Abstract

Conventional economic theory indicates that the free market contributes to allocative efficiency. However, specific energy markets present network industry characteristics which distance them from perfect competition. These markets, therefore, need effective regulation. The liberalizing reforms which took place in the Organization for Economic Cooperation and Development (OECD) and emerging countries from the 1990s onwards have reduced the share of state ownership in the energy sector, but not its functions of regulation, coordination and planning. It is also worth noting the expansion of the government’s agenda due to the energy transition that has unequivocally imposed itself in the 21st century. This article uses the Slacks-Based Measure of the Data Envelopment Analysis (SBM-DEA) methodology to investigate the relationship between market liberalization and sustainability in a low-carbon energy transition context. Taking the cases of the natural gas and electricity markets, we verify whether liberalization contributes to the progress of the energy transition, driven by the emergency need to tackle climate change. The results show that the most advanced markets, in their processes of opening up, tend to be positively associated with a more vigorous energy transition. European nations, such as the United Kingdom and Norway, have experienced a relatively more advanced market liberalization leading to an efficient path toward energy transition. Chile, Canada and Colombia also have efficient scores regarding their energy transitions. For low performing countries, such as Brazil, the study suggests some calls for action that should be pursued to improve their energy market indicators, resulting in a stronger energy transition towards renewables, more competitive energy prices and a larger participation of natural gas in the energy mix, which will contribute to decreasing its external dependency.

1. Introduction

Economic theory indicates that the free market contributes to allocative efficiency. Aspects such as an absence of barriers to entry, a great number of agents in relation to the size of the market and price-taking companies are desirable to achieve an efficient allocation of resources. Efficient markets are desired because, according to neoclassical economic theory, they guarantee better price signaling and higher levels of well-being. However, specific energy markets, such as electricity and natural gas, present characteristics of a network industry (or natural monopoly) [1] which distance them from perfect competition. Therefore, such markets require effective regulation, capable of incorporating these network characteristics so that pure monopolies and market power do not occur.

The liberalizing reforms which took place in the Organization for Economic Cooperation and Development (OECD) and emerging countries from the 1990s onwards reduced the participation of states as owners in the energy sector, but not their functions of regulation, coordination and planning. It is also noteworthy that the transition to a low-carbon economy, the need for which unequivocally imposed itself in the 21st century, expanded the government’s agenda, in particular in achieving SDG 7 (Sustainable Development Goal 7: Accessible and clean energy). Thus, the state still remains a key player in the energy sector, in the pursuit of energy security, efficiency and sustainability. The energy transition has become a central goal in the liberalization of the energy sector, opening up new technological possibilities with a view to generating energy with lower carbon emissions.

Energy transition refers to changes in energy systems to bring about sustainability, accessibility, value creation, security and lower environmental impacts. Various energy transitions have been observed in human history, both in terms of supply and consumption, all of them under the influence of certain technical, economic and/or political factors [2,3]. The scientific community has highlighted the importance of the recent energy transition, guided by renewable energies, as a driver for tackling climate change [4,5,6,7,8]. Furthermore, the World Economic Forum (WEF) published the Energy Transition Index (ETI) and its database [9], a regional indicator that estimates the level of performance and readiness of energy systems for transition.

The natural gas and electricity markets have played a relevant role in the recent energy transition. Investments in renewable resources and stable sources are essential for energy sustainability and for ensuring the reliability of the supply. The importance of renewable resources lies in the fact that they are non-finite and clean. Although natural gas is a fossil resource, it burns more cleanly than other fossil fuels, such as coal and oil. This characteristic makes natural gas as a key fuel in the energy transition. Worldwide, natural gas represents 24.2% of the total primary energy and 21% of the GHG emissions [10]. More recently, electrification has been indicated as a path towards more sustainable energy systems, on the condition that the electricity is generated mainly from renewable resources [11].

These markets have been opening up in some countries. The United Kingdom (UK) is a European example, having been an exponent of the liberalization of energy markets in the 1980s. In Latin America, Chile has experienced openness in its natural gas market, and the Brazilian government has recently approved a new regulatory framework for the natural gas market [11]. In general, opening up means a greater number of companies and smaller states acting, which implies a market aiming at competition. In this regard, the Product Market Regulation (PMR) indicators estimated by the OECD [12] assess the level of barriers to entry of a given industry, in terms of regulation and public ownership. Regulation deals with aspects of the rules for access to the transmission system of a network industry and the existence of a competitive wholesale market for electricity and natural gas, while state ownership encompasses the level of state influence on the ownership of companies in these markets. It is understood that state ownership is only justified in cases where private companies are not able to operate competitively.

This article sets out to verify whether the liberalization of energy markets, especially those for natural gas and electricity, contributes to economic efficiency in the context of energy transition. In particular, it attempts to classify the degree of efficiency related to countries’ energy transitions, considering the state of development of the natural gas and electricity markets. In terms of non-efficient countries, this study identifies possible pathways that these nations could follow in order to achieve efficiency.

The original contribution of this study is the focus on the relationship between liberalization and sustainability. While the literature relates liberalization to cost reduction [12,13,14], this study takes a step further, investigating whether there is a relationship between liberalization and increasing the share of low-carbon energy in the electricity systems, as well as decreasing external dependency on energy sources.

To reach its objective, this study uses the Slacks-Based Measure of the Data Envelopment Analysis (SBM-DEA) methodology [15]. This is an optimization model that compares decision-making units based on predefined variables. In this particular case, the decision-making units are the countries, and the predefined variables are the indicators of liberalization and energy transition in the natural gas and electricity markets.

Different studies have used the SBM-DEA methodology to compare countries’ performances. Zhang & Chen [16] compared the energy efficiency of countries in the Regional Comprehensive Economic Partnership (RCEP) group, which includes China, Australia, South Korea, Japan, New Zealand, Malaysia, the Philippines, Thailand, Vietnam and others. They concluded that government efficiency has positive impact on energy efficiency. Zhou & Xu [17] also carried out this analysis, except that they considered undesirable products, such as countries’ carbon dioxide emissions, which lead them to the results that China, Japan and Australia have the best score for energy efficiency. Sarpong et al. [18] used the SBM-DEA model to assess energy efficiency drivers in African countries, while Almeida Neves et al. [19] used DEA to compare technical efficiency in electric vehicle batteries from 20 European countries. Sarpong et al. [18] concluded that African countries have been improving their energy efficiency in the recent years, although they still have improvements to make in terms of reducing greenhouse gases and other pollutants. Almeida Neves et al. [19] found that renewable electricity generation increases the DEA scores of the countries and leads the inefficient nations closer to the efficiency frontier.

Additionally, Dogan et al. [20] have compared OECD countries in terms of economic complexity, renewable energy consumption and carbon emissions, using regression technics. They concluded that economic progress and the increasing consumption of renewables could help to mitigate environmental issues in OECD countries, including carbon emissions. Still regarding economic complexity, Dogan et al. [21] study the relationship between renewable energy consumption and economic growth. The authors conclude that the use of renewable energy sources brings more economic growth than non-renewable consumption.

It can be seen that earlier studies used DEA primarily to assess the energy efficiency and energy consumption of countries. The novelty of this study lies in the fact that it evaluates the level of change in the energy matrix (the energy transition) of countries on the basis of a comparative quantitative analysis, and not just on their efficiency in the consumption of existing resources. Sustainable development will not be achieved with the efficient use of fossil fuels only, but also by exchanging fossil fuels for renewables [14,22].

Since the 1990s, the liberalization of the energy markets in OECD countries has focused on reaching a balance between introducing market forces and maintaining a suitable regulatory framework, as expressed by the design of the PMR indicators. More recently, the transition to a low-carbon energy system has added a new dimension to energy sector reform processes, posing the question of whether liberalization and decarburization can go hand in hand. The answer to this will definitely depend on each country’s specific regulatory framework; therefore, we are far from a “one size fits all” type of policy.

In addition to the Introduction, this study includes the Materials and Methods section, presenting the database of the PMR and ETI indicators, the SBM-DEA model and the assumptions of the case study. The Results section presents the main results in terms of the efficiency of countries. The Discussion section suggests possible changes in regulatory frameworks and public ownership that could lead to better performance and explains the results and justifies the obtained efficiencies. The Conclusions and policy implications section highlights recommendations and future research.

2. Materials and Methods

The methodological framework constructed in this study is based on different databases and on an optimization model, the SBM-DEA, to verify whether the liberalization of energy markets can induce energy transition. This section now describes the databases used, the SBM-DEA model and the relationship between them.

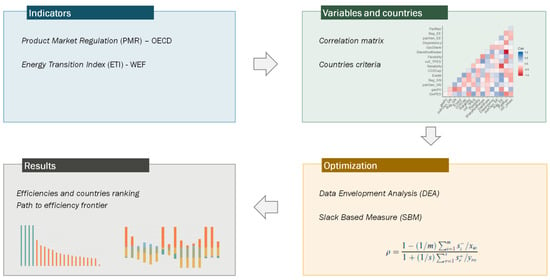

Figure 1 describes the methodological approach. First, the country-level data collected from the PMR and ETI indicator databases were processed. The variables were selected for 2018, the last year of publication of PMR indicators.

Figure 1.

Methodology. Source: The authors.

Although such indicators have been published for more recent years, the calculation methodology used by the OECD changed from 2018 onwards, which means that the results for that year are not comparable with the indicators for other periods. Since newer data do not have regulation and public ownership breakdowns, the 2018 indicators were used in this analysis. Therefore, in order to ensure data comparability, the choice of using 2018 data was made.

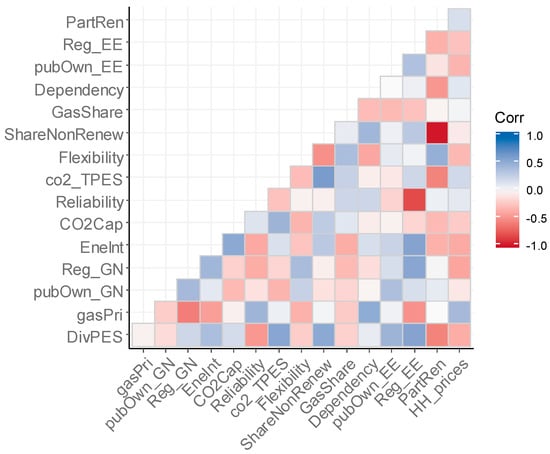

The second step was the choosing of energy market variables (electricity and natural gas) and countries. After identifying the different variables which could represent the markets studied and the energy transition in these markets, a correlation matrix was constructed that showed the coherence between the variables raised. For example, the PMR indicator of regulatory barriers to entry and the Reliability indicator of the ETI database show consistency with each other: the lower the regulatory barriers, the greater the reliability of the countries’ electric systems. In addition to the PMR indicators, 12 primary variables used in building the World Economic Forum’s (WEF) Energy Transition Index (ETI) database, which refer to countries’ energy systems, were analyzed. Table 1 describes the variables analyzed. The correlation matrix between the variables is presented in Appendix A.

Table 1.

Variables analyzed. Source: Drawn up by the authors.

The third step of the methodology was optimization, performed using the Slacks-Based Measure (SBM) of the Data Envelopment Analysis model. This model compares decision-making units from the point of view of production, considering the use of inputs to generate products. An efficiency measure is thus calculated. The countries were chosen according to data availability, resulting in 21 countries for the electricity market and 19 for natural gas, as shown in Table 2.

Table 2.

Selected countries analyzed. Source: Drawn up by the authors.

2.1. Product Market Regulation (PMR) Indicators

PMR indicators are indices which reflect regulatory barriers to entry and competition in markets characterized as network industries [23]. They analyze the dimensions of regulation and public ownership and are given values between 0 and 6, where 0 indicates a total absence of barriers to entry and 6 indicates considerable barriers to entry. For example, the United Kingdom stands out as having the best performance in terms of this indicator, with a value of 0 for the energy sector, both for natural gas and for electricity, thereby denoting the absence of barriers to entry, with a maximum degree of competition and transparency.

The indicators are constructed by the OECD based on questionnaires answered by energy sector national authorities of the countries analyzed. The questionnaires are put through a response verification process to ensure that the respondents have correctly interpreted the questions. The OECD also checks them against the information it already has on the countries [23].

The responses are coded and given values according to their type. Qualitative responses are coded differently from quantitative responses. In any event, responses more favorable to openness receive lower values. The indicators are calculated on the basis of mean response values after estimating the weight of the industry segment analyzed. The weights, defined by the OECD (2020a), are shown in Table 3.

Table 3.

Weights for calculating PMR indicators. Source: [23].

2.2. Energy Transition Index (ETI)

The Energy Transition Index (ETI) framework was developed by the WEF with a view to comprehensively monitoring energy transition at the global level. Given the diversity of energy sources, market rules and governance structures, as well as the interconnectivity of supply chains and international trade, the indicator considers a broad framework in terms of the definition of energy transition. The analytical framework contains two parts: the current performance of the energy system and the enabling environment for a conducive energy transition. Progress in energy transition is determined by the extent to which a favorable and robust economic environment can be created, which includes political commitments, a flexible regulatory framework, a stable business environment, incentives for investment and innovation, consumer awareness and the adoption of new technologies. Thus, the ETI measures transition as a change in the technological, market and regulatory structures, as well as in consumption patterns and social norms, that guarantees universal access to safe, sustainable, affordable and reliable energy supplies [24].

Currently, the ETI provides an assessment of the energy transition progress in 115 countries, which are selected on the basis of minimum data availability and consistency over the previous 10 years. The score for each country is aggregated from 38 indicators, encompassing factors from the quality of education and infrastructure through to the degree of investment in renewable energy, prices and commitment to climate goals (see Annex I). It is worth mentioning that the database for these indicators has several sources, drawing mainly from the World Bank and the World Economic Forum (WEF), but also from the International Monetary Fund (IMF), International Energy Agency (IEA), International Renewable Energy Agency (IRENA), ENERDATA, etc. The selection of indicators is determined by their conceptual relevance for each dimension of the analytical framework, in addition to the availability, frequency of updates and consistency of the methodology of collecting and disseminating the data. To allow the aggregation of indicators with different scales and magnitudes, the ETI adopts the min-max method to transform the score of an indicator into a common scale of 0–100, with 100 being the ideal score.

Given the systemic and endogenous nature of the energy transition, countries’ scores are the result of a combination of factors, including resource endowment, geography, climate, demography and economic structure. In addition, some scores are based on factors beyond the scope of national decision-making, such as commodity market volatility, geopolitics, climatic actions and international financial market sentiment. Countries’ scores must therefore be considered in the context of each country’s unique set of circumstances.

2.3. Slacks-Based Measure of Data Envelopment Analysis Model (SBM-DEA)

Data Envelopment Analysis (DEA) is a multicriteria analysis methodology in which the weights of each variable are defined on the basis of mathematical programming problems. This method is based on the theory of production, in which inputs are used to generate products, and the ratio between the quantity of products and the use of inputs generates the productive efficiency [25]. Its aim is to maximize efficiency, which can be achieved both by minimizing the use of inputs and by maximizing the products generated. This tool is widely used in various fields of knowledge, such as Statistics, Economics and Energy Planning [26,27,28]. The advantages of Data Envelopment Analysis include the facts that it establishes the weights objectively, it is widely used and the interpretation of its results is simple. In addition, this methodology does not demand a prior theory with a direction of causality between the variables in order to assess data adjustment. In terms of its disadvantages, it has a tendency towards corner solutions and a complex mathematical formulation, in certain cases.

The DEA model used in this study is the Slacks-Based Measure (SBM), created by [15]. Its logic is to minimize slack in production, which arises from an excessive use of inputs in relation to the products generated and/or a lack of generation of products in relation to the inputs used. The mathematical formulation is shown below [15].

s.t.

where:

- : ratio between the slacks of the DMU o;

- : number of inputs used;

- : number of products generated;

- : slack in the use of input “i”, excess input used;

- : slack in the generation of product “r”, lack of generated product;

- quantity of input “i” used by DMU “o”;

- quantity of product “r” produced by DMU “o”;

- : quantity of input “x” seen in DMU “o”;

- : quantity of product “y” seen in DMU “o”;

- matrix of inputs of all DMUs;

- matrix of products of all DMUs;

- : decision variable which represents the weight that the evaluated DMU gives to the variable (input or product) of the other DMUs.

The results derive from the comparison between the Decision-Making Units (DMU) and consider the efficient frontier, formed by the DMUs which do not present slack in their production, and thereby achieve maximum efficiency. In addition, the results present a possible pathway to reaching the frontier for inefficient DMUs. In the case of the present study, the DMUs are the countries analyzed, and the variables used diverge depending on the network industry in question. Such variables will be shown in Section 3.

2.4. Data

The database (see Data Availability Statement) for this analysis used the OECD’s PMR indicators of regulation and public ownership [23] and the information used as input for constructing the WEF’s energy transition index [9]. The matrix of correlations between the variables, shown in Figure A1 of Appendix A, was adopted to choose the variables to be used in each sector analyzed.

The variables which presented coherent signs were chosen. For example, in the electricity sector, the regulation and reliability indicators presented a negative correlation, which indicated that the lower the regulatory barriers to entry, the greater the reliability of the electrical system analyzed. In the natural gas sector, the share of gas and external dependency are negatively correlated, showing that the greater the dependency, the lower the share of natural gas in total energy consumption.

From the correlation analysis, five variables were selected for the electricity market and four for the natural gas market, according to Table 4 below. In the electricity market, PMR indicators and household prices were considered inputs, while reliability and the share of renewables in the electricity matrix were defined as products. The analysis of the natural gas market included the PMR indicators referring to said market and the index of external dependency as inputs and the share of natural gas in the total consumption of energy as a product.

Table 4.

Qualitative description of the variables. Source: Drawn up by the authors, based on [9,23].

Table 4 above also shows the parameterization of the DEA-SBM model. The variables considered as inputs are those expected to be minimized, while the variables defined as products are those it is desirable to maximize. Efficient countries are those with the lowest values of inputs relative to the highest values of products. Table 5 shows the descriptive statistics of the data used.

Table 5.

Descriptive statistics of the variables analyzed. Source: Drawn up by the authors, based on [9,23].

Analysis of the descriptive statistics shows the variability of the database used in the simulations of the DEA. As the information is given according to different scales, the data are normalized considering their maximum and minimum values, in order to standardize them between zero and one, thereby removing the scale effect of the variables.

3. Results

3.1. Electricity Market

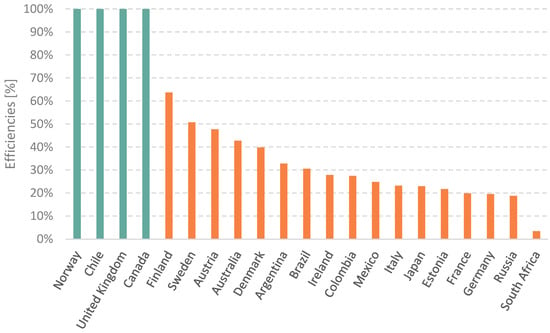

The efficiency frontier of the electricity market was formed by Norway, Chile, the United Kingdom and Canada. It is made up of two European countries, one North American and one South American, as shown in Figure 2. Such nations present unitary efficiency because they have satisfactory indicators in most of the dimensions of the electricity market analyzed. For example, Norway and Canada stand out in the share of renewable resources in the electricity mix, with 98% and 67%, respectively. Both countries still have relatively low electricity prices, below the 25% lowest values.

Figure 2.

Efficiency ranking—electricity market. Source: The authors. Note: In green: efficient countries; in orange: inefficient countries.

The United Kingdom and Chile are comparatively good in the market openness indicators, for both the regulatory and the public ownership aspects. This result confirms the hypothesis that countries more experienced in the market opening process tend to be part of the frontier of the most efficient countries. This result could have been different, because the DEA considers all dimensions in conjunction in order to determine the efficiency of each country. Thus, a country with adequate opening indicators is not guaranteed to be part of the frontier. One such example is Australia, which, although it presents the best possible market opening index for regulation (0.001), has not reached the efficiency frontier given that its share of renewable sources is still relatively low, only 17.9%.

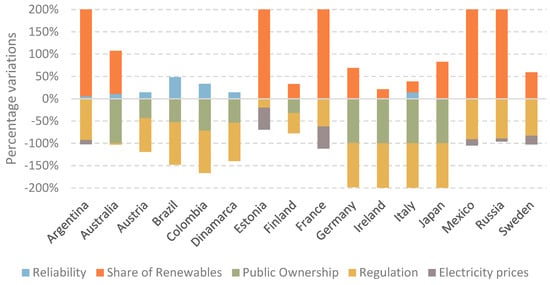

In additional, the DEA methodology provides modifications which countries can pursue in order to reach the efficiency frontier, as shown in Figure 3. The graph shows the change in the value of each dimension that countries have to obtain in order to reach the efficiency frontier. For example, if Germany increases its share of renewables to 69% from its current level (40%), then it would be efficient in this dimension.

Figure 3.

Modifications for reaching the frontier—electricity market. Source: The authors.

In addition to Germany, other European countries, such as France, Sweden and Italy, received recommendations to increase their share of renewable sources in the electricity matrix. The European commitment to investment in renewable energies has been significant, especially after the release of a report expressing the EU’s interest in importing 20 Mt of green hydrogen (produced from renewable sources) in more ambitious energy consumption scenarios [29].

Reducing regulatory barriers has been recommended in 93% of the non-efficient countries. Increasing their share of renewables appears as a recommendation for 75% of them, while reducing public ownership has been recommended in 62% of the countries and increasing reliability in 25% of the sample of non-efficient countries.

Brazil has been working to reduce its regulatory barriers in the electricity market by modernizing its electricity system, as suggested by the model proposed in this study. New regulations have been drafted, such as the Brazilian Electric Energy Code [30] and the new framework for distributed generation [31]. The Brazilian Electric Energy Code is under debate in Parliament and seeks to unify regulations, laws and ordinances to a single document, which could lead to a deeper understanding of Brazilian regulation and thereby reduce regulatory barriers. The new framework for distributed generation, instituted by Law 14.300/2022, was approved in 2022. What is unique about this law is its requirement that prosumers must start paying for tariff components related to the remuneration, depreciation, maintenance and operation of the assets of the distribution network. By adjusting this charge, the regulation delimits incentives without burdening the distributor. The above-mentioned cases of Europe and Brazil show initiatives being taken of the type indicated by the results of the model in the present study, which suggest that the model is responding adequately to the dynamics seen in the electricity markets of the countries analyzed.

3.2. Natural Gas Market

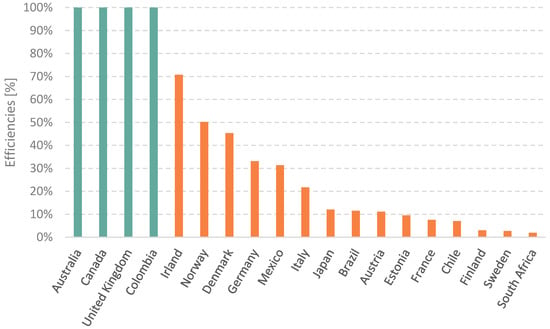

The efficiency frontier for the natural gas market includes Australia, Canada, the United Kingdom and Colombia, as shown in Figure 4. It is made up of one country in Oceania, one in North America, one in Europe and one in South America, so several continents are represented in this frontier.

Figure 4.

Efficiency ranking—natural gas market. Source: The authors. Note: In green: efficient countries; in orange: inefficient countries.

These frontier countries present a pattern with relatively high shares of natural gas in their respective electricity matrices, ranging from 25% (Australia, according to [32]) to 38% (UK and Canada). The vast domestic natural gas reserves of these countries mean that they have relatively low external dependencies, with the exception of the UK, which imported 1.1 EJ in 2020.

Although the UK is an importer of natural gas, it belongs to the efficiency frontier. This is justified by the satisfactory market opening indicators. The UK has the lowest possible values of the PMR indicators for regulatory barriers to entry and for public ownership. This is due to the fact that its national policies have always focused on market liberalization, incentivizing the entry of new agents and competition from a greater number of firms in the energy market. At the same time, it has always encouraged less state participation in the operation of infrastructure companies.

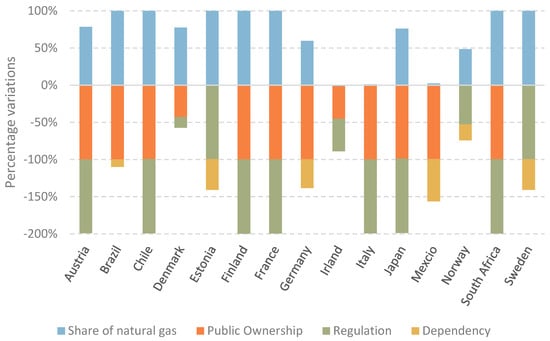

The changes to be pursued by countries wishing to reach the efficiency frontier are shown in Figure 5. The model suggests that 87% of non-efficient countries should increase the share of natural gas in their energy matrices, 80% of countries should reduce state participation and regulatory barriers to entry, and external dependency should be reduced in 40% of countries. It is worth noting that reducing external dependency could be very difficult in certain cases, where there are no technically or economically viable alternatives which respect the environmental restrictions imposed by the current context of energy transition.

Figure 5.

Modifications for reaching the frontier—natural gas market. Source: The authors.

According to the results of the DEA model, Brazil could reach the maximum efficiency score by increasing the share of natural gas in its energy matrix and reducing the state’s participation in its natural gas market. In this respect, it has passed a law with a view to achieving these objectives [33]. Among the new determinations are permission for a greater number of natural gas transport agents, in what had previously been a state monopoly. More private companies will be able to invest in the expansion of the country’s gas pipeline network, which currently is just 9400 km long [34]. For comparative purposes, that represents 31% of the length of the Argentine network and 0.2% of the length of the gas pipeline network in the United States.

4. Discussion

When the present analysis is compared with previous studies which have used DEA models to confront countries in the field of energy planning, it can be seen that the focus of past studies was energy efficiency, i.e., the efficient consumption of energy resources ([16,17,18]). This study considers the additional aspect of assessing the energy transition, which encompasses not only the increase in the efficiency of resource consumption, but also changes in the technological, market and regulatory structures governing consumption patterns and social norms that guarantee universal access to safe, sustainable, affordable and reliable energy supplies in the countries evaluated.

In addition, the studies identified compared countries which are similar in terms of regional and socioeconomic aspects. For example, Refs. [16,17] evaluated the countries of the Regional Comprehensive Economic Partnership (RCEP) group and [18] analyzed African countries, while [19] analyzed European countries. The present study evaluated a sample containing countries from all of the world’s continents, with significant socioeconomic differences. This broader sample allows for the generation of a more representative analysis.

Differences between countries in the targeting of energy policies are verified by the SBM-DEA model, to the extent that such policies are reflected in energy transition. For example, countries which adopt specific policies for the promotion of renewable sources tend to have a greater share of these fuels in their electricity matrices, which is captured by the variable “Share of renewables”. The SBM-DEA method is not interested in controlling the adoption of policies by countries, but rather in evaluating their efficiency.

There are some limitations to this study. Firstly, it should be noted that the analysis is static, i.e., the countries were compared using data from 2018. Although it allows for a diagnosis of their energy markets, the use of one year only hinders the identification of these countries’ development paths. The research could be continued by using the SBM-DEA methodology in a time series, thereby evaluating the electricity and natural gas markets dynamically. A dynamic analysis defines whether the country has been showing variations in its market indicators or whether it remains stagnant in a structure that does not encompass the current energy transition.

The linear variables of the SBM-DEA model could induce corner solutions. In addition, the results are dependent on the specifics of the sample used. Therefore, the efficiency frontier changes when the group of countries evaluated changes and/or when a different descriptive indicator of the market is used. For example, if the electricity market analysis considered the flexibility of electricity systems instead of their reliability, the result would be different.

In summary, the main limitations of this paper relate to a static aspect of the analysis, the possibility of corner solutions, and the huge influence of the inputted indicators on the final efficiency frontiers. Future research should focus on a dynamic analysis capable of determining countries’ development paths towards energy transition and performing new SBM-DEA runs with different sets of indicators in order to validate the efficiency frontiers obtained by this study.

5. Conclusions

This study addresses the relationship between the liberalization of energy markets and the recent energy transition undertaken to tackle climate change. Its aim was to verify whether the liberalization of the natural gas and electricity markets contributes to the energy transition. To accomplish this, the study used a Data Envelopment Analysis (SBM-DEA) model to compare the current status of energy markets in different countries. The model assigned a score to each country, which represents that country’s efficiency in terms of energy transition. Because it is a quantitative methodology for comparing markets, the approach of this study allows a diagnosis of the best performing markets in terms of the following indicators: household prices, share of renewables, reliability, regulation and publicly-owned indexes for electricity market and external dependency, share of natural gas regulation and publicly-owned indexes for natural gas markets. Additionally, the study highlights possibilities for changes in inefficient markets, with regard to the modification of the aforementioned variables.

In terms of efficient markets, the results showed that the markets which are most advanced in their opening up processes tend to present better energy transition results, such as a greater share of renewable sources in the electricity sector, a greater share of natural gas in the energy matrix, lower electricity prices, lower levels of external dependency and other transition indicators.

As for inefficient countries, the study suggests quantitative changes to be pursued for the energy market indicators evaluated in order to improve their performance on the pathway to energy transition. In terms of electricity and natural gas markets in Brazil, reductions in regulatory barriers to entry and the reduction of state participation are relevant to bringing about improvements in the pursuit of energy transition.

In the specific case of Brazil, the study also concluded that such efforts are already being applied by new legislation, such as the new natural gas law, the Brazilian electricity code and the new regulatory framework for distributed generation. In addition, there has also been a relative reduction in the share of publicly-owned companies in these markets.

Finally, even when bearing in mind the limitations of the analysis, the methodology suggested proved to be reproducible, so that countries considered inefficient can use these results to guide their policies targeting energy transition. On the other hand, countries can also use the SBM-DEA model to evaluate other energy market indicators, such as greenhouse gas emissions, electric system flexibility, energy intensity, diversity of sources in primary energy supply and others. From evaluations with different market indicators, new energy policies can be established. Uncertainties are not considered in this study [35], and incorporating them will provide an interesting research direction.

The methodological framework applied in this study allows for the highlighting of the dimensions to be improved for each analyzed country. However, in order to formulate policies towards energy transition, it is necessary to deeply understand the institutional and regulatory frameworks of each nation under study, which is not the focus of this article. One size does not fit all.

Author Contributions

Conceptualization, R.C.M., M.B.G.P.S.G.; Methodology, R.C.M.; Formal analysis, R.C.M., B.S.L.C., M.J.C.d.M.; Writing—original draft, R.C.M., B.S.L.C.; Supervision, A.O.P.J. All authors have read and agreed to the published version of the manuscript.

Funding

R.C.M. and B.S.L.C. thank Human Resources Program of the National Agency of Petroleum, Natural Gas, and Biofuels—PRH-41/ANP (in Portuguese), supported with funds from the investment of oil companies qualified in the R&DI Clause of ANP Resolution 50/2015.

Data Availability Statement

The data used in this analysis are available in Zenodo repository at https://doi.org/10.5281/zenodo.7352705, created on 23 November 2022. The original dataset of PMR indicators can be found at: https://www.oecd.org/publications/the-2018-edition-of-the-oecd-pmr-indicators-and-database-methodological-improvements-and-policy-insights-2cfb622f-en.htm, accessed on 15 November 2022. The original dataset of the Energy Transition Index can be found at: https://www.weforum.org/reports/fostering-effective-energy-transition-2021, accessed on 15 November 2022.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Additional Information

A list of all variables analyzed by the Energy Transition Index is given below. Those in bold were chosen to be part of the correlation analysis of the SBM-DEA model [36]:

- Performance of the energy system:

- Economic development and growth:

- Cost of externalities;

- Subsidies for energy;

- Exportation of fuels;

- Importation of fuels;

- Electricity prices for the household sector;

- Electricity prices for the industrial sector;

- Natural gas prices (wholesale);

- Environmental sustainability:

- CO2 emissions per capita;

- CO2 intensity;

- Energy intensity;

- PM2.5 emissions;

- Access to energy and energy security:

- Dependency on imports;

- Diversity of imports;

- Diversity of energy sources;

- Quality of energy supply;

- Electrification rate;

- Access to clean fuels;

- Transition readiness:

- Investment and capital:

- Ability to invest in renewable energies;

- Access to credit;

- Freedom of investment index;

- Investment in energy efficiency;

- Regulation and political commitment:

- Regulation favoring renewables;

- Regulation favoring energy efficiency;

- Regulation favoring access to energy;

- Stability of the political system;

- Fidelity and adherence to international climate commitments;

- Institutions and governance:

- Credit Rating of the country;

- Well-defined laws;

- Transparency;

- Infrastructure and environment for innovation:

- Environment conducive to innovation;

- Logistics performance;

- Quality of transport infrastructure;

- Human capital:

- Jobs in low-carbon industries;

- Quality of education;

- Structure of the energy system:

- Share in global fossil fuel reserves;

- Share of renewables in electricity generation;

- Share of coal in electricity generation;

- Flexibility of the energy system;

- Energy per capita.

After an initial analysis of the variables, those not showing redundancy with the PMR indicators and those which best represent the natural gas and electricity markets were chosen to participate in the correlation analysis. Figure A1. presents the matrix of correlations between the variables analyzed

Figure A1.

Matrix of correlations between input data. Source: Drawn up by the authors, based on [9,12].

A description of the variables follows (in bold, those used by the DEA-SBM model):

- ShareRen: Share of renewables in total electricity generation in 2018

- Reg_EE: PMR indicator referring to regulation of the electricity market

- pubOwn_EE: PMR indicator referring to public ownership of the electricity market

- Dependency: Share of natural gas imports in its total consumption

- ShareGas: Share of gas in total energy consumption

- ShareNonRen: Share of non-renewables in total electricity generation in 2018

- Flexibility: Share of total electricity generated by oil, natural gas or hydropower

- co2_TPES: CO2 emissions per unit of primary energy produced

- Reliability: Reliability in supply and transparency of electricity tariffs

- CO2Cap: CO2 emissions per capita

- EneInt: Energy intensity

- Reg_NG: PMR indicator referring to Regulation of the natural gas market

- pubOwn_NG: PMR indicator referring to public ownership of natural gas market

- gasPri: Natural gas prices (wholesale)

- DivPES: Diversity in primary energy supply

- HH_prices: Household electricity prices

References

- Viscusi, W.P.; Harrington, J.E.; Sappington, D.E.M. Economics of Regulation and Antitrust; MIT Press: Londres, UK, 2018; ISBN 0262038064. [Google Scholar]

- Geels, D.I.F.W. The dynamics of transitions in socio-technical systems: A multi-level analysis of the transition pathway from horse-drawn carriages to automobiles (1860–1930). Technol. Anal. Strateg. Manag. 2005, 17, 445–476. [Google Scholar] [CrossRef]

- Fouquet, R. A Brief History of Energy. In International Handbook on the Economics of Energy; Edward Elgar Publishing: Florence, Italy, 2009. [Google Scholar]

- IRENA. Rethinking Energy 2017: Accelerating the Global Energy Transformation; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2017; p. 129. ISBN 978-92-95111-06-6. [Google Scholar]

- IRENA. Rethinking Energy: Renewable Energy and Climate Change; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2015; p. 39. [Google Scholar]

- IEA. Net Zero by 2050 A Roadmap for the Global Energy Sector. 2021. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 14 November 2022).

- IPCC. Technical Summary. In Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Shukla, P.R., Skea, J., Slade, R., Al Khourdajie, A., van Diemen, R., McCollum, D., Pathak, M., Some, S., Vyas, P., Fradera, R., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2021. [Google Scholar] [CrossRef]

- IPCC. Summary for Policymakers. In Global Warming of 1.5 °C; An IPCC Special Report on the impacts of global warming of 1.5 °C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty; Masson-Delmotte, V., Zhai, P., Pörtner, H.-O., Roberts, D., Skea, J., Shukla, P.R., Pirani, A., Moufouma-Okia, W., Péan, C., Pidcock, R., et al., Eds.; 2018; in press. [Google Scholar]

- WEF. Fostering Effective Energy Transition, 2021th ed.; World Economic Forum: Cologny/Geneva, Switzerland, 2021. [Google Scholar]

- IEA. Greenhouse Gas Emissions from Energy Data Explorer. Available online: https://www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer (accessed on 4 December 2022).

- IPCC. Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Shukla, P., Skea, J., Slade, R., Al Khourdajie, A., van Diemen, R., McCollum, D., Pathak, M., Some, S., Vyas, P., Fradera, R., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2022. [Google Scholar] [CrossRef]

- OECD. The 2018 Edition of the OECD PMR Indicators and Database—Methodological Improvements and Policy Insights; Organisation for Economic Co-Operation and Development: Paris, France, 2020. [Google Scholar]

- Kwoka, J.E. The Role of Competition in Natural Monopoly: Costs, Public Ownership, and Regulation. Rev. Ind. Organ. 2006, 29, 127–147. [Google Scholar] [CrossRef]

- Sioshansi, F.P. Competitive Electricity Markets: Design, Implementation, Performance; Elsevier: Amsterdam, The Netherlands, 2008. [Google Scholar]

- Tone, K. Slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, P. Applying the three-stage SBM-DEA model to evaluate energy efficiency and impact factors in RCEP countries. Energy 2022, 241, 122917. [Google Scholar] [CrossRef]

- Zhou, S.; Xu, Z. Energy efficiency assessment of RCEP member states: A three-stage slack based measurement DEA with undesirable outputs. Energy 2022, 253, 124170. [Google Scholar] [CrossRef]

- Sarpong, F.A.; Wang, J.; Cobbinah, B.B.; Makwetta, J.J.; Chen, J. The drivers of energy efficiency improvement among nine selected West African countries: A two-stage DEA methodology. Energy Strateg. Rev. 2022, 43, 100910. [Google Scholar] [CrossRef]

- Almeida Neves, S.; Cardoso Marques, A.; Moutinho, V. Two-stage DEA model to evaluate technical efficiency on deployment of battery electric vehicles in the EU countries. Transp. Res. Part D Transp. Environ. 2020, 86, 102489. [Google Scholar] [CrossRef]

- Doğan, B.; Driha, O.M.; Balsalobre Lorente, D.; Shahzad, U. The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 2021, 29, 1–12. [Google Scholar] [CrossRef]

- Dogan, B.; Lorente, D.B.; Ali Nasir, M. European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. J. Environ. Manag. 2020, 273, 111146. [Google Scholar] [CrossRef] [PubMed]

- Meeus, L. The Evolution of Electricity Markets in Europe; Edward Elgar Publishing: Florence, Italy, 2020; ISBN 978 1 78990 546 5. [Google Scholar]

- OECD. Product Market Regulation: A Detailed Explanation of the Methodology Used to Build the OECD PMR Indicators; Organisation for Economic Co-Operation and Develoment: Paris, France, 2020. [Google Scholar]

- Singh, H.V.; Bocca, R.; Gomez, P.; Dahlke, S.; Bazilian, M. The energy transitions index: An analytic framework for understanding the evolving global energy system. Energy Strateg. Rev. 2019, 26, 100382. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision-making units. Eur. J. Oper. Res. 1978, 2, 19611. [Google Scholar] [CrossRef]

- Kassai, S. Utilização da Análise Envoltória de Dados (DEA), na Análise de Demonstrações Contábeis; Universidade de São Paulo: São Paulo, Brazil, 2002. [Google Scholar]

- Souza, M.A.M.; Rodrigues, L.F.; Faria, G.A.F. Análise Envoltória de Dados aplicada ao Setor Brasileiro de Distribuição de Energia Elétrica. Simpósio Bras. Pesqui. Oper. 2016, 48, 888–899. [Google Scholar]

- Souza, M.G.Z.N.d. Avaliação da Eficiência Energética Usando Análise Envoltória de Dados: Aplicação aos Países em Desenvolvimento. 2012. Available online: https://repositorio.usp.br/item/002338863 (accessed on 20 October 2022).

- European Comission. Commission Staff Working Document: Implementing the Repower EU Action Plan: Investment Needs, Hydrogen Accelerator and Achieving the Bio-Methane Targets; European Comission: Brussels, Belgium, 2022. [Google Scholar]

- Brasil. Anteprojeto de lei no2: Código Brasileiro de Energia Elétrica. 2019. Available online: https://www2.camara.leg.br/atividade-legislativa/comissoes/comissoes-temporarias/especiais/56a-legislatura/codigo-brasileiro-de-energia-eletrica/outros-documentos/AnteprojetodoCdigoBrasileirodeEnergiaEltricav1.pdf (accessed on 1 December 2022).

- Brasil. Lei No 14.300/2022. 2022; pp. 1–15. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2022/lei/L14300.htm (accessed on 1 December 2022).

- IEA. Countries and Regions. Available online: https://www.iea.org/countries (accessed on 1 December 2022).

- Brasil. Lei 14.134. 2021; pp. 1–15. Available online: https://www.planalto.gov.br/ccivil_03/_ato2019-2022/2021/lei/l14134.htm (accessed on 1 December 2022).

- ANP. Anuário Estatístico 2022. Available online: https://www.gov.br/anp/pt-br/centrais-de-conteudo/dados-abertos/anuario-estatistico-2022 (accessed on 20 October 2022).

- Wang, W.; Wu, Y. Is uncertainty always bad for the performance of transportation systems? Commun. Transp. Res. 2021, 1, 100021. [Google Scholar] [CrossRef]

- WEF. Appendix: Methodology. Available online: https://www.weforum.org/reports/fostering-effective-energy-transition-2021/in-full/appendix-methodology (accessed on 26 July 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).