Sustainable Development of Operational Infrastructure for Electric Vehicles: A Case Study for Poland

Abstract

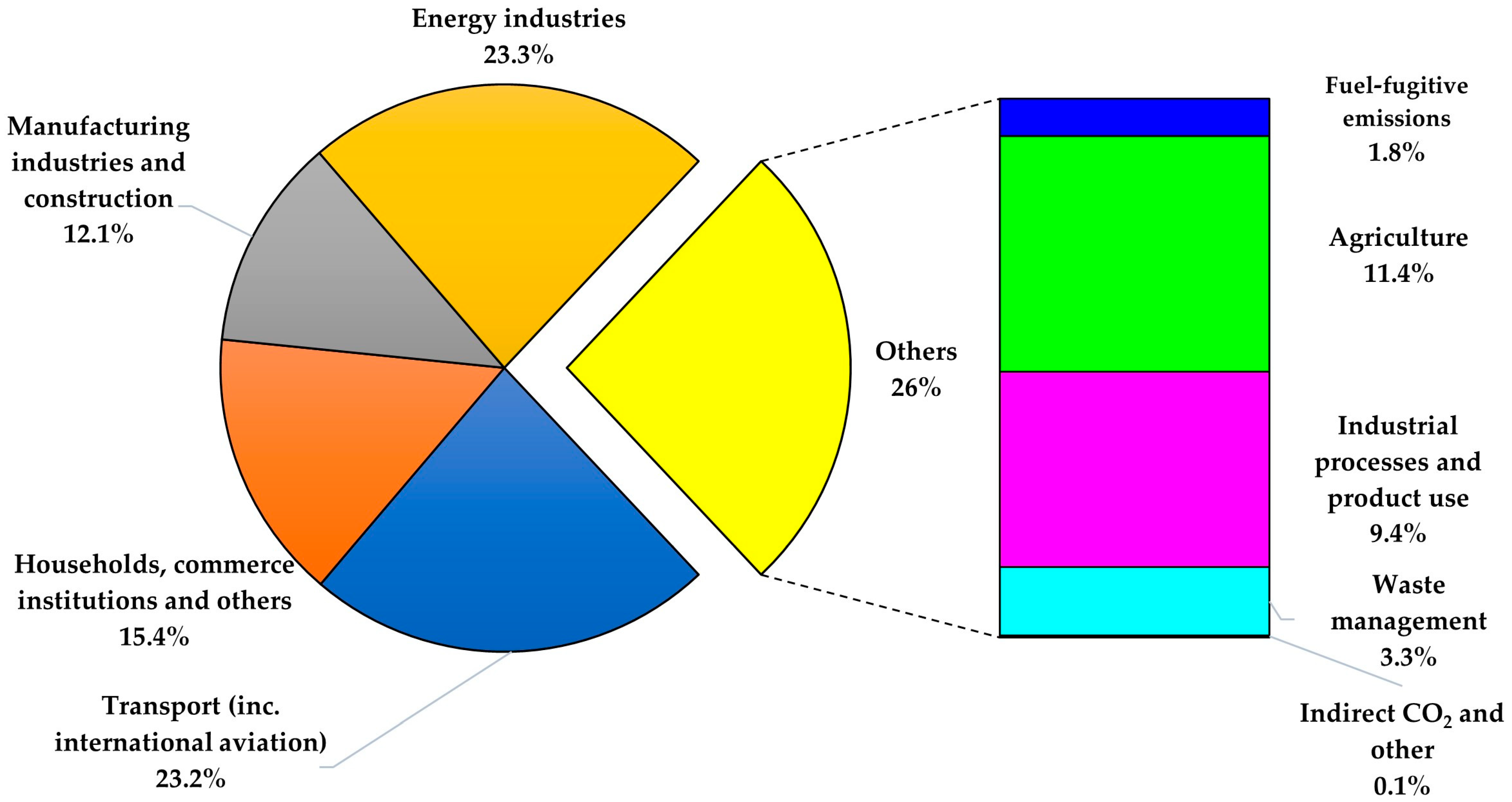

1. Introduction

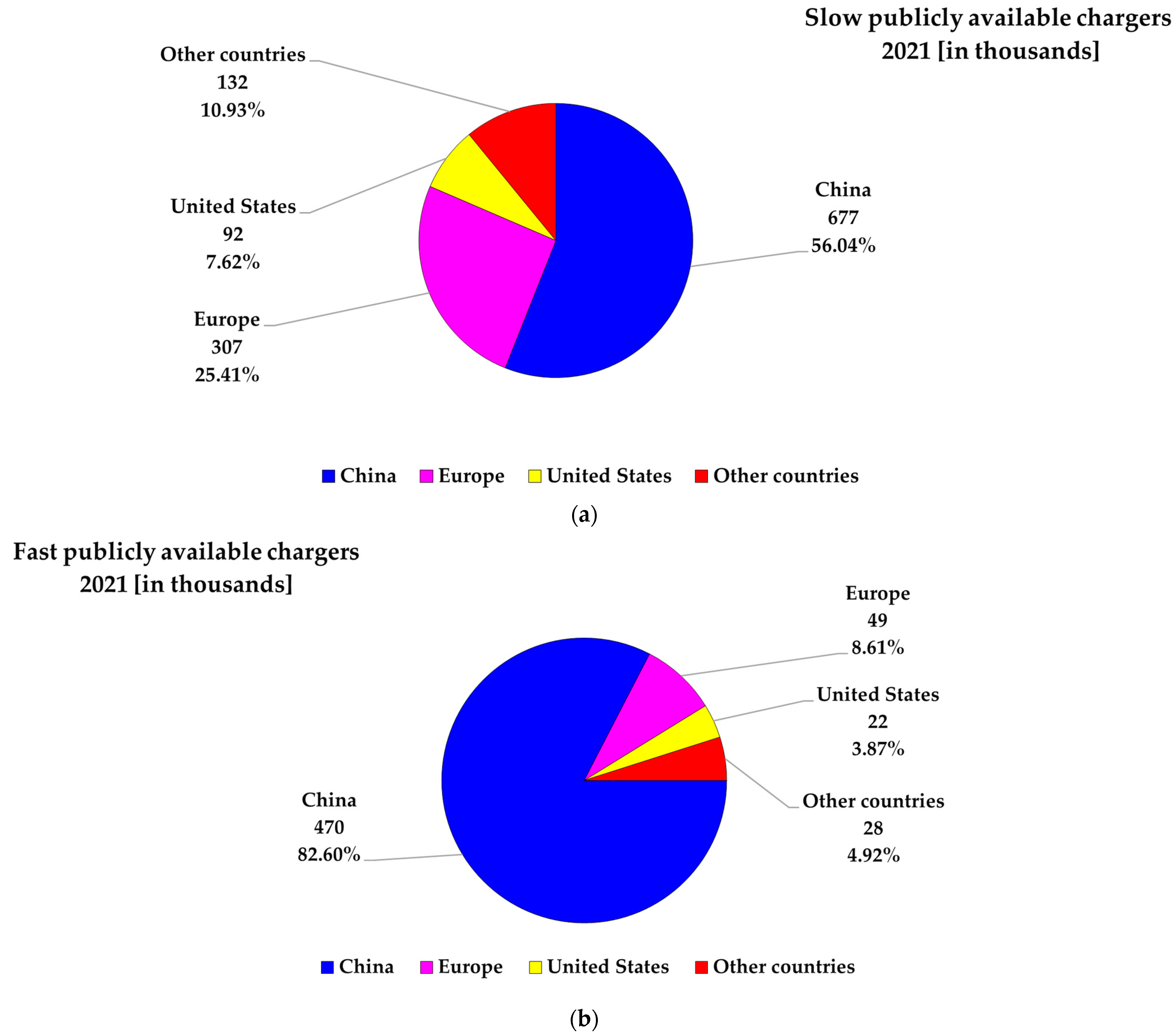

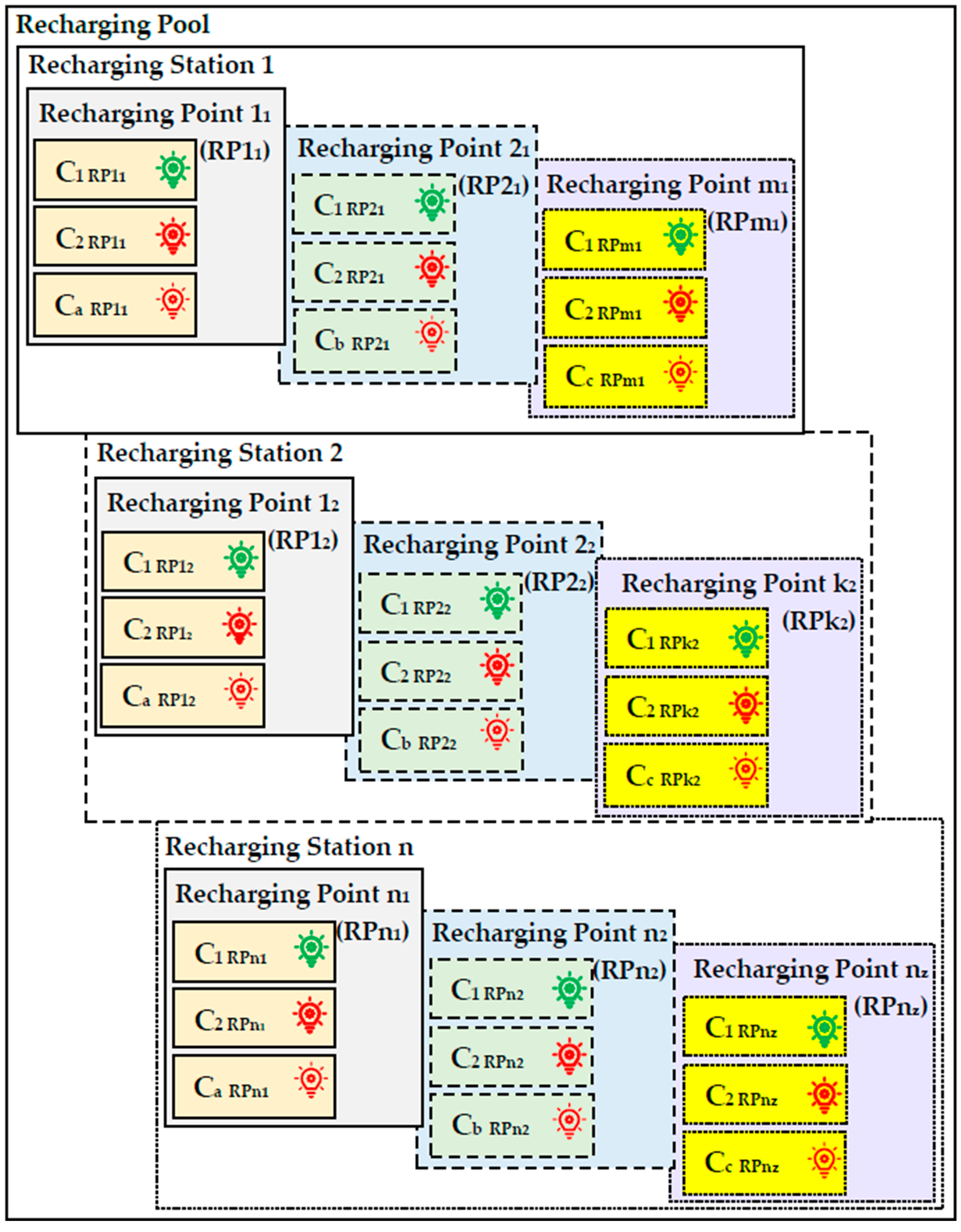

2. Electric Vehicle Market Architecture

- ✓

- In AC 50 kW mode using the IEC 62196-2 Mennekes (Type 2) connector;

- ✓

- In DC CCS mode (Combo 2) up to 350 kW and optionally CHAdeMO 2.0 with charging power up to 150 kW.

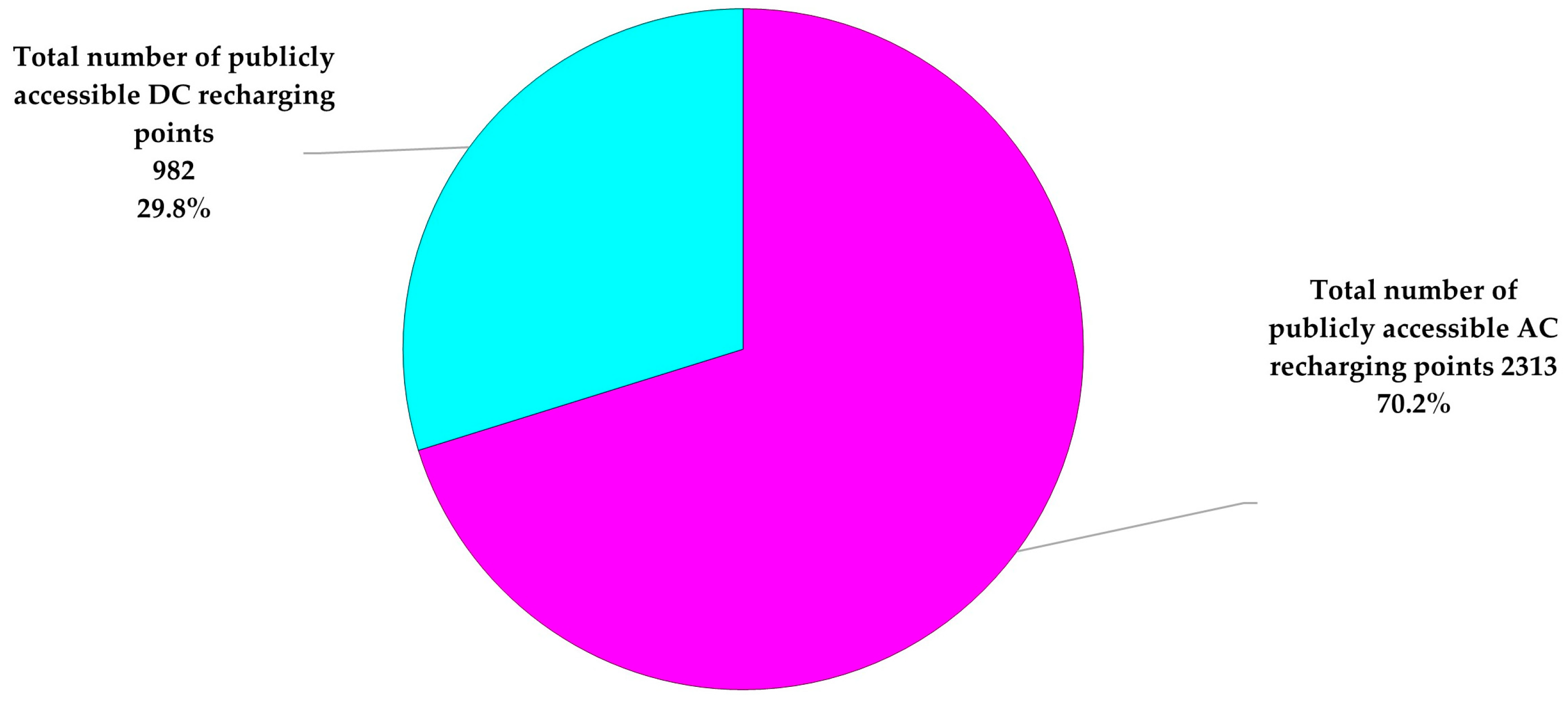

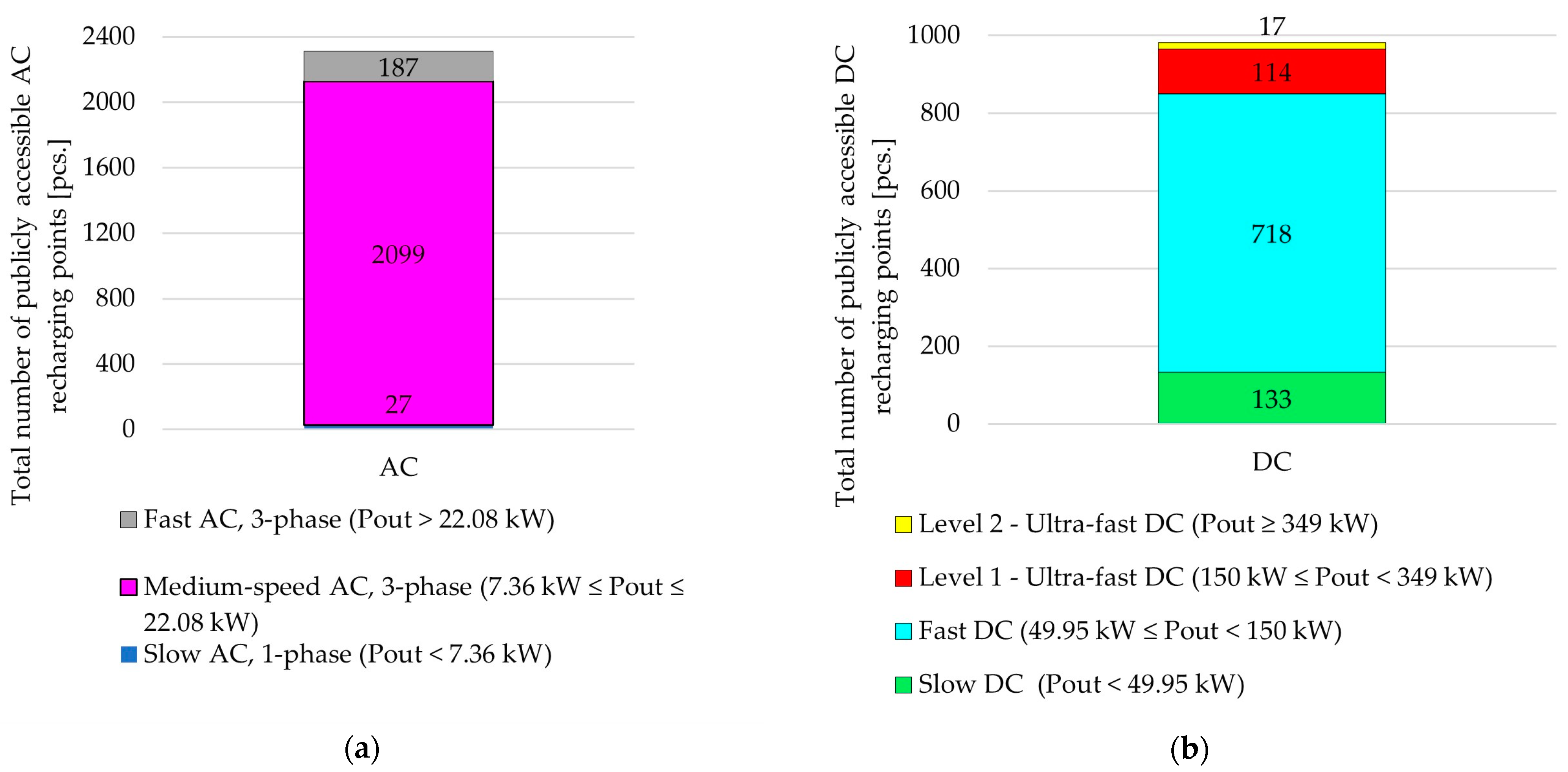

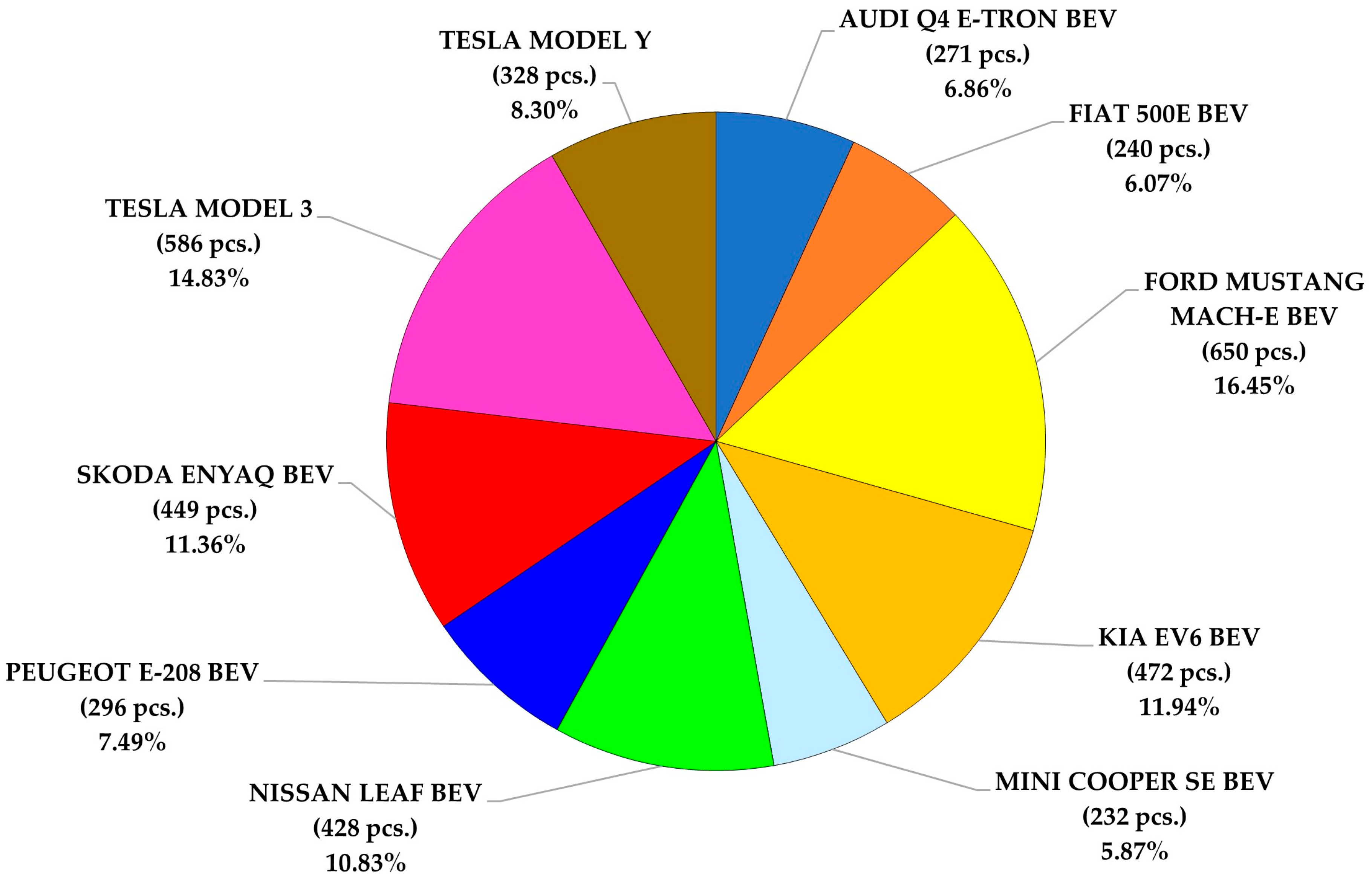

3. The Current State of Development of Operational Infrastructure for Electric Vehicles in Poland

- ✓

- Equipping the station with a metering system, enabling the measurement of electricity consumption and transferring measurement data from this system to the station management system.

- ✓

- Equipping the station with software that allows it to connect and charge an electric vehicle.

- ✓

- Compliance with technical requirements by charging stations.

- ✓

- Providing data to the Register of Alternative Fuels Infrastructure on the availability of a charging point and the price for the charging service (on the website [82]).

- ✓

- Conclusion of a distribution agreement with the Distribution System Operator (DSO) for the needs of the operation of the charging station and the provision of charging services.

| Operator | PKN Orlen | Greenway | |||

|---|---|---|---|---|---|

| Producer | ABB Terra CE 54 CJG | Ekoenergetyka AXON EASY | Efacec QC45 | ABB Terra Wallbox | Delta Slim 100 |

| Example model graphical view |  |  |  |  |  |

| EV connectors | CCS2—1 pc. CHAdeMO—1 pc. Type 2 AC—1 pc. | CCS2—1 pc. CHAdeMO—1 pc. Type 2 AC—1 pc (optional) | CCS2—1 pc. CHAdeMO—1 pc. Type 2 AC—1 pc | CCS2—1 pc. CHAdeMO—1 pc. | CCS2—1 pc. CHAdeMO—1 pc. Type 2 AC—1 pc |

| Output power [kW] | 50 kW DC 43 kW AC | 60/120/180 kW DC 43 kW AC | 50 kW DC 43 kW AC | 24 kW DC (peak) 22.5 kW DC (cont.) | 100 kW DC 22 kW AC |

| Output voltage range [V] | 150–500 V DC 400 V AC | 150–1000 V | 50–500 V | 150–920 V | 200–920 V |

| Output current [A] | 125 A DC 32 A AC 3phase | CCS2 200/250/300 A CHAdeMO 125 A 32 A AC | AC: up to 63 A 3 phase DC: up to 120 A | 60 A | CCS2 250 A CHAdeMO 12 A 32 A AC 3phase |

| Connection Power [kVA or kW] | 98 kW | 90/156/222 kW | n.a. | n.a. | n.a. |

| Supply voltage [V] | 380–415 VAC AC 3-phase | 400 V AC 3-phase | 400 V AC +/−10% | 400 V AC +/−10% | |

| Input current [A] | 143 A | n.a. | 73 A | 100 A | 203 A |

| Current type | DC AC 3-phase | DC AC 3-phase | DC AC 3-phase | DC | DC |

| Peak efficiency | >94% | >94% | >93 | >95% | >94% |

| Size DxWxH [m] | 0.78 × 0.78 × 1.9 | 0.98 × 0.75 × 2 | 0.3 × 0.58 × 0.77 | 0.44 × 1.62 × 0.89 | |

| Weight | 325 kg | 450–550 kg | 600 kg | 60 kg | 230 kg |

| Communication Interface | 4G, Ethernet | 4G, 5G, Ethernet | 3G (GSM/CDMA), LAN, Wi-Fi | GSM/4G modem, Ethernet | Ethernet, Cellurlar 2G/3G/4G |

| Load management method | OCCP | OCCP | OCPP | OCCP | OCCP |

| Authentication method | RFID, NFC, Pincode, App | RFID, NFC | RFID | RFID, NFC, Mifare, Calypso | RFID, NFC, |

| Time to add 100 km (reference battery usage capacity 75 kWh) | ~22 min (43 kW) ~19 min (50 kW) | ~22 min (43 kW) ~16 min (60 kW) ~8 min (120 kW) ~5.5 min (180 kW) | ~22 min (43 kW) ~19 min (50 kW) | ~42 min (22.5 kW) | ~43 min (22 kW) ~10 min (100 kW) |

| Charging fee [PLN/kWh] | AC for 50 kW: 1.89 PLN/kWh DC for x ≤ 50 kW: 2.69 PLN/kWh DC for 50 kW < x ≤ 125 kW: 2.89 PLN/kWh DC for x > 125 kW: 3.19 PLN/kWh | Energia STANDARD AC: 1.95 PLN/kWh DC for x ≤ 100 kW: 2.95 PLN/kWh DC for x > 100 kW: 3.25 PLN/kWh | |||

| Parking fee [PLN/min] | 0.40 PLN/min AC: after 60 min—recharging stations with AC&DC connectors AC: after 720 min—recharging stations with AC connectors only DC: after 45 min | 0.40 PLN/min AC: after 600 min (valid from 7:00 to 21:00) DC: after 60 min | |||

| Cost of charging per 100 km (no parking fee) | 29.3 PLN (AC—43 kW) for 22 min 41.7 PLN (DC—50 kW) for 19 min 44.8 PLN (DC—60 kW/120 kW) for 16 min/8 min 49.5 PLN (DC—180 kW) for 5.5 min | 30.22 PLN (AC—22 kW) for 43 min 45.72 PLN (DC—50 kW/100 kW) for 19 min/10 min 50.37 PLN (DC—x > 100 kW) | |||

| No. | Appearance | EV Model | Car Type | Price [Thousands of EUR] | Drive Range WLTPm [km] | Energy Consumption WLTPm [Wh/km] | Battery Capacity [kWh] | Battery Usage [kWh] | Duration for a Full Charge (From SOC = 0.2 to SOC = 0.8) | |

|---|---|---|---|---|---|---|---|---|---|---|

| AC Level 2 Charging | DC | |||||||||

| 1 |  | AUDI Q4 e-tron 40 | SUV | 55.21 | 520 | 169 | 82 | 76.6 | 4 h 30 min for 11 kW | ~23 min for 135 kW (CCS) |

| 2 |  | FIAT 500E RED FWD | Hatchback | 35.67 | 326 | 138 | 42 | 37.3 | 2 h 33 min for 11 kW | ~26 min for 85 kW (CCS) |

| 3 |  | FORD MUSTANG MACH-E GT | SUV | 96.41 | 490 | 212 | 98 | 91 | 9 h 27 min for 11 kW | ~40 min for 107 kW (CCS) |

| 4 |  | KIA EV6 AWD | SUV | 58.87 | ~506 | 180 | 77.4 | 74 | 6 h 36 min for 11 kW | ~16 min for 350 kW (CCS) |

| 5 |  | MINI COOPER SE | Hatchback | 36.64 | 226–233 | 152–158 | 32.6 | 28.9 | 2 h 2 min for 11 kW | 27 min for 50 kW (CCS) |

| 6 |  | NISSAN LEAF N-Connecta | Hatchback | 42.87 | 385 | 185 | 62 | 59 | 6 h 27 min for 6.6 kW | 59 min for 46 kW (CHAdeMO) |

| 7 |  | PEUGEOT E-208 GT+ | Hatchback | 40.36 | 362 | 159 | 50 | 45 | 3 h 2 min for 11 kW | ~24 min for 100 kW (CCS) |

| 8 |  | SKODA ENYAQ 80 | SUV | 53.91 | 544 | 157.7 | 82 | 77 | 4 h 57 min for 11 kW | ~29 min for 135 kW (CCS) |

| 9 |  | TESLA MODEL 3 LONG RANGE Dual Motor | Sedan | 58.44 | 547 | 155 | 78.1 | 75 | 4 h 57 min for 11 kW | ~23 min for 250 kW (Supercharging/CCS) |

| 10 |  | TESLA MODEL Y Long Range Dual Motor AWD | SUV | 59.22 | 533 | 172 | 78.1 | 75 | 4 h 57 min for 11 kW | 23 min for 250 kW (Supercharging/CCS) |

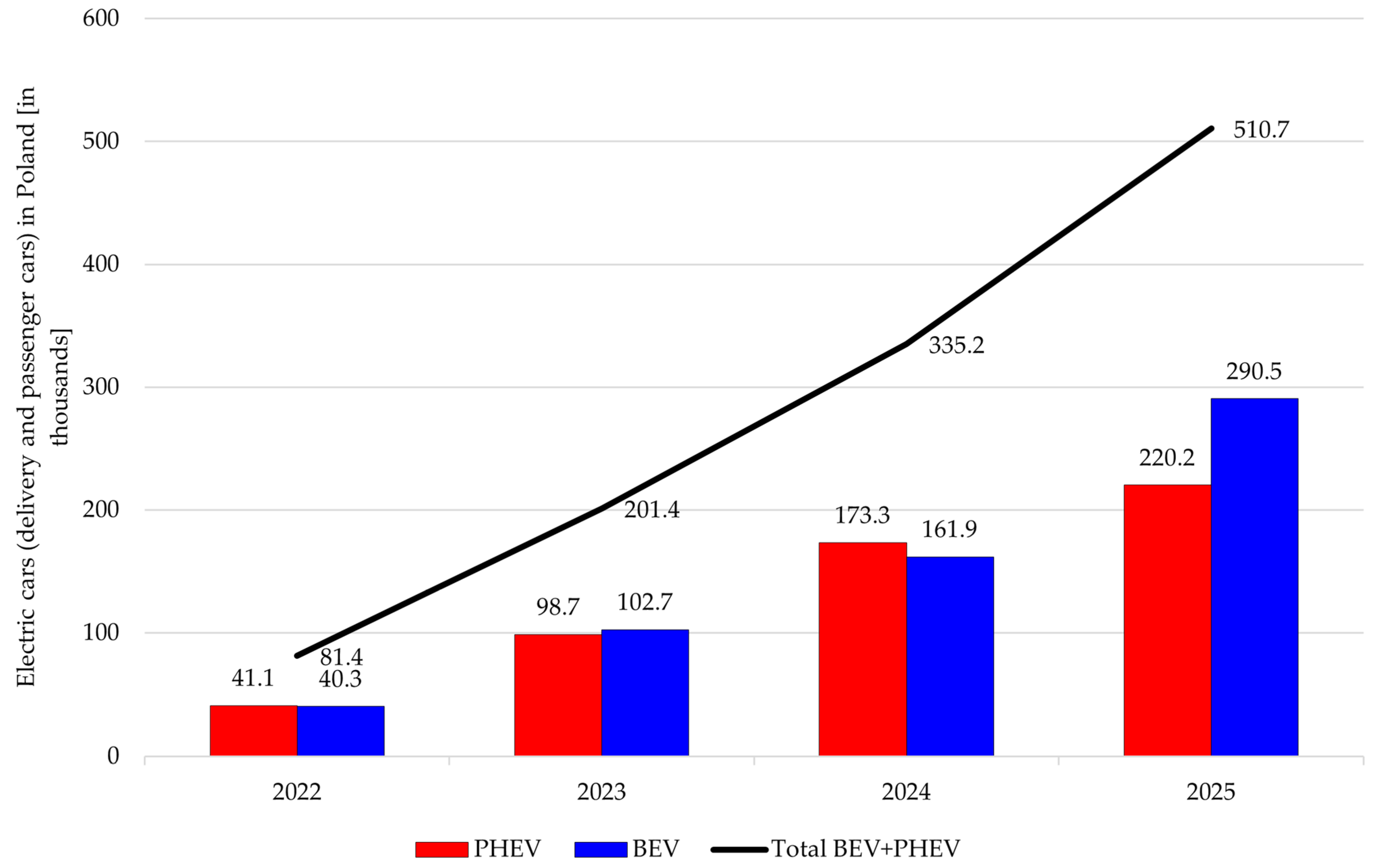

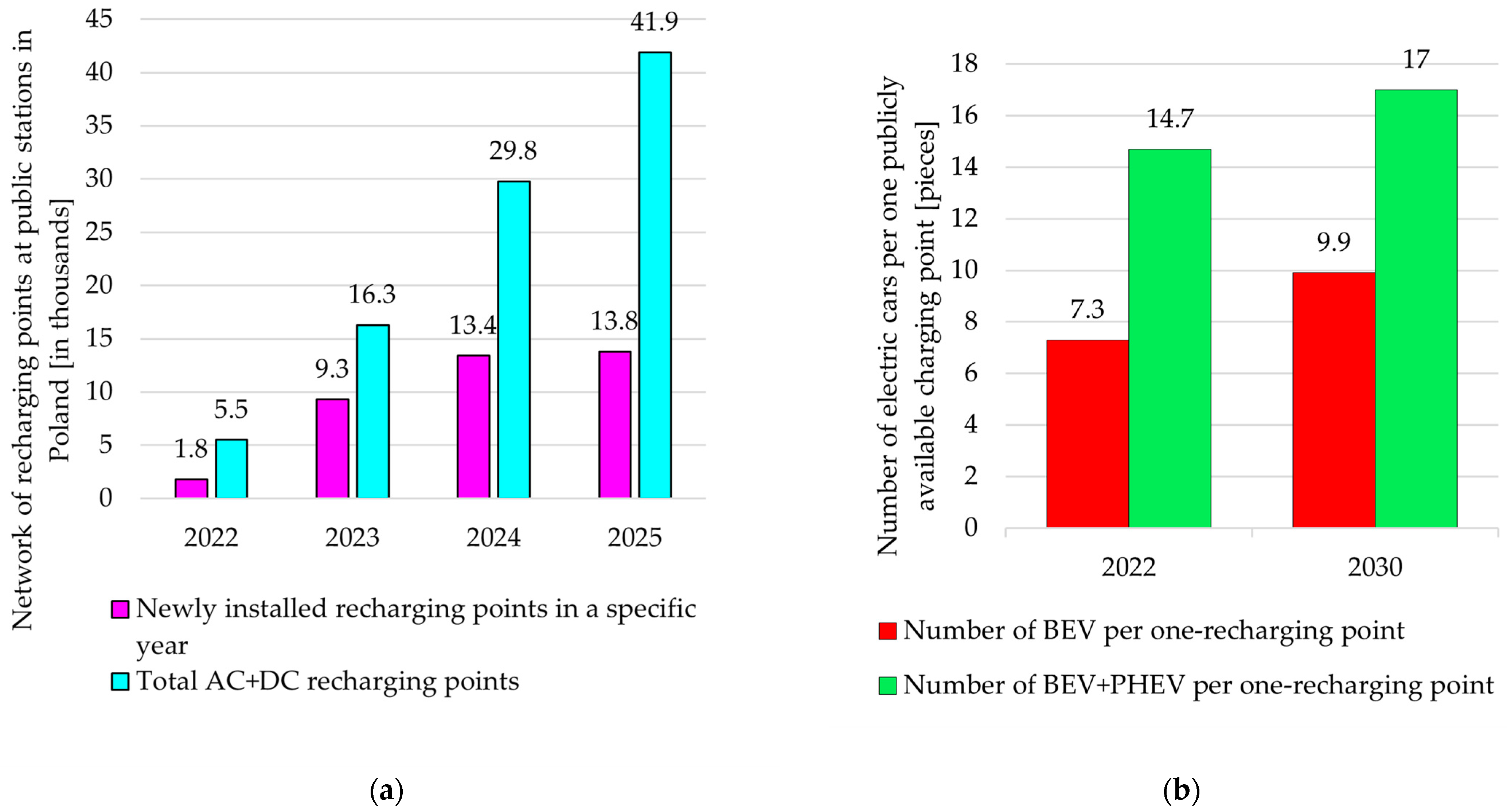

4. Prospective Development of EV and Charging Infrastructure in Poland

4.1. Trends in the Development of Electric Vehicles and Charging Infrastructure in the Perspective of 2025 and 2030

- ✓

- ✓

- Automatic authentication with all operators of public charging infrastructure.

- ✓

- Supplying DC charging stations with a power of more than 50 kW with payment terminals;

- ✓

- Ad-hoc payment with all operators of public charging stations;

- ✓

- Introduction of a mechanism for comparing prices and transparency of charging services and presenting/displaying information at publicly available charging stations on charging costs in the format “price per 100 km”;

- ✓

- The obligation to appropriately mark public charging infrastructure in the Trans-European Transport Network (TEN-T);

- ✓

- Expansion of the public charging infrastructure in the TEN-T network [115], so that DC charging points are spaced every 60 km;

- ✓

- Increasing the power installed in public charging stations within the TEN-T network from the current level of 19.7 MW to 217.6 MW in 2025 and 665.3 MW in 2030 for electric Light-Duty Vehicles (eLDV) and electric Heavy-Duty Vehicles (eHDV), respectively;

- ✓

- Correlating the development of charging infrastructure, charging power at publicly available charging points, and the development of electric vehicles (1 kW was assumed for each newly registered BEV and 0.66 kW for each newly registered PHEV).

4.2. Barriers to the Development of Charging Infrastructure for Electric Vehicles in Poland and Selected Solutions

- ✓

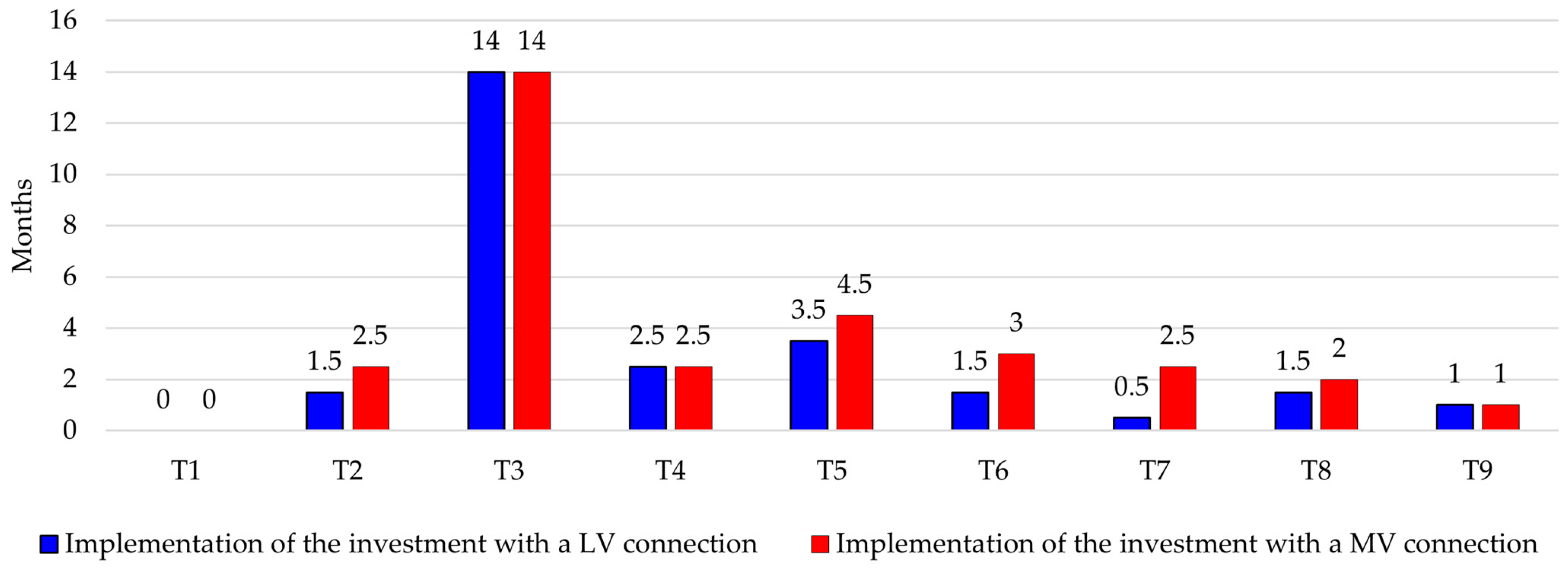

- The waiting time for DSO to build a connection, ranging from 1 to 3 years (on average 1.5 years), see Figure 16.

- ✓

- Unfavourable connection conditions for publicly available charging stations include the indicated location of connection points. Indication of connection points to the power grid at a considerable distance from the target location of a publicly available charging station. The consequence of the change of location is increased investment outlays, several times exceeding the outlays for purchasing and installing charging stations.

- ✓

- Charging the construction costs of transformer stations and participation in the prices of long connections by operators of publicly available charging stations in a situation where DSOs issue conditions for connecting to the medium voltage power grid. As a result, investments in publicly available charging stations are unprofitable due to the increase in investment outlays.

- ✓

- Lack of adaptation of the power grid and energy infrastructure on expressways and highways. The key problem is the failure to ensure the appropriate value of the connection power to expand the already existing and generally available charging infrastructure, e.g., at petrol stations, and passenger service points. In addition, in this context, there is affiliation with the General Directorate for National Roads and Motorways [116] and ownership of infrastructure in passenger service points, limiting the possibility of effective power-grid expansion adapted to the needs of connecting publicly available charging stations.

4.3. Potential for the Development of Charging Infrastructure for Electric Vehicles in Housing Cooperatives/Communities and Detached Houses

- ✓

- Private chargers that belong to individual residents who use them only for their own needs to charge an electric vehicle.

- ✓

- Semi-private chargers that are owned by the building owner and used to charge electric vehicles owned by residents.

- ✓

- Public chargers owned by the building owner or the operator of a public charging station (external operator), used to charge electric vehicles belonging to the residents of a given community/housing cooperative and bystanders, not residents of a given community/housing cooperative.

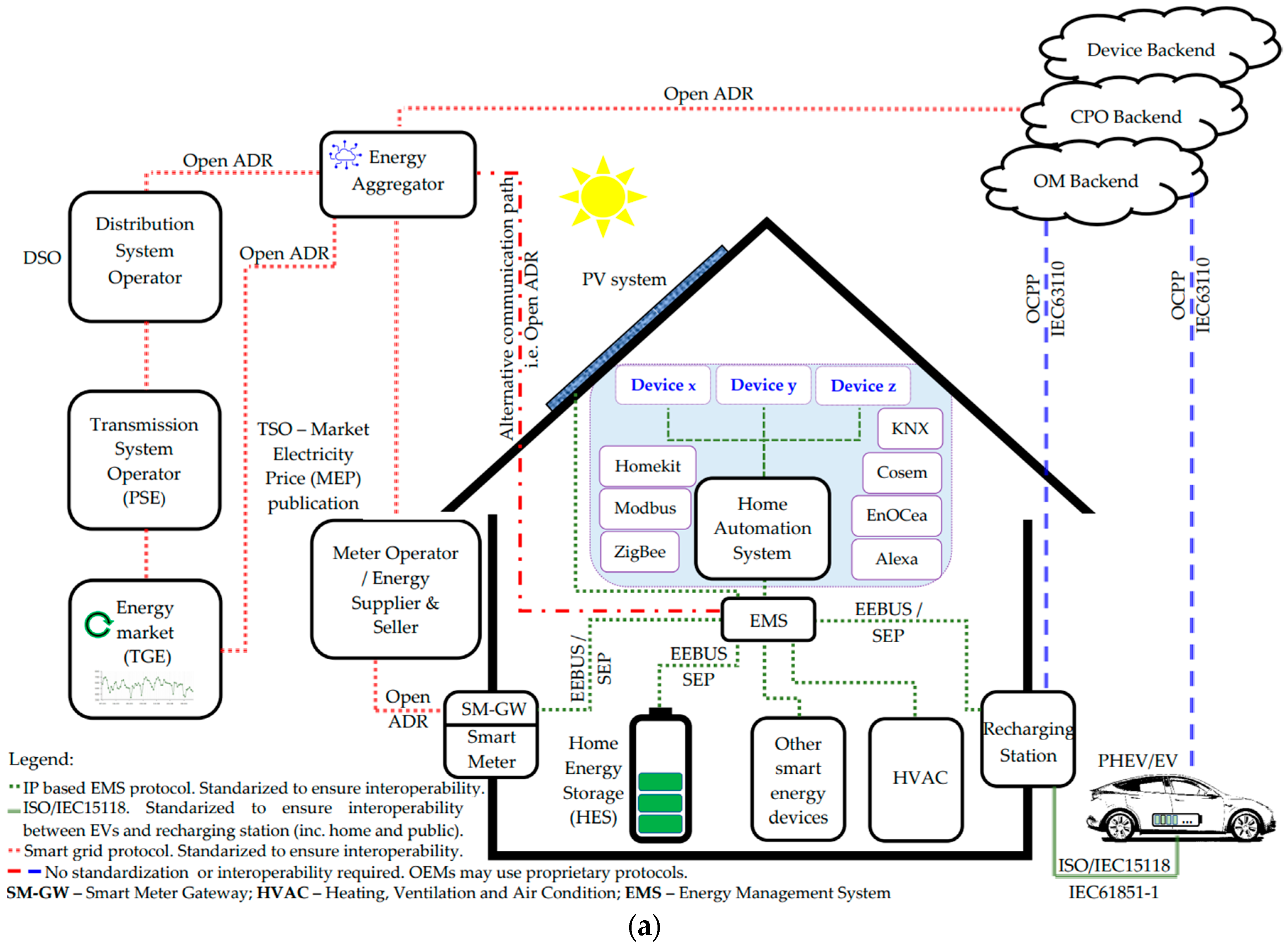

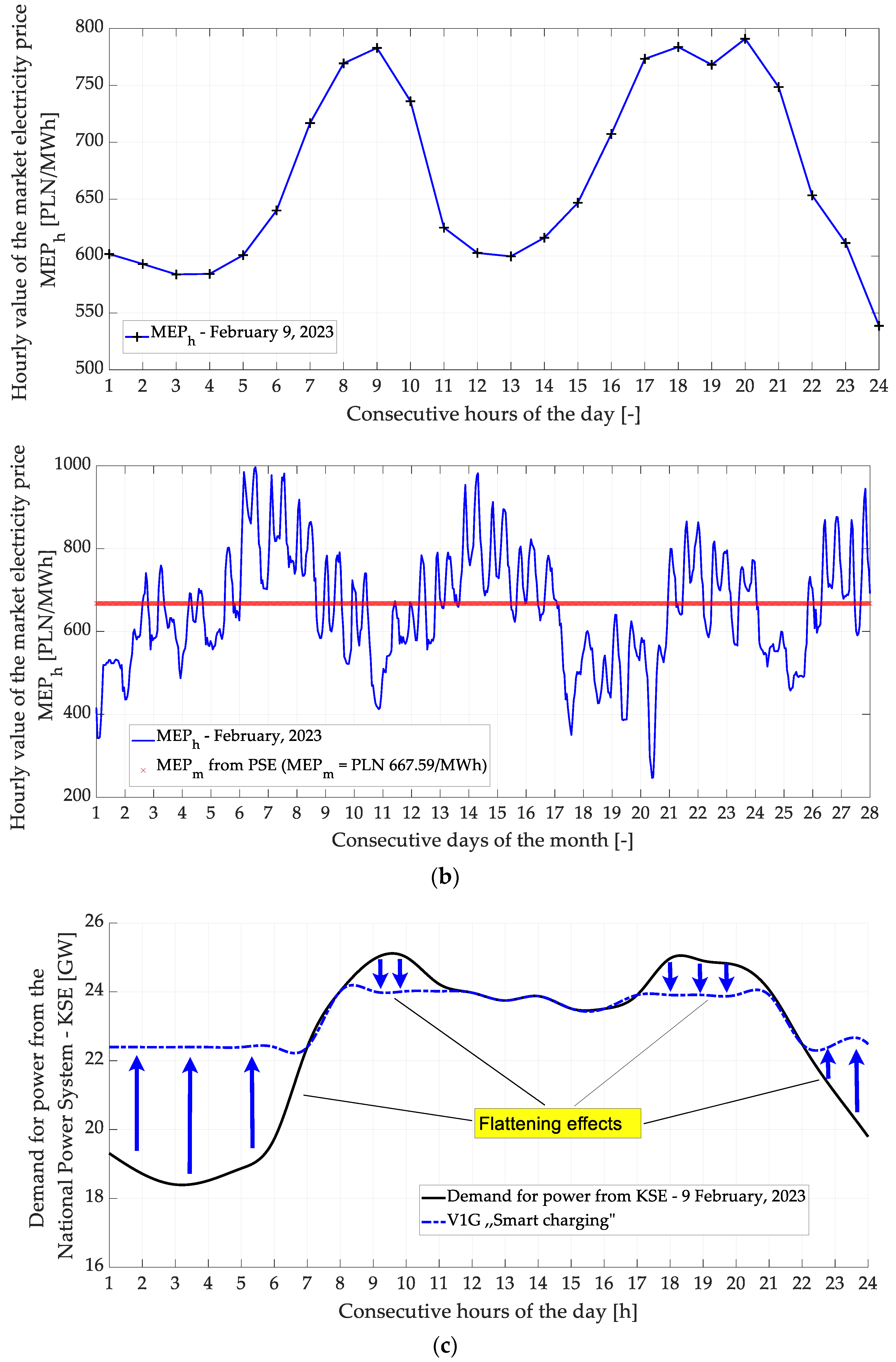

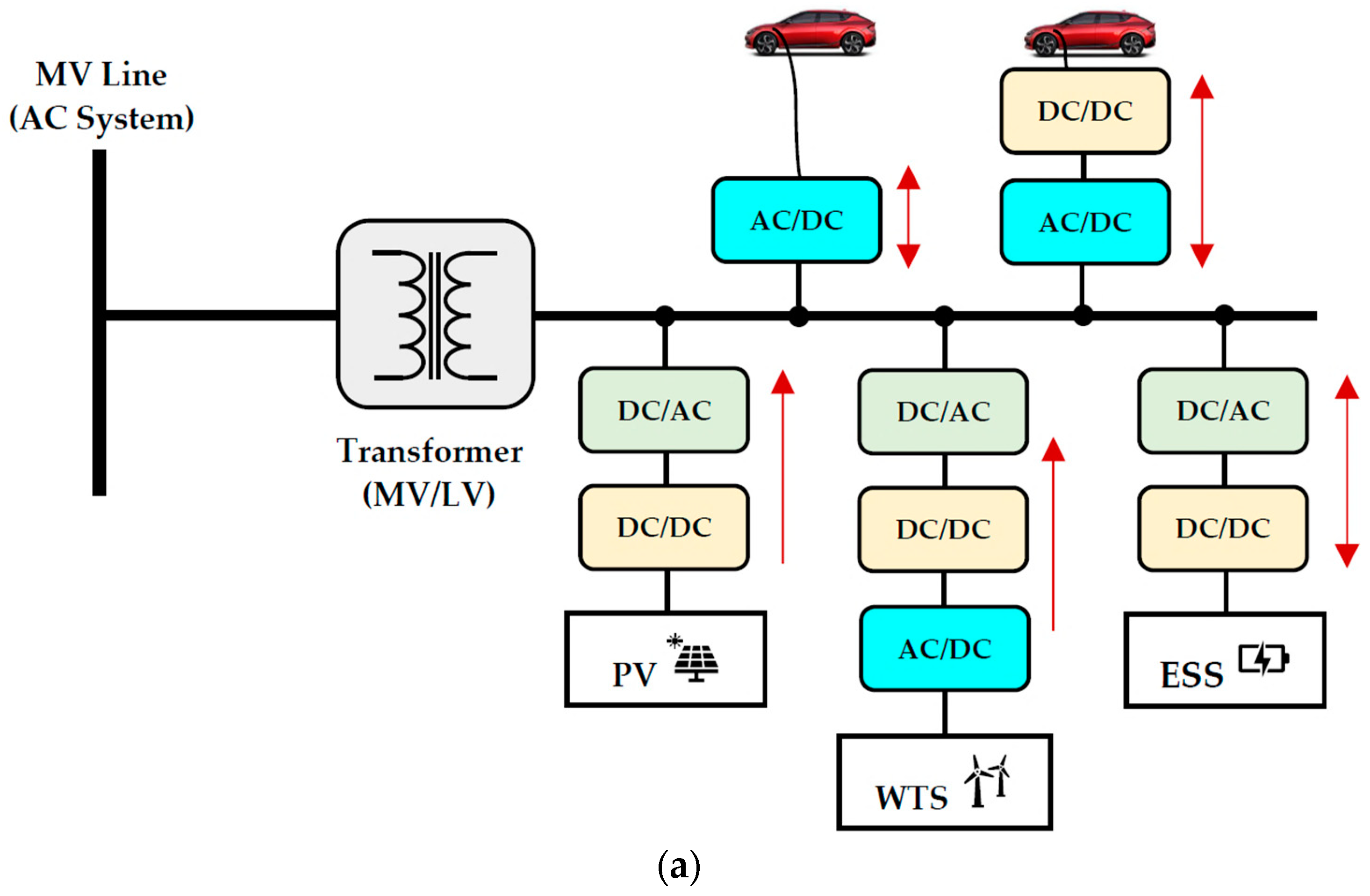

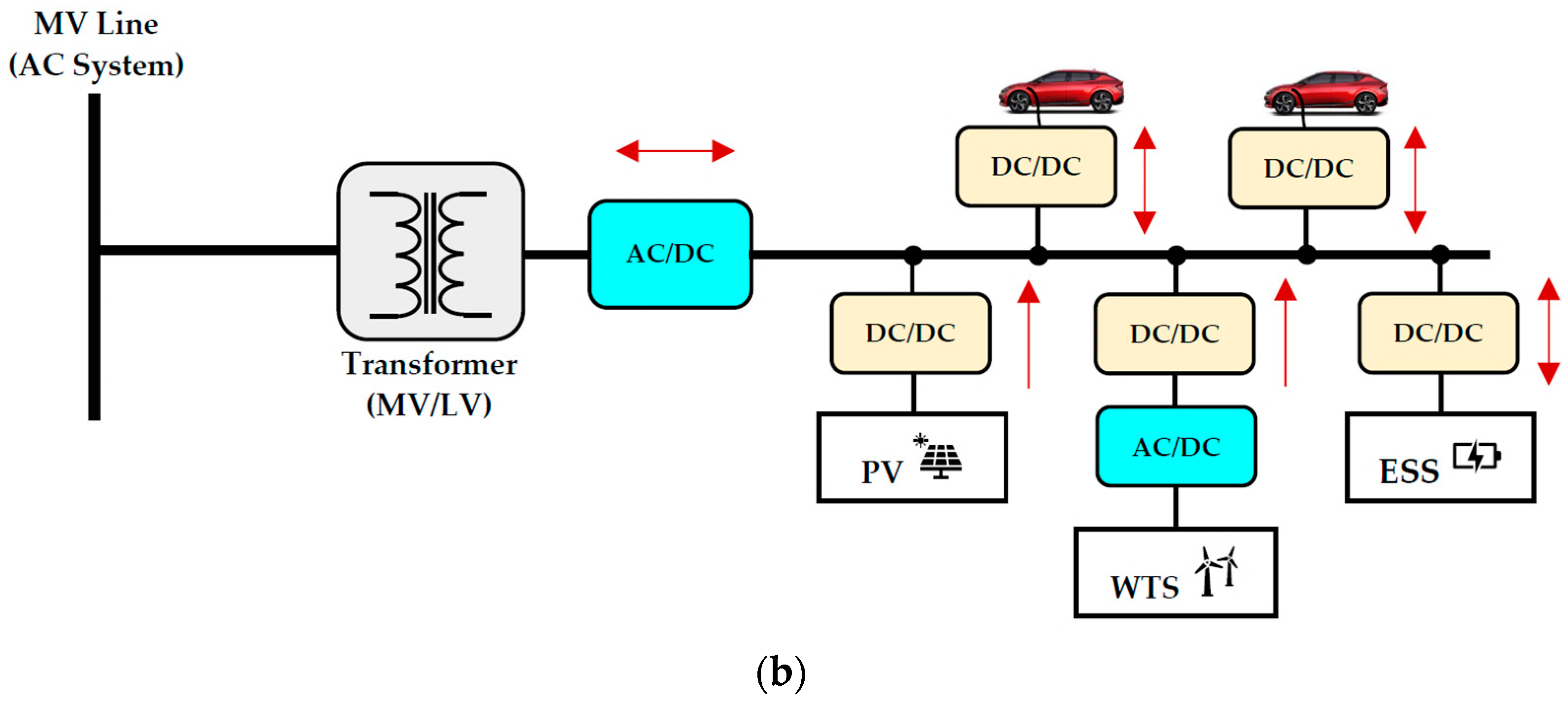

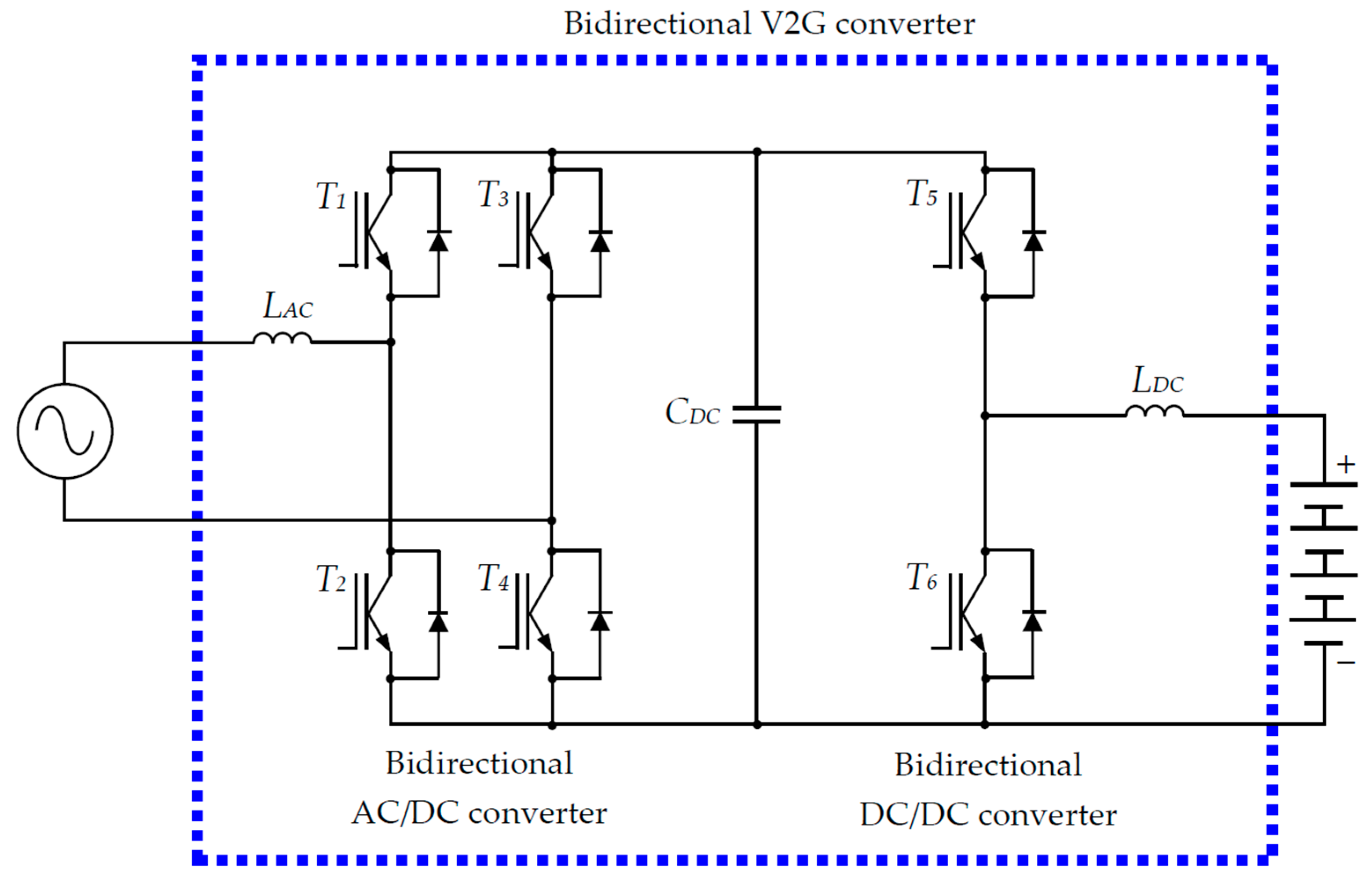

4.4. Prospective Use of Private Chargers in RES Micro-Installations with Energy Storage

- (a)

- The sum of the amount of electricity fed into the power grid by a renewable energy prosumer in individual imbalance settlement periods (t) making up a given calendar month, marked in relation (1) with the symbol Ebi(t) with negative values.

- (b)

- The monthly market price of electricity determined for a given calendar month.

- (c)

- The amount of electricity fed into the low-voltage power grid by the renewable energy prosumer, marked in relation (1) with the symbol Ebi(t) with a negative value.

- (d)

- The market price of electricity, provided that if the value of this price is negative for a given imbalance settlement period (t), then to determine the value of electricity introduced to the grid in period t by a renewable energy prosumer, the price is assumed to be zero.

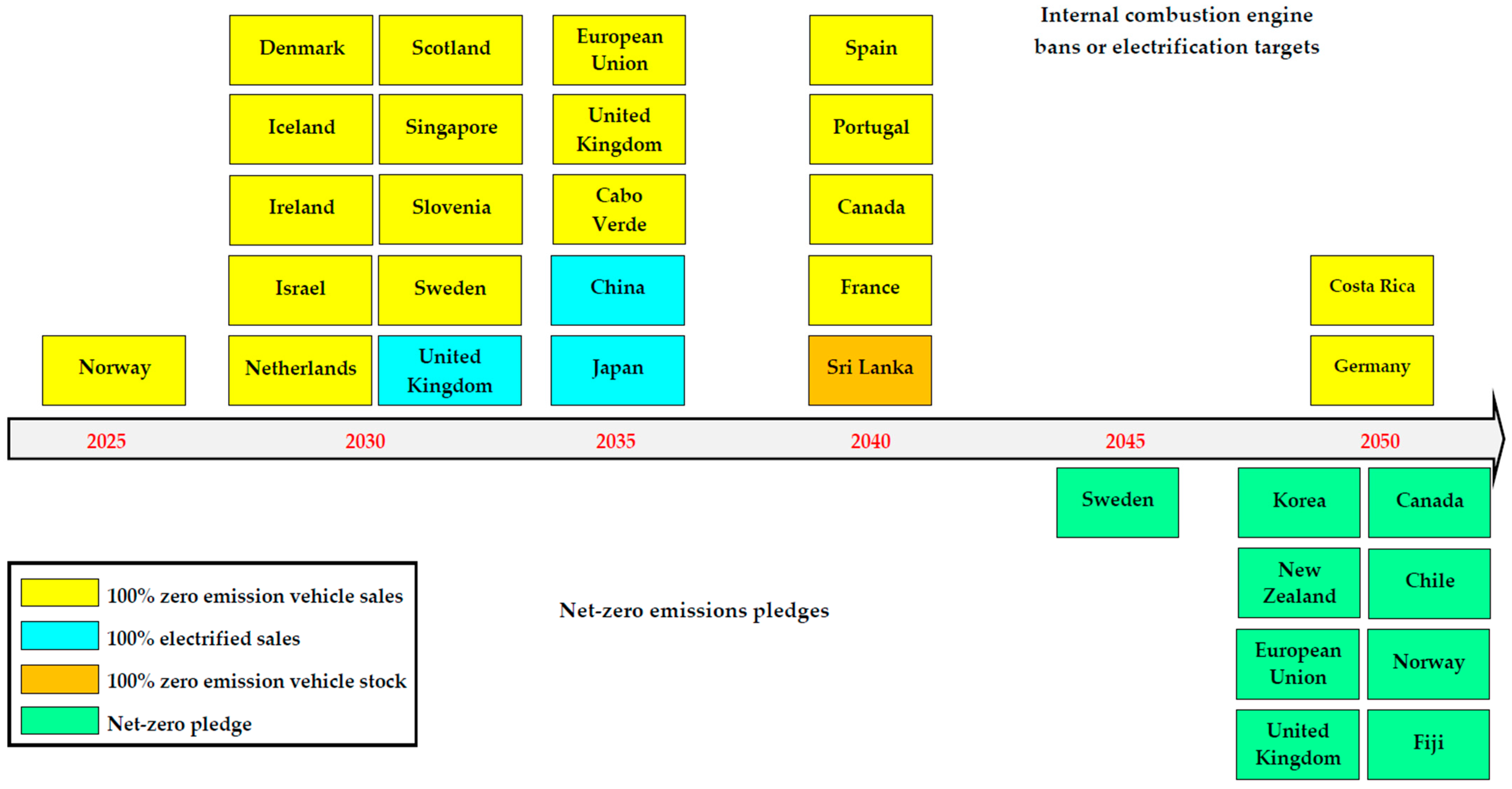

4.5. Comparison of Incentives in Poland and Norway to Achieve 100% Zero-Emission Vehicle Sales

5. Conclusions

- Increasing the number of high-power recharging points above 150 kW (Ultra-Fast DC Level 1 and Level 2) at public charging stations in Poland, so that the AFIR goals are met (1 kW for each newly registered BEV and 0.66 kW for each PHEV).

- Location of high-power recharging points above 150 kW (Ultra-Fast DC Level 1 and Level 2) in the TENT-T network every 60 km.

- Informing users about the charging cost in the PLN/20 kWh format will be a substitute for the PLN/100 km price for most electric passenger vehicles.

- Implementation of the “smart charging” functionality in the law for all operators at all publicly available charging stations.

- Equipping all public DC charging stations with payment terminals.

- Introducing the obligation to inform users about the current status and availability of charging points in a given location (displaying the availability status and the price on the pylon, e.g., in the “▲HP-DC × 3” format, i.e., three high power charging points available over 150 kW.

- Introducing a provision in the law concerning the maximum duration of the contract for connecting the charging station to the low and medium-voltage power grid, not exceeding six months.

- Introduction of legal provisions imposing a statutory obligation on DSOs to provide information on possible connections to the charging infrastructure, at the request of an entity interested in a given investment, with the obligation to respond within 1–2 months. Information is provided for a fee, and in the event of costs incurred by the DSO, reimbursement of these costs by the applicant.

- 50% off tolls on toll roads by 2035.

- 50% discount on ferry fares until 2035.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Intergovernmental Panel on Climate Change. Climate Change 2022: Mitigation of Climate Change Report. Available online: https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_FullReport.pdf (accessed on 28 January 2023).

- Watabe, A.; Yamabe-Ledoux, A.M. Low-Carbon Lifestyles beyond Decarbonisation: Toward a More Creative Use of the Carbon Footprinting Method. Sustainability 2023, 15, 4681. [Google Scholar] [CrossRef]

- The Paris Agreement. Official Journal of the European Union. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:22016A1019(01)&from=EN (accessed on 28 January 2023).

- The European Green Deal COM(2019) 640 Final—European Commision. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0002.02/DOC_1&format=PDF (accessed on 28 January 2023).

- European Commision. Sustainable and Smart Mobility Strategy—Putting European Transport on Track for the Future COM(2020) 789 Final. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:5e601657-3b06-11eb-b27b-01aa75ed71a1.0001.02/DOC_1&format=PDF (accessed on 28 January 2023).

- Song, K.; Lan, Y.; Zhang, X.; Jiang, J.; Sun, C.; Yang, G.; Yang, F.; Lan, H. A Review on Interoperability of Wireless Charging Systems for Electric Vehicles. Energies 2023, 16, 1653. [Google Scholar] [CrossRef]

- Yang, F.; Jiang, J.; Sun, C.; He, A.; Chen, W.; Lan, Y.; Song, K. Efficiency Improvement of Magnetic Coupler with Nanocrystalline Alloy Film for UAV Wireless Charging System with a Carbon Fiber Fuselage. Energies 2022, 15, 8363. [Google Scholar] [CrossRef]

- Jiang, J.; Lan, Y.; Zhang, Z.; Zhou, X.; Song, K. Thermal Estimation and Thermal Design for Coupling Coils of 6.6 kW Wireless Electric Vehicle Charging System. Energies 2022, 15, 6797. [Google Scholar] [CrossRef]

- Song, K.; Lan, Y.; Wei, R.; Yang, G.; Yang, F.; Li, W.; Jiang, J.; Zhu, C.; Li, Y. A Control Strategy for Wireless EV Charging System to Improve Weak Coupling Output Based on Variable Inductor and Capacitor. IEEE Trans. Power Electron. 2022, 37, 12853–12864. [Google Scholar] [CrossRef]

- Eurostat Data Browser. Greenhouse Gas Emissions by Source Sector in European Union. Available online: https://ec.europa.eu/eurostat/databrowser/view/ENV_AIR_GGE/default/table?lang=en (accessed on 28 January 2023).

- Mohideen, M.M.; Subramanian, B.; Sun, J.; Ge, J.; Guo, H.; Radhamani, A.V.; Ramakrishna, S.; Liu, Y. Techno-economic analysis of different shades of renewable and non-renewable energy-based hydrogen for fuel cell electric vehicles. Renew. Sustain. Energy Rev. 2023, 174, 113153. [Google Scholar] [CrossRef]

- Pielecha, I.; Szałek, A.; Tchorek, G. Two Generations of Hydrogen Powertrain—An Analysis of the Operational Indicators in Real Driving Conditions (RDC). Energies 2022, 15, 4734. [Google Scholar] [CrossRef]

- Aminudin, M.A.; Kamarudin, S.K.; Lim, B.H.; Majilan, E.H.; Masdar, M.S.; Shaari, N. An overview: Current progress on hydrogen fuel cell vehicles. Int. J. Hydrogen Energy 2023, 48, 4371–4388. [Google Scholar] [CrossRef]

- Eurostat. Greenhouse Gas Emissions by Source Sector. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Greenhouse_gas_emissions_by_source_sector,_EU,_2020.png (accessed on 28 January 2023).

- European Environmental Agency. Decarbonising Road Transport—The Role of Vehicles, Fuels and Transport Demand. Available online: https://www.eea.europa.eu/publications/transport-and-environment-report-2021 (accessed on 15 February 2023).

- International Energy Agency. Global EV Outlook. 2022. Available online: https://iea.blob.core.windows.net/assets/ad8fb04c-4f75-42fc-973a-6e54c8a4449a/GlobalElectricVehicleOutlook2022.pdf (accessed on 28 January 2023).

- International Energy Agency. Global EV Data Explorer. Available online: https://www.iea.org/data-and-statistics/data-tools/global-ev-data-explorer (accessed on 28 January 2023).

- Regulation (EU) 2019/631 of the European Parliament and of the Council of 17 April 2019 setting CO2 Emission Performance Standards for New Passenger Cars and for New Light Commercial Vehicles, and Repealing Regulations (EC) No 443/2009 and (EU) No 510/2011. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019R0631&from=PL (accessed on 15 February 2023).

- Polskie Stowarzyszenie Paliw Alternatywnych (Polish Alternative Fuels Association). Raport AFIR na Horyzoncie Jak Przyspieszyć Rozbudowę Ogólnodostępnej Infrastruktury Ładowania w Polsce? (In Polish). Available online: https://elektromobilni.pl/wp-content/uploads/2022/09/PSPA_AFIR_Jak_przyspieszyc_rozbudowe_infrastruktury_ladowania_w_Polsce_Raport-1.pdf (accessed on 15 February 2023).

- European Commission. ANNEXES to the Proposal for a Regulation of the European Parliament and of the Council on the Deployment of Alternative Fuels Infrastructure, and Repealing Directive 2014/94/EU of the European Parliament and of the Council. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:dbb134db-e575-11eb-a1a5-01aa75ed71a1.0001.02/DOC_2&format=PDF (accessed on 28 January 2023).

- European Commission. Proposal for a Regulation of the European Parliament and of the Council on the Deployment of Alternative Fuels Infrastructure, and Repealing Directive 2014/94/EU of the European Parliament and of the Council. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:dbb134db-e575-11eb-a1a5-01aa75ed71a1.0001.02/DOC_1&format=PDF (accessed on 28 January 2023).

- Buberger, J.; Kersten, A.; Kuder, M.; Eckerle, R.; Weyh, T.; Thiringer, T. Total CO2-equivalent life-cycle emissions from commercially available passenger cars. Renew. Sustain. Energy Rev. 2022, 159, 112158. [Google Scholar] [CrossRef]

- Ustawa z Dnia 11 Stycznia 2018 r. o Elektromobilności i Paliwach Alternatywnych (Opracowano na Podstawie: T.j. Dz. U. z 2022 r. Poz. 1083, 1260, 2687). (In Polish). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20220001083/U/D20221083Lj.pdf (accessed on 28 February 2023).

- Ustawa z Dnia 2 Grudnia 2021 r. o Zmianie Ustawy o Elektromobilności i Paliwach Alternatywnych Oraz Niektórych Innych Ustaw. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20210002269/O/D20212269.pdf (accessed on 28 February 2023).

- U.S. Department of Energy. Alternative Fuels Data Center. Available online: https://afdc.energy.gov/vehicles/electric_batteries.html (accessed on 28 March 2023).

- Katalog Pojazdów Elektrycznych 2023. Available online: https://pspa.com.pl/wp-content/uploads/2023/03/PSPA_Katalog_EV_2023.pdf (accessed on 28 March 2023).

- U.S. Department of Energy. Electric Vehicles. Available online: https://www.energy.gov/eere/electricvehicles/find-electric-vehicle-models (accessed on 28 March 2023).

- Worldwide Harmonised Light-Duty Vehicles Test Procedure (WLTP) and Real Driving Emissions (RDE). Regulation (EU) 2017/1151—Supplementing Regulation (EC) No 715/2007 on Type-Approval of Motor Vehicles with Respect to Emissions from Light Passenger and Commercial Vehicles (Euro 5 and Euro 6) and on Access to Vehicle Repair and Maintenance Information. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32017R1151&from=EN (accessed on 28 March 2023).

- Kam, K.C.; Doeff, M.M. Electrode Materials for Lithium Ion Batteries. Available online: https://www.sigmaaldrich.com/PL/pl/technical-documents/technical-article/materials-science-and-engineering/batteries-supercapacitors-and-fuel-cells/electrode-materials-for-lithium-ion-batteries (accessed on 28 March 2023).

- Office of Technical Inspection (UDT). Stacje i Punkty Ładowania Pojazdów Elektrycznych, Przewodnik UDT dla Operatorów i Użytkowników. Available online: https://elektromobilni.pl/wp-content/uploads/2022/11/ELEKTROMOBILNOSC_2022_WCAG.pdf (accessed on 28 January 2023).

- Polskie Stowarzyszenie Paliw Alternatywnych (Polish Alternative Fuels Association). Instalacja Infrastruktury Ładowania Pojazdów Elektrycznych w Budynkach Mieszkalnych Wielorodzinnych—Przewodnik. (In Polish). Available online: https://elektromobilni.pl/wp-content/uploads/2022/10/PSPA_Przewodnik_Instalacji_Ladowarki_Budynki_Wielorodzinne_2022.pdf (accessed on 28 January 2023).

- Rajendran, G.; Vaithilingam, C.A.; Misron, N. A comprehensive review on system architecture and international standards for electric vehicle charging stations. J. Energy Storage 2021, 42, 103099. [Google Scholar] [CrossRef]

- Das, H.S.; Rahman, M.M.; Li, S.; Tan, C.W. Electric vehicles standards, charging infrastructure, and impact on grid integration: A technological review. Renew. Sustain. Energy Rev. 2020, 120, 109618. [Google Scholar] [CrossRef]

- Mastoi, M.S.; Zhuang, S.; Munir, H.M.; Haris, M.; Hassan, M.; Usman, M.; Bukhari, S.S.H.; Ro, J.-S. An in-depth analysis of electric vehicle charging station infrastructure, policy implications, and future trends. Energy Rep. 2022, 8, 11504–11529. [Google Scholar] [CrossRef]

- Saadaoui, A.; Ouassaid, M.; Maaroufi, M. Overview of Integration of Power Electronic Topologies and Advanced Control Techniques of Ultra-Fast EV Charging Stations in Standalone Microgrids. Energies 2023, 16, 1031. [Google Scholar] [CrossRef]

- Kakkar, R.; Gupta, R.; Agrawal, S.; Tanwar, S.; Sharma, R.; Alkhayyat, A.; Neagu, B.-C.; Raboaca, M.S. A Review on Standardizing Electric Vehicles Community Charging Service Operator Infrastructure. Appl. Sci. 2022, 12, 12096. [Google Scholar] [CrossRef]

- European Commision. European Alternative Fuels Observatory, Recharging Systems. Available online: https://alternative-fuels-observatory.ec.europa.eu/general-information/recharging-systems (accessed on 28 January 2023).

- USTAWA z Dnia 10 Kwietnia 1997 r. Prawo Energetyczne—Na dzień 1 Marca 2023 r. 1 Tekst Ujednolicony w Departamencie Prawnym i Rozstrzygania Sporów URE. Available online: https://www.ure.gov.pl/pl/urzad/prawo/ustawy/17,Ustawa-z-dnia-10-kwietnia-1997-r-Prawo-energetyczne.html (accessed on 5 March 2023).

- Ronanki, D.; Kelkar, A.; Williamson, S.S. Extreme Fast Charging Technology—Prospects to Enhance Sustainable Electric Transportation. Energies 2019, 12, 3721. [Google Scholar] [CrossRef]

- Srdic, S.; Lukic, S. Toward extreme fast charging: Challenges and opportunities in directly connecting to medium-voltage line. IEEE Electrif. Mag. 2019, 7, 22–31. [Google Scholar] [CrossRef]

- Borkowski, D. Average-value model of energy conversion system consisting of PMSG, diode bridge rectifier and DPCSVM controlled inverter. In Proceedings of the International Symposium on Electrical Machines (SME), Naleczow, Poland, 18–21 June 2017; pp. 1–6. [Google Scholar]

- Saidi, S.; Abbassi, R.; Chebbi, S. Power Quality Improvement Using VF-DPC-SVM Controlled Three-Phase Shunt Active Filter. In Proceedings of the 12th International Multi-Conference on Systems, Signals & Devices, Mahdia, Tunisia, 16–19 March 2015; pp. 1–5. [Google Scholar]

- Bayram, I.S.; Michailidis, G.; Devetsikiotis, M.; Granelli, F. Electric power allocation in a network of fast charging stations. IEEE J. Sel. Areas Commun. 2013, 31, 1235–1246. [Google Scholar] [CrossRef]

- Mehrjerdi, H.; Hemmati, R. Electric vehicle charging station with multilevel charging infrastructure and hybrid solar-battery-diesel generation incorporating comfort of drivers. J. Energy Storage 2019, 26, 100924. [Google Scholar] [CrossRef]

- Beheshtaein, S.; Cuzner, R.M.; Forouzesh, M.; Savaghebi, M.; Guerrero, J.M. DC microgrid protection: A comprehensive review. IEEE J. Emerg. Sel. Top. Power Electron. 2019, 1–25. [Google Scholar] [CrossRef]

- Kakigano, H.; Miura, Y.; Ise, T. Low-Voltage Bipolar-Type DC Microgrid for Super High Quality Distribution. IEEE Trans. Power Electron. 2010, 25, 3066–3075. [Google Scholar] [CrossRef]

- Regensburger, B.; Sinha, S.; Kumar, A.; Maji, S.; Afridi, K.K. High-Performance Multi-MHz Capacitive Wireless Power Transfer System for EV Charging Utilizing Interleaved-Foil Coupled Inductors. IEEE J. Emerg. Sel. Top. Power Electron. 2022, 10, 35–51. [Google Scholar] [CrossRef]

- Lukic, X.S.; Pantic, Z. Cutting the cord: Static and dynamic inductive wireless charging of electric vehicles. IEEE Electrif. Mag. 2013, 1, 57–64. [Google Scholar] [CrossRef]

- Chen, W.; Liu, C.; Lee, C.H.T.; Shan, Z. Cost-Effectiveness Comparison of Coupler Designs of Wireless Power Transfer for Electric Vehicle Dynamic Charging. Energies 2016, 9, 906. [Google Scholar] [CrossRef]

- Jeong, S.; Jang, Y.J.; Kum, D. Economic Analysis of the Dynamic Charging Electric Vehicle. IEEE Trans. Power Electron. 2015, 30, 6368–6377. [Google Scholar] [CrossRef]

- Azad, A.N.; Echols, A.; Kulyukin, V.A.; Zane, R.; Pantic, Z. Analysis, Optimization, and Demonstration of a Vehicular Detection System Intended for Dynamic Wireless Charging Applications. IEEE Trans. Transp. Electrif. 2019, 5, 147–161. [Google Scholar] [CrossRef]

- Elghanam, E.; Sharf, H.; Odeh, Y.; Hassan, M.S.; Osman, A.H. On the Coordination of Charging Demand of Electric Vehicles in a Network of Dynamic Wireless Charging Systems. IEEE Access 2022, 10, 62879–62892. [Google Scholar] [CrossRef]

- Zhang, B.; Carlson, R.B.; Galigekere, V.P.; Onar, C.O.; Mohammad, M.; Dickerson, C.C.; Walker, L.K. Quasi-Dynamic Electromagnetic Field Safety Analysis and Mitigation for High-Power Dynamic Wireless Charging of Electric Vehicles. In Proceedings of the IEEE Transportation Electrification Conference & Expo (ITEC), Chicago, IL, USA, 21–25 June 2021; pp. 1–7. [Google Scholar]

- Rahulkumar, J.; Narayanamoorthi, R.; Vishnuram, P.; Bajaj, M.; Blazek, V.; Prokop, L.; Misiak, S. An Empirical Survey on Wireless Inductive Power Pad and Resonant Magnetic Field Coupling for In-Motion EV Charging System. IEEE Access 2023, 11, 4660–4693. [Google Scholar] [CrossRef]

- Green Car Congress. Available online: https://www.greencarcongress.com/2017/02/20170212-witricity.html (accessed on 29 March 2023).

- ABT E-LINE. Available online: https://www.abt-eline.de/emobility-news (accessed on 30 March 2023).

- Society of Automotive Engineers (SAE). SAE Electric Vehicle and Plug in Hybrid Electric Vehicle Conductive Charge Coupler J1772_201710. Available online: https://www.sae.org/standards/content/j1772_201710/ (accessed on 30 March 2023).

- Charging Basics 102: Electric Vehicle Charging Levels, Modes and Types Explained|North America vs. Europe Charging Cables and Plug Types. Available online: https://www.emobilitysimplified.com/2019/10/ev-charging-levels-modes-types-explained.html (accessed on 30 March 2023).

- BMW Rechargers. Available online: https://www.bmwusa.com/charging.html#!#home-charging (accessed on 30 March 2023).

- ElectroNite. Available online: https://electronite.eu/en/categories/portable-charger/ (accessed on 30 March 2023).

- Blink Charging—Level 2. Available online: https://www.bestbuy.com/site/blink-charging-j1772-level-2-nema-14-50-electric-vehicle-ev-charger-up-to-50a-23-black/6523728.p?skuId=6523728 (accessed on 30 March 2023).

- Grasen—DC EV Charging Station. Available online: https://www.grasencharge.com/product/dc-ev-charging-station/ (accessed on 30 March 2023).

- Habib, S.; Khan, M.M.; Abbas, F.; Tang, H. Assessment of electric vehicles concerning impacts, charging infrastructure with unidirectional and bidirectional chargers, and power flow comparisons. Int. J. Energy Res. 2018, 42, 3416–3441. [Google Scholar] [CrossRef]

- Sadeghian, O.; Mohammadi-ivatloo, B.; Vahidinasab, V.; Anvari-Moghaddam, A. A comprehensive review on electric vehicles smart charging: Solutions, strategies, technologies, and challenges. J. Energy Storage 2022, 54, 105241. [Google Scholar] [CrossRef]

- Entratek. Available online: https://www.entratek.de/Ladestationen/DC-Ladestationen.html (accessed on 30 March 2023).

- IEC 61851-1:2017; Electric Vehicle Conductive Charging System—Part 1: General Requirements. International Electrotechnical Commision: Geneva, Switzerland, 2017.

- IEC 61851-1-1:2023; Electric Vehicle Conductive Charging System—Part 1-1: Specific Requirements for Electric Vehicle Conductive Charging System Using type 4 Vehicle Coupler. International Electrotechnical Commision: Geneva, Switzerland, 2023.

- Arar, A. All about Circuit—The Four EV Charging Modes in the IEC 61851 Standard. Available online: https://www.allaboutcircuits.com/technical-articles/four-ev-charging-modes-iec61851-standard/ (accessed on 30 March 2023).

- Rata, M.; Rata, G.; Filote, C.; Raboaca, M.S.; Graur, A.; Afanasov, C.; Felseghi, A.-R. The ElectricalVehicle Simulator for Charging Station in Mode 3 of IEC 61851-1 Standard. Energies 2020, 13, 176. [Google Scholar] [CrossRef]

- Vector—Protocols. Available online: https://www.vector.com/int/en/know-how/protocols/gbt-27930/#c151957 (accessed on 30 March 2023).

- IEC 62196-2:2022; Plugs, Socket-Outlets, Vehicle Connectors and Vehicle Inlets—Conductive Charging of Electric Vehicles—Part 2: Dimensional Compatibility Requirements for AC Pin and Contact-Tube Accessories. International Electrotechnical Commision: Geneva, Switzerland, 2022.

- IEC 62196-3:2022; Plugs, Socket-Outlets, Vehicle Connectors and Vehicle Inlets—Conductive Charging of Electric Vehicles—Part 3: Dimensional Compatibility Requirements for DC and AC/DC Pin and Contact-Tube Vehicle Couplers. International Electrotechnical Commision: Geneva, Switzerland, 2022.

- Zhang, X.; Ni, F.; Dai, M.; Li, X.; Sang, L.; Cheng, L. Research on the design and verification of the charging compatibility for electric vehicle ChaoJi charging. Energy Rep. 2022, 8, 116–125. [Google Scholar] [CrossRef]

- China Electricity Council. White Paper of ChaoJi EV Charging Technology. Available online: https://www.cec.org.cn/upload/1/editor/1594869131179.pdf (accessed on 28 February 2023).

- International Council on Clean Transportation. Strategies for Setting a National Electric Vehicle Charger Standard: Relevant Factors and the Case of Chile (Working Paper 2023-02). Available online: https://theicct.org/wp-content/uploads/2023/01/lat-am-evs-choose-charger-std-chile-jan23.pdf (accessed on 28 January 2023).

- SCANIA Group. Megawatt Charging System for Heavy Duty Vehicles. Available online: https://www.scania.com/group/en/home/newsroom/news/2022/megawatt-charging-in-sight.html (accessed on 30 March 2023).

- A Briefing by Transport & Environment. Truck CO2: Europe’s Chance to Lead Position Paper on the Review of the HDV CO2 Standards. Available online: https://fppe.pl/wp-content/uploads/2022/09/202209_HDV_CO2_position_paper_final-1.pdf (accessed on 30 March 2023).

- Town, G.; Taghizadeh, S.L.; Deilami, S. Review of Fast Charging for Electrified Transport: Demand, Technology, Systems, and Planning. Energies 2022, 15, 1276. [Google Scholar] [CrossRef]

- LaMonaca, S.; Ryan, L. The state of play in electric vehicle charging services—A review of infrastructure provision, players, and policies. Renew. Sustain. Energy Rev. 2022, 154, 111733. [Google Scholar] [CrossRef]

- Elma, O.; Cali, U.; Kuzlu, M. An overview of bidirectional electric vehicles charging system as a Vehicle to Anything (V2X) under Cyber–Physical Power System (CPPS). Energy Rep. 2022, 8, 25–32. [Google Scholar] [CrossRef]

- European Alternative Fuels Observatory. Available online: https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road/poland/infrastructure (accessed on 28 January 2023).

- Register of Alternative Fuels Infrastructure. Available online: https://eipa.udt.gov.pl/ (accessed on 30 March 2023).

- Energy Regulatory Office. List of Energy Companies Designated to Act as the Operator of a Publicly Available Charging Station and the Provider of Charging Services. Available online: https://www.ure.gov.pl/pl/energia-elektryczna/operatorzy-ogolnodostep/9283,Wykaz-przedsiebiorstw-energetycznych-wyznaczonych-do-pelnienia-funkcji-operatora.html (accessed on 30 March 2023).

- Polskie Stowarzyszenie Paliw Alternatywnych. Available online: https://pspa.com.pl/2022/raport/czy-w-polsce-zabraknie-stacji-ladowania-samochodow-elektrycznych/ (accessed on 30 March 2023).

- Polskie Stowarzyszenie Paliw Alternatywnych. Polish EV Outlook; Polskie Stowarzyszenie Paliw Alternatywnych: Warsaw, Poland, 2022; Available online: https://polishevoutlook.pl/ (accessed on 28 March 2023).

- Greenway. Available online: https://greenwaypolska.pl/ (accessed on 28 January 2023).

- PKN Orlen. Available online: https://www.orlen.pl/pl/ (accessed on 28 January 2023).

- ABB. Terra CE 54 CJG. Available online: https://new.abb.com/products/6AGC063056/terra-ce-54-cjg-4n1-7m-0-0 (accessed on 28 January 2023).

- Efacec. Available online: https://www.efacec.pt/ (accessed on 28 January 2023).

- ABB. Terra Wallbox. Available online: https://new.abb.com/ev-charging/pl/terra-dc-wallbox (accessed on 28 January 2023).

- Delta. Delta Slim 100. Available online: https://www.deltaww.com/en-US/products/EV-Charging/SLIM100 (accessed on 28 January 2023).

- Ekoenergetyka. Available online: https://ekoenergetyka.com.pl/pl/produkty/axon-easy/ (accessed on 28 January 2023).

- Narodowy Fundusz Ochrony Środowiska i Gospodarki Wodnej (Program Priorytetowy “Mój elektryk”)/The National Fund for Environmental Protection and Water Management (the Priority Program “My Electrician”). Available online: https://www.gov.pl/web/elektromobilnosc/nabor-dla-przedsiebiorcow-i-podmiotow-innych-niz-osoby-fizyczne (accessed on 28 February 2023).

- Audi. AUDI Q4 e-tron 40. Available online: https://ev-database.org/uk/car/1490/Audi-Q4-e-tron-40 (accessed on 28 January 2023).

- FIAT 500E RED FWD. Available online: https://ev-database.org/uk/car/1285/Fiat-500e-Hatchback-42-kWh (accessed on 28 January 2023).

- FORD MUS-TANG MACH-E GT. Available online: https://www.ford.pl/ (accessed on 28 January 2023).

- KIA EV6 AWD. Available online: https://www.kia.com/pl/modele/ev6 (accessed on 28 January 2023).

- MINI COOPER SE. Available online: https://www.mini.com.pl/pl_PL/home/range/electric.html (accessed on 28 January 2023).

- NISSAN LEAF N-Connecta. Available online: https://www.nissan.pl/pojazdy/nowe-pojazdy/leaf/ (accessed on 28 January 2023).

- PEUGEOT E-208 GT+. Available online: https://ev-database.org/uk/car/1583/Peugeot-e-208#charge-table (accessed on 28 January 2023).

- SKODA EN-YAQ 80. Available online: https://ev-database.org/uk/car/1280/Skoda-Enyaq-iV-80 (accessed on 28 January 2023).

- TESLA Model 3. Available online: https://www.tesla.com/ownersmanual/model3/pl_pl/GUID-E414862C-CFA1-4A0B-9548-BE21C32CAA58.html (accessed on 28 January 2023).

- TESLA Model Y Long Range Dual Motor AWD. Available online: https://www.tesla.com/pl_pl/modely/design#overview (accessed on 28 January 2023).

- Hydrogen Stations in Poland. Available online: http://gashd.eu/wodor-h2/stacje-wodorowe-w-polsce/ (accessed on 24 May 2023).

- U.S. Department of Energy. Fuel Cell Electric Vehicles. Available online: https://afdc.energy.gov/vehicles/fuel_cell.html (accessed on 24 May 2023).

- Recharge—Global News and Intelligence for the Energy Transition. Available online: https://www.rechargenews.com/energy-transition/opinion-why-market-dynamics-will-reduce-the-average-price-of-green-hydrogen-to-1-50-kg-by-2030/2-1-1292801 (accessed on 24 May 2023).

- Toyota Mirai Technical Data. Available online: https://toyota-cms-media.s3.amazonaws.com/wp-content/uploads/2021/11/2022-Toyota-Mirai_Product-Info-Guide.pdf (accessed on 24 May 2023).

- Hydrogen Cost in Poland. Available online: https://elektrowoz.pl/ladowarki/wodor-szybko-sie-tankuje-i-na-pewno-nie-bedzie-drozszy-niz-benzyna-w-kalifornii-juz-25-dolarow-kg-do-120-zl-100-km/ (accessed on 24 May 2023).

- Regulation (EU) No 1315/2013 of the European Parliament and of the Council of 11 December 2013 on Union Guidelines for the Development of the Trans-European Transport Network and Repealing Decision No 661/2010/EU. Available online: http://publications.europa.eu/resource/cellar/f277232a-699e-11e3-8e4e-01aa75ed71a1.0006.01/DOC_1 (accessed on 28 March 2023).

- Kubli, M. EV drivers’ willingness to accept smart charging: Measuring preferences of potential adopters. Transp. Res. Part D 2022, 109, 103396. [Google Scholar] [CrossRef]

- Ramsebner, J.; Hiesl, A.; Haas, R.; Auer, H.; Ajanovic, A.; Mayrhofer, G.; Reinhardt, A.; Wimmer, A.; Ferchhumer, E.; Mitterndorfer, B.; et al. Smart charging infrastructure for battery electric vehicles in multi apartment buildings. Smart Energy 2023, 9, 100093. [Google Scholar] [CrossRef]

- Afentoulis, K.D.; Bampos, Z.N.; Vagropoulos, S.I.; Keranidis, S.D.; Biskas, P.N. Smart charging business model framework for electric vehicle aggregators. Appl. Energy 2022, 328, 120179. [Google Scholar] [CrossRef]

- Eurelectric. Smart Charging: Steering the Charge, Driving the Change; Eurelectric: Brussels, Belgium, 2015. [Google Scholar]

- Rather, Z.; Dahiwale, P.V.; Lekshmi, D.; Hartung, A.; Maity, S.; Brandl, R.; Frías, P.; Wu, Q.; Henze, N.; Kalia, S.; et al. A Critical Review: Smart Charging Strategies and Technologies for Electric Vehicles. Led by Fraunhofer-Institute for Energy Economics and Energy System Technology IEE. Available online: https://changing-transport.org/wp-content/uploads/2021_Smart_Charging_Strategies_and_technologies_for_Electric_Vehicles.pdf (accessed on 15 April 2023).

- Polskie Stowarzyszenie Paliw Alternatywnych (Polish Alternative Fuels Association). Electric Vehicles as an Element of Power Grid Report. Available online: https://pspa.com.pl/reports/?lang=en (accessed on 28 January 2023).

- Generalna Dyrekcja Dróg Krajowych i Autostrad (General Directorate for National Roads and Motorways). Available online: https://www.gov.pl/web/gddkia/generalna-dyrekcja-drog-krajowych-i-autostrad (accessed on 28 March 2023).

- Directive (EU) 2018/844 of the European Parliament and of the Council of 30 May 2018 Amending Directive 2010/31/EU on the Energy Performance of Buildings and Directive 2012/27/EU on Energy Efficiency. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0844&from=pl (accessed on 5 April 2023).

- BMW Wallbox. Available online: https://bmwsklep.pl/produkt/stacja-ladowania-bmw-wallbox-essential/?gclid=EAIaIQobChMIpvWx5bKV_gIVQUGRBR1EkgjGEAAYASAAEgJY__D_BwE (accessed on 5 April 2023).

- ABB Wallbox. Available online: https://search.abb.com/library/Download.aspx?DocumentID=9AKK107680A2257&LanguageCode=en&DocumentPartId=&Action=Launch (accessed on 28 March 2023).

- Tesla Wallbox. Available online: https://www.tesla.com/pl_pl/home-charging (accessed on 28 March 2023).

- Entrel Inch Charging Station. Available online: https://etrel.com/wp-content/uploads/2022/07/2021-015-10-HW_web-2.pdf (accessed on 28 March 2023).

- Ustawa z Dnia 24 Czerwca 1994 r. o Własności Lokali. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU19940850388/U/D19940388Lj.pdf (accessed on 28 March 2023).

- Tauron. Grupa Taryfowa G13. Available online: https://www.tauron.pl/dla-domu/prad/taryfa-sprzedawcy/g13 (accessed on 5 March 2023).

- Ceny Energii Elektrycznej w Polsce. Available online: http://www.cena-pradu.pl/tabela.html (accessed on 5 March 2023).

- USTAWA z Dnia 20 Lutego 2015 r. o Odnawialnych Źródłach Energii—Tekst Ujednolicony 18 January 2023. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20150000478/U/D20150478Lj.pdf (accessed on 5 March 2023).

- Zhang, H.; Sun, C.; Ge, M. Review of the Research Status of Cost-Effective Zinc–Iron Redox Flow Batteries. Batteries 2022, 8, 202. [Google Scholar] [CrossRef]

- Zarządca Rozliczeń Energii Odnawialnej. Available online: https://www.zrsa.pl/ (accessed on 5 March 2023).

- Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the Internal Market for Electricity. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019R0943&from=PL (accessed on 5 March 2023).

- Towarowa Giełda Energii. Available online: https://tge.pl/electricity-dam?dateShow=04-04-2023&dateAction= (accessed on 5 March 2023).

- Polskie Sieci Elektroenergetyczne. Rynkowa Cena Energii Elektrycznej. Available online: https://www.pse.pl/dane-systemowe/funkcjonowanie-rb/raporty-dobowe-z-funkcjonowania-rb/podstawowe-wskazniki-cenowe-i-kosztowe/rynkowa-cena-energii-elektrycznej-rce (accessed on 5 March 2023).

- Polskie Sieci Elektroenergetyczne. Rynkowa Miesięczna Cena Energii Elektrycznej. Available online: https://www.pse.pl/oire/rcem-rynkowa-miesieczna-cena-energii-elektrycznej (accessed on 5 March 2023).

- Yadav, K.; Singh, M. Design and development of a bidirectional DC net meter for vehicle to grid technology at TRL-9 level. Measurement 2023, 207, 112403. [Google Scholar] [CrossRef]

- Hutty, T.D.; Pena-Bello, A.; Dong, S.; Parra, D.; Rothman, R.; Brown, S. Peer-to-peer electricity trading as an enabler of increased PV and EV ownership. Energy Convers. Manag. 2021, 245, 114634. [Google Scholar] [CrossRef]

- Zheng, S.; Huang, G.; Lai, A.C.K. Coordinated energy management for commercial prosumers integrated with distributed stationary storages and EV fleets. Energy Build. 2023, 282, 112773. [Google Scholar] [CrossRef]

- Ordóñez, Á.; Sánchez, E.; Rozas, L.; García, R.; Parra-Domínguez, J. Net-metering and net-billing in photovoltaic self-consumption: The cases of Ecuador and Spain. Sustain. Energy Technol. Assess. 2022, 53, 102434. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Innovation Landscape Brief: Net Billing Schemes. 2019. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/Feb/IRENA_Net_billing_2019.pdf?la=en&hash=DD239111CB0649A9A9018BAE77B9AC06B9EA0D25 (accessed on 5 March 2023).

- Kabir, M.A.; Farjana, F.; Choudhury, R.; Kayes, A.I.; Ali, M.S.; Farrok, O. Net-metering and Feed-in-Tariff policies for the optimum billing scheme for future industrial PV systems in Bangladesh. Alex. Eng. J. 2023, 63, 157–174. [Google Scholar] [CrossRef]

- IEA. New Net Billing and Distributed Generation Law (Law 21.118). Available online: https://www.iea.org/policies/12967-new-net-billing-and-distributed-generation-law-law-21118 (accessed on 28 March 2023).

- US Department of Energy. Available online: https://www.energy.gov/eere/femp/demand-response-and-time-variable-pricing-programs-western-states (accessed on 28 March 2023).

- Yang, Z.; Yang, F.; Min, H.; Hu, W.; Liu, J. Review on optimal planning of new power systems with distributed generations and electric vehicles. Energy Rep. 2023, 9, 501–509. [Google Scholar] [CrossRef]

- Chai, Y.T.; Che, H.S.; Tan, C.K.; Tan, W.-N.; Yip, S.-N.; Gan, M.-T. A two-stage optimization method for Vehicle to Grid coordination considering building and Electric Vehicle user expectations. Int. J. Electr. Power Energy Syst. 2023, 148, 108984. [Google Scholar] [CrossRef]

- Agregatorzy Energii w Polsce. Available online: https://www.pse.pl/uslugi-dsr/agregatorzy-i-osd (accessed on 28 March 2023).

- Interwencyjna Redukcja Poboru Mocy w Polsce—Wykonawcy. Available online: https://www.pse.pl/-/piec-umow-na-usluge-interwencyjnej-ofertowej-redukcji-poboru-mocy-przez-odbiorcow-irp-nowe-firmy-nadal-moga-sie-zglaszac- (accessed on 28 March 2023).

- Guziński, J.; Adamowicz, M.; Kamiński, J. Infrastruktura ładowania pojazdów elektrycznych. Autom. Elektr. Zakłócenia 2014, 1, 74–83. [Google Scholar]

- Mastoi, M.S.; Zhuang, S.; Munir, H.M.; Haris, M.; Hassan, M.; Alqarni, M.; Alamri, B. A study of charging-dispatch strategies and vehicle-to-grid technologies for electric vehicles in distribution networks. Energy Rep. 2023, 9, 1777–1807. [Google Scholar] [CrossRef]

- Zecchino, A.; Prostejovsky, A.M.; Ziras, C.; Marinelli, M. Large-scale provision of frequency control via V2G: The Bornholm power system case. Electr. Power Syst. Res. 2019, 170, 25–34. [Google Scholar] [CrossRef]

- Schulz, F.; Rode, J. Public charging infrastructure and electric vehicles in Norway. Energy Policy 2022, 160, 112660. [Google Scholar] [CrossRef]

- Unterluggauer, T.; Rich, J.; Andersen, P.B.; Hashemi, S. Electric vehicle charging infrastructure planning for integrated transportation and power distribution networks: A review. eTransportation 2022, 12, 100163. [Google Scholar] [CrossRef]

- Gonül, Ö.; Duman, A.C.; Güler, Ö. Electric vehicles and charging infrastructure in Turkey: An overview. Renew. Sustain. Energy Rev. 2021, 143, 110913. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, H.; Zhu, L.; Campana, P.E.; Lu, H.; Wallin, F.; Sun, Q. Factors influencing the economics of public charging infrastructures for EV—A review. Renew. Sustain. Energy Rev. 2018, 94, 500–509. [Google Scholar] [CrossRef]

- Zheng, X.; Menezes, F.; Zheng, X.; Wu, C. An empirical assessment of the impact of subsidies on EV adoption in China: A difference-in-differences approach. Transp. Res. Part A 2022, 162, 121–136. [Google Scholar] [CrossRef]

- Lin, J.; Sun, J.; Feng, Y.; Zheng, M.; Yu, Z. Aggregate demand response strategies for smart communities with battery-charging/switching electric vehicles. J. Energy Storage 2023, 58, 106413. [Google Scholar] [CrossRef]

- Sachan, S.; Singh, P.P. Charging infrastructure planning for electric vehicle in India: Present status and future challenges. Reg. Sustain. 2022, 3, 335–345. [Google Scholar] [CrossRef]

- George-Williams, H.; Wade, N.; Carpenter, R.N. A probabilistic framework for the techno-economic assessment of smart energy hubs for electric vehicle charging. Renew. Sustain. Energy Rev. 2022, 162, 112386. [Google Scholar] [CrossRef]

- Amry, Y.; Elbouchikhi, E.; Le Gall, F.; Ghogho, M.; El Hani, S. Optimal sizing and energy management strategy for EV workplace charging station considering PV and flywheel energy storage system. J. Energy Storage 2023, 62, 106937. [Google Scholar] [CrossRef]

- Mirheli, A.; Hajibabai, L. Hierarchical optimization of charging infrastructure design and facility utilization. IEEE Trans. Intell. Transp. Syst. 2022, 23, 15574–15587. [Google Scholar] [CrossRef]

- ABB Vehicle-to-Grid Technology. Available online: https://new.abb.com/ev-charging/abb-s-vehicle-to-grid-technology (accessed on 28 March 2023).

- Smappee EV Wall. Available online: https://www.smappee.com/ (accessed on 28 March 2023).

- Myenergi Zappi V2. Available online: https://www.myenergi.com/wiki/zappi-v2/box_contents/ (accessed on 28 March 2023).

- Anderson A2. Available online: https://andersen-ev.com/pages/andersen-a2 (accessed on 28 March 2023).

- EO Mini PRO 3. Available online: https://www.eocharging.com/support/home-charging/eo-mini-pro-3 (accessed on 28 March 2023).

- ZJ Beny BCP Series. Available online: http://m.zjbenydc.com/Content/upload/pdf/202117379/ev-charger-1123.pdf?rnd=11 (accessed on 28 March 2023).

- FIMER FLEXA AC Wallbox. Available online: https://www.fimer.com/system/files/2023-02/FIMER_AC-Wallbox-FIMER%20FLEXA__EN_Rev_C_0.pdf (accessed on 28 March 2023).

- Ocular IQ Wallbox. Available online: https://ocularcharging.com.au/ocular-iq-wallbox/ (accessed on 28 March 2023).

- Enel-x JuiceBox 40. Available online: https://evcharging.enelx.com/store/residential/juicebox-40?i_variant_characteristic_id=154 (accessed on 28 March 2023).

- Tesla Wall Connector. Available online: https://www.tesla.com/support/home-charging-installation/wall-connector (accessed on 28 March 2023).

- Pearre, N.S.; Ribberink, H. Review of research on V2X technologies, strategies, and operations. Renew. Sustain. Energy Rev. 2019, 105, 61–70. [Google Scholar] [CrossRef]

- Chmielewski, A.; Gumiński, R.; Mączak, J.; Radkowski, S.; Szulim, P. Aspects of balanced development of RES and distributed micro-cogeneration use in Poland: Case study of a mCHP with Stirling engine. Renew. Sustain. Energy Rev. 2016, 60, 930–952. [Google Scholar] [CrossRef]

- Nissan Leaf V2G. Available online: https://www.nissan.com.au/about-nissan/news-and-events/news/2022/Dec/the-vehicle-to-grid-revolution-ha-arrived-in-australia.html (accessed on 28 March 2023).

- Mitsubishi Motors Group. Available online: https://www.mitsubishi-motors.com/en/sustainability/report/pdf/2021e_all.pdf (accessed on 28 March 2023).

- VIRTA. Available online: https://www.virta.global/news/virta-enables-nissan-v2g-integration-with-e.on (accessed on 28 March 2023).

- Clean Energy Reviews—Bidirectional Charging. Available online: https://www.cleanenergyreviews.info/blog/bidirectional-ev-charging-v2g-v2h-v2l (accessed on 14 April 2023).

- Ford F-150 Lightning. Available online: https://www.ford.com/trucks/f150/f150-lightning/2022/ (accessed on 14 April 2023).

- Hyundai Ioniq 5. Available online: https://www.hyundai.com/worldwide/en/eco/ioniq5/charging (accessed on 14 April 2023).

- KIA EV6. Available online: https://www.kia.com/content/dam/kia2/in/en/content/ev6-manual/topics/chapter1_3_4.html (accessed on 14 April 2023).

- BYD Atto 3. Available online: https://bydautomotive.com.au/brochures/BYD-ATTO-3-Owners-Handbook-2022.pdf (accessed on 14 April 2023).

- BYD Han EV. Available online: https://ev-database.org/car/1784/BYD-HAN (accessed on 14 April 2023).

- MG ZS EV. Available online: https://www.mg.co.uk/electric-life/vehicle-to-load-charging-v2l-guide (accessed on 14 April 2023).

- National Fund for Environmental Protection and Water Management. Available online: https://www.gov.pl/web/gov/skorzystaj-z-programu-moj-prad (accessed on 1 May 2023).

- Rosenberg, E.; Espegren, K.; Danebergs, J.; Fridstrøm, L.; Hovi, I.B.; Madslien, A. Modelling the interaction between the energy system and road freight in Norway. Transp. Res. Part D 2023, 114, 103569. [Google Scholar] [CrossRef]

- Yang, A.; Liu, C.; Yang, D.; Lu, C. Electric vehicle adoption in a mature market: A case study of Norway. J. Transp. Geogr. 2023, 106, 103489. [Google Scholar] [CrossRef]

- Figenbaum, E. Retrospective Total cost of ownership analysis of battery electric vehicles in Norway. Transp. Res. Part D 2022, 105, 103246. [Google Scholar] [CrossRef]

- Aasness, M.A.; Odeck, J. Road users’ attitudes towards electric vehicle incentives: Empirical evidence from Oslo in 2014–2020. Res. Transp. Econ. 2023, 97, 101262. [Google Scholar] [CrossRef]

- Khatua, A.; Kumar, R.R.; De, S.K. Institutional enablers of electric vehicle market: Evidence from 30 countries. Transp. Res. Part A 2023, 170, 103612. [Google Scholar] [CrossRef]

- Koch, N.; Ritter, N.; Rohlf, A.; Scarazzato, F. When is the electric vehicle market self-sustaining? Evidence from Norway. Energy Econ. 2022, 110, 105991. [Google Scholar] [CrossRef]

- Alternative Fuels Observatory—Norway. Available online: https://alternative-fuels-observatory.ec.europa.eu/transport-mode/road/norway/vehicles-and-fleet (accessed on 14 April 2023).

- Norsk Elbilforening. Available online: https://elbil.no/om-elbil/elbilstatistikk/ (accessed on 14 April 2023).

- Regulation (EU) 2023/851 of the European Parliament and of the Council of 19 April 2023 Amending Regulation (EU) 2019/631 as Regards Strengthening the CO2 Emission Performance Standards for New Passenger Cars and New Light Commercial Vehicles in Line with the Union’s Increased Climate Ambition. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32023R0851 (accessed on 1 May 2023).

- Milewski, J.; Kupecki, J.; Szczęśniak, A.; Uzunow, N. Hydrogen production in solid oxide electrolyzers coupled with nuclear reactors. Int. J. Hydrogen Energy 2021, 72, 35765–35776. [Google Scholar] [CrossRef]

- International Energy Agency. Global EV Outlook. 2021. Available online: https://iea.blob.core.windows.net/assets/ed5f4484-f556-4110-8c5c-4ede8bcba637/GlobalEVOutlook2021.pdf (accessed on 28 March 2023).

| Power Level Types | Charger Location | Application | Energy Supply Interface | Power Level | Charging Time | Vehicle Technology |

|---|---|---|---|---|---|---|

| Level 1—Slow Charging Station (EU: 230 V, US: 120 V): | On Board (1-phase) | Home charging/Office | Convenience Outlet | 1.44 kW for 12 A/1.92 kW for 16 A/3.68 kW for 16 A | 11–36 h/4–11 h | PHEV/EV |

| Level 2—Fast Charging Station (EU:400 V, US: 240 V) | On Board (1-phase or 3-phase) | Private/Public outlets | Dedicated EVSE | From 4 kW for 17 A To 48 kW for 120 A | Up to 10 h | |

| Level 3—Rapid Charging Station (UAC: 208 V–600 V, UDC: 208 V–600 V) | Off-Board (3-phase) | Commercial | Dedicated EVSE | 50 kW for 100 A 100 kW for 200 A | Up to 2 h-50 kW/up to 1 h-100 kW |

| Power Level (DC) | Charger Location | Application | Energy Supply Interface | Power Level | Charging Time | Vehicle Technology |

|---|---|---|---|---|---|---|

| Level 1 (UDC: 200–450 V) | Off-Board | Commercial | Dedicated EVSE | Up to 36 kW for 80 A | 11–36 h/4–11 h | All PHEV/EV |

| Level 2 (UDC: 200–450 V) | Off-Board | Commercial | Dedicated EVSE | Up to 90 kW for 200 A | Up to 1.5 h | |

| Level 3 (UDC: 200–600 V) | Off-Board | Commercial | Dedicated EVSE | Up to 240 kW for 400 A | Up to 30 min |

| Current Type AC/DC | Category | Subcategory | Maximum Power Output | Definition Based on Art. 2 [21] |

|---|---|---|---|---|

| AC | AC—Category 1 | Slow AC recharging point (1-phase) | Pout < 7.4 kW | Normal power recharging point |

| Medium-speed AC recharging point (3-phase) | 7.4 kW < Pout < 22 kW | |||

| Fast AC recharging point (3-phase) | Pout > 22 kW | High power recharging point | ||

| DC | DC—Category 2 | Slow DC recharging point | Pout < 50 kW | |

| Fast DC recharging point | 50 kW ≤ Pout < 150 kW | |||

| Level 1—Ultra-fast DC recharging point | 150 kW ≤ P < 350 kW | |||

| Level 2—Ultra-fast DC recharging point | P ≥ 350 kW |

| Connector Graphical View | Current Type/Geographical Zone | Maximum Power (the Charger’s Technical Maximum Capability) [kW] | Market Solution (Maximum Capability in Public Charging Infrastructure) [kW] | |||

|---|---|---|---|---|---|---|

| North America | European Union | Japan & South Korea | China | |||

SAE J1772 (Type 1) | AC/DC | AC | AC | - | 19.2 kW | 7.7 kW (Level 2) |

IEC 62196-2 Mennekes (Type 2) | - | AC | - | - | Up to 50 kW | 22 kW–48 kW |

GB/T 20234.2 AC | AC | 27.7 kW | 22 kW–48 kW | |||

Tesla Supercharger | AC/DC | AC/DC | - | - | 250 kW (Level 3) | up to 150 kW |

CCS (Combo 1) | DC | - | - | - | 400 kW (1000 V, 400 A) | 150 kW |

CHAdeMO | DC | DC | DC | - | 400 kW (1000 V, 400 A) | 150 kW |

CCS (Combo 2) | - | DC | 400 kW (1000 V, 400 A) | 350 kW | ||

GB/T 20234.3 DC | - | - | - | DC | 250 kW (1000 V, 250 A) | 125 kW |

ChaoJi DC GB/T 20234 and IEC 62196 (planned from 2024) | - | - | DC | DC | 900 kW (1500 V, 600 A) | 500 kW |

Megawatt Charging System (MCS) IEC 15118-20 (Planned from 2024) | - | DC | - | - | 3750 kW (1250 V, 3000 A) | n.a. |

| Barrier | Elimination Method |

|---|---|

| Several months of waiting for the construction of the connection by the DSO. | Establishment of legal provisions regarding the possibility of building connections by operators of publicly available charging stations on the terms of the issued connection conditions with the obligation to later repurchase the infrastructure by DSO operators. |

| There are no binding deadlines for connecting the charging station to the power grid. | 1. Making the connection agreements more detailed and specific by indicating the maximum and non-extendable deadline (e.g., 6 or 12 months) along with specifying contractual penalties for failure to meet it 2. In case of exceeding the connection deadline, introducing the possibility of substitute performance at the DSO’s cost and risk. |

| The unprofitability of the investment, additional costs of PLN 200–500 thousand [19], construction of power infrastructure (transformer stations, power lines) due to the DSO issuing conditions for connecting to the low-voltage power grid—specifying the connection power not exceeding 150 kW. | Introduction of legal provisions enabling the selection of the voltage level at which electricity will be supplied by the entity applying for connection to a publicly available charging station. |

| No requirement to provide information to the operators of publicly available charging stations from the DSO on the possibility of connecting the station in a given location. The result of such an action is the difficulty in determining the decision on the profitability of a given investment. | Introduction of legal provisions imposing a statutory obligation on DSOs to provide information on possible connections to the charging infrastructure, at the request of an entity interested in a given investment, with the obligation to respond within 1–2 months. Information is provided for a fee, and in the event of costs incurred by the DSO, reimbursement of these costs by the applicant. |

| Lack of ordering the ownership structure of the power infrastructure at the Service Station (SS). The effects of this state of affairs are: the necessity for operators to build charging stations of their own infrastructure, while the owner of the infrastructure—already existing at the SS—is the General Directorate for National Roads and Motorways and the inability to apply the e-tariff when connecting charging stations. | Legal regulation on enabling SS entities (i.e., operators of public charging stations) to transfer to the DSO the elements of the network and infrastructure owned by them (including transformer stations, regardless of the date when they were built). |

| There is no need to develop plans to expand the power infrastructure in Service Areas (motorways). As a result, the connection power values are not adjusted to the needs related to the development of fast charging stations. | A legal regulation requiring the creation of periodic plans for the construction and expansion of a SS, taking into account the location within the SS area for the charging infrastructure, while maintaining the connection power reserve. |

| Different fees for connecting the charging station to the medium and low voltage grids applied by DSOs. | Legal regulation concerning standardization of connection fees. |

| Poland | Norway |

|---|---|

| 1. Excise tax exemption for fully electric (BEV) and hydrogen-powered passenger cars (FCEV) 2. A write-off for the wear and tear of a BEV passenger car is a tax-deductible cost up to a value not exceeding EUR 30,000 (other vehicles up to EUR 20,000). | No tax on the purchase and import of electric vehicles (valid from 1990 to 2022). From 2023, a car weight-based purchase tax on all new electric vehicles. |

| Co-financing from the “My Electrician” program from 22 November 2021, to 30 September 2025, for the purchase of a new electric vehicle for: 1. individual persons in category M1: (a) up to PLN 18,750, the price of a new vehicle may not exceed PLN 225,000, (b) families with a “large family” card up to PLN 27,000 without the price limit of a new vehicle. 2. entities other than natural persons (leasing is also allowed), for vehicles in the following categories: (a) N1: subsidy up to 20% of eligible costs, but not more than PLN 50,000 or subsidy up to 30% of eligible costs, but maximum PLN 70,000 in the case of declaration of average annual mileage above 20,000 km, (b) L1e-L7e: subsidy up to 30% of eligible costs, but maximum PLN 4000. | 25% VAT exemption on purchase (valid from 2001 to 2022). Since 2023, Norway has introduced 25% VAT on the purchase price of at least NOK 500,000 |

| 25% reduced tax on company cars (valid from 2000 to 2008). 50% reduction in company car tax (valid from 2009 to 2017). Reducing the tax on company cars to 40% (valid from 2018 to 2021) and 20% since 2022. | |

| Exemption from 25% VAT on leasing (valid since 2015). | |

| 1. Exemption from tolls for travel on public roads until 31 August 2028 for zero-emission buses of the public collective transport operator, providing public utility transport, are exempt from tolls for travel on national roads. 2. Other electric vehicles are not exempt from road tax and other tolls (e.g., motorway tolls). | Exemption from annual road tax (applicable from 1996 to 2021). Reduced road tax from 2021. Full road tax since 2022. |

| No discounts. | No tolls on toll roads (valid from 1997 to 2017). |

| No discounts. | No fees on ferries (valid from 2009 to 2017). |

| No discounts. | Maximum 50% of the total amount on toll roads (valid from 2018 to 2022). Since 2023 it has increased to 70%. |

| BEVs are exempt from paying for parking on public roads in the paid parking zone (except for designated places at public charging stations)—effective since 2018. | Free city parking (valid from 1999 to 2017). |

| Possibility of moving electric vehicles on bus lanes until 1 January 2026. Possibility of entering the clean transport zone | Access to bus lanes (valid from 2005). New rules allow local authorities to restrict access to only electric vehicles carrying one or more passengers (valid from 2016). |

| Regulation 2023/851 assumes 100% registration of zero-emission vehicles (electric or e-fuel [189]) among new vehicles in the European Union from January 2036. From 01.2036, according to the data in [188], there will be a ban on registration for combustion vehicles powered by fossil fuels derived from crude oil processing, including: petrol, diesel, LPG, etc. | The Norwegian Parliament has decided on a national target that all new cars sold by 2025 should be emission-free (electric or hydrogen, valid since 2017). |

| The Act of 2 December 2021 amending the Act on electromobility and alternative fuels and certain other acts, specifying, among others, procedures for installing charging points in multi-family buildings: cooperatives and housing associations (valid since 2022). | Established Charging Law for people living in apartment buildings (valid since 2017). |

| Share of BEV in the fleet of vehicles used by the chief and central state administration bodies (from 1 January 2020 to 31 December 2022 at least 10%, from 1 January 2023 to 31 December 2024 at least 10%, from 1 January 2025 at least 50%). | From 2022, cars must be ZEV for public procurement. Since 2025, the same applies to city buses. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chmielewski, A.; Piórkowski, P.; Możaryn, J.; Ozana, S. Sustainable Development of Operational Infrastructure for Electric Vehicles: A Case Study for Poland. Energies 2023, 16, 4528. https://doi.org/10.3390/en16114528

Chmielewski A, Piórkowski P, Możaryn J, Ozana S. Sustainable Development of Operational Infrastructure for Electric Vehicles: A Case Study for Poland. Energies. 2023; 16(11):4528. https://doi.org/10.3390/en16114528

Chicago/Turabian StyleChmielewski, Adrian, Piotr Piórkowski, Jakub Możaryn, and Stepan Ozana. 2023. "Sustainable Development of Operational Infrastructure for Electric Vehicles: A Case Study for Poland" Energies 16, no. 11: 4528. https://doi.org/10.3390/en16114528

APA StyleChmielewski, A., Piórkowski, P., Możaryn, J., & Ozana, S. (2023). Sustainable Development of Operational Infrastructure for Electric Vehicles: A Case Study for Poland. Energies, 16(11), 4528. https://doi.org/10.3390/en16114528