Using Natural Gas Resources to De-Risk Renewable Energy Investments in Lower-Income Countries

Abstract

:1. Introduction

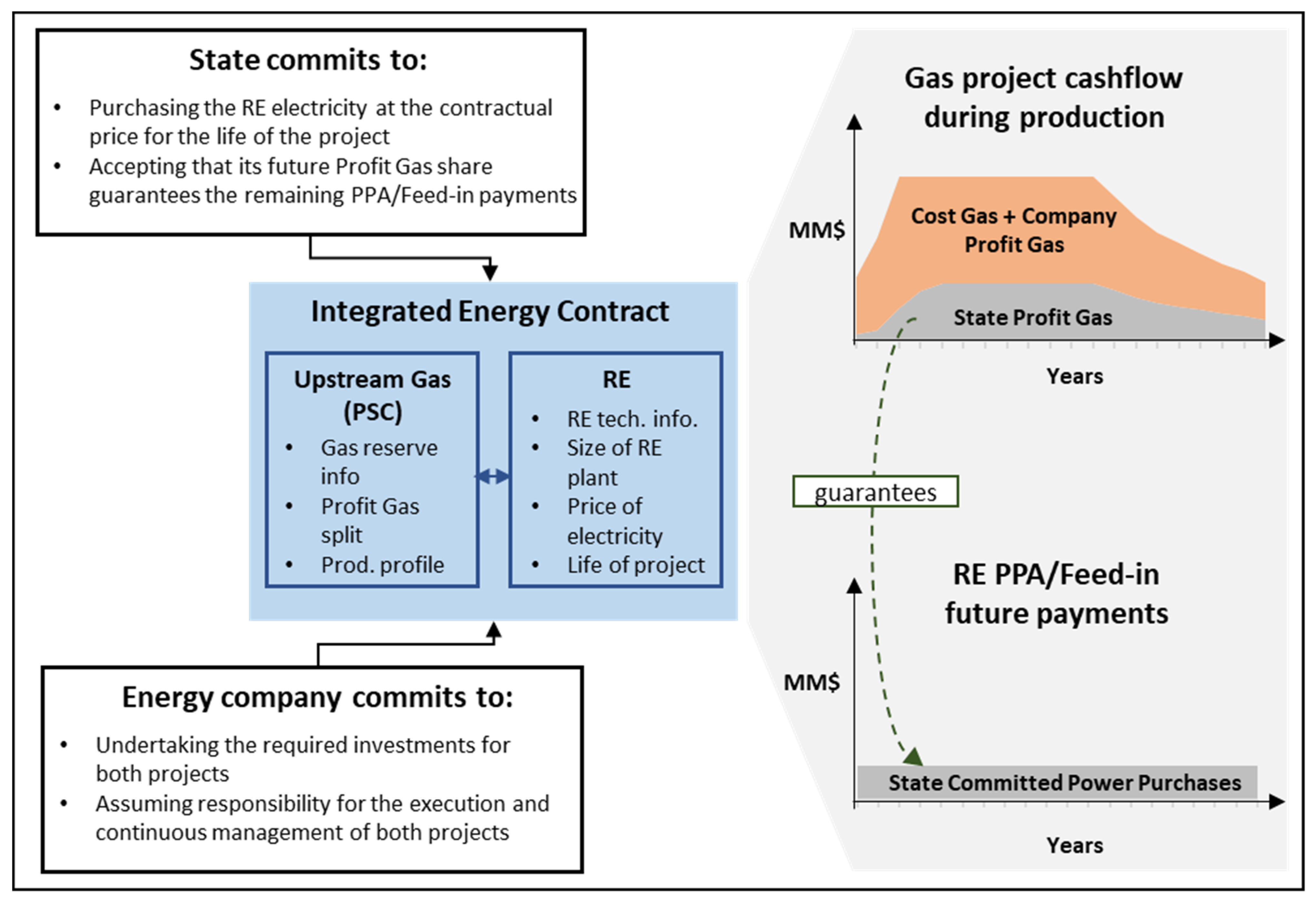

2. The Integrated Energy Contract

2.1. Rationale

2.2. Structure

3. Materials and Methods

3.1. Details of the Integrated Energy Contracts

3.2. Elements of the Monte Carlo Simulations

- The approach adopted to compute the country-specific gas price forecasts;

- The reasoning behind the assumed discount rates for the upstream and renewable energy projects;

- The parametrization of the various estimates used in the simulations.

3.2.1. Country-Specific Natural Gas Prices

Forecasting Hub Prices

Linking Country-Specific Prices to Hub Prices

3.2.2. Discount Rates

3.2.3. Upstream Gas and Renewable Energy Estimates

4. Results and Discussion

- The effectiveness of the guarantee mechanism in protecting against the risk of off-taker default;

- The benefits that the considered countries achieve from the proposed integrated energy contract.

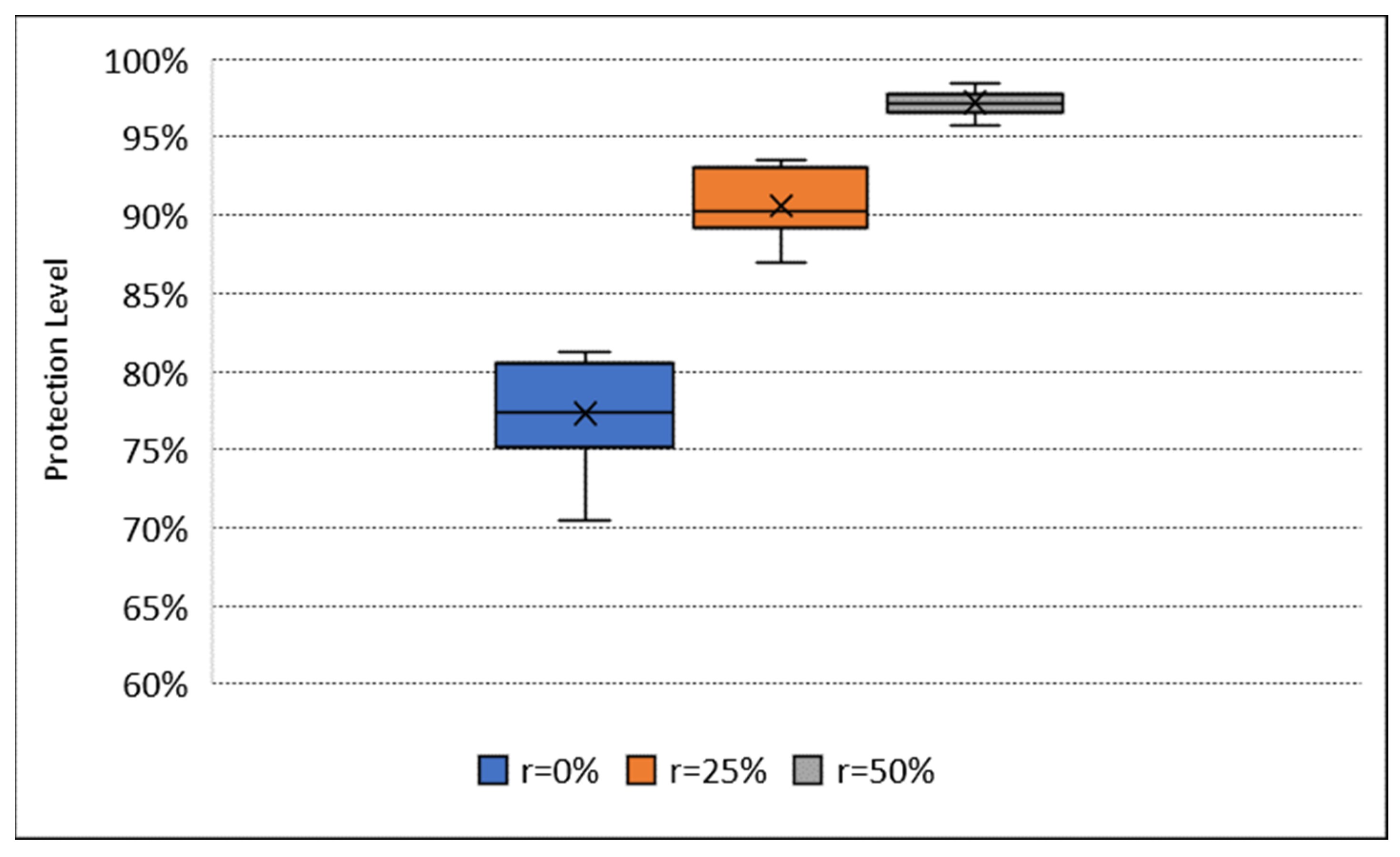

4.1. Guarantee Protection

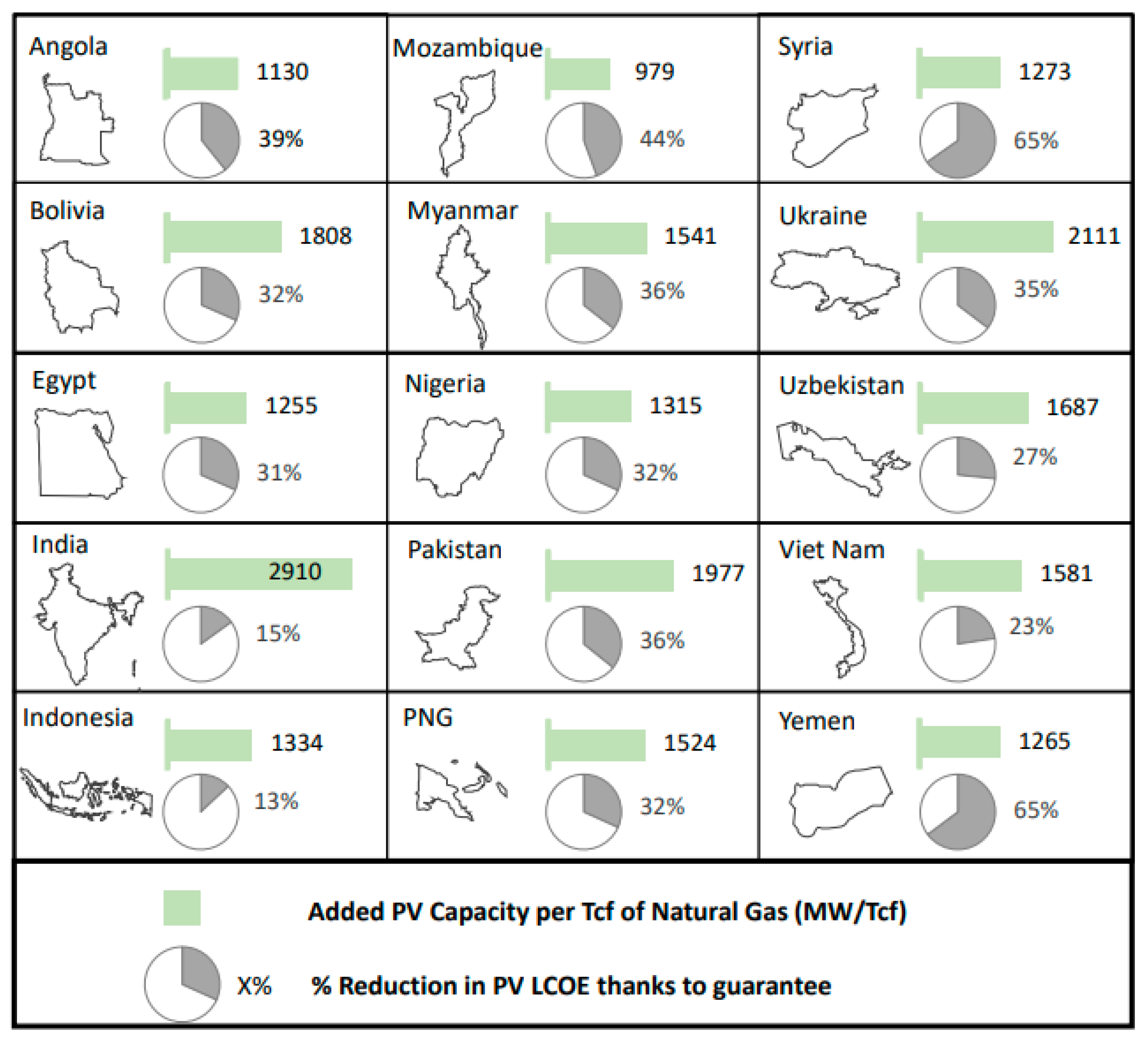

4.2. Country Results of the Integrated Energy Contract

4.3. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- IPCC. IPCC, Summary for Policymakers. In Global Warming of 1.5 C. An IPCC Special Report on the Impacts of Global Warming of 1.5 C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty; Intergovernmental Panel on Climate Change: Geneva, Switzerland, 2018; pp. 3–24. [Google Scholar]

- Padilla, E.; Serrano, A. Inequality in CO2 emissions across countries and its relationship with income inequality: A distributive approach. Energy Policy 2006, 34, 1762–1772. [Google Scholar] [CrossRef] [Green Version]

- Jakob, M.; Steckel, J.C. How climate change mitigation could harm development in poor countries. Wiley Interdiscip. Rev. Clim. Change 2014, 5, 161–168. [Google Scholar] [CrossRef]

- Cantarero, M.; Vanegas, M. Of renewable energy, energy democracy, and sustainable development: A roadmap to accelerate the energy transition in developing countries. Energy Res. Soc. Sci. 2020, 70, 101716. [Google Scholar] [CrossRef]

- Afful-Dadzie, A. Global 100% energy transition by 2050: A fiction in developing economies? Joule 2021, 5, 1641–1643. [Google Scholar] [CrossRef]

- Merzic, A.; Music, M.; Haznadar, Z. Conceptualizing sustainable development of conventional power systems in developing countries–A contribution towards low carbon future. Energy 2017, 126, 112–123. [Google Scholar] [CrossRef]

- Relva, S.G.; da Silva, V.O.; Gimenes, A.L.V.; Udaeta, M.E.M.; Ashworth, P.; Peyerl, D. Enhancing developing countries’ transition to a low-carbon electricity sector. Energy 2021, 220, 119659. [Google Scholar] [CrossRef]

- Millner, A.; Dietz, S. Adaptation to climate change and economic growth in developing countries. Environ. Dev. Econ. 2015, 20, 380–406. [Google Scholar] [CrossRef] [Green Version]

- Olsson, L.; Opondo, M.; Tschakert, P.; Agrawal, A.; Eriksen, S.; Ma, S.; Perch, L.; Zakeldeen, S. Livelihoods and poverty: Climate change 2014: Impacts, adaptation, and vulnerability. Part A: Global and sectoral aspects. Contribution of working group II to the fifth assessment report of the intergovernmental panel on climate change. In Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects; Cambridge University Press: Cambridge, UK, 2014; pp. 793–832. [Google Scholar]

- De Bruijn, E.-J.; Antonides, G. Poverty and economic decision making: A review of scarcity theory. Theory Decis. 2021, 92, 5–37. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Finance: Sovereign Guarantees; International Renewable Energy Agency: Masdar City, United Arab Emirates, 2020. [Google Scholar]

- Jakob, M.; Steckel, J.C.; Flachsland, C.; Baumstark, L. Climate finance for developing country mitigation: Blessing or curse? Clim. Dev. 2015, 7, 1–15. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar] [CrossRef]

- Painuly, J.P. Barriers to renewable energy penetration; a framework for analysis. Renew. Energy 2001, 24, 73–89. [Google Scholar] [CrossRef]

- Sen, S.; Ganguly, S. Opportunities, barriers and issues with renewable energy development–A discussion. Renew. Sustain. Energy Rev. 2017, 69, 1170–1181. [Google Scholar] [CrossRef]

- Steckel, J.C.; Jakob, M. The role of financing cost and de-risking strategies for clean energy investment. Int. Econ. 2018, 155, 19–28. [Google Scholar] [CrossRef]

- Ameli, N.; Dessens, O.; Winning, M.; Cronin, J.; Chenet, H.; Drummond, P.; Calzadilla, A.; Anandarajah, G.; Grubb, M. Higher cost of finance exacerbates a climate investment trap in developing economies. Nat. Commun. 2021, 12, 4046. [Google Scholar] [CrossRef] [PubMed]

- Polzin, F.; Egli, F.; Steffen, B.; Schmidt, T.S. How do policies mobilize private finance for renewable energy—A systematic review with an investor perspective. Appl. Energy 2019, 236, 1249–1268. [Google Scholar] [CrossRef]

- Sweerts, B.; Dalla Longa, F.; van der Zwaan, B. Financial de-risking to unlock Africa’s renewable energy potential. Renew. Sustain. Energy Rev. 2019, 102, 75–82. [Google Scholar] [CrossRef]

- Matthäus, D.; Mehling, M. De-risking Renewable Energy Investments in Developing Countries: A Multilateral Guarantee Mechanism. Joule 2020, 4, 2627–2645. [Google Scholar] [CrossRef]

- McElroy, M.B. Natural Gas: The Least Polluting of the Fossil Fuels. In Energy and Climate: Vision for the Future; Oxford University Press: Oxford, UK, 2016. [Google Scholar]

- Gurbanov, S. Role of Natural Gas Consumption in the Reduction of CO2 Emissions: Case of Azerbaijan. Energies 2021, 14, 7695. [Google Scholar] [CrossRef]

- Pickl, M.J. The renewable energy strategies of oil majors–From oil to energy? Energy Strategy Rev. 2019, 26, 100370. [Google Scholar] [CrossRef]

- Pickl, M.J. The trilemma of oil companies. Extr. Ind. Soc. 2021, 8, 100868. [Google Scholar] [CrossRef]

- Olleik, M.; Auer, H.; Nasr, R. A petroleum upstream production sharing contract with investments in renewable energy: The case of Lebanon. Energy Policy 2021, 154, 112325. [Google Scholar] [CrossRef]

- Dincer, I.; Joshi, A.S. Solar Based Hydrogen Production Systems; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Nepal, R.; Phoumin, H.; Khatri, A. Green Technological Development and Deployment in the Association of Southeast Asian Economies (ASEAN)—At Crossroads or Roundabout? Sustainability 2021, 13, 758. [Google Scholar] [CrossRef]

- Timmerberg, S.; Kaltschmitt, M. Hydrogen from renewables: Supply from North Africa to Central Europe as blend in existing pipelines–Potentials and costs. Appl. Energy 2019, 237, 795–809. [Google Scholar] [CrossRef]

- United Nations. World Economic Situation and Prospects 2020; United Nations: New York, NY, USA, 2020.

- EIA Natural Gas. Available online: https://www.eia.gov/international/data/world/natural-gas/dry-natural-gas-reserves (accessed on 1 November 2021).

- IRENA Statistical Profiles. Available online: https://www.irena.org/Statistics/Statistical-Profiles (accessed on 1 November 2021).

- UNFCCC NDC Registry. Available online: https://www4.unfccc.int/sites/NDCStaging/Pages/All.aspx (accessed on 1 November 2021).

- Reuters Egypt Aims to Generate 42% of Power from Renewables by 2030. Available online: https://www.reuters.com/business/sustainable-business/egypt-aims-generate-42-power-renewables-by-2030-2021-11-04/ (accessed on 5 November 2021).

- Ministry of External Affairs (India). National Statement by Prime Minister Shri Narendra Modi at COP26 Summit in Glasgow; Ministry of External Affairs: New Delhi, India, 2021.

- Association of Gas Producers of Ukraine. Ukraine Oil & Gas Industry Guide 2021; Association of Gas Producers of Ukraine: Kyiv, Ukraine, 2021. [Google Scholar]

- Shadrina, E. Non-Hydropower Renewable Energy in Central Asia: Assessment of Deployment Status and Analysis of Underlying Factors. Energies 2020, 13, 2963. [Google Scholar] [CrossRef]

- Kang, X.; Khan, F.U.; Ullah, R.; Arif, M.; Rehman, S.U.; Ullah, F. Does Foreign Direct Investment Influence Renewable Energy Consumption? Empirical Evidence from South Asian Countries. Energies 2021, 14, 3470. [Google Scholar] [CrossRef]

- Watkins, E. Total Exits Syria Following Tightened EU Sanctions. Available online: https://www.ogj.com/general-interest/government/article/17265863/total-exits-syria-following-tightened-eu-sanctions (accessed on 1 November 2021).

- Reuters Yemen Urges Oil Companies to Restart Production: Document. Available online: https://www.reuters.com/article/us-yemen-oil-idUSKCN1UO1FC (accessed on 1 November 2021).

- TotalEnergies Solar and Wind: Our Ambition in Renewable Energies. Available online: https://totalenergies.com/energy-expertise/exploration-production/renewable-energies/solar-energy-and-wind-energy (accessed on 27 December 2021).

- BP. From IOC to IEC, Second Quarter 2020 Financial Results and Strategy Presentation. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/investors/bp-second-quarter-2020-results-presentation-slides-and-script.pdf (accessed on 1 November 2021).

- Eni. Boosting Our Transformation, Strategy Presentation 2021–2024. Available online: https://www.eni.com/assets/documents/eng/investor/presentations/2021/strategy-4q-2020/strategy-2021-2024.pdf (accessed on 1 November 2021).

- Repsol. Investor Update 2021 Stepping up the Transition Driving Growth and Value February 2021. Available online: https://www.repsol.com/content/dam/repsol-corporate/es/accionistas-e-inversores/pdf/0221-investor-update.pdf (accessed on 1 November 2021).

- Equinor. Accelerating our Transition. Available online: https://www.equinor.com/content/dam/statoil/documents/quarterly-reports/2021/cmd-2021/cmd-2021-ceo-anders-opedal-equinor.pdf (accessed on 1 November 2021).

- Allen&Overy. Guide to Extractive Industries Documents—Oil & Gas; World Bank Institute Governance for Extractive Industries Programme: 2013. Available online: https://www.allenovery.com/global/-/media/sharepoint/publications/sitecollectiondocuments/geiprogram.pdf?la=en-gb&hash=2F1773051C1304034AFA76F3E6618DE7 (accessed on 1 November 2021).

- Bindemann, K. Production-Sharing Agreements: An Economic Analysis; Oxford Institute for Energy Studies: Oxford, UK, 1999. [Google Scholar]

- Heck, N.; Smith, C.; Hittinger, E. A Monte Carlo approach to integrating uncertainty into the levelized cost of electricity. Electr. J. 2016, 29, 21–30. [Google Scholar] [CrossRef]

- The World Bank Global Solar Atlas. Available online: https://globalsolaratlas.info/map (accessed on 1 November 2021).

- Zhang, D.; Wang, T.; Shi, X.; Liu, J. Is hub-based pricing a better choice than oil indexation for natural gas? Evidence from a multiple bubble test. Energy Econ. 2018, 76, 495–503. [Google Scholar] [CrossRef]

- Li, Y.; Chevallier, J.; Wei, Y.; Li, J. Identifying price bubbles in the US, European and Asian natural gas market: Evidence from a GSADF test approach. Energy Econ. 2020, 87, 104740. [Google Scholar] [CrossRef]

- Hamie, H.; Hoayek, A.; Auer, H. Modeling the price dynamics of three different gas markets-records theory. Energy Strategy Rev. 2018, 21, 121–129. [Google Scholar] [CrossRef]

- Efimova, O.; Serletis, A. Energy markets volatility modelling using GARCH. Energy Econ. 2014, 43, 264–273. [Google Scholar] [CrossRef]

- Zhang, Z.; Moore, J. Chapter 8—Autoregressive moving average models. In Mathematical and Physical Fundamentals of Climate Change; Elsevier: Boston, MA, USA, 2015; pp. 239–290. [Google Scholar]

- The World Bank. World Bank Commodity Price Data (The Pink Sheet); World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Dufour, J.-M.; Neves, J. Finite-sample inference and nonstandard asymptotics with Monte Carlo tests and R. In Handbook of Statistics; Elsevier: Amsterdam, The Netherlands, 2019; Volume 41, pp. 3–31. [Google Scholar]

- Rogers, H. The LNG Shipping Forecast: Costs Rebounding, Outlook Uncertain; The Oxford Institute for Energy Studies: Oxford, UK, 2018. [Google Scholar]

- Steuer, C. Outlook for Competitive LNG Supply; The Oxford Institute for Energy Studies: Oxford, UK, 2019; p. 21. [Google Scholar]

- Jensen, J.T. The Development of a Global LNG Market: Is It Likely? If So, When? Oxford Institute for Energy Studies: Oxford, UK, 2004. [Google Scholar]

- Damodaran, A. Country Risk: Determinants, Measures and Implications—The 2020 Edition; SSRN: Rochester, NY, USA, 2020. [Google Scholar]

- IRENA. Global Landscape of Renewable Energy Finance 2020; International Renewable Energy Agency: Masdar City, United Arab Emirates, 2020. [Google Scholar]

- Gatti, S. Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public Projects; Academic Press: Cambridge, MA, USA, 2013. [Google Scholar]

- Steffen, B. Estimating the cost of capital for renewable energy projects. Energy Econ. 2020, 88, 104783. [Google Scholar] [CrossRef]

- Schmidt, T.S. Low-carbon investment risks and de-risking. Nat. Clim. Change 2014, 4, 237–239. [Google Scholar] [CrossRef]

- Angelopoulos, D.; Doukas, H.; Psarras, J.; Stamtsis, G. Risk-based analysis and policy implications for renewable energy investments in Greece. Energy Policy 2017, 105, 512–523. [Google Scholar] [CrossRef]

- Damodaran, A. Country Default Spreads and Risk Premiums. Available online: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html (accessed on 1 November 2021).

- Total. Results and Outlook February 2021. Available online: https://totalenergies.com/system/files/documents/2021-02/2020_results_outlook.pdf (accessed on 1 November 2021).

- Royal Dutch Shell plc. Shell Strategy Day 2021—Slides. Available online: https://www.shell.com/investors/investor-presentations/2021-investor-presentations/strategy-day-2021/_jcr_content/par/textimage_1038086377.stream/1613410966913/8cd4fe1b174147fa20b33d1c189349dd36a9017d/strategy-day-2021-slides.pdf (accessed on 1 November 2021).

- KPMG Corporate Tax Rates Table. Available online: https://home.kpmg/xx/en/home/services/tax/tax-tools-and-resources/tax-rates-online/corporate-tax-rates-table.html (accessed on 1 November 2021).

- Egli, F.; Steffen, B.; Schmidt, T.S. A dynamic analysis of financing conditions for renewable energy technologies. Nat. Energy 2018, 3, 1084–1092. [Google Scholar] [CrossRef]

- IEA. Projected Costs of Generating Electricity 2020; International Energy Agency: Paris, France, 2020.

- Warusawitharana, M. The Social Discount Rate in Developing Countries; Board of Governors of the Federal Reserve System (US): Washington, DC, USA, 2014.

- Syrian Ministry of Electricity Syria Feed-in Tariff Syria AR, Ministry of Electricity. 2011. Available online: https://taqaway.net/documents/syria-feed-tariff-syria-ar-ministry-electricity-2011 (accessed on 1 November 2021).

- Almohamadi, A. Priorities for the Recovery of the Electricity Sector in Yemen; Deep Root Consulting: London, UK, 2021. [Google Scholar]

- African Development Bank. Power Sector Reform Support Program—Angola; African Development Bank: Abidjan, Cote D’Ivoire, 2014. [Google Scholar]

- IRENA. Renewable Energy in Latin America 2015: An Overview of Policies; IRENA: Masdar City, United Arab Emirates, 2015. [Google Scholar]

- El-Mazghouny, D. The Renewable Energy Law Review: Egypt. Available online: https://thelawreviews.co.uk/title/the-renewable-energy-law-review/egypt (accessed on 1 November 2021).

- Prateek, S. Feed-In Tariffs to Make a Comeback in India for Small Solar and Wind Projects. Available online: https://mercomindia.com/feed-in-tariff-solar-wind/ (accessed on 1 November 2021).

- IEA. Solar Feed-In Tariff of Indonesia (2016); IEA: Paris, France, 2021.

- Parliament—Mozambique, Regulations Establishing the New and Renewable Energy Feed-In Tariff. Available online: https://rise.esmap.org/data/files/library/mozambique/Documents/Renewable%20Energy/Mozambique_REFIT_Regulation%20feed-in%20tariff_2014.pdf (accessed on 1 November 2021).

- Ross, R.P. Myanmar’s Path to Electrification—The role of Distributed Energy Systems; Center for Strategic & International Studies: Washington, DC, USA, 2015. [Google Scholar]

- Adeniyi, F. Overcoming the Market Constraints to On-Grid Renewable Energy Investments in Nigeria; The Oxford Institute for Energy Studies: Oxford, UK, 2019. [Google Scholar]

- Khan, A.J. Structure and Regulation of the Electricity Networks in Pakistan. Pak. Dev. Rev. 2014, 53, 505–528. [Google Scholar] [CrossRef] [Green Version]

- Department of Petroleum Energy in Papua New Guinea PAPUA NEW GUINEA: National Energy Policy 2016–2020. Available online: https://policy.asiapacificenergy.org/node/2676 (accessed on 1 November 2021).

- Radchenko, V. Electricity Law and Regulation in Ukraine. Available online: https://cms.law/en/int/expert-guides/cms-expert-guide-to-electricity/ukraine#:~:text=1.2.,1.2. (accessed on 1 November 2021).

- Kabilov, J.-S.; Abdurazakov, F. The Renewable Energy Law Review: Uzbekistan. Available online: https://thelawreviews.co.uk/title/the-renewable-energy-law-review/uzbekistan (accessed on 1 November 2021).

- Tien, T.F.; Thanh, B. Overview of Investment in Renewable Energy in Vietnam; Freshfields Bruckhaus Deringer: London, UK, 2020. [Google Scholar]

- Flanders Investment and Trade. Oil & Gas Report Angola; Flanders Investment and Trade: Flanders, Belgium, 2021. [Google Scholar]

- Honore, A. South American Gas Markets and the Role of LNG; The Oxford Institute for Energy Studies: Oxford, UK, 2016. [Google Scholar]

- Raus, L. Overview of Egypt’s Upstream Sector. Available online: https://egyptoil-gas.com/features/overview-of-egypts-upstream-sector/ (accessed on 1 November 2021).

- Mordor Intelligence India Oil and Gas Usptream Market—Growth, Trends, COVID-19 Impact and Forecasts (2021–2026). Available online: https://www.mordorintelligence.com/industry-reports/india-oil-and-gas-upstream-market (accessed on 1 November 2021).

- Oxford Business Group How Indonesia Supports Upstream Activity in Energy Sector. Available online: https://oxfordbusinessgroup.com/overview/capacity-change-oil-fields-mature-and-domestic-consumption-rises-sector-refocuses-boosting-upstream (accessed on 1 November 2021).

- Energy Capital & Power Upstream to Downstream: Mozambique’s Major Developments. Available online: https://energycapitalpower.com/upstream-to-downstream-mozambiques-major-developments/ (accessed on 1 November 2021).

- Agha, S.; Penglis, E.; Roland-Holst, D.W.; Rabbi, F. An Initial Assessment of the Economic Costs of Natural Gas for Myanmar’s Domestic Market; The World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Anderson, S. Why Investors May Have Nigerian Upstream Assets in Their Sights. Available online: https://www.woodmac.com/news/opinion/why-investors-may-have-nigerian-upstream-assets-in-their-sights/ (accessed on 1 November 2021).

- Gomes, I. Natural Gas in Pakistan and Bangladesh: Current Issues and Trends; The Oxford Institute for Energy Studies: Oxford, UK, 2013. [Google Scholar]

- Turkes, H. Total and Partners Sign Agreement for Papua LNG Project. Available online: https://www.aa.com.tr/en/energy/general/total-and-partners-sign-agreement-for-papua-lng-project/25097 (accessed on 1 November 2021).

- Pirani, S. Central Asian Gas: Prospects for the 2020s; The Oxford Institute for Energy Studies: Oxford, UK, 2019. [Google Scholar]

- IES & EMCa. Viet Nam: Roadmap for Natural Gas Market Development; Intelligent Energy Systems (IES) & Energy Market Consulting Associates (EMCa). Available online: https://ppiaf.org/documents/5572/download (accessed on 1 November 2021).

- S&P Global. Devastated by War, Yemen’s still Surviving Oil and Gas Sector needs Peace to Recover. Available online: https://www.spglobal.com/platts/en/market-insights/latest-news/oil/081221-devastated-by-war-yemens-still-surviving-oil-and-gas-sector-needs-peace-to-recover (accessed on 1 November 2021).

- Tran, T.T.; Smith, A.D. Incorporating performance-based global sensitivity and uncertainty analysis into LCOE calculations for emerging renewable energy technologies. Appl. Energy 2018, 216, 157–171. [Google Scholar] [CrossRef]

- IRENA. Renewable Power Generation Costs in 2020; IRENA: Masdar City, United Arab Emirates, 2021. [Google Scholar]

- Lazard. Lazard’s Levelized Cost of Energy Analysis; Lazard: Tokyo, Japan, 2020. [Google Scholar]

- Goldberg, M.J. Gas Sector Development Project—Bolivia-Brazil Gas Pipeline. Available online: https://projects.worldbank.org/en/projects-operations/project-detail/P006549 (accessed on 1 November 2021).

- CNPC. Overview of the Myanmar-China Oil & Gas Pipelines. Available online: https://www.cnpc.com.cn/en/myanmarcsr/201407/f115a1cc6cdb4700b55def91a0d11d03/files/dec09c5452ec4d2ba36ee33a8efd4314.pdf (accessed on 1 November 2021).

- CNPC. Flow of Natural Gas from Central Asia. Available online: https://www.cnpc.com.cn/en/FlowofnaturalgasfromCentralAsia/FlowofnaturalgasfromCentralAsia2.shtml (accessed on 1 November 2021).

- Sayigh, Y. The War Over Syria’s Gas Fields. Available online: https://carnegie-mec.org/diwan/60316 (accessed on 1 November 2021).

- EIA. Country Analysis: Bolivia. Available online: https://www.eia.gov/international/analysis/country/BOL (accessed on 1 November 2021).

- EIA. Country Analysis: Angola. Available online: https://www.eia.gov/international/analysis/country/AGO (accessed on 1 November 2021).

- AngolaLNG Angola Gas Supply. Available online: https://www.angolalng.com/en/operations/gas-supply/ (accessed on 1 November 2021).

- Widdershoven, C. Egypt is Shaping up to Become a Real Energy Hub. Available online: https://berrycommodities.com/egypt-is-shaping-up-to-become-a-real-energy-hub/ (accessed on 1 November 2021).

- Fouad, A. Egypt’s Future in the LNG Market. Available online: https://www.mei.edu/publications/egypts-future-lng-market (accessed on 1 November 2021).

- EIA. Country Analysis: Egypt. Available online: https://www.eia.gov/international/analysis/country/EGY (accessed on 1 November 2021).

- EIA. Country Analysis: Indonesia. Available online: https://www.eia.gov/international/analysis/country/IDN (accessed on 1 November 2021).

- Jamieson, A. Momentum Grows in Mozambique Mega Gas Projects, but Multiple Challenges Lie Ahead. Available online: https://www.turnerandtownsend.com/en/perspectives/momentum-grows-in-mozambique-mega-gas-projects-but-multiple-challenges-lie-ahead/ (accessed on 1 November 2021).

- EIA. Country Analysis: Mozambique. Available online: https://www.eia.gov/international/analysis/country/MOZ (accessed on 1 November 2021).

- Bidaurratzaga, A.E.; Colom, J.A. Mozambique’s Megaproject-Based Economic Model: Still Struggling with Uneven Development? Adv. Afr. Econ. Soc. Political Dev. 2019, 2019, 95–113. [Google Scholar] [CrossRef]

- Napims Crude Oil Reserves/Production—Nigeria. Available online: https://napims.nnpcgroup.com/Pages/Crude-Oil-Reserves-Production.aspx (accessed on 1 November 2021).

- EIA. Country Analysis: Nigeria. Available online: https://www.eia.gov/international/analysis/country/NGA (accessed on 1 November 2021).

- Humphreys, S. Papua New Guinea: A Review and Forecast of Exploration and Production. Available online: https://ihsmarkit.com/research-analysis/papua-new-guinea-exploration-and-production.html (accessed on 1 November 2021).

- PNG LNG. Available online: https://www.pnglng.com/About (accessed on 1 November 2021).

- EIA. Country Analysis: Yemen. Available online: https://www.eia.gov/international/analysis/country/YEM (accessed on 1 November 2021).

- Petroleum & Natural Gas Regulatory Board—India. “Vision 2030” Natural Gas Infrastructure in India. Available online: https://www.pngrb.gov.in/Hindi-Website/pdf/vision-NGPV-2030-06092013.pdf (accessed on 1 November 2021).

- EIA. Country Analysis: India. Available online: https://www.eia.gov/international/analysis/country/IND (accessed on 1 November 2021).

- Gong, J.-M.; Liao, J.; Liang, J.; Lei, B.-H.; Chen, J.-W.; Khalid, M.; Haider, S.W.; Meng, M. Exploration prospects of oil and gas in the Northwestern part of the Offshore Indus Basin, Pakistan. China Geol. 2020, 3, 633–642. [Google Scholar] [CrossRef]

- EIA. Country Analysis: Pakistan. Available online: https://www.eia.gov/international/analysis/country/PAK (accessed on 1 November 2021).

- EIA. Country Analysis: Viet Nam. Available online: https://www.eia.gov/international/analysis/country/VNM (accessed on 1 November 2021).

- Chávez-Rodríguez, M.F.; Garaffa, R.; Andrade, G.; Cárdenas, G.; Szklo, A.; Lucena, A.F.P. Can Bolivia keep its role as a major natural gas exporter in South America? J. Nat. Gas Sci. Eng. 2016, 33, 717–730. [Google Scholar] [CrossRef]

- EIA. Country Analysis: Uzbekistan. Available online: https://www.eia.gov/international/analysis/country/UZB (accessed on 1 November 2021).

- EIA. Country Analysis: Syria. Available online: https://www.eia.gov/international/analysis/country/SYR (accessed on 1 November 2021).

- Piran, S.; Sharples, J. Ukraine-EU Gas Market Integration; The Oxford Institute for Energy Studies: Oxford, UK, 2021. [Google Scholar]

- Rystad Energy UCube Barrel Breakdown. Available online: http://graphics.wsj.com/oil-barrel-breakdown/ (accessed on 1 November 2021).

- Jaganathan, J. Analysis: Qatar Tightens Global Gas Market Grip with Bold Expansion Moves. Available online: https://www.reuters.com/article/us-qatar-lng-exports-analysis-idUSKBN2B80EZ (accessed on 1 November 2021).

- Mikulska, A.; Kosinski, E. What’s Next for Natural Gas in Ukraine? Baker Institute for Public Policy: Houston, TX, USA, 2020. Available online: https://www.bakerinstitute.org/media/files/files/6754d0f0/ces-wp-ukraine-050720.pdf (accessed on 1 November 2021).

| Country | Natural Gas Reserves (Tcf) a | Access to Electricity b | Total Electricity Capacity (MW) b | Renewable Electricity Capacity (MW) b | Share of Renewable Electricity Generation b | Renewable Energy Targets in 2030 (MW or Share of Total Generation) c | |

|---|---|---|---|---|---|---|---|

| Hydro | Non-Hydro | ||||||

| Angola | 12.1 | 45% | 5931 | 3729 | 64 | 72% | Hydro: 6310 Non-Hydro: 1740 |

| Bolivia | 10.7 | 93% | 3537 | 736 | 321 | 36% | 81% |

| Egypt | 63 | 100% | 59,420 | 2832 | 3139 | 9% | 42% |

| India | 48.8 | 95% | 452,308 | 45,955 | 88,302 | 17% | 500,000 |

| Indonesia | 49.7 | 99% | 70,387 | 6210 | 4344 | 16% | 21,650 |

| Mozambique | 100 | 31% | 2915 | 2204 | 109 | 95% | NA |

| Myanmar | 22.5 | 66% | 7336 | 3304 | 144 | 52% | Hydro: 5676 Non-Hydro: 3070 |

| Nigeria | 203.4 | 57% | 13,154 | 2153 | 41 | 25% | Hydro: 17,653 Non-Hydro: 22,741 |

| Pakistan | 20.9 | 73% | 39,428 | 10,002 | 2404 | 31% | 60% |

| PNG d | 6.5 | 59% | 1037 | 258 | 75 | 63% | 78% |

| Syria | 8.5 | 86% | 8625 | 1490 | 10 | 3% | 10% |

| Ukraine | 39 | 100% | 57,643 | 4819 | 8945 | 8% | 13.2% |

| Uzbekistan | 65 | 100% | 16,041 | 2005 | 4 | 11% | 25% |

| Viet Nam | 24.7 | 100% | 69,355 | 18,165 | 17,484 | 43% | NA |

| Yemen | 16.9 | 62% | 1947 | 0 | 253 | 14% | NA |

| Energy Company | Renewable Energy Capacity Target in 2030 (GW) |

|---|---|

| TotalEnergies [40] | 100 |

| BP [41] | 50 |

| Eni [42] | 15 |

| Repsol [43] | 15 |

| Equinor [44] | 12 to 16 |

| Parameter | Value |

|---|---|

| PV | |

| Years of construction | 1 |

| (Weight of debt) | 80% |

| (Default spread of RE projects) | 2% |

| (USD risk free rate) | 2.14% |

| Upstream | |

| Years of construction | 5 |

| State | |

| State discount rate a | 11% |

| Country | Added PV Capacity (MW) | % of 2030 RE Target Capacity Additions Achieved | % Increase in Total Electricity Capacity | Positive FID Rate |

|---|---|---|---|---|

| Angola | 1369 | 32% | 23% | 49% |

| Bolivia | 1934 | NA | 55% | 55% |

| Egypt | 7904 | NA | 13% | 48% |

| India | 14,187 | 4% | 3% | 76% |

| Indonesia | 6635 | 60% | 9% | 64% |

| Mozambique | 9792 | NA | 336% | 31% |

| Myanmar | 3467 | 65% | 47% | 76% |

| Nigeria | 26,762 | 70% | 203% | 61% |

| Pakistan | 4135 | NA | 10% | 85% |

| PNG | 985 | NA | 95% | 72% |

| Syria | 1082 | NA | 13% | 53% |

| Ukraine | 8235 | NA | 14% | 81% |

| Uzbekistan | 10,965 | NA | 68% | 66% |

| Viet Nam | 3906 | NA | 6% | 79% |

| Yemen | 2138 | NA | 110% | 55% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Olleik, M.; Hamie, H.; Auer, H. Using Natural Gas Resources to De-Risk Renewable Energy Investments in Lower-Income Countries. Energies 2022, 15, 1651. https://doi.org/10.3390/en15051651

Olleik M, Hamie H, Auer H. Using Natural Gas Resources to De-Risk Renewable Energy Investments in Lower-Income Countries. Energies. 2022; 15(5):1651. https://doi.org/10.3390/en15051651

Chicago/Turabian StyleOlleik, Majd, Hassan Hamie, and Hans Auer. 2022. "Using Natural Gas Resources to De-Risk Renewable Energy Investments in Lower-Income Countries" Energies 15, no. 5: 1651. https://doi.org/10.3390/en15051651