Investigating the Impact of Agricultural, Financial, Economic, and Political Factors on Oil Forward Prices and Volatility: A SHAP Analysis

Abstract

1. Introduction

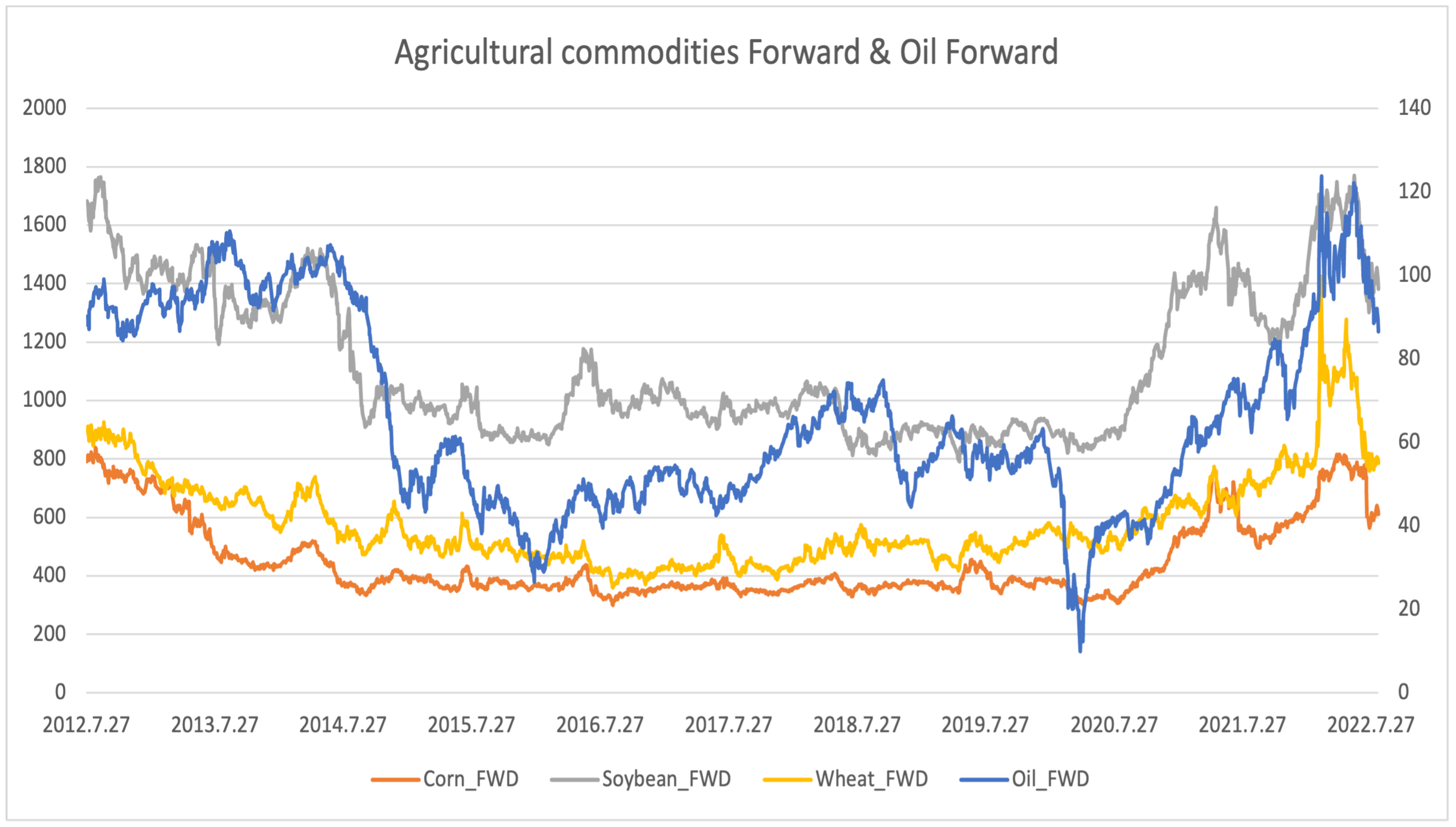

- The relationship between the crude oil market and agricultural commodities is tightly interdependent. Agricultural crops, which can be used to produce biodiesel as a substitute for crude oil, also affect crude oil demand.

- The relationship between the crude oil market and stock indices, like the S&P 500, is remarkable. Stock indices serve as economic indicators, and fluctuations in stock prices directly affect the crude oil market due to the changing demand associated with economic cycles.

- There is a notable connection between the crude oil market and currency exchange rates, notably concerning the U.S. Dollar index (DXY). The U.S. Dollar, as the global reserve currency and primary medium of exchange for international oil transactions, plays a pivotal role in influencing both crude oil prices and currency exchange rates.

- There exists an evident relationship between crude oil prices and EPU. Changes in EPU may also influence crude oil prices through the impact on investor sentiment and risk perceptions.

- The relationship between crude oil prices and GPR is noticeable. Geopolitical tensions in major oil-producing regions can directly impact crude oil prices by disrupting supply chains, limiting production capacity or creating uncertainty about future supplies.

2. Literature Review

2.1. Oil and Various Factors

2.2. Econometric Methods

2.3. Machine Learning Methods

3. Data and Research Design

3.1. Data Description

3.2. Research Design

4. Machine Learning and SHAP

4.1. Machine Learning Models

4.1.1. Extreme Gradient Boosting (XGBoost)

4.1.2. LightGBM

4.1.3. Random Forest

4.2. SHAP Framework

5. Empirical Results and Discussion

5.1. Empirical Results

5.2. Discussion

6. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Guo, J.; Zhao, Z.; Sun, J.; Sun, S. Multi-perspective crude oil price forecasting with a new decomposition-ensemble framework. Resour. Policy 2022, 77, 102737. [Google Scholar] [CrossRef]

- Safari, A.; Davallou, M. Oil price forecasting using a hybrid model. Energy 2018, 148, 49–58. [Google Scholar] [CrossRef]

- Baumeister, C.; Peersman, G. Time-varying effects of oil supply shocks on the US economy. Am. Econ. J. Macroecon. 2013, 5, 1–28. [Google Scholar] [CrossRef]

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Political Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Hamilton, J.D. This is what happened to the oil price-macroeconomy relationship. J. Monet. Econ. 1996, 38, 215–220. [Google Scholar] [CrossRef]

- Jones, C.M.; Kaul, G. Oil and the stock markets. J. Financ. 1996, 51, 463–491. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Kilian, L.; Park, C. The impact of oil price shocks on the US stock market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Pönkä, H. Real oil prices and the international sign predictability of stock returns. Financ. Res. Lett. 2016, 17, 79–87. [Google Scholar] [CrossRef]

- Rapach, D.E.; Strauss, J.K.; Zhou, G. International stock return predictability: What is the role of the United States? J. Financ. 2013, 68, 1633–1662. [Google Scholar] [CrossRef]

- Chai, J.; Xing, L.M.; Zhou, X.Y.; Zhang, Z.G.; Li, J.X. Forecasting the WTI crude oil price by a hybrid-refined method. Energy Econ. 2018, 71, 114–127. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Yang, L. Forecasting crude oil market volatility: A Markov switching multifractal volatility approach. Int. J. Forecast. 2016, 32, 1–9. [Google Scholar] [CrossRef]

- Gholamian, M.R.; Ghomi, S.F.; Ghazanfari, M. A hybrid systematic design for multiobjective market problems: A case study in crude oil markets. Eng. Appl. Artif. Intell. 2005, 18, 495–509. [Google Scholar] [CrossRef]

- Chen, S.S.; Hsu, K.W. Reverse globalization: Does high oil price volatility discourage international trade? Energy Econ. 2012, 34, 1634–1643. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, C.; He, K.; Zheng, A. Multi-step-ahead crude oil price forecasting using a hybrid grey wave model. Phys. A Stat. Mech. Its Appl. 2018, 501, 98–110. [Google Scholar] [CrossRef]

- Zhao, Y.; Zhang, W.; Gong, X.; Wang, C. A novel method for online real-time forecasting of crude oil price. Appl. Energy 2021, 303, 117588. [Google Scholar] [CrossRef]

- Yu, L.; Zhao, Y.; Tang, L. Ensemble forecasting for complex time series using sparse representation and neural networks. J. Forecast. 2017, 36, 122–138. [Google Scholar] [CrossRef]

- Hou, A.; Suardi, S. A nonparametric GARCH model of crude oil price return volatility. Energy Econ. 2012, 34, 618–626. [Google Scholar] [CrossRef]

- Mirmirani, S.; Li, H.C. A comparison of VAR and neural networks with genetic algorithm in forecasting price of oil. In Applications of Artificial Intelligence in Finance and Economics; Emerald Group Publishing Limited: Bingley, UK, 2004. [Google Scholar]

- Jammazi, R.; Aloui, C. Crude oil price forecasting: Experimental evidence from wavelet decomposition and neural network modeling. Energy Econ. 2012, 34, 828–841. [Google Scholar] [CrossRef]

- Yu, L.; Zhang, X.; Wang, S. Assessing potentiality of support vector machine method in crude oil price forecasting. EURASIA J. Math. Sci. Technol. Educ. 2017, 13, 7893–7904. [Google Scholar] [CrossRef]

- Wu, Y.X.; Wu, Q.B.; Zhu, J.Q. Improved EEMD-based crude oil price forecasting using LSTM networks. Phys. A Stat. Mech. Its Appl. 2019, 516, 114–124. [Google Scholar] [CrossRef]

- Belkin, M.; Hsu, D.; Ma, S.; Mandal, S. Reconciling modern machine-learning practice and the classical bias–variance trade-off. Proc. Natl. Acad. Sci. USA 2019, 116, 15849–15854. [Google Scholar] [CrossRef] [PubMed]

- Jabeur, S.B.; Khalfaoui, R.; Arfi, W.B. The effect of green energy, global environmental indexes, and stock markets in predicting oil price crashes: Evidence from explainable machine learning. J. Environ. Manag. 2021, 298, 113511. [Google Scholar] [CrossRef] [PubMed]

- Sarp, S.; Kuzlu, M.; Cali, U.; Elma, O.; Guler, O. An interpretable solar photovoltaic power generation forecasting approach using an explainable artificial intelligence tool. In Proceedings of the 2021 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference (ISGT), Washington, DC, USA, 16–18 February 2021; pp. 1–5. [Google Scholar]

- Homafar, A.; Nasiri, H.; Chelgani, S.C. Modeling coking coal indexes by SHAP-XGBoost: Explainable artificial intelligence method. Fuel Commun. 2022, 13, 100078. [Google Scholar] [CrossRef]

- Li, Z. Extracting spatial effects from machine learning model using local interpretation method: An example of SHAP and XGBoost. Comput. Environ. Urban Syst. 2022, 96, 101845. [Google Scholar] [CrossRef]

- Yang, G.; Yuan, E.; Wu, W. Predicting the long-term CO2 concentration in classrooms based on the BO–EMD–LSTM model. Build. Environ. 2022, 224, 109568. [Google Scholar] [CrossRef]

- Fatahi, R.; Nasiri, H.; Dadfar, E.; Chehreh Chelgani, S. Modeling of energy consumption factors for an industrial cement vertical roller mill by SHAP-XGBoost: A “conscious lab” approach. Sci. Rep. 2022, 12, 7543. [Google Scholar] [CrossRef]

- Farzipour, A.; Elmi, R.; Nasiri, H. Detection of Monkeypox cases based on symptoms using XGBoost and Shapley additive explanations methods. Diagnostics 2023, 13, 2391. [Google Scholar] [CrossRef]

- Stef, N.; Başağaoğlu, H.; Chakraborty, D.; Jabeur, S.B. Does institutional quality affect CO2 emissions? Evidence from explainable artificial intelligence models. Energy Econ. 2023, 11, 106822. [Google Scholar] [CrossRef]

- Mao, C.; Xu, W.; Huang, Y.; Zhang, X.; Zheng, N.; Zhang, X. Investigation of Passengers’ Perceived Transfer Distance in Urban Rail Transit Stations Using XGBoost and SHAP. Sustainability 2023, 15, 7744. [Google Scholar] [CrossRef]

- Yang, C.; Abedin, M.Z.; Zhang, H.; Weng, F.; Hajek, P. An interpretable system for predicting the impact of COVID-19 government interventions on stock market sectors. Ann. Oper. Res. 2023, 1–28. [Google Scholar] [CrossRef]

- Baffes, J. Oil spills on other commodities. Resour. Policy 2007, 32, 126–134. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Erdem, C.; Soytas, U. Volatility spillover between oil and agricultural commodity markets. Energy Econ. 2013, 36, 658–665. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Yang, L. Oil price shocks and agricultural commodity prices. Energy Econ. 2014, 44, 22–35. [Google Scholar] [CrossRef]

- Rezitis, A.N. The relationship between agricultural commodity prices, crude oil prices and US dollar exchange rates: A panel VAR approach and causality analysis. Int. Rev. Appl. Econ. 2015, 29, 403–434. [Google Scholar] [CrossRef]

- Paris, A. On the link between oil and agricultural commodity prices: Do biofuels matter? Int. Econ. 2018, 155, 48–60. [Google Scholar] [CrossRef]

- Yip, P.S.; Brooks, R.; Do, H.X.; Nguyen, D.K. Dynamic volatility spillover effects between oil and agricultural products. Int. Rev. Financ. Anal. 2020, 69, 101465. [Google Scholar] [CrossRef]

- Naeem, M.A.; Farid, S.; Nor, S.M.; Shahzad, S.J.H. Spillover and drivers of uncertainty among oil and commodity markets. Mathematics 2021, 9, 441. [Google Scholar] [CrossRef]

- Sun, Y.; Mirza, N.; Qadeer, A.; Hsueh, H.P. Connectedness between oil and agricultural commodity prices during tranquil and volatile period. Is crude oil a victim indeed? Resour. Policy 2021, 72, 102131. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Abakah, E.J.A.; Adewuyi, A.O.; Lee, C.C. Quantile risk spillovers between energy and agricultural commodity markets: Evidence from pre and during COVID-19 outbreak. Energy Econ. 2022, 113, 106235. [Google Scholar] [CrossRef]

- Wei, Y.; Yu, B.; Guo, X.; Zhang, C. The impact of oil price shocks on the US and Chinese stock markets: A quantitative structural analysis. Energy Rep. 2023, 10, 15–28. [Google Scholar] [CrossRef]

- Cong, R.G.; Wei, Y.M.; Jiao, J.L.; Fan, Y. Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy 2008, 36, 3544–3553. [Google Scholar] [CrossRef]

- Li, X.; Wei, Y. The dependence and risk spillover between crude oil market and China stock market: New evidence from a variational mode decomposition-based copula method. Energy Econ. 2018, 74, 565–581. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G.; Arora, V. Oil prices and stock markets: A review of the theory and empirical evidence. Energy J. 2018, 39, 85–130. [Google Scholar] [CrossRef]

- Sakaki, H. Oil price shocks and the equity market: Evidence for the S&P 500 sectoral indices. Res. Int. Bus. Financ. 2019, 49, 137–155. [Google Scholar]

- Wei, Y.; Qin, S.; Li, X.; Zhu, S.; Wei, G. Oil price fluctuation, stock market and macroeconomic fundamentals: Evidence from China before and after the financial crisis. Financ. Res. Lett. 2019, 30, 23–29. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Jouini, J.; Nguyen, D.K. On the impacts of oil price fluctuations on European equity markets: Volatility spillover and hedging effectiveness. Energy Econ. 2012, 34, 611–617. [Google Scholar] [CrossRef]

- Bagirov, M.; Mateus, C. Oil prices, stock markets and firm performance: Evidence from Europe. Int. Rev. Econ. Financ. 2019, 61, 270–288. [Google Scholar] [CrossRef]

- Joo, Y.C.; Park, S.Y. Oil prices and stock markets: Does the effect of uncertainty change over time? Energy Econ. 2017, 61, 42–51. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Wang, R.; Zhang, D. Direct and indirect oil shocks and their impacts upon energy related stocks. Econ. Syst. 2014, 38, 451–467. [Google Scholar] [CrossRef]

- Ding, H.; Kim, H.G.; Park, S.Y. Crude oil and stock markets: Causal relationships in tails? Energy Econ. 2016, 59, 58–69. [Google Scholar] [CrossRef]

- Katsampoxakis, I.; Christopoulos, A.; Kalantonis, P.; Nastas, V. Crude oil price shocks and European stock markets during the COVID-19 period. Energies 2022, 15, 4090. [Google Scholar] [CrossRef]

- Peersman, G.; Van Robays, I. Oil and the Euro area economy. Econ. Policy 2009, 24, 603–651. [Google Scholar] [CrossRef]

- Samanta, S.K.; Zadeh, A.H. Co-movements of Oil, Gold, the US Dollar, and Stocks. Mod. Econ. 2012, 3, 111–117. [Google Scholar] [CrossRef]

- Malliaris, A.G.; Malliaris, M. Are oil, gold and the euro inter-related? Time series and neural network analysis. Rev. Quant. Financ. Account. 2013, 40, 1–14. [Google Scholar] [CrossRef]

- Arfaoui, M.; Ben Rejeb, A. Oil, gold, US dollar and stock market interdependencies: A global analytical insight. Eur. J. Manag. Bus. Econ. 2017, 26, 278–293. [Google Scholar] [CrossRef]

- Sun, X.; Lu, X.; Yue, G.; Li, J. Cross-correlations between the US monetary policy, US dollar index and crude oil market. Phys. A Stat. Mech. Its Appl. 2017, 467, 326–344. [Google Scholar] [CrossRef]

- Donkor, R.A.; Mensah, L.; Sarpong-Kumankoma, E. Oil price volatility and US dollar exchange rate volatility of some oil-dependent economies. J. Int. Trade Econ. Dev. 2022, 31, 581–597. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef]

- Gu, X.; Zhu, Z.; Yu, M. The macro effects of GPR and EPU indexes over the global oil market—Are the two types of uncertainty shock alike? Energy Econ. 2021, 100, 105394. [Google Scholar] [CrossRef]

- Ilyas, M.; Khan, A.; Nadeem, M.; Suleman, M.T. Economic policy uncertainty, oil price shocks and corporate investment: Evidence from the oil industry. Energy Econ. 2021, 97, 105193. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Hao, L.N.; Tao, R. The stability of US economic policy: Does it really matter for oil price? Energy 2020, 198, 117315. [Google Scholar] [CrossRef]

- Liu, J.; Ma, F.; Tang, Y.; Zhang, Y. Geopolitical risk and oil volatility: A new insight. Energy Econ. 2019, 84, 104548. [Google Scholar] [CrossRef]

- Huang, J.; Ding, Q.; Zhang, H.; Guo, Y.; Suleman, M.T. Nonlinear dynamic correlation between geopolitical risk and oil prices: A study based on high-frequency data. Res. Int. Bus. Financ. 2021, 56, 101370. [Google Scholar] [CrossRef]

- Qian, L.; Zeng, Q.; Li, T. Geopolitical risk and oil price volatility: Evidence from Markov-switching model. Int. Rev. Econ. Financ. 2022, 81, 29–38. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C. Forecasting energy market volatility using GARCH models: Can multivariate models beat univariate models? Energy Econ. 2012, 34, 2167–2181. [Google Scholar] [CrossRef]

- Wen, F.; Gong, X.; Cai, S. Forecasting the volatility of crude oil futures using HAR-type models with structural breaks. Energy Econ. 2016, 59, 400–413. [Google Scholar] [CrossRef]

- Charles, A.; Darné, O. Forecasting crude-oil market volatility: Further evidence with jumps. Energy Econ. 2017, 67, 508–519. [Google Scholar] [CrossRef]

- Nademi, A.; Nademi, Y. Forecasting crude oil prices by a semiparametric Markov switching model: OPEC, WTI, and Brent cases. Energy Econ. 2018, 74, 757–766. [Google Scholar] [CrossRef]

- Lin, Y.; Xiao, Y.; Li, F. Forecasting crude oil price volatility via a HM-EGARCH model. Energy Econ. 2020, 87, 104693. [Google Scholar] [CrossRef]

- Scarcioffolo, A.R.; Etienne, X.L. Regime-switching energy price volatility: The role of economic policy uncertainty. Int. Rev. Econ. Financ. 2021, 76, 336–356. [Google Scholar] [CrossRef]

- Xie, W.; Yu, L.; Xu, S.; Wang, S. A new method for crude oil price forecasting based on support vector machines. In Proceedings of the Computational Science–ICCS 2006: 6th International Conference, Reading, UK, 28–31 May 2006; pp. 444–451. [Google Scholar]

- Zhang, J.L.; Zhang, Y.J.; Zhang, L. A novel hybrid method for crude oil price forecasting. Energy Econ. 2015, 49, 649–659. [Google Scholar] [CrossRef]

- Zhang, Y.; Hamori, S. Forecasting crude oil market crashes using machine learning technologies. Energies 2020, 13, 2440. [Google Scholar] [CrossRef]

- Manowska, A.; Bluszcz, A. Forecasting crude oil consumption in Poland based on LSTM recurrent neural network. Energies 2022, 15, 4885. [Google Scholar] [CrossRef]

- Zhang, S.; Luo, J.; Wang, S.; Liu, F. Oil price forecasting: A hybrid GRU neural network based on decomposition–reconstruction methods. Expert Syst. Appl. 2023, 218, 119617. [Google Scholar] [CrossRef]

- Luo, Z.; Cai, X.; Tanaka, K.; Takiguchi, T.; Kinkyo, T.; Hamori, S. Can we forecast daily oil futures prices? Experimental evidence from convolutional neural networks. J. Risk Financ. Manag. 2019, 12, 9. [Google Scholar] [CrossRef]

- Kim, W.J.; Jung, G.; Choi, S.Y. Forecasting Cds term structure based on nelson–siegel model and machine learning. Complexity 2020, 2020, 2518283. [Google Scholar] [CrossRef]

- Shobana, G.; Umamaheswari, K. Forecasting by machine learning techniques and econometrics: A review. In Proceedings of the 2021 6th International Conference on Inventive Computation Technologies (ICICT), Coimbatore, India, 20–22 January 2021; pp. 1010–1016. [Google Scholar]

- Xu, Z.; Mohsin, M.; Ullah, K.; Ma, X. Using econometric and machine learning models to forecast crude oil prices: Insights from economic history. Resour. Policy 2023, 83, 103614. [Google Scholar] [CrossRef]

- Chen, T.; Guestrin, C. Xgboost: A scalable tree boosting system. In Proceedings of the 22nd Acm Sigkdd International Conference on Knowledge Discovery and Data Mining, San Francisco, CA, USA, 13–17 August 2016; pp. 785–794. [Google Scholar]

- Feng, Y.; Duan, Q.; Chen, X.; Yakkali, S.S.; Wang, J. Space cooling energy usage prediction based on utility data for residential buildings using machine learning methods. Appl. Energy 2021, 291, 116814. [Google Scholar] [CrossRef]

- Nasiri, H.; Homafar, A.; Chelgani, S.C. Prediction of uniaxial compressive strength and modulus of elasticity for Travertine samples using an explainable artificial intelligence. Results Geophys. Sci. 2021, 8, 100034. [Google Scholar] [CrossRef]

- Alsahaf, A.; Petkov, N.; Shenoy, V.; Azzopardi, G. A framework for feature selection through boosting. Expert Syst. Appl. 2022, 187, 115895. [Google Scholar] [CrossRef]

- Guliyev, H.; Mustafayev, E. Predicting the changes in the WTI crude oil price dynamics using machine learning models. Resour. Policy 2022, 77, 102664. [Google Scholar] [CrossRef]

- Tissaoui, K.; Zaghdoudi, T.; Hakimi, A.; Nsaibi, M. Do Gas Price and Uncertainty Indices Forecast Crude Oil Prices? Fresh Evidence Through XGBoost Modeling. Comput. Econ. 2022, 62, 663–687. [Google Scholar] [CrossRef] [PubMed]

- Khalfaoui, R.; Ben Jabeur, S.; Hammoudeh, S.; Ben Arfi, W. The role of political risk, uncertainty, and crude oil in predicting stock markets: Evidence from the UAE economy. Ann. Oper. Res. 2022, 1–31. [Google Scholar]

- Ke, G.; Meng, Q.; Finley, T.; Wang, T.; Chen, W.; Ma, W.; Ye, Q.; Liu, T.Y. Lightgbm: A highly efficient gradient boosting decision tree. In Proceedings of the Advances in Neural Information Processing Systems 30 (NIPS 2017), Long Beach, CA, USA, 4–9 December 2017; Volume 30. [Google Scholar]

- Al Daoud, E. Comparison between XGBoost, LightGBM and CatBoost using a home credit dataset. Int. J. Comput. Inf. Eng. 2019, 13, 6–10. [Google Scholar]

- Breiman, L. Random forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Rodriguez-Galiano, V.; Sanchez-Castillo, M.; Chica-Olmo, M.; Chica-Rivas, M. Machine learning predictive models for mineral prospectivity: An evaluation of neural networks, random forest, regression trees and support vector machines. Ore Geol. Rev. 2015, 71, 804–818. [Google Scholar] [CrossRef]

- Shapley, L.S. Stochastic games. Proc. Natl. Acad. Sci. USA 1953, 39, 1095–1100. [Google Scholar] [CrossRef]

- Bloch, L.; Friedrich, C.M. Data analysis with Shapley values for automatic subject selection in Alzheimer’s disease data sets using interpretable machine learning. Alzheimer’s Res. Ther. 2021, 13, 1–30. [Google Scholar] [CrossRef]

- Dong, H.; Sun, J.; Sun, X. A multi-objective multi-label feature selection algorithm based on shapley value. Entropy 2021, 23, 1094. [Google Scholar] [CrossRef]

- Rozemberczki, B.; Sarkar, R. The shapley value of classifiers in ensemble games. In Proceedings of the 30th ACM International Conference on Information & Knowledge Management, Virtual Event, 1–5 November 2021; pp. 1558–1567. [Google Scholar]

- Aas, K.; Jullum, M.; Løland, A. Explaining individual predictions when features are dependent: More accurate approximations to Shapley values. Artif. Intell. 2021, 298, 103502. [Google Scholar] [CrossRef]

- Lundberg, S.M.; Lee, S.I. A unified approach to interpreting model predictions. In Proceedings of the Advances in Neural Information Processing Systems 30 (NIPS 2017), Long Beach, CA, USA, 4–9 December 2017; Volume 30. [Google Scholar]

- Li, S.F.; Zhu, H.M.; Yu, K. Oil prices and stock market in China: A sector analysis using panel cointegration with multiple breaks. Energy Econ. 2012, 34, 1951–1958. [Google Scholar] [CrossRef]

- Wen, F.; Xiao, J.; Xia, X.; Chen, B.; Xiao, Z.; Li, J. Oil prices and chinese stock market: Nonlinear causality and volatility persistence. Emerg. Mark. Financ. Trade 2019, 55, 1247–1263. [Google Scholar] [CrossRef]

- Kristoufek, L. Leverage effect in energy futures. Energy Econ. 2014, 45, 1–9. [Google Scholar] [CrossRef]

- Chan, J.C.; Grant, A.L. Modeling energy price dynamics: GARCH versus stochastic volatility. Energy Econ. 2016, 54, 182–189. [Google Scholar] [CrossRef]

- Yang, C.; Gong, X.; Zhang, H. Volatility forecasting of crude oil futures: The role of investor sentiment and leverage effect. Resour. Policy 2019, 61, 548–563. [Google Scholar] [CrossRef]

- Liang, C.; Liao, Y.; Ma, F.; Zhu, B. United States Oil Fund volatility prediction: The roles of leverage effect and jumps. Empir. Econ. 2022, 62, 2239–2262. [Google Scholar] [CrossRef]

- Brandt, M.W.; Gao, L. Macro fundamentals or geopolitical events? A textual analysis of news events for crude oil. J. Empir. Financ. 2019, 51, 64–94. [Google Scholar] [CrossRef]

- Li, B.; Chang, C.P.; Chu, Y.; Sui, B. Oil prices and geopolitical risks: What implications are offered via multi-domain investigations? Energy Environ. 2020, 31, 492–516. [Google Scholar] [CrossRef]

- Mei, D.; Ma, F.; Liao, Y.; Wang, L. Geopolitical risk uncertainty and oil future volatility: Evidence from MIDAS models. Energy Econ. 2020, 86, 104624. [Google Scholar] [CrossRef]

- Hassouneh, I.; Serra, T.; Goodwin, B.K.; Gil, J.M. Non-parametric and parametric modeling of biodiesel, sunflower oil, and crude oil price relationships. Energy Econ. 2012, 34, 1507–1513. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Bilgin, M.H. Commodity markets volatility transmission: Roles of risk perceptions and uncertainty in financial markets. J. Int. Financ. Mark. Inst. Money 2016, 44, 35–45. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Boachie, M.K.; Suleman, M.T.; Gupta, R. Structure dependence between oil and agricultural commodities returns: The role of geopolitical risks. Energy 2021, 219, 119584. [Google Scholar] [CrossRef]

- Olesen, J.E.; Bindi, M. Consequences of climate change for European agricultural productivity, land use and policy. Eur. J. Agron. 2002, 16, 239–262. [Google Scholar] [CrossRef]

- Chen, S.; Chen, X.; Xu, J. Impacts of climate change on agriculture: Evidence from China. J. Environ. Econ. Manag. 2016, 76, 105–124. [Google Scholar] [CrossRef]

- Liang, X.Z.; Wu, Y.; Chambers, R.G.; Schmoldt, D.L.; Gao, W.; Liu, C.; Liu, Y.A.; Sun, C.; Kennedy, J.A. Determining climate effects on US total agricultural productivity. Proc. Natl. Acad. Sci. USA 2017, 114, E2285–E2292. [Google Scholar] [CrossRef]

- Sarkar, M.S.K.; Begum, R.A.; Pereira, J.J. Impacts of climate change on oil palm production in Malaysia. Environ. Sci. Pollut. Res. 2020, 27, 9760–9770. [Google Scholar] [CrossRef]

- Mall, R.; Lal, M.; Bhatia, V.; Rathore, L.; Singh, R. Mitigating climate change impact on soybean productivity in India: A simulation study. Agric. For. Meteorol. 2004, 121, 113–125. [Google Scholar] [CrossRef]

- Kucharik, C.J.; Serbin, S.P. Impacts of recent climate change on Wisconsin corn and soybean yield trends. Environ. Res. Lett. 2008, 3, 034003. [Google Scholar] [CrossRef]

- Liang, C.; Umar, M.; Ma, F.; Huynh, T.L. Climate policy uncertainty and world renewable energy index volatility forecasting. Technol. Forecast. Soc. Chang. 2022, 182, 121810. [Google Scholar] [CrossRef]

- He, M.; Zhang, Y. Climate policy uncertainty and the stock return predictability of the oil industry. J. Int. Financ. Mark. Inst. Money 2022, 81, 101675. [Google Scholar] [CrossRef]

- Ren, X.; Li, J.; He, F.; Lucey, B. Impact of climate policy uncertainty on traditional energy and green markets: Evidence from time-varying granger tests. Renew. Sustain. Energy Rev. 2023, 173, 113058. [Google Scholar] [CrossRef]

- Zhou, D.; Siddik, A.B.; Guo, L.; Li, H. Dynamic relationship among climate policy uncertainty, oil price and renewable energy consumption—Findings from TVP-SV-VAR approach. Renew. Energy 2023, 204, 722–732. [Google Scholar] [CrossRef]

- Ji, Q.; Fan, Y. How does oil price volatility affect non-energy commodity markets? Appl. Energy 2012, 89, 273–280. [Google Scholar] [CrossRef]

| Study | Method | Advantages | Limitations | Data Requirements |

|---|---|---|---|---|

| Hou and Suardi [18] | GARCH | Volatility Clustering Forecasting Volatility Flexibility | Assumption of Normal Distribution Stationary Requirement Computational Intensity | Financial Time Series Data Return Series Stationary Time-Series |

| Wen et al. [69] | HAR | Captures Long Memory Simple Structure Ease of Interpretation | Assumption of Linearity Volatility Forecasting Sensitivity to Measurement Error | Financial Time Series Data Volatility Series Aggregated Time Horizons |

| Charles and Darné [70] Nademi and Nademi [71] Lin et al. [72] | EGARCH | Leverage Effect No Restriction on Parameters Robust to Large Shocks | Complexity Sensitivity to Outliers Forecasting Horizon | Return Series Data Stationary Time Series High-Frequency Data |

| Study | Method | Advantages | Limitations | Data Requirements |

|---|---|---|---|---|

| Xie et al. [74] | SVM | High-Dimensional Spaces Memory Efficiency Versatility | Kernel Models Scalability Output Interpretability | Numerical Data |

| Wu et al. [22], Kim et al. [80] | LSTM | Long-Term Dependencies Flexibility Handling Sequential Data | Complexity Training Time Tuning | Sequential Data |

| Zhang et al. [78] | VMD | Mode Decomposition Adaptation Noise Robustness | Parameter Selection Computational Complexity Application Specificity | Time Series Data |

| Luo et al. [79] | CNNs | Excellent for Image Data Feature Learning Versatility | Computational Intensity Overfitting Interpretability | Transformed into Embeddings |

| Zhang and Hamori [76] | XGBoost | High Performance Efficiency Feature Importance | Parameter Tuning Overfitting High-Dimensional Sparse Data | Numerical, Categorical Data |

| Sectors | Asset | Mean | Max. | Min. | Std. Dev. | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| Forward | Oil | 66.12 | 123.7 | −37.63 | 22.81 | 0.39 | −0.74 |

| Corn | 451.64 | 838.75 | 301.5 | 133.69 | 1.30 | 0.43 | |

| Soybean | 1128.74 | 1769 | 791 | 254.58 | 0.71 | −0.82 | |

| Wheat | 583.20 | 1425.25 | 361 | 156.40 | 1.50 | 2.69 | |

| Volatility index | Oil | 37.38 | 325.15 | 14.5 | 20.10 | 4.99 | 42.35 |

| Stock index | S&P 500 | 2646.95 | 4793.54 | 1353.33 | 878.54 | 0.76 | −0.37 |

| Eurostoxx50 | 3330.66 | 4401.49 | 2263.36 | 415.72 | 0.10 | −0.14 | |

| Nikkei225 | 20,095.27 | 30,670.1 | 8534.12 | 5115.39 | −0.04 | −0.43 | |

| SSEC | 2975.47 | 5166.35 | 1950.01 | 559.66 | 0.08 | 0.40 | |

| Currency | DXY | 92.62 | 108.54 | 78.85 | 6.90 | −0.62 | −0.60 |

| Euro index | 97.18 | 113.19 | 84.4 | 7.49 | 0.47 | −0.78 | |

| Risk factors | US EPU | 121.84 | 861.1 | 3.32 | 97.68 | 2.68 | 10.05 |

| GPR | 109.54 | 542.66 | 14.36 | 52.03 | 2.45 | 11.66 |

| Model | MAE | MSE | RMSE | R2 |

|---|---|---|---|---|

| Random Forest | 2.1813 | 13.7509 | 3.6809 | 0.9731 |

| Light Gradient Boosting Machine | 2.5674 | 15.385 | 3.8857 | 0.9699 |

| Extreme Gradient Boosting | 2.5484 | 15.6656 | 3.9277 | 0.9693 |

| K Neighbors | 2.8626 | 25.6515 | 5.0456 | 0.9496 |

| Decision Tree | 2.6412 | 26.0652 | 5.0633 | 0.9489 |

| Gradient Boosting | 3.793 | 28.4029 | 5.3058 | 0.9444 |

| AdaBoost | 6.4469 | 62.8457 | 7.9245 | 0.8763 |

| Bayesian Ridge | 8.4772 | 113.112 | 10.6054 | 0.7785 |

| Linear Regression | 8.4906 | 113.114 | 10.6055 | 0.7784 |

| Model | MAE | MSE | RMSE | R2 |

|---|---|---|---|---|

| Random Forest | 2.4417 | 28.1812 | 4.9049 | 0.9426 |

| Extreme Gradient Boosting | 2.7017 | 29.3377 | 5.055 | 0.9382 |

| Gradient Boosting | 3.9056 | 40.1237 | 6.1372 | 0.9079 |

| Light Gradient Boosting Machine | 2.8973 | 44.591 | 6.0797 | 0.9117 |

| Decision Tree | 3.0093 | 46.4475 | 6.4154 | 0.899 |

| K Neighbors | 3.3234 | 48.0869 | 6.5249 | 0.8972 |

| AdaBoost | 8.3166 | 112.596 | 10.5284 | 0.7118 |

| Least Angle | 8.3092 | 212.7261 | 14.2385 | 0.5115 |

| Bayesian Ridge | 8.288 | 212.7279 | 14.2352 | 0.5119 |

| Oil Forward Price | Oil Volatility | |||||||

|---|---|---|---|---|---|---|---|---|

| Model | MAE | MSE | RMSE | R2 | MAE | MSE | RMSE | R2 |

| Random Forest | 1.1445 | 3.3493 | 1.8301 | 0.9933 | 1.6547 | 7.0638 | 2.6578 | 0.9194 |

| LightGBM | 0.8344 | 1.9783 | 1.4065 | 0.9961 | 1.0628 | 4.4600 | 2.1119 | 0.9491 |

| XGBoost | 0.9878 | 2.6332 | 1.6227 | 0.9948 | 1.0819 | 3.6257 | 1.9041 | 0.9587 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, H.-S.; Kim, H.-S.; Choi, S.-Y. Investigating the Impact of Agricultural, Financial, Economic, and Political Factors on Oil Forward Prices and Volatility: A SHAP Analysis. Energies 2024, 17, 1001. https://doi.org/10.3390/en17051001

Kim H-S, Kim H-S, Choi S-Y. Investigating the Impact of Agricultural, Financial, Economic, and Political Factors on Oil Forward Prices and Volatility: A SHAP Analysis. Energies. 2024; 17(5):1001. https://doi.org/10.3390/en17051001

Chicago/Turabian StyleKim, Hyeon-Seok, Hui-Sang Kim, and Sun-Yong Choi. 2024. "Investigating the Impact of Agricultural, Financial, Economic, and Political Factors on Oil Forward Prices and Volatility: A SHAP Analysis" Energies 17, no. 5: 1001. https://doi.org/10.3390/en17051001

APA StyleKim, H.-S., Kim, H.-S., & Choi, S.-Y. (2024). Investigating the Impact of Agricultural, Financial, Economic, and Political Factors on Oil Forward Prices and Volatility: A SHAP Analysis. Energies, 17(5), 1001. https://doi.org/10.3390/en17051001