Lithium Supply Chain Optimization: A Global Analysis of Critical Minerals for Batteries

Abstract

:1. Introduction

1.1. Critical Minerals and Lithium

1.2. Benefits of Electric Vehicles

1.3. Framework and Case Study Overview

2. Case Study Background

2.1. Energy Storage Technologies

2.1.1. Lithium-Ion

2.1.2. Lithium Anode and Solid State Batteries

2.1.3. Alternative Non-Lithium Chemistry Limitations

2.2. Lithium Supply Chain

2.2.1. Lithium Mining and Extraction

2.2.2. Lithium Processing

2.2.3. Component Production

2.2.4. Cell Production

2.2.5. Pack Production

2.2.6. Recycling

2.3. Battery Metrics

2.4. Lithium Supply Chain Modeling

3. Methods

3.1. Mathematical Formulation

3.1.1. Sets

| Major Set | Stages |

| s ∊ S: mine, proc, cath, cell, pack, rec | Stages |

| Major Set | Technology |

| t ∊ T: , , , , , | Technology |

| Extraction Technologies | |

| Processing Technologies | |

| Cathode Technologies | |

| Cell Production Technologies | |

| Pack Production Technologies | |

| Recycling Technologies | |

| Input Technologies | |

| Output Technologies |

3.1.2. Decision Variables

3.1.3. Parameters

Demand Parameters

Miscellaneous Parameters

Cost Parameters

Emission Parameters

3.1.4. Objective Function

3.1.5. Constraints

Demand Constraints

Capacity Constraints

4. Results

4.1. Cost Objective Scenario

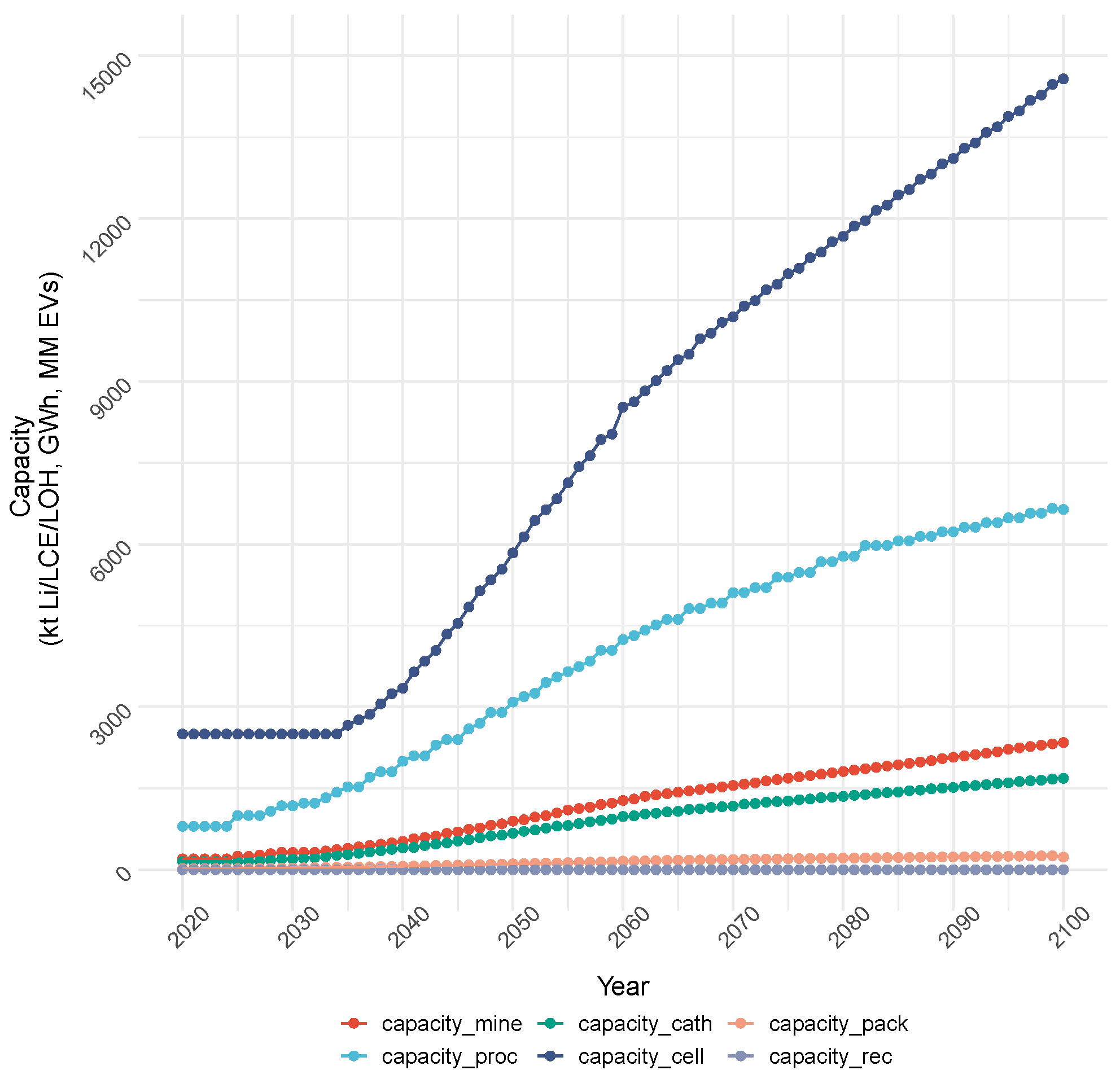

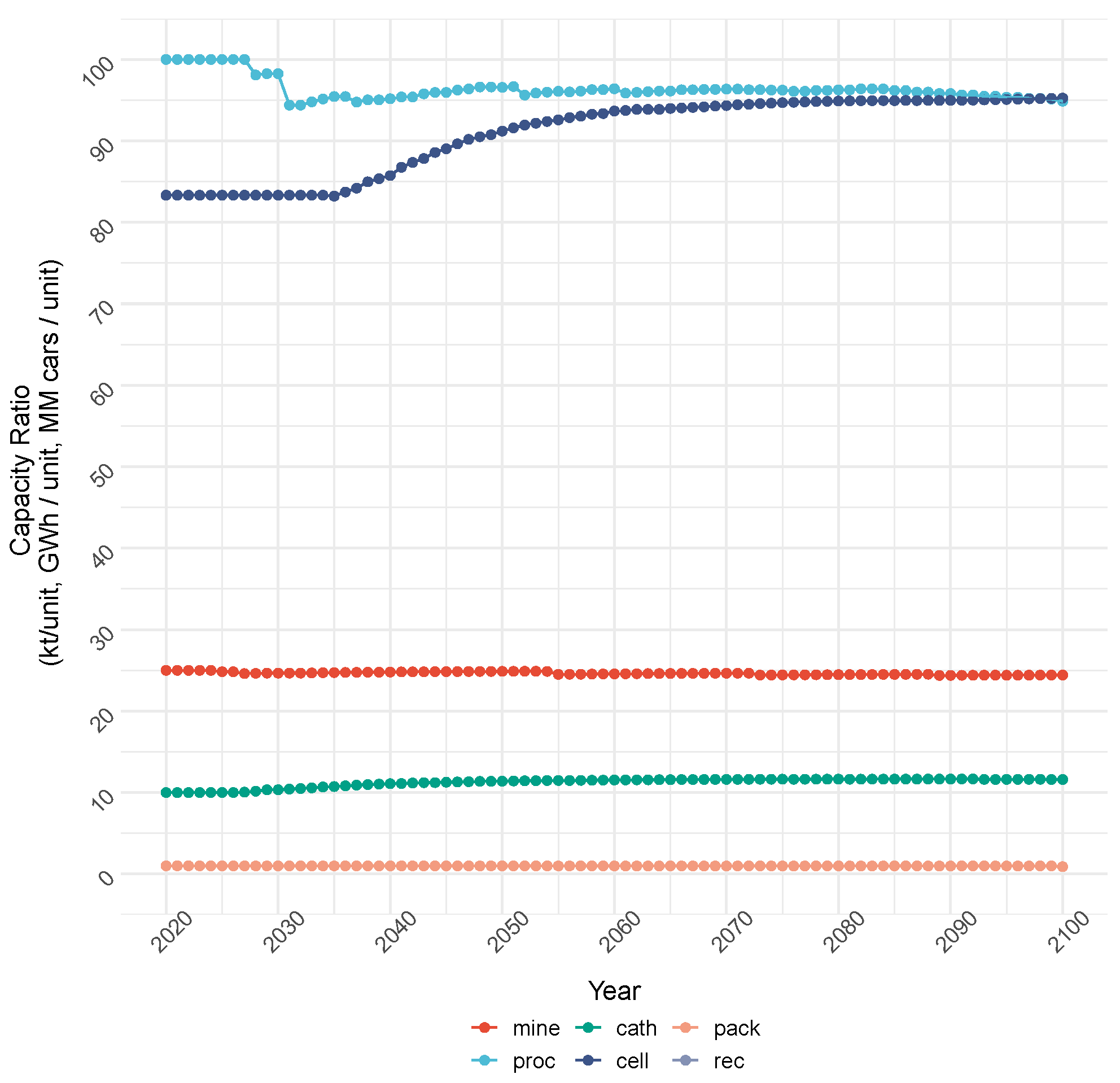

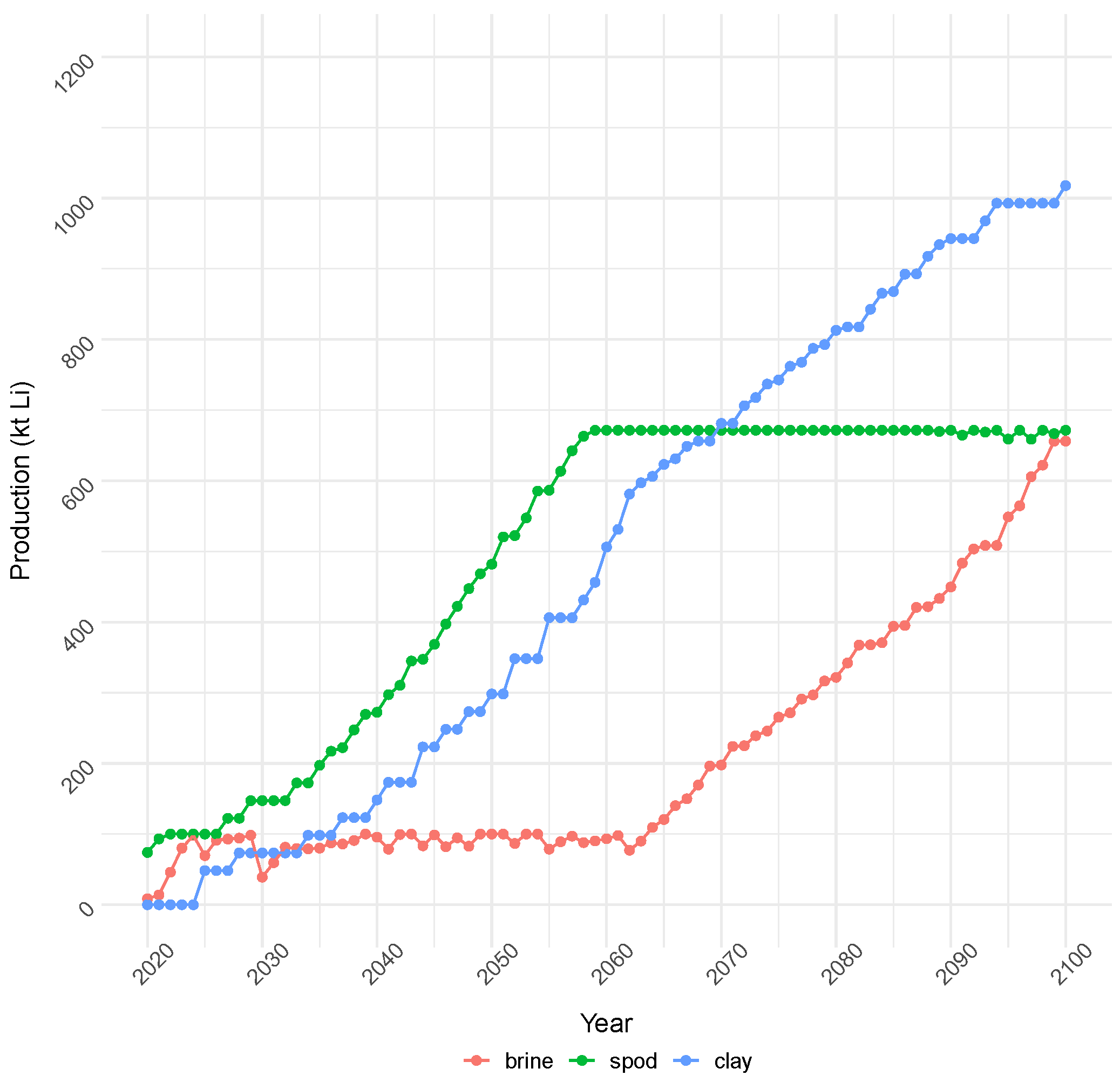

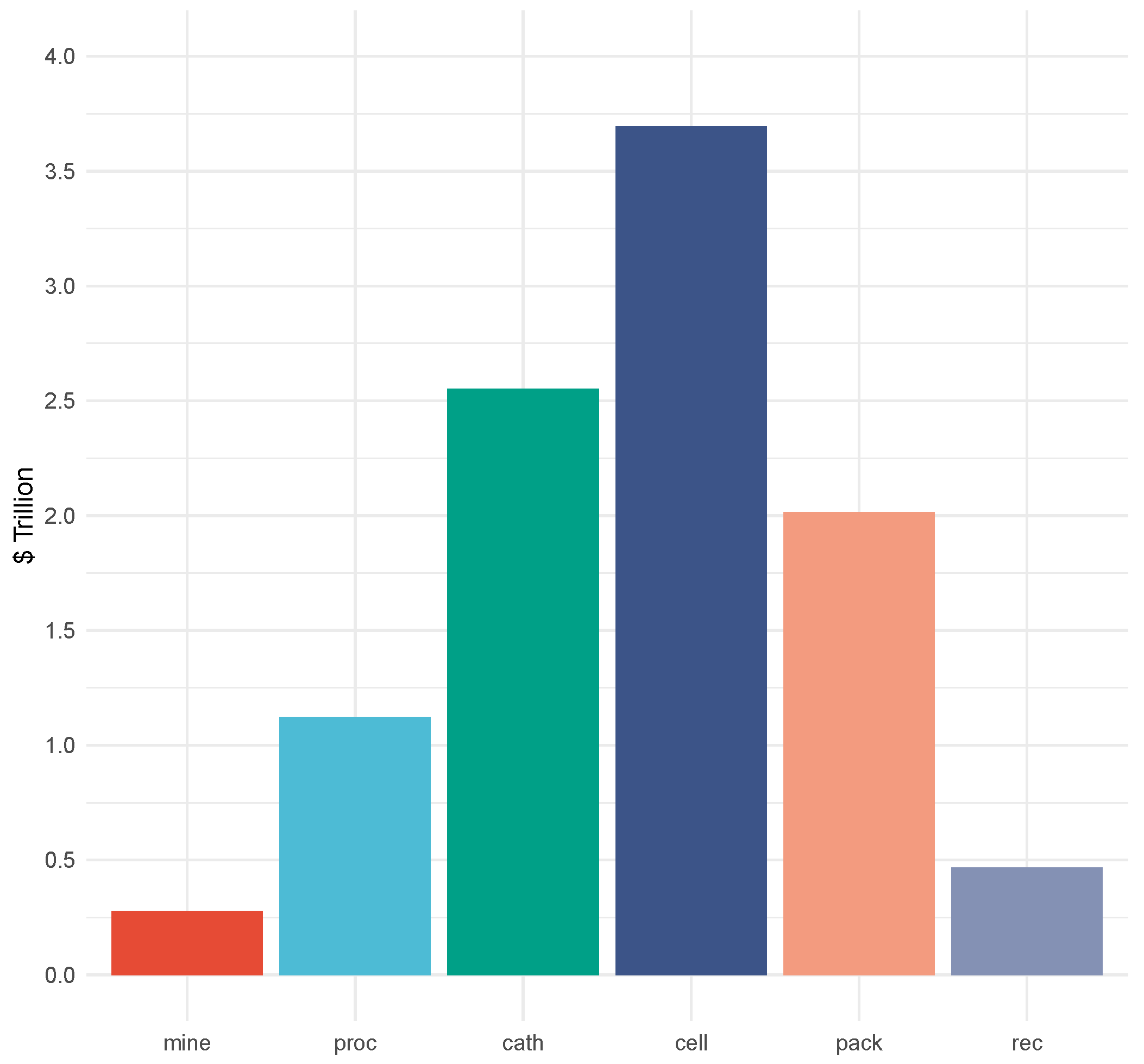

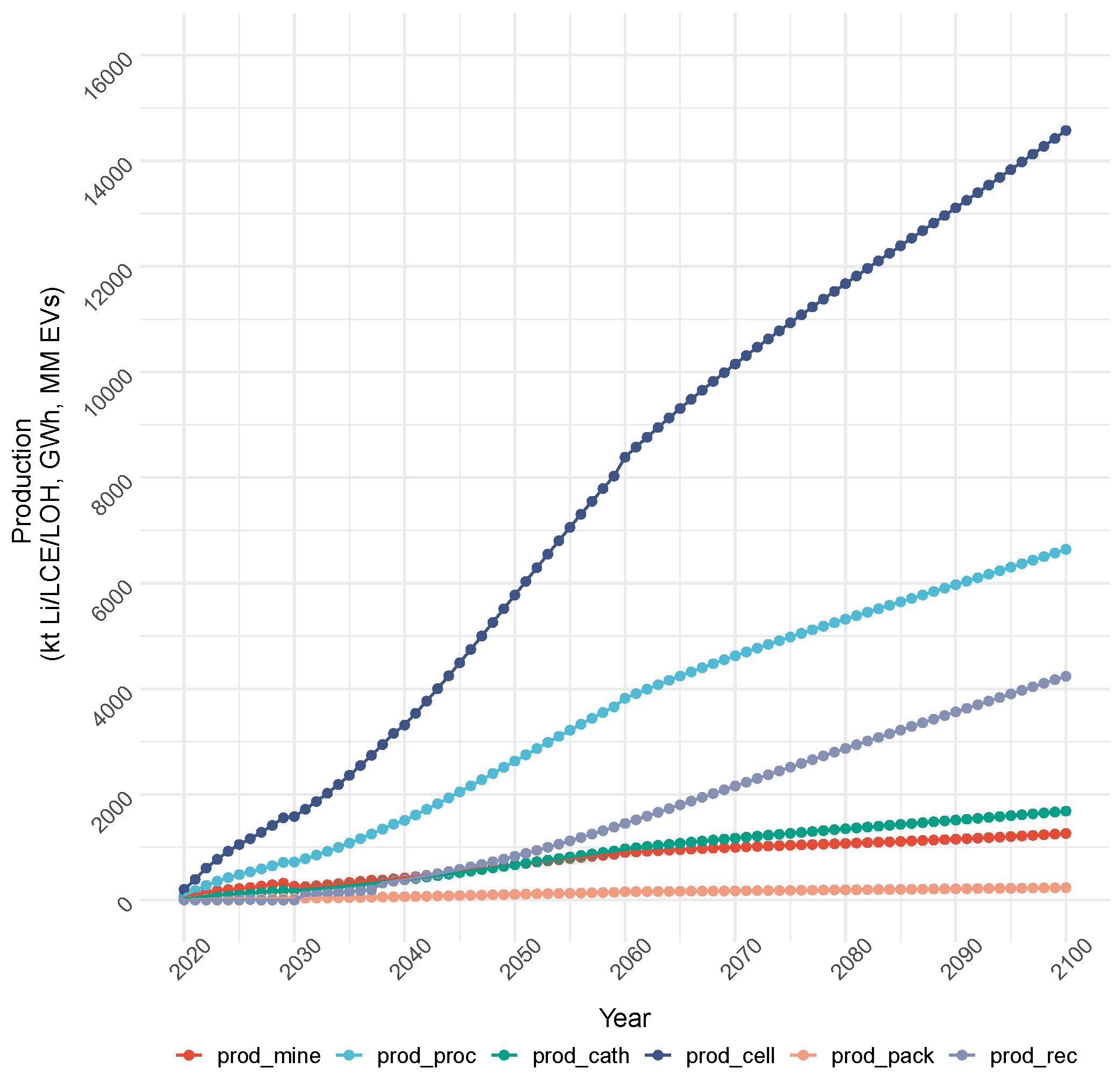

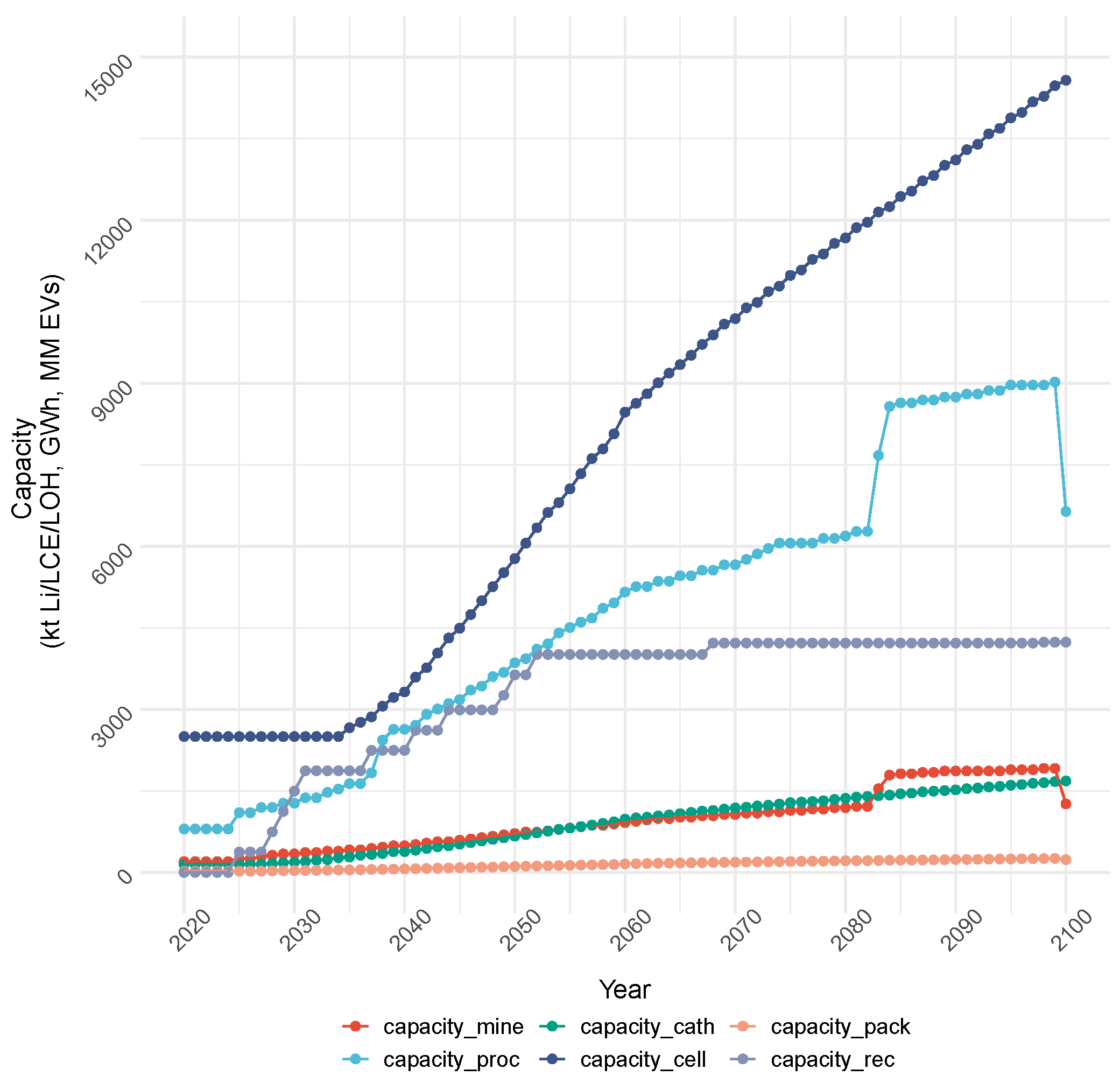

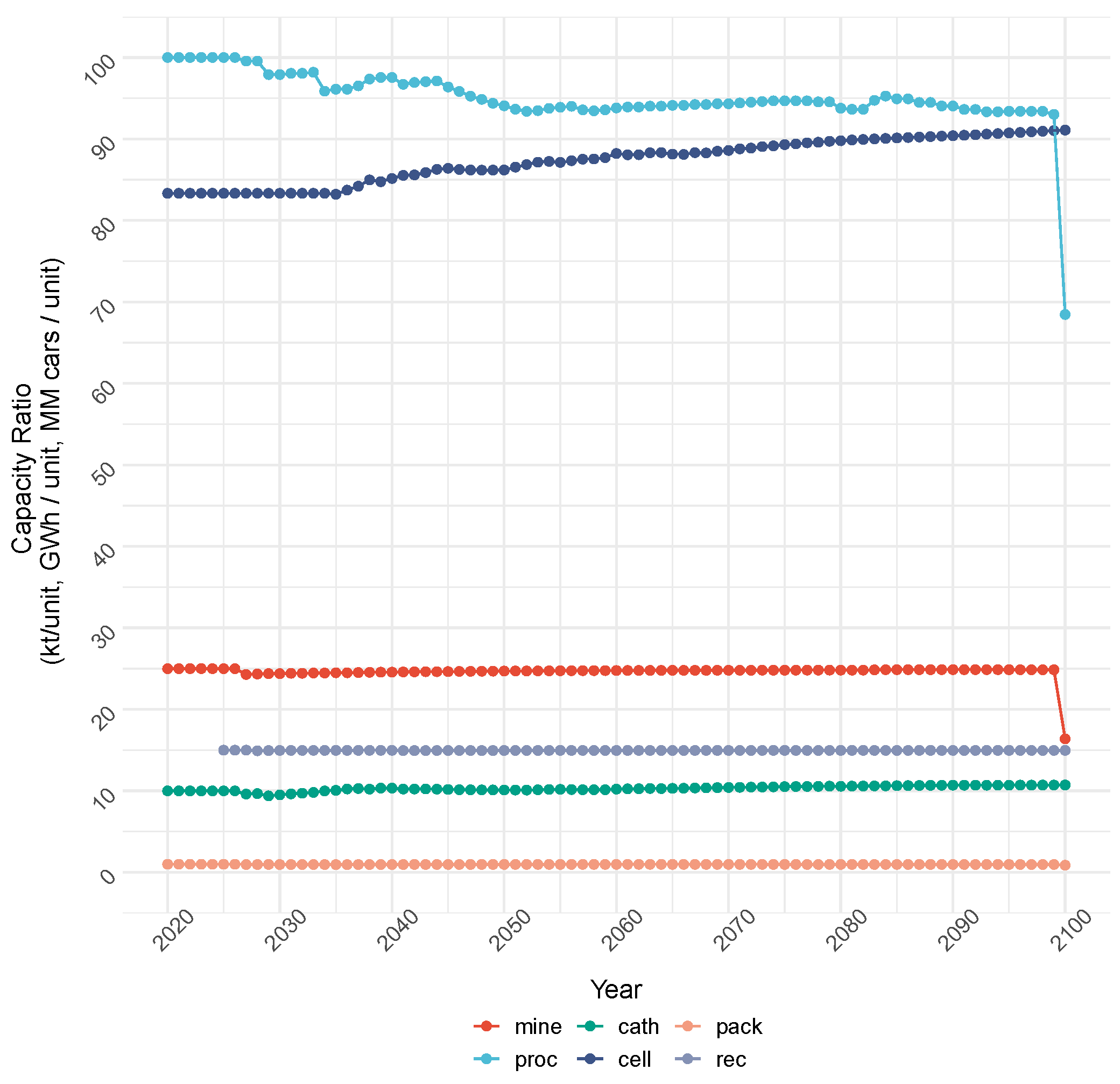

4.1.1. Cost Objective: Production and Capacity

4.1.2. Cost Objective: Total Cost and Emissions

4.2. Objective

4.2.1. Objective: Total Cost and Emissions

4.2.2. Production and Investments

5. Discussion

5.1. Key Insights from the Global Lithium Supply Chain Case Study

5.2. Future Work

Funding

Data Availability Statement

Conflicts of Interest

References

- IEA. The Role of Critical Minerals in Clean Energy Transitions—Analysis; IEA: Paris, France, 2021. [Google Scholar]

- Energy Transitions Commission. Material and Resource Requirements for the Energy Transition The Barriers to Clean Electrification Series; Energy Transitions Commission: London, UK, 2023. [Google Scholar]

- Barbanell, M. Securing Critical Minerals Supply Is Key to US Climate Action/World Resources Institute; U.S. Department of Energy (DOE): Washington, DC, USA, 2023. [Google Scholar]

- US Office of Manufacturing. Supply Chain Progress Report—August 2023; U.S. Department of Energy (DOE): Washington, DC, USA, 2023. [Google Scholar]

- USGS. Mineral Commodity Summaries 2024; U.S. Geological Survey (USGS): Reston, VA, USA, 2024. [Google Scholar] [CrossRef]

- The White House. Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth; The White House: Washington, DC, USA, 2021. [Google Scholar]

- DOD News. CHIPS Articles: DoD Takes Immediate Action to Shore up Critical Materials Supply Chain. 2021. Available online: https://www.doncio.navy.mil/CHIPS/ArticleDetails.aspx?ID=14769 (accessed on 3 March 2024).

- Nate, S.; Bilan, Y.; Kurylo, M.; Lyashenko, O.; Napieralski, P.; Kharlamova, G. Mineral Policy within the Framework of Limited Critical Resources and a Green Energy Transition. Energies 2021, 14, 2688. [Google Scholar] [CrossRef]

- Barman, P.; Dutta, L.; Azzopardi, B. Electric Vehicle Battery Supply Chain and Critical Materials: A Brief Survey of State of the Art. Energies 2023, 16, 3369. [Google Scholar] [CrossRef]

- IEA. Global EV Outlook 2023; IEA: Paris, France, 2023; Available online: https://www.iea.org/reports/global-ev-outlook-2023 (accessed on 3 March 2024).

- IEA. Global Supply Chains of EV Batteries—Analysis; IEA: Paris, France, 2022; Available online: https://www.iea.org/reports/global-supply-chains-of-ev-batteries (accessed on 3 March 2024).

- Greim, P.; Solomon, A.A.; Breyer, C. Assessment of lithium criticality in the global energy transition and addressing policy gaps in transportation. Nat. Commun. 2020, 11, 4570. [Google Scholar] [CrossRef] [PubMed]

- EPA. Draft Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990–2022; US EPA: Washington, DC, USA, 2024. [Google Scholar]

- EIA. Short-Term Energy Outlook; U.S. Energy Information Agency (EIA): Washington, DC, USA, 2024. [Google Scholar]

- Henderson, K. Climate Risk and Decarbonization: What Every Mining CEO Needs to Know; McKinsey. 2020. Available online: https://www.mckinsey.com/capabilities/sustainability/our-insights/climate-risk-and-decarbonization-what-every-mining-ceo-needs-to-know (accessed on 3 March 2024).

- Stampatori, D.; Raimondi, P.P.; Noussan, M. Li-Ion Batteries: A Review of a Key Technology for Transport Decarbonization. Energies 2020, 13, 2638. [Google Scholar] [CrossRef]

- EPA. Comparison: Your Car vs. an Electric Vehicle; U.S. Environmental Protection Agency (EPA): Washington, DC, USA, 2023. [Google Scholar]

- Flaticon. ’image: Flaticon.com’. This Cover has been Designed Using Images from Flaticon.com. 2024. Available online: https://www.flaticon.com/ (accessed on 3 March 2024).

- Burgos, J.C.; Jones, E.; Balbuena, P.B. Effect of the Metal-Substrate Interaction Strength on the Growth of Single-Walled Carbon Nanotubes. J. Phys. Chem. C 2011, 115, 7668–7675. [Google Scholar] [CrossRef]

- Burgos, J.C.; Jones, E.; Balbuena, P.B. Dynamics of Topological Defects in Single-Walled Carbon Nanotubes during Catalytic Growth. J. Phys. Chem. C 2014, 118, 4808–4817. [Google Scholar] [CrossRef]

- Jones, E.C.; Leibowicz, B.D. Contributions of shared autonomous vehicles to climate change mitigation. Transp. Res. Part D Transp. Environ. 2019, 72, 279–298. [Google Scholar] [CrossRef]

- Biney, J.; Jones, E.C.; Jones, E.C., Jr. Understanding the EV Semiconductor Chip Sustainable Supply Chain Chip Shortage. Int. Supply Chain. Technol. J. 2024, 10. [Google Scholar] [CrossRef]

- Jones, E.C.; Leibowicz, B.D. Climate risk management in agriculture using alternative electricity and water resources: A stochastic programming framework. Environ. Syst. Decis. 2022, 42, 117–135. [Google Scholar] [CrossRef]

- Jones, E.C.; Leibowicz, B.D. Co-optimization and community: Maximizing the benefits of distributed electricity and water technologies. Sustain. Cities Soc. 2021, 64, 102515. [Google Scholar] [CrossRef]

- Jones, E. Decomposing Systems: Illustrating the Utility of Distributed Energy Resources with Decomposition Techniques. In Proceedings of the 2020 IISE Annual Conference. Institute of Industrial and System Engineers, New Orleans, LA, USA, 30 May–2 June 2020. [Google Scholar]

- Jones, E.C.; Yaw, S.; Bennett, J.A.; Ogland-Hand, J.D.; Strahan, C.; Middleton, R.S. Designing multi-phased CO2 capture and storage infrastructure deployments. Renew. Sustain. Energy Transit. 2022, 2, 100023. [Google Scholar] [CrossRef]

- Varekar, S.; Srinivasan, S.; Shah, N.; Gopalakrishnan, N.N.; Jones, E.C., Jr. Analyzing the Connectivity of Combined Statistical Areas in Different Census Regions Using ArcGIS. Int. Supply Chain. Technol. J. 2023, 9. [Google Scholar] [CrossRef]

- Jones, E.C., Jr.; Chen, V.; Sharma, V.; Gudikandula, S.; Sigler, J.; Smalls, R. Training teachers to integrate a sustainability assessment for green building and retrofitting project into a K-12 classroom. In Proceedings of the 2023 ASEE Gulf-Southwest Annual Conference. American Society of Engineering Education, Denton, TX, USA, 15–17 March 2023. [Google Scholar]

- Thompson, L.; Hovey, J.; Sigler, J.; Smalls, R.; Mohammadpour, S.R.; Sharma, V.; Sood, J.; Jones, E.C., Jr.; Rosenberger, J.M.; Chen, V. Training teachers to employ design and analysis of computer experiments for research on sustainable building design. In Proceedings of the 2024 American Society for Engineering Education (ASEE) Annual Conference and Exposition. American Society of Engineering Education, Portland, OR, USA, 22–25 June 2024. [Google Scholar]

- Harmon, D.; Jones, E.; Moss, J.; Wolfe, E. Pathways for reducing energy burdens in harris county. In Proceedings of the Study on Energy Efficiency in Buildings. American Council for an Energy-Efficient Economy, Pacific Grove, CA, USA, 4–9 August 2020; p. 13. [Google Scholar]

- Jones, E.C., Jr.; Reyes, A. Identifying Themes in Energy Poverty Research: Energy Justice Implications for Policy, Programs, and the Clean Energy Transition. Energies 2023, 16, 6698. [Google Scholar] [CrossRef]

- Jones, E.; Azeem, G.; Jones, E.C., II; Jefferson, F. Impacting at Risk Communities using AI to optimize the COVID-19 Pandemic Therapeutics Supply Chain. Int. Supply Chain. Technol. J. 2020, 6. [Google Scholar] [CrossRef]

- Jones, E.C.; Azeem, G.; Jones, E.C., Jr.; Jefferson, F.; Henry, M.; Abolmaali, S.; Sparks, J. Understanding the Last Mile Transportation Concept Impacting Underserved Global Communities to Save Lives During COVID-19 Pandemic. Front. Future Transp. 2021, 2. [Google Scholar] [CrossRef]

- Kemabonta, T.; Jones, E.; Harmon, D.; Pittman, J. A new approach to developing community solar projects for LMI communities in ERCOT’s competitive electricity markets. In Proceedings of the 2021 11th IEEE Global Humanitarian Technology Conference, GHTC, Virtual, 19–23 October 2021; pp. 86–93. [Google Scholar] [CrossRef]

- Jones, N. The new car batteries that could power the electric vehicle revolution. Nature 2024, 626, 248–251. [Google Scholar] [CrossRef] [PubMed]

- Miao, Y.; Hynan, P.; Jouanne, A.V.; Yokochi, A. Current Li-Ion Battery Technologies in Electric Vehicles and Opportunities for Advancements. Energies 2019, 12, 1074. [Google Scholar] [CrossRef]

- Li, W.; Erickson, E.M.; Manthiram, A. High-nickel layered oxide cathodes for lithium-based automotive batteries. Nat. Energy 2020, 5, 26–34. [Google Scholar] [CrossRef]

- Je, M.; Han, D.Y.; Ryu, J.; Park, S. Constructing Pure Si Anodes for Advanced Lithium Batteries. Accounts Chem. Res. 2023, 56, 2213–2224. [Google Scholar] [CrossRef]

- Wang, C.; Yang, C.; Zheng, Z. Toward Practical High-Energy and High-Power Lithium Battery Anodes: Present and Future. Adv. Sci. 2022, 9, 2105213. [Google Scholar] [CrossRef]

- Patel, P. The Age of Silicon Is Here…for Batteries. 2023. Available online: https://www.vvcresources.com/the-age-of-silicon-is-here-for-batteries (accessed on 3 March 2024).

- Hampson, M. The Lithium-Ion Battery May Not Be the Best Bet for EVs. 2024. Available online: https://spectrum.ieee.org/ev-batteries-environment (accessed on 3 March 2024).

- Wang, X.; Kerr, R.; Chen, F.; Goujon, N.; Pringle, J.M.; Mecerreyes, D.; Forsyth, M.; Howlett, P.C. Toward High-Energy-Density Lithium Metal Batteries: Opportunities and Challenges for Solid Organic Electrolytes. Adv. Mater. 2020, 32, 1905219. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Li, Y.; Zhang, L.; Tao, H.; Li, Q.; Zhang, J.; Yang, X. Lithiophilicity: The key to efficient lithium metal anodes for lithium batteries. J. Energy Chem. 2023, 77, 123–136. [Google Scholar] [CrossRef]

- Zhan, R.; Yang, Z.; Bloom, I.; Pan, L. Significance of a Solid Electrolyte Interphase on Separation of Anode and Cathode Materials from Spent Li-Ion Batteries by Froth Flotation. ACS Sustain. Chem. Eng. 2021, 9, 531–540. [Google Scholar] [CrossRef]

- Imanishi, N.; Yamamoto, O. Perspectives and challenges of rechargeable lithium–air batteries. Mater. Today Adv. 2019, 4, 100031. [Google Scholar] [CrossRef]

- Patel, P. Oxygen-Ion Battery Unlocks Green-Grid Promise. 2023. Available online: https://www.extremetech.com/science/oxygen-ion-batteries-could-power-a-green-energy-grid (accessed on 3 March 2024).

- Genkina, D. For Cheaper Lithium-Ion Batteries, Just Add Salt. 2023. Available online: https://spectrum.ieee.org/lithium-battery (accessed on 3 March 2024).

- Reid, M. Sodium-Ion Batteries: Disrupt and conquer? Wood Mackenzie. 2023. Available online: https://www.woodmac.com/news/opinion/sodium-ion-batteries-disrupt/ (accessed on 3 March 2024).

- Yang, Z.G. It’s Big and Long-Lived, and It Won’t Catch Fire: The Vanadium Redox-Flow Battery. 2017. Available online: https://spectrum.ieee.org/its-big-and-longlived-and-it-wont-catch-fire-the-vanadium-redoxflow-battery (accessed on 3 March 2024).

- Charette, R.N. Can Flow Batteries Finally Beat Lithium? 2023. Available online: https://spectrum.ieee.org/flow-battery-2666672335 (accessed on 3 March 2024).

- Stauffer, N.W. Flow Batteries for Grid-Scale Energy Storage; MIT Energy Initiative. 2023. Available online: https://news.mit.edu/2023/flow-batteries-grid-scale-energy-storage-0407 (accessed on 3 March 2024).

- Bradley, D.C.; Stillings, L.L.; Jaskula, B.W.; Munk, L.; McCauley, A.D. Lithium; U.S. Department of the Interior: Washington, DC, USA, 2017. [Google Scholar] [CrossRef]

- Gruber, P.W.; Medina, P.A.; Keoleian, G.A.; Kesler, S.E.; Everson, M.P.; Wallington, T.J. Global Lithium Availability. J. Ind. Ecol. 2011, 15, 760–775. [Google Scholar] [CrossRef]

- Benson, T.R.; Coble, M.A.; Dilles, J.H. Hydrothermal enrichment of lithium in intracaldera illite-bearing claystones. Sci. Adv. 2023, 9, 35. [Google Scholar] [CrossRef]

- Neumann, J.; Petranikova, M.; Meeus, M.; Gamarra, J.D.; Younesi, R.; Winter, M.; Nowak, S. Recycling of Lithium-Ion Batteries—Current State of the Art, Circular Economy, and Next Generation Recycling. Adv. Energy Mater. 2022, 12, 2102917. [Google Scholar] [CrossRef]

- Pagliaro, M.; Meneguzzo, F. Lithium battery reusing and recycling: A circular economy insight. Heliyon 2019, 5, e01866. [Google Scholar] [CrossRef] [PubMed]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef] [PubMed]

- Yu, J.; He, Y.; Li, H.; Xie, W.; Zhang, T. Effect of the secondary product of semi-solid phase Fenton on the flotability of electrode material from spent lithium-ion battery. Powder Technol. 2017, 315, 139–146. [Google Scholar] [CrossRef]

- Yu, J.; He, Y.; Ge, Z.; Li, H.; Xie, W.; Wang, S. A promising physical method for recovery of LiCoO2 and graphite from spent lithium-ion batteries: Grinding flotation. Sep. Purif. Technol. 2018, 190, 45–52. [Google Scholar] [CrossRef]

- Bai, Y.; Hawley, W.B.; Jafta, C.J.; Muralidharan, N.; Polzin, B.J.; Belharouak, I. Sustainable recycling of cathode scraps via Cyrene-based separation. Sustain. Mater. Technol. 2020, 25, e00202. [Google Scholar] [CrossRef]

- Gao, H.; Yan, Q.; Xu, P.; Liu, H.; Li, M.; Liu, P.; Luo, J.; Chen, Z. Efficient Direct Recycling of Degraded LiMn2O4 Cathodes by One-Step Hydrothermal Relithiation. ACS Appl. Mater. Interfaces 2020, 12, 51546–51554. [Google Scholar] [CrossRef]

- Dai, Q.; Spangenberger, J.; Ahmed, S.; Gaines, L.; Kelly, J.C.; Wang, M. EverBatt: A Closed-Loop Battery Recycling Cost and Environmental Impacts Model; Argonne National Laboratory: Lemont, IL, USA, 2019. [Google Scholar]

- Doose, S.; Mayer, J.K.; Michalowski, P.; Kwade, A. Challenges in Ecofriendly Battery Recycling and Closed Material Cycles: A Perspective on Future Lithium Battery Generations. Metals 2021, 11, 291. [Google Scholar] [CrossRef]

- Gaines, L.; Wang, Y. How to Maximize the Value Recovered from Li-Ion Batteries: Hydrometallurgical or Direct Recycling? Electrochem. Soc. Interface 2021, 30, 51–54. [Google Scholar] [CrossRef]

- Loh, A.; Grosvenor, R.; Arora, A.; Collie, B.; Gökbulut, A.; Niese, N.; Taylor, L. Can OEMs Catch the Next Wave of EV Adopters? 2024. Available online: https://www.bcg.com/publications/2024/can-oems-catch-the-next-wave-of-ev-adopters (accessed on 3 March 2024).

- Stoikou, E. Battery Prices Are Falling Again as Raw Material Costs Drop. 2023. Available online: https://www.bloomberg.com/news/articles/2023-11-26/battery-prices-are-falling-again-as-raw-material-costs-drop (accessed on 3 March 2024).

- Catsaros, O. Lithium-Ion Battery Pack Prices Hit Record Low of $139/kWh. 2023. Available online: https://about.bnef.com/blog/lithium-ion-battery-pack-prices-hit-record-low-of-139-kwh/ (accessed on 3 March 2024).

- IEA. World Energy Outlook 2023—Analysis; IEA: Paris, France, 2023. [Google Scholar]

- CATL. CATL Launches Condensed Battery with an Energy Density of up to 500 Wh/kg, Enables Electrification of Passenger Aircrafts. 2023. Available online: https://www.catl.com/en/news/6015.html (accessed on 3 March 2024).

- Mobility, S.G. Affordability Tops Charging and Range Concerns in Slowing EV Demand. 2023. Available online: https://www.spglobal.com/mobility/en/research-analysis/affordability-tops-charging-and-range-concerns-in-slowing-ev-d.html (accessed on 3 March 2024).

- Tisshaw, M. Lucid Aims for Electric Cars to Achieve 6.2 Miles per kWh; Autocar. 2024. Available online: https://www.autocar.co.uk/car-news/new-cars/lucid-aims-electric-cars-achieve-62-miles-kwh (accessed on 3 March 2024).

- Ank, M.; Sommer, A.; Gamra, K.A.; Schöberl, J.; Leeb, M.; Schachtl, J.; Streidel, N.; Stock, S.; Schreiber, M.; Bilfinger, P.; et al. Lithium-Ion Cells in Automotive Applications: Tesla 4680 Cylindrical Cell Teardown and Characterization. J. Electrochem. Soc. 2023, 170, 120536. [Google Scholar] [CrossRef]

- Krok, A. Deep Dive: The 2017 Chevrolet Bolt’s Electric Powertrain. 2016. Available online: https://www.cnet.com/roadshow/news/deep-dive-2017-chevrolet-bolt-electric-powertrain/ (accessed on 3 March 2024).

- Motorreviewer. Toyota 2ZR-FE/FAE/FXE 1.8L Engine Specs, Problems, Reliability, Oil—In-Depth Review. 2010. Available online: https://www.motorreviewer.com/engine.php?engine_id=155 (accessed on 3 March 2024).

- Alessia, A.; Alessandro, B.; Maria, V.G.; Carlos, V.A.; Francesca, B. Challenges for sustainable lithium supply: A critical review. J. Clean. Prod. 2021, 300, 126954. [Google Scholar] [CrossRef]

- Tosarkani, B.M.; Amin, S.H. An environmental optimization model to configure a hybrid forward and reverse supply chain network under uncertainty. Comput. Chem. Eng. 2019, 121, 540–555. [Google Scholar] [CrossRef]

- Abdelbaky, M.; Schwich, L.; Henriques, J.; Friedrich, B.; Peeters, J.R.; Dewulf, W. Global warming potential of lithium-ion battery cell production: Determining influential primary and secondary raw material supply routes. Clean. Logist. Supply Chain. 2023, 9, 100130. [Google Scholar] [CrossRef]

- Bridge, G.; Faigen, E. Towards the lithium-ion battery production network: Thinking beyond mineral supply chains. Energy Res. Soc. Sci. 2022, 89, 102659. [Google Scholar] [CrossRef]

- Weimer, L.; Braun, T.; vom Hemdt, A. Design of a systematic value chain for lithium-ion batteries from the raw material perspective. Resour. Policy 2019, 64, 101473. [Google Scholar] [CrossRef]

- Scheller, C.; Schmidt, K.; Spengler, T.S. Decentralized master production and recycling scheduling of lithium-ion batteries: A techno-economic optimization model. J. Bus. Econ. 2021, 91, 253–282. [Google Scholar] [CrossRef]

- Jin, P.; Wang, S.; Meng, Z.; Chen, B. China’s lithium supply chains: Network evolution and resilience assessment. Resour. Policy 2023, 87, 104339. [Google Scholar] [CrossRef]

- Sun, X.; Hao, H.; Geng, Y.; Liu, Z.; Zhao, F. Exploring the potential for improving material utilization efficiency to secure lithium supply for China’s battery supply chain. Fundam. Res. 2024, 4, 167–177. [Google Scholar] [CrossRef]

- Konewka, T.; Bednarz, J.; Czuba, T. Building a Competitive Advantage for Indonesia in the Development of the Regional EV Battery Chain. Energies 2021, 14, 7332. [Google Scholar] [CrossRef]

- Li, L.; Dababneh, F.; Zhao, J. Cost-effective supply chain for electric vehicle battery remanufacturing. Appl. Energy 2018, 226, 277–286. [Google Scholar] [CrossRef]

- Scheller, C.; Schmidt, K.; Spengler, T.S. Effects of network structures on the production planning in closed-loop supply chains—A case study based analysis for lithium-ion batteries in Europe. Int. J. Prod. Econ. 2023, 262, 108892. [Google Scholar] [CrossRef]

- Yan, W.; Wang, X.; Liu, Y.; Zhang, X.-m.; Jiang, Z.-g.; Huang, L. A stochastic programming approach for EOL electric vehicle batteries recovery network design under uncertain conditions. Sci. Rep. 2024, 14, 876. [Google Scholar] [CrossRef]

- Liu, C.Y.; Wang, H.; Tang, J.; Chang, C.T.; Liu, Z. Optimal recovery model in a used batteries closed-loop supply chain considering uncertain residual capacity. Transp. Res. Part E Logist. Transp. Rev. 2021, 156, 102516. [Google Scholar] [CrossRef]

- Gonzales-Calienes, G.; Yu, B.; Bensebaa, F. Development of a Reverse Logistics Modeling for End-of-Life Lithium-Ion Batteries and Its Impact on Recycling Viability—A Case Study to Support End-of-Life Electric Vehicle Battery Strategy in Canada. Sustainability 2022, 14, 15321. [Google Scholar] [CrossRef]

- Liao, G.H.W.; Luo, X. Collaborative reverse logistics network for electric vehicle batteries management from sustainable perspective. J. Environ. Manag. 2022, 324, 116352. [Google Scholar] [CrossRef]

- Marcos, J.T.; Scheller, C.; Godina, R.; Spengler, T.S.; Carvalho, H. Sources of uncertainty in the closed-loop supply chain of lithium-ion batteries for electric vehicles. Clean. Logist. Supply Chain. 2021, 1, 100006. [Google Scholar] [CrossRef]

- Franca, R.B.; Jones, E.C.; Richards, C.N.; Carlson, J.P. Multi-objective stochastic supply chain modeling to evaluate tradeoffs between profit and quality. Int. J. Prod. Econ. 2010, 127, 292–299. [Google Scholar] [CrossRef]

- Jones, E.C. Supply Chain Engineering and Logistics Handbook; CRC Press: Boca Raton, FL, USA, 2019. [Google Scholar] [CrossRef]

- Ashcroft, S. Keith Oliver—The Man Who Gave us “Supply Chain Management”. Supply Chain Magazine. 2022. Available online: https://supplychaindigital.com/digital-supply-chain/keith-oliver-the-man-who-gave-us-supply-chain-management (accessed on 3 March 2024).

- USGS. Mineral Commodity Summaries 2021. 2021. Available online: https://pubs.usgs.gov/publication/mcs2021 (accessed on 3 March 2024).

- USGS. Mineral Commodity Summaries 2022. 2022. Available online: https://pubs.usgs.gov/publication/mcs2022 (accessed on 3 March 2024).

- USGS. Mineral Commodity Summaries 2023. 2023. Available online: https://pubs.usgs.gov/publication/mcs2023 (accessed on 3 March 2024).

- Winjobi, O.; Kelly, J.C.; Dai, Q. Life-cycle analysis, by global region, of automotive lithium-ion nickel manganese cobalt batteries of varying nickel content. Sustain. Mater. Technol. 2022, 32, e00415. [Google Scholar] [CrossRef]

- Adamas Intelligence. The Average Battery Size of Plug-In-Hybrids is Soaring; Adamas Intelligence. 2023. Available online: https://www.adamasintel.com/ev-increase-battery-capacity-average-kwh-phev-up-27-percent/ (accessed on 3 March 2024).

- Gutsch, M.; Leker, J. Costs, carbon footprint, and environmental impacts of lithium-ion batteries—From cathode active material synthesis to cell manufacturing and recycling. Appl. Energy 2024, 353, 122132. [Google Scholar] [CrossRef]

- Blois, M. Lithium Americas Expects $2.3 Billion US Loan for Lithium Mine. 2024. Available online: https://cen.acs.org/energy/energy-storage-/Lithium-Americas-expects-23-billion/102/web/2024/03 (accessed on 3 March 2024).

- Reuters. Albemarle to Build $1.3 bln Lithium Plant in South Carolina. 2023. Available online: https://www.reuters.com/markets/commodities/albemarle-invest-over-1-bln-lithium-plant-ev-battery-demand-grows-2023-03-22/ (accessed on 3 March 2024).

- LG Chem. LG Chem Takes Leap as Top Cathode Supplier in the U.S. with Groundbreaking of Tennessee Plant. 2023. Available online: https://www.lgcorp.com/media/release/27138 (accessed on 3 March 2024).

- Bellan, R. Tracking the EV Battery Factory Construction Boom across North America; TechCrunch. 2023. Available online: https://techcrunch.com/2023/08/16/tracking-the-ev-battery-factory-construction-boom-across-north-america/ (accessed on 3 March 2024).

- Plante, M.; Rindels, J. Texas to Get New Type of Refinery: A lithium Refinery. Available online: https://www.dallasfed.org/research/swe/2023/swe2302 (accessed on 3 March 2024).

- Chandrasekharam, D.; Şener, M.F.; Recepoğlu, Y.K.; Isık, T.; Demir, M.M.; Baba, A. Lithium: An energy transition element, its role in the future energy demand and carbon emissions mitigation strategy. Geothermics 2024, 119, 102959. [Google Scholar] [CrossRef]

- Tabelin, C.B.; Dallas, J.; Casanova, S.; Pelech, T.; Bournival, G.; Saydam, S.; Canbulat, I. Towards a low-carbon society: A review of lithium resource availability, challenges and innovations in mining, extraction and recycling, and future perspectives. Miner. Eng. 2021, 163, 106743. [Google Scholar] [CrossRef]

- Kim, H.C.; Wallington, T.J.; Arsenault, R.; Bae, C.; Ahn, S.; Lee, J. Cradle-to-Gate Emissions from a Commercial Electric Vehicle Li-Ion Battery: A Comparative Analysis. Environ. Sci. Technol. 2016, 50, 7715–7722. [Google Scholar] [CrossRef] [PubMed]

- Qiao, Q.; Zhao, F.; Liu, Z.; He, X.; Hao, H. Life cycle greenhouse gas emissions of Electric Vehicles in China: Combining the vehicle cycle and fuel cycle. Energy 2019, 177, 222–233. [Google Scholar] [CrossRef]

- Milovanoff, A.; Balasubramanian, R.; Minet, L.; Cheah, L.; Posen, I.D.; MacLean, H.L. Greenhouse gas emission mitigation pathways for urban passenger land transport under ambitious climate targets. Environ. Sci. Technol. 2021, 55, 8236–8246. [Google Scholar] [CrossRef]

- Allison, E.; Mandler, B. Petroleum and the Environment. 2018. Available online: https://www.americangeosciences.org/geoscience-currents/petroleum-and-environment-introduction (accessed on 3 March 2024).

- Ritchie, H. Mining Quantities for Low-Carbon Energy is Hundreds to Thousands of Times Lower than Mining for Fossil Fuels; American Geosciences Institute: Alexandria, VA, USA, 2023. [Google Scholar]

- Ritchie, H. The Low-Carbon Energy Transition will Need Less Mining than Fossil Fuels, Even when Adjusted for Waste Rock; 2023. Available online: https://www.sustainabilitybynumbers.com/p/mining-low-carbon-vs-fossil (accessed on 3 March 2024).

- Friedlingstein, P.; O’Sullivan, M.; Jones, M.W.; Andrew, R.M.; Bakker, D.C.E.; Hauck, J.; Landschützer, P.; Quéré, C.L.; Luijkx, I.T.; Peters, G.P.; et al. Global Carbon Budget 2023. Earth Syst. Sci. Data 2023, 15, 5301–5369. [Google Scholar] [CrossRef]

| Demand Category (Units) | 2020 | 2023 | 2030 | 2040 | 2050 | 2100 | Notes | Sources |

|---|---|---|---|---|---|---|---|---|

| Total Cars (MM) | 85.24 | 93 | 119 | 129 | 142.5 | 234.35 | 2% growth rate from 2025 | [68] |

| BEVs (MM) | 2.27 | 9.92 | 22.18 | 47.13 | 83.31 | 221.38 | S-curve from Equation (1) from 2023 | [1,11,21] |

| PHEVs (MM) | 0.97 | 4.25 | 8.94 | 16.1 | 23.4 | 12.98 | S-curve until 2060. After: (Total − BEVs) | [1,11,21] |

| Stock EVs (MM) | 19 | 40.16 | 190.9 | 569 | 1188.1 | 5344.5 | = (Cumulative EV Demand − Scrap) | [68] |

| Recoverable Li (GWh) | 0 | 82.7 * | 276 | 838.3 | 1796 | 9191.3 | 3% scrap rate starting 2024 * | [68] |

| Total Li (kt Li) | 85.5 | 180 | 259.56 | 516.26 | 880.23 | 2345.32 | = (EV + Battery + Other) | [5,94,95,96] |

| Battery Li (kt Li) | 58.58 | 156.6 | 222.66 | 466.68 | 813.59 | 2053.21 | (EV Li/0.8) from 2030 | [5,11,94,95,96] |

| EV Li (kt Li) | 18.34 | 80.07 | 178.13 | 373.34 | 650.87 | 1642.57 | Based on EV demand | [5,11,94,95,96] |

| Other Uses (kt Li) | 23.93 | 30 | 36.9 | 49.59 | 66.64 | 292.14 | 3% growth rate from 2023 | [5,94,95,96] |

| Stage | Tech In | Tech Out | Average Size (kt, GWH) | 2023 Fixed Cost (USD MM) | 2023 Variable Cost (USD MM/kt [GWh]) | 2023 Production Cost (USD MM/kt [GWh]) | USD/kWh | Annuitized (Fixed + Variable) 2023 Average Cost (USD MM) | Notes | Sources |

|---|---|---|---|---|---|---|---|---|---|---|

| mine | earth | clay | 8 | 1000 | 150 | 15 | 4.37 | 176.5 | [54,99,100] | |

| mine | earth | spod | 8 | 1000 | 150 | 19 | 4.85 | 176.5 | [11,99] | |

| mine | earth | brine | 8 | 1000 | 200 | 20 | 5.44 | 208.6 | [11,99] | |

| proc | spod | loh | 50 | 500 | 50 | 24.56 | 19.90 | 240.7 | baseline | [11,99,101] |

| proc | spod | lce | 80 | 500 | 30 | 30 | 16.88 | 232.7 | same as loh cost | [11,99] |

| proc | brine | lce | 80 | 500 | 20 | 24.56 | 13.68 | 168.5 | baseline | [11,99] |

| proc | brine | loh | 50 | 500 | 50 | 27.9 | 22.17 | 240.7 | USD 2500/kg LCE premium | [11,99] |

| proc | clay | lce | 80 | 500 | 30 | 17.5 | 10.47 | 232.7 | baseline | [11,99] |

| proc | clay | loh | 50 | 500 | 50 | 42.5 | 32.06 | 240.7 | USD 2500/kg LCE premium | [11,99] |

| cath | lce | lfp | 7 | 500 | 50 | 345 | 34.18 | 68.2 | [11,66,99] | |

| cath | loh | nmc | 7 | 500 | 50 | 250 | 33.06 | 68.2 | 30% more than lce | [66,99,102] |

| cell | lfp | GWh_lfp | 35 | 2500 | 50 | 44 | 53.74 | 341.0 | [11,67,99] | |

| cell | nmc | GWh_nmc | 35 | 2500 | 50 | 44 | 53.74 | 341.0 | [11,67,103] | |

| pack | lfp | bev_lfp | 0.5 | 2000 | 2000 | 1500 | 31.96 | 240.7 | [11,67,99] | |

| pack | lfp | phev_lfp | 0.5 | 2000 | 2000 | 15 | 33.10 | 240.7 | [11,67,99] | |

| pack | nmc | bev_nmc | 0.5 | 2000 | 2000 | 1500 | 31.96 | 240.7 | [11,67,99] | |

| pack | nmc | phev_nmc | 0.5 | 2000 | 2000 | 15 | 33.10 | 240.7 | [11,67,99] | |

| rec | GWh | lce | 8 | 500 | 100 | 8 | 10.79 | 104.3 | [11,99] | |

| rec | GWh | loh | 8 | 500 | 100 | 8 | 14.25 | 104.3 | [11,99] |

| Stage | Tech In | Tech Out | Max Size (kt, GWH) | kg / kWh | kt / kt (GWh) | kt / Average Facility | Notes | Source |

|---|---|---|---|---|---|---|---|---|

| mine | earth | clay | 25 | 0.508 | 4.306 | 34.45 | [11,54,99,107] | |

| mine | earth | spod | 25 | 0.508 | 4.306 | 34.45 | [11,99,107] | |

| mine | earth | brine | 25 | 0.508 | 4.306 | 34.45 | baseline | [11,99,107] |

| proc | spod | loh | 100 | 7.6 | 18.7 | 935.9 | 5× baseline | [11,99,107] |

| proc | spod | lce | 100 | 4.6 | 7.3 | 582.4 | 3× baseline | [11,99,107] |

| proc | brine | lce | 100 | 1.5 | 2.4 | 194.1 | baseline | [11,99,107] |

| proc | brine | loh | 100 | 3.0 | 7.5 | 374.4 | 2× baseline | [11,99,107] |

| proc | clay | lce | 100 | 3.0 | 4.9 | 388.3 | 2× baseline | [11,99,107] |

| proc | clay | loh | 100 | 5.3 | 13.1 | 655.1 | 3.5× baseline | [11,99,107] |

| cath | lce | lfp | 12 | 33.0 | 279.4 | 1956 | [11,99,107] | |

| cath | loh | nmc | 12 | 33.0 | 279.4 | 1956 | baseline | [11,99,107] |

| cell | lfp | GWh_lfp | 100 | 56.0 | 56.0 | 1960 | [11,99,107] | |

| cell | nmc | GWh_nmc | 100 | 56.0 | 56.0 | 1960 | baseline | [11,99,107] |

| pack | lfp | bev_lfp | 1 | 49.0 | 3038.0 | 1519 | [11,99,107] | |

| pack | lfp | phev_lfp | 1 | 49.0 | 735.0 | 367.5 | [11,99,107] | |

| pack | nmc | bev_nmc | 1 | 49.0 | 3038.0 | 1519 | [11,99,107] | |

| pack | nmc | phev_nmc | 1 | 49.0 | 735.0 | 367.5 | baseline | [11,99,107] |

| rec | GWh | lce | 15 | 0.8 | 1.46 | 11.70 | [11,99,107] | |

| rec | GWh | loh | 15 | 0.8 | 1.71 | 13.66 | [11,99] |

| Facility/Year (Scenario) | 2023 | 2030 (Cost) | 2040 (Cost) | 2050 (Cost) | 2100 (Cost) | 2023 | 2030 () | 2040 () | 2050 () | 2100 () |

|---|---|---|---|---|---|---|---|---|---|---|

| Mining Facilities | 8 | 13 | 21 | 36 | 96 | 8 | 14 | 20 | 29 | 77 |

| Processing Facilities | 8 | 12 | 21 | 32 | 70 | 8 | 13 | 27 | 41 | 97 |

| Cathode Production Facilities | 15 | 19 | 36 | 59 | 145 | 15 | 20 | 37 | 66 | 157 |

| Cell Production Facilities | 30 | 30 | 39 | 64 | 153 | 30 | 30 | 39 | 67 | 160 |

| Pack Production Facilities | 22 | 33 | 65 | 110 | 261 | 22 | 35 | 68 | 112 | 266 |

| Recycling Facilities | 0 | 0 | 0 | 0 | 0 | 0 | 100 | 150 | 243 | 283 |

| Total Discounted Cost | USD 9.51 trillion | USD 10.1 trillion | ||||||||

| Total Emissions | 56.8 gigatons | 55.7 gigatons | ||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jones, E.C., Jr. Lithium Supply Chain Optimization: A Global Analysis of Critical Minerals for Batteries. Energies 2024, 17, 2685. https://doi.org/10.3390/en17112685

Jones EC Jr. Lithium Supply Chain Optimization: A Global Analysis of Critical Minerals for Batteries. Energies. 2024; 17(11):2685. https://doi.org/10.3390/en17112685

Chicago/Turabian StyleJones, Erick C., Jr. 2024. "Lithium Supply Chain Optimization: A Global Analysis of Critical Minerals for Batteries" Energies 17, no. 11: 2685. https://doi.org/10.3390/en17112685

APA StyleJones, E. C., Jr. (2024). Lithium Supply Chain Optimization: A Global Analysis of Critical Minerals for Batteries. Energies, 17(11), 2685. https://doi.org/10.3390/en17112685