Risk-Averse Stochastic Programming for Planning Hybrid Electrical Energy Systems: A Brazilian Case

Abstract

:1. Introduction

1.1. Motivation and Background

1.2. Literature Review

1.3. Main Contributions

1.4. Paper Structure

2. Stochastic and Risk Management Modeling

2.1. Uncertainty Modeling

2.2. Risk Management

3. HEES Planning and Operating Model

4. Case Study

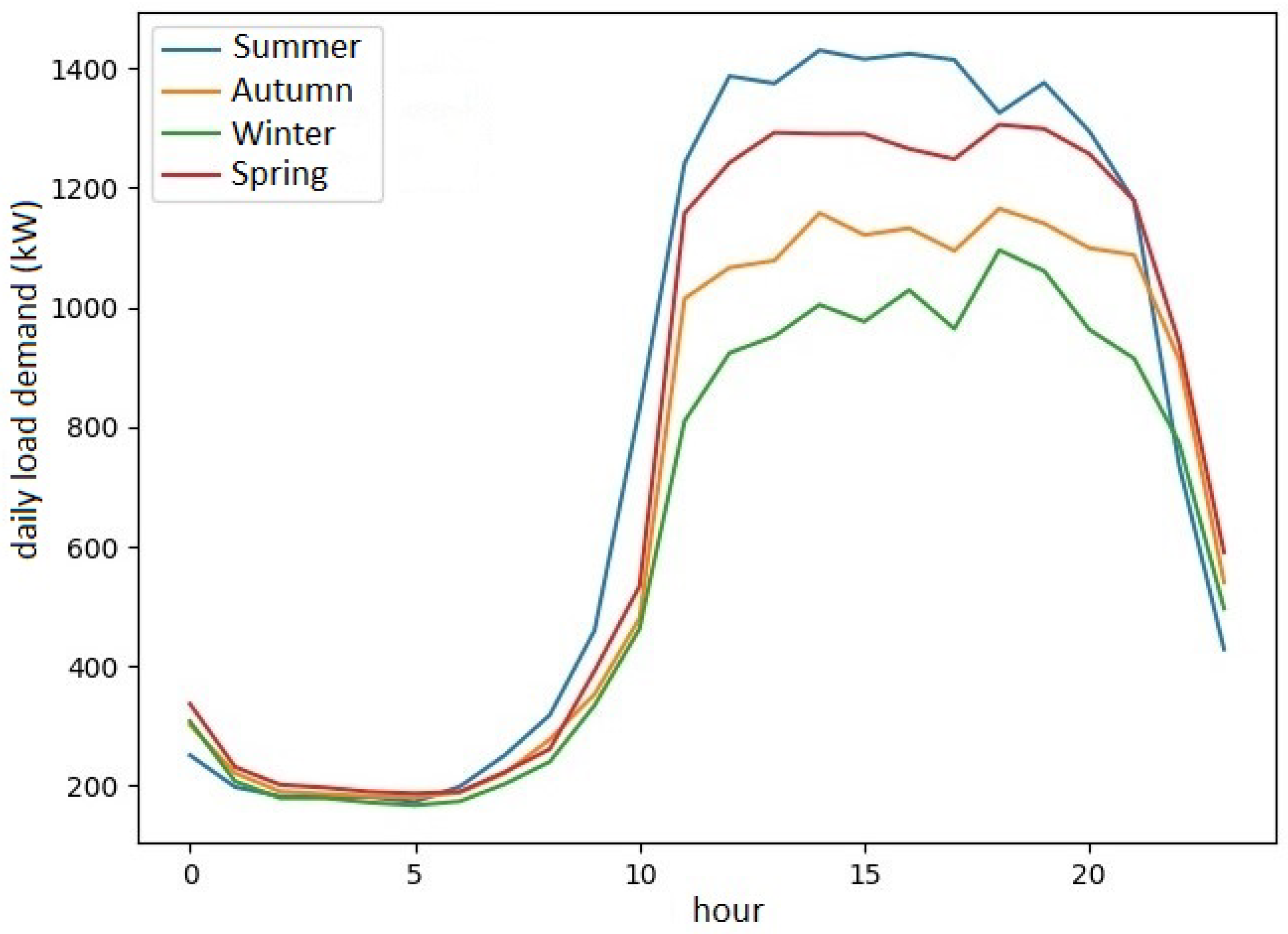

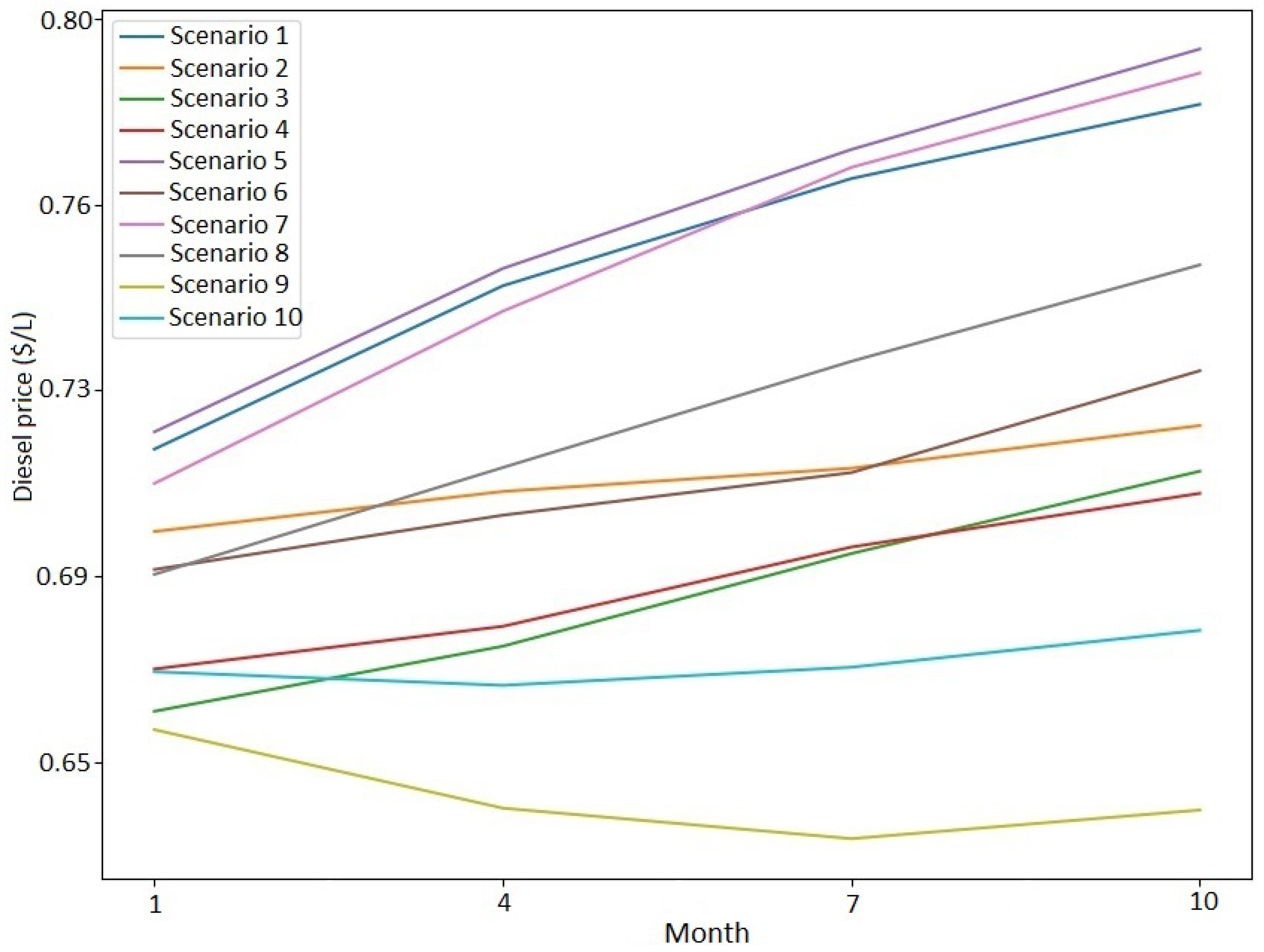

4.1. Case Characterization

4.2. Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Acronyms

| HEES | Hybrid electrical energy systems |

| PV | Photovoltaic |

| CVaR | Conditional value at risk |

| RES | Renewable energy sources |

| DER | Distributed energy resources |

| DS | Distribution systems |

| DG | Distributed generation |

| ANEEL | Brazilian Regulatory Agency |

| BEES | Battery energy storage system |

| VaR | Value-at-risk |

| SSE | Sum of squared error |

| GBM | Geometric brownian motion |

| SOC | State of charge |

| O&M | Operation and maintenance |

| ACR | Brazilian regulated contracting environment |

| INMET | National Institute of Meteorology |

| CEMIG | Minas Gerais Energy Company |

| ANP | National Agency for Petroleum, Natural Gas and Biofuels |

| NCA | Nickel-Cobalt-Aluminum |

| DOD | Depth of discharge |

References

- Castro, N.; Dantas, G. Distributed Generation: International Experiences and Comparative Analyses. In Grupo de Estudos do Setor Elétrico; Publit: Rio de Janeiro, Brazil, 2017; pp. 1–224. [Google Scholar]

- ANEEL. Resolução Normativa 482. 2012. Available online: http://www2.aneel.gov.br/cedoc/bren2012482.pdf (accessed on 23 September 2021).

- Fodhil, F.; Hamidat, A.; Nadjemi, O. Potential, optimization and sensitivity analysis of photovoltaic-diesel-battery hybrid energy system for rural electrification in Algeria. Energy 2019, 169, 613–624. [Google Scholar] [CrossRef]

- Islam, M.R.; Akter, H.; Howlader, H.O.R.; Senjyu, T. Optimal Sizing and Techno-Economic Analysis of Grid-Independent Hybrid Energy System for Sustained Rural Electrification in Developing Countries: A Case Study in Bangladesh. Energies 2022, 15, 6381. [Google Scholar] [CrossRef]

- Tarife, R.; Nakanishi, Y.; Chen, Y.; Zhou, Y.; Estoperez, N.; Tahud, A. Optimization of Hybrid Renewable Energy Microgrid for Rural Agricultural Area in Southern Philippines. Energies 2022, 15, 2251. [Google Scholar] [CrossRef]

- Bahramara, S.; Sheikhahmadi, P.; Golpîra, H. Co-optimization of energy and reserve in standalone micro-grid considering uncertainties. Energy 2019, 176, 792–804. [Google Scholar] [CrossRef]

- Ming, M.; Wang, R.; Zha, Y.; Zhang, T. Multi-Objective Optimization of Hybrid Renewable Energy System Using an Enhanced Multi-Objective Evolutionary Algorithm. Energies 2017, 10, 674. [Google Scholar] [CrossRef]

- Kitamura, D.T.; Rocha, K.P.; Oliveira, L.W.; Oliveira, J.G.; Dias, B.H.; Soares, T.A. Planejamento de de Sistemas Híbridos de Energia Elétrica Utilizando Programação Inteira Mista. In Proceedings of the XV Simpósio Brasileiro de Automação Inteligente (SBAI), Rio Grande do Sul, Brazil, 17–20 October 2021; Volume 1. [Google Scholar] [CrossRef]

- Tsai, C.T.; Beza, T.M.; Wu, W.B.; Kuo, C.C. Optimal Configuration with Capacity Analysis of a Hybrid Renewable Energy and Storage System for an Island Application. Energies 2019, 13, 8. [Google Scholar] [CrossRef]

- Sawle, Y.; Gupta, S.; Bohre, A.K. Optimal sizing of standalone PV/Wind/Biomass hybrid energy system using GA and PSO optimization technique. Energy Procedia 2017, 117, 690–698. [Google Scholar] [CrossRef]

- Gharibi, M.; Askarzadeh, A. Size and power exchange optimization of a gridconnected diesel generator-photovoltaic-fuel cell hybrid energy system considering reliability, cost and renewability. Int. J. Hydrogen Energy 2019, 44, 25428–25441. [Google Scholar] [CrossRef]

- Nesamalar, J.J.D.; Suruthi, S.; Raja, S.C.; Tamilarasu, K. Techno-economic analysis of both on-grid and off-grid hybrid energy system with sensitivity analysis for an educational institution. Energy Convers. Manag. 2021, 239, 114188. [Google Scholar] [CrossRef]

- López-Salamanca, H.L.; Arruda, L.V.; Magatão, L.; Normey-Rico, J.E. Optimization of Grid-Tied Microgrids Under Binomial Differentiated Tariff and Net Metering Policies: A Brazilian Case Study. J. Control. Autom. Electr. Syst. 2018, 29, 731–741. [Google Scholar] [CrossRef]

- Kitamura, D.T.; Rocha, K.P.; Oliveira, L.W.; Oliveira, J.G.; Dias, B.H.; Soares, T.A. Optimization approach for planning hybrid electrical energy system: A Brazilian case. Electr. Eng. 2021, 1, 587–601. [Google Scholar] [CrossRef]

- Fatih Güven, A.; Mahmoud Samy, M. Performance analysis of autonomous green energy system based on multi and hybrid metaheuristic optimization approaches. Energy Convers. Manag. 2022, 269, 116058. [Google Scholar] [CrossRef]

- Güven, A.F.; Yörükeren, N.; Samy, M.M. Design optimization of a stand-alone green energy system of university campus based on Jaya-Harmony Search and Ant Colony Optimization algorithms approaches. Energy 2022, 253, 124089. [Google Scholar] [CrossRef]

- Mokhtara, C.; Negrou, B.; Settou, N.; Settou, B.; Samy, M.M. Design optimization of off-grid Hybrid Renewable Energy Systems considering the effects of building energy performance and climate change: Case study of Algeria. Energy 2021, 219, 119605. [Google Scholar] [CrossRef]

- Han, D.; Lee, J.H. Two-stage stochastic programming formulation for optimal design and operation of multi-microgrid system using data-based modeling of renewable energy sources. Appl. Energy 2019, 291, 116830. [Google Scholar] [CrossRef]

- Medina-Santana, A.A.; Cárdenas-Barrón, L.E. Optimal Design of Hybrid Renewable Energy Systems Considering Weather Forecasting Using Recurrent Neural Networks. Energies 2022, 15, 9045. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, W.; Li, J.; Zhang, W.; Liu, Y.; Zhao, B.; Zhang, Y. Optimal Sizing for Grid-Tied Microgrids With Consideration of Joint Optimization of Planning and Operation. IEEE Trans. Sustain. Energy 2018, 19, 237–248. [Google Scholar] [CrossRef]

- Wu, D.; Ma, X.; Huang, S.; Fu, T.; Balducci, P. Stochastic optimal sizing of distributed energy resources for a cost-effective and resilient Microgrid. Energy 2020, 198, 117284. [Google Scholar] [CrossRef]

- Yu, J.; Ryu, J.; Lee, I. A stochastic optimization approach to the design and operation planning of a hybrid renewable energy system. Appl. Energy 2019, 247, 212–220. [Google Scholar] [CrossRef]

- Li, R.; Yang, Y. Multi-objective capacity optimization of a hybrid energy system in two-stage stochastic programming framework. Energy Rep. 2021, 7, 1837–1846. [Google Scholar] [CrossRef]

- Mavromatidis, G.; Orehounig, K.; Carmeliet, J. Design of distributed energy systems under uncertainty: A two-stage stochastic programming approach. Appl. Energy 2018, 222, 932–950. [Google Scholar] [CrossRef]

- Narayan, A.; Ponnambalam, K. Risk-averse stochastic programming approach for microgrid planning under uncertainty. Renew. Energy 2017, 101, 399–408. [Google Scholar] [CrossRef]

- Gazijahani, F.S.; Salehi, J. Optimal Bilevel Model for Stochastic Risk-Based Planning of Microgrids Under Uncertainty. IEEE Trans. Ind. Inform. 2018, 14, 3054–3064. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizadeh-Kermani, H.; Najafi, H.; Anvari-Moghaddam, A.; Guerrero, J.M. Stochastic security and risk-constrained scheduling for an autonomous microgrid with demand response and renewable energy resources. IET Renew. Power Gener. 2017, 11, 1812–1821. [Google Scholar] [CrossRef]

- Sheikhahmadi, P.; Mafakheri, R.; Bahramara, S.; Damavandi, M.Y.; Catalão, J.P.S. Risk-Based Two-Stage Stochastic Optimization Problem of Micro-Grid Operation with Renewables and Incentive-Based Demand Response Programs. Energies 2018, 11, 610. [Google Scholar] [CrossRef]

- Zou, K.; Agalgaonkar, A.P.; Muttaqi, K.M.; Perera, S. Distribution System Planning With Incorporating DG Reactive Capability and System Uncertainties. IEEE Trans. Sustain. Energy 2012, 3, 112–123. [Google Scholar] [CrossRef]

- Liu, Y.; Li, G.; Hou, R.; Wang, C.; Wang, X. A hybrid stochastic/robust-based multi-period investment planning model for island microgrid. Int. J. Electr. Power Energy Syst. 2021, 130, 106998. [Google Scholar] [CrossRef]

- Lai, C.; Jia, Y.; McCulloch, M.; Xu, Z. Daily Clearness Index Profiles Cluster Analysis for Photovoltaic System. IEEE Trans. Ind. Inform. 2017, 13, 2322–2332. [Google Scholar] [CrossRef]

- Nainggolan, R.; Perangin-angin, R.; Simarmata, E.; Tarigan, A.F. Improved the Performance of the K-Means Cluster Using the Sum of Squared Error (SSE) optimized by using the Elbow Method. J. Phys. Conf. Ser. 2019, 1361, 012015. [Google Scholar] [CrossRef]

- Conejo, A.J.; Carrión, M.; Morales, J.M. (Eds.) Decision Making under Uncertainty in Electricity Markets; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar] [CrossRef]

- HOMER. How HOMER Calculates the PV Array Power Output. 2021. Available online: https://www.homerenergy.com/products/pro/docs/latest/how_homer_calculates_the_pv_array_power_output.html (accessed on 23 September 2021).

- Deotti, L.; Guedes, W.; Dias, B.; Soares, T. Technical and Economic Analysis of Battery Storage for Residential Solar Photovoltaic Systems in the Brazilian Regulatory Context. Energies 2020, 13, 6517. [Google Scholar] [CrossRef]

- GTES. Manual de Engenharia para Sistemas Fotovoltaicos; CEPEL-CRESEB: Rio de Janeiro, Brazil, 2014. [Google Scholar]

- Martinez-Bolanos, J.R.; Udaeta, M.E.M.; Gimenes, A.L.V.; Silva, V.O. Economic feasibility of battery energy storage systems for replacing peak power plants for commercial consumers under energy time of use tariffs. Energy Storage 2020, 29, 101373. [Google Scholar] [CrossRef]

- Cummins. Grupos Geradores. 2021. Available online: https://www.cummins.com.br/ (accessed on 23 September 2021).

- INMET. Históricos de Dados Meteorológicos. 2021. Available online: https://portal.inmet.gov.br/dadoshistoricos (accessed on 23 September 2021).

- CEMIG. Valores de Tarifas e Serviços. 2021. Available online: https://www.cemig.com.br/atendimento/valores-de-tarifas-e-servicos/ (accessed on 23 September 2021).

- MINHA-CASA-SOLAR. 2021. Available online: https://www.minhacasasolar.com.br/ (accessed on 23 September 2021).

- Nakabayashi, R. Microgeração Fotovoltaica No Brasil: Viabilidade Econômica; Technical Report; Instituto de Energia e Ambiente da USP: São Paulo, Brazil, 2015. [Google Scholar]

- Solar, C. Canadian Solar CS3W-420P Datasheet. 2023. Available online: https://www.ecorienergiasolar.com.br/assets/uploads/2bcef-canadian_solar-datasheet-hiku_cs3w-p-420_425_430_435_1000v1500v_v5.584.pdf (accessed on 20 January 2023).

- Solar, C. Canadian Solar CS3W-395P Datasheet. 2023. Available online: https://www.canadiansolar.com/test-au/wp-content/uploads/sites/2/2020/04/Canadian_Solar-Datasheet-HiKu_CS3W-P_v5.59_AU.pdf (accessed on 20 January 2023).

- Solar, R. Risen Solar RSM156-6-445M Datasheet. 2023. Available online: https://betsolar.es/wp-content/uploads/2020/03/RSM156-6-425-445M-G2.3-Plus-IEC1500V-40mm-2019H2-3-EN.pdf (accessed on 20 January 2023).

- Solar, C. Canadian Solar CS3W-450MS Datasheet. 2023. Available online: https://www.canadiansolar.com/wp-content/uploads/2019/12/Canadian_Solar-Datasheet-HiKu_CS3W-MS_EN.pdf (accessed on 20 January 2023).

- ABB. ABB PVS-100/120-TL Datasheet. 2023. Available online: https://loja.l8energy.com/wp-content/uploads/2018/04/Datasheet-PVS-100-120-TL_EN_Rev-G_POR.pdf (accessed on 20 January 2023).

- Cummins. Cummins C500 D6 Datasheet. 2023. Available online: https://productos.cumminsperu.pe/wp-content/uploads/2018/09/C500D6.pdf (accessed on 20 January 2023).

- Botelho, D.; de Oliveira, L.; Dias, B.; Soares, T.; Moraes, C. Prosumer integration into the Brazilian energy sector: An overview of innovative business models and regulatory challenges. Energy Policy 2022, 161, 112735. [Google Scholar] [CrossRef]

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

| 0.052 | 0.15 | 0.123 | 0.113 | 0.092 | |

| Scenario 6 | Scenario 7 | Scenario 8 | Scenario 9 | Scenario 10 | |

| 0.069 | 0.091 | 0.116 | 0.087 | 0.107 |

| PIS | COF | ||||

| (kW) | (kW) | ($/kW) | ($/kW) | (%) | (%) |

| 2000 | 1800 | 2.70 | 8.16 | 5.32 | 1.15 |

| ICM | [42] | ||||

| (%) | (%) | ($/kWh) | ($/kWh) | ($/kWh) | ($/kWh) |

| 25 | 8.7 | 0 | 0.00341 | 0.00722 | 0.01726 |

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | Scenario 5 | |

| ($/kWh) | 0.08191 | 0.06457 | 0.06923 | 0.05884 | 0.06906 |

| ($/kWh) | 0.11053 | 0.09319 | 0.09786 | 0.08747 | 0.09768 |

| Scenario 6 | Scenario 7 | Scenario 8 | Scenario 9 | Scenario 10 | |

| ($/kWh) | 0.05026 | 0.05845 | 0.07364 | 0.06525 | 0.07896 |

| ($/kWh) | 0.07888 | 0.08708 | 0.10226 | 0.09387 | 0.10759 |

| Type | Manufacturer | Model | Area () | Cost ($) |

|---|---|---|---|---|

| 1 | Canadian Solar | CS3W-420P [43] | 2.209184 | 155.39 |

| 2 | Canadian Solar | CS3W-395P [44] | 2.209184 | 145.25 |

| 3 | Risen Solar | RSM156-6-445M [45] | 2.060388 | 185.83 |

| 4 | Canadian Solar | CS3W-450MS [46] | 2.209184 | 184.14 |

| Manufacturer | Model | (%) | ($/kW) | Lifetime (Years) |

|---|---|---|---|---|

| ABB | PVS-100/120-TL [47] | 98.4 | 173.69 | 15 |

| Manufacturer | Model | (L/kWh) | (L/kWh) | ($/kW) | (%) |

|---|---|---|---|---|---|

| Cummins | C500 D6 [48] | 0.015 | 0.246 | 100 | 7.29 |

| Lifecycle [20,50,80] %DOD | Round-Trip Efficiency (%) | (%) | ($/kWh) |

|---|---|---|---|

| [77,500,9800,4800] | 92 | 0.25 | 525.64 |

| 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | |

| (kW) | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 |

| ($ ) | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 |

| (kW) | 0 | 1046.09 | 1090.52 | 1101.89 | 1126.63 | 1137.73 |

| DG cost ($ ) | 0 | 1527.78 | 1582.34 | 1594.28 | 1592.67 | 1993.52 |

| EG cost ($ ) | 8680.29 | 7157.75 | 7105.36 | 7093.80 | 7097.20 | 7202.96 |

| OBF ($ ) | 10,427.96 | 10,604.83 | 10,775.86 | 10,945.83 | 11,115.43 | 11,284.77 |

| CVaR ($ ) | 11,776.60 | 11,291.34 | 11,286.60 | 11,285.88 | 11,284.90 | 11,284.77 |

| Green | Yellow | Red Level 1 | Red Level 2 | |

|---|---|---|---|---|

| 0.3875 | 0.2 | 0.2625 | 0.15 |

| 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | |

| (kW) | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 |

| ($ ) | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 |

| EG cost ($ ) | 7526.14 | 7526.14 | 7526.14 | 7526.14 | 7526.14 | 7649.40 |

| OBF ($ ) | 9273.81 | 9486.45 | 9699.10 | 9911.74 | 10,124.39 | 10,318.10 |

| CVaR ($ ) | 10,633.46 | 10,337.03 | 10,337.03 | 10,337.03 | 10,337.03 | 10,318.10 |

| Green | Yellow | Red Level 1 | Red Level 2 | |

|---|---|---|---|---|

| 0.3298 | 0.1702 | 0.2234 | 0.2766 |

| 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | |

(kW) | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 |

($ ) | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 |

| (kW) | 0 | 0 | 0 | 0 | 0 | 995.59 |

| DG cost ($ ) | 0 | 0 | 0 | 0 | 0 | 1734.48 |

| EG cost ($ ) | 7698.03 | 7698.03 | 7698.03 | 7698.03 | 7698.03 | 6552.07 |

| OBF (R$ ) | 9445.70 | 9658.08 | 9870.46 | 10,082.84 | 10,295.22 | 10,506.37 |

| CVaR (R$ ) | 10,803.72 | 10,507.59 | 10,507.59 | 10,507.59 | 10,507.59 | 10,506.37 |

| 4556 | 4556 | 4556 | 4556 | 4556 | 4556 | |

(kW) | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 | 1799.62 |

| ($ ) | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 | 1747.67 |

| (kWh) | 6278.71 | 6242.31 | 6227.84 | 6227.84 | 6227.84 | 6227.84 |

| ($ ) | 436.60 | 434.07 | 433.07 | 433.07 | 433.07 | 433.07 |

| EG cost ($ ) | 6996.59 | 6999.13 | 7000.15 | 7000.15 | 7000.15 | 7404.61 |

| OBF ($ ) | 9180.87 | 9386.16 | 9591.44 | 9796.71 | 10,001.99 | 10,207.26 |

| CVaR ($ ) | 10,505.32 | 10,207.30 | 10,207.26 | 10,207.26 | 10,207.26 | 10,207.26 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kitamura, D.; Willer, L.; Dias, B.; Soares, T. Risk-Averse Stochastic Programming for Planning Hybrid Electrical Energy Systems: A Brazilian Case. Energies 2023, 16, 1463. https://doi.org/10.3390/en16031463

Kitamura D, Willer L, Dias B, Soares T. Risk-Averse Stochastic Programming for Planning Hybrid Electrical Energy Systems: A Brazilian Case. Energies. 2023; 16(3):1463. https://doi.org/10.3390/en16031463

Chicago/Turabian StyleKitamura, Daniel, Leonardo Willer, Bruno Dias, and Tiago Soares. 2023. "Risk-Averse Stochastic Programming for Planning Hybrid Electrical Energy Systems: A Brazilian Case" Energies 16, no. 3: 1463. https://doi.org/10.3390/en16031463

APA StyleKitamura, D., Willer, L., Dias, B., & Soares, T. (2023). Risk-Averse Stochastic Programming for Planning Hybrid Electrical Energy Systems: A Brazilian Case. Energies, 16(3), 1463. https://doi.org/10.3390/en16031463