Case Study on the Financial Viability of Forest Management on Public Lands in the Brazilian Amazon

Abstract

:1. Introduction

2. Materials and Methods

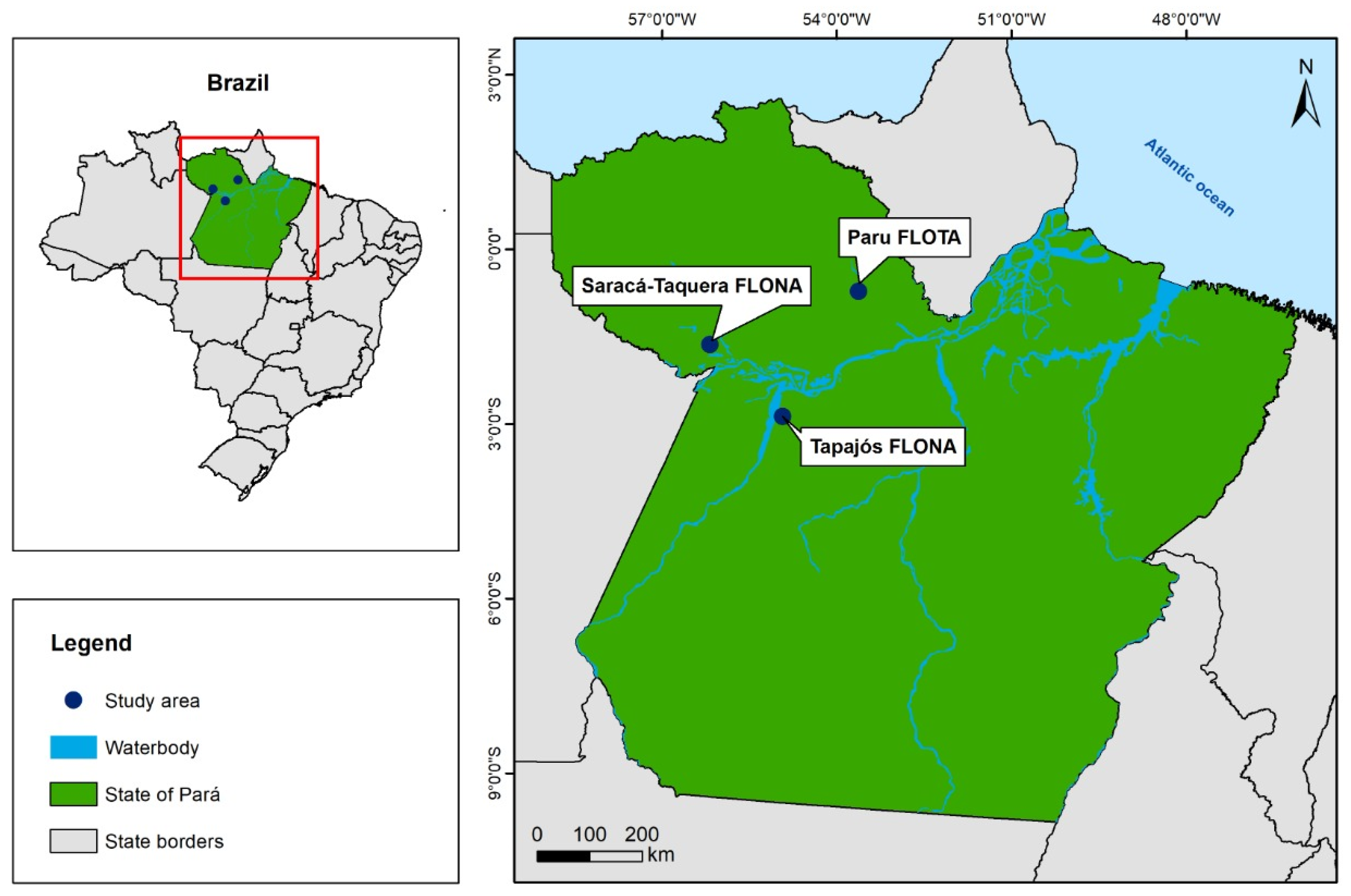

2.1. Study Sites

- Saracá-Taquera federal forest concession, which has 32,000 ha Forest Management Unit (UMF) 2 of FLONA (01°41′58″ S and 56°14′05″ W);

- Paru state forest concession, which has 99,868.54 ha UMF 1 of FLOTA (01°12′07″ S and 53°18′54″ W);

- Tapajós community forest management, which has 30,063 ha of FLONA (02°50′50″ S and 54°54′40″ W).

2.2. Data

2.3. Financial Evaluation

3. Results

- Federal concession: The infrastructure cost, taxes, permanent plot monitoring, administrative sector employee payments, protective materials and clothing, and labor charges.

- State concession: Costs with the administrative sector, forest inventory, permanent plot monitoring, and profit sharing with the company’s owners.

- Community forest management: The maintenance of machinery and equipment, labor rights, taxes, the payment of outsourced employees, administrative sector expenses, employee displacement, permanent plot monitoring, consulting, team training, protection materials and clothing, labor charges, and profit sharing with the members.

4. Discussion

Considerations on the Feasibility of Forest Management

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Brazil, MAPA (Ministério da Agricultura, Pecuária e Abastecimento); SFB (Serviço Florestal Brasileiro). Florestas do Brasil em Resumo. 2019. Available online: https://www.abema.org.br/images/noticias/2020/06/Florestas_Brasil_2019_Portugu%C3%AAs.pdf (accessed on 25 March 2023).

- Pulla, P.; Schuck, A.; Verkerk, P.J.; Lasserre, B.; Marchetti, M.; Green, T. Mapping the Distribution of Forest Ownership in Europe, 1st ed.; European Forest Institute: Torikatu, Finland, 2013; pp. 7–11. [Google Scholar]

- Brazil, SFB (Serviço Florestal Brasileiro). Concessões Florestais em Andamento. Available online: https://www.gov.br/agricultura/pt-br/assuntos/servico-florestal-brasileiro/concessao-florestal/concessoes-florestais-em-andamento-1 (accessed on 2 March 2023).

- Brazil. Lei No 9.985, de 18 de Julho de 2000. Available online: http://www.planalto.gov.br/ccivil_03/leis/l9985.htm (accessed on 21 February 2023).

- Chudy, R.P.; Cubbage, F.W. Research trends: Forest investments as a financial asset class. For. Policy Econ. 2020, 119, 102273. [Google Scholar] [CrossRef] [PubMed]

- Brazil. Lei No 11.284, de 02 de Março de 2006. Available online: http://www.planalto.gov.br/ccivil_03/_ato2004-2006/2006/lei/l11284.htm (accessed on 15 January 2023).

- Brandt, J.S.; Nolteb, C.; Agrawalc, A. Deforestation and timber production in Congo after implementationof sustainable forest management policy. Land Use Policy 2016, 52, 15–22. [Google Scholar] [CrossRef]

- Capanema, V.P.; Escada, M.I.S.; Andrade, P.R.; Landini, L.G. Assessing logging legislation parameters and forest growth dissimilarities in the Brazilian Amazon. For. Ecol. Manag. 2022, 513, 120170. [Google Scholar] [CrossRef]

- Brazil, MMA (Ministério do Meio Ambiente). Resolução CONAMA No. 406, de 02 de Fevereiro de 2009. Available online: http://www2.mma.gov.br/port/conama/legiabre.cfm?codlegi=597 (accessed on 1 September 2023).

- Rodrigues, M.I.; de Souza, Á.N.; Mazzei, L.; Silva, J.N.M.; Joaquim, M.S.; Pereira, R.S.; Biali, L.J.; Rodriguez, D.R.O.; Lustosa Junior, I.M.L. Financial variability of the second cutting of forest management in Tapajós National Forest, Brazil. For. Policy Econ. 2022, 136, 102694. [Google Scholar] [CrossRef]

- Mazzei, L.; Ruschel, A. Estoque comercial para o segundo ciclo de corte na Floresta Nacional do Tapajós—Área experimental KM 67—Embrapa. In Seminário de Pesquisa Científica da Floresta Nacional do Tapajós. Anais do II Seminário de Pesquisa Científica da Floresta Nacional do Tapajós; ICMBio: Belém, BR, Brazil, 2014; pp. 161–166. [Google Scholar]

- Hajjar, R.; Oldekop, J.A. Research frontiers in community forest management. Curr. Opin. Environ. Sustain. 2018, 32, 119–125. [Google Scholar] [CrossRef]

- Muniz, T.F.; Pinheiro, A.S.O. Concessão florestal como instrumento para a redução de exploração ilegal madeireira em Unidades de Conservação em Rondônia. Rev. FAROL 2019, 8, 121–142. [Google Scholar]

- Lima, R.Y.M.; Azevedo-Ramos, C. Compliance of Brazilian forest concession system with international guidelines for tropical forests. For. Policy Econ. 2020, 119, 102285. [Google Scholar] [CrossRef]

- Di Girolami, E.; Kampen, J.; Arts, B. Two systematic literature reviews of scientific research on the environmental impacts of forest certifications and community forest management at a global scale. For. Policy Econ. 2023, 146, 102864. [Google Scholar] [CrossRef]

- Fernandes, A.P.D.; Hoeflich, V.A.; Viana, G.; Amendola, E.C.; Oliveria, F.E.M.; Ansolin, R.D. Destination of public forests in brazil: An analysis of forest concessions. Nativa 2017, 5, 497–503. [Google Scholar] [CrossRef]

- Brazil, SFB (Serviço Florestal Brasileiro). Plano Anual de Outorga Florestal. 2023. Available online: https://www.gov.br/agricultura/pt-br/assuntos/servico-florestal-brasileiro/concessao-florestal/plano-anual-de-outorga-florestal/Paof_2023.pdf (accessed on 12 March 2023).

- Azevedo-Ramos, C.; Silva, J.N.M.; Merry, F. The evolution of Brazilian forest concessions. Elem. Sci. Anth. 2015, 3, 000048. [Google Scholar] [CrossRef]

- Higuchi, N.; Santos, J.; Lima, A.J.N.; Higuchi, F.G.; Silva, R.P.; Souza, C.A.S.; Pinto, F.R.; Teixeira, L.M.; Carneiro, M.C.; Silva, S.R. Perspectivas do manejo florestal sustentável para a Amazônia brasileira. Hiléia—Rev. Direito Ambient. Amaz. 2010, 8, 78–93. [Google Scholar]

- Carvalho, J.O.P.; Silva, J.N.M.; Lopes, J.C.A.; Costa, H.B. Manejo de Florestas Naturais do Trópico Úmido com Referência Espacial à Floresta Nacional do Tapajós no Estado do Pará; Documentos 26; Embrapa-CPATU: Belem, BR, Brazil, 1984. [Google Scholar]

- Rodrigues, M.I.; de Souza, Á.N.; Joaquim, M.S.; Sanches, K.L.; Araújo, J.B.C.N.; Castanheira Neto, F.; Coelho Junior, L.M. Financial analysis of investments in forest concession for Amazon Brazilian by deterministic and stochastic methods. Cerne 2019, 25, 482–490. [Google Scholar] [CrossRef]

- Humphries, S.; Holmes, T.P.; Kainer, K.; Koury, C.G.G.; Cruz, E.; Rocha, R.M. Are community-based forest enterprises in the tropics financially viable? Case studies from the Brazilian Amazon. Ecol. Econ. 2012, 77, 62–73. [Google Scholar] [CrossRef]

- Metropolis, N.; Ulam, S. The Monte Carlo Method. J. Am. Stat. Assoc. 1949, 44, 335–341. [Google Scholar] [CrossRef] [PubMed]

- Samuelson, P.A. Proof that Properly Anticipated Prices Fluctuate Randomly. Ind. Manag. Rev. 1965, 6, 41–49. [Google Scholar]

- Chules, E.L.; Scardua, F.P.; Martins, R.C.C. Desafios da implementação da política de concessões florestais no Brasil. Rev. Direito Econ. E Socioambient. 2018, 9, 295–318. [Google Scholar] [CrossRef]

- da Silva, B.K.; Shons, S.Z.; Cubbage, F.W.; Parajuli, R. Spatial and crossproduct price linkages in the Brazilian pine timber markets. For. Policy Econ. 2020, 117, 102186. [Google Scholar] [CrossRef]

- Lescuyer, G.; Kakundika, T.M.; Lubala, I.M.; Ekyamba, I.S.; Tsanga, R.; Cerutti, P.O. Are community forests a viable model for the Democratic Republic of Congo? Ecol. Soc. 2019, 24, 15. [Google Scholar] [CrossRef]

- Whaldhoff, P.; Vidal, E. Manejo florestal comunitário na Amazônia: Comparação entre um modelo introduzido e a extração ilegal de madeira. Novos Cad. NAEA 2019, 22, 51–68. [Google Scholar] [CrossRef]

- Gnych, S.; Lawry, S.; Mclain, R.; Monterroso, I.; Adhikary, A. Is community tenure facilitating investment in the commons for inclusive and sustainable development? For. Policy Econ. 2020, 111, 102088. [Google Scholar] [CrossRef]

- Humphries, S.; Mcgrath, D.G.; Andrade, D. Cooperativa mista da FLONA do Tapajós (Coomflona): A successful community-based forest enterprise in Brazil. In Democratising Forest Business: A Compendium of Successful Locally Controlled Forest Business Organisations, 1st ed.; Macqueen, D., Bolin, A., Greijmans, M., Eds.; IIED—International Institute for Environment and Development: London, UK, 2015; Volume 1, pp. 61–83. [Google Scholar]

- Medina, G.; Pokorny, B. Financial assessment of community forest management: Lessons from a cross-sectional study of timber management systems in the Brazilian Amazon. Int. For. Rev. 2022, 24, 197–207. [Google Scholar] [CrossRef]

- Frey, G.E.; Cubbage, F.W.; Holmes, T.P.; Reyes-Retana, G.; Davis, R.R.; Megevand, C.; Chemor-Salas, D.N. Competitiveness, certification, and support of timber harvest by community forest enterprises in Mexico. For. Policy Econ. 2019, 107, 101923. [Google Scholar] [CrossRef]

- Pokorny, B.; Johnson, J. Community forestry in the Amazon: The unsolved challenge of forests and the poor. Nat. Resour. Perspect. 2008, 112. [Google Scholar] [CrossRef]

- Medina, G.; Pokorny, B. Avaliação financeira do manejo florestal comunitário. Novos Cad. NAEA 2011, 14, 25–36. [Google Scholar] [CrossRef]

- Schwartz, G.; Falkowski, V.; Peña-Claros, M. Natural regeneration of tree species in the Eastern Amazon: Short-term responses after reduced-impact logging. For. Ecol. Manag. 2017, 385, 97–103. [Google Scholar] [CrossRef]

- Brazil. Lei No 12.651, de 25 de Maio de 2012. Available online: http://www.planalto.gov.br/ccivil_03/_Ato2011-2014/2012/Lei/L12651.htm (accessed on 3 February 2023).

- Gomes, K.M.A.; Silva-Ribeiro, R.B.; Gama, J.R.V.; Andrade, D.F.C. Eficiência na estimativa volumétrica de madeira na Floresta Nacional do Tapajós. Nativa 2018, 6, 170–176. [Google Scholar] [CrossRef]

- Sales, A.; Siviero, M.A.; Pereira, P.C.G.; Vieira, S.B.; Berberian, G.A.; Miranda, B.M. Estimation of the commercial height of trees with laser meter: A viable alternative for forest management in the Brazilian Amazon. Ecol. Evol. 2020, 10, 3578–3583. [Google Scholar] [CrossRef] [PubMed]

- Almeida, A.N.; Angelo, H.; Silva, J.C.G.L.; Hoeflich, V.A. Mercado de madeiras tropicais: Substituição na demanda de exportação. Acta Amazon. 2010, 40, 119–126. [Google Scholar] [CrossRef]

- Schulze, M.; Grogan, J.; Uhl, C.; Lentini, M.; Vidal, E. Evaluating ipê (Tabebuia, Bignoniaceae) logging in Amazonia: Sustainable management or catalyst for forest degradation? Biol. Conserv. 2008, 141, 2071–2085. [Google Scholar] [CrossRef]

| Local | Periods | Area (ha) | Volume (m3) | Harvested Volume (m3/ha) | Costs (USD) | Revenues (USD) |

|---|---|---|---|---|---|---|

| Saracá-Taquera FLONA (federal forest concession) | 1 | - | - | - | 1,204,462.31 | - |

| 2 | - | - | - | 134,286.45 | - | |

| 3 | - | - | - | 40,179.87 | - | |

| 4 | 1013.00 | 21,627.63 | 21.35 | 1,353,514.85 | 1,787,668.93 | |

| 5 | 971.42 | 13,683.56 | 14.09 | 995,289.41 | 1,151,056.55 | |

| 6 | 1321.00 | 22,179.23 | 16.79 | 1,513,637.81 | 1,946,827.30 | |

| 7 | 996.33 | 19,906.93 | 19.98 | 1,624,918.13 | 1,747,371.09 | |

| 8 | 929.33 | 19,377.00 | 20.85 | 1,656,256.11 | 1,743,377.62 | |

| 9–40 | 921.42 | 17,148.93 | 18.61 | 1,470,255.59 | 1,542,914.48 | |

| Paru FLOTA (state forest concession) | 1 | - | - | - | 457,172.11 | - |

| 2 | 9258.53 | 3600.44 | 14.99 | 263,362.41 | 263,362.41 | |

| 3 | 50,106.74 | 2,776,782.79 | 2,780,615.54 | |||

| 4 | 29,744.85 | 2,199,552.97 | 2,192,328.47 | |||

| 5 | 42,259.80 | 2,729,604.41 | 2,886,270.94 | |||

| 6 | 13,035.27 | 932,526.70 | 932,526.70 | |||

| 7–30 | 3140.72 | 47,066.35 | 14.99 | 3,357,595.17 | 3,367,066.24 | |

| Tapajós FLONA (community forest management) | 1 | 100.00 | 1544.80 | 15.45 | 129,607.63 | 143,041.44 |

| 2 | 300.00 | 3650.80 | 12.17 | 162,801.52 | 201,469.53 | |

| 3 | 521.00 | 7843.20 | 15.05 | 117,427.84 | 114,714.05 | |

| 4 | 700.00 | 13,452.00 | 19.22 | 249,967.67 | 337,266.26 | |

| 5 | 1000.00 | 14,884.90 | 14.88 | 360,506.71 | 390,978.46 | |

| 6 | 1000.00 | 15,845.70 | 15.85 | 433,913.30 | 550,744.90 | |

| 7 | 1000.00 | 19,981.70 | 19.98 | 621,717.01 | 646,944.57 | |

| 8 | 1000.00 | 22,027.90 | 22.03 | 618,849.66 | 730,407.17 | |

| 9 | 1600.00 | 37,563.50 | 23.48 | 970,110.11 | 1,054,430.57 | |

| 10 | 1600.00 | 38,090.40 | 23.81 | 1,309,122.05 | 1,547,243.60 | |

| 11 | 1600.00 | 28,628.65 | 17.89 | 983,932.72 | 1,162,904.27 | |

| 12 | 1600.00 | 28,628.65 | 17.89 | 983,932.72 | 1,162,904.27 | |

| 13 | 1436.74 | 21,421.00 | 14.91 | 964,030.76 | 1,372,990.36 | |

| 14–30 | 741.69 | 13,270.99 | 17.89 | 597,247.89 | 850,611.45 |

| Forest Management | Inputs | Maximum | Probable | Minimum |

|---|---|---|---|---|

| Federal | Harvested volume (m3/ha) | 21.35 | 18.61 | 14.09 |

| Price (USD/m3) | 257.44 | 226.18 | 207.79 | |

| State | Harvested volume (m3/ha) | 18.95 | 14.99 | 11.61 |

| Price (USD/m3) | 74.11 | 71.94 | 55.80 | |

| Community | Harvested volume (m3/ha) | 23.81 | 17.89 | 12.17 |

| Price (USD/m3) | 77.34 | 64.45 | 25.21 |

| Indexes | Forest Management | ||

|---|---|---|---|

| Federal Concession | State Concession | Community | |

| NPV (USD) | −468,574.14 | −266,415.17 | 1,507,868.45 |

| ANPV (USD) | −43,558.47 | −25,931.88 | 146,770.41 |

| APC (USD/m3) | 229.74 | 70.87 | 36.85 |

| Statistic | Federal | State | Community |

|---|---|---|---|

| Minimum value | −1,199,617.99 | −5,716,694.58 | −1,035,406.39 |

| Maximum value | 968,317.57 | 457,145.53 | 3,593,054.16 |

| Mean | −324,982.34 | −1,549,512.54 | 1,575,260.33 |

| Percentiles | |||

| 5% | −935,580.15 | −3,683,364.60 | −6,739,837.63 |

| 25% | −620,701.74 | −2,331,880.42 | 940,017.95 |

| 50% | −363,212.39 | −1,355,462.97 | 1,694,355.26 |

| 75% | −48,441.66 | −607,297.18 | 2,273,273.90 |

| 95% | 235,419.01 | −55,458.75 | 2,870,419.48 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rodrigues, M.I.; Souza, Á.N.d.; Mazzei de Freitas, L.J.; Silva, J.N.M.; Joaquim, M.S.; Pereira, R.S.; Biali, L.J.; Inkotte, J.; Araújo, J.B.C.N.; Matias, R.A.M. Case Study on the Financial Viability of Forest Management on Public Lands in the Brazilian Amazon. Forests 2023, 14, 2309. https://doi.org/10.3390/f14122309

Rodrigues MI, Souza ÁNd, Mazzei de Freitas LJ, Silva JNM, Joaquim MS, Pereira RS, Biali LJ, Inkotte J, Araújo JBCN, Matias RAM. Case Study on the Financial Viability of Forest Management on Public Lands in the Brazilian Amazon. Forests. 2023; 14(12):2309. https://doi.org/10.3390/f14122309

Chicago/Turabian StyleRodrigues, Maisa Isabela, Álvaro Nogueira de Souza, Lucas José Mazzei de Freitas, José Natalino Macedo Silva, Maísa Santos Joaquim, Reginaldo Sérgio Pereira, Leonardo Job Biali, Jonas Inkotte, Juliana Baldan Costa Neves Araújo, and Renan Augusto Miranda Matias. 2023. "Case Study on the Financial Viability of Forest Management on Public Lands in the Brazilian Amazon" Forests 14, no. 12: 2309. https://doi.org/10.3390/f14122309