Pumped Storage Hydropower as a Part of Energy Storage Systems in Poland—Młoty Case Study

Abstract

1. Introduction

- The ability to quickly change the operating mode along with dynamic changes in operating points,

- Supplying power and reactive energy, and

- Self-start capability, i.e., the ability to start a power plant without power from the NPS [10].

2. State of the Art

3. Materials and Methods

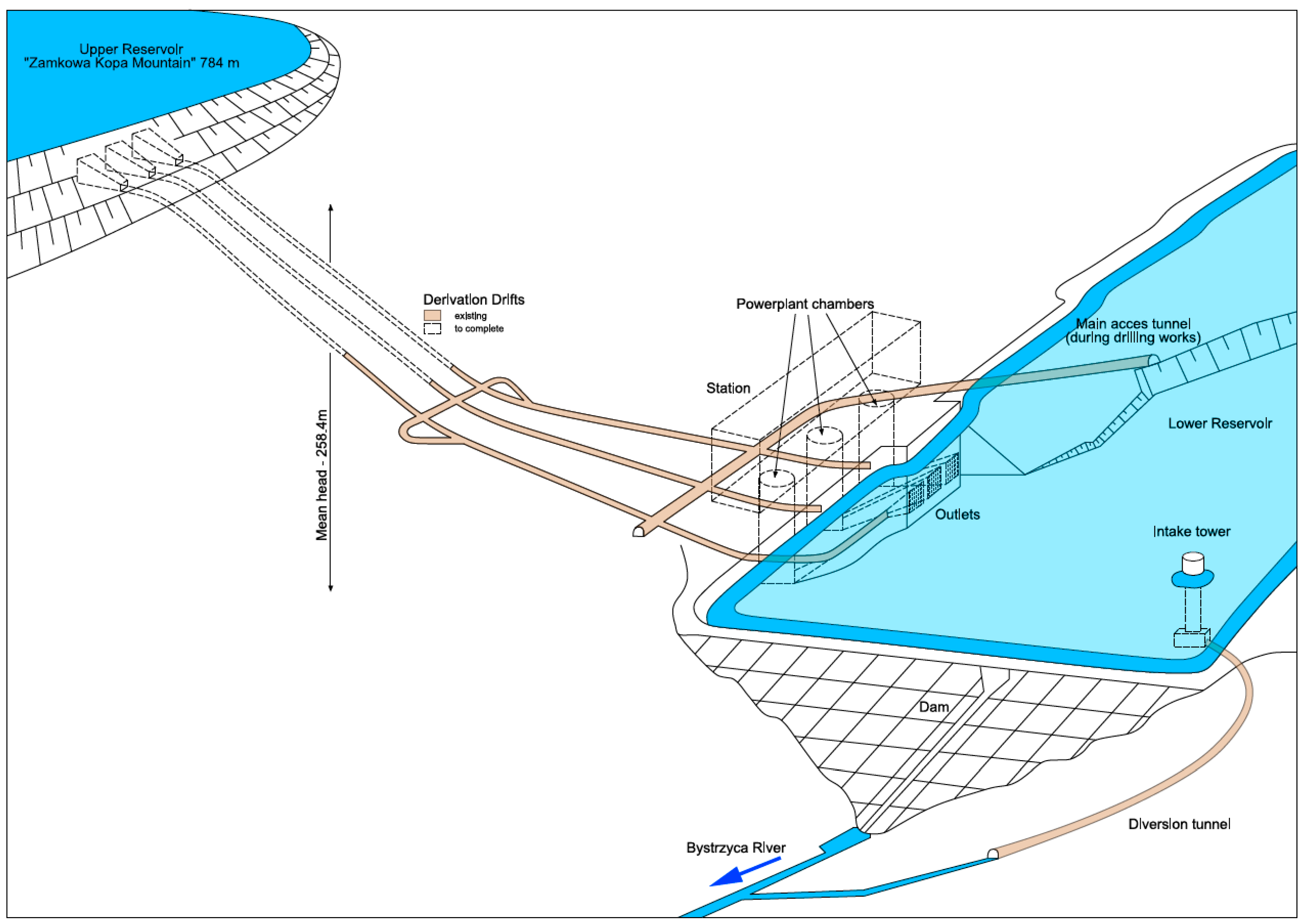

3.1. Characteristics of PSH Młoty—The Main Object of the Analysis

- -

- Maximum flow: 25.8 m3/s,

- -

- Minimum flow: 0.02 m3/s, and

- -

- Average: 0.66 m3/s.

3.2. Energy Market and PSH Facilities in Poland—Technical Aspects

- RTE—round-trip efficiency, %;

- EG—gross electricity generation, MWh;

- EC—electricity consumption, MWh.

3.3. Efficiency including Comparison to Lithium-Ion Storage

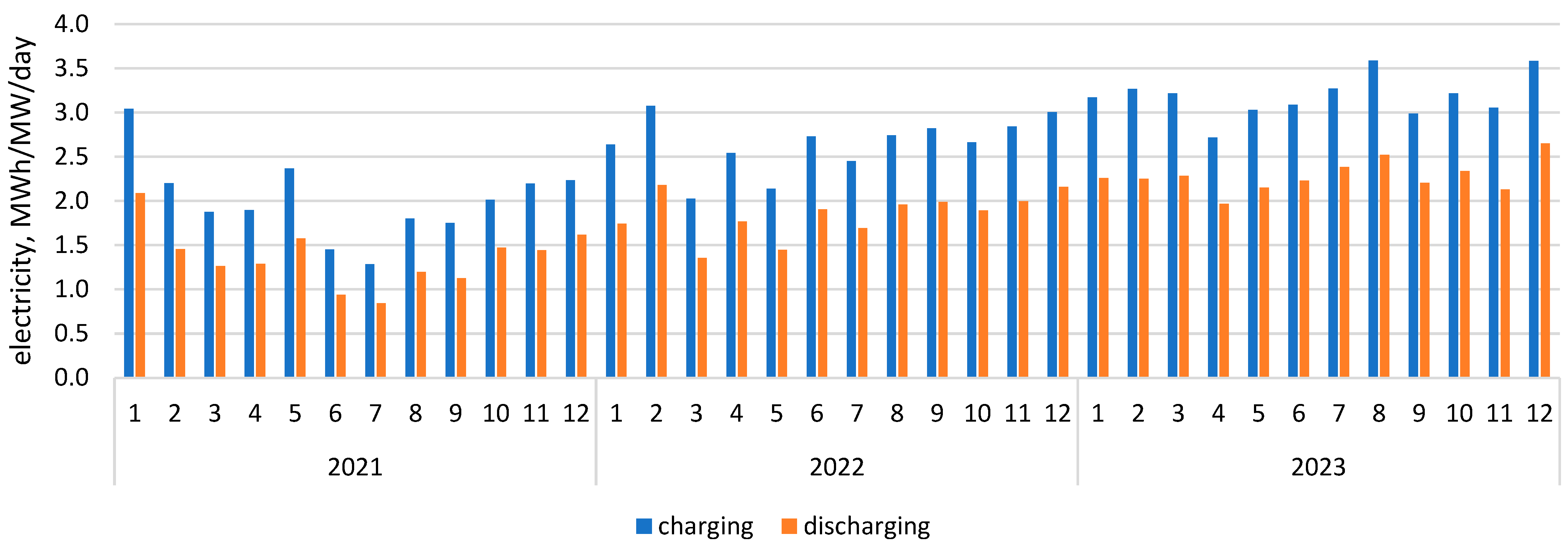

3.4. Number of Cycles and Energy Production

- NEC—Annual mean number of effective cycles per day;

- year—2021, 2022, and 2023;

- SC3—Summed storage capacity, MWh;

- nh—Number of hours (τ) in the period.

- EEG—Expected Yearly Energy Generation, GWh;

- TEG—Theoretical Yearly Energy Generation, GWh;

- y—year.

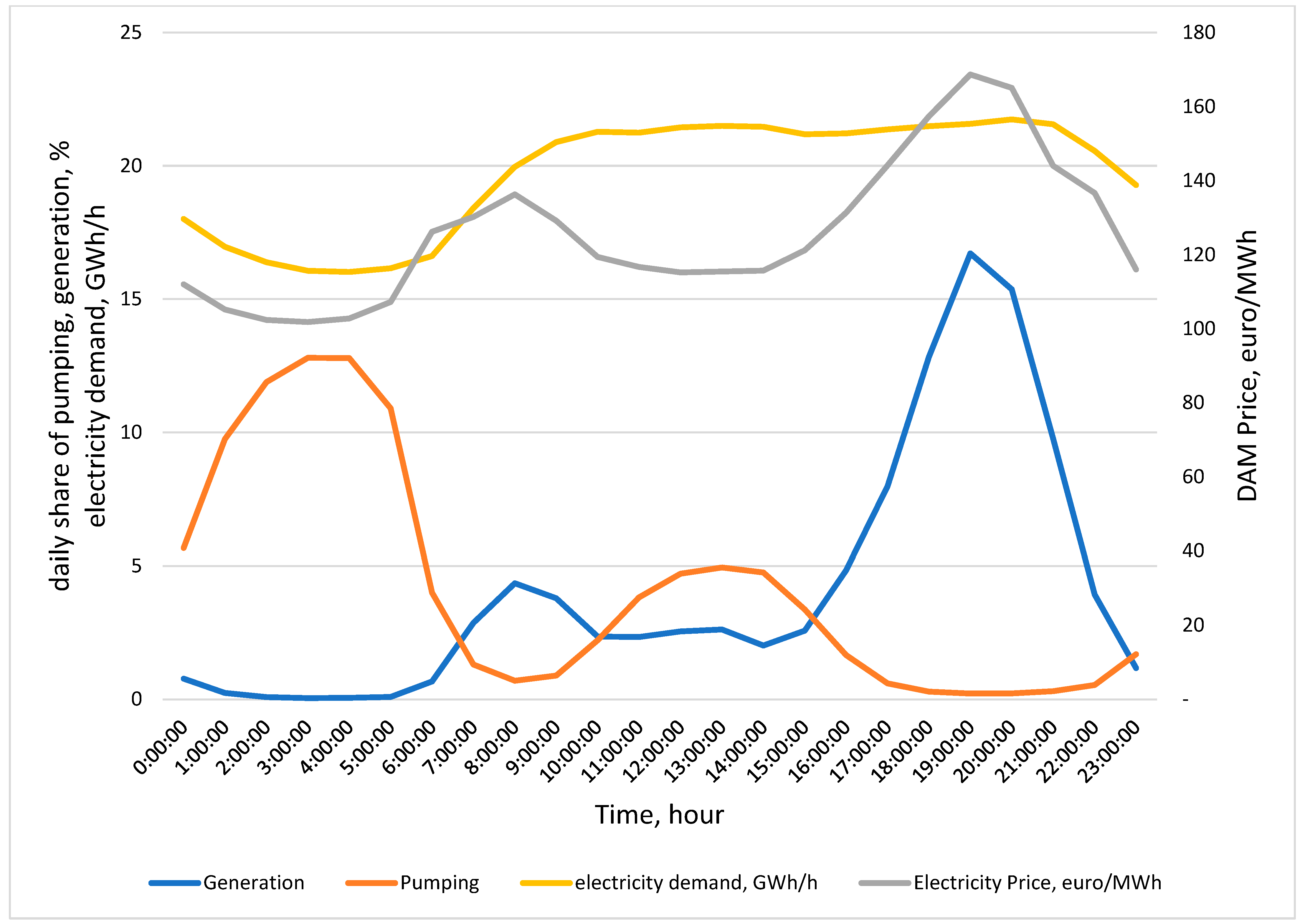

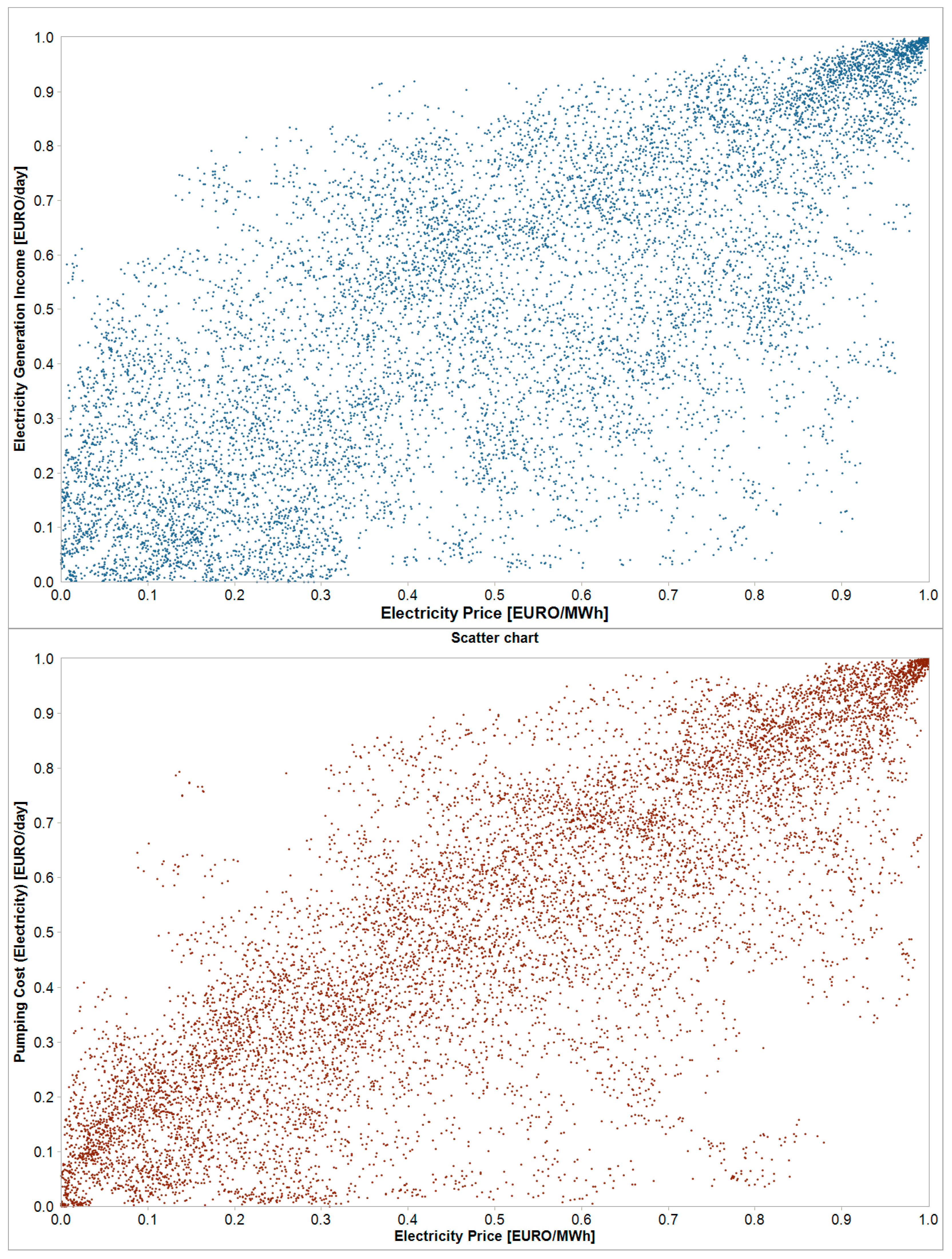

3.5. Work Loading—Pumping, Generating Cycles and Energy Price Distributions

4. PSH Młoty Economic Efficiency Analysis

4.1. Concept of Economic Analysis

- Revenues in the production phase,

- Operating costs in the pumping phase, and

- Market electricity prices on the Polish Power Exchange (TGE).

- Amortization and depreciation of fixed assets: Am,

- Capital expenditures: CAPEX,

- Net working capital: NWC, and

- Residual value: W.

- TV—the quotient of the average FCF cash flows after the detailed forecast period;

- TEG—discount rate assumed in the analysis: 8%.

4.2. Capital Expenditures

| Reservoirs: | 325.0 |

| Tunnels: | 107.0 |

| Powerhouse and BOP (Balance of Plant) electromechanical: | 374.5 |

| Other expenditures: | 107.0 |

| Capital repairs and overhauls: | 75.2 |

| Capital refurbishments: | 60.2 |

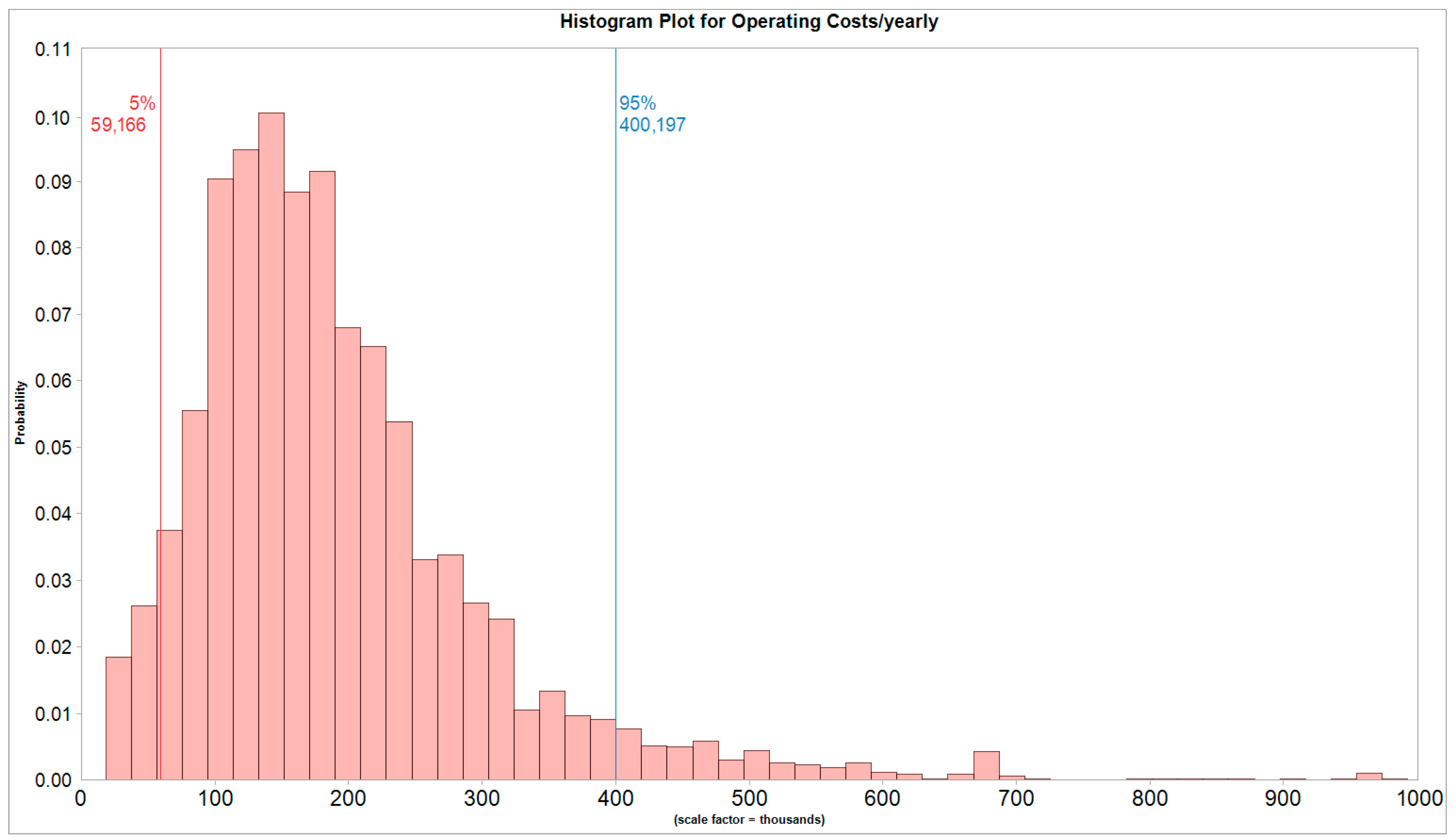

4.3. Annualized Operating Costs

- OPEX—operational costs of PSH Młoty, EUR/year;

- n—[1,2,3…mn] iterations;

- t—years of analysis [1,2,3…40];

- mEC(h)—average hourly electricity consumption, MWh;

- DAMP(h,n)—day-ahead price of electricity from three years data set, EUR/MWh;

- FC—fix costs, EUR/year;

- VC—variable costs, EUR/year;

- mn—maximum number of iterations: 10,000;

- d—number of days;

- h—number of hours.

4.4. Annualized Revenues

- REV—revenues from PSH Młoty, EUR;

- n—[1,2,3…mn] iterations;

- t—years of analysis [1,2,3…40];

- mEG(h)—average hourly electricity generation, MWh;

- DAMP(h,n)—day-ahead price of electricity from three years data set, EUR/MWh;

- CS—capacity services, EUR/year;

- mn—maximum number of iterations: 10,000;

- d—number of days;

- h—number of hours.

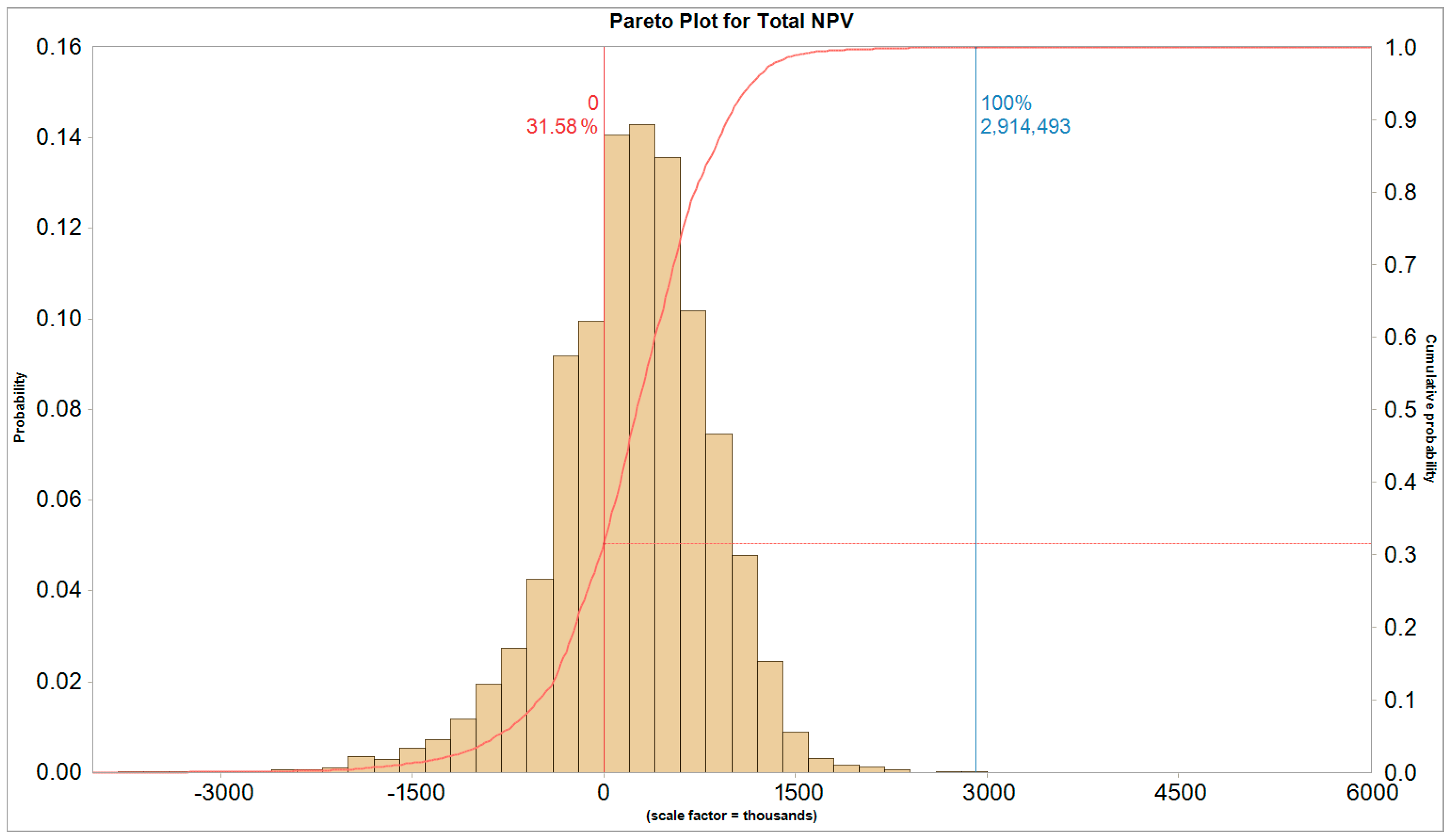

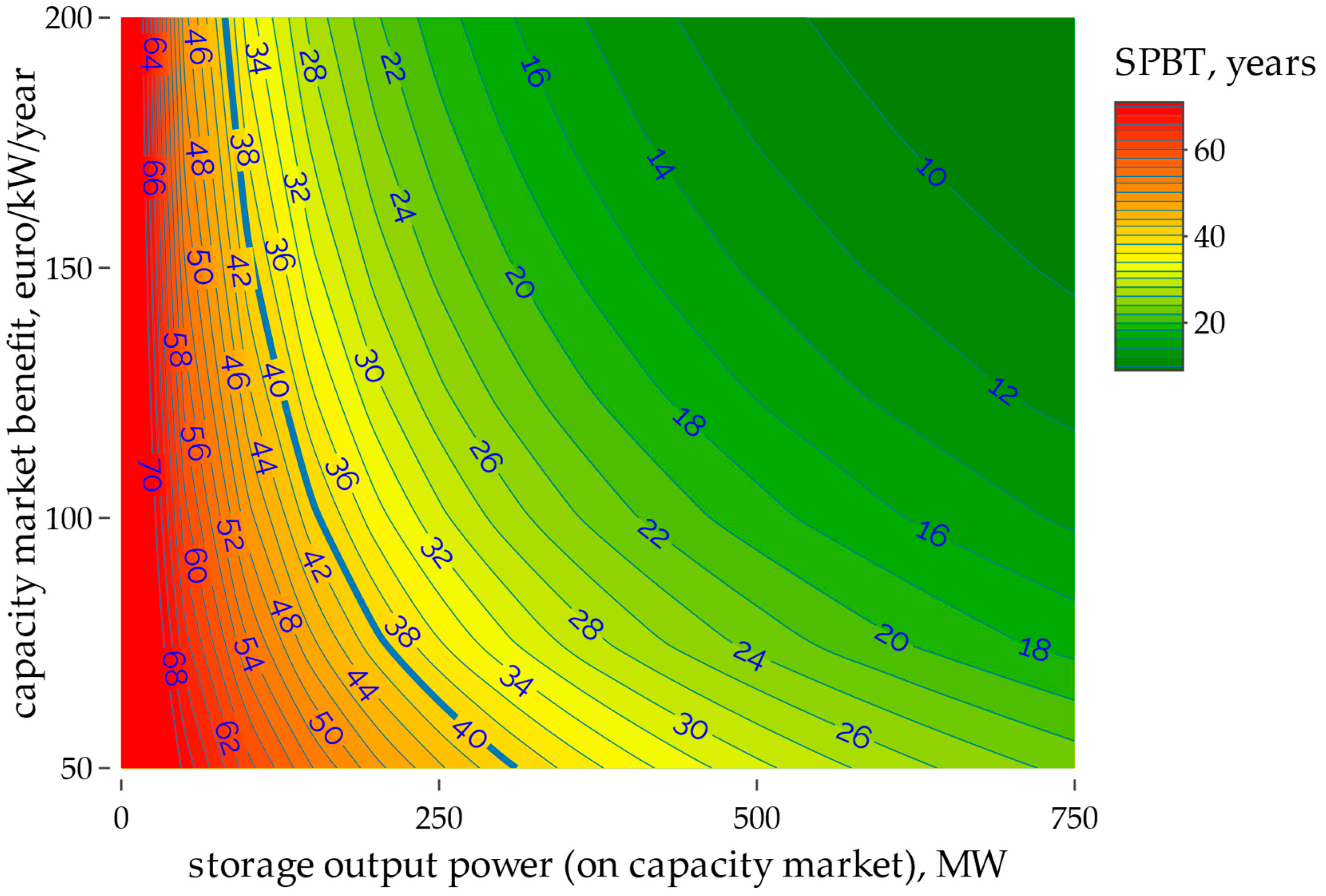

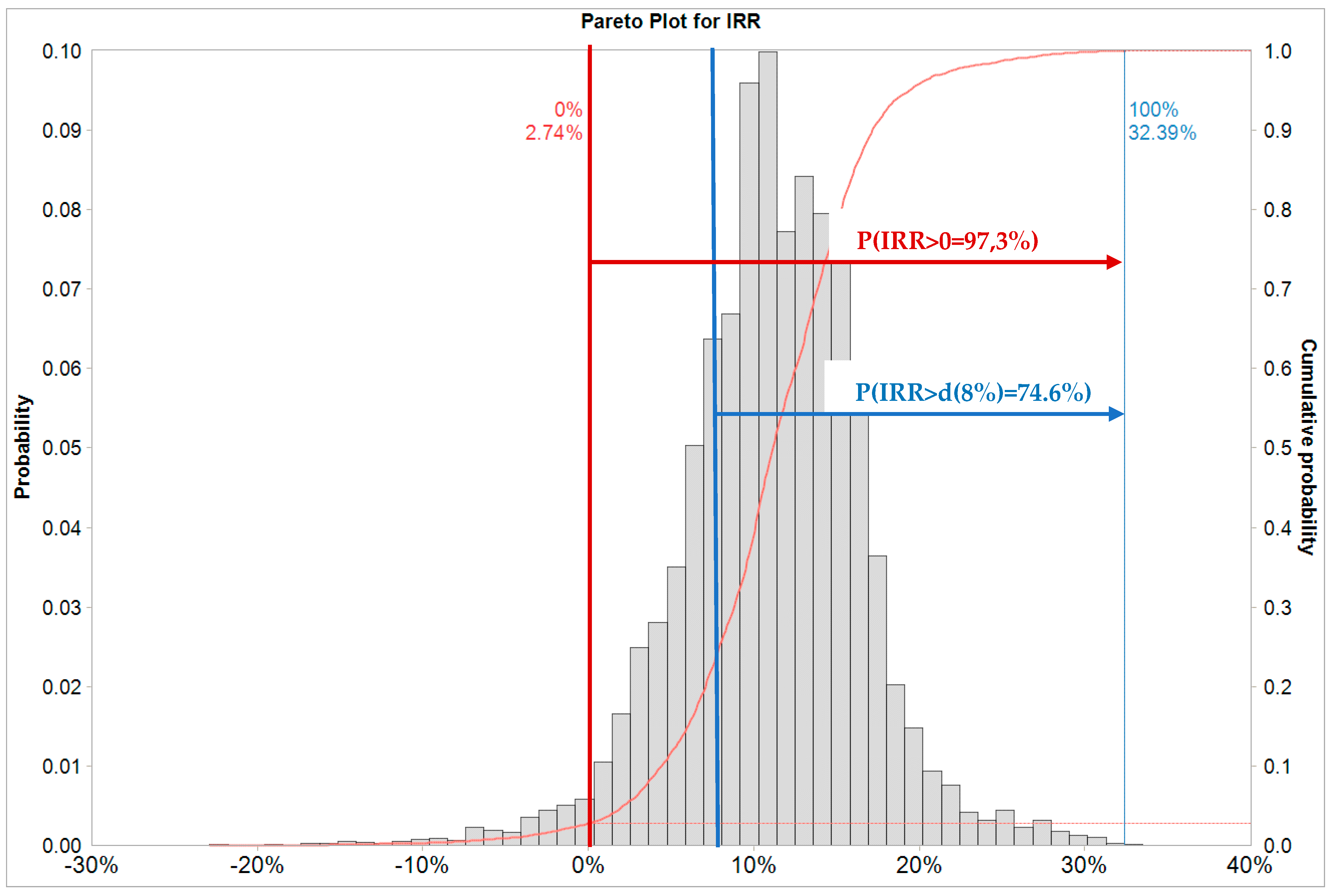

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Specification | Unit | Value |

|---|---|---|

| The power of the power plant | MW | 750 |

| Capacity, SC | MWh | 3500 |

| Theoretical annual energy production, TEG | GWh | 1275 |

| Actual annual energy production, EEG | GWh | 573 |

| Round-trip efficiency (RTE), % | % | 77.3 |

References

- Le, T.S.; Nguyen, T.N.; Bui, D.-K.; Ngo, T.D. Optimal sizing of renewable energy storage: A techno-economic analysis of hydrogen, battery and hybrid systems considering degradation and seasonal storage. Appl. Energy 2023, 336, 120817. [Google Scholar] [CrossRef]

- Liu, J.; Zhou, Y.; Yang, H.; Wu, H. Net-zero energy management and optimization of commercial building sectors with hybrid renewable energy systems integrated with energy storage of pumped hydro and hydrogen taxis. Appl. Energy 2022, 321, 119312. [Google Scholar] [CrossRef]

- Komorowska, A.; Olczak, P.; Hanc, E.; Kamiński, J. An analysis of the competitiveness of hydrogen storage and Li-ion batteries based on price arbitrage in the day-ahead market. Int. J. Hydrogen Energy 2022, 47, 28556–28572. [Google Scholar] [CrossRef]

- Komorowska, A.; Benalcazar, P.; Kamiński, J. Evaluating the competitiveness and uncertainty of offshore wind-to-hydrogen production: A case study of Poland. Int. J. Hydrogen Energy 2023, 48, 14577–14590. [Google Scholar] [CrossRef]

- IEA Grid-Scale Storage. Available online: https://www.iea.org/data-and-statistics/charts/annual-grid-scale-battery-storage-additions-2017-2022 (accessed on 12 July 2023).

- Niewiński, G.; Rajewski, A. Ekonomiczne uwarunkowania pracy elektrowni szczytowej na paliwa gazowe w Krajowym Systemie Elektroenergetycznym. Nierówności Społeczne A Wzrost Gospod. 2018, 54, 403–424. [Google Scholar] [CrossRef]

- Olczak, P.; Matuszewska, D. Energy Storage Potential Needed at the National Grid Scale (Poland) in Order to Stabilize Daily Electricity Production from Fossil Fuels and Nuclear Power. Energies 2023, 16, 6054. [Google Scholar] [CrossRef]

- Blakers, A.; Stocks, M.; Lu, B.; Cheng, C. A review of pumped hydro energy storage. Prog. Energy 2021, 3, 022003. [Google Scholar] [CrossRef]

- Dzikuć, M.; Gorączkowska, J.; Piwowar, A.; Dzikuć, M.; Smoleński, R.; Kułyk, P. The analysis of the innovative potential of the energy sector and low-carbon development: A case study for Poland. Energy Strateg. Rev. 2021, 38, 100769. [Google Scholar] [CrossRef]

- Rola Elektrowni Szczytowopompowych w Krajowym Systemie Elektroenergetycznym: Uwarunkowania i Kierunki Rozwoju; Warsaw, Poland. 2022. Available online: https://www.gov.pl/attachment/5560c5ac-fdc9-46e0-bf06-eb0dabd113dd (accessed on 10 May 2023).

- Pasqualetti, M.; Stremke, S. Energy landscapes in a crowded world: A first typology of origins and expressions. Energy Res. Soc. Sci. 2018, 36, 94–105. [Google Scholar] [CrossRef]

- Chazarra, M.; Pérez-Díaz, J.I.; García-González, J.; Praus, R. Economic viability of pumped-storage power plants participating in the secondary regulation service. Appl. Energy 2018, 216, 224–233. [Google Scholar] [CrossRef]

- Chazarra, M.; Pérez-Díaz, J.I.; García-González, J. Economic Viability of Pumped-Storage Power Plants Equipped with Ternary Units and Considering Hydraulic Short-Circuit Operation. J. Phys. Conf. Ser. 2017, 813, 012013. [Google Scholar] [CrossRef]

- Abdellatif, D.; AbdelHady, R.; Ibrahim, A.M.; El-Zahab, E.A. Conditions for economic competitiveness of pumped storage hydroelectric power plants in Egypt. Renew. Wind Water Sol. 2018, 5, 2. [Google Scholar] [CrossRef]

- Madlener, R.; Specht, J.M. An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Coal Mines; E.ON Energy Research Center, RWTH Aachen University: Aachen, Germany, 2013. [Google Scholar]

- Madlener, R.; Specht, J.M. An Exploratory Economic Analysis of Underground Pumped-Storage Hydro Power Plants in Abandoned Deep Coal Mines. Energies 2020, 13, 5634. [Google Scholar] [CrossRef]

- Sivakumar, N.; Das, D.; Padhy, N.P. Economic analysis of Indian pumped storage schemes. Energy Convers. Manag. 2014, 88, 168–176. [Google Scholar] [CrossRef]

- Henden, A.L.; Doorman, G.; Helseth, A. Economic Analysis of Large-Scale Pumped Storage Plants in Norway. Energy Procedia 2016, 87, 116–123. [Google Scholar] [CrossRef][Green Version]

- Zeng, M.; Feng, J.; Xue, S.; Wang, Z.; Zhu, X.; Wang, Y. Development of China’s pumped storage plant and related policy analysis. Energy Policy 2013, 61, 104–113. [Google Scholar]

- Ko, Y.; Choi, G.; Lee, S.; Kim, S. Economic analysis of pumped hydro storage under Korean governmental expansion plan for renewable energy. Energy Rep. 2020, 6, 214–220. [Google Scholar] [CrossRef]

- Deane, J.P.; Ó Gallachóir, B.P.; McKeogh, E.J. Techno-economic review of existing and new pumped hydro energy storage plant. Renew. Sustain. Energy Rev. 2010, 14, 1293–1302. [Google Scholar] [CrossRef]

- Bayazıt, Y.; Bakış, R.; Koç, C. A study on transformation of multi-purpose dams into pumped storage hydroelectric power plants by using GIS model. Int. J. Green Energy 2021, 18, 308–318. [Google Scholar] [CrossRef]

- Xu, B.; Zhang, J.; Egusquiza, M.; Zhang, J.; Chen, D.; Egusquiza, E. Exploring the Regulation Reliability of a Pumped Storage Power Plant in a Wind–Solar Hybrid Power Generation System. Water 2021, 13, 2548. [Google Scholar] [CrossRef]

- Mennemann, J.-F.; Marko, L.; Schmidt, J.; Kemmetmüller, W.; Kugi, A. Nonlinear model predictive control of a variable-speed pumped-storage power plant. IEEE Trans. Control Syst. Technol. 2019, 29, 645–660. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, T.; Xu, C.; Zhang, B.; Li, L.; Ke, Y.; Yan, Y.; Xu, R. Optimal location selection for offshore wind-PV-seawater pumped storage power plant using a hybrid MCDM approach: A two-stage framework. Energy Convers. Manag. 2019, 199, 112066. [Google Scholar] [CrossRef]

- Fu, X.; Li, D.; Wang, H.; Yang, J.; Wei, X. Multi-objective optimization of guide vane closure scheme in clean pumped-storage power plant with emphasis on pressure fluctuations. J. Energy Storage 2022, 55, 105493. [Google Scholar] [CrossRef]

- Pérez-Díaz, J.I.; Lafoz, M.; Burke, F. Integration of fast acting energy storage systems in existing pumped-storage power plants to enhance the system’s frequency control. Wiley Interdiscip. Rev. Energy Environ. 2020, 9, e367. [Google Scholar] [CrossRef]

- Holzer, T.; Muetze, A.; Traxler-Samek, G.; Lecker, M.; Zerobin, F. Generator design possibilities for full-size converter operation of large pumped storage power plants. IEEE Trans. Ind. Appl. 2020, 56, 3644–3655. [Google Scholar] [CrossRef]

- Mukhammadiev, M.M.; Dzhuraev, K.S. Justification of the energy and economic parameters of pumped storage power plants in Uzbekistan. Appl. Sol. Energy 2020, 56, 227–232. [Google Scholar] [CrossRef]

- Rezghi, A.; Riasi, A. The interaction effect of hydraulic transient conditions of two parallel pump-turbine units in a pumped-storage power plant with considering “S-shaped” instability region: Numerical simulation. Renew. Energy 2018, 118, 896–908. [Google Scholar] [CrossRef]

- Savchyn, I.; Vaskovets, S. Local geodynamics of the territory of Dniester pumped storage power plant. Acta Geodyn. Geomater. 2018, 15, 189. [Google Scholar] [CrossRef]

- Urishev, B. Selection of parameters of pumped storage power plants at large pumping stations for water use. Appl. Sol. Energy 2018, 54, 477–480. [Google Scholar] [CrossRef]

- Nasir, J.; Javed, A.; Ali, M.; Ullah, K.; Kazmi, S.A.A. Capacity optimization of pumped storage hydropower and its impact on an integrated conventional hydropower plant operation. Appl. Energy 2022, 323, 119561. [Google Scholar] [CrossRef]

- Botterud, A.; Levin, T.; Koritarov, V. Pumped Storage Hydropower: Benefits for Grid Reliability and Integration of Variable Renewable Energy; Argonne National Laboratory: Argonne, IL, USA, 2014.

- Wessel, M.; Madlener, R.; Hilgers, C. Economic feasibility of semi-underground pumped storage hydropower plants in open-pit mines. Energies 2020, 13, 4178. [Google Scholar] [CrossRef]

- Luick, H.; Niemann, A.; Perau, E.; Schreiber, U. Coalmines as Underground Pumped Storage Power Plants (UPP)—A contribution to a sustainable energy supply. Proc. Geophys. Res. Abstr. 2012, 14, 4205. [Google Scholar]

- Peczkis, G. Practical possibilities of pumped-storage power plants implementation in liquidated underground mines. J. Power Technol. 2021, 101, 4. [Google Scholar]

- Dyczko, A.; Kamiński, P.; Stecuła, K.; Prostański, D.; Kopacz, M.; Kowol, D. Thermal and mechanical energy storage as a chance for energy transformation in Poland. Polityka Energ. Energy Policy J. 2021, 24, 43–60. [Google Scholar] [CrossRef]

- Kulpa, J.; Kamiński, P.; Stecuła, K.; Prostański, D.; Matusiak, P.; Kowol, D.; Kopacz, M.; Olczak, P. Technical and Economic Aspects of Electric Energy Storage in a Mine Shaft—Budryk Case Study. Energies 2021, 14, 7337. [Google Scholar] [CrossRef]

- Saigustia, C.; Robak, S. Review of Potential Energy Storage in Abandoned Mines in Poland. Energies 2021, 14, 6272. [Google Scholar] [CrossRef]

- Kozieł, J.; Majka, M.; Wac-Włodarczyk, A.; Naglak, K. Optimization of the wind farm structure through the use of PV installations and the use of pumped storage power plants. Przegląd Elektrotechniczny 2022, 98, 86–89. [Google Scholar] [CrossRef]

- Richter, W.; Pikl, F.; Zenz, G.; Vereide, K.; Pummer, E.; Lia, L. Economic and sustainable energy transition enabled by pumped-storage hydropower plants. In Proceedings of the Hydro Conference 2020, Strasbourg, France, 26–28 October 2020. [Google Scholar]

- Tedla, F.K.; Wieprecht, S.; Gillies, I. The Role of Pumped Storage Hydropower in Improving the Integration of Generation from Renewable Sources–The Case of Germany. In Proceedings of the HYDRO 2017, Seville, Spain, 9–11 October 2017. [Google Scholar]

- Kubiak-Wójcicka, K.; Szczęch, L. Exploitation of Rivers in Poland for Electricity Production–Current Condition and Perspectives for Development. In Management of Water Resources in Poland; Springer: Cham, Switzerland, 2021; pp. 327–355. [Google Scholar]

- Kubiak-Wójcicka, K.; Szczęch, L. Dynamics of electricity production against the backdrop of climate change: A case study of hydropower plants in Poland. Energies 2021, 14, 3427. [Google Scholar] [CrossRef]

- Kuta, M. Mobilized thermal energy storage (M-TES) system design for cooperation with geothermal energy sources. Appl. Energy 2023, 332, 120567. [Google Scholar] [CrossRef]

- Tyryk, M. Simulation of Static Excitation System of a Hydrogenerator of a Pumped Storage Power Plant in Żarnowiec; Institute of Heat Engineering, Warsaw University of Technology: Warsaw, Poland, 2022. [Google Scholar]

- Lewandowski, S.; Lewandowski, M.; Steller, J. Hydrozespoły odwracalne o zmiennej prędkości obrotowej–możliwości i korzyści techniczno-ekonomiczne. Napędy Sterow. 2021, 23, 91–101. [Google Scholar]

- Igliński, B.; Krukowski, K.; Mioduszewski, J.; Pietrzak, M.B.; Skrzatek, M.; Piechota, G.; Wilczewski, S. Assessment of the Current Potential of Hydropower for Water Damming in Poland in the Context of Energy Transformation. Energies 2022, 15, 922. [Google Scholar] [CrossRef]

- Twaróg, B. Modelling of the Solina-Myczkowce pumped storage power plant. Tech. Trans. 2023, 120, 1–11. [Google Scholar] [CrossRef] [PubMed]

- Rotkegel, M.; Szot, Ł.; Sobczak, D. Ograniczenie ryzyka utraty stateczności obudowy w wyrobiskach Elektrowni Szczytowo-Pompowej „Młoty”. Wiadomości Górnicze 2017, 2, 112–120. [Google Scholar]

- Kowalski, E.; Rotkegel, M.; Stałęga, S. Uwarunkowania geologiczno-inżynierskie wznowienia budowy elektrowni szczytowo-pompowej koło Bystrzycy Kłodzkiej. Górnictwo Geonżynieria 2008, 32, 213–226. [Google Scholar]

- DZIENNIK URZĘDOWY RZECZYPOSPOLITEJ POLSKIEJ Zarządzenie nr 351 Prezesa Rady Ministrów z Dnia 28 Grudnia 2021 r. w Sprawie Zespołu Eksperckiego do Spraw Budowy Elektrowni Szczytowo-Pompowych, Warsaw, Poland. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WMP20220000006 (accessed on 1 February 2022).

- Zarębska, J.; Dzikuć, M. Determining the environmental benefits of life cycle assessment (LCA) on example of the power industry. Sci. J. Marit. Univ. Szczecin 2013, 34, 97–102. [Google Scholar]

- PSE. Dane Systemowe. Available online: https://www.pse.pl/dane-systemowe (accessed on 18 July 2023).

- PSE. Praca KSE-Generacja Mocy Jednostek Wytwórczych. Available online: https://www.pse.pl/dane-systemowe/funkcjonowanie-kse/raporty-dobowe-z-pracy-kse/generacja-mocy-jednostek-wytworczych (accessed on 12 February 2024).

- PSE. Plan Rozwoju w Zakresie Zaspokojenia Obecnego i Przyszłego Zapotrzebowania na Energię Elektryczną na Lata 2023–2032; PSE: Konstancin-Jeziorna, Poland, 2022. [Google Scholar]

- Ibrahim, H.; Ilinca, A.; Perron, J. Energy storage systems—Characteristics and comparisons. Renew. Sustain. Energy Rev. 2008, 12, 1221–1250. [Google Scholar] [CrossRef]

- Berrada, A.; Loudiyi, K. Operation, sizing, and economic evaluation of storage for solar and wind power plants. Renew. Sustain. Energy Rev. 2016, 59, 1117–1129. [Google Scholar] [CrossRef]

- U.S. Energy Information and Administration. Today in Energy. Available online: https://www.eia.gov/todayinenergy/ (accessed on 18 July 2023).

- Bowen, T.; Chernyakhovskiy, I.; Xu, K.; Gadzanku, S.; Coney, K. USAID Grid-Scale Energy Storage Technologies Primer; NREL: Golden, CO, USA, 2021.

- Aneke, M.; Wang, M. Energy storage technologies and real life applications–A state of the art review. Appl. Energy 2016, 179, 350–377. [Google Scholar] [CrossRef]

- Zakeri, B.; Syri, S. Electrical energy storage systems: A comparative life cycle cost analysis. Renew. Sustain. Energy Rev. 2015, 42, 569–596. [Google Scholar] [CrossRef]

- Frate, G.F.; Ferrari, L.; Desideri, U. Energy storage for grid-scale applications: Technology review and economic feasibility analysis. Renew. Energy 2021, 163, 1754–1772. [Google Scholar] [CrossRef]

- Mongird, K.; Viswanathan, V.; Alam, J.; Vartanian, C.; Sprenkle, V.; Baxter, R. 2020 Grid Energy Storage Technology Cost and Performance Assessment; 2020. Available online: https://www.pnnl.gov/sites/default/files/media/file/Final%20-%20ESGC%20Cost%20Performance%20Report%2012-11-2020.pdf (accessed on 10 June 2023).

- TGE SA Polish Day-Ahead Market. Available online: http://tge.pl/electricity-dam (accessed on 18 July 2023).

- Cherubini, U.; Luciano, E.; Vecchiato, W. Copula Methods in Finance; John Wiley & Sons: Hoboken, NJ, USA, 2004; ISBN 0-47-086345-5. [Google Scholar]

- Vose, D. Risk Analysis: A Quantitative Guide; John Wiley & Sons: Hoboken, NJ, USA, 2008; ISBN 0-47-051284-9. [Google Scholar]

- Kopacz, M.; Kulpa, J.; Galica, D.; Dyczko, A.; Jarosz, J. Economic valuation of coal deposits—The value of geological information in the resource recognition process. Resour. Policy 2019, 63, 101450. [Google Scholar] [CrossRef]

- Immendoerfer, A.; Tietze, I.; Hottenroth, H.; Viere, T. Life-cycle impacts of pumped hydropower storage and battery storage. Int. J. Energy Environ. Eng. 2017, 8, 231–245. [Google Scholar] [CrossRef]

- PGE Energia Odnawialna, S.A. Trzy Elektrownie PGE Energia Odnawialna z Kontraktami Rynku Mocy. Available online: https://pgeeo.pl/aktualnosci/trzy-elektrownie-pge-energia-odnawialna-z-kontraktami-rynku-mocy (accessed on 10 April 2023).

- Kryzia, D.; Kopacz, M.; Kryzia, K. The Valuation of the Operational Flexibility of the Energy Investment Project Based on a Gas-Fired Power Plant. Energies 2020, 13, 1567. [Google Scholar] [CrossRef]

- Komorowska, A.; Olczak, P. Economic viability of Li-ion batteries based on the price arbitrage in the European day-ahead markets. Energy 2024, 290, 130009. [Google Scholar] [CrossRef]

- Benalcazar, P.; Komorowska, A.; Kamiński, J. A GIS-based method for assessing the economics of utility-scale photovoltaic systems. Appl. Energy 2024, 353, 122044. [Google Scholar] [CrossRef]

- Kaszyński, P.; Komorowska, A.; Kamiński, J. Revisiting Market Power in the Polish Power System. Energies 2023, 16, 4856. [Google Scholar] [CrossRef]

| Name of PSH | Żarnowiec | Porąbka-Żar | Żydowo |

|---|---|---|---|

| Location (voivodeship) | Czymanowo (Pomeranian Voivodeship) | Międzybrodzie Żywieckie (Silesian Voivodeship) | Żydowo (West Pomeranian Voivodeship) |

| Capacity, MWh | 3800 | 2015 | 687 |

| Installed capacity, MW | 780 | 552 | 165 |

| Number of hydro units | 4 | 4 | 3 |

| Generation in 2021, MWh | 425,433 | 272,618 | 68,533 |

| Pumping in 2021, MWh | 612,378 | 359,193 | 92,824 |

| Yearly mean RTE, % | 69.47 | 75.90 | 73.83 |

| Type | Power/Capacity | CAPEX | OPEX (Annual) | Lifetime | |||

|---|---|---|---|---|---|---|---|

| $/kW | $/kWh | $/kW | $/kWh | Number of Cycles at 80% of Discharge | Project Lifetime | ||

| PSH | 100 MW/ 400 MWh | 1534 | 384 | 30.4 | 7.60 | 15,000 | 40 |

| 100 MW/ 1000 MWh | 1967 | 197 | 30.4 | 3.04 | |||

| 1000 MW/ 4000 MWh | 1288 | 322 | 17.8 | 4.45 | |||

| 100 MW/ 10 000 MWh | 1651 | 165 | 17.8 | 1.78 | |||

| Lithium-ion iron phosphate (LFP) batteries | 100 MW/ 800 MWh | 2894 | 362 | 7.15 | 0.89 | 5500 | 10 |

| 100 MW/ 1000 MWh | 3565 | 356 | 8.82 | 0.88 | |||

| Lithium-ion nickel manganese cobalt (NMC) batteries | 100 MW/ 800 MWh | 2974 | 372 | 7.35 | 0.92 | 3500 | 10 |

| 100 MW/ 1000 MWh | 3664 | 366 | 9.07 | 0.91 | |||

| Item | Electricity Generation | Pumping Cost | Electricity Price |

|---|---|---|---|

| Electricity Generation | 1.00 | 0.62 | 0.70 |

| Pumping Cost | 0.62 | 1.00 | 0.81 |

| Electricity Price | 0.70 | 0.81 | 1.00 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kulpa, J.; Kopacz, M.; Stecuła, K.; Olczak, P. Pumped Storage Hydropower as a Part of Energy Storage Systems in Poland—Młoty Case Study. Energies 2024, 17, 1830. https://doi.org/10.3390/en17081830

Kulpa J, Kopacz M, Stecuła K, Olczak P. Pumped Storage Hydropower as a Part of Energy Storage Systems in Poland—Młoty Case Study. Energies. 2024; 17(8):1830. https://doi.org/10.3390/en17081830

Chicago/Turabian StyleKulpa, Jarosław, Michał Kopacz, Kinga Stecuła, and Piotr Olczak. 2024. "Pumped Storage Hydropower as a Part of Energy Storage Systems in Poland—Młoty Case Study" Energies 17, no. 8: 1830. https://doi.org/10.3390/en17081830

APA StyleKulpa, J., Kopacz, M., Stecuła, K., & Olczak, P. (2024). Pumped Storage Hydropower as a Part of Energy Storage Systems in Poland—Młoty Case Study. Energies, 17(8), 1830. https://doi.org/10.3390/en17081830