Do the Energy-Related Uncertainties Stimulate Renewable Energy Demand in Developed Economies? Fresh Evidence from the Role of Environmental Policy Stringency and Global Economic Policy Uncertainty

Abstract

:1. Introduction

2. Uncertainties and Renewable Energy: A Literature Review

3. Data and Methodology

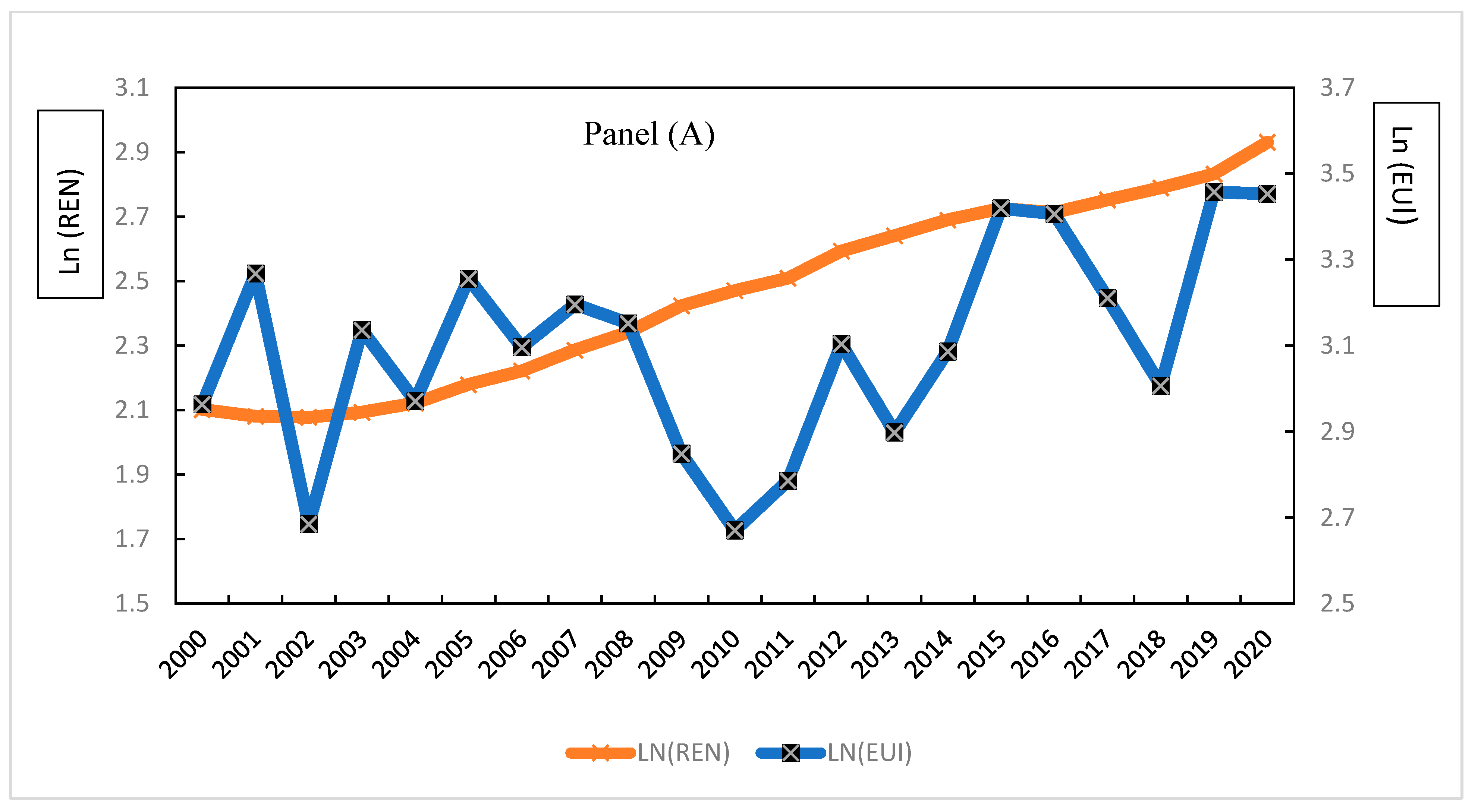

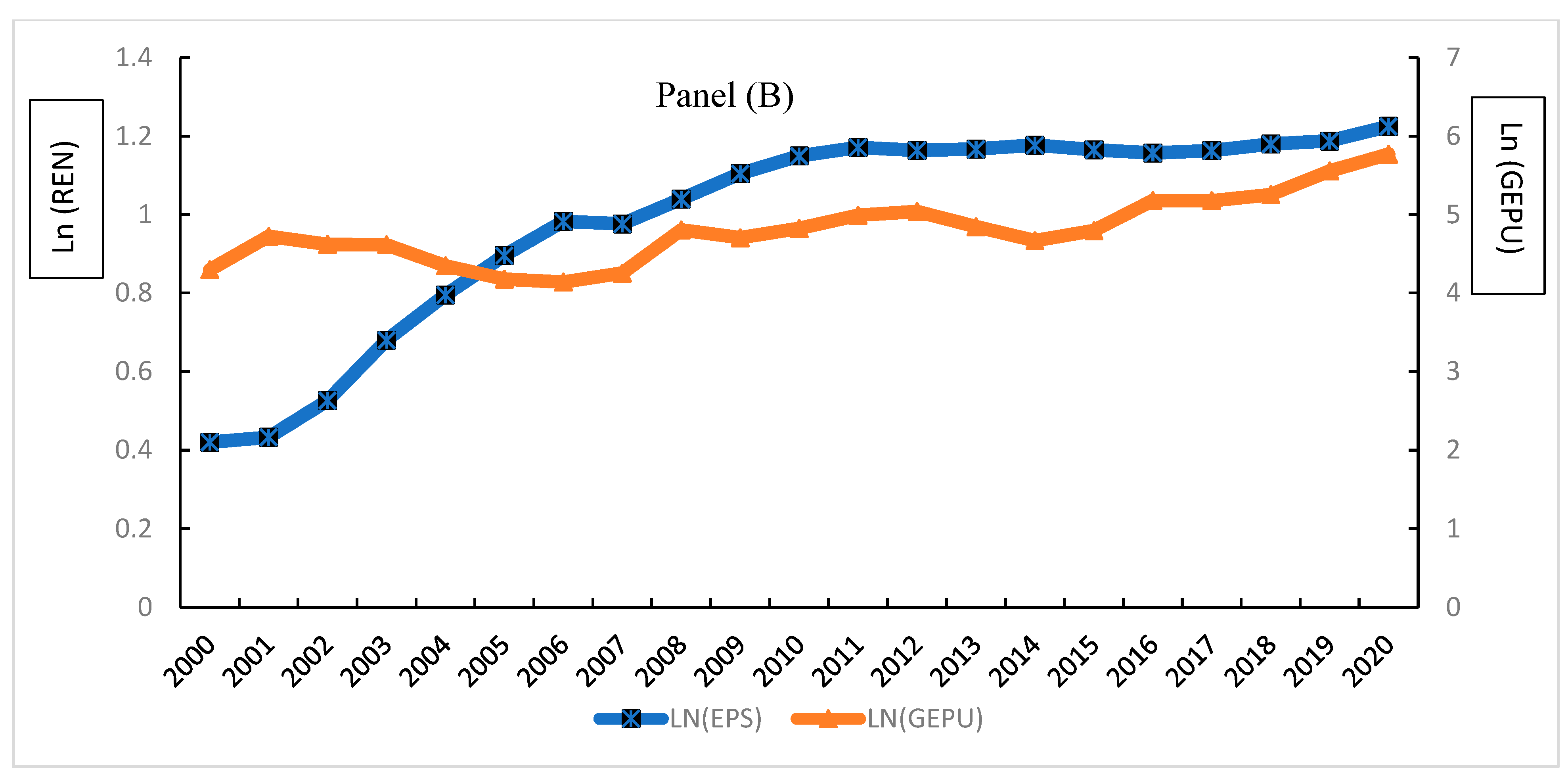

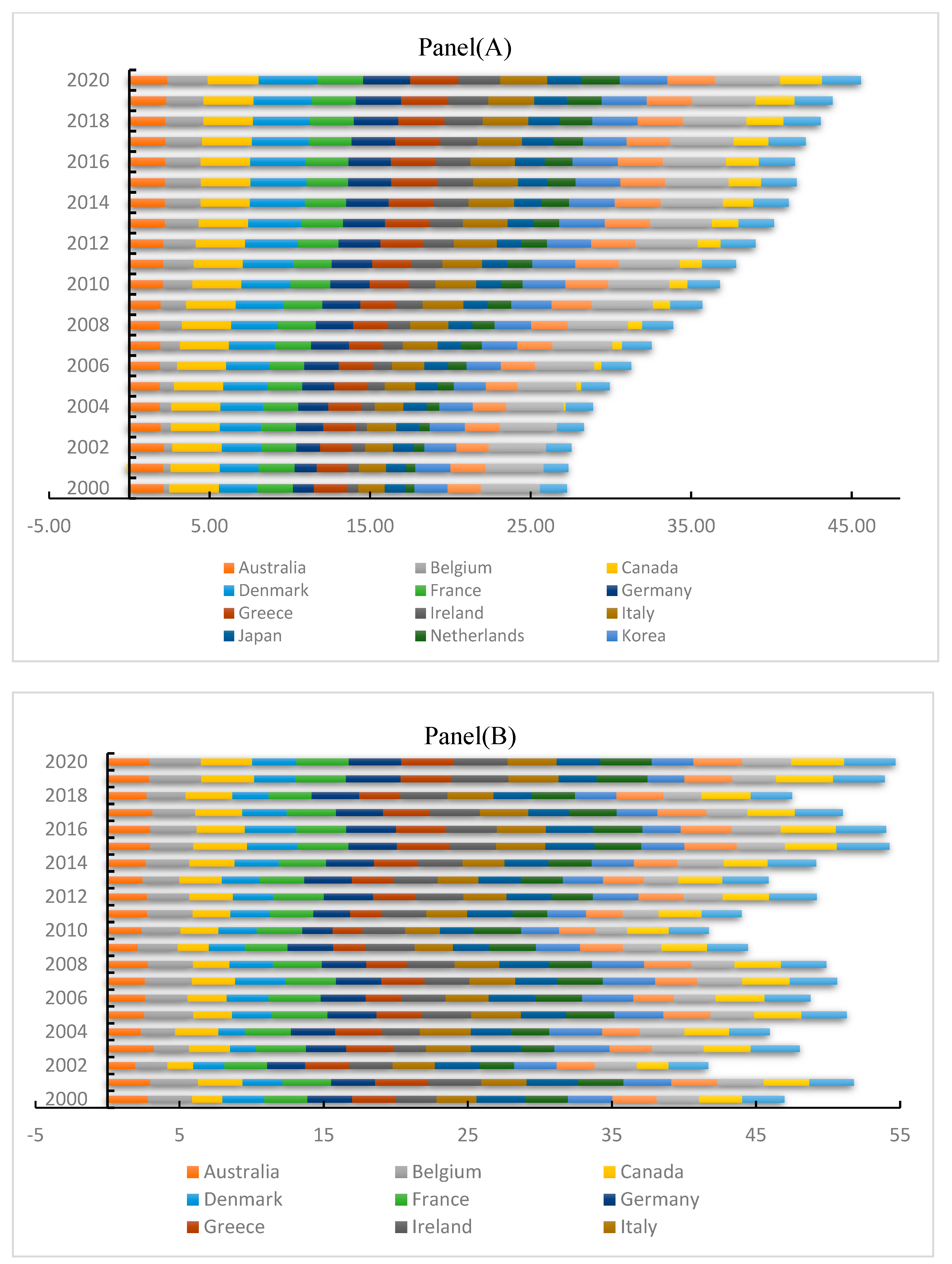

3.1. Data

3.2. Model and Methodology

4. Results

4.1. Univariate Results

4.2. Empirical Results

4.2.1. Multivariate Results

4.2.2. Further Analysis: Do the GEPU and EPS Play a Moderator or Catalyst Role?

5. Robustness Check

6. Conclusions

6.1. Policy Suggestions

6.2. Study Limitations and Future Directions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| REN | Renewable energy consumption |

| RENE | Renewable energy |

| EUI | Energy-related uncertainty index |

| EPS | Environmental policy stringency |

| GEPU | Global economic policy uncertainty |

| SDGs | Sustainable development goals |

| GPR | Geopolitical risk |

| CPU | Climate policy uncertainty |

| FE | Fixed effects |

| CD | Cross-sectional dependence |

Appendix A

| Sample Economies | Ln(REN) | Ln(STV) | Ln(FDI) | Ln(REMIT) | Ln(CO2) | Ln(TNRR) | Ln(GDPC) | Ln(EUI) | Ln(EPS) |

|---|---|---|---|---|---|---|---|---|---|

| Australia | 2.115 | 4.302 | 1.250 | −1.957 | 12.845 | 1.554 | 10.660 | 2.682 | 0.767 |

| Belgium | 1.564 | 3.106 | 2.740 | 0.724 | 11.529 | −3.492 | 10.581 | 2.972 | 0.924 |

| Canada | 3.079 | 4.379 | 0.901 | −2.574 | 13.209 | 0.807 | 10.597 | 2.913 | 0.820 |

| Denmark | 3.062 | 3.379 | 0.581 | −1.017 | 10.674 | −0.033 | 10.854 | 2.792 | 1.187 |

| France | 2.433 | 4.088 | 0.537 | −0.234 | 12.737 | −3.075 | 10.499 | 3.329 | 1.195 |

| Germany | 2.301 | 3.875 | 0.817 | −1.096 | 13.545 | −2.108 | 10.564 | 3.145 | 1.053 |

| Greece | 2.434 | 2.636 | −0.588 | −0.738 | 11.317 | −2.099 | 9.932 | 3.024 | 0.793 |

| Ireland | 1.634 | 1.761 | 2.938 | −1.531 | 10.606 | −2.726 | 10.871 | 3.218 | 0.817 |

| Italy | 2.380 | 3.955 | −0.146 | −1.145 | 12.871 | −2.316 | 10.366 | 3.102 | 1.100 |

| Japan | 1.612 | 4.439 | −1.418 | −3.244 | 13.976 | −3.736 | 10.575 | 3.052 | 1.196 |

| Netherlands | 1.389 | 4.457 | 3.040 | −1.649 | 11.979 | −0.691 | 10.713 | 3.049 | 1.011 |

| Korea | 0.379 | 4.759 | −0.141 | −0.608 | 13.202 | −2.950 | 10.010 | 3.103 | 0.944 |

| Spain | 2.493 | 4.389 | 1.034 | −1.934 | 12.551 | −2.997 | 10.176 | 3.056 | 0.801 |

| Sweden | 3.796 | 4.500 | 0.979 | −0.628 | 10.695 | −0.560 | 10.769 | 2.964 | 1.192 |

| United Kingdom | 1.151 | 4.419 | 1.179 | −1.606 | 13.031 | −0.374 | 10.599 | 3.241 | 0.971 |

| United States | 2.005 | 5.366 | 0.479 | −3.287 | 15.477 | −0.264 | 10.806 | 3.162 | 0.671 |

References

- World Bank. World Development Indicators 2016; World Bank Publications: Chicago, IL, USA, 2016. [Google Scholar]

- BP. Statistical Review of World Energy 2020; BP: London, UK, 2020. [Google Scholar]

- Doğan, B.; Balsalobre-Lorente, D.; Nasir, M.A. European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. J. Environ. Manag. 2020, 273, 111146. [Google Scholar] [CrossRef]

- Adams, S.; Nsiah, C. Reducing carbon dioxide emissions; Does renewable energy matter? Sci. Total Environ. 2019, 693, 133288. [Google Scholar] [CrossRef]

- Zhou, A.; Li, J. Heterogeneous role of renewable energy consumption in economic growth and emissions reduction: Evidence from a panel quantile regression. Environ. Sci. Pollut. Res. 2019, 26, 22575–22595. [Google Scholar] [CrossRef]

- Bloomberg New Energy Finance. Global Trends in Clean Energy Investment; Bloomberg: New York, NY, USA, 2019. [Google Scholar]

- World Irena. Energy Transitions Outlook: 1.5 °C Pathway; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2021; pp. 1–352. Available online: www.irena.org/publications (accessed on 1 June 2024).

- Athari, S.A. The impact of financial development and technological innovations on renewable energy consumption: Do the roles of economic openness and financial stability matter in BRICS economies? Geol. J. 2024, 59, 288–300. [Google Scholar] [CrossRef]

- Athari, S.A. Global economic policy uncertainty and renewable energy demand: Does environmental policy stringency matter? Evidence from OECD economies. J. Clean. Prod. 2024, 450, 141865. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Nasreen, S.; Anwar, M.A. Impact of equity market development on renewable energy consumption: Do the role of FDI, trade openness and economic growth matter in Asian economies? J. Clean. Prod. 2022, 334, 130244. [Google Scholar] [CrossRef]

- Ferrier, G.D.; Reyes, J.; Zhu, Z. Technology diffusion on the international trade network. J. Public Econ. Theory 2016, 18, 291–312. [Google Scholar] [CrossRef]

- Zhao, Z.; Gozgor, G.; Lau, M.C.K.; Mahalik, M.K.; Patel, G.; Khalfaoui, R. The impact of geopolitical risks on renewable energy demand in OECD countries. Energy Econ. 2023, 122, 106700. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W. The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew. Energy 2020, 145, 382–390. [Google Scholar] [CrossRef]

- Saeed, T.; Bouri, E.; Alsulami, H. Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Econ. 2021, 96, 105017. [Google Scholar] [CrossRef]

- Subramaniam, Y.; Masron, T.A.; Loganathan, N. Remittances and renewable energy: An empirical analysis. Int. J. Energy Sect. Manag. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Lei, W.; Liu, L.; Hafeez, M.; Sohail, S. Do economic policy uncertainty and financial development influence the renewable energy consumption levels in China? Environ. Sci. Pollut. Res. 2022, 29, 7907–7916. [Google Scholar] [CrossRef]

- Alsagr, N.; van Hemmen, S. The impact of financial development and geopolitical risk on renewable energy consumption: Evidence from emerging markets. Environ. Sci. Pollut. Res. 2021, 28, 25906–25919. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, M.C.K.; Zeng, Y.; Yan, C.; Lin, Z. The impact of geopolitical risks on tourism supply in developing economies: The moderating role of social globalization. J. Travel Res. 2022, 61, 872–886. [Google Scholar] [CrossRef]

- Gozgor, G.; Paramati, S.R. Does energy diversification cause an economic slowdown? Evidence from a newly constructed energy diversification index. Energy Econ. 2022, 109, 105970. [Google Scholar] [CrossRef]

- Lei, W.; Xie, Y.; Hafeez, M.; Ullah, S. Assessing the dynamic linkage between energy efficiency, renewable energy consumption, and CO2 emissions in China. Environ. Sci. Pollut. Res. 2021, 29, 19540–19552. [Google Scholar] [CrossRef]

- Zhang, X.; Guo, Q. How useful are energy-related uncertainty for oil price volatility forecasting? Financ. Res. Lett. 2024, 60, 104953. [Google Scholar] [CrossRef]

- Wang, Y.; Huang, X.; Huang, Z. Energy-related uncertainty and Chinese stock market returns. Financ. Res. Lett. 2024, 62, 105215. [Google Scholar] [CrossRef]

- Dang, T.H.-N.; Nguyen, C.P.; Lee, G.S.; Nguyen, B.Q.; Le, T.T. Measuring the energy-related uncertainty index. Energy Econ. 2023, 124, 106817. [Google Scholar] [CrossRef]

- Chu, L.K.; Doğan, B.; Ghosh, S.; Shahbaz, M. The influence of shadow economy, environmental policies and geopolitical risk on renewable energy: A comparison of high-and middle-income countries. J. Environ. Manag. 2023, 342, 118122. [Google Scholar] [CrossRef]

- Shafiullah, M.; Miah, M.D.; Alam, M.S.; Atif, M. Does economic policy uncertainty affect renewable energy consumption? Renew. Energy 2021, 179, 1500–1521. [Google Scholar] [CrossRef]

- Ivanovski, K.; Marinucci, N. Policy uncertainty and renewable energy: Exploring the implications for global energy transitions, energy security, and environmental risk management. Energy Res. Soc. Sci. 2021, 82, 102415. [Google Scholar] [CrossRef]

- Khan, K.; Su, C.W. Does policy uncertainty threaten renewable energy? Evidence from G7 countries. Environ. Sci. Pollut. Res. 2022, 29, 34813–34829. [Google Scholar] [CrossRef]

- Li, Z.Z.; Su, C.W.; Moldovan, N.C.; Umar, M. Energy consumption within policy uncertainty: Considering the climate and economic factors. Renew. Energy 2023, 208, 567–576. [Google Scholar] [CrossRef]

- Sweidan, O.D. The geopolitical risk effect on the US renewable energy deployment. J. Clean. Prod. 2021, 293, 126189. [Google Scholar] [CrossRef]

- Cai, Y.; Wu, Y. Time-varying interactions between geopolitical risks and renewable energy consumption. Int. Rev. Econ. Financ. 2021, 74, 116–137. [Google Scholar] [CrossRef]

- Flouros, F.; Pistikou, V.; Plakandaras, V. Geopolitical risk as a determinant of renewable energy investments. Energies 2022, 15, 1498. [Google Scholar] [CrossRef]

- Pommeret, A.; Schubert, K. Intertemporal emission permits trading under uncertainty and irreversibility. Environ. Resour. Econ. 2018, 71, 73–97. [Google Scholar] [CrossRef]

- Antoniuk, Y.; Leirvik, T. Climate change events and stock market returns. J. Sustain. Financ. Invest. 2024, 14, 42–67. [Google Scholar] [CrossRef]

- Shang, Y.; Han, D.; Gozgor, G.; Mahalik, M.K.; Sahoo, B.K. The impact of climate policy uncertainty on renewable and non-renewable energy demand in the United States. Renew. Energy 2022, 197, 654–667. [Google Scholar] [CrossRef]

- Liang, C.; Umar, M.; Ma, F.; Huynh, T.L. Climate policy uncertainty and world renewable energy index volatility forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- Ren, X.; Li, J.; He, F.; Lucey, B. Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew. Sustain. Energy Rev. 2023, 173, 113058. [Google Scholar] [CrossRef]

- Syed, Q.R.; Apergis, N.; Goh, S.K. The dynamic relationship between climate policy uncertainty and renewable energy in the US: Applying the novel Fourier augmented autoregressive distributed lags approach. Energy 2023, 275, 127383. [Google Scholar] [CrossRef]

- Zhang, H.; Hong, H.; Ding, S. The role of climate policy uncertainty on the long-term correlation between crude oil and clean energy. Energy 2023, 284, 128529. [Google Scholar] [CrossRef]

- Zhou, D.; Siddik, A.B.; Guo, L.; Li, H. Dynamic relationship among climate policy uncertainty, oil price and renewable energy consumption—Findings from TVP-SV-VAR approach. Renew. Energy 2023, 204, 722–732. [Google Scholar] [CrossRef]

- Zhang, L.; Wang, L.; Wang, X.; Zhang, Y.; Pan, Z. How macro-variables drive crude oil volatility? Perspective from the STL-based iterated combination method. Resour. Policy 2022, 77, 102656. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Yu, S.; Wang, L. Risk transmission of El Niño-induced climate change to regional Green Economy Index. Econ. Anal. Policy 2023, 79, 860–872. [Google Scholar] [CrossRef]

- Dai, Z.; Wu, T. The impact of oil shocks on systemic risk of the Commodity markets. J. Syst. Sci. Complex. 2024. [Google Scholar] [CrossRef]

- Işık, C.; Kuziboev, B.; Ongan, S.; Saidmamatov, O.; Mirkhoshimova, M.; Rajabov, A. The volatility of global energy uncertainty: Renewable alternatives. Energy 2024, 297, 131250. [Google Scholar] [CrossRef]

- Hsiao, C. Analysis of Panel Data (No. 54); Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Cambridge Working Papers in Economics, 0435; University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Anton, S.G.; Nucu, A.E.A. The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 2020, 147, 330–338. [Google Scholar] [CrossRef]

- Ma, Y.; Zhao, Y.; Jia, R.; Wang, W.; Zhang, B. Impact of financial development on the energy intensity of developing countries. Heliyon 2022, 8, e09904. [Google Scholar] [CrossRef] [PubMed]

- Kutan, A.M.; Paramati, S.R.; Ummalla, M.; Zakari, A. Financing renewable energy projects in major emerging market economies: Evidence in the perspective of sustainable economic development. Emerg. Mark. Financ. Trade 2018, 54, 1761–1777. [Google Scholar] [CrossRef]

- Dogan, E.; Majeed, M.T.; Luni, T. Analyzing the impacts of geopolitical risk and economic uncertainty on natural resources rents. Resour. Policy 2021, 72, 102056. [Google Scholar] [CrossRef]

- Shahzad, U.; Doğan, B.; Sinha, A.; Fareed, Z. Does Export product diversification help to reduce energy demand: Exploring the contextual evidences from the newly industrialized countries. Energy 2021, 214, 118881. [Google Scholar] [CrossRef]

- Allan, G.; Lecca, P.; McGregor, P.; Swales, K. The economic and environmental impact of a carbon tax for Scotland: A computable general equilibrium analysis. Ecol. Econ. 2014, 100, 40–50. [Google Scholar] [CrossRef]

- Bashir, M.F.; Ma, B.; Bashir, M.A.; Radulescu, M.; Shahzad, U. Investigating the role of environmental taxes and regulations for renewable energy consumption: Evidence from developed economies. Econ. Res.-Ekon. Istraživanja 2021, 35, 1262–1284. [Google Scholar] [CrossRef]

- Johnstone, N.; Haščič, I.; Poirier, J.; Hemar, M.; Michel, C. Environmental policy stringency and technological innovation: Evidence from survey data and patent counts. Appl. Econ. 2012, 44, 2157–2170. [Google Scholar] [CrossRef]

- Jenner, S.; Groba, F.; Indvik, J. Assessing the strength and effectiveness of renewable electricity feed-in tariffs in European Union countries. Energy Policy 2013, 52, 385–401. [Google Scholar] [CrossRef]

- Li, X.; Ozturk, I.; Raza Syed, Q.; Hafeez, M.; Sohail, S. Does green environmental policy promote renewable energy consumption in BRICST? Fresh insights from panel quantile regression. Econ. Res.-Ekon. Istraživanja 2022, 35, 5807–5823. [Google Scholar] [CrossRef]

- Saliba, C.B.; Hassanein, F.R.; Athari, S.A.; Dördüncü, H.; Agyekum, E.B.; Adadi, P. The Dynamic Impact of Renewable Energy and Economic Growth on CO2 Emissions in China: Do Remittances and Technological Innovations Matter? Sustainability 2022, 14, 14629. [Google Scholar] [CrossRef]

- Athari, S.A.; Adaoglu, C. Nexus between institutional quality and capital inflows at different stages of economic development. Int. Rev. Financ. 2019, 19, 435–445. [Google Scholar] [CrossRef]

- Athari, S.A.; Shaeri, K.; Kirikkaleli, D.; Ertugrul, H.M.; Ozun, A. Global competitiveness and capital flows: Does stage of economic development and risk rating matter? Asia-Pac. J. Account. Econ. 2020, 27, 426–450. [Google Scholar] [CrossRef]

- Athari, S.A. Does the sovereign environmental, social, and governance sustainability activities jeopardize the banking sector’s stability: Evidence from the Arab economies. Sustain. Futures 2024, 7, 100204. [Google Scholar] [CrossRef]

- Athari, S.A.; Saliba, C.; Abboud, E.; El-Bayaa, N. Examining the Quadratic Impact of Sovereign Environmental, Social, and Governance Practices on Firms’ Profitability: New Insights from the Financial Industry in Gulf Cooperation Council Countries. Sustainability 2024, 16, 2783. [Google Scholar] [CrossRef]

- Athari, S.A.; Kirikkaleli, D. How do climate policy uncertainty and renewable energy and clean technology stock prices co-move? evidence from Canada. Empir. Econ. 2024. [Google Scholar] [CrossRef]

- Athari, S.A.; Khalid, A.A.; Syed, Q.R. Twitter-Based Economic Uncertainty and US Energy Market: An Investigation Using Wavelet Coherence. Energy Res. Lett. 2023, 5. [Google Scholar] [CrossRef]

| Variables | Codes | Measurements | Links |

|---|---|---|---|

| Renewable energy consumption | REN | Renewable energy consumption (% of total final energy consumption) | World Bank |

| Financial market development | STV | Stocks traded, total value (% of GDP) | World Bank |

| Economic openness | FDI | Foreign direct investment, net inflows (% of GDP) | World Bank |

| Remittances | REMIT | Personal remittances received (% of GDP) | World Bank |

| Carbon dioxide emissions | CO2 | CO2 emissions (kt) | World Bank |

| Natural resources rents | TNRR | Total natural resources rents (% of GDP) | World Bank |

| Economic activity | GDPC | GDP per capita (current US$) | World Bank |

| Energy-related uncertainty | EUI | Energy-related uncertainty index | www.policyuncertainty.com, 20 May 2024 |

| Global economic policy uncertainty | GEPU | Global economic policy uncertainty index | www.policyuncertainty.com, 20 May 2024 |

| Environmental policy stringency | EPS | Environmental policy stringency index | https://stats.oecd.org/, 20 May 2024 |

| STV | FDI | REMIT | CO2 | TNRR | GDPC | EUI | EPS | GEPU | VIF | |

|---|---|---|---|---|---|---|---|---|---|---|

| STV | 1.000 | 1.04 | ||||||||

| FDI | 0.066 | 1.000 | 1.01 | |||||||

| REMIT | −0.248 * | 0.051 | 1.000 | 1.08 | ||||||

| CO2 | −0.041 | −0.135 * | −0.273 * | 1.000 | 1.09 | |||||

| TNRR | 0.229 * | −0.038 | −0.248 * | 0.022 | 1.000 | 1.14 | ||||

| GDPC | −0.192 * | 0.134 * | −0.078 | 0.137 * | 0.234 * | 1.000 | 1.03 | |||

| EUI | −0.113 * | 0.002 | 0.013 | 0.048 | −0.317 * | 0.036 | 1.000 | 1.11 | ||

| EPS | −0.294 * | −0.133 * | 0.081 | −0.212 * | −0.136 * | 0.245 * | 0.14 6* | 1.000 | 1.05 | |

| GEPU | −0.188 * | −0.162 * | 0.052 | −0.121 * | −0.057 | 0.264 * | 0.292 * | 0.261 * | 1.000 | 1.12 |

| Variables | No. of Obs. | Mean | Median | St.dev | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Ln(REN) | 336 | 2.114 | 2.182 | 0.931 | −0.371 | 4.067 |

| Ln(STV) | 336 | 4.010 | 4.203 | 0.980 | 0.893 | 5.768 |

| Ln(FDI) | 336 | 0.839 | 0.837 | 1.474 | −6.524 | 4.460 |

| Ln(REMIT) | 336 | −1.408 | −1.425 | 1.083 | −4.163 | 0.900 |

| Ln(CO2) | 336 | 12.515 | 12.758 | 1.296 | 10.217 | 15.569 |

| Ln(TNRR) | 336 | −1.566 | −1.976 | 1.659 | −4.343 | 2.166 |

| Ln(GDPC) | 336 | 10.536 | 10.612 | 0.368 | 9.355 | 11.362 |

| Ln(EUI) | 336 | 3.050 | 3.072 | 0.400 | 1.782 | 3.997 |

| Ln(EPS) | 336 | 0.965 | 1.051 | 0.350 | −0.325 | 1.587 |

| Ln(GEPU) | 336 | 4.799 | 4.797 | 0.425 | 4.140 | 5.771 |

| REN | STV | FDI | REMIT | CO2 | TNRR | GDPC | EUI | EPS | |

|---|---|---|---|---|---|---|---|---|---|

| Pesaran’s test | 11.588 ** | 20.537 * | 34.216 ** | 22.447 * | 18.634 * | 22.548 * | 14.822 ** | 25.413 ** | 18.488 * |

| Variables | Panel (A): LLC (2002) | Panel (B): IPS (2003) | ||

|---|---|---|---|---|

| With Trend | With Cross-Sectional Dependence | With Trend | With Cross-Sectional Dependence | |

| LnREN | −5.436 * | −4.354 * | −4.314 * | −4.283 * |

| LnSTV | −3.551 * | −5.285 * | −5.621 * | −5.556 * |

| LnFDI | −6.546 * | −3.669 * | −4.232 * | −4.332 * |

| LnREMIT | −4.258 * | −5.261 * | −3.182 * | −3.106 * |

| LnCO2 | −2.218 ** | −2.115 ** | −2.926 * | −4.258 * |

| LnTNRR | −3.689 * | −2.226 ** | −2.218 ** | −3.324 * |

| LnGDPG | −2.026 ** | −6.753 * | −4.565 * | −2.214 ** |

| LnEUI | −3.448 * | −2.288 ** | −6.637 * | −5.652 * |

| LnEPS | −5.386 * | −3.395 * | −5.765 * | −6.448 * |

| LnGEPU | −2.135 ** | −4.522 * | −4.391 * | −4.523 * |

| H0 | F-Statistics | [Probability] | Decision | ||

|---|---|---|---|---|---|

| LnSTV | → | LnREN | 6.363 * | [0.000] | ✓ |

| LnFDI | → | LnREN | 4.425 * | [0.000] | ✓ |

| LnREMIT | → | LnREN | 2.224 ** | [0.023] | ✓ |

| LnCO2 | → | LnREN | 5.348 * | [0.000] | ✓ |

| LnTNRR | → | LnREN | 4.856 * | [0.001] | ✓ |

| LnGDPG | → | LnREN | 2.151 ** | [0.019] | ✓ |

| LnEUI | → | LnREN | 6.653 * | [0.000] | ✓ |

| LnEPS | → | LnREN | 5.846 * | [0.000] | ✓ |

| LnGEPU | → | LnREN | 2.252 ** | [0.026] | ✓ |

| Independent Variables | Quantile Estimated Coefficients | FE | |||

|---|---|---|---|---|---|

| Q.25 | Q.50 | Q.75 | Q.95 | Coefficients | |

| LnSTV | 0.381 * | 0.064 | 0.205 *** | 0.264 * | 0.087 ** |

| (4.70) | (0.41) | (1.67) | (3.35) | (2.03) | |

| LnFDI | 0.052 | 0.037 ** | 0.007 | 0.018 * | 0.036 ** |

| (0.80) | (2.06) | (0.16) | (4.39) | (2.15) | |

| LnREMIT | 0.164 | 0.045 | 0.019 ** | 0.077 * | 0.009 *** |

| (1.41) | (0.43) | (2.13) | (4.18) | (1.73) | |

| LnCO2 | −0.171 ** | −0.061 | −0.213 ** | −0.317 * | −1.049 * |

| (−2.07) | (−0.41) | (−2.18) | (−4.22) | (−5.56) | |

| LnTNRR | −0.163 * | −0.216 * | −0.212 * | −0.237 | −0.074 |

| (−3.36) | (−3.74) | (−5.91) | (−1.22) | (−1.07) | |

| LnGDPC | −0.124 | −0.393 ** | −0.533 * | −0.176 | −0.941 * |

| (−0.774) | (−2.04) | (−3.09) | (−0.62) | (−4.78) | |

| LnEUI | 0.042 * | 0.378 ** | 0.237 ** | 0.108 * | 0.035 ** |

| (4.24) | (2.05) | (2.12) | (3.04) | (2.14) | |

| LnGEPU | −0.515 * | −0.419 * | −0.486 * | −0.506 ** | −0.271 ** |

| (−2.65) | (−3.01) | (−3.79) | (−2.02) | (−2.14) | |

| LnEPS | 0.441 ** | 0.657 ** | 0.827 * | 0.251 * | 0.109 *** |

| (2.03) | (2.40) | (3.73) | (5.63) | (1.73) | |

| CD-test (p-value) | --- | --- | --- | --- | (0.339) |

| Time dummy | ✓ | ✓ | ✓ | ✓ | ✓ |

| Country dummy | ✓ | ✓ | ✓ | ✓ | ✓ |

| Independent Variables | Global Economic Policy Uncertainty (GEPU) | Environmental Policy Stringency (EPS) | Sample Countries | ||||

|---|---|---|---|---|---|---|---|

| Low GEPU | High GEPU | Sample Countries | Low EPS | High EPS | Sample Countries | ||

| LnEUI | 0.455 * | 0.638 ** | 0.951 | 0.254 ** | 0.286 * | 0.342 | 0.126 ** |

| (3.64) | (2.02) | (1.17) | (2.11) | (4.66) | (1.24) | (2.07) | |

| LnGEPU | −0.143 | −0.165 | −0.175 ** | −0.086 | −0.194 ** | −0.515 * | −0.316 |

| (−1.16) | (−1.44) | (−2.08) | (−0.64) | (−2.05) | (−5.56) | (−0.58) | |

| LnEPS | 0.363 | 0.462 ** | 0.628 * | 0.197 | 0.213 | 0.441 ** | 0.144 |

| (1.12) | (2.18) | (4.49) | (1.44) | (0.69) | (2.03) | (1.22) | |

| LnEUI × LnGEPU | −0.093 ** | −0.126 * | −0.213 *** | --- | --- | --- | −0.088 *** |

| (−2.22) | (−5.17) | (−1.89) | --- | --- | --- | (−1.71) | |

| LnEUI × LnEPS | --- | --- | --- | 0.014 ** | 0.032 * | 0.009 *** | 0.023 ** |

| --- | --- | --- | (2.01) | (3.18) | (1.73) | (2.16) | |

| Control variables | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Time dummy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Country dummy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Adj R2 | 0.26 | 0.32 | 0.41 | 0.23 | 0.29 | 0.36 | 0.43 |

| Independent Variables | Quantile Estimated Coefficients | FE | GMM-SYS | |||

|---|---|---|---|---|---|---|

| Q.25 | Q.50 | Q.75 | Q.95 | Coefficients | Coefficients | |

| Lag dependent variable | --- | --- | --- | --- | --- | 0.138 |

| --- | --- | --- | --- | --- | (1.33) | |

| LnSMT | 0.147 * | 0.093 | 0.219 ** | 0.185 *** | 0.066 ** | 0.244 *** |

| (4.46) | (1.24) | (2.05) | (1.73) | (2.13) | (1.69) | |

| LnFDI | 0.013 | 0.074 ** | 0.138 * | 0.105 | 0.042 *** | 0.028 * |

| (0.55) | (2.02) | (4.56) | (0.94) | (1.71) | (3.63) | |

| LnREMIT | 0.262 | 0.087 | 0.066 * | 0.138 *** | 0.075 | 0.163 ** |

| (0.88) | (1.11) | (5.58) | (1.68) | (1.37) | (2.03) | |

| LnCO2 | −0.242 * | −0.009 | −0.356 *** | −0.118 ** | −0.007 | −0.115 |

| (−5.33) | (−0.46) | (−1.69) | (−2.16) | (−1.22) | (−0.83) | |

| LnTNRR | −0.063 | −0.124 ** | −0.252 ** | −0.153 | −0.337 * | −0.078 |

| (−1.03) | (−2.05) | (−2.22) | (−1.41) | (−4.67) | (−1.43) | |

| LnGDPC | −0.233 * | −0.141 | −0.473 ** | −0.126 | −0.351 * | −0.094 |

| (−5.12) | (−1.57) | (−2.06) | (−0.77) | (−6.33) | (−1.26) | |

| LnEUI | 0.058 * | 0.342* | 0.151 *** | 0.276 ** | 0.128 * | 0.304 ** |

| (3.66) | (4.72) | (1.73) | (2.08) | (5.31) | (2.24) | |

| LnGEPU | −0.362 * | −0.453 ** | −0.278 * | −0.541 *** | −0.342 * | −0.248 ** |

| (−4.26) | (−2.11) | (−5.43) | (−1.73) | (−4.55) | (−2.13) | |

| LnEPS | 0.362 * | 0.441 | 0.426 * | 0.251 ** | 0.133 | 0.425 ** |

| (4.43) | (1.06) | (4.77) | (2.13) | (1.16) | (2.19) | |

| LnTINV | 0.238 * | 0.344 ** | 0.179 ** | 0.212 | 0.286 | 0.166 *** |

| (4.22) | (2.06) | (2.13) | (1.17) | (0.88) | (1.69) | |

| CD-test (p-value) | --- | --- | --- | --- | (0.428) | --- |

| M1-test | --- | --- | --- | --- | --- | (0.026) |

| M2-test | --- | --- | --- | --- | --- | (0.451) |

| Sargan-test | --- | --- | --- | --- | --- | (0.366) |

| Hansen-test | --- | --- | --- | --- | --- | (0.477) |

| FC dummy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Time dummy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Country dummy | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saliba, C. Do the Energy-Related Uncertainties Stimulate Renewable Energy Demand in Developed Economies? Fresh Evidence from the Role of Environmental Policy Stringency and Global Economic Policy Uncertainty. Energies 2024, 17, 4746. https://doi.org/10.3390/en17184746

Saliba C. Do the Energy-Related Uncertainties Stimulate Renewable Energy Demand in Developed Economies? Fresh Evidence from the Role of Environmental Policy Stringency and Global Economic Policy Uncertainty. Energies. 2024; 17(18):4746. https://doi.org/10.3390/en17184746

Chicago/Turabian StyleSaliba, Chafic. 2024. "Do the Energy-Related Uncertainties Stimulate Renewable Energy Demand in Developed Economies? Fresh Evidence from the Role of Environmental Policy Stringency and Global Economic Policy Uncertainty" Energies 17, no. 18: 4746. https://doi.org/10.3390/en17184746