Key Factors Influencing Purchase or Rent Decisions in Smart Real Estate Investments: A System Dynamics Approach Using Online Forum Thread Data

Abstract

1. Introduction and Background

1.1. Not Enough Information (NEI)

1.2. Complicated Buy/Sell Process (BS)

1.3. House Size (HS)

1.4. Housing Costs (HC)

1.5. Mortgage (MT)

1.6. Emotion (EM)

1.7. Agents (AG)

1.8. Inspection (IP)

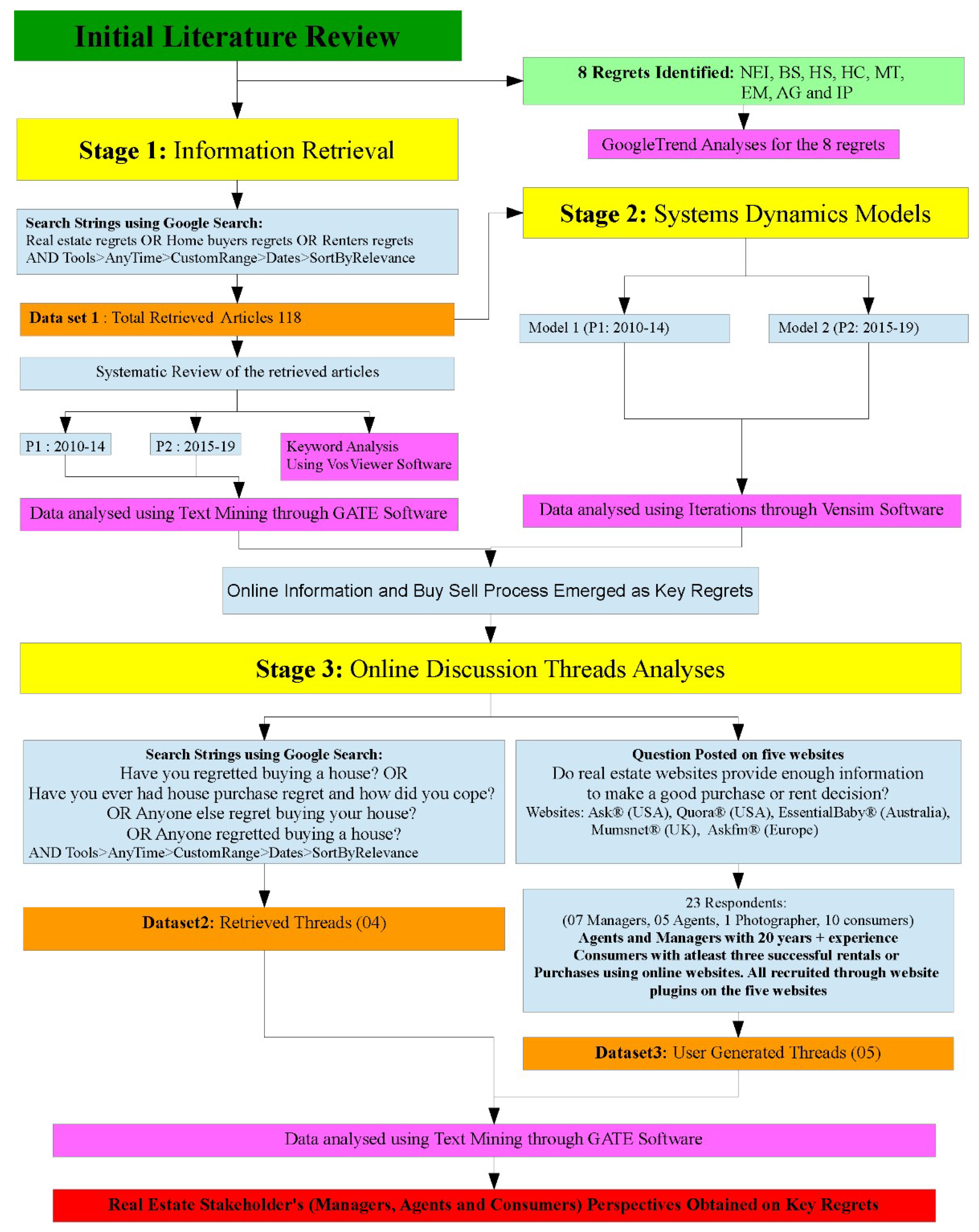

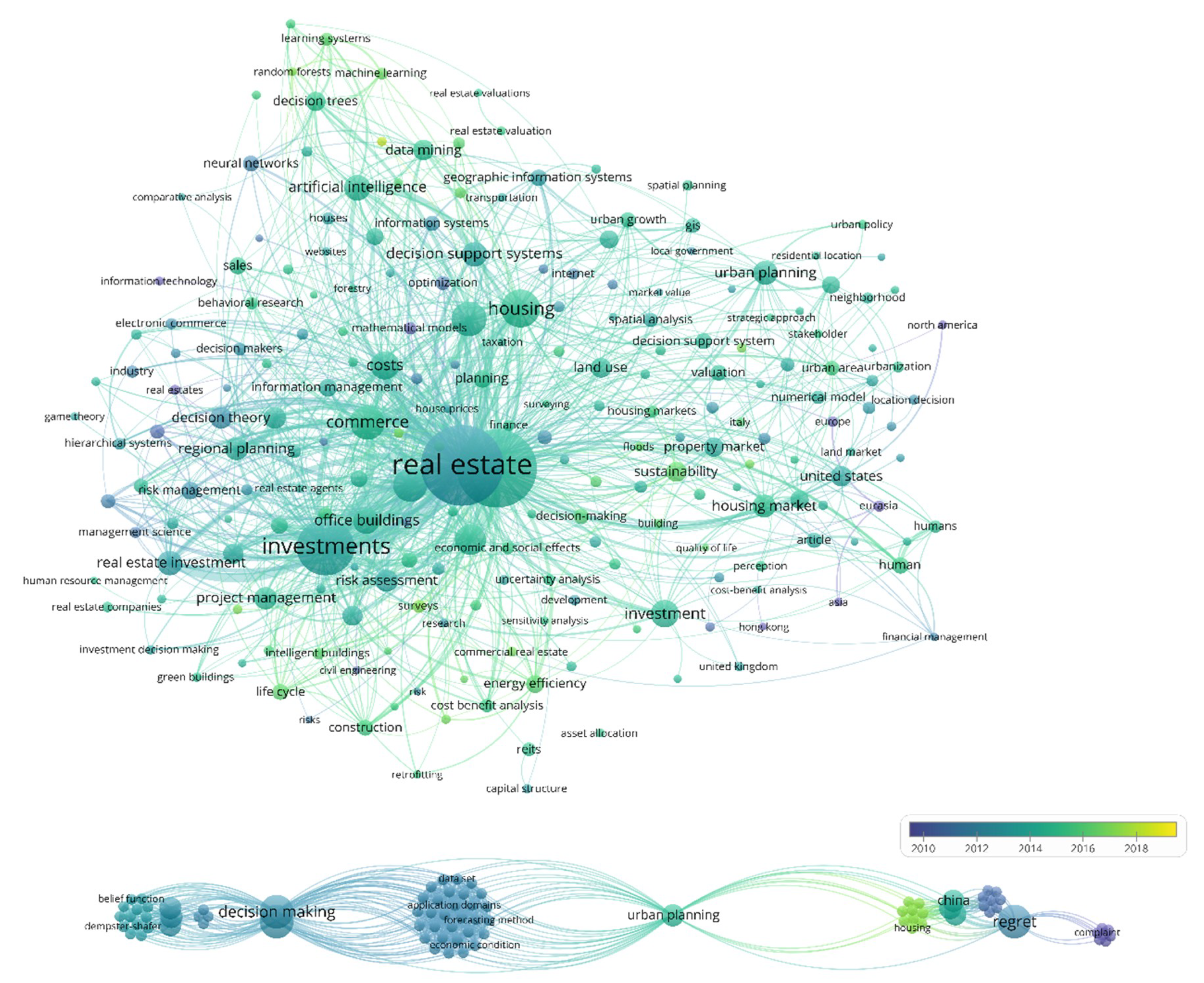

2. Materials and Methods

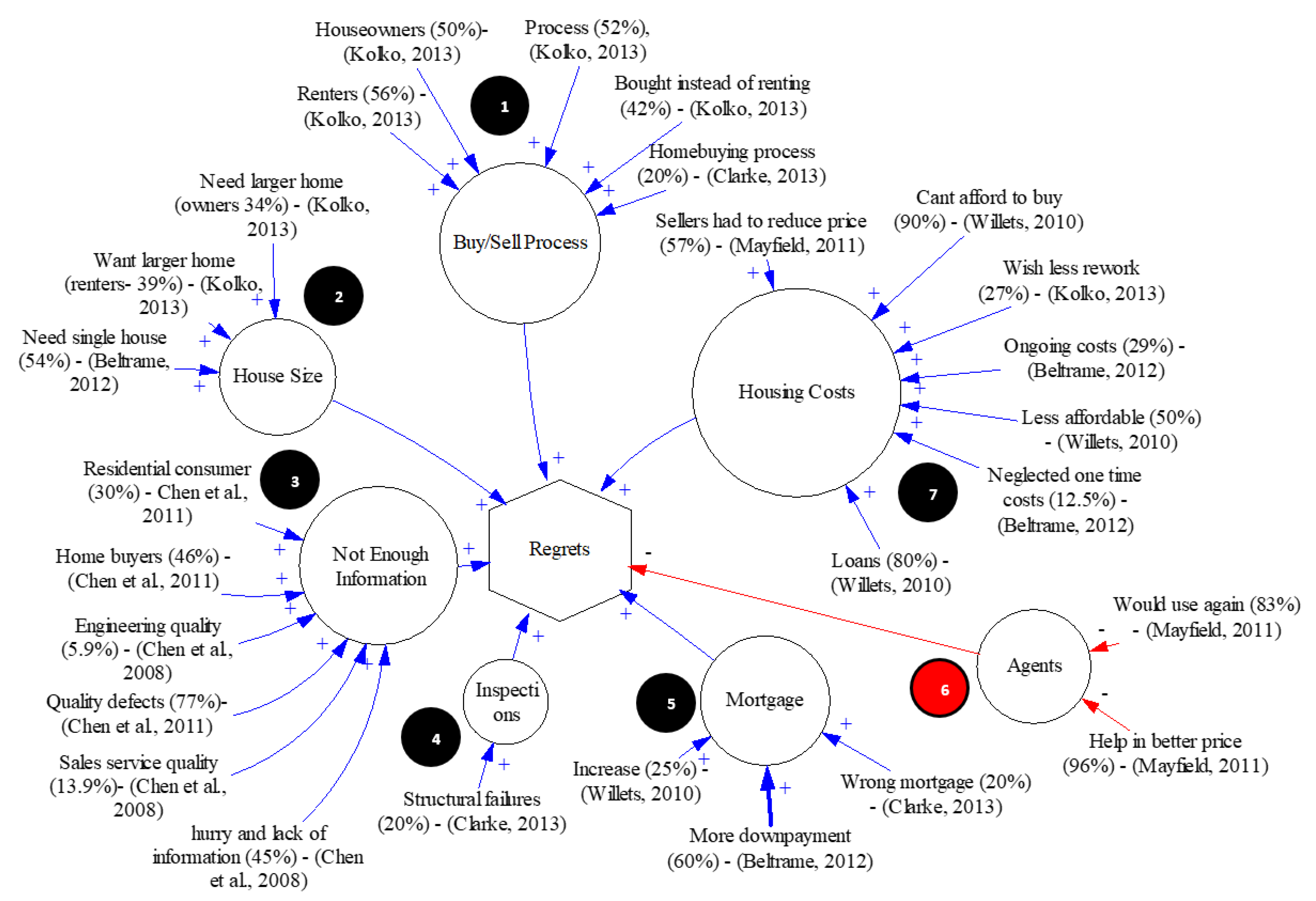

2.1. Information Retrieval

2.2. System Dynamics Models

2.3. Online Discussion Threads

3. Results and Discussions

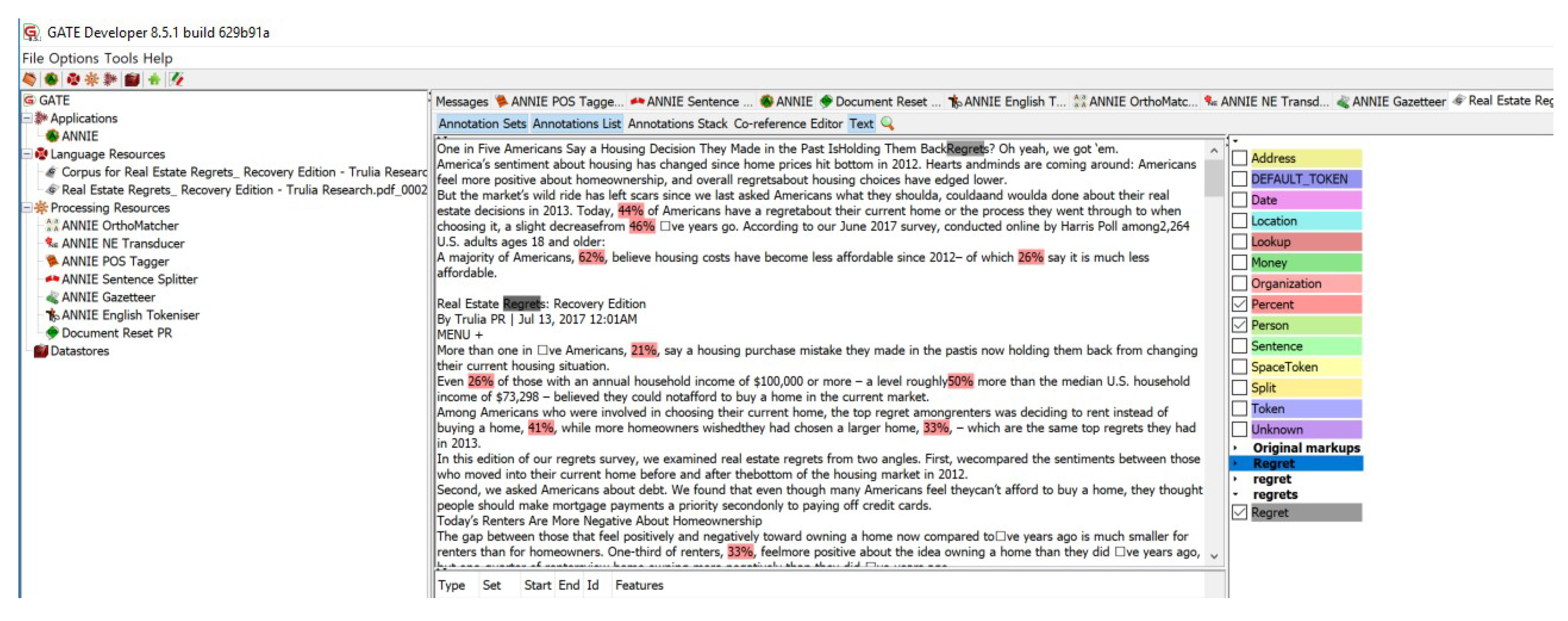

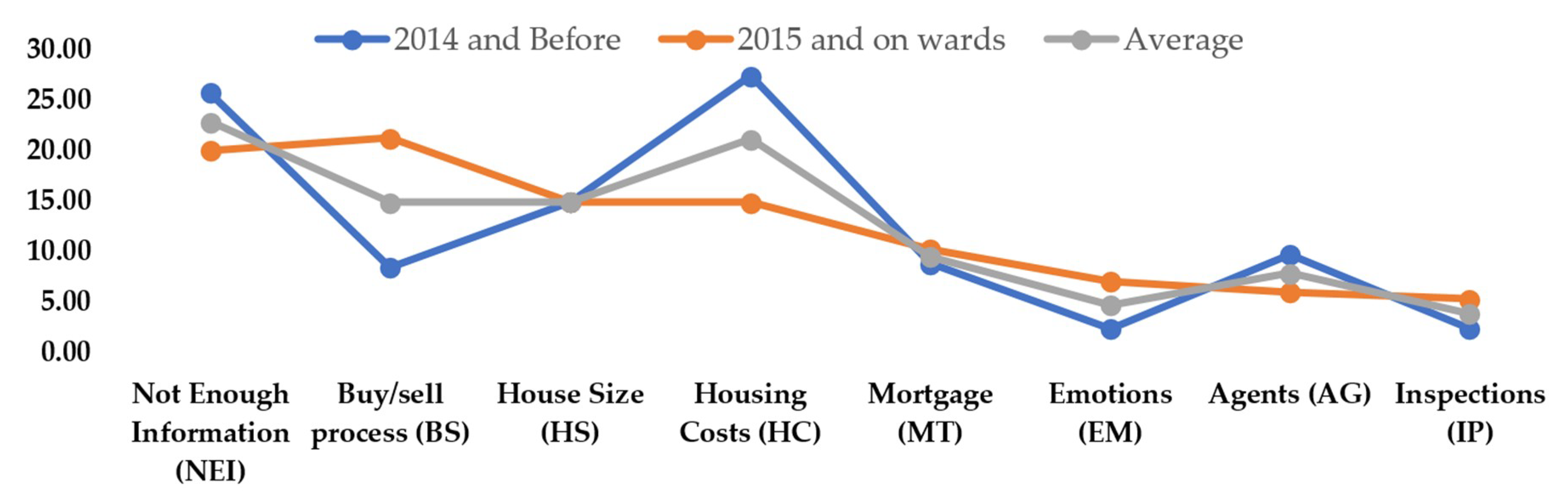

3.1. Information Retrieval Results

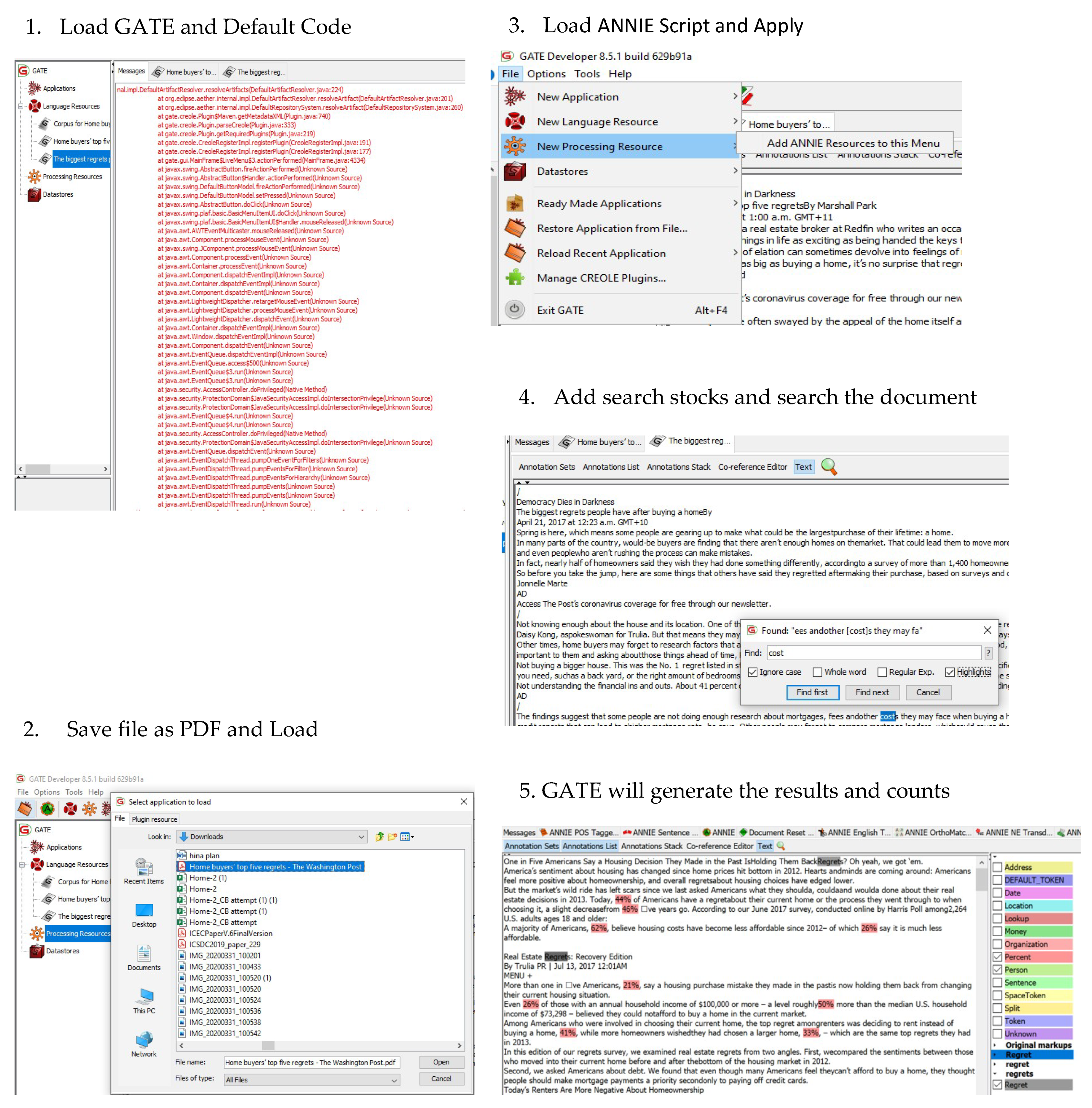

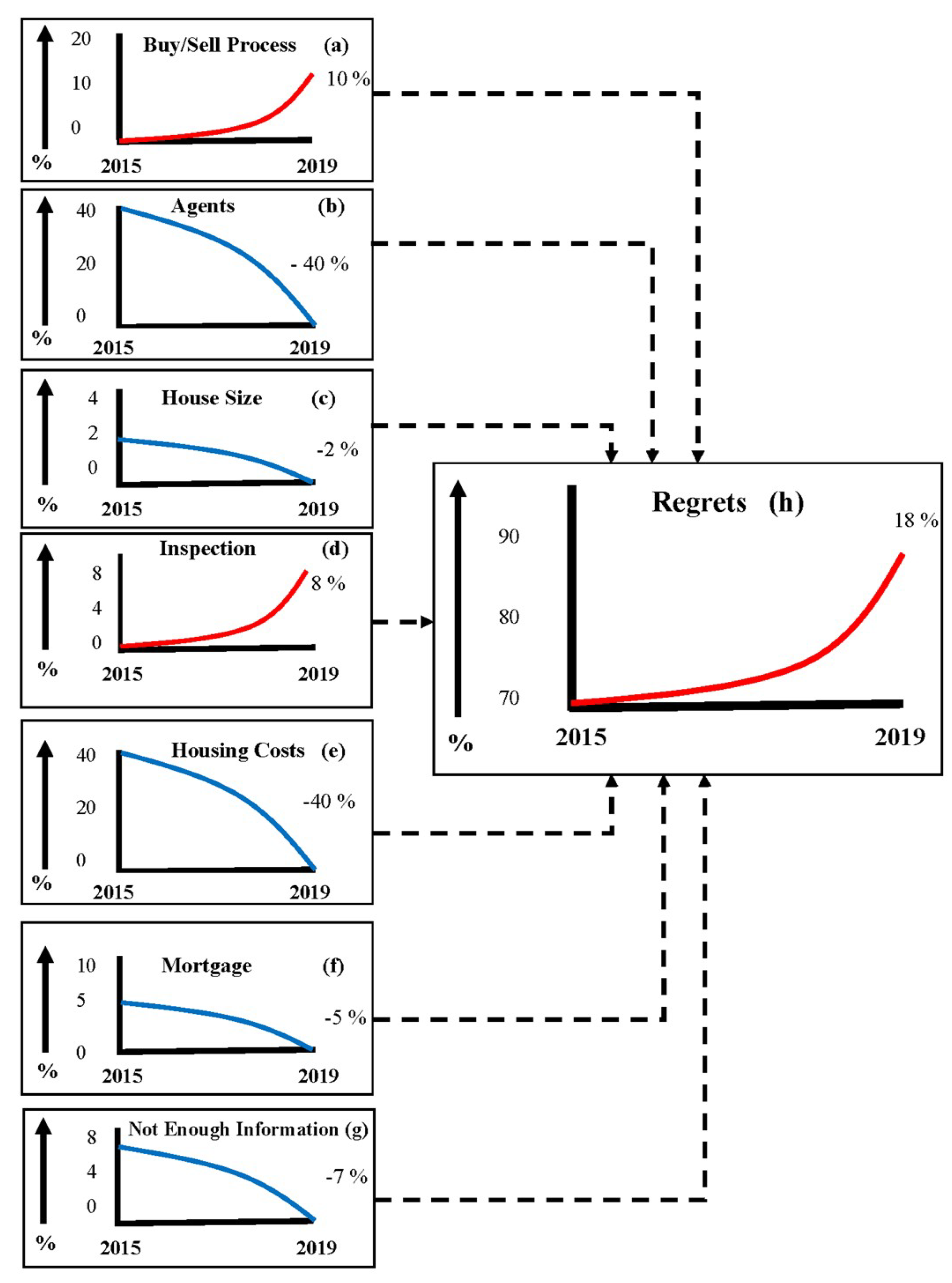

3.2. Systems Dynamics Analyses

3.3. Online Discussion Threads Analyses

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Morrison, D.; Phillips, M. The Global Outlook for 2018. In Emerging Trends in Real Estate®; Morrison, D., Ed.; PWC and ULI: Washington, DC, USA, 2018; p. 32. [Google Scholar]

- Statista. Transaction Volumes in the Real Estate Market in the United States from 2005 to 2017 (in billion U.S. dollars). Available online: https://www.statista.com/statistics/245103/real-estate-capital-flows/ (accessed on 8 June 2018).

- Ullah, F.; Sepasgozar, S.; Wang, C. A Systematic Review of Smart Real Estate Technology: Drivers of, and Barriers to, the Use of Digital Disruptive Technologies and Online Platforms. Sustainability 2018, 10, 3142. [Google Scholar] [CrossRef]

- Ullah, F.; Shinetogtokh, T.; Sepasgozar, P.S.; Ali, T.H. Investigation of the users’ interaction with online real estate platforms in Australia. In Proceedings of the 2nd International Conference on Sustainable Development in Civil Engineering (ICSDC 2019), Jamshoro Pakistan, 5–7 December 2019; MUET: Jamshoro Pakistan, 2019; p. 81. [Google Scholar]

- Munawar, H.S.; Qayyum, S.; Ullah, F.; Sepasgozar, S. Big Data and Its Applications in Smart Real Estate and the Disaster Management Life Cycle: A Systematic Analysis. Big Data Cogn. Comput. 2020, 4, 4. [Google Scholar] [CrossRef]

- Chen, J.; Hui, E.C.; Wang, Z. Perceived risk, anticipated regret and post-purchase experience in the real estate market: The case of China. Hous. Stud. 2011, 26, 385–402. [Google Scholar] [CrossRef]

- Marte, J. The Biggest Regrets People have after Buying a Home. Available online: https://www.washingtonpost.com/news/get-there/wp/2017/04/20/the-biggest-regrets-people-have-after-buying-a-home/?noredirect=on&utm_term=.79bc863bc842 (accessed on 8 June 2018).

- Duboeuf, T. Local power and land-use strategies in mountain resorts: Sustainability of local tourism development and the challenges of governance. Revue de Géographie Alpine 2006, 94, 42–51. [Google Scholar] [CrossRef]

- Hobson, K. Consumption, environmental sustainability and human geography in Australia: A missing research agenda? Aust. Geogr. Stud. 2003, 41, 148–155. [Google Scholar] [CrossRef]

- Dobrovolskienė, N.; Tamošiūnienė, R.; Banaitis, A.; Ferreira, F.A.; Banaitienė, N.; Taujanskaitė, K.; Meidutė-Kavaliauskienė, I. Developing a composite sustainability index for real estate projects using multiple criteria decision making. Oper. Res. 2019, 19, 617–635. [Google Scholar] [CrossRef]

- Daily, G.C.; Ehrlich, P.R. Socioeconomic equity, sustainability, and Earth’s carrying capacity. Ecol. Appl. 1996, 6, 991–1001. [Google Scholar] [CrossRef]

- Chia, J.; Harun, A.; Kassim, A.W.M.; Martin, D.; Kepal, N. Understanding factors that influence house purchase intention among consumers in Kota Kinabalu: An application of buyer behavior model theory. J. Technol. Manag. Bus. 2016, 3, 2. [Google Scholar]

- Ullah, F.; Sepasgozar, P.S.; Ali, T.H. Real Estate Stakeholders Technology Acceptance Model (RESTAM): User-focused Big9 Disruptive Technologies for Smart Real Estate Management. In Proceedings of the 2nd International Conference on Sustainable Development in Civil Engineering (ICSDC 2019), Jamshoro Pakistan, 5–7 December 2019; MUET: Jamshoro Pakistan, 2019. [Google Scholar]

- Tomal, M. Moving towards a Smarter Housing Market: The Example of Poland. Sustainability 2020, 12, 683. [Google Scholar] [CrossRef]

- Park, M. Home Buyers’ Top Five Regrets. Available online: https://www.washingtonpost.com/news/where-we-live/wp/2015/01/27/home-buyers-top-five-regrets/?utm_term=.88b73d31c991 (accessed on 25 April 2018).

- Chica-Olmo, J.; Cano-Guervos, R.; Chica-Rivas, M. Estimation of housing price variations using spatio-temporal data. Sustainability 2019, 11, 1551. [Google Scholar] [CrossRef]

- Waldron, R.; Redmond, D. “We’re just existing, not living!” Mortgage stress and the concealed costs of coping with crisis. Hous. Stud. 2017, 32, 584–612. [Google Scholar] [CrossRef]

- Pawson, H.; Hulse, K.; Morris, A. Interpreting the rise of long-term private renting in a liberal welfare regime context. Hous. Stud. 2017, 32, 1062–1084. [Google Scholar] [CrossRef]

- Ali, Q.; Thaheem, M.J.; Ullah, F.; Sepasgozar, S.M. The Performance Gap in Energy-Efficient Office Buildings: How the Occupants Can Help? Energies 2020, 13, 1480. [Google Scholar] [CrossRef]

- Munawar, H.S.; Hammad, A.; Ullah, F.; Ali, T.H. After the Flood: A Novel Application of Image Processing and Machine Learning for Post-Flood Disaster Management. In Proceedings of the 2nd International Conference on Sustainable Development in Civil Engineering (ICSDC 2019), Jamshoro Pakistan, 5–7 December 2019; MUET: Jamshoro Pakistan, 2019; pp. 52–61. [Google Scholar]

- Lin, Y.; Ma, Z.; Zhao, K.; Hu, W.; Wei, J. The impact of population migration on urban housing prices: Evidence from China’s major cities. Sustainability 2018, 10, 3169. [Google Scholar] [CrossRef]

- Fang, L.; Tian, C.; Yin, X.; Song, Y. Political cycles and the mix of industrial and residential land leasing. Sustainability 2018, 10, 3077. [Google Scholar] [CrossRef]

- Barreca, A.; Curto, R.; Rolando, D. Housing vulnerability and property prices: Spatial analyses in the Turin real estate market. Sustainability 2018, 10, 3068. [Google Scholar] [CrossRef]

- Trulia. Real Estate Regrets: Recovery Edition. Available online: https://www.trulia.com/blog/trends/regrets-2017/ (accessed on 25 April 2018).

- Bloom, E. The 3 Biggest Mistakes Anyone can make when Buying a High-End Home. Available online: https://www.cnbc.com/2017/06/13/the-biggest-mistakes-people-make-when-buying-million-dollar-properties.html (accessed on 8 June 2018).

- Woodruff, M. 1 in 4 Homeowners Regrets Buying a House. Available online: https://finance.yahoo.com/news/homeowners-regrets-buying-a-house-redfin-163113390.html (accessed on 8 June 2018).

- Geffner, M. Real Estate Regrets: 80 Percent of Homebuyers want a do-over. Available online: https://www.hsh.com/finance/real-estate/homebuyer-regrets.html (accessed on 8 June 2018).

- Leigh, A. Top 10 Most Common Real Estate Regrets. Available online: https://www.knockoutmortgages.com/index.php/articles/viewarticle/1247/top-10-most-common-real-estate-regrets (accessed on 8 June 2018).

- Chen, J.; Hui, E.C.; Wang, Z. Service quality, homebuyers’ regret and dissatisfaction in China real estate market. In Proceedings of the IEEE International Conference on Industrial Engineering and Engineering Management, Singapore, 8–11 December 2008. [Google Scholar]

- Heffter, E. Rookie Mistakes: Learn From First-Time Home Buyers’ Biggest Regrets. Available online: https://www.zillow.com/blog/first-time-home-buyer-regrets-152757/ (accessed on 8 June 2018).

- Ullah, F.; Sepasgozar, S.M. A Study of Information Technology Adoption for Real-Estate Management: A System Dynamic Model. Innov. Prod. Constr. Transform. Constr. Emerg. Technol. 2019, 469. [Google Scholar] [CrossRef]

- Reimsbach, D.; Hahn, R.; Gürtürk, A. Integrated reporting and assurance of sustainability information: An experimental study on professional investors’ information processing. Eur. Account. Rev. 2018, 27, 559–581. [Google Scholar] [CrossRef]

- Grewal, J.; Hauptmann, C.; Serafeim, G. Material sustainability information and stock price informativeness. J. Bus. Ethics 2020, 1–32. [Google Scholar] [CrossRef]

- Kearns, D. Home Buyer Reality Report 2017. Available online: https://www.nerdwallet.com/blog/mortgages/2017-home-buyer-reality-report/ (accessed on 8 June 2018).

- Clarke, W. One in Five Britons Regrets House-Buying Mistakes. Available online: https://www.telegraph.co.uk/finance/personalfinance/borrowing/mortgages/10078336/One-in-five-Britons-regrets-house-buying-mistakes.html (accessed on 8 June 2018).

- Kolko, J. Woulda Shoulda Coulda: Real Estate Regrets to Avoid. Available online: https://www.trulia.com/blog/trends/trulia-real-estate-regrets-survey/ (accessed on 8 June 2018).

- Shimizu, C.; Nishimura, K.G.; Watanabe, T. House prices at different stages of the buying/selling process. Reg. Sci. Urban Econ. 2016, 59, 37–53. [Google Scholar] [CrossRef]

- Nelson, T.-N. Top 5 homebuyer regrets. Available online: https://www.inman.com/2012/08/27/top-5-homebuyer-regrets/ (accessed on 8 June 2018).

- Chen, J.; Hui, E.; Wang, Z. More promotion-focused, more happy? Regulatory focus, post-purchase evaluations and regret in the real estate market. Urban Stud. 2017, 54, 251–268. [Google Scholar] [CrossRef]

- Sangkakoon, P.; Ngarmyarn, A.; Panichpathom, S. The influence of group references in home purchase intention in Thailand. In Proceedings of the 21st Annual European Real Estate Society Conference, Bucharest, Romania, 25–28 June 2014. [Google Scholar]

- Balderjahn, I.; Peyer, M.; Seegebarth, B.; Wiedmann, K.-P.; Weber, A. The many faces of sustainability-conscious consumers: A category-independent typology. J. Bus. Res. 2018, 91, 83–93. [Google Scholar] [CrossRef]

- Testa, F.; Russo, M.V.; Cornwell, T.B.; McDonald, A.; Reich, B. Social Sustainability as Buying Local: Effects of Soft Policy, Meso-Level Actors, and Social Influences on Purchase Intentions. J. Public Policy Mark. 2018, 37, 152–166. [Google Scholar] [CrossRef]

- Beltrame, J. To Avoid Home-Buyers’ Regret, Do Your Homework. Available online: https://www.theglobeandmail.com/real-estate/mortgages-and-rates/to-avoid-home-buyers-regret-do-your-homework/article4484879/ (accessed on 8 June 2018).

- Bloom, E. This Is the No. 1 Thing Buyers Regret about Purchasing a Home. Available online: https://www.cnbc.com/2017/07/17/this-is-the-no-1-thing-buyers-regret-about-purchasing-a-home.html (accessed on 8 June 2018).

- Omagwa, J.; Aduda, J. The Mediating Effect of Housing Search on the relationship between Demographics and Residential Housing Decisions amongst Apartment Households in Nairobi County, Kenya. Adv. Manag. Appl. Econ. 2015, 5, 105. [Google Scholar]

- Viggers, H.; Keall, M.; Wickens, K.; Howden-Chapman, P. Occupancy inefficiency of larger detached houses. In Proceedings of the 7th International Conference on Energy and Environment of Residential Buildings, Brisbane, Australia, 20–24 November 2016. [Google Scholar]

- Khajehzadeh, I.; Vale, B. How house size impacts type, combination and size of rooms: A floor plan study of New Zealand houses. Archit. Eng. Des. Manag. 2017, 13, 291–307. [Google Scholar] [CrossRef]

- Wong, S.Y.; Susilawati, C.; Miller, W.; Mardiasmo, D. Perspectives of Australian property practitioners on sustainability features in residential property. J. Hous. Built Environ. 2020, 1–23. [Google Scholar] [CrossRef]

- Forrest, N.; Stein, Z.; Wiek, A. Water-independent residential properties as a transformational solution to achieve water sustainability in desert cities? J. Clean. Prod. 2019, 214, 1038–1049. [Google Scholar] [CrossRef]

- Li, X.; Lim, M.K.; Ni, D.; Zhong, B.; Xiao, Z.; Hao, H. Sustainability or continuous damage: A behavior study of prosumers’ electricity consumption after installing household distributed energy resources. J. Clean. Prod. 2020, 121471. [Google Scholar] [CrossRef]

- Willets, D. No Place Like Home: The Generation Who Can’t Afford to Buy. Available online: https://www.independent.co.uk/property/house-and-home/no-place-like-home-the-generation-who-cant-afford-to-buy-1921781.html (accessed on 8 June 2018).

- Mayfield, J.D. Real Estate Statistics: Why You Should Know the Data. Available online: http://realtormag.realtor.org/for-brokers/feature/article/2011/08/real-estate-statistics-why-you-should-know-data (accessed on 8 June 2018).

- Ahmad, T.; Thaheem, M.J.; Anwar, A. Developing a green-building design approach by selective use of systems and techniques. Archit. Eng. Des. Manag. 2016, 12, 29–50. [Google Scholar] [CrossRef]

- Ullah, F.; Speasgozar, S.M.E.; Siddiqui, S.Q. An Investigation of Real Estate Technology Utilization in Technologically Advanced Marketplace. In Striving Towards Resilient Built Environment, Proceedings of the 9th International International Civil Engineering Congress (ICEC-2017), Karachi, Pakistan, 22–23 December 2017; Arif, S.H.L.F., Sangi, A.J., Eds.; Institute of Engineers Pakistan & NED University: Karachi Pakistan, 2017; pp. 173–183. [Google Scholar]

- Cerutti, E.; Dagher, J.; Dell’Ariccia, G. Housing finance and real-estate booms: A cross-country perspective. J. Hous. Econ. 2017, 38, 1–13. [Google Scholar] [CrossRef]

- Glaeser, E.; Huang, W.; Ma, Y.; Shleifer, A. A real estate boom with Chinese Characteristics. J. Econ. Perspect. 2017, 31, 93–116. [Google Scholar] [CrossRef]

- Wang, X.-Q.; Hao, L.-N.; Tao, R.; Su, C.-W. Does money supply growth drive housing boom in China? A wavelet-based analysis. J. Hous. Built Environ. 2019, 35, 1–17. [Google Scholar] [CrossRef]

- Basten, C.; Koch, C. The causal effect of house prices on mortgage demand and mortgage supply: Evidence from Switzerland. J. Hous. Econ. 2015, 30, 1–22. [Google Scholar] [CrossRef]

- Szymanoski, E.J.; Lam, A.; Feather, C. Financial Sustainability and the Home Equity Conversion Mortgage: Advancing Fiscal Soundness and Affordable Financing for Senior Homeowners. Cityscape 2017, 19, 47–72. [Google Scholar]

- Li, S.; Gao, N. Housing price and enterprise financing: Does mortgage effect exist? China Financ. Rev. Int. 2019, 9, 137–152. [Google Scholar] [CrossRef]

- Małkowska, A.; Uhruska, M.; Tomal, M. Age and Experience versus Susceptibility to Client Pressure among Property Valuation Professionals—Implications for Rethinking Institutional Framework. Sustainability 2019, 11, 6759. [Google Scholar] [CrossRef]

- Luchs, M.G.; Brower, J.; Chitturi, R. Product choice and the importance of aesthetic design given the emotion-laden trade-off between sustainability and functional performance. J. Prod. Innov. Manag. 2012, 29, 903–916. [Google Scholar] [CrossRef]

- Tanner, K.J. Emotion, gender and the sustainability of communities. J. Community Inform. 2005, 1, 2. [Google Scholar]

- Herbertson, L. Australians only Spending one Hour to Buy a Home. Available online: https://www.news.com.au/finance/real-estate/perth-wa/australians-only-spending-one-hour-to-buy-a-home/news-story/d2cd80ee981a2d0a02b3edfc317193d1 (accessed on 8 June 2018).

- Besbris, M. Romancing the home: Emotions and the interactional creation of demand in the housing market. Socio-Econ. Rev. 2016, 14, 461–482. [Google Scholar] [CrossRef]

- Clark, W.A.; Duque-Calvache, R.; Palomares-Linares, I. Place attachment and the decision to stay in the neighbourhood. Popul. Space Place 2017, 23. [Google Scholar] [CrossRef]

- Phillimore, J. Housing, home and neighbourhood renewal in the era of superdiversity: Some lessons from the West Midlands. Hous. Stud. 2013, 28, 682–700. [Google Scholar] [CrossRef]

- Barwick, P.J.; Pathak, P.A. The costs of free entry: An empirical study of real estate agents in Greater Boston. RAND J. Econ. 2015, 46, 103–145. [Google Scholar] [CrossRef]

- Munneke, H.J.; Ooi, J.T.; Sirmans, C.; Turnbull, G.K. Real estate agents, house prices, and liquidity. J. Real Estate Financ. Econ. 2015, 50, 1–33. [Google Scholar] [CrossRef]

- Wong, S.Y.; Susilawati, C.; Miller, W.F.; Mardiasmo, D. Understanding Australian real estate agent perspectives in promoting sustainability features in the residential property market. In Proceedings of the 7th International Conference on Energy and Envrionment of Residential Buildings, Brisbane, Australia, 20–24 November 2016; Queensland University of Technology: Queensland, Australia, 2016. [Google Scholar]

- Bryant, L.; Eves, C. Home sustainability policy and mandatory disclosure. Prop. Manag. 2012, 30, 29–51. [Google Scholar] [CrossRef][Green Version]

- Gatzlaff, D.; McCullough, K.; Medders, L.; Nyce, C.M. The impact of hurricane mitigation features and inspection information on house prices. J. Real Estate Financ. Econ. 2015, 4, 1–26. [Google Scholar] [CrossRef]

- Sir, E.S.; Pariazar, M.; Sir, M.Y. Capacitated inspection scheduling of multi-unit systems. Comput. Ind. Eng. 2018, 120, 471–479. [Google Scholar]

- Felli, F.; Liu, C.; Ullah, F.; Sepasgozar, S. Implementation of 360 videos and mobile laser measurement technologies for immersive visualisation of real estate & properties. In Proceedings of the 42nd AUBEA Conference, Singapore, 26–28 September 2018. [Google Scholar]

- Shirowzhan, S.; Sepasgozar, S.M.; Li, H.; Trinder, J.; Tang, P. Comparative analysis of machine learning and point-based algorithms for detecting 3D changes in buildings over time using bi-temporal lidar data. Autom. Constr. 2019, 105, 102841. [Google Scholar] [CrossRef]

- Shirowzhan, S.; Sepasgozar, S.M.; Ullah, F.; Minhas, P.S. Implication of a Construction Labour Tracking System for Measuring Labour Productivity. Innov. Prod. Constr. Transform. Constr. Emerg. Technol. 2019, 1. [Google Scholar] [CrossRef]

- Sepasgozar, S.; Lim, S.; Shirowzhan, S.; Kim, Y.; Nadoushani, Z.M. Utilisation of a new terrestrial scanner for reconstruction of as-built models: A comparative study. In Proceedings of the International Symposium on Automation and Robotics in Construction, Oulu, Finland, 15–18 June 2015; IAARC Publications: London, UK, 2015. [Google Scholar]

- Sepasgozar, S.; Davis, S. Construction technology adoption cube: An investigation on process, factors, barriers, drivers and decision makers using NVivo and AHP analysis. Buildings 2018, 8, 74. [Google Scholar] [CrossRef]

- Weiss, S.M.; Indurkhya, N.; Zhang, T. Fundamentals of Predictive Text Mining; Springer: Berlin, Germany, 2015. [Google Scholar]

- Moro, S.; Cortez, P.; Rita, P. Business intelligence in banking: A literature analysis from 2002 to 2013 using text mining and latent Dirichlet allocation. Expert Syst. Appl. 2015, 42, 1314–1324. [Google Scholar] [CrossRef]

- Pletscher-Frankild, S.; Pallejà, A.; Tsafou, K.; Binder, J.X.; Jensen, L.J. DISEASES: Text mining and data integration of disease–gene associations. Methods 2015, 74, 83–89. [Google Scholar] [CrossRef] [PubMed]

- Zamani, M.; Schwartz, H.A. Using Twitter Language to Predict the Real Estate Market. In Proceedings of the 15th Conference of the European Chapter of the Association for Computational Linguistics, Valencia, Spain, 3–7 April 2017; Volume 2. Short Papers 2017. [Google Scholar]

- Gan, V.; Agarwal, V.; Kim, B. Data mining analysis and predictions of real estate prices. Issues Inf. Syst. 2015, 16, 30–36. [Google Scholar]

- Zhou, Y.; Tong, Y.; Gu, R.; Gall, H. Combining text mining and data mining for bug report classification. J. Softw. Evol. Process 2016, 28, 150–176. [Google Scholar] [CrossRef]

- Hsiao, Y.-H.; Chen, M.-C.; Liao, W.-C. Logistics service design for cross-border E-commerce using Kansei engineering with text-mining-based online content analysis. Telemat. Inform. 2017, 34, 284–302. [Google Scholar] [CrossRef]

- Predictive Analytics. General Architecture for Text Engineering- GATE. Available online: https://www.predictiveanalyticstoday.com/general-architecture-text-engineering-gate/ (accessed on 18 April 2020).

- Sterman, J.D. Learning in and about complex systems. Syst. Dyn. Rev. 1994, 10, 291–330. [Google Scholar] [CrossRef]

- Forrester, J.W. Counterintuitive behavior of social systems. Theory Decis. 1971, 2, 109–140. [Google Scholar] [CrossRef]

- Ullah, F.; Thaheem, M.J.; Sepasgozar, S.M.; Forcada, N. System dynamics model to determine concession period of PPP infrastructure projects: Overarching effects of critical success factors. J. Legal Aff. Disput. Resolut. Eng. Constr. 2018, 10, 04518022. [Google Scholar] [CrossRef]

- Ullah, F.; Thaheem, M.J.; Siddiqui, S.Q.; Khurshid, M.B. Influence of Six Sigma on project success in construction industry of Pakistan. TQM J. 2017, 29, 276–309. [Google Scholar] [CrossRef]

- Ding, Z.; Zhu, M.; Tam, V.W.; Yi, G.; Tran, C.N. A system dynamics-based environmental benefit assessment model of construction waste reduction management at the design and construction stages. J. Clean. Prod. 2018, 176, 676–692. [Google Scholar] [CrossRef]

- Robin, E. Performing real estate value (s): Real estate developers, systems of expertise and the production of space. Geoforum 2018. [Google Scholar] [CrossRef]

- Hanan, J.S. Home is where the capital is: The culture of real estate in an era of control societies. Commun. Crit. Cult. Stud. 2010, 7, 176–201. [Google Scholar] [CrossRef]

- Kucharska-Stasiak, E. Reproduction of Real Estate Valuation Methodology in Practice. An Attempt at Identifying Sources of Divergences. Real Estate Manag. Valuat. 2014, 22, 67–79. [Google Scholar] [CrossRef]

- Poursaeed, O.; Matera, T.; Belongie, S. Vision-based real estate price estimation. Mach. Vis. Appl. 2018, 29, 667–676. [Google Scholar] [CrossRef]

| Time | Strings Used | Articles Retrieved | Duplicates |

|---|---|---|---|

| Unrestricted | Real estate regrets OR Homebuyers regrets OR Renters regrets | 18,400,000 | |

| P1 (2010-14) | AND Tools>AnyTime>CustomRange>1Jan2010- | ||

| 31Dec2014>SortByRelevance | 287 | ||

| Remove Duplicates | 240 | 47 | |

| ENGLSIH Language only limit | 212 | ||

| AND NO Videos, Images, Descriptions | 162 | ||

| AND NO non-statistical articles | 57 | ||

| P2 (2015-19) | AND Tools>AnyTime>CustomRange>1Jan2015- | ||

| 31Dec2019>SortByRelevance | 337 | ||

| Remove Duplicates | 275 | 62 | |

| ENGLSIH Language only limit | 237 | ||

| AND NO Videos, Images, Descriptions | 193 | ||

| AND NO non-statistical articles | 61 | ||

| Total Articles Retrieved | 118 | ||

| Criteria | Values | Individual Factor Values (Given and Normalised) | Total Count | Contribution | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NEI | GP2 | 22 | 14 | 15 | 25 | 14 | 15 | 14 | 15 | 7 | 17 | 24 | 14 | 21 | 217 | 13.53 |

| NP2 | 0.10 | 0.06 | 0.07 | 0.12 | 0.06 | 0.07 | 0.06 | 0.07 | 0.03 | 0.08 | 0.11 | 0.06 | 0.10 | |||

| GP1 | 30 | 46 | 5.9 | 77 | 13.9 | 45 | 217.8 | 19.20 | ||||||||

| NP1 | 0.14 | 0.21 | 0.03 | 0.35 | 0.06 | 0.21 | ||||||||||

| BS | GP2 | 80 | 21 | 32 | 42 | 19 | 55 | 49 | 38 | 44 | 61 | 16 | 457 | 28.49 | ||

| NP2 | 0.18 | 0.05 | 0.07 | 0.09 | 0.04 | 0.12 | 0.11 | 0.08 | 0.1 | 0.13 | 0.04 | |||||

| GP1 | 56 | 50 | 52 | 42 | 20 | 220 | 19.40 | |||||||||

| NP1 | 0.25 | 0.23 | 0.24 | 0.19 | 0.09 | |||||||||||

| HS | GP2 | 62 | 9 | 16 | 42 | 12 | 33 | 20 | 20 | 214 | 13.34 | |||||

| NP2 | 0.29 | 0.04 | 0.07 | 0.2 | 0.06 | 0.15 | 0.09 | 0.09 | ||||||||

| GP1 | 54 | 39 | 34 | 127 | 11.20 | |||||||||||

| NP1 | 0.43 | 0.31 | 0.27 | |||||||||||||

| HC | GP2 | 15 | 62 | 11 | 15 | 29 | 28 | 18 | 40 | 38 | 20 | 20 | 14 | 310 | 19.33 | |

| NP2 | 0.05 | 0.2 | 0.04 | 0.05 | 0.09 | 0.09 | 0.06 | 0.13 | 0.12 | 0.06 | 0.06 | 0.05 | ||||

| GP1 | 57 | 90 | 27 | 29 | 50 | 12.5 | 80 | 265.5 | 23.41 | |||||||

| NP1 | 0.21 | 0.34 | 0.10 | 0.11 | 0.19 | 0.05 | 0.30 | |||||||||

| MT | GP2 | 41 | 27 | 18 | 86 | 5.36 | ||||||||||

| NP2 | 0.48 | 0.31 | 0.21 | |||||||||||||

| GP1 | 25 | 60 | 20 | 105 | 9.26 | |||||||||||

| NP1 | 0.24 | 0.57 | 0.19 | |||||||||||||

| EM | GP2 | 90 | 20 | 110 | 6.86 | |||||||||||

| NP2 | 0.82 | 0.18 | ||||||||||||||

| GP1 | NA | NA | ||||||||||||||

| NP1 | ||||||||||||||||

| AG | GP2 | 32 | 23 | 29 | 84 | 5.24 | ||||||||||

| NP2 | 0.38 | 0.27 | 0.35 | |||||||||||||

| GP1 | 83 | 96 | 179 | 15.68 | ||||||||||||

| NP1 | 0.46 | 0.54 | ||||||||||||||

| IP | GP2 | 15 | 41 | 11 | 10 | 14 | 15 | 20 | 126 | 7.86 | ||||||

| NP2 | 0.12 | 0.33 | 0.09 | 0.08 | 0.11 | 0.12 | 0.16 | |||||||||

| GP1 | 20 | 20 | 1.76 | |||||||||||||

| NP1 | 1 | |||||||||||||||

| Respondent | Code | Profession | Experience | Country |

|---|---|---|---|---|

| 1 | M1 | Real Estate Managers | 41 Years | USA |

| 2 | M2 | 22 Years | Australia | |

| 3 | M3 | 20 Years | USA | |

| 4 | M4 | 30 Years | Australia | |

| 5 | M5 | 38 Years | UK | |

| 6 | M6 | 20 Years | USA | |

| 7 | M7 | 20 Years | Australia | |

| 8 | A1 | Real Estate Agents | 22 Years | USA |

| 9 | A2 | 27 Years | Australia | |

| 10 | A3 | 42 Years | UK | |

| 11 | A4 | 25 Years | USA | |

| 12 | A5 | 30 Years | Australia | |

| 13 | P1 | Photographer | 12 Years | USA |

| 14 | C1 | Real Estate Consumers | 3 Purchases | USA |

| 15 | C2 | 5 Rentals | Australia | |

| 16 | C3 | 3 Purchases | Australia | |

| 17 | C4 | 8 Rentals | UK | |

| 18 | C5 | 4 Purchases | USA | |

| 19 | C6 | 6 Rentals | UK | |

| 20 | C7 | 3 Rentals | Australia | |

| 21 | C8 | 3 Purchases | Australia | |

| 22 | C9 | 4 Rentals | UK | |

| 23 | C10 | 12 Rentals | Australia |

| Thread | Question Title | Running Period | Responses | Sub Classification |

|---|---|---|---|---|

| T1 | Have you regretted buying a house? | P1 | 50 | All responses in P1 |

| T2 | Have you ever had house purchase regret and how did you cope? | P2 | 14 | All responses in P2 |

| T3 | Anyone else regret buying your house? | P1, P2 | 44 | 16 in P1, 28 in P2 |

| T4 | Anyone regretted buying a house? | P1 | 27 | All responses in P1 |

| Article Topic | Regrets | NEI | BS | HS | HC | MT | EM | AG | IP | Total |

|---|---|---|---|---|---|---|---|---|---|---|

| Homebuyers’ Regrets | 780 | 509 | 41 | 0 | 0 | 0 | 59 | 61 | 0 | 1450 |

| House Affordability | 14 | 11 | 277 | 26 | 30 | 109 | 0 | 29 | 0 | 496 |

| Regrets and Post-purchase experience | 256 | 73 | 572 | 10 | 61 | 11 | 70 | 13 | 0 | 1066 |

| Real Estate Statistics | 0 | 107 | 351 | 0 | 0 | 0 | 0 | 67 | 0 | 525 |

| Avoiding Home buyers Regrets | 72 | 28 | 229 | 13 | 100 | 83 | 0 | 70 | 22 | 617 |

| Home buying Mistakes | 88 | 0 | 19 | 0 | 11 | 87 | 0 | 10 | 0 | 215 |

| Real Estate Regrets to avoid | 565 | 31 | 253 | 84 | 72 | 29 | 0 | 0 | 0 | 1034 |

| Real Estate regrets: do-over | 135 | 121 | 167 | 48 | 38 | 73 | 0 | 0 | 0 | 582 |

| First Time Buyers regrets | 210 | 109 | 191 | 41 | 40 | 12 | 31 | 57 | 0 | 691 |

| Home buyers regrets | 73 | 33 | 130 | 0 | 10 | 28 | 17 | 17 | 41 | 349 |

| Top 10 real estate regrets | 107 | 29 | 170 | 18 | 29 | 56 | 0 | 28 | 27 | 464 |

| Home Buyers Regrets | 102 | 99 | 211 | 11 | 37 | 12 | 0 | 38 | 9 | 519 |

| Biggest mistakes in house buying | 47 | 23 | 99 | 9 | 10 | 0 | 25 | 0 | 0 | 213 |

| House Purchase regrets | 88 | 27 | 100 | 20 | 11 | 0 | 0 | 0 | 0 | 246 |

| Home buyers’ reality report | 106 | 69 | 432 | 1 | 29 | 1037 | 18 | 50 | 0 | 1742 |

| Regrets after buying a house | 77 | 41 | 178 | 0 | 72 | 61 | 0 | 0 | 11 | 440 |

| Real Estate Regrets | 462 | 103 | 69 | 51 | 48 | 62 | 0 | 0 | 0 | 795 |

| Australian House buying | 19 | 21 | 96 | 0 | 0 | 0 | 17 | 0 | 63 | 216 |

| Total | 3201 | 1434 | 3585 | 332 | 598 | 1660 | 237 | 440 | 173 | 11,660 |

| Regret Group | Factors | P1 | P2 | TR | TH | TGR | TGH | ||

|---|---|---|---|---|---|---|---|---|---|

| R | H | R | H | ||||||

| NEI | Neighbourhood Information | 12 | 2 | 7 | 1 | 19 | 3 | 45 | 7 |

| Less or little Information | 6 | 0 | 8 | 1 | 14 | 1 | |||

| Travel time to amenities | 5 | 0 | 2 | 0 | 7 | 0 | |||

| Natural Sunlight | 1 | 1 | 3 | 0 | 4 | 1 | |||

| Social Life | 1 | 0 | 0 | 0 | 1 | 0 | |||

| Security Issues | 0 | 2 | 0 | 0 | 0 | 2 | |||

| HS | House Size | 9 | 1 | 11 | 1 | 20 | 2 | 36 | 5 |

| House Design | 5 | 0 | 10 | 2 | 15 | 2 | |||

| Garden and Greenery | 0 | 0 | 1 | 1 | 1 | 1 | |||

| BS | Transaction Costs | 16 | 18 | 16 | 0 | 32 | 18 | 41 | 30 |

| Sale Losses | 6 | 10 | 3 | 2 | 9 | 12 | |||

| HC | Renovation Required | 14 | 5 | 17 | 0 | 31 | 5 | 31 | 5 |

| MT | Mortgage Payments | 8 | 6 | 7 | 0 | 15 | 6 | 15 | 6 |

| IP | Inspections | 0 | 1 | 4 | 0 | 4 | 1 | 4 | 1 |

| EM | Impatient Decisions | 4 | 0 | 6 | 0 | 10 | 0 | 10 | 0 |

| AG | Bad Agents | 0 | 0 | 1 | 0 | 1 | 0 | 1 | 0 |

| Yearly Total | 87 | 46 | 96 | 8 | 183 | 54 | 183 | 54 | |

| Sample Size | 80 | 55 | 135 | ||||||

| Groups | Keywords | M1 | M2 | M3 | M4 | M5 | M6 | M7 | P1 | A1 | A2 | A3 | A4 | A5 | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| IP | Inspection | * | * | * | * | * | * | * | * | * | * | * | * | * | * | 14 | |||||||||

| NEI | Less or little Information | * | * | * | * | * | * | * | * | * | 9 | ||||||||||||||

| Property Records | * | * | * | 3 | |||||||||||||||||||||

| Neighbourhood Information | * | * | 2 | ||||||||||||||||||||||

| Financial History | * | * | 2 | ||||||||||||||||||||||

| Video Walk throughs | * | 1 | |||||||||||||||||||||||

| WI | Info Accuracy | * | * | * | * | * | * | * | * | 8 | |||||||||||||||

| Website Reliability | * | * | * | * | 4 | ||||||||||||||||||||

| Speed & Results | * | 1 | |||||||||||||||||||||||

| BS | Prefer Renting | * | * | 2 | |||||||||||||||||||||

| Hidden Costs | * | 1 | |||||||||||||||||||||||

| Wrong Valuation | * | * | 2 | ||||||||||||||||||||||

| AG | Reliable Agents | * | * | * | 3 | ||||||||||||||||||||

| EM | Patience | * | 1 | ||||||||||||||||||||||

| Count | 4 | 2 | 1 | 1 | 4 | 2 | 1 | 5 | 3 | 2 | 2 | 2 | 3 | 3 | 2 | 2 | 1 | 2 | 2 | 4 | 2 | 2 | 1 | 53 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ullah, F.; Sepasgozar, S.M.E. Key Factors Influencing Purchase or Rent Decisions in Smart Real Estate Investments: A System Dynamics Approach Using Online Forum Thread Data. Sustainability 2020, 12, 4382. https://doi.org/10.3390/su12114382

Ullah F, Sepasgozar SME. Key Factors Influencing Purchase or Rent Decisions in Smart Real Estate Investments: A System Dynamics Approach Using Online Forum Thread Data. Sustainability. 2020; 12(11):4382. https://doi.org/10.3390/su12114382

Chicago/Turabian StyleUllah, Fahim, and Samad M. E. Sepasgozar. 2020. "Key Factors Influencing Purchase or Rent Decisions in Smart Real Estate Investments: A System Dynamics Approach Using Online Forum Thread Data" Sustainability 12, no. 11: 4382. https://doi.org/10.3390/su12114382

APA StyleUllah, F., & Sepasgozar, S. M. E. (2020). Key Factors Influencing Purchase or Rent Decisions in Smart Real Estate Investments: A System Dynamics Approach Using Online Forum Thread Data. Sustainability, 12(11), 4382. https://doi.org/10.3390/su12114382