A Cooperation Model for EPC Energy Conservation Projects Considering Carbon Emission Rights: A Case from China

Abstract

1. Introduction

2. Literature Review

2.1. Cooperation Model of EPC

2.2. Revenue of EPC

2.3. Risks of EPC

3. Methods

3.1. Method Selection

3.2. Key Stakeholders

3.2.1. Energy Service Company (ESCO)

3.2.2. Power Plants

3.2.3. Financial Institutions

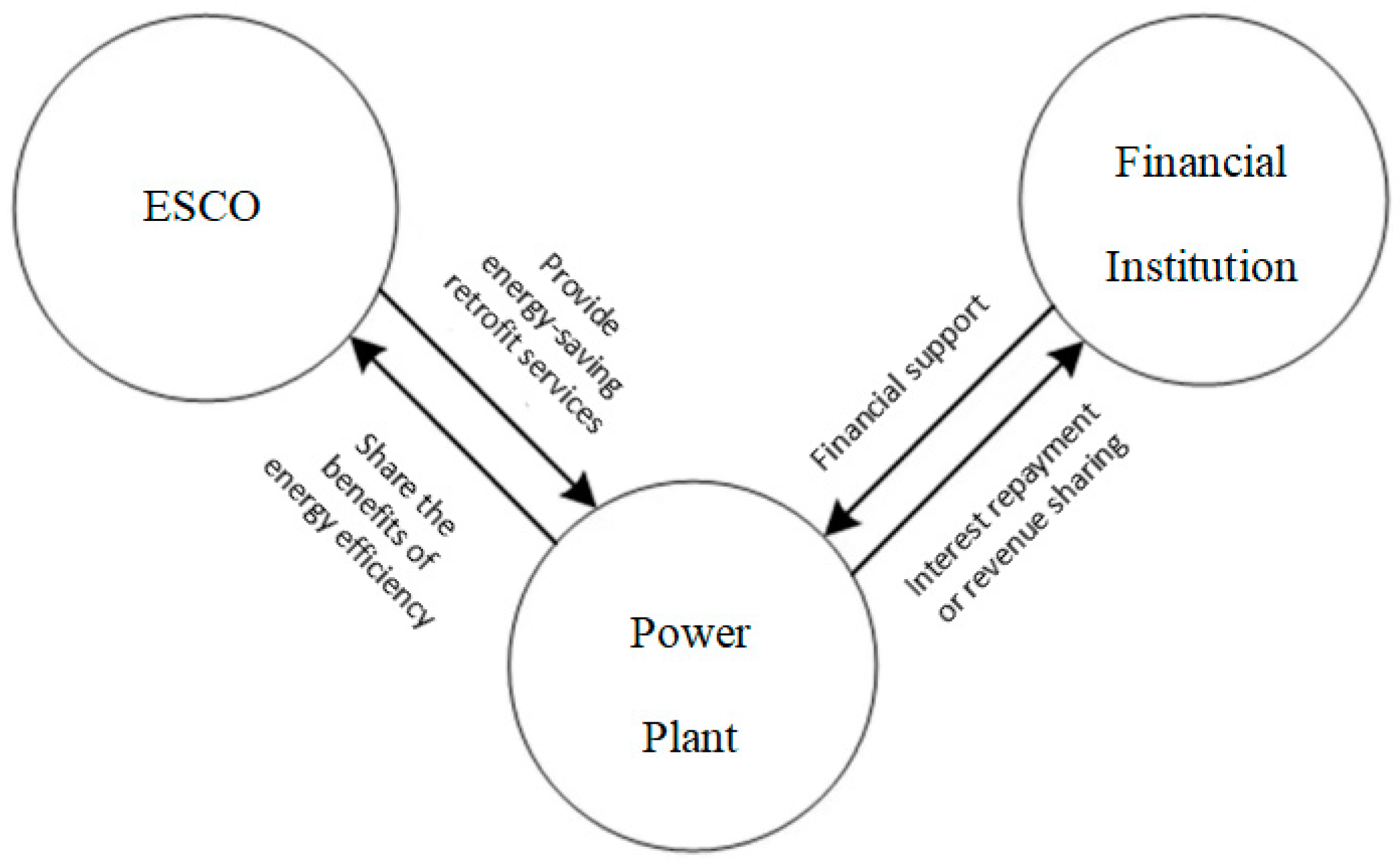

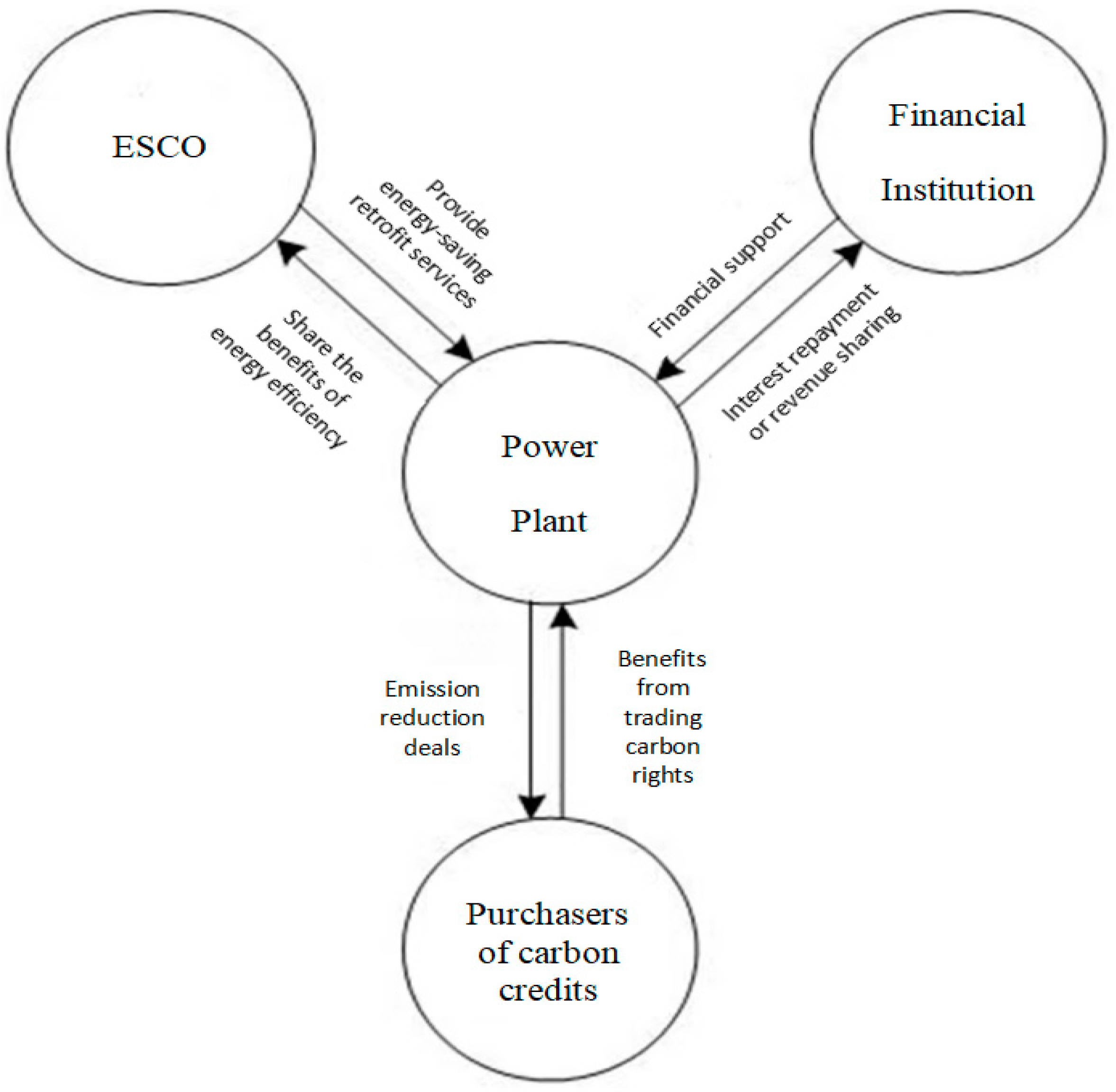

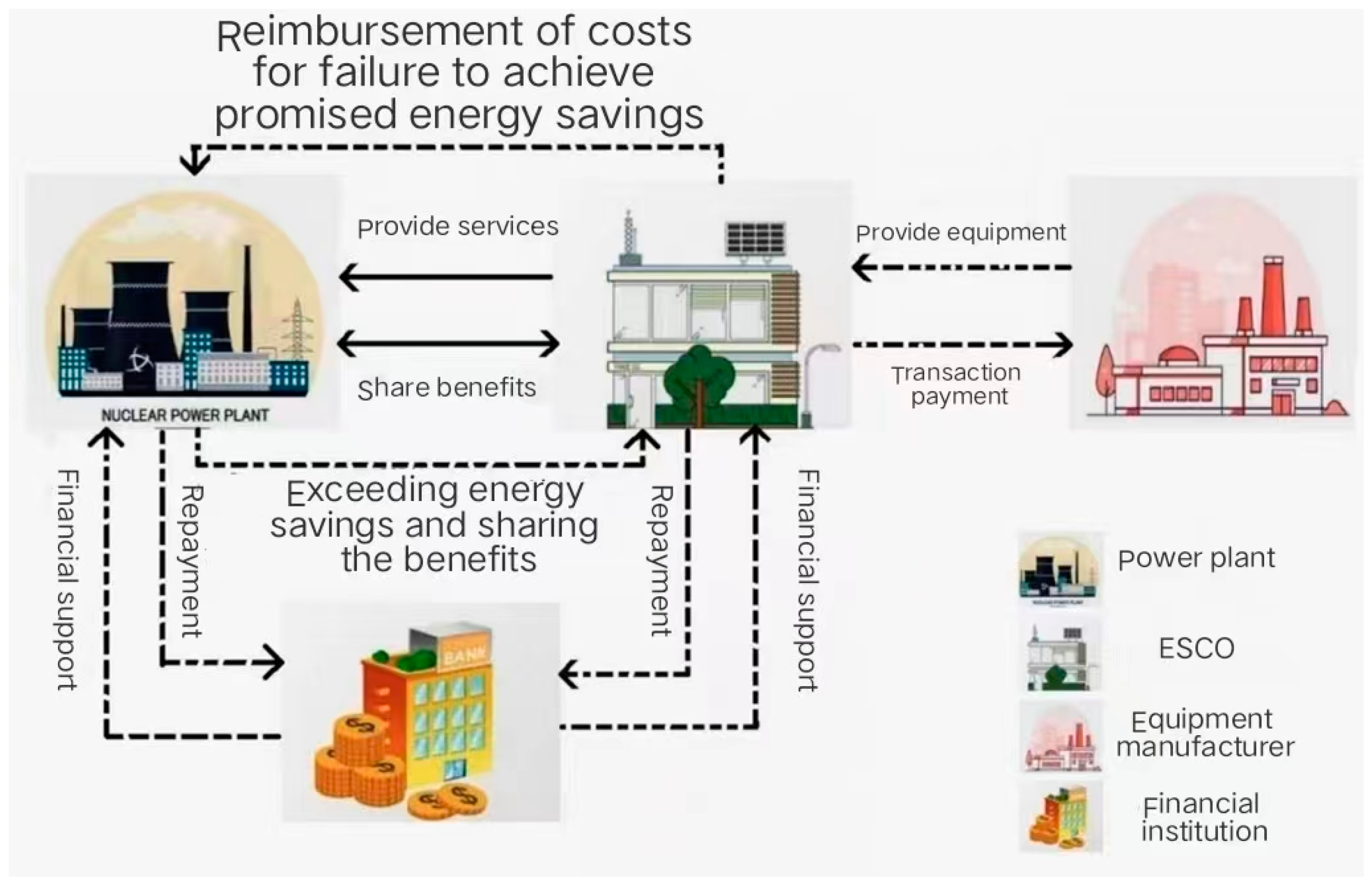

3.3. Cooperation Models

3.3.1. General Model for Energy Efficiency Retrofit Projects

3.3.2. A Model for Energy Efficiency Retrofit Projects That Include Carbon Credits

3.4. EPC Project Benefit Sharing Methodology

3.4.1. Initial Allocation

3.4.2. Shapley’s Improved Allocation with Impact Factor

3.4.2.1. Determination of Impact Factors

3.4.2.2. Determination of Weighting of Each Impact Factor

- Determination of risk compensation factor weights

- Determination of input compensation factor weights

- Determination of effort level factor weights

- Consider the benefit correction for each impact factor

3.4.3. Shapley Improvement Allocation with Carbon Rights Impact Factor

3.4.3.1. Identification of Indicator System

3.4.3.2. Determination of Indicator Weights

4. Case Studies

4.1. Background

4.2. Project Collaboration Process

4.3. A Comparison of the Benefits of the Three Different Models

4.3.1. Initial Benefit Sharing

4.3.2. Benefit Sharing Considering Impact Factors (Not Considering the Carbon Rights Factor)

4.3.3. Benefit Sharing Considering Impact Factors (Taking into Account the Carbon Rights Factor)

5. Discussion

6. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ding, T. Study on the Financing Model of Contract Energy Management for Chinese Energy Service Companies. Master’s Thesis, Hunan University, Changsha, China, 2015. [Google Scholar]

- Vine, E. An international survey of the energy service company (ESCO) industry. Energy Policy 2005, 33, 691–704. [Google Scholar] [CrossRef]

- Shang, T.; Liu, P.; Guo, J. How to allocate energy-saving benefit for guaranteed savings EPC projects? A case of China. Energy 2020, 191, 116–499. [Google Scholar] [CrossRef]

- Wu, B. Design and Implementation of a Customer Relationship System for Contract Energy Management. Master’s Thesis, Fudan University, Shanghai, China, 2013. [Google Scholar]

- Yik, F.W.H.; Lee, W.L. Partnership in building energy performance contracting. Build. Res. Inf. 2004, 32, 235–243. [Google Scholar] [CrossRef]

- Sorrell, S. The economics of energy service contracts. Energy Policy 2007, 35, 507–521. [Google Scholar] [CrossRef]

- Aasen, M.; Westekog, H.; Korneliussen, K. Energy performance contracts in the municipal sector in Norway: Overcoming barriers to energy savings? Energy Effic. 2016, 9, 171–185. [Google Scholar] [CrossRef]

- Bertoldi, P.; Rezessy, S.; Vine, E. Energy service companies in European countries: Current status and a strategy to foster their development. Energy Policy 2006, 34, 1818–1832. [Google Scholar] [CrossRef]

- Polzin, F.; Migendt, M.; Taube, F.A.; von Flotow, P. Public policy influence on renewable energy investments—A panel data study across OECD countries. Energy Policy 2015, 80, 98–111. [Google Scholar] [CrossRef]

- Frangou, M.; Aryblia, M.; Tournaki, S.; Tsoutsos, T. Renewable energy performance contracting in the tertiary sector Standardization to overcome barriers in Greece. Renew. Energy 2018, 125, 829–839. [Google Scholar] [CrossRef]

- Principi, P.; Roberto, F.; Carbonari, A.; Lemma, M. Evaluation of energy conservation opportunities through Energy Performance Contracting: A case study in Italy. Energy Build. 2016, 128, 886–899. [Google Scholar] [CrossRef]

- Rochas, C.; Zvaigznitis, K.; Kamenders, A.; Žogla, G. Energy performance contracting for multi-family residential buildings in Latvia. First steps. In Proceedings of the Environmental Engineering Proceedings of the International Conference on Environmental Engineering ICEE, F, 2014. C Vilnius Gediminas Technical University, Department of Construction Economics, Hong Kong, China, 21–22 September 2014. [Google Scholar]

- Wu, X. Research on Countermeasures to Promote the Development of China’s Energy-Saving Service Industry. Master’s Thesis, China University of Petroleum, Beijing, China, 2009. [Google Scholar]

- Yang, H. Research on the Market of Building Energy Efficiency Services in China. Master’s Thesis, Tianjin University, Tianjin, China, 2006. [Google Scholar]

- Shen, X. Research and Development Suggestions for Contract Energy Management in China. Master’s Thesis, North China University of Electric Power (Beijing), Beijing, China, 2008. [Google Scholar]

- Zhang, S.; Deng, X. Energy-saving management model of commercial buildings based on property management. J. Shenzhen Univ. 2016, 33, 627–638. [Google Scholar]

- Zhu, X. Research on Factors and Strategies of Contract Energy Management Financing in Green Finance Environment. Master’s Thesis, North China Electric Power University, Beijing, China, 2020. [Google Scholar]

- Chen, Y.; Guo, J. Research on the evaluation of EPC capacity based on 3D matrix model. J. Eng. Manag. 2021, 35, 22–27. [Google Scholar]

- Chen, Y.; Guo, J. Modeling the cooperation mechanism of public institutions’ contract energy management projects. Sci. Technol. Manag. Res. 2021, 41, 185–192. [Google Scholar]

- Liu, G. Research on banking industry chain model financing to support the development of contract energy management industry. Shanghai Energy Conserv. 2020, 11, 1284–1289. [Google Scholar]

- Shang, T.; Zhang, K.; Liu, P.; Chen, Z. A review of energy performance contracting business models: Status and recommendation. Sustain. Cities Soc. 2017, 34, 203–210. [Google Scholar] [CrossRef]

- Hannon, M.J.; Foxon, T.J.; Gale, W.F. The co-evolutionary relationship between Energy Service Companies and the UK energy system: Implications for a low-carbon transition. Energy Policy 2013, 61, 1031–1045. [Google Scholar] [CrossRef]

- Shang, T.C.; Gao, J.Q.; Liu, P.H.; Zhang, Y. Construction of an energy management contract financing model for emission allowance savings. J. Tianjin Univ. 2012, 14, 7–9. [Google Scholar]

- Ling Yang, M.; Ling Yang, X.; Zhao, F. Benefit allocation of energy efficiency retrofit projects based on EPC model. J. Civ. Eng. Manag. 2016, 33, 115–120. [Google Scholar]

- Zeng, Z. Benefit allocation of shared energy management projects based on comprehensive evaluation method. J. Wuhan Univ. Technol. 2014, 36, 144–148. [Google Scholar]

- Jia, C.; Li, H.; Gao, H. Study on Energy Consumption Optimization and Multi-entity Benefit Distribution of Park Based on Contract Energy Management. Smart Power 2020, 48, 30–36+98. [Google Scholar]

- Shang, T.C.; Liu, P.H.; Li, X.X.; Guo, J.X. Revenue allocation of energy-saving guaranteed contract energy management projects. J. Tianjin Univ. 2013, 15, 298–301. [Google Scholar]

- Nolden, C.; Sorrell, S. The UK market for energy service contracts in 2014–2015. Energy Effic. 2016, 9, 1405–1420. [Google Scholar] [CrossRef]

- Polzin, F.; Von Flotow, P.; Nolden, C. What encourages local authorities to engage with energy performance contracting for retrofitting? Evidence from German municipalities. Energy Policy 2016, 94, 317–330. [Google Scholar] [CrossRef]

- Wang, J.; Sun, X.; Wang, J. Problems and suggestions for improvement in the promotion of contract energy management. Energy Conserv. Environ. Prot. 2022, 01, 36–38. [Google Scholar]

- Wang, Y. Suggestions for Continued Implementation of Energy Management Contracts in Beijing under the Background of Double Carbon. Energy Conserv. Environ. Prot. 2021, 11, 34–36. [Google Scholar]

- Liu, H.; Tan, L.; Hu, M.; Qin, J.; Zhu, H. The role of government in contractual energy management of existing buildings—A study based on fuzzy Shapley values. Oper. Res. Manag. 2020, 29, 213–221. [Google Scholar]

- Pagliaro, F.; Hugony, F.; Zanghirella, F.; Basili, R.; Misceo, M.; Colasuonno, L.; Del Fatto, V.J.E.P. Assessing building energy performance and energy policy impact through the combined analysis of EPC data–The Italian case study of SIAPE. Energy Policy 2021, 159, 112–119. [Google Scholar] [CrossRef]

- Curtis, J.; Devitt, N.; Whelan, A. Using census and administrative records to identify the location and occupancy type of energy inefficient residential properties. Sustain. Cities Soc. 2015, 18, 56–65. [Google Scholar] [CrossRef]

- Abela, A.; Hoxley, M.; McGrath, P.; Goodhew, S.J.E. An investigation of the appropriateness of current methodologies for energy certification of Mediterranean housing. Energy Build. 2016, 130, 210–218. [Google Scholar] [CrossRef]

- Diakaki, C.; Grigoroudis, E.; Kabelis, N.; Kolokotsa, D.; Kalaitzakis, K.; Stavrakakis, G.J.E. A multi-objective decision model for the improvement of energy efficiency in buildings. Energy 2010, 35, 5483–5496. [Google Scholar] [CrossRef]

- De Wilde, P. The gap between predicted and measured energy performance of buildings: A framework for investigation. Autom. Constr. 2014, 41, 40–49. [Google Scholar] [CrossRef]

- Lee, P.; Lam, P.; Lee, W.L.J.E. Risks in energy performance contracting (EPC) projects. Energy Build. 2015, 92, 116–127. [Google Scholar] [CrossRef]

- Papachristos, G. A modelling framework for the diffusion of low carbon energy performance contracts. Energy Effic. 2020, 13, 767–788. [Google Scholar] [CrossRef]

- Larsen, P.H.; Golaman, C.A.; Satchwell, A. Evolution of the US energy service company industry: Market size and project performance from 1990–2008. Energy Policy 2012, 50, 802–820. [Google Scholar] [CrossRef]

- Roth, A.E.; Shapley, L.S. The Shapley Value: Essays in Honor of Lloyd S. Shapley; Cambridge University Press: Cambridge, UK, 2005. [Google Scholar]

| Business Models | Investment and Financing Parties | Construction Operators | Revenue Distribution | Applicable Scenarios | Advantages | Disadvantages | Position |

|---|---|---|---|---|---|---|---|

| the Share Savings Model | ESCOs | ESCOs | Proportional sharing between both parties | Office buildings, etc. | Zero investment and zero financing risk for customers | None for customers | Stronger market acceptance, dominant position |

| the Guaranteed Savings Model | Customers | ESCOs | Guaranteed energy savings; share the excess, make up the shortfall | Industrial companies | Customers bear zero financing risk | Consumers have less incentive to save energy and reduce emissions | ----- |

| the Energy-cost Trust Model | ESCOs | ESCOs | Guaranteed energy savings and stable hosting costs; make up the shortfall | Industries with stable energy demand | Reduced retrofit risks for customers and relatively stable future revenues for ESCOs | ESCOs cannot enjoy the benefits of energy saving | ----- |

| the Finance Lease Model | Customers | Construction: ESCOs; Operation: Customers | ESCOs benefit from construction costs; customers enjoy exclusive energy-saving benefits | Enterprises with strong energy-saving needs and energy-saving operation capabilities | Customers enjoy full benefits | ESCOs cannot enjoy the benefits of energy saving | Initial stage |

| Symbol | Explanation |

|---|---|

| Energy-saving service companies | |

| power plants | |

| members of the alliance | |

| payoff function | |

| benefits of member | |

| risk of member | |

| input of member | |

| effort of member | |

| excess benefits of member | |

| carbon rights input of member | |

| excess benefits considering carbon rights | |

| benefits of member | |

| risk of member |

| Target Level | Guideline Level | Indicator Layer | Indicator Meaning |

|---|---|---|---|

| EPC Contract Energy Management | Risk sharing | Policy risks | Risks arising from changes to carbon trading policies |

| Market risk | Risks arising from competitive market conditions and market fluctuations | ||

| Technical risks | The maturity and complexity of the technology and the risks associated with changes and updates to the technology | ||

| Asset risk | The risk of failure of cooperation due to abnormal asset turnover and the breakage of the capital chain | ||

| Risk of default | The risk of intentional or unintentional breach of contractual agreements by both partners | ||

| Operational risks | Risks in the contractual terms, commercial operations, and financial management of members in the partnership | ||

| Member input | Staff input | The amount of input from the people involved in the execution of the contract | |

| Equipment input | The amount of relevant equipment input during the execution of the contract | ||

| Financial input | The total amount of money invested in the execution of the contract | ||

| Non-material inputs | Total capital input during contract execution. Non-material input such as patents, technology, knowledge, etc., during contract execution | ||

| Level of effort | Degree of contract execution | The extent to which the partner strictly enforces the terms of the contract in order to maximize the benefits of the project | |

| Organizational management level | The quality of the manager’s career, professionalism, the level of management resources invested, and the quality of the management results achieved | ||

| Level of information exchange | The degree of information exchange achieved between partners to achieve information parity | ||

| Willingness to cooperate | The extent to which the partner is willing to put in the effort to achieve the objectives of the contract |

| Target Level | Guideline Level | Indicator Layer |

|---|---|---|

| EPC Contract Energy Management | Member contributions | Staff input |

| Equipment input | ||

| Financial input | ||

| Non-material inputs | ||

| Carbon rights input |

| Scale | Importance Comparison |

|---|---|

| 0.5 | is equally important compared to |

| 0.6 | slightly more important than |

| 0.7 | is clearly important compared to |

| 0.8 | is much more important compared to |

| 0.9 | is extremely important compared to |

| 0.1, 0.2, 0.3, 0.4 | If element is compared with element to obtain judgment , then element is compared with element to obtain judgment as 1 − |

| Target Level | Guideline Level | Indicator Layer |

|---|---|---|

| EPC Contract Energy Management | Risk sharing (0.3853) | Policy risks (0.1937) |

| Market risk (0.1817) | ||

| Technical risks (0.1661) | ||

| Asset risk (0.1624) | ||

| Risk of default (0.1467) | ||

| Operational risks (0.1494) | ||

| Member input (0.3103) | Staff input (0.3030) | |

| Equipment input (0.2474) | ||

| Financial input (0.2543) | ||

| Non-material inputs (0.1953) | ||

| Level of effort (0.3045) | Degree of contract execution (0.2859) | |

| Organizational management level (0.2654) | ||

| Level of information exchange (0.2184) | ||

| Willingness to cooperate (0.2303) |

| C | 0.5284 | 0.0284 | 5517.208 | 0.4725 | 0.3644 | −0.1356 |

| ESCO | 0.4716 | −0.0284 | 155.8116 | −0.4725 | 0.6356 | 0.1356 |

| Target Level | Guideline Level | Indicator Layer |

|---|---|---|

| EPC Contract Energy Management | Member input | Stuff input (0.2356) |

| Equipment input (0.2091) | ||

| Financial input (0.2091) | ||

| Non-material input (0.1664) | ||

| Carbon rights input (0.1798) |

| C | 0.5284 | 0.0284 | 5517.208 | 0.4756 | 0.3644 | −0.1356 |

| ESCO | 0.4716 | −0.0284 | 155.8116 | −0.4756 | 0.6356 | 0.1356 |

| No EPC | EPC | ||||

|---|---|---|---|---|---|

| No Carbon Rights | Carbon Rights | ||||

| Typical Shapley | Amendments Shapley | Typical Shapley | Amendments Shapley | ||

| C | 164.67 | 581.5 | 735.867 | 878.92 | 901.0189 |

| ESCO | 329.34 | 746.17 | 591.803 | 714.25 | 692.1511 |

| Total Revenue | 494.01 | 1327.67 | 1327.67 | 1593.17 | 1593.17 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, H.; Pan, J.; Han, Y.; Li, Z.; Cai, Z. A Cooperation Model for EPC Energy Conservation Projects Considering Carbon Emission Rights: A Case from China. Energies 2024, 17, 3071. https://doi.org/10.3390/en17133071

Luo H, Pan J, Han Y, Li Z, Cai Z. A Cooperation Model for EPC Energy Conservation Projects Considering Carbon Emission Rights: A Case from China. Energies. 2024; 17(13):3071. https://doi.org/10.3390/en17133071

Chicago/Turabian StyleLuo, Haiyan, Junlin Pan, Yan Han, Zheng Li, and Zhuo Cai. 2024. "A Cooperation Model for EPC Energy Conservation Projects Considering Carbon Emission Rights: A Case from China" Energies 17, no. 13: 3071. https://doi.org/10.3390/en17133071

APA StyleLuo, H., Pan, J., Han, Y., Li, Z., & Cai, Z. (2024). A Cooperation Model for EPC Energy Conservation Projects Considering Carbon Emission Rights: A Case from China. Energies, 17(13), 3071. https://doi.org/10.3390/en17133071