Circular Economy and Environmental Sustainability: A Policy Coherence Analysis of Current Italian Subsidies

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. The Data Set Used

- aims and definitions;

- methods of environmental assessment;

- references to emerging CE policies and measures.

3.1.1. Aims and Definitions

3.1.2. Environmental Assessment Methods of the Catalogue

- literature references (academic studies, research reports, literature reviews, environmental assessment manuals, guidelines for evaluating external costs, etc.);

- environmental indicators provided by statistical institutes;

3.1.3. References to Emerging CE Policies and Measures

3.2. CE Principles for Subsidy Analysis

- the first EU Action Plan for a CE (2015) [34];

- the 2017 Commission guidelines on the role of waste-to-energy in the CE [72];

- the new EU Action Plan for a CE (March 2020) [35];

- the EU Regulation n. 852 of 18 June 2020 on the Taxonomy for sustainable finance [15], that provides an official definition and a list of principles of the CE;

- the categorization system for the CE developed by the Circular Economy Finance Expert Group (CEFEG), an expert group supporting the Commission on CE, published in March 2020 [73].

- land (CEFEG circular category “2d”): artificially degraded land and brownfield sites are not seen as “definitively consumed land”; on the contrary they are seen as resources that can be reused, after a proper environmental reclamation and restoration;

- water (CEFEG circular category “3d”): water used and subsequently discharged (wastewater) is also seen as a resource that—especially in situations of scarcity—can be usefully treated and distributed for new uses.

3.3. The Assessment Method

- potentially harmful subsidies for the circular economy (HCE): subsidies with at least one CE principle that is harmed by the effect of the subsidy, all other principles remaining substantially neutral. For example, a tax discount on Liquified Petroleum Gas (LPG) used for water heating (see 3.1.1) favors higher energy consumptions through energy price reduction and distorts competition with solar thermal; this is harming the CE principles of efficient use of scarce natural resources (fossil fuels) and of renewable source use, while other CE principles are not favored;

- potentially friendly subsidies for the circular economy (FCE): these are subsidies with at least one CE principle that is favored by the effect of the subsidy, all other principles remaining substantially neutral. For example, the subsidy for the maintenance of olive tree plantations (AR.SD.08 in Section 4.2.3) increases the lifetime of plantations and prevents land consumption (artificial coverage), with no significant adverse effects on other CE principles;

- uncertain subsidies for the circular economy (UCE): subsidies for which the comparison with the CE principles has led to contrasting signs of the effect (for example, see the case of the lower excise duty on diesel as compared to petrol, Section 4.1.1);

- neutral subsidies for the circular economy (NCE): subsidies that have no significant effects on the CE principles. This category has been added to prepare the subsequent comparison of results with the Catalogue. In fact, the category of neutral subsidies from the environmental point of view is implicit in the evaluation methodology of the Catalogue [19] (p. 129). The Catalogue’s assessment procedure starts with the preliminary selection of those existing subsidies that are potentially relevant for the environment, that are subsequently submitted for evaluation and classification within the Catalogue files;

- subsidies not anymore in force in 2018. This class is due to the fact that during the CE analysis emerged that 5 subsidies included in the 3rd edition of the Catalogue (which should cover subsidies in force in Italian legislation until the end of 2018) ended in 2017 and were not anymore in force during 2018 (they should have been excluded in the yearly updating of Catalogue). These subsidies have been excluded from the circularity assessment.

4. Results

- the Catalogue code (sector, type, numbering) and subsidy’s title;

- the environmental qualification of the Catalogue (EHS, EFS or EUS);

- the CE principles that respectively motivate the new classification of subsidies as harmful for the circular economy (HCE) or Friendly (FCE);

- the financial value of the subsidy in the period 2017–2019 (as said in Section 3.2, not all subsidies have been financially quantified by the Catalogue; the aggregated values should be considered as minimum values).

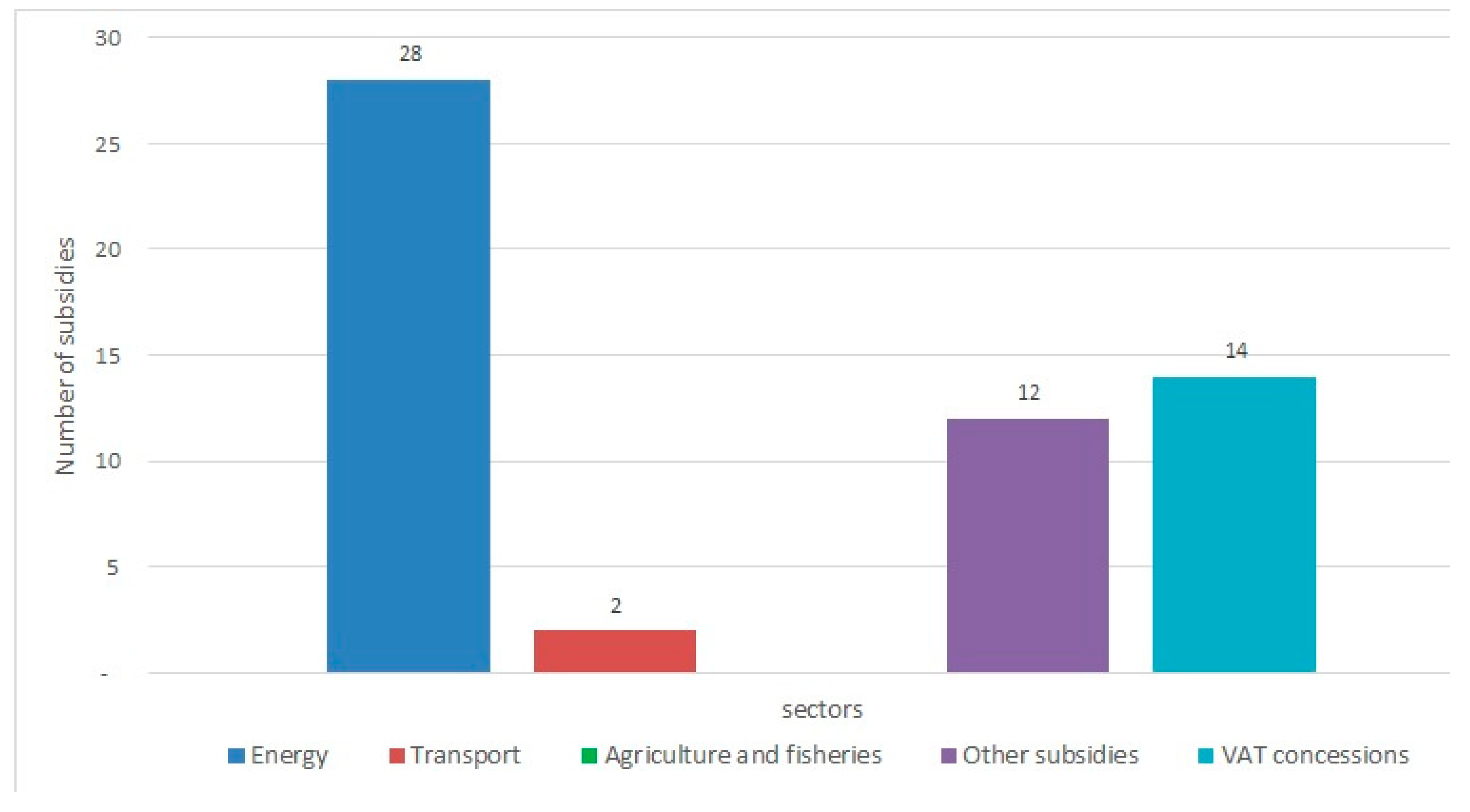

4.1. Subsidies That Are Harmful for the Circular Economy (HCE)

4.1.1. Energy

4.1.2. Transport

- TR.SI.04—Tax concessions on company car fringe benefits, since this subsidy favors the purchase of large displacement cars and their higher use by the employee (higher yearly mileages, as stated by the Catalogue);

- TR.SD.05—Scrapping fund for rail freight wagons, which in the Catalogue is considered an EFS (new rail wagons increase the quality of the transport service, thus favoring the use of the more sustainable rail transport as compared to road transport of goods); from the point of view of the CE the subsidy reduces the useful life of wagons.

4.1.3. Agriculture and Fishing

4.1.4. Other Subsidies

4.1.5. VAT Allowances

4.2. Subsidies That Are Friendly for the Circular Economy (FCE)

4.2.1. Energy

- EN.SD.06—Incentives for electricity produced from renewable sources other than photovoltaic, Ministerial Decree 23 June 2016 (5052 million euros in 2019 [82]) (this is not the last incentive scheme for renewable sources, the last edition of the Catalogue [19] covers subsidies in force until the end of 2018);

- EN.SD.08—Promotion of energy efficiency and energy production from thermal RES–Thermal account 2.0, Inter-ministerial Decree of 16 February 2016 (264 million euros in 2019 [83]).

- for thermodynamic solar, wind, ocean, hydroelectric, geothermal energy: use of renewable sources and saving of fossil fuels (in the case of hydroelectric plants, the art. 4 par. 3 of the Decree introduces many water protection restrictions).

- for biogas from anaerobic digestion of waste and sludge: use of renewable sources, saving of fossil fuels and compliance with EU waste hierarchy (the production of biogas is part of a process that gives priority to sludge recycling as compost for crops fertilization);

- for bioliquids obtained from agricultural residues: use of renewable sources to replace fossil fuels and saving of material natural resources for producing fuels. Bioliquids must currently comply with the Sustainability criteria required by Fuel Quality Directive 2009/30/EC [84] transposed in Italy through art. 38–39 of Leg. Decree 28/2011. The Directive 2018/2001/EU on the promotion of renewable sources (RED II [68]) which has yet to be transposed in Italy (deadline in June 2021), favors second generation biofuels obtained from waste streams and has further strengthened the sustainability criteria for biofuels, bioliquids and biomass fuels;

- for biomass obtained from by-products (from the processing of forest products, forest management, public green pruning, straw and agricultural residues, animal by-products not intended for human consumption, agro-industry and wood processing by-products): use of renewable sources to replace fossil fuels and saving of material natural resources for producing fuels.

- from the positive side, the mechanism promotes the use of renewable sources and saving of fossil fuels. In addition, a national law has prohibited since 2012 to subsidize ground-mounted photovoltaic systems in agricultural areas (rather than in already urbanized areas or on the roofs of buildings), preventing land consumption. Moreover, the mechanism has been conceived to manage the end-of-life phase of the photovoltaic (PV) panels (WEEE—Waste of Electrical and Electronic Equipment). In fact, national legislation has introduced since 2011 the responsibility of producers on PV panels at the end-of-life (M.D. of 5 May 2011, M.D. of 5 July 2012, Leg.D. 49/2014), to guarantee the financing of an adequate management of the collection, transport, treatment, recovery and disposal operations of waste deriving from photovoltaic panels, also through the use of a collective system (recycling consortia);

- as regards the negative aspects, the mechanism appears to be in contrast with the principle of efficiency in resource use. In fact, there is evidence in the scientific literature regarding the high consumption of scarce natural resources in the production cycle of cells and PV modules. For example, a recent LCA study [87] has shown that, for the same amount of energy produced, the 2017 national mix of PV plants causes a higher consumption of abiotic resources than gas, coal or oil based thermal plants. This result is mainly due to the production processes of zinc concentrate and the silver extraction processes. Zinc is used for galvanizing in the production of aluminum supports for solar panels and of aluminum alloys used in the panel. The method used to calculate the “mineral, fossil and renewable resource” impact indicator is the one developed by CML Leiden [88], according to which the scarcity of each substance extracted from the natural system is calculated as the annual extraction of the substance divided by its availability squared.

4.2.2. Transport

- TR.SI.07—Reduction of the car property tax for electric vehicles;

- TR.SI.11—Tax deductions for the purchase and installation of charging infrastructure for electricity powered vehicles;

- TR.SD.06—Contribution for the purchase of a brand new electric or hybrid two-wheeled vehicle (two wheels bonus);

- TR.SD.07—Contribution for the purchase of new low CO2 emissions car (car bonus).

4.2.3. Agriculture and Fishing

- The group of EHSs in support of animal husbandry in its various types (AP.SD.03—Beef cattle, AP.SD.09—Dairy cattle and AP.SD.10—Dairy buffalo), where the subsidy also indirectly encourages production of animal slurry which, according to current Italian legislation, can be excluded from the legal regime of waste if it is subject to “agronomic use”. This legislative provision promotes the reuse of slurry from intensive farming to fertilize the fields, avoiding the use of chemical fertilizers. This agricultural practice has deep historical roots (albeit with different volumes at stake from the current ones) and is consistent with the recycling principle of the circular economy (FCE); but it must be underlined that this is a case of contrasting outcome when applying the environmental perspective, since the Catalogue [19] (pp. 149–150) classifies this subsidy as harmful for the environment (EHS), due to the significant ammonia emissions of such practice, with harmful effects on health.

- A large group of agricultural subsidies that the Catalogue considers uncertain from an environmental point of view (EUS), but which from the point of view of the CE play an important role in preventing the abandonment and urbanization of marginal land (for example, this group includes AP.SD.11—Support for dairy livestock in mountain areas, AP.SD.17—Support of agricultural practices beneficial for the climate and the environment, AP.SD.20—Specific support for beef cattle breeding (suckler cows) and AP.SD.21—Specific support for sheep and goat livestock).

- Another group is made of agricultural subsidies, impacting on biodiversity (EHS in the Catalogue), that under a CE perspective have the positive function of protecting and renovating traditional farming systems and related economic activities, such as olive groves (AP.SD.08, AP.SD.19 and AP.SD.32-33) or vineyards and wine production (AP.SD.34-36). An emblematic example is constituted by AP.SD.08—Measures for the relaunch of the olive sector in areas affected by Xylella fastidiosa, which from the point of view of the CE extends the useful life of the crop system and prevents abandonment of agriculture in an area (Puglia region) that is subject to high rates of land consumption [79]. The Catalogue classifies this subsidy in the opposite way (EHS) by stating that “the measure encourages replanting with a plant type that is tolerant to the bacterium, a practice that favors a reduction of species diversity by exposing them to new epidemics in the future. The goal should be to diversify in genetic terms to minimize future risk” [19] (p. 148).

4.2.4. Other Subsidies

- AL.SD.05—Increase from 20% to 100% of the revenue recycling percentage required by the law establishing the regional tax on waste disposed in landfills and incineration plants (TARI): the revenues of the tax are allocated to interventions for the CE [18] (art. 34);

- AL.SI.25—Provisions to promote prevention policies in the production of waste: Municipalities are enabled to introduce discounts on TARI to non-domestic users who achieve waste production savings as the result of preventing actions and recycling of the organic fraction [18] (art. 36);

- AL.SI.28—Waste tax allowances to avoid food waste: allowances are provided to non-domestic users who donate food to poor people (art. 17 Law of 19 August 2016, n. 166);

- AL.SI.20—Green garden bonus: a 36% deduction from the personal income tax of the cost for small greening actions in private uncovered areas of existing buildings (art. 1 c. 12-15 Law of 27 December 2017, n. 205, that is the budget law for 2018);

- AL.SI.29—Tax credit for purchases of mixed plastics (plasmix) from separate collection: company income tax credit of 36% for the purchases of products made with mixed recycled plastics aimed at promoting the recycling of plastics (art.1 c. 96-99 of budget law for 2018);

- AL.SI.33—Company income tax credit of 36% for the purchase of products made with recycled plastic, biodegradable and compostable packaging or packaging made with recycled paper or recycled aluminum (art. 1 c-73-77 Law of 30 December 2018, n. 145, that is the budget law 2019);

- AL.SI.31 and AL.SI.32: two company income tax credits, respectively on the recovery and reuse of packaging by the selling company and on the purchase of compost or intermediate products with a recycled content of 75% at least, introduced by art. 26bis and 26ter Law of 28 June 2019 n.58.

4.2.5. VAT Allowances

- IVA.20—Building repair and renovation services of private homes;

- IVA.14b—Provision of services dependent on procurement contracts relating to building restoration interventions;

- IVA.19—Leases of renovated residential buildings carried out by the construction companies.

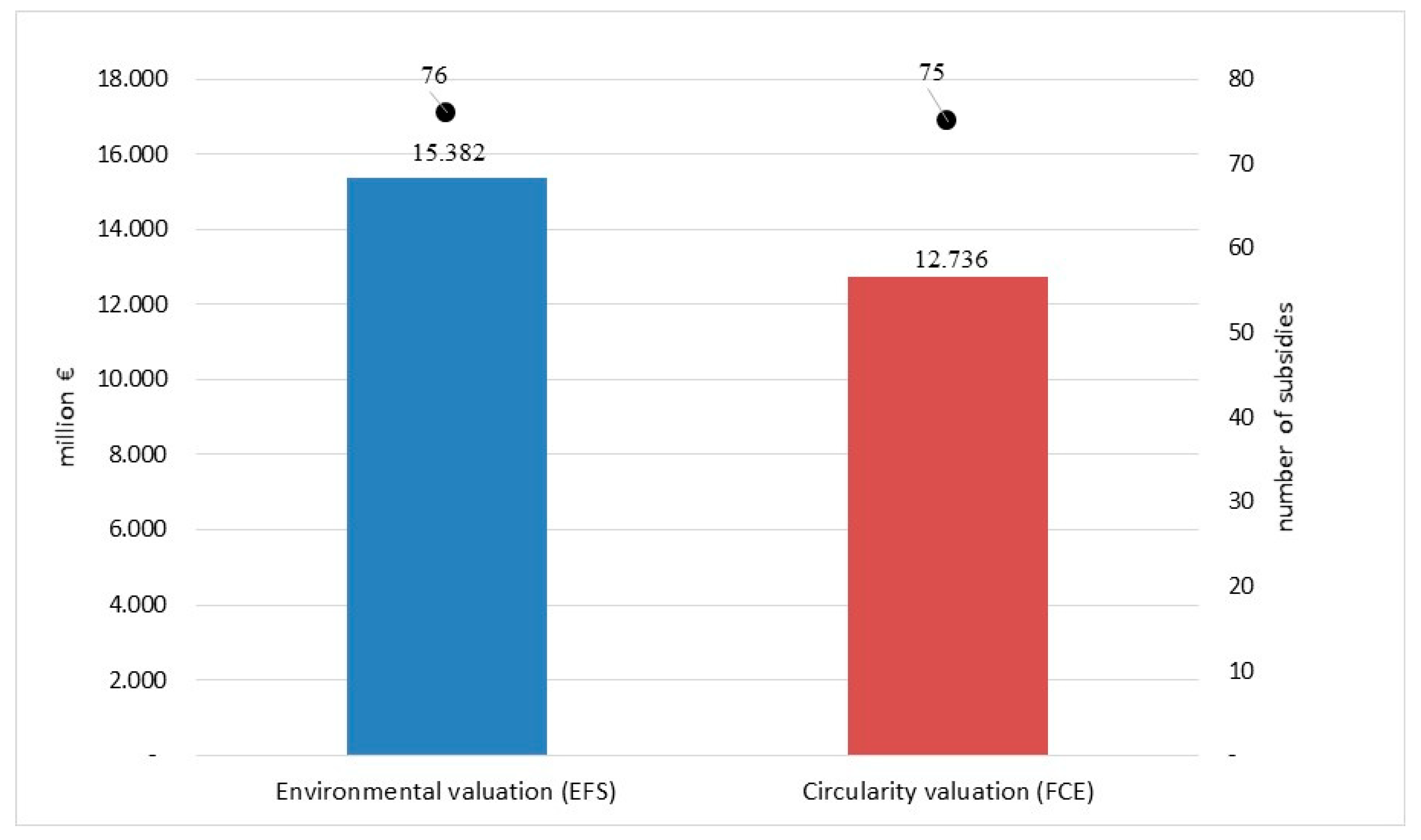

4.3. Comparison of the Results with the Environmental Subsidies of the Catalogue

4.3.1. Harmful Subsidies Comparison

4.3.2. Friendly Subsidies Comparison

4.3.3. Detailed Comparison between the Environmental Assessment and the Circularity Assessment

5. Methodological and Analysis Limitations

6. Conclusions

Supplementary Materials

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Disclaimer

Appendix A. CE and Its Concepts: An Historical Overview

Appendix B. Description of the Data-Set: Summary of the Catalogue Results

| Sectors | EFS Friendly | EHS Harmful | EUS Uncertain | Total | ||||

|---|---|---|---|---|---|---|---|---|

| n. | M€ | n. | M€ | n. | M€ | n. | M€ | |

| Energy | ||||||||

| Indirect subsidies | 4 | 77 | 30 | 11.761 | 3 | 78 | 37 | 11.916 |

| Direct subsidies | 7 | 11.568 | 3 | 1.402 | 1 | - | 11 | 12.970 |

| Energy total | 11 | 11.645 | 33 | 13.163 | 4 | 78 | 48 | 24.886 |

| Transport | ||||||||

| Indirect subsidies | 5 | 15 | 4 | 1.637 | 9 | 1.651 | ||

| Direct subsidies | 6 | 24 | 1 | 49 | 7 | 73 | ||

| Transport total | 11 | 39 | 4 | 1.637 | 1 | 49 | 16 | 1.724 |

| Agriculture and fishing | ||||||||

| Indirect subsidies | 2 | 4 | - | - | 2 | 311 | 4 | 315 |

| Direct subsidies | 21 | 1.213 | 8 | 270 | 11 | 4.829 | 40 | 6.312 |

| Agriculture and fishing total | 23 | 1.217 | 8 | 270 | 13 | 5.141 | 44 | 6.627 |

| Other subsidies | ||||||||

| Indirect subsidies | 21 | 2.387 | 9 | 655 | 5 | 1.561 | 35 | 4.604 |

| Direct subsidies | 3 | 6 | 1 | - | 2 | 405 | 6 | 411 |

| Other subsidies total | 24 | 2.393 | 10 | 655 | 7 | 1.966 | 41 | 5.014 |

| VAT allowances | ||||||||

| Indirect subsidies | 4 | 13 | 17 | 4.024 | 1 | 1.416 | 22 | 5.452 |

| VAT allowances total | 4 | 13 | 17 | 4.024 | 1 | 1.416 | 22 | 5.452 |

| All sectors | ||||||||

| Indirect subsidies | 36 | 2.495 | 60 | 18.077 | 11 | 3.367 | 107 | 23.938 |

| Direct subsidies | 37 | 12.811 | 12 | 1.672 | 15 | 5.283 | 64 | 19.766 |

| All sectors total | 73 | 15.306 | 72 | 19.748 | 26 | 8.650 | 171 | 43.704 |

References

- UNCED (United Nations Conference on Environment & Development). Agenda 21, Rio de Janeiro, Brazil, 3–14 June 1992. Available online: https://sustainabledevelopment.un.org/content/documents/Agenda21.pdf (accessed on 2 December 2020).

- United Nations General Assembly. Transforming Our World: The 2030 Agenda for Sustainable Development. Resolution Adopted by the General Assembly on 25 September 2015, A/RES/70/1; United Nations: New York, NY, USA, 2015. Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_70_1_E.pdf (accessed on 2 December 2020).

- Baumol, W.J.; Oates, W.E. The Theory of Environmental Policy, 2nd ed.; Cambridge University Press: Cambridge, UK, 1988; p. 312. Available online: https://ideas.repec.org/b/cup/cbooks/9780521311120.html (accessed on 4 December 2020).

- Sterner, T. Policy Instruments for Environmental and Natural Resource Management; Routledge RFF Press: New York, NY, USA, 2010; ISBN 9781936331833. [Google Scholar]

- Crespi, F.; Ghisetti, C.; Quatraro, F. Taxonomy of Implemented Policy Instruments to Foster the Production of Green Technologies and Improve Environmental and Economic Performance. In WWW for Europe Working Paper; WIFO Studies: Wien, Austria, 2015; Available online: https://ideas.repec.org/b/wfo/wstudy/58131.html (accessed on 3 March 2021).

- Flachenecker, F.; Rentschler, J. Investing in Resource Efficiency. The Economics and Politics of Financing the Resource Transition; Springer: Berlin/Heidelberg, Germany, 2018; ISBN 978-3-319-78867-8. Available online: https://www.springer.com/gp/book/9783319788661 (accessed on 3 March 2021).

- Flachenecker, F.; Rentschler, J. From barriers to opportunities: Enabling investments in resource efficiency for sustainable development. Public Sect. Econ. 2019, 43, 345–373. [Google Scholar] [CrossRef]

- Aranda-Usón, A.; Portillo-Tarragona, P.; Marín-Vinuesa, L.M.; Scarpellini, S. Financial Resources for the Circular Economy: A Perspective from Businesses. Sustainability 2019, 11, 888. [Google Scholar] [CrossRef] [Green Version]

- OECD. Global Material Resources Outlook to2060. Economic Drivers and Environmental Consequences; OECD Publishing: Paris, France, 2018. [Google Scholar] [CrossRef]

- European Commission—Joint Research Centre. Critical Materials for Strategic Technologies and Sectors in the EU—A Foresight Study; 2020 Publications Office of the European Union: Luxembourg, 2020. Available online: https://ec.europa.eu/docsroom/documents/42882 (accessed on 5 March 2021).

- European Commission. Communication of the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee, and the Committee of Regions, Critical Raw Materials Resilience: Charting a Path towards Greater Security and Sustainability, COM (2020) 474 Final, 202. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0474 (accessed on 5 March 2021).

- Valero, A.; Valero, A.; Calvo, G.; Ortego, A. Material bottlenecks in the future development of green technologies. Renew. Sustain. Energy Rev. 2018, 93, 178–200. [Google Scholar] [CrossRef]

- Grandell, L.; Höök, M. Assessing Rare Metal Availability Challenges for Solar Energy Technologies. Sustainability 2015, 7, 11818–11837. [Google Scholar] [CrossRef] [Green Version]

- Valero, A.; Valero, A. Thermodynamic Rarity and Recyclability of Raw Materials in the Energy Transition: The Need for an In-Spiral Economy. Entropy 2019, 21, 873. [Google Scholar] [CrossRef] [Green Version]

- European Parliament and Council. Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the Establishment of a Framework to Facilitate Sustainable Investment, Amending Regulation (EU) 2019/2088. OJEU 2020, L198, 13–43. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:32020R0852 (accessed on 30 July 2020).

- OECD. Environmentally Harmful Subsidies: Challenges for Reform; OECD Publishing: Paris, France, 2005; Available online: https://www.oecd.org/fr/tad/environmentallyharmfulsubsidieschallengesforreform.htm (accessed on 2 September 2020).

- OECD. Better Policies for Sustainable Development 2016: A New Framework for Policy Coherence; OECD Publishing: Paris, France, 2016. [Google Scholar] [CrossRef]

- Parlamento Italiano, Legge 28 Dicembre 2015, n. 221. Disposizioni in Materia Ambientale per Promuovere Misure di Green Economy e Per Il Contenimento Dell’uso Eccessivo di Risorse Naturali. Gazzetta Ufficiale, n. 13, 18 1 2016. Available online: https://www.gazzettaufficiale.it/eli/id/2016/1/18/16G00006/sg (accessed on 7 September 2020).

- Ministero dell’Ambiente, della Tutela del Territorio e del Mare (MATTM). Il Catalogo Dei Sussidi Ambientalmente Dannosi e Ambientalmente Favorevoli, Terza Edizione Anno 2018; MATTM: Roma, Italy, 2020; Executive Summary in English is available in the report; Available online: https://www.minambiente.it/sites/default/files/archivio/allegati/sviluppo_sostenibile/csa_terza_edizione_2018_dicembre_2019_1.pdf (accessed on 8 September 2020).

- OECD. Paris Collaborative on Green Budgeting. Available online: https://www.oecd.org/environment/green-budgeting/ (accessed on 4 April 2021).

- Oosterhuis, F.H.; ten Brink, P. Paying the Polluter Environmentally. Harmful Subsidies and Their Reform; Edward Elgar: Cheltenham, UK, 2014; p. 368. ISBN 978 1 78254 530 9. Available online: https://www.e-elgar.com/shop/gbp/paying-the-polluter-9781782545309.html (accessed on 5 April 2021).

- Valsecchi, C.; ten Brink, P.; Bassi, S.; Withana, S.; Lewis, M.; Best, A.; Oosterhuis, F.; Dias Soares, C.; Rogers-Ganter, H.; Kaphengst, T. Environmentally Harmful Subsidies: Identification and Assessment, Final Report for the European Commission’s DG Environment, November 2009. Available online: https://ec.europa.eu/environment/enveco/taxation/pdf/Harmful%20Subsidies%20Report.pdf (accessed on 5 September 2020).

- OECD. Environmental Fiscal Reform. Problems, Progress and Pitfalls, OECD Report for the G7 Environment Ministers, June 2017. Available online: https://www.oecd.org/tax/tax-policy/environmental-fiscal-reform-G7-environment-ministerial-meeting-june-2017.pdf (accessed on 5 September 2020).

- Wilts, H.; Von Gries, N.; Bahn-Walkowiak, B. From Waste Management to Resource Efficiency—The Need for Policy Mixes. Sustainability 2016, 8, 622. [Google Scholar] [CrossRef] [Green Version]

- Domenech, T.; Bahn-Walkowiak, B. Transition towards a resource efficient circular economy in Europe: Policy lessons from the EU and the member states. Ecol. Econ. 2019, 155, 7–19. [Google Scholar] [CrossRef]

- Hartley, K.; van Santen, R.; Kirchherr, J. Policies for transitioning towards a circular economy: Expectations from the European Union (EU). Resour. Conserv. Recycl. 2020, 155, 104634. [Google Scholar] [CrossRef]

- Wilts, H.; O’Brien, M. A Policy Mix for Resource Efficiency in the EU: Key Instruments, Challenges and Research Needs. Ecol. Econ. 2019, 155, 59–69. [Google Scholar] [CrossRef]

- Bigano, A.; Śniegocki, A.; Zotti, J. Policies for a More Dematerialized EU Economy. Theoretical Underpinnings, Political Context and Expected Feasibility. Sustainability 2016, 8, 717. [Google Scholar] [CrossRef] [Green Version]

- Andersen, M.S. An introductory note on the environmental economics of the circular economy. Sustain. Sci. 2007, 2, 133–140. [Google Scholar] [CrossRef]

- Söderholm, P. Taxing virgin natural resources: Lessons from aggregates taxation in Europe, Resources. Conserv. Recycl. 2011, 55, 911–922. [Google Scholar] [CrossRef]

- Eckermann, F.; Golde, M.; Herczeg, M.; Mazzanti, M.; Zoboli, R.; Speck, S. Material Resource Taxation—An Analysis for Selected Material Resources; European Topic Centre on Sustainable Consumption and Production & European Topic Centre on Waste and Materials: Brussels, Belgium, 2015. [Google Scholar]

- Milios, L. Towards a Circular Economy Taxation Framework: Expectations and Challenges of Implementation. Circ. Econ. Sust. 2021. [Google Scholar] [CrossRef]

- Croci, E.; Frey, M.; Molocchi, A. Agenzie e Governo Dell’ambiente. Il Caso Italiano a Confronto Con Esperienze Estere, Franco Angeli editore; Collana Economia e Politica dell’Energia: Milano, Italy, 1994; p. 320. ISBN 9788820486662. Available online: https://www.francoangeli.it/%28X%281%29%29/ricerca/Scheda_Libro.aspx?ID=1433&Tipo=10 (accessed on 5 April 2021).

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Closing the Loop. An EU Action Plan for the Circular Economy, COM (2015) 614 Final, Brussels, 2 12 2015. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52015DC0614 (accessed on 11 September 2020).

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. Circular Economy Action Plan. For a cleaner and more competitive Europe, COM (2020) 98 final, Brussels, 11 3 2020. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2020:98:FIN&WT.mc_id=Twitter (accessed on 11 September 2020).

- OECD. Improving the Environment through Reducing Subsidies; OECD Publishing: Paris, France, 1998; p. 433. Available online: https://www.cbd.int/financial/fiscalenviron/g-subsidyreform-oecd1998.pdf (accessed on 5 September 2020).

- OECD. Environmentally Harmful Subsidies—Policy Issues and Challenges; OECD publishing: Paris, France, 2003; Available online: https://www.cbd.int/financial/fiscalenviron/g-subsidyharmful-oecd.pdf (accessed on 5 September 2020).

- IEEP. Reforming Environmentally Harmful Subsidies, Final Report to the European Commission’s DG Environment. 2007. Available online: https://ieep.eu/uploads/articles/attachments/8a52f66a-27c0-4ea7-9af0-577b487dcfc8/Full_report_on_EHS.pdf?v=63664509707 (accessed on 8 September 2020).

- Rentschler, J.; Bazilian, M. Reforming fossil fuel subsidies: Drivers, barriers and the state of progress. Clim. Policy 2017, 17, 891–914. [Google Scholar] [CrossRef] [Green Version]

- Ministero Dell’ambiente, Della Tutela Del Territorio e Del Mare, Catalogo Dei Sussidi Ambientalmente Dannosi e Dei Sussidi Ambientalmente Favorevoli. Available online: https://www.minambiente.it/pagina/catalogo-dei-sussidi-ambientalmente-dannosi-e-dei-sussidi-ambientalmente-favorevoli (accessed on 30 December 2020).

- The Federal Environment Agency (Umweltbundesamt—UBA). Environmentally Harmful Subsidies. Available online: https://www.umweltbundesamt.de/en/environmentally-harmful-subsidies#direct-and-indirect-subsidies (accessed on 20 January 2020).

- IEA. Energy Subsidies. Tracking the Impact of Fossil-Fuel Subsidies. Available online: https://www.iea.org/topics/energy-subsidies (accessed on 2 February 2021).

- IEA. Energy Subsidies. Methodology and Assumptions. The Price Gap Approach. Available online: https://www.iea.org/topics/energy-subsidies#methodology-and-assumptions (accessed on 2 February 2021).

- Parry, I.W.; Heine, M.D.; Lis, E.; Li, S. Getting Energy Prices Right. From Principle to Practice; International Monetary Fund: Washington, DC, USA, 2014; Available online: https://www.elibrary.imf.org/doc/IMF071/21171-9781484388570/21171-9781484388570/Other_formats/Source_PDF/21171-9781498309035.pdf (accessed on 20 September 2020).

- Coady, D.; Parry, I.; Le, N.P.; Shang, B. Global Fossil Fuel Subsidies Remain Large: An Update Based on Country—Level Estimates; IMF Working Papers: Washington, DC, USA, 2019; Available online: file:///C:/Users/unieuro/AppData/Local/Temp/WPIEA2019089.pdf (accessed on 20 September 2020).

- IMF—International Monetary Fund. Climate Change—Fossil Fuel Subsidies. Available online: https://www.imf.org/en/Topics/climate-change/energy-subsidies (accessed on 9 December 2020).

- Sovacool, B.K. Reviewing, Reforming, and Rethinking Global Energy Subsidies: Towards a Political Economy Research Agenda. Ecol. Econ. 2017, 135, 150–163. [Google Scholar] [CrossRef]

- Gençsü, I.; Whitley, S.; Trilling, M.; van der Burg, L.; McLynn, M.; Worrall, L. Phasing out public financial flows to fossil fuel production in Europe, 2020. Clim. Policy 2020, 2, 1010–1023. [Google Scholar] [CrossRef]

- IEA. Tracking Fossil Fuel Subsidies in APEC Economies. Toward a Sustained Subsidy Reform, Insights Series 2017, OECD/IEA. Available online: https://www.iea.org/reports/insights-series-2017-tracking-fossil-fuel-subsidies-in-apec-economies (accessed on 8 April 2021).

- G20. G20 Leaders’ Statement, The Pittsburgh Summit, September 24–25 2009; US Presidency: Pittsburgh, PA, USA, 2020; Available online: https://www.oecd.org/g20/summits/pittsburgh/G20-Pittsburgh-Leaders-Declaration.pdf (accessed on 2 December 2020).

- OECD. G20 Voluntary Peer Reviews of the Reform of Inefficient Fossil Fuel Subsidies. Available online: https://www.oecd.org/fossil-fuels/publication/ (accessed on 5 December 2020).

- Ministry of Economic Development; Ministry of Environment Land and Sea; Ministry of Economy and Finance. G20 Peer Review of Fossil Fuels Subsidies—Self Report Italy; Ministero dell’ambiente, Ministero dello sviluppo economico, Ministero dell’economia e delle finanze: Roma, Italy, 2018; Available online: https://www.oecd.org/fossil-fuels/publication/Italy%20G20%20Self-Report%20IFFS.pdf (accessed on 5 December 2020).

- G20 Peer Review Team. Italy’s Effort to Phase out and Rationalise Its Fossil-Fuel Subsidies—A Report on the G20 Peer-Review of Inefficient Fossil-Fuel Subsidies That Encourage Wasteful Consumption in Italy. G20-OECD. 2019. Available online: https://www.oecd.org/fossil-fuels/publication/Italy%20G20%20Peer%20Review%20IFFS%20.pdf (accessed on 5 December 2020).

- Ministero dell’Ambiente, della Tutela del Territorio e del Mare (MATTM). Il Catalogo Dei Sussidi Ambientalmente Dannosi e Ambientalmente Favorevoli, Prima Edizione Anno 2016, 1 ed.; MATTM: Roma, Italy, 2016; Available online: https://www.minambiente.it/sites/default/files/archivio/allegati/sviluppo_sostenibile/catalogo_sussidi_ambientali.pdf (accessed on 8 September 2020).

- G7. G7 Ise-Shima leaders’ Declaration 26–27 5 2016; Japan Presidency: Ise-Shima, Japan, 2016; Available online: https://www.mofa.go.jp/files/000160266.pdf (accessed on 2 December 2020).

- G7 Environment. G7 Bologna Environment Ministers’ Meeting 11-12 June Communiqué; Italy Presidency: Bologna, Italy, 2017; Available online: http://www.g7italy.it/sites/default/files/documents/Communiqu%c3%a9%20G7%20Environment%20-%20Bologna/index.pdf (accessed on 2 December 2020).

- European Commission. Communication of the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee, and the Committee of Regions. The European Green Deal. COM (2019) 640 Final; European Commission: Brussels, Belgium, 2019. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2019%3A640%3AFIN (accessed on 4 December 2020).

- European Commission. Revision of the Energy Tax Directive. Available online: https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12227-Revision-of-the-Energy-Tax-Directive (accessed on 4 December 2020).

- Álvarez, A.D. Study on Assessing the Environmental Fiscal Reform Potential for the EU28, Report for the European Commission; Publications Office of the European Union: Luxembourg, 2016; ISBN 978-92-79-54701-0. [CrossRef]

- Umweltbundesamt—UBA. Umweltschädliche Subventionen in Deutschland. Aktualisierte Ausgabe 2016; UBA: Berlin, Germany, 2016. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/479/publikationen/uba_fachbroschuere_umweltschaedliche-subventionen_bf.pdf (accessed on 10 April 2021).

- Centre d’analyse stratégique. Les Aides Publiques Dommageables à la Biodiversité. Rapport de la Mission pre Présidée par Guillame Sainteny, La Documentation Française, Rapports et Documents; Premier Ministre: Paris, France, 2012; Volume 43, Available online: http://archives.strategie.gouv.fr/cas/system/files/rapport_43_web_0.pdf (accessed on 10 April 2021).

- France Gouvernment. Rapport Sur l’impact Environnemental du Budget de l’État, # PLF 2021, Septembre 2020. Available online: https://www.vie-publique.fr/sites/default/files/rapport/pdf/276480.pdf (accessed on 23 April 2021).

- Gondjian, G.; Merle, C. France maps green and brown expenses over 2021 budget proposal—auspicious developments for climate change mainstreaming and sustainable finance. Natixis Newsl. 2020. Available online: https://gsh.cib.natixis.com/our-center-of-expertise/articles/france-maps-green-and-brown-expenses-over-2021-budget-proposal-auspicious-developments-for-climate-change-mainstreaming-and-sustainable-finance (accessed on 26 April 2021).

- Ministry of Economic Development and Ministry of Environment Land and Sea. Integrated National Energy and Climate Plan (INECP); Ministry of Economic Development: Roma, Italy, 2020. Available online: https://www.mise.gov.it/images/stories/documenti/it_final_necp_main_en.pdf (accessed on 4 December 2020).

- Commissione Interministeriale per lo Studio e L’elaborazione di Proposte per la Transizione Ecologica e per la Riduzione Dei sussidi Ambientalmente Dannosi, Consultazione On-Line Sulle Proposte Normative per la Rimodulazione dei Sussidi Ambientalmente Dannosi (SAD). Ministero dell’Ambiente, Della Tutela del Territorio e del Mare: Roma, Italy, 31 July 2020. Available online: https://www.minambiente.it/pagina/consultazione-line-sad-relazione-introduttiva (accessed on 24 October 2020).

- Molocchi, A. Chi inquina, Paga? Tasse Ambientali e Sussidi Dannosi per L’ambiente. Ipotesi di Riforma alla Luce dei Costi Esterni Delle Attività Economiche in Italia. Ufficio di Valutazione d’Impatto del Senato, Documento di Valutazione n. 6, Dicembre 2017. Available online: http://www.senato.it/4746?dossier=2295 (accessed on 8 September 2020).

- Ravazzi Douvan, A.; Camporeale, C.; Grassi, L.; Castaldi, G.; Iannotti, M.; Lucaroni, G.; Molocchi, A. The Italian Catalogue of EHS and EFS. In Environmental Tax Studies for the Ecological Transition. Comparative Analysis Addressing Urban Concentration and Increasing Transport Challenges; Cámara Barroso, M., Del, C., Villar Ezcurra, M., Eds.; Editorial Civitas: Madrid, Spain, 2019; pp. 69–80. ISBN 978-84-9197-701-8. Available online: https://www.marcialpons.es/libros/environmental-tax-studies-for-the-ecological-transition/9788491977018/ (accessed on 9 April 2021).

- The European Parliament and the Council. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018, on the promotion of the use of energy from renewable sources (recast). OJEU 2018, L328, 82–209. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv:OJ.L_.2018.328.01.0082.01.ENG (accessed on 17 September 2020).

- The European Parliament and the Council. Directive (EU) 2014/94 of the European Parliament and of the Council, of 22 October 2014, on the deployment of infrastructure for alternative fuels. OJEU 2014, L307, 1–204. Available online: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A32014L0094 (accessed on 20 September 2020).

- Ministero dello Sviluppo Economico e Ministero Dell’ambiente e Della Tutela del Territorio e Del Mare, Verso un Modello Di economia Circolare in Italia. Documento di Inquadramento e di Posizionamento Strategico. Ministero Dell’ambiente e Della tutela del Territorio e del Mare: Roma, Italy. 2017. Available online: http://consultazione-economiacircolare.minambiente.it/sites/default/files/verso-un-nuovo-modello-di-economia-circolare_HR.pdf (accessed on 9 October 2020).

- Ministero dell’Ambiente e della Tutela del Territorio e del Mare, Direzione Generale per lo Sviluppo Sostenibile, per il Danno Ambientale e per i Rapporti con l’Unione Europea e gli Organismi internazionali, Divisione I Strategia d’azione nazionale per uno sviluppo sostenibile. Ministero dell’Ambiente e della Tutela del Territorio e del Mare: Roma, Italy. 2017. Available online: https://www.minambiente.it/sites/default/files/archivio_immagini/Galletti/Comunicati/snsvs_ottobre2017.pdf (accessed on 18 September 2020).

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. The Role of Waste to Energy in the Circular Economy; COM (2017) 34 fin: Brussels, Belgium, 2017. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52017DC0034&from=en (accessed on 29 July 2020).

- Circular Economy Finance Expert Group (CEFEG). Categorization System for the Circular Economy; European Commission DG Research and Innovation: Brussels, Belgium, 2020; Available online: https://op.europa.eu/en/publication-detail/-/publication/ca9846a8-6289-11ea-b735-01aa75ed71a1 (accessed on 3 August 2020).

- Camporeale, C.; Grassi, L.; Molocchi, A. The diesel fuel excise duty gap as compared to gasoline: An environmental coherence assessment through the external costs approach. In Proceedings of the Sixth Iaere—Italian Association of Environmental and Resource Economics Annual Conference, Turin, Italy, 15–16 February 2018; IAERE: Turin, Italy, 2018. Available online: https://www.iaere.org/conferences/2018/files/camporeale.pdf (accessed on 13 October 2020).

- UNRAE. Book 2020—Analisi del Mercato Autoveicoli in Italia, 21st ed.; UNRAE: Roma, Italy, 2021; Available online: http://www.unrae.it/files/Book%20UNRAE%202020_6038d7a7636d9.pdf (accessed on 28 February 2021).

- UNRAE. Immatricolazioni in Italia di Autovetture e Fuoristrada—Top Ten per Modello e Alimentazione, Gennaio-Dicembre 2020; UNRAE: Roma, Italy, 2021; Available online: http://www.unrae.it/files/06%20dicembre%20Top%2010%20per%20alimentazione_5ff32ed50d06c.pdf (accessed on 28 February 2021).

- Motor1.com. Ecco la Graduatoria Dei Consumi Di Tutte Le Prove Su Strada. Available online: https://it.motor1.com/reviews/213238/le-auto-che-consumano-meno-la-classifica-del-roma-forli/ (accessed on 7 November 2020).

- Sicurauto.it. Consumi Auto Elettriche e Ibride: Il Test su 10 Modelli a Confronto. 2020. Available online: https://www.sicurauto.it/news/auto-elettriche-ibride/consumi-auto-elettriche-e-ibride-il-test-su-10-modelli-a-confronto/ (accessed on 8 November 2020).

- Strollo, A.; Smiraglia, D.; Bruno, R.; Assennato, F.; Congedo, L.; De Fioravante, P.; Giuliani, C.; Marinosci, I.; Riitano, N.; Munafò, M. Land consumption in Italy. J. Maps 2020, 16, 113–123. [Google Scholar] [CrossRef]

- ISPRA. Rapporto Sul Consumo Di Suolo, Dinamiche Territoriali e Servizi Ecosistemici. Quinta edizione. Rapporti ISPRA, 288. 2018. Available online: https://www.isprambiente.gov.it/it/pubblicazioni/rapporti/consumo-di-suolo-dinamiche-territoriali-e-servizi-ecosistemici.-edizione-2018 (accessed on 15 July 2020).

- Terna, Pubblicazioni Statistiche—Produzione. Terna Statistical Data 2019. Terna: Roma, Italy. 2020. Available online: https://download.terna.it/terna/5-PRODUZIONE_8d833bdb946e47d.pdf (accessed on 30 December 2020).

- GSE (Gestore dei Servizi Energetici). Rapporto Delle Attività 2019; GSE: Roma, Italy, 2020; Available online: https://www.gse.it/documenti_site/Documenti%20GSE/Rapporti%20delle%20attivit%C3%A0/RA2019.pdf (accessed on 22 November 2020).

- GSE. Contatore Conto Termico. Available online: https://www.gse.it/contatore-conto-termico (accessed on 24 November 2020).

- European Commission. Biofuels—Sustainability Criteria. Available online: https://ec.europa.eu/energy/topics/renewable-energy/biofuels/sustainability-criteria_en (accessed on 6 December 2020).

- GSE. Incentivazione Della Produzione Di Energia Termica Da Impianti a Fonti Rinnovabili ed Interventi di Efficienza Energetica di Piccole Dimensioni, Regole applicative del D.M. 16 Febbraio 2016; GSE: Roma, Italy, 2016; Available online: https://www.gse.it/documenti_site/Documenti%20GSE/Servizi%20per%20te/CONTO%20TERMICO/REGOLE%20APPLICATIVE/REGOLE_APPLICATIVE_CT.pdf (accessed on 22 November 2020).

- ISO. ISO 50001:2018, Energy Management Systems—Requirements with Guidance for Use. Available online: https://www.iso.org/standard/69426.html (accessed on 23 November 2020).

- Gargiulo, A.; Girardi, P.; Mela, G. Life Cycle Assessment Della Produzione di Energia Elettrica Nazionale Attuale ed al 2030. Rapporto Ricerca di Sistema 19012876; RSE: Milano, Italy, 2019; Available online: http://www.rse-web.it/temi.page?RSE_originalURI=/temi/sottotema/documenti/1&RSE_manipulatePath=yes&docType_1=yes&resultList=yes,yes&objId=1&docIdType=1,1&typeDesc=Rapporto,Report&country=ita (accessed on 22 August 2020).

- van Oers, L.; Guinée, J.B.; Heijungs, R. Abiotic resource depletion potentials (ADPs) for elements revisited—updating ultimate reserve estimates and introducing time series for production data. Int. J. Life Cycle Assess. 2020, 25, 294–308. [Google Scholar] [CrossRef] [Green Version]

- Sanguesa, J.A.; Torres-Sanz, V.; Garrido, P.; Martinez, F.J.; Marquez-Barja, J.M. A Review on Electric Vehicles: Technologies and Challenges. Smart Cities 2021, 4, 372–404. [Google Scholar] [CrossRef]

- Zhao, Y.; Pohl, O.; Bhatt, A.I.; Collis, G.E.; Mahon, P.J.; Rüther, T.; Hollenkamp, A.F. A Review on Battery Market Trends, Second-Life Reuse, and Recycling. Sustain. Chem. 2021, 2, 167–205. [Google Scholar] [CrossRef]

- Hill, N.; Clarke, D.; Blair, L.; Menadue, H. Circular Economy Perspectives for the Management of Batteries used in Electric Vehicles, Final Project Report by Ricardo Energy & Environment for the JRC; Publications Office of the European Union: Luxembourg, 2019; ISBN 978-92-76-10937-2. [CrossRef]

- Eurostat, Statistics Explained. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Recycling_efficiencies_for_lead-acid_batteries_2012_and_2018_(useful_recycled_materials_in_%25_of_input_fractions).png (accessed on 15 April 2021).

- Brambilla, C.; Temporelli, A.; Mela, G. Analisi LCA Di Veicoli Elettrici, Ibridi Plug-in e a Combustione Interna a Fronte Dell’evoluzione dei Veicoli e del Parco di Generazione Elettrico, Rapporto Ricerca di Sistema 20000379; RSE: Milano, Italy, 2019; Available online: http://www.rse-web.it/temi.page?typeDesc=Rapporto&objId=3COTEVOS_D1.1_needs_for_interoperability&docType_1=yes&resultList=yes&RSE_manipulatePath=yes&docIdType=1&RSE_originalURI=/temi/sottotema/documenti/9&country=ita (accessed on 29 September 2020).

- Caizzi, A.; Girardi, P. Comparative LCA of electric mopeds versus internal combustion mopeds. SAE Tech. Pap. 2001, 1. [Google Scholar] [CrossRef]

- Vallecillo Rodriguez, S.; La Notte, A.; Pulce, C.; Zulian, G.; Alexandris, N.; Ferrini, S.; Maes, J. Ecosystem Services Accounting: Part I—Outdoor Recreation and Crop Pollination, JRC Technical Reports, 110321; Publications Office of the European Union: Luxembourg, 2018. [CrossRef]

- Miralles-Wilhelm, F. Nature Based Solutions in Agriculture—Sustainable Management and Conservation of Land, Water and Biodiversity; FAO and The Nature Conservancy: Rome, Italy, 2021. [Google Scholar] [CrossRef]

- Sánchez-Ortiz, J.; Rodríguez-Cornejo, V.; Río-Sánchez, D.; García-Valderrama, T. Indicators to Measure Efficiency in Circular Economies. Sustainability 2020, 12, 4483. [Google Scholar] [CrossRef]

- Korhonen, J.; Honkasalo, A.; Seppälä, I. Circular Economy: The Concept and its Limitations. Ecol. Econ. 2018, 143, 37–46. [Google Scholar] [CrossRef]

- OECD. CBA and other decision-making approaches. In Cost-Benefit Analysis and the Environment: Further Developments and Policy Use; OECD Publishing: Paris, France, 2018; Chapter 18; pp. 441–454. [Google Scholar] [CrossRef]

- Fruhmann, C. Cost-Effectiveness of EU Renewable Energy Support Systems; Climate Policy Info Hub, Ecologic Institute gemeinnützige GmbH: Berlin, Germany, 2015; Available online: http://climatepolicyinfohub.eu/cost-effectiveness-eu-renewable-energy-support-systems (accessed on 30 December 2020).

- Teusch, J.; Braathen, N.A. Ex-post cost-benefit analysis of environmentally related tax policies: Building on programme evaluation studies. In Environmental Fiscal Challenges for Cities and Transport, Critical Issues in Environmental Taxation Series; Villar Ezcurra, M., Milne, J.E., Ashiabor, H., Andersen, M.S., Eds.; Elgar: Cheltenham, UK, 2019; pp. 196–212. [Google Scholar] [CrossRef]

- OECD. Current use of cost benefit analysis. In Cost-Benefit Analysis and the Environment: Further Developments and Policy Use; OECD Publishing: Paris, France, 2018; Chapter 16; pp. 399–422. [Google Scholar] [CrossRef]

- Rockström, J.; Steffen, W.; Noone, K.; Persson, Å.; Chapin III, F.S.; Lambin, E.; Crutzen, P.; Foley, J. Planetary Boundaries: Exploring the Safe Operating Space for Humanity. Ecol. Soc. 2009, 14, 32. [Google Scholar] [CrossRef]

- Robért, K.-H.; Broman, G.; Basile, G. Analyzing the concept of planetary boundaries from a strategic sustainability perspective: How does humanity avoid tipping the planet? Ecol. Soc. 2013, 18, 5. [Google Scholar] [CrossRef]

- Majer, S.; Wurster, S.; Moosmann, D.; Ladu, L.; Sumfleth, B.; Thrän, D. Gaps and Research Demand for Sustainability Certification and Standardisation in a Sustainable Bio-Based Economy in the EU. Sustainability 2018, 10, 2455. [Google Scholar] [CrossRef] [Green Version]

- Morone, P. Sustainability Transition towards a Biobased Economy: Defining, Measuring and Assessing. Sustainability 2018, 10, 2631. [Google Scholar] [CrossRef] [Green Version]

- Gruppo di Lavoro Sull’erosione Fiscale, Relazione Finale Sull’erosione Fiscale. Ministero Dell’economia e Delle Finanze: Roma, Italy, 22 11 2011. Available online: https://www.mef.gov.it/primo-piano/documenti/20111229/Relazione_finale_del_gruppo_di_lavoro_sullxerosione_fiscale.pdf (accessed on 7 September 2020).

- Italian Republic President. Decreto-Legge 1 Marzo 2021, n. 22, Disposizioni Urgenti in Materia di Riordino Delle Attribuzioni dei Ministeri. (21G00028) (GU Serie Generale n.51 del). Available online: https://www.gazzettaufficiale.it/eli/id/2021/03/01/21G00028/sg (accessed on 1 March 2021).

- European Commission. Renewed Sustainable Finance Strategy and Implementation of the Action Plan on Financing Sustainable Growth, 5 8 2020. Available online: https://ec.europa.eu/info/publications/sustainable-finance-renewed-strategy_en (accessed on 12 October 2020).

- CIRAIG (International Reference Centre for the Life Cycle of Products, Processes and Services). Circular Economy: A Critical Literature Review of Concepts; Polytechnique Montréal: Montréal, QC, Canada, 2015; Available online: https://www.ciraig.org/pdf/CIRAIG_Circular_Economy_Literature_Review_Oct2015.pdf (accessed on 5 April 2021).

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Res. Con. Rec. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Merli, R.; Preziosi, M.; Acampora, A. How do scholars approach the circular economy? A systematic literature review. J. Clean. Prod. 2018, 178, 703–722. [Google Scholar] [CrossRef]

- Pierce, D.W.; Turner, R.K. Economics of Natural Resources and the Environment; Harvester Wheatsheaf: London, UK, 1990; ISBN 0 7450 0225 0. Available online: https://ideas.repec.org/a/eee/agisys/v37y1991i1p100-101.html (accessed on 7 April 2021).

- Ellen MacArthur Foundation (EMAF). Towards the Circular Economy, Economic and Business Rationale for an Accelerated Transition. 2013. Available online: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/Ellen-MacArthur-Foundation-Towards-the-Circular-Economy-vol.1.pdf (accessed on 7 April 2021).

- Lyle, J.T.; Wiley, J. Regenerative Design for Sustainable Development. 1994. Available online: https://www.wiley.com/en-am/Regenerative+Design+for+Sustainable+Development-p-9780471178439 (accessed on 8 April 2021).

- Stahel, W.R. The Performance Economy. Palgrave Macmillan. 2006. Available online: https://scholar.google.com/scholar_lookup?title=The%20Performance%20Economy&author=W.R.%20Stahel&publication_year=2006 (accessed on 8 April 2021).

- Braungart, M.; McDonough, W. Cradle to Cradle: Remaking the Way We Make Things; North Point Press: New York, NY, USA, 2002; Available online: https://scholar.google.com/scholar_lookup?title=Cradle%20to%20Cradle%3A%20Remaking%20the%20Way%20We%20Make%20Things&author=M.%20Braungart&publication_year=2002 (accessed on 8 April 2021).

- Frosch, D.; Gallopoulos, N. Strategies for manufacturing. Sci. Am. 1989, 261, 94–102. [Google Scholar] [CrossRef]

- Graedel, T.E. On the concept of industrial ecology. Annu. Rev. Energy Environ. 1996, 21, 69–98. [Google Scholar] [CrossRef] [Green Version]

- Benyus, J.M. Biomimicry—Innovation Inspired by Nature; William Morrow and Company: New York, NY, USA, 1997; Available online: https://scholar.google.com/scholar_lookup?title=Biomimicry%20-%20Innovation%20Inspired%20by%20Nature&author=J.M.%20Benyus&publication_year=1997 (accessed on 8 April 2021).

- UNEP. Resource Efficiency: Potential and Economic Implications. A Report of the International Resource Panel; Ekins, P., Hughes, N., Eds.; United Nations Environment: Paris, France, 2017; ISBN 978-92-807-3645-8. Available online: https://www.resourcepanel.org/sites/default/files/documents/document/media/resource_efficiency_report_march_2017_web_res.pdf (accessed on 10 April 2021).

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, W.W. The Limits to Growth. A Report for the Club of Rome’s Project on the Predicament of Mankind; Potomac Associate Book: Washington, DC, USA, 1972; ISBN 0-87663-165-0. Available online: http://www.donellameadows.org/wp-content/userfiles/Limits-to-Growth-digital-scan-version.pdf (accessed on 10 April 2021).

- OECD WPEP. Environmental Performance Reviews (1st Cycle) Conclusions and Recommendations. 32 Countries (1993–2000). 2000. Available online: https://www.oecd.org/env/country-reviews/2432829.pdf (accessed on 8 September 2020).

- Circular Economy Promotion Law of the People’s Republic of China, Order of the President of the People’s Republic of China (No.4) 29.08.2008. Available online: https://www.lawinfochina.com/display.aspx?id=7025&lib=law (accessed on 12 April 2021).

- European Commission. Communication of the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee, and the Committee of Regions, Roadmap to a Resource Efficient Europe, COM (2011) 571 Final Brussels. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52011DC0571 (accessed on 20 September 2011).

- European Commission. Communication of the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee, and the Committee of Regions, Thematic Strategy on the Sustainable use of Natural Resources, Brussels, COM (2005) 670 Final. Available online: https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX%3A52005DC0670 (accessed on 21 December 2005).

- European Commission. Legislative Train Schedule: Circular Economy Package, December 2015. Available online: https://www.europarl.europa.eu/legislative-train/theme-new-boost-for-jobs-growth-and-investment/package-circular-economy-package (accessed on 8 September 2020).

| Comparison with [19] | Number of Subsidies | % |

|---|---|---|

| EHS-HCE | 51 | 29.3% |

| EUS-HCE | 3 | 1.7% |

| EFS-HCE | 2 | 1.1% |

| EFS-FCE | 61 | 35.1% |

| EUS-FCE | 8 | 4.6% |

| EHS-FCE | 6 | 3.4% |

| EHS-UCE | 10 | 5.7% |

| EUS-UCE | 14 | 8.0% |

| EFS-UCE | 7 | 4.0% |

| EHS-NCE | 4 | 2.3% |

| EFS-NCE | 3 | 1.7% |

| EUS-NCE | 0 | - |

| Subsidies not anymore in force in 2018 | 5 | 2.9% |

| Total | 174 | 100.0% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Molocchi, A. Circular Economy and Environmental Sustainability: A Policy Coherence Analysis of Current Italian Subsidies. Sustainability 2021, 13, 8150. https://doi.org/10.3390/su13158150

Molocchi A. Circular Economy and Environmental Sustainability: A Policy Coherence Analysis of Current Italian Subsidies. Sustainability. 2021; 13(15):8150. https://doi.org/10.3390/su13158150

Chicago/Turabian StyleMolocchi, Andrea. 2021. "Circular Economy and Environmental Sustainability: A Policy Coherence Analysis of Current Italian Subsidies" Sustainability 13, no. 15: 8150. https://doi.org/10.3390/su13158150

APA StyleMolocchi, A. (2021). Circular Economy and Environmental Sustainability: A Policy Coherence Analysis of Current Italian Subsidies. Sustainability, 13(15), 8150. https://doi.org/10.3390/su13158150