Leveraging System Dynamics to Predict the Commercialization Success of Emerging Energy Technologies: Lessons from Wind Energy

Abstract

1. Introduction

2. Background on Energy Systems

2.1. Description of an Energy System

- Sources of Electricity: In the United States, as of 2023, most electricity is generated from fossil fuels, specifically natural gas and coal [5]. Fossil fuel-based energy sources are associated with heavy carbon dioxide (CO2) emissions, leading to a large push for the transition to zero- or low-emission sources for electricity generation, such as renewable and nuclear energy. Renewable energy sources include solar- and wind-based power generation, as well as hydropower and smaller sources such as geothermal and wave energy.

- Energy Sources Other than Electricity: Large industrial processes rely on energy sources other than electricity (e.g., steam). The energy sources for the industrial processes in the United States are also mainly fossil fuels (i.e., natural gas, coal, and oil). Many industrial processes also require feedstock other than energy to produce their products (e.g., hydrogen and oxygen). For example, the steel manufacturing industry uses large amounts of hydrogen and oxygen, both generated mostly from fossil fuel-based feedstock using processes with heavy CO2 emissions. These areas are illustrated under “Process Energy Sources” and “Sources of Hydrogen” in Figure 1.

- Energy Consumption: Energy consumers rely on electricity and nonelectrical energy sources. Many industrial processes and the transportation sector primarily use fossil fuels. These hard-to-electrify industries drive the need to develop breakthrough clean energy solutions beyond electricity.

- Energy Economy: The energy transition is significantly influenced by the energy economy, which encompasses the production, distribution, and consumption of energy. The interplay between energy markets, federal policies, and projected energy demands shapes the trajectory of this transition.

2.2. Dynamics of Novel Energy System Diffusion

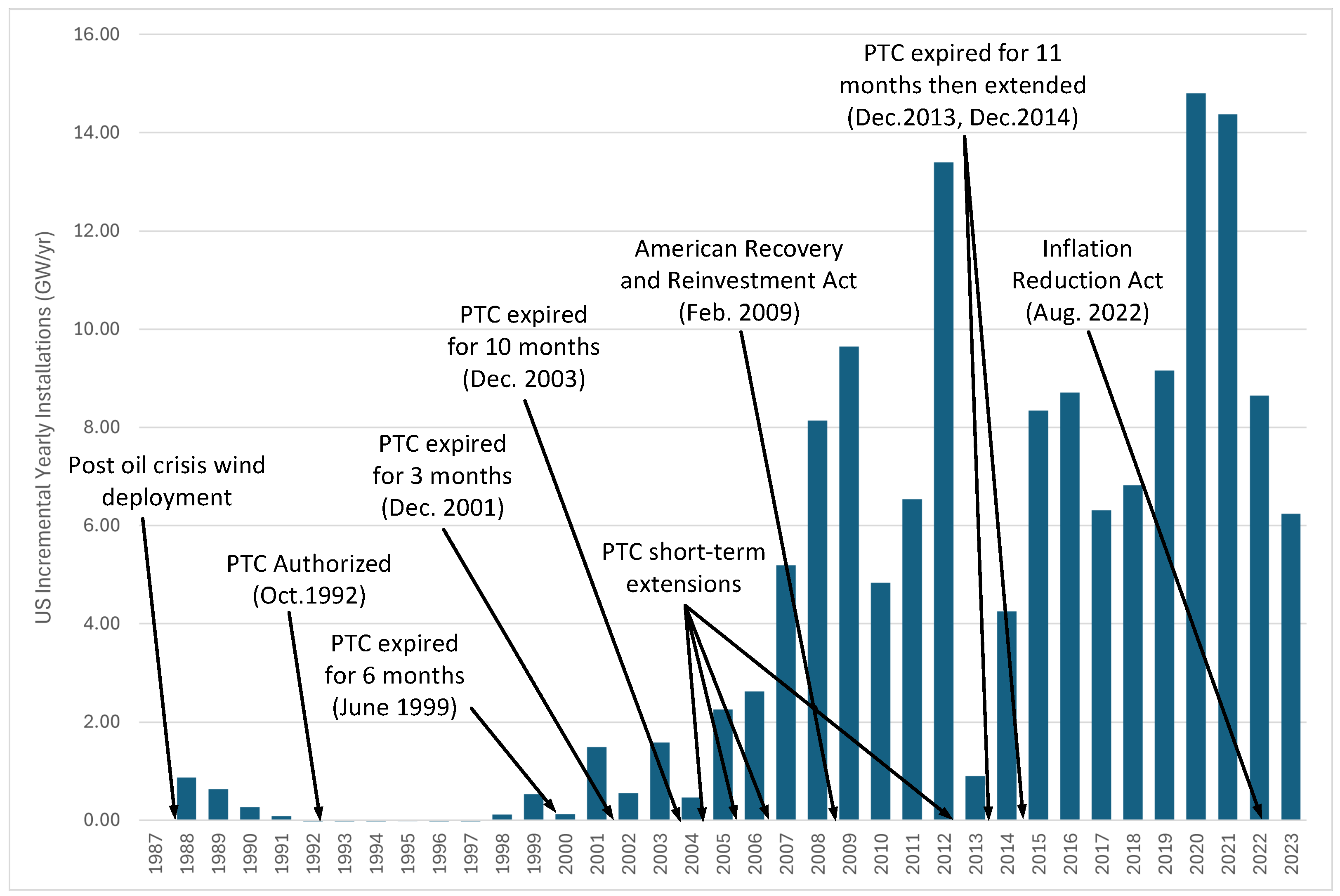

- Policy and Regulation: Government policies, subsidies, tax incentives, and regulations play a crucial role in encouraging or hindering the energy transition, as supportive policies can significantly accelerate the adoption of novel energy technologies.

- Technological Advancements: Technological innovations improve efficiency and reduce costs, making them more competitive with incumbent fossil-fuel-based energy solutions. Cost reductions due to technological advancements have been observed in wind and solar electricity generation and storage technologies [1,2,27].

- Economic Factors: The cost of new energy technologies versus incumbent ones, the availability of financing, and the overall economic climate influence investment decisions for the energy sector.

- Environmental Concerns: Growing awareness of climate change drives the demand for cleaner energy solutions. International agreements like the Paris Agreement also pressure countries to reduce greenhouse gas emissions, given that the electricity sector is the primary contributor of CO2 emissions.

- Energy Security: Diversifying energy sources can enhance national energy security by reducing reliance on imported fuels and mitigating the risks associated with geopolitical tensions.

- Market Dynamics: The energy market’s structure, including energy prices, market competition, and the extent to which markets are open to new entrants, affects the pace and nature of the energy transition.

- Availability of Resources: The availability of the resources required for a novel energy technology is a key factor influencing the success of that technology’s commercialization. Resource constraints, either real or perceived, add significant uncertainties to the overall success of the technology’s commercialization, which may preclude willingness to invest in those technologies (e.g., access to fuel and land resources needed for renewable installations).

- Public Perception and Social Acceptance: Public awareness and support for novel energy projects can influence their deployment. Social acceptance is crucial for the successful implementation of large-scale projects and the eventual nationwide diffusion of the technology.

- Infrastructure and Grid Capability: The existing energy infrastructure’s ability to integrate renewable energy sources, including grid capacity and storage solutions, affects the energy transition process.

- Research and Development: Investment in research and development (R&D) for new energy technologies and improvements in existing ones can significantly impact the speed and efficiency of the energy transition.

- International Cooperation: Cross-border collaboration on technology transfer, funding, and policy alignment can facilitate an efficient and widespread energy transition.

3. Literature Review

3.1. Existing Approaches to Modeling Energy Systems and Energy Transition

3.2. Systems Engineering Principles and Tools to Enhance Decision-Making for Energy Systems

Model-Based Systems Engineering

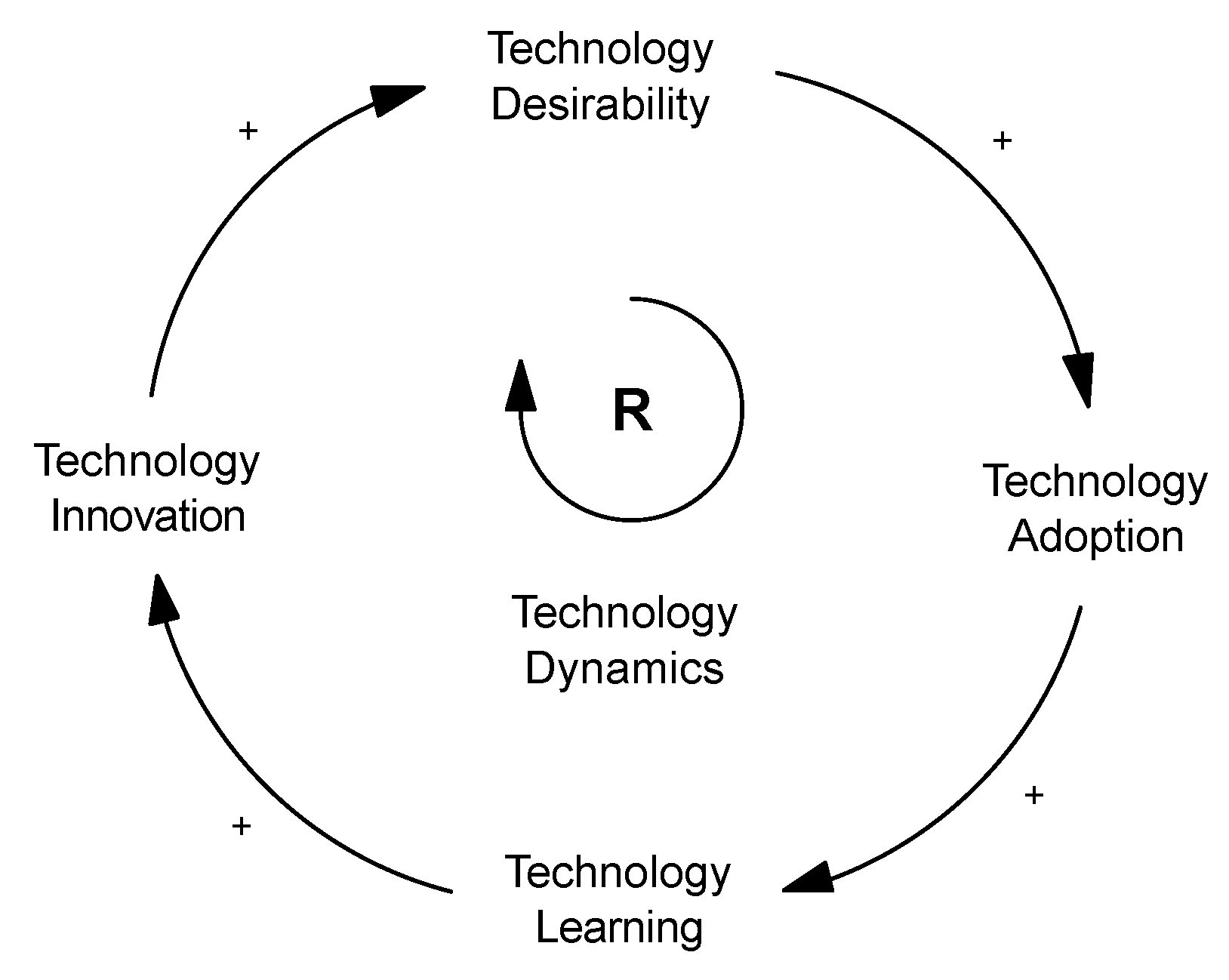

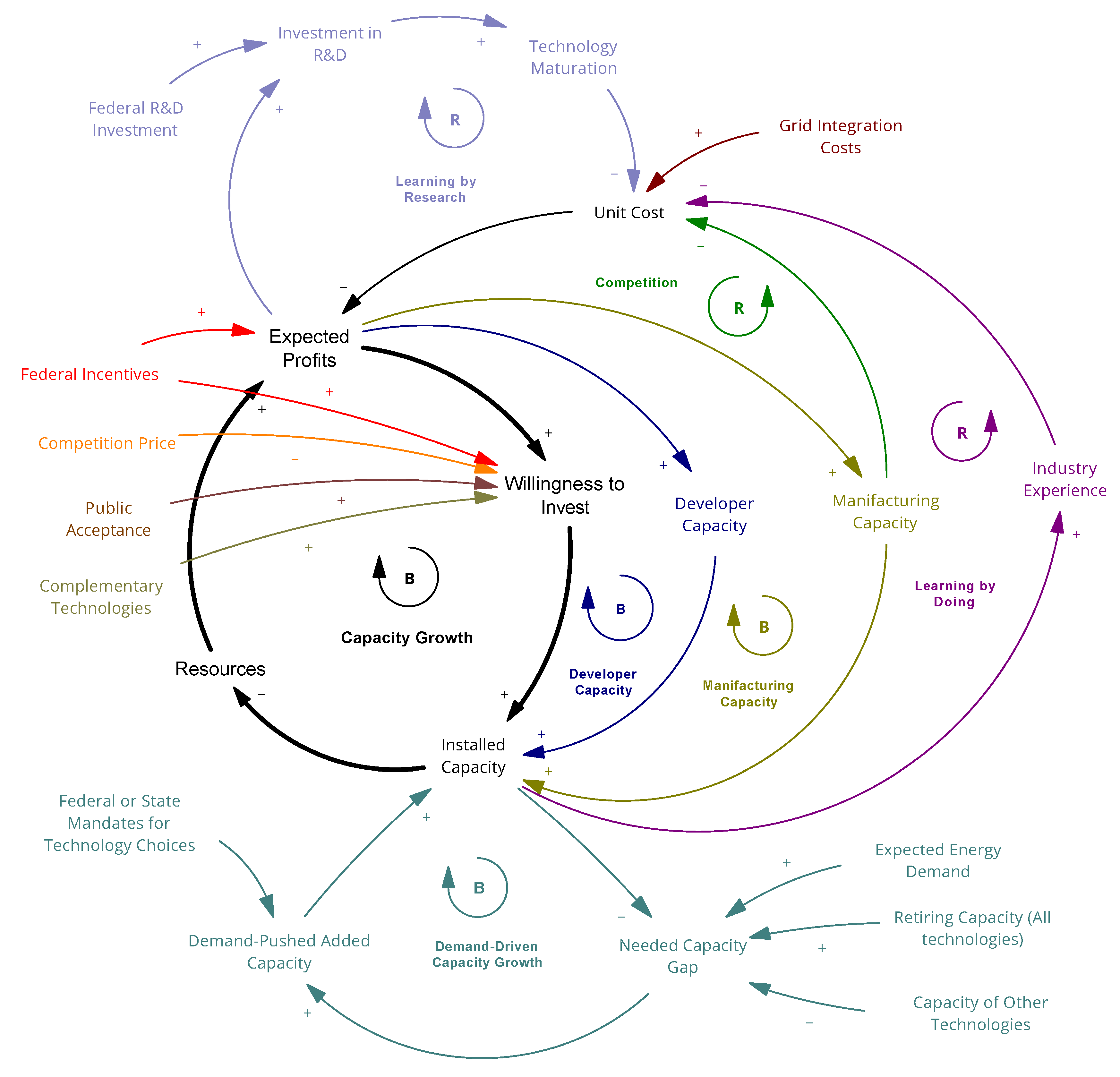

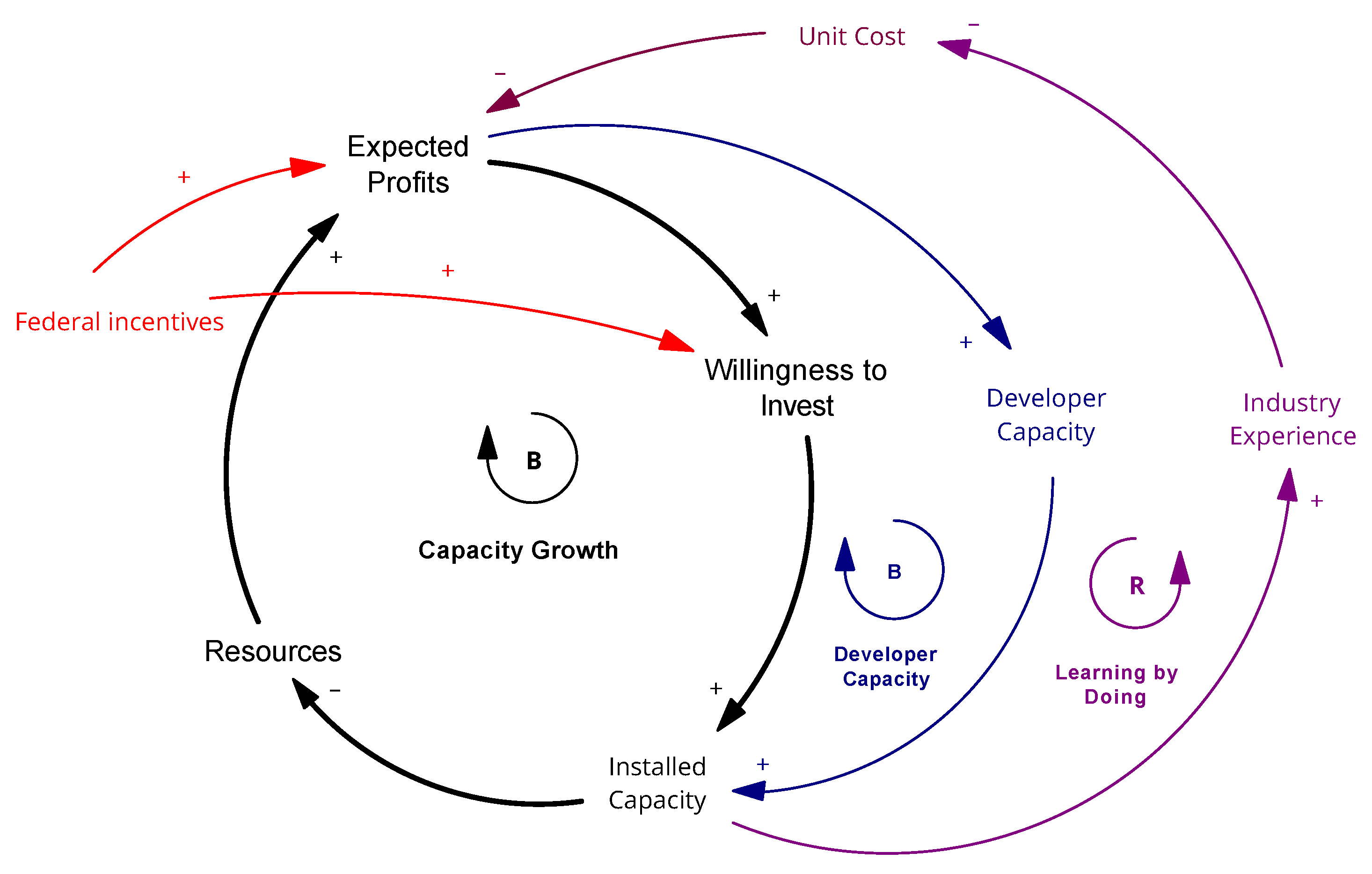

- Feedback loops, or causal-loop diagrams (CLD)s, which illustrate the interconnected relationships between different components, such as how a decrease in costs can drive an increase in technology installations and the increase in installations, further driving down costs.

- Stocks, which represent accumulated quantities, such as installed capacity.

- Flows, which indicate the rates of change within the system, such as the rate of incremental capacity additions.

4. Qualitative Modeling of Energy System Commercialization Dynamics

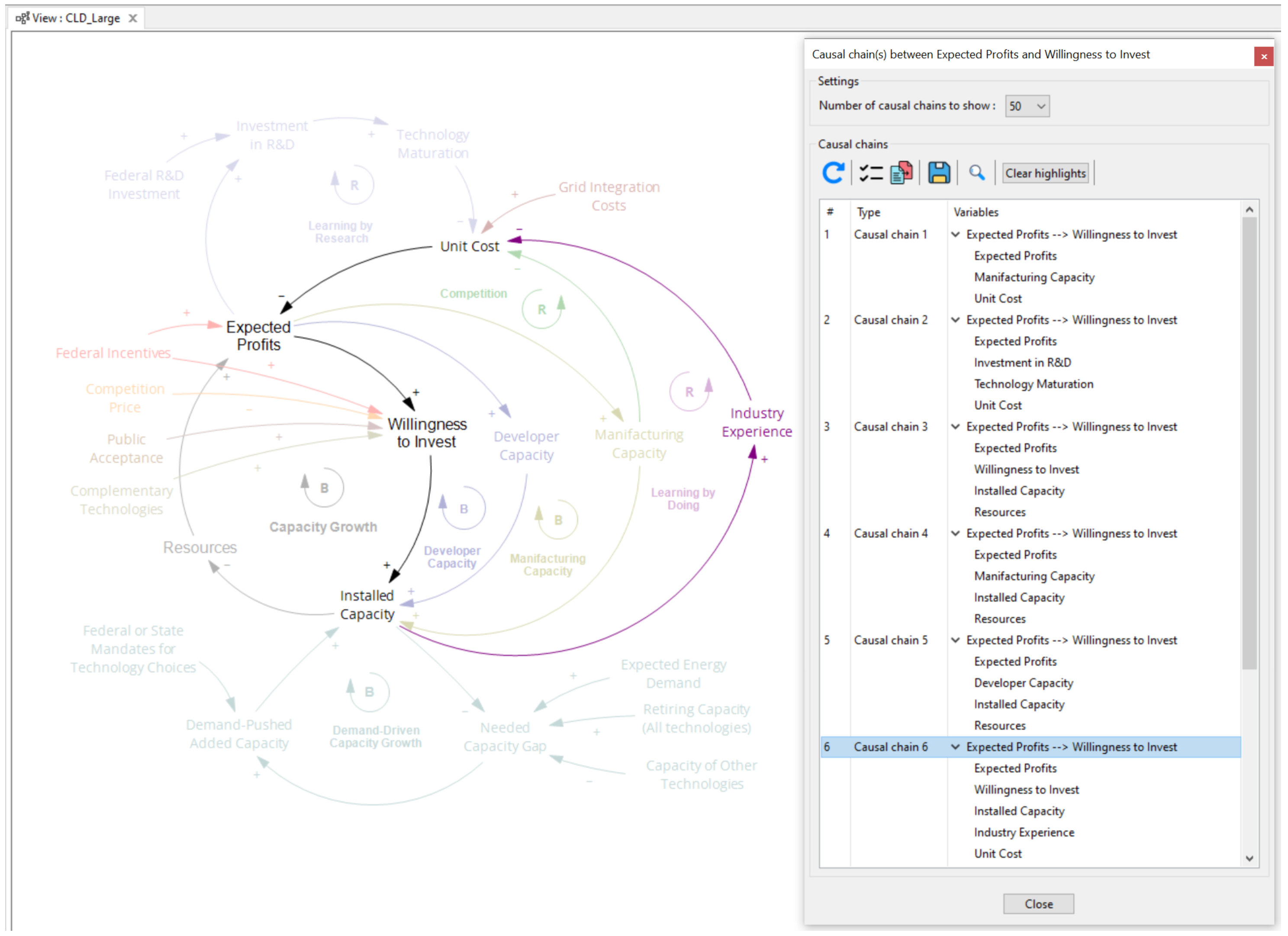

4.1. Modeling Methods: Causal-Loop Diagram

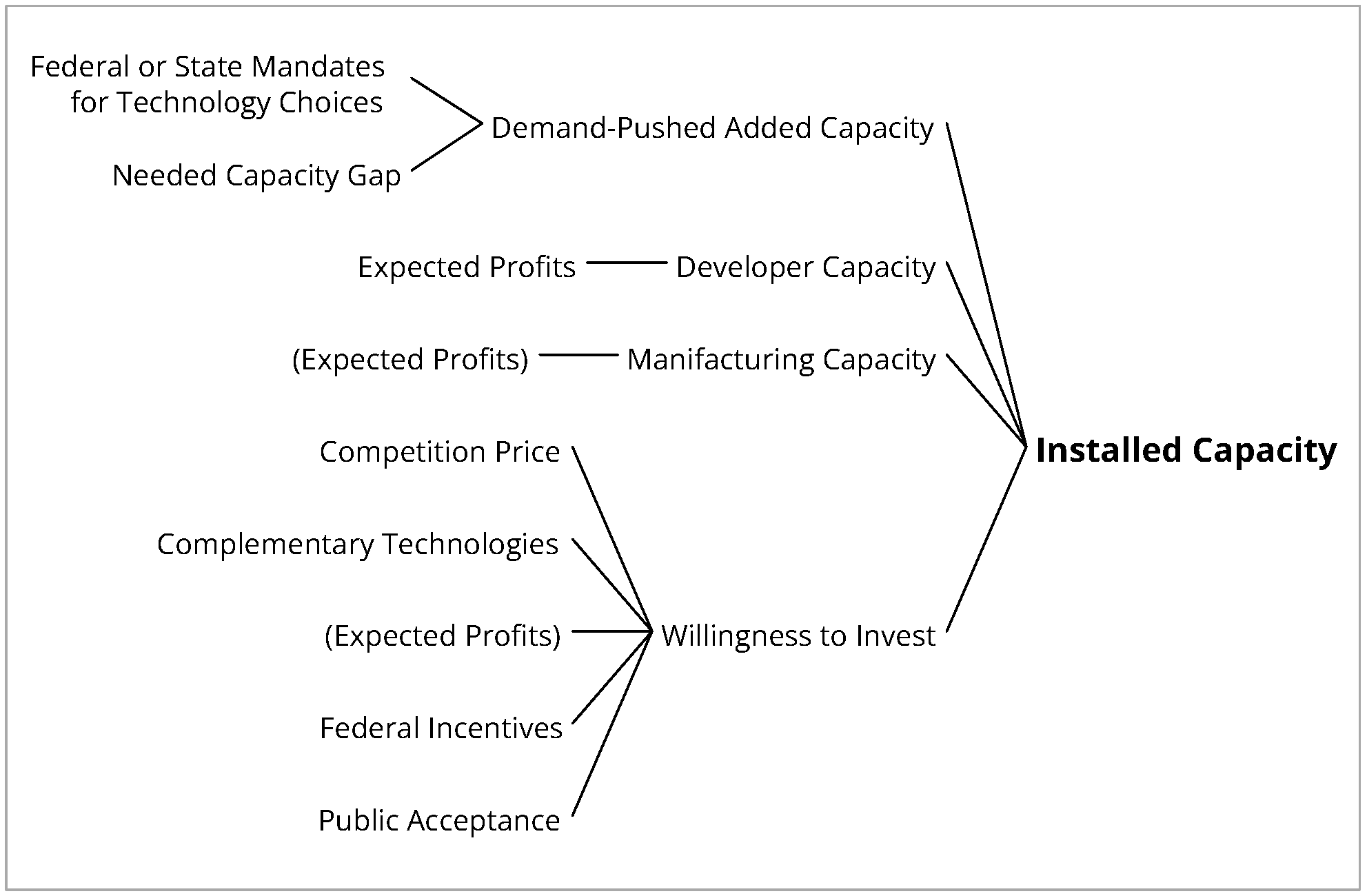

4.2. Model of Dynamics of Novel Energy Systems

4.3. Results of Model-Based Qualitative Assessments

5. Quantitative Modeling of Energy System Commercialization Dynamics

5.1. Model Boundaries and Key Assumptions

5.2. System Dynamics: Model Input Specification and Calibration

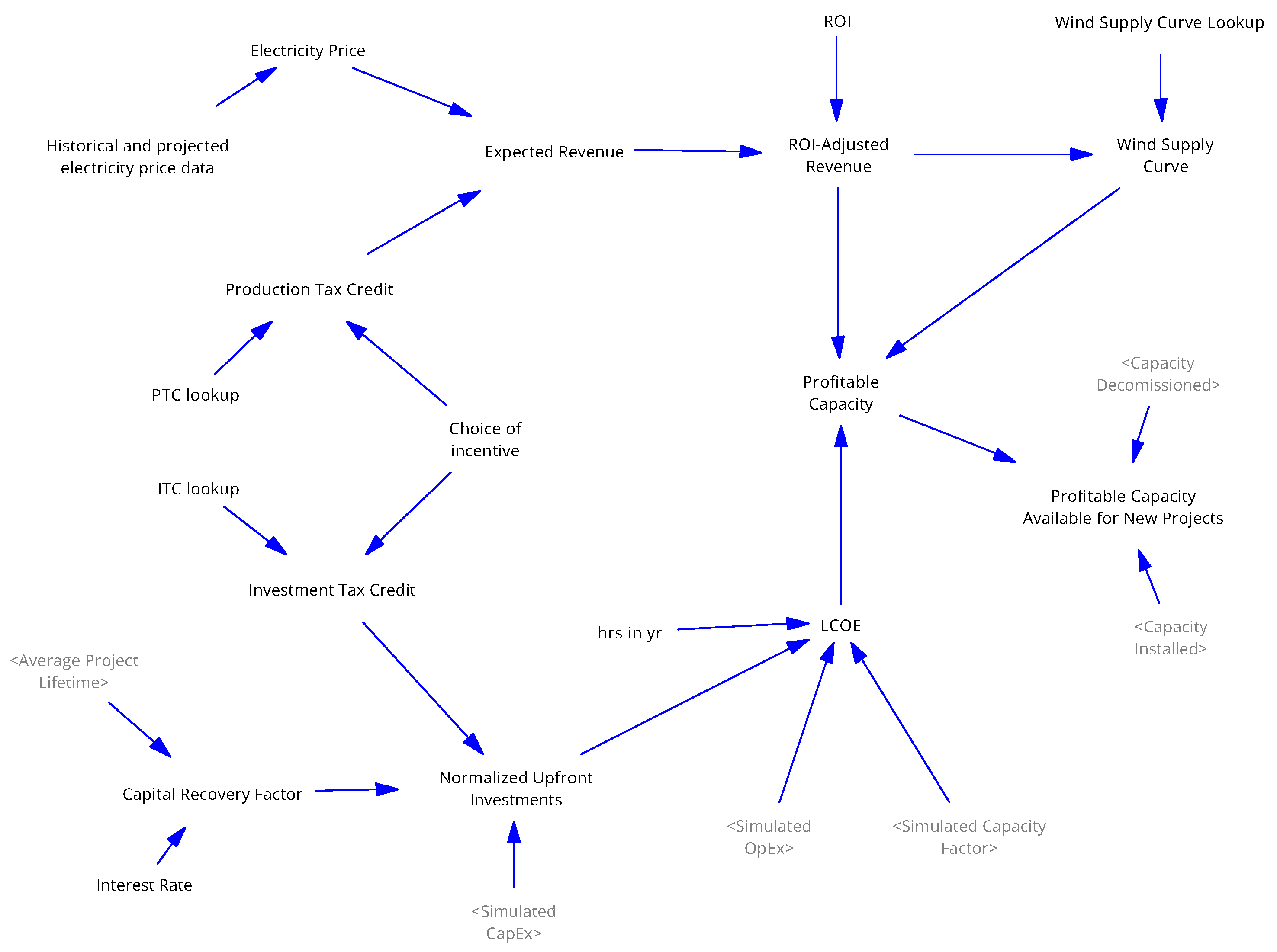

- Profitable capacity models resources suitable for new energy system installations based on the total available resources, their portion available for installations, and a smaller portion of the available resources that is considered profitable;

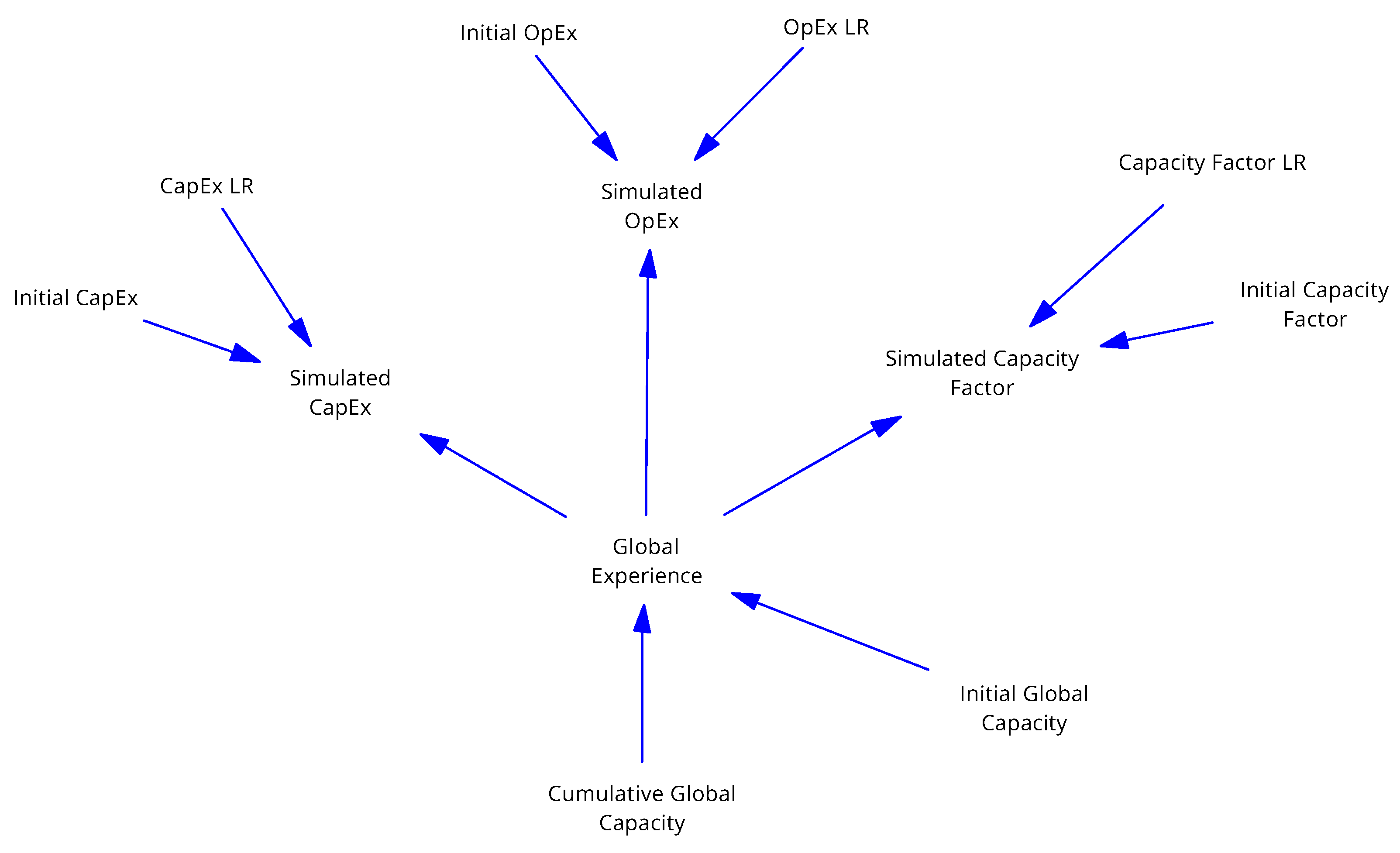

- Technological learning models improvements in performance and decline in cost as a function of cumulative installations;

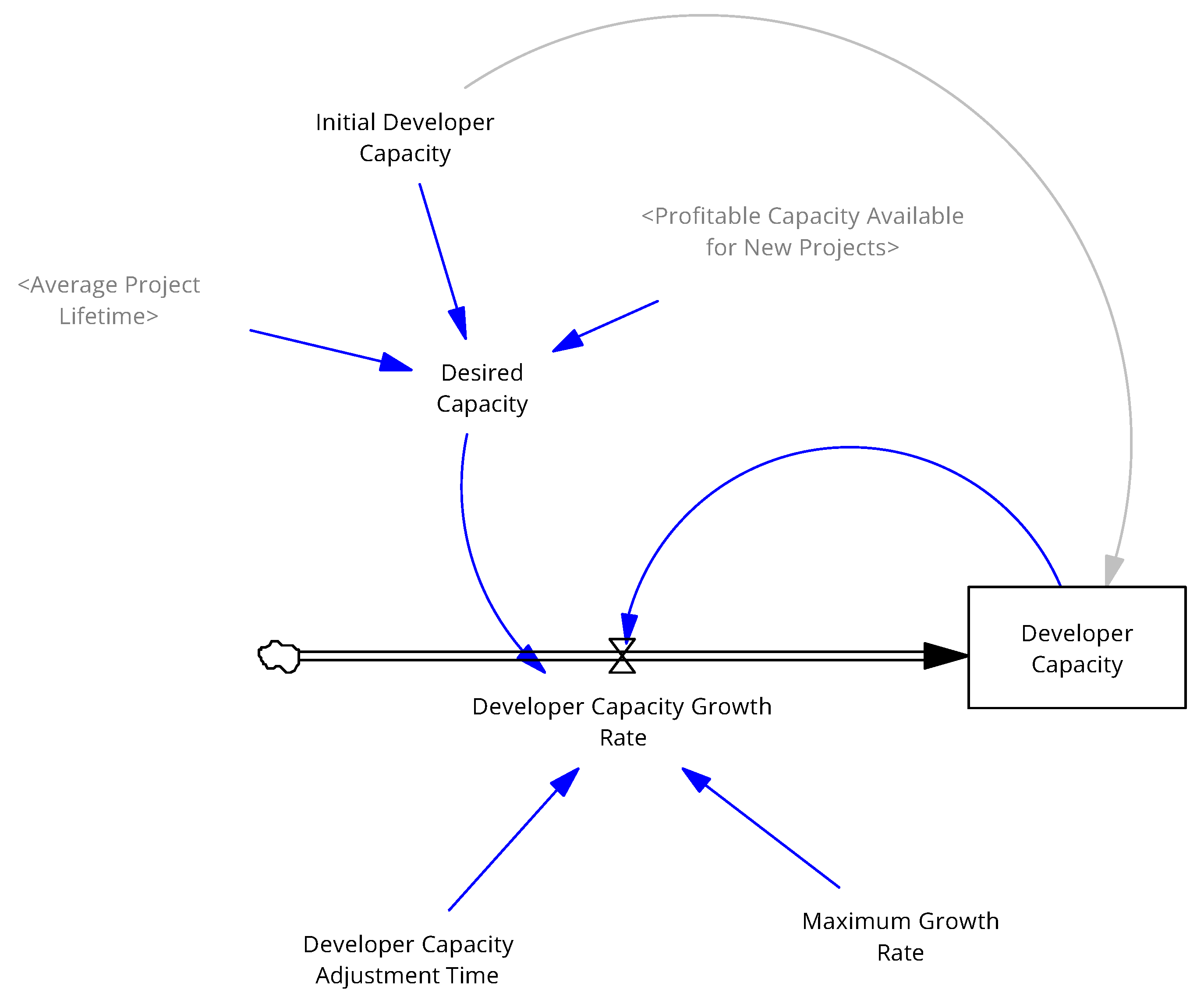

- Developer capacity growth describes factors that affect the industry’s capability to scale and install the growing number of projects;

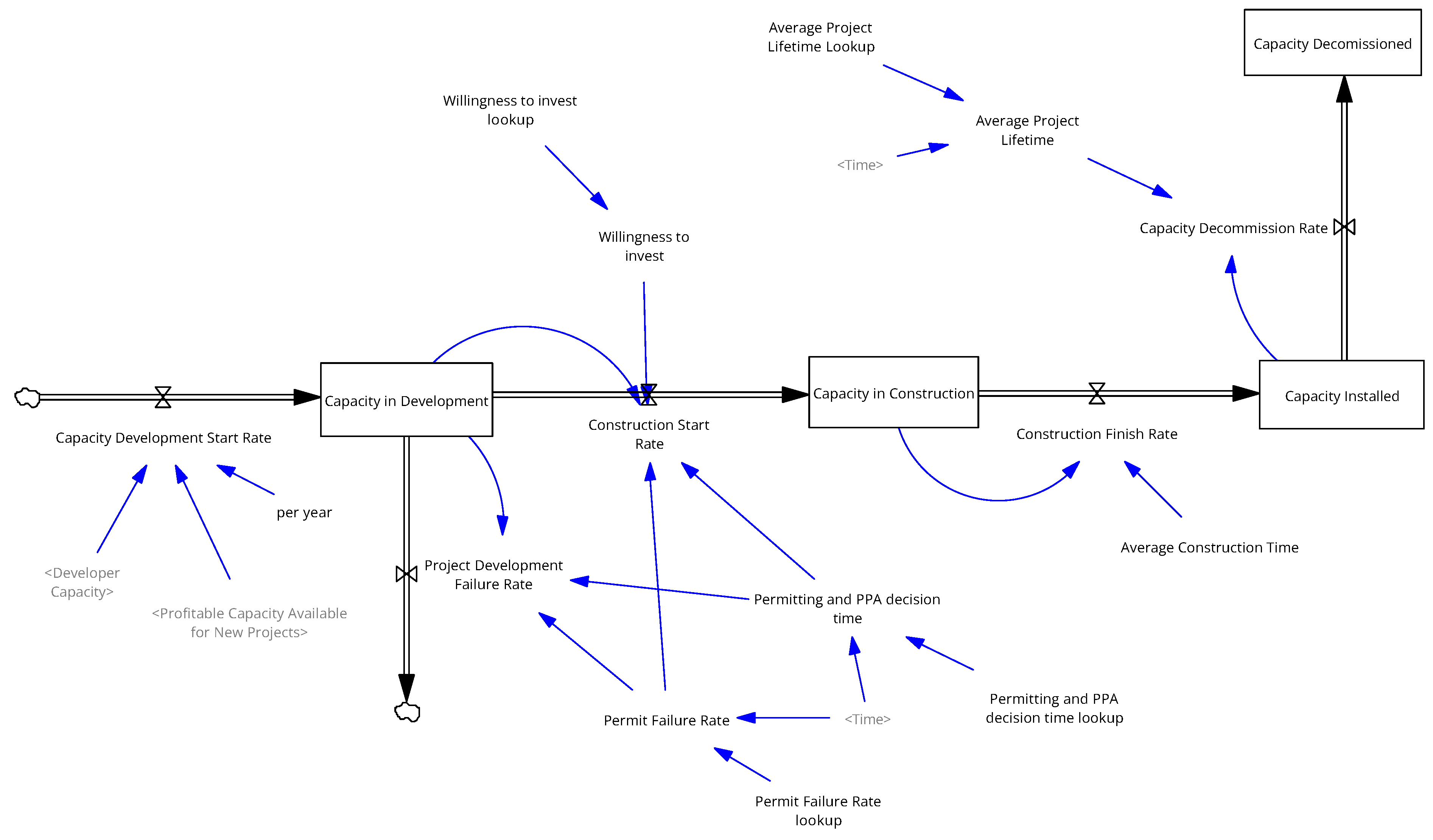

- Capacity growth models the project’s progress from the initial consideration to completion, including multiple factors that affect the process.

5.2.1. Profitable Capacity

5.2.2. Technological Learning

5.2.3. Developer Capacity Growth

5.2.4. Capacity Growth

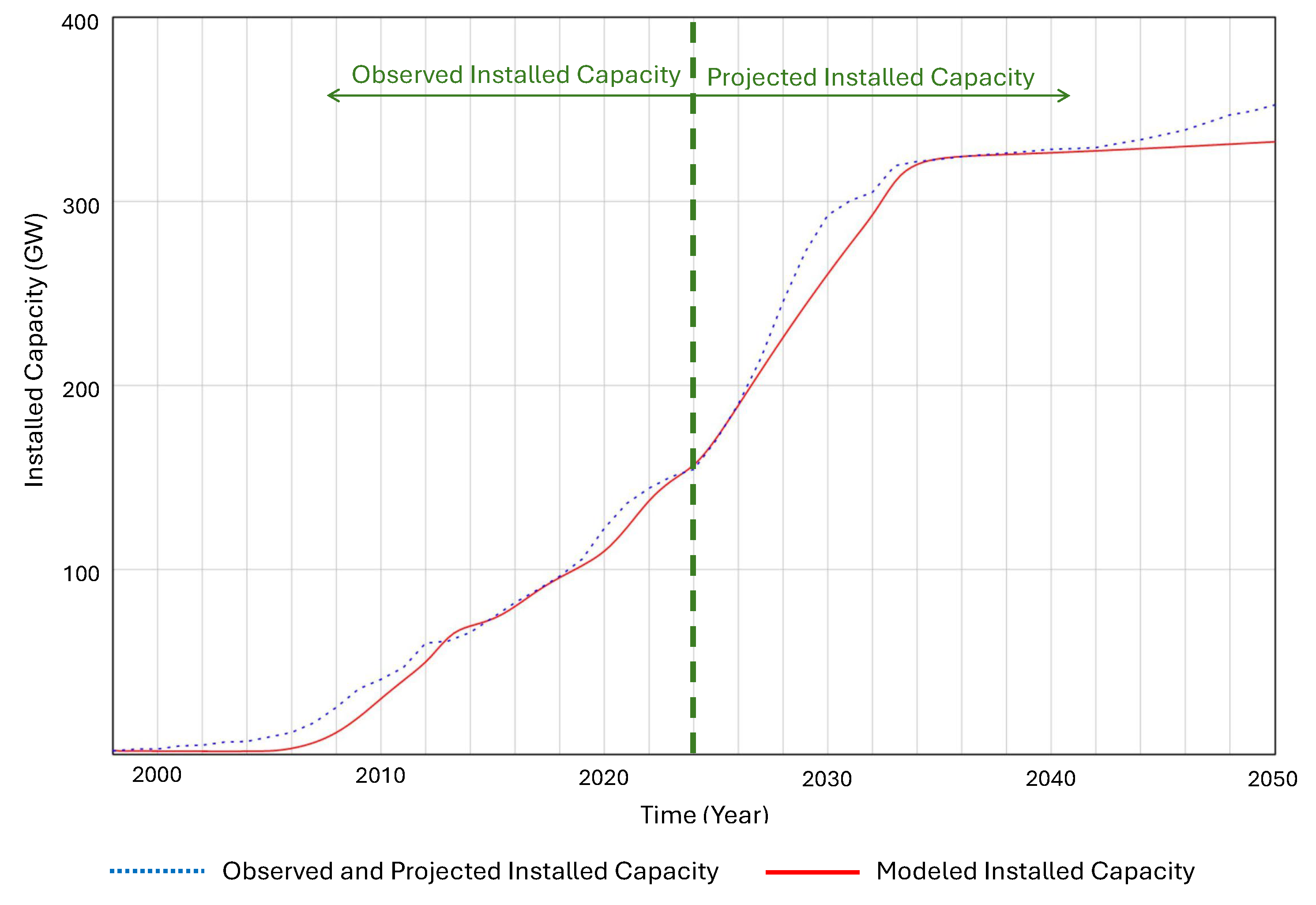

5.3. Results of Model-Based Quantitative Assessment

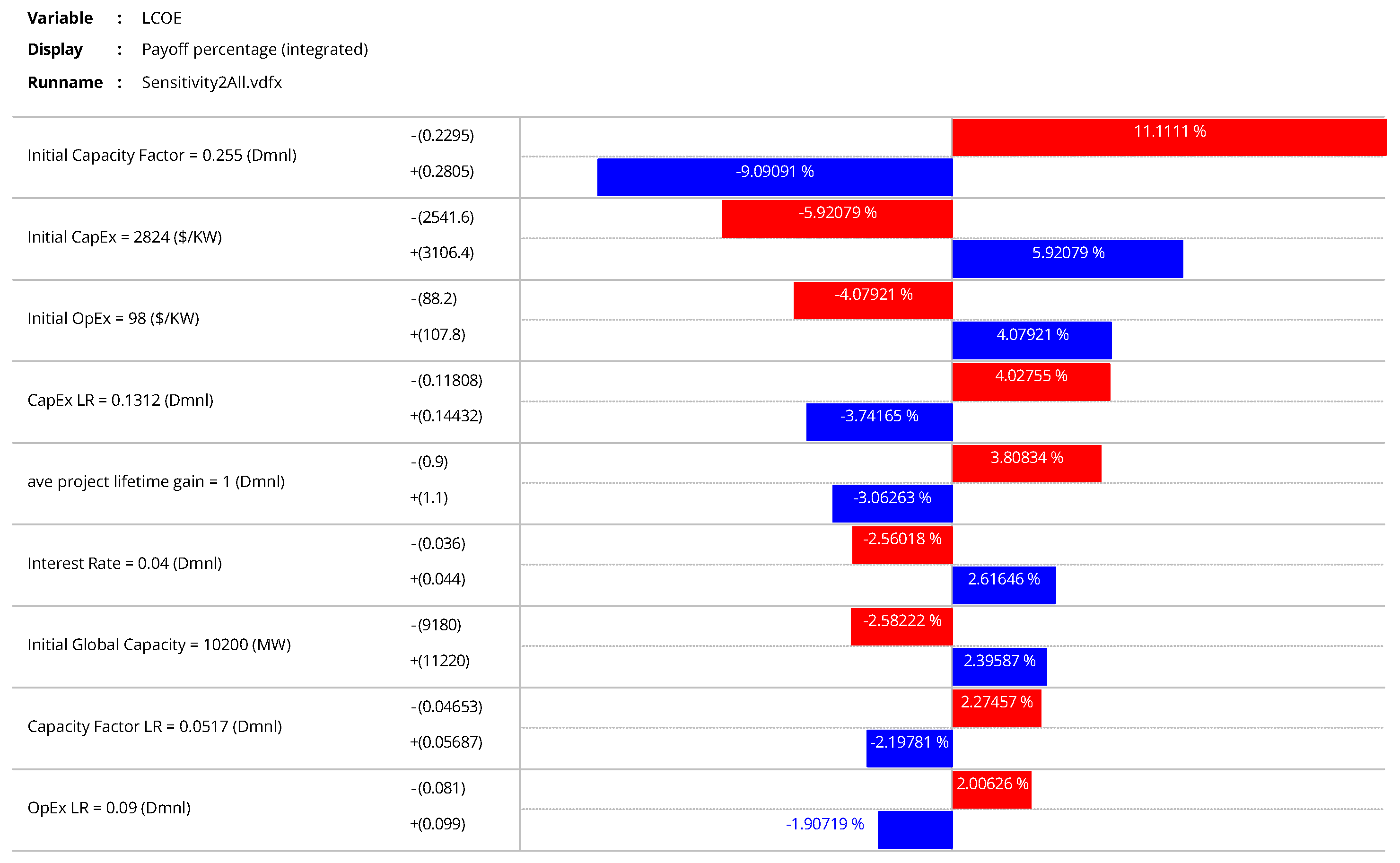

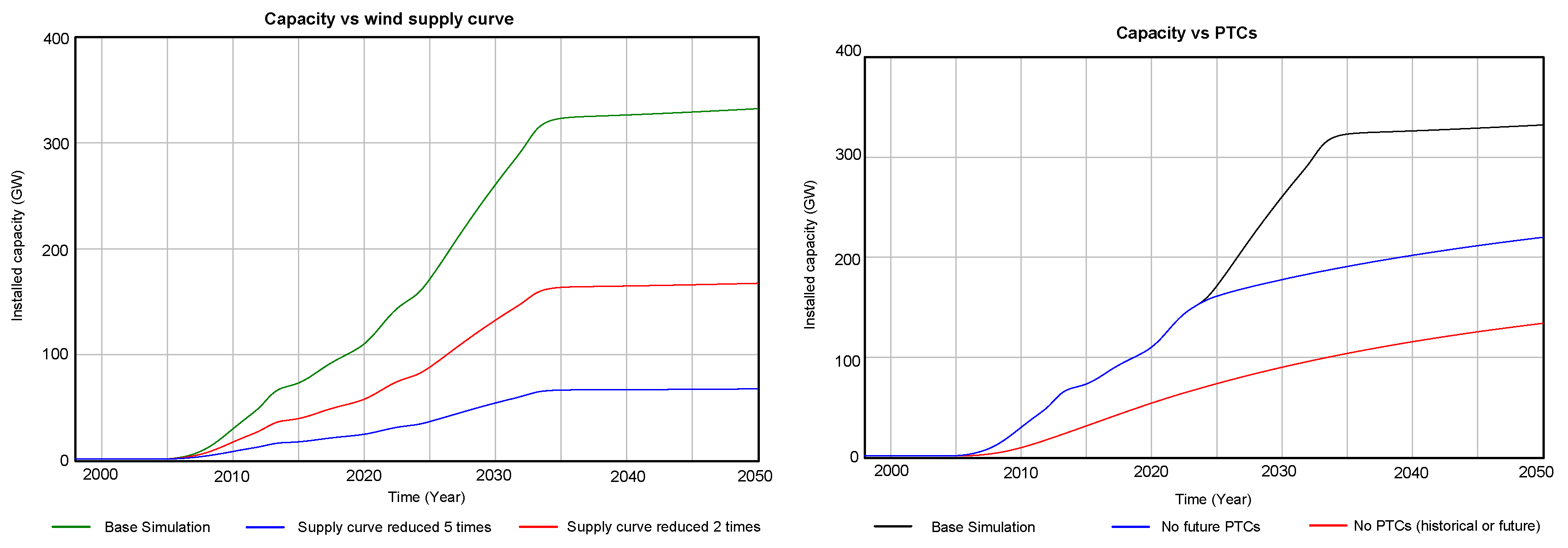

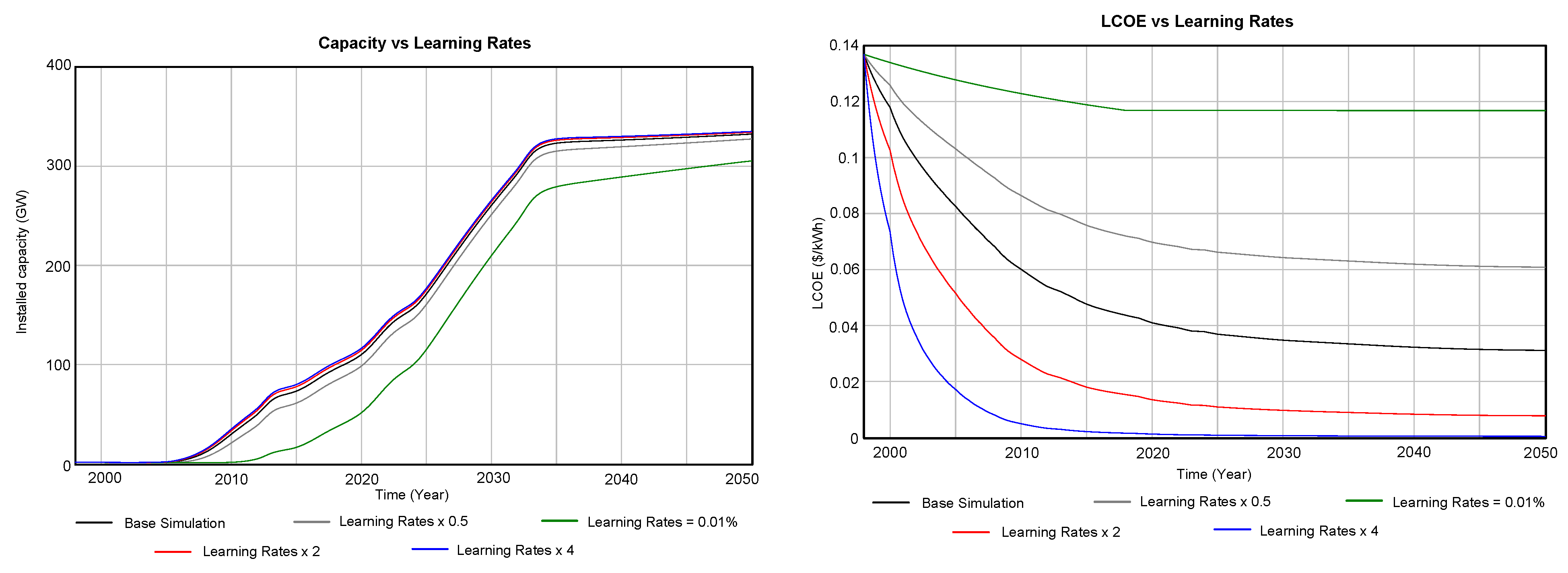

5.3.1. Sensitivity Studies

5.3.2. Scenario Analysis

6. Discussion

Future Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CLD | causal loop diagrams |

| CRF | capital recovery factor |

| ITC | investment tax credit |

| LCA | life cycle assessment |

| LCOE | levelized cost of energy |

| MBSE | model-based systems engineering |

| O&M | operation and maintenance |

| PPA | power purchase agreement |

| PTC | production tax credit |

| R&D | research and development |

| ROI | return on investment |

| RPS | renewable portfolio standard |

| SD | system dynamics |

| SE | systems engineering |

References

- Wiser, R.; Millstein, D.; Hoen, B.; Bolinger, M.; Gorman, W.; Rand, J.; Barbose, G.; Cheyette, A.; Darghouth, N.; Jeong, S.; et al. Land-Based Wind Market Report: 2024 Edition; Technical Report; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2024. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs in 2023; Technical Report; IRENA: Abu Dhabi, United Arab Emirates, 2024. [Google Scholar]

- International Renewable Energy Agency (IRENA). Renewable Capacity Statistics 2024; Technical Report; IRENA: Abu Dhabi, United Arab Emirates, 2024. [Google Scholar]

- Wind Systems. Wind Energy and the PTC: Sustaining an American Success Story. Available online: https://www.windsystemsmag.com/wind-energy-and-the-ptc-sustaining-an-american-success-story (accessed on 24 December 2024).

- U.S. Energy Information Administration. What Is U.S. Electricity Generation by Energy Source? Available online: https://www.eia.gov/tools/faqs/faq.php?id=427 (accessed on 8 June 2024).

- U.S. Energy Information Administration. Annual Energy Outlook 2023, Renewable Energy Generating Capacity and Generation. Available online: https://www.eia.gov/outlooks/aeo/ (accessed on 23 December 2024).

- International Energy Agency. World Energy Outlook 2021; Technical Report; International Energy Agency: Paris, France, 2021. [Google Scholar]

- bp. Energy Outlook 2024. Available online: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html (accessed on 24 January 2025).

- Esmaeili, P.; Rafei, M.; Salari, M.; Balsalobre-Lorente, D. From oil surges to renewable shifts: Unveiling the dynamic impact of supply and demand shocks in global crude oil market on U.S. clean energy trends. Energy Policy 2024, 192, 114252. [Google Scholar] [CrossRef]

- Frazier, A.W.; Marcy, C.; Cole, W. Wind and solar PV deployment after tax credits expire: A view from the standard scenarios and the annual energy outlook. Electr. J. 2019, 32, 106637. [Google Scholar] [CrossRef]

- Harvey, H.; Orvis, R.; Rissman, J. Designing Climate Solutions: A Policy Guide for Low-Carbon Energy; Island Press: Washington, DC, USA, 2018. [Google Scholar] [CrossRef]

- IEA. United States 2024: Energy Policy Review; Technical Report; International Energy Agency (IEA): Paris, France, 2024. [Google Scholar]

- U.S. Department of Energy. Energy Independence and Security. Available online: https://www.energy.gov/eere/energy-independence-and-security (accessed on 24 January 2025).

- Resilient Energy Platform. Renewable Energy to Support Energy Security. Available online: https://www.nrel.gov/docs/fy20osti/74617.pdf (accessed on 24 January 2025).

- McKinsey & Company. Global Energy Perspective 2024. Available online: https://www.mckinsey.com/industries/energy-and-materials/our-insights/global-energy-perspective (accessed on 24 January 2025).

- Simeoni, P.; Nardin, G.; Ciotti, G. Planning and design of sustainable smart multi energy systems. The case of a food industrial district in Italy. Energy 2018, 163, 443–456. [Google Scholar] [CrossRef]

- Huang, Z.; Yu, H.; Peng, Z.; Feng, Y. Planning community energy system in the industry 4.0 era: Achievements, challenges and a potential solution. Renew. Sustain. Energy Rev. 2017, 78, 710–721. [Google Scholar] [CrossRef]

- Arriaga, M.; Caizares, C.A.; Kazerani, M. Long-Term Renewable Energy Planning Model for Remote Communities. IEEE Trans. Sustain. Energy 2016, 7, 221–231. [Google Scholar] [CrossRef]

- Herrera de Reyes, M.A.; Knighton, T.; Cheng, W.C.; Sweeney, K.P.; Joseck, F.C.; Cadogan, J.; Guaita, N.; Boardman, R.D.; Bafana, A.P.; Hanumante, N.C.; et al. Hydrogen Generation and Industrial Heat Opportunities for Nuclear Plants in the Gulf Coast; Technical Report; Idaho National Laboratory (INL): Idaho Falls, ID, USA, 2024. [Google Scholar] [CrossRef]

- Garrouste, M.; Wendt, D.S.; Jenson, W.D.; Zhang, Q.; Herrera Diaz, M.A.; Joseck, F.C. Grid-Integrated Production of Fischer-Tropsch Synfuels from Nuclear Power; Technical Report; Idaho National Laboratory (INL): Idaho Falls, ID, USA, 2023. [Google Scholar] [CrossRef]

- Freeman, R. Modelling the socio-political feasibility of energy transition with system dynamics. Environ. Innov. Soc. Transit. 2021, 40, 486–500. [Google Scholar] [CrossRef]

- Yang, Y.; Xia, S.; Huang, P.; Qian, J. Energy transition: Connotations, mechanisms and effects. Energy Strategy Rev. 2024, 52, 101320. [Google Scholar] [CrossRef]

- Neofytou, H.; Nikas, A.; Doukas, H. Sustainable energy transition readiness: A multicriteria assessment index. Renew. Sustain. Energy Rev. 2020, 131, 109988. [Google Scholar] [CrossRef]

- Young, J.; Brans, M. Analysis of factors affecting a shift in a local energy system towards 100% renewable energy community. J. Clean. Prod. 2017, 169, 117–124. [Google Scholar] [CrossRef]

- Guo, P.; Kong, J.; Guo, Y.; Liu, X. Identifying the influencing factors of the sustainable energy transitions in China. J. Clean. Prod. 2019, 215, 757–766. [Google Scholar] [CrossRef]

- Skoczkowski, T.; Bielecki, S.; Wojtyńska, J. Long-Term Projection of Renewable Energy Technology Diffusion. Energies 2019, 12, 4261. [Google Scholar] [CrossRef]

- Seel, S.J.; Kemp, J.M.; Cheyette, A.; Millstein, D.; Gorman, W.; Jeong, S.; Robson, D.; Setiawan, R.; Bolinger, M. Utility-Scale Solar, 2024 Edition; Technical Report; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2024. [Google Scholar] [CrossRef]

- Pruyt, E. System Dynamics Models of Electrical Wind Power. In Proceedings of the International Conference of the System Dynamics Society, Oxford, UK, 25–29 July 2004. [Google Scholar]

- Pruyt, E. The EU-25 Power Sector: A System Dynamics Model of Competing Electricity Generation Technologies. In Proceedings of the International Conference of the System Dynamics Society, Boston, MA, USA, 29 July–2 August 2007. [Google Scholar]

- Dykes, K.L.; Sterman, J.D. Boom and Bust Cycles in Wind Energy Diffusion Due to Inconsistency and Short-term Bias in National Energy Policies. In Proceedings of the International Conference of the System Dynamics Society, Seoul, Republic of Korea, 25–29 July 2010. [Google Scholar]

- Tejeda, J.; Ferreira, S. Applying Systems Thinking to Analyze Wind Energy Sustainability. Procedia Comput. Sci. 2014, 28, 213–220. [Google Scholar] [CrossRef]

- Savio, A.; De Giovanni, L.; Guidolin, M. Modelling Energy Transition in Germany: An Analysis through Ordinary Differential Equations and System Dynamics. Forecasting 2022, 4, 438–455. [Google Scholar] [CrossRef]

- Laimon, M.; Mai, T.; Goh, S.; Yusaf, T. System dynamics modelling to assess the impact of renewable energy systems and energy efficiency on the performance of the energy sector. Renew. Energy 2022, 193, 1041–1048. [Google Scholar] [CrossRef]

- Hafner, S.; Gottschamer, L.; Kubli, M.; Pasqualino, R.; Ulli-Beer, S. Building the Bridge: How System Dynamics Models Operationalise Energy Transitions and Contribute towards Creating an Energy Policy Toolbox. Sustainability 2024, 16, 8326. [Google Scholar] [CrossRef]

- Klein, M.; Reeg, M.; Frey, U. Models Within Models—Agent-Based Modelling and Simulation in Energy Systems Analysis. J. Artif. Soc. Soc. Simul. 2019, 22, 6. [Google Scholar] [CrossRef]

- Esmaeili Aliabadi, D.; Kaya, M.; Sahin, G. Competition, risk and learning in electricity markets: An agent-based simulation study. Appl. Energy 2017, 195, 1000–1011. [Google Scholar] [CrossRef]

- Anatolitis, V.; Welisch, M. Putting renewable energy auctions into action—An agent-based model of onshore wind power auctions in Germany. Energy Policy 2017, 110, 394–402. [Google Scholar] [CrossRef]

- Gallo, G. Electricity market games: How agent-based modeling can help under high penetrations of variable generation. Electr. J. 2016, 29, 39–46. [Google Scholar] [CrossRef]

- Plazas-Niño, F.; Ortiz-Pimiento, N.; Montes-Páez, E. National energy system optimization modelling for decarbonization pathways analysis: A systematic literature review. Renew. Sustain. Energy Rev. 2022, 162, 112406. [Google Scholar] [CrossRef]

- Fishbone, L.G.; Abilock, H. Markal, a linear-programming model for energy systems analysis: Technical description of the bnl version. Int. J. Energy Res. 1981, 5, 353–375. [Google Scholar] [CrossRef]

- Kydes, A.S. The Brookhaven Energy System Optimization Model: Its Variants and Uses. In Energy Policy Modeling: United States and Canadian Experiences: Volume II Integrative Energy Policy Models; Springer: Dordrecht, The Netherlands, 1980; pp. 110–136. [Google Scholar] [CrossRef]

- Howells, M.; Rogner, H.; Strachan, N.; Heaps, C.; Huntington, H.; Kypreos, S.; Hughes, A.; Silveira, S.; DeCarolis, J.; Bazillian, M.; et al. OSeMOSYS: The Open Source Energy Modeling System: An introduction to its ethos, structure and development. Energy Policy 2011, 39, 5850–5870. [Google Scholar] [CrossRef]

- Hunter, K.; Sreepathi, S.; DeCarolis, J.F. Modeling for insight using Tools for Energy Model Optimization and Analysis (Temoa). Energy Econ. 2013, 40, 339–349. [Google Scholar] [CrossRef]

- Prina, M.G.; Cozzini, M.; Garegnani, G.; Manzolini, G.; Moser, D.; Filippi Oberegger, U.; Pernetti, R.; Vaccaro, R.; Sparber, W. Multi-objective optimization algorithm coupled to EnergyPLAN software: The EPLANopt model. Energy 2018, 149, 213–221. [Google Scholar] [CrossRef]

- Pietzcker, R.C.; Ueckerdt, F.; Carrara, S.; de Boer, H.S.; Després, J.; Fujimori, S.; Johnson, N.; Kitous, A.; Scholz, Y.; Sullivan, P.; et al. System integration of wind and solar power in integrated assessment models: A cross-model evaluation of new approaches. Energy Econ. 2017, 64, 583–599. [Google Scholar] [CrossRef]

- Krey, V.; Guo, F.; Kolp, P.; Zhou, W.; Schaeffer, R.; Awasthy, A.; Bertram, C.; de Boer, H.S.; Fragkos, P.; Fujimori, S.; et al. Looking under the hood: A comparison of techno-economic assumptions across national and global integrated assessment models. Energy 2019, 172, 1254–1267. [Google Scholar] [CrossRef]

- Binsted, M.; Iyer, G.; Cui, R.; Khan, Z.; Dorheim, K.; Clarke, L. Evaluating long-term model-based scenarios of the energy system. Energy Strategy Rev. 2020, 32, 100551. [Google Scholar] [CrossRef]

- Grubb, M.; Wieners, C.; Yang, P. Modeling myths: On DICE and dynamic realism in integrated assessment models of climate change mitigation. WIREs Clim. Change 2021, 12, e698. [Google Scholar] [CrossRef]

- Luo, X.; Oyedele, L.O.; Owolabi, H.A.; Bilal, M.; Ajayi, A.O.; Akinade, O.O. Life cycle assessment approach for renewable multi-energy system: A comprehensive analysis. Energy Convers. Manag. 2020, 224, 113354. [Google Scholar] [CrossRef]

- Ciacci, L.; Passarini, F. Life Cycle Assessment (LCA) of Environmental and Energy Systems. Energies 2020, 13, 5892. [Google Scholar] [CrossRef]

- Volkart, K.; Mutel, C.L.; Panos, E. Integrating life cycle assessment and energy system modelling: Methodology and application to the world energy scenarios. Sustain. Prod. Consum. 2018, 16, 121–133. [Google Scholar] [CrossRef]

- Reinert, C.; Deutz, S.; Minten, H.; Dörpinghaus, L.; von Pfingsten, S.; Baumgärtner, N.; Bardow, A. Environmental impacts of the future German energy system from integrated energy systems optimization and dynamic life cycle assessment. Comput. Chem. Eng. 2021, 153, 107406. [Google Scholar] [CrossRef]

- INCOSE. Systems Engineering Handbook, 5th ed.; Number INCOSE-TP-2003–002-05; John Wiley & Sons: Hoboken, NJ, USA, 2023. [Google Scholar]

- Noguchi, R.A. Recommended Best Practices based on MBSE Pilot Projects. In Proceedings of the INCOSE International Symposium, Orlando, FL, USA, 20–25 July 2019; Volume 29, pp. 753–770. [Google Scholar] [CrossRef]

- Sterman, J.D. Business Dynamics, Systems Thinking and Modeling for a Complex World; McGraw Hill: New York, NY, USA, 2010. [Google Scholar]

- Ventana Systems, Inc. Vensim. Available online: https://vensim.com/ (accessed on 20 January 2025).

- ISEE Systems. Stella Professional. Available online: https://www.iseesystems.com/store/products/stella-professional.aspx (accessed on 20 January 2025).

- Powersim Software AS. Powersim Software. Available online: https://powersim.com/ (accessed on 20 January 2025).

- Dykes, K. Dynamics of Technology Innovation and Diffusion with Emphasis on Wind Energy. Ph.D. Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2016. [Google Scholar]

- Bass, F.M. A New Product Growth for Model Consumer Durables. Manag. Sci. 1969, 15, 215–227. [Google Scholar] [CrossRef]

- Maier, F.H. New product diffusion models in innovation management—A system dynamics perspective. Syst. Dyn. Rev. 1998, 14, 285–308. [Google Scholar] [CrossRef]

- Maalla, E.; Kunsch, P. Simulation of micro-CHP diffusion by means of System Dynamics. Energy Policy 2008, 36, 2308–2319. [Google Scholar] [CrossRef]

- Chen, W.S.; Chen, K.F. Modeling Product Diffusion by System Dynamics Approach. J. Chin. Inst. Ind. Eng. 2007, 24, 397–413. [Google Scholar] [CrossRef]

- Dyner, I.; Zuluaga, M.M. SD for Assessing the Diffusion of Wind Power in Latin America: The Colombian Case. In Proceedings of the International Conference of the System Dynamics Society, Nijmegen, The Netherlands, 23–27 July 2006. [Google Scholar]

- Energy Innovations. Energy Policy Simulator. Available online: https://energypolicy.solutions/ (accessed on 22 December 2024).

- U.S. EPA’s Clean Air Markets Division, Office of Air and Radiation. Documentation for EPA Base Case v.5.13 Using the Integrated Planning Model; Technical Report EPA #450R13002; U.S. Environmental Protection Agency: Washington, DC, USA, 2013. [Google Scholar]

- Junginger, M.; Louwen, A. Technological Learning in the Transition to a Low-Carbon Energy System; Academic Press: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Divan, D.; Sharma, S. Accelerating Commercialization of Energy Innovations. In ENERGY 2040; Springer: Berlin/Heidelberg, Germany, 2024; pp. 165–191. [Google Scholar] [CrossRef]

- Arrow, K.J. The Economic Implications of Learning by Doing. Rev. Econ. Stud. 1962, 29, 155–173. [Google Scholar] [CrossRef]

- Rubin, E.S.; Azevedo, I.M.; Jaramillo, P.; Yeh, S. A review of learning rates for electricity supply technologies. Energy Policy 2015, 86, 198–218. [Google Scholar] [CrossRef]

- Wene, C.O. Energy Technology Learning Through Deployment in Competitive Markets. Eng. Econ. 2008, 53, 340–364. [Google Scholar] [CrossRef]

- Bosetti, V.; Carraro, C.; Duval, R.; Tavoni, M. What should we expect from innovation? A model-based assessment of the environmental and mitigation cost implications of climate-related R&D. Energy Econ. 2011, 33, 1313–1320. [Google Scholar] [CrossRef]

- Castrejon-Campos, O.; Aye, L.; Hui, F.K.P. Effects of learning curve models on onshore wind and solar PV cost developments in the USA. Renew. Sustain. Energy Rev. 2022, 160, 112278. [Google Scholar] [CrossRef]

- Morrison, J.B. Putting the learning curve in context. J. Bus. Res. 2008, 61, 1182–1190. [Google Scholar] [CrossRef]

- Esmaieli, M.; Ahmadian, M. The effect of research and development incentive on wind power investment, a system dynamics approach. Renew. Energy 2018, 126, 765–773. [Google Scholar] [CrossRef]

- de Gooyert, V.; de Coninck, H.; ter Haar, B. How to make climate policy more effective? The search for high leverage points by the multidisciplinary Dutch expert team ‘Energy System 2050’. Syst. Res. Behav. Sci. 2024, 41, 900–913. [Google Scholar] [CrossRef]

- Wang, R.; Hasanefendic, S.; Von Hauff, E.; Bossink, B. A System Dynamics Approach to Technological Learning Impact for the Cost Estimation of Solar Photovoltaics. Energies 2023, 16, 8005. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration. Total Energy: Average Price of Electricity to Ultimate Customers. Available online: https://www.eia.gov/totalenergy/ (accessed on 22 December 2024).

- U.S. Energy Information Administration. Annual Energy Outlook 2023: Total Energy Supply, Disposition, and Price Summary. Available online: https://www.eia.gov/outlooks/aeo/data/browser/#/?id=1-AEO2023®ion=0-0&cases=ref2023~highmacro~lowmacro~highprice~lowprice~highogs~lowogs~highZTC~lowZTC~aeo2022ref&sourcekey=0 (accessed on 22 December 2024).

- CONGRESS.GOV. Legislation. Available online: https://www.congress.gov/ (accessed on 22 December 2024).

- Brian Lips. The Past, Present, and Future of Federal Tax Credits for Renewable Energy. Available online: https://nccleantech.ncsu.edu/2024/11/19/the-past-present-and-future-of-federal-tax-credits-for-renewable-energy/ (accessed on 22 December 2024).

- Feldman, D.; Bolinger, M.; Schwabe, P. Current and Future Costs of Renewable Energy Project Finance Across Technologies; Technical Report NREL/TP-6A20-76881; National Renewable Energy Laboratory: Golden, CO, USA, 2020. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory. Wind Supply Curves. Available online: https://www.nrel.gov/gis/wind-supply-curves (accessed on 22 December 2024).

- Brown, L.R. World on the Edge: How to Prevent Environmental and Economic Collapse; W. W. Norton & Company: New York, NY, USA, 2011. [Google Scholar]

- Earth Policy Institute. Supporting Data for World on the Edge: How to Prevent Environmental and Economic Collapse. Available online: https://wayback.archive-it.org/22906/20240418170609/https:/www.earth-policy.org/books/wote/wote_data_topic (accessed on 23 December 2024).

- U.S. Energy Information Administration. International Energy Outlook 2023. Available online: https://www.eia.gov/outlooks/ieo/ (accessed on 23 December 2024).

- Wiser, R.; Bolinger, M.; Lantz, E. Assessing Wind Power Operating Costs in the United States: Results from a Survey of Wind Industry Experts. Renew. Energy Focus 2019, 30, 46–57. [Google Scholar] [CrossRef]

- American Clean Power. U.S. Permitting Delays Hold Back Economy, Cost Jobs. Available online: https://cleanpower.org/wp-content/uploads/gateway/2024/04/ACP-Pass-Permitting-Reform_Fact-Sheet.pdf (accessed on 24 December 2024).

- Wiser, R.; Bolinger, M. Benchmarking Anticipated Wind Project Lifetimes: Results from a Survey of U.S. Wind Industry Professionals; Technical Report; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2019. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration. Electricity Explained, Electricity in the United States. Available online: https://www.eia.gov/energyexplained/electricity/electricity-in-the-us.php (accessed on 22 December 2024).

- Servert, J.; Cerrajero, E.; López, D.; Rodríguez, A. Cost evolution of components and services in the STE sector: A two-factor learning curve. AIP Conf. Proc. 2018, 2033, 020007. [Google Scholar] [CrossRef]

- Kittner, N.; Lill, F.; Kammen, D.M. Energy storage deployment and innovation for the clean energy transition. Nat. Energy 2017, 2, 17125. [Google Scholar] [CrossRef]

- Söderholm, P.; Klaassen, G. Wind Power in Europe: A Simultaneous Innovation–Diffusion Model. Environ. Resour. Econ. 2007, 36, 136–190. [Google Scholar] [CrossRef]

- Nemet, G.F. Beyond the learning curve: Factors influencing cost reductions in photovoltaics. Energy Policy 2006, 34, 3218–3232. [Google Scholar] [CrossRef]

- Yao, Y.; Xu, J.H.; Sun, D.Q. Untangling global levelised cost of electricity based on multi-factor learning curve for renewable energy: Wind, solar, geothermal, hydropower and bioenergy. J. Clean. Prod. 2021, 285, 124827. [Google Scholar] [CrossRef]

- Samadi, S. The experience curve theory and its application in the field of electricity generation technologies—A literature review. Renew. Sustain. Energy Rev. 2018, 82, 2346–2364. [Google Scholar] [CrossRef]

- Way, R.; Ives, M.C.; Mealy, P.; Farmer, J.D. Empirically grounded technology forecasts and the energy transition. Joule 2022, 6, 2057–2082. [Google Scholar] [CrossRef]

- The International Energy Agency (IEA). Onshore Wind Equipment Manufacturing Capacity by Region and Component, 2022–2025. Available online: https://www.iea.org/data-and-statistics/charts/onshore-wind-equipment-manufacturing-capacity-by-region-and-component-2022-2025 (accessed on 22 December 2024).

- Statista. Global Market Share of the World’s Leading Wind Turbine Manufacturers in 2022, Based on Take-In-Orders. Available online: https://www.statista.com/statistics/272813/market-share-of-the-leading-wind-turbine-manufacturers-worldwide/ (accessed on 22 December 2024).

- Wood Mackenzie. Global Wind OEM Market Share. Available online: https://www.woodmac.com/press-releases/2024-press-releases/global-wind-oem-marketshare/ (accessed on 22 December 2024).

- Statista. Distribution of Solar Photovoltaic Module Production Worldwide in 2023, by Country. Available online: https://www.statista.com/statistics/668749/regional-distribution-of-solar-pv-module-manufacturing/ (accessed on 22 December 2024).

- The International Energy Agency (IEA). Solar PV Manufacturing Capacity and Production by Country and Region, 2021–2027. Available online: https://www.iea.org/data-and-statistics/charts/solar-pv-manufacturing-capacity-and-production-by-country-and-region-2021-2027 (accessed on 22 December 2024).

- Bolinger, M.; Wiser, R. Understanding Trends in Wind Turbine Prices over the Past Decade; Technical Report LBNL-5119E; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2011. [Google Scholar] [CrossRef]

- The International Chamber of Shipping. Supply Chain and Turbine Operation Challenges Pose Threat to Renewable Fuel Generation. Available online: https://www.ics-shipping.org/news-item/supply-chain-and-turbine-operation-challenges-pose-threat-to-renewable-fuel-generation (accessed on 22 December 2024).

- The Manufacturer. Supply Chain Among the Top List of Concerns for the Wind Industry. Available online: https://www.themanufacturer.com/articles/supply-chain-among-the-top-list-of-concerns-for-wind-the-industry (accessed on 22 December 2024).

- Wood Mackenzie. The Wind Energy Industry Paradox: Short-Term Headwinds and Long-Term Optimism. Available online: https://www.woodmac.com/news/opinion/wind-energy-industry-paradox (accessed on 22 December 2024).

- Castrejon-Campos, O.; Aye, L.; Hui, F.K.P.; Vaz-Serra, P. Economic and environmental impacts of public investment in clean energy RD&D. Energy Policy 2022, 168, 113134. [Google Scholar] [CrossRef]

- Lopez, A.; Mai, T.; Lantz, E.; Harrison-Atlas, D.; Williams, T.; Maclaurin, G. Land use and turbine technology influences on wind potential in the United States. Energy 2021, 223, 120044. [Google Scholar] [CrossRef]

- National Renewable Energy Laboratory. Energy Analysis, Simple Levelized Cost of Energy (LCOE) Calculator Documentation. Available online: https://www.nrel.gov/analysis/tech-lcoe-documentation.html (accessed on 22 December 2024).

- Lee, J.T.; Kim, H.G.; Kang, Y.H.; Kim, J.Y. Determining the Optimized Hub Height of Wind Turbine Using the Wind Resource Map of South Korea. Energies 2019, 12, 2949. [Google Scholar] [CrossRef]

- Pluchinotta, I.; Zhou, K.; Zimmermann, N. Dealing with soft variables and data scarcity: Lessons learnt from quantification in a participatory system dynamics modelling process. Syst. Dyn. Rev. 2024, 40, e1770. [Google Scholar] [CrossRef]

- Coyle, G. Qualitative and quantitative modelling in system dynamics: Some research questions. Syst. Dyn. Rev. 2000, 16, 225–244. [Google Scholar] [CrossRef]

- Sterman, J.D. All models are wrong: Reflections on becoming a systems scientist. Syst. Dyn. Rev. 2002, 18, 501–531. [Google Scholar] [CrossRef]

- Zhang, Y.-Z.; Zhao, X.-G.; Ren, L.-Z.; Zuo, Y. The development of the renewable energy power industry under feed-in tariff and renewable portfolio standard: A case study of China’s wind power industry. J. Clean. Prod. 2017, 168, 1262–1276. [Google Scholar] [CrossRef]

- Lantz, E.; Steinberg, D.; Mendelsohn, M.; Zinaman, O.; James, T.; Porro, G.; Hand, M.; Mai, T.; Logan, J.; Heeter, J.; et al. Implications of a PTC Extension on U.S. Wind Deployment; Technical Report NREL/TP-6A20-61663; National Renewable Energy Laboratory: Golden, CO, USA, 2014. [Google Scholar] [CrossRef]

- Shrimali, G.; Lynes, M.; Indvik, J. Wind energy deployment in the U.S.: An empirical analysis of the role of federal and state policies. Renew. Sustain. Energy Rev. 2015, 43, 796–806. [Google Scholar] [CrossRef]

- Bartlett, J. Beyond Subsidy Levels: The Effects of Tax Credit Choice for Solar and Wind Power in the Inflation Reduction Act; Technical Report; Resources for the Future: Washington, DC, USA, 2023. [Google Scholar]

- Deschenes, O.; Malloy, C.; McDonald, G. Causal effects of Renewable Portfolio Standards on renewable investments and generation: The role of heterogeneity and dynamics. Resour. Energy Econ. 2023, 75, 101393. [Google Scholar] [CrossRef]

- U.S. Energy Information Administration. Annual Energy Outlook 2022; Technical Report; U.S. Energy Information Administration: Washington, DC, USA, 2023. [Google Scholar]

| Submodel | Variable | Value | Data Source |

|---|---|---|---|

| Profitable Capacity | Historical and projected electricity price data: | ||

| Historical (1998–2023) | Data | [78] | |

| Projected (2024–2050) | Data | [79] | |

| PTC Lookup | Data | [80,81] | |

| ITC Lookup | Not used | ||

| Interest Rate | 4% | [82] | |

| ROI | 10% | ||

| Wind Supply Curve | Data | [83] | |

| Technological Learning | Cumulative Global Capacity: | ||

| Historical (1998–2023) | Data | [3,84,85] | |

| Projected (2024–2050) | Data | [86] | |

| Initial Global Capacity—Total Globally Installed Capacity in 1998 | 10,200 MW | [84,85] | |

| Initial CapEx—Total Installed Costs in 1998 | 2824 USD/kW | [2] | |

| CapEx LR—Learning Rate for Total Installed Costs | 0.1312 | Estimated | |

| Initial OpEx—O&M Costs in 1998 | 98 USD/kW | [1] | |

| OpEx LR—Learning Rate for O&M Costs | 0.09 | [87] | |

| Initial Capacity Factor—Capacity Factor in 1998 | 0.255 | [1] | |

| Capacity Factor LR—Capacity Factor Learning Rate | 0.0517 | Estimated | |

| Developer Capacity Growth | Initial Developer Capacity in 1998 | 500 MW | [1] |

| Maximum Growth Rate | 40% | [59] | |

| Developer Capacity Adjustment Time | 1 year | [59] | |

| Capacity Growth | Permit Failure Rate | 75% | [59] |

| Permitting and PPA Decision Time Lookup | 4–5 years | [88] | |

| Willingness to Invest | Data | Estimated | |

| Average Construction Time | 1 year | [59] | |

| Average Project Lifetime | 20–30 years | [89] | |

| Historical Installed Wind Capacity in the United States | Data | [1] | |

| Projected Wind Capacity in the United States | Data | [6] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lawrence, S.; Herber, D.R.; Shahroudi, K.E. Leveraging System Dynamics to Predict the Commercialization Success of Emerging Energy Technologies: Lessons from Wind Energy. Energies 2025, 18, 2048. https://doi.org/10.3390/en18082048

Lawrence S, Herber DR, Shahroudi KE. Leveraging System Dynamics to Predict the Commercialization Success of Emerging Energy Technologies: Lessons from Wind Energy. Energies. 2025; 18(8):2048. https://doi.org/10.3390/en18082048

Chicago/Turabian StyleLawrence, Svetlana, Daniel R. Herber, and Kamran Eftekhari Shahroudi. 2025. "Leveraging System Dynamics to Predict the Commercialization Success of Emerging Energy Technologies: Lessons from Wind Energy" Energies 18, no. 8: 2048. https://doi.org/10.3390/en18082048

APA StyleLawrence, S., Herber, D. R., & Shahroudi, K. E. (2025). Leveraging System Dynamics to Predict the Commercialization Success of Emerging Energy Technologies: Lessons from Wind Energy. Energies, 18(8), 2048. https://doi.org/10.3390/en18082048