Design and Application of Experience Management Tools from the Perspective of Customer Perceived Value: A Study on the Electric Vehicle Market

Abstract

1. Introduction

1.1. Background

1.2. Research Gap

1.3. Objectives

1.4. Methodology

1.5. Significance

2. Literature Review

2.1. Customer Perceived Value

2.2. Customer Experience Management

2.3. Customer Experience Management in the Automotive Industry

2.4. Experience Management Tools

2.5. Research Gap in Customer Experience Management Tools for Electric Vehicles

3. Methodology

3.1. Research through Design (RtD)

3.2. Empirical Research and Factor Analysis

3.3. Fuzzy-Set Qualitative Comparative Analysis (fsQCA)

3.4. Semi-Structured Interviews

3.5. Expert Reviews and the Delphi Method

3.6. Usability Testing with the System Usability Scale (SUS)

3.7. Overview of Case Studies

4. Case Study 1: Identifying Key Factors Influencing Electric Vehicle Purchase Decisions

4.1. Hypotheses

4.2. Methodology

4.3. Results

4.3.1. Reliability and Validity of the Sample

4.3.2. Descriptive Statistics and Correlations

4.3.3. fsQCA Factor Combination Analysis

4.3.4. Hypothesis Testing and Analysis Results

4.4. Conclusions

- User willingness to purchase new energy vehicles (NEVs) does not require any prerequisite conditions. Previous research, such as Kowalska-Pyzalska et al. (2021), identified significant positive impacts and the absence of negative impacts as influencing purchase intention [53,54]. However, our study shows that no single factor is absolute; negative factors can persist, and positive factors may disappear. This suggests that automotive companies can focus on market breakthrough strategies to optimize resource use in NEV design and sales.

- Quality value is a key factor influencing users’ willingness to purchase NEVs. Using the fsQCA method, we identified four configurations that enhance purchase intentions, emphasizing quality value. These insights guide the design and planning of offline experience spaces, optimizing R&D investment. Future research should include additional indicators like vehicle models and brand recognition to enrich the model’s complexity.

4.5. Discussion

5. Case Study 2: In-Depth Interview Analysis of Customer Experience Management Tool Users

5.1. Methodology

5.2. Result

5.3. Conclusions and Discussion

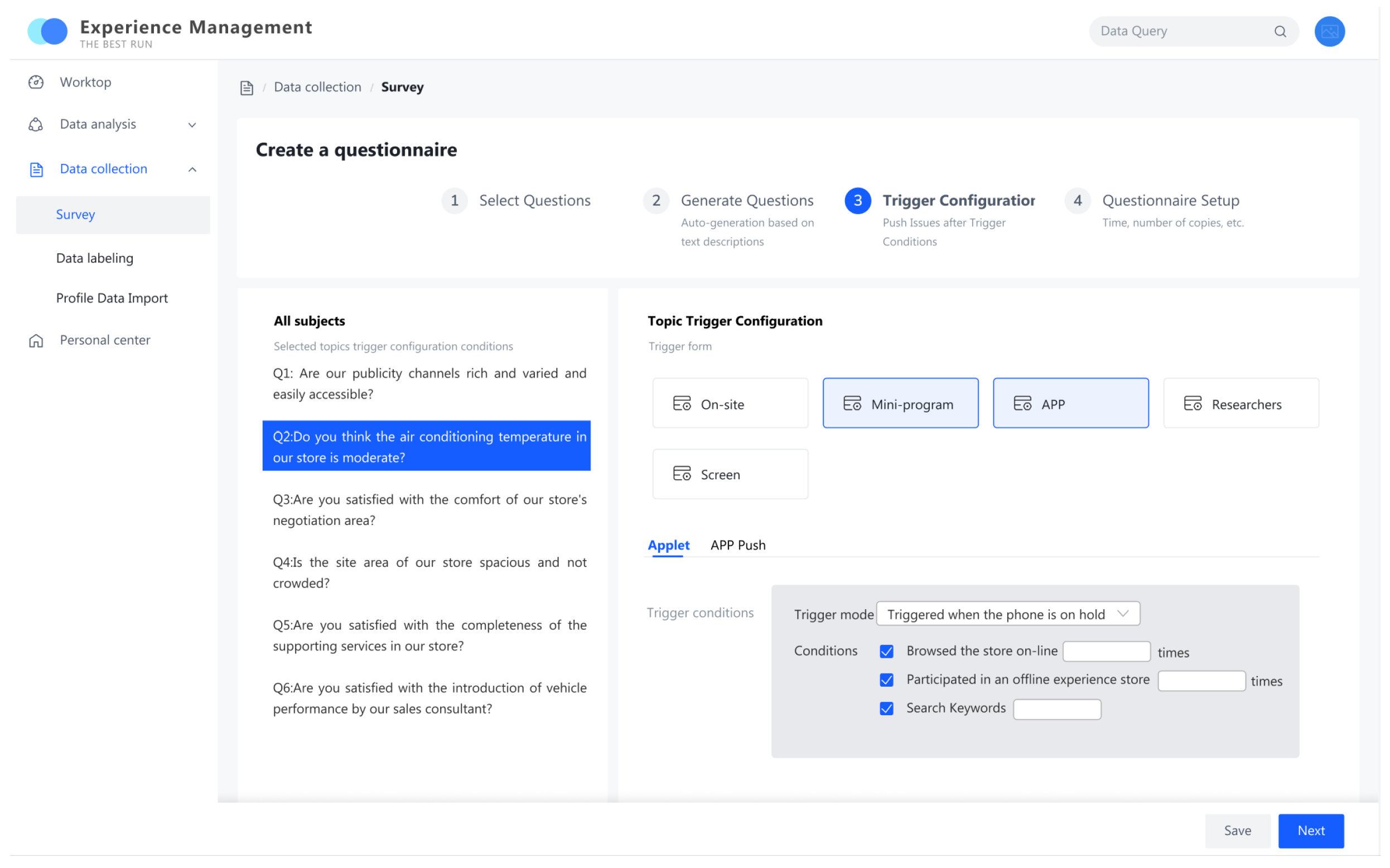

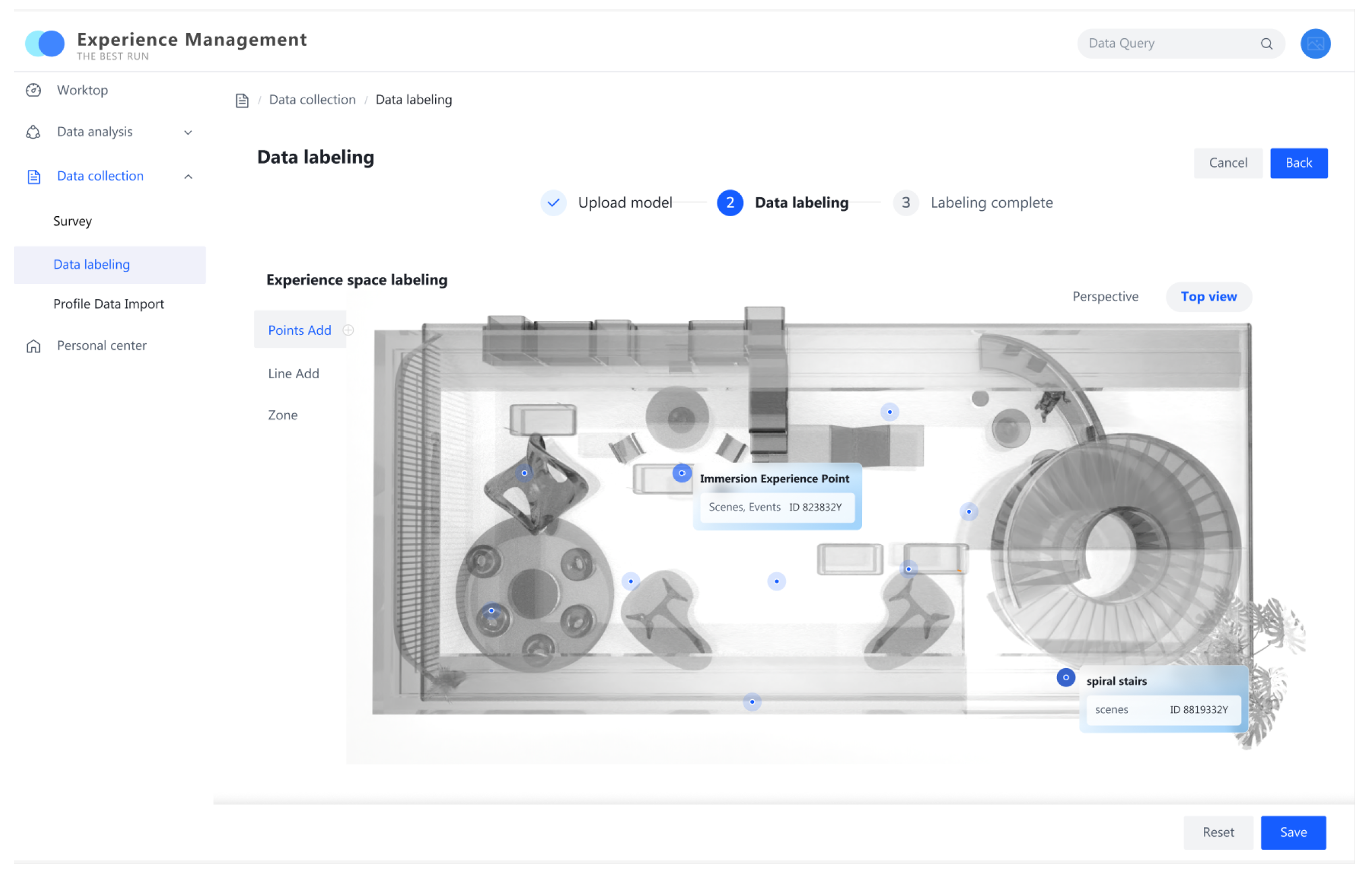

6. Case Study 3: Validation and Optimization of the Prototype

6.1. Methodology

6.1.1. Research Objectives and Participants

6.1.2. Testing Process

6.2. Results

6.2.1. On-Site Observation Analysis

- Three users experienced hesitation during Task 5 when saving and locating the user journey map in data analysis.

- Two users had difficulty finding the data dissection button for perceived value analysis during Task 7.

6.2.2. SUS Scores and User Feedback Analysis

7. Case Study 4: Usability Testing and Optimization of the Customer Experience Management Tool

7.1. Methodology

7.1.1. Testing Methods and Objectives

7.1.2. Test Participants

7.1.3. Testing Procedures and Content

7.1.4. Experimental Procedures

7.2. Results

7.3. Conclusions

8. Discussion

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Item | Source |

|---|---|---|

| Use Value | Travel efficiency | Sheth et al. (1991) [56,57] |

| Driving mileage | ||

| Structural safety | ||

| Good performance | ||

| Easy operation | ||

| Stability and comfort | ||

| Price Value | Policy subsidies | Sweeney and Soutar (2001) [14] |

| Loan discounts | ||

| Low cost | ||

| Affordable maintenance | ||

| Cost performance | ||

| Emotional Value | Pleasant mood | Chen Jie (2015) [58] |

| Fashionable and trendy | ||

| Green and environmentally friendly | ||

| Environmental contribution | ||

| Social recognition | ||

| Social Value | Low carbon and dual reduction | Chen et al. (2019) [59] |

| Petroleum consumption | ||

| Environmental protection | ||

| Social responsibility | ||

| Purchase Intention | Desire to purchase | Dodds et al. (1991) [60]; Ng et al. (2018) [61] |

| Priority purchase | ||

| Recommend purchase |

| Characteristic | Category | Frequency | Percentage (%) |

|---|---|---|---|

| Gender | Male | 165 | 55.00 |

| Female | 135 | 45.00 | |

| Age | Under 18 | 11 | 3.66 |

| 19–28 | 104 | 34.67 | |

| 29–45 | 93 | 31.00 | |

| 46–59 | 72 | 24.00 | |

| Over 60 | 20 | 6.67 | |

| Education | Middle school or below | 12 | 4.00 |

| High school or technical school | 28 | 9.33 | |

| Junior college | 76 | 25.33 | |

| Bachelor’s degree | 158 | 52.67 | |

| Master’s degree or above | 26 | 8.67 | |

| Occupation | Ordinary workers or service personnel | 58 | 19.33 |

| Staff of government organizations, institutions, and state-owned enterprises | 92 | 30.67 | |

| Staff in education, research, and healthcare | 56 | 18.67 | |

| Private enterprise owners or employees | 50 | 16.67 | |

| Self-employed | 32 | 10.66 | |

| Student | 12 | 4.00 | |

| Monthly Income | Less than 3000 RMB | 15 | 5.00 |

| 3000–5500 RMB | 101 | 33.67 | |

| 5501–8000 RMB | 92 | 30.66 | |

| 8001–10,000 RMB | 51 | 17.00 | |

| More than 10,000 RMB | 41 | 13.67 | |

| Household Registration | Urban household | 158 | 52.67 |

| Rural household | 142 | 47.33 | |

| Have you purchased a new energy vehicle? | Yes | 36 | 12.00 |

| No | 264 | 88.00 | |

| Car Ownership | 0 | 61 | 20.33 |

| 1 | 197 | 65.67 | |

| 2 | 38 | 12.67 | |

| 3 | 4 | 1.33 | |

| Annual Mileage | Less than 15,000 km | 80 | 26.67 |

| 15,000–30,000 km | 62 | 20.66 | |

| 30,001–40,000 km | 92 | 30.67 | |

| More than 40,001 km | 66 | 22.00 | |

| Awareness of New Energy Vehicles | Never heard of it | 0 | 0.00 |

| Heard only in the news or other channels | 30 | 10.00 | |

| Slightly familiar | 129 | 43.00 | |

| Quite familiar | 101 | 33.67 | |

| Very familiar | 40 | 13.33 | |

| Do you own any new energy vehicles? | Yes | 115 | 38.33 |

| No | 185 | 61.67 |

Appendix B. Questionnaire

- Gender: [single choice]

- Male

- Female

- Age: [single choice]

- Under the age of 18

- 19 to 28 years old

- 29 to 45 years old

- 46 to 59 years old

- Over 60 years old

- Educational background: [single choice]

- Junior high school and below

- High school or technical secondary school

- Junior college

- Undergraduate

- Master’s degree or above

- Occupation [single choice]

- General workers or service personnel

- Staff of government organizations, institutions, and state-owned enterprises

- Staff in the fields of education, scientific research, or health

- Owners or employees of private enterprises

- Self-employed person

- Student

- Monthly income [single choice]

- Below CNY 3000

- CNY 3000–5500

- CNY 5501–8000

- CNY 8001–10,000

- Over CNY 10,000

- Your household registration type is [single choice]

- Urban

- Rural

- Have you bought a vehicle [single choice]

- Purchased

- Not purchased

- The number of vehicles you own is [single choice]

- 0

- 1

- 2

- 3

- Your annual mileage is approximately (km/year) [single choice]

- Less than 15,000 km

- 15,000–30,000 km

- 30,001–40,000 km

- Longer than 40,001 km

- Do you know or hear about new energy vehicles [single choice]

- Never heard of

- Only heard of it over the news or by other means

- Know a little

- Better understanding

- Very well

- Do you own any NEVs? [single choice]

- Yes

- No

- New energy vehicles can improve driving efficiency

- The driving range of new energy vehicles can meet the requirements of driving distance

- The design and body structure of new energy vehicles are safer

- The power performance of new energy vehicles is good and the speed is fast

- The driving and operation of new energy vehicles are simple and convenient

- New energy vehicles have low driving noise and are stable and comfortable when driving

- Large subsidies for new energy vehicles

- New energy vehicles have preferential loan and tax policies

- Low use cost of new energy vehicles (electricity price lower than oil price)

- The late maintenance of new energy vehicles is economical and practical

- The purchase of new energy vehicles is cost effective

- Buying or driving new energy cars can make me happy

- Buying or driving a new energy car fits my fashionable image

- Buying or driving a new energy car fits my green image

- Buying or driving a new energy car makes me feel like I’m contributing to the environment

- Buying or driving new energy vehicles can gain more social recognition

- Buying or driving new energy vehicles is in response to the country’s low-carbon double reduction policy

- Buying or driving new energy vehicles reduces oil consumption in the long run

- Buying or driving new energy vehicles helps protect the environment

- Buying or driving new energy vehicles is a socially responsible act

- I want to buy a new energy car

- When buying a car, I will give priority to new energy vehicles

- I would like to recommend my friends to buy new energy vehicles

References

- Zauner, A.; Koller, M.; Hatak, I. Customer perceived value—Conceptualization and avenues for future research. Cogent Psychol. 2015, 2, 1061782. [Google Scholar] [CrossRef]

- Aulia, S.A.; Sukati, I.; Sulaiman, Z. A review: Customer perceived value and its dimension. Asian J. Soc. Sci. Manag. Stud. 2016, 3, 150–162. [Google Scholar] [CrossRef]

- Chang, C.; Dibb, S. Reviewing and conceptualising customer-perceived value. Mark. Rev. 2012, 12, 253–274. [Google Scholar] [CrossRef]

- Yang, Z.; Peterson, R.T. Customer perceived value, satisfaction, and loyalty: The role of switching costs. Psychol. Mark. 2004, 21, 799–822. [Google Scholar] [CrossRef]

- Eggert, A.; Ulaga, W. Customer perceived value: A substitute for satisfaction in business markets? J. Bus. Ind. Mark. 2002, 17, 107–118. [Google Scholar]

- Miao, R.; Xu, F.; Zhang, K.; Jiang, Z. Development of a multi-scale model for customer perceived value of electric vehicles. Int. J. Prod. Res. 2014, 52, 4820–4834. [Google Scholar] [CrossRef]

- He, X.; Hu, Y. Understanding the role of emotions in consumer adoption of electric vehicles: The mediating effect of perceived value. J. Environ. Plan. Manag. 2022, 65, 84–104. [Google Scholar] [CrossRef]

- Kim, M.K.; Oh, J.; Park, J.H.; Joo, K. Perceived value and adoption intention for electric vehicles in Korea: Moderating effects of environmental traits and government supports. Energy 2018, 159, 799–809. [Google Scholar] [CrossRef]

- Bányai, Á. Energy-Efficiency and Sustainability in Cross-Docking Supply Using E-Vehicles. Acta Electrotech. Inform. 2023, 8, 1–7. [Google Scholar] [CrossRef]

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar]

- Lapierre, J. Customer-perceived value in industrial contexts. J. Bus. Ind. Mark. 2000, 15, 122–145. [Google Scholar] [CrossRef]

- Petrick, J.F. Development of a multi-dimensional scale for measuring the perceived value of a service. J. Leis. Res. 2002, 34, 119–134. [Google Scholar] [CrossRef]

- Sweeney, J.C.; Soutar, G.N. Consumer perceived value: The development of a multiple item scale. J. Retail. 2001, 77, 203–220. [Google Scholar] [CrossRef]

- Holbrook, M.B. Consumer Value: A Framework for Analysis and Research; Routledge: London, UK, 1999. [Google Scholar]

- Chen, Z.; Dubinsky, A.J. A conceptual model of perceived customer value in e-commerce: A preliminary investigation. Psychol. Mark. 2003, 20, 323–347. [Google Scholar] [CrossRef]

- Chen, P.T.; Hu, H.H. The effect of relational benefits on perceived value in relation to customer loyalty: An empirical study in the Australian coffee outlets industry. Int. J. Hosp. Manag. 2010, 29, 405–412. [Google Scholar] [CrossRef]

- Chen, C.F. Investigating structural relationships between service quality, perceived value, satisfaction, and behavioral intentions for air passengers: Evidence from Taiwan. Transp. Res. Part A Policy Pract. 2008, 42, 709–717. [Google Scholar] [CrossRef]

- Tu, Y.T.; Chih, H.C. An empirical study of corporate brand image, customer perceived value and satisfaction on loyalty in shoe industry. J. Econ. Behav. Stud. 2013, 5, 469–483. [Google Scholar] [CrossRef]

- Chen, C.F.; Chen, F.S. Experience quality, perceived value, satisfaction and behavioral intentions for heritage tourists. Tour. Manag. 2010, 31, 29–35. [Google Scholar] [CrossRef]

- Homburg, C.; Jozić, D.; Kuehnl, C. Customer experience management: Toward implementing an evolving marketing concept. J. Acad. Mark. Sci. 2017, 45, 377–401. [Google Scholar] [CrossRef]

- Pine, B.J.; Gilmore, J.H. The Experience Economy; Harvard Business Press: Boston, MA, USA, 2011. [Google Scholar]

- Jauhiainen, S. Investigating Customer Experiences of a Public Limited Company Brand in a B2B Context: A Case Study of the EV Charging Industry. 2023. Available online: https://jyx.jyu.fi/handle/123456789/87514 (accessed on 2 January 2024).

- Ullah, A.; Aimin, W.; Ahmed, M. Smart automation, customer experience and customer engagement in electric vehicles. Sustainability 2018, 10, 1350. [Google Scholar] [CrossRef]

- Al-Saadi, M.; Patkowski, B.; Zaremba, M.; Karwat, A.; Pol, M.; Chełchowski, Ł.; Mierlo, J.V.; Berecibar, M. Slow and fast charging solutions for li-ion batteries of electric heavy-duty vehicles with fleet management strategies. Sustainability 2021, 13, 10639. [Google Scholar] [CrossRef]

- Alexander, O.; Sloan, D.; Hughes, K.; Ashby, S. Engaging with quality via the CEM model: Enhancing the content and performance management of postgraduate in-sessional academic skills provision. J. Engl. Acad. Purp. 2017, 27, 56–70. [Google Scholar] [CrossRef]

- Arineli, A.; Quintella, H.L.M.M. CEM: Increasing productivity through the management and monitoring of experiences provided to customers. Cogent Bus. Manag. 2015, 2, 1023015. [Google Scholar] [CrossRef]

- Mert, ˙I.S.; Rihab, G.; Cem, ¸S.E.N. Understanding the Cognitive Dissonance on Women Post-Purchase Behavior. J. Int. Trade Logist. Law 2024, 10, 245–272. [Google Scholar]

- Lindholm, A.L.; Nenonen, S. A conceptual framework of CREM performance measurement tools. J. Corp. Real Estate 2006, 8, 108–119. [Google Scholar] [CrossRef]

- Meyer, C.; Schwager, A. Understanding customer experience. Harv. Bus. Rev. 2007, 85, 116. [Google Scholar]

- Lemon, K.N.; Verhoef, P.C. Understanding customer experience throughout the customer journey. J. Mark. 2016, 80, 69–96. [Google Scholar] [CrossRef]

- Ng, S.; Russell-Bennett, R.; Dagger, T. A typology of mass services: The role of service delivery and consumption purpose in classifying service experiences. J. Serv. Mark. 2007, 21, 471–480. [Google Scholar] [CrossRef]

- Hu, L.; Basiglio, A. A multiple-case study on the adoption of customer relationship management and big data analytics in the automotive industry. TQM J. 2023, 36, 1–21. [Google Scholar] [CrossRef]

- Bamford, D.R.; Greatbanks, R.W. The use of quality management tools and techniques: A study of application in everyday situations. Int. J. Qual. Reliab. Manag. 2005, 22, 376–392. [Google Scholar] [CrossRef]

- Rao, M. Knowledge Management Tools and Techniques; Routledge: Abingdon, UK, 2012. [Google Scholar]

- Ahmed, T.M.; Bezemer, C.P.; Chen, T.H.; Hassan, A.E.; Shang, W. Studying the effectiveness of application performance management (APM) tools for detecting performance regressions for web applications: An experience report. In Proceedings of the 13th International Conference on Mining Software Repositories, Austin, TX, USA, 14–15 May 2016; pp. 1–12. [Google Scholar]

- Laugwitz, B.; Held, T.; Schrepp, M. Construction and evaluation of a user experience questionnaire. In Proceedings of the HCI and Usability for Education and Work: 4th Symposium of the Workgroup Human-Computer Interaction and Usability Engineering of the Austrian Computer Society, USAB 2008, Graz, Austria, 20–21 November 2008; pp. 63–76. [Google Scholar]

- Rababah, K.; Mohd, H.; Ibrahim, H. Customer relationship management (CRM) processes from theory to practice: The pre-implementation plan of CRM system. Int. J. E-Educ. E-Bus. E-Manag. E-Learn. 2011, 1, 22–27. [Google Scholar]

- Wilson, H.; Daniel, E.; McDonald, M. Factors for success in customer relationship management (CRM) systems. J. Mark. Manag. 2002, 18, 193–219. [Google Scholar] [CrossRef]

- Kumar, V.; Reinartz, W. Customer Relationship Management; Springer: New York, NY, USA, 2018. [Google Scholar]

- Secinaro, S.; Calandra, D.; Lanzalonga, F.; Ferraris, A. Electric vehicles’ consumer behaviours: Mapping the field and providing a research agenda. J. Bus. Res. 2022, 150, 399–416. [Google Scholar] [CrossRef]

- Onat, N.C.; Kucukvar, M. A systematic review on sustainability assessment of electric vehicles: Knowledge gaps and future perspectives. Environ. Impact Assess. Rev. 2022, 97, 106867. [Google Scholar] [CrossRef]

- Weiller, C.; Neely, A. Using electric vehicles for energy services: Industry perspectives. Energy 2014, 77, 194–200. [Google Scholar] [CrossRef]

- Li, B.; Kisacikoglu, M.C.; Liu, C.; Singh, N.; Erol-Kantarci, M. Big data analytics for electric vehicle integration in green smart cities. IEEE Commun. Mag. 2017, 55, 19–25. [Google Scholar] [CrossRef]

- Zimmerman, J.; Forlizzi, J.; Evenson, S. Research through design as a method for interaction design research in HCI. In Proceedings of the SIGCHI Conference on Human Factors in Computing Systems, San Jose, CA, USA, 28 April–3 May 2007; pp. 493–502. [Google Scholar]

- Gaver, W. What should we expect from research through design? In Proceedings of the SIGCHI Conference on Human Factors in Computing Systems, Austin, TX, USA, 5–10 May 2012; pp. 937–946. [Google Scholar]

- Stappers, P.J.; Giaccardi, E. Research through design. In The Encyclopedia of Human-Computer Interaction; The Interaction Design Foundation: Aarhus, Denmark, 2017; pp. 1–94. [Google Scholar]

- Zimmerman, J.; Forlizzi, J. Research through design in HCI. In Ways of Knowing in HCI; Springer: New York, NY, USA, 2014; pp. 167–189. [Google Scholar]

- Desmet, P.; Overbeeke, K.; Tax, S. Designing products with added emotional value: Development and application of an approach for research through design. Des. J. 2001, 4, 32–47. [Google Scholar] [CrossRef]

- Zhao, H.; Furuoka, F.; Rasiah, R. The Influence of Psychological Factors on Consumer Purchase Intention for Electric Vehicles: Case Study from China: Integrating the Necessary Condition Analysis Methodology from the Perspective of Self-Determination Theory. World Electr. Veh. J. 2024, 15, 331. [Google Scholar] [CrossRef]

- Zhao, H.; Furuoka, F.; Rasiah, R.A.; Shen, E. Consumers’ Purchase Intention toward Electric Vehicles from the Perspective of Perceived Green Value: An Empirical Survey from China. World Electr. Veh. J. 2024, 15, 267. [Google Scholar] [CrossRef]

- Kraus, S.; Ribeiro-Soriano, D.; Schüssler, M. Fuzzy-set qualitative comparative analysis (fsQCA) in entrepreneurship and innovation research–the rise of a method. Int. Entrep. Manag. J. 2018, 14, 15–33. [Google Scholar] [CrossRef]

- Douglas, E.J.; Shepherd, D.A.; Prentice, C. Using fuzzy-set qualitative comparative analysis for a finer-grained understanding of entrepreneurship. J. Bus. Ventur. 2020, 35, 105970. [Google Scholar] [CrossRef]

- Geras, A.; Smith, M.; Miller, J. A prototype empirical evaluation of test driven development. In Proceedings of the 10th International Symposium on Software Metrics, Washington, DC, USA, 11–17 September 2004; pp. 405–416. [Google Scholar]

- Mahatody, T.; Sagar, M.; Kolski, C. State of the art on the cognitive walkthrough method, its variants and evolutions. Int. J. Hum.-Comput. Interact. 2010, 26, 741–785. [Google Scholar] [CrossRef]

- Blackmon, M.H.; Polson, P.G.; Kitajima, M.; Lewis, C. Cognitive walkthrough for the web. In Proceedings of the SIGCHI Conference on Human Factors in Computing Systems, Minneapolis, MN, USA, 20–25 April 2002; pp. 463–470. [Google Scholar]

- Kowalska-Pyzalska, A.; Michalski, R.; Kott, M.; Skowrońska-Szmer, A.; Kott, J. Consumer preferences towards alternative fuel vehicles. Results from the conjoint analysis. Renew. Sustain. Energy Rev. 2022, 155, 111776. [Google Scholar] [CrossRef]

- Sheth, J.N.; Newman, B.I.; Gross, B.L. Why we buy what we buy: A theory of consumption values. J. Bus. Res. 1991, 22, 159–170. [Google Scholar] [CrossRef]

- Chen, J. The Influence of Customer Perceived Value on Purchase Intention of New Energy Vehicles. Ph.D. Thesis, Donghua University, Shanghai, China, 2015. [Google Scholar]

- Chen, K.; Ren, C.; Gu, R.; Zhang, P. Exploring purchase intentions of new energy vehicles: From the perspective of frugality and the concept of “mianzi”. J. Clean. Prod. 2019, 230, 700–708. [Google Scholar] [CrossRef]

- Dodds, W.B.; Monroe, K.B.; Grewal, D. Effects of price, brand, and store information on buyers’ product evaluations. J. Mark. Res. 1991, 28, 307–319. [Google Scholar]

- Ng, M.; Law, M.; Zhang, S. Predicting purchase intention of electric vehicles in Hong Kong. Australas. Mark. J. (AMJ) 2018, 26, 272–280. [Google Scholar] [CrossRef]

| Stages | Activities | Objectives |

|---|---|---|

| Awareness | Marketing, Social Media Engagement | Increase Brand Awareness, Educate Customers |

| Consideration | Test Drives, Product Comparisons | Provide Information, Build Trust |

| Purchase | Sales Process, Financing Options | Ensure Smooth Purchase Experience, Close Sales |

| Service | Maintenance, Customer Support | Provide Excellent Service, Address Issues |

| Loyalty | Feedback, Loyalty Programs | Foster Loyalty, Encourage Repeat Purchases |

| Case Study | Purpose | Objective | Method | Results |

|---|---|---|---|---|

| Case Study 1 | Identifying Factors Influencing EV Purchases | Identify key factors influencing EV purchase decisions | Surveys analyzed with fsQCA | Identified price, quality, and brand image as key factors |

| Case Study 2 | Interview Analysis of CEM Tool Users | Understand workflows of CEM tool users | Semi-structured interviews | Identified issues in time management and communication |

| Case Study 3 | Prototype Validation through Expert Reviews | Validate research findings and prototype design | Expert reviews using Delphi method | Validated hypotheses and suggested prototype improvements |

| Case Study 4 | Usability Testing of CEM Tool | Evaluate effectiveness of CEM tool | Usability testing with SUS | Identified strengths and weaknesses, guiding optimization |

| Variable | Cronbach’s α |

|---|---|

| Purchase Intention | 0.921 |

| Use Value | 0.894 |

| Price Value | 0.873 |

| Emotional Value | 0.898 |

| Social Value | 0.971 |

| Measure | Value |

|---|---|

| Kaiser–Meyer–Olkin Measure | 0.983 |

| Bartlett’s Test of Sphericity | |

| Approx. Chi-Square | 7412.743 |

| Degrees of Freedom (df) | 531 |

| Significance (p-value) | 0.000 |

| Variable | Mean | Std. Dev | Quality Value | Price Value | Emotional Value | Social Value | Purchase Intention |

|---|---|---|---|---|---|---|---|

| Quality Value | 3.7855 | 0.78123 | 0.815 | ||||

| Price Value | 3.8968 | 0.77234 | 0.432 ** | 0.873 | |||

| Emotional Value | 3.8872 | 0.76532 | −0.012 | −0.035 | 0.781 | ||

| Social Value | 3.6712 | 0.82134 | −0.051 | −0.039 | 0.497 ** | 0.769 | |

| Purchase Intention | 3.6515 | 0.82467 | 0.435 ** | 0.548 ** | −0.232 ** | −0.114 | 0.812 |

| Antecedent Condition | Purchase Intention | Non-Purchase Intention | ||

|---|---|---|---|---|

| Consistency | Coverage | Consistency | Coverage | |

| Use Value | 0.759795 | 0.753630 | 0.469121 | 0.615996 |

| -Use Value | 0.612822 | 0.466725 | 0.814764 | 0.819815 |

| Price Value | 0.731932 | 0.723492 | 0.484774 | 0.633137 |

| -Price Value | 0.628611 | 0.479989 | 0.791001 | 0.799102 |

| Emotional Value | 0.621032 | 0.486147 | 0.729022 | 0.753901 |

| -Emotional Value | 0.670453 | 0.652923 | 0.502991 | 0.637035 |

| Social Value | 0.648611 | 0.658902 | 0.654774 | 0.746269 |

| -Social Value | 0.702932 | 0.604766 | 0.615269 | 0.699869 |

| Condition | Config 1 | Config 2 | Config 3 | Config 4 |

|---|---|---|---|---|

| Use Value | O | O | O | |

| Price Value | O | • | O | |

| Emotional Value | • | • | • | |

| Social Value | x | x | • | |

| Original Coverage | 0.451406 | 0.555453 | 0.417559 | 0.398906 |

| Unique Coverage | 0.0524269 | 0.0410322 | 0.0746638 | 0.0713743 |

| Consistency | 0.869756 | 0.918945 | 0.939575 | 0.882943 |

| Overall Solution Coverage | 0.710585 | |||

| Overall Solution Consistency | 0.837724 |

| No. | Position | Location | Gender | Age | Job Responsibilities |

|---|---|---|---|---|---|

| S1 | Sales | Beijing | Male | 28 | Communicate with potential customers, understand their needs, and provide product information. Maintain a professional image to ensure customer trust. |

| S2 | Sales | Shanghai | Male | 25 | |

| C1 | UX Designer | Beijing | Female | 25 | Design user interfaces and experiences to enhance customer satisfaction. |

| C2 | UX Designer | Shenzhen | Male | 32 | |

| T1 | Product Manager | Shanghai | Female | 35 | Develop product strategies, plan roadmaps, and collaborate with teams to improve product quality. |

| T2 | Product Manager | Chengdu | Male | 28 | |

| M1 | Marketing | Shanghai | Female | 25 | Develop marketing strategies and conduct market analysis to ensure product market entry and recognition. |

| M2 | Marketing | Shanghai | Female | 29 | |

| O1 | Service Supervisor | Nanjing | Male | 30 | Ensure efficient operation and high service quality of the customer service team. |

| O2 | Service Supervisor | Shanghai | Female | 37 |

| Interview Phase | Interview Content |

|---|---|

| Phase 1 | Action: Ice breaking, introduction to the study background, and ethical principles based on the Helsinki Declaration. |

| Goal: Establish trust and rapport with the interviewees and ensure they understand the importance of the research. | |

| Phase 2 | Action: Collect basic information about the interviewees, such as age, gender, education, occupation, etc. |

| Goal: Better understand the interviewees’ backgrounds and personal characteristics. | |

| Phase 3 | Action: Understand the current customer experience management tools used by the interviewees and how they use these tools to manage customer relationships. |

| Goal: Identify the problems and challenges faced by the interviewees in using these tools to better understand their needs and expectations. | |

| Phase 4 | Action: Explore the interviewees’ work experiences, such as how they manage time, communicate with colleagues, handle tasks, and interact with customers. |

| Goal: Gain a deeper understanding of the interviewees’ work scenarios, workflows, and work requirements. |

| Pain Points | Impact on Perceived Customer Value | Innovation Design Opportunities |

|---|---|---|

| 1. Limited offline experience maps | Reduces use and emotional value due to lack of reuse and coordination | Implement online experience map creation |

| 2. No visualization of customer footprints | Lowers emotional and social value, causing dissatisfaction | Add visualization of customer footprints and profiles |

| 3. Absence of component libraries | Complicates design, affecting use and emotional value | Introduce customizable component libraries |

| 4. No multi-channel surveys | Misses changes in emotional value, reducing loyalty | Deploy multi-channel experience surveys |

| 5. Undefined customer journey metrics | Hinders understanding of product value | Define clear customer journey metrics |

| 6. Inconsistent metrics across departments | Varies service quality, impacting perceived value | Integrate operational metrics tracking |

| Task Number | Task Content |

|---|---|

| 1 | Find and enter the workstation to select and open a recent project. |

| 2 | Locate the most recent project in project management and open the user profile. |

| 3 | Edit the user’s name, age, and notes in the profile and save the changes. |

| 4 | Find and open the user’s journey map to edit user tags. |

| 5 | Save the user journey map and find it in data analysis. |

| 6 | Locate and open multidimensional data analysis in the data analysis section. |

| 7 | Open the user perceived value analysis, dissect the data, and find the source file. |

| 8 | Use the data annotation function to upload a test file and perform data annotation. |

| 9 | Free exploration phase, allowing participants to explore the prototype as they wish. |

| Expert Name | Position | Company | Responsible Product | Industry Experience |

|---|---|---|---|---|

| Zhang Kai | Senior Customer Experience Researcher | Shanghai Automotive Group | Electric Vehicle Intelligent Connectivity System | Over 10 years in EV customer experience, specializing in user research, needs analysis, and experience design. |

| Li Ming | Senior Interaction Designer | Beijing Automotive Group | EV Infotainment System | Over 7 years in EV customer experience design, experienced in user research, interaction design, and usability testing. |

| Wang Qiang | Senior Systems Engineer | Guangzhou Tesla Center | EV Intelligent Driving Assistance System | Extensive experience in EV customer experience management tools, specializing in systems engineering design and intelligent control algorithms. |

| Chen Jing | Senior Software Engineer | Shenzhen BYD | EV Intelligent Charging System | Over 10 years in EV customer experience management tools, specializing in software development, experience design, and testing. |

| Participant | Q1 | Q2 | Q3 | Q4 | Q5 | Q6 | Q7 | Q8 | Q9 | Q10 | Total Score | SUS Score |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 5 | 3 | 4 | 2 | 5 | 4 | 3 | 4 | 4 | 5 | 39 | 78 |

| 2 | 4 | 2 | 3 | 5 | 4 | 3 | 5 | 5 | 3 | 4 | 38 | 76 |

| 3 | 3 | 4 | 4 | 3 | 4 | 4 | 5 | 3 | 4 | 4 | 38 | 76 |

| 4 | 4 | 2 | 3 | 2 | 4 | 2 | 2 | 4 | 3 | 4 | 30 | 60 |

| 5 | 5 | 4 | 4 | 4 | 5 | 4 | 4 | 4 | 3 | 5 | 42 | 84 |

| 6 | 3 | 5 | 5 | 5 | 4 | 2 | 5 | 3 | 3 | 3 | 38 | 76 |

| 7 | 4 | 3 | 4 | 3 | 4 | 5 | 3 | 4 | 5 | 4 | 39 | 78 |

| 8 | 2 | 2 | 2 | 2 | 2 | 4 | 2 | 4 | 5 | 2 | 27 | 54 |

| 9 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 5 | 2 | 3 | 31 | 62 |

| 10 | 4 | 4 | 3 | 4 | 4 | 5 | 5 | 4 | 3 | 4 | 40 | 80 |

| Average | 4 | 3.2 | 3.5 | 3.3 | 3.9 | 3.6 | 3.7 | 4 | 3.5 | 3.8 | 36.2 | 72.4 |

| No. | Name | Company | Role |

|---|---|---|---|

| 1 | Karen Lee | N | Sales |

| 2 | Michael Chen | N | UX Designer |

| 3 | Michelle Wang | N | Product Manager |

| 4 | Sophie Liu | P | Service Manager |

| 5 | John Wu | P | Marketing |

| 6 | Jessica Zhang | S | B2B UX Designer |

| 7 | Alex Wang | S | B2B Product Manager |

| 8 | Jane Li | S | Marketing |

| 9 | Eric Li | C | Service Manager |

| 10 | Emily Wang | C | Marketing |

| 11 | Kevin Chen | B | B2B UX Designer |

| 12 | Lily Zhang | B | B2B Product Manager |

| 13 | Tony Chen | B | Operations |

| 14 | Grace Zhou | A | Service Manager |

| 15 | Michael Liu | A | Marketing |

| 16 | Sarah Wu | A | B2B UX Designer |

| 17 | Jason Chen | D | Product Manager |

| 18 | Steven Zhang | D | Service Manager |

| Category | Experimental Group | Control Group | X2 | p-Value |

|---|---|---|---|---|

| Age | 0.083 | 0.773 | ||

| 25 and under | 7 (70%) | 6 (67%) | ||

| 26–35 | 2 (20%) | 2 (22%) | ||

| 36 and over | 1 (10%) | 1 (11%) | ||

| Gender | 0.000 | 1.000 | ||

| Male | 6 (60%) | 5 (56%) | ||

| Female | 4 (40%) | 4 (44%) |

| Task Stage | Task Details |

|---|---|

| Data Collection | Task 1: Open the questionnaire collection feature |

| Task 2: Find and view data from the “Metaverse Virtual Space” survey | |

| Task 3: Publish the completed “Experience Design Questionnaire A” | |

| Task 4: Select the app delivery method for the questionnaire | |

| Task 5: Change Q2 trigger to “phone screen off” | |

| Task 6: Save and send the questionnaire | |

| Action Improvement | Task 7: Open the welcome page of the workstation |

| Task 8: Search for the warning center in the search box | |

| Task 9: View the warnings in the warning center | |

| Task 10: Track a low-score experience | |

| Task 11: Trace the customer journey to find issues | |

| Data Annotation | Task 12: Upload “demo.3ds” model to the annotation interface |

| Task 13: Add and rename a point of interest (POI) | |

| Task 14: Add paths between POI A and B | |

| Task 15: View and delete POI C in the global view | |

| Task 16: Save the model annotations |

| Step | Time | Experimental Group | Control Group |

|---|---|---|---|

| Pre-experiment | 10 min | Introduce objectives, background, and methods | Fill out basic information |

| Sign informed consent | |||

| Experiment | 20 min | Introduce prototype and usage | Introduce Beisite XM and usage |

| Complete tasks using prototype | Complete tasks using Beisite XM | ||

| Post-experiment | 10 min | Fill out questionnaire | |

| Participant interviews | |||

| End of experiment, gift distribution |

| Job Function | Experimental Group | Control Group |

|---|---|---|

| Marketing | 2 | 1 |

| Service Manager | 2 | 2 |

| Product Manager | 2 | 2 |

| Sales | 2 | 2 |

| UX Design | 2 | 2 |

| X2 | 0.500 | |

| p | >0.05 |

| Metric | Experimental Group | Control Group | Difference | t | p |

|---|---|---|---|---|---|

| Usability | 4.2 ± 0.3 | 3.7 ± 0.3 | 0.5 ± 0.4 | 2.33 | 0.033 |

| Understandability | 3.5 ± 0.2 | 3.0 ± 0.2 | 0.5 ± 0.28 | 2.83 | 0.012 |

| Efficiency | 4.0 ± 0.3 | 3.7 ± 0.3 | 0.3 ± 0.4 | 1.50 | 0.148 |

| Effectiveness | 4.1 ± 0.2 | 3.8 ± 0.2 | 0.3 ± 0.3 | 1.74 | 0.096 |

| Aesthetics | 3.25 ± 0.27 | 2.75 ± 0.27 | 0.50 ± 0.38 | 5.111 | 0.002 |

| Metric | Experimental Group | Control Group | Difference | t | p |

|---|---|---|---|---|---|

| Usability | 3.5 ± 0.2 | 3.0 ± 0.2 | 0.5 ± 0.4 | 2.83 | 0.012 |

| Understandability | 3.2 ± 0.3 | 2.8 ± 0.3 | 0.4 ± 0.4 | 2.33 | 0.033 |

| Efficiency | 3.2 ± 0.2 | 3.6 ± 0.2 | 0.4 ± 0.3 | 2.83 | 0.012 |

| Effectiveness | 3.8 ± 0.3 | 3.5 ± 0.3 | 0.3 ± 0.4 | 1.74 | 0.096 |

| Aesthetics | 3.7 ± 0.3 | 3.3 ± 0.3 | 0.4 ± 0.4 | 2.33 | 0.033 |

| Metric | Experimental Group | Control Group | Difference | t | p |

|---|---|---|---|---|---|

| Usability | 3.2 ± 0.3 | 2.8 ± 0.3 | 0.4 ± 0.4 | 2.33 | 0.003 ** |

| Understandability | 3.0 ± 0.2 | 3.5 ± 0.2 | 0.5 ± 0.3 | 2.83 | 0.004 ** |

| Efficiency | 3.1 ± 0.3 | 2.8±0.3 | 0.3 ± 0.4 | 2.33 | 0.029 |

| Effectiveness | 3.7 ± 0.2 | 3.3±0.2 | 0.4 ± 0.3 | 2.83 | 0.045 |

| Aesthetics | 3.4 ± 0.3 | 2.8 ± 0.3 | 0.6 ± 0.4 | 2.33 | 0.001 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Y.; Shan, X.; Guo, M.; Gao, W.; Lin, Y.-S. Design and Application of Experience Management Tools from the Perspective of Customer Perceived Value: A Study on the Electric Vehicle Market. World Electr. Veh. J. 2024, 15, 378. https://doi.org/10.3390/wevj15080378

Xu Y, Shan X, Guo M, Gao W, Lin Y-S. Design and Application of Experience Management Tools from the Perspective of Customer Perceived Value: A Study on the Electric Vehicle Market. World Electric Vehicle Journal. 2024; 15(8):378. https://doi.org/10.3390/wevj15080378

Chicago/Turabian StyleXu, Yuanyuan, Xinyang Shan, Mingcheng Guo, Weiting Gao, and Yin-Shan Lin. 2024. "Design and Application of Experience Management Tools from the Perspective of Customer Perceived Value: A Study on the Electric Vehicle Market" World Electric Vehicle Journal 15, no. 8: 378. https://doi.org/10.3390/wevj15080378

APA StyleXu, Y., Shan, X., Guo, M., Gao, W., & Lin, Y.-S. (2024). Design and Application of Experience Management Tools from the Perspective of Customer Perceived Value: A Study on the Electric Vehicle Market. World Electric Vehicle Journal, 15(8), 378. https://doi.org/10.3390/wevj15080378