Impact of New Energy Vehicle Development on China’s Crude Oil Imports: An Empirical Analysis

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Variable Selection and Data Sources

3.2. Time Series Smoothness Test

3.3. Multiple Linear Regression Modeling

4. Result and Discussion

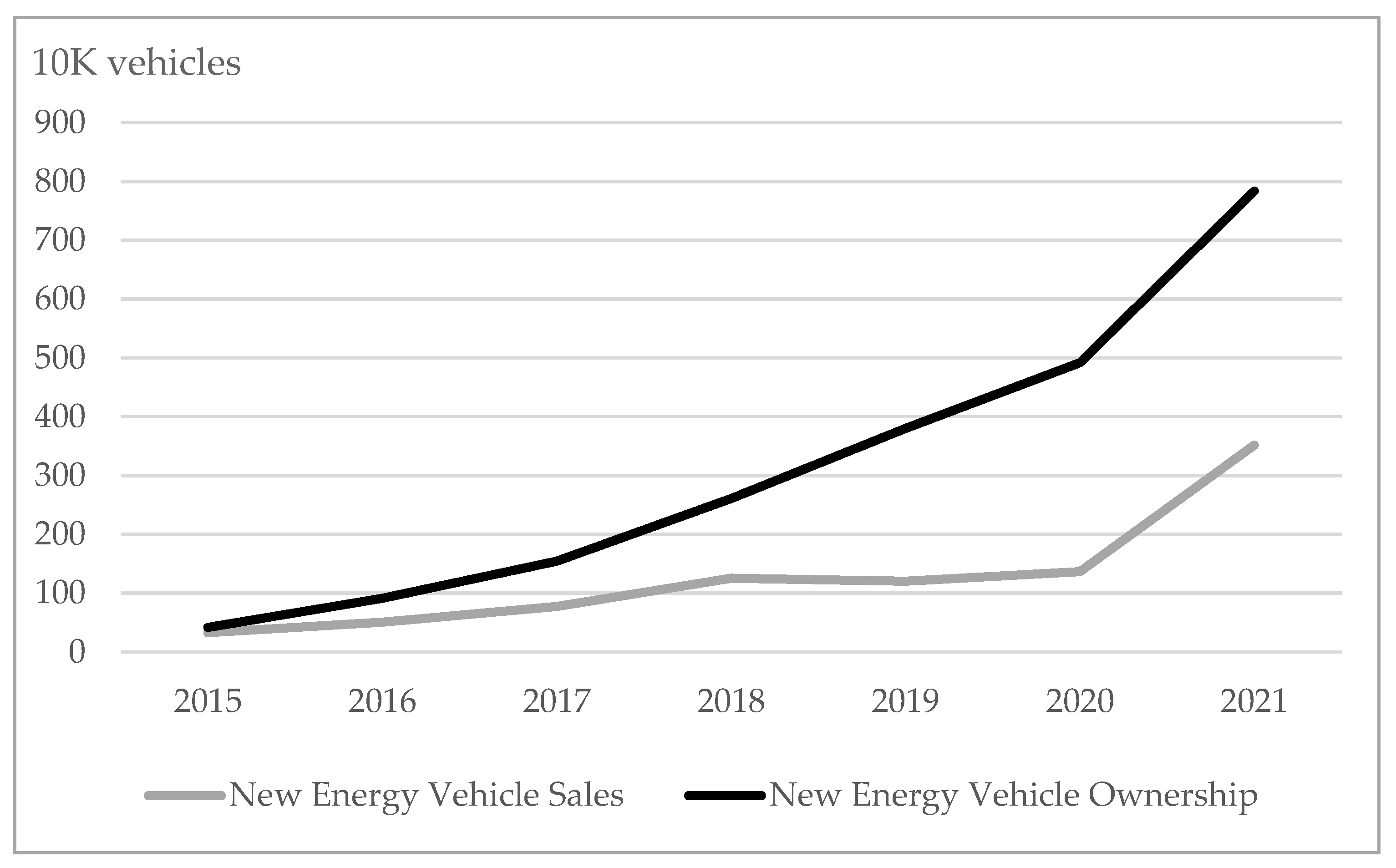

4.1. Time Series Analysis

| import | nev | price | pro | |

|---|---|---|---|---|

| 2015 | 33,549.00 | 1.25% | 303.15 | 21,393.80 |

| 2016 | 38,104.00 | 1.79% | 284.23 | 19,957.80 |

| 2017 | 41,394.70 | 2.65% | 343.75 | 19,190.80 |

| 2018 | 46,399.40 | 4.44% | 428.69 | 18,863.90 |

| 2019 | 50,588.70 | 4.68% | 392.93 | 19,126.70 |

| 2020 | 54,240.00 | 5.22% | 220.08 | 19,499.10 |

| 2021 | 51,323.80 | 13.43% | 449.41 | 19,939.40 |

| CAGR for 2015–2021 | 6.26% | 40.36% | 5.79% | −1.00% |

| CAGR for 2015–2018 | 8.44% | 37.25% | 9.05% | −3.10% |

| CAGR for 2019–2021 | 0.48% | 42.06% | 4.58% | 1.40% |

| Year-on-year growth rate 2020–2021 | −5.38% | 156.97% | 104.20% | 2.26% |

4.2. Model Testing

4.3. Regression Results and Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhang, S.X.; Ma, B.Y. Development Trend of World Energy and Future Development Directions of China’s Energy. Nat. Resour. Econ. China 2019, 10, 20–27, 33. [Google Scholar]

- BP. BP Statistical Review of World Energy 2022, 71st ed.; BP p.l.c.: London, UK, 2022. [Google Scholar]

- Zhou, J.P. Global energy transformation and deepening China’s reform & opening up in all respects. Int. Pet. Econ. 2019, 27, 34–42. [Google Scholar]

- Zou, C.N.; He, D.B.; Jia, C.Y.; Xiong, B.; Zhao, Q.; Pan, S.Q. Connotation and pathway of world energy transition and its significance for carbon neutral. Acta Pet. Sin. 2021, 42, 233–247. [Google Scholar]

- Wang, K.-H.; Su, C.-W.; Umar, M. Geopolitical risk and crude oil security: A Chinese perspective. Energy 2021, 219, 119555. [Google Scholar] [CrossRef]

- Maghyereh, A.; Abdoh, H. Asymmetric effects of oil price uncertainty on corporate investment. Energy Econ. 2010, 86, 104622. [Google Scholar]

- Yang, Y.; Yu, H.Y.; Lu, G.; Wang, L.M.; Zhao, Y.; Hao, L.S.; Ren, D.M.; Fang, W.; An, Z.H.; Cai, G.T. Centennial Changes in World Energy and National Energy Security. J. Nat. Resour. 2020, 35, 2803–2820. [Google Scholar]

- Zhili, D.; Boqiang, L.; Chunxu, G. Development path of electric vehicles in China under environmental and energy security constraints. Resour. Conserv. Recycl. 2019, 143, 17–26. [Google Scholar]

- Dai, J.Q.; Peng, T.B.; Han, B.; Wang, L.N.; Zang, H.M. Research on the low-carbon transformation path of China’s transportation sector and its impact on oil demand under the “double carbon” goal. Int. Pet. Econ. 2021, 29, 1–9. [Google Scholar]

- The State Council. Action Plan for Carbon Dioxide Peak before 2030. Available online: http://www.gov.cn/zhengce/content/2021-10/26/content_5644984.htm (accessed on 1 November 2021).

- Kester, J.; Sovacool, B.K.; de Rubens, G.Z.; Noel, L. Novel or normal? Electric vehicles and the dialectic transition of Nordic automobility. Energy Res. Soc. Sci. 2020, 69, 101642. [Google Scholar] [CrossRef]

- Yan, J.R.; Zhao, Y.; Cui, P.P.; Tang, W.M. Evolution of Temporal and Spatial Pattern of China’s Crude Oil Import Trade from the Perspective of Petroleum Security. Econ. Geogr. 2020, 40, 112–120. [Google Scholar]

- Wang, Q.; Li, S.Y.; Li, R.R. China’s dependency on foreign oil will exceed 80% by 2030: Developing a novel NMGM-ARIMA to forecast China’s foreign oil dependence from two dimensions. Energy 2018, 163, 151–167. [Google Scholar] [CrossRef]

- Zhang, Q. Study on the Dependence of China’s Oil Import; Wuhan University: Wuhan, China, 2013. [Google Scholar]

- Shi, D. The Formation Mechanism of International Oil Price and Its Impact on China’s Economic Development. Econ. Res. J. 2000, 12, 48–53. [Google Scholar]

- Liu, Y. Research on Transmission Mechanism of International Oil Price Fluctuation to China’s Automobile Market. Prices Mon. 2017, 5, 15–18. [Google Scholar]

- Tan, J.; Xiao, J.; Zhou, X. Market equilibrium and welfare effects of a fuel tax in China: The impact of consumers’ response through driving patterns. J. Environ. Econ. Manag. 2019, 93, 20–43. [Google Scholar] [CrossRef]

- Yin, J.P.; Sun, D.Y. Automobile Consumption Growth and China’s Oil Security. Reform. Strategy 2010, 26, 44–46. [Google Scholar]

- Wang, H.L.; Ou, X.M.; Zhang, X.L. Mode, technology, energy consumption, and resulting CO2 emissions in China’s transport sector up to 2050. Energy Policy 2017, 109, 719–733. [Google Scholar] [CrossRef]

- Sheldon, T.L.; Dua, R. Effectiveness of China’s plug-in electric vehicle subsidy. Energy Econ. 2020, 88, 104773. [Google Scholar] [CrossRef]

- WOODMAC. By 2035, six major themes of the international oil market will be determined—The development scale and cost of shale oil in the United States. The cost competition between shale oil and traditional oil and gas, OPEC production reduction strategy and geopolitical crisis will determine the future oil market supply; Transportation oil will determine the peak of oil demand. The rapid development of electric vehicles will have an impact on oil demand. The demand for petrochemical raw materials will be strong in the future. World Pet. Ind. 2017, 24, 21–25. [Google Scholar]

- Bansal, P.; Dua, R. Fuel consumption elasticities, rebound effect and feebate effectiveness in the Indian and Chinese new car markets. arXiv 2022, arXiv:2201.08995. [Google Scholar] [CrossRef]

- Schwert, G.W. Tests for Unit Roots: A Monte Carlo Investigation. J. Bus. Econ. Stat. 1989, 7, 147–159. [Google Scholar]

- Zhao, Y.; Yan, Z.; Pan, Z.; Suo, L.; Fang, X.; Chen, X.; Zhang, Q. Analysis on Safety and Stability Detection Between Electric Vehicle Charging Piles and Power Grid. In Proceedings of the 2022 Power System and Green Energy Conference (PSGEC), Shanghai, China, 7–12 August 2022. [Google Scholar]

- Liu, A.; Dua, R.; Hu, W.M.; Ku, A.L. Choosing to diet: The impact and cost-effectiveness of China’s vehicle ownership restrictions. Transp. Res. Part D Transp. Environ. 2022, 111, 103456. [Google Scholar]

| Augmented Dickey–Fuller Test for Unit Root | Number of Obs. = 81 | |||||

|---|---|---|---|---|---|---|

| Interpolated Dickey–Fuller | ||||||

| Test Statistic | 1% Critical Value | 5% Critical Value | 10% Critical Value | |||

| Z(t) | −3.610 | −4.082 | −3.469 | −3.161 | ||

| MacKinnon approximate p-value for Z(t) = 0.0290 | ||||||

| D. | Coef. | Std. Err. | t | p >|t| | [95% Conf. Interval] | |

| L1. | −0.465582 | 0.1289637 | −3.61 | 0.001 | −0.7224354 | −0.2087286 |

| LD. | −0.1428571 | 0.1288302 | −1.11 | 0.271 | −0.3994446 | 0.1137304 |

| L2D. | −0.0507267 | 0.111588 | −0.45 | 0.651 | −0.2729736 | 0.1715201 |

| _trend | 0.0146344 | 0.0045483 | 3.22 | 0.002 | 0.0055756 | 0.0236931 |

| _cons | −2.169748 | 0.630921 | −3.44 | 0.001 | −3.426336 | −0.9131595 |

| Variables | Description |

|---|---|

| Natural logarithm of crude oil imports | |

| Elasticity coefficient of each explanatory variable concerning the explanatory variable | |

| Natural logarithm of crude oil price values | |

| Natural logarithm of new energy vehicle sales/car sales | |

| Natural logarithm of crude oil production | |

| Random interference term |

| Year | The Growth Rate of Car Sales | The Growth Rate of New Energy Vehicle Sales | The Growth Rate of the New Energy Vehicle Market Share |

|---|---|---|---|

| 2016 | 13.74% | 62.93% | 43.25% |

| 2017 | 3.59% | 53.34% | 48.03% |

| 2018 | −2.97% | 62.36% | 67.34% |

| 2019 | −8.29% | −3.25% | 5.49% |

| 2020 | −1.83% | 9.53% | 11.57% |

| 2021 | 3.82% | 166.79% | 156.97% |

| Instrumental Variables (GMM) Regression | Number of Obs. = 83 | |||||

|---|---|---|---|---|---|---|

| Wald chi2(3) = 217.17 | ||||||

| Prob>chi2 = 0.0000 | ||||||

| R-squared = 0.6524 | ||||||

| GMM weight matrix: Robust | Root MSE = 0.10593 | |||||

| Coef. | Robust Std. Err. | z | p >|z| | [95% Conf. Interval] | ||

| 0.1552873 | 0.0132317 | 11.74 | 0.000 | 0.1293537 | 0.1812209 | |

| −0.1631925 | 0.0311057 | −5.25 | 0.000 | −0.2241586 | −0.1022263 | |

| −1.339897 | 0.2731435 | −4.91 | 0.000 | −1.875248 | −0.8045455 | |

| _cons | 19.6154 | 2.036066 | 9.63 | 0.000 | 15.62479 | 23.60602 |

| Source | SS | df | MS | Number of Obs. = 83 | ||

|---|---|---|---|---|---|---|

| Model | 5.11711104 | 1 | 5.11711104 | F(1, 81) = 6.62 | ||

| Residual | 62.5767142 | 81 | 0.772552027 | Prob > F = 0.0119 | ||

| Total | 67.6938253 | 82 | 0.825534454 | R-squared = 0.0756 | ||

| Adj R-squared = 0.0642 | ||||||

| Root MSE = 0.87895 | ||||||

| Coef. | Std. Err. | t | p >|t| | [95% Conf. Interval] | ||

| 0.7201797 | 0.2798288 | 2.57 | 0.012 | 0.1634083 | 1.276951 | |

| _cons | −7.600421 | 1.625701 | −4.68 | 0.000 | −10.83506 | −4.365787 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, Z.; Sun, S.; Wang, Y.; Ni, J.; Qian, X. Impact of New Energy Vehicle Development on China’s Crude Oil Imports: An Empirical Analysis. World Electr. Veh. J. 2023, 14, 46. https://doi.org/10.3390/wevj14020046

Guo Z, Sun S, Wang Y, Ni J, Qian X. Impact of New Energy Vehicle Development on China’s Crude Oil Imports: An Empirical Analysis. World Electric Vehicle Journal. 2023; 14(2):46. https://doi.org/10.3390/wevj14020046

Chicago/Turabian StyleGuo, Zehui, Shujie Sun, Yishan Wang, Jingru Ni, and Xuepeng Qian. 2023. "Impact of New Energy Vehicle Development on China’s Crude Oil Imports: An Empirical Analysis" World Electric Vehicle Journal 14, no. 2: 46. https://doi.org/10.3390/wevj14020046

APA StyleGuo, Z., Sun, S., Wang, Y., Ni, J., & Qian, X. (2023). Impact of New Energy Vehicle Development on China’s Crude Oil Imports: An Empirical Analysis. World Electric Vehicle Journal, 14(2), 46. https://doi.org/10.3390/wevj14020046