| Classical quick liquidity ratio (second-degree liquidity) | 1.32 | 1.39 | 1.45 | 1.60 | 1.65 | |

| Receivables turnover rate in days (receivables cycle) | 75 | 68 | 69 | 81 | 78 | |

| Overall debt ratio | 77.29% | 74.09% | 72.87% | 66.66% | 63.38% | |

| Net Return on Sales (ROS) | 0.58% | 1.29% | 0.41% | 3.08% | 2.89% | |

| Return on assets (ROA) | 1.90% | 4.38% | 1.51% | 8.56% | 8.73% | |

| Return on assets (ROA) | 8.36% | 16.90% | 5.56% | 25.68% | 23.84% |

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 2.02 (0.33) | 1.46 | 0.220 | 0.95 |

| studied | 1.64 (0.32) | ||||

| 2018 | control | 2.37 (0.59) | 1.71 | 0.170 | 1.09 |

| studied | 1.64 (0.44) | ||||

| 2019 | control | 2.14 (0.65) | 1.06 | 0.360 | 0.66 |

| studied | 1.67 (0.42) | ||||

| 2020 | control | 3.6 (2.95) | 1.14 | 0.370 | 0.55 |

| studied | 1.64 (0.5) | ||||

| 2021 | control | 1.88 (0.72) | 0.85 | 0.450 | 0.52 |

| studied | 1.47 (0.43) |

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 73.00 (12.29) | 1.25 | 0.280 | 0.82 |

| studied | 60.00 (13.08) | ||||

| 2018 | control | 69.33 (13.32) | 1.16 | 0.320 | 0.72 |

| studied | 58.67 (8.62) | ||||

| 2019 | control | 63.00 (9.64) | 0.67 | 0.540 | 0.43 |

| studied | 57.33 (11.06) | ||||

| 2020 | control | 64.00 (5.29) | 0.13 | 0.910 | 0.07 |

| studied | 62.67 (16.8) | ||||

| 2021 | control | 58.33 (6.66) | −0.32 | 0.770 | −0.18 |

| studied | 61.33 (14.74) |

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 0.43 (0.01) | −1.67 | 0.240 | −0.77 |

| studied | 0.59 (0.16) | ||||

| 2018 | control | 0.40 (0.06) | −2.26 | 0.110 | −1.30 |

| studied | 0.59 (0.13) | ||||

| 2019 | control | 0.39 (0.07) | −2.20 | 0.110 | −1.31 |

| studied | 0.58 (0.13) | ||||

| 2020 | control | 0.32 (0.04) | −4.72 | 0.020 | −2.63 |

| studied | 0.58 (0.09) | ||||

| 2021 | control | 0.39 (0.13) | −3.03 | 0.080 | −1.53 |

| studied | 0.62 (0.03) |

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 0.07 (0.02) | 1.29 | 0.270 | 0.82 |

| studied | 0.04 (0.03) | ||||

| 2018 | control | 0.08 (0.02) | 1.28 | 0.290 | 0.76 |

| studied | 0.05 (0.04) | ||||

| 2019 | control | 0.08 (0.06) | 0.63 | 0.560 | 0.41 |

| studied | 0.05 (0.05) | ||||

| 2020 | control | 0.12 (0.06) | 1.09 | 0.340 | 0.71 |

| studied | 0.06 (0.06) | ||||

| 2021 | control | 0.06 (0.02) | 0.19 | 0.860 | 0.12 |

| studied | 0.06 (0.04) |

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 0.12 (0.09) | 0.75 | 0.490 | 0.49 |

| studied | 0.07 (0.08) | ||||

| 2018 | control | 0.14 (0.10) | 0.52 | 0.630 | 0.34 |

| studied | 0.1 (0.11) | ||||

| 2019 | control | 0.14 (0.13) | 0.44 | 0.680 | 0.29 |

| studied | 0.1 (0.13) | ||||

| 2020 | control | 0.18 (0.14) | 0.64 | 0.560 | 0.41 |

| studied | 0.11 (0.12) | ||||

| 2021 | control | 0.13 (0.09) | 0.27 | 0.800 | 0.18 |

| studied | 0.11 (0.12) |

| Year | Group | M (SD) | tWelch | p | |

|---|---|---|---|---|---|

| 2017 | control | 0.22 (0.16) | 0.39 | 0.720 | 0.25 |

| studied | 0.17 (0.15) | ||||

| 2018 | control | 0.24 (0.17) | 0.09 | 0.930 | 0.06 |

| studied | 0.23 (0.18) | ||||

| 2019 | control | 0.24 (0.22) | 0.19 | 0.860 | 0.12 |

| studied | 0.21 (0.23) | ||||

| 2020 | control | 0.27 (0.22) | 0.06 | 0.960 | 0.04 |

| studied | 0.26 (0.22) | ||||

| 2021 | control | 0.23 (0.18) | −0.18 | 0.870 | −0.11 |

| studied | 0.26 (0.27) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stanislawska, M. The Impact of the COVID-19 Pandemic and Energy Crisis on CSR Policy in Transport Industry in Poland. Energies 2022, 15, 8892. https://doi.org/10.3390/en15238892

Stanislawska M. The Impact of the COVID-19 Pandemic and Energy Crisis on CSR Policy in Transport Industry in Poland. Energies. 2022; 15(23):8892. https://doi.org/10.3390/en15238892

Chicago/Turabian StyleStanislawska, Marta. 2022. "The Impact of the COVID-19 Pandemic and Energy Crisis on CSR Policy in Transport Industry in Poland" Energies 15, no. 23: 8892. https://doi.org/10.3390/en15238892

APA StyleStanislawska, M. (2022). The Impact of the COVID-19 Pandemic and Energy Crisis on CSR Policy in Transport Industry in Poland. Energies, 15(23), 8892. https://doi.org/10.3390/en15238892