Informal Seed Traders: The Backbone of Seed Business and African Smallholder Seed Supply

Abstract

:1. Introduction

- Potential seed traders (aka seed/grain traders) are not immediately recognizable or locatable. They are not known by a storefront or signage, but are known by their customers. They do not have specific potential seed shops and their business by nature is seasonal. Most of the year, such traders sell mainly grain. Their potential seed business accelerates in the months prior and during sowing periods.

- There has been a need to develop refined methods to trace the potential seed trade, as distinct from grain and from formally sanctioned certified or quality declared seed (QDS). In field investigations, traders easily used terminology directly referring to local seed business—or grain then sorted as seed—while researchers were often reluctant to recognize any local material as seed. (For some of the seed-linked terminology used in varied field investigations see: https://seedsystem.org/assessments-and-e-learning-course/tips-for-planning-implementation/).

- Legal regulations challenge the very existence of potential seed in many countries in Africa, the geographic scope of this article. Seed is only ‘seed‘ if it is formally produced by a registered set of growers and sold in clearly stipulated outlets [14,15]. Traders selling potential seed could fear legal prosecution or monetary fines if they advertise their wares specifically as ‘seed’ and sell them in venues where farmers seek seed, such as in open markets and rural corner shops.

2. Materials and Methods

2.1. Scope and Context

2.2. Sample Size and Specific ID of Potential Seed Traders

2.3. Instruments

3. Results

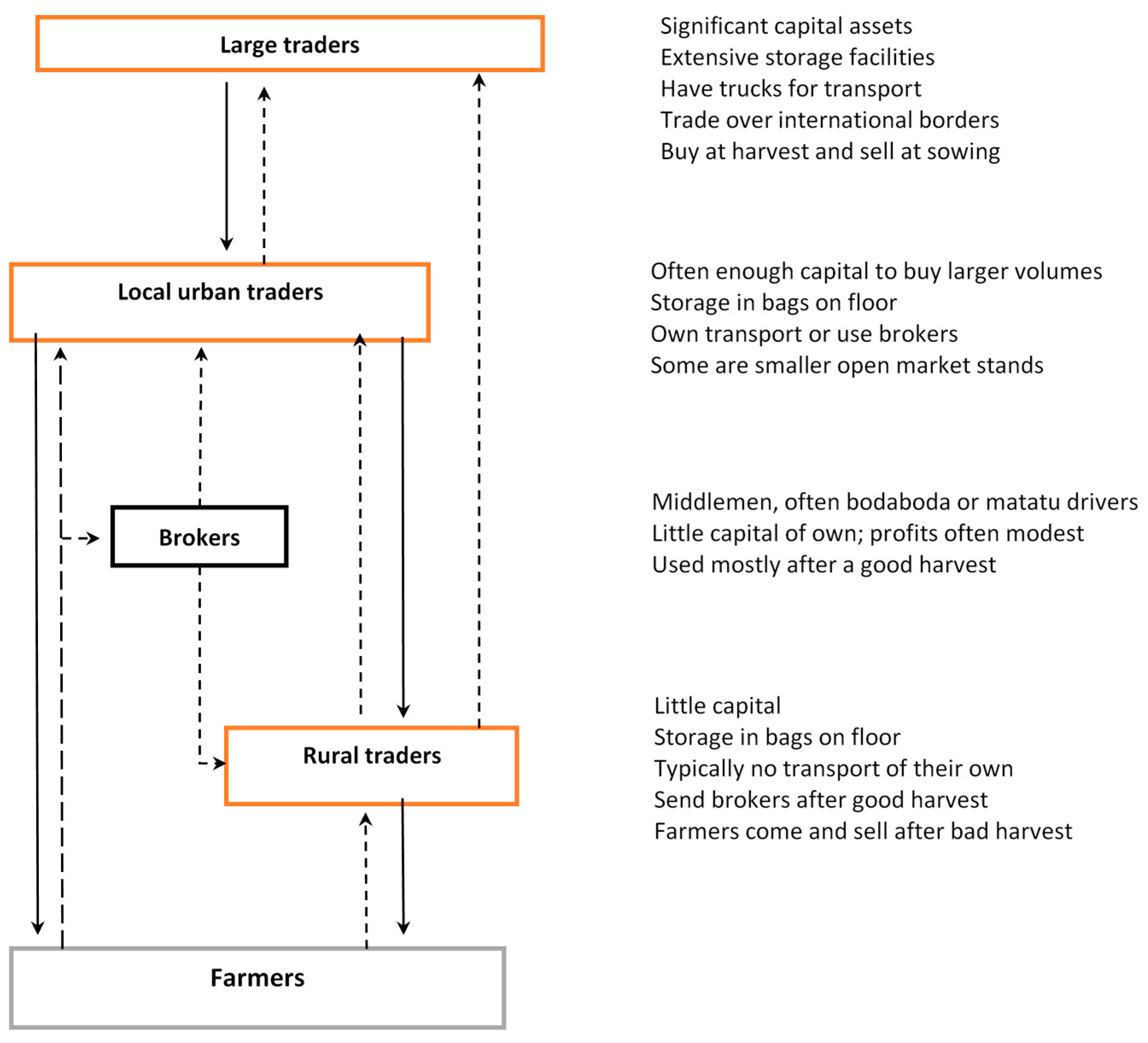

3.1. Traders: Type and Hierarchy

3.1.1. Levels

3.1.2. Diagramming Specific Potential Seed Flows

- a.

- Eastern Kenya potential seed trader diagram 2011

- b.

- Northeastern Zimbabwe—potential seed trader diagram

3.1.3. Discussion of Potential Seed Trader Hierarchies

- (a)

- Traders serving high-stress areas, and those who deal in crops with narrow adaptation, are acutely aware of the market for potential seed, rather than for just grain. As examples: large traders serving Hararghe routinely source sorghum seed within a 25 km radius, in contrast to the 100 km+ radius for sourcing common bean seed [17], with these stocks kept separate during storage and sale. In northern Mali, a cluster of villages is well-known for producing an early maturing pearl millet variety, essential for the more arid areas of Douentza Circle. This trade again, conducted at a regional scale, is quite specialized towards adapted local seed—not grain (SSSA Mali 2006).

- (b)

- Larger traders serving urban and peri-urban markets recognize that important numbers of town dwellers maintain small, intensively-cultivated plots. Such is the case for a number of large traders in the Mbare Msika market, Harare, Zimbabwe, who cater to a surrounding population of 500,000 farmers or more (SSSA Zimbabwe 2017).

3.2. Traders Managing Potential Seed and Farmers Seeking Potential Seed

3.2.1. Trader Potential Seed Management: Specific Actions

3.2.2. Farmer Seed-Buying Signals

- directly asks for seed;

- asks about the provenance of the varieties, whether they are locally adapted and whether they have been directly procured from farmers; sometimes asks for specific seed grower’s name;

- asks about the performance, in terms of maturity and yield;

- sorts out, carefully, from the bins, the specific varieties he/she wants;

- demands a specific variety, by name, known for performance;

- asks for ‘modern’ seeds;

- requires seed from most recent harvest (or asks about exact harvest date);

- requires that the batches be ‘pure’ of a single variety;

- enquires about storage conditions;

- asks about germination; bites and smells the seed to look at freshness and moisture content;

- buys a small amount, in a ‘sowing size’ tin.

3.3. Price Differences Between Potential Seed and Grain

3.4. Traders and Stress Periods

4. Discussion

- (a)

- For formal sector proponents, market seed is not recognized as seed at all, but rather labeled ‘grain’ or ‘grain markets’; and

- (b)

- Informal sector enthusiasts often hold dear to the tenet that smallholders always save their seed or share liberally through social networks—so market use for seed is invisible or deemed minimal [24,25]. In some regions, even farmers themselves may hide use of local markets for seed, feeling shamed for seeking seed off-farm or stigmatized as less-good managers (SSSA Mali 2006).

4.1. Framework for Supporting Seed Security-Linked Traders

- Introduce new varieties

- Maintain and enhance quality of seed

- Diminish storage loss of seed—take over risk from farmer

- Serve as service provider in a storage function

- Maintain local varieties and serve as source of local varieties

- Serve as information function on good seed and new varieties

- Serve as seed security function (provide seed stocks, in normal and stress periods)

- Move seed to remote areas… (They may act fast, good social connections, social certification, knowledge of adaptation zones, planting times, potential seed demand, end market demand)

4.2. Legal and Donor Insight into Embracing Trader Roles

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Barriga, A.; Fiala, N. The supply chain for seed in Uganda: Where does it go wrong? World Development 2020, 130, 104928. [Google Scholar] [CrossRef]

- World Bank. Enabling the Business of Agriculture; World Bank Group: Washington, DC, USA, 2017; Available online: http://documents.worldbank.org/curated/en/369051490124575049/Enabling-the-business-of-agriculture-2017 (accessed on 6 August 2020).

- FAO. Seeds in Emergencies: A Technical Handbook; Food and Agricultural Organization of the United Nations: Rome, Italy, 2010; Available online: http://www.fao.org/resilience/resources/resources-detail/en/c/278935/ (accessed on 8 August 2020).

- McGuire, S.J.; Sperling, L. Seed systems smallholder farmers use. Food Secur. 2016, 8, 179–195. [Google Scholar] [CrossRef] [Green Version]

- Sperling, L.; McGuire, S.J. Understanding and Strengthening Informal Seed Markets. Exper. Agric. 2010, 46, 119–136. [Google Scholar] [CrossRef] [Green Version]

- Rachkara, P.; Phillips, D.P.; Kalule, S.W.; Gibson, R.W. Innovative and beneficial informal sweetpotato seed private enterprise in northern Uganda. Food Secur. 2017, 9, 595–610. [Google Scholar] [CrossRef]

- David, S.; Sperling, L. Improving technology delivery mechanisms: Lessons from bean seed systems research in Eastern and Central Africa. Agric. Hum. Val. 1999, 16, 381–388. [Google Scholar] [CrossRef]

- Lipper, L.; Anderson, L.; Dalton, T.J. (Eds.) Seed Trade in Rural Markets: Implications for Crop Diversity and Agricultural Development; Earthscan: London, UK, 2010. [Google Scholar]

- Smale, M.; Diakité, L.; Keita, N. Millet transactions in market fairs, millet diversity and farmer welfare in Mali. Environ. Dev. Econ. 2012, 17, 523–546. [Google Scholar] [CrossRef]

- AGRA. The Africa Agriculture Status Report: Focus on Staple Crops; Alliance for a Green Revolution in Africa: Nairobi, Kenya, 2013; Available online: http://www.farmaf.org/en/publications-and-resources/related-materials/54-the-africa-agriculture-status-report-focus-on-staple-crops-2013 (accessed on 28 August 2020).

- Awotide, B.A.; Awoyemi, T.T.; Diagne, A. Access to certified, improved rice seed and farmers’ income in Nigeria. J. Crop. Improv. 2012, 26, 558–579. [Google Scholar] [CrossRef]

- ICARDA. Strengthening Seed Systems for Robust Food Security; International Center for Agricultural Research in the Dry Areas: Beirut, Lebanon, 2014; Available online: http://www.icarda.org/strengthening-seed-systems-robust-food-security (accessed on 20 August 2014).

- Martens, B.J.; Scheibe, K.P.; Bergey, P.K. Supply chains in sub-Saharan Africa: A decision support system for small-scale seed entrepreneurs. Decis. Sci. 2012, 43, 737–759. [Google Scholar] [CrossRef] [Green Version]

- FAO. Review of the Status and Trends of Seed Policies and Seed Laws; Commission on Genetic Resources for Food and Agriculture: Rome, Italy, 2019; Available online: http://www.fao.org/3/my782en/my782en.pdf (accessed on 20 August 2020).

- ISSD Africa. The Support for Farmer-Led Systems in African Seed Laws. Synthesis Paper; ISSD: Amsterdam, The Netherlands, 2017; Available online: http://hdl.handle.net/10568/81545 (accessed on 31 July 2018).

- Byrne, K.G.; March, J.; McGuire, S.; Meissner, L.; Sperling, L. The role of evidence in humanitarian assessment: The Seed System Security Assessment and the Emergency Market Mapping and Analysis. Disasters 2013, 37, S83–S104. [Google Scholar] [CrossRef] [PubMed]

- Sperling, L. When Disaster Strikes: A Guide for Assessing Seed Security; CIAT: Cali, Colombia, 2008; Available online: https://seedsystem.org/wp-content/uploads/2013/07/sssa_manual_ciat.pdf (accessed on 6 August 2020).

- Birachi, E.; Sperling, L.; Kadege, E.; Mdachi, M.; Upendo, T.; Kessy, R.F. An Analysis of the Yellow Bean Corridor: A Status Report of Tanzania; CIAT: Arusha, Tanzania, 2020. [Google Scholar]

- Sperling, L.; Templar, N.; Gallagher, P.; Kadege, E.; Mcharo, D.; Kessy, R.F.; Mutua, M.; Mbiu, J.; Raya, N.; Ndunguru, A.; et al. The Informal Seed Sector Driving the Yellow Bean Corridor in Tanzania; ABC-PABRA: Nairobi, Kenya, 2020; In prep. [Google Scholar]

- Otsyula, R.; Rachier, G.; Ambitsi, N.; Juma, R.; Ndiya, C.; Buruchara, R.; Sperling, L. The use of informal seed producer groups for diffusing root rot resistant varieties during period of acute stress. In Addressing Seed Security in Disaster Response: Linking Relief with Development; Sperling, L., Remington, T., Haugen, J., Nagoda, S., Eds.; CIAT: Cali, Colombia, 2004; pp. 69–89. [Google Scholar]

- McGuire, S.J.; Sperling, L. Making seed systems more resilient to stress. Glob. Environ. Chang. 2013, 23, 644–653. [Google Scholar] [CrossRef]

- Sperling, L.; Cooper, H.D.; Remington, T. Moving towards more effective seed aid. J. Dev. Stud. 2008, 44, 586–612. [Google Scholar] [CrossRef]

- Sperling, L.; Gallagher, P.; McGuire, S.J.; March, J. Tailoring seed markets for smallholder farmers: Focus on the legumes. Int. J. Agric. Sustain. 2020. under review. [Google Scholar]

- Bezner Kerr, R. Seed struggles and food sovereignty in northern Malawi. J. Peasant Stud. 2013, 40, 867–897. [Google Scholar] [CrossRef]

- Zerbe, N. Biodiversity, ownership, and indigenous knowledge: Exploring legal frameworks for community, farmers, and intellectual property rights in Africa. Ecol. Econ. 2005, 53, 493–506. [Google Scholar] [CrossRef]

- Remington, T.; Maroko, J.; Walsh, S.; Omanga, P.; Charles, E. Getting off the Seeds-and-Tools treadmill with CRS Seed Vouchers and Fairs. Disasters 2002, 26, 316–328. [Google Scholar] [CrossRef] [PubMed]

- Sperling, L. Cash/Market—Based Interventions (Emergency) Tied to Specific Seed Security Problems: A Framework; Seedsystem.org: Sherman, CT, USA, 2019. [Google Scholar]

- Baributsa, D.; Ignacio, M.C.C. Developments in the Use of Hermetic Bags for Grain Storage. In Advances in Postharvest Management of Cereals and Grains; Burleigh Dodds Series in Agricultural Science; Burleigh Dodds Science Publishing: Cambridge, UK, 2020. [Google Scholar]

- McGuire, S.J.; Sperling, L. Leveraging farmers’ strategies for coping with stress: Seed aid in Ethiopia. Glob. Environ. Chang. 2008, 18, 679–688. [Google Scholar] [CrossRef]

- Rubyogo, J.-C.; Sperling, L.; Muthoni, R.; Buruchara, R. Bean seed delivery for small farmers in Sub-Saharan Africa: The power of partnerships. Soc. Nat. Res. 2010, 23, 285–302. [Google Scholar] [CrossRef]

- African Centre for Biodiversity. Towards National and Regional Seed Policies in Africa that Recognise and Support Farmer Seed Systems. 2018. Available online: http://acbio.org.za/sites/default/files/documents/Seed_Policies_in_Africa_report_WEB.pdf (accessed on 31 July 2018).

- Otieno, G.A.; Reynolds, T.W.; Karasapan, A.; Noriega, I.L. Implications of seed policies for on-farm agro-biodiversity in Ethiopia and Uganda. Sustain. Agric. Res. 2017, 6, 12–30. [Google Scholar] [CrossRef] [Green Version]

- Visser, B. The Impact of National Seed Laws on the Functioning of Small-Scale Seed Systems. A country Case Study; OXFAM-Novib: Amsterdam, The Netherlands, 2017; Available online: https://www.sdhsprogram.org/assets/wbb-publications/770/Seedlawstudy_Bert%20Visser.pdf (accessed on 31 July 2018).

- FAO. The Impact of Implementation of Seed Legislation on Diversity of PGRFA; Commission on Genetic Resources for Food and Agriculture/Intergovernmental Technical Working Group on Plant Genetic Resources for Food and Agriculture: Rome, Italy, forthcoming.

- Solidarites International. Strengthening Resiliency Capacities and Improving Access to Water, Good Hygiene and Nutritional Practices of the Population of Fitri, Batha Region, Chad; Solidarites International: N’Djamena, Chad, 2013. [Google Scholar]

- USAID/OFDA. Application Guidelines, October18, 2019; USAID Office of U.S. Foreign Disaster Assistance: Washington, DC, USA, 2019. Available online: https://www.usaid.gov/sites/default/files/documents/1866/usaidofda_application_guidelines_10-18-2019.pdf (accessed on 30 July 2020).

| SSSA Country (Africa Only) | Year | Sites Selected in Regions of: | N Traders | Stress Context | |

|---|---|---|---|---|---|

| Immediate (Acute) | Longer-Term (Chronic) | ||||

| Malawi | 2011 | Zomba Balaka Chikwawa | 37 | Drought | Low purchasing power |

| Kenya | 2011 | Makueni Tharaka-Nithi Kilifi | 52 | Drought | Decline of maize yields Low purchasing power |

| DR Congo | 2012 | Katanga + | 56 | Ongoing conflict | Low innovation Weak infrastructure Weak state |

| South Sudan | 2010 | Countrywide (excluding Unity) | 70 | Post-conflict | Weak state and infrastructure |

| Zimbabwe | 2009 | Murewha Tshlotsho Bikita Beitbridge | 6 | Political instability Currency collapse | Declining purchasing power |

| Zambia | 2013 | Chipata Ludzi | 6 | Drought | Lack of crop diversification |

| Madagascar | 2013 | Vavatenia Ambovombe | 11 | Drought | Low innovation Weak infrastructure |

| Ethiopia | 2016 | Tigray, Amhara SNNPR Oromiya | 9 | Drought | Weak infrastructure |

| DR Congo | 2017 | Kasai-Oriental | 14 | Some conflict at border | Low innovation Weak infrastructure Weak state |

| Burundi | 2017 | Muyinga Province | 11 | -- | Developmental work in area plagued by food insecurity |

| Zimbabwe | 2017 | Murewha Mudzi | 7 | Currency challenge (local currency lacking value) | Not unusually stressed, although Mudzi is a low rainfall zone |

| Tanzania | 2018 | Mbeya | 8 | -- | Not unusually stressed |

| TOTAL | 287 | ||||

| Site * | N Traders | Get Grain from Specific Regions (Adapted) | Seek Out Specific Varieties | Buy from Growers Known for Quality Seed | Keep Variety Pure | Keep Freshly Harvested Stocks Apart | Grade Stocks | Do Germination Tests | Use Special Storage Conditions | Sort Out ‘Waste’: Pebbles, Dirt | Sort Out ‘Bad Grains’: Broken, Discolored | Sell Seed and Grain Separately |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Burundi 2017 | 11 | 36 | 36 | 27 | 64 | 91 | 45 | 0 | 64 | 45 | 45 | 55 |

| DRC Kasai 2017 | 14 | 89 | 89 | 0 | 55 | 100 | 67 | 0 | 55 | 100 | 100 | 67 |

| DRC Katanga 2012 | 56 | 98 | 93 | 61 | 79 | 65 | 42 | 13 | 45 | 86 | 64 | 57 |

| Ethiopia 2016 | 9 | 33 | 56 | 22 | 89 | 78 | 67 | 33 | 0 | 89 | 89 | 56 |

| Kenya 2011 | 52 | 87 | 81 | 63 | 77 | 71 | 27 | 12 | 54 | 37 | 42 | 54 |

| Madagascar 2013 | 11 | 64 | 26 | 17 | 4 | 27 | 9 | 4 | 17 | 30 | 9 | 9 |

| Malawi 2011 | 37 | 68 | 65 | 41 | 81 | 78 | 24 | 5 | 38 | 95 | 92 | 5 |

| Tanzania 2018 | 8 | 100 | 88 | 50 | 100 | 88 | 88 | 0 | 50 | 100 | 88 | 63 |

| Zambia 2013 | 6 | 100 | 83 | 67 | 83 | 83 | 83 | 17 | 67 | 100 | 100 | 0 |

| Zimbabwe 2018 | 7 | 29 | 57 | 57 | 43 | 29 | 43 | 14 | 43 | 57 | 57 | 29 |

| Total | 211 | |||||||||||

| Simple average ** | 70 | 67 | 41 | 67 | 71 | 49 | 10 | 43 | 74 | 69 | 39 | |

| Weighted average | 80 | 75 | 48 | 73 | 71 | 39 | 10 | 45 | 71 | 65 | 43 |

| Crop | No. of Traders | % Price Change |

|---|---|---|

| Beans | 10 | 65.5% |

| Cassava | 1 | 10.0% |

| Cowpea | 3 | 25.1% |

| Groundnut | 13 | 53.9% |

| Maize | 14 | 45.7% |

| Millet | 2 | 35.0% |

| Sesame | 9 | 61.5% |

| Sorghum | 28 | 40.9% |

| Vegetables | 1 | 0.0% |

| Wheat | 1 | 7.1% |

| Total | 82 | |

| Avg of all transactions | 47.0% |

| CROP | Grain Price (Food) | Seed Price (Less Desired Varieties) | Seed Price (Most Desired Varieties | Margin |

|---|---|---|---|---|

| Wheat | 7.5 ETB/kg | 8 to 8.5 ETB/kg | 9.5 ETB/kg | +27% |

| Teff | 18 ETB/kg | 20 ETB/kg (red and white mixed) | 21 ETB/kg (white) | +17% |

| Seed Security Parameter | Market-Based Interventions—Supporting Trader Roles on the Supply Side |

|---|---|

| Focus: Informal Sector | |

| Availability | Transport vouchers/cash to traders to move supplies to remote areas, with supplies screened (this cross-cuts availability and access); support also for storage rental. Capital advances to traders/loans—to seek out supplies in anticipation of stress. Support traders’ commissioning and multiplication of popular, highly adapted varieties. Advocacy for diversified quality restrictions—allowing for more supplies at different price points. |

| Access | Transport vouchers to traders to move supplies to remote areas, with screened seed (this cross-cuts availability and access); support also for storage rental. Traders to sell small packs (of certified seed)—to move new varieties. |

| Quality-Seed Health | Work with traders to improve seed storage facilities and practices—even with local varieties. Work with traders to diminish storage loss of seed—take over risk from farmers. (high-risk crops, such as cowpeas)—via use of hermetic or other seed storage technology. |

| Quality-Variety Quality | Work with traders to distinguish among varieties—and to keep stocks separate. Provide capacity building of traders along the path on seed quality identification and even seed selection. |

| Information Two-way information systems | Link traders to sources of information on new/modern varieties (as traders may serve as modified extension agents where there is a gap). Provide traders with information systems to help farmers learn about stress-tolerant varieties/crops. General information systems geared to trader potential seed business: e.g., where supplies might be available, market trends, demand and price information. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sperling, L.; Gallagher, P.; McGuire, S.; March, J.; Templer, N. Informal Seed Traders: The Backbone of Seed Business and African Smallholder Seed Supply. Sustainability 2020, 12, 7074. https://doi.org/10.3390/su12177074

Sperling L, Gallagher P, McGuire S, March J, Templer N. Informal Seed Traders: The Backbone of Seed Business and African Smallholder Seed Supply. Sustainability. 2020; 12(17):7074. https://doi.org/10.3390/su12177074

Chicago/Turabian StyleSperling, Louise, Patrick Gallagher, Shawn McGuire, Julie March, and Noel Templer. 2020. "Informal Seed Traders: The Backbone of Seed Business and African Smallholder Seed Supply" Sustainability 12, no. 17: 7074. https://doi.org/10.3390/su12177074

APA StyleSperling, L., Gallagher, P., McGuire, S., March, J., & Templer, N. (2020). Informal Seed Traders: The Backbone of Seed Business and African Smallholder Seed Supply. Sustainability, 12(17), 7074. https://doi.org/10.3390/su12177074