Renewable Energy and Governance Resilience in the Gulf

Abstract

:1. Introduction

2. Theoretical Background, Framework, and Research Hypotheses

3. Results of the Nexus between Renewable Energy and Monarchial Resilience

3.1. Renewable Energy and Neopatrimonialist Structures

3.1.1. Utility-Scale Renewable Power

3.1.2. Structure of Special Purpose Vehicles

3.1.3. Limited Role for Distributed Energy

3.2. Renewable Energy and Revenue Streams

3.3. Renewable Energy and the Exogenous Environment

4. Intra-Gulf Differences in Renewable Energy Deployment

5. Conclusions and Discussion

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bloomberg. Covid Resilience Ranking; 27 October ed.; Bloomberg: Manhattan, NY, USA, 2021. [Google Scholar]

- World Bank. The Worldwide Governance Indicators; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Raleigh, C.; Linke, A.; Hegre, H.; Karlsen, J. Introducing ACLED: An armed conflict location and event dataset: Special data feature. J. Peace Res. 2010, 47, 651–660. [Google Scholar] [CrossRef]

- Tagliapietra, S. The Political Economy of Middle East and North Africa oil Exporters in Times of Global Decarbonisation; Bruegel: Brussels, Belgium, 2017. [Google Scholar]

- Soummane, S.; Ghersi, F.; Lefèvre, J. Macroeconomic Pathways of the Saudi Economy: The Challenge of Global Mitigation Action versus the Opportunity of National Energy Reforms. Energy Policy 2019, 130, 263–282. [Google Scholar] [CrossRef]

- Coffin, M.; Dalman, A.; Grant, A. Beyond Petrostates; Carbon Tracker Initiative: London, UK, 2021. [Google Scholar]

- WRI. Aqueduct Country Rankings; World Resources Institute: Washington, DC, USA, 2021. [Google Scholar]

- Lelieveld, J.; Proestos, Y.; Hadjinicolaou, P.; Tanarhte, M.; Tyrlis, E.; Zittis, G. Strongly increasing heat extremes in the Middle East and North Africa (MENA) in the 21st century. Clim. Change 2016, 137, 245–260. [Google Scholar] [CrossRef] [Green Version]

- ESMAP Regulatory Indicators for Sustainable Energy 2022: Building Resilience; World Bank: Washington, DC, USA, 2022.

- WEC. World Energy Trilemma Index; World Energy Council: London, UK, 2022. [Google Scholar]

- ND-GAIN. ND-GAIN Country Index; University of Notre Dame Global Adaptation Initiative: Notre Dame, IN, USA, 2021. [Google Scholar]

- Hinnebusch, R. Syria: From ‘authoritarian upgrading’ to revolution? Int. Aff. 2012, 88, 95–113. [Google Scholar] [CrossRef]

- Boix, C. Democracy, Development, and the International System. Am. Political Sci. Rev. 2011, 105, 809–828. [Google Scholar] [CrossRef] [Green Version]

- Bader, J.; Faust, J. Foreign Aid, Democratization, and Autocratic Survival. Int. Stud. Rev. 2014, 16, 575–595. [Google Scholar] [CrossRef]

- Lührmann, A.; Lindberg, S.I. Lindberg A third wave of autocratization is here: What is new about it? Democratization 2019, 26, 1095–1113. [Google Scholar] [CrossRef]

- Tsourapas, G. Global Autocracies: Strategies of Transnational Repression, Legitimation, and Co-Optation in World Politics. Int. Stud. Rev. 2021, 23, 616–644. [Google Scholar] [CrossRef]

- Levitsky, S.; Way, L.A. The New Competitive Authoritarianism. J. Democr. 2020, 31, 51–65. [Google Scholar] [CrossRef] [Green Version]

- Clulow, Z.; Reiner, D.M. Democracy, Economic Development and Low-Carbon Energy: When and Why Does Democratization Promote Energy Transition? Sustainability 2022, 14, 13213. [Google Scholar] [CrossRef]

- Sullivan, P. Under the Volcano: Geothermal is Key to Saudi Arabia’s Energy Future; Arab Gulf States Institute in Washington: Washington, DC, USA, 2021. [Google Scholar]

- Heydemann, S. Networks of Privilege: Rethinking the Politics of Economic Reform in the Middle East. In Networks of Privilege in the Middle East: The Politics of Economic Reform Revisited; Heydemann, S., Ed.; Palgrave Macmillan: Basingstoke, UK, 2004. [Google Scholar]

- Schlumberger, O. Structural adjustment, economic order, and development: Patrimonial capitalism. Rev. Int. Political Econ. 2008, 5, 622–649. [Google Scholar] [CrossRef]

- Almezaini, K. Private Sector Actors in the UAE and Their Role in the Process of Economic and Political Reform. In Business Politics in the Middle East; Hertog, S., Luciani, G., Valeri, M., Eds.; Hurst & Company: London, UK, 2013. [Google Scholar]

- Hertog, S. State and private sector in the GCC after the Arab uprisings. J. Arab. Stud. 2014, 3, 174–195. [Google Scholar] [CrossRef] [Green Version]

- Warren, D.H. Rivals in the Gulf: Yusuf al-Qaradawi, Abdullah Bin Bayyah, and the Qatar-UAE Contest Over the Arab Spring and the Gulf Crisis; Routledge: London, UK, 2021. [Google Scholar]

- Herb, M. The Wages of Oil: Parliaments and Economic Development in Kuwait and the UAE; Cornell University Press: Ithaca, NY, USA, 2014. [Google Scholar]

- Heydemann, S. Upgrading Authoritarianism in the Arab World; Brookings: Washington, DC, USA, 2007. [Google Scholar]

- Lucas, R.E. Monarchical Authoritarianism: Survival and Political Liberalization in a Middle Eastern Regime Type. Int. J. Middle East Stud. 2004, 36, 103–119. [Google Scholar] [CrossRef]

- Al-Rasheed, M. Modernizing Authoritarian Rule in Saudi Arabia. Contemp. Arab Aff. 2009, 2, 587–601. [Google Scholar] [CrossRef]

- Karolak, M. Authoritarian Upgrading and the “Pink Wave”: Bahraini Women in Electoral Politics. Contemp. Arab Aff. 2021, 14, 79–104. [Google Scholar] [CrossRef]

- Young, K.E. The Political Economy of Energy, Finance, and Security in United Arab Emirates: Between the Majlis and the Market; Palgrave: Basingstoke, UK, 2014. [Google Scholar]

- Braunstein, J. Domestic Sources of Twenty-first century Geopolitics: Domestic Politics and Sovereign Wealth Funds in GCC Economies. New Political Econ. 2019, 24, 197–217. [Google Scholar] [CrossRef]

- Mogielnicki, R. A Political Economy of Free Zones in Gulf Arab States; Palgrave: London, UK, 2021. [Google Scholar]

- Ennis, C.A. The Gendered Complexities of Promoting Female Entrepreneurship in the Gulf. New Political Econ. 2019, 24, 365–384. [Google Scholar] [CrossRef] [Green Version]

- Hanieh, A. Money, Markets, and Monarchies: The Gulf Cooperation Council and the Political Economy of the Contemporary Middle East; Cambridge University Press: Cambridge, UK, 2018. [Google Scholar]

- Mirgani, S. Introduction: Art and Cultural Production in the GCC. J. Arab. Stud. 2017, 7, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Ennis, C.A. Reading entrepreneurial power in small Gulf states: Qatar and the UAE. Int. J. 2018, 73, 573–595. [Google Scholar] [CrossRef] [Green Version]

- Sim, L.-C. Re-branding Abu Dhabi: From oil giant to energy titan. Place Brand. Public Dipl. 2012, 8, 83–98. [Google Scholar] [CrossRef]

- Ardemagni, E. Gulf Monarchies’ Militarized Nationalism; Carnegie Endowment for International Peace: Washington, DC, USA, 2019. [Google Scholar]

- Gause, F.G. Kings for All Seasons: How the Middle East’s Monarchies Survived the Arab Spring; Brookings: Doha, Qatar, 2013. [Google Scholar]

- Sim, L.-C. Powering the Middle East and North Africa with Nuclear Energy: Stakeholders and Technopolitics. In Low Carbon Energy in the Middle East and North Africa; Mills, R., Sim, L.-C., Eds.; Palgrave: London, UK, 2021. [Google Scholar]

- Beblawi, H. The Rentier State in the Arab World. In The Rentier State; Beblawi, H., Luciani, G., Eds.; Croom Helm: London, UK, 1987. [Google Scholar]

- Luciani, G. Allocation vs. Production States: A Theoretical Framework. In The Rentier State; Beblawi, H., Luciani, G., Eds.; Croom Helms: London, UK, 1987. [Google Scholar]

- Tsai, I.-T.; Mezher, T. Rationalizing energy policy reforms in the gulf cooperation council: Implications from an institutional analysis. Energy Policy 2020, 142, 111545. [Google Scholar] [CrossRef]

- Krane, J. Political enablers of energy subsidy reform in Middle Eastern oil exporters. Nat. Energy 2018, 3, 547–552. [Google Scholar] [CrossRef]

- Hertog, S. Reforming Wealth Distribution in Kuwait: Estimating Costs and Impacts; London School of Economics and Political Science: London, UK, 2020. [Google Scholar]

- Arezki, R.; Nabli, M.K. Natural Resources, Volatility, and Inclusive Growth: Perspectives from the Middle East and North Africa; International Monetary Fund: Washington, DC, USA, 2012. [Google Scholar]

- Gray, M. A Theory of “Late Rentierism” in the Arab States of the Gulf; Center for International and Regional Studies, Georgetown University School of Foreign Service in Qatar: Doha, Qatar, 2011. [Google Scholar]

- AD. Global Medium Term Note Program: Supplement Dated 8 September 2021 to the Offering Circular Dated 28 May 2021; Abu Dhabi Department of Finance: Abu Dhabi, United Arab Emirates, 2021. [Google Scholar]

- Freer, C. The Symbiosis of Sectarianism, Authoritarianism, and Rentierism in the Saudi State. Stud. Ethn. Natl. 2019, 19, 88–108. [Google Scholar] [CrossRef] [Green Version]

- Lambert, L.A. Water, State Power, and Tribal Politics in the GCC: The Case of Kuwait and Abu Dhabi; Center for International and Regional Studies, Georgetown University School of Foreign Service in Qatar: Doha, Qatar, 2014. [Google Scholar]

- Hertog, S. Defying the Resource Curse: Explaining Successful State-Owned Enterprises in Rentier States. World Politics 2010, 62, 261–301. [Google Scholar] [CrossRef] [Green Version]

- Marcel, V. Oil Titans: National Oil Companies in the Middle East; Brookings Press/Chatham House: Washington, DC, USA, 2006. [Google Scholar]

- Crystal, J. Oil and Politics in the Gulf: Rulers and Merchants in Kuwait and Qatar; Cambridge University Press: Cambridge, UK, 1995. [Google Scholar]

- Hanieh, A. Capitalism and Class in the Gulf Arab States; Palgrave Macmillan: London, UK, 2011. [Google Scholar]

- Elbadawi, I.; Selim, H. Understanding and Avoiding the Oil Curse in Resource-rich Arab Economies; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar]

- Feierstein, G.M. Persian Gulf nations modernizing under new generation of leaders. The Hill, 13 December 2016. Available online: https://thehill.com/blogs/pundits-blog/international/310231-persian-gulf-nations-modernizing-under-new-generation-of/(accessed on 1 March 2023).

- Kinninmont, J. Future Trends in the Gulf; Chatham House: London, UK, 2015. [Google Scholar]

- Lawson, F.H.; Legrenzi, M. Repression and Monarchial Resilience in the Arab Gulf States. Int. Spect. 2017, 52, 76–87. [Google Scholar] [CrossRef]

- Fatafta, M. Transnational Digital Repression in the MENA Region; George Washington University: Washington, DC, USA, 2021. [Google Scholar]

- FH Saudi Arabia: Transnational Repression Case Study; Freedom House: Washington, DC, USA, 2021.

- Bischof, D.; Fink, S. Repression as a Double-Edged Sword: Resilient Monarchs, Repression and Revolution in the Arab World. Swiss Political Sci. Rev. 2015, 21, 377–395. [Google Scholar] [CrossRef]

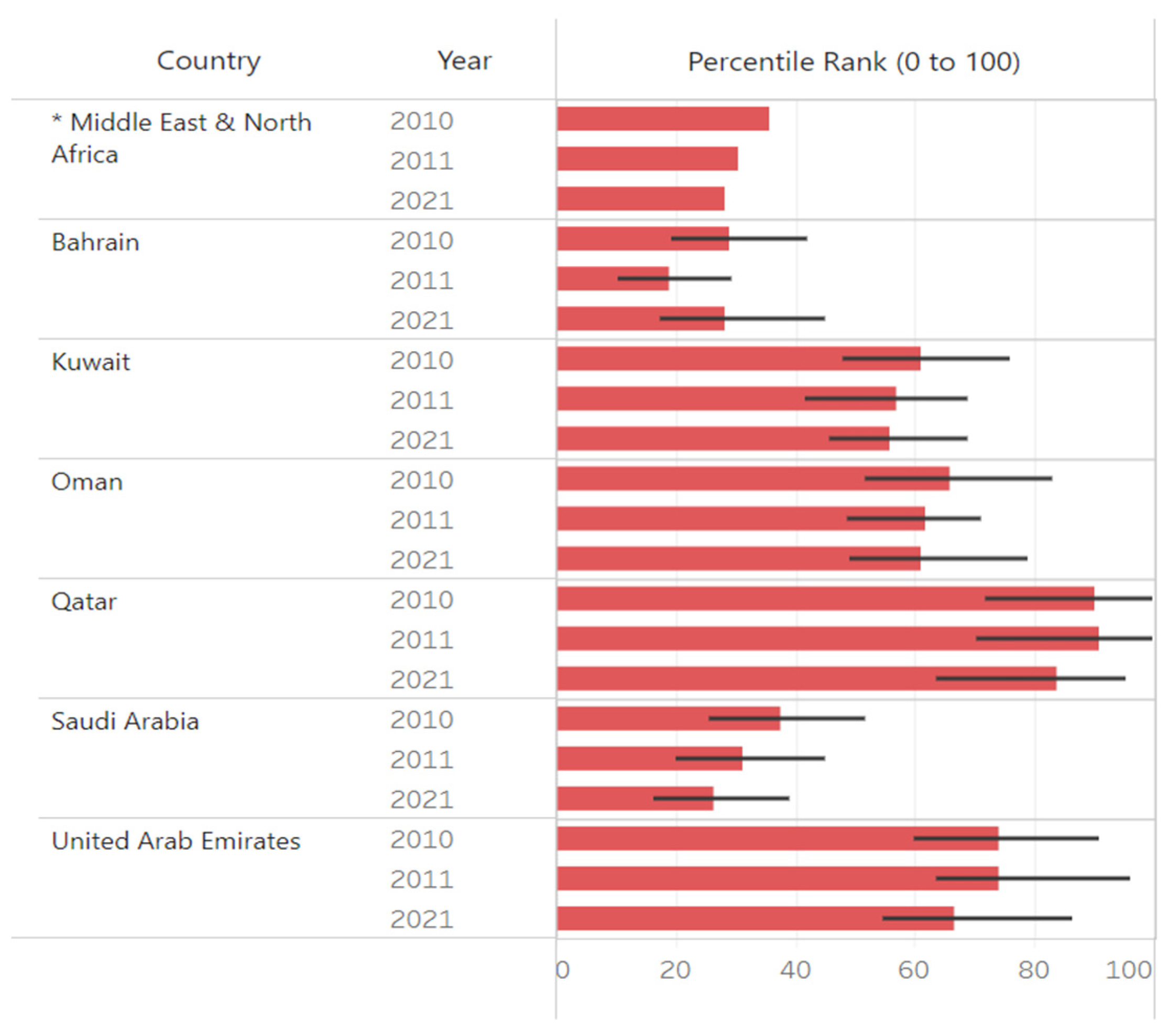

- WB. World Government Indicators—Government Effectiveness; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Brown, C. International Politics and the Middle East: Old Rules, Dangerous Game; I B Tauris: London, UK, 1984. [Google Scholar]

- Yom, S.L. Collaboration and Community amongst the Arab Monarchies; POMEPS memo; POMEPS: Washington, DC, USA, 2016. [Google Scholar]

- Zumbrägel, T.; Demmelhuber, T. Temptations of Autocracy: How Saudi Arabia Influences and Attracts Its Neighbourhood. J. Arab. Stud. 2020, 10, 51–71. [Google Scholar] [CrossRef]

- Schuetze, B. Promoting Democracy and Reinforcing Authoritarianism: US and European Policy in Jordan; Cambridge University Press: Cambridge, UK, 2019. [Google Scholar]

- Brownlee, J. Democracy Prevention: The Politics of the U.S.-Egyptian Alliance; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- SIPRI. Trends in World Military Expenditure 2019; Stockholm International Peace Research Institute: Stockholm, Sweden, 2020. [Google Scholar]

- Frost & Sullivan. Overview of Middle East Homeland Security Market. Frost Perspectives, 17 October 2017. Available online: https://www.frost.com/frost-perspectives/overview-of-middle-east-homeland-security-market/(accessed on 1 March 2023).

- Fulton, J.; Sim, L.-C. External Powers and the Gulf Monarchies; Routledge: Abingdon, UK, 2018. [Google Scholar]

- O’Rourke, R. Renewed Great Power Competition: Implications for Defense—Issues for Congress; Congressional Research Service: Washington, DC, USA, 2021. [Google Scholar]

- Chen, J.; Calhoun, K. Op-ed: Clean Energy Tipping Points. Rocky Mountain Institute Blog, 27 May 2020. Available online: https://rmi.org/op-ed-clean-energy-tipping-points/(accessed on 1 March 2023).

- Fattouh, B.; Poudineh, R.; West, R. The rise of renewables and energy transition: What adaptation strategy exists for oil companies and oil-exporting countries? Energy Transit. 2019, 3, 45–58. [Google Scholar] [CrossRef] [Green Version]

- IRENA. Global Renewables Outlook: Energy Transformation 2050; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- IEA. Net Zero by 2050: A Roadmap for the Global Energy Sector; International Energy Agency: Paris, France, 2021. [Google Scholar]

- BP. BP Statistical Review of World Energy; BP: London, UK, 2022. [Google Scholar]

- Atalay, Y.; Biermann, F.; Kalfagiann, A. Adoption of renewable energy technologies in oil-rich countries: Explaining policy variation in the Gulf Cooperation Council states. Renew. Energy 2016, 85, 206–214. [Google Scholar] [CrossRef]

- El-Katiri, L. Regional Electricity Cooperation in the GCC; Anwar Gargash Diplomatic Academy: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Apostoleris, H.; Al Ghaferi, A.; Chiesa, M. What is going on with Middle Eastern solar prices, and what does it mean for the rest of us? Prog. Photovolt. 2021, 29, 638–648. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Market Analysis: GCC 2019; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Sovacool, B.K.; Griffiths, S. The cultural barriers to a low-carbon future: A review of six mobility and energy transitions across 28 countries. Renew. Sustain. Energy Rev. 2020, 119, 109569. [Google Scholar] [CrossRef]

- Al-Saidi, M. From Economic to Extrinsic Values of Sustainable Energy: Prestige, Neo-Rentierism, and Geopolitics of the Energy Transition in the Arabian Peninsula. Energies 2020, 13, 5545. [Google Scholar] [CrossRef]

- Alliance, M.H. The Potential for Green Hydrogen in the GCC; Dii desert energy and Roland Berger: Dubai, United Arab Emirates, 2021; Available online: https://www.menaenergymeet.com/wp-content/uploads/the-potential-for-green-hydrogen-in-the-gcc-region.pdf (accessed on 1 March 2023).

- Griffiths, S. Bilateral Energy Diplomacy in a Time of Energy Transition; Emirates Diplomatic Academy: Abu Dhabi, United Arab Emirates, 2018. [Google Scholar]

- Weatherby, C.; Eyler, B. UAE Energy Diplomacy: Exporting Renewable Energy to the South; Stimson Center: Washington, DC, USA, 2018. [Google Scholar]

- Bianco, C. Power Play: Europe’s Climate Diplomacy in the Gulf; European Council on Foreign Relations: Berlin, Germany, 2021. [Google Scholar]

- Mahdavi, P.; Udin, N. Governance amidst the transition to renewable energy in the Middle East and North Africa. In Low Carbon Energy in the Middle East and North Africa; Mills, R., Sim, L.-C., Eds.; Palgrave: London, UK, 2021. [Google Scholar]

- Tsai, I.-T. Political economy of energy policy reforms in the Gulf Cooperation Council: Implications of paradigm change in the rentier social contract. Energy Res. Soc. Sci. 2018, 41, 89–96. [Google Scholar] [CrossRef]

- Sim, L.-C. Low-carbon energy in the Gulf: Upending the rentier state? Energy Res. Soc. Sci. 2020, 70, 101752. [Google Scholar] [CrossRef]

- IRENA. Renewable Capacity Statistics 2022; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- ESMAP. Global Photovoltaic Power Potential by Country; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- IRENA. Energy Profile: United Arab Emirates; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- Obeid, J. Energy Governance: Is the new meeting the old in Saudi Arabia’s energy industries? In Governance and Domestic Policy-Making in Saudi Arabia: Transforming Society, Economics, Politics and Culture; Thompson, M.C., Quilliam, N., Eds.; Bloomsbury: London, UK, 2022. [Google Scholar]

- Shaila, S.Z.; Al-Ashmawy, R.; Obeid, J. Leveraging Energy Storage Systems in MENA; Arab Petroleum Investments Corporation Dammam: Dammam, Saudi Arabia, 2021. [Google Scholar]

- IEA-PVPS. Trends in Photovoltaic Applications; International Energy Agency Photovoltaic Power Systems Program: Paris, France, 2020. [Google Scholar]

- Braunstein, J. Green Ambitions, Brown Realities: Making Sense of Renewable Investment Strategies in the Gulf; Harvard Kennedy School Belfer Center for International Affairs: Cambridge, MA, USA, 2020. [Google Scholar]

- WRI. Global Power Plant Database; Global Energy Observatory, Google, KTH Royal Institute of Technology in Stockholm, Enipedia; World Resources Institute: Washington, DC, USA, 2021. [Google Scholar]

- DEWA. DEWA Smart Grid Report 2022; Government of Dubai: Dubai, United Arab Emirates, 2022. [Google Scholar]

- Mills, R. Under a Cloud: The Future of Middle East Gas Demand; Center on Global Energy Policy, Columbia University: New York, NY, USA, 2020. [Google Scholar]

- Krupa, J.; Poudineh, R.; Harvey, L.D.D. Renewable electricity finance in the resource-rich countries of the Middle East and North Africa: A case study on the Gulf Cooperation Council. Energy 2019, 166, 1047–1062. [Google Scholar] [CrossRef]

- Lazard. Lazard’s Levelized Cost of Energy Analysis—Version 13.0; Lazard: Hamilton, Bermuda, 2019. [Google Scholar]

- Apostoleris, H.; Sgouridis, S.; Stefancich, M.; Chiesa, M. Evaluating the factors that led to low-priced solar electricity projects in the Middle East. Nat. Energy 2018, 3, 1109–1114. [Google Scholar] [CrossRef]

- Akhonbay, H.M. The Economics of Renewable Energy in the Gulf; Routledge: Abingdon, UK, 2019. [Google Scholar]

- WB. Rural population (% of total population). World Bank Open Data; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Eurostat. Eurostat Regional Yearbook; Eurostat: Luxembourg, 2020. [Google Scholar]

- Leiren, M.D.; Aakre, S.; Linnerud, K.; Julsrud, T.E.; Di Nuccia, M.-R.; Krug, M. Community Acceptance of Wind Energy Developments: Experience from Wind Energy Scarce Regions in Europe. Sustainability 2020, 12, 1754. [Google Scholar] [CrossRef] [Green Version]

- Gross, S. Renewables, Land Use, and Local Opposition in the United States; Brookings: Washington, DC, USA, 2020. [Google Scholar]

- Bremmer, I. The Return of State Capitalism. Survival 2008, 50, 55–64. [Google Scholar] [CrossRef]

- Jones, T.C. The Dogma of Development: Technopolitics and power in Saudi Arabia. In Saudi Arabia in Transition: Insights on Social, Political, Economic, and Religious Change; Haykel, B., Hegghammer, T., Lacroix, S., Eds.; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Scott, D. Author’s interview with Mr David Scott, Senior Director, Executive Affairs Authority Abu Dhabi. 21 November 2019. [Google Scholar]

- Al-Sulayman, F. The Obstacles Facing Renewables in the Gulf. Gulf Aff. 2016, 11, 9–11. [Google Scholar]

- GPP. Electricity prices. Available online: Globalpetrolprices.com (accessed on 17 November 2020).

- Schiffbauer, M.; Sy, A.; Hussain, S.; Sahnoun, H.; Keefer, P. Jobs or Privileges: Unleashing the Employment Potential of the Middle East and North Africa; The World Bank: Washington, DC, USA, 2015. [Google Scholar]

- FS. Energy and Water: Industry in Duabi; Frost & Sullivan: New York, NY, USA, 2017. [Google Scholar]

- Utilities ME. Mai Dubai solar installations produce more than 30 million kWh of power in 2020. Utilities Middle East, 11 February 2021. Available online: https://www.utilities-me.com/news/16769-mai-dubai-solar-installations-produce-more-than-30-million-kwh-of-power-in-2020#:~:text=Mai%20Dubai%2C%20the%20bottled%20water,only%2026%20million%20kWh%2C%20according(accessed on 1 March 2023).

- Woertz, E. The Energy Politics of the Middle East and North Africa (MENA). In The Oxford Handbook of Energy Politics; Hancock, K.J., Allison, J.E., Eds.; Oxford University Press: Oxford, UK, 2019. [Google Scholar]

- Workman, D. Electricity Exports by Country. Available online: http://www.worldstopexports.com/electricity-exports-country/ (accessed on 23 March 2023).

- EY. How to Capture the Sun: The Economics of Solar; EY Americas: Boston, MA, USA, 2018. [Google Scholar]

- PwC. Driving Value in Upstream Oil & Gas; PwC: London, UK, 2013. [Google Scholar]

- WB. Electric Power Transmission and Distribution Losses (% of Output); World Bank: Washington, DC, USA, 2014. [Google Scholar]

- Sgouridis, S.; Ali, M.; Sleptchenko, A.; Bouabid, A.; Ospina, G. Aluminum smelters in the energy transition: Optimal configuration and operation for renewable energy integration in high insolation regions. Renew. Energy 2021, 180, 937–953. [Google Scholar] [CrossRef]

- GPCA. GCC Chemical Industry to Sustain Region’s Non-Oil Economic Growth; Gulf Petrochemicals and Chemicals Association: Dubai, United Arab Emirates, 2017. [Google Scholar]

- Woertz, E. Bahrain’s Economy: Oil Prices, Economic Diversification, Saudi Support, and Political Uncertainties; CIDOB Barcelona Center for International Affairs: Barcelona, Spain, 2018. [Google Scholar]

- OBG. Aluminium production expands and exports grow in Bahrain despite imposition of US trade tariffs. In The Report: Bahrain 2019; Oxford Business Group: London, UK, 2019. [Google Scholar]

- Osman, O.; Sgouridis, S.; Sleptchenko, A. Scaling the production of renewable ammonia: A techno-economic optimization applied in regions with high insolation. J. Clean. Prod. 2020, 271, 121627. [Google Scholar] [CrossRef]

- Gandhi, K.; Apostoleris, H.; Sgouridis, S. Catching the hydrogen train: Economics-driven green hydrogen adoption potential in United Arab Emirates. Int. J. Hydrog. Energy 2022, 47, 22285–22301. [Google Scholar] [CrossRef]

- Eveloy, V.; Gebreegziabher, T. Excess electricity and power-to-gas storage potential in the future renewable-based power generation sector in United Arab Emirates. Energy 2019, 166, 426–450. [Google Scholar] [CrossRef]

- Salmon, N.; Bañares-Alcántara, R. Green ammonia as a spatial energy vector: A review. Sustain. Energy Fuels 2021, 5, 2814–2839. [Google Scholar] [CrossRef]

- Qamar Hydrogen in the GCC; Netherlands Enterprise Agency: The Hague, The Netherlands, 2020.

- Wogan, D.; Pradhan, S.; Albardi, S. GCC Energy System Overview—2017; The King Abdullah Petroleum Studies and Research Center: Riyadh, Saudi Arabia, 2017. [Google Scholar]

- KT. Saudi plans renewables strategy with eye on oil export. Khaleej Times, 14 January 2020. Available online: https://www.khaleejtimes.com/energy/saudi-plans-renewables-strategy-with-eye-on-oil-export(accessed on 1 March 2023).

- Ritchie, H.; Roser, M. CO2 and Greenhouse Gas Emissions. OurWorldInData.org. Available online: https://ourworldindata.org/co2-and-greenhouse-gas-emissions (accessed on 1 March 2023).

- Griffin, P. The Carbon Majors Database; Carbon Disclosure Project (CDP): London, UK, 2017. [Google Scholar]

- Luomi, M. Climate change policy in the Arab region. In Low Carbon Energy in the Middle East and North Africa; Mills, R., Sim, L.-C., Eds.; Palgrave: Cham, Switzerland, 2021; pp. 299–332. [Google Scholar]

- Apostoleris, H.; Sgouridis, S.; Stefancich, M.; Chiesa, M. Utility solar prices will continue to drop all over the world even without subsidies. Nat. Energy 2019, 4, 833–834. [Google Scholar] [CrossRef] [Green Version]

- Zadek, S.; Flynn, C. South-Originating Green Finance: Exploring the Potential; Geneva International Finance Dialogues: Geneva, Switzerland, 2013. [Google Scholar]

- Fardoust, S. Managing High Oil Prices and Recycling Petrodollars; Carnegie Endowment for International Peace: Washington, DC, USA, 2012. [Google Scholar]

- Busch, J. Climate Change and Development in Three Charts. Center for Global Development Blog, 18 August 2015. [Google Scholar]

- IEA. Financing Clean Energy Transitions in Emerging and Developing Economies; Internaitonal Energy Agency: Paris, France, 2021. [Google Scholar]

- Greenpeace. Saudi Arabian negotiators move to cripple COP26—Greenpeace Response; Greenpeace International Press: Amsterdam, The Netherlands, 2021. [Google Scholar]

- Ottaway, D. Saudi Arabia’s Green Initiative Aims to Exonerate Fossil Fuel Advocacy. Viewpoints. 2021. Available online: https://www.wilsoncenter.org/article/saudi-arabias-green-initiative-aims-exonerate-fossil-fuel-advocacy (accessed on 1 March 2023).

- Elgendy, K. On the bandwagon to Glasgow: Climate action in the MENA region. Al Jazeera, 29 October 2021. [Google Scholar]

- WEC. World Energy Issues Monitor; World Energy Council: London, UK, 2021. [Google Scholar]

- General Electric. Pathways to Faster Decarbonization in the GCC’s Power Sector; General Electric: Boston, MA, USA, 2021. [Google Scholar]

- Benali, L.R.; Al-Ashmawy, R.; Shatila, S.Z. MENA Energy Investment Outlook 2021–2025; Arab Petroleum Investments Corporation: Dammam, Saudi Arabia, 2020. [Google Scholar]

- Bahgat, G. The Changing Saudi Energy Outlook: Strategic Implications. Middle East J. 2013, 67, 565–579. [Google Scholar] [CrossRef]

- CEBC Energy Efficiency in MENA: Status and Outlook; Clean Energy Business Council: Abu Dhabi, United Arab Emirates, 2021.

- Young, K.E. Federal benefits: How federalism encourages economic diversification in United Arab Emirates. In Oil and the Political Economy in the Middle East: Post-2014 Adjustment Policies of the Arab Gulf and Beyond; Beck, M., Richter, T., Eds.; Manchester University Press: Manchester, UK, 2021. [Google Scholar]

- Al-Saidi, M.; Zaidan, E.; Hammad, S. Participation modes and diplomacy of Gulf Cooperation Council (GCC) countries towards the global sustainability agenda. Dev. Pract. 29 2019, 29, 545–558. [Google Scholar] [CrossRef]

- Soubrier, E. Evolving foreign and security policies: A comparative study of Qatar and United Arab Emirates. In The Small Gulf States: Foreign and Security policies before and after the Arab Spring; Almezaini, K., Rickli, J.-M., Eds.; Routledge: London, UK, 2017. [Google Scholar]

- Clausen, M.-L. Saudi Arabian military activism in Yemen: Interactions between the domestic and the systemic level. POMEPS 2019, 34, 76–80. [Google Scholar]

- Zumbrägel, T. Sustaining Power after Oil: Environmental Politics and Legitimacy in Qatar, Saudi Arabia and Kuwait; Friedrich-Alexander University Erlangen-Nuremberg (FAU): Erlangen, Germany, 2020. [Google Scholar]

- Pinto, V.C. From “Follower” to “Role Model”: The Transformation to the UAE’s International Self-Image. J. Arab. Stud. 2014, 4, 231–243. [Google Scholar] [CrossRef]

- Gygli, S.; Haelg, F.; Potrafke, N.; Sturm, J.-E. The KOF Globalisation Index—Revisited. Rev. Int. Organ. 2019, 14, 543–574. [Google Scholar] [CrossRef] [Green Version]

- WB. Trade as % of GDP; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Van de Graaf, T. Battling for a Shrinking Market: Oil producers, the renewables revolution, and the risk of stranded assets. In The Geopolitics of Renewables; Scholten, D., Ed.; Springer: New York, NY, USA, 2018. [Google Scholar]

- Smith Stegen, K. Redrawing the Geopolitical Map: International Relations and Renewable Energies. In The Geopolitics of Renewables; Scholten, D., Ed.; Springer: New York, NY, USA, 2018. [Google Scholar]

- Overland, I.; Bazilian, M.; Uulu, T.I.; Vakulchuk, R.; Westphal, K. The GeGaLo index: Geopolitical gains and losses after energy transition. Energy Strategy Rev. 2019, 26, 100406. [Google Scholar] [CrossRef]

- Manley, D.; Heller, P. Risky Bet: National Oil Companies in the Energy Transition; National Resource Governance Institute: New York, NY, USA, 2021. [Google Scholar]

| Country | Overall Target |

|---|---|

| Bahrain a | 5% by 2025 10% by 2035 |

| Kuwait | 15% by 2030 |

| Oman | 10% by 2025 |

| Qatar | 20% by 2030 |

| Saudi Arabia a | 10% by 2025 50% by 2030 |

| UAE a Abu Dhabi Dubai | 44% by 2050 b 55% by 2025 b 75% by 2050 c |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sim, L.-C. Renewable Energy and Governance Resilience in the Gulf. Energies 2023, 16, 3225. https://doi.org/10.3390/en16073225

Sim L-C. Renewable Energy and Governance Resilience in the Gulf. Energies. 2023; 16(7):3225. https://doi.org/10.3390/en16073225

Chicago/Turabian StyleSim, Li-Chen. 2023. "Renewable Energy and Governance Resilience in the Gulf" Energies 16, no. 7: 3225. https://doi.org/10.3390/en16073225

APA StyleSim, L.-C. (2023). Renewable Energy and Governance Resilience in the Gulf. Energies, 16(7), 3225. https://doi.org/10.3390/en16073225