Abstract

This review explores the interplay between renewable energy and monetary policy, highlighting how central banks can contribute to renewable energy development. Although the shift towards renewable energy is tremendous for sustainable development, it also comes with notable economic and financial challenges. Supervenient, the energy transition has raised significant interest among decision-makers and academia, prompting them to explore new innovative policies and strategies; as a result, these actions acknowledged that research in this field is essential for identifying optimal solutions. Moreover, recent global crises, including the energy crisis, have emphasised the important role of macroeconomic policies in crisis management. Within this framework, it’s essential to investigate how monetary policy, as the main tool of central banks, can foster renewable energy development. This comprehensive review systematically examines existing literature through a semi-structured literature analysis, which allows for a more flexible, complex, and thorough approach to identifying key issues and providing insights into the potential of monetary policy to address renewable energy challenges. We identified four main clusters of research: sustainability and development, economic growth and energy, monetary policy and investment, and emissions and renewable energy. Furthermore, exploring the interaction between monetary policy and renewable energy objectives to uncover paths for harmonizing monetary strategies with the goals of renewable energy development contributes to highlighting the existing gaps in the field and represents a starting point for further research topics. This study provides a comprehensive overview of the existing knowledge, identifies gaps in the literature, and suggests directions for future research.

1. Introduction

The current period is marked by a series of successive and simultaneous crises, presenting urgent and complex challenges. Climate change stands out as a top priority due to the significant risks it poses, including physical and transition risks to a green economy. These crises highlight the interconnectedness of the global systems, in which economic stability, environmental sustainability, and social well-being become more and more interdependent. The transition to renewable energy sources has also emerged as a global imperative, driven by climate change and the depletion of fossil resources. Therefore, addressing climate change requires an integrated approach that considers economic policies alongside environmental strategies.

The topic addressed in the paper belongs to this broader field, given that climate change policy aims to achieve net zero carbon emissions. It is assumed that the gradual orientation of economic and human activities towards using renewable energy sources would be the solution for achieving this objective and greening the economy. The development and adoption of large-scale renewable energies, such as solar, wind, and hydro, are crucial for reducing greenhouse gas emissions and ensuring a sustainable future. The transition to renewable energy, while vital for achieving sustainable development goals, is not without important obstacles. This transition path involves notable challenges, such as the high costs associated with shifting from fossil fuels to renewable sources, the need for substantial and sustained investment in infrastructure development, and the inherent fluctuations in renewable energy production due to factors like weather variability. These challenges must be addressed convincingly to ensure a smooth and effective transition to a more sustainable energy system. The concerns refer not only to improving the technologies for valorising this source or evaluating the efficiency of its use in the economy in general but also to finding solutions to encourage the development of this field by stimulating green investments, creating facilities for granting green loans, etc.

This study aims to uncover the relationship between monetary policy and renewable energy, a topic of growing interest. The choice of this topic is based on the fact that, on the one hand, research in the field of renewable energy has become a priority both at the level of decision-makers and in the academic environment. On the other hand, macroeconomic policies are considered necessary tools in managing various crises (including those in the case of the climate change crisis and fuel prices crisis) and transition processes (including those towards the green economy).

While the government is traditionally seen as the main decision-making factor in climate change policy, it’s important to recognise the increasingly significant role of the central bank in greening the economy [1]. Their potential effects on the functioning and stability of the financial system make them a crucial player in this transition. Through its objectives of price stability and financial stability, the central bank can contribute to an orderly transition to a low-carbon economy [2]. Low and stable inflation is necessary for efficient resource allocation and for attracting sustainable investments. Moreover, resource scarcity and climate change are increasingly influencing financial decisions worldwide. These challenges have fiscal and monetary implications, as effective energy transition requires coordinated economic policies. Fiscal policy is critical in providing the necessary funding for infrastructure development, thus offering financial support to renewable energy projects through subsidies and tax incentives. Complementarily, monetary policy can facilitate this transition by using levers to stimulate the economy and ensure adequate financing. Together, these policies can play a very important role in generating a successful shift towards sustainable energy.

The central bank has proven to be one of the main pillars in managing recent crises. The experience gained by using its tools makes it a potential actor in managing the climate change crisis and the transition towards a green economy. In this context, developing renewable energy is considered a solution for achieving a green economy. Therefore, an important subject to be addressed for research is the extent to which monetary policy, as the central bank’s main instrument, can respond to the challenges related to renewable energy development.

Monetary policy has expanded its range of instruments, especially after the onset of the global financial crisis. These tools are now frequently used to manage more complex risks in the financial system. There is a growing emphasis on incorporating environmental objectives into monetary policy operations in this context. Several monetary policy instruments can be adjusted to support environmental objectives, including purchasing programs for green assets, guarantee mechanisms adapted to consider climate risks, financing and refinancing schemes for sustainable investments, adjusting reserve requirements, applying preferential interest rates granted to green investments, etc. These monetary policy tools could contribute to a smoother transition towards a green economy.

The physical and transition risks generated by climate change, as well as the orientation of efforts towards the development of a low-carbon economy, require measures to ensure financial stability. Physical risks and asset losses affect the monetary transmission mechanism and, implicitly, the central bank’s ability to achieve its primary objective (ensuring price stability) and other objectives that are part of its field of competence—including financial stability and banking supervision. Lane [3] points out that the worldwide implementation of emission quotas and their tightening will limit the demand for fossil fuels, but, at the same time, it will increase the prices for the use of these resources and carbon-intensive goods relative to the prices of other goods and services. Although intended, such an effect produced to discourage carbon-intensive activities poses a challenge for the central bank in meeting the objective of price stability and firmly anchoring inflationary expectations. Such potential risks justify a direct interest of this institution in getting involved in the process of “ecological transition”. Some studies argue in favour of greater involvement from a broader perspective [4]. In this regard, it is emphasised that the central bank can play a key role in addressing climate change not only by integrating environmental factors into the monetary policy framework without explicitly prioritizing the sustainability issue but also by actively using monetary and prudential tools to encourage green investments and discourage polluting ones. Analysing the effects of climate change on financial stability through the lens of the price dynamics of financial assets and the financial position of firms [5], the authors of the study find that climate-induced financial instability can negatively affect credit expansion and reduce the level of economic activity. The authors also note that by destroying firms’ capital and reducing profitability, climate change can gradually damage firms’ liquidity, leading to a high rate of loan defaults with negative effects on the economy. These findings prove that the risk of climate change can become systemic, and managing systemic risk in the financial sector is the responsibility of a central bank as the guardian of financial stability [6]. In this regard, the central bank is the only institution that has the authority to require financial institutions to proactively conduct risk assessments regarding the impact of climate change on the activity and operations of financial institutions [7]. The central bank’s involvement in climate change policy is also motivated by the phenomenon of credit market failure [8] as a result of the conflict between the interests of credit institutions (profit) and the development objectives set by society (sustainable development) whose achievement is conditional on the availability of financial resources and a certain monetary stability. The allocation of resources can be suboptimal from a societal perspective by orienting lending towards polluting activities with intensive coal consumption.

On the other hand, the central bank’s involvement in the policy of greening the economy entails certain risks. In addition to the risk of affecting the effectiveness of monetary policy by abandoning the neutral position towards the market [9,10,11], there is the risk of undermining independence in the decision-making process in the areas that must remain its responsibility, along with the attraction of the central bank on the political stage [11], as well as the risk of damage to the credibility and the long-term compromise of the central bank’s reputation [12].

Despite divergent opinions on this subject, more and more monetary authorities are considering formulating a strategy that takes into account environmental objectives, directing their attention to green finance and the greening of the economy. The notion of greening the central bank appeared, and the extent to which this institution is involved in climate change policy is even evaluated based on scores [13]. Moreover, the central banks’ concerns in this field were crystallised through the initiative of eight central banks and financial supervisory authorities to establish, in December 2017, the Network for Greening the Financial Systems (NGFS) with the aim of sharing best practices for managing the climate-related financial risks and mobilizing financing flows to support the transition to a sustainable economy. Since then, the number of NGFS members has increased significantly, reaching 138 in March 2024.

Beyond these observations, an additional argument for supporting the central bank’s interest in greening the economy refers to the direct link between the economy’s energy resources and inflation. Although the production and consumption of energy, as well as investments in renewable energy, are issues that belong to the field of greening the economy, their dynamics influence the price of energy and implicitly inflation in the conditions in which this variable is taken into account when calculating inflation—a benchmark for monetary policy decisions in fulfilling its fundamental objective—price stability.

The central bank is increasingly interested in the evolution and fluctuations of the price of energy, including renewable energy, especially since the latter can produce structural changes in the economy that will affect the total price of energy. Moreover, the recent global inflationary episode has been fuelled and exacerbated by the energy crisis, with fluctuating fossil fuel prices and rising energy prices showing that central bank policy is circumscribing these challenges.

We can find from the literature a growing interest in this topic, but notably, some areas worthy of study remain unexplored, leaving some knowledge gaps. Through a rigorous analysis of published research on relevant subjects, we can obtain a perspective on the way monetary policy can contribute to the approach to the challenges associated with renewable energy.

The main objective of this paper is to synthesise these perspectives and highlight the connections and research clusters in the literature.

This paper is, therefore, structured to make an effective linkage between the challenges of renewable energy and monetary policy through a critical review of existing literature. Our study, therefore, introduces the context and significance of research on this topic in the Section 1, considering the urgent need for sustainable solutions for energy issues from the perspective of monetary policy. The methodology presentation is provided in the Section 2, which covers the selection criteria and the tools used to collect and analyse relevant academic research papers. In the Section 3, we provide details regarding the results obtained from the collaboration network mapping, pointing out the main actors in this field and the inter-connection elements we found. The Section 4 presents our conclusions, discussing the results and elaborating on the way in which monetary policy can be aligned with the objectives of renewable energy, thus pointing out potential paths for future research.

2. Materials and Methods

2.1. Research Methods

Considering that it is a topic included in several fields—finance, economy, technology, ecology, and sustainable development—a semi-structured review combining a systematic analysis with a narrative one appeared to be the more appropriate approach in this study. We use the systematic method for the first part of the analysis process (selecting research papers) and the narrative (semi-systematic) method for the second part (content analysis of the selected studies based on value judgments).

Our systematic method involves applying bibliometric research methods, which is a valuable tool for identifying pertinent studies addressing the connections between monetary policy and renewable energy.

The narrative review method is applied to analyse the content of the studies selected based on bibliometric research. This method describes the evolution of research on the topic over time and other valuable insights relevant to the research questions, main findings, commonalities, and differences.

The bibliometric analysis is a tool used by academics to make systematic literature reviews [14]. It is an objective scientific computer-assisted review methodology that extracts, explores, organises, analyses, and synthesises large volumes of unstructured scientific data to present the current state, the gaps and ideas for future research on a topic or field [14]. These characteristics led us to use bibliometric analysis, as the scope of our review is broad, and the number of scientific papers we explore is too high for manual analysis [15].

Furthermore, the diverse bibliometric software (from which we chose VOSviewer 1.6.20) has allowed us to present the results visually, in intuitive and comprehensible maps, which has enabled us to have a valuable overview of the existing literature, to detect knowledge gaps, to reveal new trends and to extract fresh ideas for further research studies [15,16]. Using VOSviewer as a tool for conducting the bibliometric analysis allowed the visualization of complex networks and the identification of key research clusters. The narrative review complemented this analysis, providing qualitative context and perspectives on top of the quantitative findings.

Two types of techniques are used in bibliometric analysis: performance analysis and science mapping [15]. Performance analysis is descriptive, and it looks into, measures, and sorts the contributions of research constituents (e.g., authors, citation, keyword frequency, institutions, countries, and journals) to a certain domain and the relationships among them. It consists of publication-related metrics, citation-related metrics, and citation-and-publication-related metrics. The most important measures are the number of citations and papers published every year by every researcher under analysis, where the citation is an estimate of impact and influence, and the paper published is a substitute for productivity [15]. Thus, we could use this technique to determine the keywords that represent the key concepts in the literature, to identify networks of cooperation between authors and between countries, to uncover the most influential authors and the collaborations between them, as well as the influence of each country in the field we study.

Science mapping analyses especially the relationships between the research papers in focus and can also reveal important subjects, along with significant tendencies and gaps in the field [14]. Due to its visualization tool, we showed the relationship networks between keywords, authors, and countries.

The techniques for science mapping include citation analysis, co-citation analysis, bibliographic coupling, co-word analysis, and co-authorship analysis. The citation analysis allows us to recognise the most noteworthy papers published in a research field. Co-citation analysis can be used to reveal the significant subjects of a research domain, allowing academics to discover thematic clusters to see the progress of a research area. Bibliographic coupling helps comprehend the evolution of different subjects in a research domain. The co-word analysis offers the possibility to expand on each thematic cluster’s content and forecast future relationships among themes in a research field. Co-authorship analysis studies the relationships that exist among academics in a certain research area [15]. We used a scholarly co-citation network to indicate the most influential authors and their collaborations. Also, with the help of scholarly citations and bibliographic coupling between authors and countries, we showed the relationships between the relevant literature. Analysing the bibliographic coupling between countries, we disclosed the connections between countries and the influence of each country in the research field we study.

Last but not least, the approach with the bibliometric methods is suitable due to the cross-disciplinarity of the topic addressed in the paper to answer the challenges existing at present on climate change and sustainable development objectives [15,16].

2.2. Data Sources and Selection

We used the Web of Science (WoS) database to collect relevant published research.

As a first step, searches were conducted for key terms such as “monetary policy” and “energy” in the topic of publications, resulting in 537 documents. For a more focused analysis, the term “energy” was replaced with “renewable energy”, yielding 74 works. We collected bibliometric data regarding all available published research meeting the criteria to ensure data relevance. The next step was to export the bibliometric data in a format compatible with VOSviewer software, a powerful instrument in the analysis of research networks and the visualization of bibliometric data.

2.3. Visualization Tool

VOSviewer was developed by Nees Jan van Eck and Ludo Waltman at Leiden University’s Centre for Science and Technology Studies, and it was released in 2010 in their paper “Software survey: VOSviewer, a computer program for bibliometric mapping”, in Scientometrics. It is free software, effective in information visualization, and it pays special attention to the graphical representation of large bibliometric maps in a way that is easy to read (www.vosviewer.com). This software has been used in various research fields (e.g., Krauskopf, E. [17], Yu et al. [18], or Sweileh et al. [19]).

VOSviewer allows the development of network maps that illustrate the connections between papers based on co-citation, co-authorship, citation, bibliographic coupling, and co-occurrence of search terms. In this study, we used co-occurrence of terms analysis to highlight the main concepts and subjects discussed in the literature, co-authorship, and co-citation analysis to identify the most influential authors and the collaborations between them, and citations and bibliographic coupling to uncover the relationships between the relevant literature, the connections between the countries, and the influence of each country in the research field.

The configuration of the analysis in VOSviewer included several important steps. First, we imported the data and filtered the research papers to exclude those that didn’t meet our relevance criteria. Almost exclusively, the results were research papers published in academic journals. Next, we adjusted the visualization parameters to obtain a clear and useful representation of the networks. This included setting the co-citation level to a minimum of 10 citations and the minimum level of co-occurrences of a keyword to 5 to include only significant and relevant connections in the analysis. To better understand the collaboration networks between authors and countries, we set the minimum number of papers from one author to 1 and the minimum number of citations at 0.

We applied the criteria of five minimum citations for the set of research papers to analyse the structure of scholarly citations and the bibliographic coupling between authors.

In analysing bibliographic coupling between countries, we used a criterion of a minimum of three citations as the basis for the analysis. However, to obtain a more detailed perspective, we also applied a more permissive criterion of one minimum citation per paper.

As a final step of this stage, the interpretation of network maps and clusters obtained in this way was conducted through a detailed analysis of their structure and dynamics. Then, the identified clusters were evaluated to determine the main research fields and to analyse the connections between different research fields.

The list of the relevant resulting documents represents the body of work for the following stage, namely the narrative analysis of the literature.

2.4. The Semi-Systematic Method for Content Analysis

This method is used to identify the methodologies applied in each study and the results obtained.

The selected studies are divided into methodology-based groups according to the main techniques and tools applied. This allows for a more detailed examination of the diverse techniques used in this research field and enables a clearer and more revealing perspective.

Furthermore, literature exploration based on the narrative method allows the content analysis of the articles. At this stage, the selection of studies that examine the relationship between monetary policy and environmental and energy issues is considered. It focuses on identifying the research framework and analysing the results obtained. The narrative approach enables the categorization of research questions and the identification of commonalities and differences in the obtained results.

3. Results

3.1. General Analysis

The analysis of bibliometric data extracted from Web of Science and visualised using VOSviewer offers a comprehensive perspective on the research landscape at the point of interaction between monetary policy and renewable energy. Studying the networks of co-citation and identifying key clusters, we observe the main trends in this research area, the seminal papers, and influential researchers in this interdisciplinary research field. The maps and networks we obtained uncover the complex relationships between the various research fields and emphasise the convergence and divergence areas in the literature. In this section, we present the findings of our analysis, offering perspectives regarding the dynamics of the relevant research community and shedding light on the central topics that fuel the discussion regarding the role played by monetary policy in the initiatives related to renewable energy.

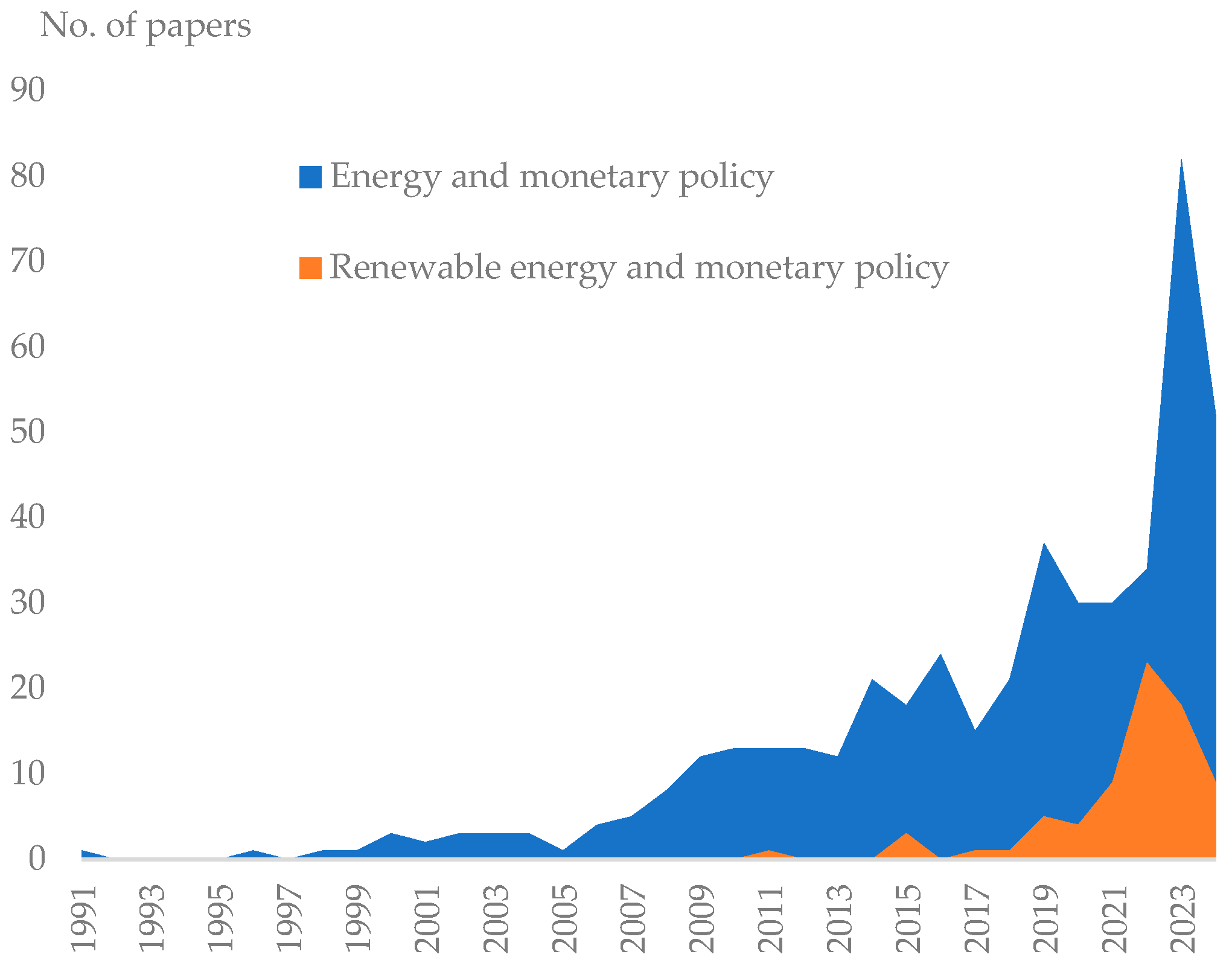

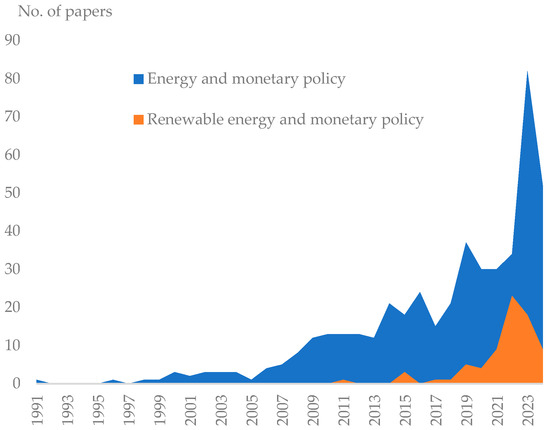

From a chronological point of view, the first articles appearing in WoS are sporadically recorded in the 1990s, with no more than four articles between 1991 and 1999. As shown in Figure 1, after 2005, the number of publications that deal with the issue of the relationship between monetary policy and the energy-environment field increased significantly, and 2011 represents the year when the first WoS article was registered that tangentially addresses the role of monetary policy in the context of the vulnerability induced by nuclear energy and renewable energy sources. The research problem addressed in this paper was prompted by the nuclear accident in Japan in 2011.

Figure 1.

The dynamics of papers published in WoS addressing the relationship between monetary policy and the energy field (yearly frequency).

Against the background of the conflict in Ukraine and the energy crisis, there is a growing concern about the sustainable development of the economy and, implicitly, the interest in researching this topic, as shown in Figure 1.

3.2. Keyword Co-Occurrence Analysis

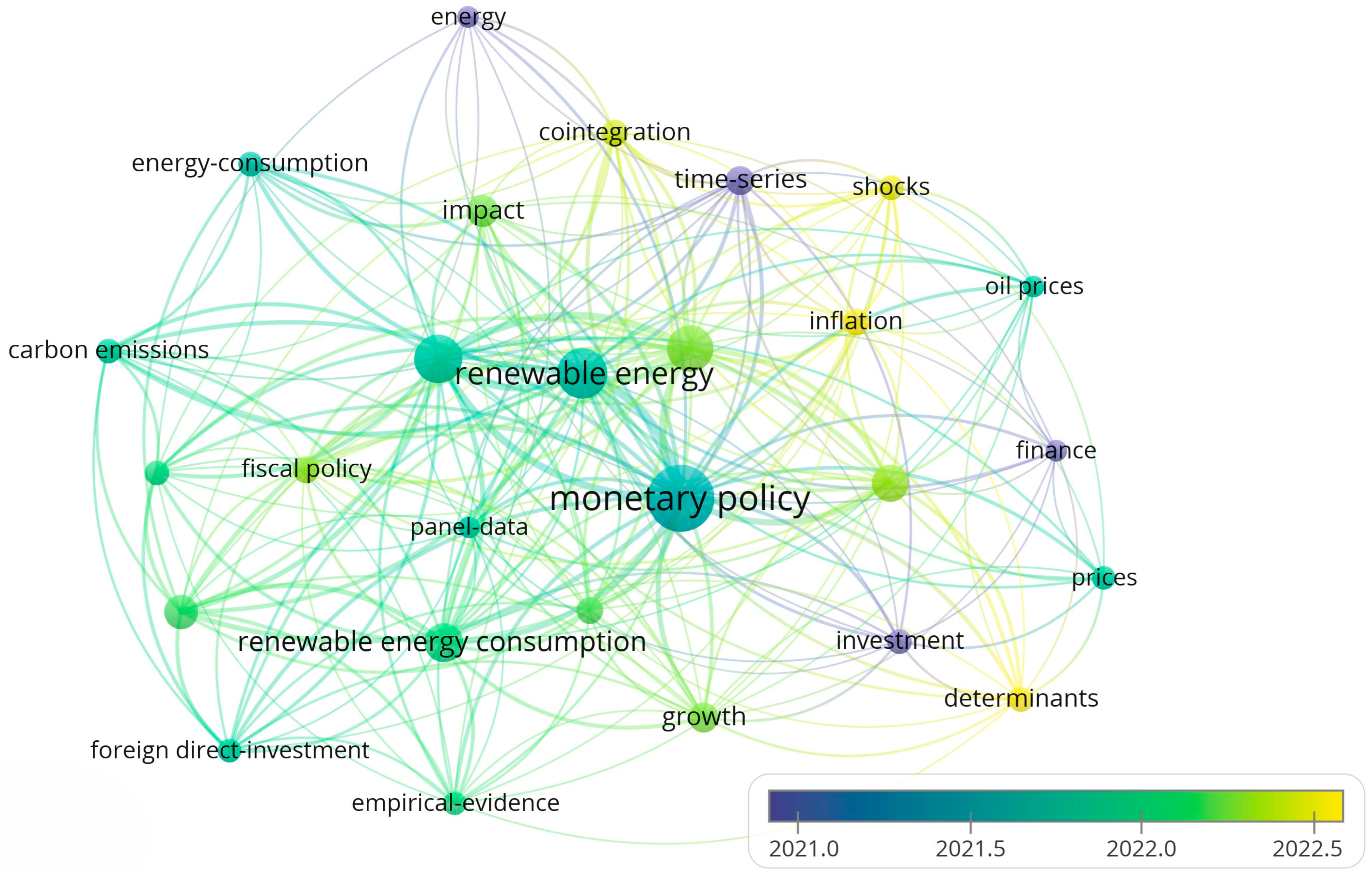

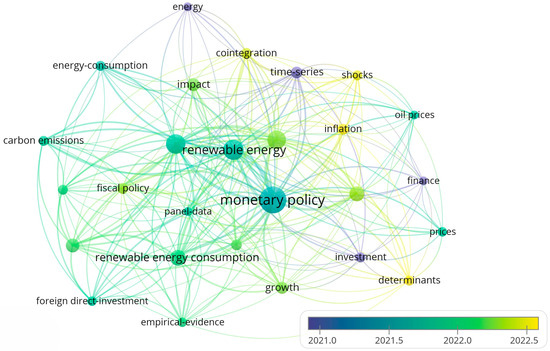

Our search segmentation led to obtaining a total of 505 keywords. The use of the Thesaurus function allowed us to eliminate any overlaps between keywords (such as between “monetary-policy” and “monetary policy”), allowing for greater clarity in the interpretation of the results. To obtain a more relevant selection, we set the minimum level of occurrences of a keyword to 5, which led to a final total of 27 relevant keywords. This final set of keywords represents the key concepts in the literature and is relevant to determine the main research areas in the field.

We used VOSviewer to create network maps to highlight the relationships between these keywords. As a result, we identified four clusters with a relatively homogenous structure in terms of the number of keywords contained.

These clusters allow us to identify the main literature themes and emerging topics of research. The network map we obtained indicates the strong bonds between key terms such as “monetary policy”, “renewable energy”, “economic growth”, and “CO2 emissions”. The several distinct clusters indicate research themes such as financial development, fiscal policy, and impact of energy consumption.

Exploring the density map we observe key terms such as “monetary policy” and “renewable energy” in high-density areas of the map, indicating their relevance and centrality in the network.

Figure 2 illustrates the overlay map for keywords, showing the temporal evolution of research topics. The colors indicate the recency of the research, with more recent topics appearing in warmer colors (e.g., yellow), suggesting a shift in academic focus towards these areas.

Figure 2.

Overlay map for keywords highlighting the temporal progression of key research themes.

Analysing the overlay map for keywords, we note the recent research tendencies. Terms such as “sustainable development” and “foreign direct investment” suggest a recent orientation of research focus towards the impact of sustainable development and foreign investment. The most recent trend in research towards areas related to shocks and inflation is quite relevant.

The bibliometric analysis of the literature regarding the intersection between monetary policy and renewable energy revealed four distinct clusters of key terms, each reflecting important research topics. The first cluster, which is also the largest in terms of the number of keywords contained, that we can call “Sustainability and Development”, includes terms such as “empirical evidence”, “environmental Kuznets curve”, and “sustainable development”, underlying the importance of sustainable economic development. Terms such as “financial development” and “foreign direct investment” indicate the influence of capital on renewable energy consumption and sustainable development. The terms “empirical evidence” and “panel data” are indicative of the methodology approach used in these studies. The average and normalised number of citations, as presented in Table 1, for terms such as “empirical evidence” and “sustainable development” indicate a significant academic interest and a major influence on the relevant literature. This cluster reflects current concerns regarding the integration of economic policies and environment and sustainability objectives.

Table 1.

Bibliometric indicators for key concepts in the literature; keyword’s structure based on clusters, links, and citations.

The second cluster, which we can call “Economic Growth and Energy”, explores the relationships between macroeconomics factors and traditional energy. The terms “cointegration” and “time series” indicate the use of advanced statistics tools to analyse the long-term relationship between the main research terms. Terms such as “inflation” and “oil prices” indicate the importance of traditional energy markets and economic fluctuations (or shocks) in the context of energy-related policies. Terms such as “economic growth”, “cointegration”, and “oil prices” are central to this cluster, with “economic growth” having one of the higher scores in terms of weight (116) but with a below-average score in terms of citations (18.74 average citations). This cluster indicates the relevance of studying the long-term economic and energy impact, highlighting market fluctuations and the implications for economic policies.

“Monetary Policy and Investment” is the third cluster, which underlines the influence of monetary policy on consumption and investment. This cluster, also containing an important key term (“monetary policy”), refers to research focused on the role played by monetary policy in influencing consumption and investments in the field of energy. Key terms such as “monetary policy”, “consumption”, and “investment” are central, with “monetary policy” having the largest total link strength in the entire data set (182) and a relatively high citations indicator (26.71). These scores indicate the crucial role of monetary policy in stimulating economic growth and supporting the transition towards renewable energy. Investment and finance are essential in this process, and research terms such as “investment” having a score for average citations of 45.29 highlight this aspect.

The final cluster we detect is “Emissions and Renewable Energy”, which focuses on the ecological impact of energy transition. This cluster highlights the link between energy consumption, carbon emissions, and the transition towards renewable energy. “Carbon emission” and “CO2 emissions” highlight the importance of reducing emissions in the context of this research. At the same time, “impact” indicates an effort to evaluate the effects of energy policies on the environment. This cluster also highlights the independencies between environmental and energy policies, underlining the need for integrated strategies to approach climate change and promote sustainable development.

Overall, the existence of these clusters indicates a thorough approach in the literature to the interaction between monetary policy, economic development, and the transition towards renewable energy sources. Each cluster seems to address a specific dimension of the greater research problem, from macroeconomic implications to the direct impact on the environment of the various energy policies. This highlights the complexity of the research field and the interdependencies between the various key factors. The data we obtained indicate a sustained academic interest in this research area, pointing to the importance of an interdisciplinary approach to answer the current challenges posed by climate change and sustainable development goals. The detailed analysis of the connections between studies, citations, and average year of publication indicates that these topics are important in academic debates and have significant implications for the formulation of public policies.

Table 1, presented below, provides a detailed breakdown of the key concepts identified in the literature, including a cluster structure, number of links, total link strength, occurrences, average publication year, average citations, and normalised citations. Each column represents specific bibliometric indicators that measure the influence and connectivity of these concepts within the research field.

3.3. Collaboration Network Mapping

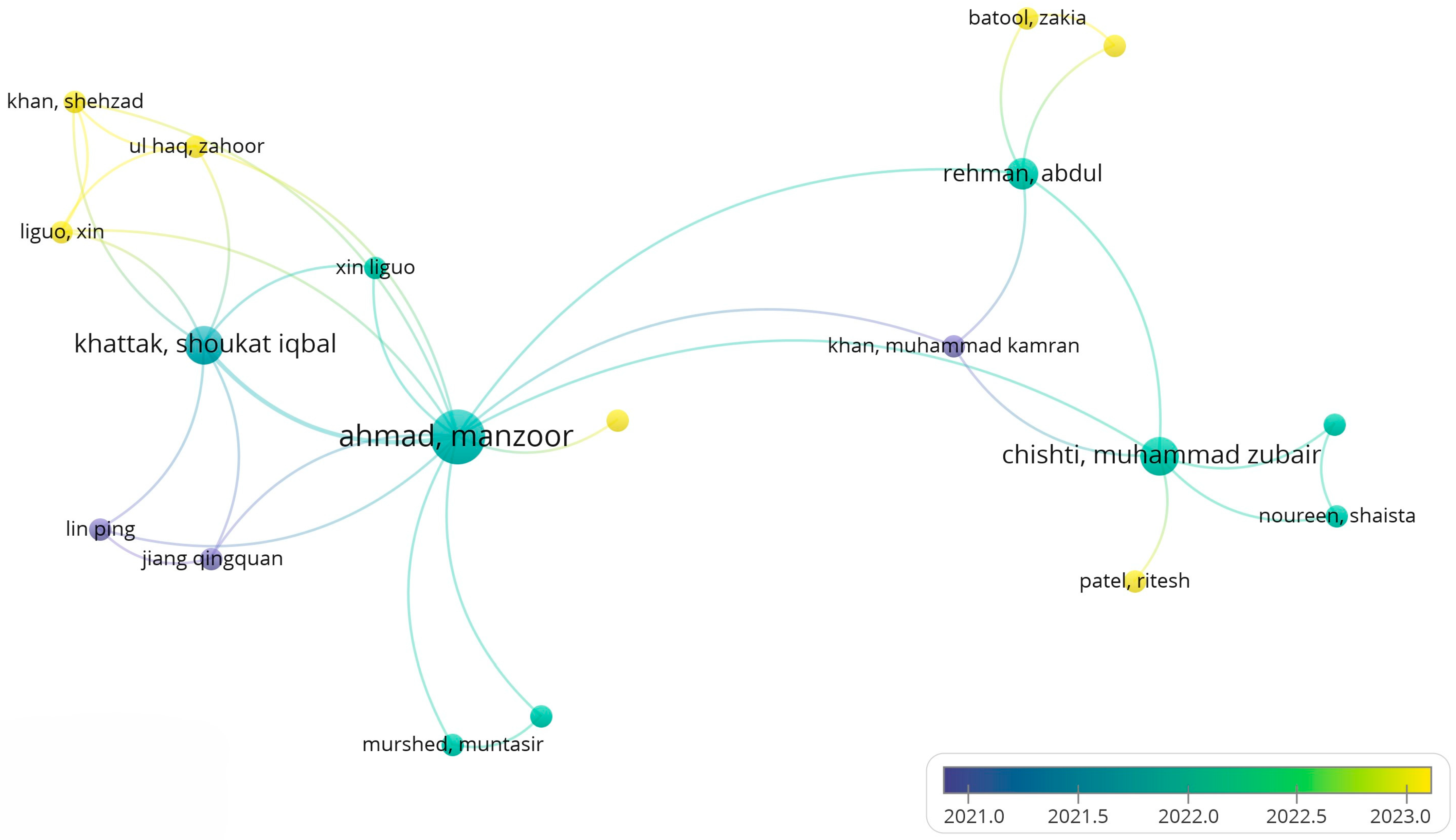

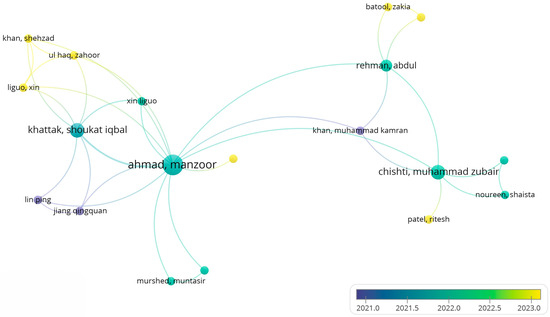

To better understand the collaboration networks between authors and countries, we set some basic criteria for the data analysis: the minimum number of papers from one author was set to 1, and the minimum number of citations was left at 0. Based on these segmentation criteria, we identified a number of 225 authors and 37 countries involved in this research area.

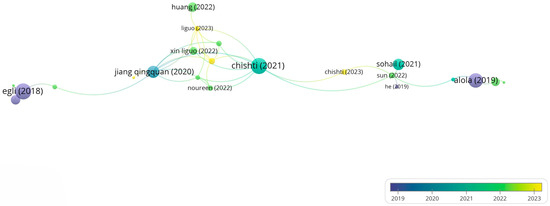

In terms of authorship clusters, we identified networks of cooperation between authors, as presented in Figure 3, containing 19 items, split into five different clusters, with 3–4 items each. Figure 3 also reveals the evolution in time of the publications, using a color code for the publication years. This allows the observation of temporal tendencies in authors’ cooperation. We note with the colour purple the authors who started to contribute to the field several years before, establishing the basis for future research. We then have an area of intermediary research, with author clusters working to develop research in the field, consolidating and expanding existing knowledge. Finally, recent contributions are highlighted in yellow. These authors reflect the new tendencies and research trends in the field of renewable energy and monetary policy.

Figure 3.

Overlay map for authors presenting the collaboration patterns among researchers, with nodes colored by the period of their research contributions.

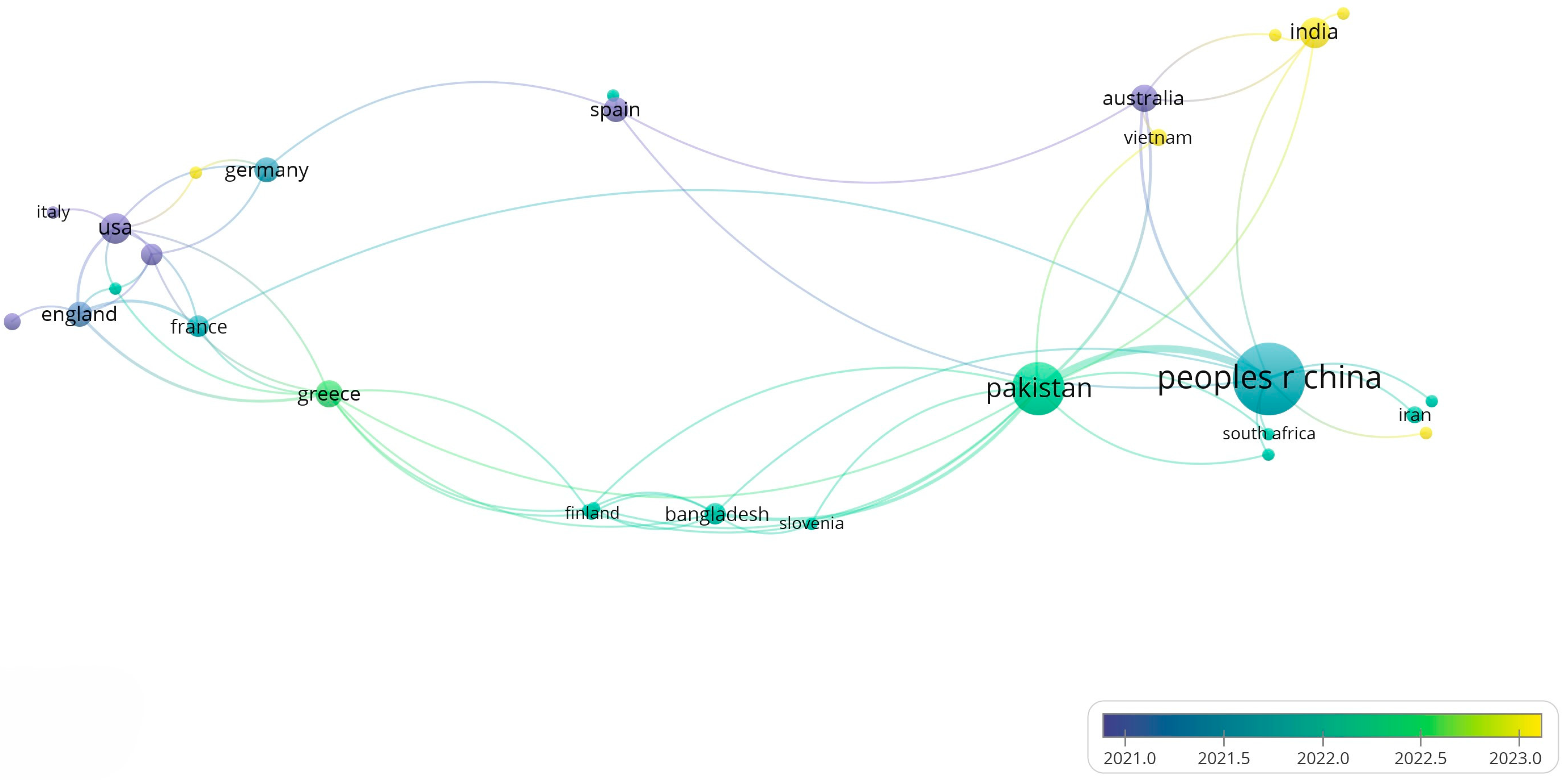

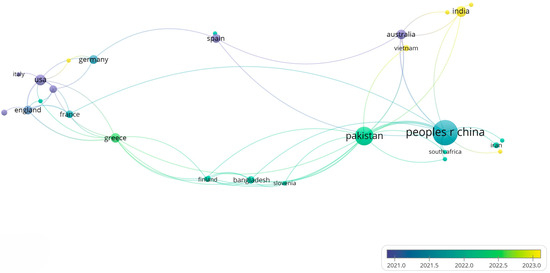

In Figure 4, the collaboration network between countries is visualised, revealing the international connection in the research regarding renewable energy and monetary policy. Larger nodes represent countries with more extensive research output and stronger international connections. The most prominent countries in the network include China, Pakistan, and the US. These countries are well connected, indicating the existence of significant international cooperation. China is the largest node in the network, which indicates a large number of international cooperations. China cooperates with various countries, including the US, Pakistan, Iran, and so on, indicating a global influence in this field. Pakistan is another central node that reflects a significant level of research activity in this field and international cooperation (Pakistan has strong links with research in Greece, Finland, and Slovenia). Although not the largest node, the US has strong research connections with European countries, such as Germany, Switzerland, and Sweden, indicating an active transatlantic activity. These networks indicate that research in the field of monetary policy and renewable energy is a global effort in which researchers from various regions of the world are actively involved.

Figure 4.

Collaboration networks between countries, depicting international research collaborations.

The analysis of collaboration networks uncovers the complex and interconnected research structure in this field. Collaboration between countries and authors underlines the importance of interdisciplinary and international approaches to tackling the current challenges of the energy transition and economic policies.

To conclude this section, we note that the temporal evolution of the research published in this field highlights the progress and dynamics of this area of research. This indicates a vibrant field of research that benefits from the constant contributions of researchers from around the world.

3.4. Scholarly Co-Citation and Citation Review

The next step in our research was to analyse the structure of scholarly citations and the bibliographic coupling between authors and countries to uncover the relationships between the relevant literature. We applied a criterion of five minimum citations for the set of research papers, resulting in 45 papers meeting this criterion. Figure 5 illustrates this document set, with influence in the field, contributing to the understanding of existing interactions. Code colouring for publishing years helps visualise temporal evolution in this field.

Figure 5.

Overlay map for citations, illustrating the temporal influence of key publications in the field [20,21,22,23,24,25,26,27,28,29,30,31].

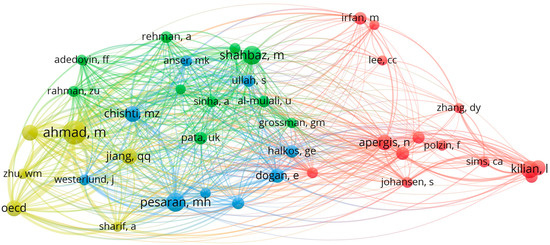

For authors co-citations, we applied a criterion of a minimum of 10 citations, resulting in 39 authors who meet the criterion out of a total of 3578. Figure 6 depicts this situation, presenting the structure of the co-citation network and indicating the most influential authors and the collaborations between them. Nodes represent authors, and the links represent the frequency with which they are cited together. This network helps identify clusters of closely related research.

Figure 6.

Co-citation network map, revealing interconnections among authors based on shared citations.

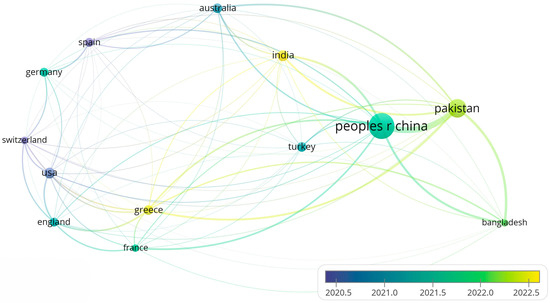

Analysing the bibliographic coupling between countries using a criterion of a minimum of three citations for the papers indicates 13 countries meet the criterion out of the total of 37 countries. The data are presented in Table 2 and can be visualised in Figure 7, which shows the bibliographic coupling between countries using a strict criterion. The size of the nodes indicates the number of citations, while the links represent the strength of the coupling. The data indicate the connections between these countries and the influence of each country in this field. Countries such as China, the US, and Germany are well connected, indicating intense research activity and powerful international cooperation.

Table 2.

Bibliographic coupling between countries.

Figure 7.

Bibliographic coupling between countries (strict criterion), highlighting research connections between countries based on shared citations.

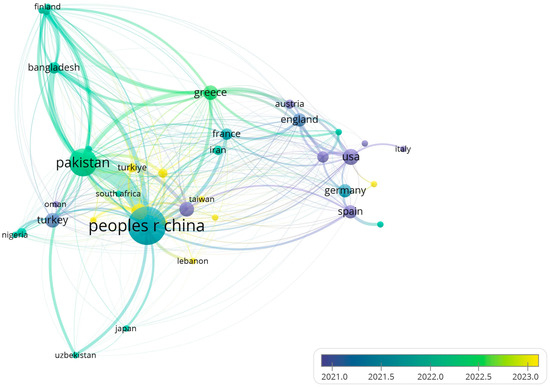

To obtain a more detailed perspective, we also applied a more permissive criterion of zero minimum citations per paper, resulting in 37 out of 37 countries meeting this criterion. Figure 8 depicts this extended network, highlighting the large global involvement in researching the connection between monetary policy and renewable energy. Observing the color codes for the temporal evolution of selected research, we can note a geographical transition from Western countries, through Central and Eastern Europe, towards Asian countries, where the major research clusters are currently located.

Figure 8.

Bibliographic coupling between countries (permissive criterion), illustrating a more extensive network of global research collaborations.

The data we obtained and analysed uncover a complex and interconnected structure of the literature, with research papers and influent authors that established the basis of research in this field and continue to concur with its development. Co-citations and bibliographic coupling between countries highlight international cooperation, which is essential for the advancement of knowledge in this field. This analysis method allowed us to obtain a deeper perspective on the influences and collaborations in the relevant literature. Our findings underline the necessity of supporting international and interdisciplinary cooperation to promote sustainable and efficient solutions in renewable energy, contributing to the formulation of robust, well-documented policies.

3.5. Methodology-Based Groupings for Research Articles

To organise the selected articles according to their methodologies, we resort to a systematic approach based on the main techniques and tools applied in each study. We have divided the articles into three significant groups (Econometric Models and Statistical Analysis, Policy Analysis and Impact Studies, Theoretical Models and Conceptual Frameworks) and identified specific subgroups to reflect the diversity of involved techniques.

The criteria for categorization included the primary method used for analysis, as well as the type of data and specific approaches used to answer the research questions. Thus, we ensured a clear and precise categorization of the existing literature in the analysed field.

Within the first group, Econometric Models and Statistical Analysis, the most consistent of the four, we identified five distinct subgroups based on specific modelling techniques: Vector Autoregressive (VAR) and Structural VAR (SVAR), ARDL (Autoregressive Distributed Lag) methods, panel data and GMM (Generalised Method of Moments) methodologies, cointegration methods and causality tests, and various methods for time series including Principal Component Analysis (PCA) and GARCH (Generalised Autoregressive Conditional Heteroskedasticity).

Table 3 synthesises the main research papers that applied VAR and SVAR modelling (first subgroup) to explore the dynamic relationships between economic and energy variables. VAR and SVAR models are essential in analysing the dynamic relationship between monetary policy and renewable energy consumption. VAR models capture interdependencies among time series, showing how changes in monetary policy variables, like interest rates, impact renewable energy over time. SVAR models add structural information to identify shocks and causal relationships, distinguishing between policy changes and other economic factors. These models are particularly valuable in the context of renewable energy, as they help disentangle the effects of monetary policy from other factors influencing energy markets, thereby providing clearer insights into how policy adjustments can promote or hinder the adoption of renewable energy sources. In this context, refs. [32,33] highlight that monetary policy—specifically, monetary tightening or shocks to the money supply—significantly impacts renewable energy production and economic growth across different countries. On the other hand, ref. [34] proves that a rise in oil prices leads to a reduction in the money supply.

Table 3.

Group 1: Econometric Models and Statistical Analysis, Subgroup 1: VAR and SVAR.

The second subgroup is dedicated to ARDL methods used to examine short- and long-term relationships between economic variables and related works are summarised in Table 4. This approach is adequate for the analysis of economic time series, as it facilitates the assessment of interconnections between multiple variables with nonlinear relationships, particularly in scenarios where variables experience nonlinear trends of growth or decline over time. In general, expansionary monetary and fiscal policies have been found to have a negative effect on environmental quality by increasing greenhouse gas emissions, while contractionary policies have the opposite effect. For example, refs. [22,28] show that expansionary monetary and fiscal policies degrade environmental quality by increasing CO2 and other greenhouse gas emissions, while contractionary policies reduce them. Ref. [26] highlight similar effects of fiscal policies on CO2 emissions in BRICS countries. Refs. [25,31] emphasise the negative impact of growth-oriented monetary instruments on CO2 emissions, with stricter monetary policies having mitigating effects. Refs. [36,37] discuss the effects of political uncertainty on green investments and CO2 emissions, suggesting that political and monetary uncertainty increases emissions, while [38] analyses how the interest rates in the United States influence renewable energy consumption in Turkey, showing significant effects driven by income and interest rate changes. Renewable energy consumption and financial development have been identified as critical factors in improving environmental quality [26,39].

Table 4.

Group 1: Econometric models and statistical analysis, Subgroup 2: ARDL methods.

Panel data and GMM methodologies (the third subgroup) are essential in econometrics for analysing datasets with multiple observations over time for various entities. Panel data controls for individual heterogeneity and captures temporal dynamics, enhancing the precision of estimates. GMM addresses endogeneity issues using internal instruments from lagged variable values, ensuring consistent and efficient parameter estimates. This method is especially useful in dynamic panel data models and can handle unobserved individual effects, autocorrelation, and heteroskedasticity, making it a robust technique for reliable empirical findings in economic research. Articles using these methods to investigate the links between monetary policy and renewable energy are summarised in Table 5. Several studies using GMM and panel data methodologies highlight the impact of monetary policy on renewable energy and environmental outcomes. Ref. [43] find that higher interest rates reduce CO2 emissions in 14 emerging economies, suggesting tighter monetary policy promotes renewable energy by discouraging fossil fuel use. Ref. [44] reports similar findings in 37 knowledge-based economies, where expansionary monetary policy increases CO2 emissions while contractionary policies and renewable energy reduce them. Ref. [45] show that negative interest rates lower CO2 emissions through the exchange rate channel in 45 countries, enhancing renewable energy competitiveness. On the other side, ref. [46] finds that financial openness combined with supportive monetary policy in 184 countries promotes energy stability, including renewable energy. Overall, these studies indicate that tighter monetary policy generally encourages renewable energy adoption, while expansionary policies favour traditional energy sources, with effectiveness varying by financial openness and economic development.

Table 5.

Group 1: Econometric Models and Statistical Analysis, Subgroup 3: Panel Data and GMM.

Cointegration methods and causality tests are crucial for analysing the long-term relationship between monetary policy and renewable energy consumption. Cointegration methods, such as the Johansen test, identify whether a stable, long-term equilibrium relationship exists between monetary policy variables (e.g., interest rates) and renewable energy consumption. Causality tests, like the Granger causality test, determine the direction of influence between these variables, indicating whether changes in monetary policy drive renewable energy adoption or vice versa. Table 6 summarises articles that employ these methods to explore the connections between monetary policy and renewable energy, using various economic variables across different countries and periods. They reveal that expansionary monetary policies generally increase CO2 emissions and negatively impact renewable energy investments, while contractionary monetary policies help mitigate emissions [21,48]. Notably, monetary policy uncertainty reduces renewable energy production in the United States [49], while fiscal expansion boosts it in G7 countries [29]. Moreover, trade openness and GDP per capita are positively associated with CO2 emissions [23], highlighting the complex interplay between economic policies and environmental outcomes. The impact of oil shocks, central bank independence, and fintech market fluctuations on energy markets and sustainable development are also explored, providing insights into the varying effects of monetary policy on energy and environmental stability across different regions [50,51].

Table 6.

Group 1: Econometric models and statistical analysis, Subgroup 4: Cointegration methods and causality tests.

Other advanced econometric methods also offer valuable insights when used to analyse the relationship between monetary policy and renewable energy. PCA reduces dimensionality to identify key influencing factors. GARCH models assess the volatility and risk associated with energy markets and policy impacts. These methods complement traditional approaches by addressing specific econometric challenges and enhancing our understanding of the effects of monetary policy on renewable energy. Table 7 summarises articles that employ these methods. Ref. [56] used PCA to reveal that trade and monetary policies significantly affect total energy usage and renewable energy consumption in Latin America. Higher interest rates negatively impact renewable energy consumption, imports, and alternative energy use. Ref. [57] applies GARCH models, finding that adjustments in interest and reserve rates, binding targets, and technology R&D reduced new energy index returns and volatility in China.

Table 7.

Group 1: Econometric models and statistical analysis, Subgroup 5: Various methods for time series.

Within the second group, Policy Analysis and Impact Studies, we identified two distinct subgroups based on the specific policies investigated: the analysis of monetary and fiscal policies and the analysis of energy and environmental policies.

The first subgroup includes studies examining the influence of monetary and fiscal policies on energy and environmental outcomes, some of which are already present in the previous group. However, we present some examples in Table 8 for illustrative purposes. The studies collectively indicate that monetary policy significantly impacts renewable energy investment and consumption. Analysing the case of China, ref. [30] found that easy monetary policy enhances investment opportunities and reduces financing constraints for renewable energy enterprises. It has been observed that in the United States [58], expansionary monetary policy promotes renewable energy consumption, particularly in the short run. Ref. [59] highlighted that improved institutional quality and central bank transparency help reduce emissions. Ref. [60] noted that a higher share of renewable electricity sources is associated with lower inflation, emphasizing the relationship between energy structure and inflationary pressures for European countries. After analysing 51 developing countries, ref. [61] emphasised that fiscal and monetary policies promote an inclusive clean environment. These findings underscore the importance of well-designed monetary and fiscal policies in supporting renewable energy and mitigating environmental impacts.

Table 8.

Group 2: Policy analysis and impact studies, Subgroup 1: Analysis of monetary and fiscal policies.

The second subgroup includes studies examining the influence of Analysis of energy and environmental policies. Table 9 summarises articles that investigate these issues. In this framework, ref. [62] shows that natural disaster costs significantly affect CO2 emissions and renewable energy use, increasing political disagreement and policy uncertainty in the United States. For Chile, ref. [63] compares energy policies, finding that non-conventional renewable sources and a sectorial cap achieve similar GHG reductions as carbon taxes but with lower impacts on electricity prices and GDP. Ref. [64] demonstrate in BRICS-T countries that monetary policy can improve environmental conditions, supporting renewable energy consumption.

Table 9.

Group 2: Policy analysis and impact studies, Subgroup 2: Analysis of energy and environmental policies.

The articles from Group 3, Theoretical Models and Conceptual Frameworks focus on developing theoretical models and conceptual frameworks to understand the complex relationships between economic, energy, and environmental variables. Table 10 summarises articles that employ these methods to explore the connections between monetary policy and renewable energy.

Table 10.

Group 3: Theoretical Models and Conceptual Frameworks.

3.6. Insights Derived from Results Analysis

Most studies identified through bibliometric analysis deal with research questions on environmental and energy issues beyond the monetary policy spectrum. Therefore, to channel the research towards the proposed objective, we selected only those research papers that address the connection between monetary policy and environmental and energy issues. Exploring the content of these articles allows the identification of commonalities and differences related to research questions and findings. We also considered not only the most cited articles in this field but also other works that address this topic.

The studies encompass countries from different regions of the world but predominantly focus on Asian countries. Likewise, some research focuses on emerging economies [26,69,70], while others examine developed [24,51,71] or mixed [21,25] economies.

The research problems addressed in the selected articles can be grouped into four main directions. The first group refers to the nexus between monetary policy stance and environmental quality, including the level of CO2 emissions (CO2e). The second one includes studies that approach the effects of monetary policy on the production and consumption of renewable energy. The third category comprises studies that explore the impact of monetary policy on sustainable investment, and the last group includes papers that focus on inflation (an important variable for monetary policy) and environmental quality.

3.6.1. Monetary Policy Stance and the Environmental Quality

Some studies argue that expansionary monetary policy worsens environmental quality while contractionary monetary policy improves it [21,24,26]. According to these findings, there is a significant long-term positive relationship between expansionary monetary policy and CO2e. In the same manner, ref. [55] reveals that a tight monetary policy reduces CO2e, while a loose monetary policy leads to environmental degradation. Analysing this subject for EU countries between 1990 and 2016, ref. [25] confirmed that a loosening monetary policy amplified the harmful effects of CO2 emissions. On the other hand, contractionary monetary policy serves as an effective measure to mitigate CO2e. These remarks are valid for both emerging economies [26] and for developed economies [24].

However, ref. [45] shows that when the interest rate falls below the zero lower bound, running the exchange rate channel can mitigate CO2e when the credit channel is blocked. This finding, however, should be researched in more detail to test the hypothesis of a potential positive impact of monetary easing measures through unconventional policies and environmental quality (by reducing CO2 emissions).

These empirical results regarding the nexus between the monetary policy and CO2e point to the potential role of central banks in promoting renewable energy by supporting commercial banks in applying for green lending programs and imposing higher interest rates on economic activities that are more than half-based on the use of fossil fuels [21,26]. Underlining that monetary policy has a major impact on the distribution of resources, consumption patterns, and investment decisions, ref. [55] considers that the central bank can contribute to reducing environmental pollution through its monetary instruments: offering green bonds under favourable conditions, special lending rates to support investments in ecological technologies and projects, etc. Policymakers should also develop a sustainable monetary strategy by implementing “ecological” monetary policy measures to stimulate credit institutions to provide green loans. One suggestion is to apply different interest rates based on the level of coal-based energy usage. For instance, higher interest rates could be imposed on loans given to companies that use at least 40% coal-based energy [24].

3.6.2. Monetary Policy and Renewable Energy Role in the Economy

The analysis of studies on this topic shows that the production and consumption of renewable energy are influenced both by the monetary policy stance [58,72] and by its uncertainty, reflected by the volatility of the monetary policy interest rate [28,49].

Exploring the impact of monetary policy on the consumption of renewable energy, especially in the case of the USA, ref. [58] shows that the conduct of the monetary policy reflected by the level of the real interest rate influences the consumption of renewable energy, both in the short term and in the long term. Thus, the restrictive monetary policy evidenced by the increase in the real interest rate decreases the consumption of renewable energy, and conversely, the easing of the monetary policy would encourage the consumption of renewable energy. By the same token, as pointed out by [32], the implementation of a contractionary monetary policy has a negative impact on the production of renewable energy.

Within this group of papers, there is also the issue of the influence of foreign monetary policy on the quality of the domestic environment. In this regard, ref. [38] analysed the spillover effects of the Fed’s monetary policy on the level of renewable energy consumption in Turkey. Their findings showed that the increase in the Fed’s interest rate reduces the consumption of renewable energy in Turkey. The results show the relevance of global monetary policy and its influence on other economies.

3.6.3. Monetary Policy and Sustainable Investments

Analysing the effects of natural resources on climate mitigation technologies in relation to a policy framework that includes monetary policy and other macroeconomic variables, ref. [27] reveals a sensitive relationship between monetary policy stance and climate mitigation technology for G-7 countries in the sense that an increase in the interest rate can hamper green technology investments. Therefore, policymakers should assess the cost of indebtedness generated by a tightening monetary policy conduit and configure an ecological strategy that offsets this cost based on granting green subsidies to encourage investments in ecological technologies [27].

The role of monetary policy in terms of sustainable investments is also discussed in [69], which analyses the connection between credit policy and financial constraints on sustainable investment in China’s renewable energy companies. According to the results, two main conclusions could be drawn. First, greater availability of commercial bank credit, higher levels of liquid assets, and higher returns on assets can increase renewable energy firms’ tangible investments. Instead, a high level of long-term debt and a heavy reliance on the bank can act as deterrents for such investments. Second, shorter-term debt and higher liability leverage significantly and positively influence the R&D investments of renewable energy companies in China. Conversely, longer-term debt and larger commercial bank loans affect the propensity to invest in R&D. Therefore, a more favourable credit policy allows firms to have easier access to short-term loans. The incentives and positive market expectations may lead renewable energy firms to take on higher liability leverage. Thus, policymakers should support the short-term lending activity from commercial banks to companies in renewable energy so that they have sufficient liquidity to invest in R&D in this field.

An extensive study of the number of countries that have taken part in the analysis of the relationship between monetary policy and green innovation is [54]. Based on a sample that includes 109 countries from both developed and emerging and developing countries, the analysis indicates that expansionary monetary policy fosters green innovation. Specifically, in developing countries, central bank independence and lower interest rates encourage green innovation. In addition, the results show that inflation and trade openness weaken the link between monetary expansion and ecological development.

3.6.4. Inflation and the Environmental Quality

Other studies consider inflation as a relevant variable for influencing sustainable development. In this regard, research shows a negative connection between inflation and environmental quality [71]. An increase in the inflation rate has a negative impact on the efficient utilization of renewable natural resources [70]. This result is in line with [73], which found a negative impact of the inflation rate on promoting sustainable projects. Furthermore, inflation is a key determinant of the ecological footprint [71], which serves as an indicator of environmental quality and is inversely correlated with it. Besides, ref. [74] (Andersson 2018) estimated that inflation has a greater effect on the price of carbon in developing countries than in developed countries.

Despite significant efforts leading to notable advancements in research, several gaps remain in the literature that require further exploration. One of these gaps refers to the research on the influence of the global monetary policy on CO2 emissions from emerging and developed countries. In addition, to our knowledge, assessing the impact of unconventional monetary policy from the point of view of environmental quality is a research topic still unexplored on a large scale.

Many studies focus on the impact of monetary and fiscal policies on renewable energy and emissions, but they often overlook the varying effects across different regions and economic contexts. For instance, the diverse economic structures and energy dependencies between developing and developed countries are frequently not adequately considered, particularly regarding monetary policy. Additionally, there is a need for a cross-sector approach to better understand these dynamics. Analysing a broader range of statistical data could illuminate causality more effectively.

While some research examines the effects of individual or a few policies, there is limited understanding of how various policies (e.g., monetary, fiscal, environmental) interact dynamically and their combined impact on renewable energy and environmental sustainability.

Furthermore, there is a significant gap in understanding how societal and behavioural factors influence the effectiveness of energy and monetary policies. This includes aspects such as public acceptance, consumer behaviour, and the role of social norms in adopting renewable energy technologies.

4. Conclusions

The use of bibliometric analysis and the narrative review method was pivotal in our research. They enabled us to identify relevant studies and extract useful information for our objective.

First of all, our research provided a timeline of the growing interest in analysing the impact of monetary policy on the energy sector, as well as the point at which the interest in studying the relationship between renewable energy and monetary policy became evident. Although the first few WoS papers addressing the connections between monetary policy and energy-environment issues were registered in the 1990s, only after 2005 did the number of publications that dealt with this topic increase significantly. However, the first WoS article that tangentially addresses the role of monetary policy on renewable energy was published in 2011.

Second, according to our selection and investigation criteria, this paper concurs with identifying the state of knowledge on the link between monetary policy and renewable energy.

The selected articles address research problems that can be grouped into four main directions: the nexus between monetary policy stance and environmental quality; the effects of monetary policy on the production and consumption of renewable energy; the impact of monetary policy on sustainable investment; and inflation, as a monetary policy variable, and environmental quality. One of the common findings is that expansionary monetary policy worsens environmental quality and increases CO2e, while contractionary monetary policy has the opposite effect. Another common finding is that restrictive monetary policy decreases consumption and negatively impacts the production of renewable energy while easing monetary policy encourages the consumption of renewable energy. Concerning the impact of monetary policy on sustainable investments, the literature reveals that a tightening monetary policy could impair this type of investment, while an easing monetary policy would encourage green investments. In this way, it is observed that monetary policy’s stance responds differently depending on the issue addressed. Therefore, central banks should find an equilibrium between these general objectives.

Co-citations analysis and bibliographic coupling between countries show that international cooperation is necessary for the progress of knowledge.

The research on this topic provided the opportunity to identify unexplored or insufficiently researched areas. One of these gaps refers to the research on the influence of the global monetary policy on CO2 emissions from emerging and developed countries. Besides, to our knowledge, assessing the impact of unconventional monetary policy from the point of view of environmental quality is a research topic still unexplored on a large scale.

In terms of future research, we believe that an investigation of interactions between various policies, including monetary, fiscal, and environmental, as well as their combined effects on renewable energy and environmental sustainability, should establish new investigation standards. These interactions should be approached by mathematical models that are able to capture multivariate phenomena with the challenge that data might be scarce and feature mixed frequencies. An enhancement of comparative studies that investigate the various types of impacts of energy and environmental policies across different regions and countries would also help to identify best practices needed to design frameworks for policy effectiveness. Another focal point should be the employment of methods for cross-sectional datasets able to generate significant trends and causal relationships, especially in a dynamic manner. Sector-specific studies, especially in high-emission industries like transportation and manufacturing, are needed to understand the challenges and opportunities that arise from energy transition.

Although hard to quantify, societal and behavioural factors, such as public acceptance, consumer behaviour, and social norms, are prone to influence the effectiveness of energy policies and the adoption of renewable energy technologies. Therefore, innovative methodologies that are designed to explore these areas will provide a more comprehensive understanding of policy impacts and help design more effective strategies for promoting renewable energy and sustainability.

To conclude, this paper synthetised existing literature regarding the interaction between renewable energy and monetary policy, highlighting the critical role of central banks in facilitating energy transition. Our results point towards the importance of integrated policies that can balance economic and environmental objectives. We believe that future research should focus on the dynamic interactions between the various policy measures and their combined impact on the larger adoption of renewable energy and environmental sustainability. Filling the identified research gaps can assist decision factors in developing more effective strategies to promote sustainable development in the context of the fast-evolving economic and climate conditions.

Author Contributions

Conceptualization, I.L. and R.L.; methodology, I.L, A.C., C.M. and R.L.; validation, I.L. and A.C.; formal analysis, I.L., A.C. and T.C.; writing—original draft preparation, I.L, A.C., T.C., C.M. and R.L.; writing—review and editing, A.C., T.C. and C.M.; visualization, I.L.; supervision, I.L.; project administration, R.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

All data that support the findings of this study are included within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Lupu, I.; Criste, A. Climate Change in the Discourse of Central Banks. Influence on Financial Stability at the European Level. Stud. Bus. Econ. 2023, 18, 235–246. [Google Scholar] [CrossRef]

- Monnin, P. Central Banks and the Transition to a Low-Carbon Economy; Discussion Notes 2018/1; Council on Economic Policies: Zurich, Switzerland, 2018. [Google Scholar]

- Lane, T. Thermometer Rising-Climate Change and Canada’s Economic Future. In Proceedings of the Finance and Sustainability Initiative, Montréal, QB, Canada, 2 March 2017. [Google Scholar]

- Dikau, S.; Volz, U. Central Banking, Climate Change and Green Finance; ADBI Working Paper 867; Asian Development Bank Institute: Tokyo, Japan, 2018. [Google Scholar]

- Dafermos, Y.; Nikolaidi, M.; Galanis, G. Climate Change, Financial Stability and Monetary Policy. Ecol. Econ. 2018, 152, 219–234. [Google Scholar] [CrossRef]

- Volz, U. On the Role of Central Banks in Enhancing Green Finance; Inquiry Working Paper 17/01; UN Environment Inquiry: Nairobi, Kenya, 2017. [Google Scholar]

- Ozili, P.K. Managing Climate Change Risk: The Policy Options for Central Banks. SSRN Electron. J. 2021, 1–12. [Google Scholar] [CrossRef]

- Campiglio, E. Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy. Ecol. Econ. 2016, 121, 220–230. [Google Scholar] [CrossRef]

- Boneva, L.; Ferrucci, G.; Mongelli, F.P. To Be or Not to Be “Green”: How Can Monetary Policy React to Climate Change? ECB Occasional Paper No. 258; Publications Office of the European Union: Luxembourg, 2021. [Google Scholar] [CrossRef]

- Matikainen, S.; Campiglio, E.; Zenghelis, D. The Climate Impact of Quantitative Easing; Policy Paper; Grantham Research Institute on Climate Change and the Environment: London, UK, 2017. [Google Scholar]

- Rusnok, J. The Changing World of Central Banking. In Proceedings of the Conference of the Czech Economic Society, Prague, Czech, 17 May 2021. [Google Scholar]

- Hansen, L.P. Central banking challenges posed by uncertain climate change and natural disasters. J. Monet. Econ. 2022, 125, 1–15. [Google Scholar] [CrossRef]

- Eames, N.; Barmes, D. The Green Central Banking Scorecard: 2022 Edition; Positive Money: London, UK, 2022. [Google Scholar]

- Lim, W.M.; Kumar, S. Guidelines for interpreting the results of bibliometric analysis: A sensemaking approach. Glob. Bus. Organ. Excell. 2024, 43, 17–26. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to conduct a bibliometric analysis: An overview and guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Öztürk, O.; Kocaman, R.; Kanbach, D.K. How to design bibliometric research: An overview and a framework proposal. Rev. Manag. Sci. 2024. [Google Scholar] [CrossRef]

- Krauskopf, E. A bibiliometric analysis of the Journal of Infection and Public Health: 2008–2016. J. Infect. Public Health 2018, 11, 224–229. [Google Scholar] [CrossRef]

- Yu, D.; Wang, W.; Zhang, W.; Zhang, S. A Bibliometric Analysis of Research on Multiple Criteria Decision Making. Curr. Sci. 2018, 114, 747. [Google Scholar] [CrossRef]

- Sweileh, W.M.; Al-Jabi, S.W.; Zyoud, S.H.; Sawalha, A.F.; Abu-Taha, A.S. Global research output in antimicrobial resistance among uropathogens: A bibliometric analysis (2002–2016). J. Glob. Antimicrob. Resist. 2018, 13, 104–114. [Google Scholar] [CrossRef] [PubMed]

- Egli, F.; Steffen, B.; Schmidt, T.S. A Dynamic Analysis of Financing Conditions for Renewable Energy Technologies. Nat. Energy 2018, 3, 1084–1092. [Google Scholar] [CrossRef]

- Qingquan, J.; Khattak, S.I.; Ahmad, M.; Ping, L. A New Approach to Environmental Sustainability: Assessing the Impact of Monetary Policy on CO2 Emissions in Asian Economies. Sustain. Dev. 2020, 28, 1331–1346. [Google Scholar] [CrossRef]

- Noureen, S.; Iqbal, J.; Chishti, M.Z. Exploring the Dynamic Effects of Shocks in Monetary and Fiscal Policies on the Environment of Developing Economies: Evidence from the CS-ARDL Approach. Environ. Sci. Pollut. Res. 2022, 29, 45665–45682. [Google Scholar] [CrossRef]

- Liguo, X.; Ahmad, M.; Khattak, S.I. Impact of Innovation in Marine Energy Generation, Distribution, or Transmission-Related Technologies on Carbon Dioxide Emissions in the United States. Renew. Sustain. Energy Rev. 2022, 159, 112225. [Google Scholar] [CrossRef]

- Liguo, X.; Ahmad, M.; Khan, S.; Haq, Z.U.; Khattak, S.I. Evaluating the Role of Innovation in Hybrid Electric Vehicle-Related Technologies to Promote Environmental Sustainability in Knowledge-Based Economies. Technol. Soc. 2023, 74, 102283. [Google Scholar] [CrossRef]

- Huang, W.; Saydaliev, H.B.; Iqbal, W.; Irfan, M. Measuring the Impact of Economic Policies on CO2 Emissions: Ways to Achieve Green Economic Recovery in the Post-COVID-19 Era. Clim. Chang. Econ. 2022, 13, 2240010. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Ahmad, M.; Rehman, A.; Khan, M.K. Mitigations Pathways towards Sustainable Development: Assessing the Influence of Fiscal and Monetary Policies on Carbon Emissions in BRICS Economies. J. Clean. Prod. 2021, 292, 126035. [Google Scholar] [CrossRef]

- Chishti, M.Z.; Patel, R. Breaking the Climate Deadlock: Leveraging the Effects of Natural Resources on Climate Technologies to Achieve COP26 Targets. Resour. Policy 2023, 82, 103576. [Google Scholar] [CrossRef]

- Sohail, M.T.; Xiuyuan, Y.; Usman, A.; Majeed, M.T.; Ullah, S. Renewable Energy and Non-Renewable Energy Consumption: Assessing the Asymmetric Role of Monetary Policy Uncertainty in Energy Consumption. Environ. Sci. Pollut. Res. 2021, 28, 31575–31584. [Google Scholar] [CrossRef]

- Sun, C.; Khan, A.; Liu, Y.; Lei, N. An Analysis of the Impact of Fiscal and Monetary Policy Fluctuations on the Disaggregated Level Renewable Energy Generation in the G7 Countries. Renew. Energy 2022, 189, 1154–1165. [Google Scholar] [CrossRef]

- He, L.; Wu, M.; Zhong, Z.; Xia, Y.; Yu, J.; Jiang, Y. Can Monetary Policy Affect Renewable Energy Enterprises Investment Efficiency? A Case Study of 92 Listed Enterprises in China. J. Renew. Sustain. Energy 2019, 11. [Google Scholar] [CrossRef]

- Alola, A.A. The Trilemma of Trade, Monetary and Immigration Policies in the United States: Accounting for Environmental Sustainability. Sci. Total Environ. 2019, 658, 260–267. [Google Scholar] [CrossRef] [PubMed]

- Chen, S.-S.; Lin, T.-Y. Monetary policy and renewable energy production. Energy Econ. 2024, 132, 107495. [Google Scholar] [CrossRef]

- Razmi, S.F.; Moghadam, M.H.; Behname, M. Time-varying effects of monetary policy on Iranian renewable energy generation. Renew. Energy 2021, 177, 1161–1169. [Google Scholar] [CrossRef]

- Liu, D.; Meng, L.; Wang, Y. Oil price shocks and Chinese economy revisited: New evidence from SVAR model with sign restrictions. Int. Rev. Econ. Financ. 2020, 69, 20–32. [Google Scholar] [CrossRef]

- Cai, Y.; Wu, Y. Time-varying interactions between geopolitical risks and renewable energy consumption. Int. Rev. Econ. Financ. 2021, 74, 116–137. [Google Scholar] [CrossRef]

- Bhowmik, R.; Syed, Q.R.; Apergis, N.; Alola, A.A.; Gai, Z. Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environ. Sci. Pollut. Res. 2022, 29, 14914–14928. [Google Scholar] [CrossRef]

- Tufail, S.; Alvi, S.; Hoang, V.-N.; Wilson, C. The effects of conventional and unconventional monetary policies of the US, EU, and China on global green investment. Energy Econ. 2024, 134, 107549. [Google Scholar] [CrossRef]

- Samour, A.; Pata, U.K. The impact of the US interest rate and oil prices on renewable energy in Turkey: A bootstrap ARDL approach. Environ. Sci. Pollut. Res. 2022, 29, 50352–50361. [Google Scholar] [CrossRef]

- Khan, F.U.; Rafique, A.; Ullah, E.; Khan, F. Revisiting the relationship between remittances and CO2 emissions by applying a novel dynamic simulated ARDL: Empirical evidence from G-20 economies. Environ. Sci. Pollut. Res. 2022, 29, 71190–71207. [Google Scholar] [CrossRef] [PubMed]

- Altunöz, U. The nonlinear and asymetric pass-through effect of crude oil prices on inflation. OPEC Energy Rev. 2022, 46, 31–46. [Google Scholar] [CrossRef]

- Yang, J.; Fang, H.; Jing, F. Renewable energy pathways toward carbon neutrality in BRICS nations: A panel data analysis. Econ. Chang. Restruct. 2024, 57, 26. [Google Scholar] [CrossRef]

- Asif, M.; Sharma, V.; Chandniwala, V.J.; Khan, P.A.; Muneeb, S.M. Modelling the Dynamic Linkage Amidst Energy Prices and Twin Deficit in India: Empirical Investigation within Linear and Nonlinear Framework. Energies 2023, 16, 2712. [Google Scholar] [CrossRef]

- Nguyen, T.P.; Tran, T.N.; Dinh, T.T.H.; Hoang, T.M.; Duong Thi Thuy, T. Drivers of climate change in selected emerging countries: The ecological effects of monetary restrictions and expansions. Cogent Econ. Financ. 2022, 10, 2114658. [Google Scholar] [CrossRef]

- Feng, C. Does cyclical innovation in environmental-related technologies make knowledge-based economies carbon neutral? Environ. Sci. Pollut. Res. 2023, 30, 49605–49617. [Google Scholar] [CrossRef]

- Ni, J.; Ruan, J. Does negative interest rate policy impact carbon emissions? Evidence from a quasi-natural experiment. J. Clean. Prod. 2023, 422, 138624. [Google Scholar] [CrossRef]

- Lee, C.-C.; Yahya, F. Mitigating energy instability: The influence of trilemma choices, financial development, and technology advancements. Energy Econ. 2024, 133, 107517. [Google Scholar] [CrossRef]

- Deyshappriya, N.P.R.; Rukshan, I.a.D.D.W.; Padmakanthi, N.P.D. Impact of Oil Price on Economic Growth of OECD Countries: A Dynamic Panel Data Analysis. Sustainability 2023, 15, 4888. [Google Scholar] [CrossRef]

- Zhang, D.; Wang, Y.; Peng, X. Carbon Emissions and Clean Energy Investment: Global Evidence. Emerg. Mark. Financ. Trade 2023, 59, 312–323. [Google Scholar] [CrossRef]