Economic Analysis of P2G Green Hydrogen Generated by Existing Wind Turbines on Jeju Island

Abstract

:1. Introduction

2. Difference with Other Studies and Impact of the Result of This Study

2.1. Difference with Other Studies

2.2. Impact of the Result of This Study

3. Object and Method of Economic Analysis

3.1. Object of Economic Analysis

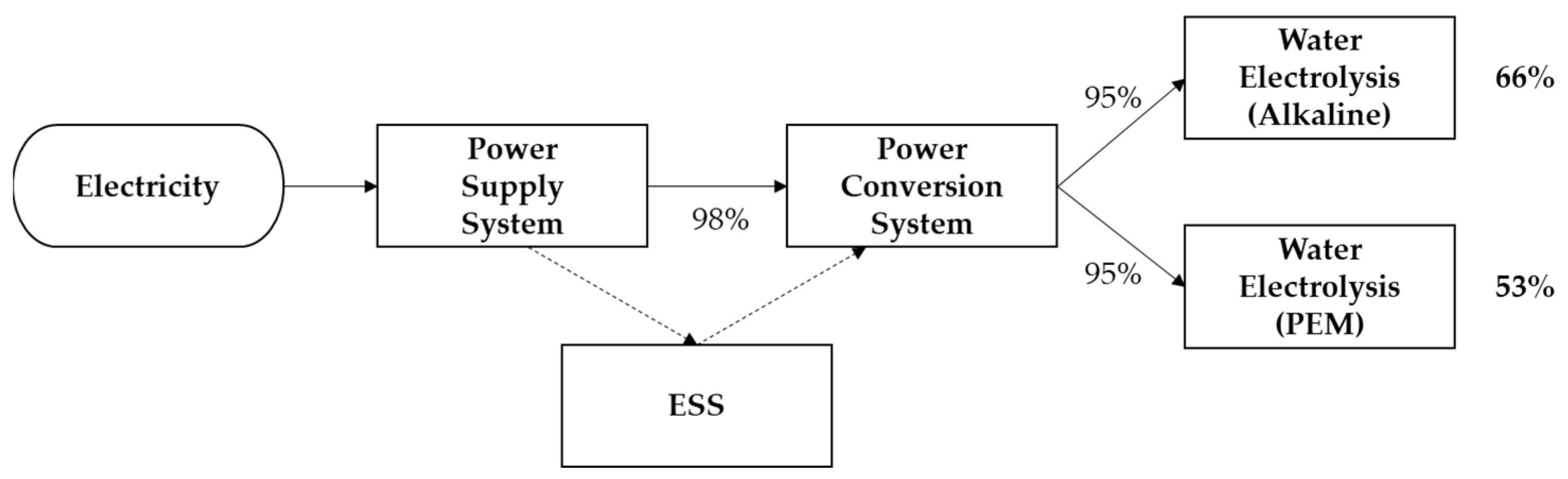

3.2. Configuration of the P2G System

2 H2O + 2 e− → H2 + 2 OH− (Cathode)

2 OH− → 1/2 O2 + H2O + 2 e− (Anode)

2 H+ + 2 e− → H2 (Cathode)

H2O → 1/2 O2 + 2 H+ + 2 e− (Anode)

3.3. Methodology of Economic Analysis

4. Premise of Economic Analysis

4.1. Premise Subject to Project Execution

4.2. Parameters or Assumptions Affecting Hydrogen Production

5. Calculation of Expenses and Amount of Hydrogen

5.1. Calculation Procedure

5.2. Calculation of Expenses

5.2.1. Capital Expenditure

5.2.2. Operating Expenditure

5.3. Calculation of the Amount of Electricity Supplied

5.4. Calculation of the Amount of Hydrogen Produced

6. Estimation of Hydrogen Cost by Scenarios

6.1. Organization of Economic Analysis Scenarios

6.2. Hydrogen Cost—According to Scenario I

6.3. Hydrogen Cost—According to Scenario II

6.4. Hydrogen Cost—According to Scenario III

6.5. Hydrogen Cost—According to Scenario IV

7. Sensitivity Analysis

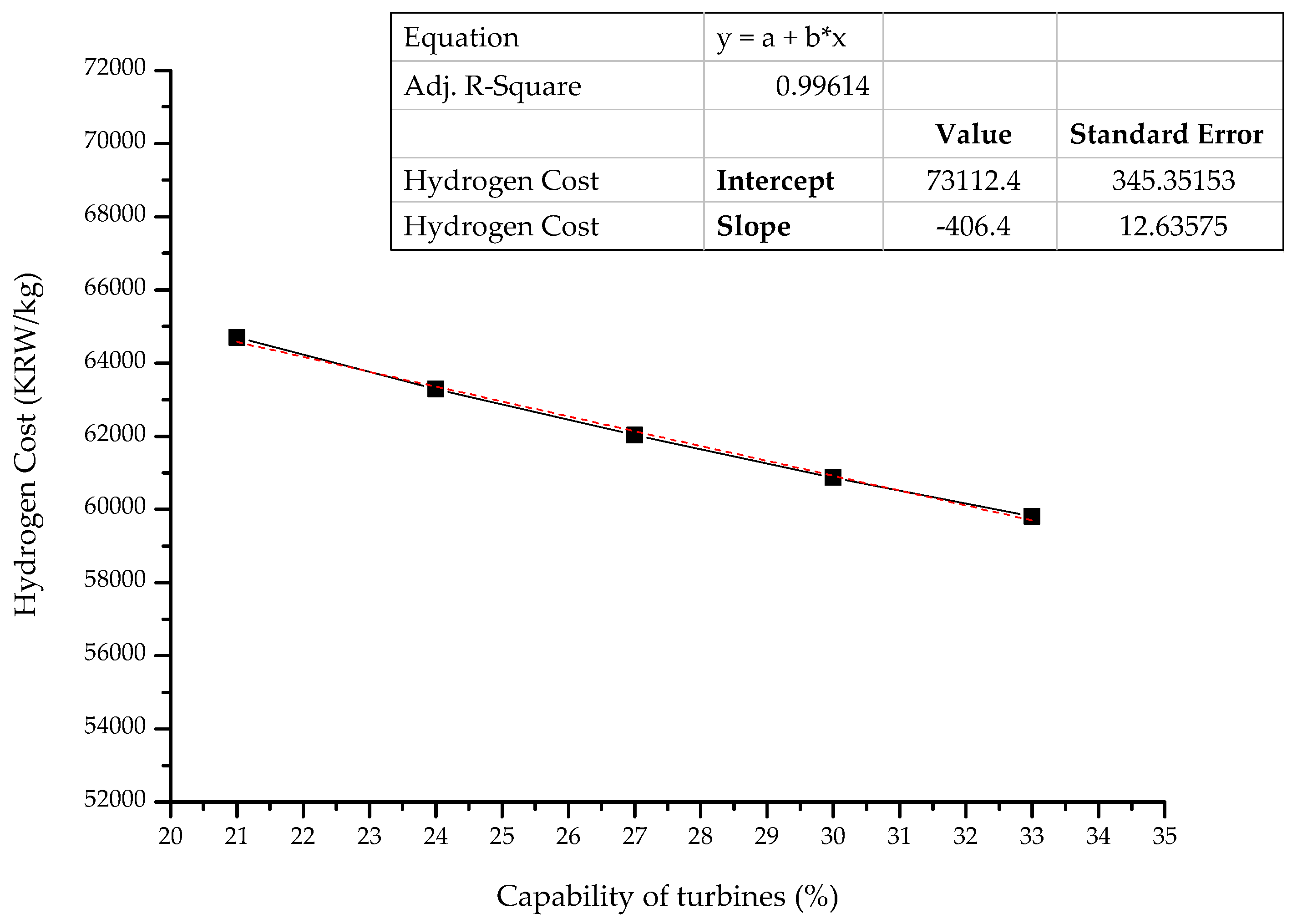

7.1. Variation in Hydrogen Cost Depending on the Capability of Wind Turbines

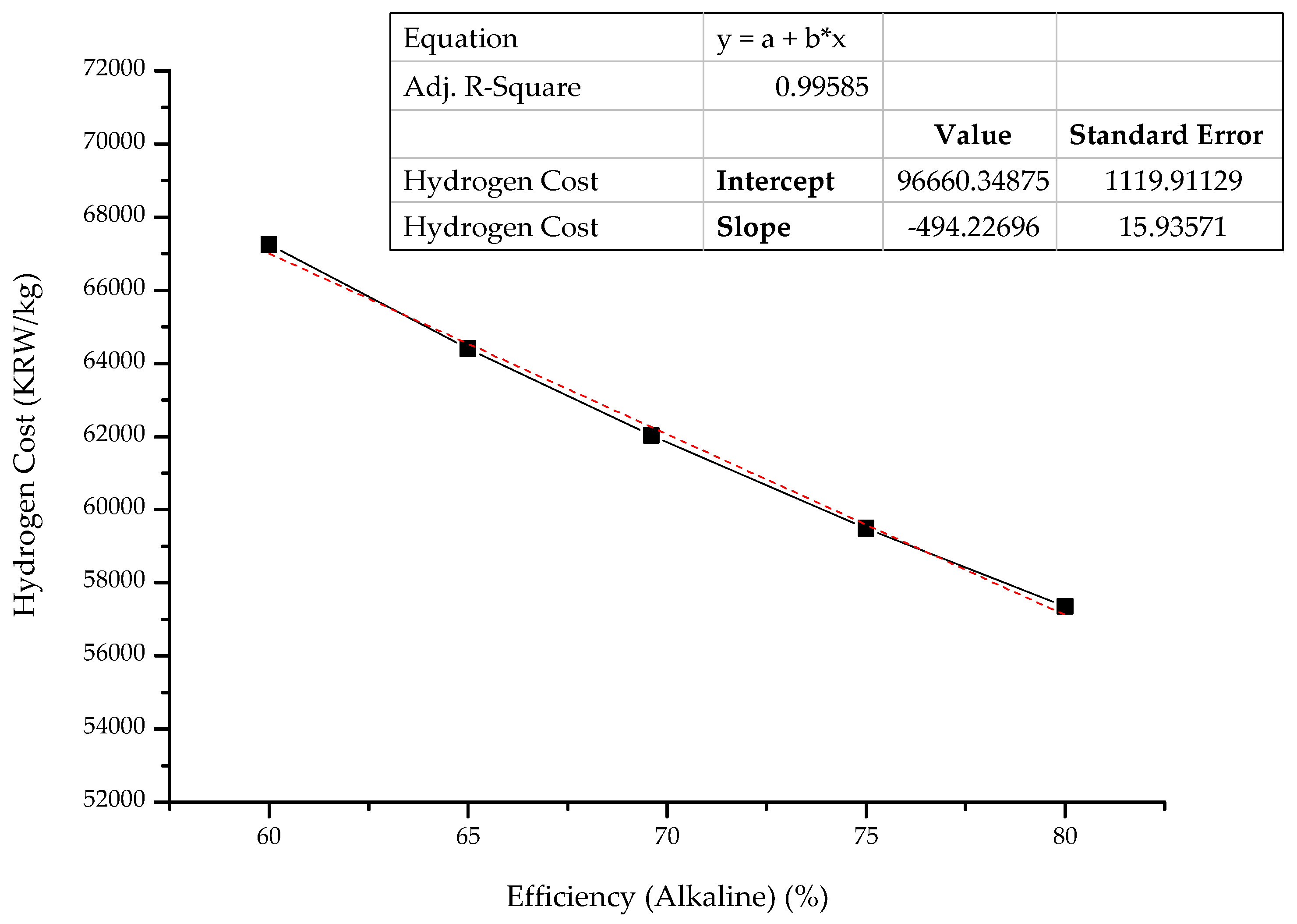

7.2. Variation in Hydrogen Cost Depending on the Efficiency of Alkaline-Type Water Electrolysis

7.3. Variation in Hydrogen Cost Depending on Efficiency of PEM-Type Water Electrolysis

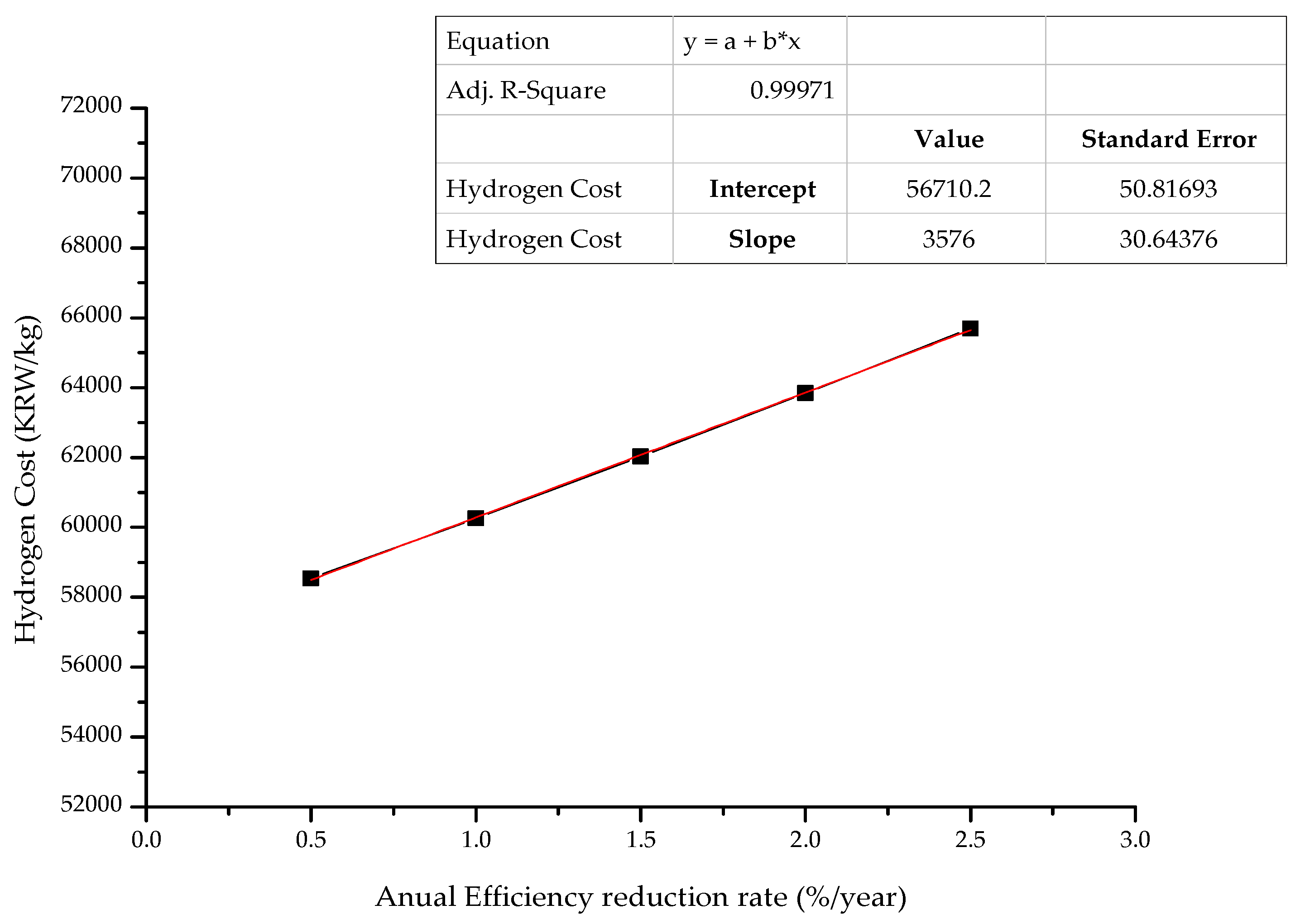

7.4. Variation in Hydrogen Cost Depending on Annual Reduction Rate of the Efficiency of the Electrolysis Stack

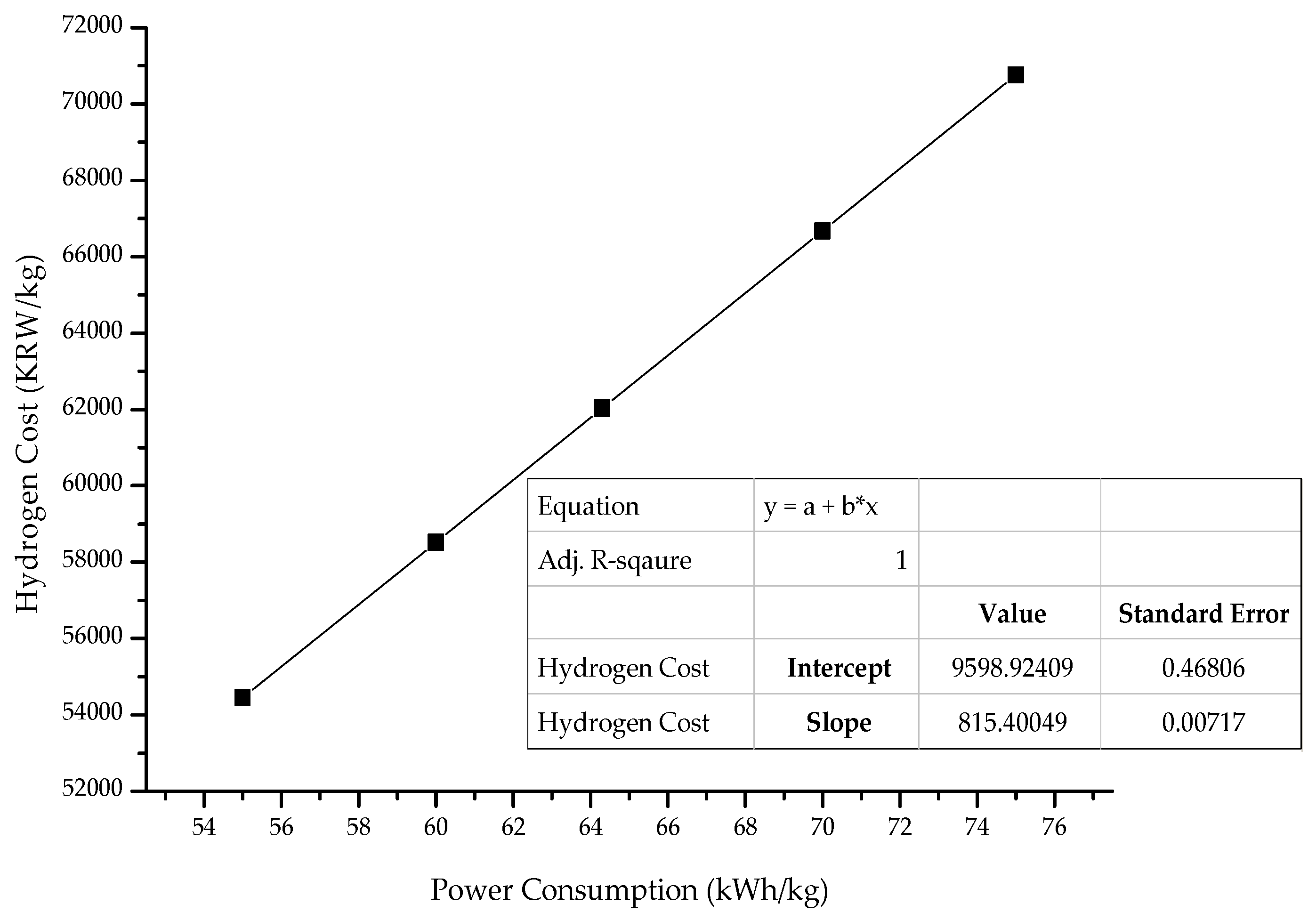

7.5. Variation in Hydrogen Cost Depending on Power Consumption for Hydrogen Production

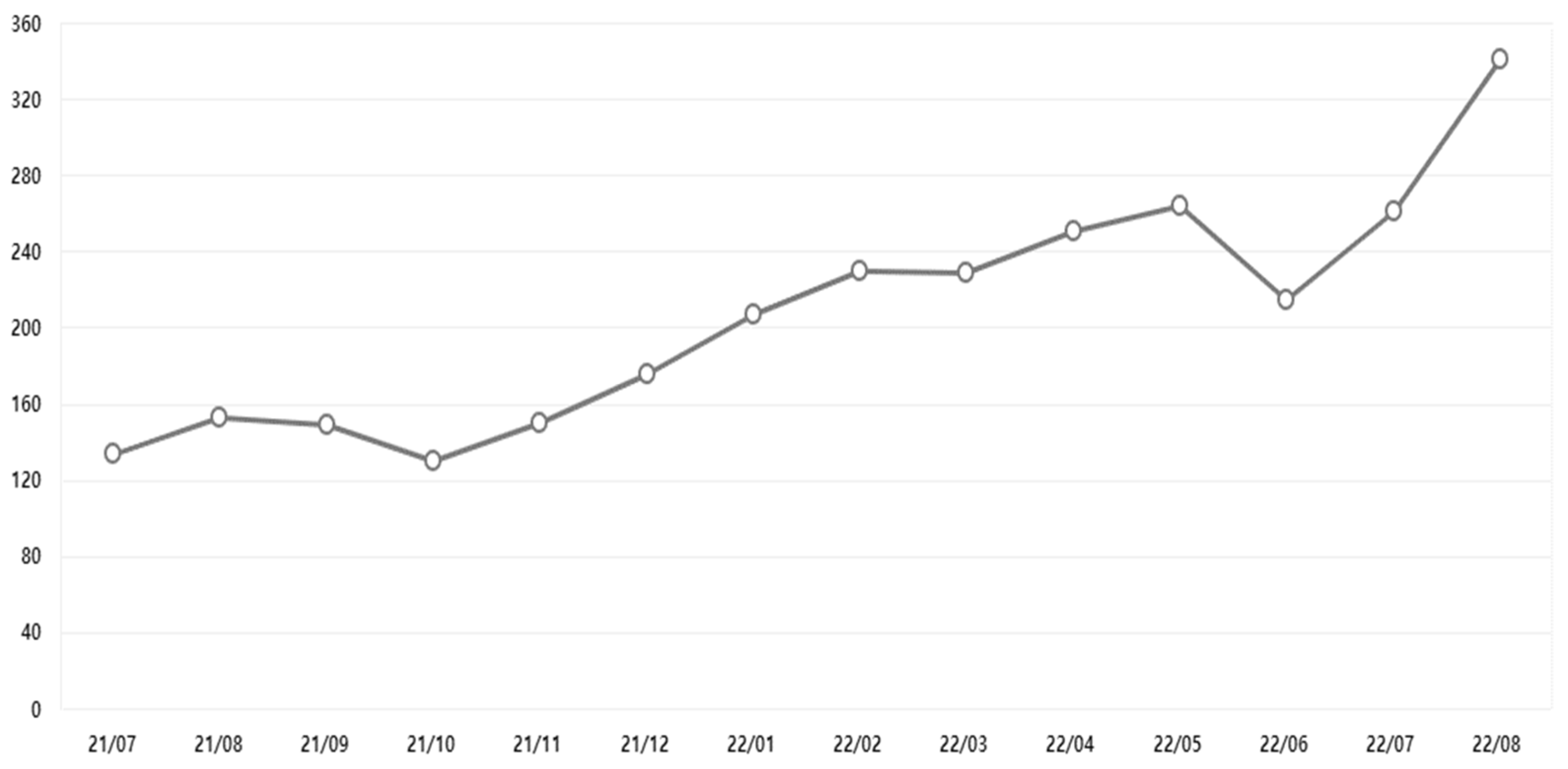

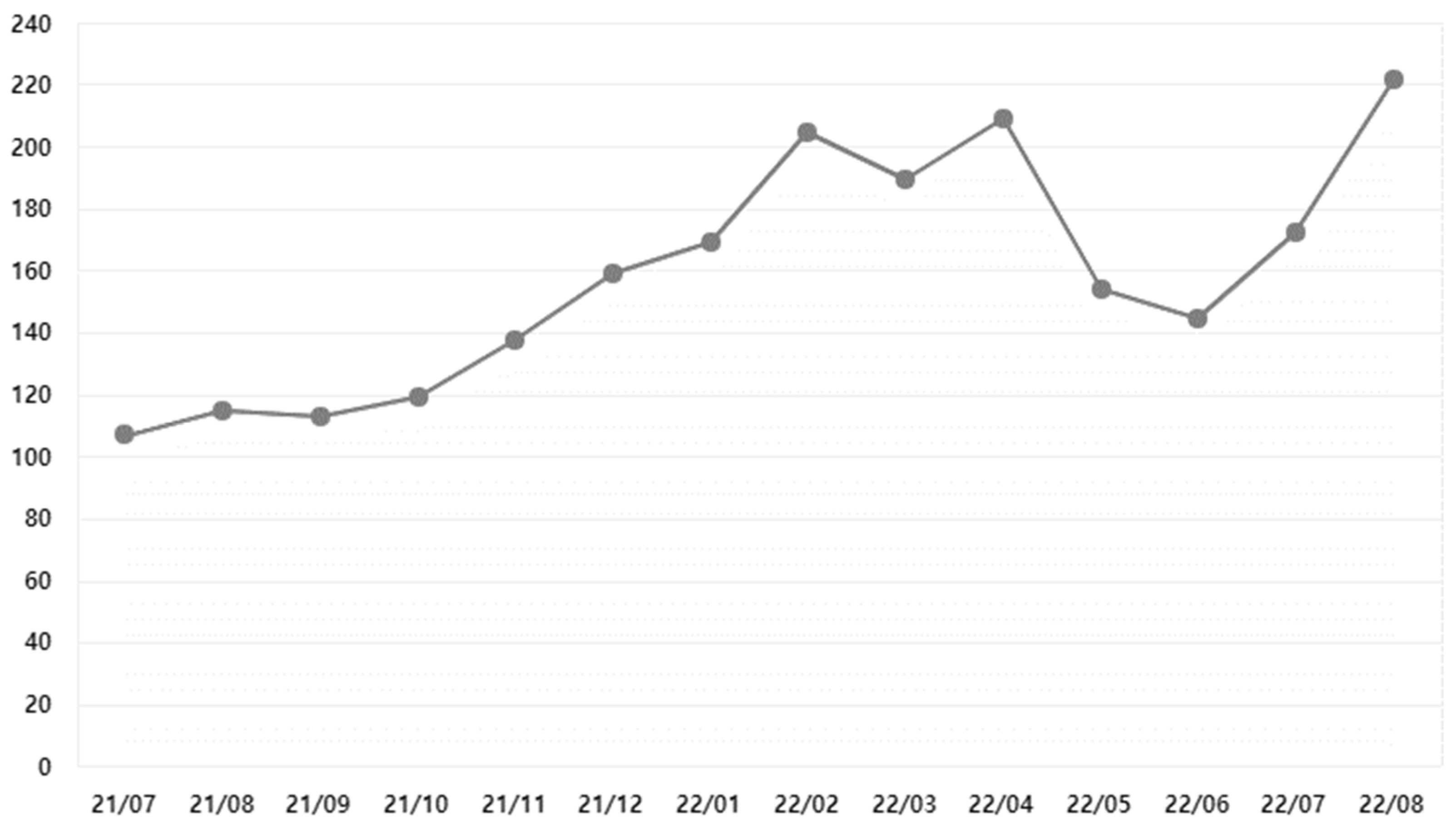

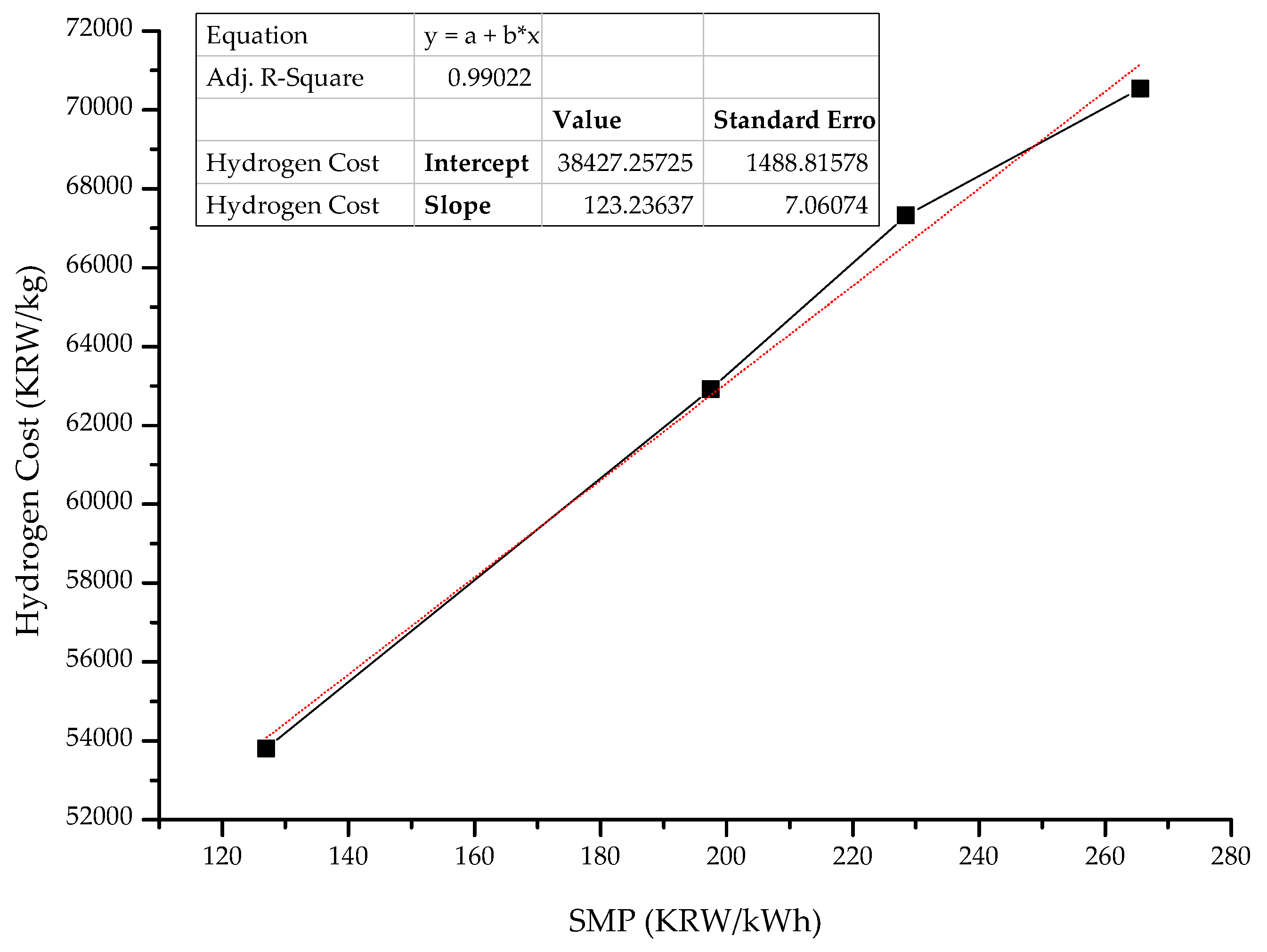

7.6. Variation in Hydrogen Cost Depending on SMP

7.7. Summary of Sensitivity Analysis

8. Proposals for a Reduction in Hydrogen Cost

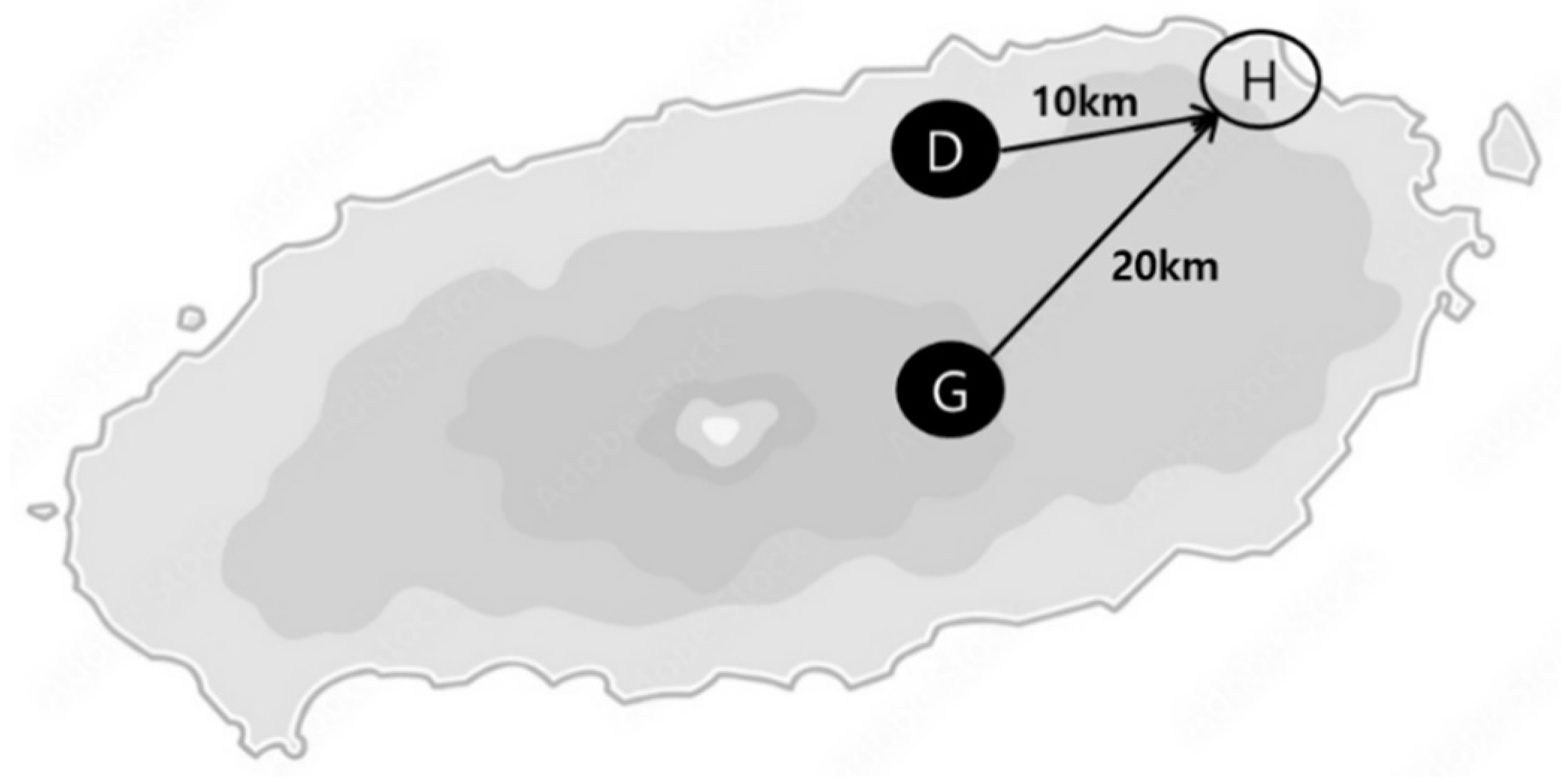

8.1. Absorption of Curtailment Assigned to Other Wind Farms—Scenario V

8.2. Enhancing Hydrogen Production through Maximizing Power Supply Capacity—Scenario VI

8.3. Commercialization of Co-Product (Oxygen)—Scenario VII

9. Calculation of Opportunity Costs

- (1)

- No use of Curtailed electricity

- (2)

- Storing curtailed electricity in ESS battery rather than converting to hydrogen

10. Discussion

11. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Korea Power Exchange (KPX). Status for Electric Generation Facilities. 2021, p. 3. Available online: https://epsis.kpx.or.kr/epsisnew/selectEkifBoardList.do?menuId=080402&boardId=040200 (accessed on 3 September 2022).

- Jeju Special Self-Governing Province. Available online: https://www.jeju.go.kr/cfi/intro/purpose.htm (accessed on 30 October 2022).

- Korea Power Exchange. Available online: https://new.kpx.or.kr/menu.es?mid=a10402030000 (accessed on 30 October 2022).

- Kim, D.; Kim, B. Record of Curtailment and Analysis of Unavailable Electricity for Onshore Wind Farm in Jeju Island; The Korean Hydrogen and New Energy Society (KHNES): Daejeon, Korea, 2021; p. 7. [Google Scholar]

- Jeju Special Self-Governing Province. Action Plan for CFI. 2030. pp. 25–26. Available online: https://www.jejuenergy.or.kr/index.php/board?act=down&seq=2357&serial=2&bd_bcid=gallery_energy&page= (accessed on 30 October 2022).

- Energy & Environment News (Korean Press). Available online: http://www.e2news.com/news/articleView.html?idxno=228955 (accessed on 30 October 2022).

- Shibata, Y. Economic Analysis of Hydrogen Production from Variable Renewables. Inst. Energy Econ. 2015, 10, 26–46. [Google Scholar]

- Yates, J.; Daiyan, R.; Patterson, R.; Egan, R.; Amal, R.; Ho-Baille, A.; Chang, N.L. Techno-Economic Analysis of Hydrogen Electrolysis from Off-Grid Stand-Alone Photovoltaics Incorporating Uncertainty Analysis. Cell Rep. Phys. Sci. 2020, 1, 100209. [Google Scholar] [CrossRef]

- Matute, G.; Yusta, J.M.; Correas, L.C. Techno-Economic Modelling of Water Electrolysers in the Range of Several MW to Provide Grid Services While Generating Hydrogen for Different Applications: A Case Study in Spain Applied to Mobility with FCEVs. Int. J. Hydrogen Energy 2019, 44, 17431–17442. [Google Scholar] [CrossRef]

- Andrea, M.F.; Sara, R.H.; Luca, D. Techno-Economic Analysis of In-Situ Production by Electrolysis, Biomass Gasification and Delivery Systems for Hydrogen Refuelling Stations: Rome Case Study. Energy Procedia 2018, 148, 82–89. [Google Scholar] [CrossRef]

- Ko, A.; Sung-ho Park, S.K. The Economic Feasibility Analysis of 100-MW Power-to-Gas System. Clean Technol. 2020, 26, 55–64. [Google Scholar]

- Gim, B.; Kim, J.; Ko, H. Economic Evaluation of Domestic Low-Temperature Water Electrolysis Hydrogen Production. In Transactions of the Korean Hydrogen and New Energy Society; Dankook University: Seoul, Republic of Korea, 2011; Volume 22, pp. 562–566. [Google Scholar]

- Energy Newspaper (Korean Press). Available online: http://www.energy-news.co.kr/news/articleView.html?idxno=84282 (accessed on 20 October 2022).

- Lee, A. Focus on Hydrogen Economy and Investment Strategy. In Proceedings of the Seminar on the Development Strategy for the Promotion of the Hydrogen Economy and Clean Ammonia Cycle, Seoul, Republic of Korea, 17 March 2022; Presentation Material. pp. 14–19. [Google Scholar]

- Korean Statistical Information Service. Available online: https://kosis.kr/statHtml/statHtml.do?orgId=101&tblId=DT_1J20005&vw_cd=MT_ZTITLE&list_id=P2_6&seqNo=&lang_mode=ko&language=kor&obj_var_id=&itm_id=&conn_path=MT_ZTITLE (accessed on 3 September 2022).

- Gongsanggongsa (Korean Press). Available online: http://www.public25.com/news/articleView.html?idxno=342 (accessed on 3 September 2022).

- Electric Power Statistics Information System. Available online: https://epsis.kpx.or.kr/epsisnew/selectEkmaSmpSmpChart.do?menuId=040201 (accessed on 3 September 2022).

- Ordinance on the Issuance of Supply Certificates and the Operation of the Transaction Markets (Revised on 2 September 2022), Korea Energy Association (KEA). p. 71. Available online: https://www.knrec.or.kr/biz/pds/related/view.do?no=623 (accessed on 2 December 2022).

- Kang, B.; Jeju Energy Corporation, Jeju-si, Republic of Korea. Personal communication, 2022.

- Daily Today (Korean Press). Available online: http://www.dtoday.co.kr/news/articleView.html?idxno=532545 (accessed on 3 September 2022).

- Korea Power Exchange. Statistics on Electricity Market in 2021. p. 147. Available online: https://epsis.kpx.or.kr/epsisnew/selectEkifBoardList.do?menuId=080401&boardId=040100 (accessed on 30 October 2022).

- Korea Energy Association. Advanced and Renewable Energy Portfolio Standard (RPS) System–Competitive Bid Announcement for Fixed Price Contract for Wind Power in 2022. p. 13. Available online: https://rps.energy.or.kr/CST_O1/O1_90_01_190_pubpop.do (accessed on 30 October 2022).

- JEJU Waterworks Authority. Available online: http://www.jeju.go.kr/jejuwater/square/rates/rate-standard/standard03.htm (accessed on 3 September 2022).

- Hojoon, B.; Jeju Energy Corporation, Jeju-si, Republic of Korea. Personal communication, 2022.

- Article 20. Of the Jeju Special Self-Governing Province Ordinance on the Wind Resource Sharing Fund and Article 5 of the Ordinance on the Permission for Wind Power Project and Designation of Districts. Available online: https://jeju.go.kr/cfi/parti/share.htm (accessed on 18 October 2022).

- Ministry of Trade, Industry and Energy [Press Release]. Available online: http://motie.go.kr/motie/ne/presse/press2/bbs/bbsView.do?bbs_seq_n=164278&bbs_cd_n=81¤tPage=1&search_key_n=&cate_n=&dept_v=&search_val_v= (accessed on 3 September 2022).

- Electric News (Korean Press). Available online: https://www.electimes.com/news/articleView.html?idxno=305239 (accessed on 30 October 2022).

- Kim, D.; Jeju National University, Jeju-si, Republic of Korea. Personal communication, 2022.

- Gas News (Korean Press). Available online: http://www.gasnews.com/news/articleView.html?idxno=60968 (accessed on 30 October 2022).

- Korea Occupational Safety and Health Agency (KOSHA). Technical Guide for Oxygen Supply Facility (KOSHA GUIDE P-32-2012). Available online: https://search.naver.com/p/crd/rd?m=1&px=706&py=189&sx=706&sy=189&p=hGFfpsprvmZssnQhiChssssstHh-349120&q=%EC%82%B0%EC%86%8C%EA%B3%B5%EA%B8%89%EC%84%A4%EB%B9%84%EC%9D%98+%EC%95%88%EC%A0%84%EA%B8%B0%EC%88%A0%EC%A7%80%EC%B9%A8&ie=utf8&rev=1&ssc=tab.nx.all&f=nexearch&w=nexearch&s=qriMsgkZMCKB29RF14%2BFxg%3D%3D&time=1669976744383&abt=%5B%7B%22eid%22%3A%22SHP-AD-UP%22%2C%22vid%22%3A%2218%22%7D%5D&a=web_gen*D.link&r=1&i=a00000fa_e231e853ed03055038568484&u=https%3A%2F%2Fwww.kosha.or.kr%2FextappKosha%2Fkosha%2Fguidance%2FfileDownload.do%3FsfhlhTchnlgyManualNo%3DP-32-2012%26fileOrdrNo%3D3&cr=1 (accessed on 2 December 2022).

- Investpedia. Available online: https://www.investopedia.com/terms/o/opportunitycost.asp#toc-formula-and-calculation-of-opportunity-cost (accessed on 15 November 2022).

| Description/Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|

| No. of occurrence for curtailment | 3 | 6 | 16 | 17 | 46 | 77 |

| Amount of curtailed electricity(MWh) | 152 | 252 | 1301 | 1366 | 9223 | 19,449 |

| Amount of whole power supplied(MWh) * | 348,188 | 466,133 | 537,994 | 536,566 | 549,944 | 574,481 |

| Ratio of curtailment | 0.04% | 0.05% | 0.24% | 0.25% | 1.68% | 3.39% |

| Category | Description |

|---|---|

| Address | Jeju-si, Jeju Special Self-Governing Province, Republic of Korea |

| Capacity of water electrolysis | 3.3 MW |

| Name of connected wind farm | “H” Wind farm |

| Capacity of wind turbines | Max. 9.38 MW * |

| Productivity of hydrogen | 200 kg/day (avg.) |

| Max. 600 kg/day |

| Equipment Description | Type | Specification |

|---|---|---|

| Water electrolysis | Alkaline | 2 MW |

| PEM | 1.3 MW | |

| Power-supply system | 0.10 kWh/Nm3 (Loss rate) | |

| Power-conversion system | 0.15 kWh/Nm3 (Loss rate) | |

| Buffer tank | D.P. 10 bar | |

| Compressor | D.P. 250 bar | |

| ESS battery | 2 MW |

| Description | Value | Remarks |

|---|---|---|

| Period of business | 15 years | |

| Max. capacity of electricity from the wind turbine to be input | 4 MW | As per the operation plan |

| Max. capacity of electricity from the grid to be input | 1.5 MW | As per the operation plan |

| Amount of curtailed electricity | 286,437 kWh/year | Same as the record of the “H” wind farm in 2021 |

| Minimum no. of employees for operation of water electrolysis | Two persons per one shift | As per the operation plan |

| Lifetime of stack (alkaline) | Five years | Design lifetime |

| Lifetime of stack (PEM) | Eight years | Design lifetime |

| Lifetime of ESS | 15 years | Design lifetime |

| Capability of “H” wind farm | 27% | Average of the wind farm |

| No. of tube trailers | 3 (1 for purchase + 2 for lease) | As per the operation plan |

| Inflation rate | 1.0%/year | Average of relevant indices * from Statistics Korea (2015~2019) [15] |

| Salary growth rate | 2.9%/year | Average increase rate of government officers’ salary (2015~2019) [16] |

| Ratio of loan | - | |

| SMP (system margin price) | Average of January to August 2022 on Jeju | As notified in Korea Power Exchange (KPX) [17] |

| REC weight factor | 1.2 (Onshore wind turbine) | Ordinance [18] |

| REC | KRW 20 | As per Jeju Energy Corporation [19] |

| Parameters | Value | Remarks |

|---|---|---|

| Efficiency of the power-supply system | 98% | From design data |

| Efficiency of power conversion system | 97% | From design data |

| Efficiency of water electrolysis (PEM) | 56% | Referenced from the value of the other company [12] |

| Efficiency of water electrolysis (alkaline) | 69.6% | From design data |

| Annual reduction rate of efficiency for stack (PEM) | 1.5%/year | Assumption |

| Annual reduction rate of efficiency for stack (alkaline) | 1.5%/year | Assumption |

| Ratio between supplied electricity (alkaline: PEM) | 2:1.3 | Same as the capacity ratio |

| Power consumption for the production of hydrogen | 64.3 kWh/kg | Referenced from the value of neighboring facility [20] |

| Amount of water consumption for electrolysis | 30 tons/day | As per the operation plan |

| Electric loss rate during transmission & distribution | 0% | Assumption |

| Year | Initial Investment | Investment for Replacement | |

|---|---|---|---|

| 1st | EPC * cost for the whole facility (initial) | ||

| 2nd | |||

| 3rd | |||

| 4th | |||

| 5th | |||

| 6th | 1st replacement cost for alkaline stack | ||

| 7th | |||

| 8th | |||

| 9th | 1st replacement cost for PEM stack | ||

| 10th | |||

| 11th | 2nd replacement cost for alkaline stack | ||

| 12th | |||

| 13th | |||

| 14th | |||

| 15th | |||

| Category | Breakdown Description | Ratio |

|---|---|---|

| Procurement (incl. engineering fee) | Procurement of the whole P2G system (initial) | 60.4% |

| Procurement of tube trailer (1 no.) | 1.6% | |

| Procurement of stack (alkaline) (for two times replacement) | 6.4% | |

| Procurement of stack (PEM) (for one-time replacement) | 7.7% | |

| Construction | Construction of the whole P2G system (initial) | 20.1% |

| Construction of stack (alkaline) (for two times replacement) | 2.6% | |

| Construction of stack (alkaline) (for one-time replacement) | 1.3% |

| Breakdown Description | Basis of Calculation | Remarks |

|---|---|---|

| Basic salary | KRW 44 million/year (initial year) | Average of a corporation operating “H” wind farm in 2019 |

| Performance salary | 16.91% of the basic salary | Average of similar three corporations |

| Extra benefit |

| Assumption |

| Retirement benefit | 12.45% of the basic salary | Average of similar three corporations |

| Welfare expenses | 14.41% of the basic salary | Average of similar three corporations |

| Travelling & transportation expenses | 0.53% of the basic salary | Average of similar three corporations |

| Communication expenses | 2.80% of the basic salary | Average of similar three corporations |

| Water cost | 30.37% of the basic salary | Average of similar three corporations |

| Taxes, utility bills | 0.64% of depreciation cost | Average of similar three corporations |

| O&M costs * | 19.66% of depreciation cost | Average of similar three corporations |

| Insurance costs * | 6.16% of depreciation cost | Average of similar three corporations |

| Vehicle maintenance costs | 2.04% of the basic salary | Average of similar three corporations |

| Education and training costs | 1.07% of the basic salary | Average of similar three corporations |

| Expenses for print | 0.08% of the basic salary | Average of similar three corporations |

| Expenses for meeting | 0.48% of the basic salary | Average of similar three corporations |

| Expenses for Consumables * | 0.30% of depreciation cost | Average of similar three corporations |

| Payment fee | 19.20% of the basic salary | Average of similar three corporations |

| Supporting fee for the village | KRW 132 million/year | Average of similar three corporations |

| Interests costs | N/A | |

| Corporate tax expenses | Not considered | |

| Grid electricity expenses | Contract unit price = Avg. of SMP (Jeju) + 1.2 REC | SMP: Avg. of Jan. to Aug. 2022 in Jeju [17] |

| Wind turbine electricity costs | KRW 220.4/kWh | Settlement unit price (2022/Jeju/Wind power) [17] |

| Expenses for tap water * | KRW 359,410 per day | Contracted price (Industrial, 300 mm Dia.) [24] |

| Rental costs for tube trailers (2 nos.) * | KRW 5 million/month | Assumption |

| Operating costs for tube trailers (3 nos.) | KRW 4800/kg·H2 | From quotation [25] |

| Year | EPC Cost for Whole Facility (Initial) | 1st Replacement Cost for Alkaline Stack | 2nd Replacement Cost for Alkaline Stack | 1st Replacement Cost for PEM Stack |

|---|---|---|---|---|

| 1st | 1/15 | |||

| 2nd | 1/15 | |||

| 3rd | 1/15 | |||

| 4th | 1/15 | |||

| 5th | 1/15 | |||

| 6th | 1/15 | 1/5 | ||

| 7th | 1/15 | 1/5 | ||

| 8th | 1/15 | 1/5 | ||

| 9th | 1/15 | 1/5 | 1/8 | |

| 10th | 1/15 | 1/5 | 1/8 | |

| 11th | 1/15 | 1/5 | 1/8 | |

| 12th | 1/15 | 1/5 | 1/8 | |

| 13th | 1/15 | 1/5 | 1/8 | |

| 14th | 1/15 | 1/5 | 1/8 | |

| 15th | 1/15 | 1/5 | 1/8 |

| Year | Amount of Hydrogen |

|---|---|

| 1st | a (1) |

| 2nd | a (1 − x (2)) |

| 3rd | a (1 − x)2 |

| 4th | a (1 − x)3 |

| 5th | a (1 − x)4 |

| 6th | a (1 − x)5 |

| 7th | a (1 − x)6 |

| 8th | a (1 − x)7 |

| 9th | a (1 − x)8 |

| 10th | a (1 − x)9 |

| 11th | a (1 − x)10 |

| 12th | a (1 − x)11 |

| 13th | a (1− x)12 |

| 14th | a (1 − x)13 |

| 15th | a (1 − x)14 |

| Classification | Off-Peak | Mid-Peak | On-Peak | Remarks |

|---|---|---|---|---|

| Time | 22:00 to 08:00 | 08:00 to 16:00 | 16:00 to 22:00 | for Jeju |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 365 days/year | |

| Operation time | 09 to 21 | 12 h/day without a break |

| SMP average | 203.40 | 09 to 16: Mid-peak 16 to 21: On-peak |

| Contract unit price | 227.40 | SMP + weight factor REC |

| No. of employees | 6 | 2 3 |

| O/T factor | 1.8 |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 2.5% | ||

| Wind turbines | 4 MW | 4,730,400 kWh | 40.8% | Capability reflected |

| Grid | 1.5 MW | 6,570,000 kWh | 56.7% | |

| Total | 11,586,837 kWh | 100.0% |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | A | 18.4% | EPC for initial & replacement | |

| OPEX | General | B | 26.3% | Corporation operating expenses (incl. wages) |

| Material | C | 47.0% |

| |

| Tube trailer operation | D | 8.3% | Fuel costs, driver expenses | |

| Total | E * | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 104 | 198 | 301 |

| 2nd | 102 | 195 | 297 |

| 3rd | 100 | 192 | 293 |

| 4th | 99 | 189 | 288 |

| 5th | 97 | 186 | 284 |

| 6th | 96 | 184 | 280 |

| 7th | 95 | 181 | 275 |

| 8th | 93 | 178 | 271 |

| 9th | 92 | 175 | 267 |

| 10th | 90 | 173 | 263 |

| 11th | 89 | 170 | 259 |

| 12th | 88 | 168 | 255 |

| 13th | 86 | 165 | 251 |

| 14th | 85 | 163 | 248 |

| 15th | 84 | 160 | 244 |

| Average | 93 | 178 | 272 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 365 days/year | |

| Operation time | 22 to 08 | 12 h/day without a break |

| SMP average | 212.52 | 22 to 08: Off-peak |

| Contract unit price | 236.52 | SMP + weight factor REC |

| No. of employees | 6 | 2 3 |

| O/T factor | 2.5 |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 2.5% | ||

| Wind turbines | 4 MW | 4,730,400 kWh | 40.8% | Capability reflected |

| Grid | 1.5 MW | 6,570,000 kWh | 56.7% | |

| Total | 11,586,837 kWh | 100.0% |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 100% of A (equivalent) | 17.4% | EPC for initial & replacement | |

| OPEX | General | 116.7% of B (16.7% increase) | 29.0% | Corporation operating expenses (incl. wages) |

| Material | 102.25% of C (2.5% increase) | 45.6% |

| |

| Tube trailer operation | 100% of D (equivalent) | 8.0% | Fuel costs, driver expenses | |

| Total | 105.4% of E (5.4% increase) | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 104 | 198 | 301 |

| 2nd | 102 | 195 | 297 |

| 3rd | 100 | 192 | 293 |

| 4th | 99 | 189 | 288 |

| 5th | 97 | 186 | 284 |

| 6th | 96 | 184 | 280 |

| 7th | 95 | 181 | 275 |

| 8th | 93 | 178 | 271 |

| 9th | 92 | 175 | 267 |

| 10th | 90 | 173 | 263 |

| 11th | 89 | 170 | 259 |

| 12th | 88 | 168 | 255 |

| 13th | 86 | 165 | 251 |

| 14th | 85 | 163 | 248 |

| 15th | 84 | 160 | 244 |

| Average | 93 | 178 | 272 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 240 days/year | |

| Operation time | 09 to 18 | 8 h/day Break time: 1 h (12 to 13) |

| SMP average | 187.11 | 09 to 16: Mid-peak 16 to 18: On-peak |

| Contract unit price | 211.11 | SMP + weight factor REC |

| No. of employees | 2 | 2 1 |

| O/T factor | 1 |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 5.5% | ||

| Wind turbines | 4 MW | 2,073,600 kWh | 39.5% | Capability reflected |

| Grid | 1.5 MW | 2,880,000 kWh | 55.0% | |

| Total | 5,240,037 kWh | 100.0% |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 100% of A (equivalent) | 33.1% | EPC for initial & replacement | |

| OPEX | General | 49.46% of B (50.54% decrease) | 23.4% | Corporation operating expenses (incl. wages) |

| Material | 43.15% of C (56.85% decrease) | 36.6% |

| |

| Tube trailer operation | 45.22% of D (54.78% decrease) | 6.9% | Fuel costs, driver expenses | |

| Total | 55.4% of E (44.6% decrease) | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 71 | 136 | 207 |

| 2nd | 70 | 134 | 204 |

| 3rd | 69 | 132 | 201 |

| 4th | 68 | 130 | 198 |

| 5th | 67 | 128 | 195 |

| 6th | 66 | 126 | 192 |

| 7th | 65 | 124 | 189 |

| 8th | 64 | 122 | 187 |

| 9th | 63 | 121 | 184 |

| 10th | 62 | 119 | 181 |

| 11th | 61 | 117 | 178 |

| 12th | 60 | 115 | 176 |

| 13th | 59 | 114 | 173 |

| 14th | 59 | 112 | 170 |

| 15th | 58 | 110 | 168 |

| Average | 64 | 123 | 187 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 240 days/year | |

| Operation time | 23 to 08 | 8 h/day Break time: 1 h (03 to 04) |

| SMP average | 209.31 | 23 to 08: Off-peak |

| Contract unit price | 233.31 | SMP + weight factor REC |

| No. of employees | 2 | 2 1 |

| O/T factor | 2 |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 5.5% | ||

| Wind turbines | 4 MW | 2,073,600 kWh | 39.5% | Capability reflected |

| Grid | 1.5 MW | 2,880,000 kWh | 55.0% | |

| Total | 5,240,037 kWh | 100.0% |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 100% of A (equivalent) | 31.4% | EPC for initial & replacement | |

| OPEX | General | 57.20% of B (42.80% decrease) | 25.6% | Corporation operating expenses (incl. wages) |

| Material | 45.55% of C (54.45% decrease) | 36.5% |

| |

| Tube trailer operation | 45.22% of D (54.78% decrease) | 6.5% | Fuel costs, driver expenses | |

| Total | 58.6% of E (41.4% decrease) | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 71 | 136 | 207 |

| 2nd | 70 | 134 | 204 |

| 3rd | 69 | 132 | 201 |

| 4th | 68 | 130 | 198 |

| 5th | 67 | 128 | 195 |

| 6th | 66 | 126 | 192 |

| 7th | 65 | 124 | 189 |

| 8th | 64 | 122 | 187 |

| 9th | 63 | 121 | 184 |

| 10th | 62 | 119 | 181 |

| 11th | 61 | 117 | 178 |

| 12th | 60 | 115 | 176 |

| 13th | 59 | 114 | 173 |

| 14th | 59 | 112 | 170 |

| 15th | 58 | 110 | 168 |

| Average | 64 | 123 | 187 |

| Year & Month | Contract Unit Price 1 (kWh/KRW) | Settlement Unit Price 2 (kWh/KRW) | Hydrogen Price (KRW/kg) |

|---|---|---|---|

| 2021.10. | 172.4 | 124.3 | 53,805 |

| 2022.01. | 257.0 | 197.9 | 62,917 |

| 2022.04. | 338.7 | 244.3 | 70,539 |

| 2022.07. | 294.0 | 238.8 | 67,317 |

| Factor | Variation of Unit Factor (Explanatory Variable) | Variation of Hydrogen Cost (Outcome Variable) |

|---|---|---|

| Capability of wind turbines | 1% | KRW 406/kg |

| Efficiency of water electrolysis (alkaline) | 1% | KRW 494/kg |

| Efficiency of water electrolysis (PEM) | 1% | KRW 326/kg |

| Annual reduction rate of efficiency for water electrolysis | 0.1% | KRW 358/kg |

| Power consumption for producing hydrogen | 1 kWh/kg | KRW 815/kg |

| SMP | KRW 10/kWh | KRW 1232/kg |

| Wind Farm | Capacity | Curtailed Energy (kWh) | |||

|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2021 | ||

| ‘D’ | 30 MW | 186,651 | 1,573,081 | 2,722,505 | 2,170,821 |

| ‘G’ | 15 MW | 213,570 | 1,067,239 | 2,169,861 | 1,396,164 |

| ‘H’ | 9.38 MW | 7057 | 20,251 | 252,537 | 286,437 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 365 days/year | |

| Operation time | 09 to 21 | 12 h/day without a break |

| SMP average | 203.40 | 09 to 16: Mid-peak 16 to 21: On-peak |

| Contract unit price | 227.40 | SMP + weight factor REC |

| No. of employees | 6 | 2 3 |

| O/T factor | 1.8 |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment (‘H’ + ‘D’ + ‘G’) | 3,853,422 kWh | 25.4% | ||

| Wind turbines | 4 MW | 4,730,400 kWh | 31.2% | Capability reflected |

| Grid | 1.5 MW | 6,570,000 kWh | 43.4% | |

| Total | 15,153,822 kWh | 100% |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 100% of A (equivalent) | 17.8% | EPC for initial & replacement | |

| OPEX | General | 100% of B (equivalent) | 25.4% | Corporation operating expenses (incl. wages) |

| Material | 101.5% of C (1.5% increase) | 46.2% |

| |

| Tube trailer operation | 130.8% of D (30.8% increase) | 10.6% | Fuel costs, driver expenses | |

| Total | 103.3% of E (3.3% increase) | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 135 | 259 | 394 |

| 2nd | 133 | 255 | 388 |

| 3rd | 131 | 251 | 383 |

| 4th | 129 | 247 | 377 |

| 5th | 127 | 244 | 371 |

| 6th | 126 | 240 | 366 |

| 7th | 124 | 236 | 360 |

| 8th | 122 | 233 | 355 |

| 9th | 120 | 229 | 349 |

| 10th | 118 | 226 | 344 |

| 11th | 116 | 223 | 339 |

| 12th | 115 | 219 | 334 |

| 13th | 113 | 216 | 329 |

| 14th | 111 | 213 | 324 |

| 15th | 110 | 210 | 319 |

| Average | 122 | 233 | 355 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 365 days/year | |

| Operation time | 09 to 21 | 12 h/day without a break |

| SMP average | 203.40 | 09 to 16: Mid-peak 16 to 21: On-peak |

| Contract unit price | 227.40 | SMP + weight factor REC |

| No. of employees | 6 | 2 3 |

| O/T factor | 1.8 |

| Description | Value | Remarks |

|---|---|---|

| Max. power consumption for water electrolysis (PEM) | 3,865,018 kWh | As of the initial year |

| Power to be supplied for max. power consumption (PEM) | 6,901,818 kWh | As of the initial year |

| Max. power consumption for water electrolysis (alkaline) | 7,390,255 kWh | As of the initial year |

| Power to be supplied for max. power consumption (alkaline) | 10,618,182 kWh | As of the initial year |

| Max. power supply to water electrolysis (PEM + alkaline) | 17,520,000 kWh/year | |

| Max. power supply before water electrolysis (PEM + alkaline) | 18,430,465 kWh/year | Reverse calculation of efficiencies for the power-supply system and power-conversion system |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 1.6% | ||

| Wind turbines | 9.38 MW | 11,092,788 kWh | 61.8% | Capability reflected |

| Grid | 1.5 MW | 6,570,000 kWh | 36.6% | |

| Total | 17,949,225 kWh | 100.0% |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 1.6% | ||

| Wind turbines | 4 MW | 4,730,400 kWh | 26.1% | Capability reflected |

| Grid | 3 MW | 13,140,000 kWh | 72.4% | |

| Total | 18,156,837 kWh | 100.0% |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 100% of A (equivalent) | 14.0% | EPC for initial & replacement | |

| OPEX | General | 100% of B (equivalent) | 20.0% | Corporation operating expenses (incl. wages) |

| Material | 156.0% of C (56.0% increase) | 55.8% |

| |

| Tube trailer operation | 159.1% of D (59.1% increase) | 10.2% | Fuel costs, driver expenses | |

| Total | 131.3% of E (31.3% increase) | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 165 | 315 | 480 |

| 2nd | 162 | 310 | 472 |

| 3rd | 160 | 306 | 465 |

| 4th | 157 | 301 | 458 |

| 5th | 155 | 296 | 451 |

| 6th | 153 | 292 | 445 |

| 7th | 150 | 288 | 438 |

| 8th | 148 | 283 | 431 |

| 9th | 146 | 279 | 425 |

| 10th | 144 | 275 | 419 |

| 11th | 142 | 271 | 412 |

| 12th | 139 | 267 | 406 |

| 13th | 137 | 263 | 400 |

| 14th | 135 | 259 | 394 |

| 15th | 133 | 255 | 388 |

| Average | 148 | 284 | 432 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 365 days/year | |

| Operation time | 09 to 21 | 12 h/day without a break |

| SMP average | 203.40 | 09 to 16: Mid-peak 16 to 21: On-peak |

| Contract unit price | 227.40 | SMP + weight factor REC |

| No. of employees | 6 | 2 3 |

| O/T factor | 1.8 |

| Source of Electricity | Capacity | Electricity Supplied | Ratio | Remarks |

|---|---|---|---|---|

| Curtailment | 286,437 kWh | 2.5% | ||

| Wind turbines | 4 MW | 4,730,400 kWh | 40.8% | Capability reflected |

| Grid | 1.5 MW | 6,570,000 kWh | 56.7% | |

| Total | 11,586,837 kWh | 100.0% |

| Category | Sub-Category | H2 | O2 | Remarks |

|---|---|---|---|---|

| Amount of production | 2n | n | ||

| CAPEX | 67% | 33% | ||

| OPEX | General | 50% | 50% | |

| Material | 67% | 33% | ||

| Tube trailer operation | 100% | - |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 67% of A (33% decrease) | 18.8% | EPC for initial & replacement | |

| OPEX | General | 50% of B (50% decrease) | 20.1% | Corporation operating expenses (incl. wages) |

| Material | 67% of C (33% decrease) | 48.2% |

| |

| Tube trailer operation | 100% of D (equivalent) | 12.8% | Fuel costs, driver expenses | |

| Total | 65.3% of E (34.7% decrease) | 100% |

| Year | Avg. Amount of H2 (PEM) | Avg. Amount of H2 (Alkaline) | Total |

|---|---|---|---|

| 1st | 104 | 198 | 301 |

| 2nd | 102 | 195 | 297 |

| 3rd | 100 | 192 | 293 |

| 4th | 99 | 189 | 288 |

| 5th | 97 | 186 | 284 |

| 6th | 96 | 184 | 280 |

| 7th | 95 | 181 | 275 |

| 8th | 93 | 178 | 271 |

| 9th | 92 | 175 | 267 |

| 10th | 90 | 173 | 263 |

| 11th | 89 | 170 | 259 |

| 12th | 88 | 168 | 255 |

| 13th | 86 | 165 | 251 |

| 14th | 85 | 163 | 248 |

| 15th | 84 | 160 | 244 |

| Average | 93 | 178 | 272 |

| Factor | Value | Remarks |

|---|---|---|

| No. of days of operation | 365 days/year | |

| Operation time | 09 to 21 | 12 h/day without a break |

| No. of employees | 6 | 2 3 |

| O/T factor | 1.8 |

| Category | Sub-Category | Expenses | Ratio | Remarks |

|---|---|---|---|---|

| CAPEX | 33.8% of A | 19.1% | EPC for initial investment | |

| OPEX | General | 32.2% of B | 80.9% | Corporation operating expenses (incl. wages) |

| Material | None | - |

| |

| Tube trailer operation | None | - | Fuel costs, driver expenses | |

| Total | 32.5% of E | 100% |

| Year | Amount of Electricity | Remarks |

|---|---|---|

| 1st | 286,437 kWh | Efficiency of the battery: 95% |

| 2nd | 269,394kWh | |

| 3rd | 266,700 kWh | |

| 4th | 264,033 kWh | |

| 5th | 261,393 kWh | |

| 6th | 258,779 kWh | |

| 7th | 256,191 kWh | |

| 8th | 253,629 kWh | |

| 9th | 251,093 kWh | |

| 10th | 248,582 kWh | |

| 11th | 246,096 kWh | |

| 12th | 243,635 kWh | |

| 13th | 241,199 kWh | |

| 14th | 238,787 kWh | |

| 15th | 236,399 kWh | |

| Average | 3,808,024 kWh |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cho, Y.; Lee, S.; Lim, J.; Lee, J. Economic Analysis of P2G Green Hydrogen Generated by Existing Wind Turbines on Jeju Island. Energies 2022, 15, 9317. https://doi.org/10.3390/en15249317

Cho Y, Lee S, Lim J, Lee J. Economic Analysis of P2G Green Hydrogen Generated by Existing Wind Turbines on Jeju Island. Energies. 2022; 15(24):9317. https://doi.org/10.3390/en15249317

Chicago/Turabian StyleCho, Youngmin, Sanglae Lee, Jinseok Lim, and Jaewoo Lee. 2022. "Economic Analysis of P2G Green Hydrogen Generated by Existing Wind Turbines on Jeju Island" Energies 15, no. 24: 9317. https://doi.org/10.3390/en15249317

APA StyleCho, Y., Lee, S., Lim, J., & Lee, J. (2022). Economic Analysis of P2G Green Hydrogen Generated by Existing Wind Turbines on Jeju Island. Energies, 15(24), 9317. https://doi.org/10.3390/en15249317