Abstract

The realization of sustainable plus energy neighborhoods (SPENs) is key to achieving a carbon neutral built environment, and meeting the objectives of the green deal. Financial schemes have demonstrated effectiveness in driving the energy transition of individual buildings. However, the role of financial schemes in initiating the development of SPENs remains unclear. This study aims to address this research gap by investigating the extent to which existing financial schemes support the technological advancements and stakeholders involved in SPEN realization. The focus is on four European countries: Austria, The Netherlands, Norway, and Spain, where noteworthy SPEN initiatives have been established. This study investigates whether and how financial schemes facilitate SPEN development and address the neighborhood-level dynamics. Our research used a mixed-methods approach comprising a literature review, case studies, and interviews. Our findings shed light on two significant barriers within current schemes. Firstly, the schemes rarely incentivize collective energy sharing and may inadvertently impede individuals’ prosumerism. Secondly, they primarily favor individuals capable of making upfront capital investments, rendering them inaccessible to a large portion of European citizens. By identifying these limitations, our study highlights the need for policy adjustments and innovative financial mechanisms to overcome the barriers hindering SPEN implementation. Moreover, our research contributes to the broader understanding of sustainable urban development and offers insights that extend beyond the examined countries, aiding policymakers and stakeholders in other regions facing similar challenges.

1. Introduction

To achieve the Paris climate agreement goals, carbon emissions generated from the built environment need to be neutral by 2050 [1]. Buildings in the EU are responsible for 40% of our energy consumption and 36% of greenhouse gas emissions, which mainly stem from construction, usage, renovation and demolition. Today, roughly 75% of the EU building stock is energy-inefficient. This means that a large part of the energy used goes to waste. Such energy loss can be minimized by shifting the focus from the building level—i.e., minimizing the energy consumption of single buildings—to the neighborhood levels—i.e., improving existing buildings sharing energy with adjacent or complementary buildings. Hence, the notion of the Sustainable Plus Energy Neighborhood (SPEN) is emerging from the need of considering mutual interactions between the built environment, inhabitants and nature [2]. This notion builds from extant knowledge and considerable efforts towards the realization of Positive Energy District (PED), which constitutes a driving concept for the urban transition to a sustainable future. PEDs are areas within cities that generate more renewable energy than they consume, contributing to cities’ energy-system transformations toward carbon neutrality [3]. These districts are characterized by several key features; these include prioritizing renewable energy generation, emphasizing energy efficiency and optimization, promoting energy sharing and flexibility, and adopting an integrated approach to urban planning. By harnessing renewable energy sources, implementing energy-efficient measures, enabling energy sharing among buildings, and considering various factors in urban planning, PEDs aim to achieve carbon neutrality and maximize energy utilization while minimizing waste [4]. Realizing SPENs and PEDs involves navigating a complex socio-technical transition. Technological advancements are crucial for balancing energy demands and supply within districts. This includes the integration of renewable energy systems, energy storage solutions, and advanced energy-management technologies. Additionally, community support plays a vital role in stimulating prosumer behaviors, where residents actively participate in energy generation and consumption practices. Achieving this requires raising awareness, promoting behavioral changes, and fostering a sense of ownership among the community. Furthermore, effective governance structures are essential for managing multi-stakeholder decision-making processes in SPEN development. Coordinating the interests and responsibilities of various actors, including residents, local authorities, utilities, and private sector entities, is key to overcoming regulatory and administrative challenges.

The initiation, development and support of PEDs constitute a priority for the political agenda of the European Union, which introduced the program “Positive Energy Districts for Sustainable Urban Development”, striving for 100 positive-energy neighborhoods by 2025 [5]. This program is one of the initiatives aimed at reducing emissions in cities, which are currently responsible for 65–70% of global energy and produce 70–75% of global emissions [6]. Other key European policy initiatives related to carbon neutrality and sustainable urban development include the Renovation Wave Strategy, which aims to double the annual renovation rate of existing buildings by promoting energy-efficient renovations, addressing energy poverty, and stimulating the use of renewable energy sources [7]. The European Intelligent Cities Initiative promotes the development of smart, sustainable, and energy-efficient cities across Europe. It encourages the integration of innovative technologies, data-driven solutions, and citizen engagement to optimize resource use, reduce carbon emissions, and enhance the quality of life in urban areas [8].

Such an important and ambitious target presents numerous challenges since the realization of PEDs involves a complex socio-technical transition [9]. Some of the challenges include technological advancements to support the balance between energy demands and supply [10] as well as local community support to stimulate prosumer behaviors [11], next to a governance structure able to manage multi-stakeholders’ decision-making processes [12]. While all these factors constitute important barriers, they are all deeply interrelated—and dependent on—a need for incentives [3,9]. In this context, incentives are social and environmental drivers and motivators. Effective incentives are built through a careful mix of financial opportunities and sustainable business models [13]. When markets are premature, e.g., demands do not coincide with the potential offer—as for example in the case of new sustainable-energy technologies—financing opportunities have been proven effective to kick-start market uptakes in the context of energy transition initiatives in the built environment. In fact, in the last decade, there have been many tangible improvements resulting from the numerous funding programs announced by the European Commission since the early 2000s [14]. For instance, crowdfunding projects, such as the “Zonnepanelen delen” initiative in the Netherlands [15], have successfully engaged local communities in collectively investing in solar-panel installations, making renewable energy more accessible. Public-private co-financing projects, such as the Dutch “Energiesprong” initiative, have supported the retrofitting of existing buildings to achieve net-zero energy consumption through innovative financing mechanisms [16]. While extant research suggests that these schemes have been effective at initiating the energy transition of buildings [14], it is not yet clear what role they (can) play in the initiation and development of SPENs.

Therefore, in this paper we investigate if and how existing financial schemes can support the technological developments and stakeholders involved in the realization of SPENs. Specifically, we examine the extent to which these financial schemes are contributing to the advancement of SPENs across four European countries: Austria, The Netherlands, Norway, and Spain, where noteworthy SPEN initiatives have been established. By analyzing the effectiveness and limitations of current financial schemes, we aim to provide insights into their applicability and identify areas for improvement. Our research is conducted within Syn.ikia, a European H2020 project [17]. This project consists of four real-life SPENs tailored to four different climatic zones. Within Syn.ikia, several innovations are developed, analyzed, optimized and monitored, demonstrating the functionality of the SPENs concept in Europe.

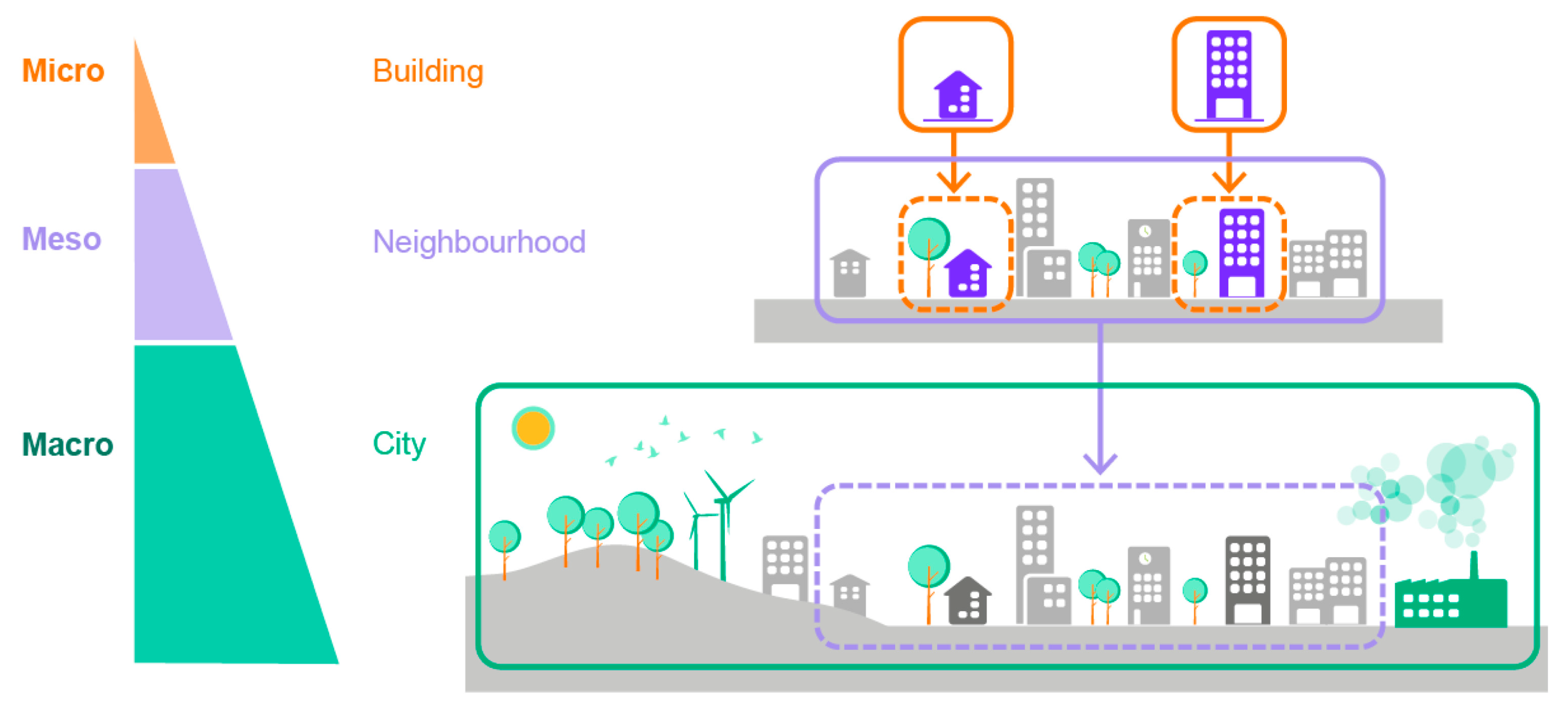

In addition to addressing the research gap regarding the role of financial schemes in SPEN initiation and development, our study contributes to filling a broader gap in the literature. While the need to shift from the micro-level (individual buildings) to the meso-level (neighborhoods) has been widely recognized in terms of energy flexibility [2] and inclusive participation [18], little attention has been given to the financial aspects at the meso-level (Figure 1). This gap is particularly problematic as business models for the energy transition of the built environment involve multiple stakeholders with potentially diverging interests, which can hinder collaborative innovation [19] and slow down the overall energy transition.

Figure 1.

Identification of the neighborhood scale. Source: IREC (2021), adapted from [20].

The paper is structured as follows: we begin by introducing the research context and method. We then present our findings for the four different countries analyzed, namely: Austria, The Netherlands, Norway, and Spain. For each county, we introduce the different schemes following the relevant target groups. We conclude with a discussion on the state of the art across countries and suggest future research avenues.

2. Context and Research Method

2.1. Context: Syn.ikia H2020

As part of the ongoing Syn.ikia H2020 project [17], four real-life SPENs tailored to different climatic zones have been developed, analyzed, optimized, and monitored. These SPENs serve as practical examples that demonstrate the viability of the plus energy neighborhood concept in Europe. The primary strategy employed to achieve these objectives involves providing a blueprint for sustainable plus energy buildings and neighborhoods. This blueprint involves the integrated application of energy design, energy- and cost-efficiency measures, local renewables, local storage, energy flexibility, and energy sharing and trading. The effectiveness of these strategies will be showcased through four real-life development projects comprising plus energy apartment blocks situated in different climatic zones and representing various types of urban development strategies.

Additionally, this project aims to deliver customized designs, innovative technologies, and decision support strategies and tools that enable key stakeholders in Europe to make informed decisions. It also emphasizes community engagement and the empowerment of users through digital platforms, driven by factors such as housing affordability, improved quality of life, and environmental awareness, with the goal of promoting behavioral change.

The project recognizes the potential of neighborhoods to act as flexibility providers, facilitating the integration of renewable energy sources (RES) into the energy system and enabling flexible management of energy demand and RES generation within neighborhoods. This approach helps avoid costly upgrades to distribution grids while enhancing the quality and reliability of energy supply.

Moreover, the project focuses on providing infrastructure management based on big data and smart networks. These, along with validated construction technologies and materials, unlock the flexibility potential within neighborhoods, foster community engagement, and ensure well-managed housing for citizens. The Syn.ikia project defines an SPEN based on a similar foundation as Positive Energy Buildings (PEB), but with an expanded geographical boundary that includes the entire neighborhood site, including local storage and energy supply units [2]. The project takes into account various factors such as cost efficiency, indoor environmental quality, spatial qualities, sustainable behavior, occupant satisfaction, social factors (such as co-use, shared services and infrastructure, and community engagement), power performance (peak shaving, flexibility, and self-consumption), and greenhouse gas emissions in its SPEN framework.

2.2. Research Method

To ensure a comprehensive understanding of financial schemes related to Sustainable Plus Energy Neighborhoods (SPENs) across different countries, we employed a range of research methods. The first step involved conducting an extensive literature review and desk research focused on financial schemes. The literature review covered the period between September 2021 and May 2023, aiming to capture the most up-to-date information on the topic.

For the literature review, we accessed scholarly databases such as Google Scholar and university library databases, including Smart Cat, to gather academic publications and research articles relevant to financial schemes and SPENs. Additionally, we explored online sources associated with various European initiatives, specifically focusing on governmental websites where policies and relevant information on financial schemes could be found. This approach ensured a comprehensive coverage of both academic and practical perspectives.

During the literature search, we utilized a set of targeted keywords to refine the search results and identify relevant sources. These keywords included “Positive Energy Districts (PED)”, “financing”, “(energy) subsidies”, “energy-saving agreements”, “prosumerism”, “district business models”, “zero-energy buildings”, “financial mechanisms”, “neighborhood energy financing”, “sustainable technologies incentives”, and others. By employing these keywords, we aimed to capture the literature and sources specifically related to financial schemes associated with SPENs.

The outcomes of the literature review and desk research provided us with a preliminary list of financial schemes and mechanisms. To ensure the relevance of the selected schemes, we excluded any schemes that were no longer operational or were outdated, based on the specified time period (September 2021 to May 2023). Given the importance of stakeholders’ incentives for the materialization of Sustainable Plus Eenergy Neighborhoods (SPENs), we focused our analysis on target groups relevant to SPENs, as specific schemes directly tailored for SPENs or at the neighborhood level are not yet available. These target groups were categorized based on their incentives and the type of support provided by the schemes. We assessed the relevance of each identified scheme to our research objective, specifically focusing on financial schemes that are directly related to SPENs. This exclusion criterion ensured that only schemes specifically designed or implemented for SPENs were included in our analysis. Schemes that did not meet this criterion were excluded from further consideration.

The target groups identified for the analysis include owners-occupiers, landlords, homeowners’ associations, (social) housing associations, SMEs or (large) enterprises, energy communities, tenants, and energy service companies. By categorizing the schemes according to these target groups, we aimed to gain insights into the range of incentives and support mechanisms available to different stakeholders in the context of SPENs.

This approach allowed us to focus specifically on schemes that are directly applicable and relevant to the development and implementation of SPENs, providing a comprehensive understanding of the financial landscape surrounding these innovative neighborhood-level initiatives.

For each identified financial mechanism, we analyzed the predominant target group and provided a brief description of its main added value. This approach allowed us to gain insights into the applicability and effectiveness of various financial schemes in supporting the initiation and development of SPENs. We evaluated the availability and accessibility of information related to the schemes. If a scheme lacked sufficient documentation or publicly available information, making it difficult to assess its implementation and impact, it was excluded from the sample. We considered the credibility and reliability of the sources providing information about the schemes. Governmental websites and reputable sources were given preference to ensure the reliability and accuracy of the included schemes.

To further enhance our understanding and identify additional schemes, we conducted semi-structured interviews with eight experts from the four demo countries. Each interviewee represented a specific demo country and possessed several years of experience in developing buildings in that country. We asked them to determine the applicability of the identified schemes in financing the innovations. However, it became clear from the interviews that the existing schemes were not suitable for financing the SPEN-related innovations. These interviews also included brainstorming questions about plausible barriers and advantages of the schemes identified. Given the limited fit of existing schemes with the neighborhood scale, we aimed to co-create forward-looking knowledge with the informants and project partners [21].

With the consent of the interviewees, the interviews were audio-recorded and transcribed. The interview transcripts were carefully reviewed and coded to identify predominant categories related to the financial schemes discussed. This coding process allowed us to extract key themes, concepts, and patterns from the interview data. We employed a thematic analysis approach, systematically identifying and organizing the content based on recurring topics and ideas. Additionally, to enhance the validity of our findings, we employed techniques such as member checking and peer debriefing. Member checking involved sharing our preliminary findings and coding results with the interviewees, giving them the opportunity to provide feedback, verify the accuracy of our interpretations, and offer additional insights. This process helped to validate our analysis and ensure that the participants’ perspectives were accurately represented.

The Syn.ikia partners and demo-site representatives were invited to review the list of schemes and their descriptions generated from our research. They were encouraged to provide feedback, suggest any additional schemes that may have been overlooked, and offer their insights based on their firsthand involvement in SPEN-related activities. This collaborative review process allowed us to benefit from their domain expertise and perspectives, ensuring that the identified schemes accurately reflected the practical realities and nuances of SPEN initiatives.

The aim of involving these stakeholders was not only to validate our findings but also to foster a sense of ownership and shared knowledge creation. By engaging in a dialogue with the Syn.ikia partners and demo-site representatives, we sought to co-create knowledge and gain a comprehensive understanding of the financial schemes relevant to SPENs. Their input and contributions enriched our analysis and ensured that our research outcomes aligned with the practical needs and challenges faced in implementing SPEN initiatives.

By incorporating multiple research methods, including the literature review, desk research, interviews, and stakeholder involvement, we ensured a rigorous and comprehensive analysis of financial schemes related to SPENs. The collaborative nature of the research, involving Syn.ikia partners and demo-site representatives, allowed us to gather additional insights, validate our findings, and identify any schemes that might have been overlooked, resulting in a more robust and reliable research outcome.

3. Findings

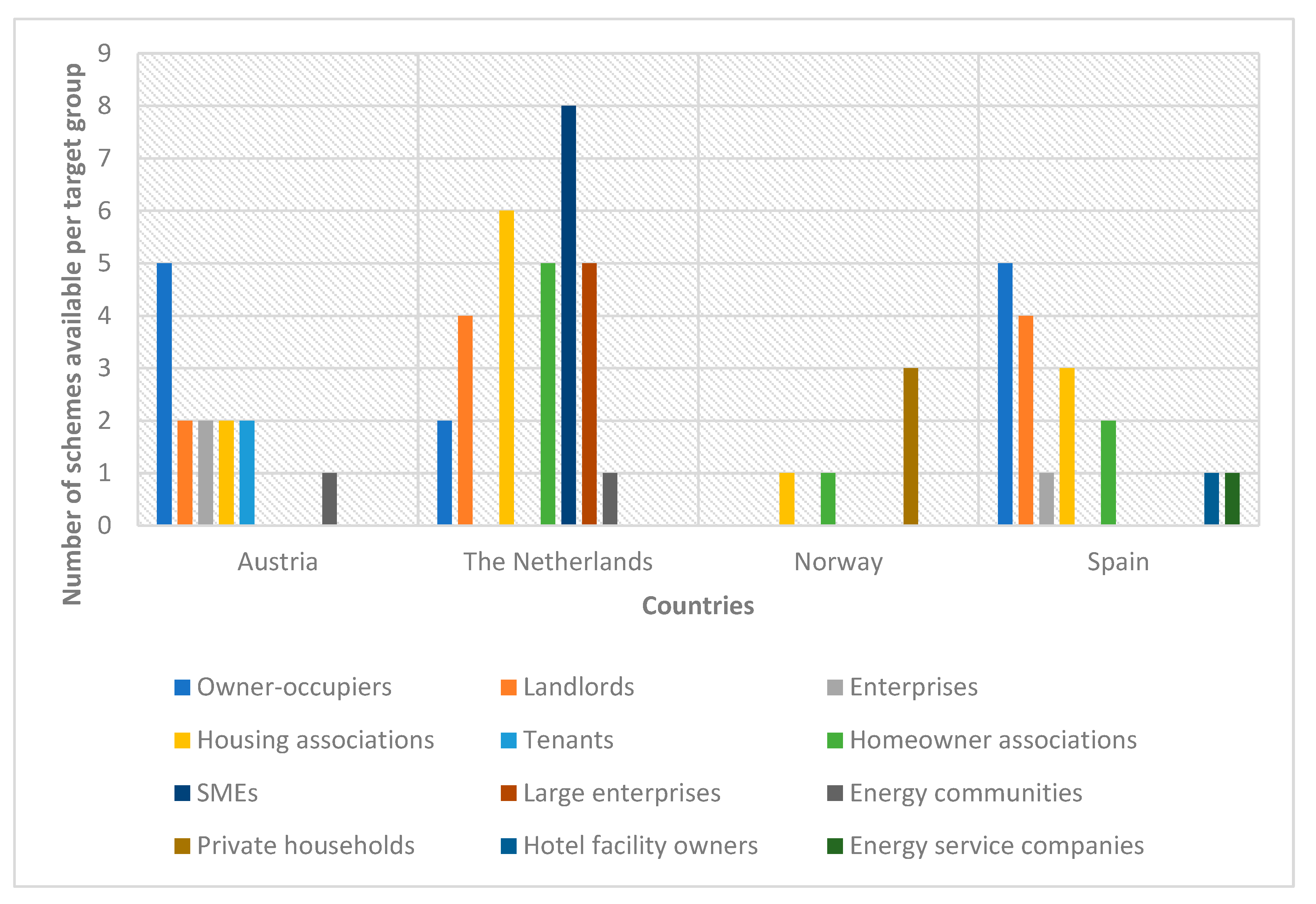

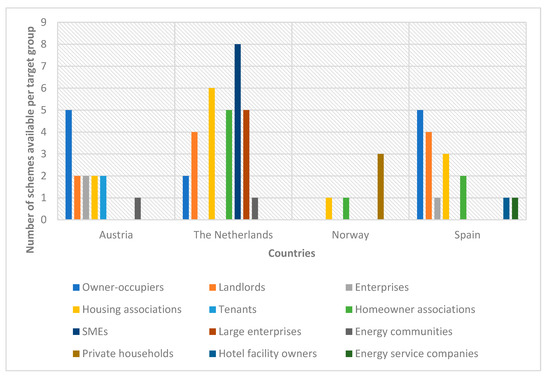

Our analysis of the financial schemes supporting energy-driven interventions in the four demo countries revealed that, at the time of writing, there are no widespread schemes specifically targeting the neighborhood level. However, it is important to note that there are notable exceptions in Austria and The Netherlands that do address the neighborhood level. To provide a comprehensive understanding of the schemes examined in this study, in what follows, we present an overview of these schemes, categorized based on their target groups (Figure 2) and the type of support they offer. Most schemes primarily focus on addressing isolated building parts, components, or single buildings, and involve stakeholders who are typically found within a neighborhood. The identified target groups encompass owners-occupiers, landlords, homeowners’ associations, (social) housing associations, SMEs or (large) enterprises, energy communities, tenants, and energy service companies. Additionally, we provide a detailed description of each scheme’s main characteristics and highlight the various implementation mechanisms employed.

Figure 2.

Number of financial schemes per target group.

By adopting this comprehensive approach, we aimed to gain valuable insights into the existing schemes, including the exceptions that target the neighborhood level, and evaluate their potential for effectively addressing energy interventions at the neighborhood level.

3.1. Target Group Definitions

The following target groups of the financial schemes were found in the four countries

- Owner-occupiers: Owner-occupiers are individuals who own and reside in their homes, assuming both the role of homeowner and occupant.

- Landlords: Landlords are individuals or entities that own residential properties and rent them out to tenants in exchange for monetary compensation.

- Housing associations: Housing associations are nonprofit organizations that play a significant role in the housing sector. They aim to provide affordable and quality housing options, particularly for individuals and families with lower incomes or limited access to the private housing market. Housing associations own, manage, and maintain a portfolio of residential properties, offering them for rent at below-market rates to ensure affordability and access to suitable housing. Additionally, housing associations may provide support services to tenants, such as property maintenance, tenant assistance, and community development initiatives.

- Tenants: Tenants are individuals or households who rent residential properties from landlords.

- Private households: Private households encompass individuals or families who reside in privately owned residences and manage their own finances. They have primary decision-making authority regarding household budgeting, savings, investments, and financial planning.

- Homeowner associations: Homeowner associations consist of individuals or families who own properties within a shared community or complex. These associations collectively manage and maintain common areas, amenities, and infrastructure, often through the payment of membership fees or dues.

- Enterprises: In specific countries like Austria and Spain, enterprises, including both small and large businesses, are targeted by financial schemes supporting energy-driven interventions.

- SMEs: In the Netherlands, financial schemes are available specifically for small and medium-sized enterprises (SMEs). SMEs are defined as businesses with fewer than 250 full-time equivalent employees and either an annual turnover not exceeding EUR 50 million or a balance sheet total not exceeding EUR 43 million.

- Large enterprises: Large enterprises in the Netherlands refer to businesses that exceed the thresholds set for SMEs in terms of employee count, annual turnover, or balance sheet total.

- Energy communities: Energy communities are groups of individuals, households, or organizations that collaborate to collectively manage and optimize their energy resources, promoting sustainable energy production, consumption, and management.

- Energy service companies (ESCOs): ESCOs are specialized firms that offer a range of energy-related services to clients, including commercial, industrial, and residential sectors. They provide comprehensive energy solutions aimed at improving energy efficiency, reducing energy consumption, and implementing sustainable energy practices.

- Hotel facility owners: Hotel facility owners are individuals, companies, or organizations that own and operate hotel establishments. They are responsible for the ownership, management, and overall operation of the hotel property and its facilities.

3.2. Austria

Austria’s nine regional governments are placing significant emphasis on prioritizing energy efficiency in the built environment, as they hold primary responsibility for creating energy efficiency policies. This focus on enhancing energy efficiency aligns with the country’s commitment to the Paris Agreement and supports the transition towards a low-carbon society [22]. The Austrian Energy Agency states that the built environment is responsible for around 40% of the country’s final energy consumption [23]. To address this issue, the current government program for the building sector aims to renovate 3% of the existing stock [24].

Financial schemes in Austria serve to facilitate the development of SPENs by supporting various interventions that promote energy efficiency, including insulation, the installation of new heating systems, and electricity generation. Six distinct financial schemes were identified (as detailed in Table 1).

Table 1.

Financial Schemes Austria.

The Wohnbauförderung program provides subsidies and loans to owner-occupiers, private sector landlords, and housing associations to promote the development of affordable housing through the support of energy efficiency measures. Examples of such interventions include the thermal insulation of windows, outer walls, roofs, and ceilings, connection to district heating, and installation of central heating systems, solar thermal plants, heat pumps, and biomass heating systems. The level of subsidy is determined based on the achieved thermal quality or efficiency of the heating system. Alternatively, the Energieförderung program is available for owner-occupiers in the federal state of Salzburg and offers support for single actions such as the installation of PV panels and green energy heating systems. In Vienna, a similar subsidy program, known as THEWOSAN, is provided to owner-occupiers, with non-repayable contributions ranging from EUR 25 to EUR 160 per m2 of floor area depending on the achieved energy efficiency level, along with an additional EUR 60 per m2 of floor area if the passive house standard is achieved. The maximum amount of the non-repayable contribution is limited to 30% of the total building costs. Furthermore, the Austrian federal government provides subsidies through the Sanierungsscheck program to incentivize retrofitting of private residential buildings and buildings used for business purposes that are over 20 years old. The subsidies cover costs associated with material, assembly, and planning and are determined based on the renovation depth and level of decrease in heat energy demand.

There is an increasing trend among subsidy schemes to mandate compliance with the klimaaktiv building standard for newly constructed buildings. Under the klimaaktiv program “Bauen & Sanieren” (building and renovation), actors in the building sector can obtain guidance on energy-efficient measures. The primary aim of the klimaaktiv program is to foster the adoption and promotion of climate-friendly technologies and services.

Austria has emerged as a leader in providing financial incentives to empower consumers and small-scale energy providers, such as renewable energy communities (Erneuerbare-Energie-Gemeinschaft/EEG), to actively participate in the energy market. These energy communities can generate, store, consume, and sell energy to their members located in close proximity [25]. Such communities promote the decentralization of renewable energy generation and increase citizen participation in renewable energy projects. The network usage fee is reduced through a nationwide uniform discount, which covers the average superimposed network costs. The purchase of energy from renewable energy communities is exempt from the renewable energy subsidy contribution (previously the green electricity subsidy contribution), and electricity tax is waived for electricity generated by photovoltaic (PV) systems and consumed within the EEG. From 1 July 2022, this exemption applies to electrical energy generated from all renewable energy sources. Furthermore, a market premium may support up to 50% of the renewable electricity produced within the energy community but not consumed.

3.3. The Netherlands

In the Netherlands, the built environment accounts for 40% of the total energy consumption [26]. To reduce energy demand and greenhouse gas emissions, the Dutch government has launched several initiatives aimed at promoting investment in energy-efficient measures [18].

The Dutch government has implemented several initiatives to encourage the use of sustainable energy technologies and to support the energy transition. Seventeen distinct financial schemes have been identified (as detailed in Table 2).

Table 2.

Financial schemes in The Netherlands.

One such initiative is the Investment Subsidy for Sustainable Energy (ISDE) scheme, which provides financial support to owner-occupiers and housing associations who purchase renewable energy systems such as solar panels, heat pumps, biomass boilers, and pellet stoves. This subsidy aims to incentivize the adoption of sustainable energy technologies in residential buildings.

Another Dutch government initiative is the National Heat Fund, also known as the Nationaal Warmtefonds, which aims to support the energy transition by providing low-interest loans to households for energy-saving measures and sustainable heating solutions. The loans can be used to finance up to 100% of the costs of energy-saving measures and sustainable heating solutions, with a maximum loan amount of EUR 25,000 per household. The fixed interest rate is currently set at 1.5% for a term of up to 10 years.

In addition, the Dutch government has launched the Incentive Scheme for Natural Gas-Free Rental Homes (SAH) to accelerate the transition to sustainable energy. The SAH provides financial incentives for social housing associations and landlords to make their rental homes more sustainable and to move away from natural gas as an energy source. To be eligible for the SAH, a plan for making homes natural gas-free is needed and interventions must be implemented within a certain timeframe. The scheme provides a subsidy for each home that is retrofitted, with the amount depending on the type of retrofit and the expected energy savings.

The Foundation for Social Housing of Dutch Municipalities (SVOH) is another initiative that aims to support the development of social housing in the Netherlands. The foundation provides financing for social housing projects and promotes cooperation between municipalities and housing associations to increase the availability of affordable housing. Additionally, the SVOH invests in research and development of sustainable and innovative solutions for social housing, such as energy-efficient construction and renovation methods.

To encourage the construction of new rental properties and to help address the shortage of affordable rental housing, the Dutch government established the Regeling Vermindering Verhuurdersheffing Nieuwbouw (RVV nieuwbouw) program. Under this program, housing associations can apply for a reduction in the landlord levy for a period of up to 25 years for new-build residential properties that meet certain criteria, such as energy efficiency standards and affordability requirements.

Furthermore, the Dutch government has implemented the Stimuleringsregeling energieprestatie huursector (SEEH) subsidy program to improve the energy efficiency of rental housing. This program provides financial support to homeowner associations who undertake energy-saving measures in their properties, which could include upgrading insulation, replacing windows, improving ventilation systems, installing energy-efficient boilers, and more.

The schemes available to housing associations can be applied to individual buildings or implemented across a set of buildings through association-led initiatives.

The Netherlands also has several programs that provide financial support for renewable energy projects. The Stimulation of Energy Transition (SCE) program offers a subsidy for the production of renewable energy, such as solar panels or wind turbines, while the Market Incentive for Energy (MEI) program provides subsidies to SMEs that invest in renewable energy projects. The Investment Subsidy for Renewable Energy (ISDE) program provides financial support to all enterprises, large and small, that invest in renewable energy, such as heat pumps, solar water heaters, and biomass boilers. The Stimulating Sustainable Energy Production (SDE+++) program provides financial support to enterprises that invest in renewable energy production, such as wind turbines, solar panels, or geothermal energy.

The Energy Investment Allowance (EIA) program provides a tax deduction to enterprises that invest in energy-saving or renewable energy projects, such as insulation or solar panels. The Random Depreciation of Environmental Investments (VAMIL) program allows enterprises to accelerate the depreciation of environmental investments, such as electric cars or solar panels.

Finally, in addition to VAMIL and MIA, the Netherlands also offers the Clean and Economical Demonstration Projects (DEI+) scheme to promote sustainable innovations. The DEI+ program targets SMEs and provides financial support for projects that demonstrate innovative technologies and processes related to energy, climate, and sustainability.

Through the DEI+ scheme, SMEs can access financial support for a variety of energy efficiency measures, such as the development and implementation of energy-efficient technologies and buildings.

In summary, the Dutch government has implemented an array of financial schemes to facilitate the transition to sustainable energy. These initiatives support individuals, housing associations, and enterprises in adopting renewable energy systems, implementing energy-saving measures, and developing innovative technologies. The schemes cater to various sectors, including residential buildings, rental properties, social housing, and SMEs, aiming to create a more sustainable and energy-efficient future.

3.4. Norway

In Norway, buildings account for the biggest demand for energy. Approximately 47% of the existing residential buildings are more than 50 years old in Norway [27]. Two national organizations are responsible for managing financial schemes to incentivize efficient energy measures for buildings—Enova (owned by the Ministry of Climate and Environment) and the Norwegian State Housing Bank (Husbanken). Four distinct financial schemes have been identified (as detailed in Table 3).

Table 3.

Financial schemes in Norway.

The Norwegian government has implemented various initiatives to promote energy efficiency and renewable energy use in private households. One of these initiatives is the Enova grant [28], which targets private households with subsidies to encourage energy-efficient upgrades. The subsidies provide financial support for measures such as insulation, energy-efficient heating systems, and renewable energy installations. The aim is to reduce energy consumption and promote sustainable living.

Another initiative is the Husbanken loans [29], which provide loans to private households for energy-efficient upgrades. These loans are designed to help homeowners finance upgrades that will reduce energy consumption and promote sustainable living. The loans have low interest rates and flexible repayment terms, making them an accessible option for many private households.

In addition to financial support, Enova also provides advice on energy efficiency through Enova answers [30]. This service offers guidance and support to private households seeking to improve their energy efficiency, helping them to identify the most effective measures and technologies to reduce energy consumption.

Enova also provides support to homeowner associations and housing associations through Enova support. This service offers advice and support to associations seeking to improve the energy efficiency of their buildings, helping them to identify and implement energy-efficient measures and technologies. This is particularly important as the energy consumption of multi-unit residential buildings can be high, making them a key target for energy efficiency measures.

Overall, these initiatives demonstrate the Norwegian government’s commitment to promoting sustainable living and reducing energy consumption. By providing financial support, advice, and support to private households and associations, these initiatives aim to make energy-efficient upgrades accessible and achievable for all.

3.5. Spain

In Spain, residential buildings consume 17% of the total energy [31]. The Spanish National Climate Change Adaptation Plan 2021–2030, known as PNACC, aligns with the Paris Agreement of 2015 and sets ambitious targets for the next decade. These targets include reducing CO2 emissions by 39%, exceeding the European goal of 26%, achieving 42% renewable energy usage in end-use, surpassing the European average of 32%, and improving energy efficiency by 39.5%, higher than the European goal of 32.5% [32]. To promote energy-performance improvements in buildings, various financial incentives are available at the federal, regional, and municipal levels [33].

The Spanish government has implemented various initiatives to promote energy conservation, energy efficiency, and the use of renewable energy sources in existing buildings, regardless of ownership or use. Seven distinct financial schemes have been identified (as detailed in Table 4).

Table 4.

Financial schemes in Spain.

The Ministry of Industry, Energy and Tourism through the Institute for Energy Diversification and Saving (IDAE) has launched the PAREER program to encourage comprehensive actions and integrated measures to improve energy efficiency and renewable energy use in residential buildings. This program provides subsidies and repayable loans for projects that involve the renovation of building envelopes, heating installations, and the use of biomass and geothermal energy instead of conventional energy sources. The aided actions should improve the energy rating of the building by at least one letter on the carbon dioxide emission scale (kg CO2/m2 year) compared to the initial energy rating of the building. Additional support is given to actions that achieve energy class A or B or increase the initial energy rating of the building by more than two letters.

The PREE program, which stands for Programa de Rehabilitación Energética de Edificios, is a government-subsidy program designed to encourage energy-efficient building renovations in both the public and private sectors. The program provides financial support for various energy-saving measures, such as insulation, heating and cooling upgrades, and renewable energy installations.

The Spanish Energy Efficiency Credit Line is a financing instrument that aims to promote energy efficiency and the use of renewable energy in Spain. It is managed by the Institute for the Diversification and Saving of Energy (IDAE), which is a public entity under the Ministry for the Ecological Transition and Demographic Challenge. The credit line offers financing to enterprises who want to carry out energy efficiency projects in their facilities. The loans are granted through collaborating financial institutions, such as banks or savings banks. The credit line covers up to 100% of the eligible investment and has a fixed interest rate. The repayment period ranges from 3 to 12 years, depending on the type of project and the amount financed.

Eligible projects include those that improve energy efficiency in buildings, such as the installation of insulation, efficient heating and cooling systems, and energy-efficient lighting. The credit line also supports the use of renewable energy sources, such as solar panels, wind turbines, and geothermal systems.

In addition, the State Housing Plan in Spain has a program to promote the improvement of the energy efficiency and sustainability of houses by providing subsidies to improve building envelopes in residential buildings. The program covers the rehabilitation of buildings and houses, urbanization of public spaces, and construction of new blocks or houses previously demolished, including shanties and shacks. While some actions are related to energy efficiency reduction, this program is generally aimed at improving conservation.

Finally, with the plan to promote the environment in the hotel sector (PIMA SOL), assistance is provided to reduce greenhouse gas emissions (GHG) in the Spanish tourism sector through energy renovations of hotel installations. Renovation projects should improve the energy rating of the building by at least two letters or achieve letter B, taking into account the provisions stated in the Royal Decree 235/2013. The BIOM-CASA-SOLCASA-GEOTCASA program, managed by the IDAE, aims to promote energy service companies and encourage efficient hot water, heating, and cooling systems powered by biomass, solar, or geothermal energy.

4. Cross-Country Comparisons

In this section we discuss the cross-country comparisons based on the findings on existing financial schemes that support the technological developments and stakeholders involved in the realization of SPENs.

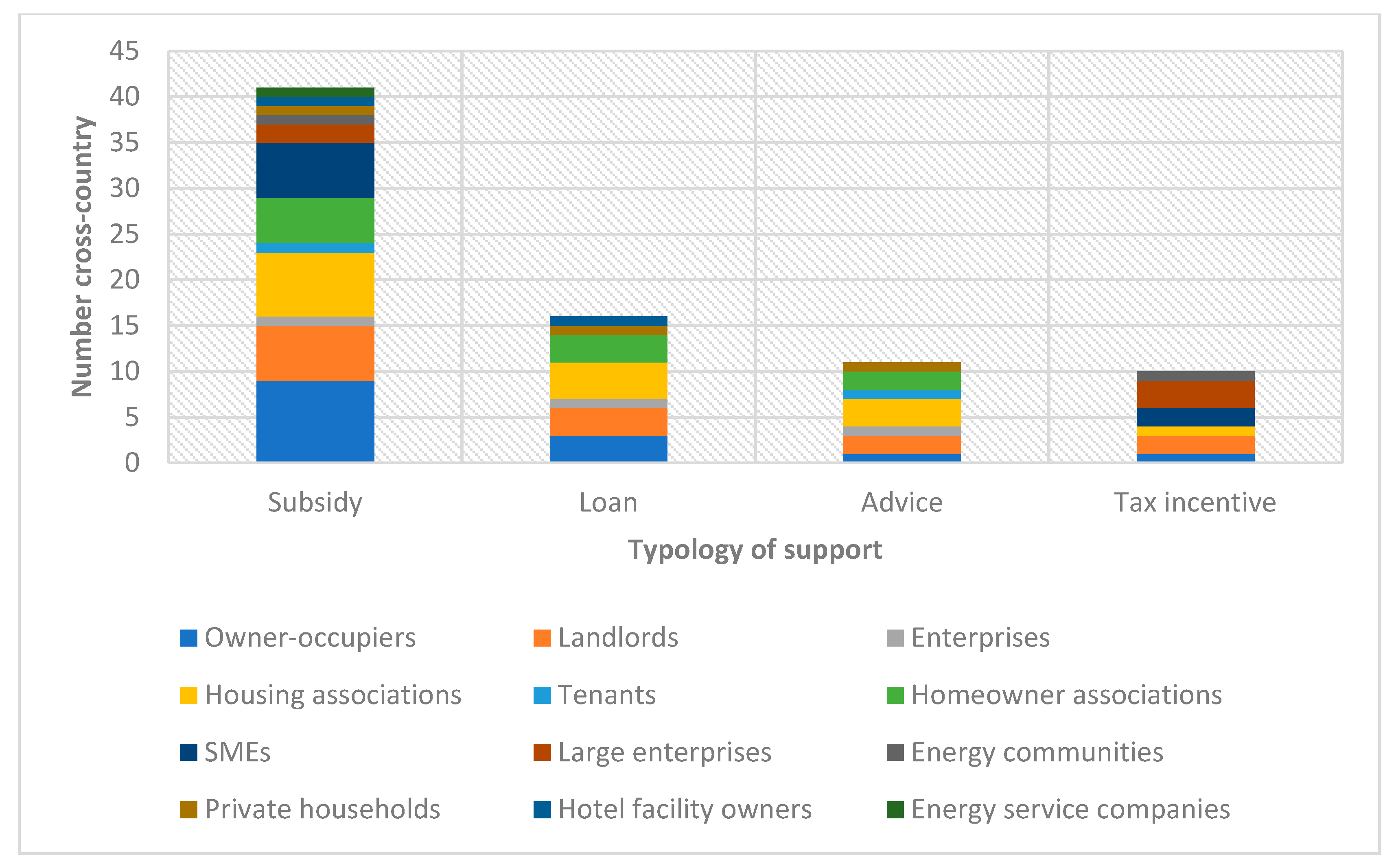

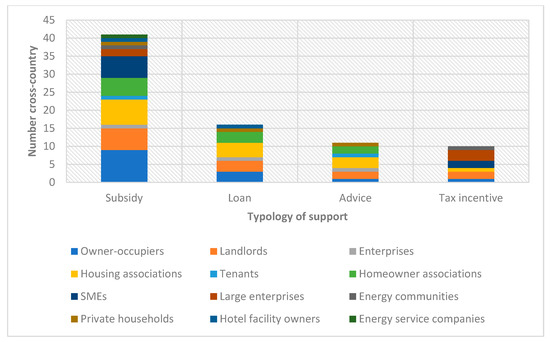

4.1. Typology of Schemes

We distinguished four types of support found in schemes across the countries. These are subsidies, loans, advice and tax incentives. As illustrated in Figure 3, subsidies are most frequently used to provide support to target groups, followed by loans. Subsidies and loans are found in all four countries. Advice is less used and was not found in Spain. Tax incentives were found in all countries, expect Norway. However, two key aspects are known to fuel the uptake of SPENs: (1) schemes and policies that can incentivize collective action, and (2) schemes that are inclusive and accessible to a variety of target groups [34,35]. In what follows, we discuss these two aspects.

Figure 3.

Typology of support in schemes, cross-country comparison.

4.2. Towards Shared Energy: From Individual to Collective Action

Interventions related to insulation and heating to improve energy efficiency are most common among the financial schemes in all four countries. These are intended to influence the energy usage in buildings and units. In supporting SPENs, energy production plays an important role, and all countries have a number of schemes that support sustainable energy production. However, there was much less to incentivize shared production among buildings and units (e.g., apartments).

In Austria and The Netherlands, energy communities, which are crucial in the organization of collective sustainable energy actions, are supported with, respectively reduced taxes and subsidies. For example, in Schnifis, Austria, the municipality together with local businesses and citizens operate in trading renewable electricity among neighbors [36]. More of these incentives targeting collective action are needed to ensure efforts are made to realize the sustainability transition of neighborhoods.

Throughout the past decade, many new renewable energy-production technologies have been made available for citizens, contributing to the ongoing shift from passive consumers to active collective prosumers [37]. However, regulatory barriers in most European countries are currently hampering prosumerism. In many instances, prosumers are unable to formally establish a renewable energy community in a legal way, or are being confronted with spatial limits and/or restrictions on installed capacity [38]. For example, in The Netherlands renewable energy communities can only exchange electricity if they share the same postal code [39]. Other major challenges in this country come from the technical rules that have to be followed by prosumers in order to be able to participate in retail electricity markets [38]. For example, in order to participate in the Dutch electricity market, prosumers are required to have a smart meter installed that meets specific technical requirements, such as the ability to measure electricity production and consumption separately [40]. These technical requirements can be challenging for smaller-scale prosumers, who may not have the necessary resources or technical expertise to meet them. This can make it more difficult for these prosumers to participate in the market, which in turn can limit the growth of prosumerism overall. Furthermore, these technical requirements may also increase the cost of prosumerism, as prosumers may need to invest in additional equipment and technology to comply with the rules. This can create a barrier to entry for some prosumers, particularly those who are less financially secure.

4.3. How Inclusive Are Financial Schemes?

Another key finding in our analysis is that most schemes only provide financial support to target groups after interventions and investments are made. In order to get access to subsidies, target groups are required to pay the high retrofit costs upfront. This poses a problem for target groups with low incomes, which in EU amount to 21.7% of the population. In 2021, there were an estimated 95.4 million people in the EU at risk of poverty or social exclusion [41]. Loans do not solve this problem as debts essentially lower the available spendable income of these groups and hence disincentivize instead. In addition, there are uncertainties related to volatile energy prices and long payback periods [42]. Subsidized loans have been found subject to free-riding [43] and do not result in higher investments to energy efficiency measures compared to regular subsidies [44].

In Norway, individuals get access to retrofitting subsidies in one single scheme from Enova. Past research has indicated that these subsidies are heavily focused on high-income households [45]. In fact, retrofits that are not completed by contractors, but for example by the households themselves, are not eligible for financial support. Moreover, highly ambitious projects, which typically involve significant changes to a household’s energy infrastructure, require specialized technical expertise, and can involve higher costs compared to more basic retrofits, are prioritized and receive larger subsidies. Examples of such projects are the installation of high-efficiency heating and cooling systems.

Similar concerns on funding uptake due to loan conditions, saving uncertainty and administrative burdens for lower income groups have been found in The Netherlands [46].

Spain appears to be the country intending to support lower-income groups the most, according to the schemes we found.

Diversity in target groups is also important given the multifaceted nature of neighborhoods. In our analysis, tenants are in all countries strongly dependent on landlords to receive support. Austria is the only country with schemes that target tenants directly.

One of the main barriers for the sustainability transition of neighborhoods (and the buildings, in general) is that the building owners—those supposed to invest in energy—do not coincide with the building users—those supposed to benefit from energy measures. This is called the split-incentive issue [47]. For example, the owner invests in PV installations, and the tenants pay lower energy bills as a result. In theory, the business case for the owner would be positive if s/he could increase the monthly rent accordingly [48]. However, for the target groups of this Horizon project (social housing) this is not an option. The threshold of monthly rent is regulated by the government and needs to remain low. This issue is affecting the sustainability of social housing [49], as both tenants and owners are disincentivized to invest in energy measures. There is a need to target both tenants and owners in the transition to sustainable energy.

The schemes in Norway have the least amount of sub-target groups. Unlike the Netherlands, no specific schemes have been found for incentivizing SMEs or larger enterprises. Neither are landlords explicitly mentioned. This constitutes a barrier to shift national energy transition efforts, since neighborhoods are constituted by multiple stakeholders.

In Spain, we found one scheme targeting energy service companies (ESCOs). ESCOs do have an important role to play as they contribute to bringing energy efficiency solutions to the market. By having schemes that are targeted at them as players it contributes to having a holistic approach to support the sustainability transition in neighborhoods. These schemes can help create a more favorable market environment for ESCOs, which in turn can increase the availability and affordability of energy-efficiency services for households and businesses in neighborhoods.

4.4. Limitations and Future Research

Given the limited extant knowledge on financial schemes for SPENs, this research was explorative in nature. Syn.ikia provided a relevant context for an early investigation on current financial incentives for the four countries in which these SPENs are being developed. Inherently, one limitation of this research is that it focused on the four European countries targeted by Syn.ikia, namely, Austria, The Netherlands, Norway, and Spain. Future research could expand a similar analysis to other Member States and investigate whether there are European countries more fertile for the initiation of SPENs from a financial perspective. Also an international comparison of financial schemes for SPENs beyond Europe could be conducted. By analyzing examples from different regions and countries, such as North America, Asia, and Oceania, researchers can identify diverse approaches, lessons learned, and potential transferability of financial schemes. This comparative analysis would provide a broader perspective and stimulate cross-cultural learning and exchange. Moreover, it would enable the identification of global best practices in supporting SPENs through financial mechanisms.

Additionally, this study primarily aimed to identify current financial schemes rather than assessing their effective implementation and impact within neighborhoods. To gain deeper insights into the outcomes and effectiveness of these financial schemes, it would be valuable to collect data from the issuing agencies of the funding schemes. By examining the actual impact and success rates of these schemes in promoting SPENs, researchers can better understand the role and contribution of financial support in the context of neighborhoods. Another promising avenue for future research consist of studying the combination of these schemes in the context of collaborative business models. With the lack of responsible jurisdiction or entity for energy management, a business model for intermediaries can foster energy sharing and the energy flexibility needed for SPENs [2]. Similarly, innovations, such as digital-twins, could potentially support the energy management of neighborhood, but are currently lacking an effective business model due to the complex value chain of the building sector and the lack of a formal problem owner. Future research can investigate effective business models for digital twins, and their introduction to the existing market through sustainable entrepreneurship [50]. This line of research would contribute to the development and adoption of collaborative business models that promote SPENs.

Stakeholder engagement is another important aspect that warrants further investigation in the design and implementation of financial schemes for SPENs. Future research should examine strategies for engaging various stakeholders, including community members, local businesses, policymakers, and energy service companies. By exploring inclusive decision-making processes and ensuring the incorporation of diverse stakeholder needs and perspectives, researchers can contribute to the development of more inclusive and effective financial support structures for SPENs.

To comprehensively assess the social and environmental impact of financial schemes for SPENs, researchers should conduct a thorough evaluation. This assessment should encompass long-term effects such as energy affordability, energy poverty reduction, carbon emissions, job creation, and community empowerment. By examining the overall sustainability and effectiveness of financial support for SPENs, researchers can provide insights that inform policy and practice in this domain.

Furthermore, an analysis of policy and regulatory frameworks is necessary to understand how they enable or hinder the implementation of financial schemes for SPENs. Identifying barriers and gaps in existing regulations and proposing policy recommendations would contribute to fostering the development of sustainable and inclusive neighborhoods. It is crucial to examine how policy coherence and coordination can be improved across different levels of governance to support the scaling up of SPENs.

By delving into these research areas, scholars and practitioners can further advance the understanding and implementation of financial schemes for SPENs, ultimately contributing to the development of sustainable and inclusive neighborhoods worldwide.

5. Conclusions

Overall, this research shows that most small-scale European and federal financial schemes are designed at the building level rather than at the neighborhood level. Most schemes address the building level or the object level (e.g., insulation, PV panels). This shortcoming makes it challenging for investors to collaboratively invest in integrated solutions. Instead, homeowners are incentivized to invest in building parts, components, or single buildings. This can constitute a barrier not only to effective SPENs, but also to the implementation of non-regret renovation approaches in the existing stock integrated in the neighborhood.

One barrier to shift the current object focus on the building level towards the neighborhood level, is that the four countries included in this research lack a responsible jurisdiction or entity for the energy management involving a diverse group of stakeholders. As a consequence, current energy business models, make it challenging to prioritize collective approaches over individual benefits (e.g., bureaucratic, contractual issues). Additionally, the knowledge and use of financial schemes are rather fragmented and scarce, and energy innovations striving for SPENS are in clear need of new business models. With the current financial landscape and market, the survival of many innovations is limited to early TRLs with several barriers to successfully reach implementation and adoption stages.

Author Contributions

Conceptualization, A.K. and A.G.; methodology, A.K. and A.G.; investigation, A.K. and A.G.; writing—original draft preparation, A.K. and A.G.; writing—review and editing, A.K. and A.G.; visualization, A.K. and A.G. All authors have read and agreed to the published version of the manuscript.

Funding

The research conducted in this paper has received funding from the European Union’s Horizon 2020 research and innovation program under grant agreement No 869918, SYN.IKIA project.

Data Availability Statement

Data sharing not applicable. No new data were created or analyzed in this study.

Acknowledgments

We acknowledge the input we received from Syn.ikia project partners and interviewees in the organizations: Arca Nova Group, Institut Català del Sòl (INCASÒL), Fundació Institut de Recerca en Energia de Catalunya (IREC), Woningcorporatie Area, Heimat Österreich (HÖ), and SINTEF.

Conflicts of Interest

The authors declare no conflict of interest.

References

- IEA. The Future of Cooling. Available online: https://www.iea.org/reports/the-future-of-cooling (accessed on 5 September 2022).

- Salom, J.; Tamm, M.; Andresen, I.; Cali, D.; Magyari, Á.; Bukovszki, V.; Balázs, R.; Dorizas, P.V.; Toth, Z.; Zuhaib, S.; et al. An evaluation framework for sustainable plus energy neighborhoods: Moving beyond the traditional building energy assessment. Energies 2021, 14, 4314. [Google Scholar] [CrossRef]

- Krangsås, S.G.; Steemers, K.; Konstantinou, T.; Soutullo, S.; Liu, M.; Giancola, E.; Prebreza, B.; Ashrafian, T.; Murauskaitė, L.; Maas, N. Positive energy districts: Identifying challenges and interdependencies. Sustainability 2021, 13, 10551. [Google Scholar] [CrossRef]

- Zhang, X.; Penaka, S.R.; Giriraj, S.; Sánchez, M.N.; Civiero, P.; Vandevyvere, H. Characterizing positive energy district (PED) through a preliminary review of 60 existing projects in europe. Buildings 2021, 11, 318. [Google Scholar] [CrossRef]

- Bossi, S.; Gollner, C.; Theierling, S. Towards 100 Positive Energy Districts in Europe: Preliminary Data Analysis of 61 European Cases. Energies 2020, 13, 6083. [Google Scholar] [CrossRef]

- Madlener, R.; Sunak, Y. Impacts of urbanization on urban structures and energy demand: What can we learn for urban energy planning and urbanization management? Sustain. Cities Soc. 2011, 1, 45–53. [Google Scholar] [CrossRef]

- European Commission. Renovation Wave. Available online: https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/renovation-wave_en (accessed on 25 June 2023).

- The Intelligent Cities Challenge. Homepage. Available online: https://www.intelligentcitieschallenge.eu/ (accessed on 25 June 2023).

- Good, N.; Martinez Cesena, E.A.; Mancarella, P.; Monti, A.; Pesch, D.; Ellis, K. Barriers, Challenges, and Recommendations Related to Development of Energy Positive Neighborhoods and Smart Energy Districts. In Energy Positive Neighborhoods and Smart Energy Districts; Elsevier: Amsterdam, The Netherlands, 2017; pp. 251–274. [Google Scholar]

- Angelakoglou, K.; Kourtzanidis, K.; Giourka, P.; Apostolopoulos, V.; Nikolopoulos, N.; Kantorovi, J. From a Comprehensive Pool to a Project-Specific List of Key Performance Indicators for Monitoring the Positive Energy Transition of Smart Cities—An Experience-Based Approach. Smart Cities 2020, 3, 705–735. [Google Scholar] [CrossRef]

- Espe, E.; Potdar, V.; Chang, E. Prosumer communities and relationships in smart grids: A literature review, evolution and future directions. Energies 2018, 11, 2528. [Google Scholar] [CrossRef]

- Nam, T.; Pardo, T.A. Smart city as urban innovation: Focusing on management, policy, and context. In Proceedings of the 5th International Conference on Theory and Practice of Electronic Governance, Tallin, Estonia, 26–29 September 2011; ACM: New York, NY, USA, 2011. [Google Scholar]

- Bocken, N.M.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Panteli, C.; Klumbytė, E.; Apanavičienė, R.; Fokaides, P.A. An overview of the existing schemes and research trends in financing the energy upgrade of buildings in Europe. J. Sustain. Archit. Civ. Eng. 2020, 27, 53–62. [Google Scholar] [CrossRef]

- Zonnepanelendelen. Homepage. Available online: https://zonnepanelendelen.nl/ (accessed on 25 June 2023).

- Energiesprong. About. Available online: https://energiesprong.org/about/ (accessed on 25 June 2023).

- NTNU Syn.Ikia—Sustainable Plus Energy Neighbourhoods-EU H2020 G.A. No. 841850. Available online: https://www.synikia.eu/ (accessed on 5 September 2022).

- Angela, G.; Long, T.B. Towards Sustainable Cities and Communities: Paradoxes of Inclusive Social Housing Strategies. In World Scientific Encyclopedia of Business Sustainability, Ethics and Entrepreneurship; World Scientific Publishing Co. Pte. Ltd.: Singapore, 2022; pp. 113–135. [Google Scholar]

- Greco, A.; Eikelenboom, M.; Long, T.B. Innovating for sustainability through collaborative innovation contests. J. Clean. Prod. 2021, 311, 127628. [Google Scholar] [CrossRef]

- Wiik, M.K.; Fufa, S.M.; Baer, D.; Sartori, I.; Andresen, I. The Zen Definition—A Guideline for the Zen Pilot Areas; Research Report; SINTEF Akademisk Forlag: Trondheim, Norway, 2018; No. 11. [Google Scholar]

- Sharma, G.; Greco, A.; Grewatsch, S.; Bansal, P. Cocreating Forward: How Researchers and Managers Can Address Wicked Problems Together. Acad. Manag. Learn. Educ. 2022, 21, 350–368. [Google Scholar] [CrossRef]

- Bundesministerium für Klimaschutz, Umwelt, Energie, Mobilität, Innovation und Technologie. Available online: https://www.bmk.gv.at/ (accessed on 23 April 2023).

- IEA. Energy Efficiency Targets and Measures in Austria. Available online: https://www.iea.org/reports/energy-efficiency-targets-and-measures-in-austria (accessed on 23 April 2023).

- Bundeskanzleramt. Aus Verantwortung für Österreich. Regierungsprogramm 2020–2024. Available online: https://www.bundeskanzleramt.gv.at/bundeskanzleramt/die-bundesregierung/regierungsdokumente.html (accessed on 23 April 2023).

- Österreichischen Koordinationsstelle für Energiegemeinschaften. Formen von Energiegemeinschaften. Available online: https://energiegemeinschaften.gv.at/grundlagen/ (accessed on 26 October 2022).

- Rijksoverheid. Rapportage Energietransitie Gebouwde Omgeving 2019. Regionale Klimaatmonitor 2022. Available online: https://klimaatmonitor.databank.nl/content/gebouwde-omgeving (accessed on 15 October 2022).

- Sintef. Energy Analysis of the Norwegian Dwelling Stock. Available online: https://www.sintef.no/globalassets/project/%20eksbo/dwelling_stock_analysis_norway_010409.pdf (accessed on 9 September 2022).

- Enova. Smarte Energi-Og Klimatiltak. Available online: https://www.enova.no/privat/alle-energitiltak/ (accessed on 9 September 2022).

- Husbanken. Loans from the Housing Bank to Individuals. Available online: https://www.husbanken.no/english/loan-from-the-housing-bank/ (accessed on 9 September 2022).

- Enova. Borettslag og Sameier. Available online: https://www.enova.no/privat/borettslag-og-sameier/ (accessed on 9 September 2022).

- Eurostat. Analysis of the Energetic Consumption of the Residential Sector in Spain. Available online: https://ec.europa.eu/eurostat/cros/system/files/SECH_Spain.pdf (accessed on 9 September 2022).

- Ministry for the Ecological Transition and the Demographic Challenge. The Spanish National Climate Change Adaptation Plan 2021–2030. Available online: https://www.miteco.gob.es/es/cambio-climatico/temas/impactos-vulnerabilidad-y-adaptacion/pnacc-2021-2030-en_tcm30-530300.pdf (accessed on 9 September 2022).

- European Commission. EU Building Factsheets. Available online: https://ec.europa.eu/energy/eu-buildings-factsheets_en (accessed on 26 October 2022).

- Kata, R.; Cyran, K.; Dybka, S.; Lechwar, M.; Pitera, R. Economic and Social Aspects of Using Energy from PV and Solar Installations in Farmers’ Households in the Podkarpackie Region. Energies 2021, 14, 3158. [Google Scholar] [CrossRef]

- IEA. Transition to Sustainable Buildings. Available online: https://www.iea.org/reports/transition-to-sustainable-buildings (accessed on 23 April 2023).

- Innovation Origins. Austrian Community Creates Circular Energy from Regenerative Agriculture. Available online: https://innovationorigins.com/en/austrian-community-creates-circular-energy-from-regenerative-agriculture/ (accessed on 19 October 2022).

- Bauwens, T.; Devine-Wright, P. Positive energies? An empirical study of community energy participation and attitudes to renewable energy. Energy Policy 2018, 118, 612–625. [Google Scholar] [CrossRef]

- Inês, C.; Guilherme, P.L.; Esther, M.G.; Swantje, G.; Stephen, H.; Lars, H. Regulatory challenges and opportunities for collective renewable energy prosumers in the EU. Energy Policy 2020, 138, 111212. [Google Scholar] [CrossRef]

- Postcoderegeling. Wat Houdt de PCR-Regeling Precies in? Available online: https://www.postcoderoosregeling.nl/wat-houdt-de-pcr-regeling-precies-in/ (accessed on 26 October 2022).

- RVO. Wetgeving Zone-Energie. Available online: https://www.rvo.nl/onderwerpen/zonne-energie/wetgeving (accessed on 3 May 2023).

- Eurostat. Living Conditions in Europe–Poverty and Social Exclusion. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Living_conditions_in_Europe_-_poverty_and_social_exclusion&oldid=584082#:~:text=In%202021%2C%20there%20were%20an,21.7%20%25%20of%20the%20total%20population (accessed on 3 May 2023).

- Hill, D.R. Energy Efficiency Financing: A review of risks and uncertainties. In Proceedings of the 42nd IAEE International Conference, Montŕeal, QC, Canada, 29 May–1 June 2019. [Google Scholar]

- Kerr, N.; Winskel, M. Household investment in home energy retrofit: A review of the evidence on effective public policy design for privately owned homes. Renew. Sustain. Energy Rev. 2020, 123, 109778. [Google Scholar] [CrossRef]

- Walls, M. Comparing subsidies, loans, and standards for improving home energy efficiency. Cityscape 2014, 16, 253–278. [Google Scholar]

- Egner, L.E.; Klöckner, C.A.; Pellegrini-Masini, G. Low free-riding at the cost of subsidizing the rich. Replicating Swiss energy retrofit subsidy findings in Norway. Energy Build. 2021, 253, 111542. [Google Scholar] [CrossRef]

- Alejandro, F.; Haffner, M.; Elsinga, M. Comparing the financial impact of housing retrofit policies on Dutch homeowners. IOP Conf. Ser. Earth Environ. Sci. 2022, 1085, 012044. [Google Scholar]

- Bird, S.; Hernández, D. Policy options for the split incentive: Increasing energy efficiency for low-income renters. Energy Policy 2012, 48, 506–514. [Google Scholar] [CrossRef] [PubMed]

- Greco, A.; Konstantinou, T.; Schipper, H.R.; Binnekamp, R.; Gerritsen, E.; de Graaf, R.; van den Dobbelsteen AA, J.F. Business case study for the zero energy refurbishment of commercial buildings. In Proceedings of the Sustainable Built Environment (SBE) Regional Conference, Zurich, Switzerland, 15–17 June 2016; pp. 334–339. [Google Scholar]

- Greco, A.; Long, T.; de Jong, G. Identity reflexivity: A framework of heuristics for strategy change in hybrid organizations. Manag. Decis. 2021, 59, 1684–1705. [Google Scholar] [CrossRef]

- Greco, A.; de Jong, G. Sustainable Entrepreneurship: Definitions, Themes and Research Gaps; Working Paper Series; University of Groningen: Groningen, The Netherlands, 2017. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).