Optimal Sizing and Operation of Hybrid Renewable Power Plants Participating in Coupled Power Markets with Different Execution Times

Abstract

:1. Introduction

- Optimization model to size resources, maximizing the net present value and adjusting to the maximum investment as a constraint (even not spending the entire budget in some cases), to find highly attractive and realistic investments;

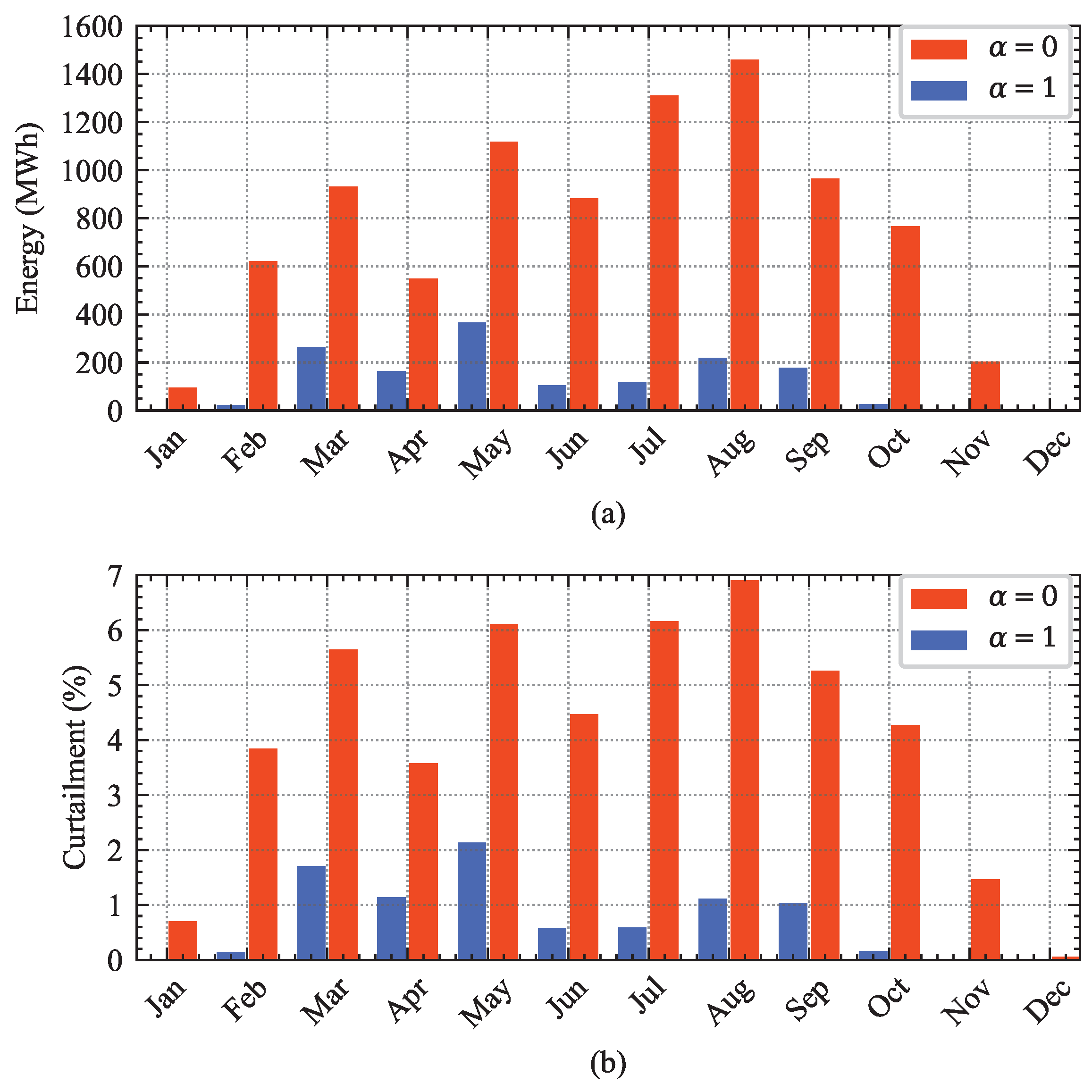

- Reduction of curtailment that occurs due to oversizing with a penalty term for lost energy, encouraging investment in storage;

- Evaluate all resources at the same level to maximize the benefit, considering availability, market prices and installation costs, choosing the best option based on the input parameters;

- Modeling and integration of participation in different time-coupled markets (hourly and fifteen minutes), with the possibility of incorporating ancillary services market;

- Consideration of the number of daily charge and discharge cycles of storage in the optimization model, taking care of the valuable life for real results.

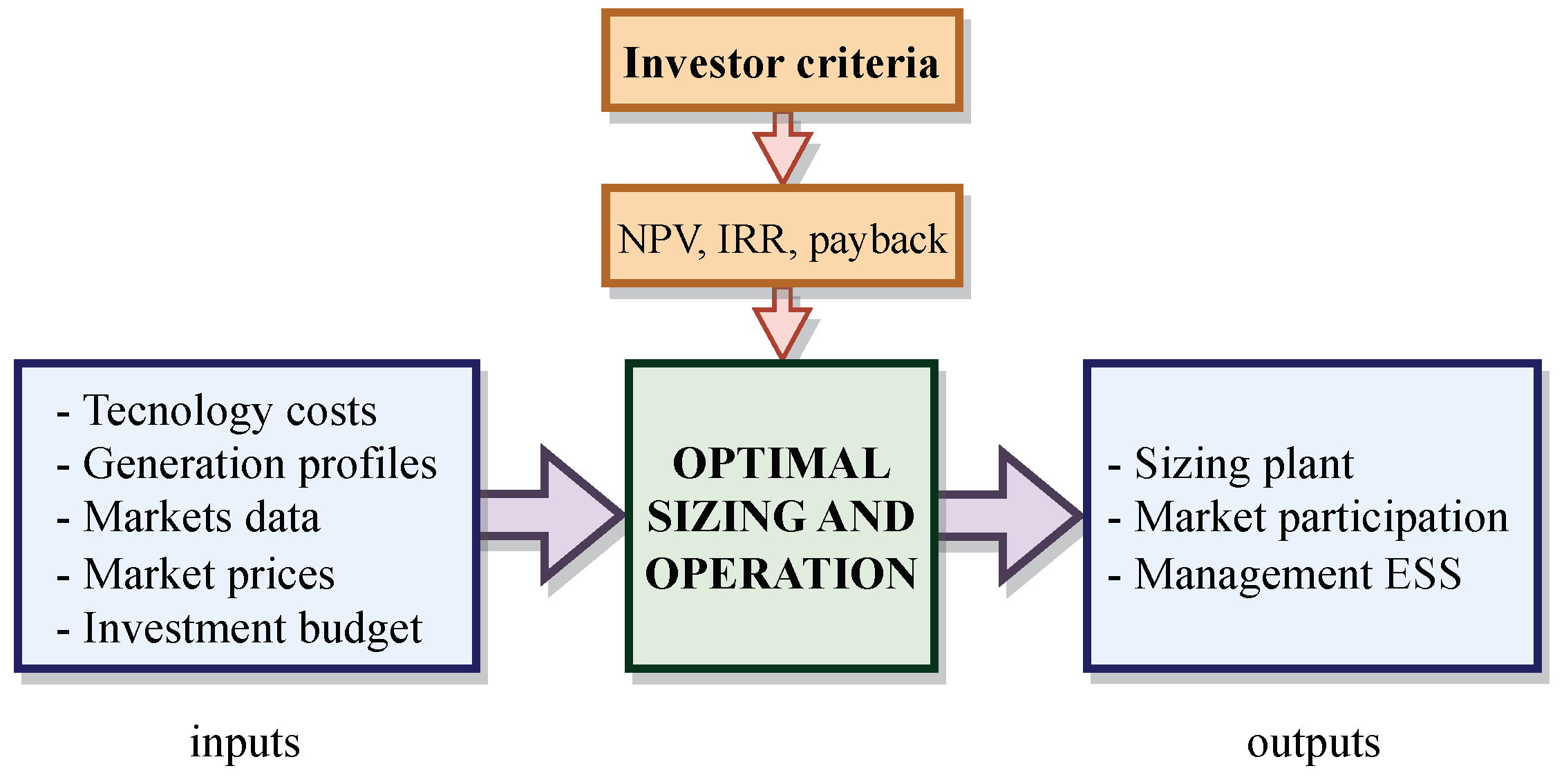

2. Method

2.1. Objective Functions

2.1.1. Operation

2.1.2. Sizing

2.2. Problem Constraints

3. Test Case

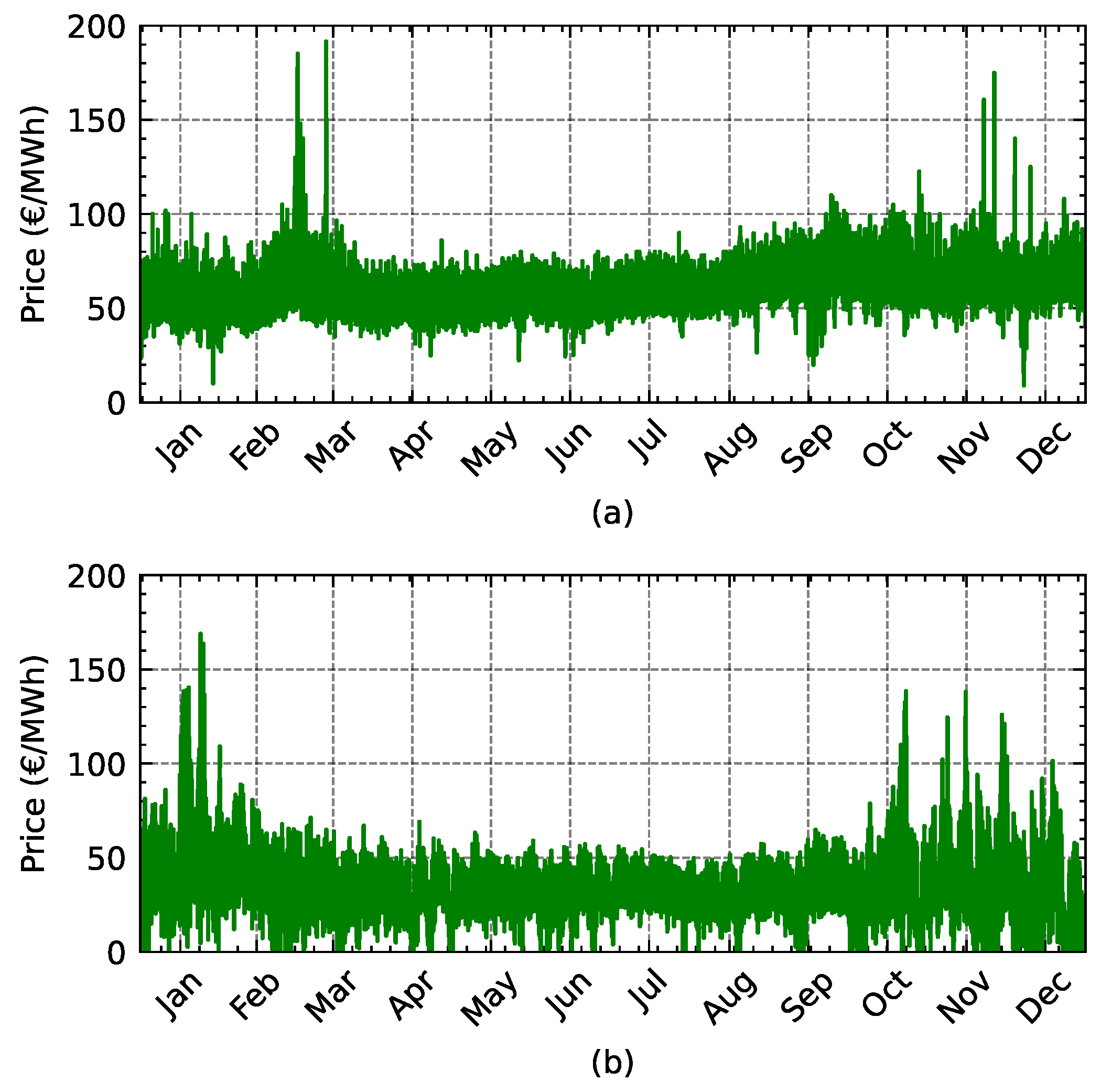

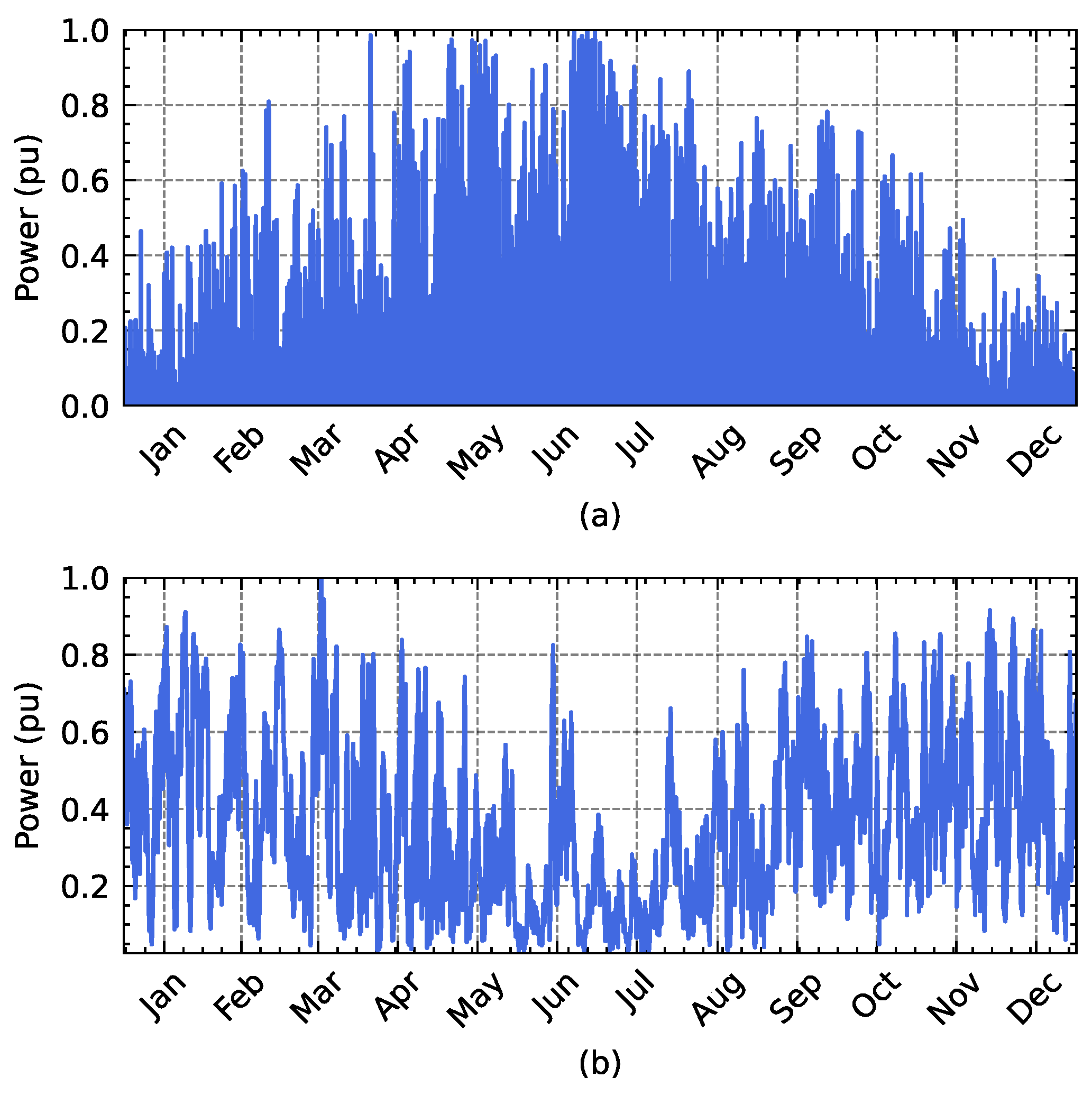

3.1. Scenario A

3.2. Scenario B

3.3. Scenario C

4. Simulations and Results

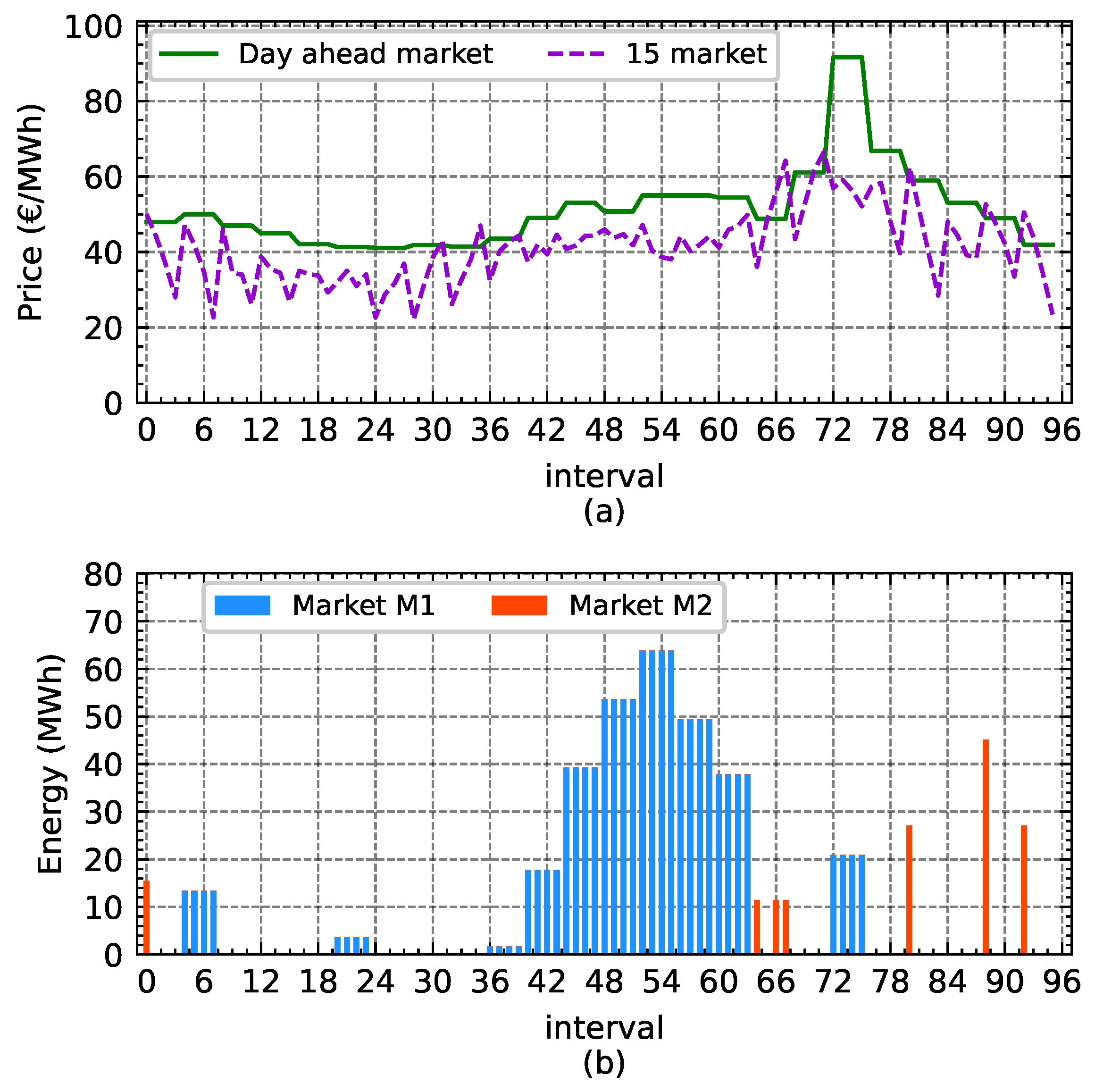

4.1. Scenario A

4.2. Scenario B

4.3. Scenario C

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IEA. World Energy Outlook 2019. 2019. Available online: https://www.iea.org/reports/world-energy-outlook-2019 (accessed on 15 December 2022).

- Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from reneWable Sources. Off. J. Eur. Union. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L2001&from=EN (accessed on 15 December 2022).

- Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on Energy Efficiency. Off. J. Eur. Union. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2012:315:0001:0056:en:PDF (accessed on 15 December 2022).

- IRENA. Renewable Energy Finance: Institutional Capital; Renewable Energy Finance Brief 02; IRENA: Abu Dhabi, United Arab Emirates, 2020; pp. 1–11. [Google Scholar]

- Ralon, P.; Taylor, M.; Ilas, A.; Diaz-Bone, H.; Kairies, K. Electricity Storage and Renewables: Costs and Markets to 2030. International Renewable Energy Agency (Issue October). 2017. Available online: http://irena.org/publications/2017/Oct/Electricity-storage-and-renewables-costs-and-markets (accessed on 15 December 2022).

- International Energy Agency. The Future of Hydrogen: Seizing Today’s Opportunities; IEA Publications: Paris, France, 2019. [Google Scholar]

- Abbas, J.; Wang, L.; Ben Belgacem, S.; Pawar, P.S.; Najam, H.; Abbas, J. Investment in renewable energy and electricity output: Role of green finance, environmental tax, and geopolitical risk: Empirical evidence from China. Energy 2023, 269, 126683. [Google Scholar] [CrossRef]

- Siddik, A.B.; Khan, S.; Khan, U.; Yong, L.; Murshed, M. The role of renewable energy finance in achieving low-carbon growth: Contextual evidence from leading renewable energy-investing countries. Energy 2023, 270, 126864. [Google Scholar] [CrossRef]

- He, X.; Khan, S.; Ozturk, I.; Murshed, M. The role of renewable energy investment in tackling climate change concerns: Environmental policies for achieving SDG-13. Sustain. Dev. 2023. [Google Scholar] [CrossRef]

- Root, C.; Presume, H.; Proudfoot, D.; Willis, L.; Masiello, R. Using battery energy storage to reduce renewable resource curtailment. In Proceedings of the 2017 IEEE Power and Energy Society Innovative Smart Grid Technologies Conference, ISGT 2017, Arlington, VA, USA, 23–26 April 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Dimopoulou, S.; Oppermann, A.; Boggasch, E.; Rausch, A. A Markov Decision Process for managing a Hybrid Energy Storage System. J. Energy Storage 2018, 19, 160–169. [Google Scholar] [CrossRef]

- Dykes, K.; King, J.; Diorio, N.; King, R.; Gevorgian, V.; Corbus, D.; Blair, N.; Anderson, K.; Stark, G.; Turchi, C.; et al. Opportunities for Research and Development of Hybrid Power Plants. May 2020. Available online: https://www.nrel.gov/docs/fy20osti/75026.pdf (accessed on 15 December 2022).

- Terlouw, T.; AlSkaif, T.; Bauer, C. Techno-Economic Assessment of PV-Coupled Battery Energy Storage Systems with Different Sizing Methodologies. In Proceedings of the 2021 IEEE Madrid PowerTech, Madrid, Spain, 28 June–2 July 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Kelly, J.J.; Leahy, P.G. Sizing Battery Energy Storage Systems: Using Multi-Objective Optimization to Overcome the Investment Scale Problem of Annual Worth. IEEE Trans. Sustain. Energy 2019, 11, 2305–2314. [Google Scholar] [CrossRef]

- Martinez-Rico, J.; de Argandona, I.R.; Zulueta, E.; Fernandez-Gamiz, U.; Armendia, M. Energy Storage Sizing Based on Automatic Frequency Restoration Reserve Market Participation of Hybrid Renewable Power Plants. In Proceedings of the 2021 International Conference on Smart Energy Systems and Technologies (SEST), Vaasa, Finland, 6–8 September 2021; pp. 1–6. [Google Scholar] [CrossRef]

- García-Santacruz, C.; Galván, L.; Carrasco, J.M.; Galván, E. Sizing and Management of Energy Storage Systems in Large-Scale Power Plants Using Price Control and Artificial Intelligence. Energies 2021, 14, 3296. [Google Scholar] [CrossRef]

- Nuvvula, R.S.S.; Elangovan, D.; Teegala, K.S.; Madurai Elavarasan, R.; Islam, M.R.; Inapakurthi, R. Optimal Sizing of Battery-Integrated Hybrid Renewable Energy Sources with Ramp Rate Limitations on a Grid Using ALA-QPSO. Energies 2021, 14, 5368. [Google Scholar] [CrossRef]

- Xia, Q.; Debnath, S.; Saeedifard, M.; Marthi, P.R.V.; Arifujjaman, M. Energy Storage Sizing and Operation of an Integrated Utility-Scale PV+ESS Power Plant. In Proceedings of the 2020 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 17–20 February 2020; pp. 1–5. [Google Scholar] [CrossRef]

- Yao, M.; Cai, X. Energy Storage Sizing Optimization for Large-Scale PV Power Plant. IEEE Access 2021, 9, 75599–75607. [Google Scholar] [CrossRef]

- Shu, Z.; Jirutitijaroen, P. Optimal Operation Strategy of Energy Storage System for Grid-Connected Wind Power Plants. IEEE Trans. Sustain. Energy 2013, 5, 190–199. [Google Scholar] [CrossRef]

- Parashar, S.; Swarnkar, A.; Niazi, K.R.; Gupta, N. Multiobjective optimal sizing of battery energy storage in grid-connected microgrid. J. Eng. 2019, 2019, 5280–5283. [Google Scholar] [CrossRef]

- Krishnamurthy, D.; Uckun, C.; Zhou, Z.; Thimmapuram, P.R.; Botterud, A. Energy Storage Arbitrage Under Day-Ahead and Real-Time Price Uncertainty. IEEE Trans. Power Syst. 2018, 33, 84–93. [Google Scholar] [CrossRef]

- Al-Shereiqi, A.; Al-Hinai, A.; Albadi, M.; Al-Abri, R. Optimal Sizing of Hybrid Wind-Solar Power Systems to Suppress Output Fluctuation. Energies 2021, 14, 5377. [Google Scholar] [CrossRef]

- Klansupar, C.; Chaitusaney, S. Optimal Sizing of Utility-scaled Battery with Consideration of Battery Installtion Cost and System Power Generation Cost. In Proceedings of the 2020 17th International Conference on Electrical Engineering/Electronics, Computer, Telecommunications and Information Technology (ECTI-CON), Phuket, Thailand, 24–27 June 2020; pp. 498–501. [Google Scholar] [CrossRef]

- Khan, M.F.; Pervez, A.; Modibbo, U.M.; Chauhan, J.; Ali, I. Flexible Fuzzy Goal Programming Approach in Optimal Mix of Power Generation for Socio-Economic Sustainability: A Case Study. Sustainability 2021, 13, 8256. [Google Scholar] [CrossRef]

- Zhao, L.; Zhang, T.; Peng, X.; Zhang, X. A novel long-term power forecasting based smart grid hybrid energy storage system optimal sizing method considering uncertainties. Inf. Sci. 2022, 610, 326–344. [Google Scholar] [CrossRef]

- Remon, D.; Cantarellas, A.M.; Martinez-Garcia, J.; Escano, J.M.; Rodriguez, P. Hybrid solar plant with synchronous power controllers contribution to power system stability. In Proceedings of the 2017 IEEE Energy Conversion Congress and Exposition (ECCE), Cincinnati, OH, USA, 1–5 October 2017; pp. 4069–4076. [Google Scholar] [CrossRef]

- Abdeltawab, H.; Mohamed, Y.A.-R.I. Energy Storage Planning for Profitability Maximization by Power Trading and Ancillary Services Participation. IEEE Syst. J. 2021, 16, 1909–1920. [Google Scholar] [CrossRef]

- Bera, A.; Chalamala, B.R.; Byrne, R.H.; Mitra, J. Sizing of Energy Storage for Grid Inertial Support in Presence of Renewable Energy. IEEE Trans. Power Syst. 2021, 37, 3769–3778. [Google Scholar] [CrossRef]

- Siface, D. Optimal Economical and Technical Sizing Tool for Battery Energy Storage Systems Supplying Simultaneous Services to the Power System. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Chiang, M.-Y.; Huang, S.-C.; Hsiao, T.-C.; Zhan, T.-S.; Hou, J.-C. Optimal Sizing and Location of Photovoltaic Generation and Energy Storage Systems in an Unbalanced Distribution System. Energies 2022, 15, 6682. [Google Scholar] [CrossRef]

- Chowdhury, T.; Hasan, S.; Chowdhury, H.; Hasnat, A.; Rashedi, A.; Asyraf, M.R.M.; Hassan, M.Z.; Sait, S.M. Sizing of an Island Standalone Hybrid System Considering Economic and Environmental Parameters: A Case Study. Energies 2022, 15, 5940. [Google Scholar] [CrossRef]

- Li, X.; Jones, G. Optimal Sizing, Location, and Assignment of Photovoltaic Distributed Generators with an Energy Storage System for Islanded Microgrids. Energies 2022, 15, 6630. [Google Scholar] [CrossRef]

- Alsagri, A.S.; Alrobaian, A.A. Optimization of Combined Heat and Power Systems by Meta-Heuristic Algorithms: An Overview. Energies 2022, 15, 5977. [Google Scholar] [CrossRef]

- Open Power System Data. A Free Open Data Platform for Power System Modeling. Available online: https://data.open-power-system-data.org/ (accessed on 20 January 2023).

- The European Commission’s Science and Knowledge Service. Photovoltaic Geographical Information System (PVGIS). Available online: ec.europa.eu/jrc/en/pvgis (accessed on 20 January 2023).

| Sets | Selling price on the market hourly market M1 (EUR/MWh). | ||

| D | Set of D days of a year, . | Selling price on the 15-min market M2 (EUR/MWh). | |

| H | Set of H hours of a day, . | Weight factor related to the to penalization of curtailment. | |

| T | Set of T intervals of an hour, . | Limit of the point of connection (MWh). | |

| Parameters | Variables | ||

| Installation cost for photovoltaic energy generation (EUR/MW). | Maximum installed capacity for photovoltaic energy resource (MW). | ||

| Installation cost for wind generation (EUR/MW). | Maximum installed capacity for wind resource (MW). | ||

| Installation cost for ESS generation (EUR/MWh). | Maximum installed capacity for ESS (MWh). | ||

| Internal load in day d, hour h and period t (MW). | Power injection by photovoltaic energy generation in interval t of hour h and day d (MWh). | ||

| Generation profile for photovoltaic energy in day d, hour h and period t (pu). | Power injection by wind generation in interval t of hour h and day d (MWh). | ||

| Generation profile for wind in day d, hour h and period t (pu). | Energy sold on market M1 in the interval t of hour h and day d (MWh). | ||

| N | Number of charge and discharge cycles. | Energy sold on market M2 in the interval t of hour h and day d (MWh). | |

| Maximum energy charged by battery in interval t of hour h and day d (MWh). | Energy charged by battery in interval t of hour h and day d (MWh). | ||

| Maximum energy discharged by battery in interval t of hour h and day d (MWh). | Energy discharged by battery in interval t of hour h and day d (MWh). | ||

| Minimum and maximum state of charge of storage. | Energy stored in the battery in interval t of hour h and day d (MWh). | ||

| Battery charge efficiency. | Binary | ||

| Battery discharge efficiency. | Binary variable to indicate the sale of energy on markets M1 and M2. | ||

| Total investment in assets in millions of euros (MEUR). | Binary variable to indicate the purchase of energy. | ||

| Binary variable to indicate the charge of battery. | |||

| Binary variable to indicate the discharge of battery. |

| Cost | Value |

|---|---|

| PV energy generation costs | 550,000 EUR/MW |

| Wind energy generation costs | 1,200,000 EUR/MW |

| Battery cost | 300,000 EUR/MWh |

| Month | PV (MW) | Wind (MW) | ESS (MWh) | NPV (EUR) | IRR (%) | Investment |

|---|---|---|---|---|---|---|

| January | 0 | 60 | 0 | 87,888,550 | 15.2 | 72 MEUR |

| February | 0 | 60 | 0 | 61,097,001 | 11.6 | 72 MEUR |

| March | 50.91 | 60 | 0 | 128,773,250 | 15.8 | 100 MEUR |

| April | 50.91 | 60 | 0 | 61,048,578 | 9.2 | 100 MEUR |

| May | 141.41 | 0 | 74.04 | 118,245,445 | 14.6 | 100 MEUR |

| June | 167.50 | 0 | 26.24 | 121,558,100 | 15.2 | 100 MEUR |

| July | 151.59 | 0 | 55.43 | 160,512,939 | 18.7 | 100 MEUR |

| August | 166.43 | 6.08 | 3.91 | 109,994,630 | 14.1 | 100 MEUR |

| September | 50.91 | 60 | 0 | 138,465,872 | 16.7 | 100 MEUR |

| October | 50.91 | 60 | 0 | 103,139,340 | 13.4 | 100 MEUR |

| November | 0 | 60 | 0 | 125,544,887 | 19.9 | 72 MEUR |

| December | 0 | 60 | 0 | 129,307,840 | 20.4 | 72 MEUR |

| Season | PV Size (MW) | ESS Size (MWh) | NPV (EUR) | IRR (%) |

|---|---|---|---|---|

| Winter | 133.60 | 88.39 | 233,110,096 | 14.6 |

| Spring | 130.17 | 94.70 | 315,173,776 | 18.4 |

| Summer | 131.15 | 92.88 | 335,398,839 | 19.3 |

| Autumn | 133.04 | 89.34 | 166,560,782 | 11.4 |

| Day | Without M2 (EUR) | With M2 (EUR) | Improve (%) |

|---|---|---|---|

| 1 | 18,359.97 | 18,853.13 | 2.61 |

| 181 | 47,283.94 | 47,622.34 | 0.71 |

| 295 | 21,544.82 | 34,219.59 | 37.04 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Santacruz, C.; Alcántara, A.; Carrasco, J.M.; Galván, E. Optimal Sizing and Operation of Hybrid Renewable Power Plants Participating in Coupled Power Markets with Different Execution Times. Energies 2023, 16, 3432. https://doi.org/10.3390/en16083432

García-Santacruz C, Alcántara A, Carrasco JM, Galván E. Optimal Sizing and Operation of Hybrid Renewable Power Plants Participating in Coupled Power Markets with Different Execution Times. Energies. 2023; 16(8):3432. https://doi.org/10.3390/en16083432

Chicago/Turabian StyleGarcía-Santacruz, Carlos, Andrés Alcántara, Juan M. Carrasco, and Eduardo Galván. 2023. "Optimal Sizing and Operation of Hybrid Renewable Power Plants Participating in Coupled Power Markets with Different Execution Times" Energies 16, no. 8: 3432. https://doi.org/10.3390/en16083432